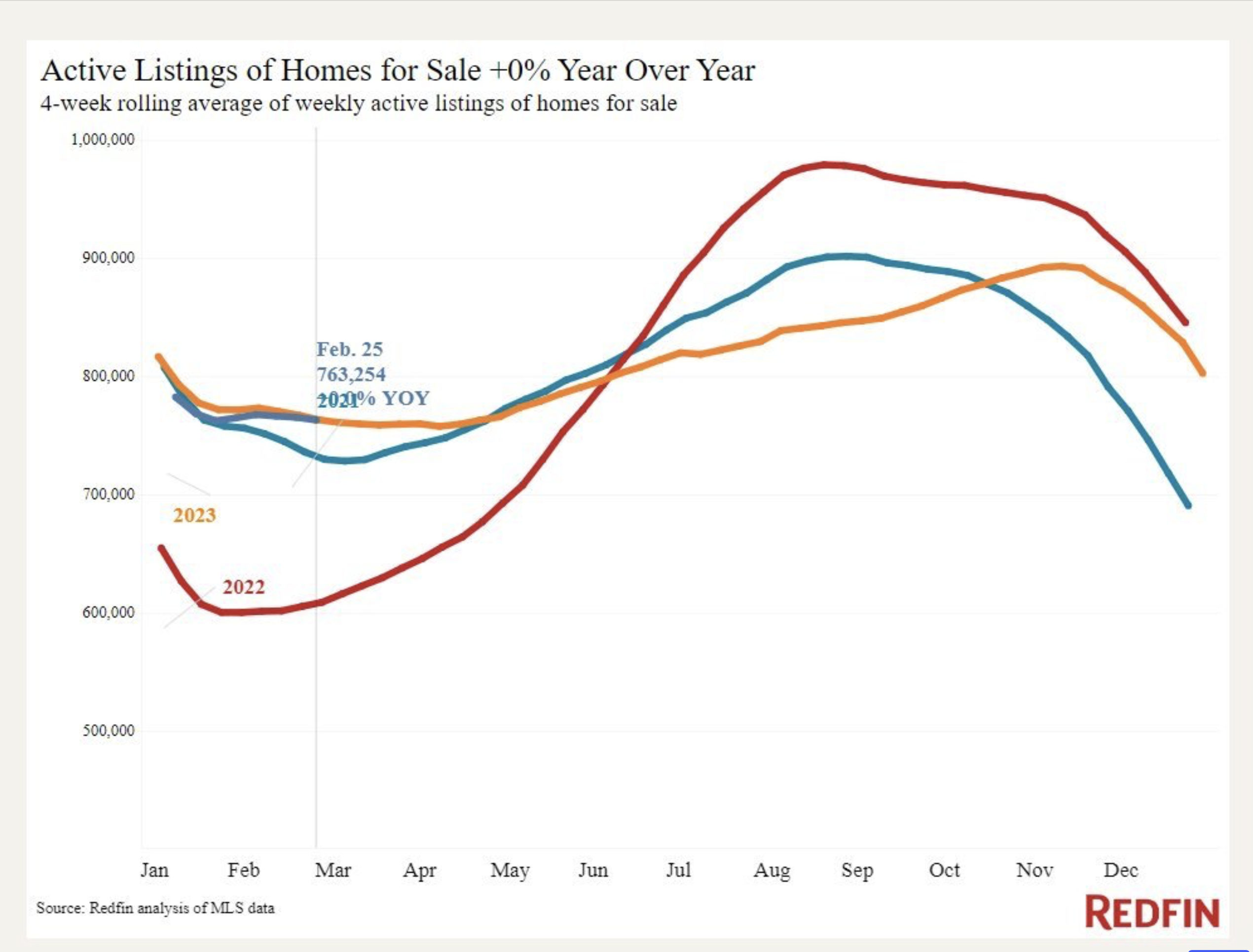

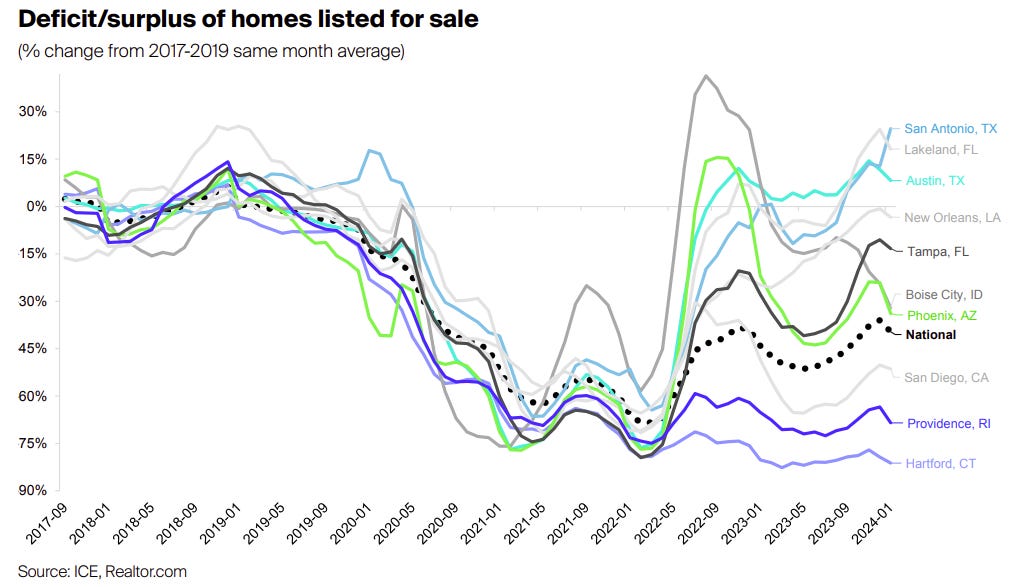

Listing inventory is finally beginning to enter the market at scale as newly signed contracts expand.

Some truths can’t be explained away, and those 30 percenters are simply wrong.

Did you miss last Friday’s Housing Notes?

March 1, 2024: Is The Housing Market OK?

