The two questions that dominate the housing market industry continue to be either:

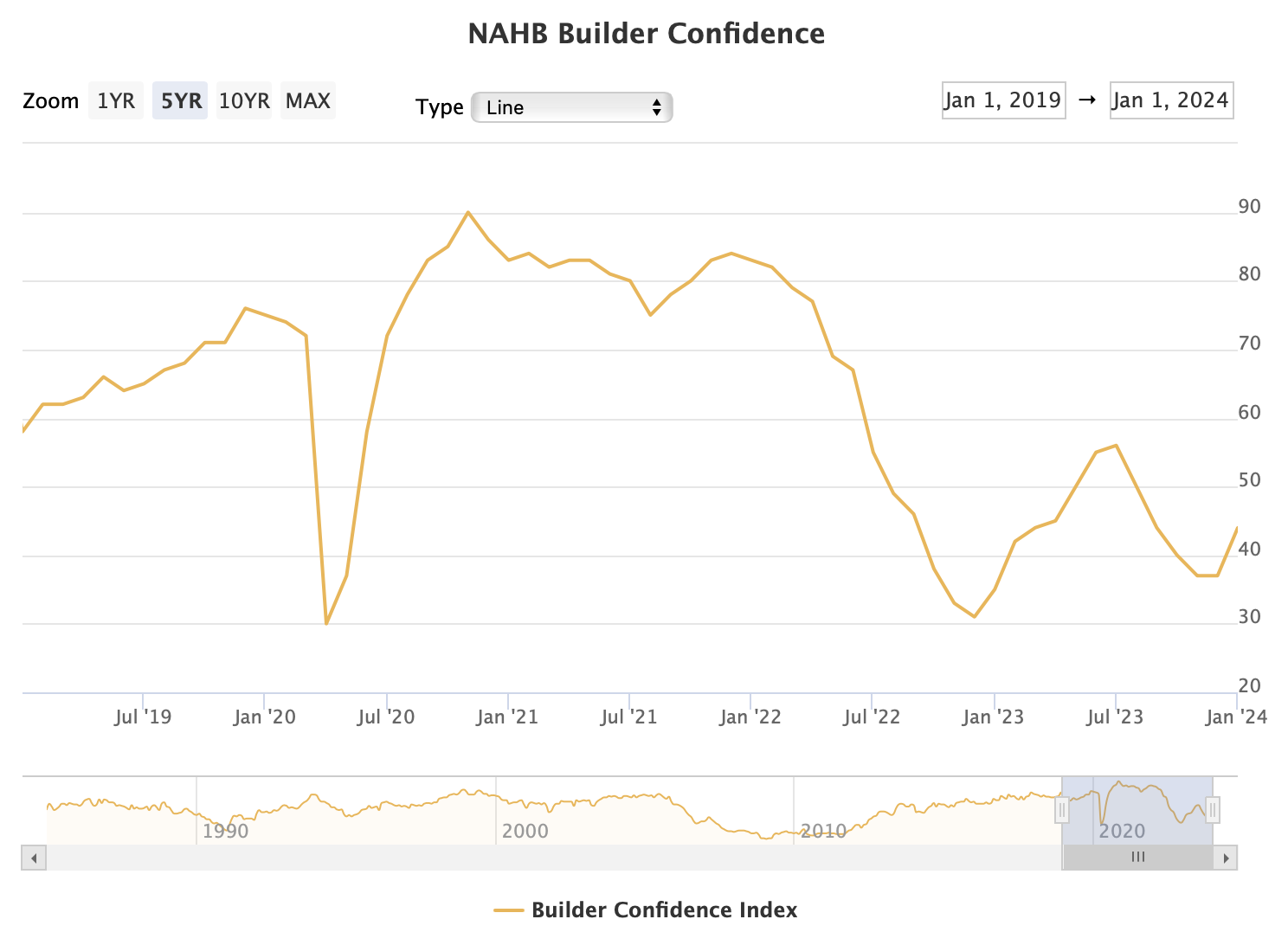

Q1: When will the Fed cut interest rates?

