While Housing Isn’t Running Of A Cliff, It’s Not Clear When Fed Cuts Will Occur Even Though The Housing Data Utilized Doesn’t Represent Current Conditions So Why Rely On It?

Here’s the path taken so far…

And here’s a potential housing result. Apparently, Alaska’s natural beauty isn’t enough to keep its residents entertained.

Did you miss last Friday’s Housing Notes?

May 3, 2024: Powell Taking Some Of The Sting Out Of The Housing Circus With No Likely Rate Hike

But I digress…

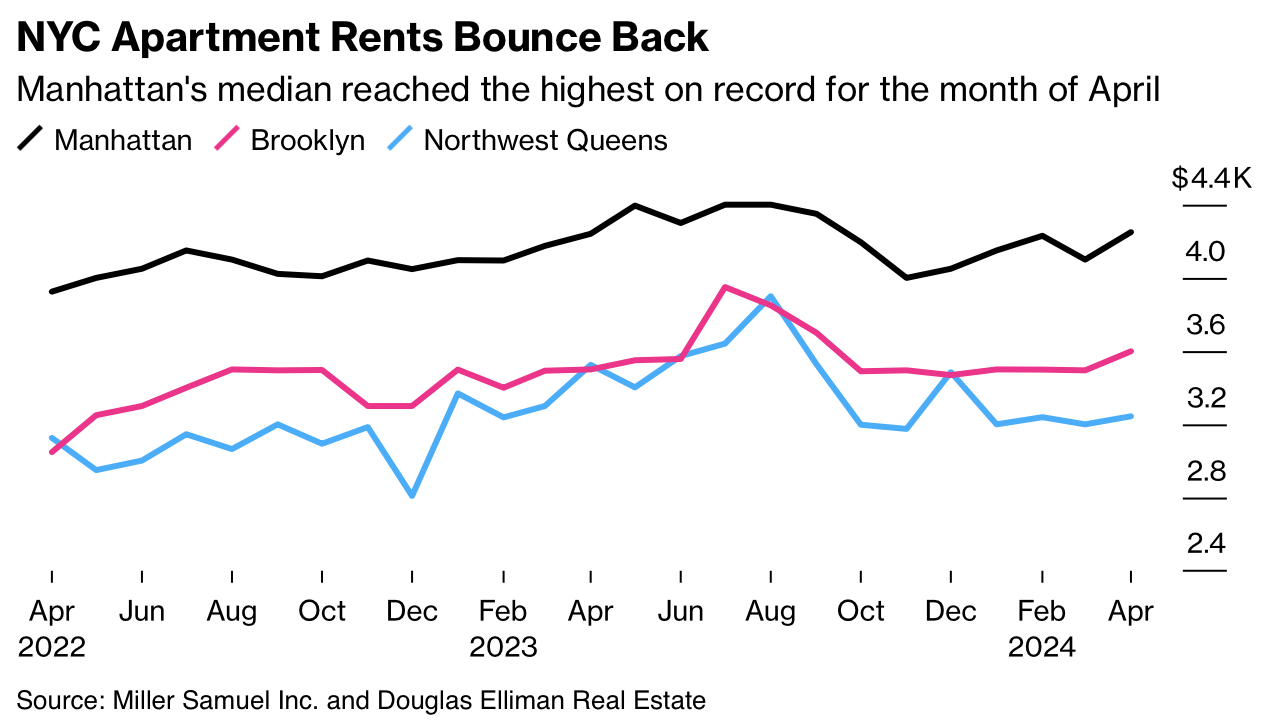

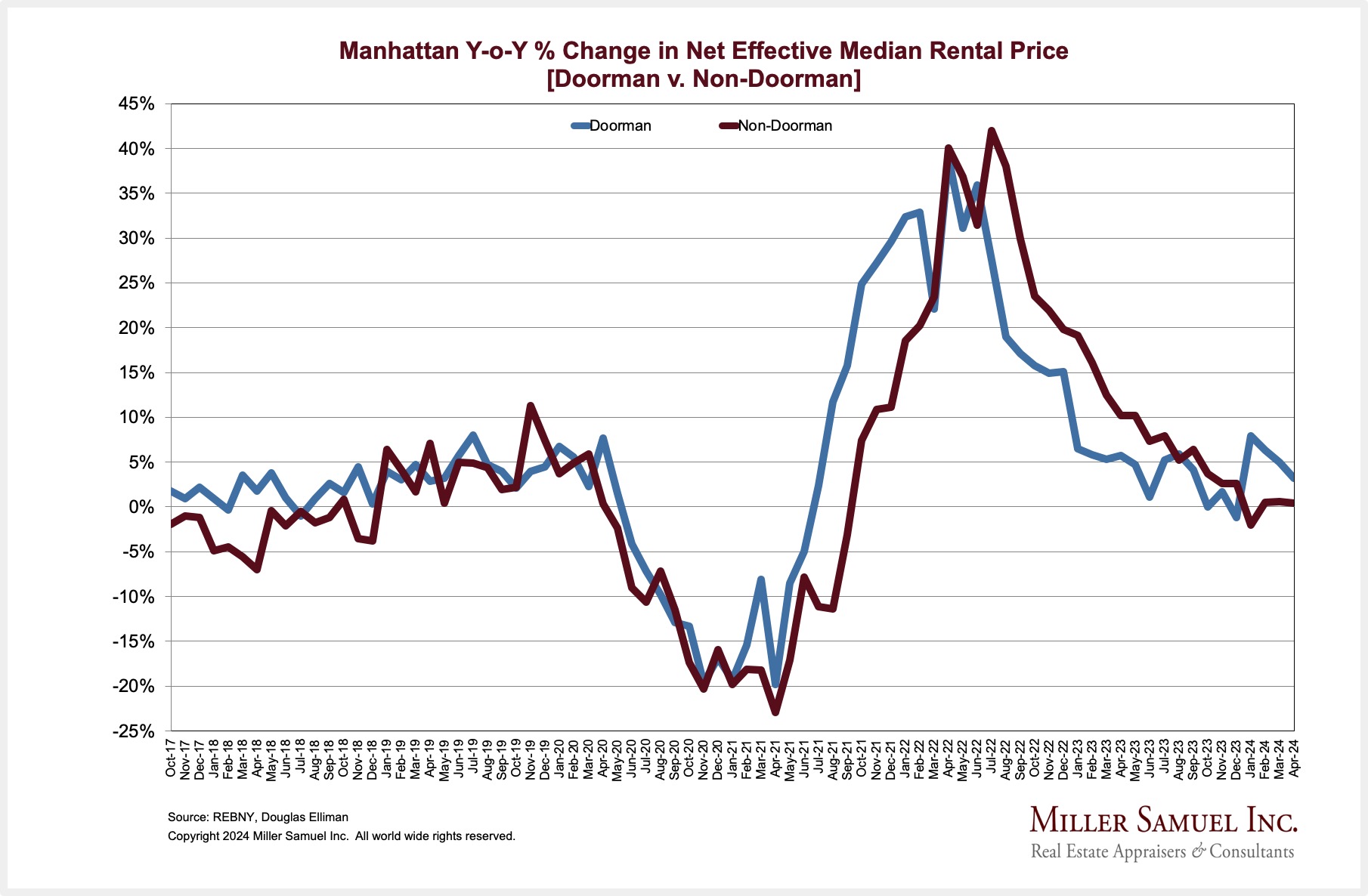

