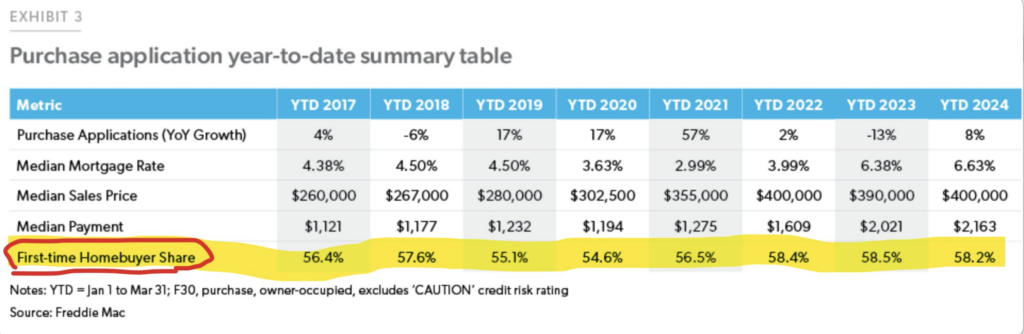

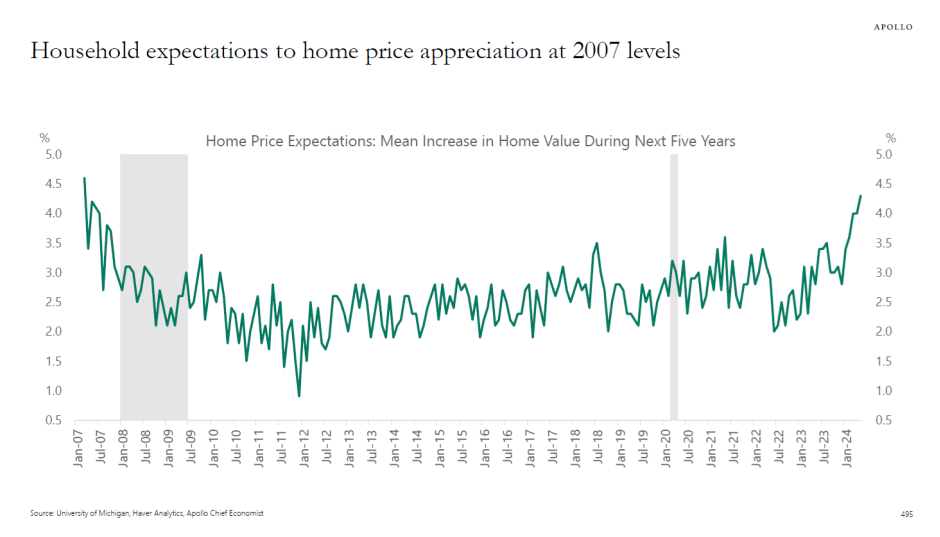

The housing market tends to see increased demand and more listing inventory this time of year to create the first big hump of each two-hump camel annual pattern. However, the uptick in sales has been a bit underwhelming. As a “non-economist” and market analyst (and an appraiser), I would submit that the stubbornness of high rates and the uncertainty of an election year has moderated the temperature a bit. However, mortgage rates have fallen a bit over the past couple of weeks, and the spring seasonality may still happen but be pushed a little later on the calendar.

Yet another reason to love NYC! Cheeseball Man!

Did you miss last Friday’s Housing Notes?

May 10, 2024: Tracking Where Fed Policy Is Running

Big Plans For Housing Notes

In the coming months, we are expanding and tweaking this Housing Notes effort, which I began in March 2015 and have never missed a Friday. The newsletter has an unusually high open rate and a large devoted following, which I appreciate enormously. We are converting this weekly effort to five days per week instead of the monster I write every Friday morning. We’ll be adding video, audio, and more social media integration. I am also moving Appraiserville off this platform and onto a new one to tighten up the focus of Housing Notes itself. I’m excited about these next steps and hope you find HN even more informative, fun, and useful than what attracted you here in the first place—more details to follow.

Incidentally, the image below was sent to me by a creative real estate agent as a suggested event. Rest assured, this type of event is not in our plans for Housing Notes, although I appreciated the suggestion. I still don’t have any tattoos.

But I digress…

First Time Buyers Still Lead The Way

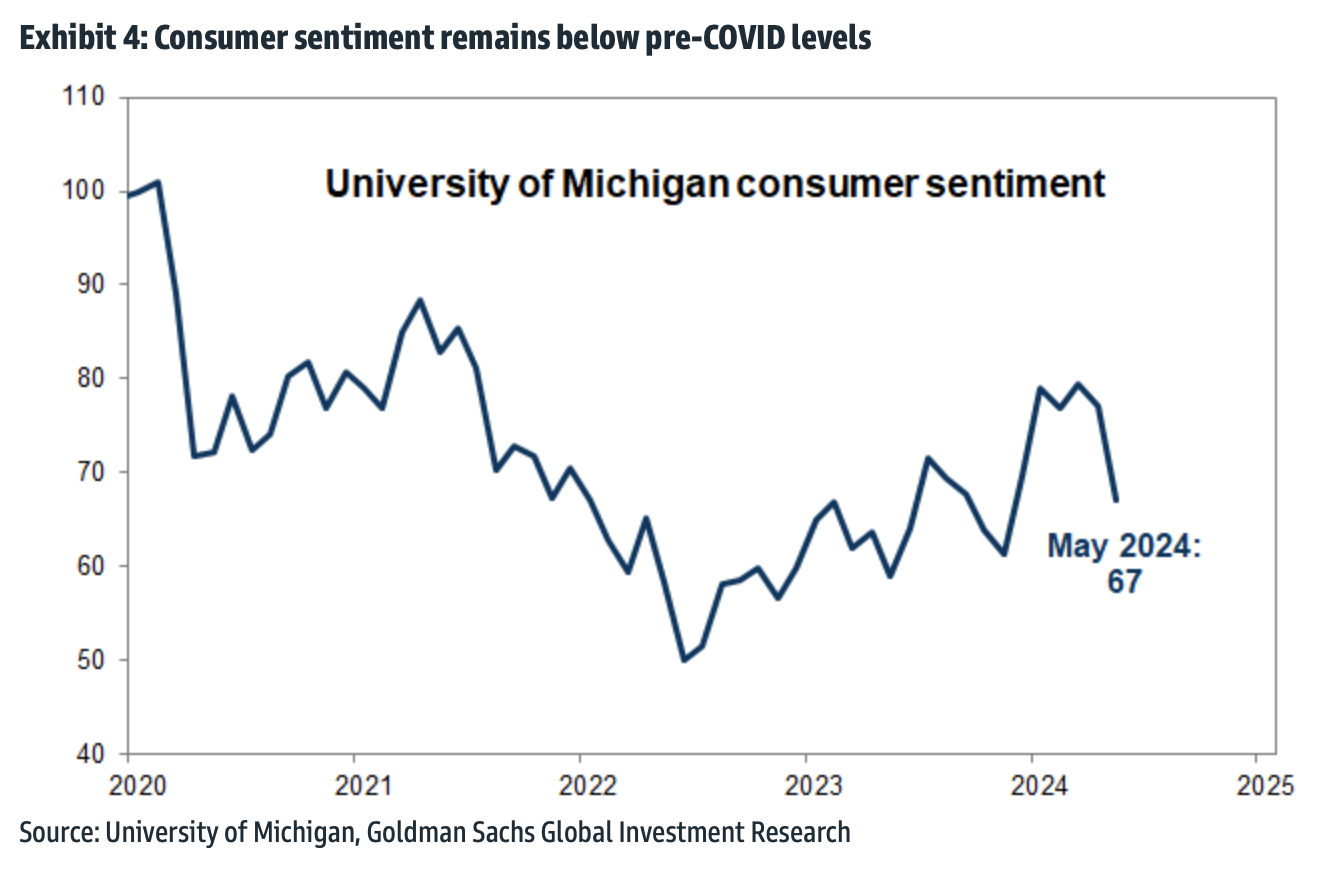

Looking at purchase application data of first-time homebuyer purchase applications from Freddie Mac, it is unfazed by higher mortgage rates – remarkably consistent. This insight is from Jay Parsons, an essential follow on Housing Twitter, even though Twitter/X has become hit-or-miss, limited engagement toxicity.

