Peanut Butter In Your Chocolate: Commercial Office Mortgage Distress For Office To Resi Conversions

2025 Is Peak Maturity For Commercial Office Mortgages But Subject To “Amend & Extend”

Office To Apartment Conversions Are Booming, Bringing Long-term Better News To Tenants

Many Of The Cities With Heighten Conversion Activity Also Have Heighten Commercial Office Duress

We continue to hear about a commercial office recovery, but that misleading – it is coming from commercial leasing brokers which is a conflict. Commercial office is often selling for ±30 cents on the dollar as WFH continues to savage rent levels. Yet the high-end office market is doing fine. And now we are seeing a surge in office to residential conversions despite the spike in interest rates. It seems like the perfect Reese’s moment.

Amend & Extend

During the housing bubble of 2006-2009, the FDIC and The Fed enabled banks to not write down asset values on their balance sheets so they would remain technically solvent. We called that practice “Extend & Pretend.” In fact I was part of an investment group that raised millions of dollars to buy what we believed were going to be a tsunami of distressed real estate assets but “Extend & Pretend” prevented that and our group was thwarted.

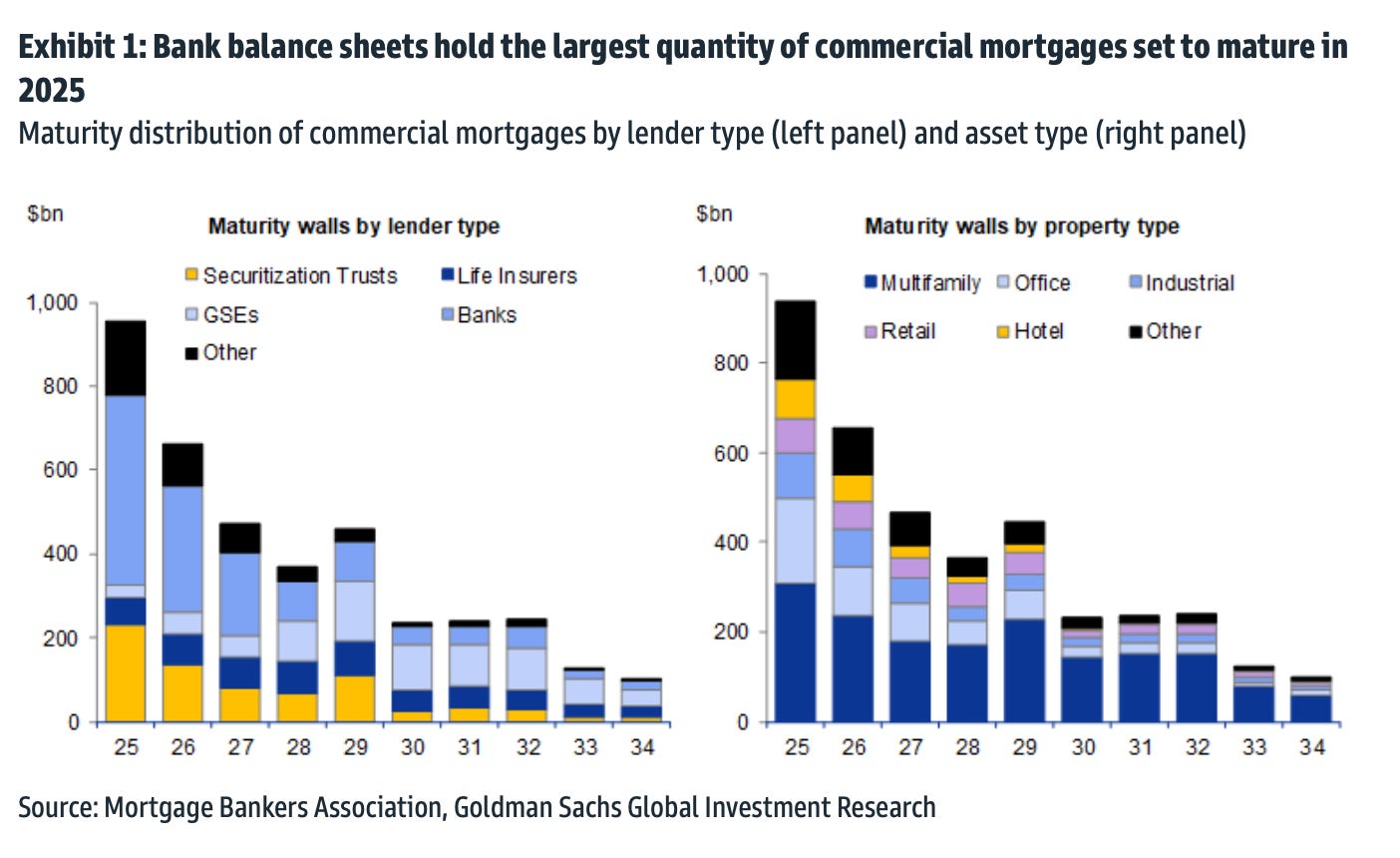

The year 2025 looks like the peak of commercial office building mortgage maturity.

The latest version is now known and “Amend & Extend” where lenders amend their loan agreements with office building landlords so they don’t have to foreclose and become landlords themselves. You can see this in the following chart where the can is kicked down the road. More than a third of the maturing debt in 2025 came from loans due in 2024.

Office To Residential Conversions Are Surging

I’ve written about the challenges of converting commercial offices to residential apartments before, and arguably its very tough to do this at scale for all the reasons outlined in The Challenge Of Office-To-Residential Conversions – Red Stapler Edition.

