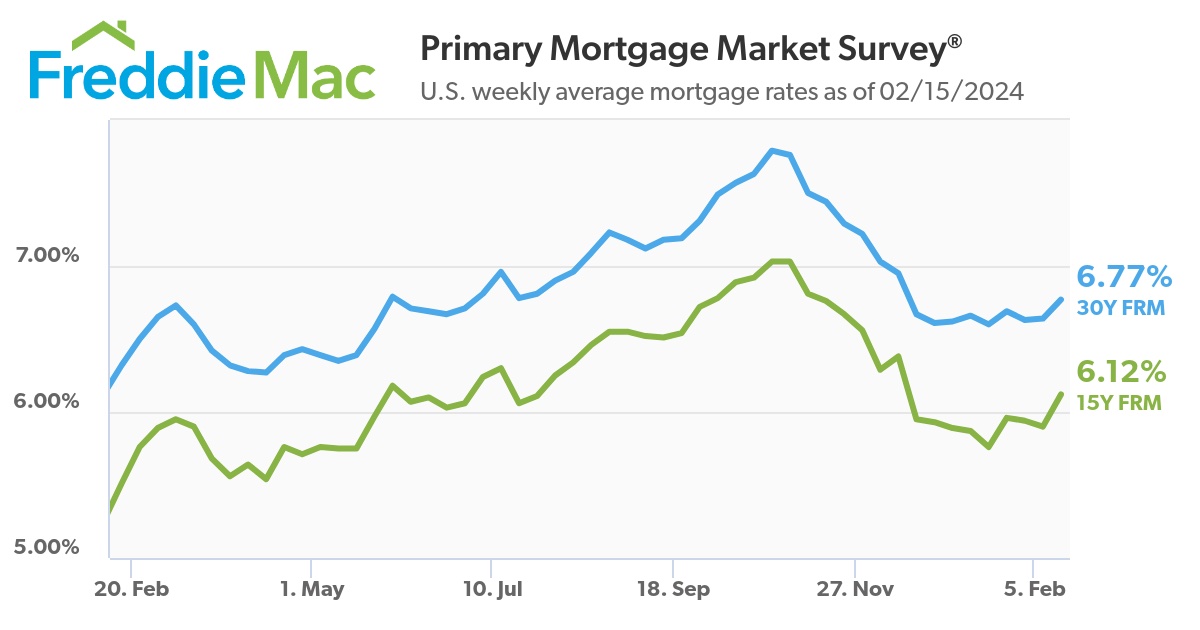

The back half of 2024 continues to look better for housing transaction volume with eventual rate cuts, combined with low unemployment.

The Chief’s Justin Watson should be nominated as the next Fed chair!

——–

Did you miss last Friday’s Housing Notes?

February 8, 2024 Housing Numbers Are Still More Powerful Than Its Letters Or Symbols

——–

But I digress…

The San Francisco And Kansas City Housing Markets Will Continue To Move A Lot Swifter After The Super Bowl

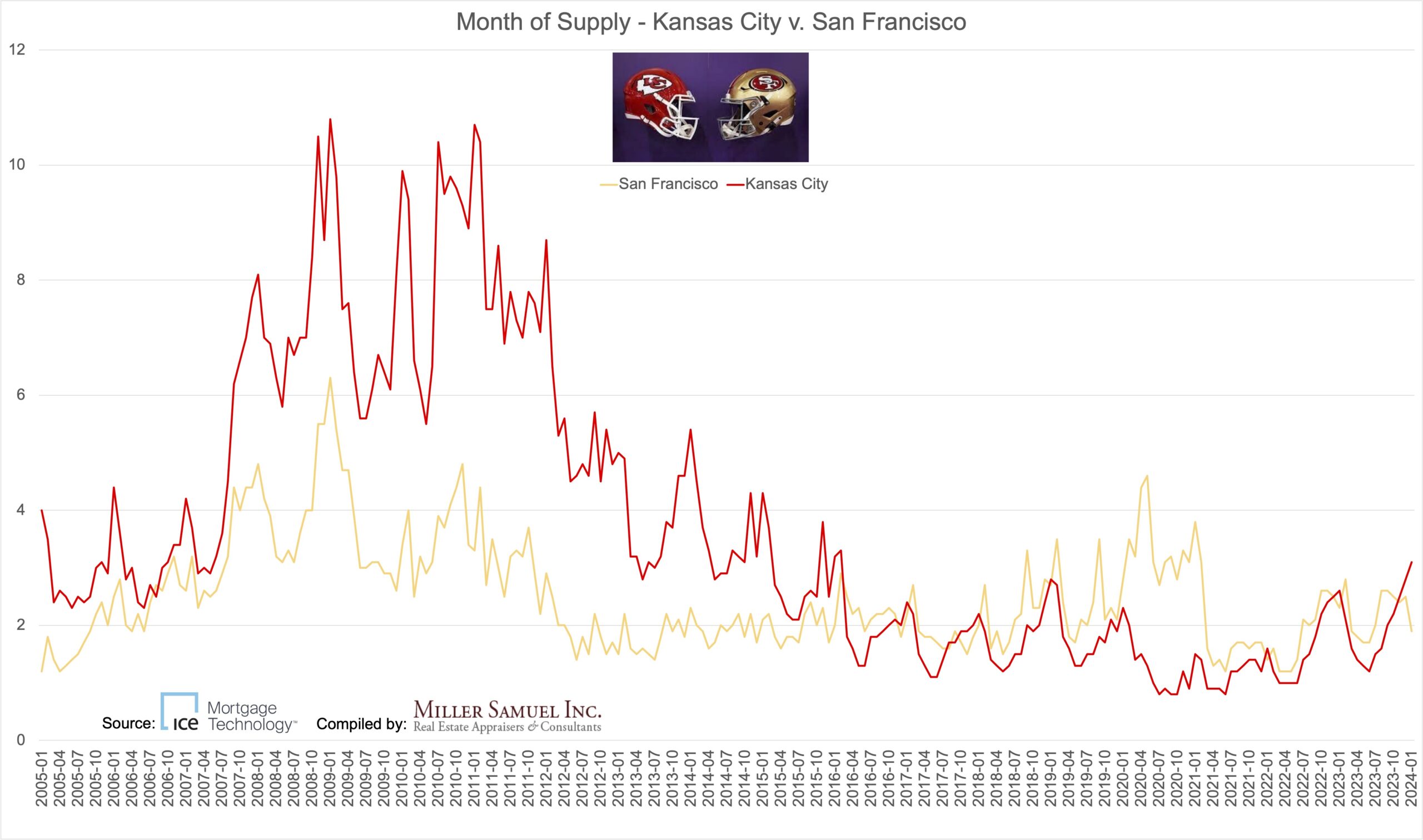

Ok I promise, that’s the last “Taylor Swift” pun of today’s newsletter. After thoroughly enjoying last weekend’s Super Bowl with a bunch of good friends in Chicago, I wondered how the two team’s housing markets compared (obviously I would think that). And since months of supply (or market pace) – the number of months to sell all available supply at the current sales rate – is a great way to look at the intersection of supply and demand – and sales have been slowed by much higher mortgage rates – and listing inventory has been chronically low coming out of the pandemic era, I got to work.

I also thought it was great to compare a midwestern location with a coastal location and a low density housing market with a high density housing market. Kansas City was clearly a much slower moving market after the housing bubble burst in 2006. But San Francisco slowed down a lot more in 2020 when the COVID pandemic began. Concerns about higher density living during that period (whether or not accurate) slowed the market quite a bit despite plunging mortgage rates at that time.

Their respective housing markets have something in common now – their market paces are blistering despite lower sales because listing inventory remains chronically low. Months of supply represents how the market “feels” on the ground to buyers and sellers and right now both feel fast.

ICE Mortgage Technology has generously provided access to HomePrice Trends® so I can share the most up-to-date housing market trends across the U.S.