The Lessons Of Surfside Remain Important And Critical

One of the lessons of the Surfside Condo tragedy reminds me of a Warren Buffet quote:

Don’t ask the barber whether you need a haircut.

Daniel S. Greenberg, then made famous by Warren Buffet

In other words, when you ask someone for an opinion who benefits from your action or lack of action, they are not an unbiased source. Why should the condominium board determine whether expensive repairs need to be made? As we saw in Surfside, pushing repairs out into the future by an entity that wants to avoid incurring significant costs can end tragically.

The WSJ did a good piece on the Surfside collapse aftermath in New Florida Law Roils Its Condo Market Three Years After Surfside Collapse. The rise in supply in South Florida is skewed heavily toward buildings older than thirty years, which has created two different markets. It’s a tough situation for those in those older buildings looking to sell, especially as banks push back, necessitating cash buyers. Newly developed units tend to be a lot more expensive than older resales.

The Commercial Real Estate Chronicles Continued

This probably means I won’t get my outstanding consulting fee from this first example.

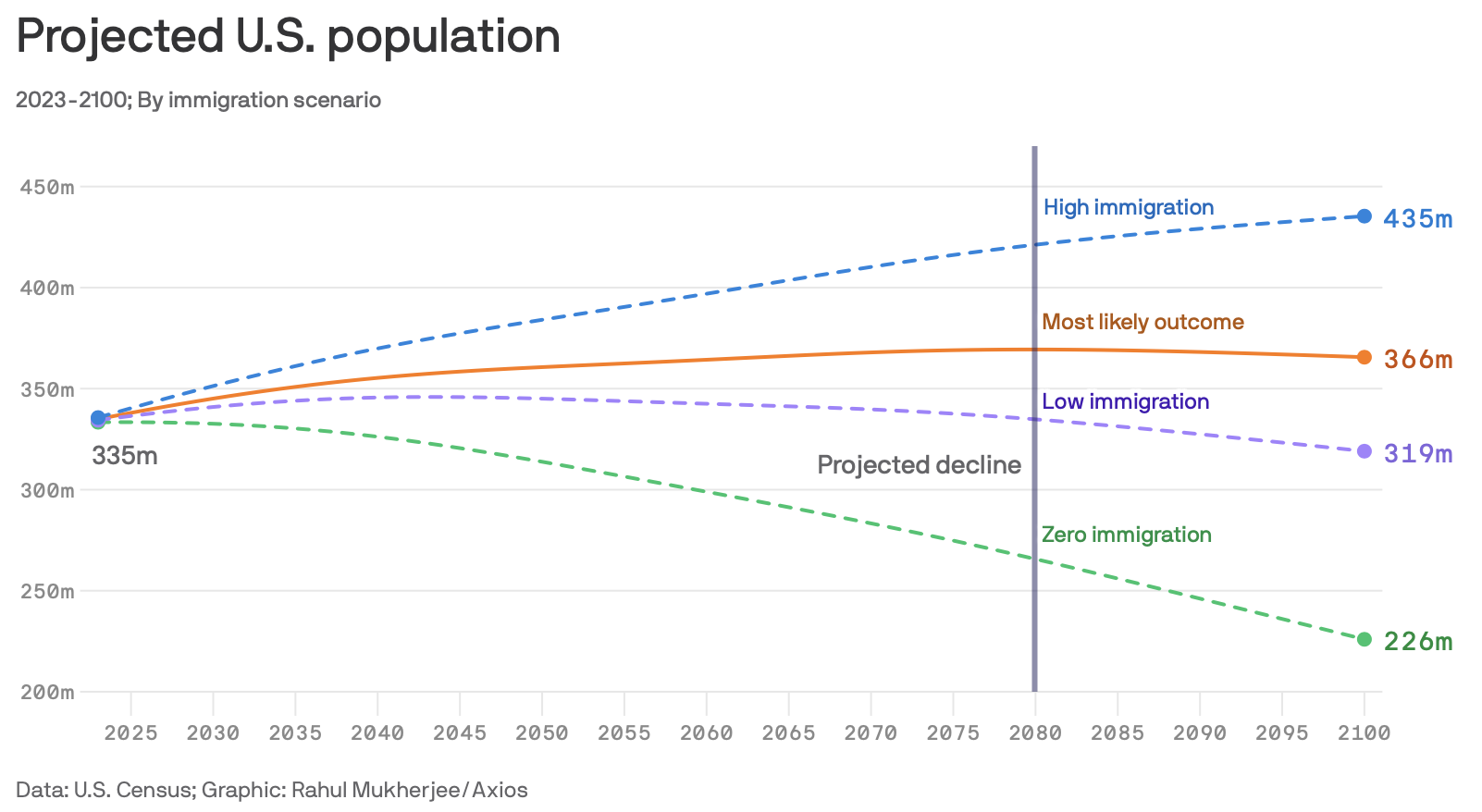

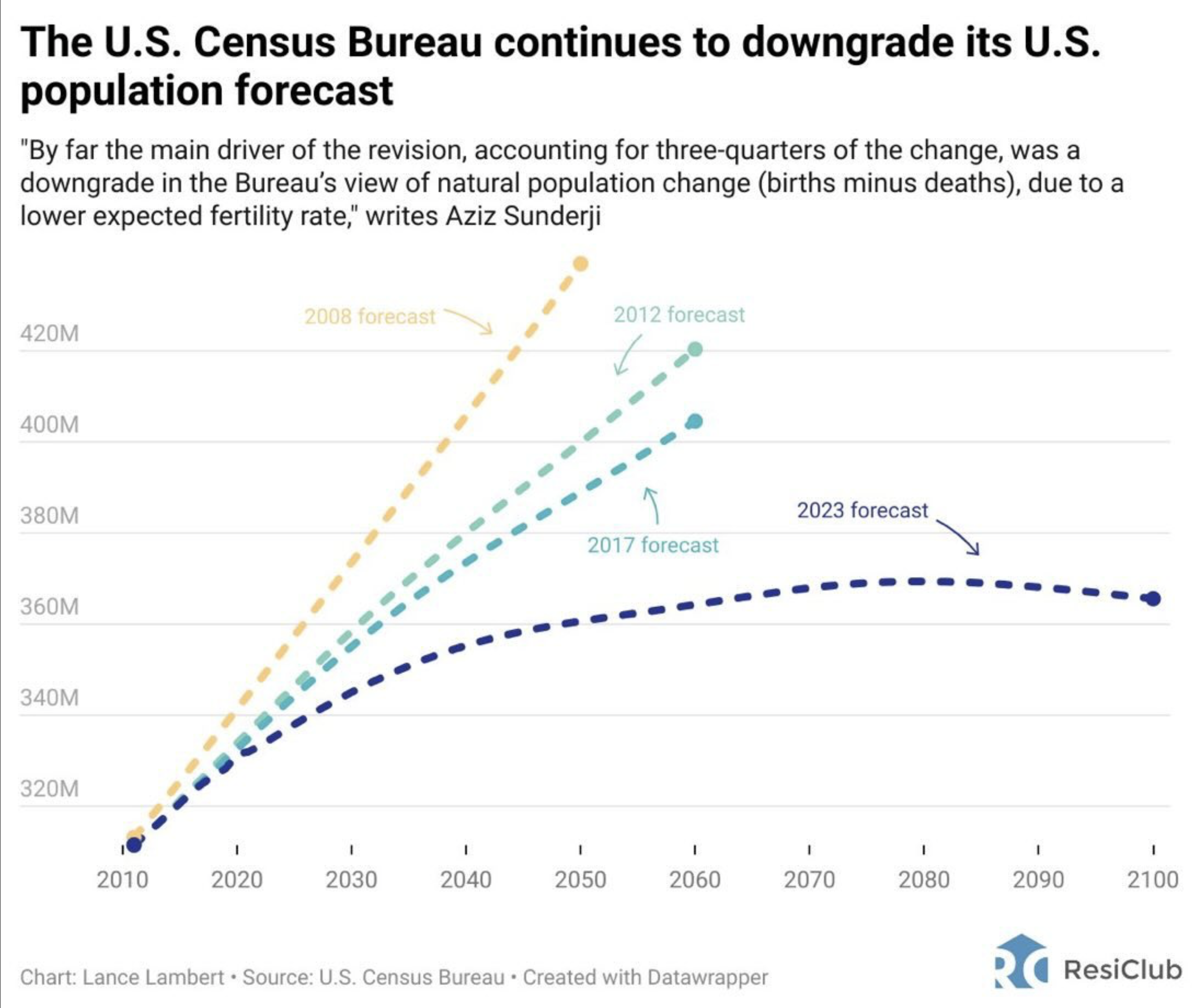

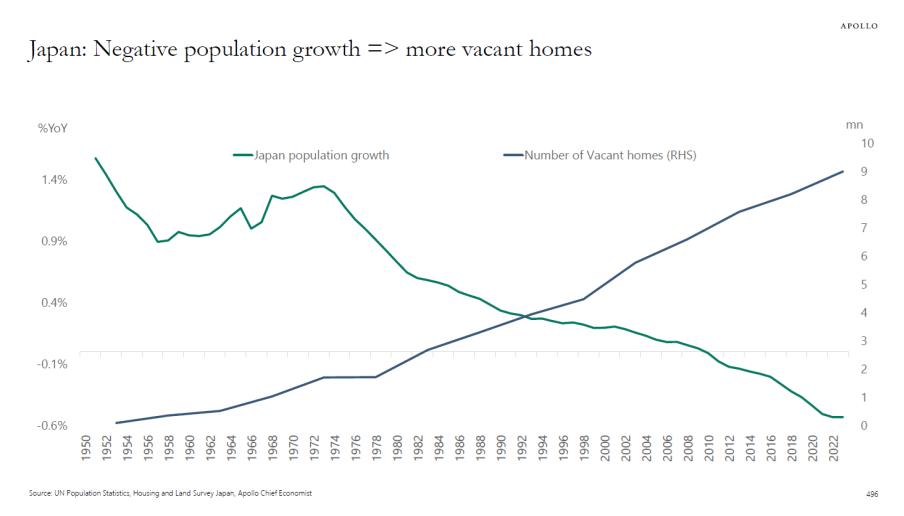

The U.S. Population Growth Rate Keeps Being Downgraded

Back in 2021 I read Zelman & Associates groundbreaking piece “Cradle to Grave: Let’s Face It, We Have a People Problem” which is behind a paywall. The rules we learned in our careers about population growth are no longer reliable. And that’s why our falling birth rate is going to cause havoc on housing supply forecasting.

