- New York City Seems To Be Impervious To The Tariff Tantrums So Far

- Some Markets Are Experiencing A Marked Slowdown In Contracts

- New Listings Are Either Being Withdrawn Or Added In Large Numbers

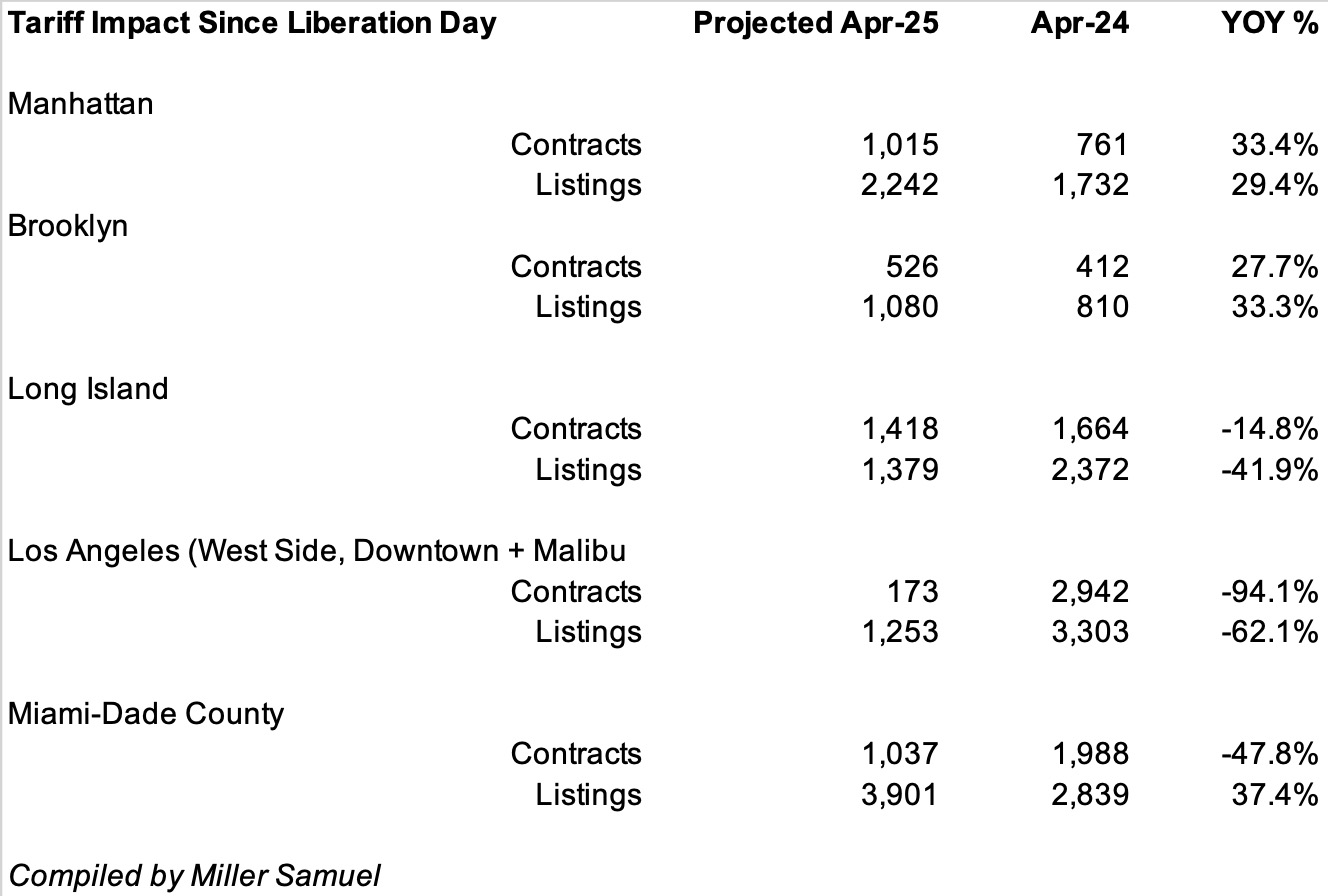

There are lots of stories coming out of the brokerage community about properties being de-listed or deals blowing up attributable to the Tariff Tantrums the world is currently enduring. I’ve been talking at length about the uncertainty that tariffs burden consumers within the decision-making process, especially when no underlying strategy or plan is driving the policy. I don’t doubt that these stories of disruption on the front lines are true. However, we are all looking for answers to understand the impact on the housing market. So, I took an initial look at newly signed contracts from “Liberation Day” on April 2nd through today to see how they matched up with year-ago levels in some of the markets we track. The damage varies greatly by market.

Methodology Of The Tariff Damage Analysis

I looked at the total of New Signed Contracts for the past 22 days (contracts signed from April 2 through April 23) and applied that daily rate to 30 days to create a projected April total. I did the same thing for New Listings. Then, I compared that result to the prior year’s number to arrive at a % change from the prior year. The Manhattan and Brooklyn numbers represent co-ops, condos, and 1-3 families, while the remainder of the markets represent 1-3 families and condos.

Post-Liberation Day Damage Assessment

New York is pushing on without much evidence of an impact, while Long Island saw consumers withdraw a lot of listings. Los Angeles County experienced a significant drop in contracts and listings; given the trauma that the market has undergone with all the wildfires, it is understandable. Miami-Dade County saw less of a decline in contract signings in April than LA, but listing inventory rose instead of falling.

