- There Is No International Homebuyer Currency Play For US Residential

- Canada’s Tourism Industry Is Boycotting The US And It Will Hurt

- European Tourism To The US Is Plummeting, Reducing Odds Of Housing Purchases

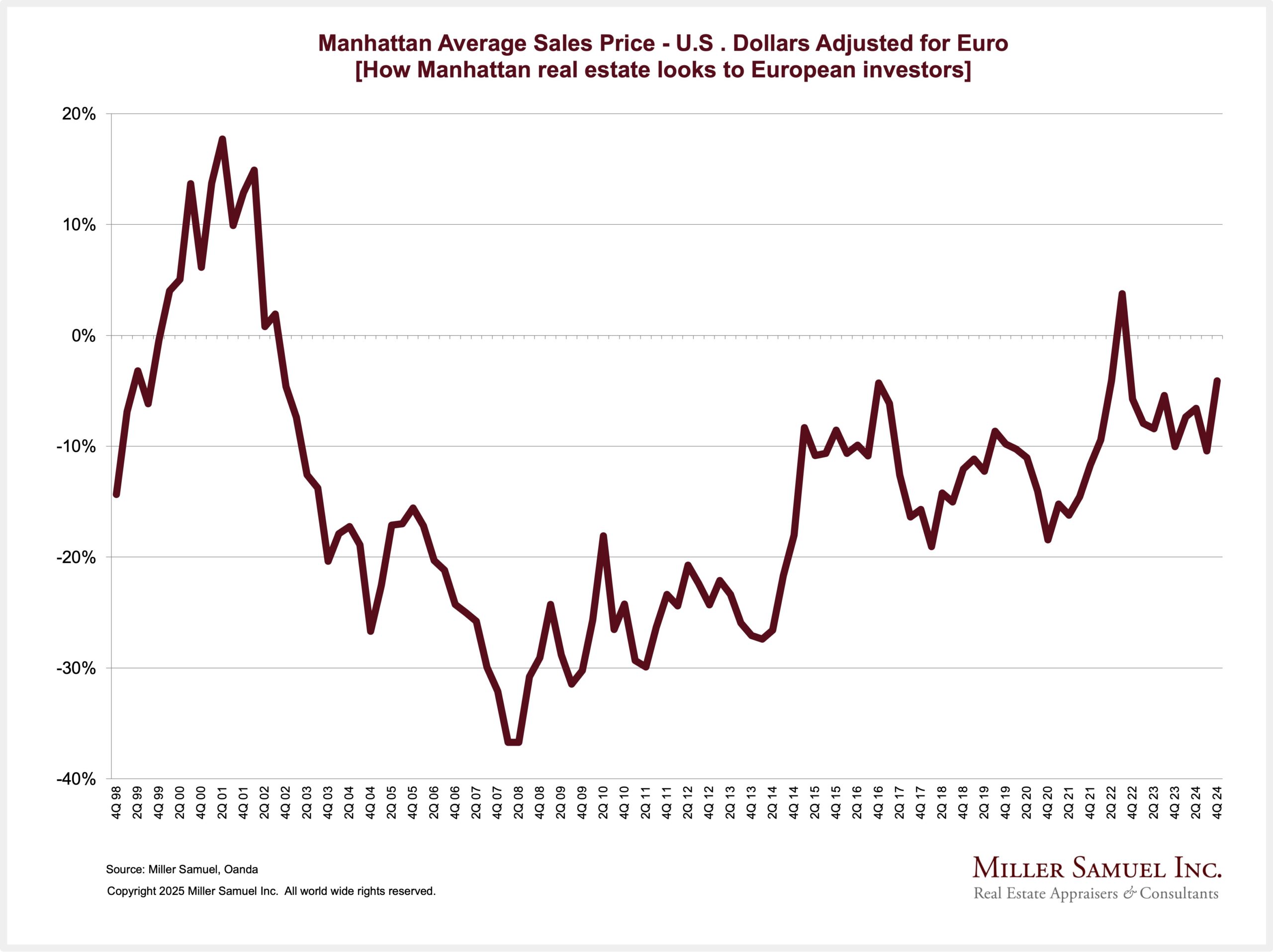

In 2006-2008, international demand for US real estate was exceptionally high because investors were able to make a currency play. Buyers in Europe were looking at nearly 40% discounts on Manhattan real estate based on currency alone.