But let’s be contrarian by looking at Detroit, where a bunch of my family lives. This NY Times piece on Detroit’s population actually growing for the first time since 1957 is something I thought I would never hear in my lifetime. I suppose I have to thank Quicken Loans for revitalizing the downtown. Rules of thumb on population we grew up with are being broken all the time.

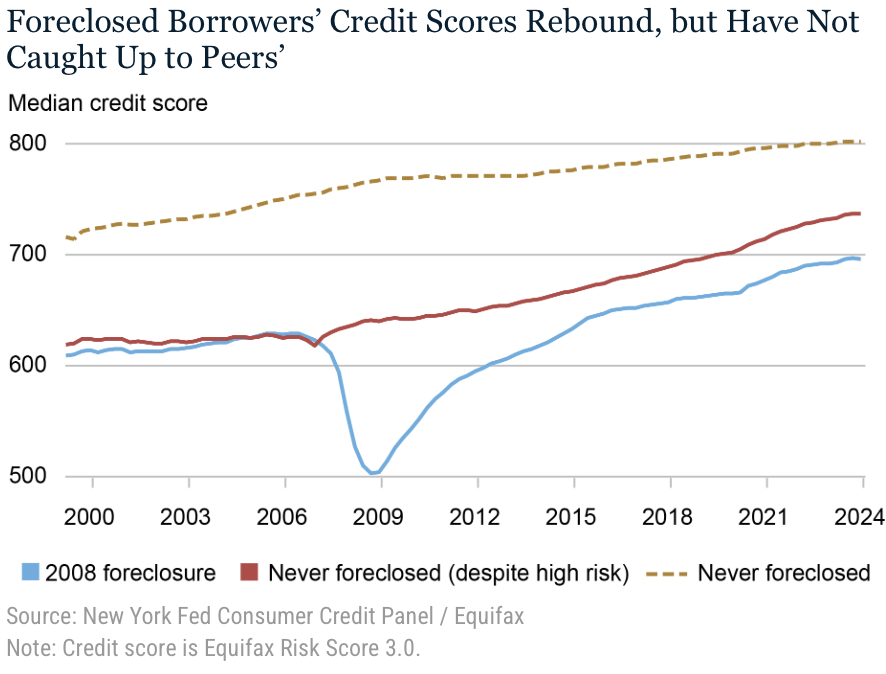

NY FED Checks In On Those Foreclosed During The Housing Bubble And They Remain Scarred

The piece is a great read: How Are They Now? A Checkup on Homeowners Who Experienced Foreclosure. In the current environment, foreclosures are a shadow of their 2010 selves but those climbing out of foreclosures still have lower credit scores.

The period of delinquency before the foreclosure starts results in a 150-point credit score drop on average and with an average score falling below 500; the addition of the flag itself is associated only with a small additional decline in the score. The average credit score steadily improves from that point as the foreclosure note ages, eventually increasing by an additional average of 20 points when the foreclosure note drops off.

NY Fed

The scars after a foreclosure remain long-term.

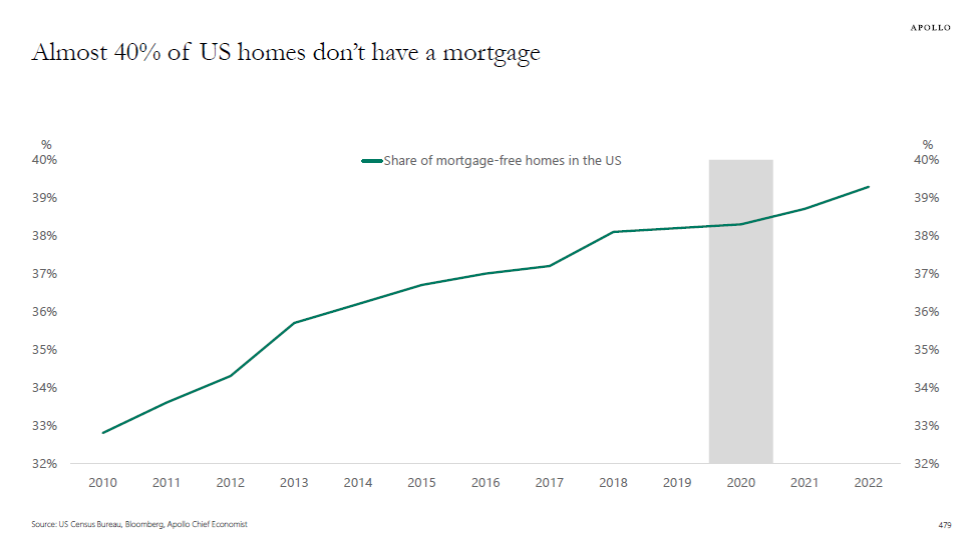

Mortgage Delinquencies Are Not A Thing This Time

Whenever I see a headline about mortgage delinquencies or foreclosures, I harken back to the 2010-2012 peak foreclosure. But the reality in this cycle is far different than before. Lenders did not lose their minds and crush lending standards to zero. Unemployment and wages are low, and creative lending products are largely non-existent.