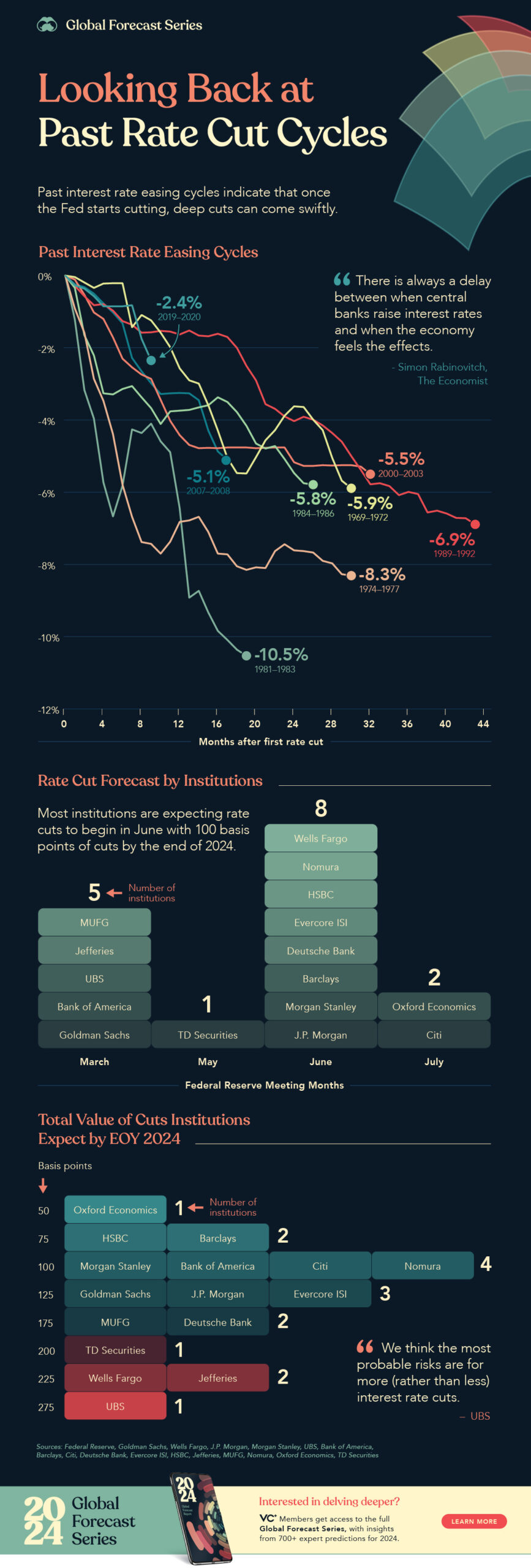

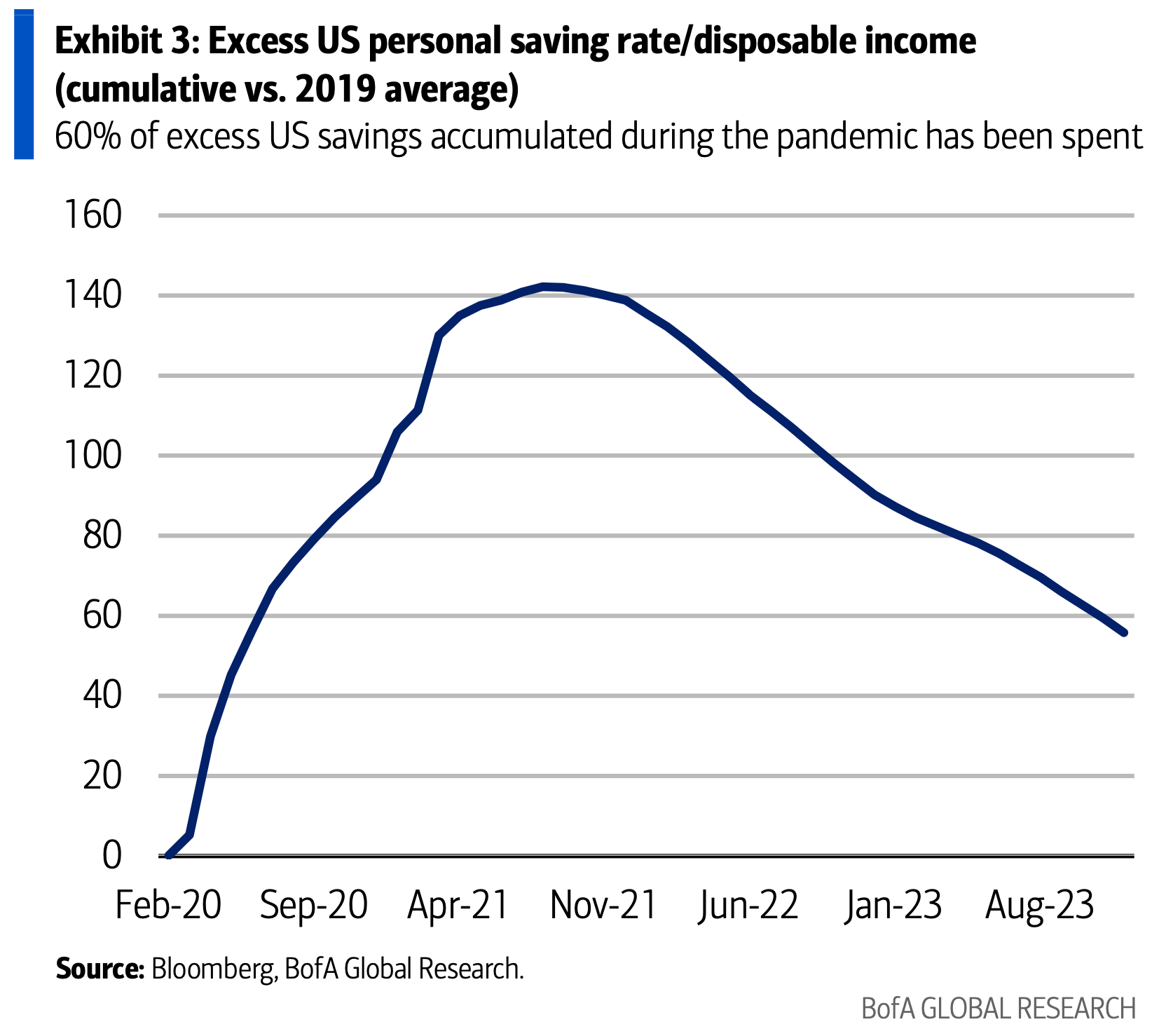

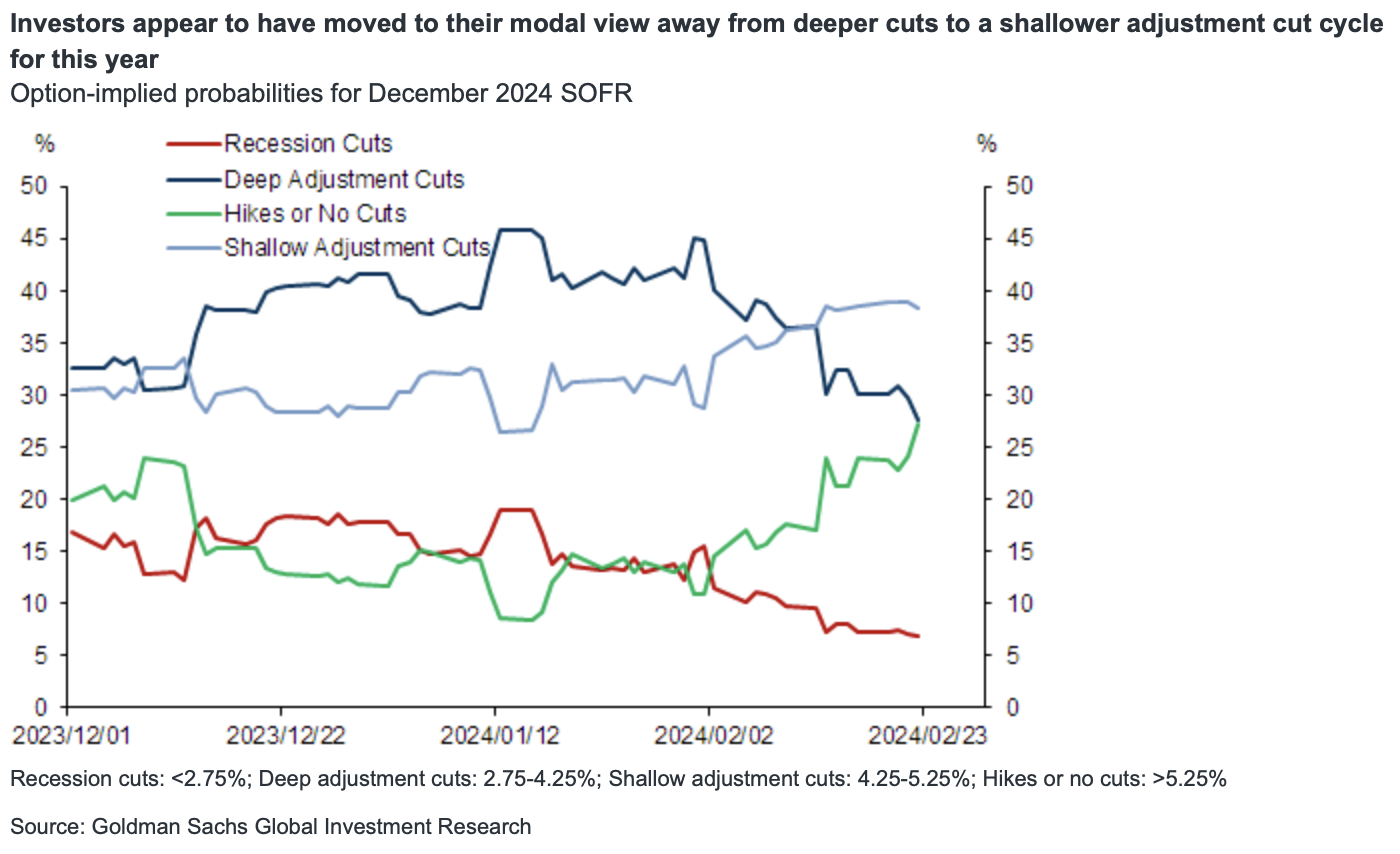

A1: Back Half of 2024? – My wild guess is that rate cuts will be in the back half of 2024. Not in March. Not in June. Unemployment is way too low. In reality, you probably shouldn’t listen to me. Here’s an historical look at how quickly those cuts occur.

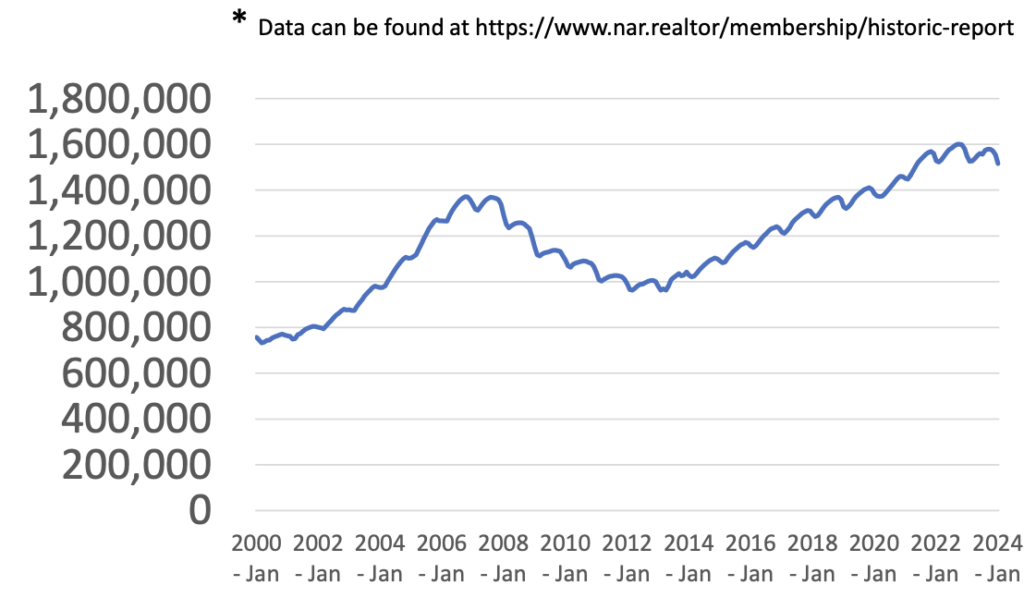

Q2: When will NAR membership collapse?

A2: Two to Three Years? – It is reasonable to assume that NAR will become a shadow of its current self as a trade group in a few years. What does it do for its members now that it’s no longer required for most real estate agents? Look for competitors like American REA to change the trade group space. The market has proved that trade groups should be “opted into” rather than required to enter the profession just like other industries. I’ve made a wild guess that NAR membership will be reduced to 300K members in 2-3 years from its current 1.6 million members – about 20% of the industry, much like doctors, lawyers, and appraisers. Membership topped out in 2022 and began to slide with the drop in sales. That’s not what I’m referring to. It’s all about NAR’s reason for being and its cost-benefit to realtors over time.

In other words, the housing market is probably “OK,” but NAR is not “OK.” The following briefly describes where the term “OK” came from. I know you’ll find this fascinating because you read Housing Notes.

Did you miss last Friday’s Housing Notes?

February 23, 2024: The Housing Market Needs More Cowbell (Lower Rates)