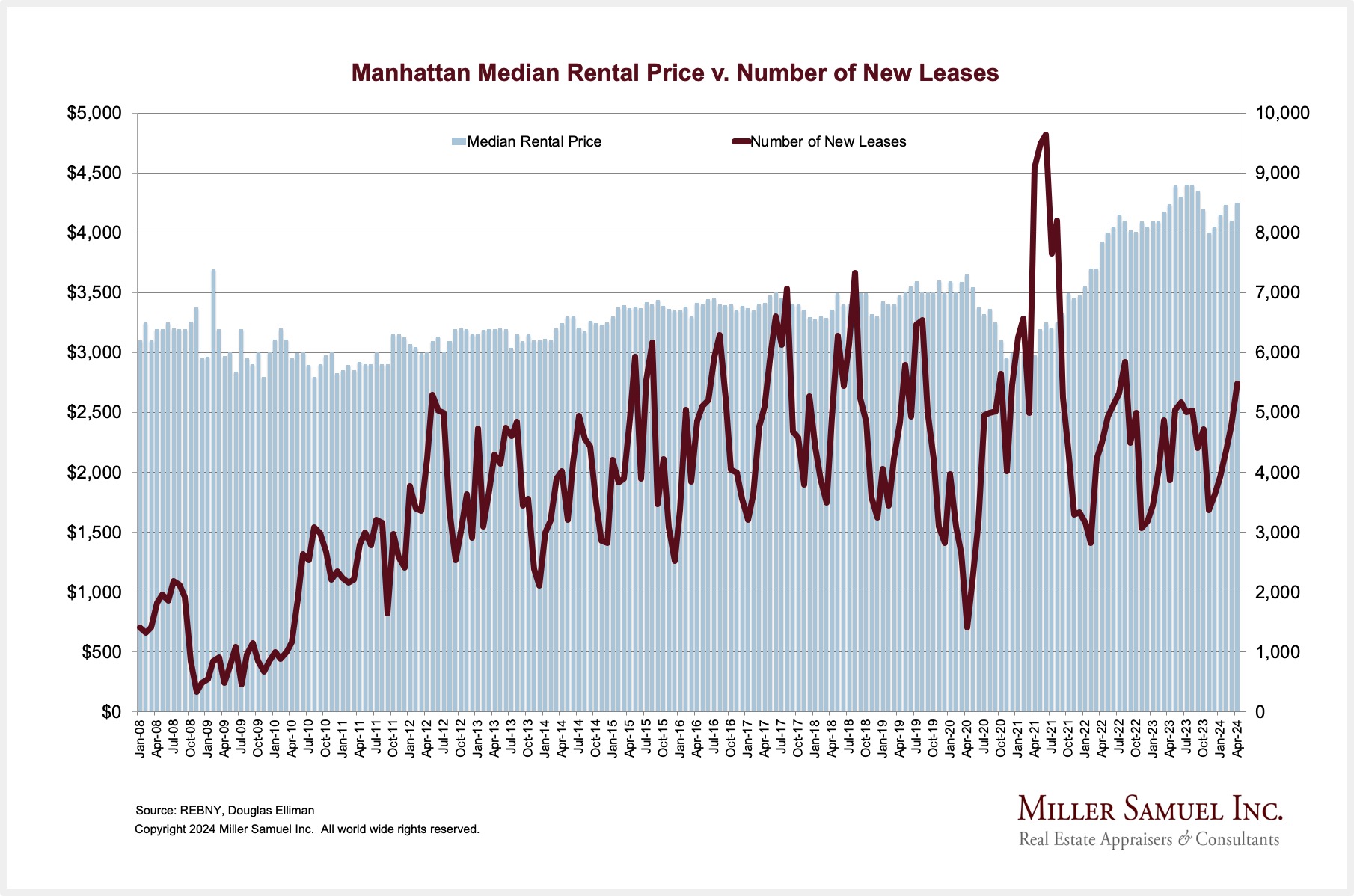

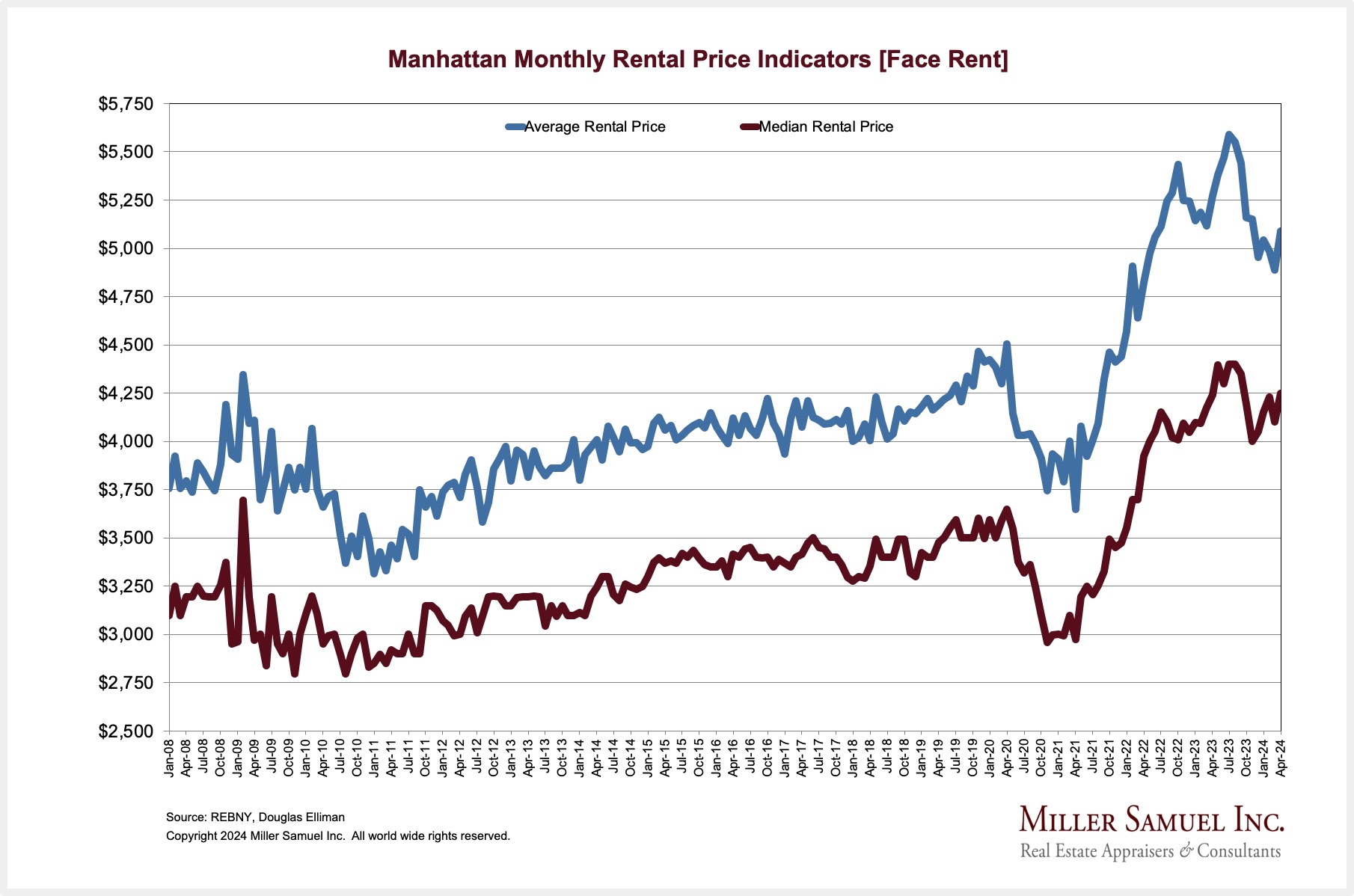

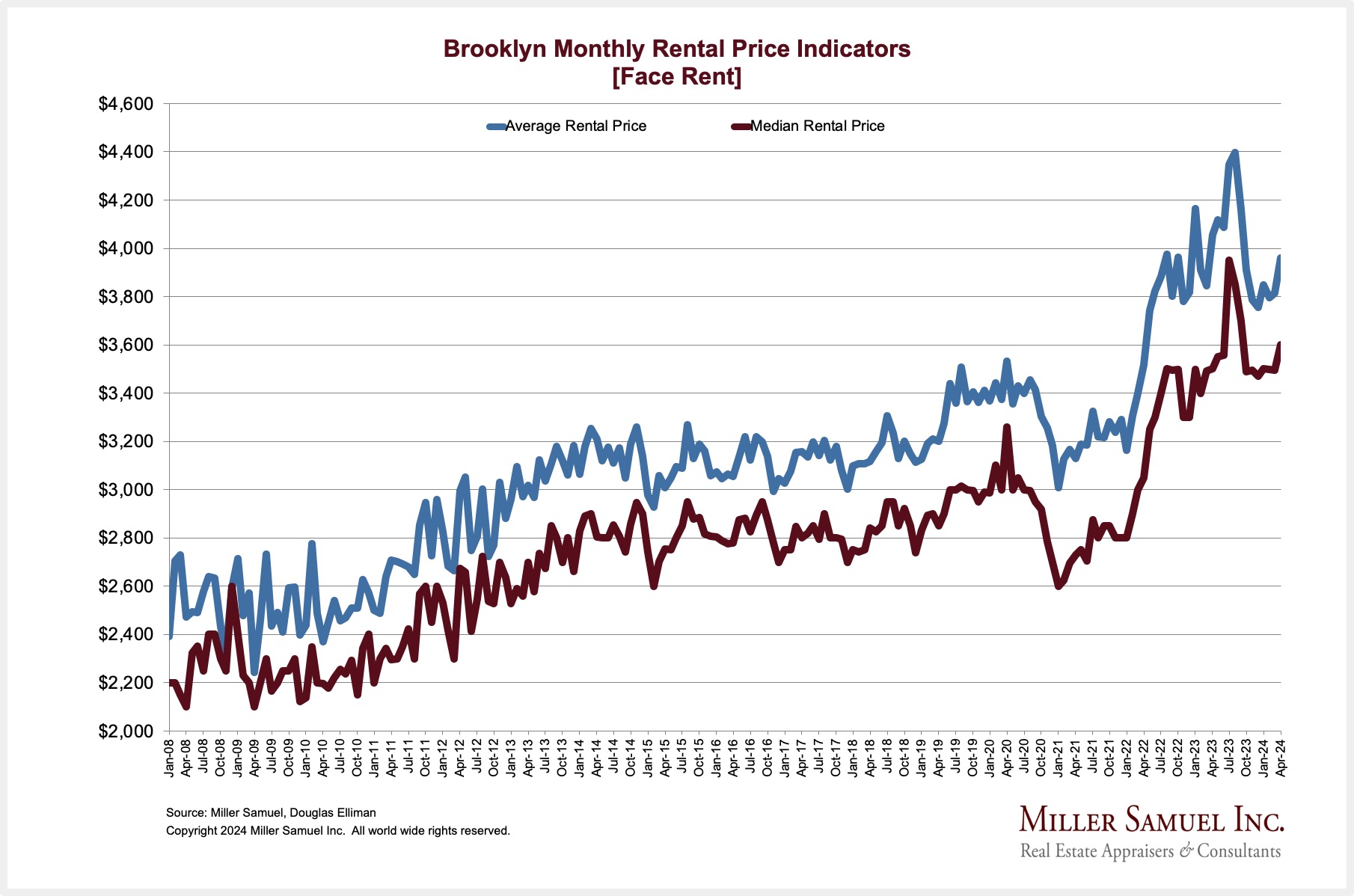

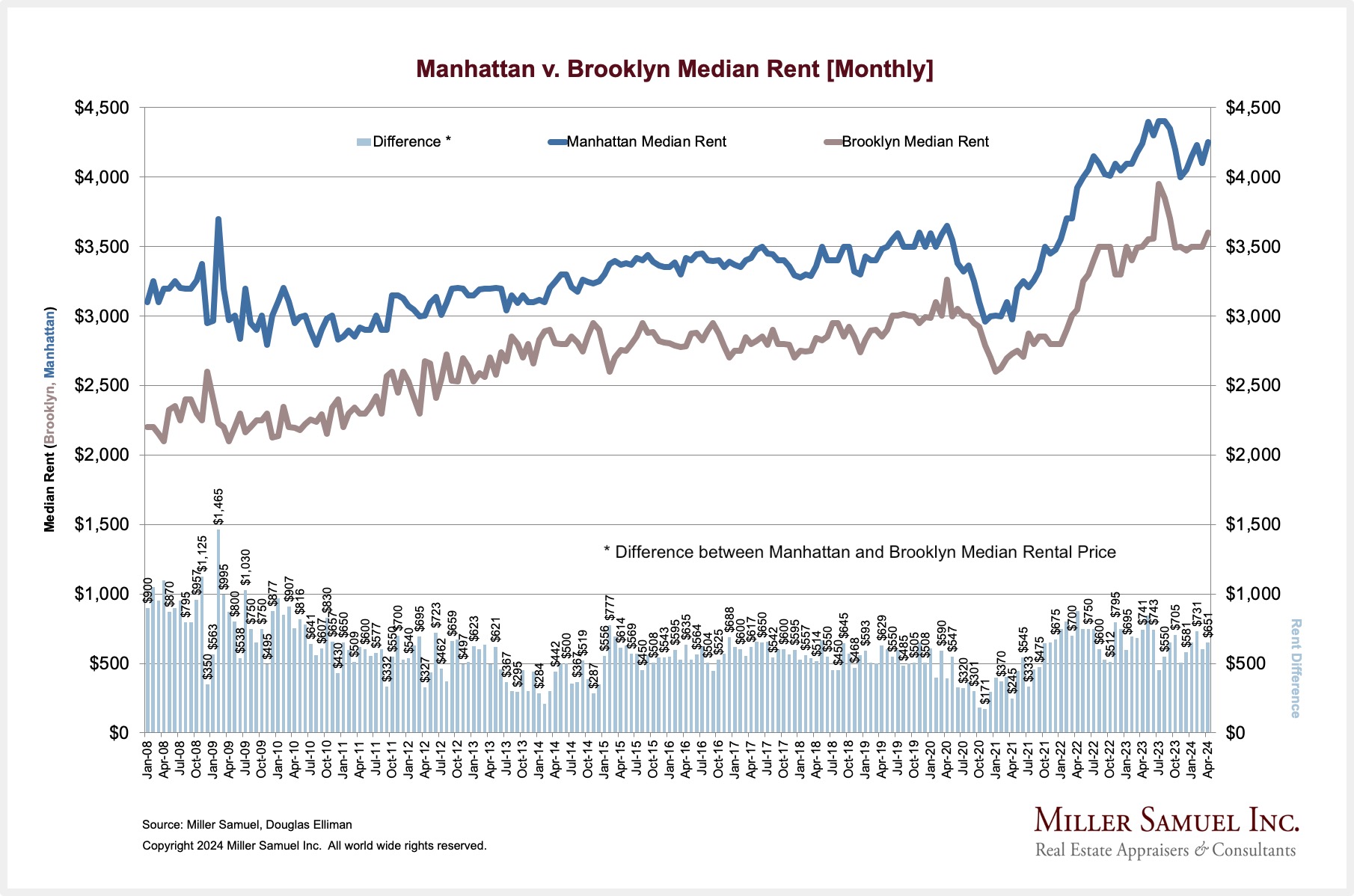

NYC Rents Are Back To Their Rising Ways

I’ve been the author of the Elliman Report series for Douglas Elliman Real Estate for thirty years. They published our research on the NYC rental market this week, and high mortgage rates have kept rents rising annually for three of the last four months.

Bloomberg News explained the results and included a chart. Lots of other coverage as well.