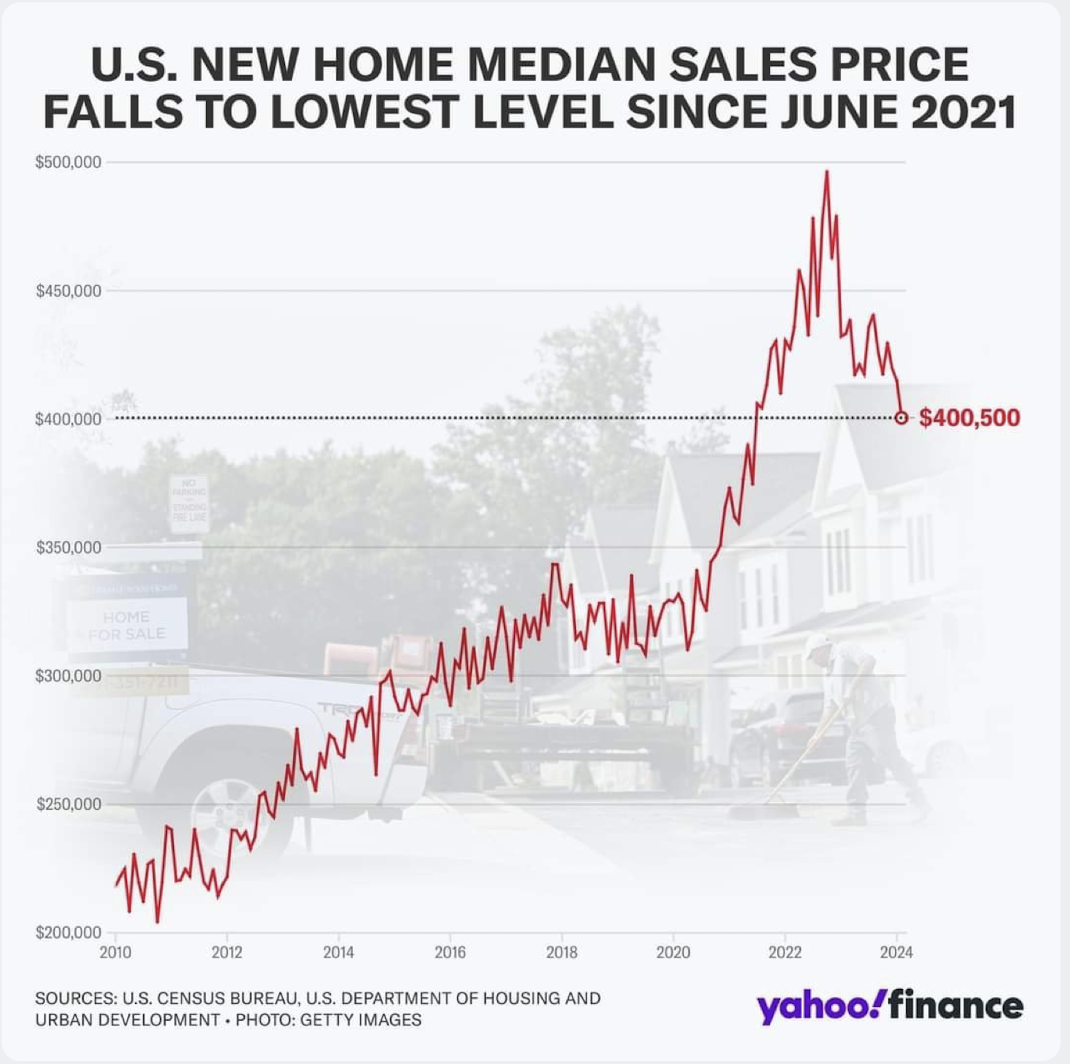

New Homes Can Be Built Quickly And Can Add More To Housing Supply Sooner Than Resale Supply

Despite the historic market share relationship of 90% Existing/10% New, New can come to market much faster than resale supply. Resales need mortgage rates to drop sharply for a lot of supply to enter the market and break the lock-in effect.

Just look at Dallas/Houston.

Highest & Best Newsletter: 😭Broken Condo Blues

If you’re interested in the Florida housing market, you should sign up for this Florida newsletter, Highest & Best, from Oshrat Carmiel, formerly of Bloomberg News…

This week’s post:

😭Broken Condo Blues – Florida condo owners are scrambling; submerged island for sale

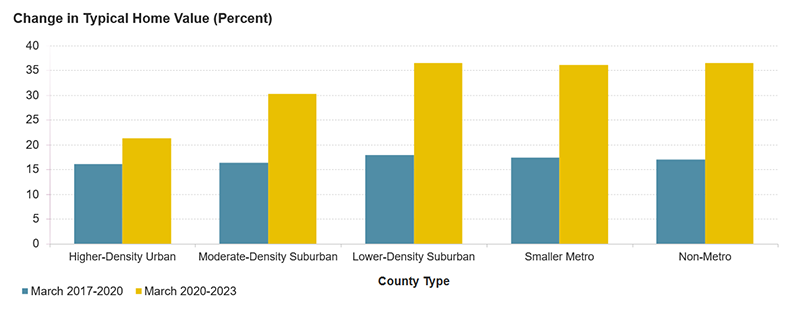

Rural Housing Markets Grew Faster Than Higher Density Markets

The JCHS of Harvard University has a fascinating study The Geography of Pandemic-Era Home Price Trends and the Implications for Affordability that confirms what many of us already knew:

…rapid home price growth was not uniform geographically. The expansion of remote work enabled many households to look further afield for housing, accelerating migration trends away from larger, higher-cost places in favor of lower-density, lower-cost counties and rural areas.

