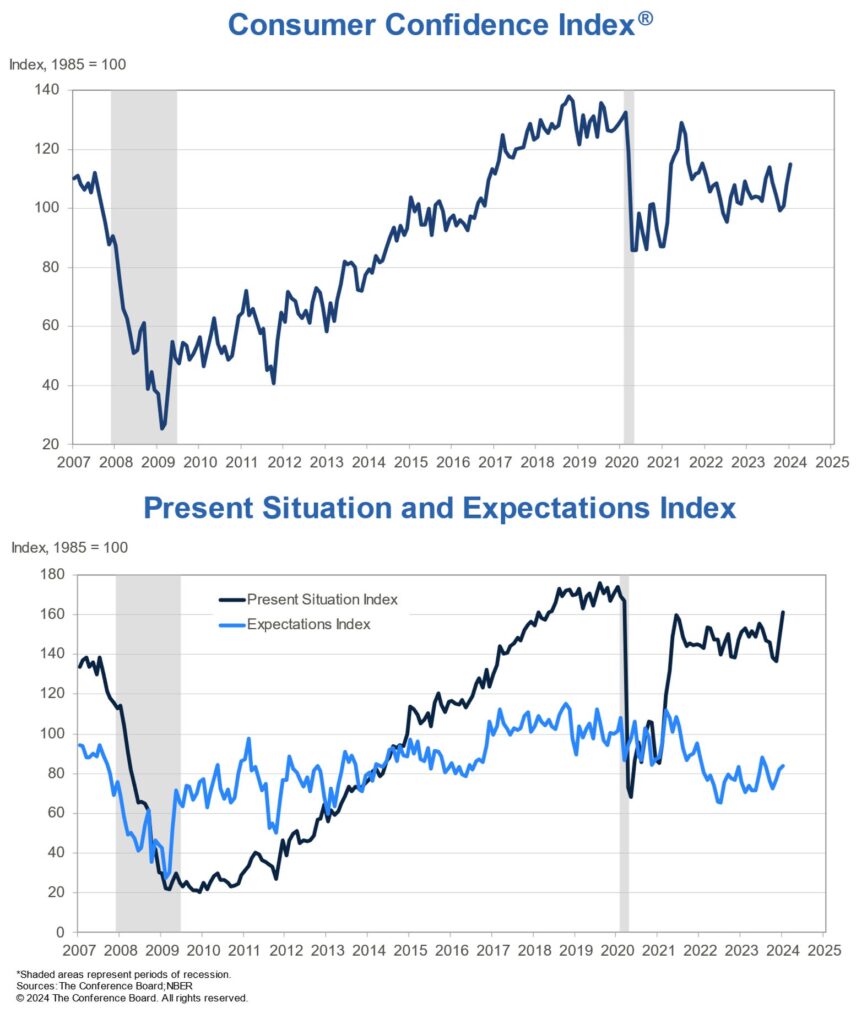

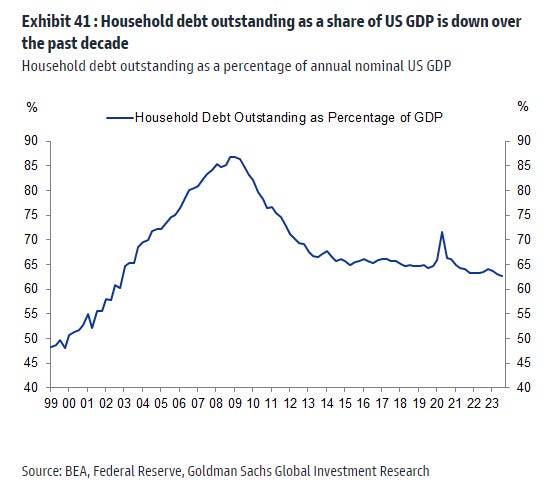

In the late 90s, the size of Former Fed Chair Alan Greenspan’s briefcase was tracked to consider the odds of a rate cut or increase. Last December, Fed Chair Powell said they planned to cut rates by 75 basis points sometime in 2024 but wasn’t specific about “when.” I prefer numbers over briefcases because who carries one these days?

Here’s a better way to look at it – stay with the video for an education.

——–

Did you miss last Friday’s Housing Notes?

February 2, 2024: ‘Date The Rate’ Is Bad For Housing Business

——–

But I digress…

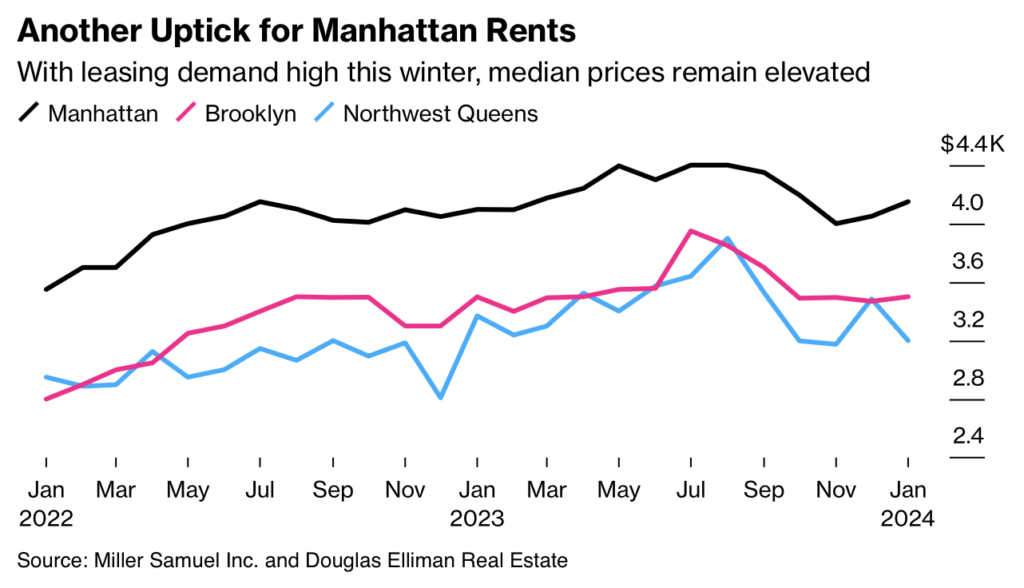

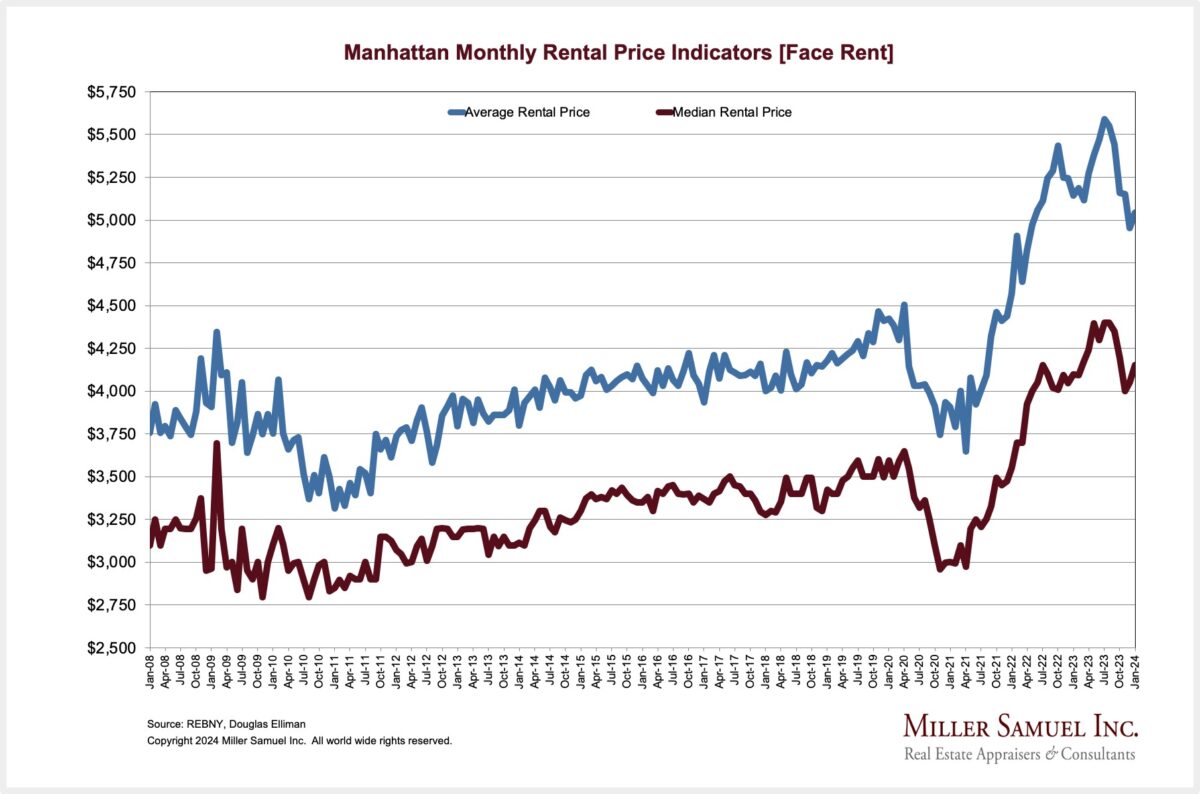

NYC Residential Rental Leasing Levels Surge

I’ve been the author of a series of market reports for Douglas Elliman since 1994. The rental report series for New York City has been the most followed since the beginning of the pandemic era. Rental prices are more quickly responsive to changes in economic conditions.