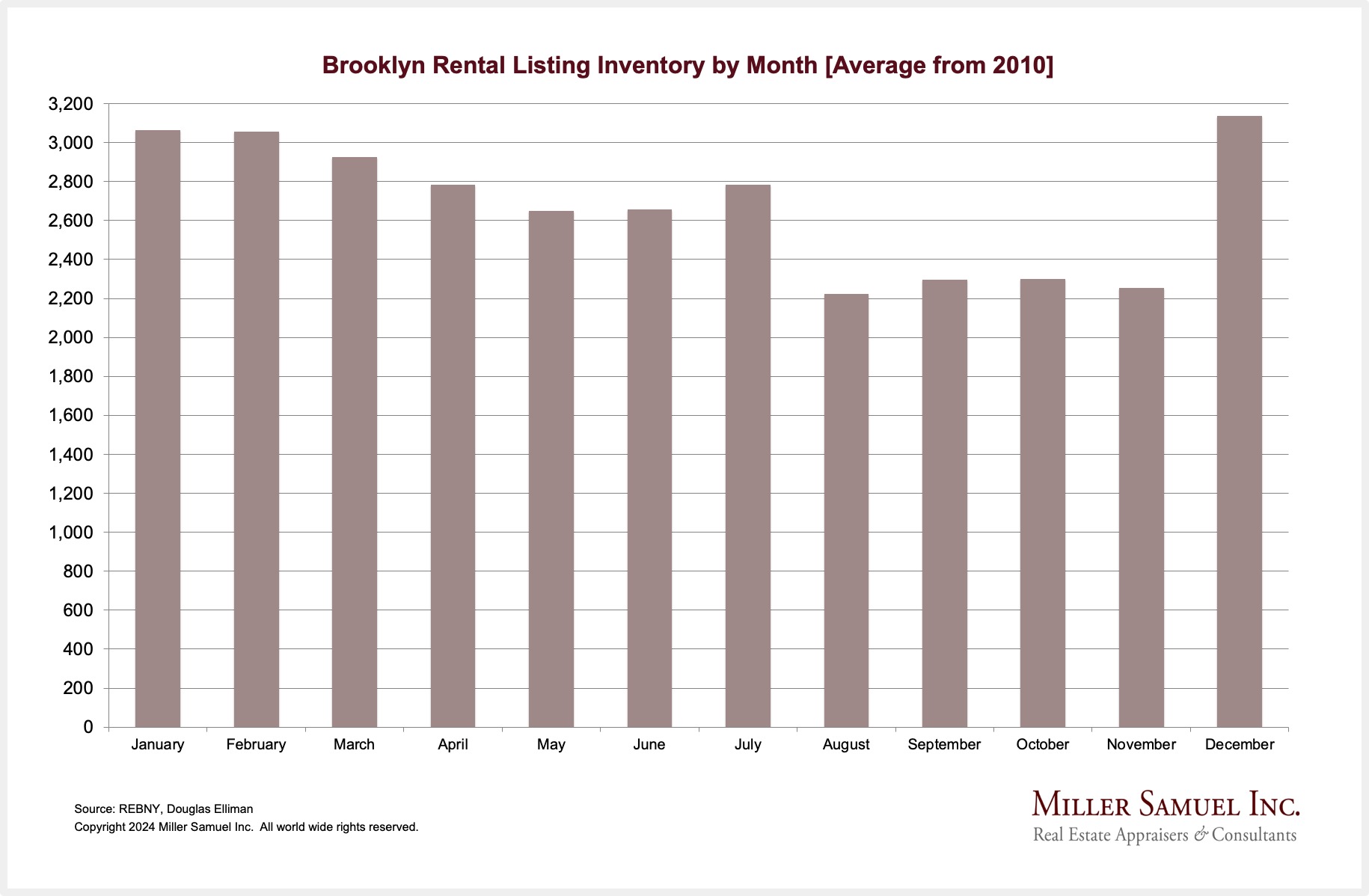

BROOKLYN RENTAL MARKET HIGHLIGHTS

Median rent and listing inventory increased year over year for the third time.

- Median rent and net effective median rent rose year over year to the highest April on record