JCHS

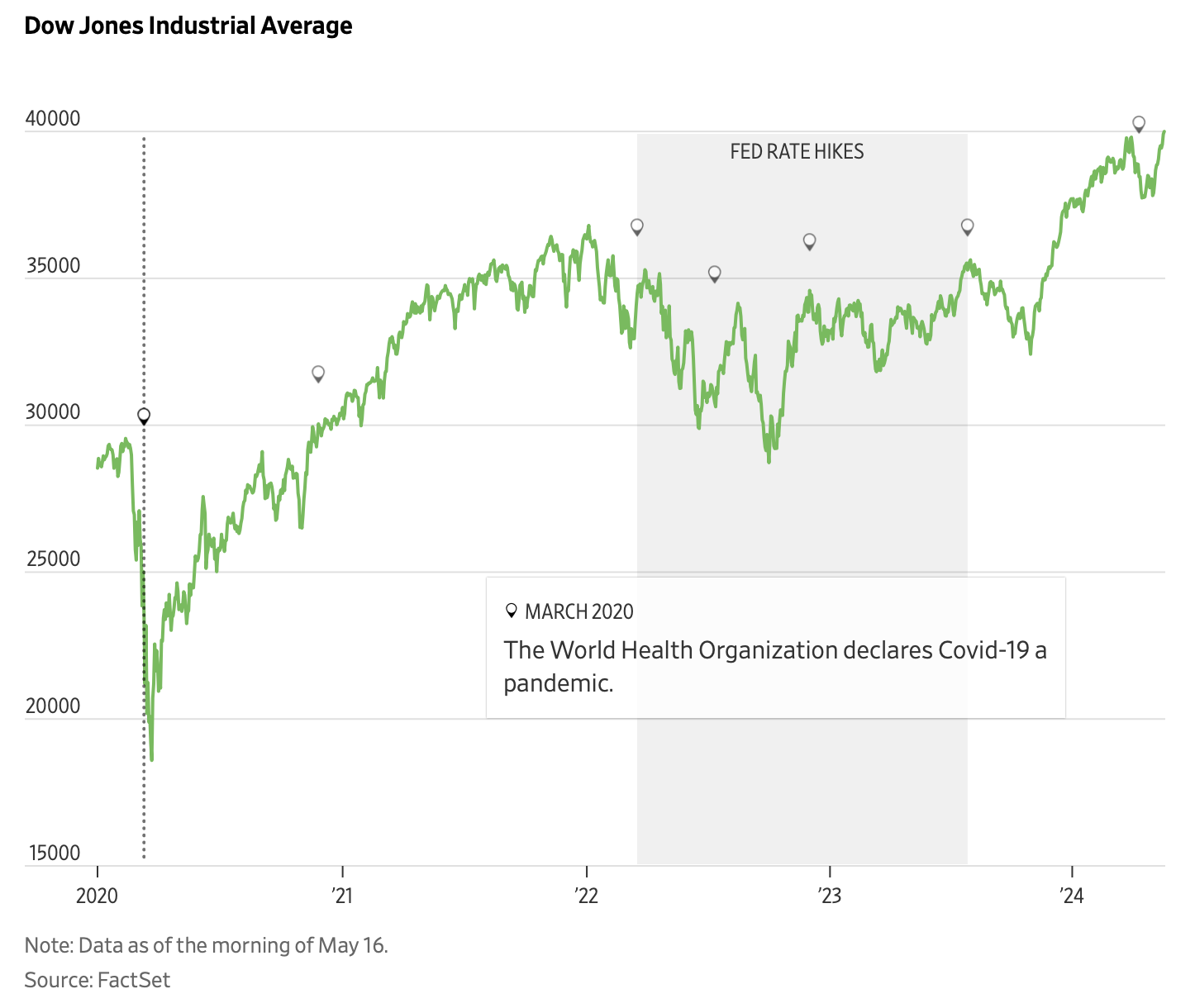

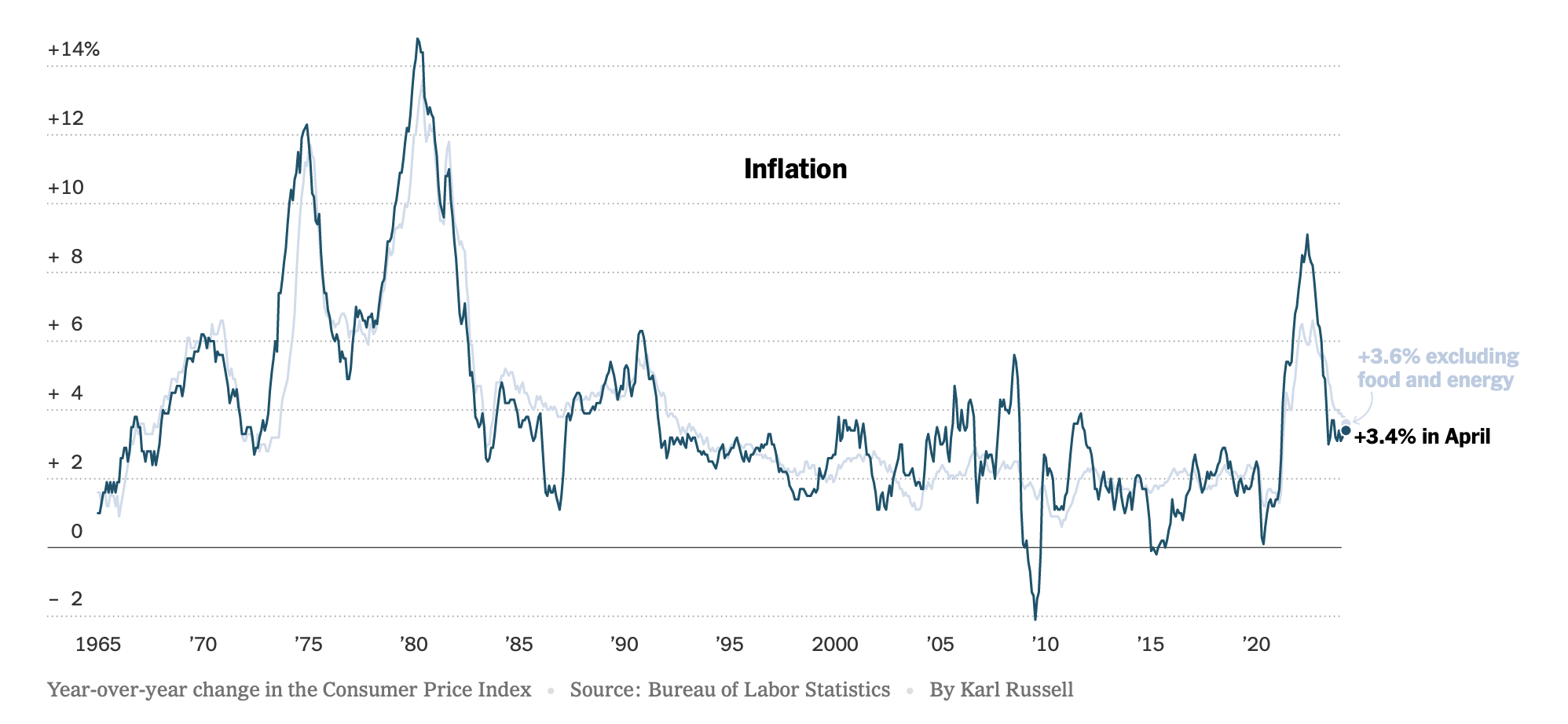

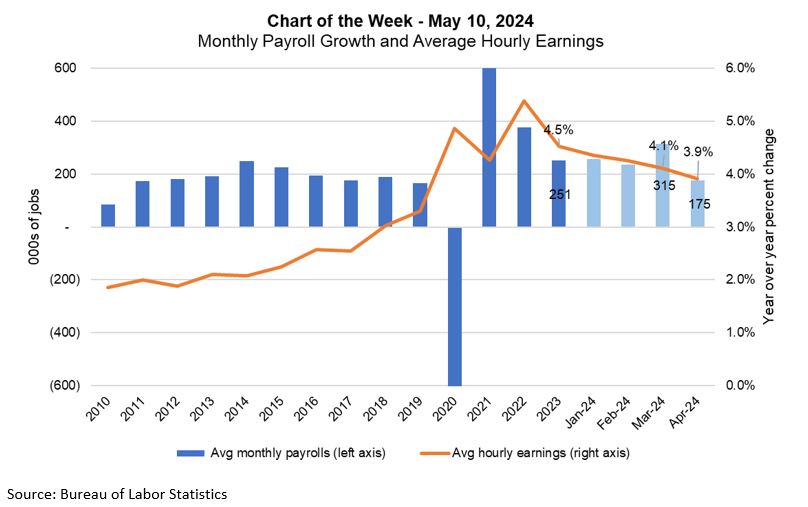

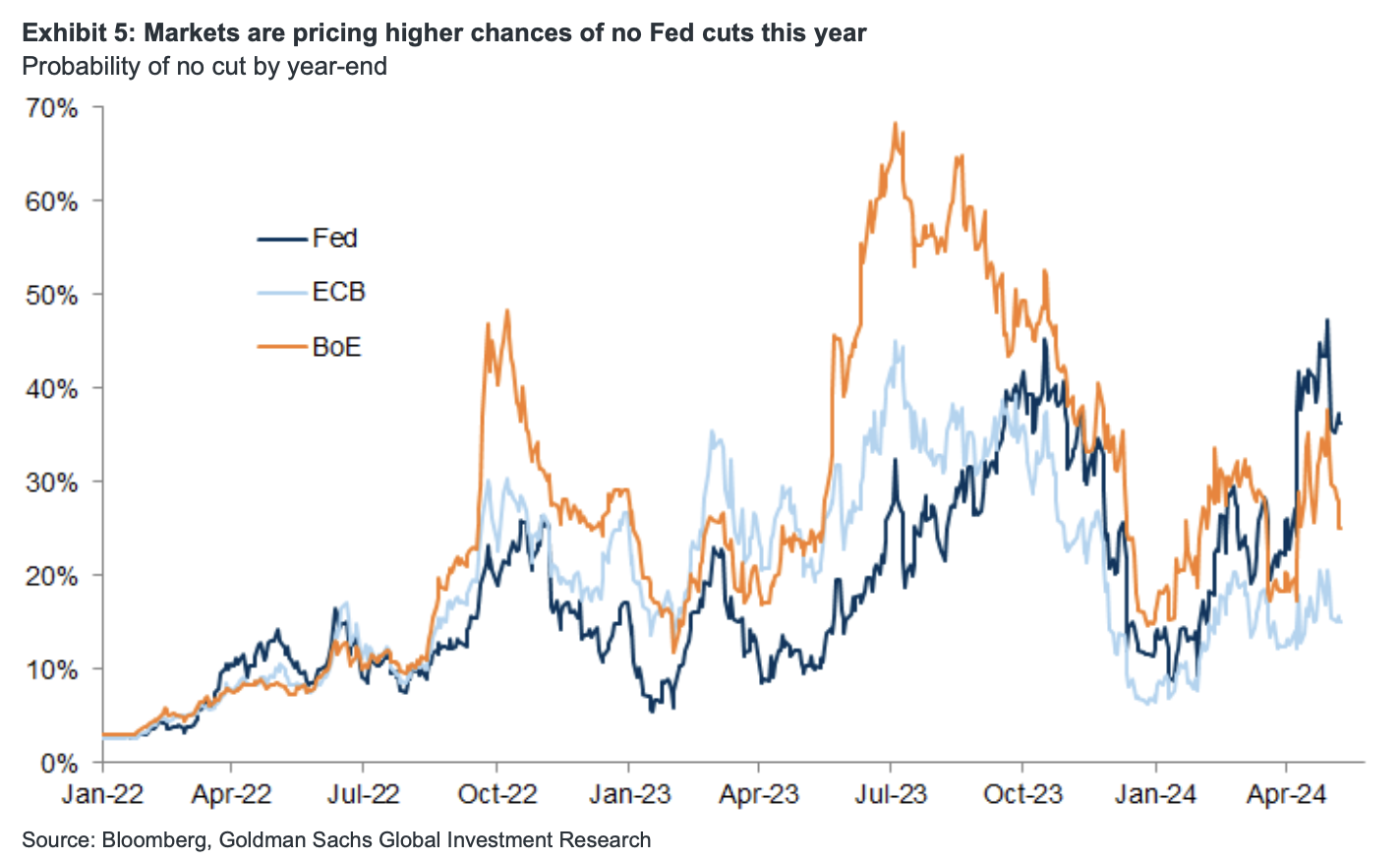

While The Fed Cuts Are Likely To Occur Later Than Sooner, The Data Still Suggests Cuts Are Coming Eventually (LOL)

More evidence that mortgages rates will fall as the ten-year is falling now. When 10-year treasury yields fall, fixed rate mortgages tend to fall as well.