But I digress…

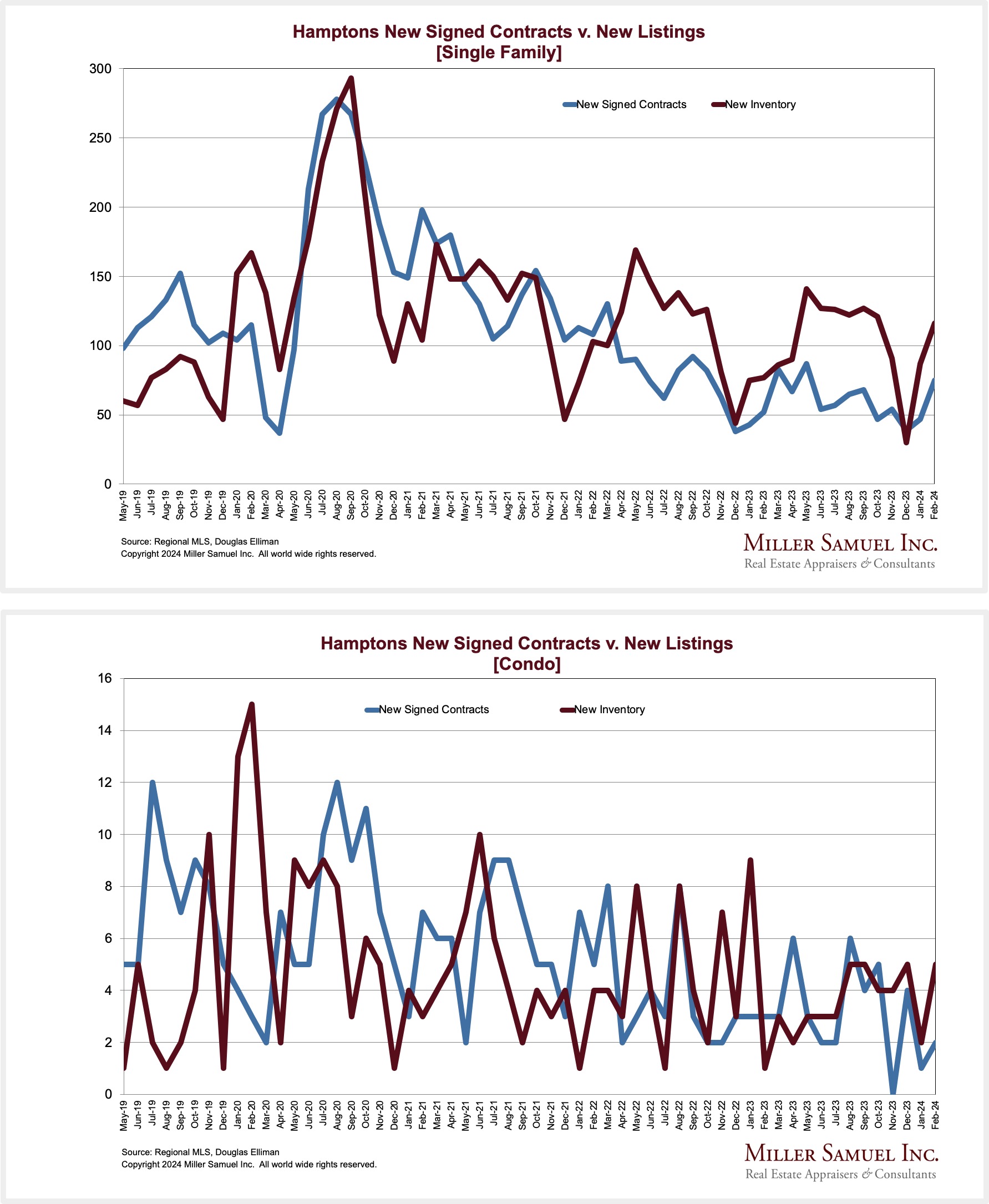

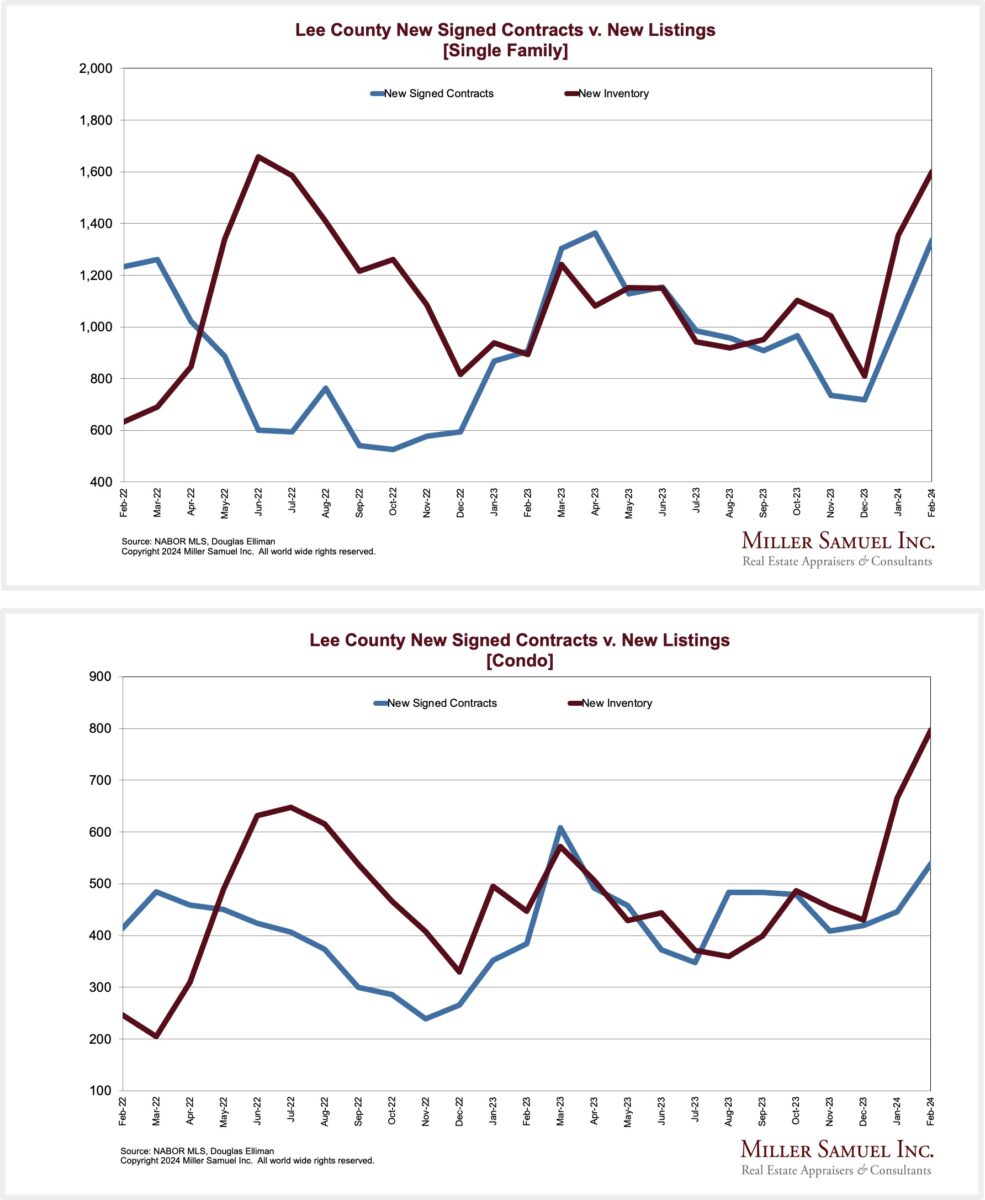

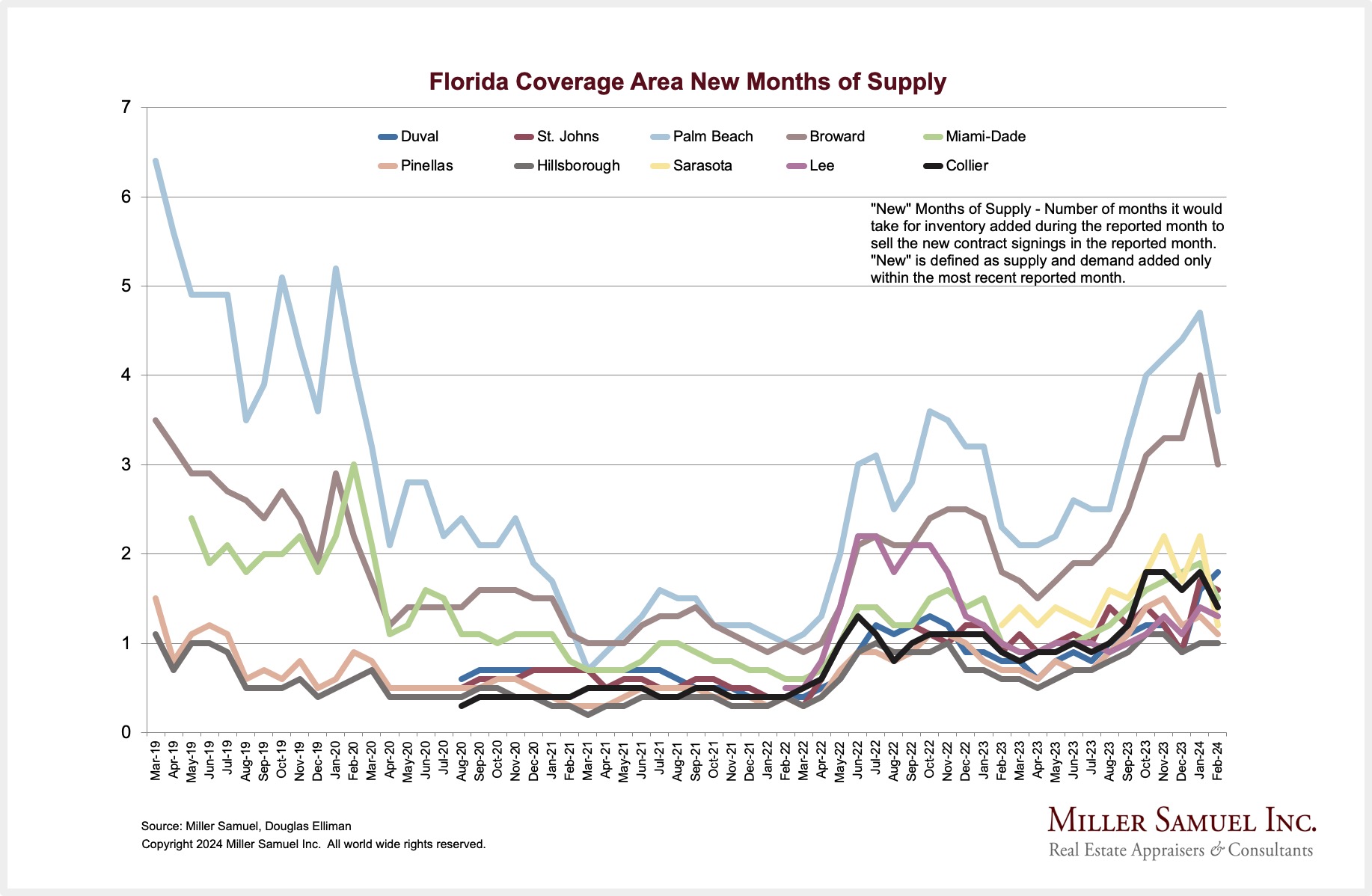

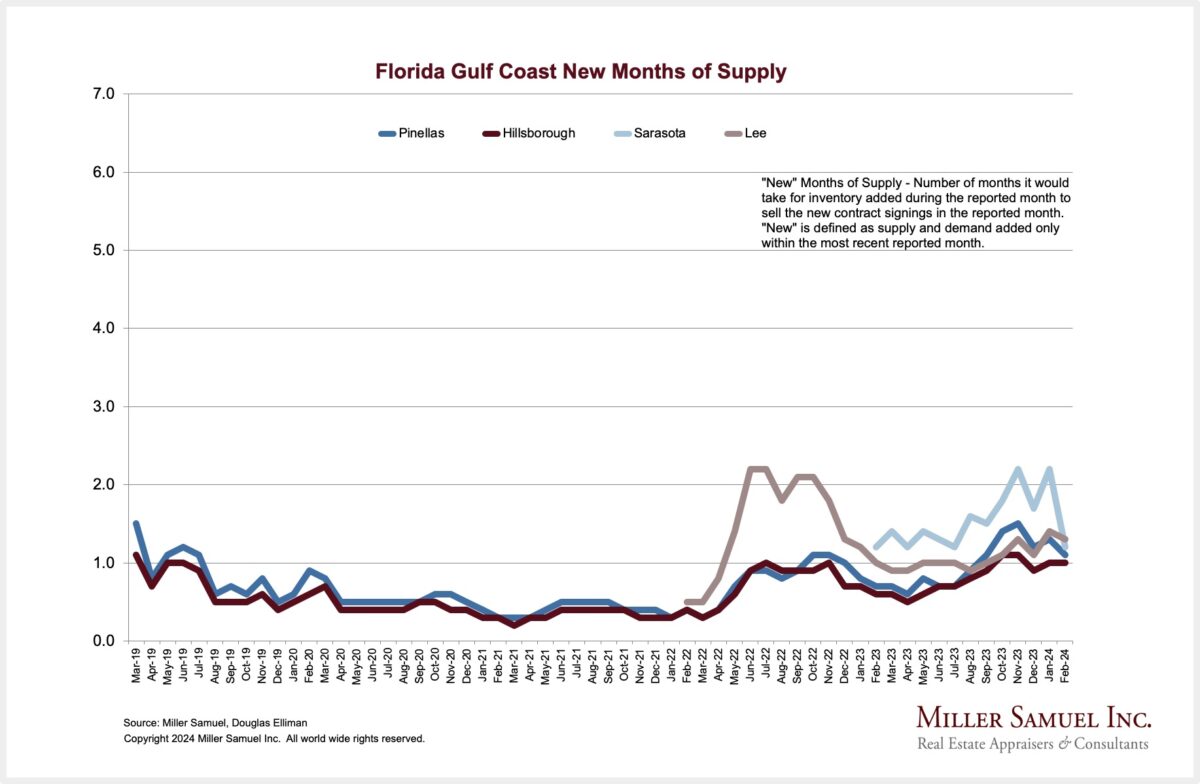

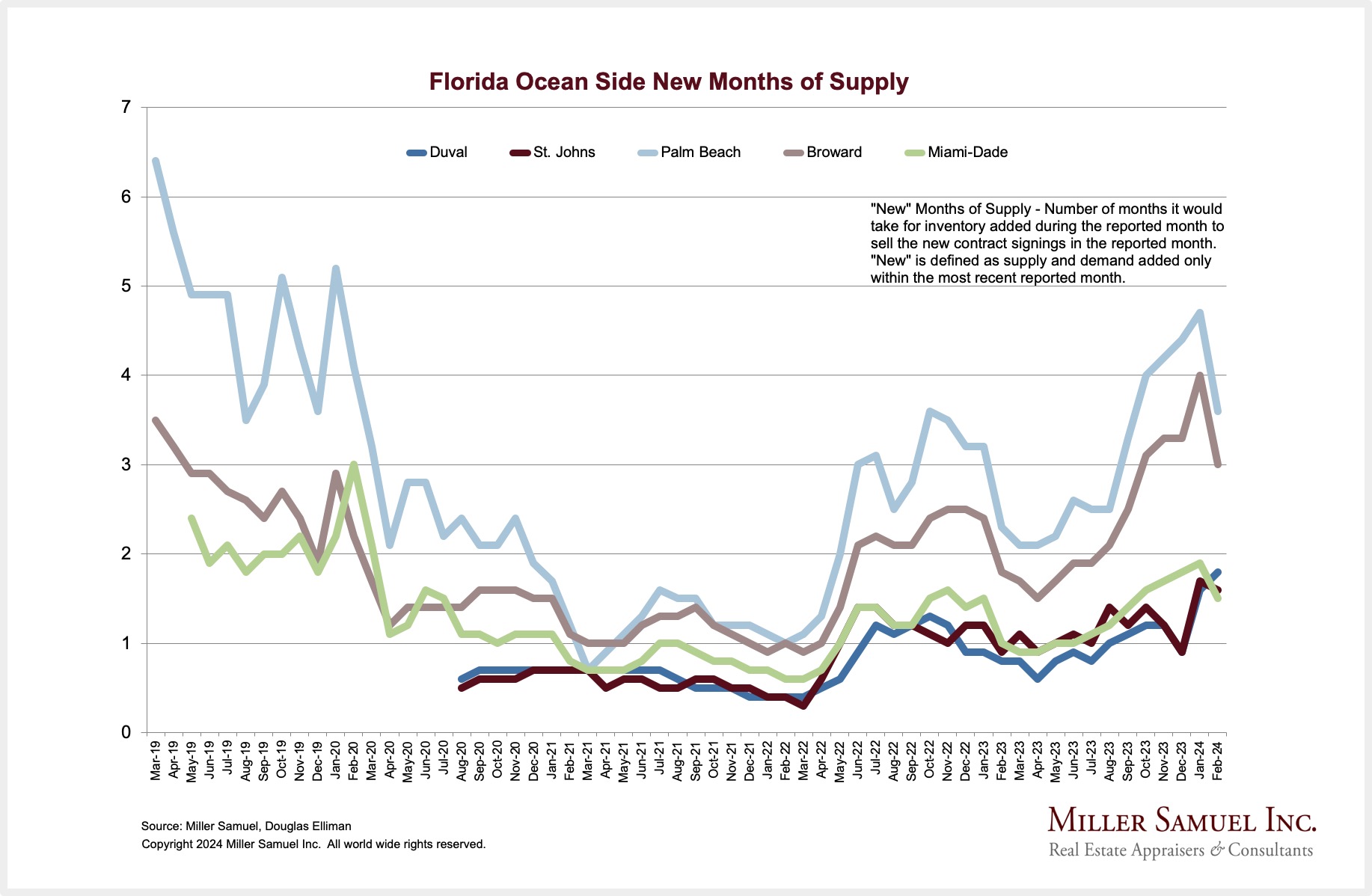

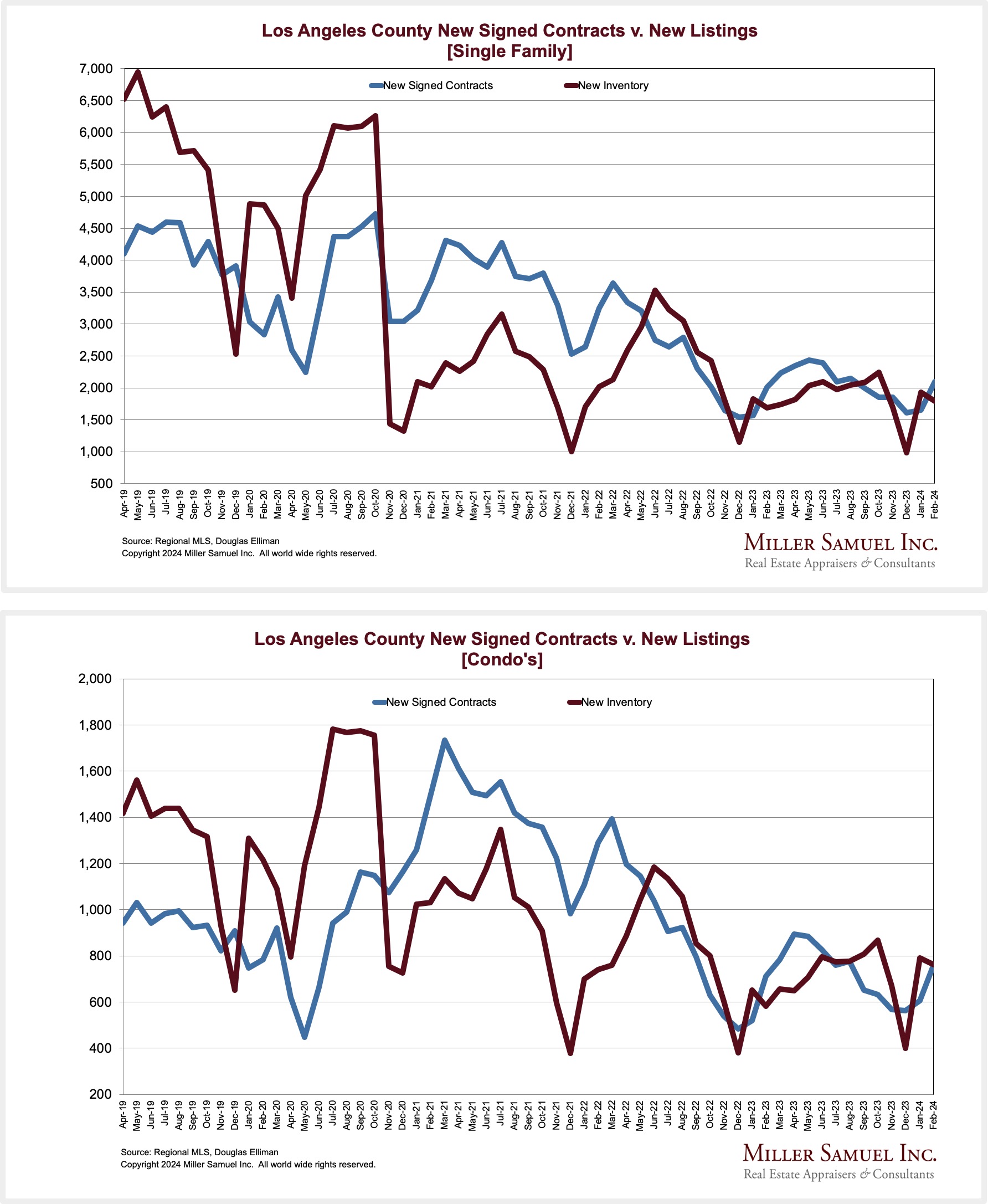

New York Metro, Florida, and So Cal Area New Signed Contracts Are Up, And So Are New Listings

I’ve been the author of the expanding market report series for real estate firm Douglas Elliman since 1994. One of the latest additions is the new signed contract reports, which we began during the pandemic.

I’ve included random charts from each region, but you can find more in our chart gallery.

Elliman Report: February 2024 New York, New Signed Contracts

Elliman Report: February 2024 Florida, New Signed Contracts

Elliman Report: February 2024 California, New Signed Contracts

Sternlicht Gets Real About The Office Market

He’s always a good speaker on commercial real estate stats, but I watch his takes with a bit of trepidation. After he pronounced Greenwich, CT, the worst housing market in the U.S. about 8ish years ago, I learned from local real estate agents that he was trying to sell his home there and couldn’t. It was reported to be still overpriced after he sharply cut the original price – and concluded, “Therefore, it’s a terrible market,” making the market all about his interests. Still, this is a good discussion.

