• Office building values have fallen by 70% or more as office rents plummet

• Vacancy rates of 20% do not nearly reflect the actual amount of vacant office space

• WFH pushed housing costs higher by enabling less compromise on location choices

Despite the bad press EV and Hybrid cars have had recently with cold weather charging issues, the spike in interest rates that began in early 2022 didn't seem to have the severe detrimental impact on car sales as it did on housing sales. With both, prices remained high despite the rates. Car sales took off and home sales slowed. Why? With the chip shortage of 20222023, new car sale listing...

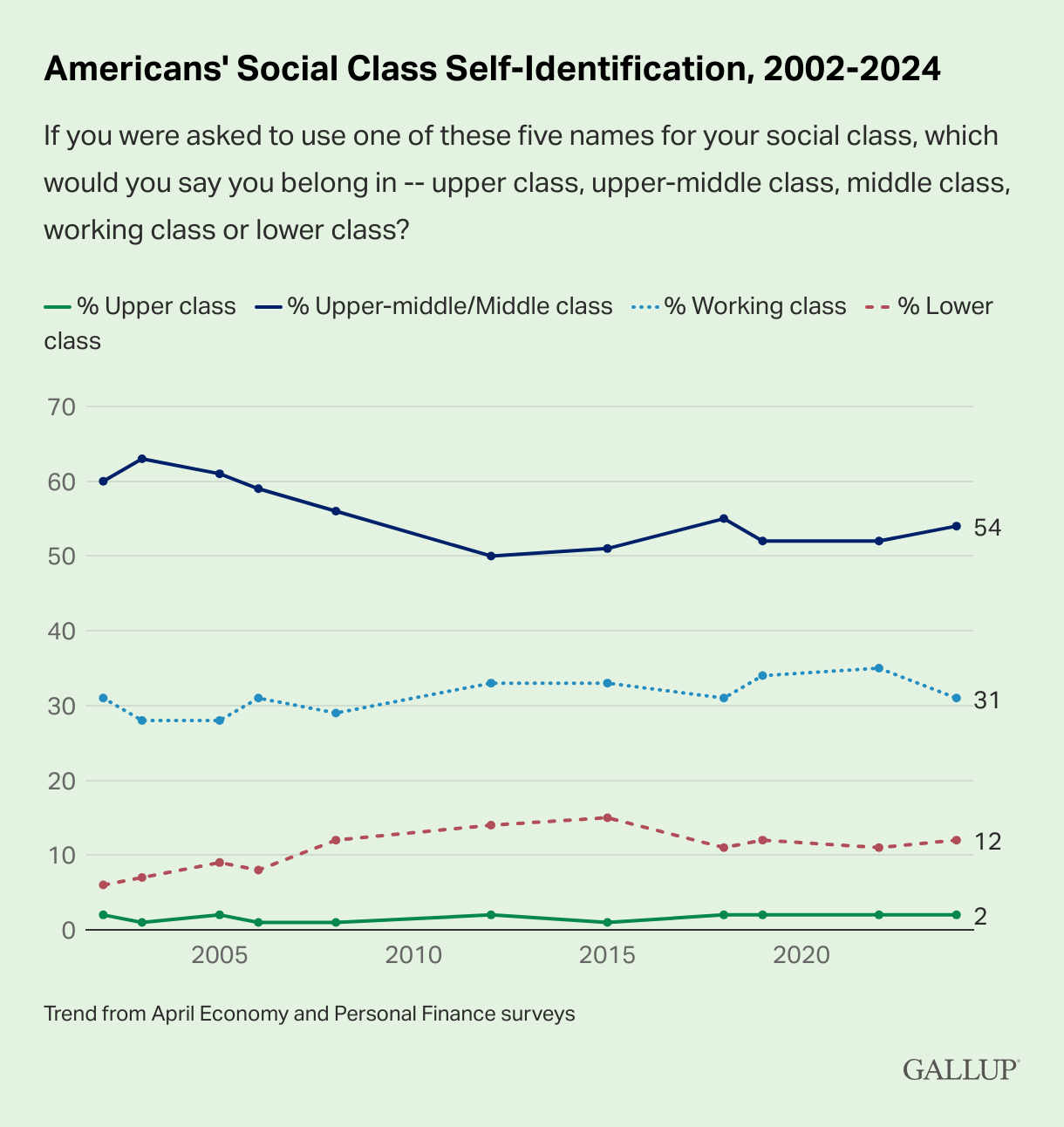

More than half of consumers identify as middle class and that fits nicely within the American Dream narrative. Housing used to fit nicely into that narrative too, before the 2022 Fed pivot created higher mortgage rates and the lack of inventory made bidding wars a fact of life. But for the consumer, some of the financial pain has been eased through higher wages as they were shifted from decades...