But I digress…

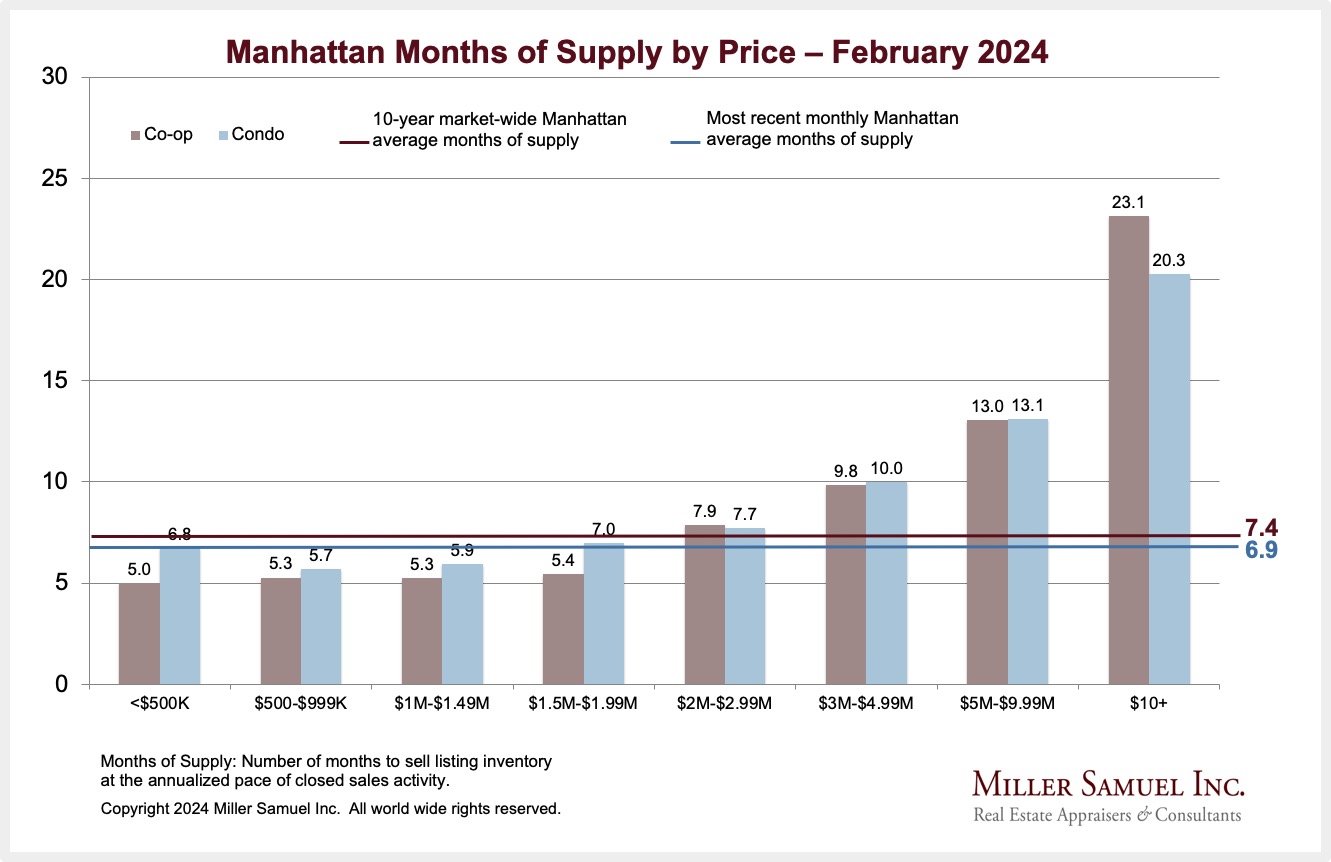

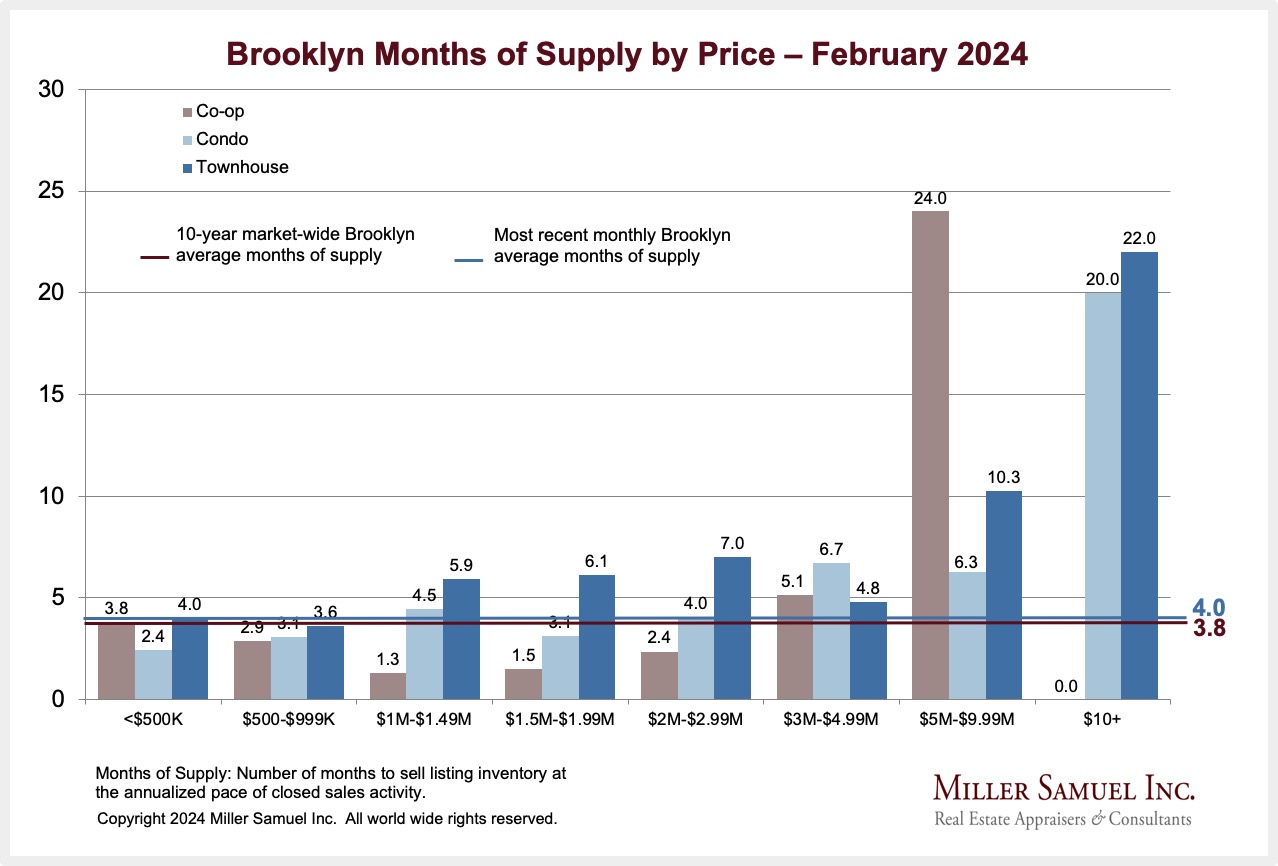

Incidentally, we are releasing a bunch of February contract data next week.

Zelman: Existing Home Sales Will Move Higher In 2024

My friend Ryan McKeveny of Zelman & Associates lays out 2024 for us. Rising mortgage rates have slowed existing home sales a bit, but the year will likely end up with more sales than in 2023.

[60 Minutes] Over 80 Million Empty New Apartments In China

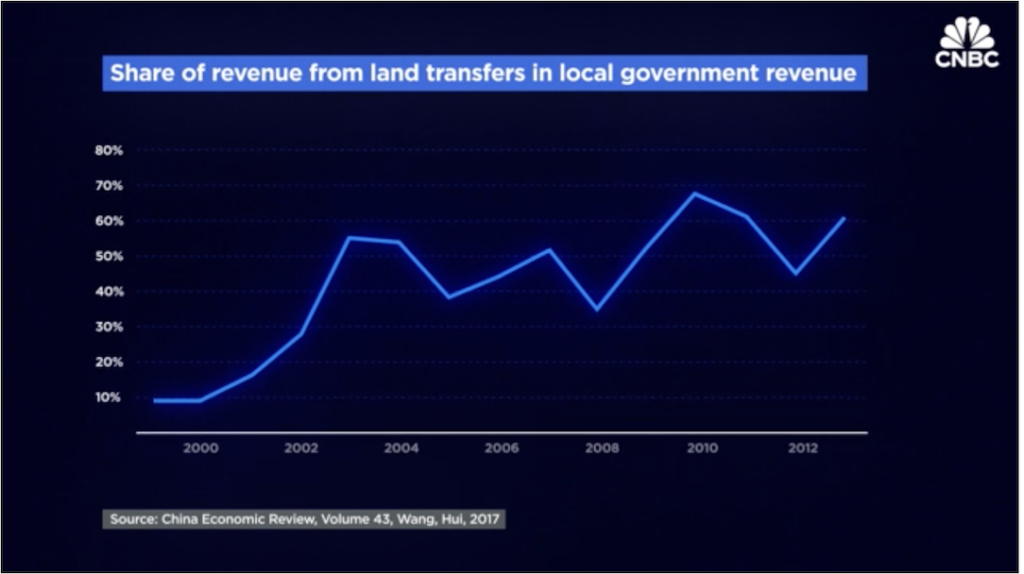

60 Minutes followed up on their 2013 story on “ghost cities.” Since the original story ran, I’ve been fortunate to visit China twice, and I asked many questions of our guides when I was there (Shanghai and Beijing). Australia’s version of 60 Minutes from 5 years ago carried the same theme: “Everything happens at a frantic pace.“

When I was in China in 2015-2016, I learned that the massive disconnect between supply and demand was likely the incentives given to regional leaders – they were ordered to increase the GDP of their regions. One of the fastest ways to grow GDP was by initiating massive construction projects around housing. 60 Minutes said Chinese citizens have lost over a trillion dollars in equity since the housing market weakened.

CNBC shared a terrific video piece on “How China’s property bubble burst.” I can’t emphasize enough how thorough this explainer video is.

1000WATT’s Important Take On Buyside Agents – Zillow Is Already Pivoting

Brian Boero of 1000WATT consulting, one of the most innovative marketing teams in the real estate agent space, provides a fascinating description of the buy-side agent world of the future and, more specifically, how Zillow already began to pivot away from buy-side lead generation about 85% of their revenue as they saw this situation coming. The entire clip is worth listening to, but the Zillow drill-down begins at around the 6-minute.

