Not Updating Your OS since 1993, like Super Low Mortgage Rates, Really Pays Off

Global Tech Meltdown Was The Largest In History, Caused By A Software Update

Southwest Airlines Avoided The Catastrophe By Not Updating Their OS Since 1992

The Consensus Is Growing For a September Rate Cut

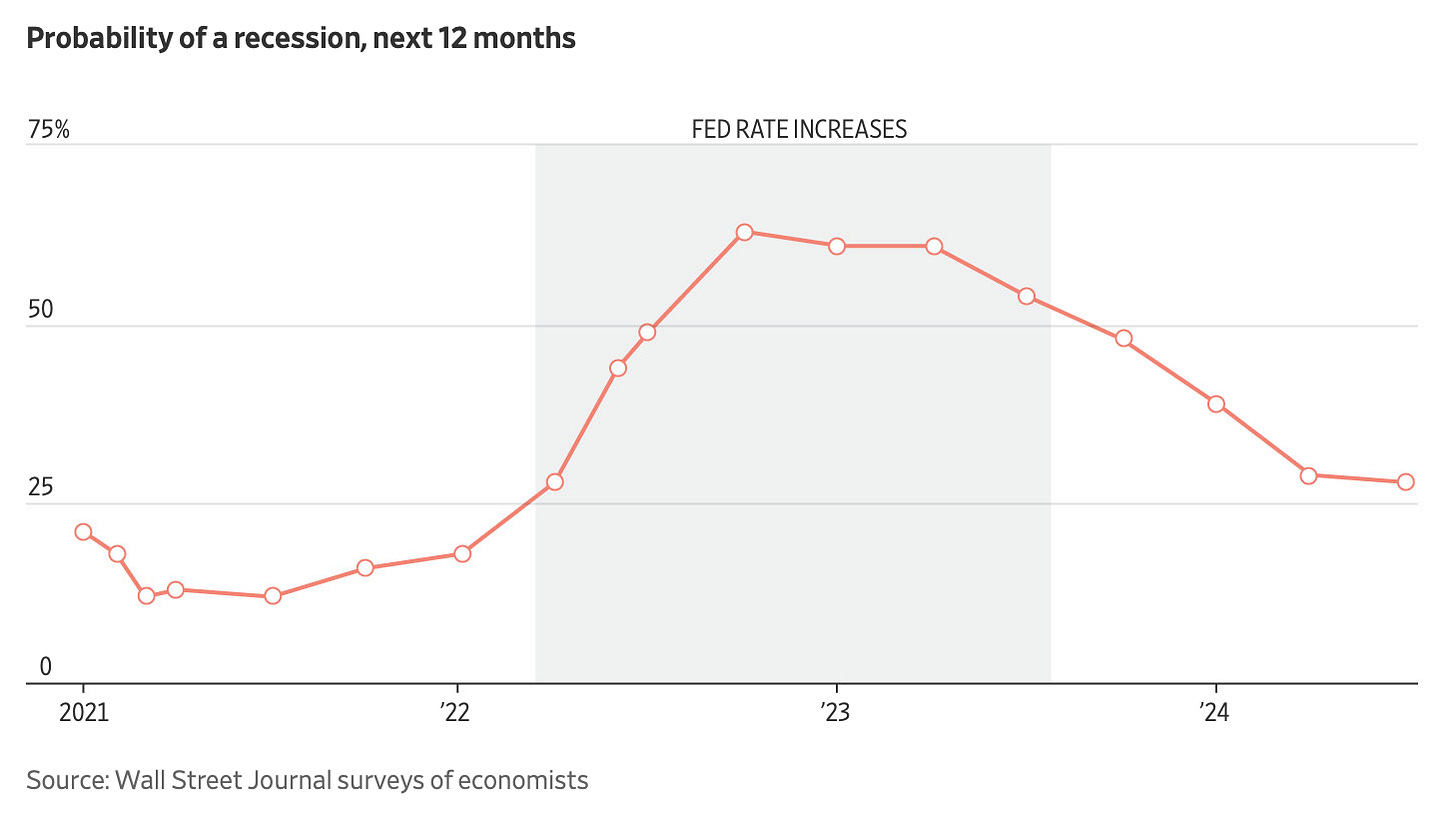

Consensus by economists on things like Fed rate cuts often seems wrong (if that’s not my cognitive dissonance kicking in). Most economists were wrong at the beginning of the year, predicting 5-6 rate cuts in 2024 after the Fed predicted at least 3. And every month, those forecasts were pulled back as the economy showed too much strength for a cut. One could argue the economists who are selected for these surveys are some of the smartest people in the business. I’m sure they are well-informed and very forward-looking.

