- Cluster Of Nine Brownstone Listings Totalling More Than $100,000,000

- The Herd Mentality Of Buyers & Sellers Applies To The High-End Market

- Sellers Anchored to the Wrong Price Take 1-2 Years to Capitulate

Here’s a little ditty about how a housing submarket defined by location or price suddenly sees a buildup in listing inventory, while nearby competing areas remain tight, causing sellers to wonder what the heck is going on.

The first time I remember seeing this happen in Manhattan was a few decades ago with Fifth Avenue penthouses. We appraised a big co-op penthouse sale overlooking Central Park for a then very high price – perhaps around $12 million. It was located in a small building that rarely saw sales and penthouse sales in the market were rare. When this penthouse came on the market, roughly ten more were listed almost immediately, and about half of those listings sold quickly. So from a lone listing came a slew of competition.

After a multi-year drought of penthouse sales converted to a quick burst, buyers and sellers were all asking “Why?” Those remaining listings never sold and were taken off the market. That perfect market moment was quite short.

I see this phenomenon periodically and it continues to create market confusion. The latest occurrence was observed in Park Slope, Brooklyn (also known as Brownstone Brooklyn) and reported by the Wall Street Journal:

Why Are So Many Townhouses For Sale in Park Slope Right Now? [WSJ]

The NYC borough of Brooklyn has long been the hotbed of sales activity as it morphed from “a place to live that was cheaper than Manhattan” to its own global identity as a brand. I’ve often pointed out that when I spoke at a real estate forum in Shanghai about eight years ago, there were lots of people wearing clothing that was labeled “Brooklyn” or or displayed a list that included Brooklyn, such as “Paris, London, Rome, Brooklyn” or other variations. Not a single “Manhattan” themed article of clothing was seen. Of course, I loved what passed as labels there as a tourist. A plaque near a public restroom in Shanghai was adorned with the name “Hall of Mildness.” That title went on my “suggested names for a high school band” list.

But I digress…

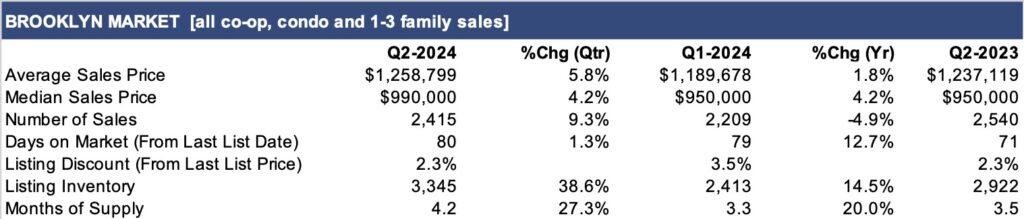

Like much of the country, sales in Brooklyn have slid over the past two and a half years, challenged by the spike in mortgage rates and a chronic shortage of listing inventory – that began well before the pandemic. Listing inventory rose 14.5% year over year borough-wide, and is now 9.7% higher than the second quarter average for the decade.

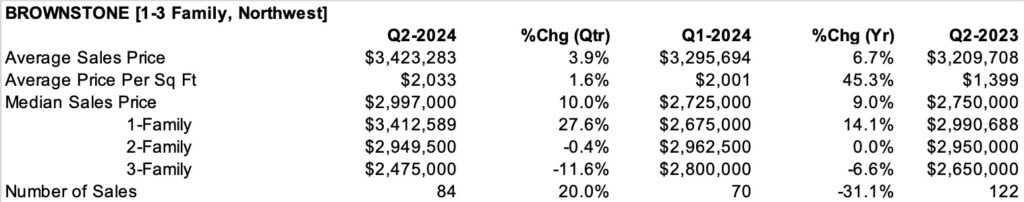

The Brownstone market has remained relatively active up until now, with sales restrained by limited supply. But the 61% surge in median price over the past decade, has helped pull new inventory on the market.

Here are some reasons why there are so many high-end listings in the neighborhood, a new twist on the local market that has largely been devoid of supply.

- Brownstone Brooklyn has been booming for the past several years and listing inventory has slowly expanded to meet the demand.

- Sellers have been pushing prices higher because of the long-time view that listing inventory was scarce.

- Listings continued to come to market despite sales slowing.

- Sellers continued to price their listings as if the market was seeing significant price gains. Buyers have pushed back, confronted with elevated mortgage costs.

- Cash buyers borough-wide comprised 42.8% of all sales, the third-highest share on record.

- Sellers take about 1-2 years to capitulate to market conditions without feeling like they left money on the table.

As a result, listing inventory slowly piled up relative to the local market with few participants taking notice, until it was too late.

The convergence is due in part to exploding home prices in the area, agents said. “People catch the fever,” said Ravi Kantha of real-estate brokerage Serhant. “They see one sale and people get aspirational. They want to go give it a shot.”

Wall Street Journal

What should sellers do with more competition in place? The excess supply isn’t necessarily a sign to cut the listing price but it is time to revisit pricing and take a hard look at the competition, something Brooklyn sellers aren’t used to

Did you miss yesterday’s Housing Notes?

July 18, 2024

A Lot Of Professionals In Real Estate Are Crackpots

Image: Chat & Ask AI

Housing Notes Reads

- Palm Beach real estate sets new record for average single-family sale price in 2Q [Palm Beach Daily News]

- Home Sales Slow In Boca Raton, Delray Beach, But Still Bring Big Bucks [BocaNewsNow.com]

- Occupiers, Conversions, Bloomberg Give NYC Office Sales Market A Boost [Bisnow]

- Home Sales Fall Annually in Palm Beach as Other South Florida Cities See an Uptick [Mansion Global]

- Why Are So Many Townhouses For Sale in Park Slope Right Now? [Wall Street Journal]

- Appraisal Is At The Root Of CRE. There Are Deep Cracks In The Industry's Foundation [Bisnow]

Market Reports

- Elliman Report: Miami Beach + Barrier Islands Sales 2Q 2024 [Miller Samuel]

- Elliman Report: Lee County Sales 2Q 2024 [Miller Samuel]

- Elliman Report: St. Petersburg Sales 2Q 2024 [Miller Samuel]

- Elliman Report: Naples Sales 2Q 2024 [Miller Samuel]

- Elliman Report: Fort Lauderdale Sales 2Q 2024 [Miller Samuel]

- Elliman Report: Coral Gables Sales 2Q 2024 [Miller Samuel]

- Elliman Report: Wellington Sales 2Q 2024 [Miller Samuel]

- Elliman Report: West Palm Beach Sales 2Q 2024 [Miller Samuel]

- Elliman Report: Weston Sales 2Q 2024 [Miller Samuel]

- Elliman Report: Vero Beach Sales 2Q 2024 [Miller Samuel]

- Elliman Report: Palm Beach Sales 2Q 2024 [Miller Samuel]

- Elliman Report: Delray Beach Sales 2Q 2024 [Miller Samuel]

- Elliman Report: Boca Raton 2Q 2024 [Miller Samuel]

- Elliman Report: Brooklyn Sales 2Q 2024 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 6-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 6-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 6-2024 [Miller Samuel]

- Elliman Report: Manhattan Sales 2Q 2024 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)