Elliman Report: January 2024 Manhattan, Brooklyn & Queens Rentals

Bloomberg News did a great writeup on our research and included the essential communications tool known as a chart!

Incidentally, a $125,000 annual income qualifies you for affordable housing in Manhattan.

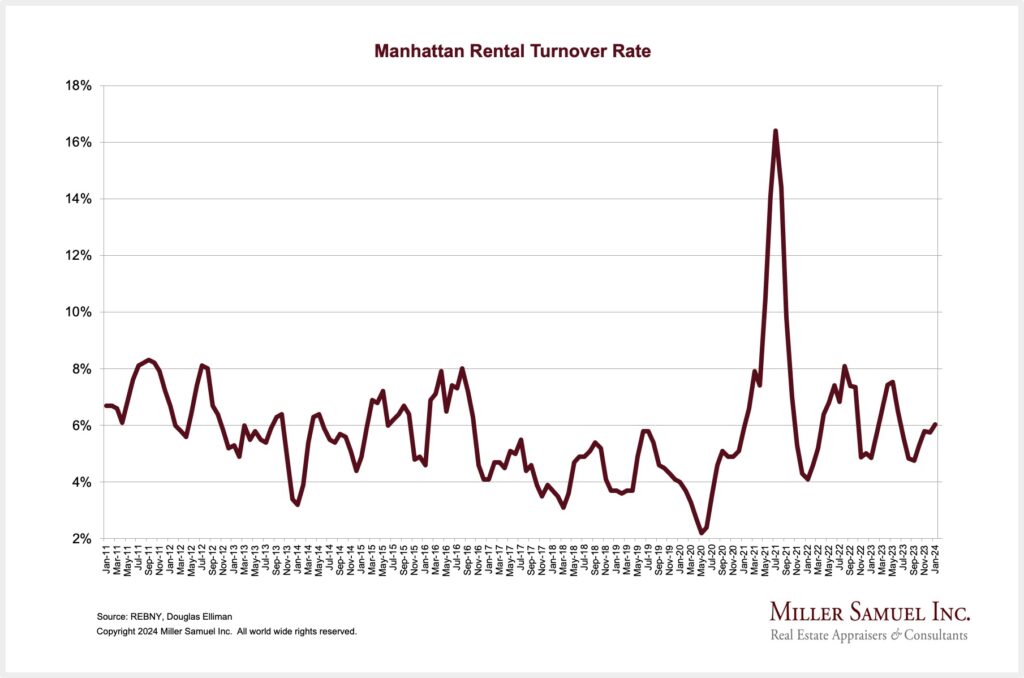

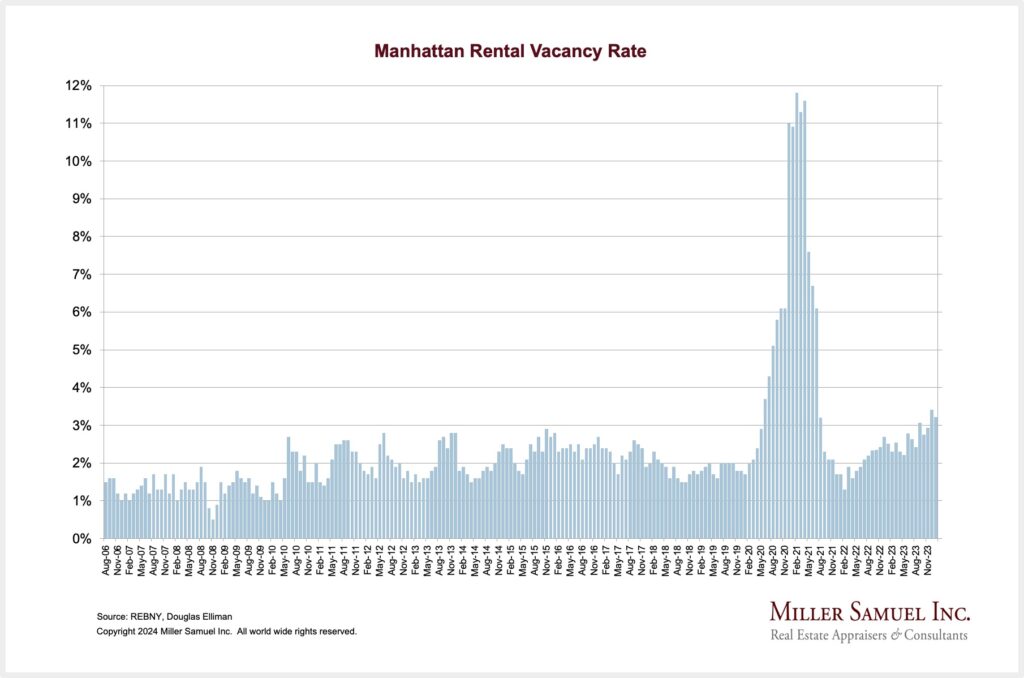

MANHATTAN RENTAL MARKET HIGHLIGHTS

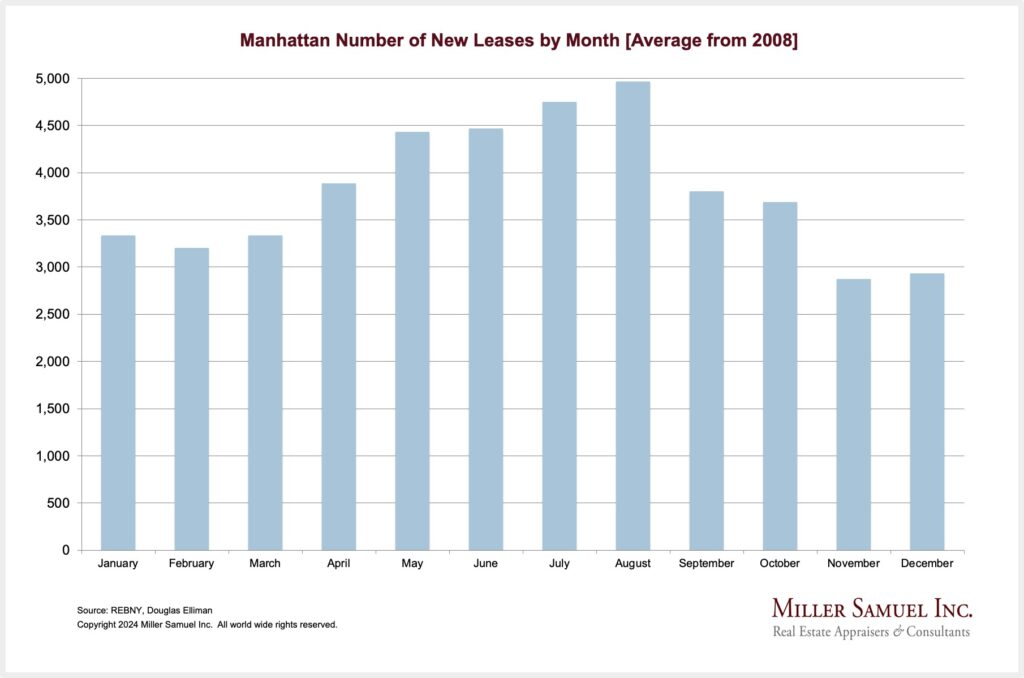

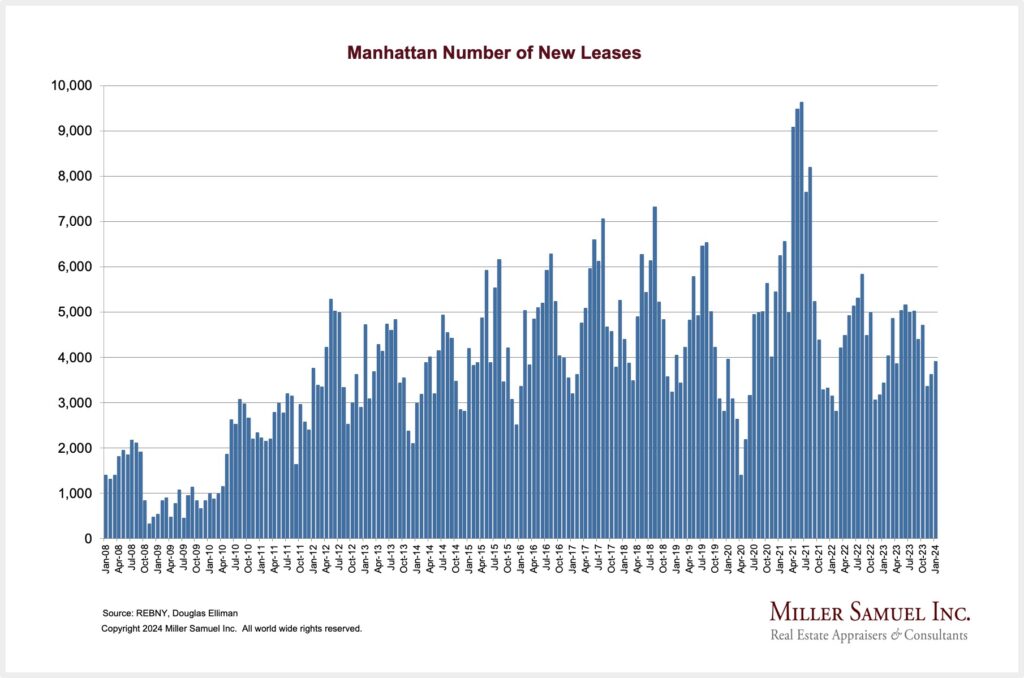

“Lower rents since the recent summer highs likely explain the rise in new lease signings in recent months.”