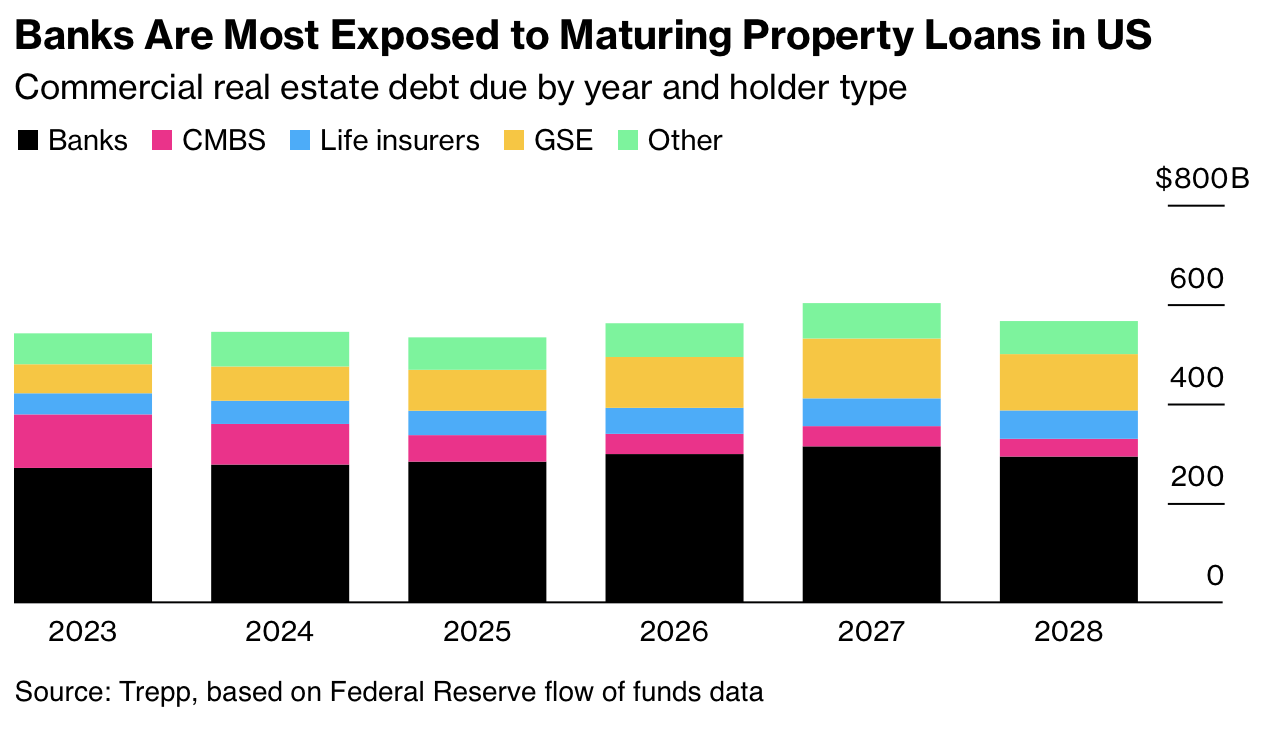

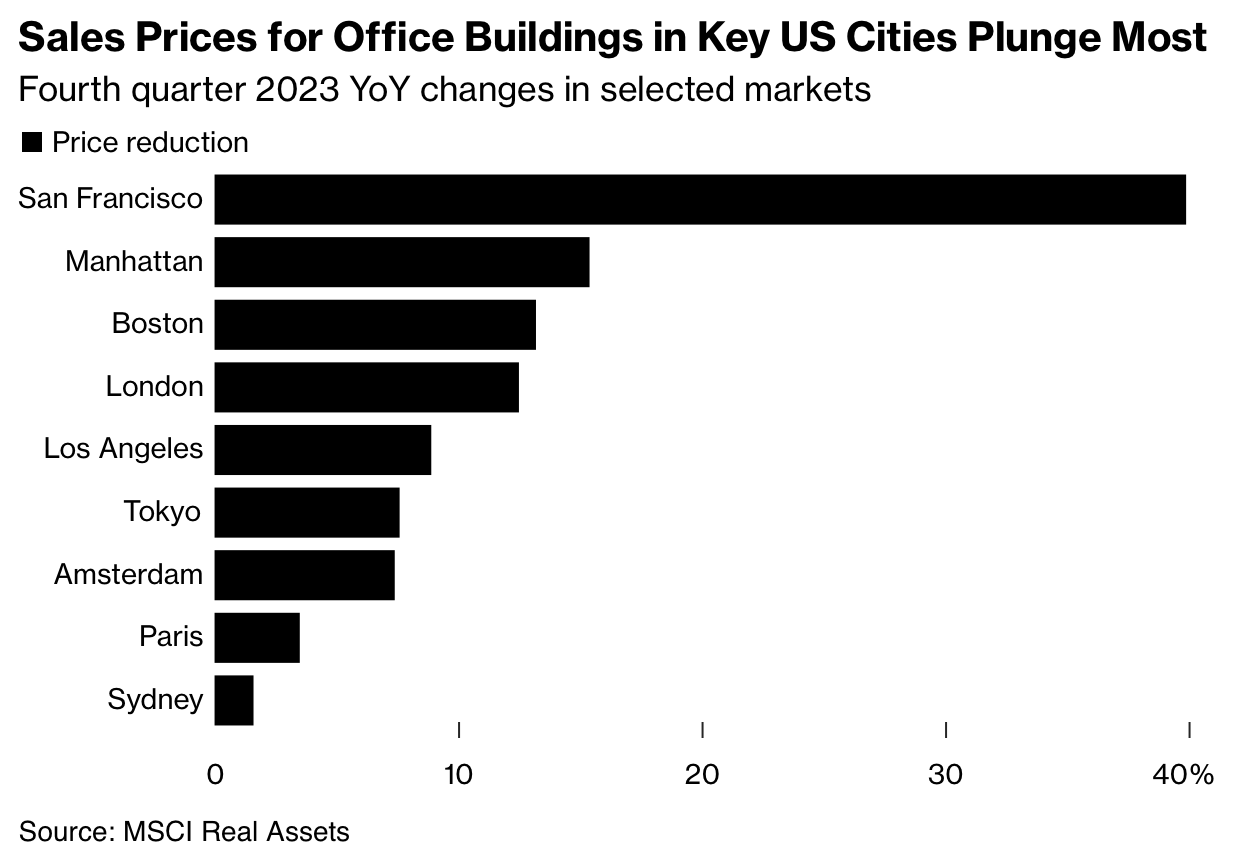

Falling Office Market Values In The Future Is Becoming A Lot More Obvious

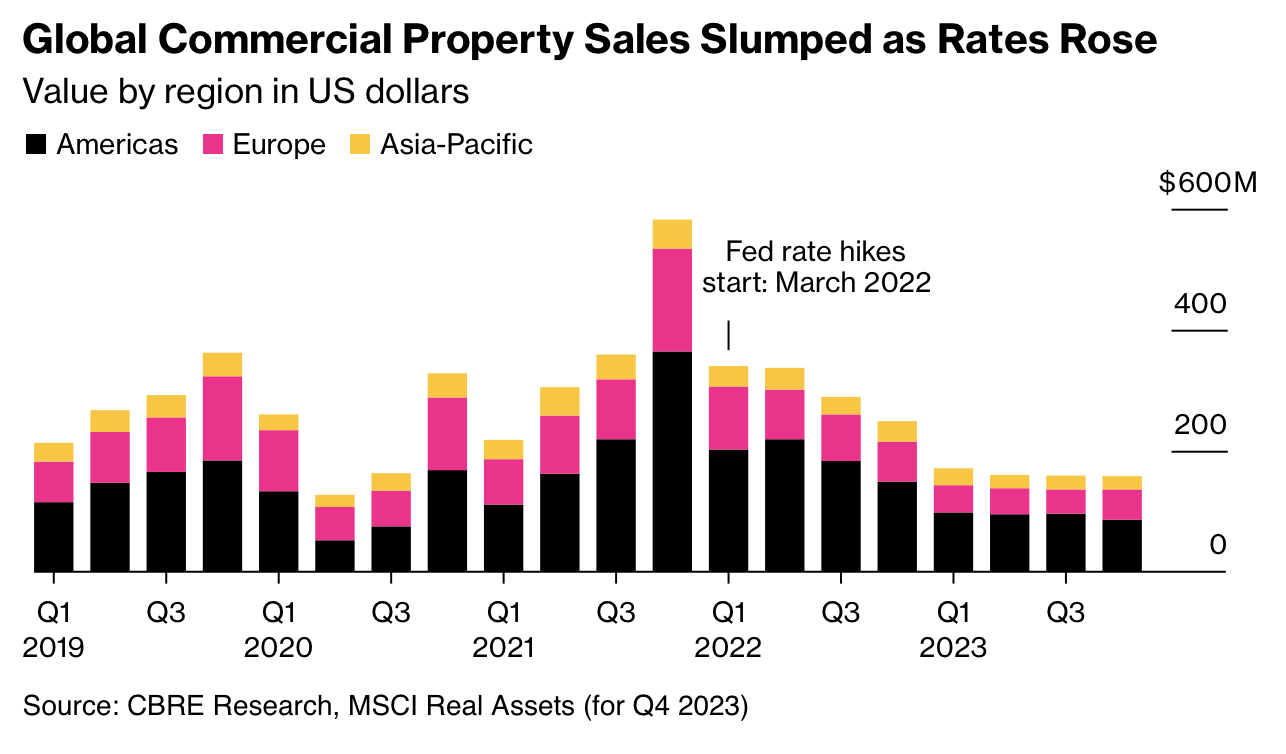

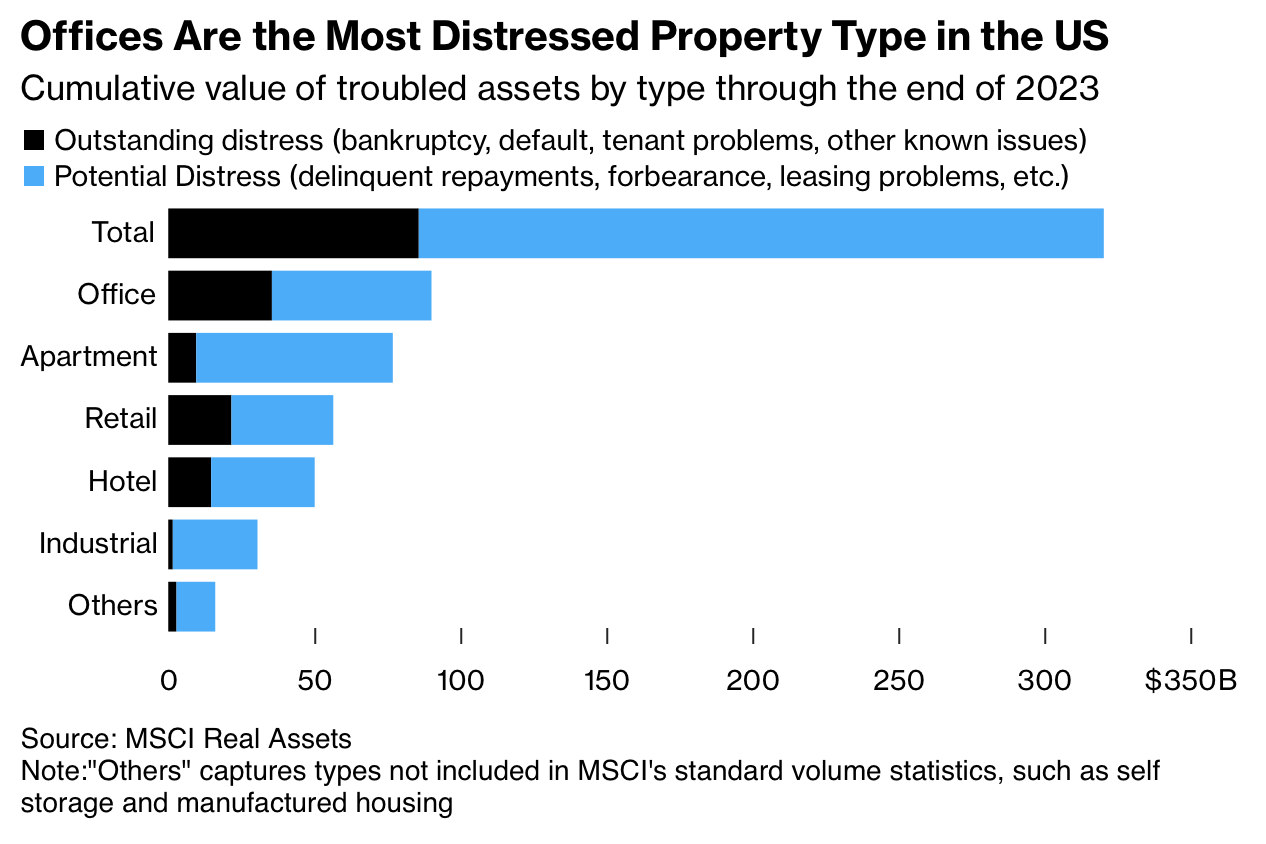

There have been a lot of office market coverage of late as everyone is beginning to realize how the future is going to look. WFH isn’t going away and debt obligations are keeping landlords from negotiating to market price.

A1 is OK: The 20th Time My Housing Research Appeared On The Front Page of the NY Times

My wife was looking at the New York Times the other day and noticed the teaser at the bottom of the front page that referred to a housing market article using our market data. Of course I checked with the A1 judges and confirmed that this technically counts as an A1 story, which finally brings me to the twentieth time my content has been there since 2000.

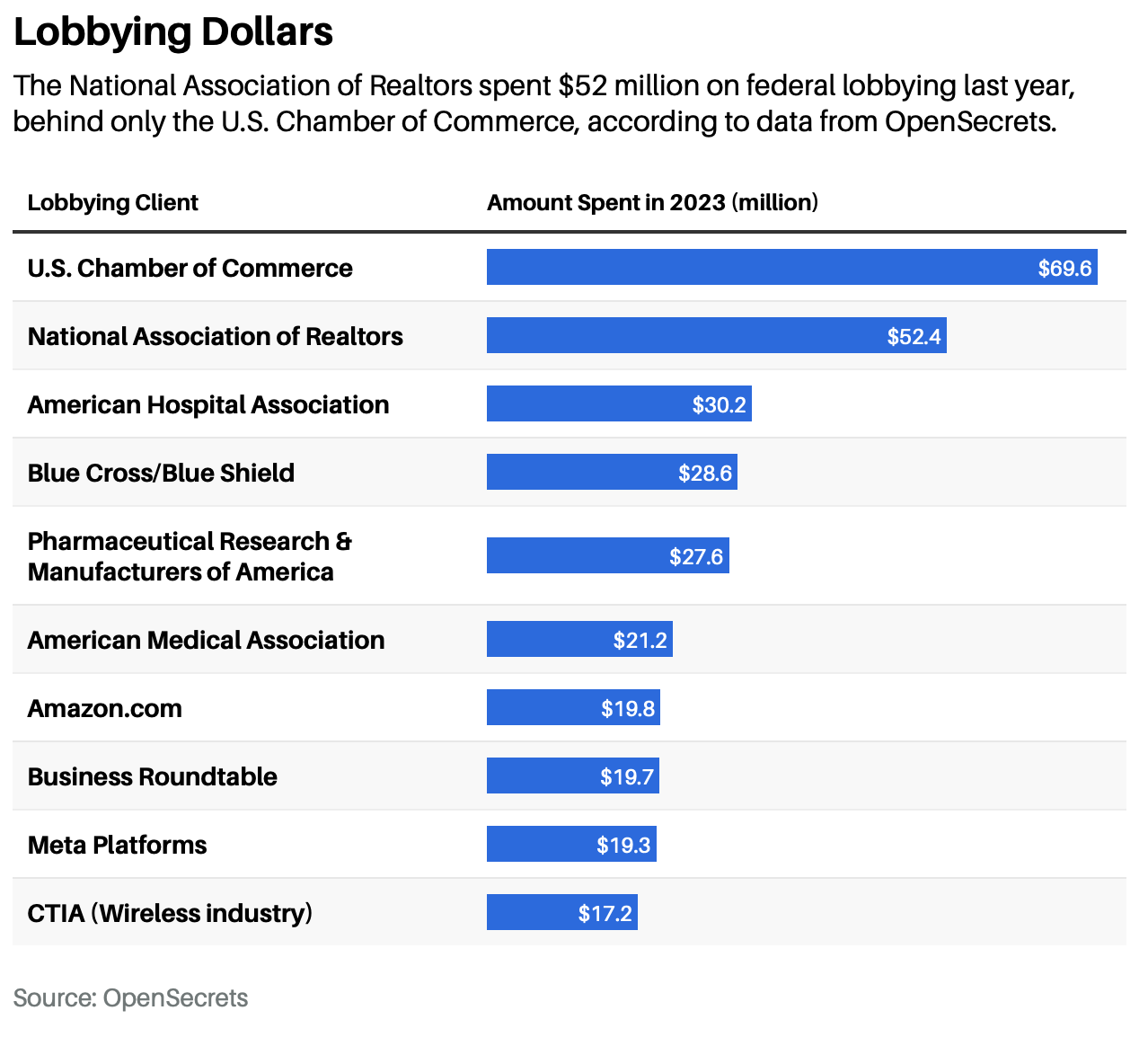

More Class Actions For NAR Over Commissions

Inman News just broke a story that a Utah homeseller filed suit against NAR and 13 others over the commission structure in the industry. There are nearly two dozen such litigations. Last fall’s Sitzer Missouri litigation was just the beginning.

