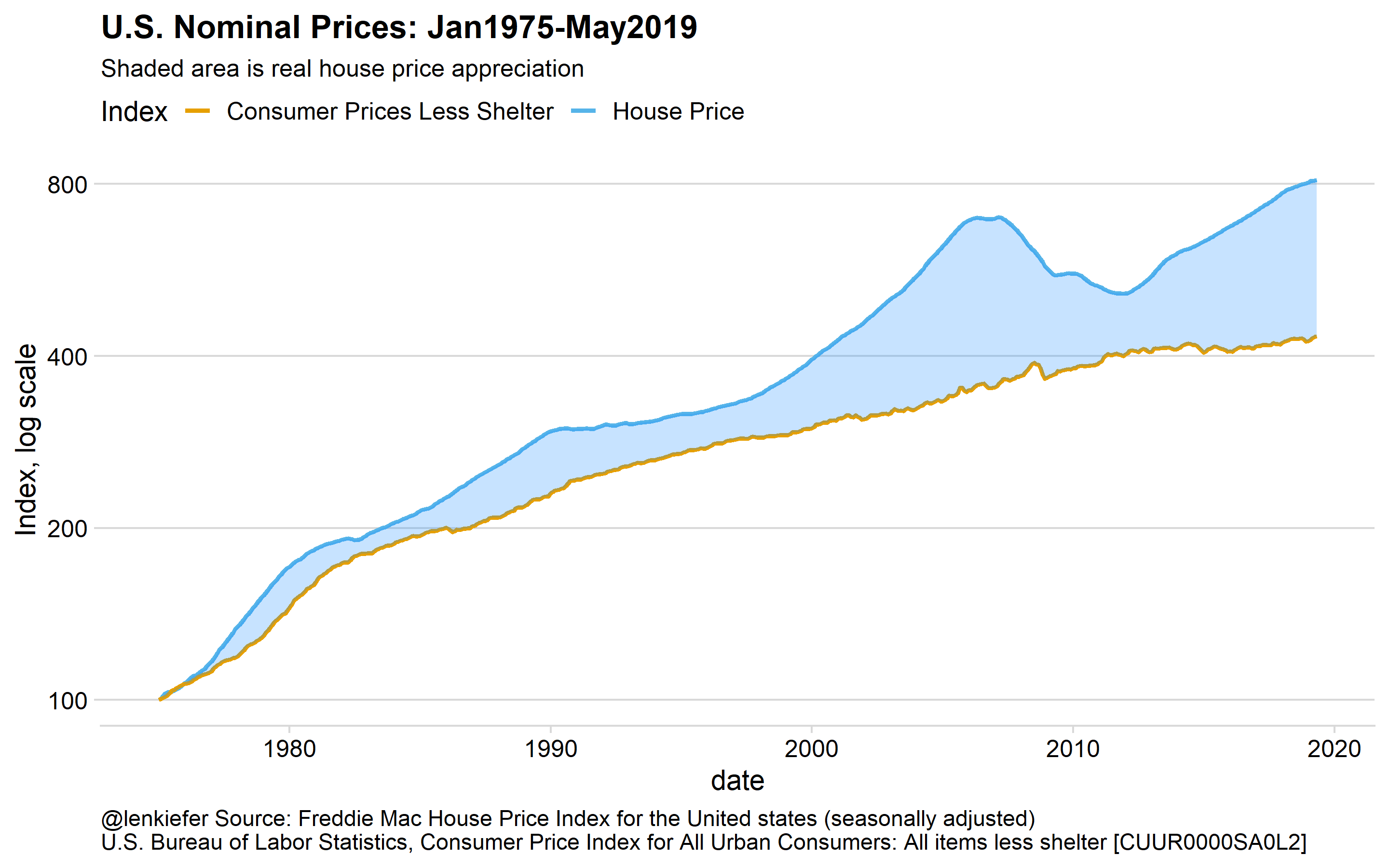

- Home prices rise faster than inflation after removing housing from the calculation

