- Consumer or Administration Still Has No Clear Understanding Of The Tariff Plan/Strategy

- Canadian And Chinese Exports To The US Are Plummeting, Shelves Expected To Be Lighter Within The Month

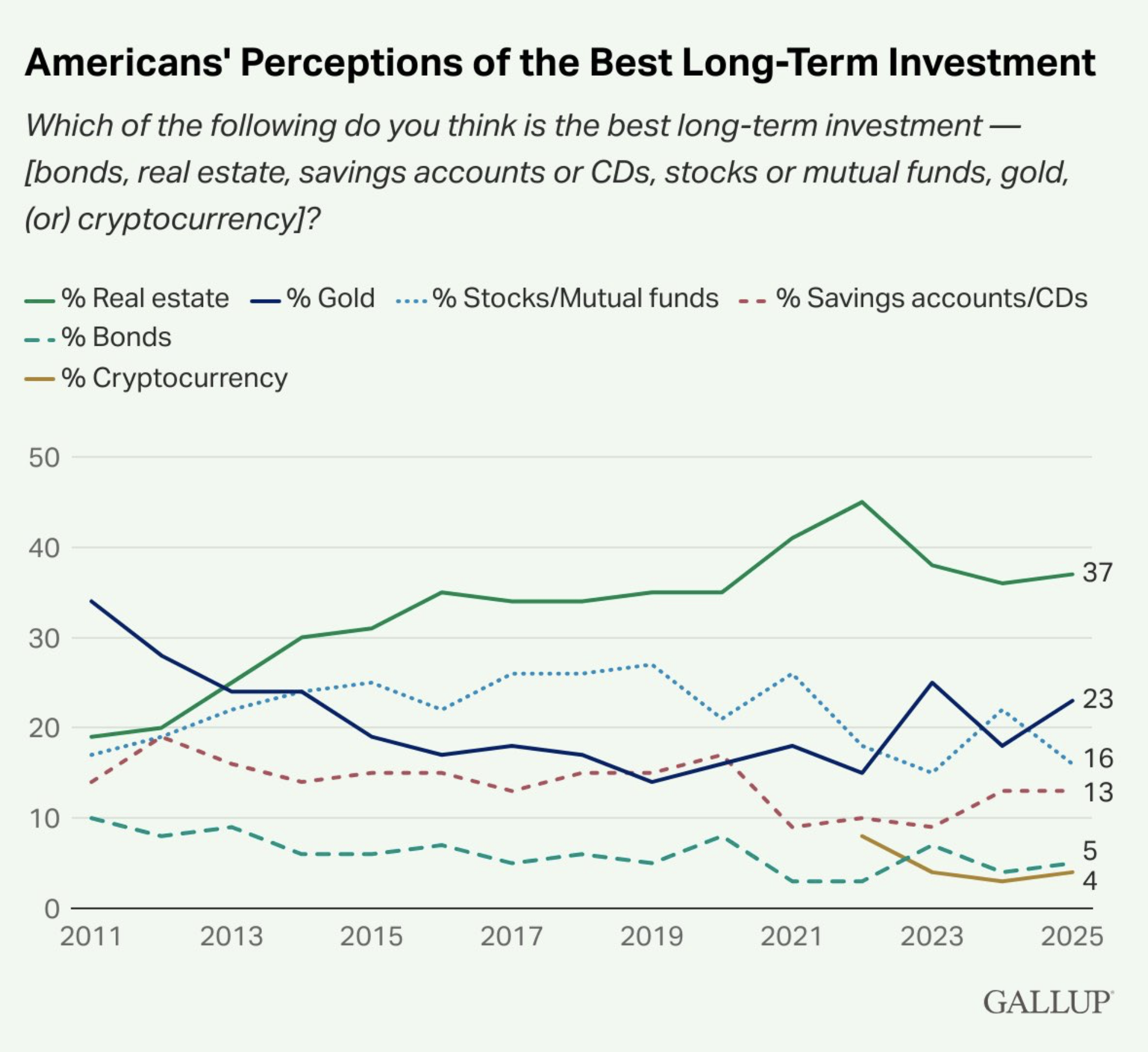

- Consumers Still Perceive Real Estate As Best Long-Term Investments

A few nights ago, we went to bed and heard the pitter-patter of footsteps above us in the attic. As I write this post, there is a protest going on outside my office with one of these on display. No matter how much we do to protect against vermin, they make their seasonal pilgrimage to our cellar and attic. As homeowners, we try to prevent them from joining us, but a few always sneak through our lines of defense. To date, the tariff policy coming out of DC is not based on sane logic andreasoning that I’ve spoken about before, so as consumers, we feel helpless. Every single person I talk with in real estate is concerned about the impact of tariffs on the US economy. A few summers ago, we visited Laurie Anderson’s exhibit at the Smithsonian in DC (find the “rat” reference in the following image), and the separation between the floors, walls, and ceilings was hard to discern, but I was still able to walk without falling. Seems like a metaphor.

Canadian Exports To The US Plunged

Our most significant trading partner is exporting far less to the US now, so we should expect to see an impact on our economy within weeks: higher prices paid by the US consumer and less availability.