Barron’s had a spectacular summary of the saga back on February 2nd that I encourage everyone to read: Realtor Commissions Are Still a Hefty Part of Home Sales. Maybe Not for Long.

I always thought of NAR as a lobbying powerhouse but in the past 5-7 years they appear to have been largely ineffective such as the 2018 federal SALT tax.

Your Florida Inflation Reminder

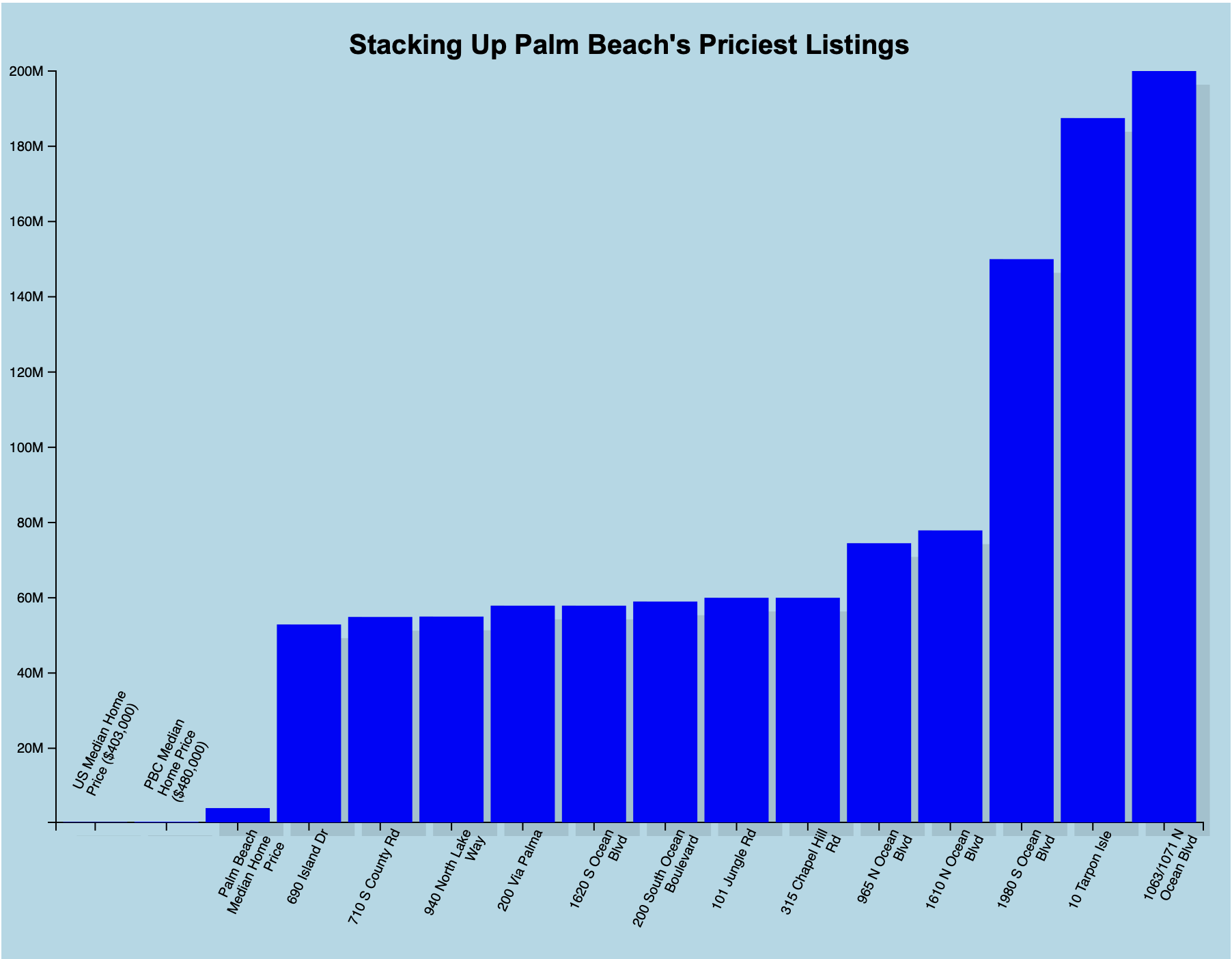

Super Luxury And Short-Stay Found Their Home In Florida

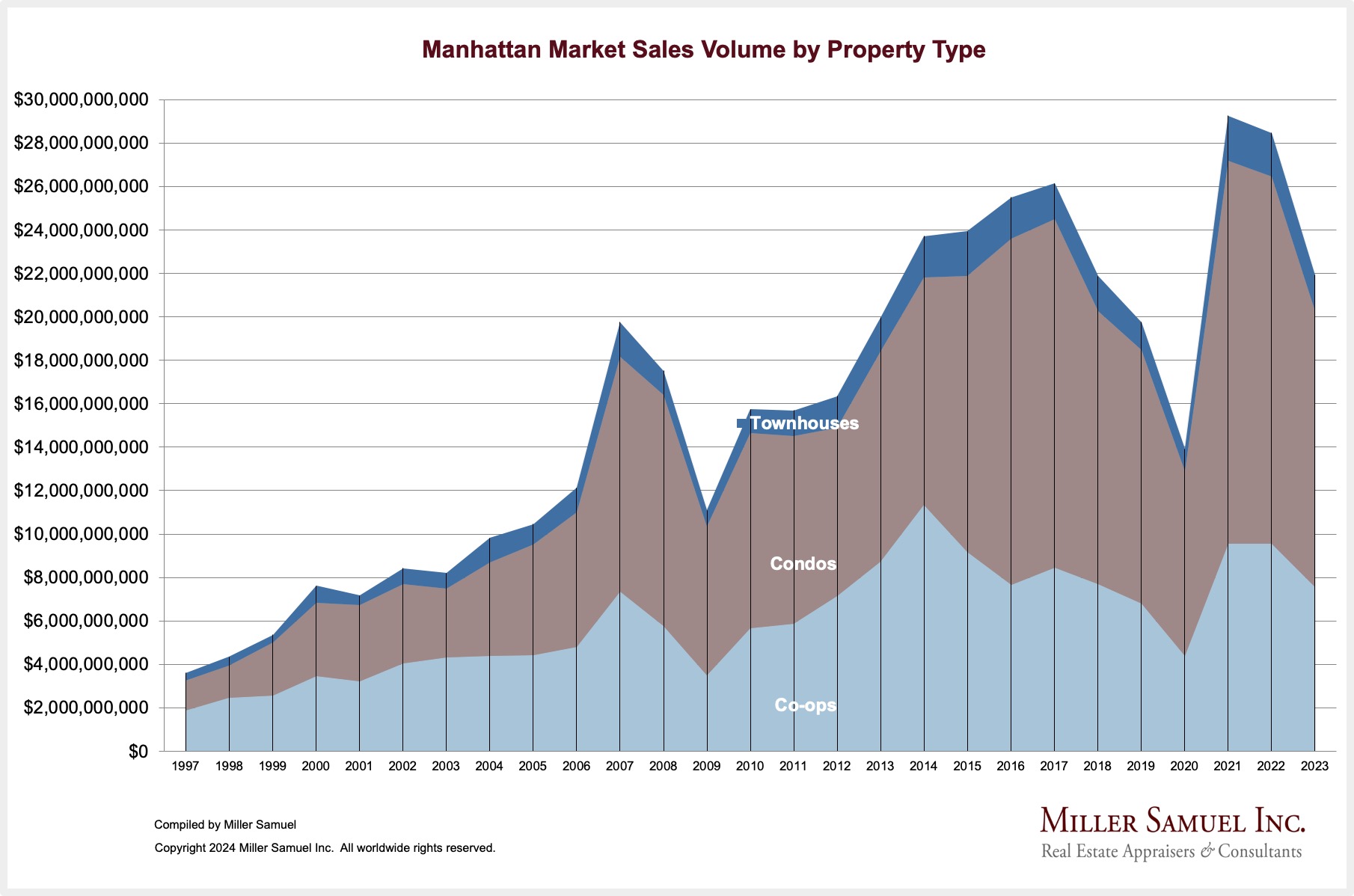

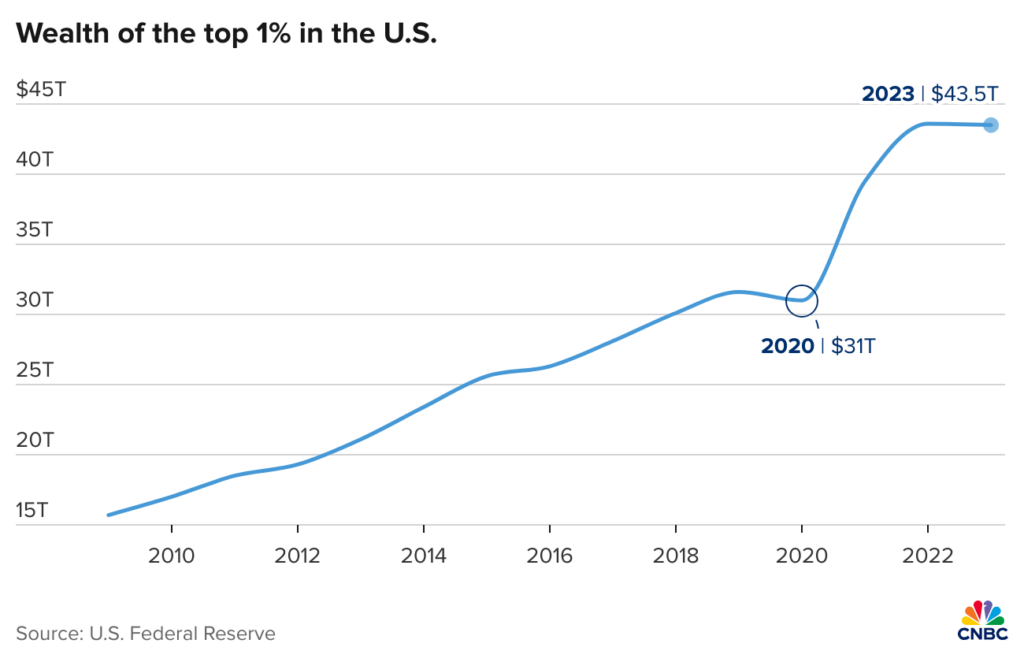

With NYC and LA seeing less super luxury transactions, Florida is filling the void as well as finding its creative groove. Innovation seems to be missing from other regions but Florida remains different, largely because of the restructuring enabled from WFH.

There was an excellent TRD piece on the super luxury phenomenon: Palm Beach ranks as America’s top resi trophy market.