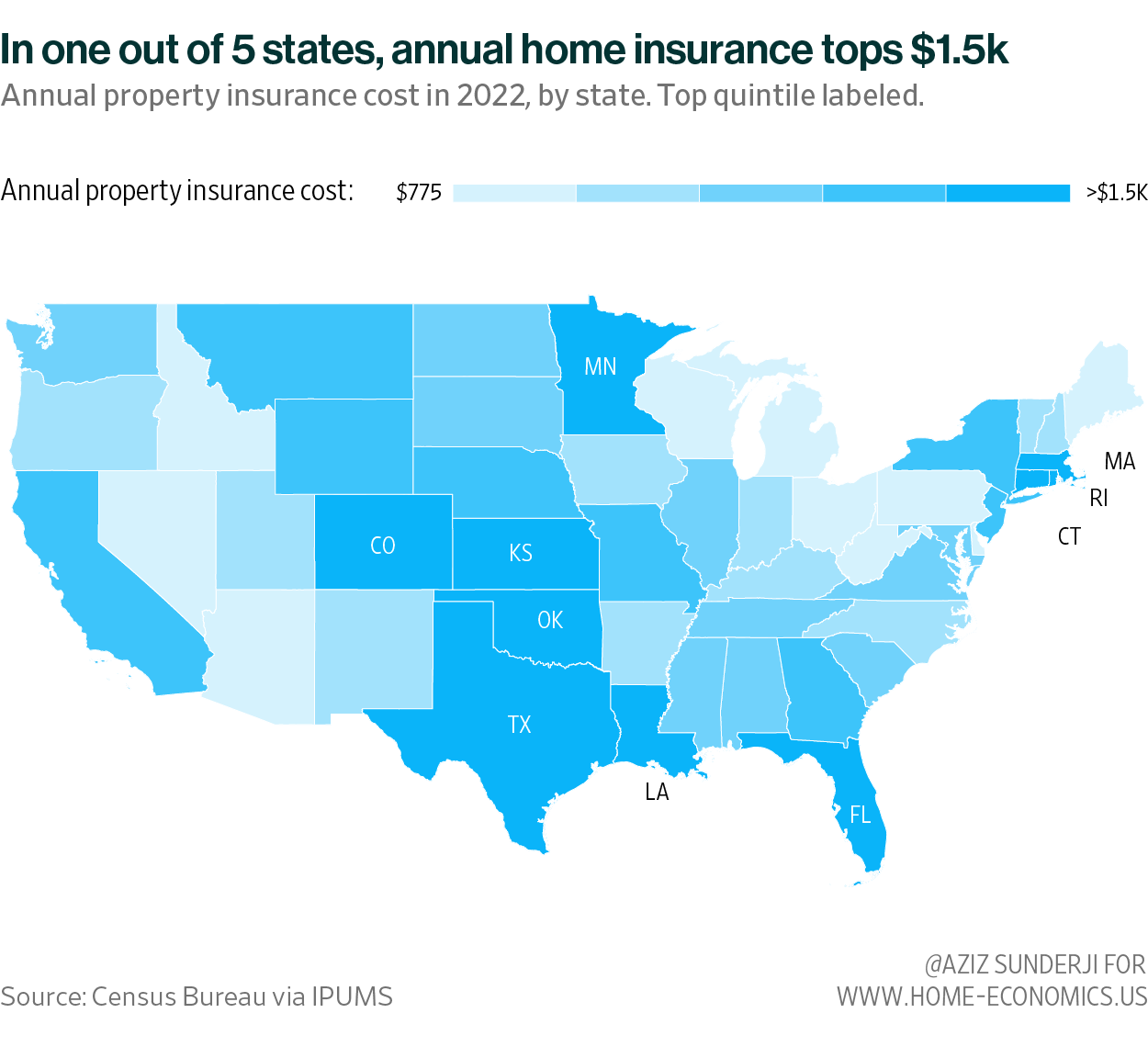

State of Housing Chartfest – Insurance, Cash, Distress & Supply

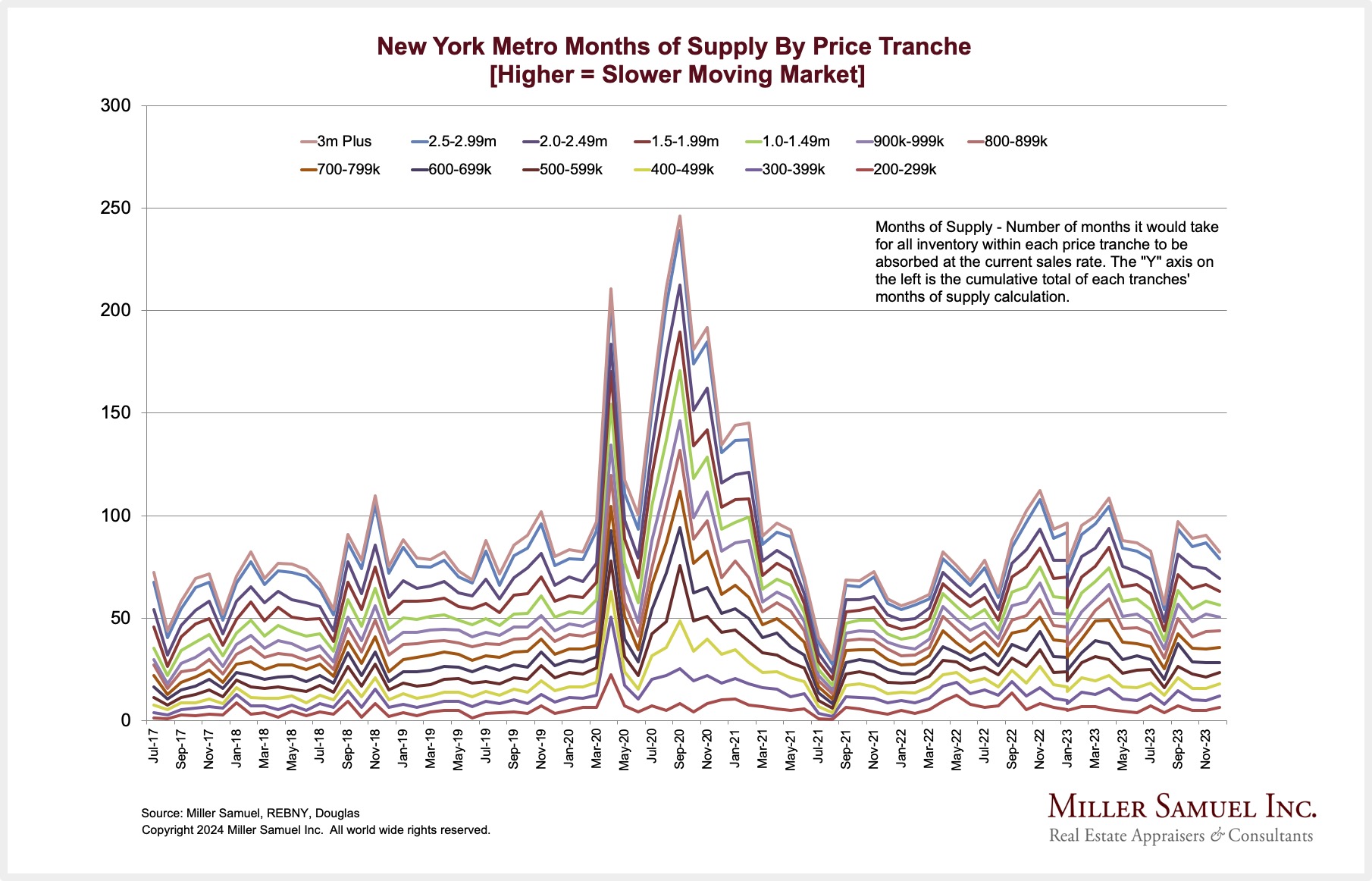

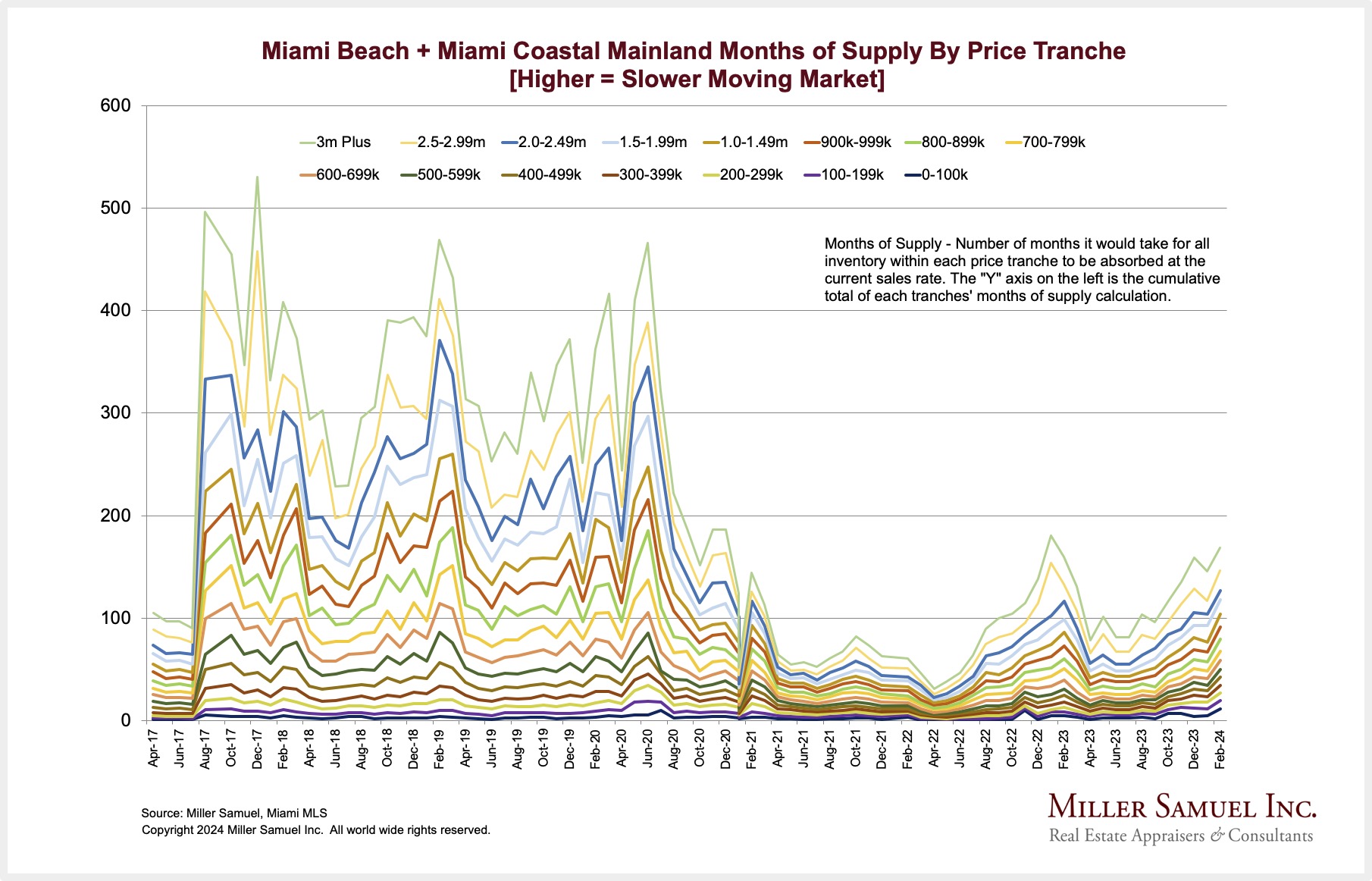

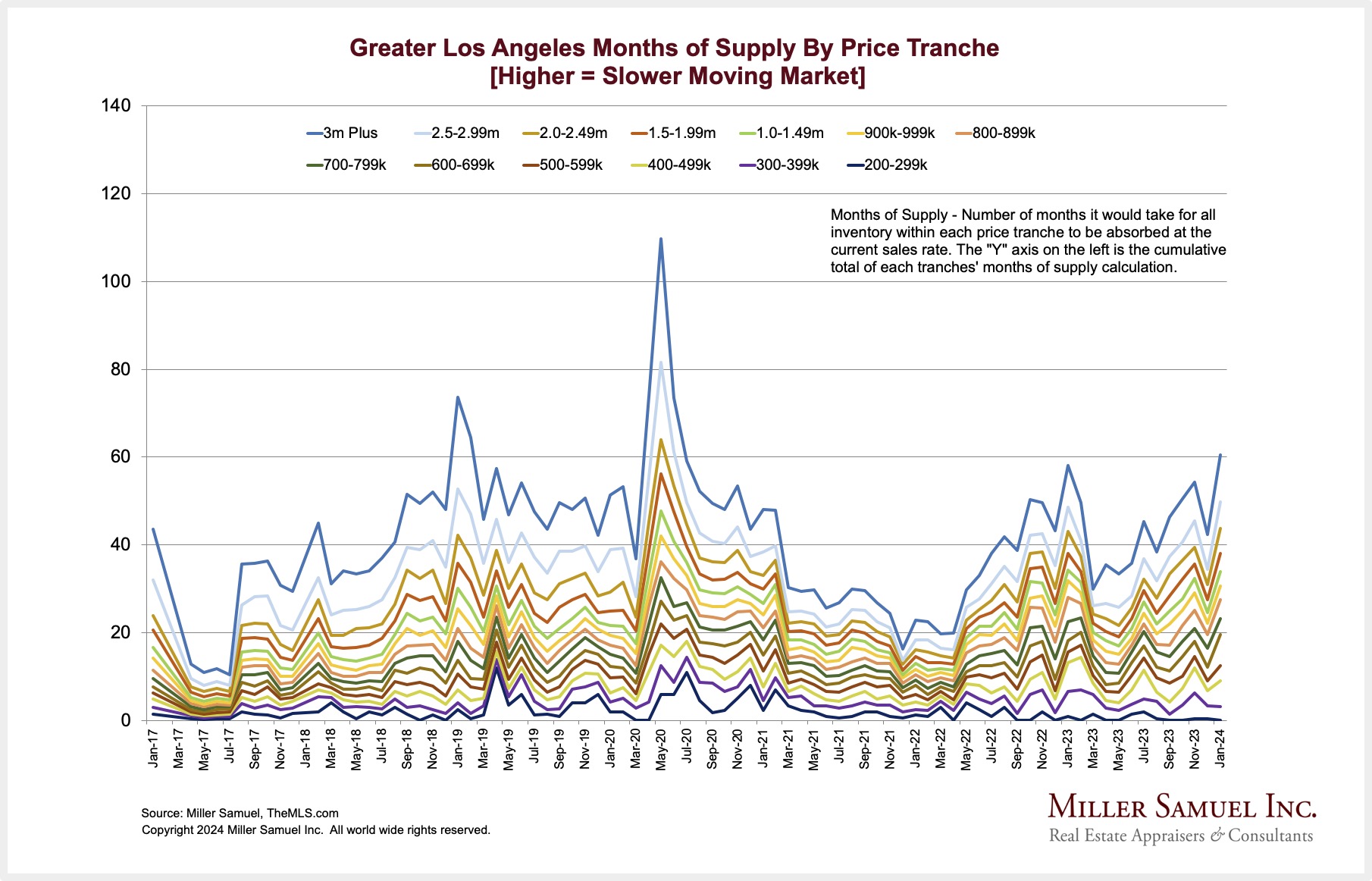

Months of Supply By Price Tranche

I thought it would be interesting to break out three key housing markets by price tranches over time using months of supply. MOS is my favorite housing market since it measures the intersection of supply and demand and is not one-sided. It measures the months it would take to sell all listings at the current sales rate.