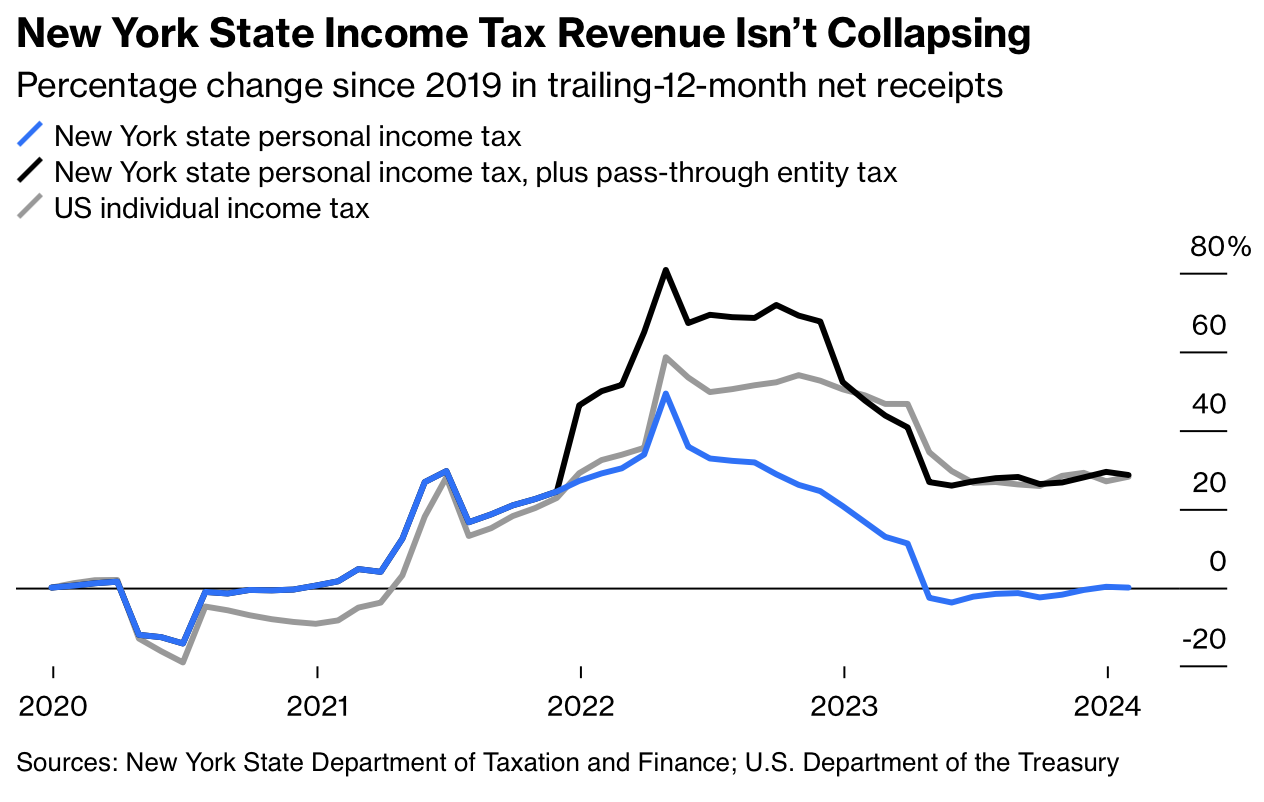

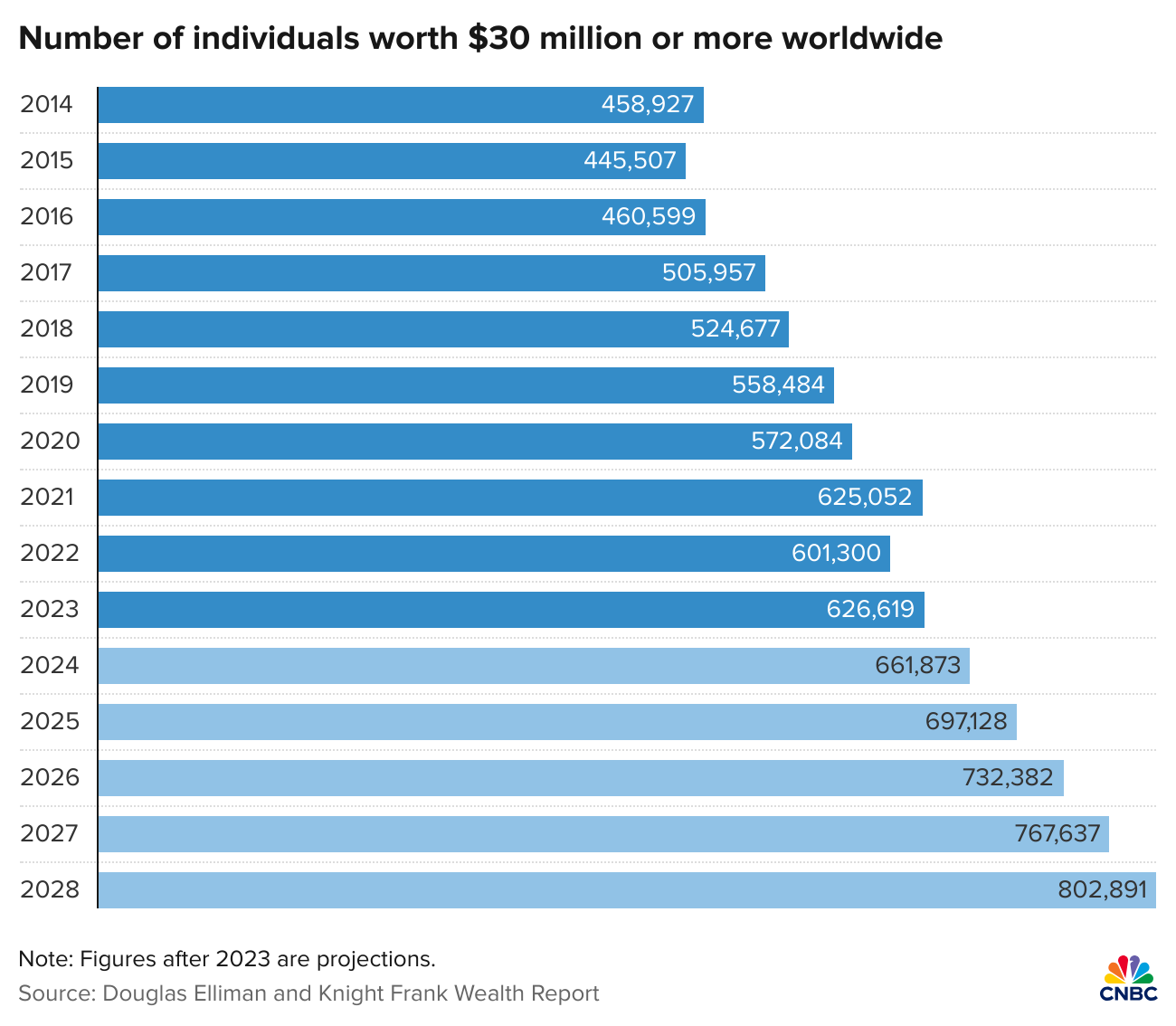

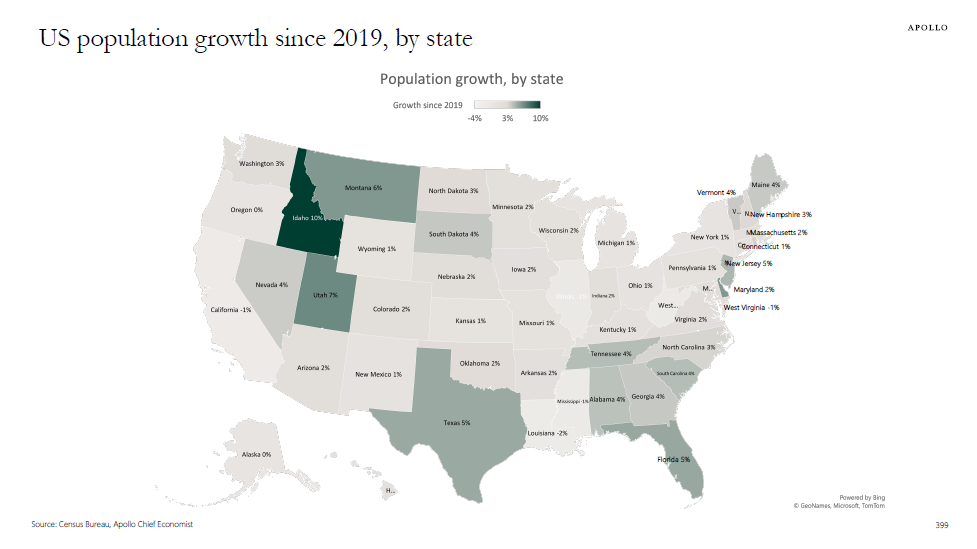

New York State Income Tax Revenue Seems Fine

In the post-pandemic world, concerns remain about where the tax revenue will come from since everyone moved to Florida, as per the narrative. As this Justin Fox piece for Bloomberg Opinion summarizes, New York Still Has Enough Rich People to Pay the Bills.

Because people who make that kind of money are a tiny minority — New York’s 84,095 tax millionaires in 2022 accounted for 41.9% of its personal income tax revenue but just 0.8% of its taxpayers — the vast majority of those leaving for other states have lower incomes and are probably motivated more by high housing costs than high taxes.

Justin Fox, Bloomberg Opinion

Highest & Best Newsletter: 🌇 Condo Cornucopia!

If you’re interested in the Florida housing market, you should sign up for this Florida newsletter, Highest & Best, from Oshrat Carmiel, formerly of Bloomberg News…

This week’s post:

🌇 Condo Cornucopia! – Florida condo costs soar; Mercedes plans a Miami skyscraper

On average, 14 renters compete for every vacant apartment in Miami, the most of anywhere in the U.S., the firm said. It takes 36 days for a vacant unit in Miami to find a tenant.