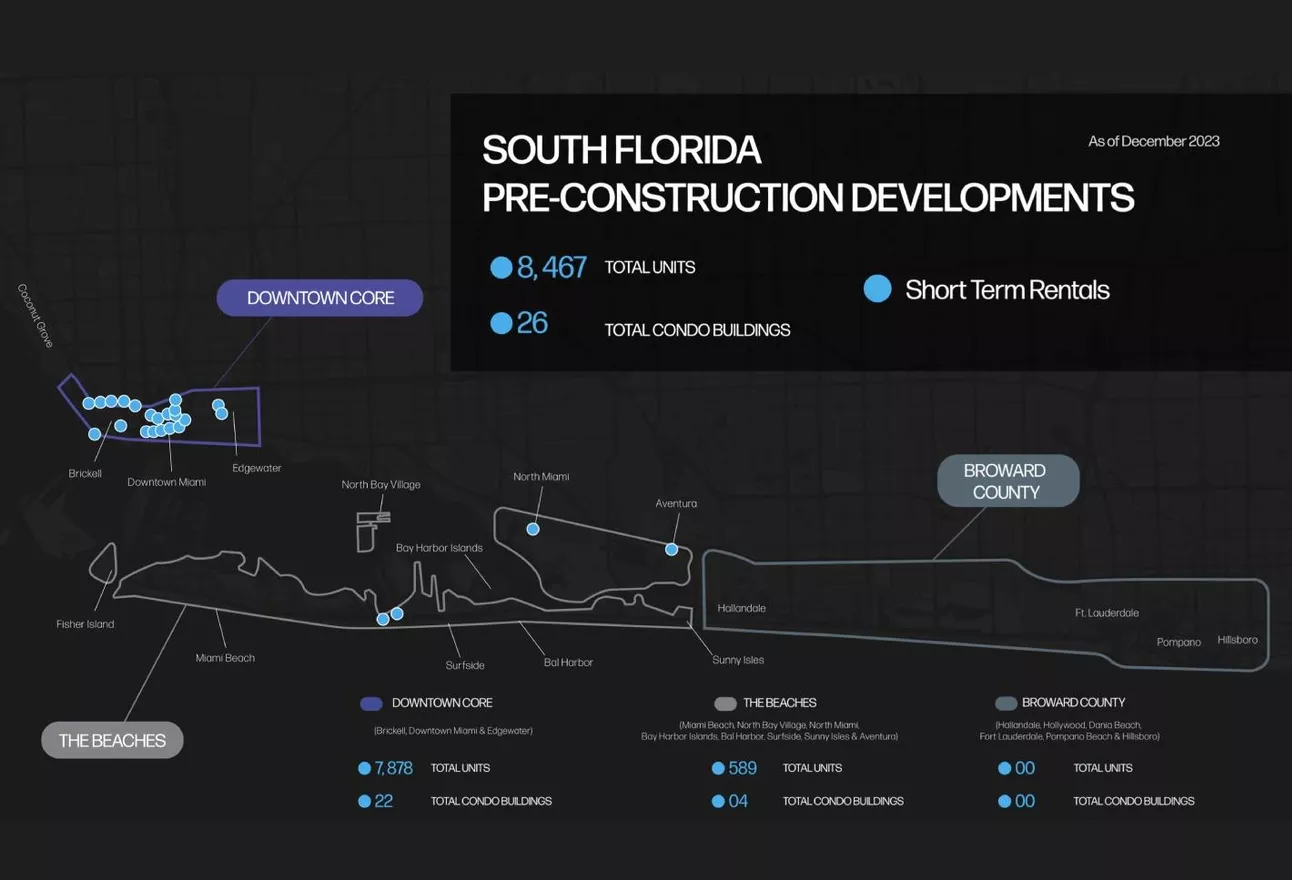

Across Downtown Miami, Brickell, Edgewater and Miami Beach, 8,467 short-term rental condos are planned across 26 projects, 55.6% of the total 15,216-unit development pipeline in the area, according to a report from the South Florida real estate firm ISG World.

Bisnow – Short-Term Rentals Outpace Traditional Condo Development In The Heart Of Miami

Highest & Best Newsletter: Storage Wars

You should sign up for this Florida newsletter I love Highest & Best from Oshrat Carmiel, formerly of Bloomberg News…

This week’s post:

Storage Wars – Miami warehouses are hot. Plus: Jeff Bezos finds a half billion

Central Bank Central Interview: Disinflation Forces Still in Place, Fed Rate Cuts in Store as Early May: Dutta

Here’s a new substack I continue to be excited about – Kathleen Hays Presents Central Bank Central. A long-time friend and journalist, Kathleen Hays has extensive experience interviewing economic experts in Fedworld from her time at Bloomberg Television. She has a steady stream of high quality interviews.