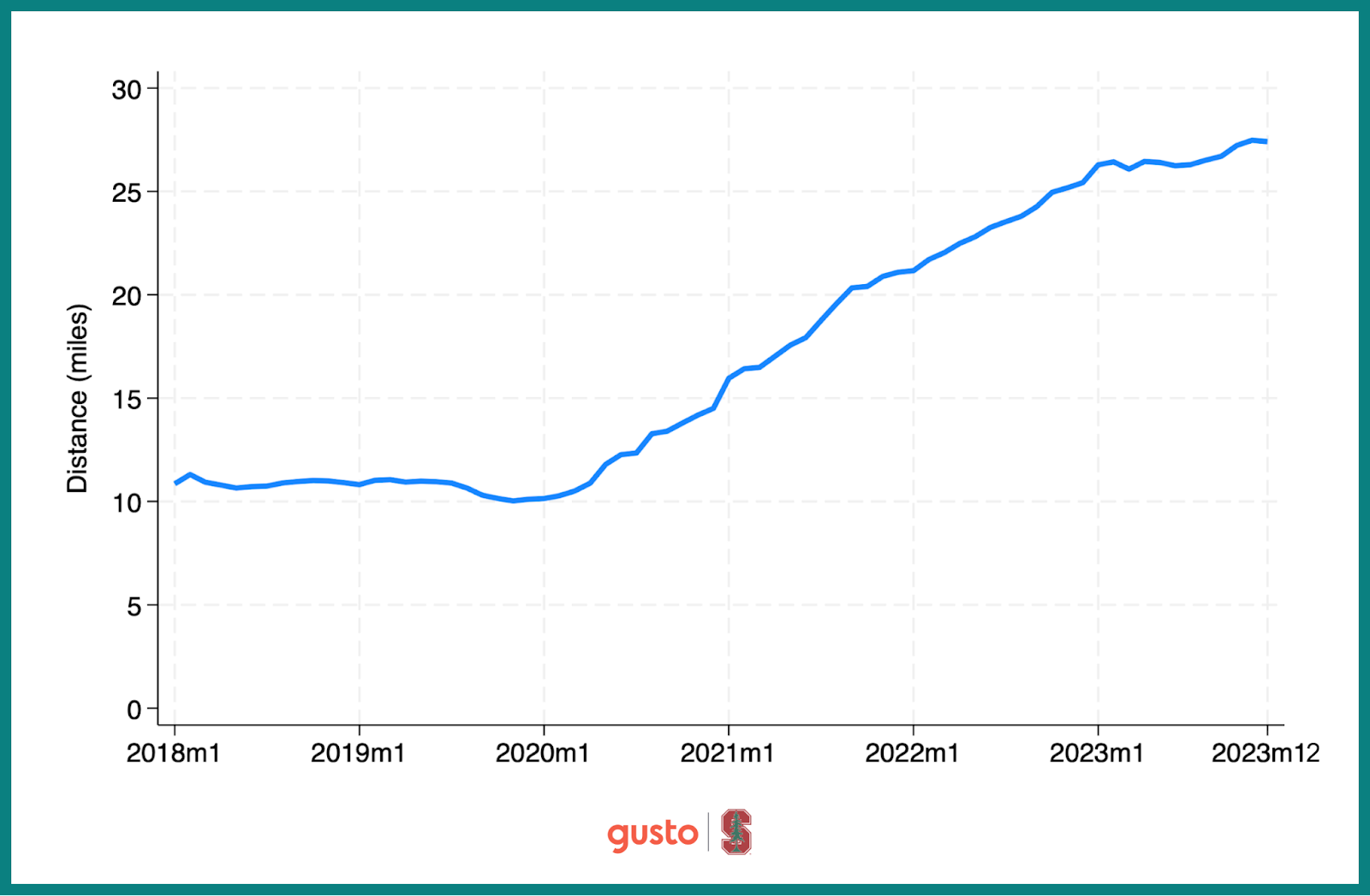

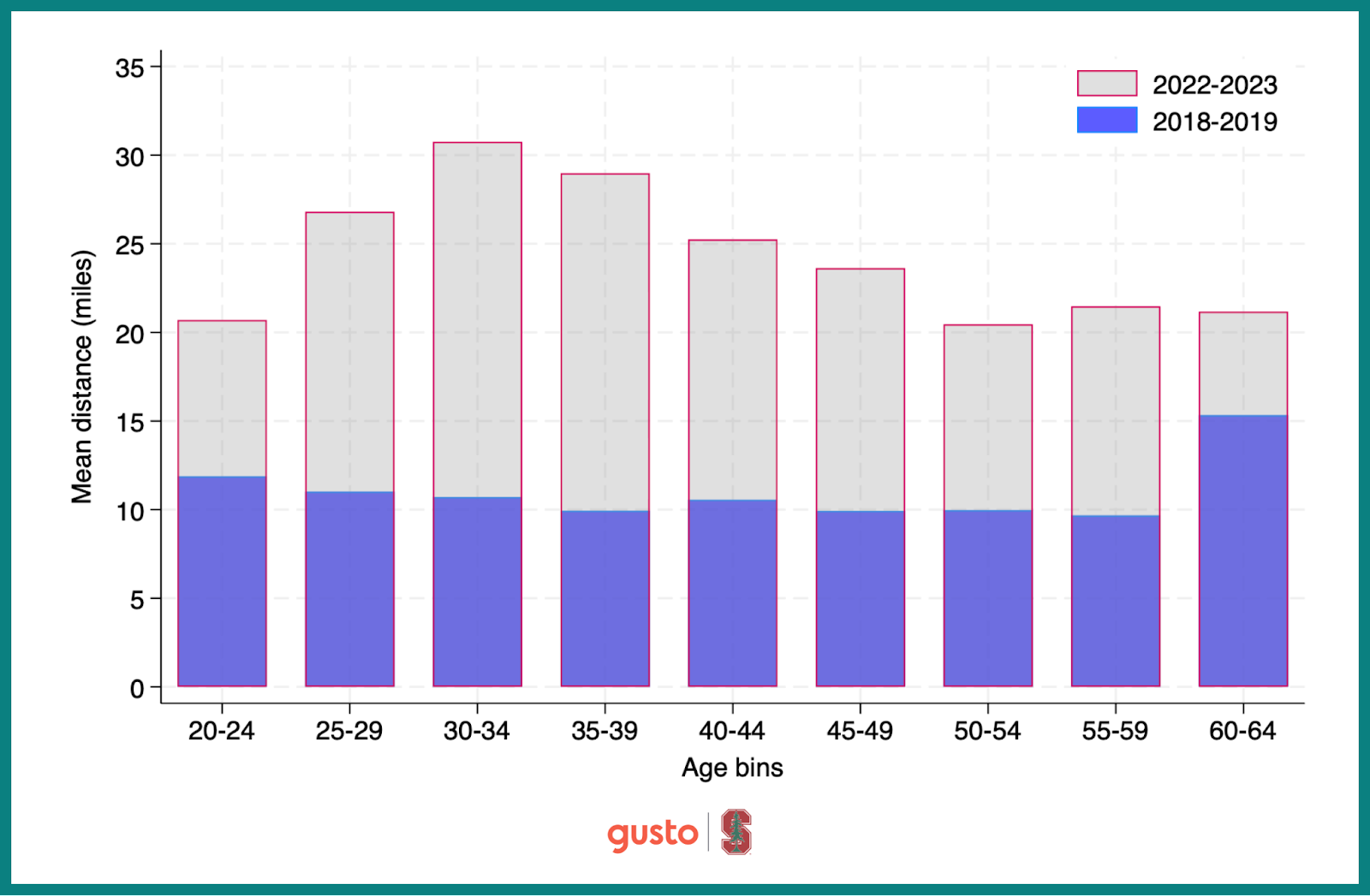

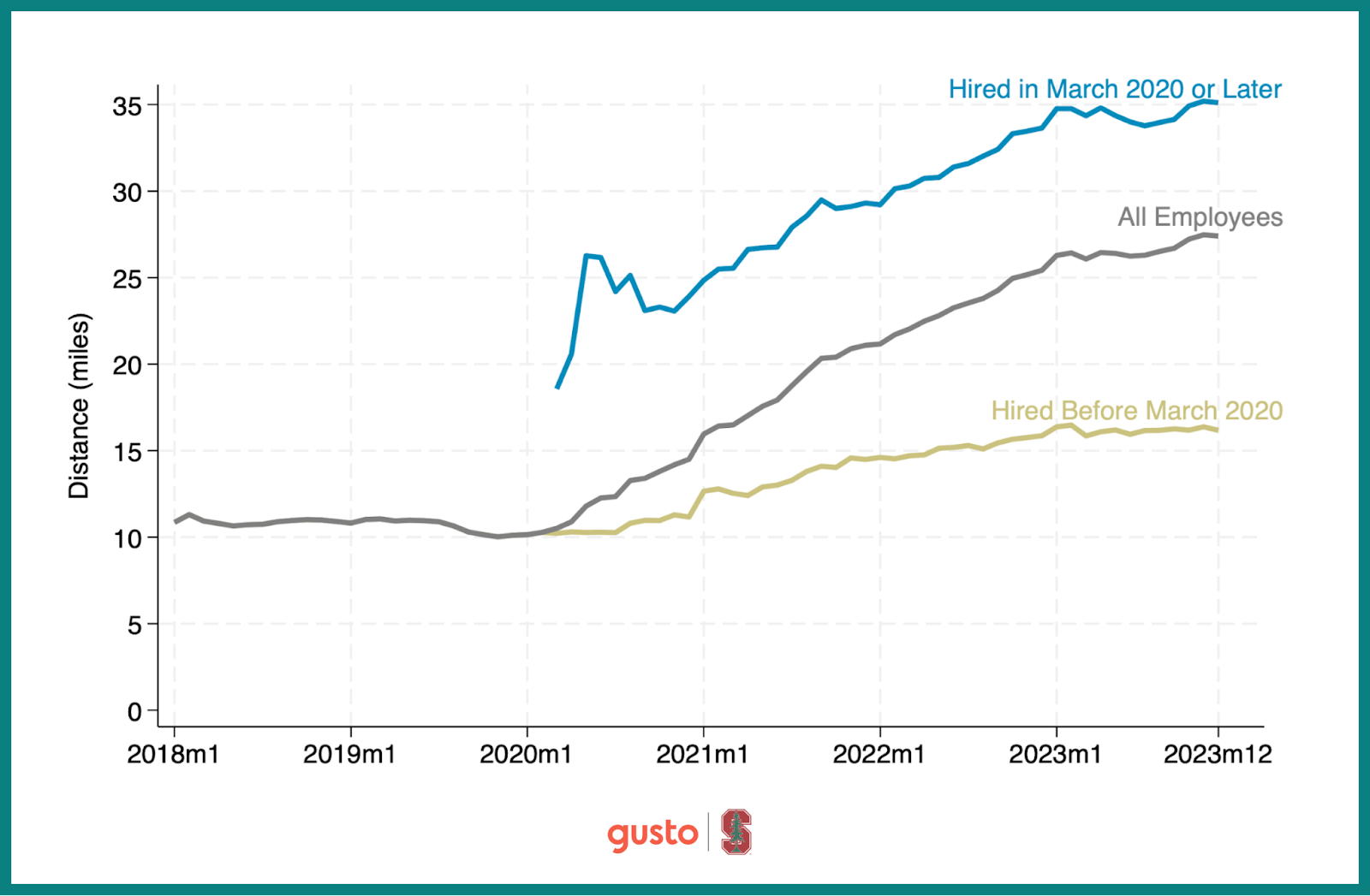

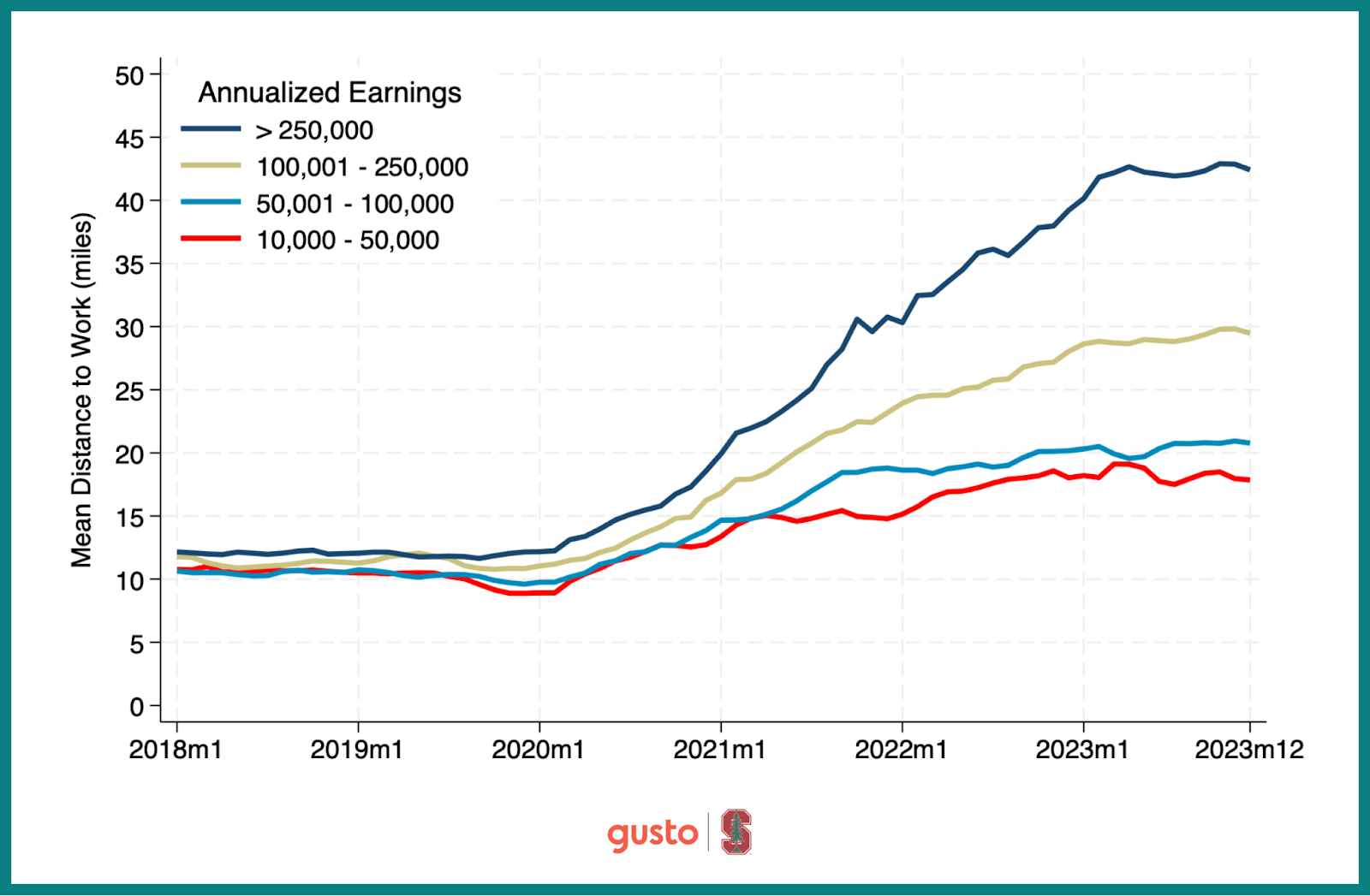

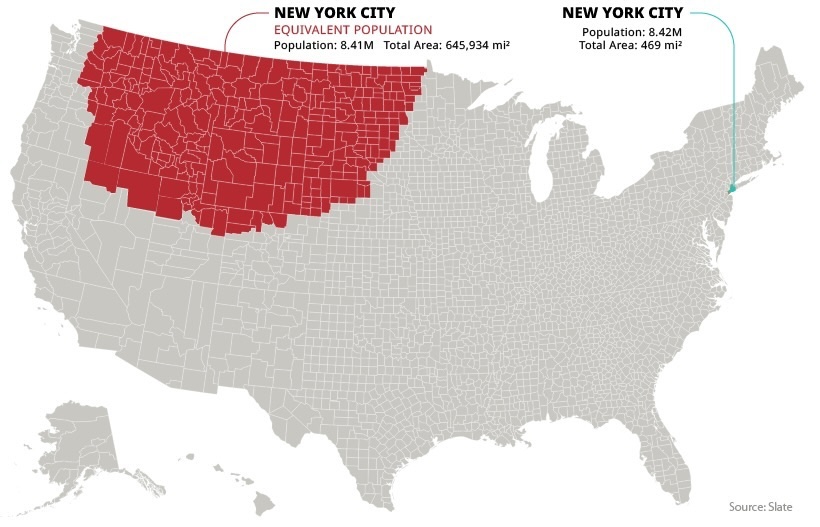

Employees Now Live Twice As Far From Work

The New York Times reported on a Gusto study of the white-collar work pattern of living further from home after the pandemic. The change has been seen across all age groups and higher earners live farther, but new hires are the critical reason for the expanding distance from work.

