I’ve been posting commercial office price drops here fairly regularly and the anecdotal drop in value is hovering around two-thirds of the pre-pandemic value (before WFH was super-charged). The most recent commercial office sale in Manhattan was a 67% discount from a 2018 purchase. This building, 321 West 44th Street, ironically houses the headquarters of the Commercial Observer, a widely-read commercial office trade publication.

Empire Capital Holdings and Namdar Realty Group struck a deal to buy the property at 321 W. 44th St. for less than $50 million, Bloomberg reported, citing sources familiar with the matter. That’s a 67% discount compared to the nearly $153 million paid by Related Fund Management in 2018.

Bloomberg via MPA

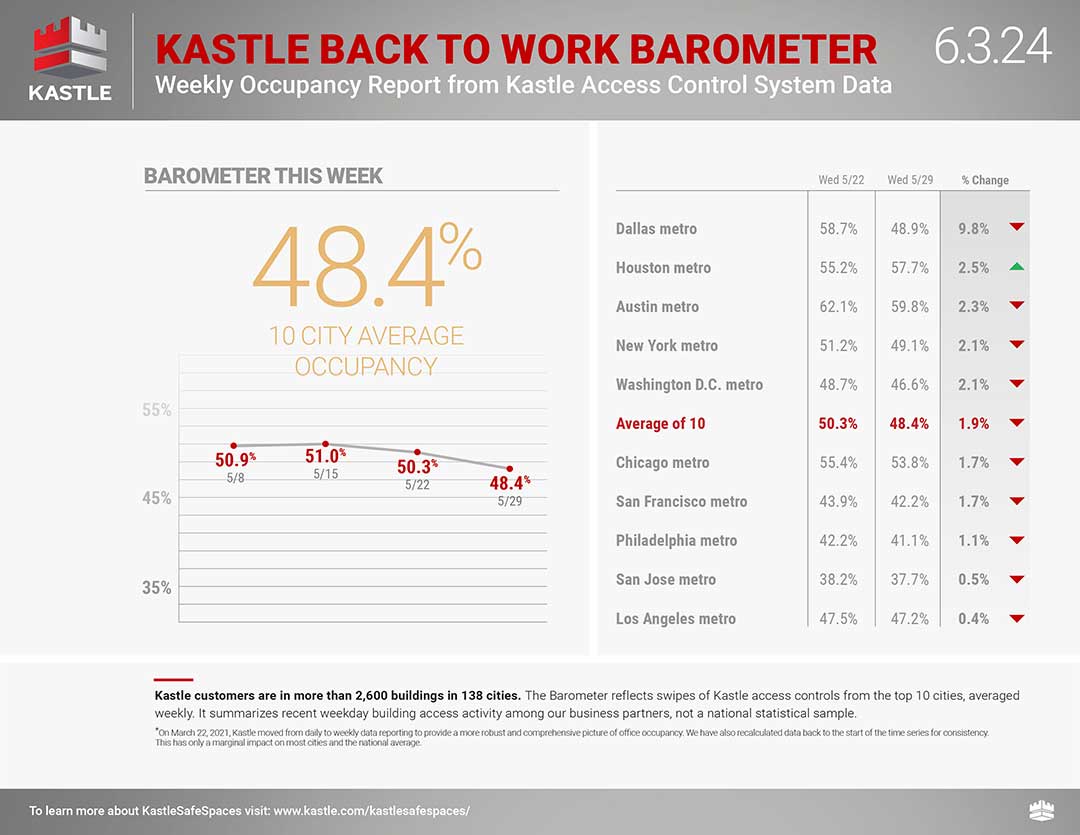

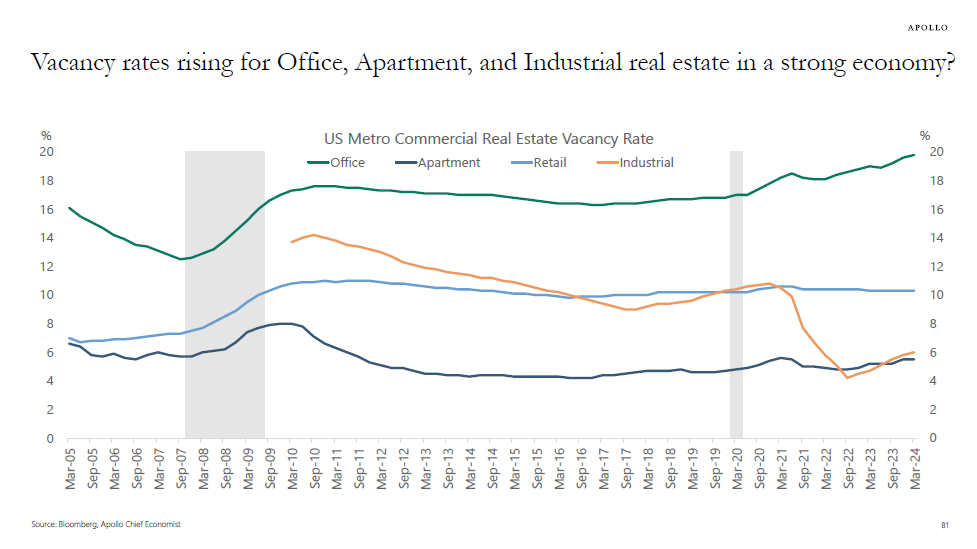

It gets better. The previous purchase of 321 West 44th Street by the Related entity was at a 7.3% discount from what the previous owner paid. While May Kastle commercial office occupancy in Manhattan has steadfastly remained at about 50% as has Kastle’s national average, one would expect that values would be down at least 50%. However, anecdotally the reporting continues to show 60% to 70% commercial office discounts. Why the spread? I suspect it has a lot to do with the much higher interest rate environment since 2022. Low unemployment and higher wages aren’t bringing workers into the office like they did pre-pandemic. This reflects a profound structural change in the relationship between work and office. I suspect there will be a lot more of this price-reset activity over the next five to seven years as commercial landlords clean up their portfolios (Slash).