Central Bank Central: link to interview

Getting Graphic

Favorite housing market charts of the week of our OWN making

Favorite housing market/economic charts of the week made by OTHERS

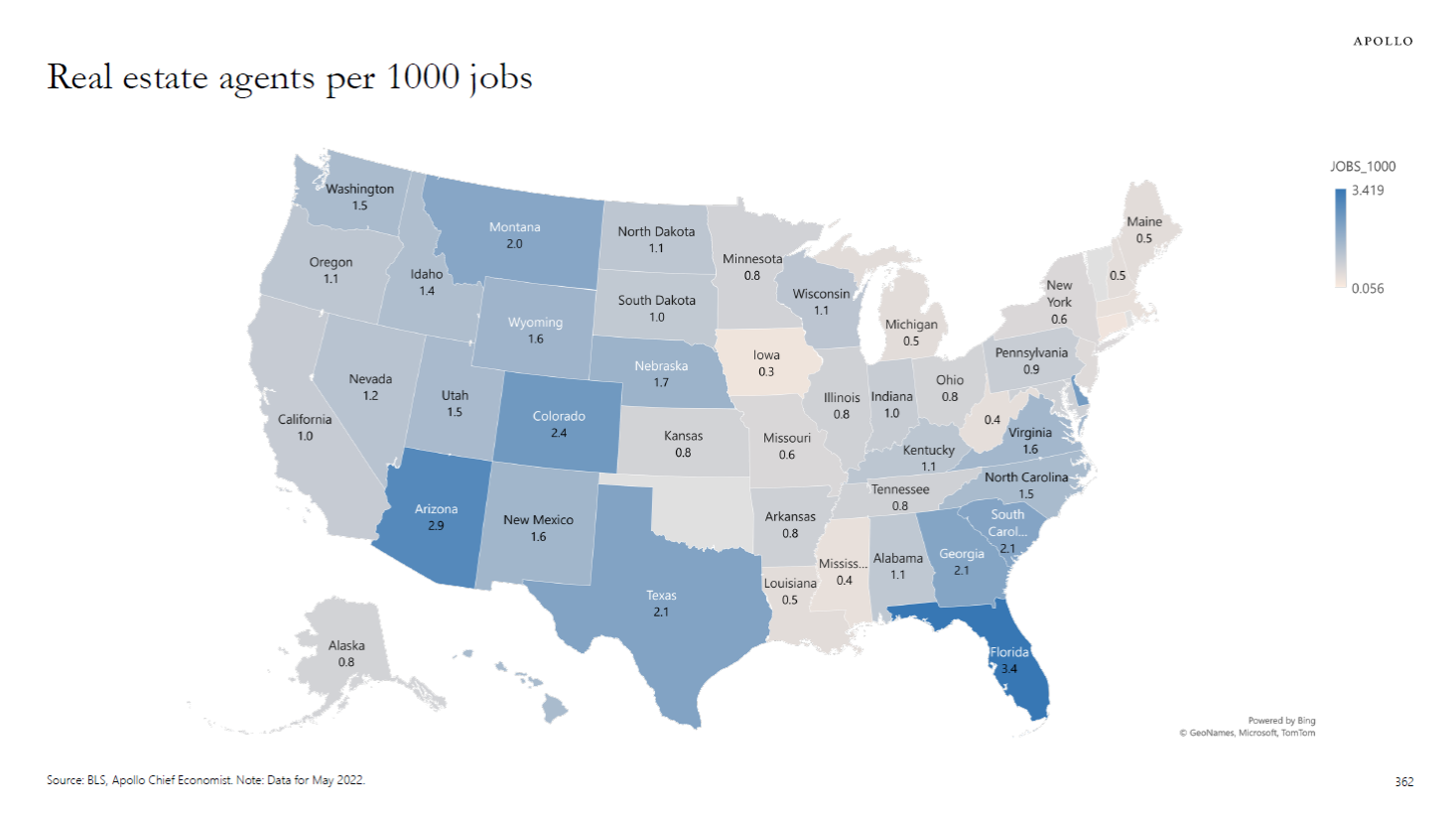

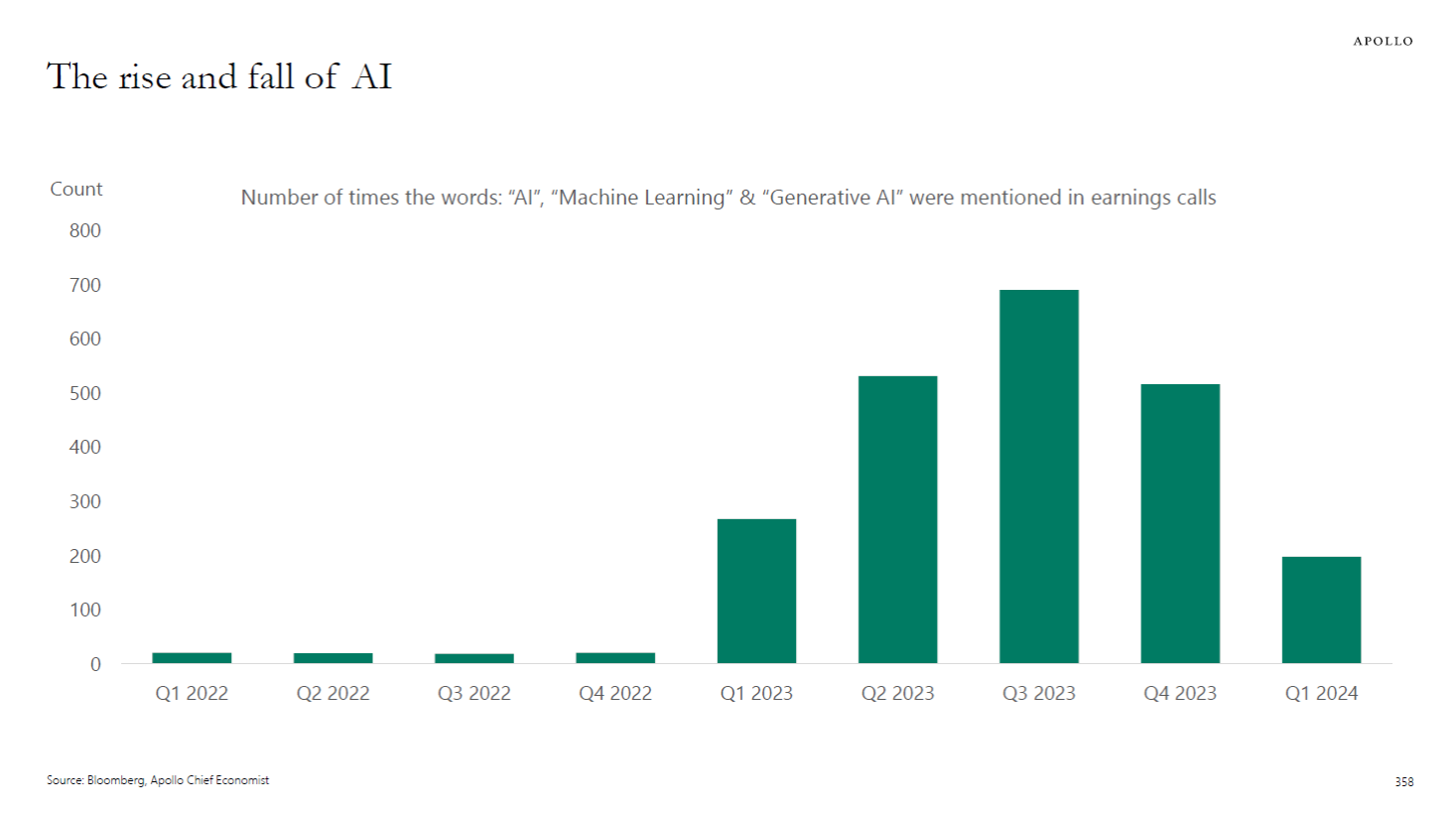

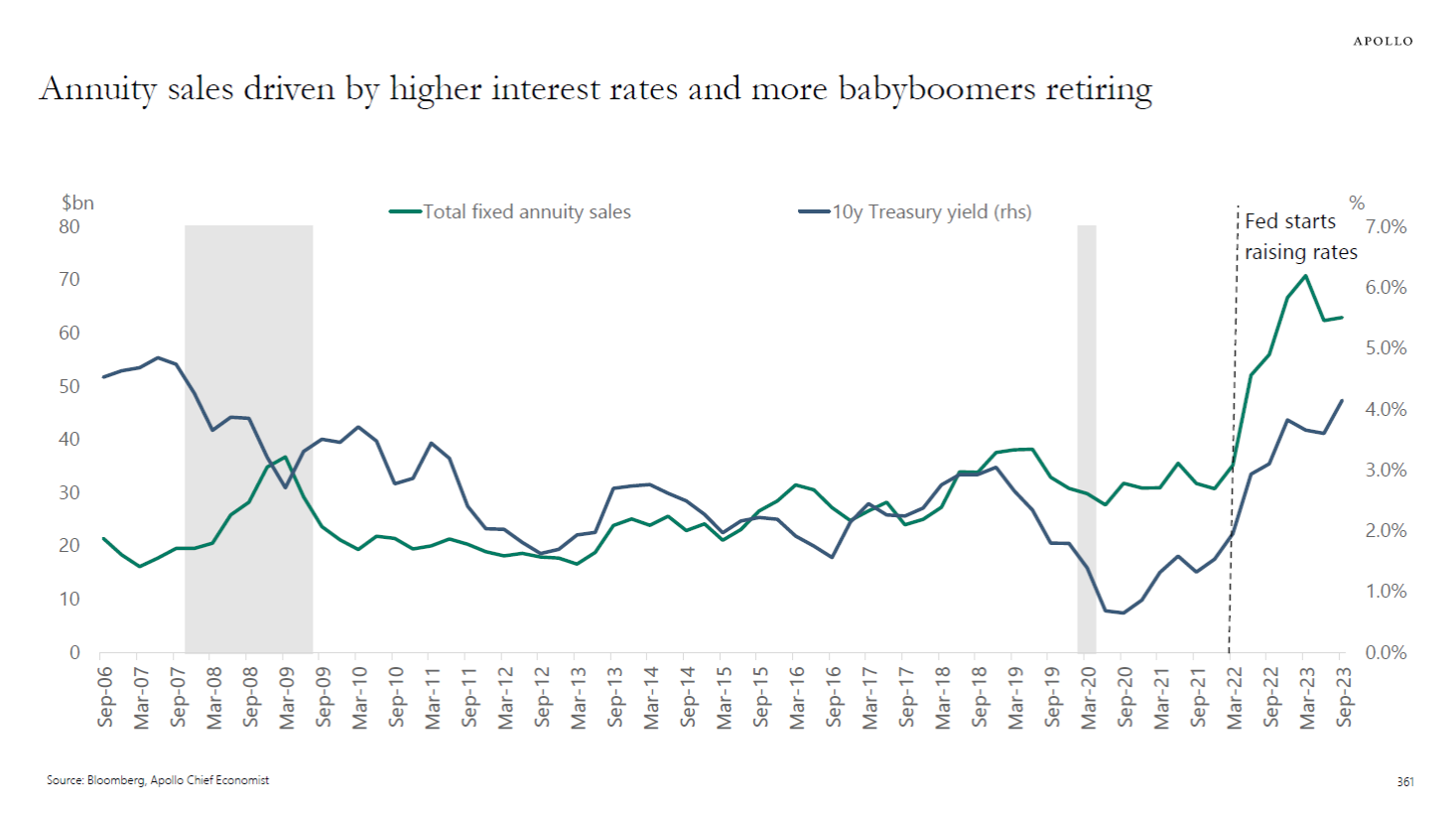

Apollo’s Torsten Slok‘s amazingly clear charts

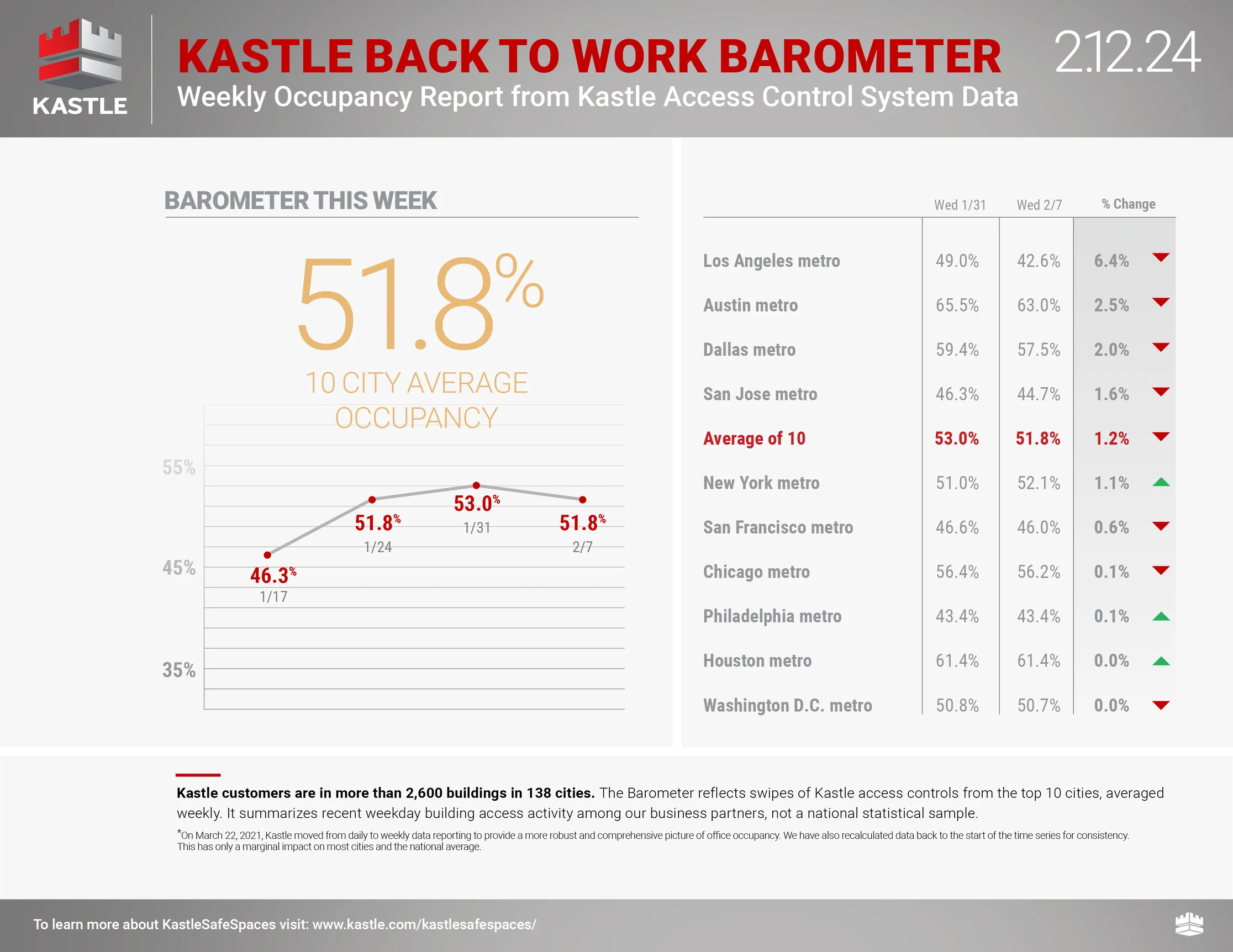

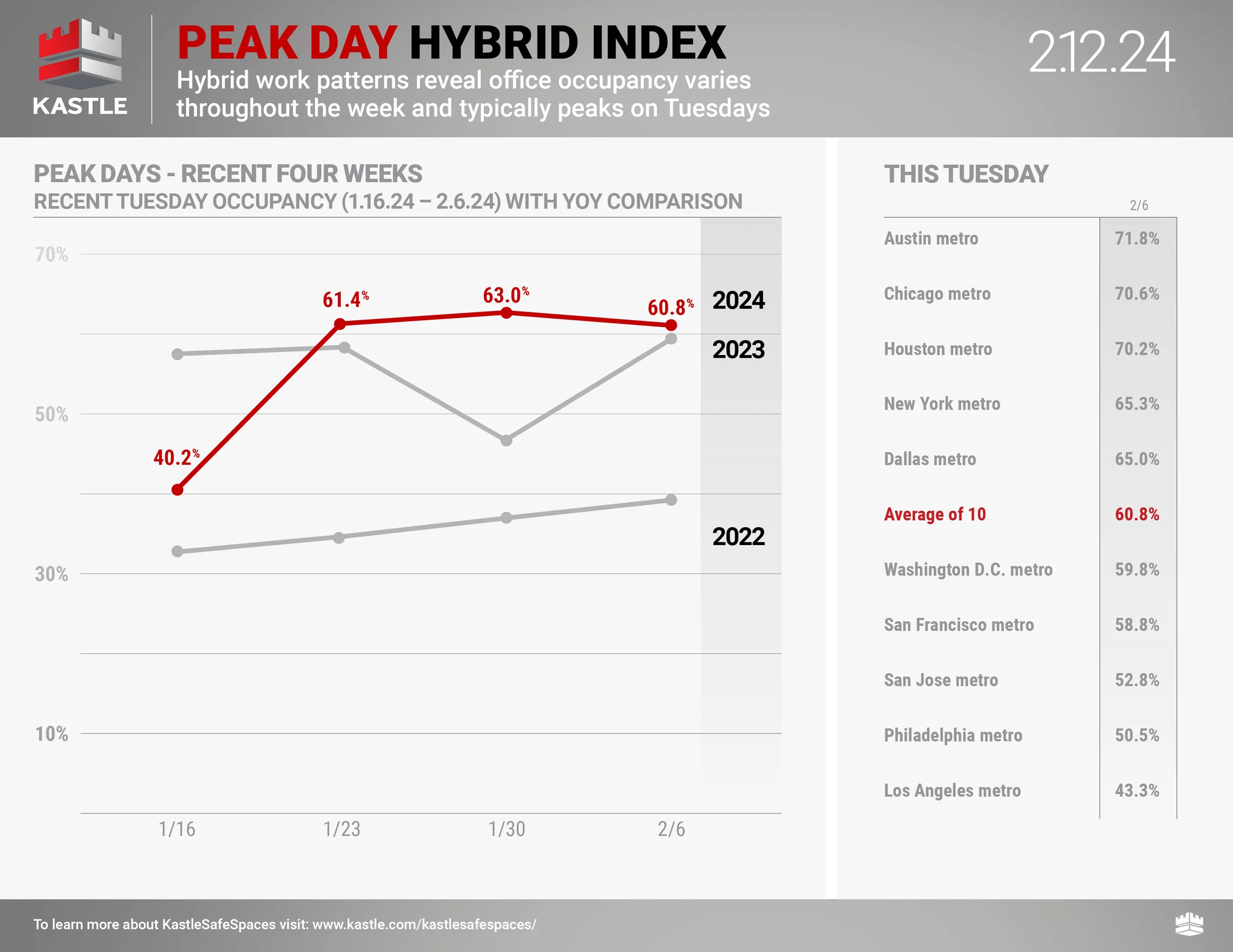

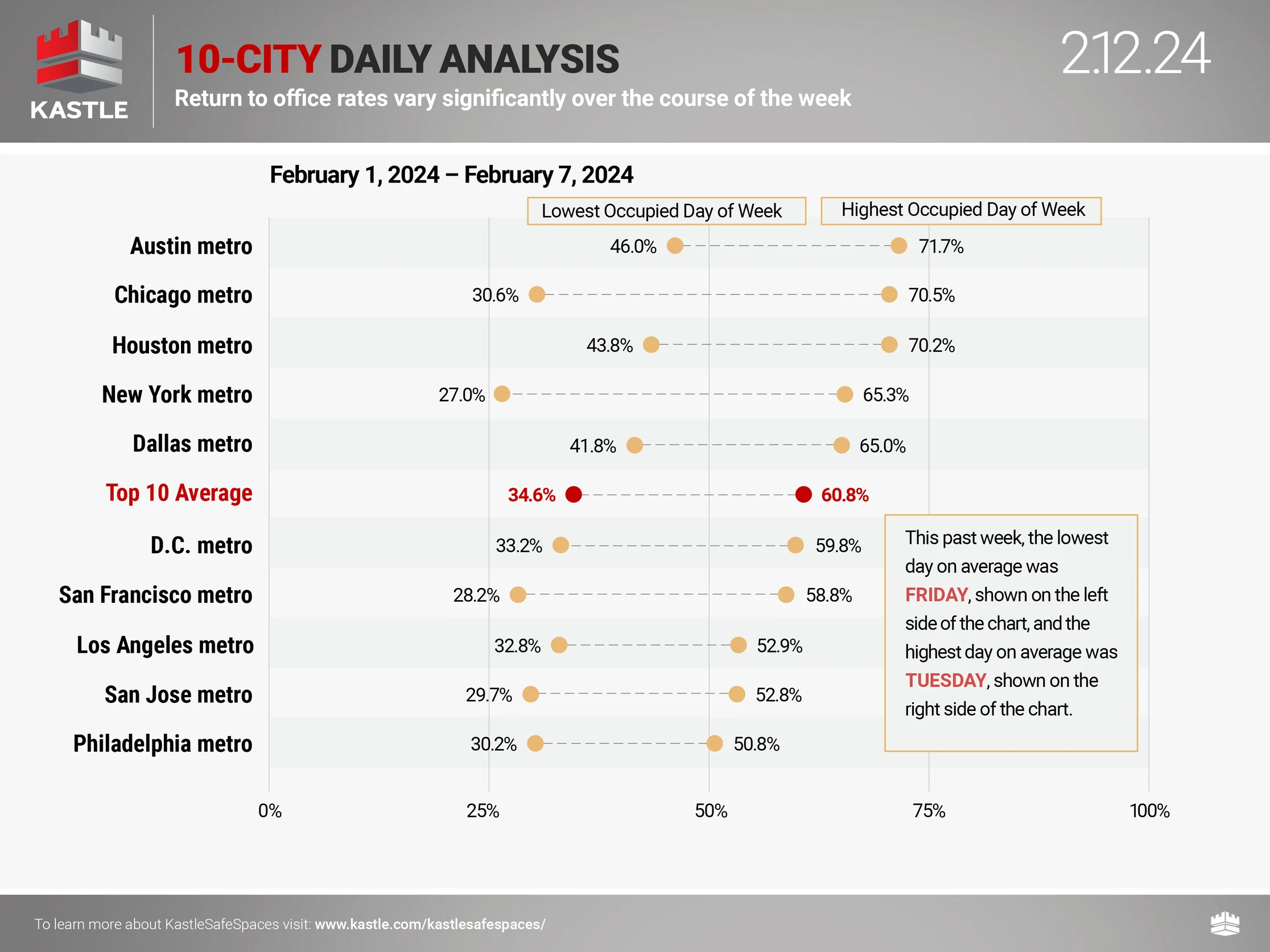

Kastle card swipe data

Remember that Kastle charts are overstating occupancy* because their pre-pandemic occupancy benchmark was 100%, which is incorrect (*measures card swipe activity as a proxy for occupancy). Still, they’ve become the standard benchmark for occupancy rates.

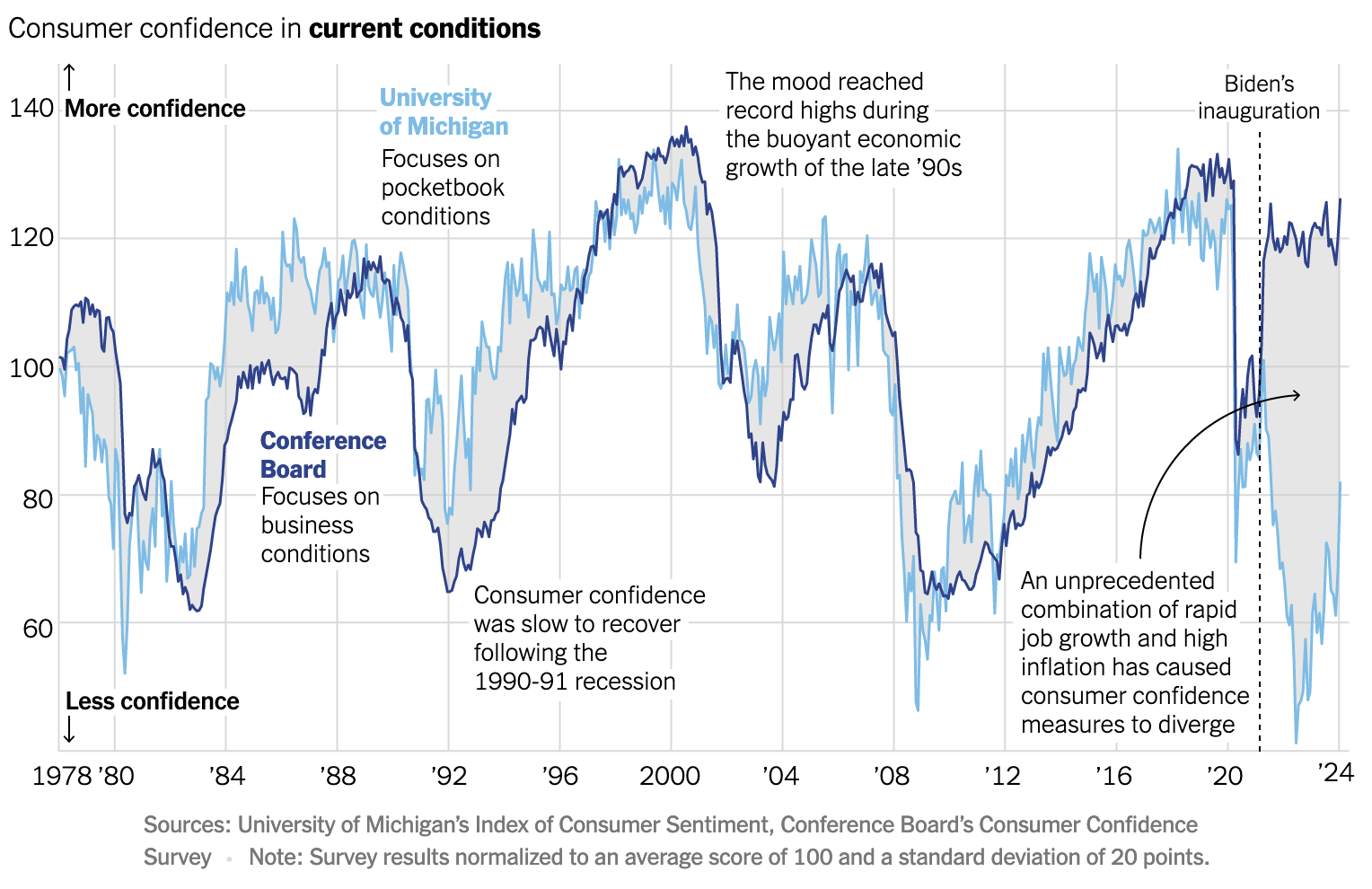