- – Median rent per square foot rose annually to a new high as median rent increased for the first time in three months

- – New lease signings jumped year over year for the third time

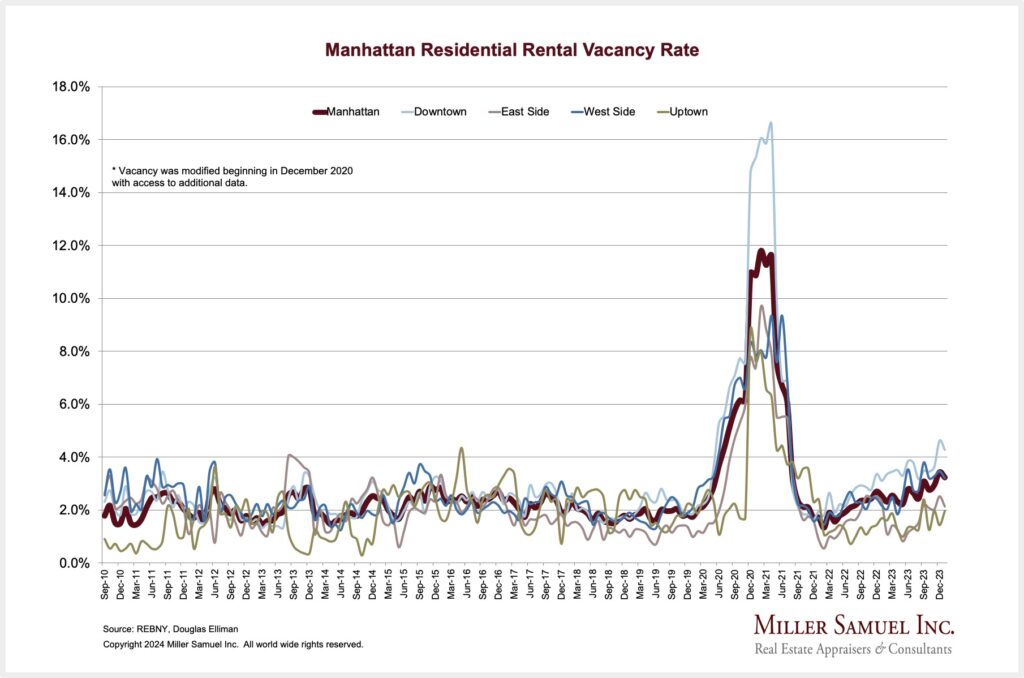

- – The vacancy rate remained above the three percent threshold for the second time

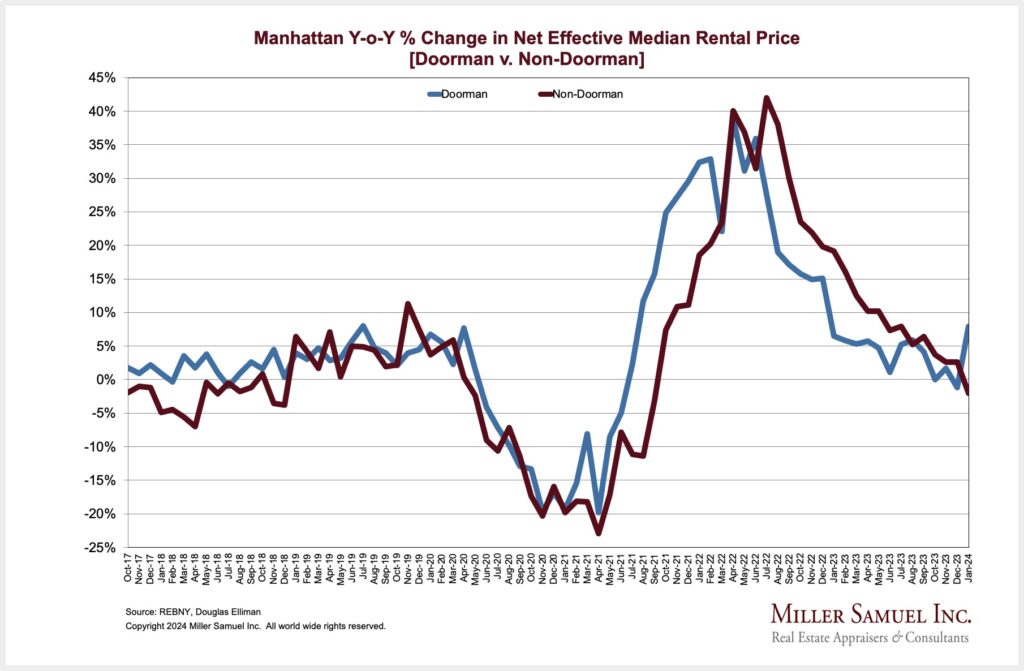

- – Doorman median rent expanded annually as non-doorman median rent fell over the same period.

- – Rental price per square foot for new developments continued to surge year over year, outpacing existing rental growth

- – Luxury price per square foot year rose year over year to the third-highest on record