- New lease signings surged annually to the second-highest level on record

- Listing inventory expanded to the second-highest April on record

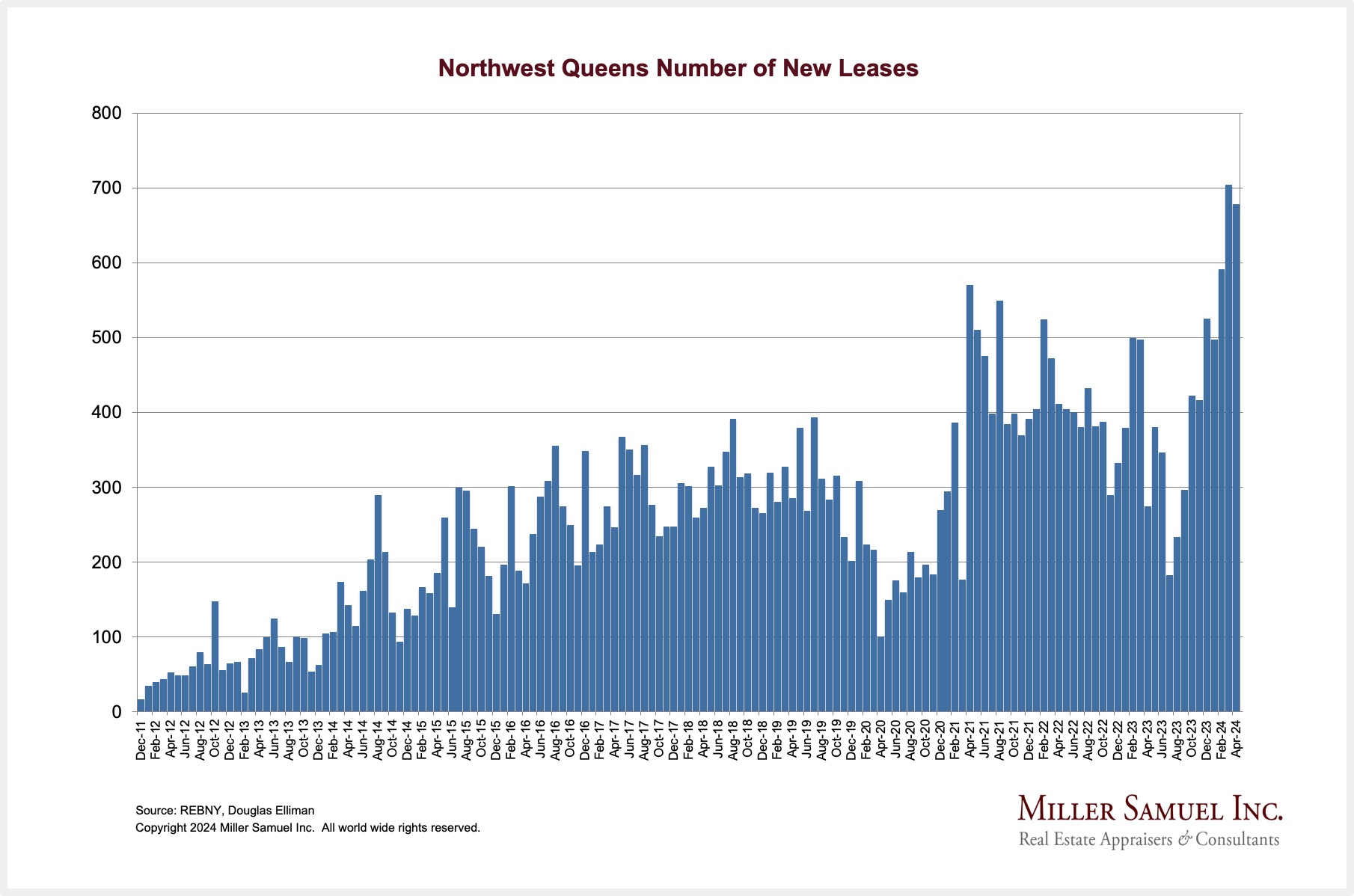

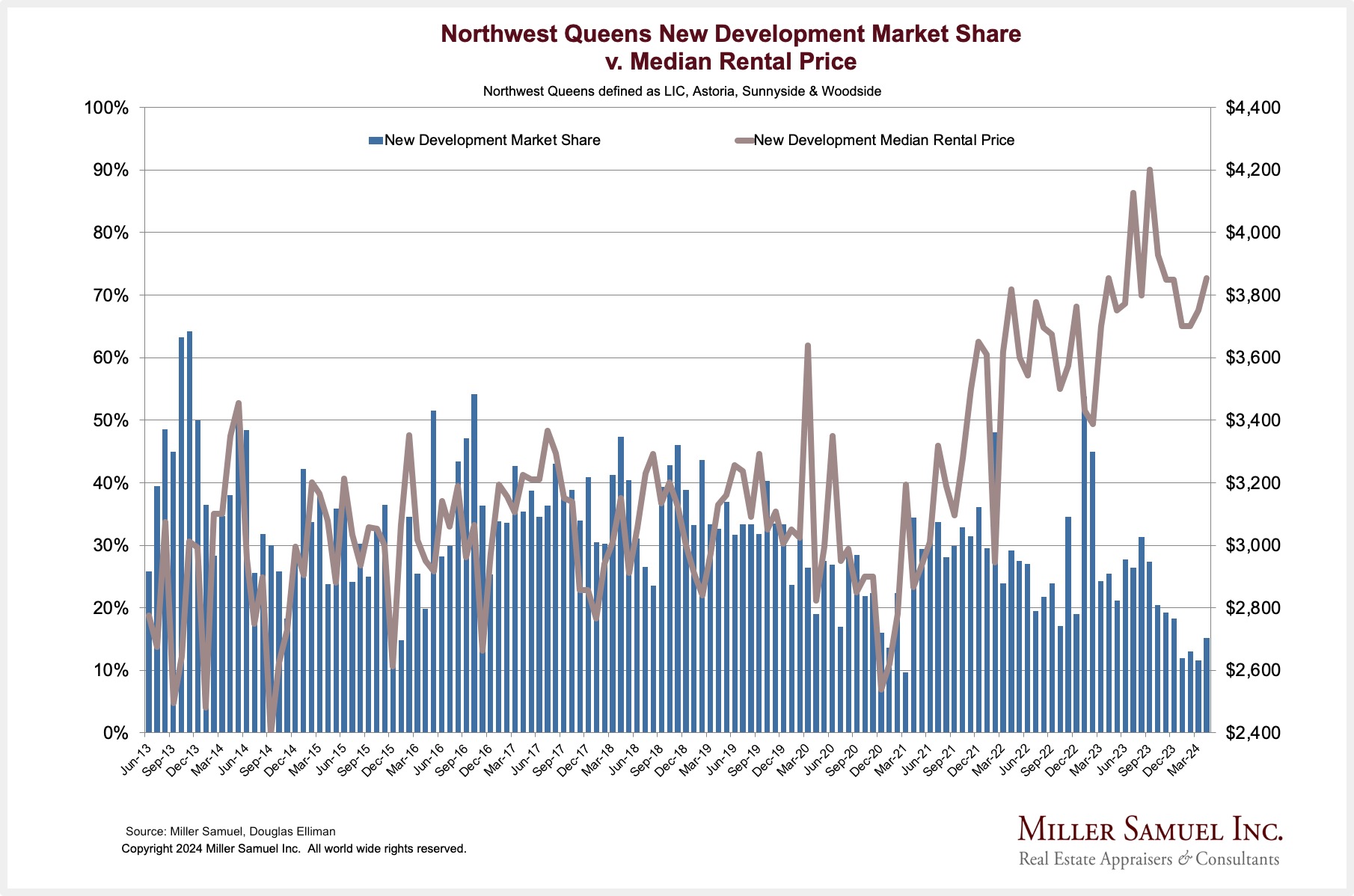

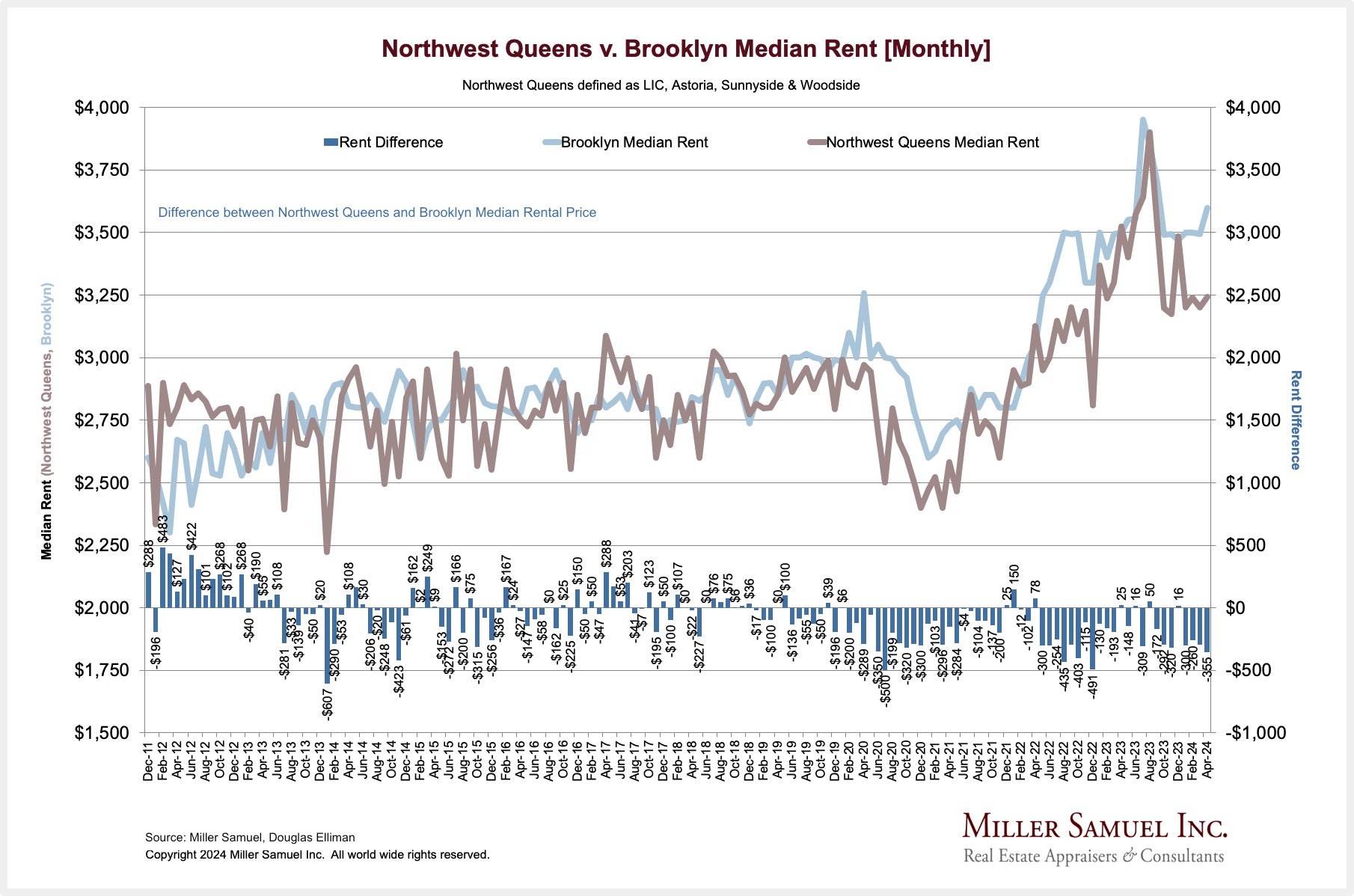

QUEENS RENTAL MARKET HIGHLIGHTS

[Northwest Region]

Median rent declined annually for the second time as new lease signings expanded for the second time in three months.

- Median rent and net effective median rent rose year over year to the second-highest April on record

- New lease signings surged annually to the second-highest level on record

- Bidding war market share reached its highest level in nearly a year

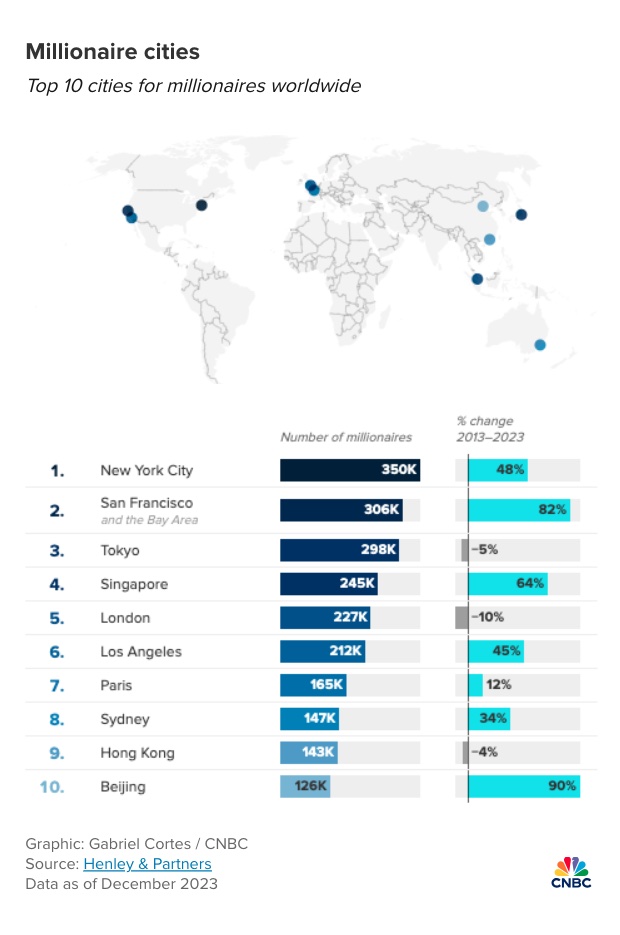

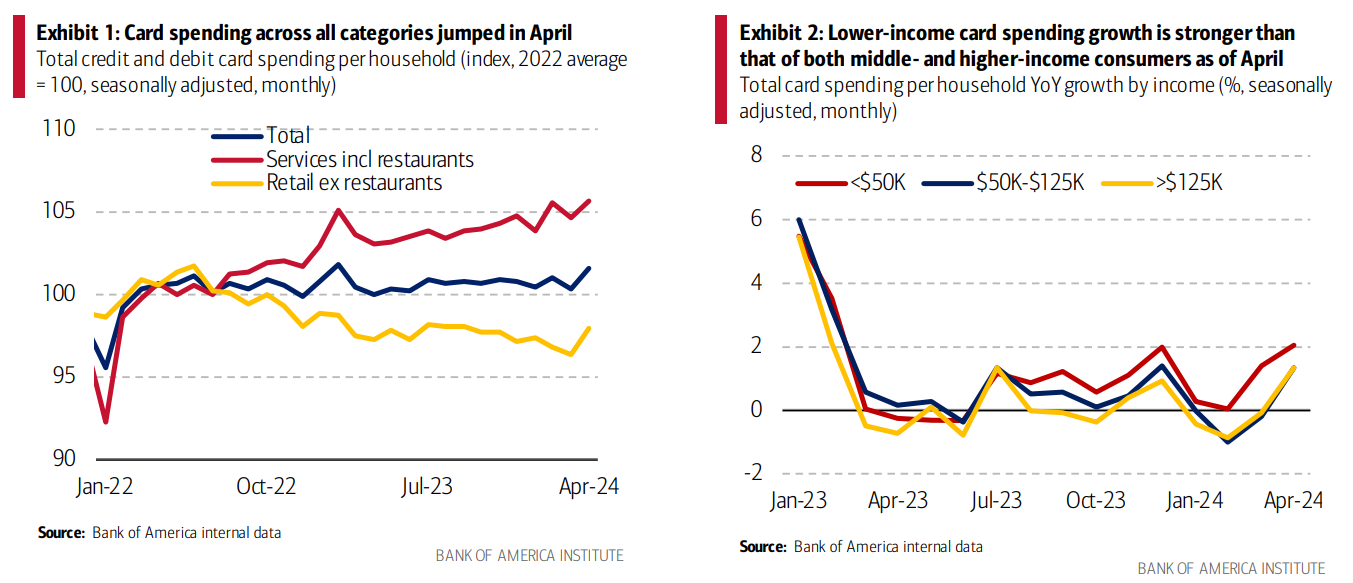

Torsten Slok: Economic Strength = Low Interest-Rate Sensitivity + Strong Demand

From Apollo’s Chief Economist – its required reading for Housing Notes fans:

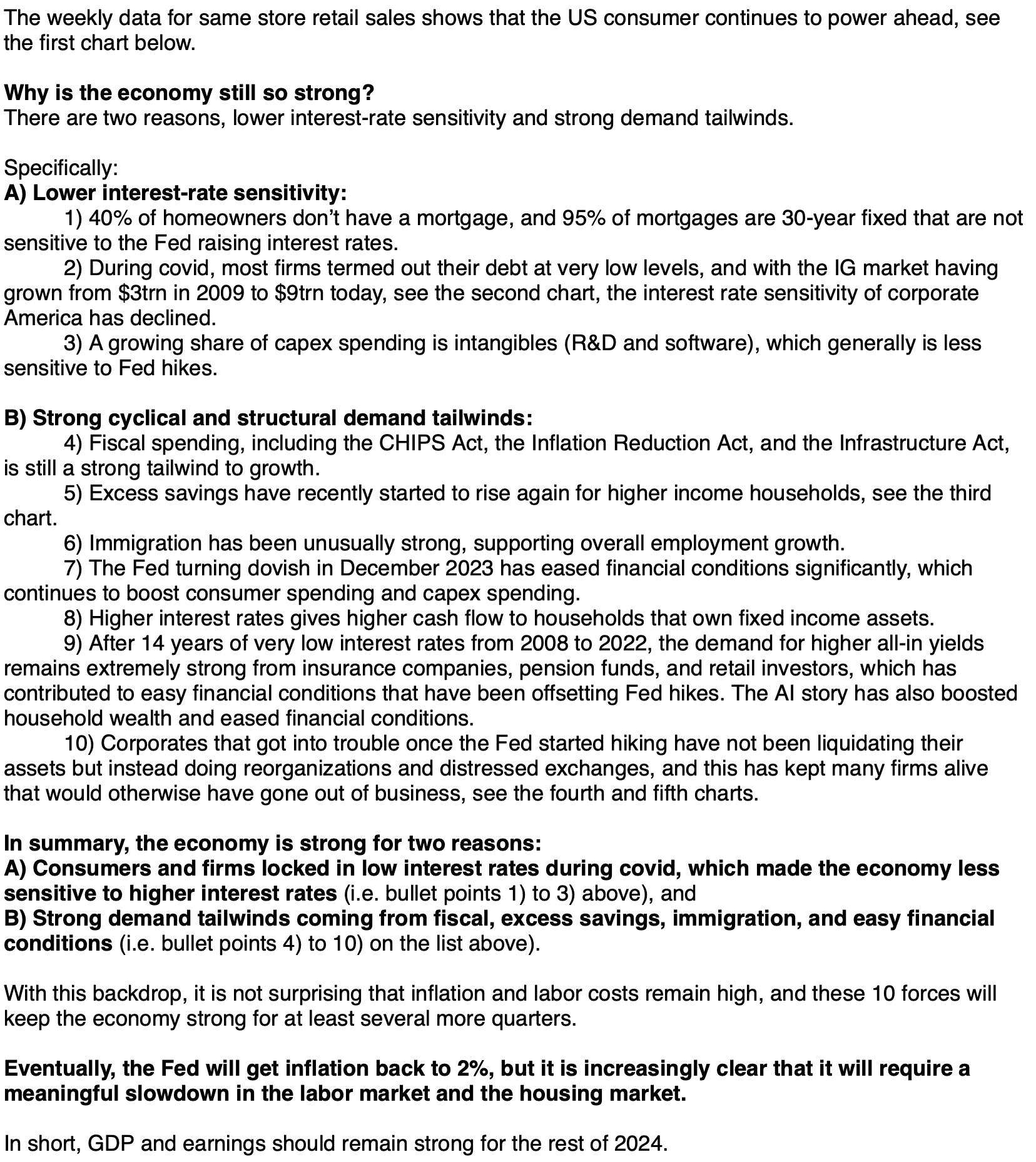

Valuing Manhattan Outdoor Space Revisited

On May 5, 2010, I posted [Terra Logic] Understanding The Value Of Manhattan Apartment Outdoor Space because I got many requests from real estate agents and brokers on how to value it. And real estate reporters, beginning with this New York Times piece, Geranium Friendly.