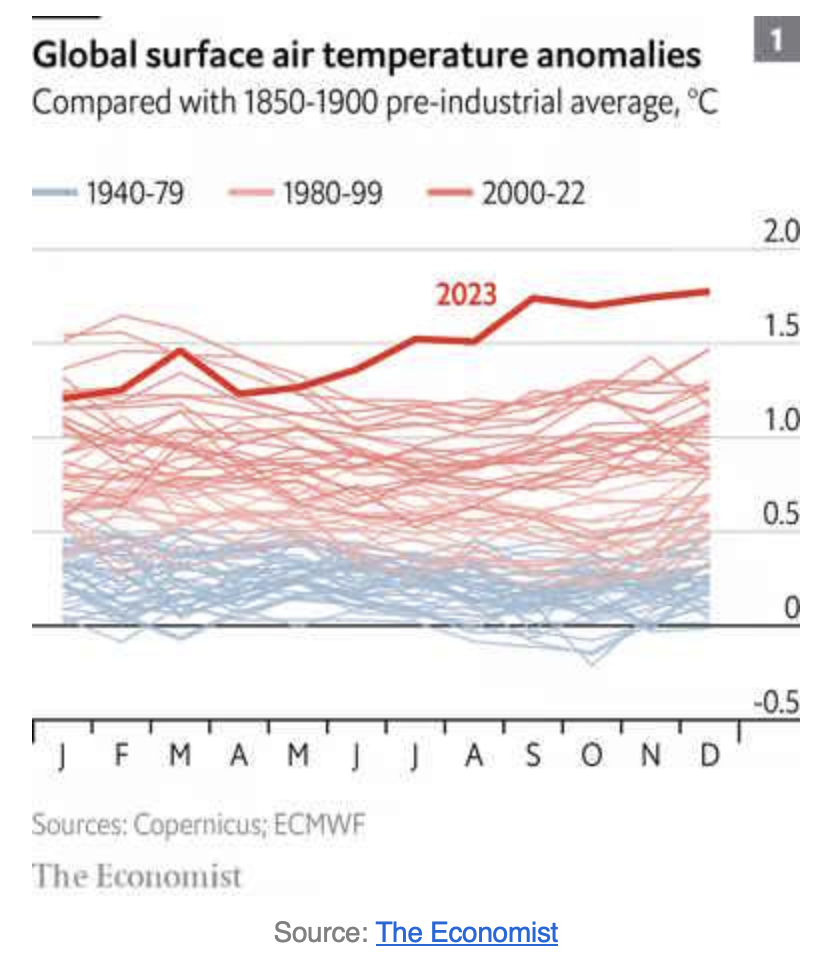

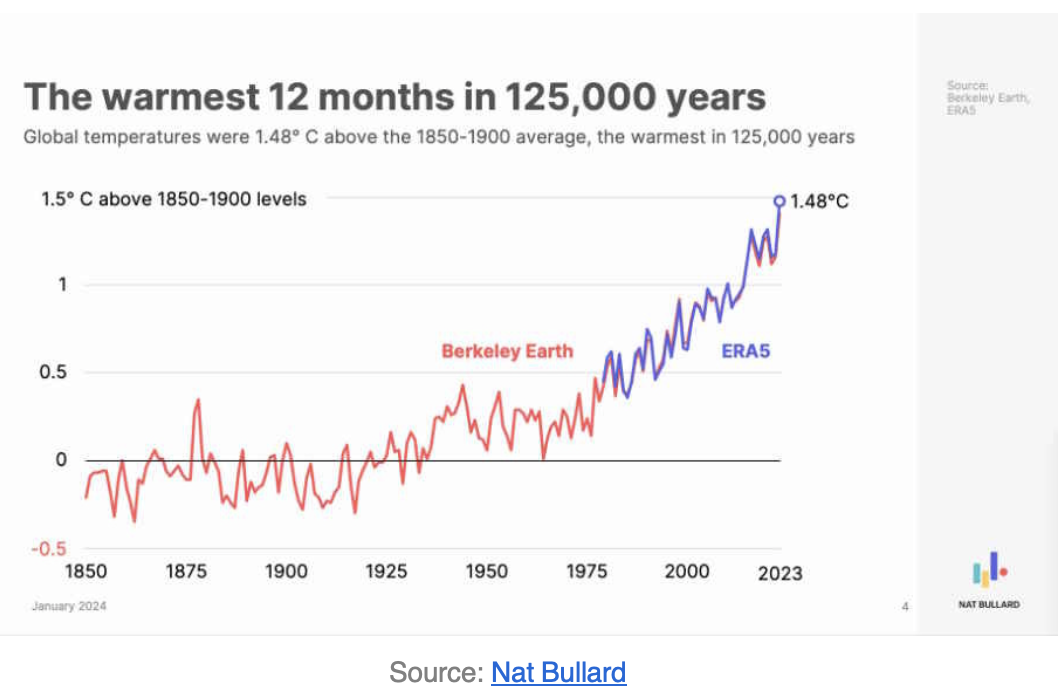

Favorite RANDOM charts of the week made by others

Appraiserville

Lyin’ Dave (“LD”) Calls Me A Liar While Lying

Before I start, I wanted to give a personal shout-out to Dave and Kelly, who will read this newsletter for damage control. For the uninitiated, The Appraisal Foundation (TAF) has been run by Dave Bunton, the only leader of the organization since its inception, and assisted by his hand-picked replacement, Kelly Davids who essentially runs it now. As a reminder, TAF is the organization that wrote the bat-shit crazy letter, the chickenshit letter and is the subject of an active investigation by HUD on whether USPAP promotes a lack of diversity in the appraisal profession (400th out of 400 occupations, according to BLS in 2021).