Canada is the number two source of NYC international visitors (UK is number one), and according to our Manhattan borough president, bookings from Canada to Manhattan are down 70% to 90% from last year. There’s a boycott going on, and there are many reasons beyond tariffs. I have seen in my appraisal practice that international real estate purchases in Manhattan roughly correlate with levels of global tourism. It’s not looking good for international real estate demand with tariff and immigration policy implementations that are counter to our long-term interests. Travel from Europe to the US is plummeting.

Economist Justin Wolfers at the University of Michigan clearly explains the Trump II administration’s tariff situation with Canada. It is also clearly illustrated by the former chief economic advisor of Trump I, who was a former Goldman Sachs banker. This conversation was noted in the book “Fear” by Bob Woodward. There is no plan.

Barry Sternicht said that tariffs are highly inflationary, and consumers don’t want to work in manufacturing (8% of US jobs), and it’s going to be robotics anyway. There is no plan.

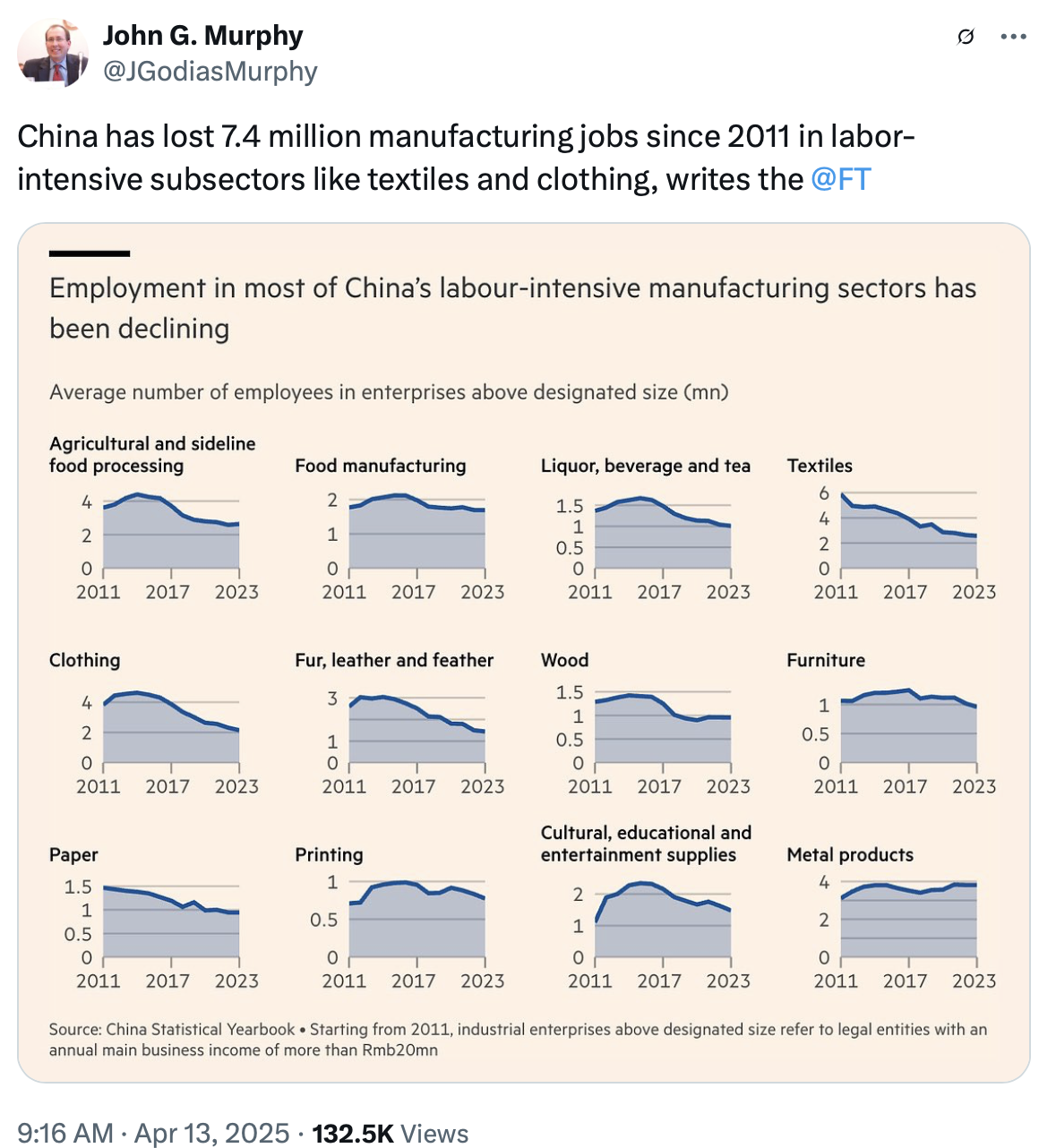

China is also seeing a significant loss in manufacturing jobs – broken out in the chart below, presumably from robotics, so it’s odd that we want to emulate China’s manufacturing prowess. Global central banks shed their US holdings at the fastest pace in history. There is no plan.

It will be fascinating to see how the NAR International Transactions in U.S. Residential Real Estate survey holds up when the new one is released in July. The data for the report ended March 31st.

Investors are being scared away from US investment right now because of immigration and tariff policy. There is no plan.

International Real Estate Demand Skews Towards New Construction

While NAR indicated that international demand for US real estate was 1.3% of existing demand in 2024, I have found in the markets that I cover that international investor skew towards new construction. In other words, the 1.3% underrepresents international participation in US residential real estate. In NYC, the global base level of demand is about 15% of all residential sales, dominated by condos. In specific periods of currency play, 50% of Manhattan condos could be purchased by international buyers. It’s a similar story in Miami. About half of foreign buyers pay cash, but domestic lenders have ample mortgage products for foreign investors of US real estate.

