- It’s Not Just Principal/Interest. All Homeownership Costs Are Rising.

- Mortgage Rates Are Not Expect To Fall Much, If Any, In 2025.

- With Migration Surging Into Flood-Prone Locations, Obtaining Insurance Becomes Key Issue.

I hope all my Housing Note readers are enjoying the holidays with family and friends. I’m visiting my wife’s family in the empty Macadam parking lots of strip malls in the din of the gray Detroit suburbs. Sadly, I can’t seem to find a postcard to share the experience with my friends back in New York City and Connecticut. She told me this location was better than if she was from Hawaii because the flight to The Motor City was only an hour and eleven minutes long from Connecticut.

Speaking of math, for about two-thirds of homebuyers, homeownership is monthly principal, interest, taxes, insurance, and homeowner’s association costs (PITIHOA). Cash buyers account for one-third, so they don’t have the principal and interest to worry about. To many, the monthly payment focus used to be principal and interest only, and the rest of the costs were nominal. But the math has changed, and it’s happening at a bad time – mortgage rates aren’t expected to fall very much, if at all, in 2025.

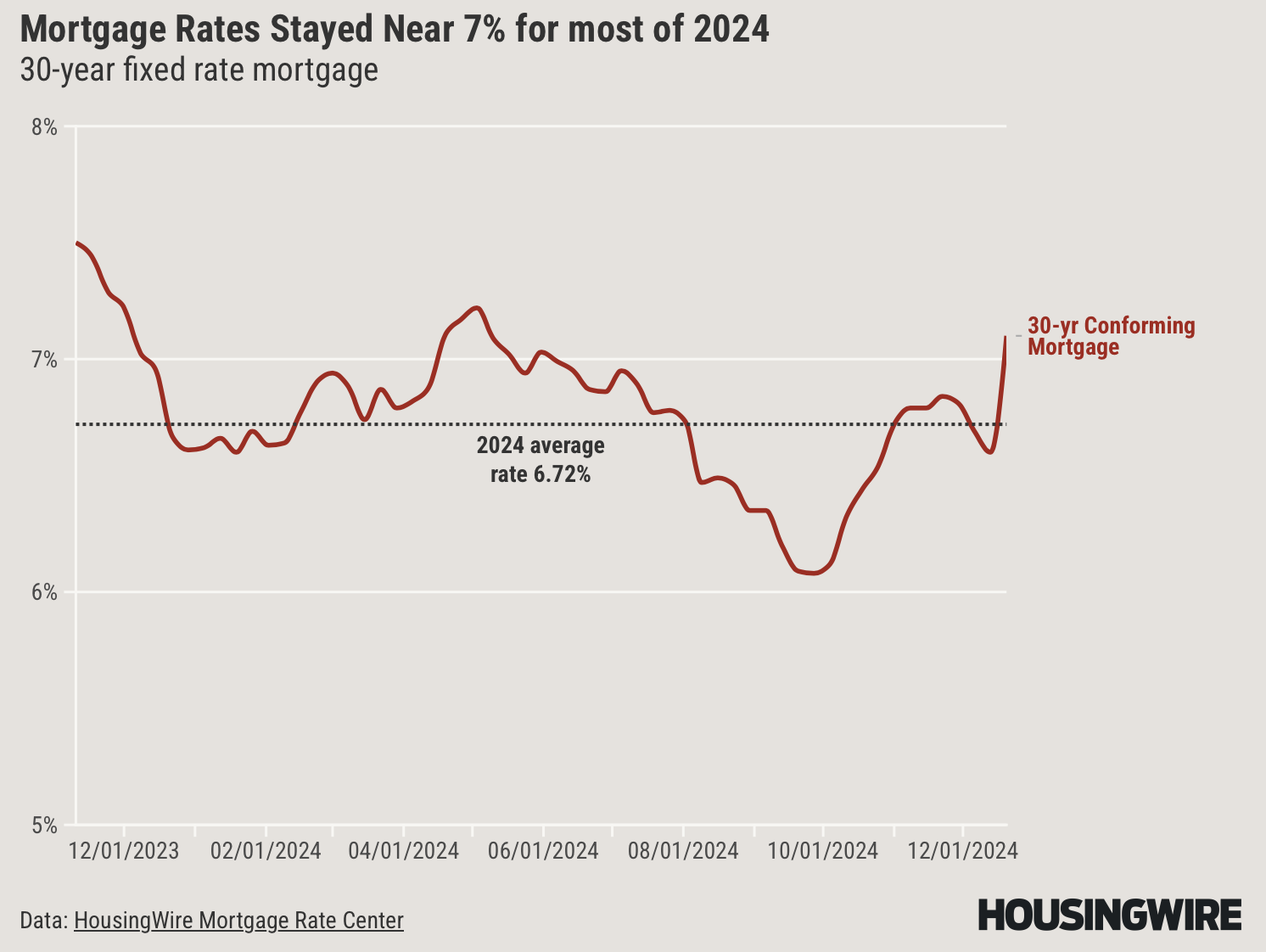

Mortgage Rates Straddled 7% in 2024

Housingwire has a good piece on mortgage rates for 2025, but basically, all forecasts made are probably wrong. The economy has remained stubbornly strong (I thought that was a good thing) and is more likely to stay where it is closer to 7 than fall into the lower 6s.