- – Luxury listing inventory expanded annually for the fifth time

- – Luxury entry threshold fell year over year for the fourth time

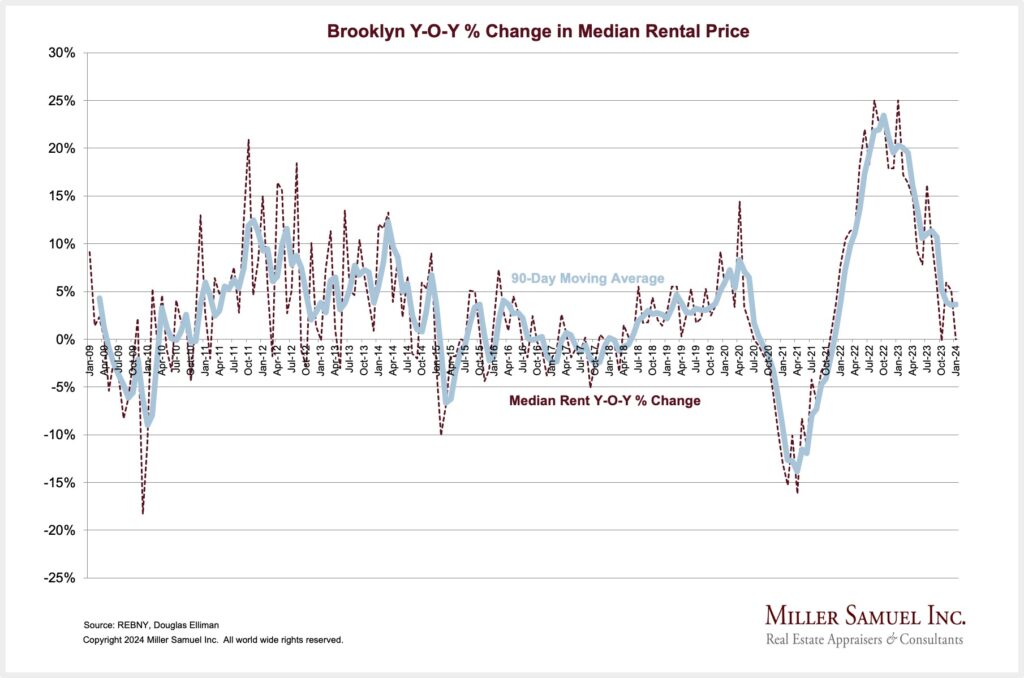

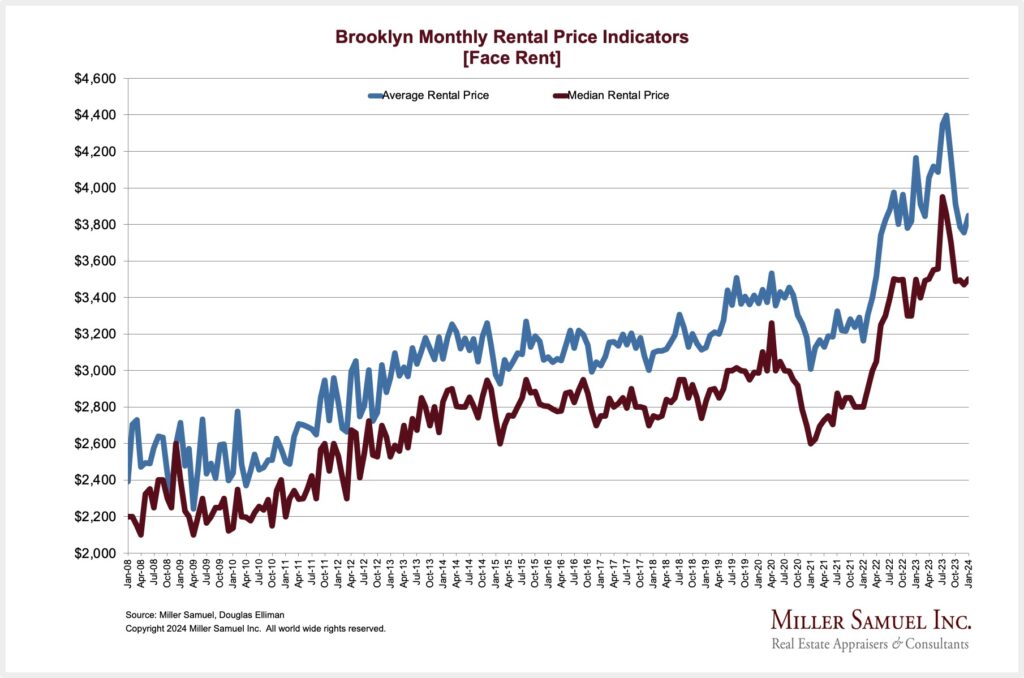

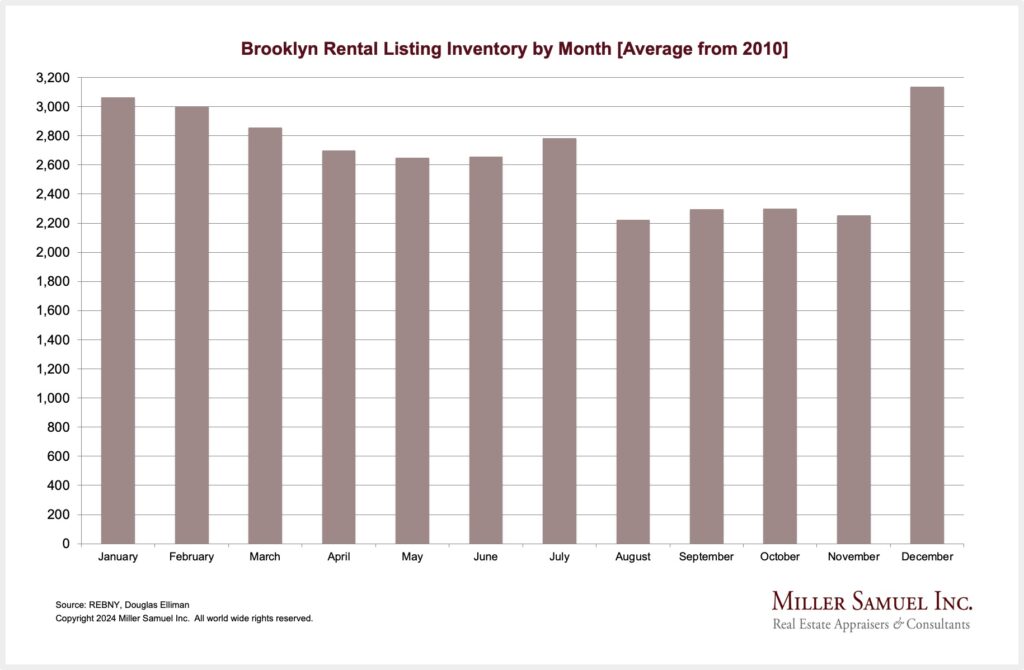

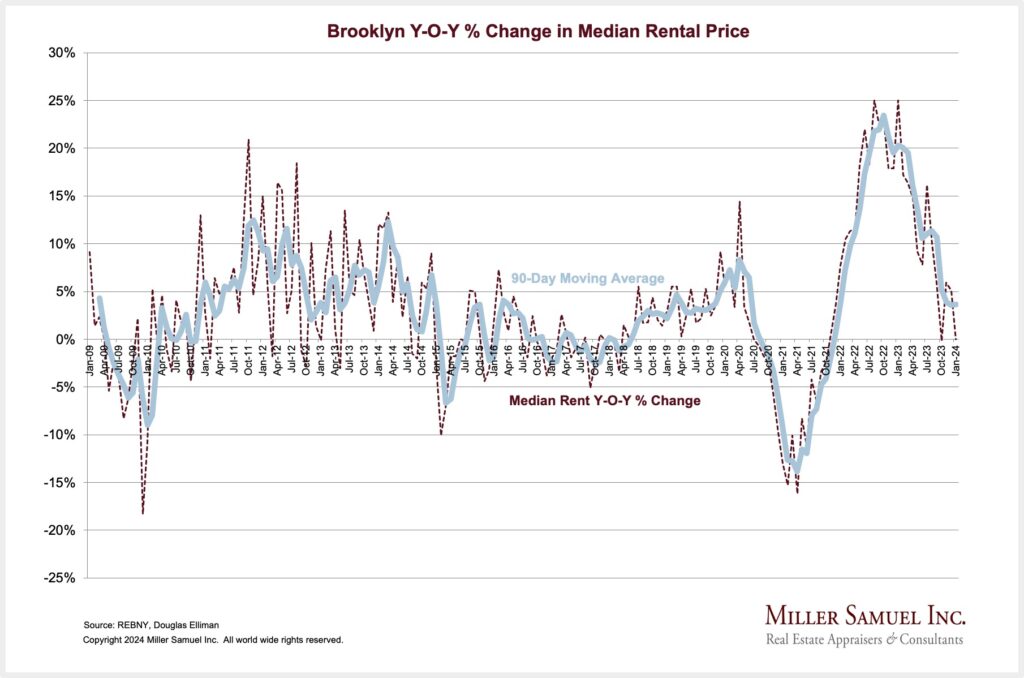

BROOKLYN RENTAL MARKET HIGHLIGHTS

“New lease signings continued to surge year over year, nearly doubling for the third time.”

- – After twenty-four months of annual increases, median rent was unchanged year over year

- – New lease signings nearly doubled year over year for the third straight month