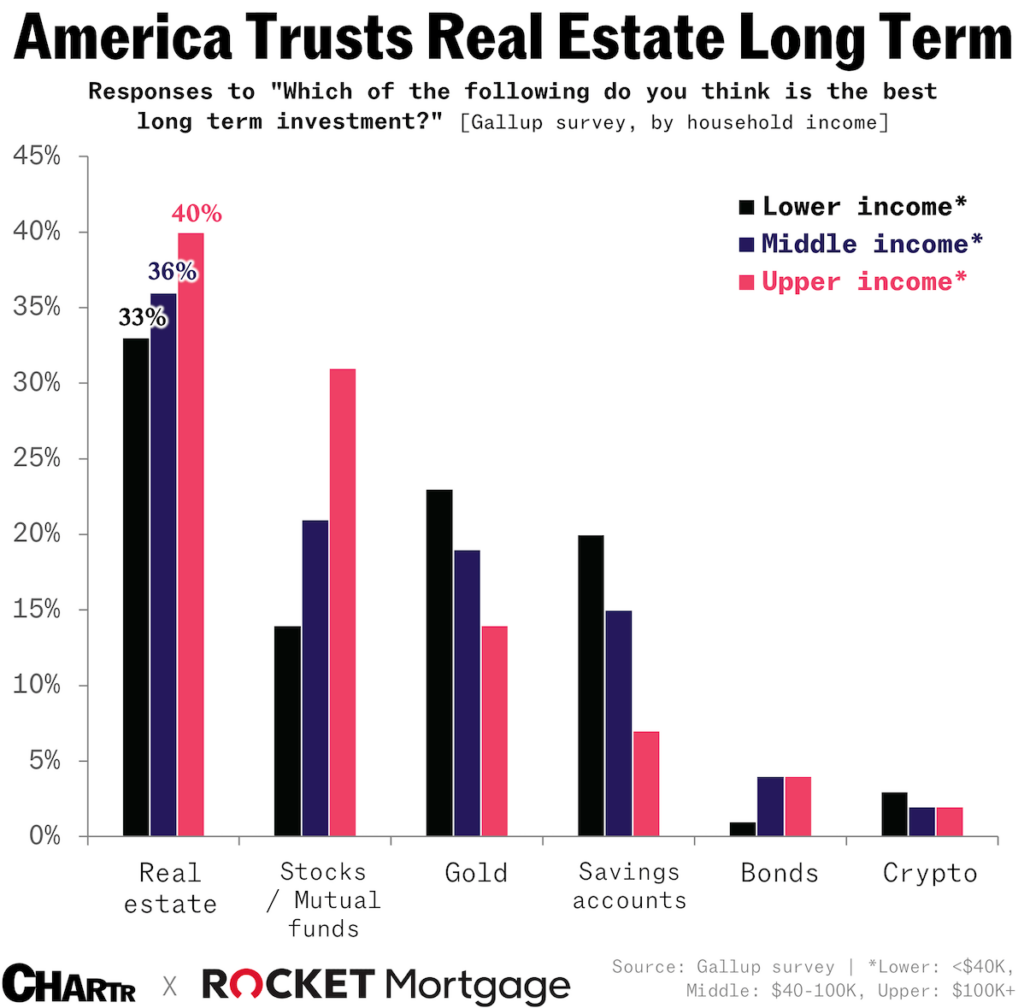

I suspect the following Gallup poll that shows the trust in long-term real estate investment will be reset soon. The survey needs to differentiate between the various types of real estate assets. As we are learning – not all real estate assets are performing the same way. Commercial office values are being “slashed” nationwide.

And what happens when values are “slashed?” Things tend to break.

UPDATE 5:57 pm ET – I forgot to insert this chart when the post went live…

Did you miss yesterday’s Housing Notes?

This Is A Whole New Thing – Housing Notes Daily

Well, I’ve been writing this Housing Notes newsletter since March 2015 (more than 9 years as a weekly exercise) and at last count were nearly 500 weekly iterations, evolving into a Friday 2 pm launch date no matter where I was in the world, whether or not I was on vacation, and what was going on in my personal life. It was such a consistent routine that many subscribers told me it marked the beginning of their weekend. But what is going to be so new about Housing Notes Daily?

Less is more. The type of content will largely remain the same but in a shorter format and the delivery will be daily instead of weekly. Starting immediately, Housing Notes will be released 5 weekdays each week at that same 2 pm Eastern time moment. My sidebar passion project Appraiserville is being moved to the Beehiiv platform soon and I plan on releasing it weekly while linking from here temporarily. More on that soon.

Housing Notes Reads

- Related Sells 321 West 44th Street at $103M Loss [Commercial Observer]

- Exclusive | Buyers Battle Over Sean Hannity’s Long Island Home, Which Sells for Roughly $12.7 Million Cash [Wall Street Journal]

- How Much Is Mar-a-Lago Actually Worth? It’s a Billion-Dollar Question. [Wall Street Journal]

- How Much Is Mar-a-Lago Actually Worth? It’s a Billion-Dollar Question. [Mansion Global]

Market Reports

- Elliman Report: Florida New Signed Contracts 5-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 5-2024 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 4-2024 [Miller Samuel]

- Elliman Report: California New Signed Contracts 4-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 4-2024 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)