Eight years later, Brick Underground interviewed me on how it works How much does outdoor space add to the price of an NYC apartment? At the time, one in seven apartments, or 14% sold, had a terrace. While the ratios we developed in our appraisal practice remain the same today, about 22% of apartments sold have a terrace. The rise in market share occurred largely because of two reasons:

- Units with outdoor space stand out more than those without, and this became a supercharged amenity during the pandemic era.

- New development condo design captured more outdoor space as a saleable area.

My friends Noah and John at Urban Digs held webinars with me recently and in 2019 on this topic.

I found an old chart I made 23 years ago that shows apartments with outdoor space were generally in the 10% to 12% market share range of sales and only 6% about 33 years ago (5 years after I co-founded Miller Samuel). The point here is that while outdoor space has always been around, its recognition as an amenity has expanded in importance over time.

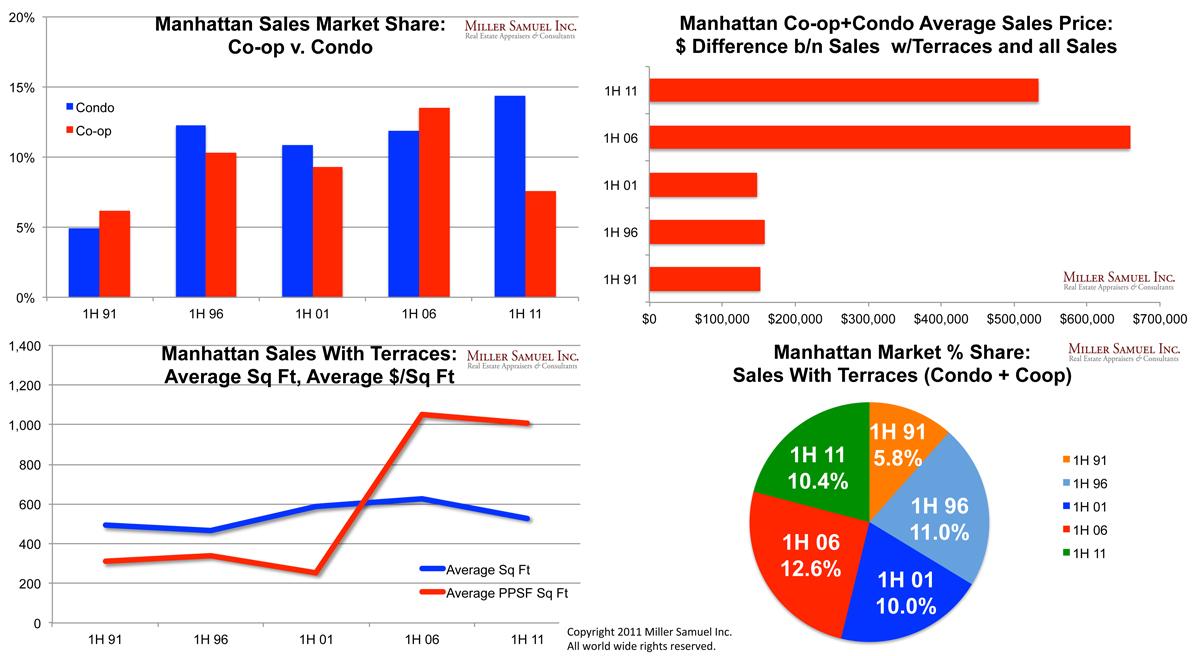

[Stat Silliness] One Out Of 24 NYC Residentials Is Walking Around In A Tux (A Millionaire)

Earlier this week, a Henley & Partners study ranked NYC as having the most millionaires. I’m beaming with pride. NYC is the largest city in the U.S., with over 8 million people. The Bay Area is in second place globally with about 7.75 million, so a per capita ranking wouldn’t make a difference.

What I find most interesting is the misplaced New York-bashing narrative that most wealthy people have left or will leave the city. That doesn’t appear to be the case. More importantly, individuals in NYC with a net worth in the single digit millions are probably middle class relative to everyone in this millionaire subset. I can assure you these millionaires aren’t walking around in tuxedos like the character on the cover of Monopoly. Heck, I don’t even own a tuxedo, and I’m a character!

Bloomberg breaks it down for us in One Out of Every 24 New York City Residents Is Now a Millionaire with their excellent chart. The surge in NYC wealth over the past decade is incredible.

’24 Real Estate Economy Remains In A Figurative Recession

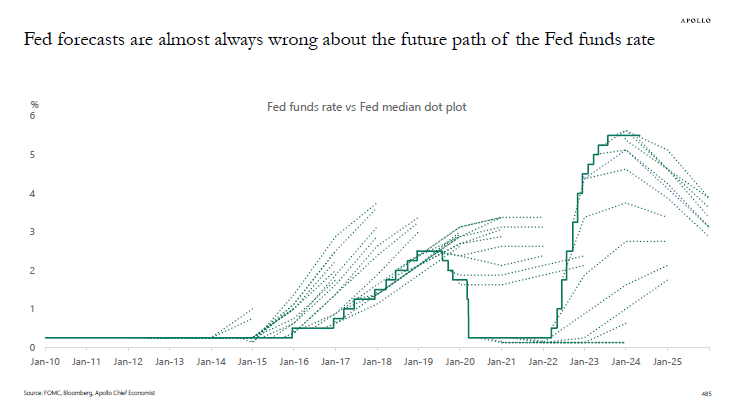

I’ve often discussed the Fed’s lag during the pandemic, when rates were kept too low for too long, resulting in the housing market distortion that is still front and center today. Last week, I shared my friend Barry Ritholtz’s sanity pitch for rate cuts because of the massive lag in housing metrics relied on for 40% of CPI. You can see this in the Fed forecast accuracy review by Torsten Slok in the chart below. The forecasts of the Fed funds rate are just not accurate.

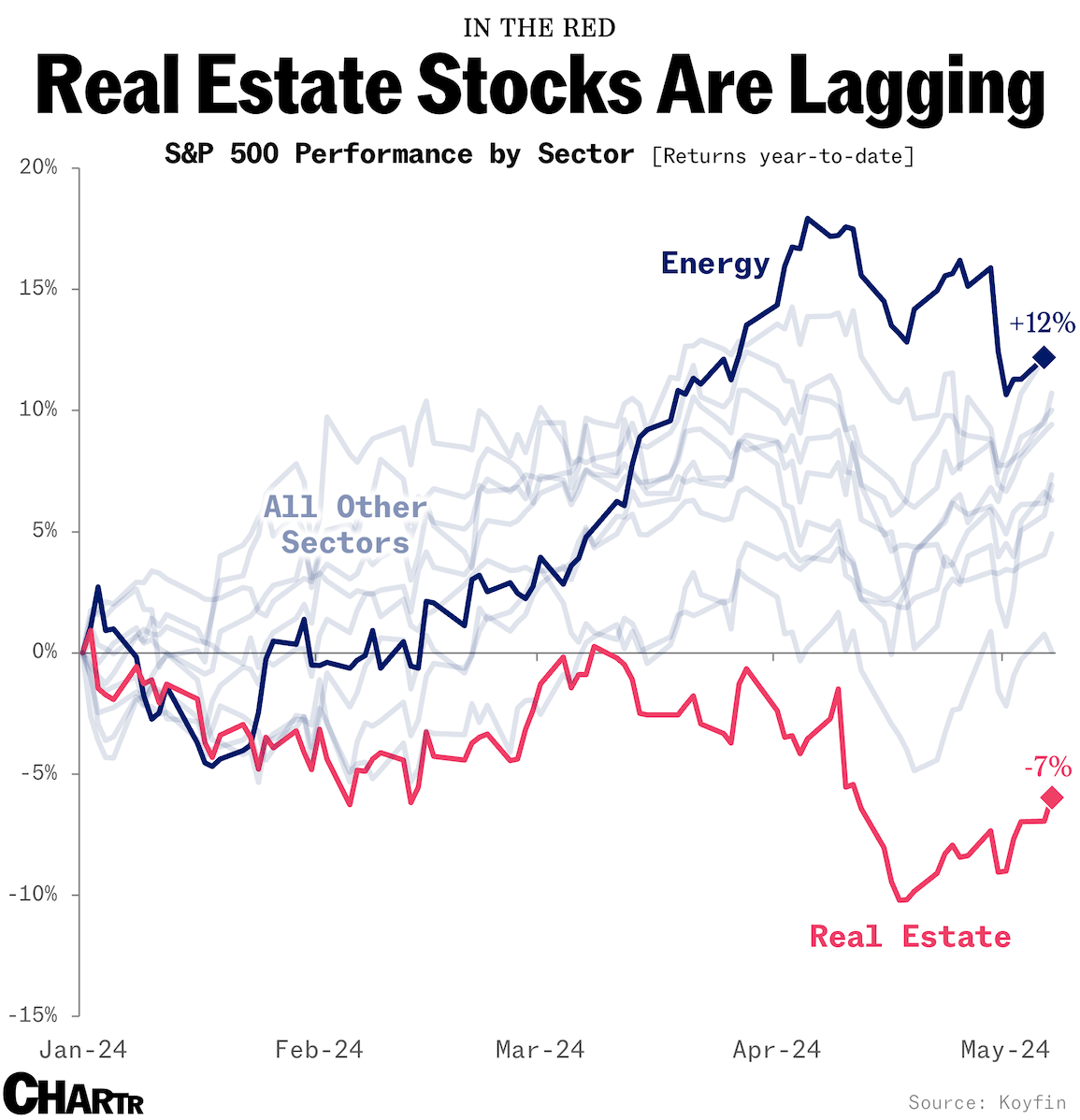

For further proof that the real estate economy feels like a recession, see how the sector is underperforming in a big way.

House Maintenance: Painting Fences Edition

I love the cut of this guy’s jib. Heh.

SoBro’s Improvement Since 1982

When I moved to NYC in 1985, many areas were completely devastated. The East Village in Manhattan was one that I was most familiar with within our appraisal practice. Although this video is from the South Bronx and not the East Village, it captures the scale of the devastation I saw firsthand. Newcomers to NYC probably won’t believe those conditions ever existed. But NYC did what it has always done—reinvent itself.

Highest & Best Newsletter: Top-Shelf Tear Downs

If you’re interested in the Florida housing market, you should sign up for this Florida newsletter, Highest & Best, from Oshrat Carmiel, formerly of Bloomberg News…

Like Bill Akerman, I always feel that Sternicht is likely working another angle related to one of his projects when he says things like Billionaire Sternlicht: Miami Growth “Hamstrung” by Schools. I first learned this nearly a decade ago when Sternlicht commented on stage at a large event, something to the effect of ‘Greenwich, CT is the worst housing market in the country.’ The scuttlebutt from the Greenwich brokerage community in response was that he was trying to sell a home for double what it was worth, and after a few years, after he cut the price by a third, he still couldn’t sell because it was still wildly overpriced. The brokerage community in Greenwich hired a PR firm to say things like “Greenwich has the best schools, the greenest parks, etc.” which no news outlet was interested in covering because that doesn’t necessarily drive higher prices in a housing market.