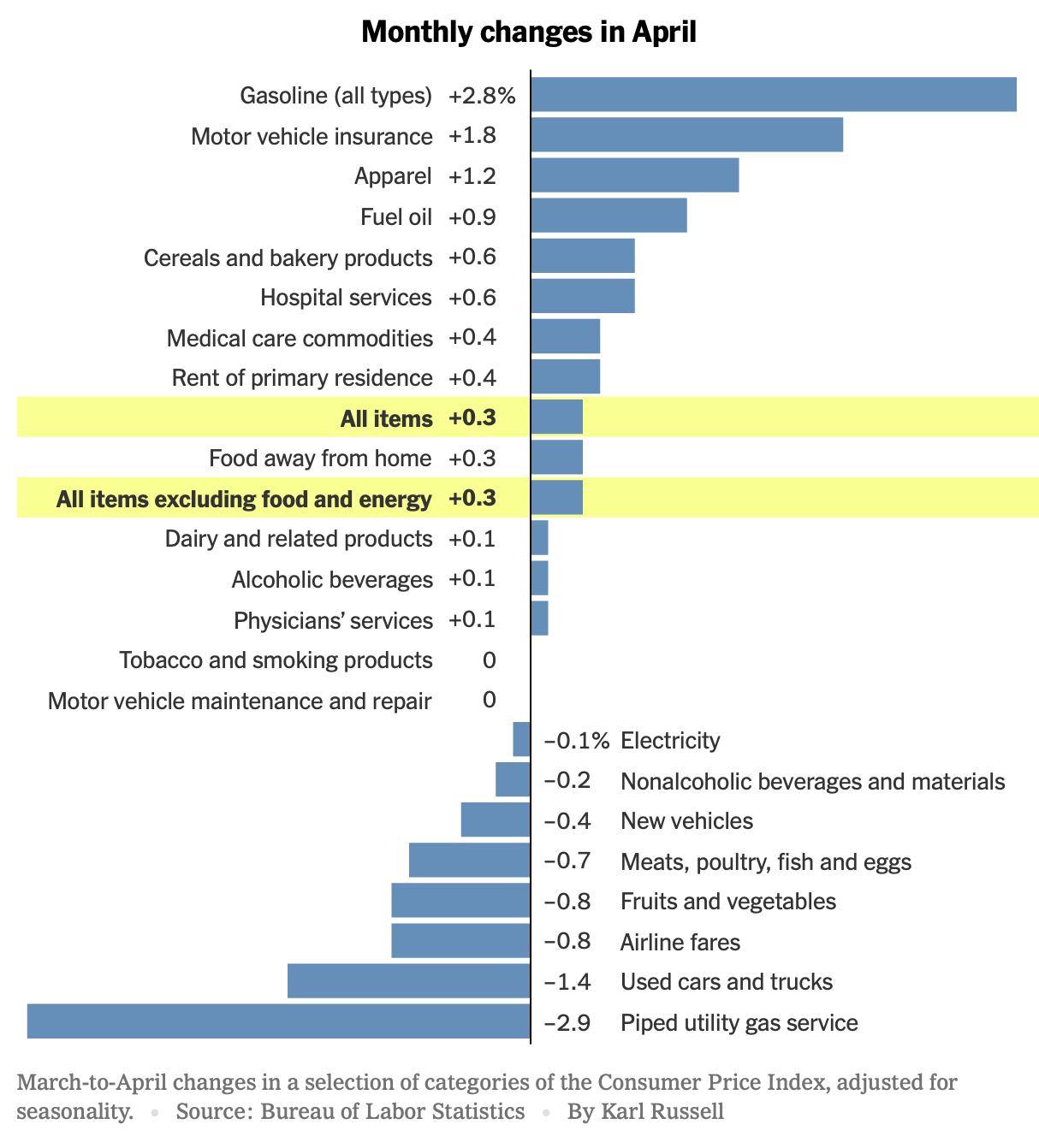

Also, inflation seems to be settling around 3% for now in this excellent NYT piece: Inflation Moderated Slightly in April, Offering Some Relief for Consumers.

Who knew there was so much more about inflation and mortgage rates than we understood before the Fed pivot in early 2022!

Central Bank Central Interview: Kroszner: Fed Must Elevate Role of Financial Stability

Here’s a new substack I’m excited about – Kathleen Hays Presents Central Bank Central. I highly recommend it. A long-time friend and journalist, Kathleen Hays has extensive experience interviewing economic experts in Fedworld from her time at Bloomberg Television.

Central Bank Central: link to interview

Getting Graphic

Favorite housing market charts of the week of our OWN making

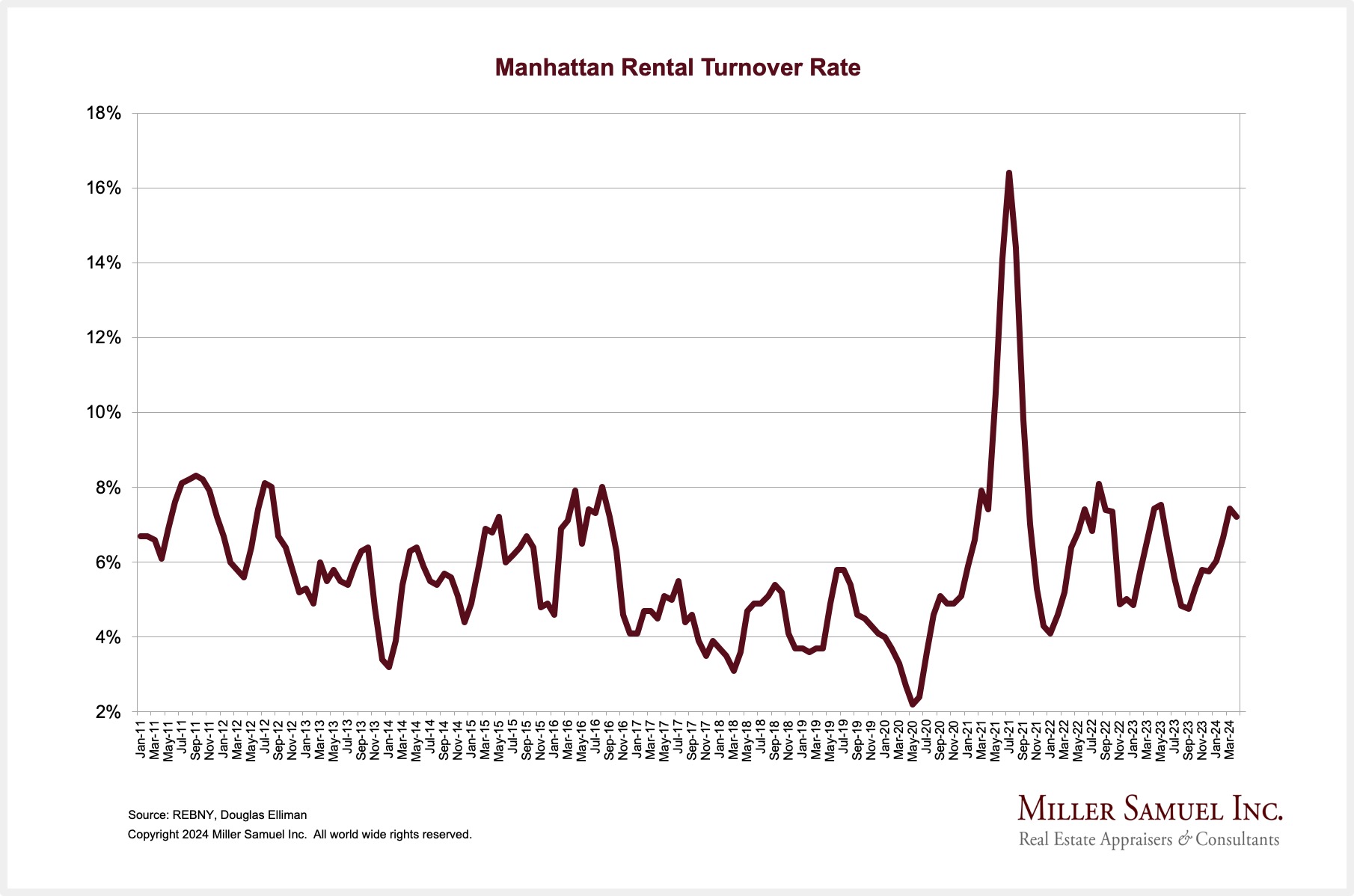

I run into this quite a bit when appraising in Manhattan. Co-op and condo buildings tend to see a 5-7% unit turnover if there is no distressed activity, significant litigation or some new problem brewing.