The economists studied employee and employer address data from nearly 6,000 employers across the country and found that the average distance between people’s homes and workplaces rose to 27 miles in 2023 from 10 miles in 2019, more than doubling.

Washington Post/Gusto

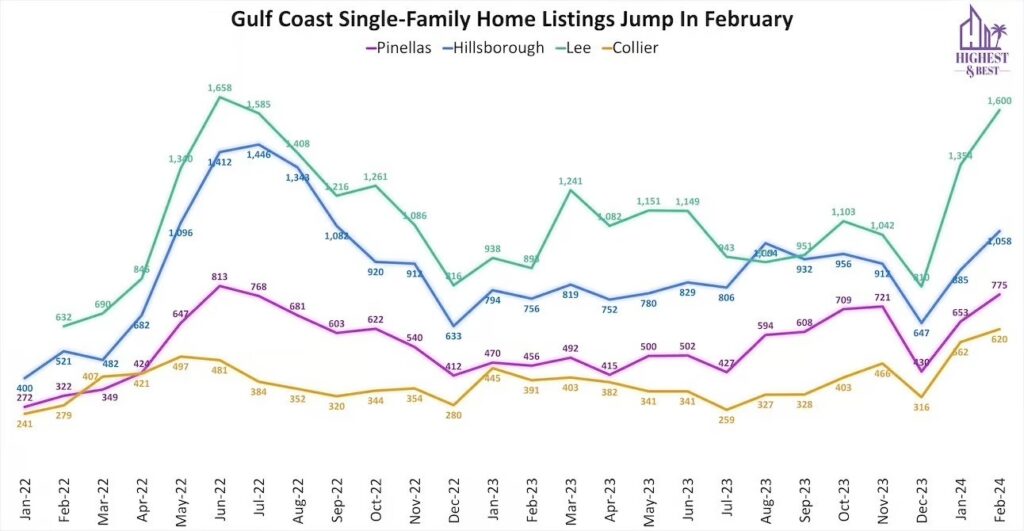

Highest & Best Newsletter: 🏡 High on Supply

If you’re interested in the Florida housing market, you should sign up for this Florida newsletter, Highest & Best, from Oshrat Carmiel, formerly of Bloomberg News…

This week’s post:

🏡 High on Supply – Florida home listings are piling higher. The pace of sales is still brisk

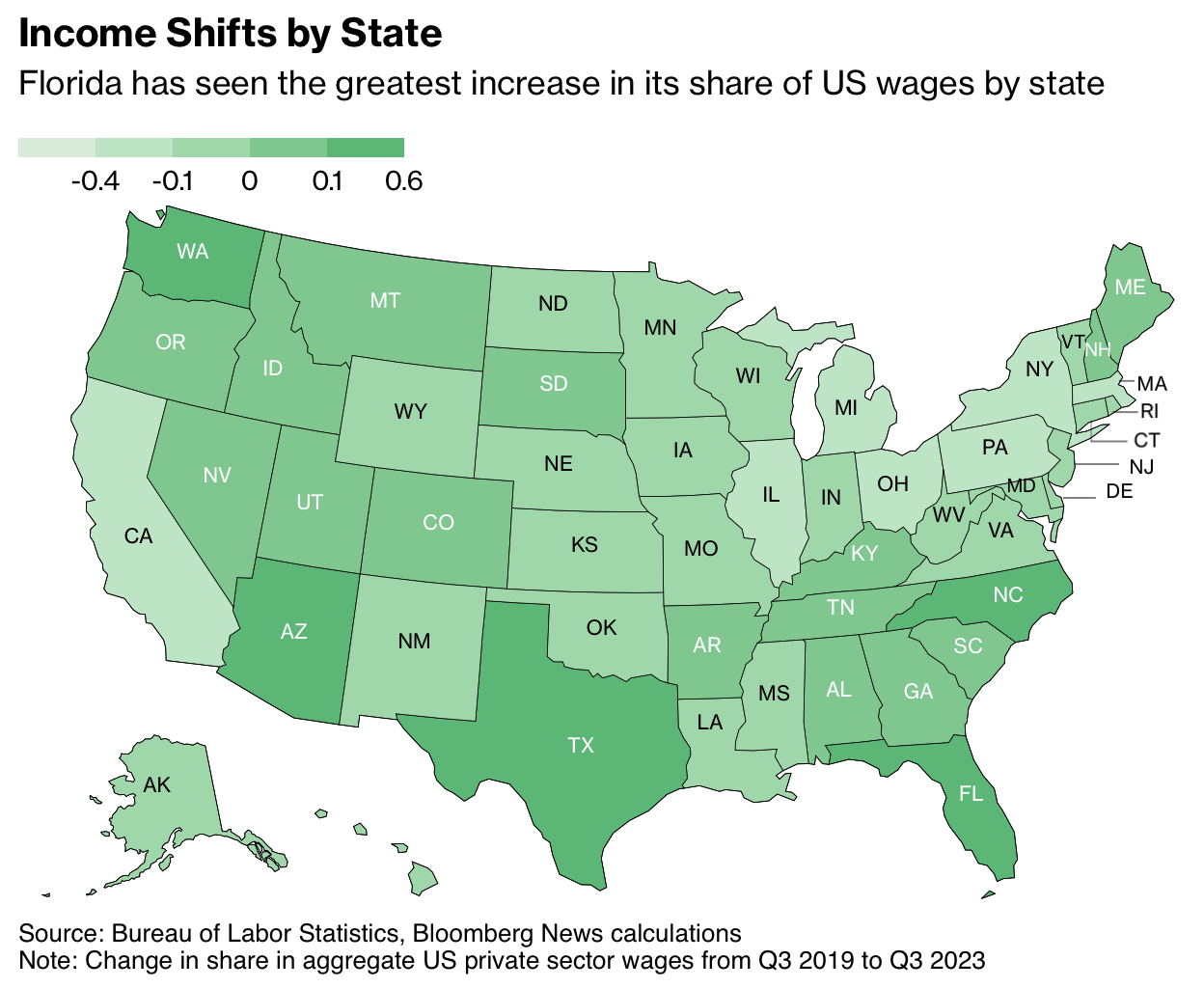

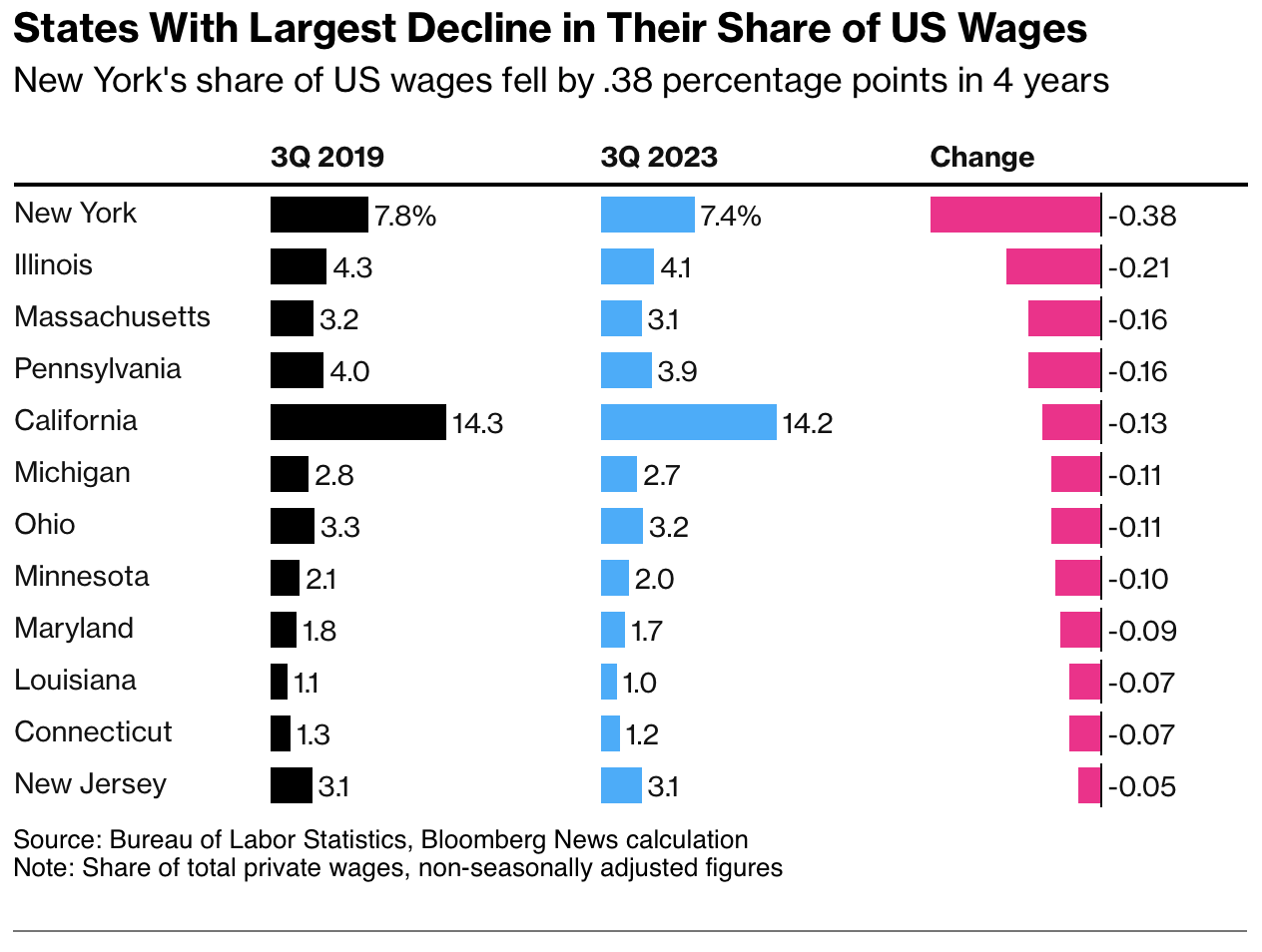

US Wage Gains Are Moving South

There was a great Bloomberg piece on the geographical shift in wages evidenced by new Census data: Florida, Texas Grab Bigger Chunk of Paychecks as New York Fades. You can see how the Sunbelt states are winning.

Compass Continues The Trend, Losing $320 Million In 2023

Exactly two years ago, I had a Twitter spat with Compass Chief Evangelist and former President Leonard Steinberg, one of their more successful agents. He commented on how Compass had a two-year plan, and they would reveal the plan for their success when two years were up. Today, they’re still losing money. Don’t get me wrong, he has long been a successful real estate broker and was instrumental in building their hiring momentum early on. I just took issue with the silliness of the proclamation since we didn’t need him to explain the plan in two years since we would have seen what they would do over the two years.

Compass had two positive cash flow quarters last year (2nd and 3rd) but continued to hemorrhage, losing $383 million. My issue has always been with the viability of their business model, not with the brokers themselves, with some of the best in the market on board. And yet here we are, well more than a decade later, never having made a profit in one of the biggest housing booms of the modern era. This is because Compass has always been a disrupter by capital, not by innovation, and when the capital infusion stopped, services were cut. It will be interesting to see how many more years it will take to turn a profit.

Central Bank Central Interview: Fed to Cut Rates 125 BPs in 2024: Hunter

Here’s a new substack I’m excited about – Kathleen Hays Presents Central Bank Central. I highly recommend it. A long-time friend and journalist, Kathleen Hays has extensive experience interviewing economic experts in Fedworld from her time at Bloomberg Television.