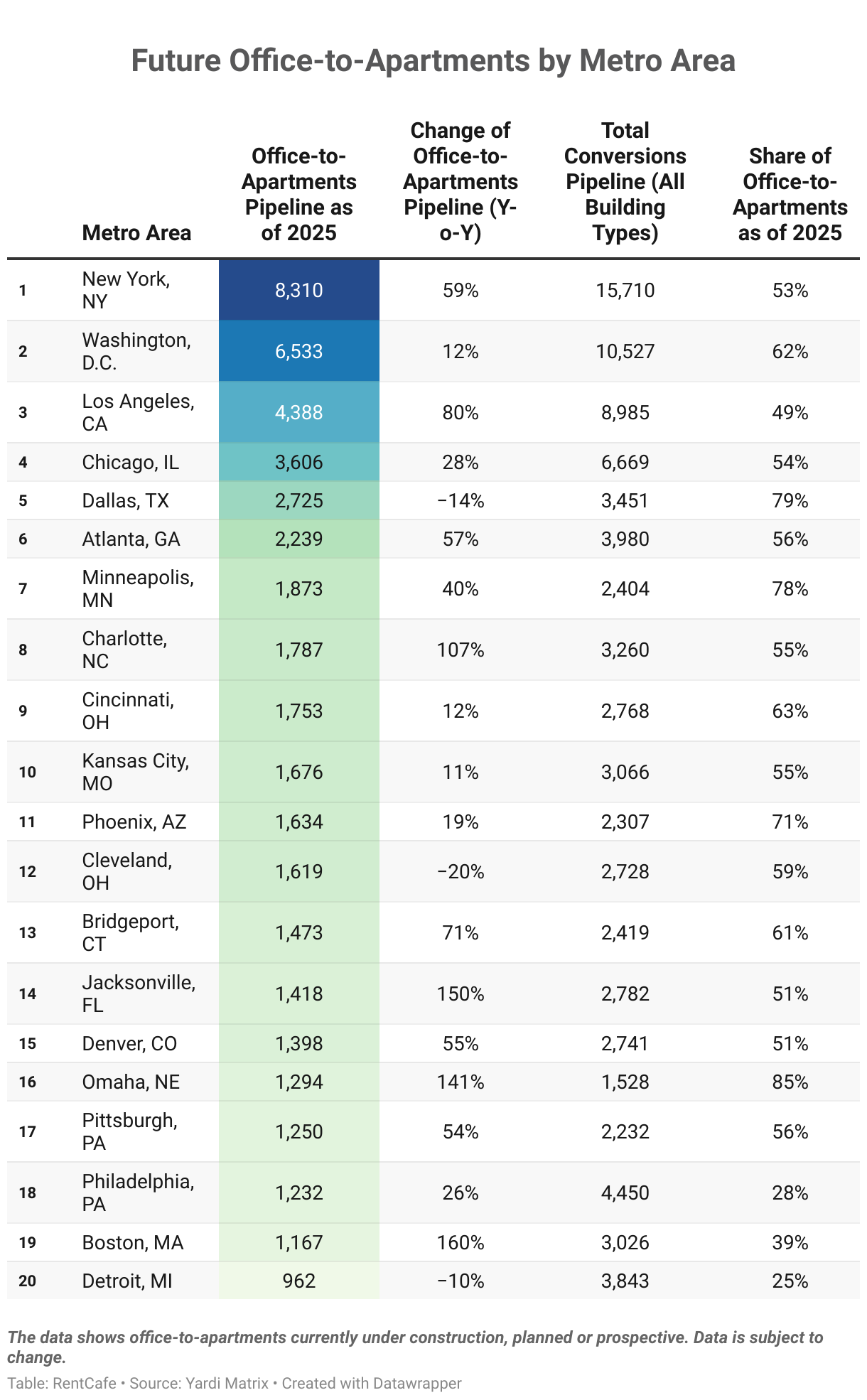

Rent Cafe chronicaled this in a must-read article: Record-Breaking 71K Apartments Set to Emerge From Office Conversions. Activity is ramping up, but the focus by the majority of developers are rentals, not sales (condos). Nearly 15% of U.S. office space is suitable for residential conversion. Manhattan has the most office to apartment conversions in the pipeline.

NYC Rents Are Rising Again

Mortgage rates seem indefinitley stuck at around ±7% with signs of inflation waking up and a lot of ongoing bluster about tariffs, we have seen Manhattan rental prices rise again, beginning to threaten new highs later this year. So the idea that there is a new source of rental inventory entering the market in a rising rent environment couldn’t come at a better time for tenants. While there are concerns that the new stock will be skewed to luxury, there is so much of it coming in it seems helpful to future overall affordability.

Final Thoughts About Chocolate In Your Peanut Butter

I used the Reese’s analogy in the intro because that’s what the distressed commercial office space versus a boom in office to residential conversions feels like to me. Incidentally, 50 years ago I had a giant box of 60 Reese’s Peanut Butter Cups in my control at summer camp. After eating all them in a week, I vowed never to eat them again. But about ten years ago my resolve weakened and they re-entered my life in much smaller amounts.

But I digress…

The collapse in commercial office valuations cuts way down on the assemblage costs for developers who are already grappling with higher labor and material costs as well as higher interest rates. The fantasy that WFH will go away is not real. The prognosticators staking claim to the fantasy have personal conflicts driving them to claim this, from bank CEOs, to developers, to commercial brokerage firms. I do believe the share of remote work will eb & flow with the state of the economy. Right now the chatter about RTO is a flex by conflicted parties only because RTO orders currently reflect a paycut.

27Speaks Podcast – Taking the Pulse of Hamptons Real Estate

A Hamptons media outlet I pay attention to is 27east of the Southampton Press and they have have invited me over the past several quarters to speak with their editors for their podcast. They ask smart questions and I try to keep up with them. In reality, while the focus is on the Hamptons and the results of our report, our discussion is highly relevant to many aspects of the U.S. housing market. Here is their summary article covering our market reports and the podcast interview. Click on the image below for the podcast (with a few dad jokes as a bonus).

Did you miss the previous Housing Notes?

February 12, 2025

Return To Work Mandates Are Just A Flex

Image: Gemini