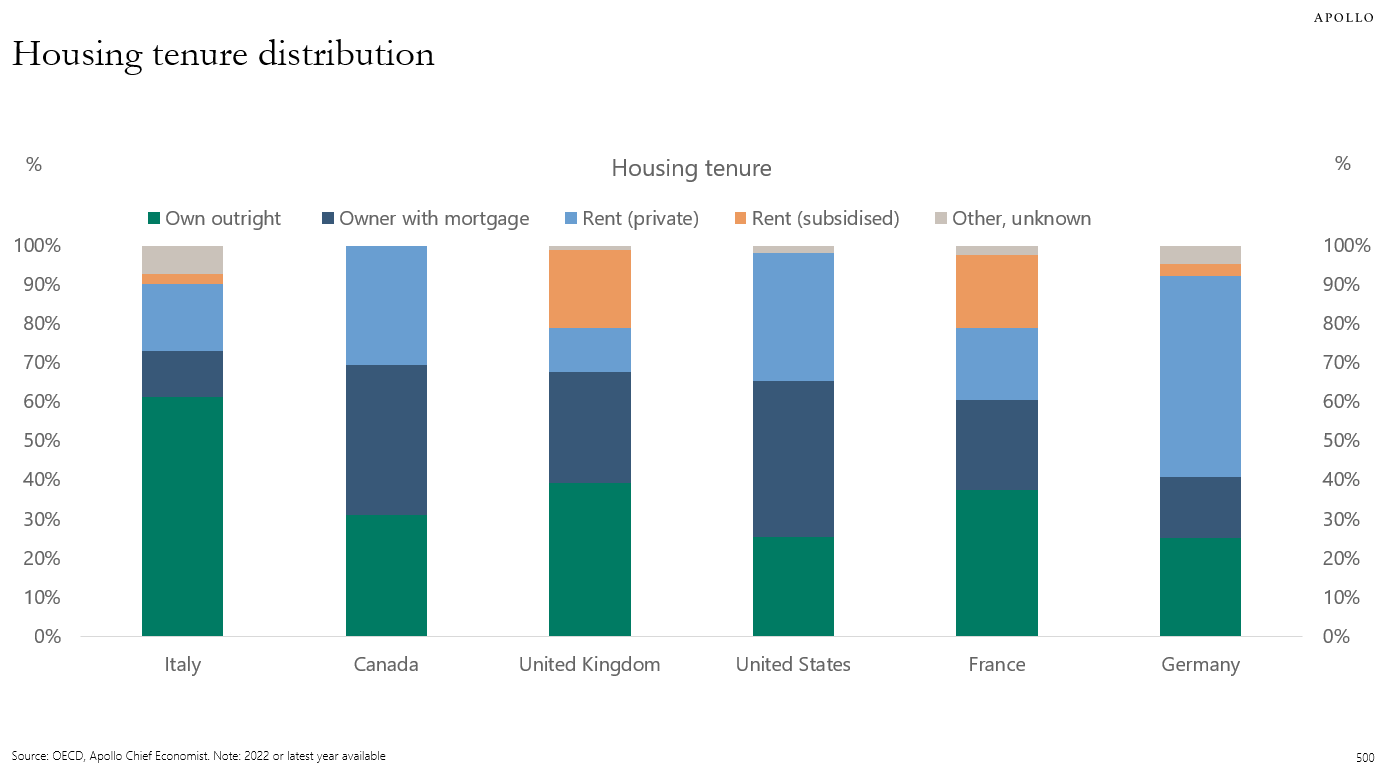

Favorite housing market/economic charts of the week made by OTHERS

Apollo’s Torsten Slok‘s amazingly clear charts

Kastle card swipe data

Remember that Kastle charts are overstating occupancy* because their pre-pandemic occupancy benchmark was 100%, which is incorrect (*measures card swipe activity as a proxy for occupancy). Still, they’ve become the standard benchmark for occupancy rates.

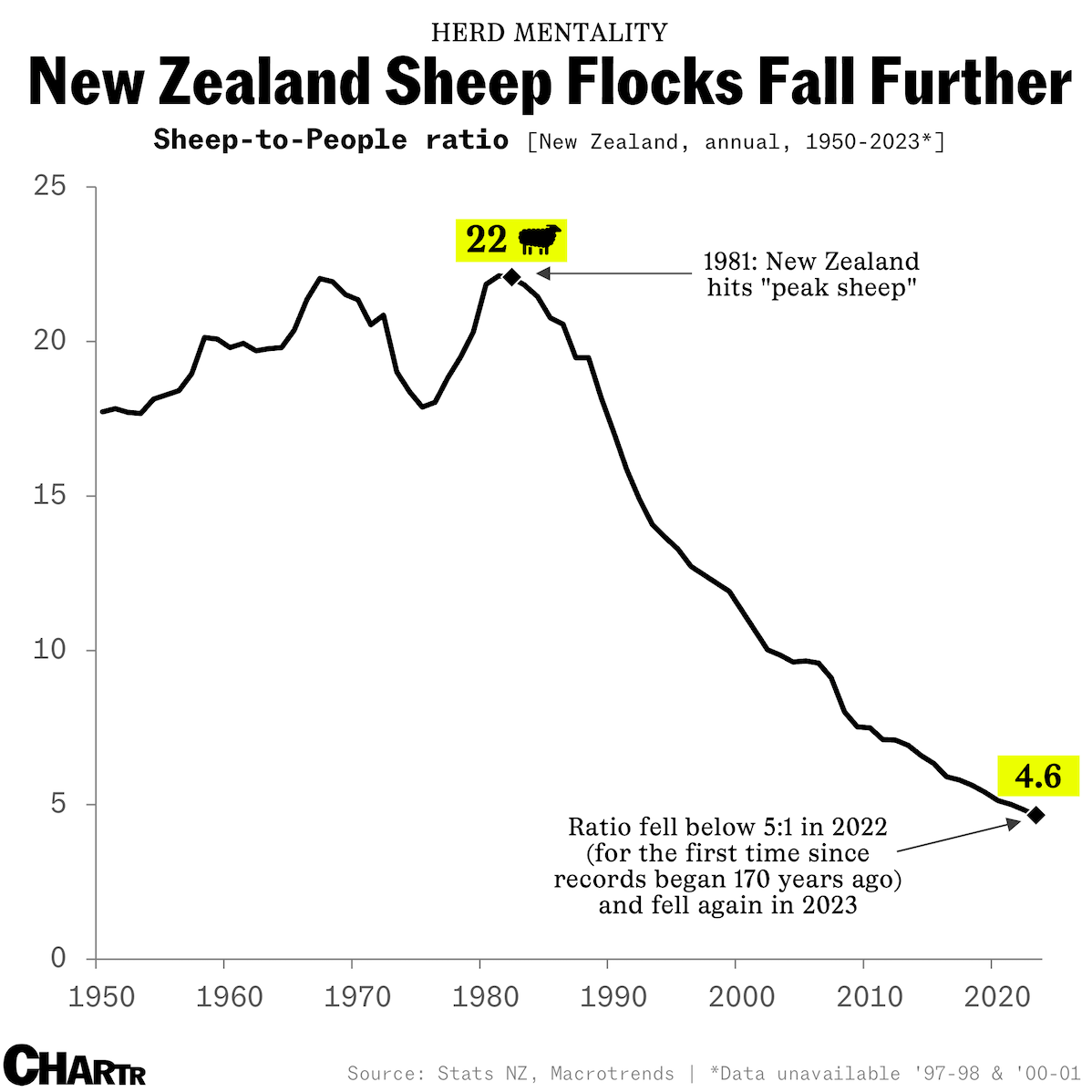

Favorite RANDOM charts of the week made by others

OFT (One Final Thought)

Trying to wake up the spring market or a dead parrot. Which is easier?