- – Listing inventory fell year over year for the first time in five months

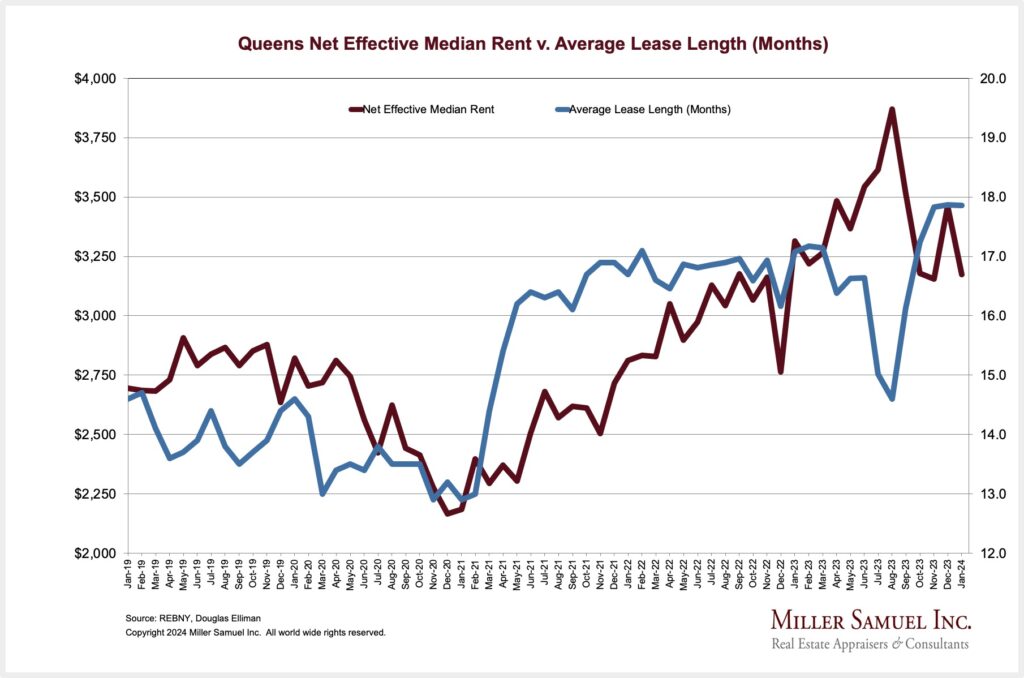

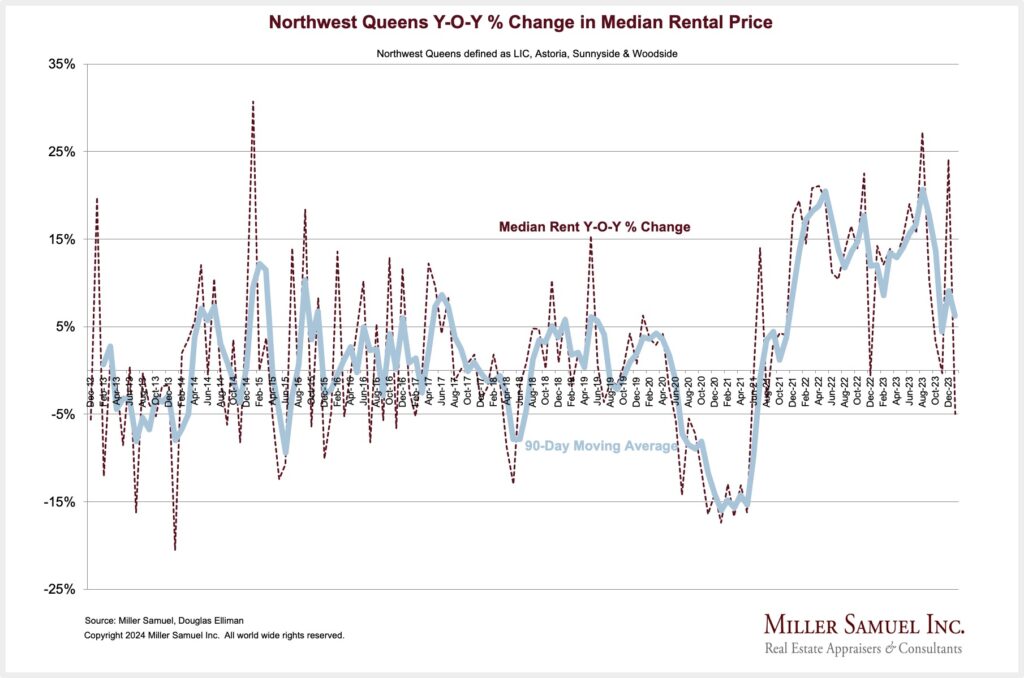

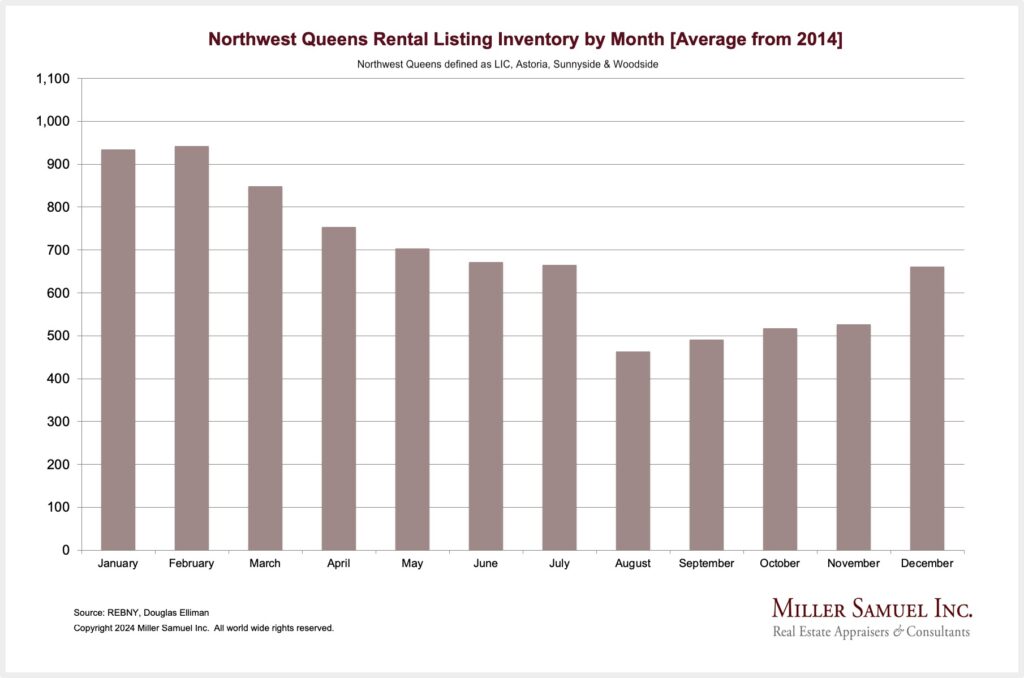

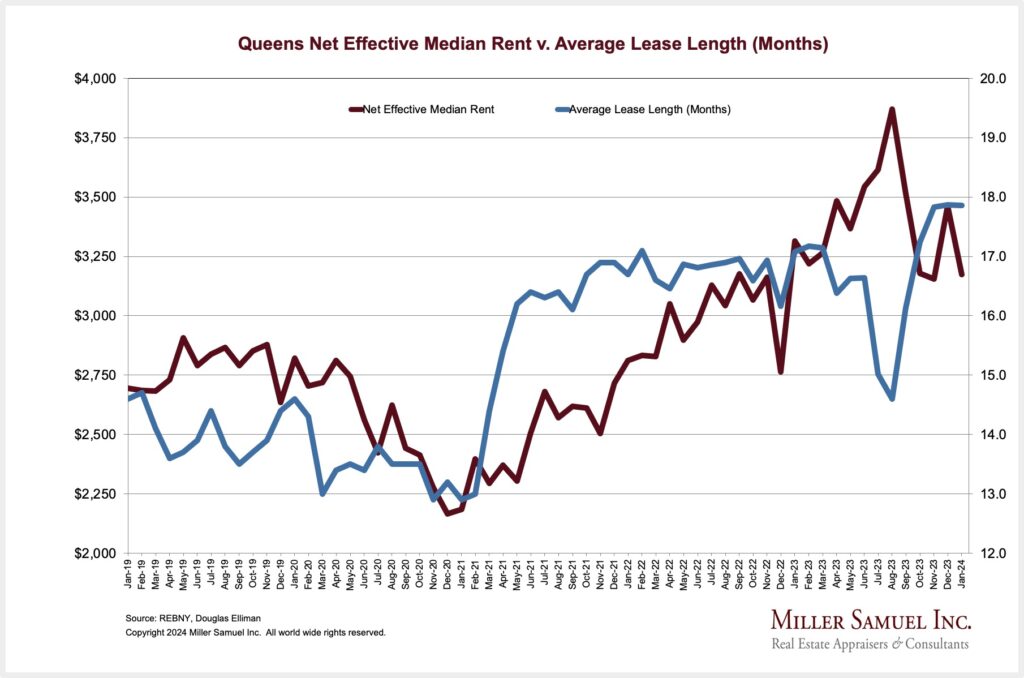

QUEENS RENTAL MARKET HIGHLIGHTS

[Northwest Region]

“New lease signings surged year over year for the third time.”

- – Median rent declined annually for the second time in three months

- – New lease signings nearly doubled year over year for the fourth time

- – Listing inventory fell year over year for the first time in five months

Business of Home Podcast: Housing’s Outlook Has Improved

I joined Dennis Scully again for the Business of Home Podcast to talk about how the outlook for the housing market has changed since the Fed Pivot in December of 2023.

BOH The Thursday Show: Real estate consultant Jonathan Miller shares some good news about the housing market.

Brick Underground Is Suspending Publishing

This is quite a loss for the New York residential housing market. Founder Teri Rogers announced the suspension of publishing for Brick Underground via LinkedIn on Thursday.

LA High-Rise Whose Construction Stalled In 2019 – Has Been Significantly Tagged

A $1 billion LA condo development known as Oceanwide Plaza stalled in 2019 when the Chinese developer faced significant financial problems. Five years later, 27 floors of the partially built towers have been tagged.

I thought this LA Times column had a super interesting, if not telling, title: Vandalism or street art? What the graffiti-tagged high-rises say about L.A.

When A Key Fee On A Rental Apartment Gets Ridiculous

There have been some stories on exorbitant key fees charged for modest rental apartments. These fees were met with fines, and a portion of those fees were returned. It specifically shows how stubbornly tight the NYC rental market continues to be. Here are a couple of the latest stories:

Brick Underground – City Wide Apartments must pay a $50,000 fine, plus $210,000 to dozens of renters.

Gothamist – A rent-stabilized 1 bedroom apartment for $1,100? In NYC? The broker’s fee is $15K.

in New York City, it’s more common for landlords to hire the brokers to list the apartments on StreetEasy, Trulia and other platforms that charge a fee, and arrange visits with applicants. It’s then left to tenants to pay their commission.

[RaaS] Retail As A Service – The Future Of Ground Floor Retail In Office Buildings

My friend Barry Ritholtz wrote a tome on the future of ground-floor retail in office buildings in his Big Picture Blog Retail as a Service.

The modern cloud-based era has seen the rise of “Software as a service” (SaaS).1 This approach was based on the idea that it was more cost-effective for the consumer and more efficient (and profitable) for the provider to offer computing operations as services instead of physically distributed goods.