In the fourth public hearing on appraisal bias on Tuesday, February 13th, Chicago residential appraiser Maureen Sweeney kicked @$$. She hammered the AMC model and the lack of transparency on the cost of appraisal vs AMC’s, which are lumped together in settlement statements as “Appraisal Fee.”

And the three+ decade president of The Appraisal Foundation Dave Bunton was grilled about his succession plans by several individuals on the Appraisal Subcommittee since he had already announced retirement. Their concern was primarily because TAF policy is the crucial reason the appraisal industry is so bad at diversity and is losing the public trust.

NEWSFLASH: Dave Bunton called me a liar in a public meeting this week as he lied about his replacement process when he retires. I’m impressed he had the nerve to slander me after what Fortune Magazine recently said about me (I’ve been waiting for the right moment to humblebrag this..ha).

Jonathan Miller may be the most respected man in New York City real estate, if not the greatest “appraiser” on the nationwide housing market

Fortune Magazine, January 3, 2024

Dave was bobbing and weaving to the series of questions thrown at him from ASC, begging off with the tired answer, I’m “not involved” in the process. That response is a lie. Even though he ironically called me a liar in this public hearing and said that I have a problem with the truth, everyone in the D.C. appraisal world knows TAF is a monarchy, and he is the king. Every board member in TAF is ultimately personally approved by Dave. I’ve had personal experience with this. Sadly, many people in the industry are more than qualified than some of the people he recycles to maintain absolute control over all boards at TAF (more on that further down).

I now dub Dave Bunton “Lyin’ Dave” (or “LD” when the mood strikes) in perpetuity and will think of “Lyin’ Eyes” everytime I write it.

For years, the TAF rumor mill has maintained that LD selected his long-time deputy, Kelly, to take over when he retires. The ASC board members at the hearing peppered him with his successor plans because they didn’t want a continuation of the status quo such as the extreme lack of diversity in the appraisal profession TAF fosters. All his bobbing and weaving to the ASC questions at the hearing made this fact more than evident as he gave non-answers on the topic of succession. It was such an embarrassing performance that I felt sorry that LD didn’t know better. One may ask why he cares about his successor so much, so it sure sounds like he has a financial incentive. I can only assume that he has a consulting deal with TAF post-retirement, so he keeps his toe in the pool of the appraisal industry for personal relevancy and draws a nice fee for doing nothing simultaneously. After all, he makes over $500,000 a year for managing a 13-person entity (excellent work if you can get it). Remember that TAF has no real “oversight,” technically as they figured out a work around to avoid taking ASC grants which were designed to provide ASC with oversight powers.

Let’s review some hard-working appraisers’ feedback on LD’s (not sworn under oath) testimony at the Tuesday hearing. Appraisers across the U.S. shared with their reactions to LD’s performance. Here are some examples.

Evidence Of Lyin’ Dave’s Lyin’ – Past Behavior Means He Is Not Leaving The Successor Decision To Others

Appraisers rely on “comps” in mortgage appraisals to establish a reasonable opinion of value (stay with me here), so to suss out LD’s claim that he will leave the selection of his replacement to the committee formed to find one, I present some blatant examples of how much he rules TAF with an iron fist like a monarchy.

- Steven H. Berg, MAI, AI-GRS, MRA, SRA was dismissed from the Appraisal Standards Board (ASB) in 2018 after serving since 2014 (by not being allowed to renew) because he apologized to Paula Konikoff of the Appraisal Institute during a public ASB meeting. It was widely known then that LD was livid and made sure Steve was punished by making sure he was off the board. At that time, LD and JA of The Appraisal Institute were going through an extended blood feud.

- John Ryan was quickly removed by LD from the chairmanship of AQB in May of 2022 because John wanted to discuss “barriers to entry” in the profession, the burning issue facing TAF for years. These two lawyer letters from John Ryan’s counsel: [11.1.22], [11.16.22] are incredible. I’ve shared all of this before, but I thought it was essential to understand why LD should not be replaced from within the TAF organization at his retirement. The “barriers to entry” item was magically removed from the AQB agenda. I would love to understand why LD didn’t want anyone discussing “barriers to entry into the appraisal profession.”

At the hearing, CFPB’s Chopra demanded LD confirm in writing about the search for his replacement, his input into the process, and the parties involved in the decision. Chopra wants to review the president selected by the search committee to insure that a new regime is running TAF. In fact, that applies to FFIAC, not just CFPB. It’s getting increasingly difficult for TAF to hide what they are doing from the ASC.

Here’s a word of warning to TAF’s BOT in this regard:

To All Board of Trustee (BOT) Members – you are ultimately responsible for selecting LD’s replacement – you can’t think you can insulate or buffer yourself from the decision. You need to look up “Board Misconduct” and check into the D&O insurance of TAF. Deferring a decision like this to a mysterious committee and/or accepting the not-very-subtle mandates of the outgoing president doesn’t insulate or buffer you. Anything less than this is legally described as Board Misconduct. My comments are below in parentheses “(” “)”

1. Duty of care

Duty of care: Handle the business of the organization with the care an ordinary and prudent person would use.

Directors must be engaged. They should actively participate in meetings, review documentation, ask questions, learn about the activities of the organization, understand risks and be intentional when deciding what risks are acceptable. As stewards of the organization, board members must think short-term and long-term, have the depth of knowledge to understand documents like financial statements and strategic reports, and know what questions to ask internal and external advisers.

2. Duty of loyalty

Duty of loyalty: Act in the best interests of the organization, even if it means forfeiting an opportunity that would benefit them personally.

Directors must not profit at the expense of the organization, or receive unreasonable compensation or benefit from the activities of the organization or from serving on its board. They should ensure that the organization’s conflict of interest policy is followed. That may mean disclosing on Form 990 any compensation, familial relationships or business transactions between the nonprofit organization and themselves (or their family member, business interest or other relevant connections).

Directors should avoid even an appearance of impropriety that they are benefiting at the expense of the organization. Any member of governance who is potentially conflicted should recuse themselves from deliberations and decision making related to a proposed transaction in which their objectively may be compromised. (If Dave, as he admitted in the hearing, has expressed his opinion regarding who should succeed him, the presumption should rightly be that the objectivity of the “committee” is compromised from the outset. Dave himself, by making the recommendations, has already compromised himself).

3. Duty of obedience

Duty of obedience: Work to ensure the organization follows all applicable laws, complies with all reporting requirements and follows the organization’s articles and bylaws.

Directors should affirm that the organization is working to fulfill its mission and purposes, while complying with all laws and required reporting. (TAF reports to no one, so this is moot (for the time being.) It’s more than conceivable that TAF, as they continue to run afoul of CFPB and FFIEC, could find themselves under far more stringent reporting requirements and governance.)

Shoutout To The CFPB: You Need Input From Chief Appraisers

To Anyone On The CFPB if you’re reading this – I can connect you with chief appraisers of significant financial institutions if you want to contact me directly. Consider this:

- Who are the largest consumers of appraisal services? Financial institutions.

- Who pays the appraisers and, by extension, all the fees that TAF rakes in? Chief appraisers of financial institutions, by paying the appraisal fees (not all end up being paid by borrowers).

- What voice isn’t even being solicited for the future of TAF? Chief appraisers. If a financial institution purchased its way into the TAF’s IAC, it might have a voice, but how many is that?

Financial institutions and their chief appraisers have seen TAF refuse to acknowledge or address the bias in appraisal and other deep problems in the running of TAF.

- Do you know who might need to address the faults TAF has systematized through 30+ years of ossification? Chief Appraisers. If the largest consumers of appraisal services have to seek solutions, they may ultimately bypass TAF when possible.

The apparent rigged search for a new president for TAF, ensuring a continuity of the mismanagement of TAF, isn’t going to cut it with our nation’s chief appraisers, the largest consumers of appraisal services.

Here’s a suggestion for CFPD to actually understand how LD’s replacement will be picked (it is currently Kelly, assumed per the entire appraisal industry).

- Hold a hearing on LD’s replacement.

- The witnesses are made to swear an oath to tell the truth (to avoid lying).

- Require the attendance of four experts: Dave, Kelly, the BOT Chair, and the Search Committee Chair.

This is the only way you’ll get the truth on the TAF succession plan.

FHFA Questions Why TAF Copyrighted Standard 1-4

When an FHFA representative of the ASC questions why USPAP Standards 1-4 were still copyrighted, TAF has no answer. If you’ll recall, TAF was forced to place these standards online for free in 2019. But to LD, it’s a game. When the copyright on every page of the document was pointed out, he mumbled that “he’ll look into it,” even though he already knew this was an issue long ago. And yet, he’s the same person who just called me a liar in this public forum.

Here’s the USPAP landing page on TAF’s website. This free version has a hard to find link (I’m assuming this was intentional).

Free USPAP Standards 1-4 [TAF]

Here’s the copyright on the bottom of all pages of the free document taken from the TAF website this week.

Voice Of Appraisal Goes All Modernization On Us

And $25 is the going rate!

OFT (One Final Thought)

Dancing in the 1960’s was all about Metal.

Brilliant Idea #1

If you need something rock solid in your life – particularly on Friday afternoons at 2:00 PM, Eastern Time (ET) – and someone forwarded this to you, you can sign up here for these weekly Housing Notes. And be sure to share with a friend or colleague if you enjoy them because:

– They’ll meet in Kansas City;

– You’ll go Swiftly;

– And I’ll dance to Metal.

Brilliant Idea #2

You’re clearly full of insights and ideas as a reader of Housing Notes. Consider sharing them with me early and often. I appreciate every email I receive, as it helps me craft future Housing Notes.

See you next week!

Jonathan J. Miller, CRE®, Member of RAC

President/CEO

Miller Samuel Inc.