Final Thoughts

In other words, there is no uniform pattern of tariff policy impact in these three US regions, making it more confusing for market participants as well as housing market observers.

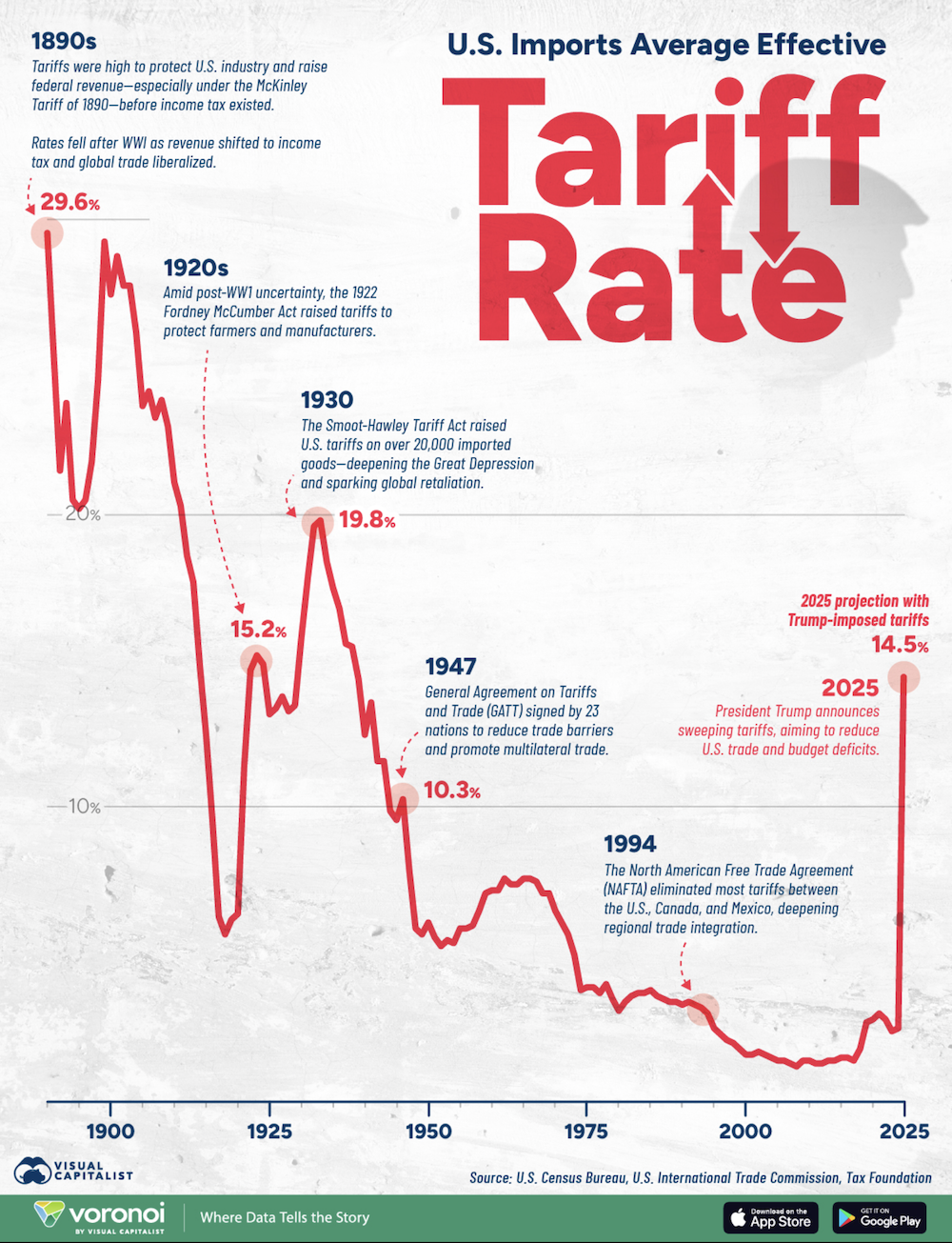

Just today, the president pulled back on his threat to fire the Fed chair, and the financial markets soared. The uncertainty of the Tariff Tantrum is now firmly embedded in the housing market, impacting trends and impacting the spring market, the most significant selling period of a typical year. Yet the tariff strategy is based on nothing but a misunderstanding of what a tariff actually is. Hopefully, because of the lack of an apparent plan or strategy, the end of this mistake will come sooner than later.

The Actual Final Thought – Another way to think about taxes…

My Podcast – What It Means with Jonathan Miller

Episode 2: April 22, 2025 More Tariff Talk

Did you miss the previous Housing Notes?

Housing Notes Reads

- Infuriating reason people find it hard to buy homes in biggest city [Daily Mail]

- Lifespan of a (Brooklyn) Fact: Can One in Seven Americans Trace Roots to Brooklyn? [Urban Omnibus]

- Demographics of Brooklyn [Wikipedia]

- Naftali’s One Williamsburg Wharf rides Brooklyn new dev wave [The Real Deal]

- Resi sales plunge in Miami Beach and barrier islands, as inventory grows across South Florida [The Real Deal]

Market Reports

- Elliman Report: Coral Gables Sales 1Q 2025 [Miller Samuel]

- Elliman Report: Palm Beach Sales 1Q 2025 [Miller Samuel]

- Elliman Report: Sarasota County Sales 1Q 2025 [Miller Samuel]

- Elliman Report: Weston Sales 1Q 2025 [Miller Samuel]

- Elliman Report: Wellington Sales 1Q 2025 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)