The current scourge of commercial office buildings (or multifamily apartment buildings) is the blight caused by vacant ground-floor retail space – it drags down achievable rents in the remainder of the project. With lower pedestrian traffic, WFH has changed the value relationship of that retail space to the project. NYT had a great write-up on the problem last year in The Ground-Floor Window Into What’s Ailing Downtowns

Big Picture Blog Retail as a Service

NYC Life In The 1940s

Getting Graphic

Favorite housing market/economic charts of the week made by OTHERS

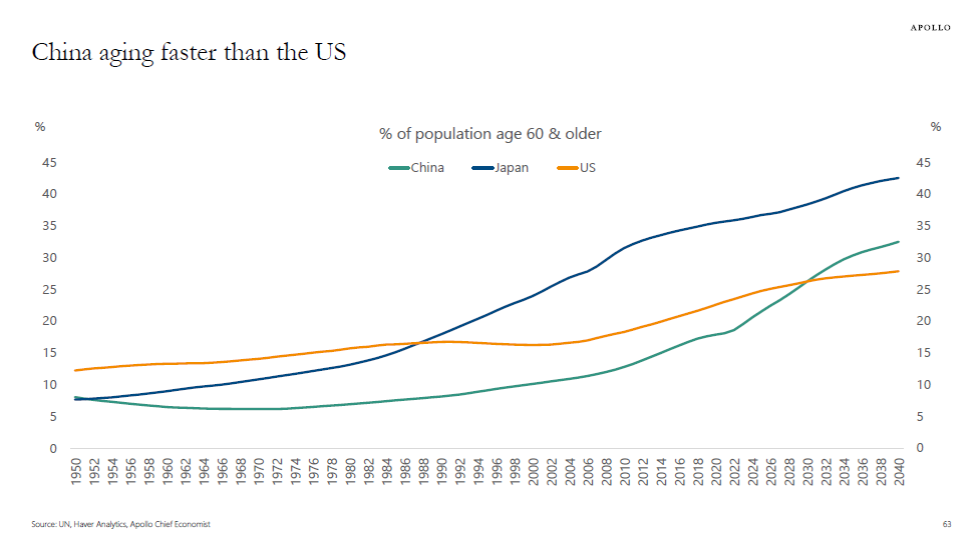

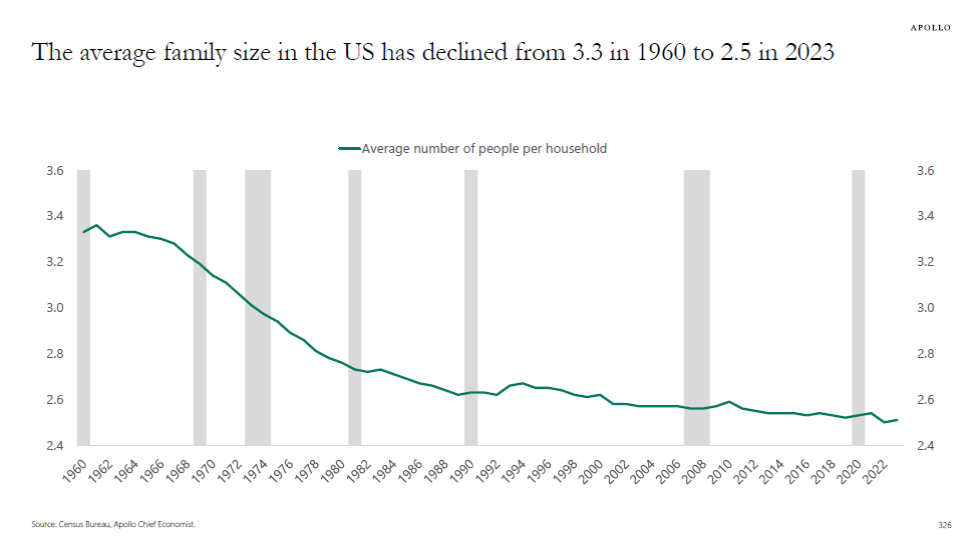

Apollo’s Torsten Slok‘s amazingly clear charts

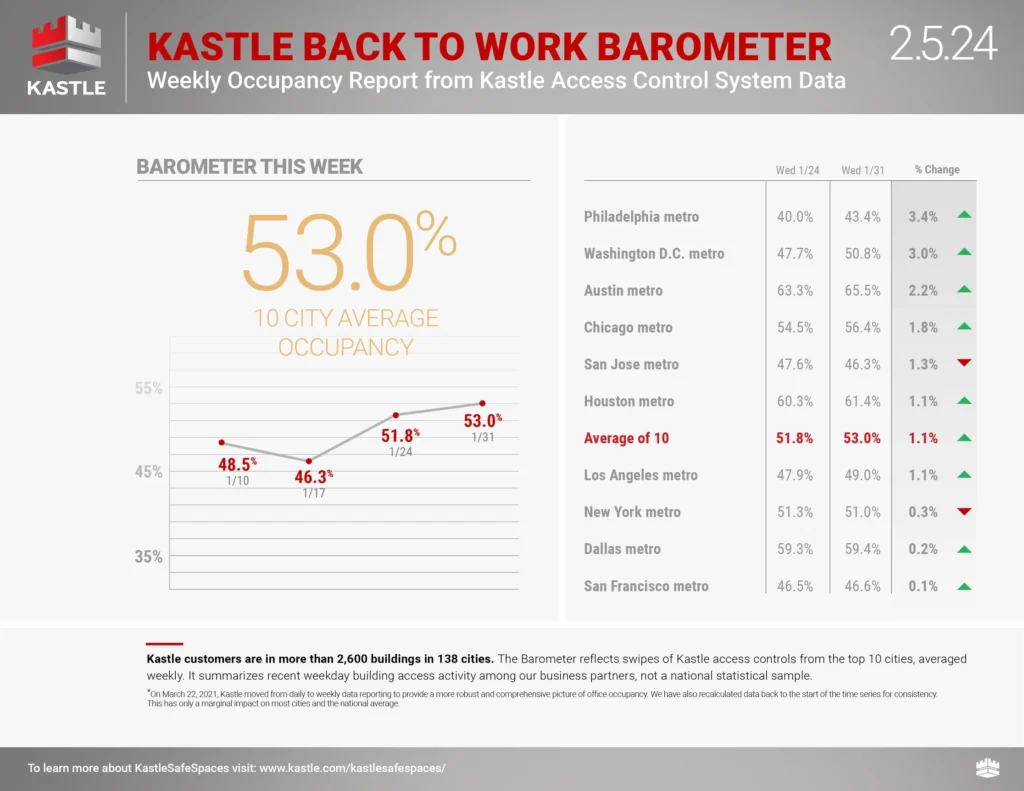

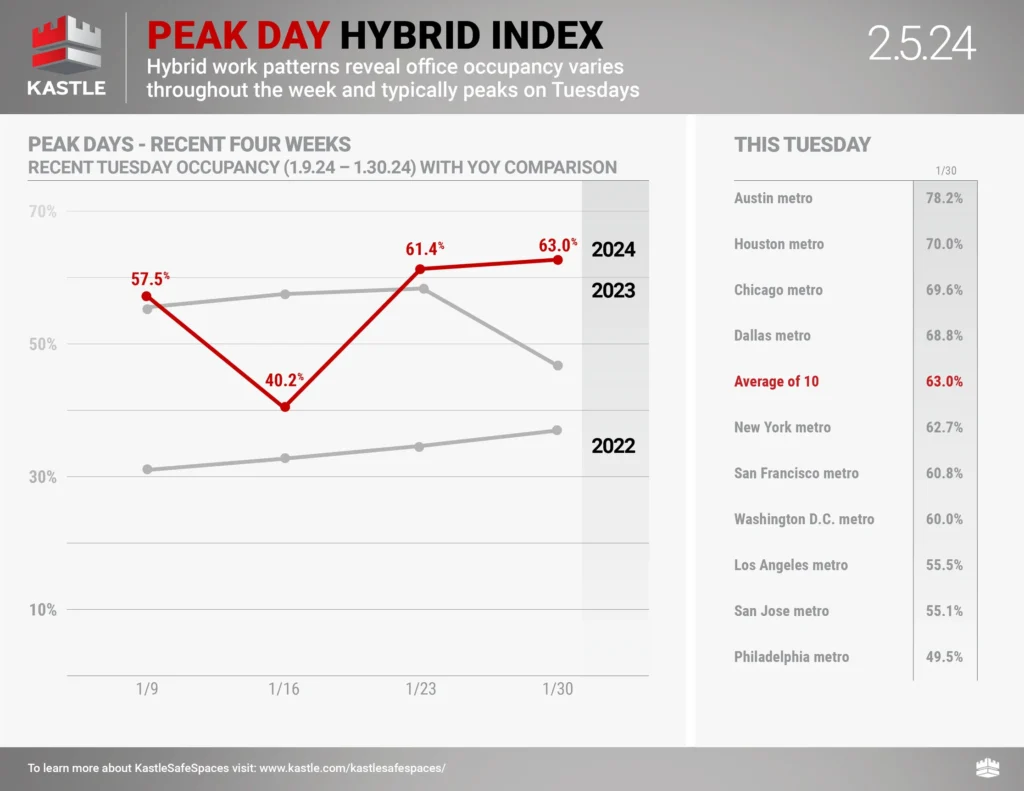

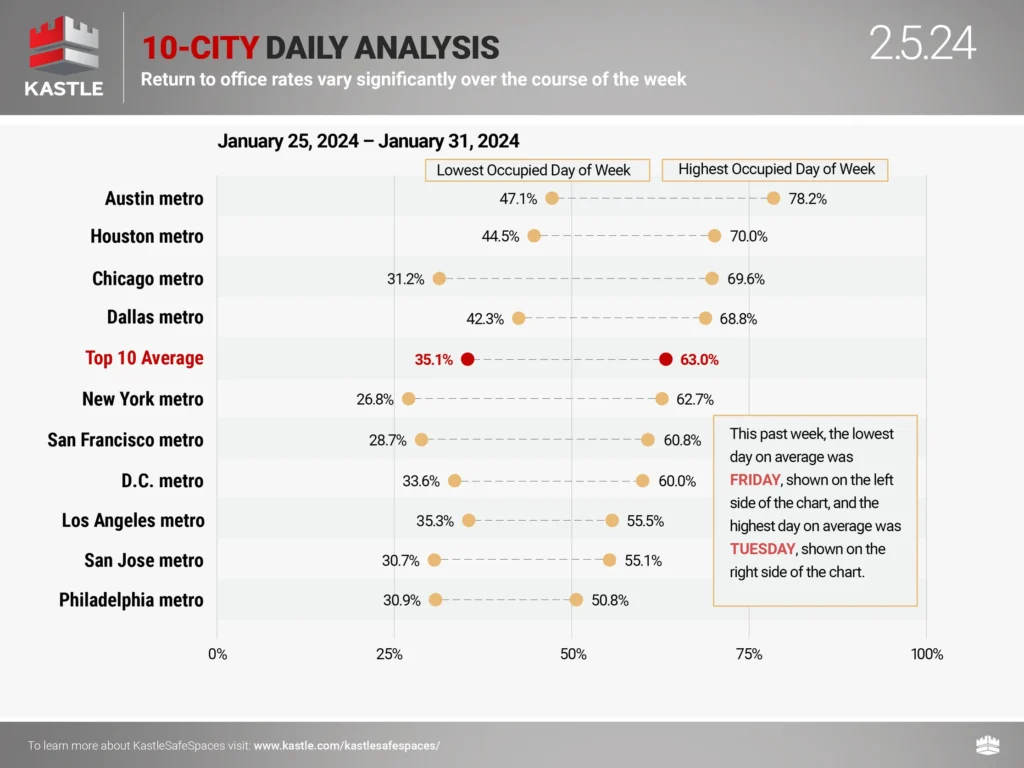

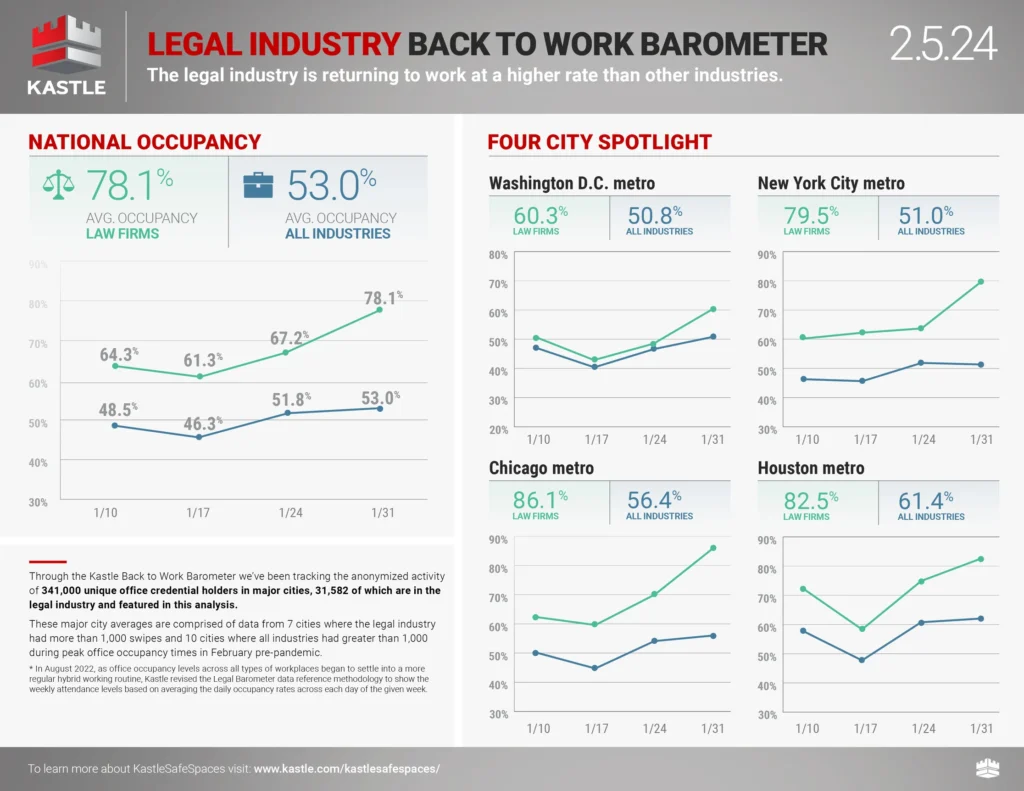

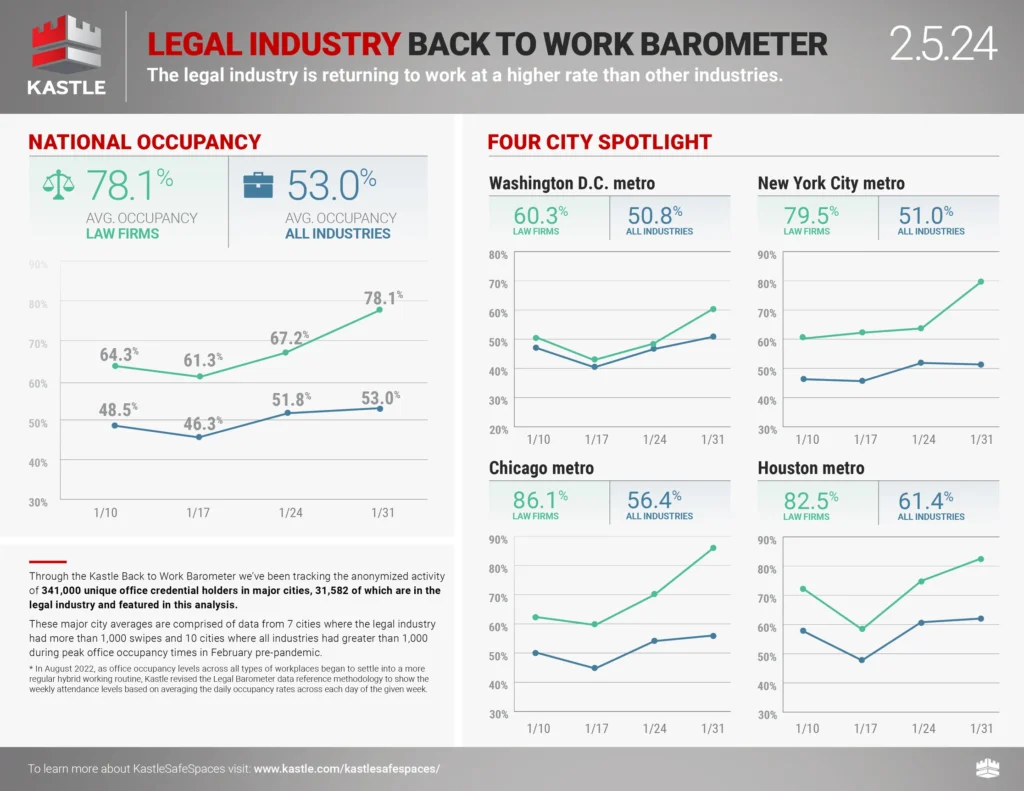

Kastle card swipe data

Remember that Kastle charts are overstating occupancy* because their pre-pandemic occupancy benchmark was 100%, which is incorrect (*measures card swipe activity as a proxy for occupancy). Still, they’ve become the standard benchmark for occupancy rates.

Favorite RANDOM charts of the week made by others

Appraiserville

Sandy Adopts JA Leadership Style To Remove Transparency

As a reminder, as AI membership pushed through their recommendations to the National Nominating Committee, JA realized he needed an FOJ on track for the presidency and implemented the sham petition process. His choice overruled the will of the membership to retain his power. One of the reasons for the downfall of JA as CEO and FOJ self-dealing at the membership’s expense was the complete lack of transparency (i.e. first class travel around the world with their emotional support spouses.)