Top-Shelf Tear Downs NYC billionaire buys unsafe condos; Plus: Miami office warnings

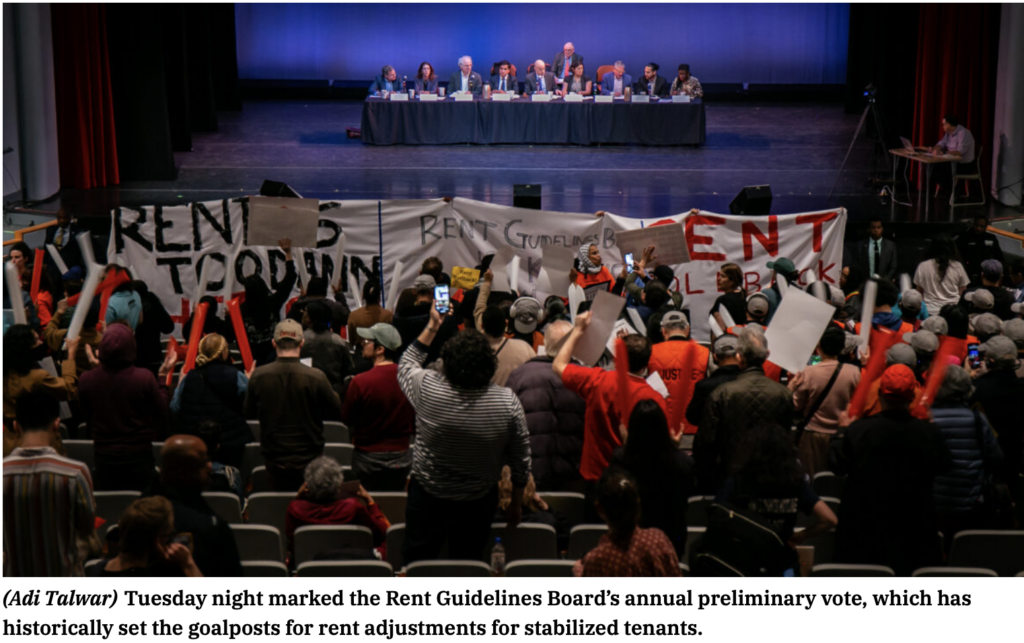

NYC Rent Guidelines Board Issues Increases

In what usually ends up as a heated session, the board:

voted 5-2 in favor of rent hikes between 2 and 4.5 percent for a one-year lease and 4 to 6.5 percent for two years

City Limits

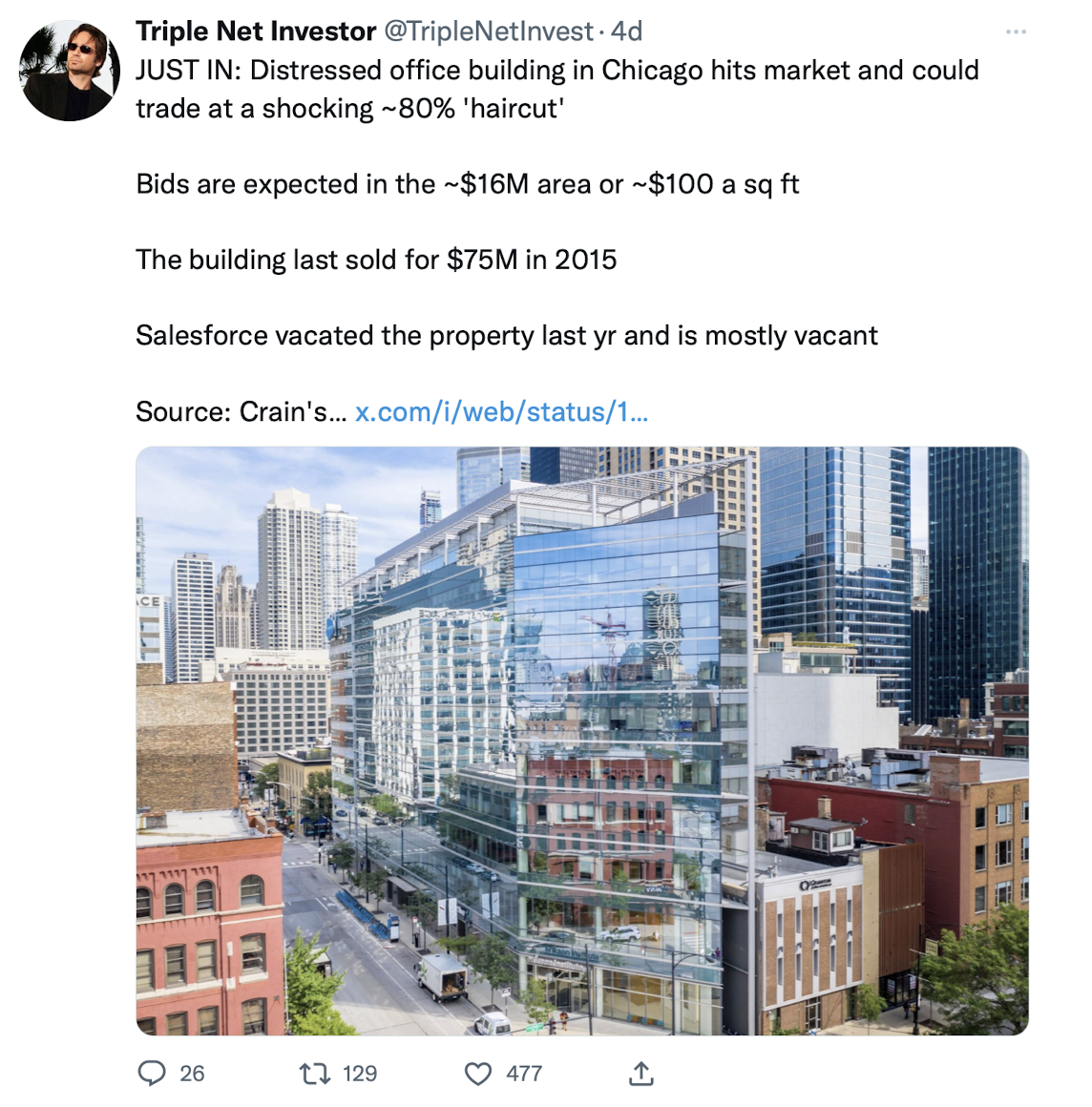

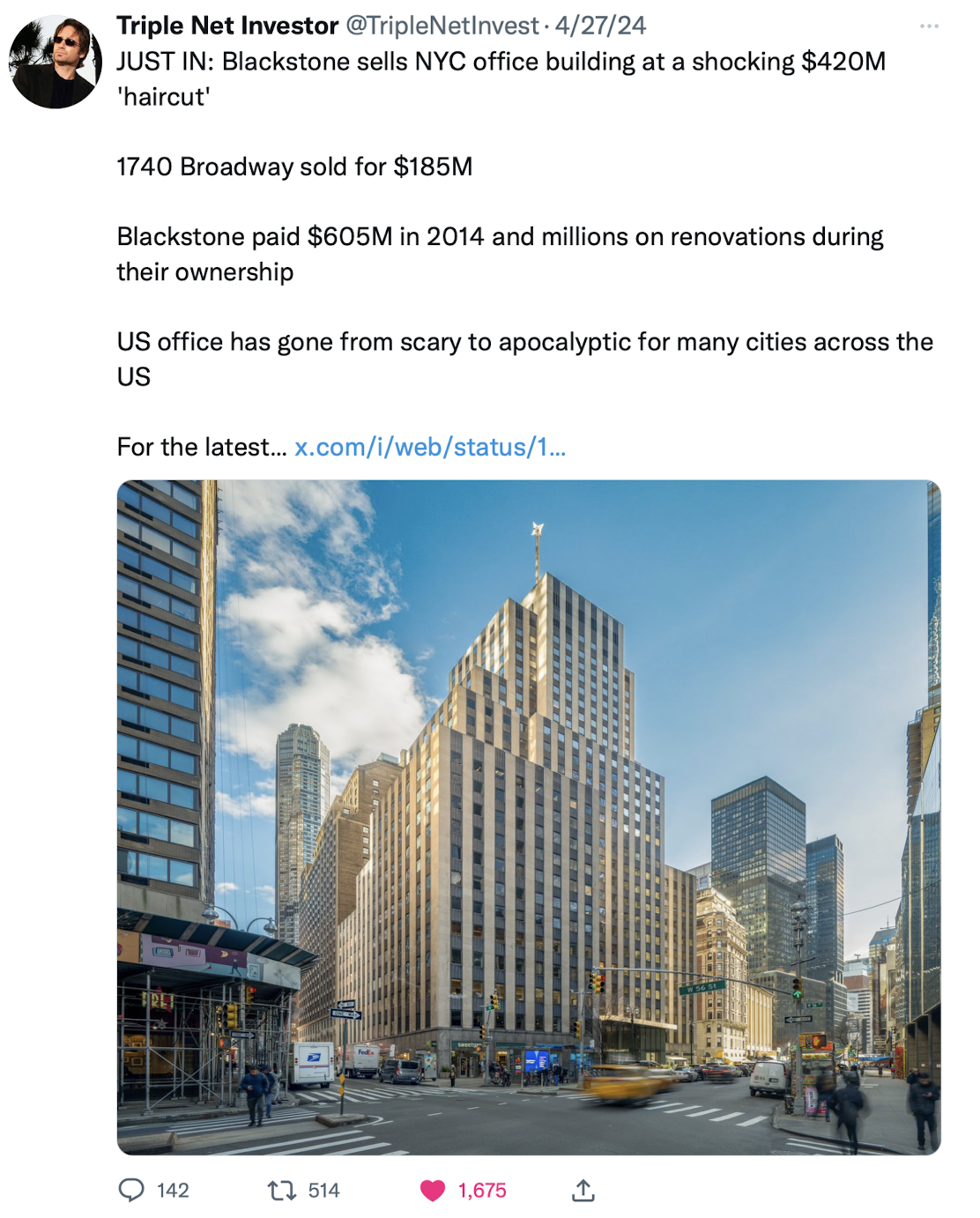

Commercial Office Price Corrections Gone Wild

I continue to post these commercial office math exercises as a constant reminder that WFH is here to stay. We will only see normalized occupancies when the existing financings are written down to allow landlords to drop leasing levels to market levels. We have at least five years, but probably more, in front of us.

For a fascinating breakdown of Chicago’s distressed office market, come for the chest hair, stay for the data, and check out Ten31’s visuals—wow.

And then scroll through some transactions from Chicago, Manhattan, and Tampa below.

Central Bank Central Interview: Bullard: Funds Rate Still Restrictive, Will Push Inflation Back Toward 2%

Here’s a new substack I’m excited about – Kathleen Hays Presents Central Bank Central. I highly recommend it. A long-time friend and journalist, Kathleen Hays has extensive experience interviewing economic experts in Fedworld from her time at Bloomberg Television.

Central Bank Central: Bullard: Funds Rate Still Restrictive, Will Push Inflation Back Toward 2%

Yeah, I think that markets probably went a little too far in their bets that might have to raise rates. I think if you’re a hawk on the committee, I think you can just say, well, we’ll just stay higher for longer. It’s misbehaving, and it did behave that well in the first quarter, but you still have a lot of disinflation that occurred in the second year of 2023, and that has not really been reversed at this point. It’s dispensed.