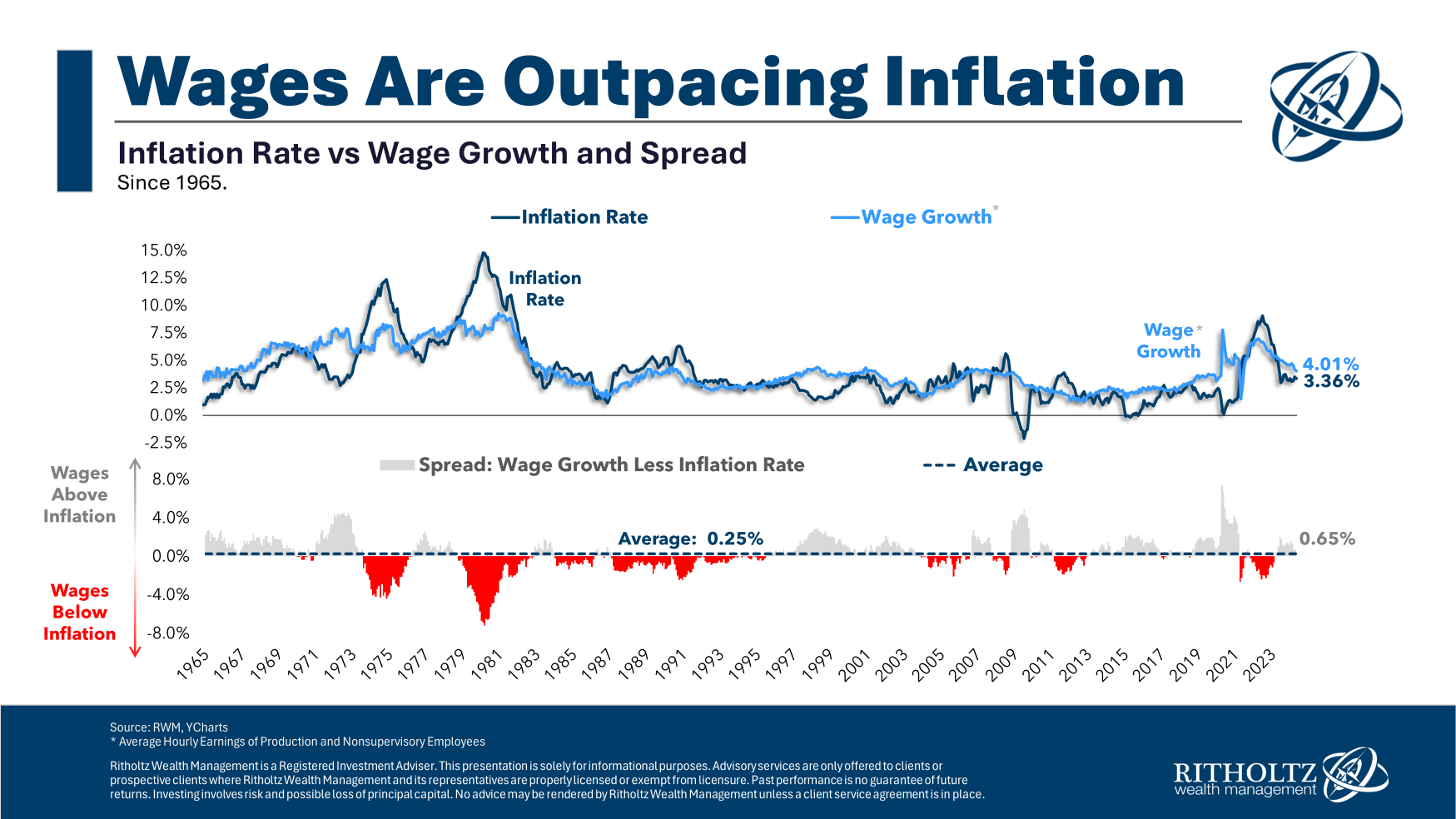

Wages have been deflationary since the 60s but have been inflationary since the pandemic. I prefer the latter for society (largely working and middle class) as well as the health of the overall housing market once mortgage rates normalize and we stop seeing a massive distortion in economic metrics. For example, I thought this was supposed to be the spring housing market where contract volume...

The housing market tends to see increased demand and more listing inventory this time of year to create the first big hump of each twohump camel annual pattern. However, the uptick in sales has been a bit underwhelming. As a "noneconomist" and market analyst (and an appraiser), I would submit that the stubbornness of high rates and the uncertainty of an election year has moderated the temperature...

While Housing Isn't Running Of A Cliff, It's Not Clear When Fed Cuts Will Occur Even Though The Housing Data Utilized Doesn't Represent Current Conditions So Why Rely On It? Here's the path taken so far... And here's a potential housing result. Apparently, Alaska's natural beauty isn't enough to keep its residents entertained. Did you miss last Friday's Housing Notes? May 3, 2024: Powell Taking...