- Redfin Report Shows Higher Property Tax Gains In Sunbelt States

- Texas And Florida Lead The Pack For States With Largest Gains

- The Extension Of The SALT Tax Is A Big Economic Unknown

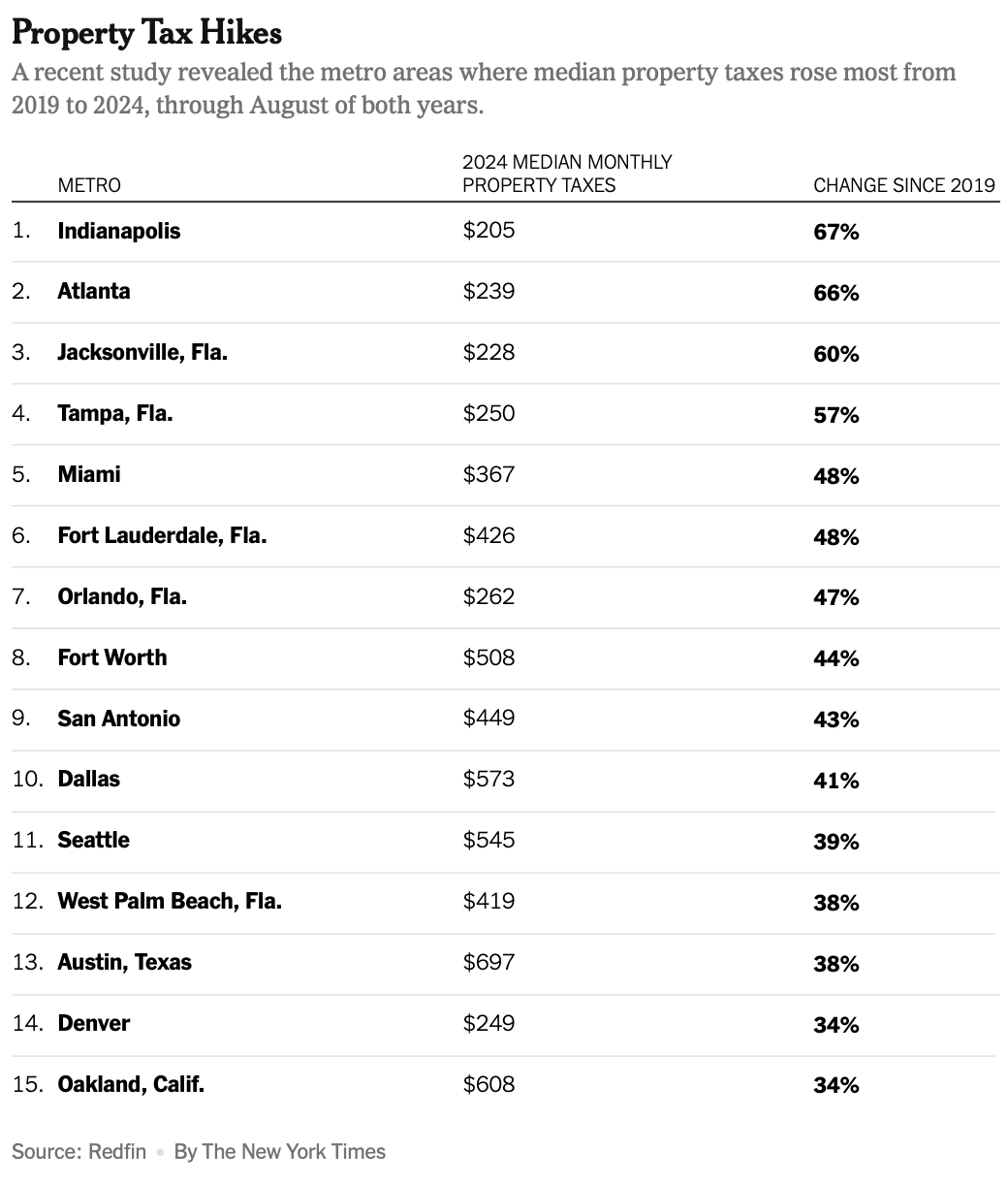

Along with higher mortgage rates and rising insurance costs, property taxes are surging. The Sun Belt is experiencing growing pains reflected in higher costs that came from extra support services needed during the pandemic. Florida and Texas housing are losing some, if not all of their competitive lower-cost advantages through the surge in the construction of new infrastructure to support all the new housing being built. In the following (gift link) New York Times/Redfin table, 10 of the top 15 cities to experience the highest rise in property taxes were located in either Florida or Texas.

