- The Fed reset expectations with a pivot from a three-then-one rate cut projection

- Even a small (25%) rate cut will fuel a surge in sales after two years of waiting

- A slight rate decline will bring in more inventory but a lot more demand

Apologies for a Rod Stewart song reference but he delivers my favorite version of it. Time flies and it is hard to believe that more than two years have passed since the 2022 Fed pivot that marked the beginning of the steepest ascent in mortgage rates in fifty years. And then this past December, the Fed pivoted again, saying there would be 75 basis points worth of cuts in 2024 only to rethink their next move in the form of one likely 25 basis point cut before the end of the year. No wonder we’re all confused.

This series of events set the stage for what I believe will be an outsized consumer reaction to an anticipated 25 basis point rate cut at the end of the year. Here is a brief articulation of my thinking in yesterday’s appearance on Bloomberg Television:

It is always a treat to be interviewed by rising star Lisa Abramowicz plus I got to meet Dani Burger and Annmarie Hordern, part of the morning brain trust.

But before I go into the conversation, I want to share that had to get up at 4 am to make the 7:30 am hit but it is always worth it. If I went to bed on time, I think I’d prefer to go to work in the dark. I wanted to point out that back in the heyday of the Foursquare app, I was the “Mayor of the Bloomberg Cafeteria.” Plus it’s always fun to speak with the other guests in the green room before my hit.

Here are the factors to consider when thinking about the initial impact of the first cut later this year.

Pent-up Demand

The pandemic-era housing boom frenzy was cut off at the knees in early 2022 when the Fed pivot signified the end of low mortgage rates. Uncertainty was injected into the market and the couple that own a 1-bedroom apartment who had triplets in 2022, have been on hold instead of trading up. But their buyer resolve has been held in check for more than two years now and I believe enough time has passed to believe it is wearing thin. How long will the initial release in pent-up demand last? It’s anyone’s guess. I am not very concerned that the initial boomlet has the potential to concern the Fed of stoking inflation. The reason is the sales boomlet will take oxygen away from the rental market, weakening it and that’s the opposite of the rental patterns that have been distorting CPI.

Doling Out Hope For Cuts, Buying Before Prices Rise

The Fed pivot last December telegraphed to the economy that there would be rate cuts as the Fed’s next move. Until this was said publically, it was assumed that mortgage rates would continue to rise. So the Fed added an expectation that the housing economy would restart as mortgage rates began to fall. And initially mortgage rates fell, fueling active months in January and February. But by March and later, it became clear that mortgage rates would remain “higher for longer.’

But for consumers waiting for mortgage rates to fall much more and then buy, prices are likely to be rising across many markets over the next three or more years. Lower mortgage rates bring in more inventory but lower rates also bring in a lot more demand (pent-up).