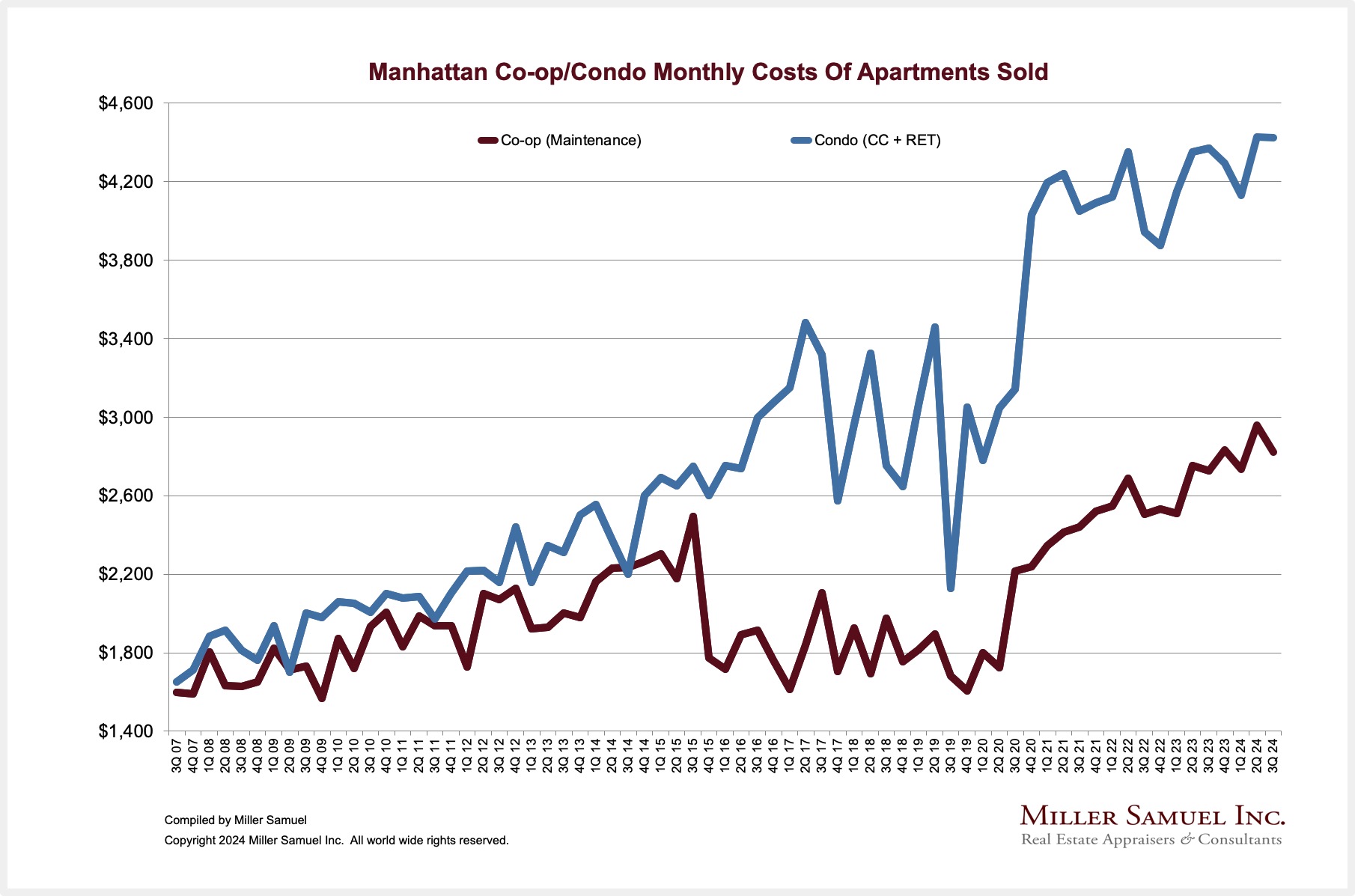

HOA Costs Are Getting To Be A Big Deal

I wrote about the rising phenomenon of HOA membership with new homes and how their costs continue to rise. Take the case of condos in Manhattan, which increased at an average annual rate of 9.3% over the past 17 years. Co-ops have risen by 4.4% annually over the past 17 years, mainly because new developments primarily occur within the condo market, and they typically have the highest monthly costs. The takeaway is that monthly HOA fees (including real estate taxes) are rising faster than inflation.