Now consider the other end of the spectrum – Southwest Airlines avoided the largest global tech meltdown in history this weekend by using a 1992 version of Microsoft Windows (3.1). I find this a little unnerving. By staying significantly behind the software update curve, Southwest Airlines avoided the catastrophe that much of the world experienced since Friday.

Tales of “piss & vinegar” and “pencil & paper” to make my point, follow next.

My wife and I flew JetBlue to attend a wedding on Jekyll Island, Georgia on Friday morning seemingly before the global tech meltdown, and returned on Sunday in the middle of the meltdown and nothing happened. Did JetBlue avoid software problems like Southwest Airlines by not updating its operating systems for decades? And this is a good thing?

Well, there was one thing related to the tech meltdown that happened – when refueling our rental car in Georgia on the way to the airport on Sunday morning, all the gas pumps were rebooting with old-school lines of DOS-like code on a black screen that took about ten minutes before we could pump gas. The attendant told all of us standing bewildered at the pumps that it was caused by the global tech meltdown. Before that moment, I never thought of gas pumps as computers.

When my wife and I moved to Manhattan from Chicago in the mid-1980s, one of my first jobs was as an on-site sales agent on a new building known as Astor Terrace, or as the building super and staff dubbed it “Disaster Terrace” because of the developer’s quirky ways. I was employed by JI Sopher who managed sales for the developer, Solomon Equities. I was told the developer’s dad gave him something like “$50 million” and said, “Don’t lose it.” The developer made good on that cash infusion, becoming a successful loft converter, and then parlayed that into this residential tower and two other office buildings simultaneously. He was very smart and so intense that if he had to wait too long for a lobby elevator, he would march up the stairs to the 18th-floor sales office.

Later when the sales manager became seriously ill, Jacob Sopher asked me to fill in as sales manager (by then I had lived in Manhattan for about 6 months). Once a week, I would go to the developer’s headquarters across the street from Saks Fifth Avenue at Tower 49 (which they developed as well) to report the status of that week’s sales contracts to the development partners (Tishman Construction, Equitable Life Assurance, and a few others). Jacob came to my first meeting to support me as a 25-year-old, saying I was full of “piss and vinegar” even though he barely knew me, and then affirming he was a believer in “pencil and paper.”

Despite the introduction, I was quite a nerd at that time. Well, kind of. My father and I as well as my former brother-in-law (the “Samuel” in “Miller Samuel”) put the entire Astor Terrace Condo “Schedule A” on our HP 41C’s using a “bitmap” technique. We walked around the building with clients using this “handheld device.” This happened around 1985, long before Palm Pilots, Blackberries, and iPhones. We were on the bleeding edge of technology at the time yet my boss was advocating “pencil and paper” to his clients (he was being driven around in a limo and I was taking the subway). Old school!

But I digress…

Fed has been delaying a rate cut because they needed to make sure inflation was under control. They got it wrong, in the context of housing, by keeping rates too low for too long during the pandemic. In other words, they were behind the times and their lag created massive distortions in the housing markets all to tame inflation. The WSJ consensus for a rate cut by their survey of economists seems much more certain about September.

Despite the September consensus, the probability of a recession is falling. Sounds like a promising situation for the housing market and yet, the Fed always seems late to the party. Here is something I wrote a few weeks ago: Outsized Rate Reactions Expected: The First Cut Is The Deepest

But then again…(and sorry)…

Did you hear about the economics graduate student who got injured by diving into a pool in winter? He forgot to seasonally adjust!

Unknown

Did you miss Friday’s Housing Notes?

July 19, 2024

A Listings Cluster Makes Sellers Confusingly Flustered

Image: Chat & Ask AI