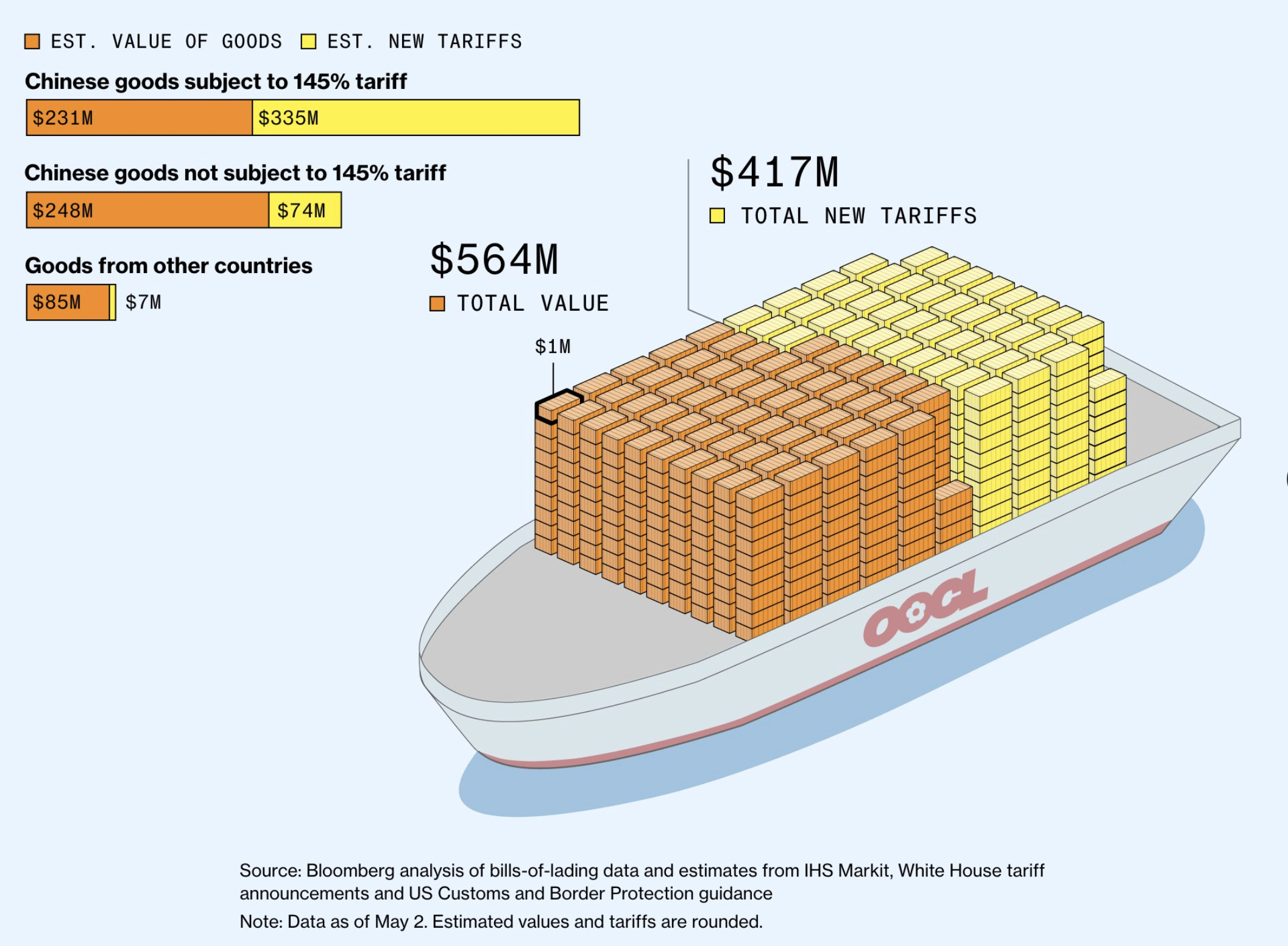

The Massive Tariffs On China Are Causing Their Exports To Drop 40%

To get an understanding of how massive the tariffs are on China, the above infographic from Bloomberg provides the proper context.

Tangible Over Intangible Assets

There has been a lot of discussion and assumptions made in real estate circles that real estate is a good long-term investment. The tariff tantrum out of DC has made the financial markets much more volatile and may spook investors into hard assets like real estate. As the above Gallup poll shows, real estate is seen by consumers as the best long-term investment.

Final Thoughts

The perceived tariff impact on housing is that it will keep mortgage rates elevated, which will continue to restrain sales levels. On the other hand, elevated mortgage rates will sustain the lock-in effect, which will restrain listing inventory from coming onto the market quickly.

The Actual Final Thought – Whatever happens with tariffs, the US housing market will remain cool.

Podcast: What It Means with Jonathan Miller

Episode 3 is out!

Feeds for “What It Means with Jonathan Miller (WIM)”

Did you miss the previous Housing Notes?

Housing Notes Reads

- 'People are really torn': Pacific Palisades property owners reckon with rebuilding realities [Costar]

- Will There Be Fireworks on the 4th of July? [Apollo Academy]

- Stagflation Coming [Apollo Academy]

- Brooklyn Home Prices Set Record as Inventory Surges [Brownstoner]

- Season in review: Palm Beach real estate saw a 'Trump bump' but there was turbulence ahead [Palm Beach Daily News]

Market Reports

- Elliman Report: Hamptons Sales 1Q 2025 [Miller Samuel]

- Elliman Report: North Fork Sales 1Q 2025 [Miller Samuel]

- Elliman Report: Long Island Sales 1Q 2025 [Miller Samuel]

- Elliman Report: Los Angeles Sales 1Q 2025 [Miller Samuel]

- Elliman Report: Orange County Sales 1Q 2025 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)