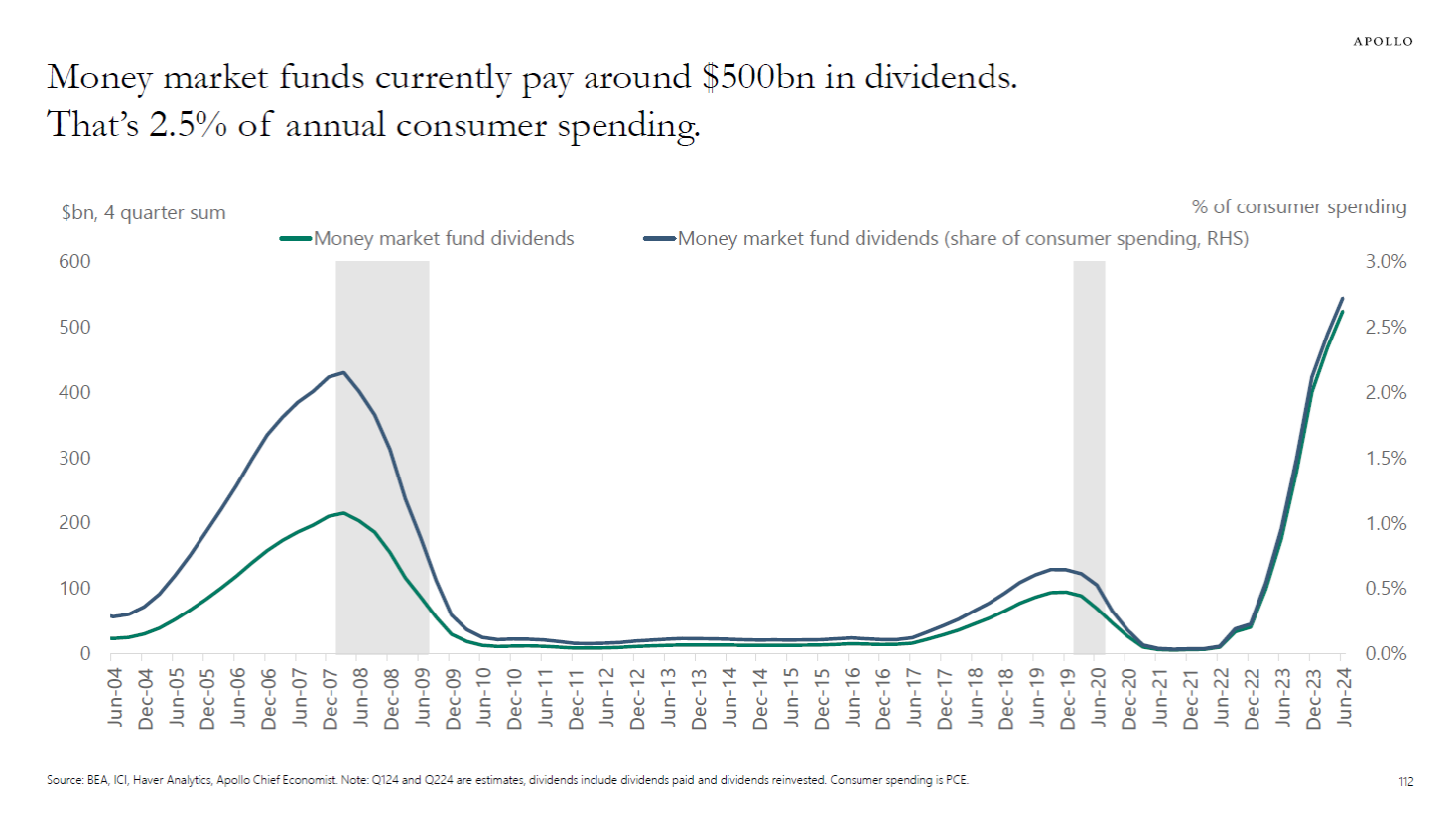

Strong Financial Markets Help Fuel Home Sales

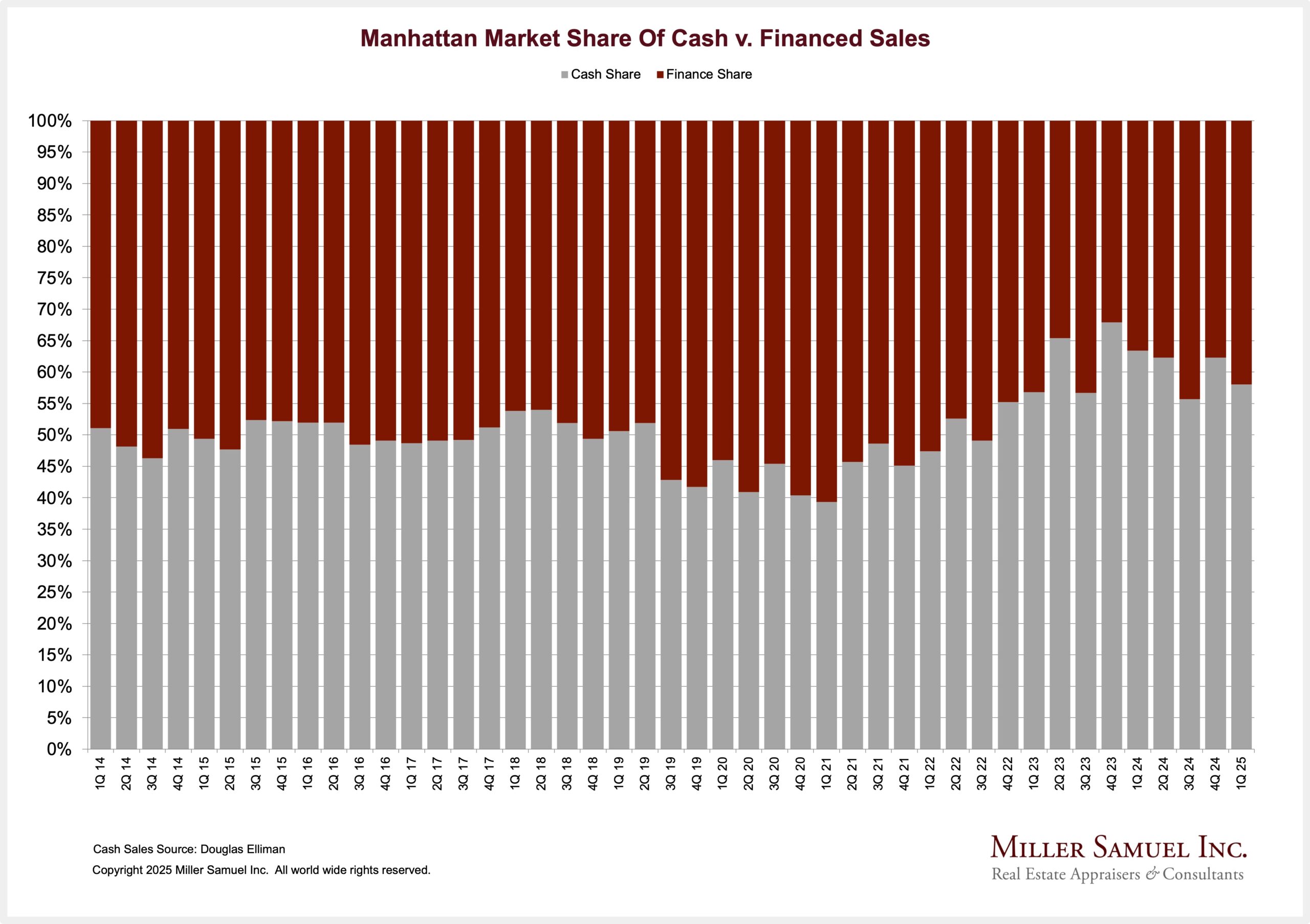

The 32% share of cash buyers reported by NAR is the highest in a decade. It’s been as high as 68% in Manhattan. Equity pulled from the stock has enabled home purchases as well.

The Fed Is Waiting For The Data, But The Data Lags

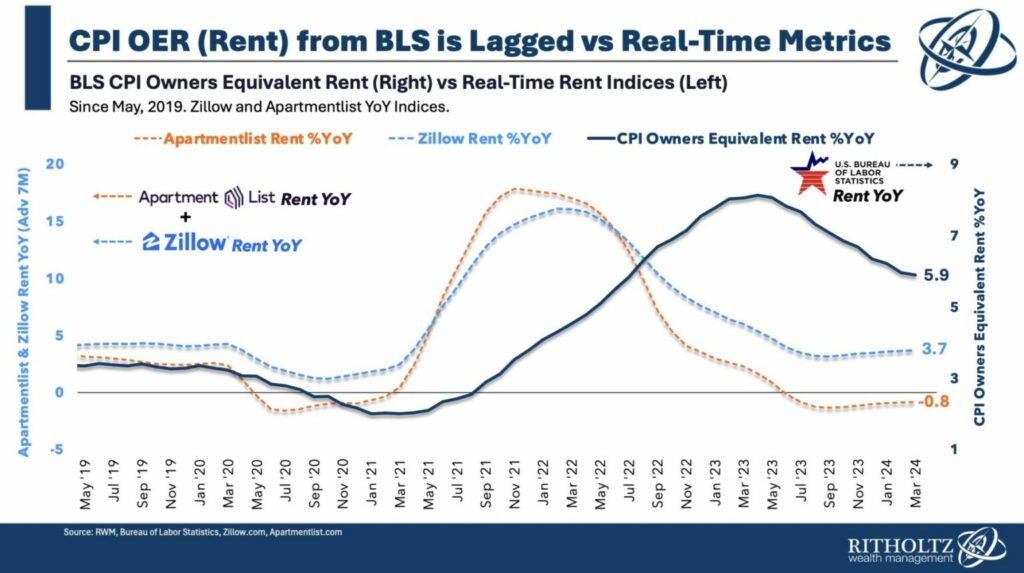

There have been a lot of insights shared about why rate cuts should happen now instead of in the back half of 2024. One of the best came from my friend, radio host, and prolific blogger Barry Ritholtz with his post Why the FED Should Be Already Cutting. It is largely about rents and the massive lag seen in the CPI Owners’ equivalent rent rather than actual rent. So while the Fed says it is waiting for the data, using actual rents shows that there is a significant lag in the data they are relying on.

Economists Continue To Change Their Minds

As the economy keeps defying performance expectations with a 4% unemployment rate, earlier this month a survey found that 70% of economists expect the rate cut to occur in September. But these are probably the same economists who thought there would be a rate cut last March, April, and June. So while the 70% result is strong, there seems to be a herd mentality. Unemployment was lower then than the 4% is now and the majority in the Reuters survey still saw rate cuts as imminent.

but I need to digress…

Here’s my only economist joke (only in fun – I highly respect the profession!)

Whats the difference between a Micro and a Macro Economist?

- a micro economist is wrong about specific things

- a macro economist is wrong about things in general

The joke was borrowed from Yoram Bauman. I’ve watched his clip and blogged about a lot more than I should of. Here’s another share. #nerdhumor