Central Bank Central: Fed to Cut Rates 125 BPs in 2024: Hunter

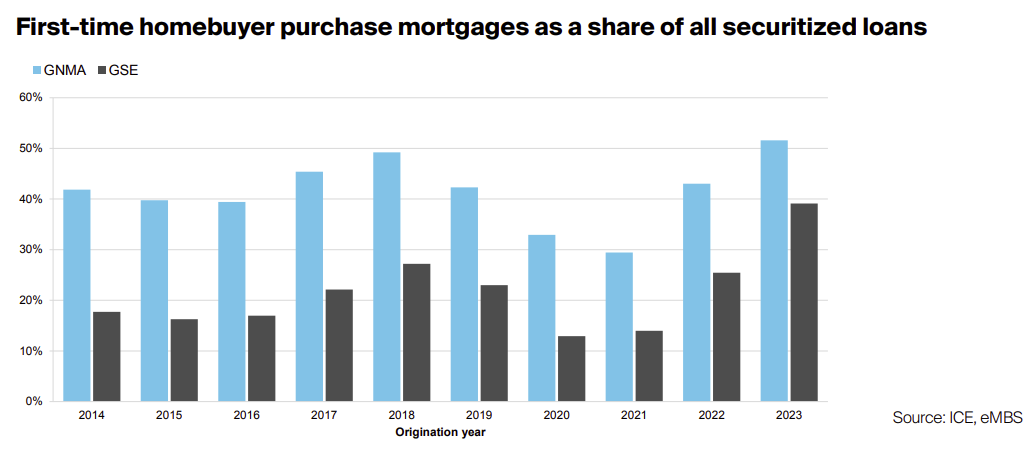

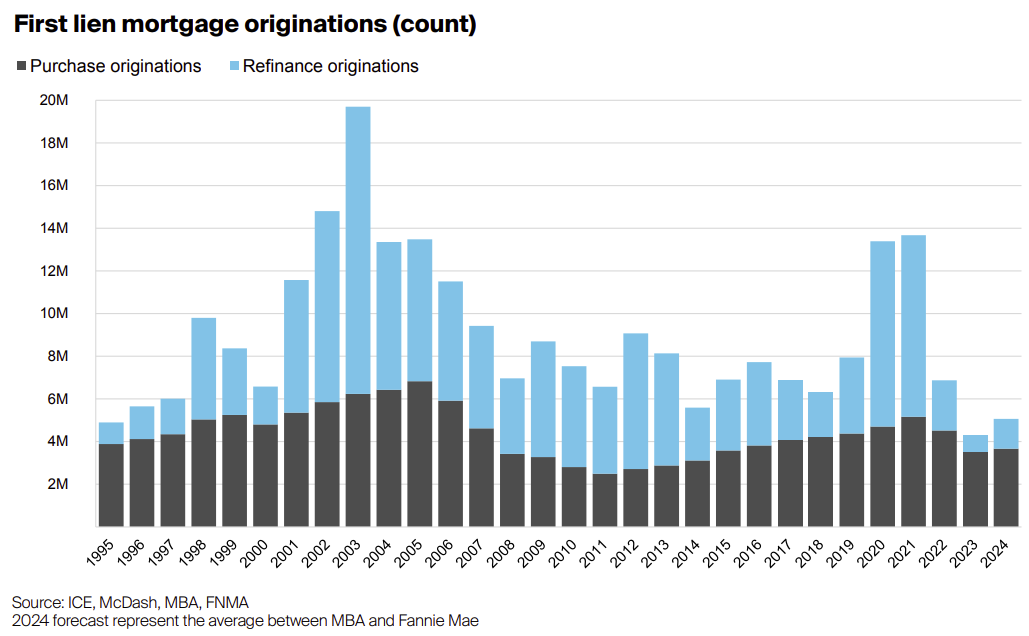

Getting Graphic

Favorite housing market/economic charts of the week made by OTHERS

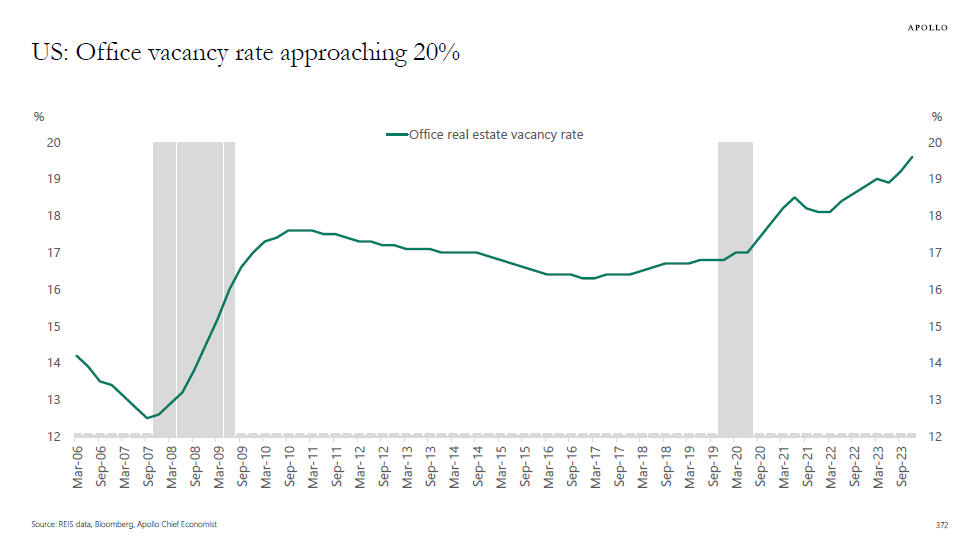

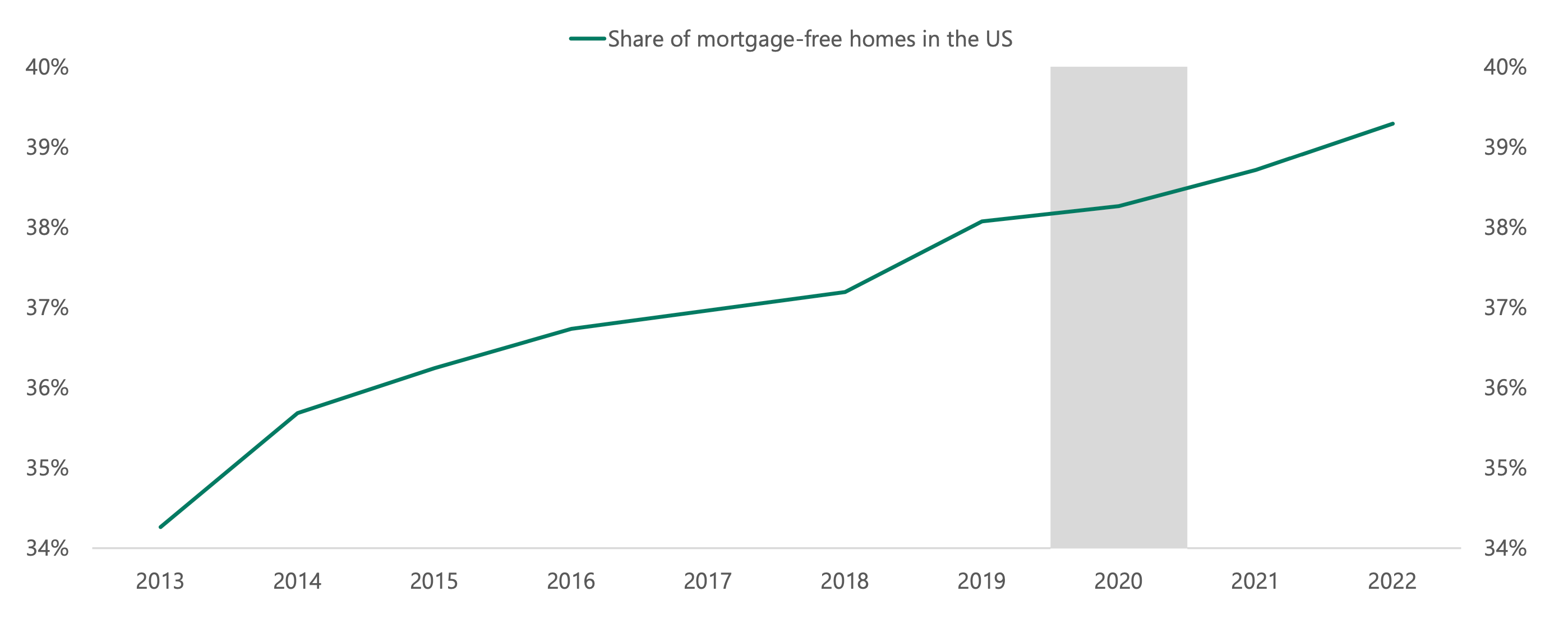

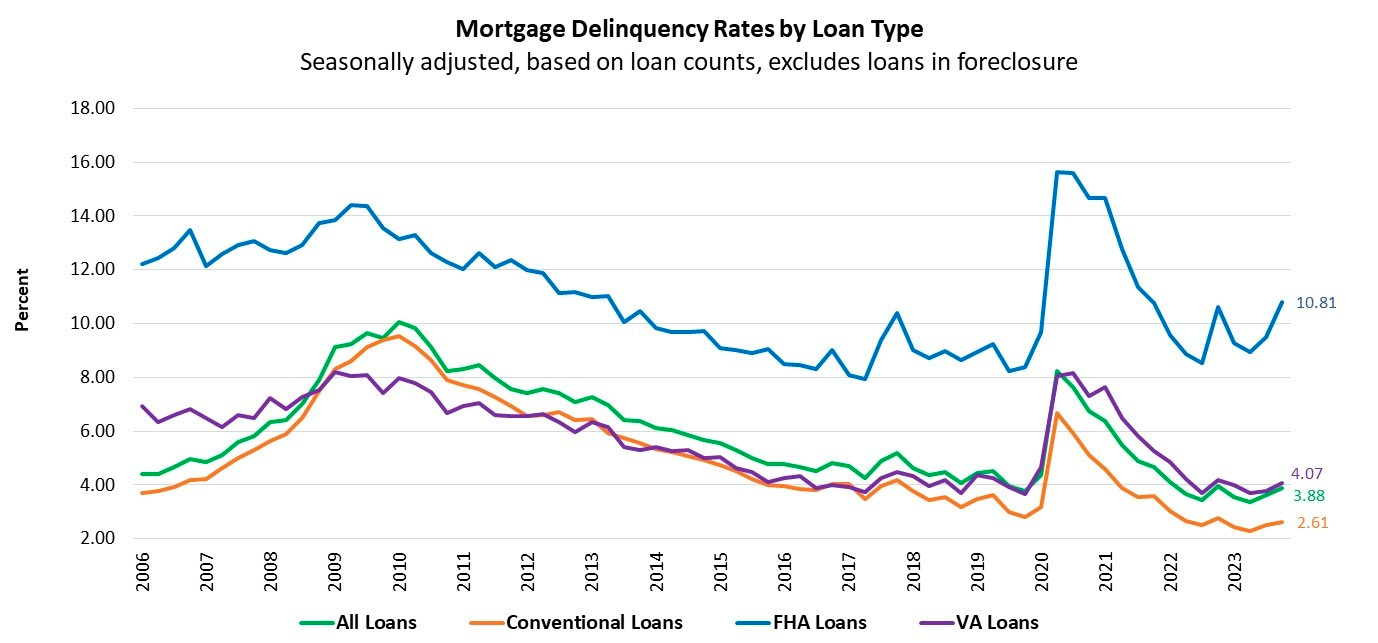

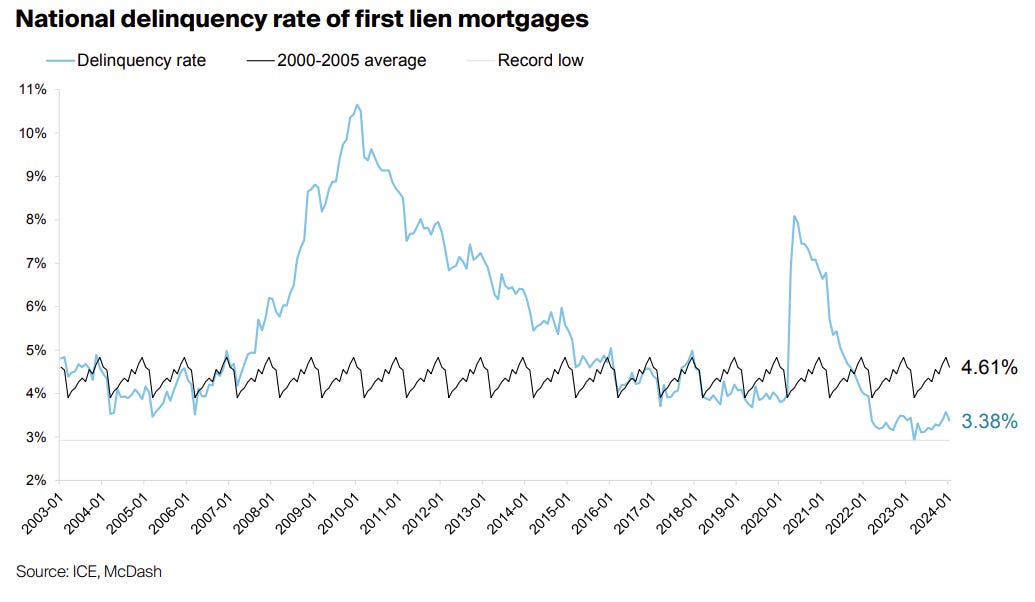

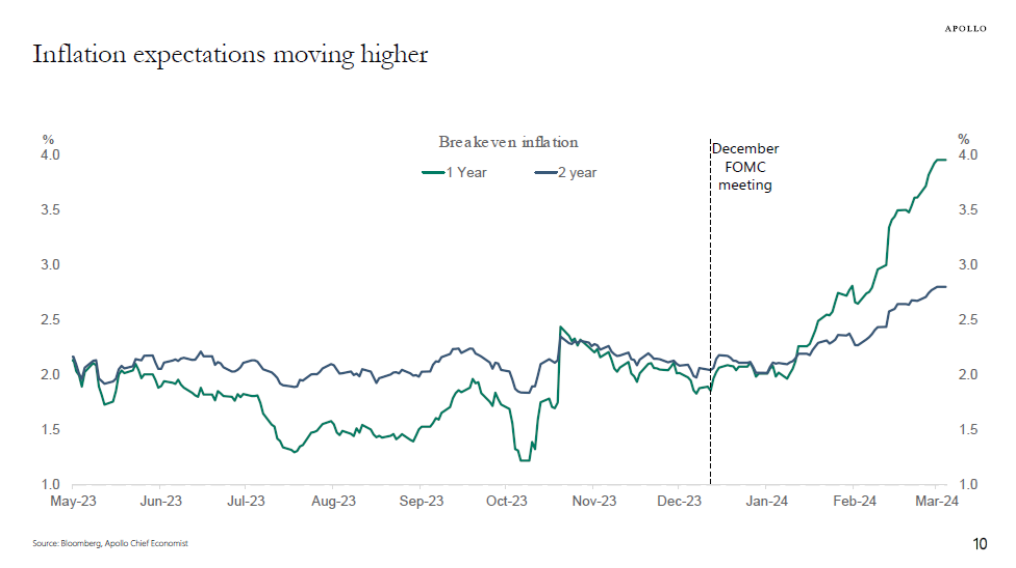

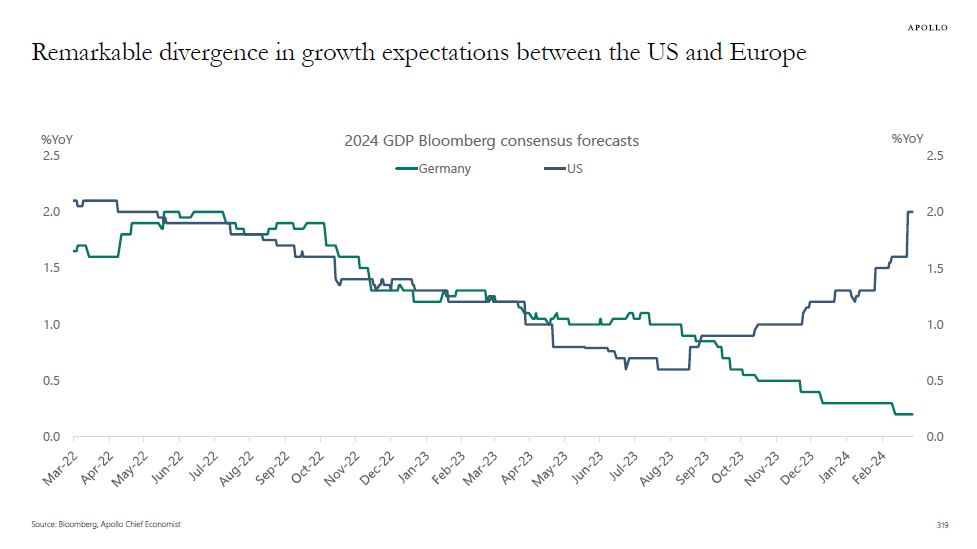

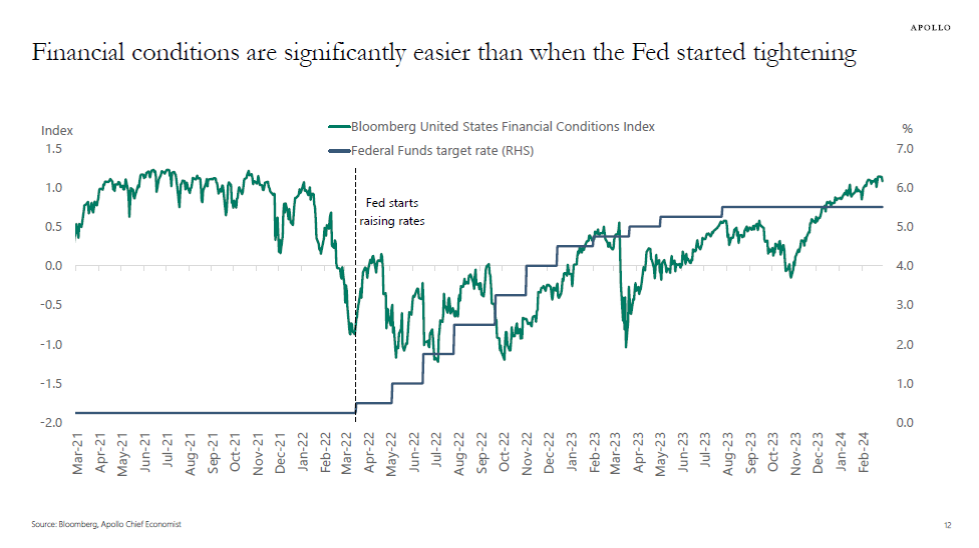