Rent Cafe

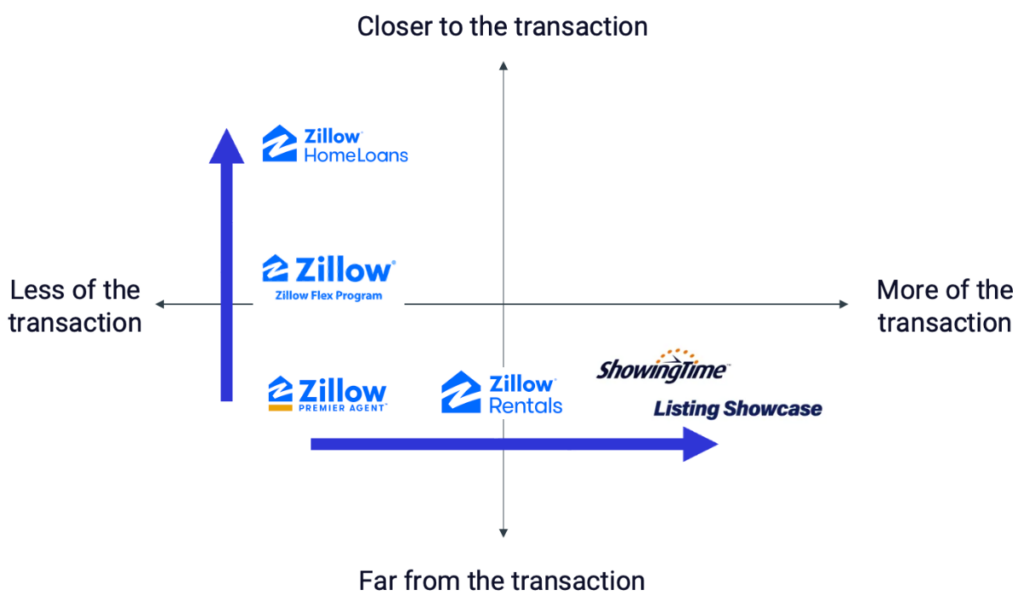

[Mike DelPrete] Zillow Shifting To A “Super App” From Lead Generator

Mike DelPrete burst onto the real estate tech scene several years ago and presents this real estate subset in easy-to-understand presentations.

After Zillow Offers crashed and burned, attempting to compete with Opendoor and others as well as feed their mortgage machine, it quickly developed a plan to pivot away from dependency as a lead generator for agents already inundated with products.

Zillow’s Transition to “Super App” Driving Revenue Growth [DelPrete]

Central Bank Central Interview: Hot Services Prices May Push Up Inflation, Hold Rate Cuts at Bay: Torres

Here’s a new substack I’m excited about – Kathleen Hays Presents Central Bank Central. I highly recommend it. A long-time friend and journalist, Kathleen Hays has extensive experience interviewing economic experts in Fedworld from her time at Bloomberg Television.

With the economy’s continuing strength, any Fed rate cuts are being pushed out later in the year.

June (rate cut) becomes a coin flip.

Jose Torres, Interactive Brokers

Central Bank Central: Hot Services Prices May Push Up Inflation, Hold Rate Cuts at Bay: Torres