Manhattan Belongs On The List

Not to be outdone, Manhattan condos showed a 66.4% increase in property taxes over the same period based on our data placing it in second place in the above table. The increase resulted in an average monthly real estate tax of $2,226 for a 1,366-square-foot, 2-bedroom condo with an average sales price of $2,794,372. That’s what you need to pay to be able to buy strawberries at 3 AM (my Dad’s favorite reason for moving to Manhattan).

Update On The 2017 Tax Cut And Jobs Act (SALT Tax)

In the first Trump administration, the “SALT” Tax (Tax Cut and Jobs Act, or TCJA) capped write-offs for the combination of property taxes and state/local taxes to a total ceiling of $10,000. This tax is one of the biggest wild cards on housing affordabilityThe SALT tax (the acronym no longer stands for “Strategic Arms Limitation Treaty” that I was raised on, ha) went into effect on January 1, 2018, and was harsh on regional housing markets with high taxes like New York, along with the greater northeast region, and California, and with the Work From Home (WFH) movement, fueled significant migration to Sun Belt states like Texas and Florida. The TCJA law added between $1 trillion and $2 trillion to the national debt which in and of itself, is inflationary looking forward. The TCJA law is due to expire at the end of 2025. During his presidential run, Trump proposed ending the law early which would signify tax relief to wealthy homebuyers in those regions but if it expires, taxpayers will see higher costs. It seems unlikely he will expend the political capital needed to end the SALT tax early. In the context of the housing market, the real question will be whether SALT will be extended and in what form.

Optics Of High Inflation Make It Hard To Cut Rates

The (gift link) underlying strength of the economy makes it less likely for housing market participants to see falling mortgage rates that were anticipated several months ago.

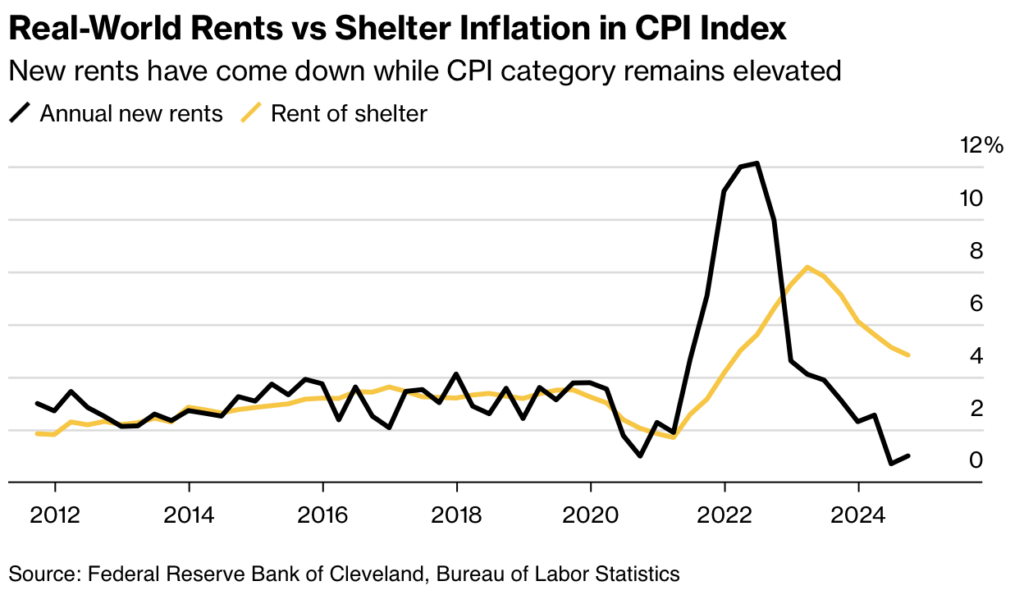

“The CPI is designed to measure inflation for the average consumer and samples rent increases for all renters, whether they’re re-signing an existing lease or entering a new one. Though current metrics from Zillow Group Inc. and Apartment List show rent growth has subsided, or even declined, in recent months, the CPI tends to follow those trends with a lag.“

The reduced mobility because of high housing costs is making rent inflation harder to leave the economy as people remain put. The Fed’s use of rental price indicators is well behind new rental activity keeping them hesitant to increase the size or frequency of rate cuts.