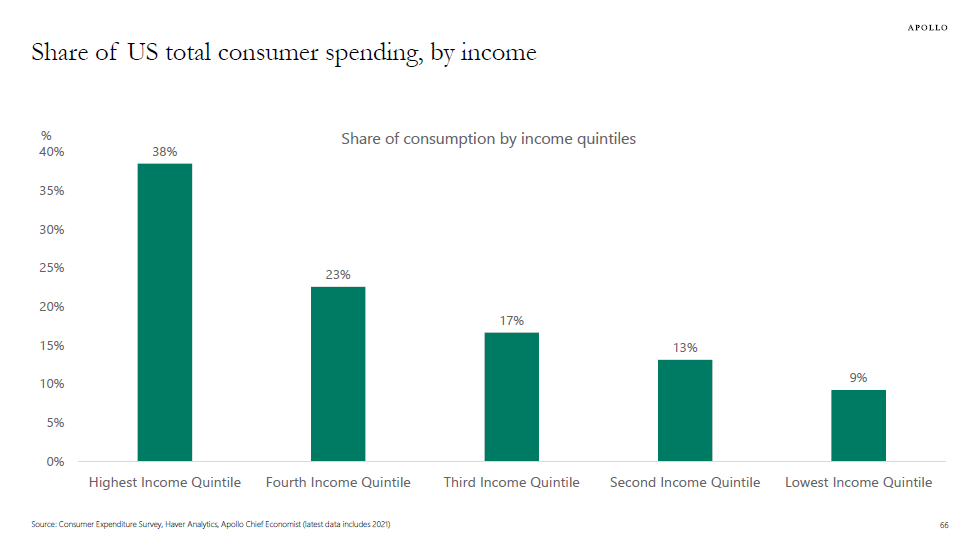

Apollo’s Torsten Slok‘s amazingly clear charts

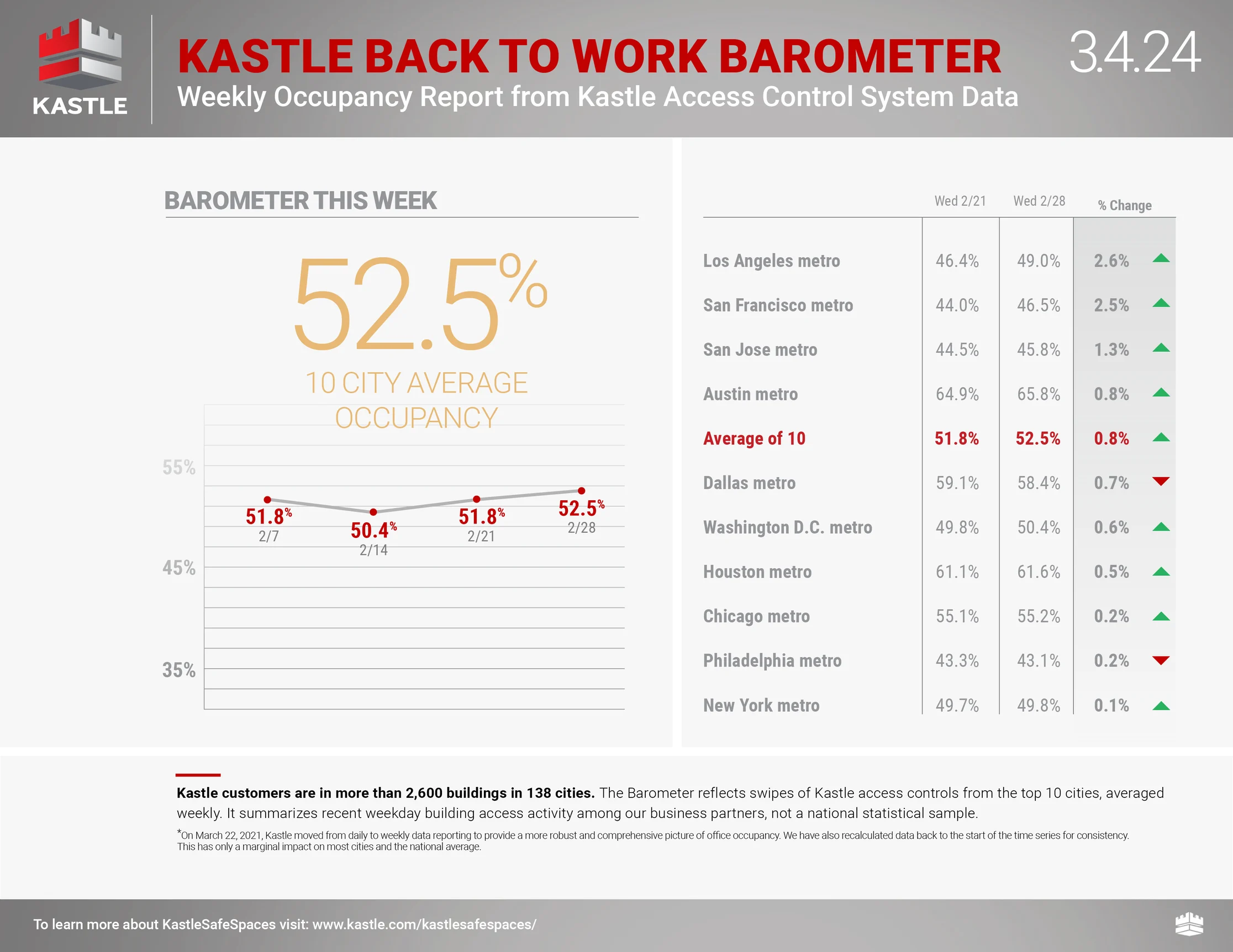

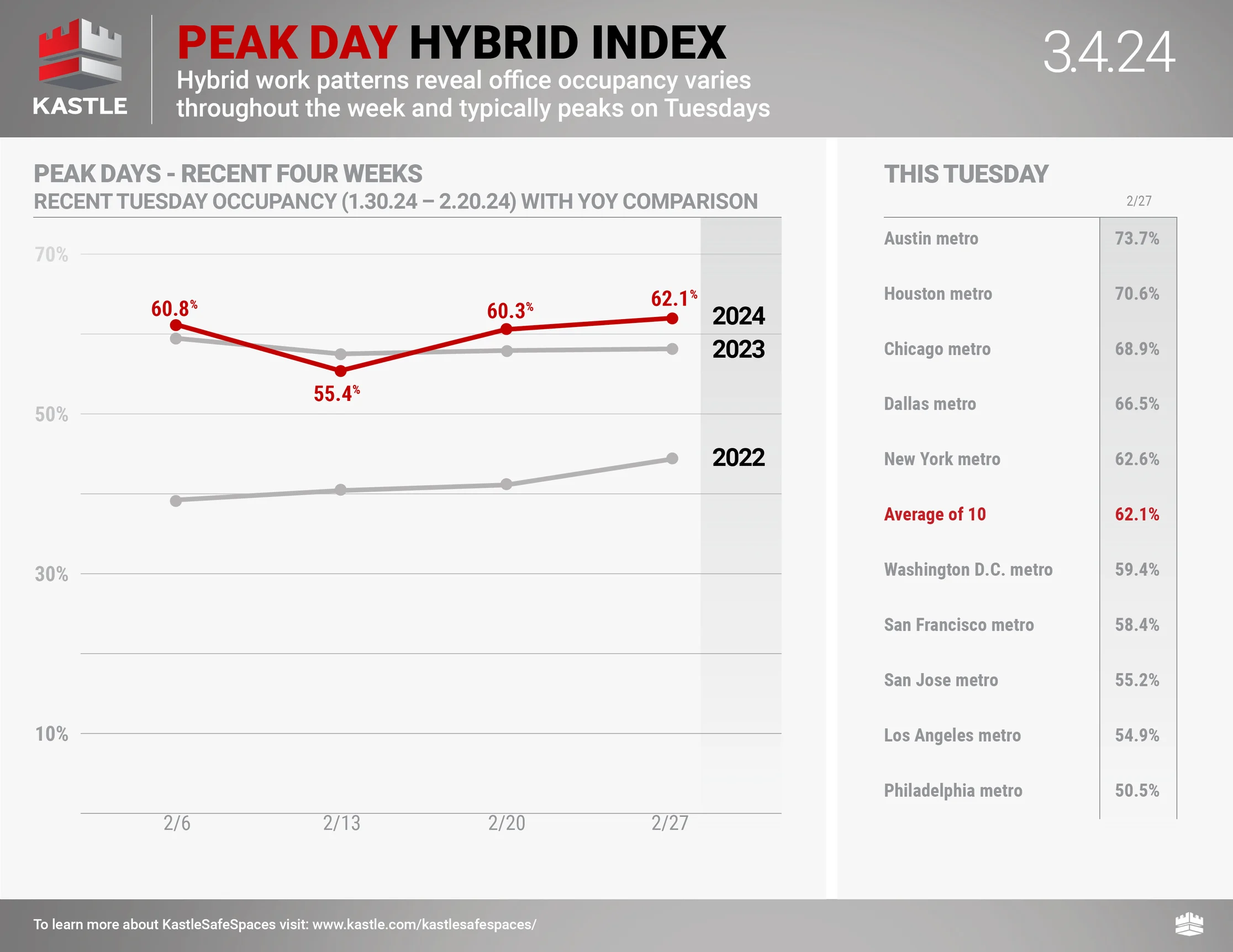

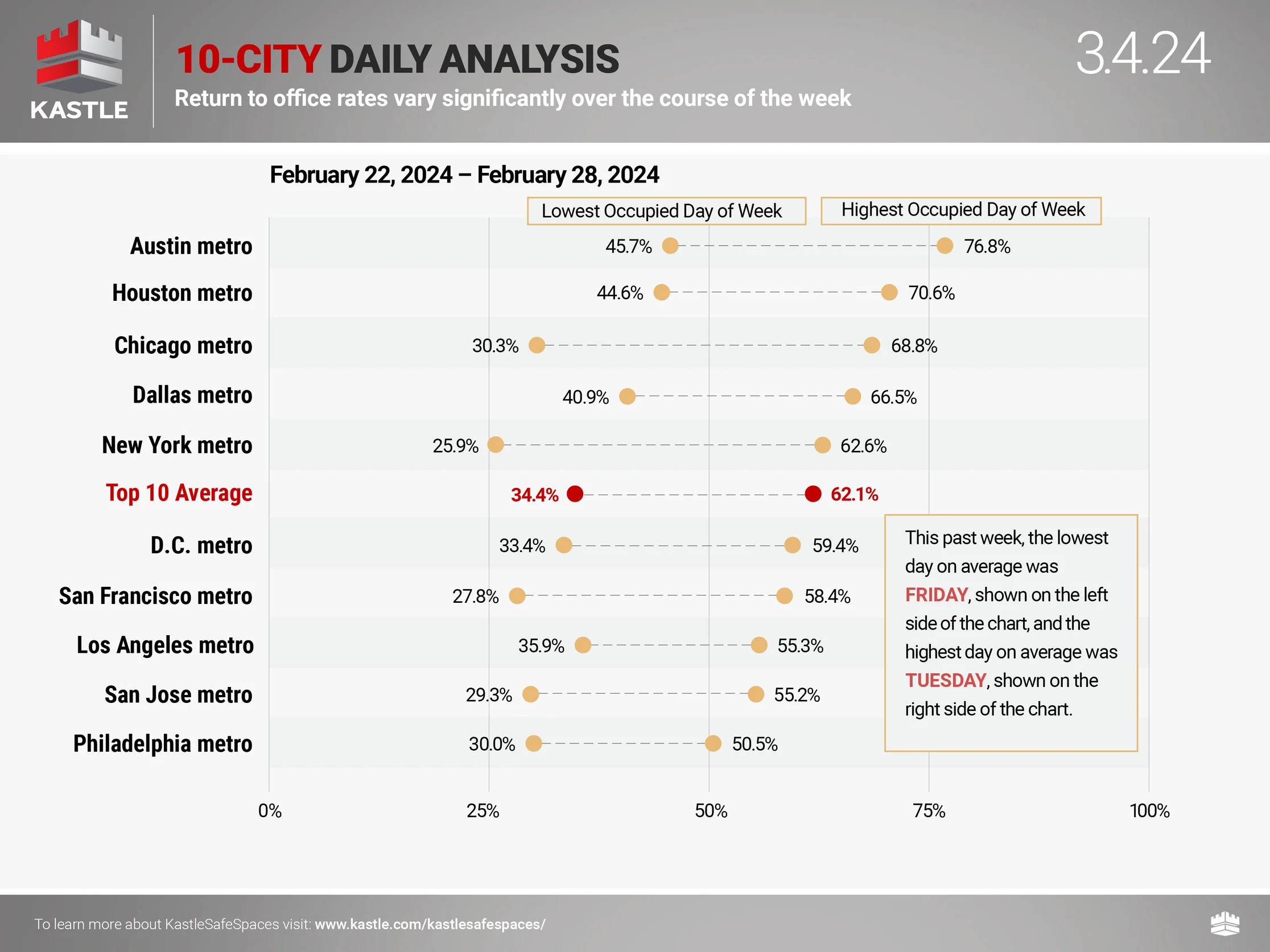

Kastle card swipe data

Remember that Kastle charts are overstating occupancy* because their pre-pandemic occupancy benchmark was 100%, which is incorrect (*measures card swipe activity as a proxy for occupancy). Still, they’ve become the standard benchmark for occupancy rates.