Fast forward to the present: What is the new AI President, Sandy Adomatis, doing? She says the quiet part out loud in the second sentence of her first letter as AI President. She is too busy to keep you and the members informed, even though that is a top-tier responsibility in her role as the president of our industry’s largest trade group. This is why JA picked her when implementing the sham petition process a few years ago. AI has staff that could help her write these monthly letters to keep the membership informed. Or perhaps there will be nothing to write about every month because nothing will be done for membership, and she is simply thinking ahead?

If you haven’t heard, Sandy just replaced two members of the residential appraiser committee (RAC) with Danny Wiley (SRA) from Freddie Mac, and the second is an MAI, Steven Albert, who owns an AMC (Allstate). The purpose of the committee is to guide recruitment efforts and help residential appraisers. How can AI grow its residential membership when there is no strategy, just FOJ politics with this president? How does this move specifically help the residential appraiser who is a member of AI? While these new committee members can be the nicest, pro-appraisers types in the world, they represent industry stakeholders that are at odds with residential appraisers. The AMC industry is crushing the livelihoods of residential members, and Freddie (and Fannie) want residential appraisers eventually replaced by automation. Fannie is pushing for residential appraisers to become data-collectors for goodness sakes.

Although Sandy is an SRA, she seems unaware of the challenges facing residential appraisers today and that she represents a trade group tasked with supporting its members. But she wasn’t handpicked by JA because she was there to represent the challenges facing AI’s residential members. She was selected for what her SRA designation symbolized on paper, as a chess move by JA. Even though the residential committee is led by powerhouse Adam Johnston out of NC, he can only do so much.

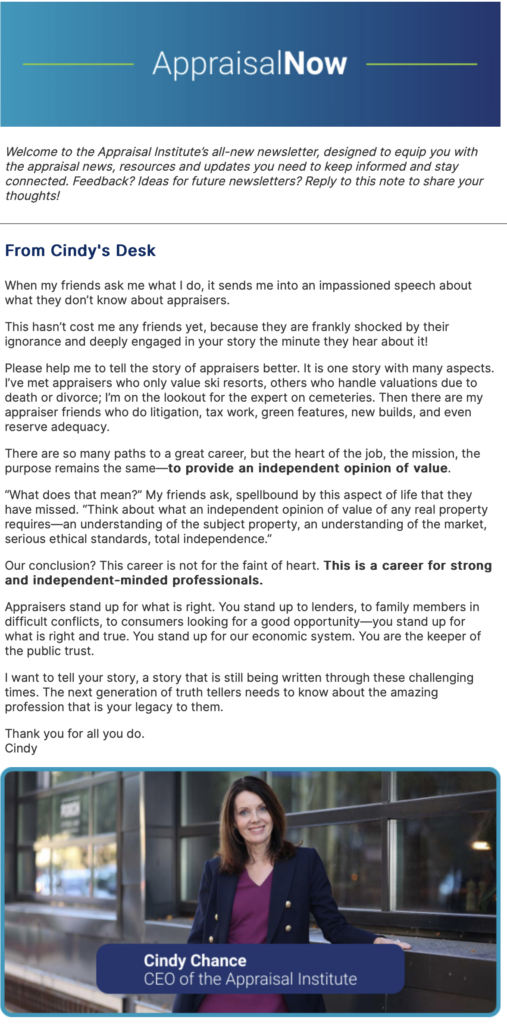

CEO Pens A New Newsletter Because Transparency Is Critical To Move The Appraisal Institute In The Right Direction

In sharp contrast with the FOJ messaging by Sandy I shared earlier, Cindy Chance, AI CEO gets what ails AI in her new newsletter. At the heart of the change in direction for AI is championing the appraisal profession outside of lobbying, which hasn’t been done in nearly two decades. When AI President Sellers severed the relationship with TAF from AI as a founding member for personal reasons years ago, AI began to lose its way in the public eye. I remember when Sellers announced that on video like it was yesterday. I’ve since spoken to a few people in the room when he announced it on that infamous video and that, my friends, is not how a leader should behave. Thankfully, the cult of FOJ lost their leader and the organization is slowly getting back on track with new leadership.

I want to tell your story, a story that is still being written through these challenging times. The next generation of truth tellers needs to know about the amazing profession that is your legacy to them.

Cindy Chance, CEO Appraisal Institute

2024 AI President Speaks To Women’s Council of Realtors To Further Her ‘Queen of Green’ Personal Brand

Take a look at this Powerpoint presentation of Sandy’s recent appearance. She is there to represent the Appraisal Institute as its president and stand for its professionalism. The pages are largely about her accomplishments and don’t provide much about what the organization stands for except for generic platitudes. It is obvious this presentation was nothing more than a personal branding opportunity as the “queen of green.”

Look at the photo she used that I’ve shared before. Its use is incredibly petty and nothing less than toxic politics. She never learned that she represents ALL members. How childish and petty that she is not recognizing the past 2023 President yet recognizes the previous FOJ “dirty dozen.” If any of my readers are at a presentation where she uses this photo again, I would encourage you to openly shame her unprofessional behavior.

Past AI President Craig Steinley Is Running For VP To Further His Efforts To Repair Years Of FOJ Neglect

This announcement was known by most people at AI who keep up to date on operations. A past president runs the National Nominating Committee (NNC) and Craig is just that. He recused himself from those duties to run for Vice President to get a professional back on the ladder of leadership to continue the breathless amount of work accomplished in 2023. This year with Sandy and next year with Paula will see little productive work for the Appraisal Institute because it is against their personal interest as FOJs. Personal branding/resume padding is all we will see from these FOJs in 2024 and 2025.

Please remember that photo and all the waste and self-dealing it symbolizes.

Next Week – PAREA

OFT (One Final Thought)

The power of lamb! The details in this epic commercial on the generation gap are incredible.

Brilliant Idea #1

If you need something rock solid in your life – particularly on Friday afternoons at 2:00 PM, Eastern Time (ET) – and someone forwarded this to you, you can sign up here for these weekly Housing Notes. And be sure to share with a friend or colleague if you enjoy them because:

– They’ll like numbers;

– You’ll still prefer letters;

– And I’ll have some lamb (the letter “b” is silent).

Brilliant Idea #2

You’re clearly full of insights and ideas as a reader of Housing Notes. Consider sharing them with me early and often. I appreciate every email I receive, as it helps me craft future Housing Notes.

See you next week!

Jonathan J. Miller, CRE®, Member of RAC

President/CEO

Miller Samuel Inc.

Real Estate Appraisers & Consultants

Matrix Blog @jonathanmiller

Reads, Listens and Visuals I Enjoyed

- Building Blocks of Change [NYC Comptroller]

- A rent-stabilized 1 bedroom apartment for $1,100? In NYC? The broker's fee is $15K. [Gothamist]

- National Association of Realtors Faces Future After Crisis [The Real Deal]

- Ex-HFZ Developer Nir Meir Jailed, Facing Extradition [The Real Deal]

- Why London’s Wealthy Are Renting Instead of Buying [Wall Street Journal]

- Luxury Retailers Are Buying Out Their Landlords [Wall Street Journal]

- The Ground-Floor Window Into What’s Ailing Downtowns [NY Times]

- Retail as a Service – The Big Picture [Ritholtz]

- How to Plan a Successful Home Swap [Conde Nast Traveler]

My New Content, Research and Mentions

- Manhattan rental market sees surprising surge in leasing activity [MPA]

- Renters snapped up larger Manhattan apartments in January [Brick Underground]

- Manhattan Breaks Another Real Estate Record, This Time in the Rental Market [Mansion Global]

- City lease signings surge as rents stabilize [Crain's New York]

- NYC rents largely flat amid falling mortgage rates [NY Daily News]

- Familiar Challenges, Possible Improvements – The Housing Market Going Into 2024 [Cooperator News]

- Manhattan Apartment Leases Surge, Keeping Rents From Sliding [Bloomberg]

- Manhattan Apartment Leases Surge, Keeping Rents From Sliding [Yahoo Finance]

- Struggling UWS luxury building sells for $265M [Crain's New York]

- Half of US tenants can't afford to pay their rent. Here's what's ahead [KSBW]

- Empire of the damned: Why some of NYC’s most prestigious homes can’t sell — like zombies who refuse to die [NY Post]

Recently Published Elliman Market Reports

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 1-2024 [Miller Samuel]

- Elliman Report: Manhattan Decade 2014-2023 [Miller Samuel]

- Elliman Report: Manhattan Townhouse Sales 2014-2023 [Miller Samuel]

- Elliman Report: San Diego County Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Orange County Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Los Angeles Sales 4Q 2023 [Miller Samuel]

- Elliman Report: North Fork Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Hamptons Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Long Island Sales 4Q 2023 [Miller Samuel]

- Miller Samuel New York City Market Brief 4Q 2023 [3 Year Comparison] | Miller Samuel Real Estate Appraisers & Consultants

Appraisal Related Reads

- Raise Funds For Trial, organized by Shane Lanham [GoFundMe]

- Housing Statistics for Beginners, Part 2 [Birmingham Appraisal Blog]

- Combatting Appraisal Bias [Florida Realtors]

- The tiny but growing trend of assuming the loan [Sacramento Appraisal Blog]

- McKissock Ditches PAREA [Appraisers Blogs]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)