Brilliant Idea #1

If you need something rock solid in your life – particularly on Friday afternoons at 2:00 PM, Eastern Time (ET) – and someone forwarded this to you, you can sign up here for these weekly Housing Notes. And be sure to share with a friend or colleague if you enjoy them because:

– They’ll buy some cheeseballs;

– You’ll overpay for some stock;

– And I’ll try to replace my dead parrot.

Brilliant Idea #2

You’re clearly full of insights and ideas as a reader of Housing Notes. Consider sharing them with me early and often. I appreciate every email I receive, as it helps me craft future Housing Notes.

See you next week!

Jonathan J. Miller, CRE®, Member of RAC

President/CEO

Miller Samuel Inc.

Real Estate Appraisers & Consultants

Matrix Blog @jonathanmiller

Reads, Listens and Visuals I Enjoyed

- Related Sells 321 West 44th Street at $103M Loss [Commercial Observer]

- Exclusive | Buyers Battle Over Sean Hannity’s Long Island Home, Which Sells for Roughly $12.7 Million Cash [Wall Street Journal]

- How Much Is Mar-a-Lago Actually Worth? It’s a Billion-Dollar Question. [Wall Street Journal]

- How Much Is Mar-a-Lago Actually Worth? It’s a Billion-Dollar Question. [Mansion Global]

- Homebuilders are still buying down rates to move houses [HousingWire]

- High-end condos, co-ops bright spots for Manhattan in May [Inman]

- After backlash, Bing is removing MLS listings [Real Estate News]

- Homes for Sale Are Piling Up, Just Not Where the Buyers Are [Bloomberg]

- 😮 Foreclosure, Fines and Forklifts [Highest & Best]

- National Housing Survey [Fannie Mae]

- ECB Sends Message of Confidence on D-Day Anniversary: Finel-Honigman [Kathleen Hays CBC]

- Manhattan Resi Market Stays Flat [The Real Deal]

- Manhattan’s $5 Million-Plus Condos Outperformed an Otherwise Sluggish Real Estate Market in May [Mansion Global]

- Asking Rents Mostly Unchanged Year-over-year [Calculated Risk]

- Vague Threats That Make No Sense [Notorious Rob]

- Hamptons Resi Market Perks Up [The Real Deal]

My New Content, Research and Mentions

- ‘Toxic’ lawsuit tanks sale prices at NYC ‘Billionaires’ Row’ luxury tower: report [NY Post]

- A Mega-Lawsuit, a Rush of Listings and Price Cuts Galore: What’s Going on at 432 Park? [MSN Money]

- Exclusive | A Mega-Lawsuit, a Rush of Listings and Price Cuts Galore: What’s Going on at 432 Park? [Wall Street Journal]

- Luxury Murray Hill apartment building sells for $68M [Crain's New York]

- Drew Barrymore Quickly Finds Buyer for Hamptons Farmhouse [The Real Deal]

- With a glut of listings, and homes selling at a loss, NYC’s famed Plaza is losing its luster [NY Post]

- Houses Up, Condos Down. What’s Selling in the Hamptons These Days? [NY Times]

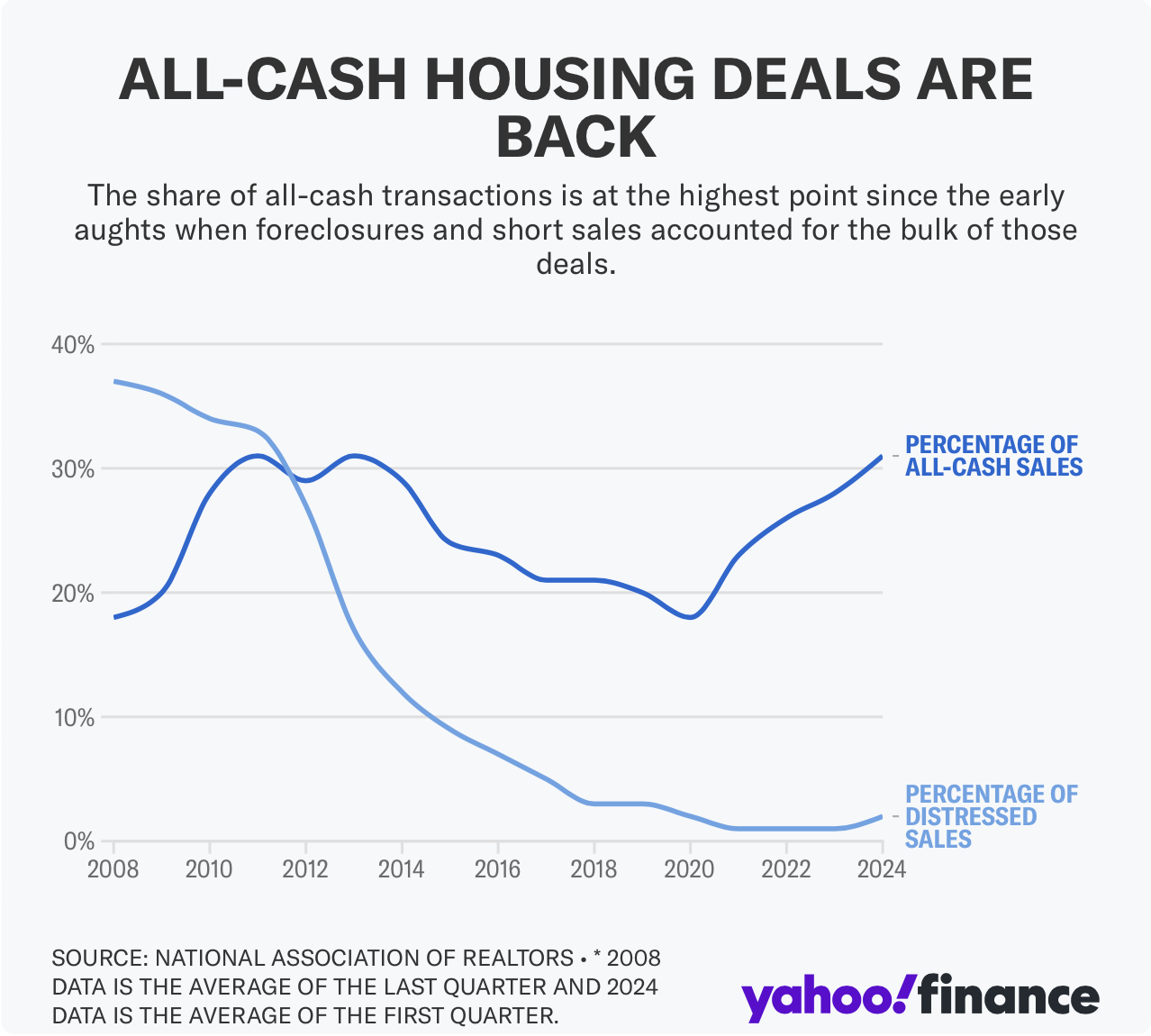

- Cash Sales in Manhattan's Real Estate Market Near Record Levels [Habitat Magazine]

Recently Published Elliman Market Reports

- Elliman Report: Florida New Signed Contracts 5-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 5-2024 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 4-2024 [Miller Samuel]

- Elliman Report: California New Signed Contracts 4-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 4-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 4-2024 [Miller Samuel]

- Elliman Report: Manalapan, Hypoluxo Island & Ocean Ridge Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Lee County Sales 1Q 2024 [Miller Samuel]

- Elliman Report: San Diego County Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Orange County Sales 1Q 2024 [Miller Samuel]

Appraisal Related Reads

- HOA fees are standing out in a bad way [Sacramento Appraisal Blog]

- FHA Announces New Guidelines Allowing Borrowers to Challenge Appraisals [The National Law Review]

- An insurance crisis wasn’t on my bingo card [Sacramento Appraisal Blog]

- Freddie Mac Calls Halt on New Loans From Appraiser BBG [Commercial Observer]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)