- NAR’s Housing Affordability Index Is A Trade Group Stunt

- Rising Income Playing A Large Role In Softening Damage Of High Mortgage Rates

- Housing Affordability Is At Crisis Levels But Millions Are Still Buying Homes

Nearly 12 years ago, my friend Barry Ritholtz wrote a takedown on NAR’s Housing Affordability Index. His conclusion? It’s worthless and still worthless, citing only one month back during that period when housing was not affordable. Remember that NAR is a trade group whose mission is to help its members, not the consumer. Of course, there are other ways to look at housing affordability too, such as rent to income ratios. Incidentally, about 20 years ago, a friend of mine in the midwest who couldn’t sell his home in a down market told me, “I fear for my three children since they will never be able to own a home.” All his kids are adults and now own homes. He sold his home for more than he paid for it. I realize this is a bit silly to infer it always works out because the cost of housing is much higher than it was twenty years ago. We are clearly in a housing affordability crisis nationwide. I’m not selling anything here. I guess I’m just pushing back on the din of today’s economic discourse of negative absolutes.

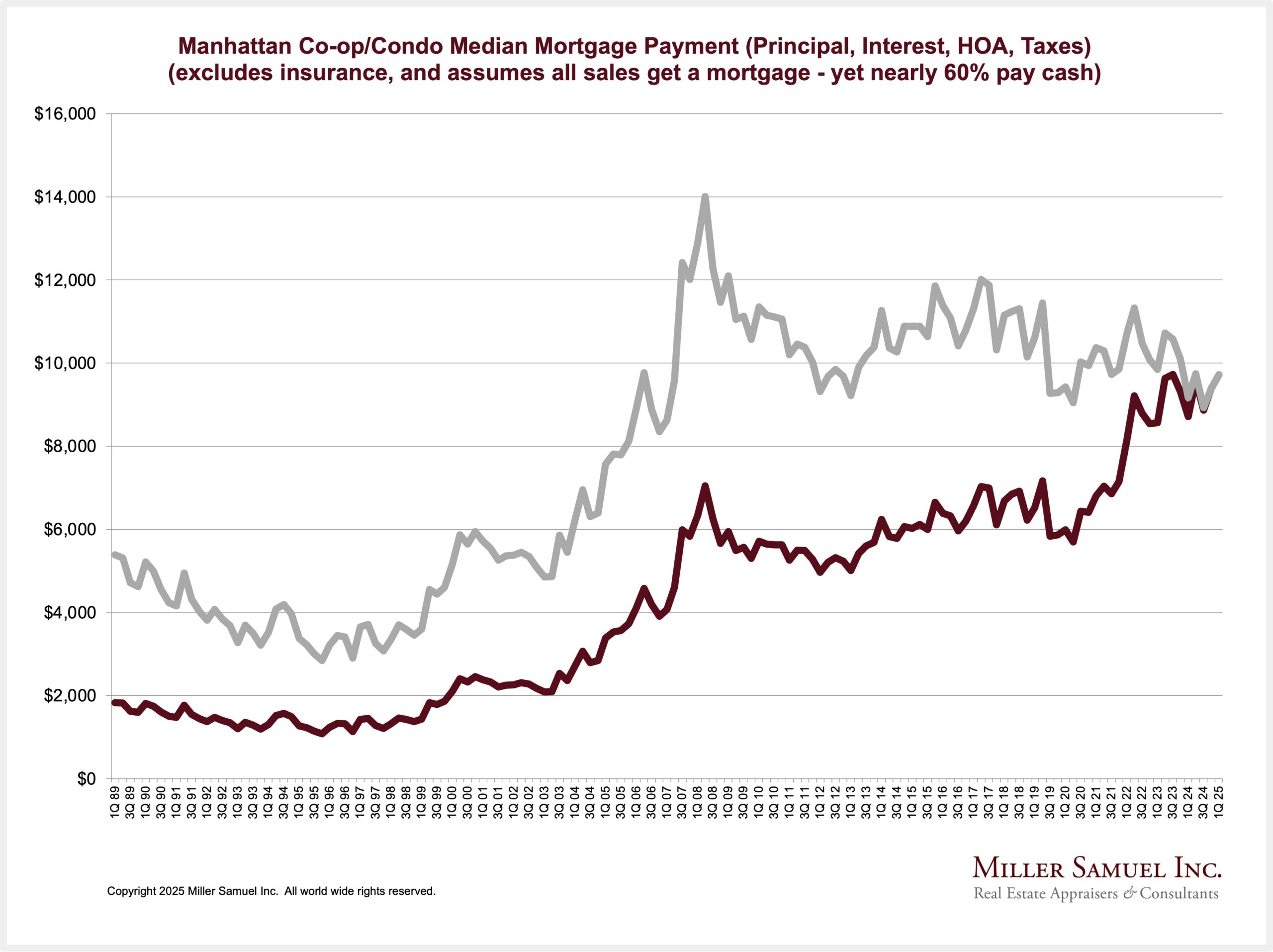

To avoid being subjected to Barry’s wrath, the above chart is not an affordability index. Ha. I’m merely tracking the median monthly payments of co-op/condo owners with everything but homeowners insurance and assuming a 20% down payment and all purchasers get a mortgage (red line). For the record, about 50% of purchasers get a mortgage (nearly 60% today).

Where I start breaking the rules is my next step, and I’m sure I’ll hear about it from my economist friends, but hey, this is my blog. I took that monthly median payment (red line) and adjusted it for inflation in today’s dollars back to 1989 (gray line). In other words, housing prices and all the additional costs were inflation-adjusted by the same amount, which is sloppy. I was just curious how it would look over time.

Since the median price for Manhattan has been flat for about a decade, the monthly payment has been constant. Back in the 1990s, today’s buyers would have mortgage payments that were 2-3 times higher in today’s economy. No matter how sloppy all this is, housing affordability shows it as a much bigger issue today than 20-30 years ago.