Real Estate Appraisers & Consultants

Matrix Blog @jonathanmiller

Reads, Listens and Visuals I Enjoyed

- 🔥 Storage Wars [Highest & Best]

- Single Family Starts Up 22% Year-over-year in January; Multi-Family Starts Down Sharply [Calculated Risk]

- Did recent weeks of 'crummy weather' in Palm Beach dampen real estate activity? Could be. [Palm Beach Daily News]

- NYC’s Oldest Scaffolding is Over 14 Years Old [Untapped New York]

- Top Commercial Sales Broker Bob Knakal Out at JLL [The Real Deal]

- The Brutal Reality of Plunging Office Values Is Here [Bloomberg]

- Utah homeseller files commission lawsuit against NAR, others [Inman]

- Office Towers Reshaped US Skylines. Now Construction Cranes Are Vanishing. [Bloomberg]

- The Life and Death of the American Mall [Atlas Obscura]

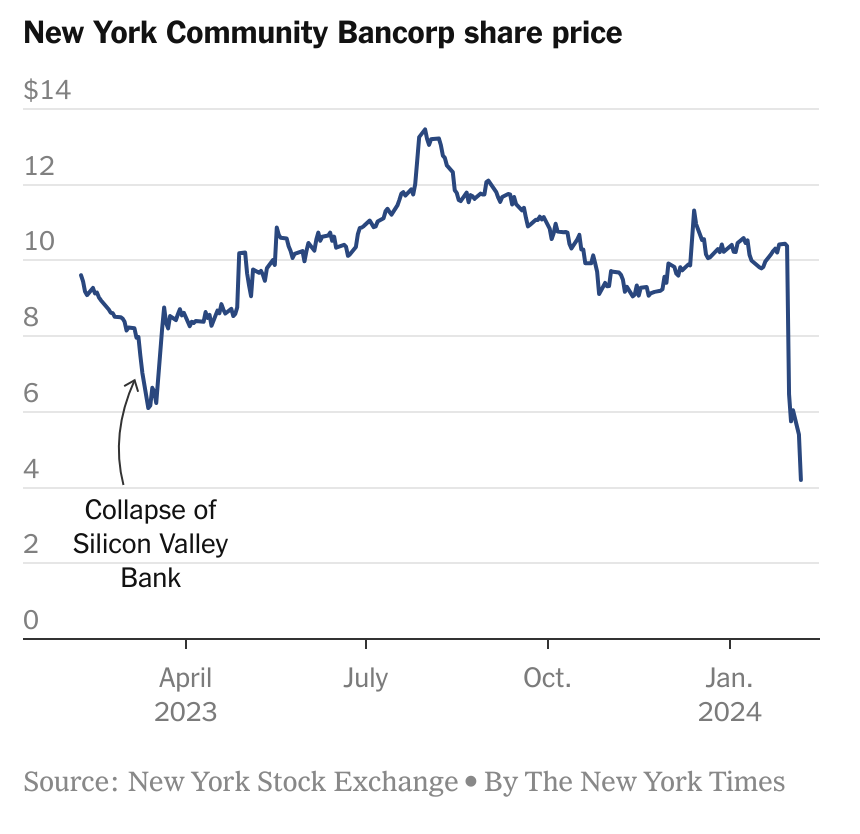

- The Real Estate Crisis Looming Over Banks [NY Times]

- The 6% Commission for Home Sales Is Under Attack. Inside the Fight to Keep It Alive. [Barron's]

- Short-Term Rentals Outpace Traditional Condo Development In The Heart Of Miami [Bisnow]

- Building Blocks of Change [NYC Comptroller]

- A rent-stabilized 1 bedroom apartment for $1,100? In NYC? The broker's fee is $15K. [Gothamist]

- National Association of Realtors Faces Future After Crisis [The Real Deal]

- Ex-HFZ Developer Nir Meir Jailed, Facing Extradition [The Real Deal]

- Why London’s Wealthy Are Renting Instead of Buying [Wall Street Journal]

- Luxury Retailers Are Buying Out Their Landlords [Wall Street Journal]

- The Ground-Floor Window Into What’s Ailing Downtowns [NY Times]

My New Content, Research and Mentions

- Mohamed Hadid-built Beverly Hills mansion sells for $36M [Inman]

- Buyers make a beeline for Manhattan’s Yorkville [Financial Times]

- Uzbek Perfume Magnate Sells Beverly Hills Mansion for $36M [The Real Deal]

- Queens resident shares struggles to make ends meet as rents rise [CBS News]

- Houses that sold for less than $400,000 on Long Island [Newsday]

- Why rents in America are plummeting – but Britain’s are soaring [Telegraph UK]

Recently Published Elliman Market Reports

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 1-2024 [Miller Samuel]

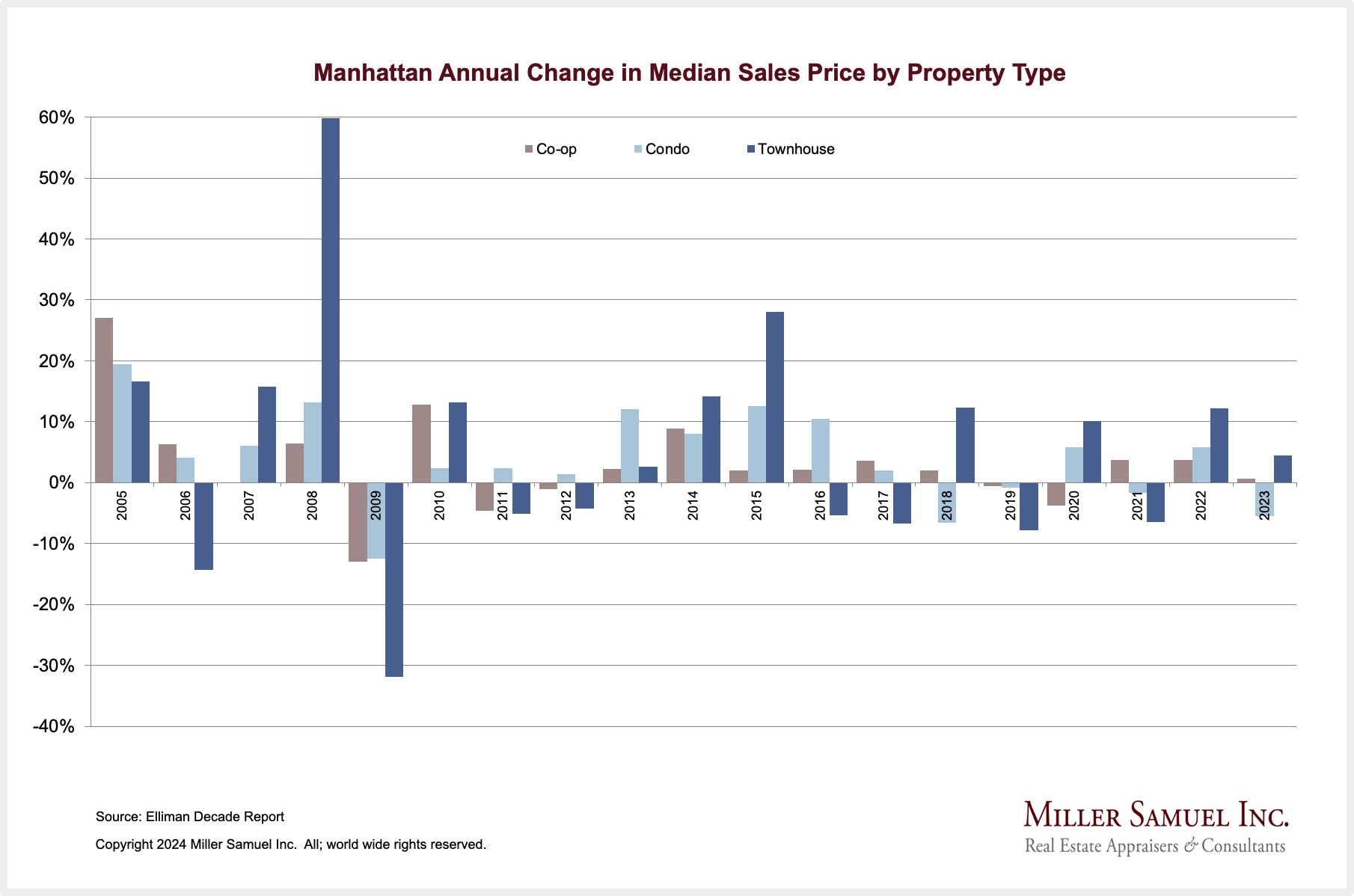

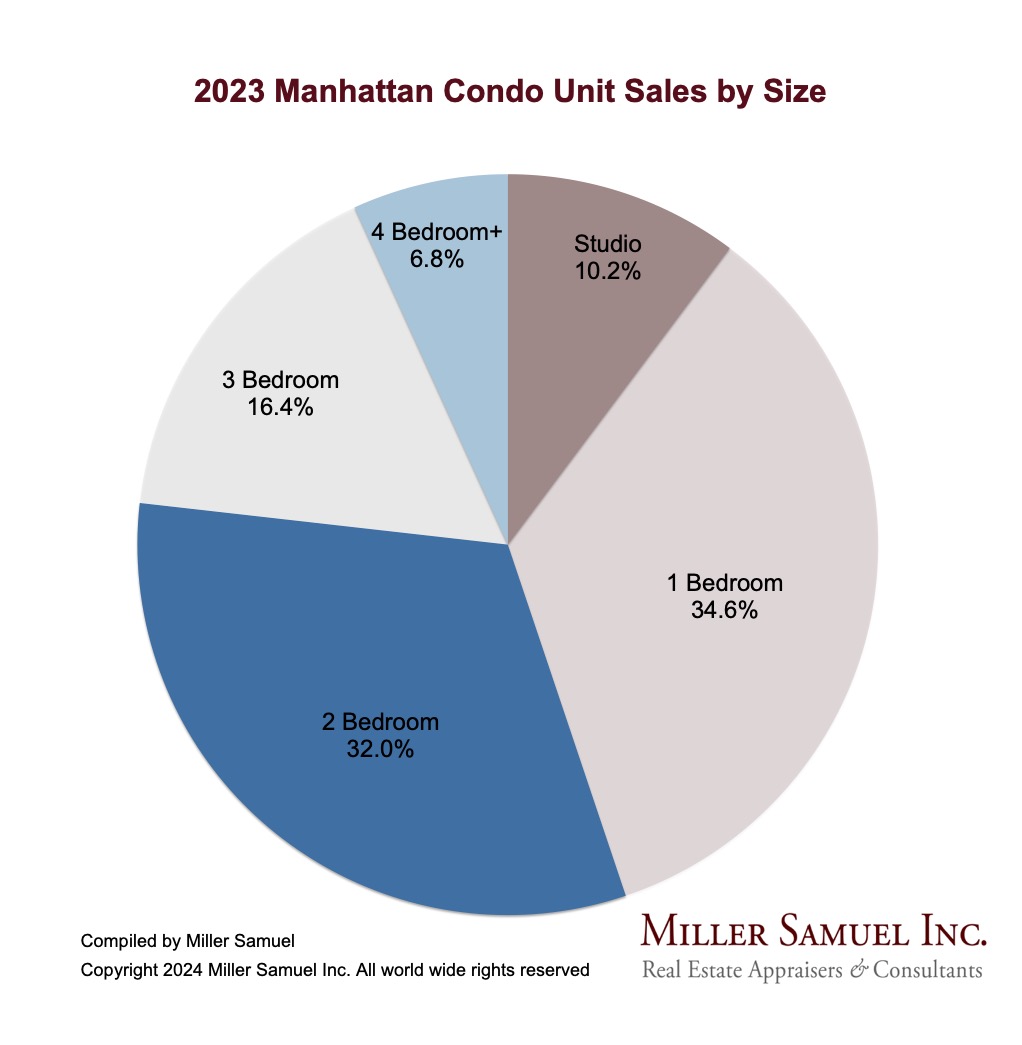

- Elliman Report: Manhattan Decade 2014-2023 [Miller Samuel]

- Elliman Report: Manhattan Townhouse Sales 2014-2023 [Miller Samuel]

- Elliman Report: San Diego County Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Orange County Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Los Angeles Sales 4Q 2023 [Miller Samuel]

- Elliman Report: North Fork Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Hamptons Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Long Island Sales 4Q 2023 [Miller Samuel]

- Miller Samuel New York City Market Brief 4Q 2023 [3 Year Comparison] | Miller Samuel Real Estate Appraisers & Consultants

That One Big Thing

Appraisal Related Reads

- FFIEC to Lenders: Appraisal Bias Compliance Management in Focus [Cooley // Global Law Firm]

- The challenge of pulling comps in 2024 [Sacramento Appraisal Blog]

- February Newsletter [DW Slater Company Blog]

- Appraiser Diversity Initiative (ADI) [Fannie Mae]

- Housing Statistics for Beginners, Part 3 [Birmingham Appraisal Blog]

- Voice of Appraisal E256 Everyone Thinks We're Crazy! [YouTube]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)