James Bullard, Former St. Louis Fed Chair

Getting Graphic

Favorite housing market charts of the week of our OWN making

Favorite housing market/economic charts of the week made by OTHERS

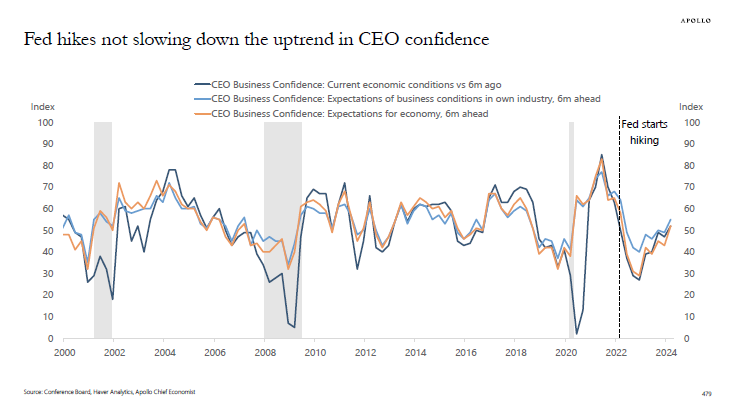

Apollo’s Torsten Slok‘s amazingly clear charts

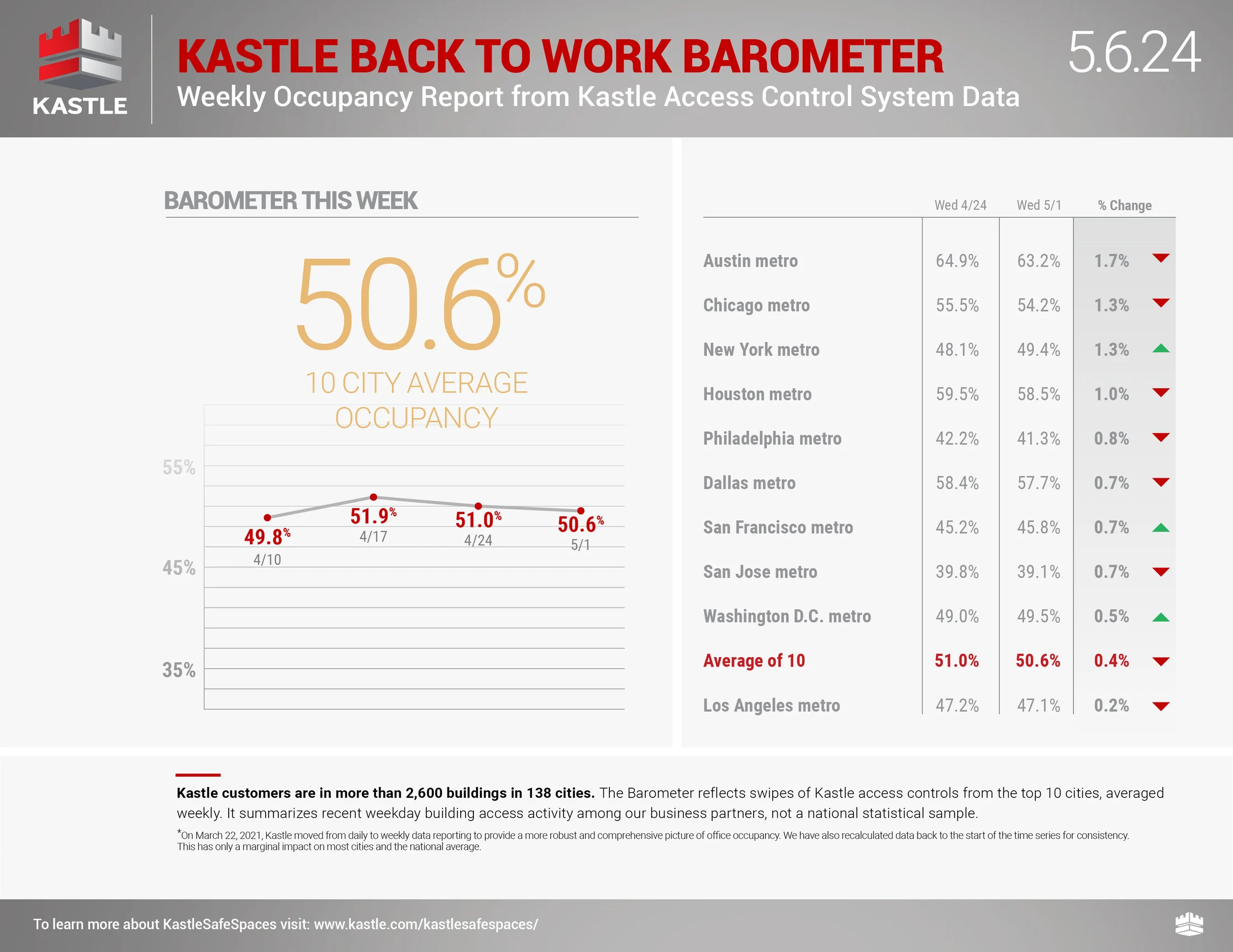

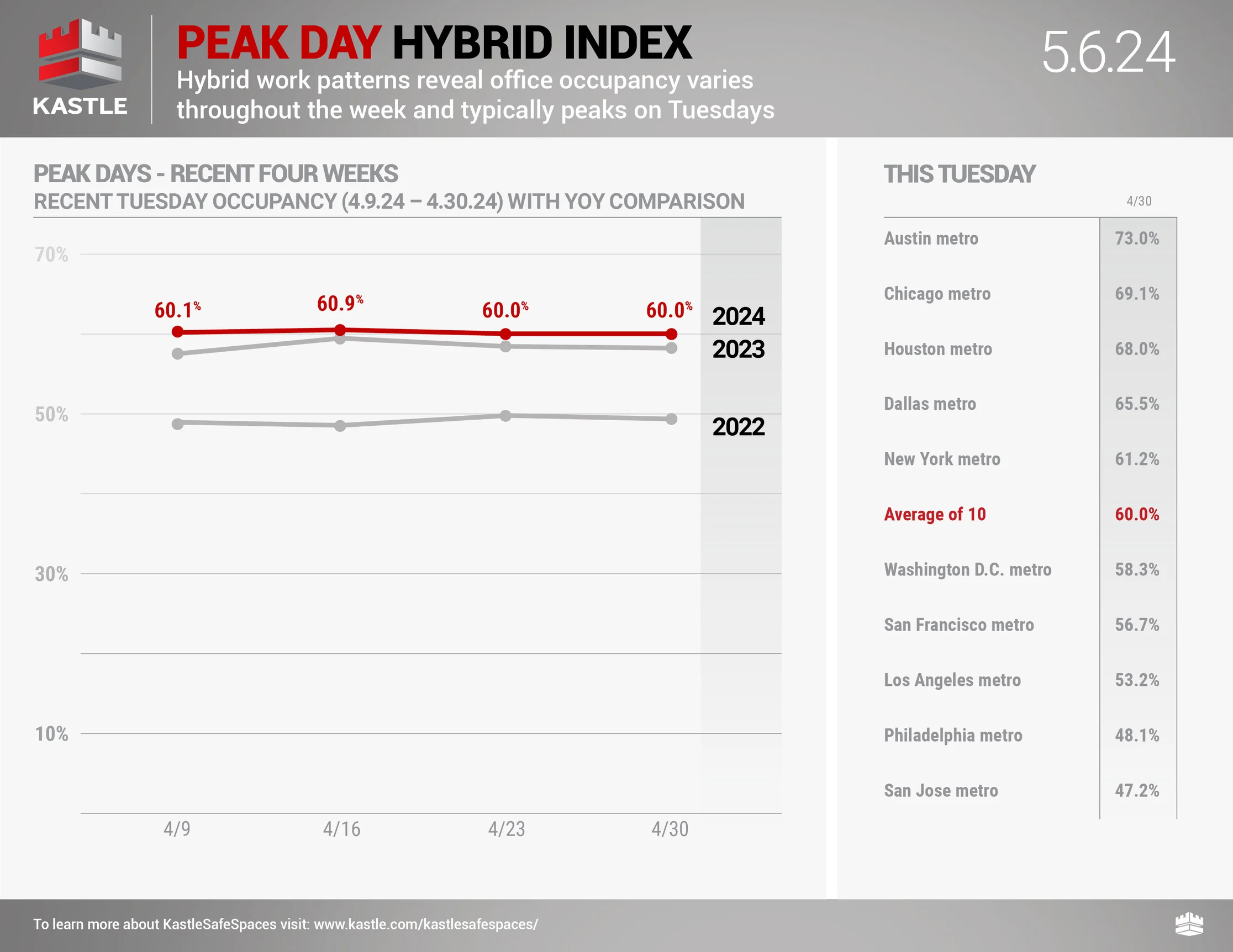

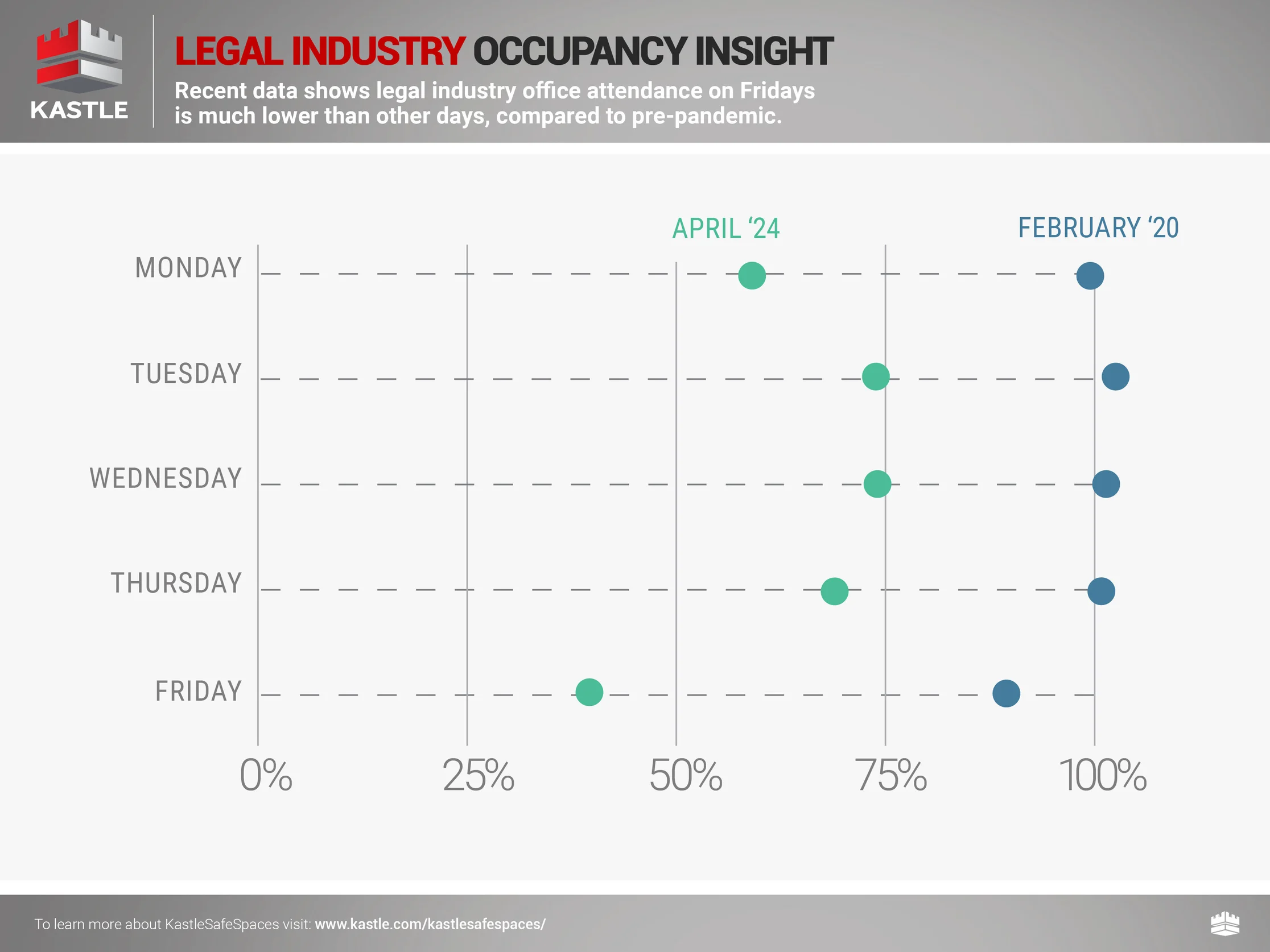

Kastle card swipe data

Remember that Kastle charts are overstating occupancy* because their pre-pandemic occupancy benchmark was 100%, which is incorrect (*measures card swipe activity as a proxy for occupancy). Still, they’ve become the standard benchmark for occupancy rates.