Rent To Income

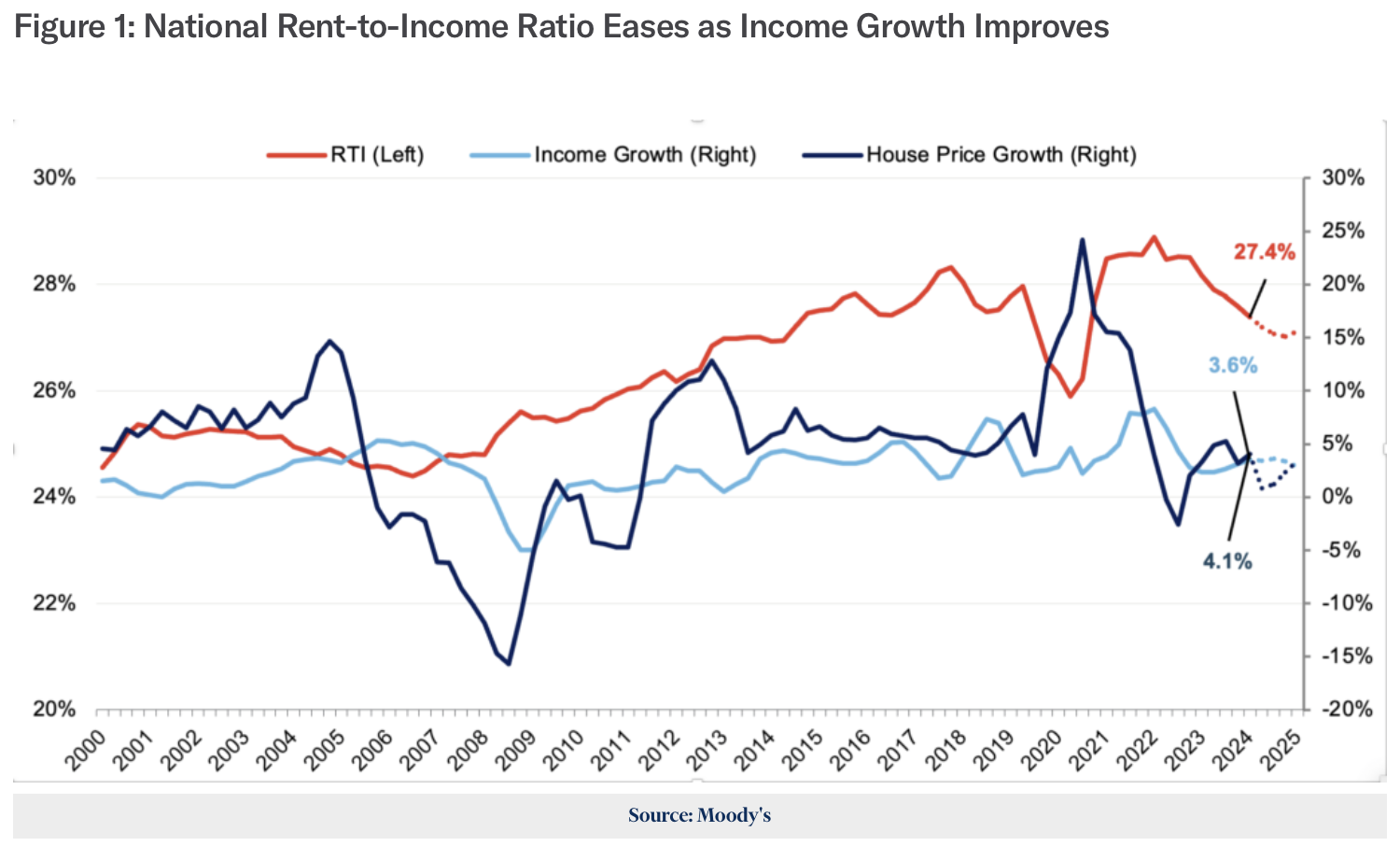

Another way to look at housing affordability is through rents instead of homeownership. Moody’s looks at rent-to-income ratios nationally, as well as home prices. The gains in income coming out of the pandemic have slightly eased the rent burden in the past couple of years. Those paying more than 30% of their income are considered rent-burdened. In NYC, most landlords use the 40x rule. If the rent is $1,500 monthly, a tenant’s income must be $60,000 annually.

From Moody’s “The national RTI ratio decreased to 27.4% in Q4, reflecting the fifth consecutive quarter of decline and returning to pre-pandemic levels. This improvement was driven by the 0.9% rise in median household income, which outpaced the 0.2% quarterly increase in asking rents across the nation to reach $1,850.” On a year-over-year basis, median household income grew by 3.6%, significantly exceeding rent growth at just 0.7%, as presented in Figure 1.”

Final Thoughts

My conclusion here is that housing is less affordable than in previous generations, and that doesn’t take a rocket scientist to figure out. However, the chorus is probably a little too loud. Millions of homes are being bought and sold, just fewer than normal.

The Actual Final Thought – Someone has been trying to sell my home in Amityville for years! The market is a horror!

Monday Mailboxes, Etc. – Sharing reader feedback on Housing Notes.