Getting Graphic

Favorite housing market charts of the week of our OWN making

Favorite housing market/economic charts of the week made by OTHERS

Apollo’s Torsten Slok‘s amazingly clear charts

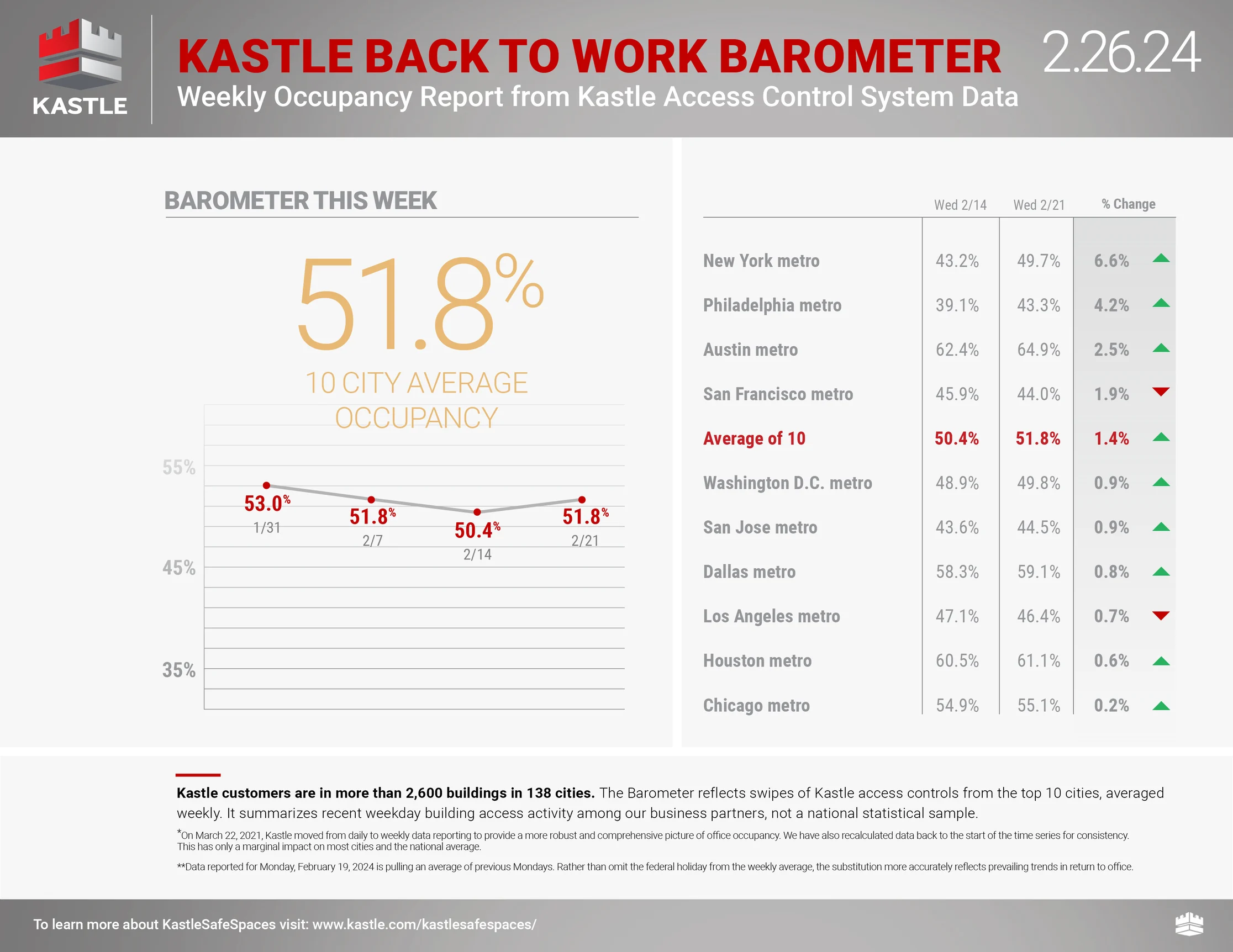

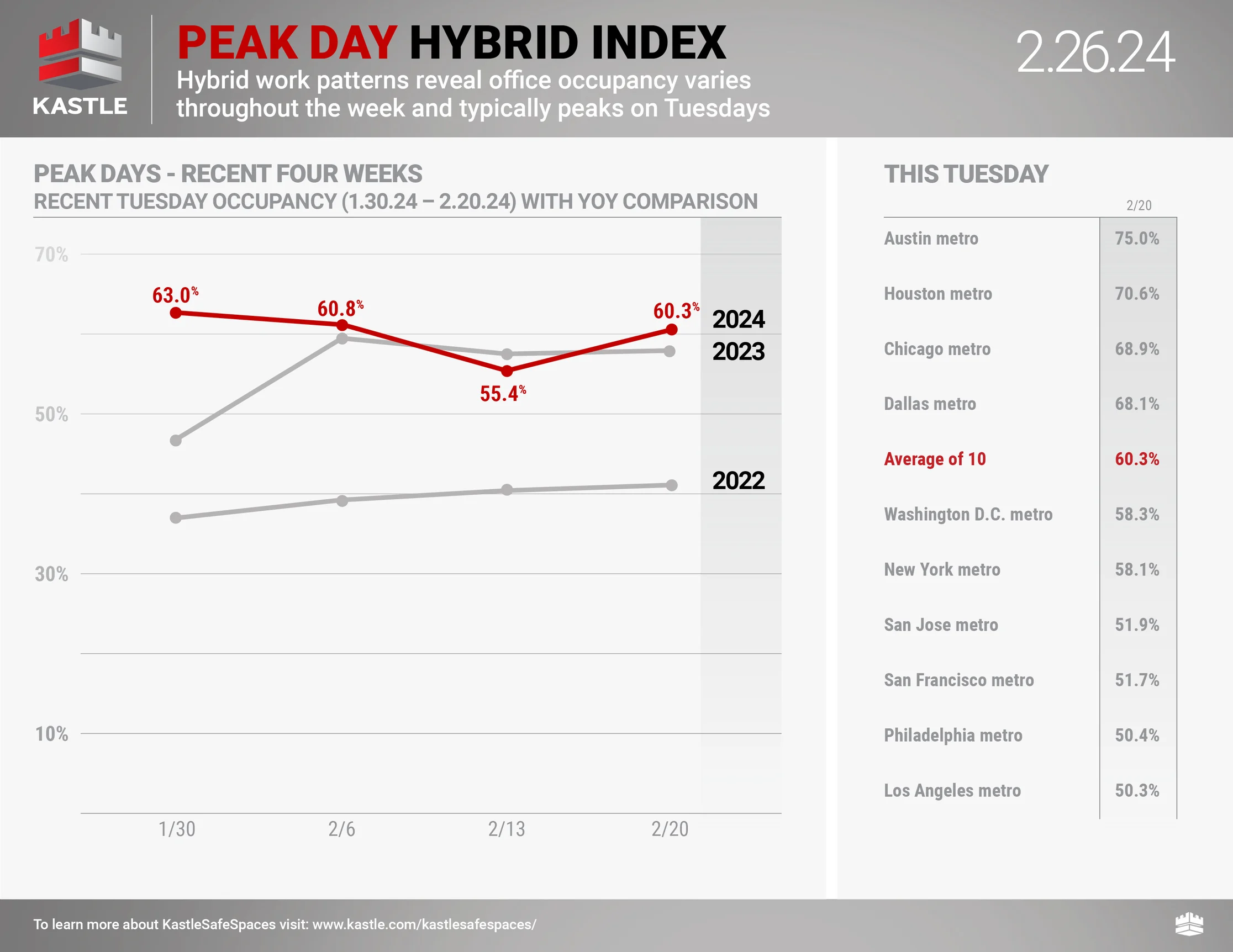

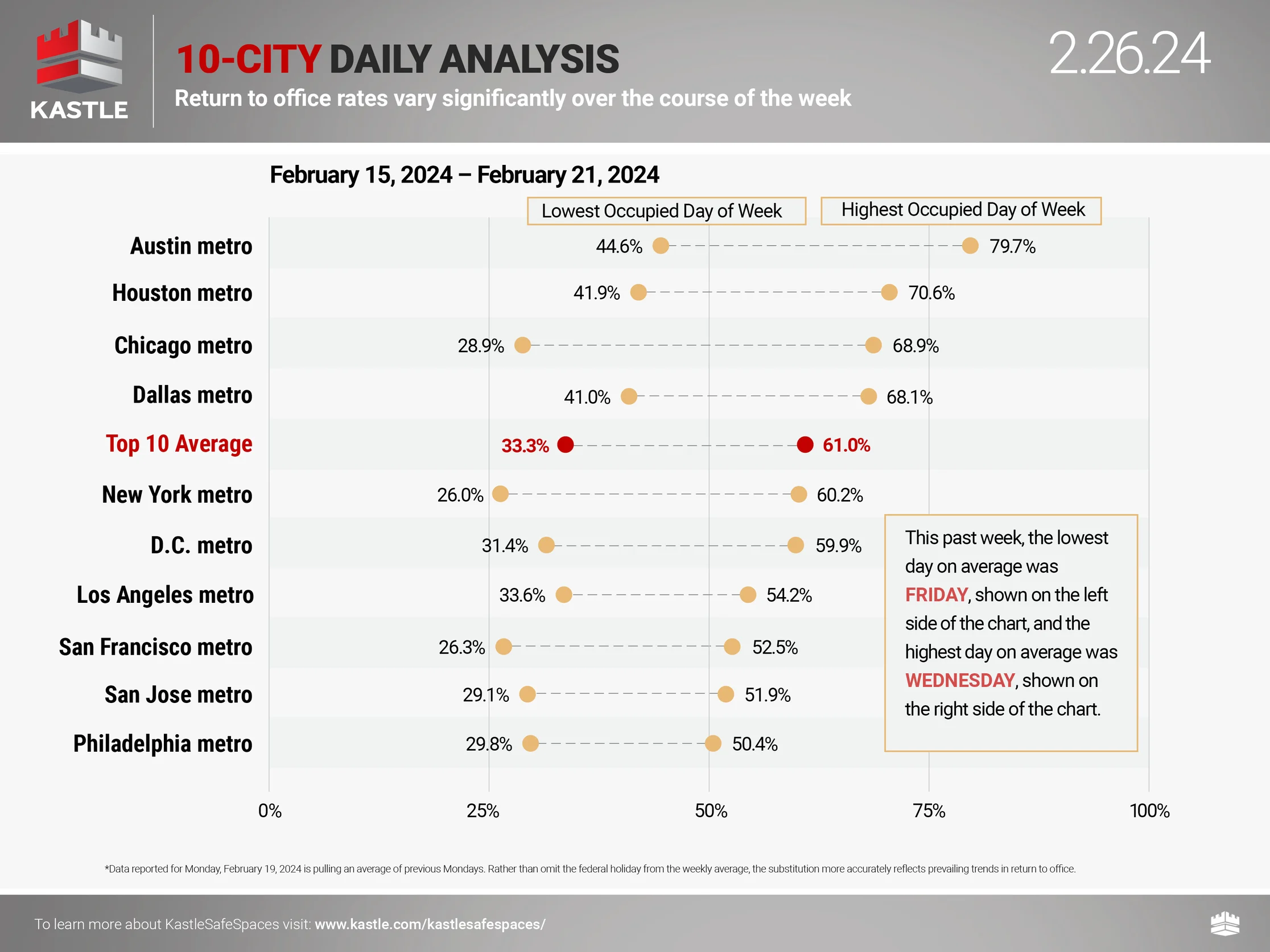

Kastle card swipe data

Remember that Kastle charts are overstating occupancy* because their pre-pandemic occupancy benchmark was 100%, which is incorrect (*measures card swipe activity as a proxy for occupancy). Still, they’ve become the standard benchmark for occupancy rates.

Favorite RANDOM charts of the week made by others

Appraiserville

For All Appraisers: Voice of Appraisal With Phil Crawford, “Our Crumbling Foundation”

Phil deeply dives into Dave Bunton’s February 13, 2024, testimony at the 4th Appraisal Bias hearing in Washington, DC. Dave is the 34-year leader of The Appraisal Foundation (its only leader in the organization’s entirety) and the maintainer of USPAP.

For the uninitiated, TAF is the organization that wrote the bat-shit crazy letter, the chickenshit letter and is the subject of an active investigation by HUD on whether USPAP promotes a lack of diversity in the appraisal profession (400th out of 400 occupations, according to BLS in 2021). As a reminder, TAF president Dave Bunton called me a liar in a February 13, 2024, OCC public forum in Washington, D.C., as he was lying – hence his new nickname “Lyin’ Dave,” a.k.a. “LD.”

Phil’s podcast is a mandatory listen for all appraisers. This episode is one of his best, being both hilarious and sad at the same time.

“Mr. Miller does have a challenge with the truth, often. Both to the times when he writes in an article. It is out there. I’ve talked to him and tried to correct him. He doesn’t want to hear about the facts.”

Dave Bunton – Lying at the February 13, 2024 OCC Hosted Hearing On Appraisal Bias (Not Under Oath)

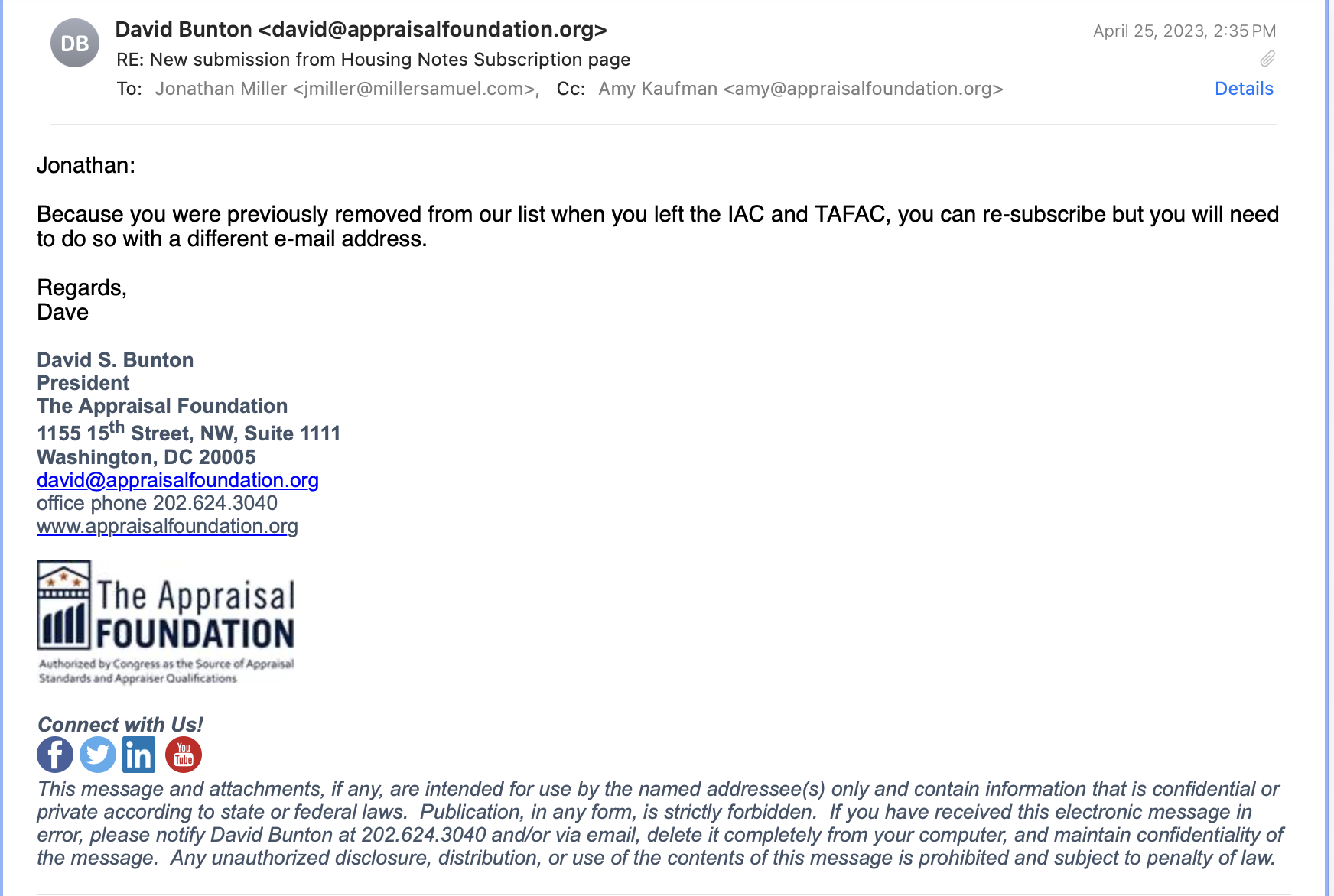

The testimony in this hearing was not made under oath, enabling Dave Bunton to convey the above lie about me without institutional legal jeopardy. For the record, Dave has never contacted me to correct me about “the facts.” Here are the two ways we connected after I became critical of TAF in 2020:

- Back in 2020, when I started to criticize TAF publicly over their insanely stupid “misleading” interpretation of USPAP, where appraisers could be liable for saying something intentionally “misleading” and unintentionally “misleading.” The typical residential appraisal form has about 800 fields, so the idea that it can be completed with 100% perfection every time is ridiculous. Even worse, as a matter of practice, TAF didn’t have updates to USPAP reviewed by counsel at that time. Dave contacted me to do damage control via phone after I wrote about the “misleading” blunder. Still, it was a letdown because he presented no facts, just his opinion conveyed (literally) by reading from a script – like he attempted to do at the 4th appraisal bias hearing on February 13th. I had to wait for him to read off a list, repeating pithy things I had already heard him say publicly many times. It was weird.

- TAF blacklisted me from their public email server in 2022, likely because I was making fun of some of the ludicrous busy work TAF was claiming as progress on the incredible lack of diversity in the industry using Dave’s monthly public mailing list. When I noticed in April 2023 that Dave had resubscribed to my Housing Notes/Appraiserville newsletter after unsubscribing in 2022 when I first became critical of TAF, I thanked him. I also asked him if he could return me to the public TAF list. He told me I could only get back on the list if I did not use the same email address I had signed up with, which happened to be my appraisal business email. I thought this was weird.

I have never heard of an email list function where you are banned for life from a public list for no longer being active in the organization. Yet, supposedly, it is an email list for the public’s use to be informed, and most receivers of these emails have never been active at all in the organization. It sure seemed weird to me. Translation: It’s a lie.

Ok, back to the hearing.

Dave “I am not involved in the search committee and do not attend their meetings” Bunton said that when you’re in the “picking people” business, you learn that you can’t attend these meetings and stick around for 34 years. This is probably an intentionally misleading statement, his whole schtick. He doesn’t need to attend meetings to have absolute control of their outcomes. That’s the only reason he’s lasted 34 years as a bureaucrat. It’s a skill he has mastered, but now that his absolute control is getting unwanted attention, he’s frequently making mistakes (including lying). Dave testified at the hearing on his replacement process, “It’s weighing upward mobility (of his hand-picked replacement, Kelly) versus an external search (he probably loses his likely retirement consulting deal or why else would he care so much about his replacement?). It’s just a hop, skip, and jump to say he is lying that he is not involved in the search for his replacement. It is common knowledge by the entire DC appraisal world that he gives final, personal approval for every BOT member, ASB member, and AQB member; therefore, it is easy to extrapolate that he approved every search committee member to find his replacement.

Everyone I’ve shared Dave Bunton’s lying about me in this public hearing, both inside and outside the profession, said it sounded like a classic case of projection.

CFPB’s Rohit Chopra Calls Out TAF’s Massive Conflicts Of Interest

If you’d like to listen to the fourth appraisal bias hearing hosted by OCC on February 13, 2024, it is posted below.

If you don’t want to listen to all three hours of the hearing, Phil Crawford has highlighted the choice parts that I shared earlier.

At the end of the three-hour session, Chopra goes after TAF with the following observations made directly to its soon-to-be retiring president, Dave Bunton, in a precise surgical style that any prosecutor would envy. Admittedly, I initially felt a dusting of sympathy for Dave for being throttled so completely by Chopra. Then, I quickly returned to the reality that Dave had just called me a liar in a public forum while he was lying. Here are Chopra’s main thoughts.

- TAF has a weird structure with Trustees, Board members, & Sponsors.

- There is a massive conflict of interest between McKissock and TAF’s ASB and between stakeholders (IAC) selecting trustees.

- Partners are removed from the new TAF structure nomenclature, and sponsors no longer have the right to appoint board members. Is this just changing names of positions?

- Dave has expressed opinions to the BOT, ASB, and AQB in the past, so he can’t say he isn’t part of the replacement selection process.

- Chopra asked that the ASC be involved in ratifying his replacement and stated that TAF has often sidestepped the monitor & review process. LD was non-committal by lying that it was “out of his hands.”

- ASC doesn’t like Dave’s leadership/legacy and will work to prevent his replacement from within (Kelly).

Here are some comments from AppraiserForum’s about Lyin’ Dave’s testimony:

With The Lack Of Diversity Comes Accusations Of Racism – Go Fund Me Edition

One of the challenges with the lack of diversity in the appraisal industry, primarily created by the actions or lack of actions by the Appraisal Foundation, is the false equivalency that loan applicants may interpret a lower value than expected as inferring racism. After all, The Appraisal Foundation has fostered a system that makes appraisers dead last in diversity. Through mismanagement, the Appraisal Foundation has essentially set up and increased the likelihood that individual appraisers will be sued for coming in below the value that a mortgage applicant expects. Please remember that there are two sides to every story.

Appraisal industry stalwart Dave Towne shares a case where he believes this may have happened in his essential emails.

=============================================

Appraisers……

Over the past 3 years, appraisers have suffered the effects of terrible accusations about being racist.

This has led to suits filed against appraisers, or complaints to HUD. One of those suits currently active is involving two married black college professors in Baltimore, MD who filed suit against Shane Lanham, claiming racism because his appraised value was too low for them to qualify for a refi loan on their property. In other words, they and their lender pre-determined what the property value should be, in advance of the appraisal. They sued after getting a second appraisal many months later with a much higher value. The only obvious change they had made, other than some maintenance, was to install a new range/oven in the original, non-renovated kitchen.

They also have publicly denigrated Shane’s reputation in that market based on these highly questionable allegations. When that happened, Shane filed a counter-suit against the black couple, charging defamation of character.

I had a lengthy phone conversation with Shane on Thurs, 2/08/24. I was also provided a copy of Shane’s original report and the second report, prior to our call. I can tell you that Shane’s report was done appropriately for the Subject property in the location it’s in, but the second report was obviously a ‘hired gun’ report which has definite competency issues in it. A review appraiser in the Baltimore market I have talked with, who also has seen both reports, came to the same conclusions I did.

Shane told me during our chat that he wants to see BOTH suits proceed, and not be settled.

The point of my message is to inform you that Shane’s legal bills are increasing astronomically. He needs help. He has a GoFundMe account here:

Fundraiser by Shane Lanham: Raise Funds For Trial (gofundme.com)

When word gets out that Shane is intending to fight the allegations and proceed with his defamation lawsuit, these kinds of shakedown suits from other race baiting ‘victims’ like happened in California, and Baltimore, will probably end. It will be important to actually get a true court judgement rather than a ‘settlement’ with no details provided.

So if you see it in your heart to help Shane, please toss a few greenbacks into the GoFundMe account. If funds are not used, they will be donated to charity.

Dave Towne, MNAA, AVAA, AGA

=============================================

OFT (One Final Thought)

We’ve been speaking about rate cuts and how real estate agents are up in “arms”, so I thought this old commercial (note the Mr. Miller reference and “arm” reference).

Brilliant Idea #1

If you need something rock solid in your life – particularly on Friday afternoons at 2:00 PM, Eastern Time (ET) – and someone forwarded this to you, you can sign up here for these weekly Housing Notes. And be sure to share with a friend or colleague if you enjoy them because:

– They’ll be OK;

– You’ll be OK;

– And I’ll have some almond milk.

Brilliant Idea #2

You’re clearly full of insights and ideas as a reader of Housing Notes. Consider sharing them with me early and often. I appreciate every email I receive, as it helps me craft future Housing Notes.

See you next week!

Jonathan J. Miller, CRE®, Member of RAC

President/CEO

Miller Samuel Inc.