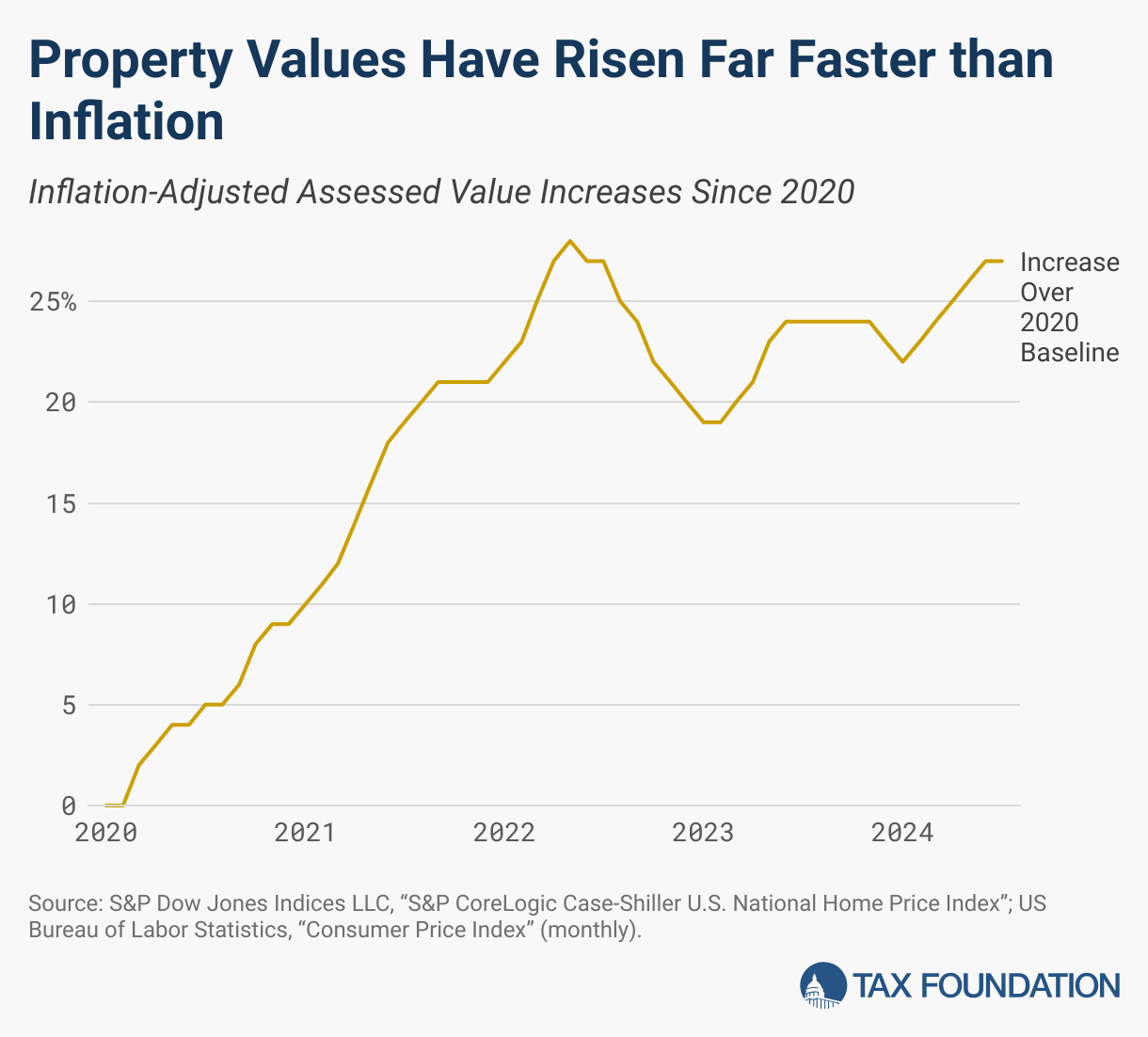

Property Taxes Are Outpacing Inflation

From the Tax Foundation: Property values have skyrocketed in recent years, rising almost 27 percent faster than inflation since 2020, which yields dramatically higher property taxes in jurisdictions that fail to adjust millages (rates) downward.

Even after adjusting for inflation, the increases in property tax charges are huge. Still, municipalities rang up large deficits during the pandemic and are not incentivized to adjust their millage rates downward. The flight to the Sun Belt states will likely ease because the affordability advantage is no longer valid. Higher “other” costs beyond PITI are rising.

Home Insurance Coverage Is No Longer Automatic

With the expansion of climate change damage bills, the replacement cost of new homes has been rising. And people continue to “flood” (sorry) into higher-risk areas. Redfin reported that migration into flood-prone counties more than doubled during the pandemic.

Final Thoughts

Sorry about the doom & gloom summary of the state of housing affordability, but it really is the perfect storm. The takeaway here is that blaming higher mortgage rates for the lower level of home sales over the past three years is a short-sighted take on the growing challenge of homeownership. Yet, weirdly, I do believe that home sales will expand in 2025 over 2024. A stronger-than-understood and appreciated economy and three years of waiting for mortgage rates to fall are no match for the pent-up housing demand that has been built up since 2022.

Another critical decision is to determine whether “Die Hard” is a Christmas movie. Genius.

Did you miss the previous Housing Notes?

Housing Notes Reads

- Insurance and Taxes Now Cost More Than Mortgages for Many Homeowners [The Wall Street Journal]

- All those 2025 mortgage rates forecasts are now wrong [Housingwire]

- Future HOA Membership Is A Growing Part Of Home Ownership Costs [Housing Notes]

- Migration Into America’s Most Flood-Prone Areas Has More Than Doubled Since the Start of the Pandemic [Redfin]