May 2, 2025: WSJ’s Mansion Global Becomes A Ten

- We love the daily info from NYC here in rural Northern California.

- Good morning Jonathan. Thanks so much for your comprehensive Housing Notes. I always look forward to reading them and gaining more knowledge.

May 1, 2025: When It Stopped Making Sense: NYC Now Has More People To Buy Strawberries At 3 AM

- I continue to enjoy your posts. It is a plus that we have the same taste in music.

April 28, 2025: Damaged: A $225 Million Sale Closed In Naples As The US Loses 20% Of Its Value

- It is interesting to see the number of companies operating offshore in US and Canada now looking at moving to US. Chinese factories closing down for a time due to lack of demand. Interesting.

Did you miss the previous Housing Notes?

Housing Notes Reads

- Housing Affordability Index [NAR]

- Q4 2024 Housing Affordability Update [Moody's CRE]

- A Bold Move to Help Fix the Housing Crisis Just Happened in an Unexpected Place [Slate]

- Data on immigrants in the US [USAFacts]

- From tariffs to tightness: What’s happening in the US housing market? [J.P. Morgan]

Market Reports

- Elliman Report: Hamptons Sales 1Q 2025 [Miller Samuel]

- Elliman Report: North Fork Sales 1Q 2025 [Miller Samuel]

- Elliman Report: Long Island Sales 1Q 2025 [Miller Samuel]

- Elliman Report: Los Angeles Sales 1Q 2025 [Miller Samuel]

- Elliman Report: Orange County Sales 1Q 2025 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)