Real Estate Appraisers & Consultants

Matrix Blog @jonathanmiller

Reads, Listens and Visuals I Enjoyed

- How China's property bubble burst [CNBC]

- New York real estate lobby pushes to roll back 2019 rent changes with new data [Politico]

- New York City’s Vacancy Rate Reaches Historic Low of 1.4 Percent, Demanding Urgent Action [NYC.gov]

- What's the Bear Case For Housing Prices? [A Wealth of Common Sense]

- New York Still Has Enough Rich People to Pay the Bills [Bloomberg]

- Freddie Reports Surge in Multifamily Serious Delinquencies [Calculated Risk]

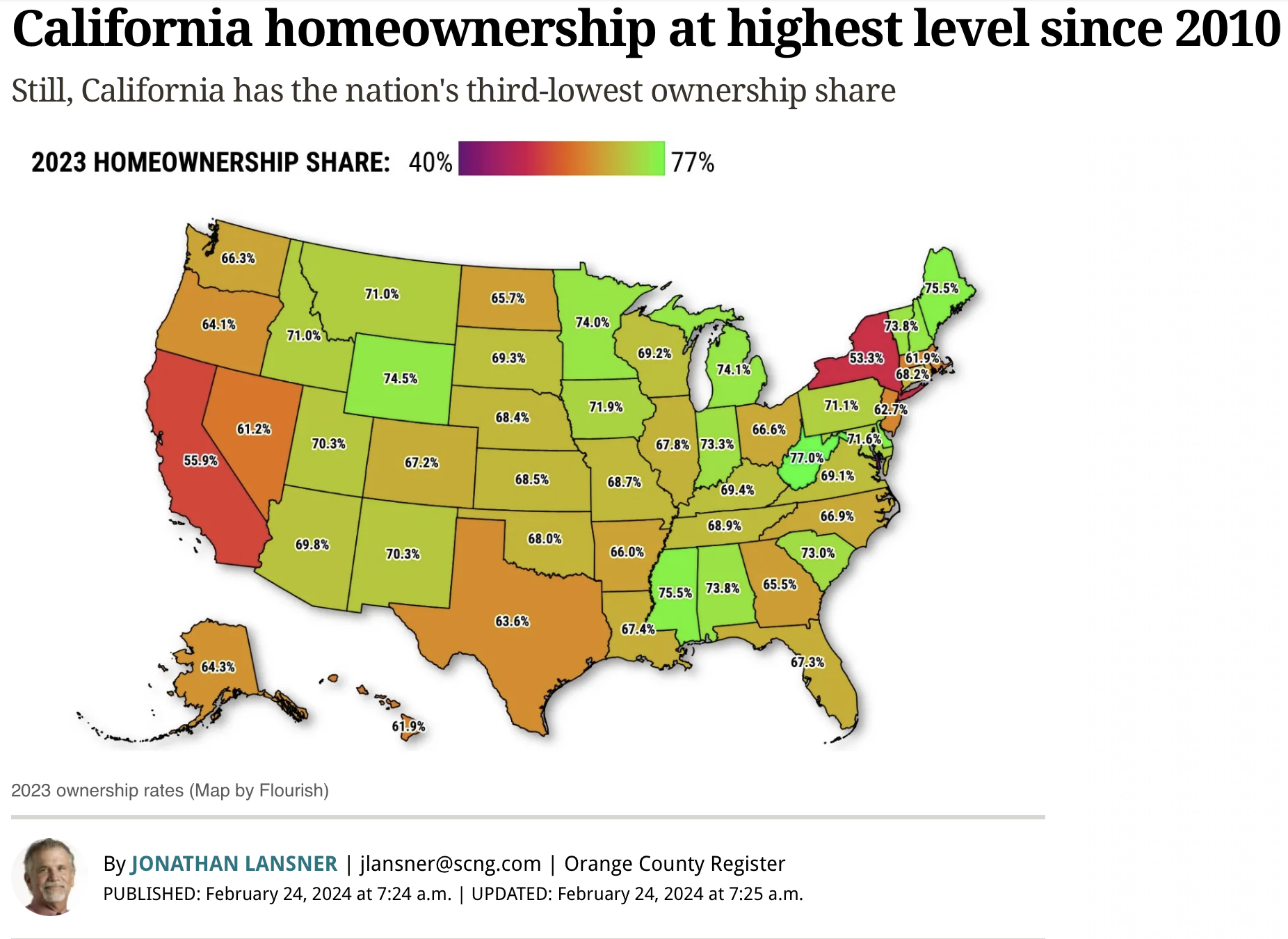

- California homeownership at highest level since 2010 [OC Register]

- Zumper National Rent Report [Zumper]

- U.S. Economic, Housing and Mortgage Market Outlook – February 2024 [FreddieMac]

- 30% of office buildings are ‘worth nothing’ and have to be torn down, say experts [Creditnews]

- A landlord's 2-year, $80,000 effort to evict a non-paying tenant [WBUR]

- Zillow’s Transition to “Super App” Driving Revenue Growth [Mike DelPrete – Real Estate Tech Strategist]

- Rents Are Falling. So Why Isn’t That Showing Up in Inflation Data? [NY Times]

- The State Of Commercial Real Estate Could Be A Lot Worse [Counselors of Real Estate]

- A Billionaires Row Apartment in NYC Was Just Sold for $180K—With One Huge Catch [Realtor]

- Can 3D Printing Help Address the Affordable Housing Crisis in the United States? [Smithsonian Magazine]

- How CNBC Built an Entire Financial Channel That Mainly Loses People Money [Slate]

My New Content, Research and Mentions

- Do Early Birds Buy the House? 9 Cities Where the Spring Housing Rush Starts Sooner Than You Think [Realtor.com]

- WSJ News Exclusive | Real-Estate Investor Gets ‘Great Deal’ on $30.1 Million Beverly Hills Spec Mansion [Wall Street Journal]

- Real-Estate Investor Gets ‘Great Deal’ on $30.1 Million Beverly Hills Spec Mansion [Mansion Global]

Recently Published Elliman Market Reports

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 1-2024 [Miller Samuel]

- Elliman Report: Manhattan Decade 2014-2023 [Miller Samuel]

- Elliman Report: Manhattan Townhouse Sales 2014-2023 [Miller Samuel]

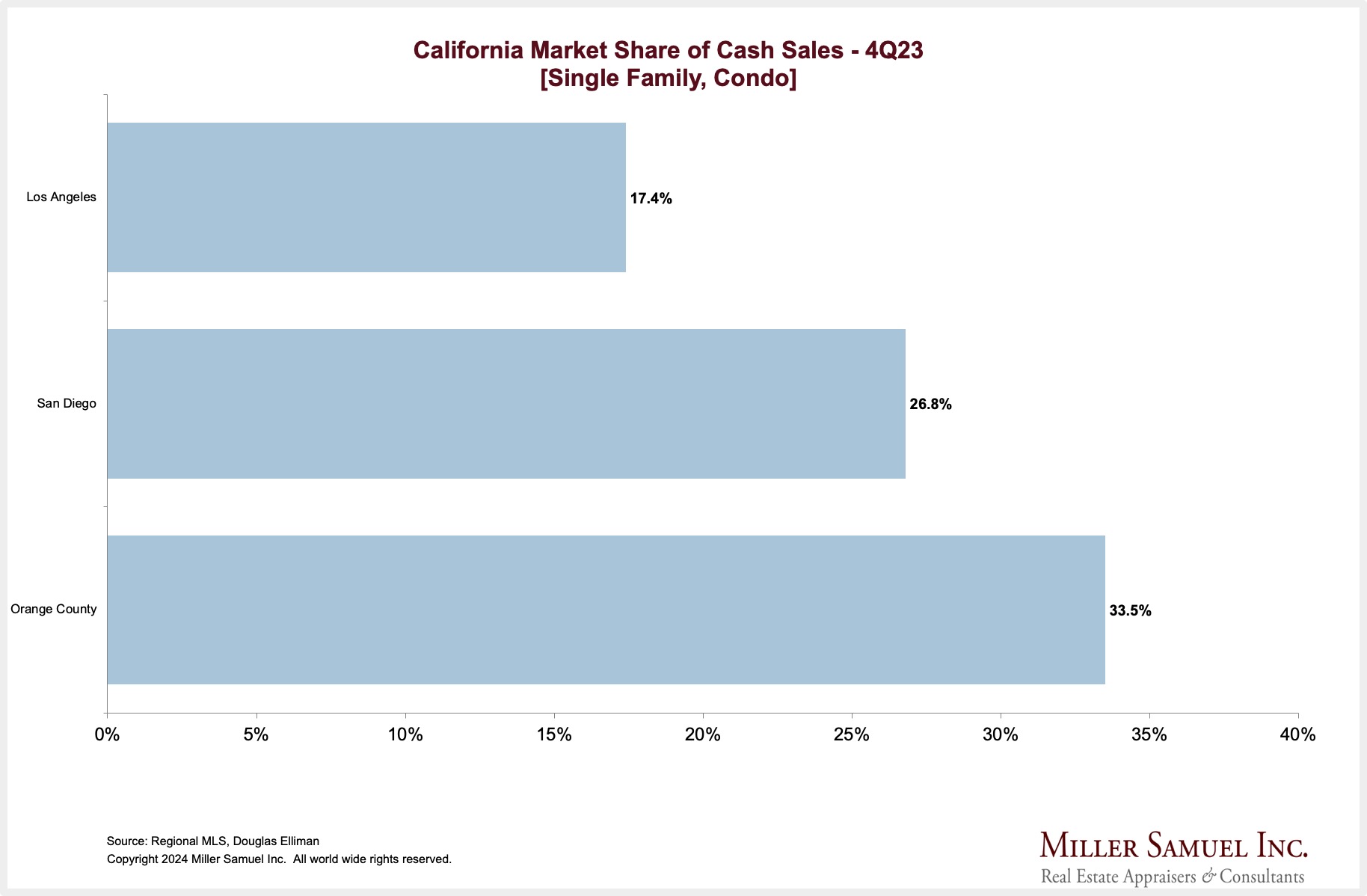

- Elliman Report: San Diego County Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Orange County Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Los Angeles Sales 4Q 2023 [Miller Samuel]

- Elliman Report: North Fork Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Hamptons Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Long Island Sales 4Q 2023 [Miller Samuel]

- Miller Samuel New York City Market Brief 4Q 2023 [3 Year Comparison] | Miller Samuel Real Estate Appraisers & Consultants

Appraisal Related Reads

- Is it a problem to remove all bathtubs in a house? [Sacramento Appraisal Blog]

- Appraisal Institute Announces Key Elements of First Quarter Board Meetings [WKRG]

![Orange County Average v. Median Sales Price [Single Family, Condo]](https://millersamuel.com/files/2024/04/2Q24OC-avgMED-1200x794.jpg)