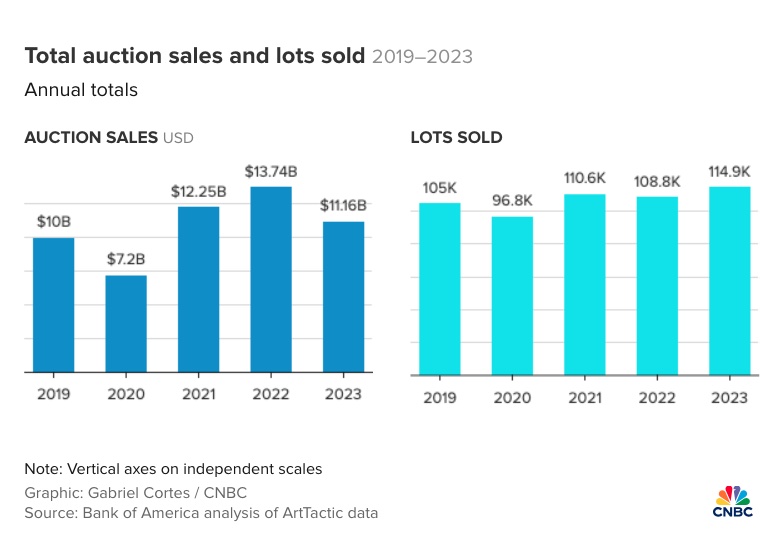

Favorite RANDOM charts of the week made by others

Appraiserville

FOJ Roach Held 6 Committee Positions Because None Of The 17K AI Members Were More Qualified

Last week, I pointed out an AI member from San Diego who responded to the call when JA appointed him to six simultaneous committee positions, and he saw nothing wrong with that. I hope all of you find the hypocrisy in his recent blogging outburst at the AI Blog as sad as I do.

Feeling inspired, Mr. Roach now has a new nickname: “6 Committees (6C)” as we shine a light on his behind-the-scenes character assassinations. Here’s a portion of 6C’s word salad (bold my emphasis as we all know that fact-based commentary is irrational and twisted) as he cosplays an elder stateman:

Folks – just so you know, when I made the original post, I turned off the ability to comment. The purpose of the post was to comment on how sad and pathetic it is that folks in AI would use a irrational blogger to attack a fellow member for their own twisted purposes. I simply wanted the folks who have done this for years to know that we all know who they are and what they’re about.

What does “we all know who they are” even mean, 6C? That you know yourself, personally? FOJs, like 6C, loved being in on the grift when the organization shunned the membership. He was all too happy to serve on six committees in an organization with 17,000 members. Isn’t that irrational and twisted in and of itself if it wasn’t for the grift? Appraisers have been asking 6C to respond to his claims of “lies,” “deceit,” and “conspiracies” he claims are being thrown his way. Still, he remains silent on that because it will dig him in even deeper, and he’s not used to being in the spotlight when secretly savaging his peers. Whiny responses to irrational, twisted bloggers are disqualifying.

If you want more of this bad behavior, zero accountability, lots of first-class flying grift, and no experience running a big organization, then ‘Tank’ is your guy. But suppose you want a path forward without that crippling baggage that FOJs have represented for nearly two decades of leadership, effectively reducing AI to near irrelevance in today’s industry. In that case, the path forward is Craig Steinley.

To membership: is there a choice? You were shut out and ignored by design during the FOJ era, from which 6C and Tank gleefully benefited. Or do you want transparency, warts and all, to understand what AI is doing as Craig has pushed?

Dave Towne’s ROV Critique

Dave is one of those essential people in our industry who continues to share changes as they occur and for which we should be all grateful. He schools us on the May 1st HUD letter:

__________________

Folks…..

Up until recently, there has never been a standardized policy for mortgage loan related Reconsideration of Value (ROV) requests after an appraisal has been submitted. Now there is, per the attached PDF HUD/FHA mortgage letter. The GSE’s have similar policies.

I’m not opposed to having a standardized ROV policy.

However, these policies are in keeping with the new initiatives surrounding alleged and often unproved appraisal bias and discrimination claims.

But when one reads deeper into the reason for implementing these procedures, it is quickly evident that actually it’s focused on the perception that the appraised VALUE is wrong.

This is the statement in the HUD/FHA ML-2024-07: “This included guidance to improve the established process by which FHA program participants may request an ROV if the initial valuation is lowerthan expected.”

OK, so who exactly decided the value should be HIGHER than what the appraiser reported, before an appraisal was ordered? Was it the borrower? The mortgage loan officer handling the loan? A Zillow Zestimate? Maybe the underwriter at the lender?

The document also mentions many times the words “material deficiencies” in the appraisal report which can trigger a ROV request.

So the implication is if the VALUE is too low, then there must be “material deficiencies” present.

And the way the current appraisal climate is being experienced, if an appraiser dares appraise a home in certain neighborhoods based on relevant nearby sales at a lower value “than expected”, then the appraiser can be assumed to be biased toward the borrower. This is especially true if the races of the borrower and appraiser are different.

Also included in these new ROV policies are allowances that the ROV requestor can submit up to FIVE additional properties for consideration.

It seems prudent to me that mortgage lending appraisers had better start including info on their ‘comp’ searches, and provide in the report details of sold properties that were considered but ultimately not used as a comparable in the report. That way, if the ROV requester submits one or more of those properties to be considered, the appraiser merely can respond with the already included discussion about the rejected properties.

__________________

OFT (One Final Thought)

I literally and figuratively have no final thoughts this week other than some exciting new content and format changes coming to Housing Notes!

Brilliant Idea #1

If you need something rock solid in your life – particularly on Friday afternoons at 2:00 PM, Eastern Time (ET) – and someone forwarded this to you, you can sign up here for these weekly Housing Notes. And be sure to share with a friend or colleague if you enjoy them because:

– They’ll walk randomly all over the place;

– You’ll have elevated interest;

– And I’ll be driving off a cliff.

Brilliant Idea #2

As a reader of Housing Notes, you’re clearly full of insights and ideas. Consider sharing them with me early and often. I appreciate every email I receive, as it helps me craft future Housing Notes.

See you next week!

Jonathan J. Miller, CRE®, Member of RAC

President/CEO

Miller Samuel Inc.

Real Estate Appraisers & Consultants

Matrix Blog @jonathanmiller

Reads, Listens and Visuals I Enjoyed

- Related Sells 321 West 44th Street at $103M Loss [Commercial Observer]

- Exclusive | Buyers Battle Over Sean Hannity’s Long Island Home, Which Sells for Roughly $12.7 Million Cash [Wall Street Journal]

- How Much Is Mar-a-Lago Actually Worth? It’s a Billion-Dollar Question. [Wall Street Journal]

- How Much Is Mar-a-Lago Actually Worth? It’s a Billion-Dollar Question. [Mansion Global]

- Homebuilders are still buying down rates to move houses [HousingWire]

- High-end condos, co-ops bright spots for Manhattan in May [Inman]

- After backlash, Bing is removing MLS listings [Real Estate News]

- Homes for Sale Are Piling Up, Just Not Where the Buyers Are [Bloomberg]

- 😮 Foreclosure, Fines and Forklifts [Highest & Best]

- National Housing Survey [Fannie Mae]

- ECB Sends Message of Confidence on D-Day Anniversary: Finel-Honigman [Kathleen Hays CBC]

- Manhattan Resi Market Stays Flat [The Real Deal]

- Manhattan’s $5 Million-Plus Condos Outperformed an Otherwise Sluggish Real Estate Market in May [Mansion Global]

- Asking Rents Mostly Unchanged Year-over-year [Calculated Risk]

- Vague Threats That Make No Sense [Notorious Rob]

- Hamptons Resi Market Perks Up [The Real Deal]

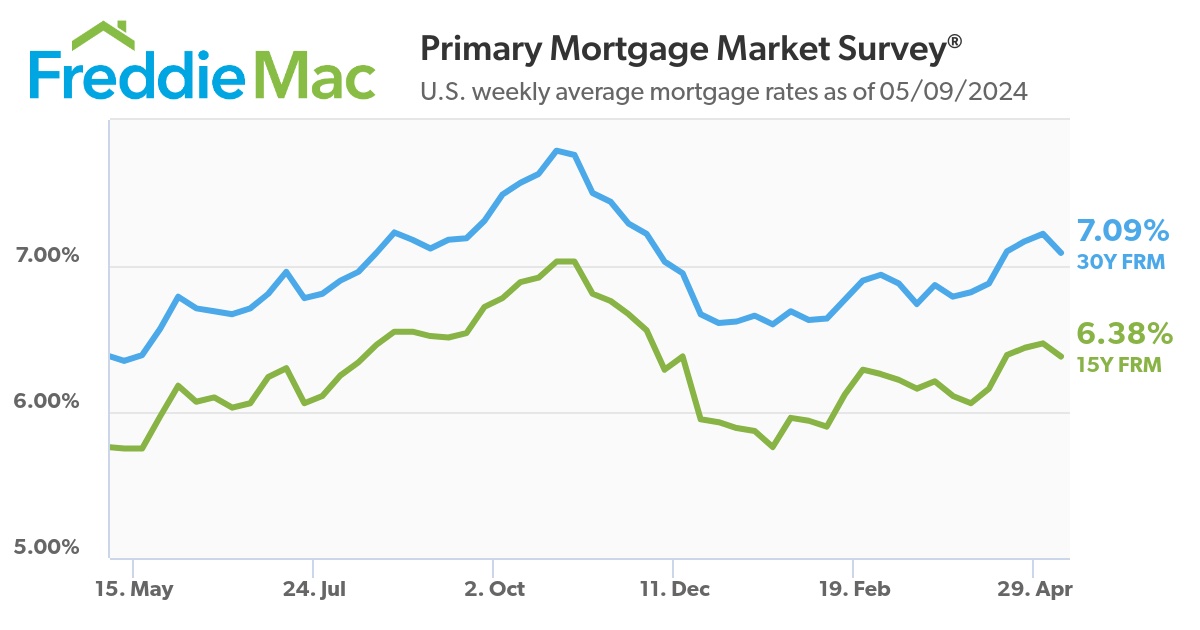

- Mortgage Rates [FreddieMac]

- Hiring blows past expectations, showing lingering labor market heat [Axios]

- I'm Overspending on Rent in New York. Should I Stop? [Bloomberg]

My New Content, Research and Mentions

- ‘Toxic’ lawsuit tanks sale prices at NYC ‘Billionaires’ Row’ luxury tower: report [NY Post]

- A Mega-Lawsuit, a Rush of Listings and Price Cuts Galore: What’s Going on at 432 Park? [MSN Money]

- Exclusive | A Mega-Lawsuit, a Rush of Listings and Price Cuts Galore: What’s Going on at 432 Park? [Wall Street Journal]

- Luxury Murray Hill apartment building sells for $68M [Crain's New York]

- Drew Barrymore Quickly Finds Buyer for Hamptons Farmhouse [The Real Deal]

- With a glut of listings, and homes selling at a loss, NYC’s famed Plaza is losing its luster [NY Post]

Recently Published Elliman Market Reports

- Elliman Report: Florida New Signed Contracts 5-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 5-2024 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 4-2024 [Miller Samuel]

- Elliman Report: California New Signed Contracts 4-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 4-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 4-2024 [Miller Samuel]

- Elliman Report: Manalapan, Hypoluxo Island & Ocean Ridge Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Lee County Sales 1Q 2024 [Miller Samuel]

- Elliman Report: San Diego County Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Orange County Sales 1Q 2024 [Miller Samuel]

Appraisal Related Reads

- HOA fees are standing out in a bad way [Sacramento Appraisal Blog]

- FHA Announces New Guidelines Allowing Borrowers to Challenge Appraisals [The National Law Review]

- An insurance crisis wasn’t on my bingo card [Sacramento Appraisal Blog]

- Freddie Mac Calls Halt on New Loans From Appraiser BBG [Commercial Observer]

- Fannie, Freddie's Offshore Gambit Imperils Privacy of Millions [Appraisers Blogs]

- The Appraiser's Guide to Evaluating Home Value Before You Buy [Birmingham Appraisal Blog]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)