Favorite RANDOM charts of the week made by others

Appraiserville

The Cosmic Cobra Guy Writes Job Description For Potential Internal TAF Hire

For the uninitiated, TAF is the organization that wrote the bat-shit crazy letter, the chickenshit letter, and is the subject of an active investigation by HUD on whether USPAP promotes a lack of diversity in the appraisal profession (400th out of 400 occupations, according to BLS in 2021). As a reminder, TAF president Dave Bunton called me a liar in a public forum in Washington, D.C., as he was lying (and not under oath) – hence his new nickname “Lyin’ Dave,” a.k.a. “LD.”

Jeremy Bagott crafts a brutally sarcastic but accurate job description for LD’s internal replacement to carry on his 34-year legacy (Kelly). My new PDF function drops the embedded links, but you can go to this version if you are curious.

White Paper To Tackle Appraisal Bias – Low Time Adjustments Systematic

Craig Gilbert, a friend and appraisal colleague of mine, authored a white paper about how to fix a significant issue with residential appraisal lending, which is attached and also shared below. I’ll have more to say about this next week.

AI President Sandy Adomatis: Getting AI Counsel Involved To Make Hypocrisy Great Again

AI General Counsel Jeff Liskar, willing shepherd of the legendary FOJ sham petition process, contacted an appraiser colleague of mine, saying she couldn’t be a leader of an appraisal-related organization while holding any position at the Appraisal Institute. Jeff forgot to look closely at the current AI President, Sandy Adomatis, an FOJ who is curiously on the RESNET Board of Directors. Oh, and AI BOD member Smedmore Bernard is also on the TAF Board of Trustees.

Does anyone have the handy bylaw that Jeff relies on? Of course not.

Now, ask Jeff if he has already called Sandy and Smedmore to tell them they would have to step down from their outside positions. Of course, he didn’t.

Here’s a word of advice to AI’s current president. The buck stops with you. If you don’t like someone and want them gone, at least try to look for the double standards you apparently can’t see. It’s no longer like the old days of FOJville, so remember that you’re the leader of the industry’s largest trade group and need to set an excellent example for membership and other trade groups in the space. Otherwise, it reflects poorly on the AI brand and, of course, the membership.

ALERT!!!

This is a timely reminder that the National Nominating Committee will do its thing in May. JA and his FOJs are working behind the scenes to get a leadership position come hell or high water, and FOJ PK will be in the president’s seat in 2025. Even with AI CEO Cindy Chance fixing things from years of FOJ self-dealing, neglect, and toxicity, JA desperately wants back in with or without his Artificial Intelligence, and FOJs desperately want to return to frequently flying on First Class boondoggles to China and Europe with their emotional support spouses like the old days (2022).

Don’t be complacent at this critical moment. Make your voice heard at the chapter level or higher NOW, and get involved NOW! The cult of FOJ has already taken enough from the membership!

OFT (One Final Thought)

Brilliant Idea #1

If you need something rock solid in your life – particularly on Friday afternoons at 2:00 PM, Eastern Time (ET) – and someone forwarded this to you, you can sign up here for these weekly Housing Notes. And be sure to share with a friend or colleague if you enjoy them because:

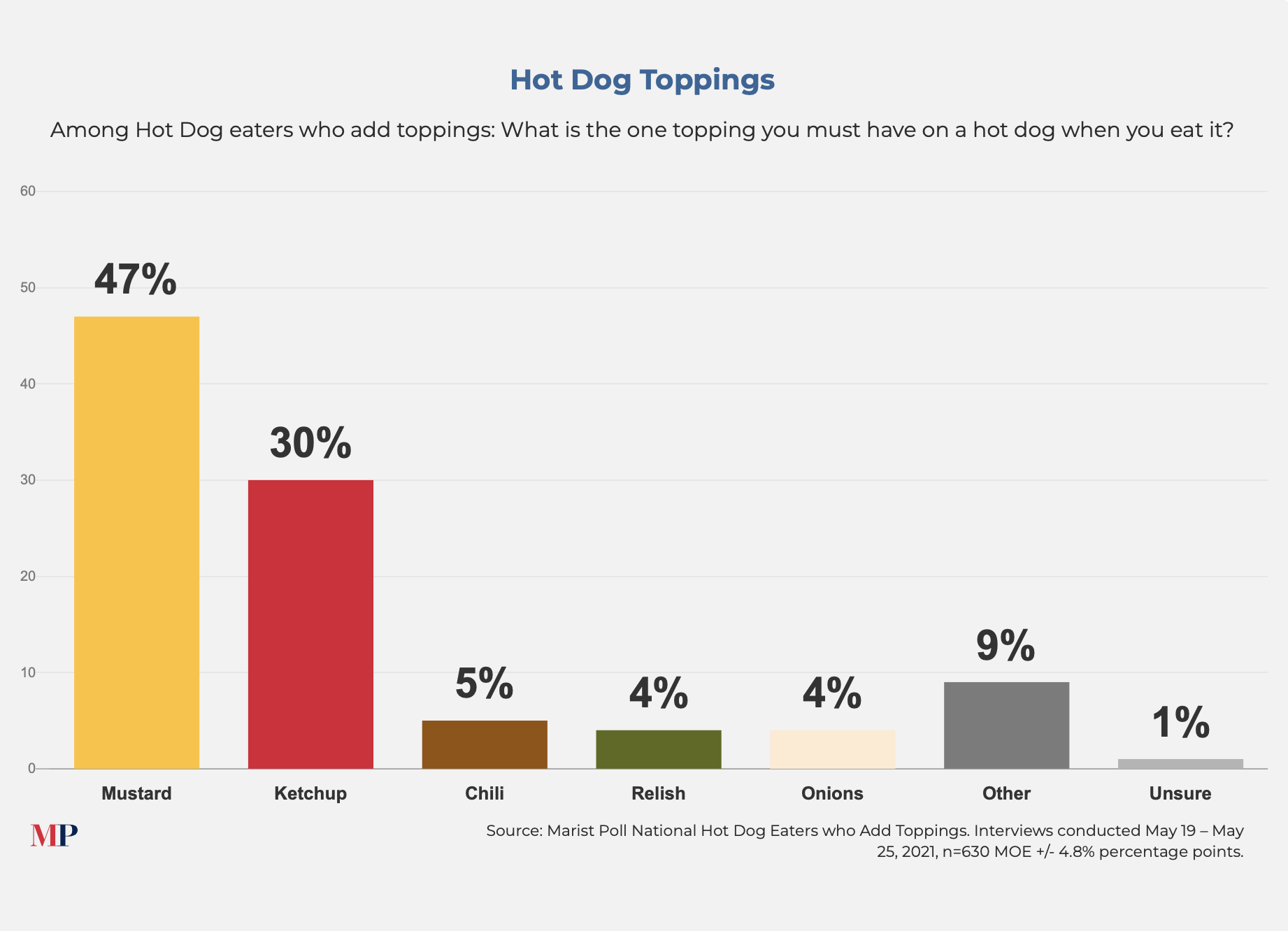

– They’ll put ketchup on a hot dog;

– You’ll consider placing ketchup on a hot dog;

– And I’ll be vehemently opposed to letting ketchup anywhere near a hot dog.

Brilliant Idea #2

You’re clearly full of insights and ideas as a reader of Housing Notes. Consider sharing them with me early and often. I appreciate every email I receive, as it helps me craft future Housing Notes.

See you next week!

Jonathan J. Miller, CRE®, Member of RAC

President/CEO

Miller Samuel Inc.

Real Estate Appraisers & Consultants

Matrix Blog @jonathanmiller

Reads, Listens and Visuals I Enjoyed

- Americans Now Live Farther From Their Employers [Gusto]

- Biden to propose new $5,000 tax credit for first-time home buyers [Washington Post]

- New York Court Decision Disrupts “Good Guy Guaranty” Liability Limitations [Blank Rome LLP]

- An Architect Who Builds Community Wins the Pritzker Prize [NY Times]

- NYC data shows deep disparities in affordable housing creation [Gothamist]

- Roughly $30 billion slashed from real estate agents’ commissions: Fed economists pose solution to the 'anomaly' in the American housing market [Fortune]

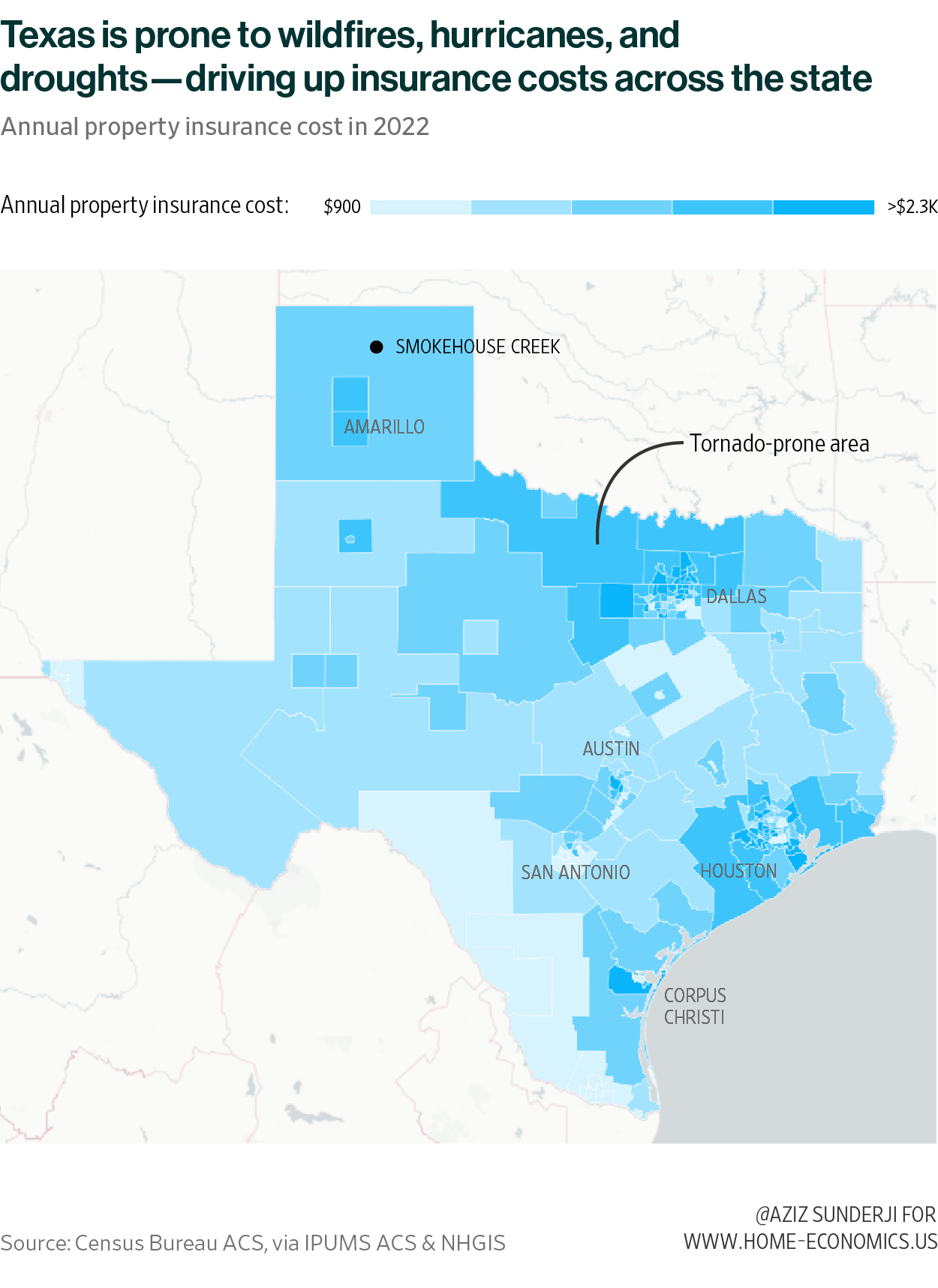

- There’s a New Financial Crisis Brewing in Uninsurable US Homes [Bloomberg]

- The ZIP Code Shift: Why Many Americans No Longer Live Where They Work [NY Times]

- Florida, Texas Grab Bigger Chunk of Paychecks as New York Fades [Bloomberg]

- The NYC Building Makeover Being Watched Around the Country [Wall Street Journal]

- Compass Reports Fourth Quarter Loss of $83 Million [The Real Deal]

- Buying Houses Before Finding Spouses [NY Times]

- America’s Apartment Buildings Are Getting Bigger and Taller [Wall Street Journal]

- Brick Underground to be Acquired, Saved From Extinction [The Real Deal]

- Tackling New York City’s Housing Crisis is a ‘Shared Responsibility’ [Furman Center]

My New Content, Research and Mentions

- Palm Beach County February Condo Sales Report [The Real Deal]

- Hamptons Housing Market Bounces Back [The Real Deal]

- Palm Beach County Real Estate Sales Mixed, New Listings Up [BocaNewsNow.com]

- Upper East Side 5th Ave Mansion Price Cut To $60M [The Real Deal]

Recently Published Elliman Market Reports

- Elliman Report: California New Signed Contracts 2-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 2-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 2-2024 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 1-2024 [Miller Samuel]

- Elliman Report: Manhattan Decade 2014-2023 [Miller Samuel]

- Elliman Report: Manhattan Townhouse Sales 2014-2023 [Miller Samuel]

- Elliman Report: San Diego County Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Orange County Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Los Angeles Sales 4Q 2023 [Miller Samuel]

- Elliman Report: North Fork Sales 4Q 2023 [Miller Samuel]

Appraisal Related Reads

- Bare Knuckle Conservation Easement Brawl Leaves Participants in Limbo [National Law Review]

- Sacramento Appraisal Blog – Market trends and real estate appraisals for divorce, estate settlement, loans, property tax appeal, pre-listing and more. We cover Sacramento, Placer and Yolo County. We're professional, courteous and timely. [Sacramento Appraisal Blog]

- The Lack of Transparency in Appraiser Compensation [Appraisers Blogs]

- When a property gets 147 offers [Sacramento Appraisal Blog]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)