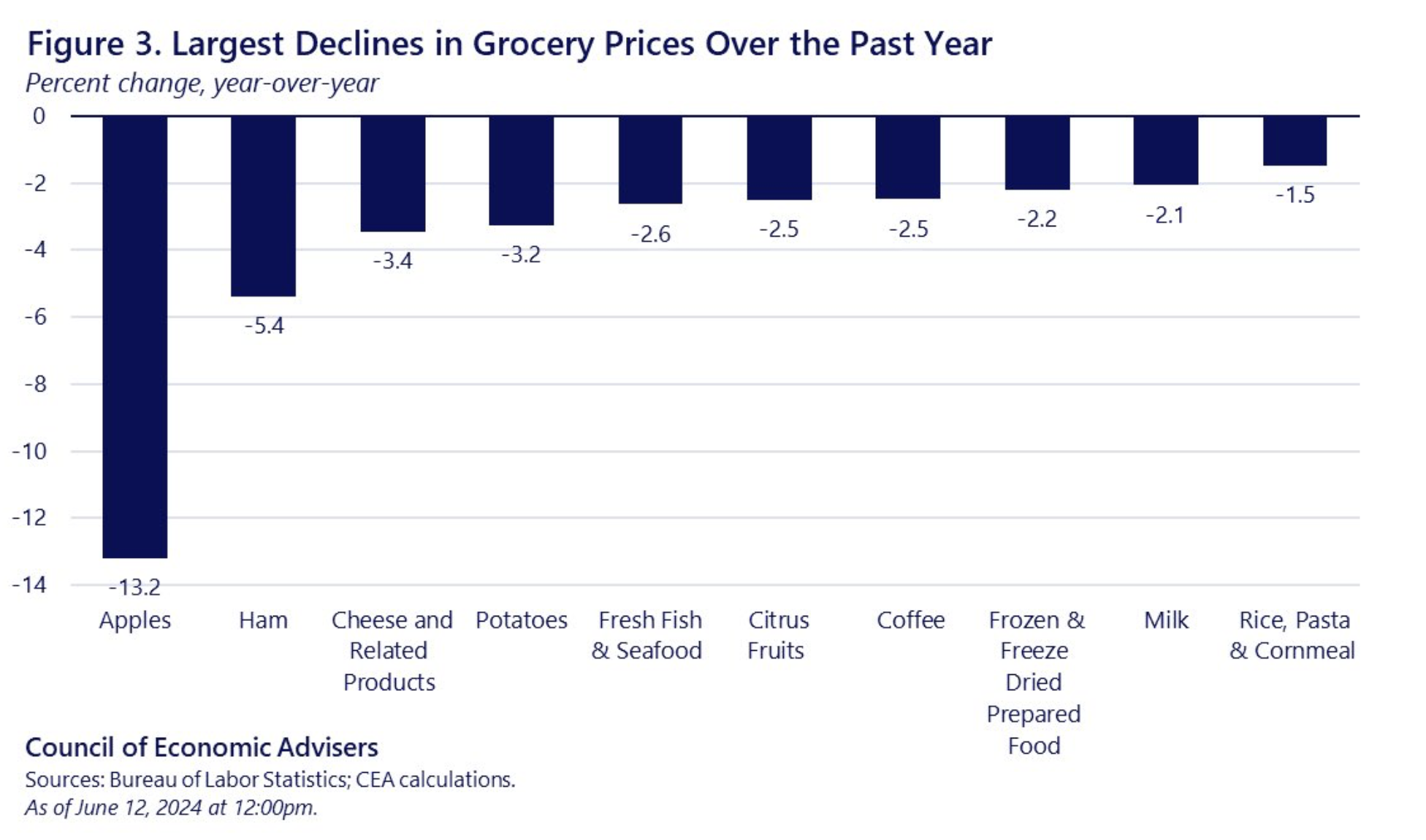

- Greedflation has proven true as retailers try to woo back consumers with lower prices