Final Thoughts – There Is No Plan

I have mentioned frequently in this piece that there is no strategy behind the Tariff Tantrums because it goes against common sense and economic theory. Investors need political stability, the rule of law, and financial certainty. Americans who still believe tariffs are good for our economy don’t understand what a tariff is – it’s a tax on the American consumer. Tariffs have their role in economic theory, but only when their impact is understood. International tourism volume is dropping right in front of our eyes, and tourism levels correlate with global demand for US real estate.

You want to see the numbers that reflect what this mistep is doing to the soft economic data? Here they are.

Because there is no plan or strategy, it’s easy for the real estate industry and the buyers and sellers they work with to overreact or panic because this is all so dumb. The real estate industry is dependent on stability and safety. The tariff fixation is an unforced economic policy error based on a lack of understanding of what a tariff really is. This stunning lack of knowledge is pushing interest rates higher and our allies further away.

The Actual Final Thought – When I turned fifty, my favorite color switched from blue to orange – it was not planned, and it’s a long story I’ve told before. Without going into the details, here’s how to think about it.

Did you miss the previous Housing Notes?

Housing Notes Reads

- European travellers cancel US visits as Trump’s policies threaten tourism [FT]

- ⚽ Leasing & Leo [Highest & Best]

- Consumer Confidence Is Weaker than During the 2008 Financial Crisis [Apollo Academy]

- Stock market mayhem no match for Long Island housing market [Newsday]

- Brooklyn hit a new price record in the first quarter [The Real Deal]

Market Reports

- Elliman Report: Queens Sales 1Q 2025 [Miller Samuel]

- Elliman Report: Brooklyn Sales 1Q 2025 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 3-2025 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 3-2025 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 3-2025 [Miller Samuel]

- Elliman Report: Manhattan Sales 1Q 2025 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)