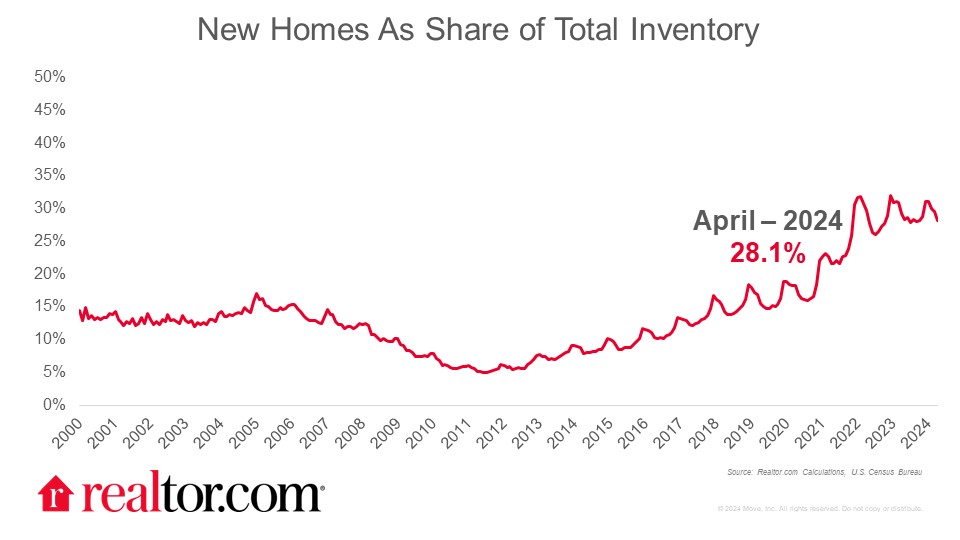

- New homes as share of total inventory at record levels from limited existing supply

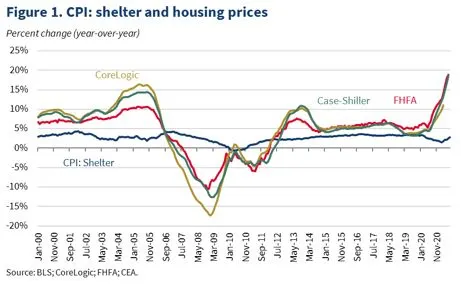

The concept of “greedflation” has been gaining legitimacy, rising from a conspiracy theory to a phenomenon with growing empirical evidence. More consumer resistance to high prices has been causing more retailers to cut prices. Greedflation is the phenomenon of corporations raising prices faster than their costs but inferring they are raising prices because of their rising costs. In the housing market, it’s tempting to see rising home prices in the same way but it’s not that straightforward. The irony* here is that the housing market has a disproportionally large influence on inflation.

*As an aspiring hipster, our tribe is defined as those persons always searching for irony.

housing (or shelter) component of the CPI is keeping inflation propped up, which means interest rates are remaining high. Higher rates, in turn, lead to less housing supply and higher home prices.

Real Estate News

The inventory of new homes historically represents about 10% of total inventory while the remaining 90% are existing homes. However, new home supply as a percentage of total supply has surged to record highs, largely because of the chronic lack of existing home supply. A classic shift in the mix.

Existing home sale prices rising faster than new home prices

The median new home sale price in April was $433,500 while the existing home sale price during the same period was $419,300, representing only a 3.4% premium for new in aggregate.

A decade ago, the median price of an existing home sale was $212,000 while the median sales price of a new home was $263,700, a 24.4% premium. The reduction in the spread between new and existing over the past decade was more about the existing home prices rising faster than new home prices because of supply shortages of existing.

Retailers Are Cutting Prices

How Are Housing Prices A Hedge Against Inflation?

Over the long run, housing prices tend to outpace inflation, so in the context of housing, inflation can be good for two-thirds of Americans who own their own homes. The challenge to many consumers is viewing housing as a long-term, less liquid asset than stocks.

Did you miss yesterday’s Housing Notes?

Housing Notes Reads

- Vornado’s 220 Central Park South Notches $82M Resale [The Real Deal]

- DOJ says REX deserves a do-over in Zillow/NAR case [Real Estate News]

- 😎 Going Full Floridian [Highest & Best]

- NAR Membership Remains Steady Notwithstanding Slower Home Sales [NAR]

- Decades of NAR membership data has vanished [Inman]

Market Reports

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 5-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 5-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 5-2024 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)