Raising Property Taxes Increases Home Affordability

Made you look!

The Federal Reserve Bank of Minneapolis just released a paper: How higher property taxes increase home affordability.

This reminds me of my contention that lower mortgage rates made housing much less affordable during the pandemic era by obliterating inventory faster than it could be created. Here are two of the three key points from the paper:

- “Higher property taxes raise ongoing financial burden of homeownership but consequently lower initial home prices”

- “Model finds raising property taxes shifts homeownership toward younger families, motivates older adults to downsize”

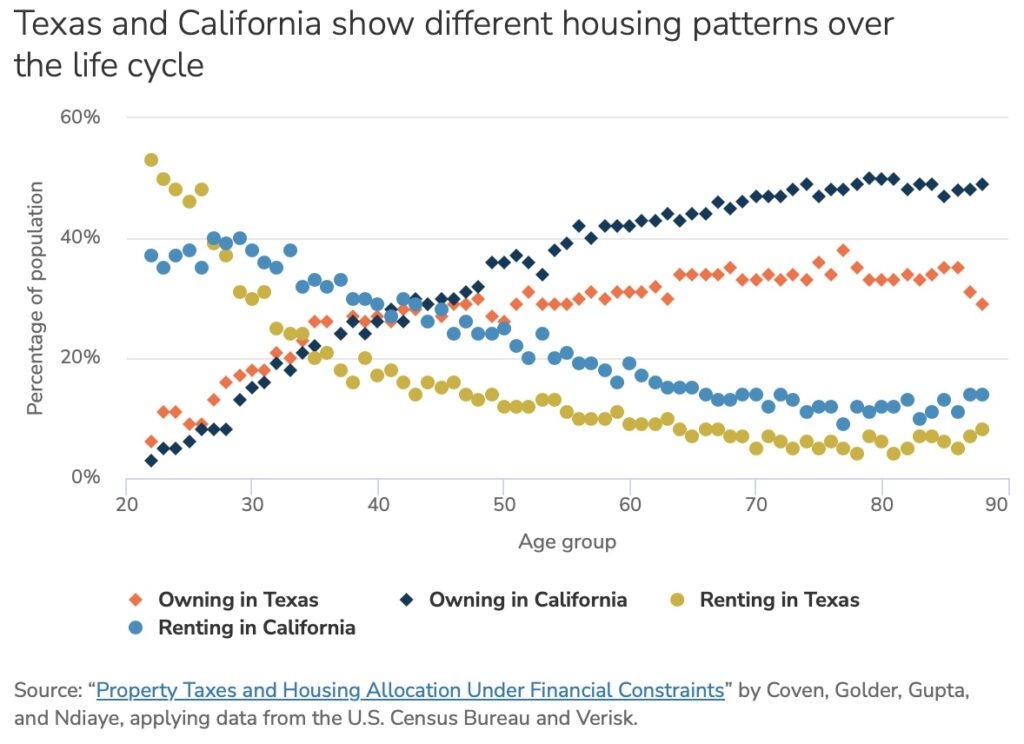

The economists compare owning and renting in the two states they use for their analysis. At younger ages, the homeownership rate is similar in high-tax Texas and low-tax California (Figure 2). But around age 50, the rates strikingly diverge.

This raises an important point about low inventory challenges to housing – older homeowners are more likely to downsize in areas with higher property taxes, potentially raising market supply. Otherwise, they underutilize their square footage ownership over time as they age.

The idea is to incentivize consumers to move to create more inventory. A similar concept was explained concerning the development of vacant land in Manhattan: Privilege In The Wasted Land: An Analysis of LLC Ownership And Vacant Land In New York City. The study suggests ways of shortening the hold times of vacant land to enable more development of housing, especially affordable housing.

“there is rising popular concern about the presence of empty apartments and vacant lots throughout expensive cities like NYC (Bagli, 2013; Gould, 2021). A symptom of speculation, vacancy indicates the presence of investors who are happy to park their wealth in real estate and profit from rising land values without the hassle of actually having to build or rent empty units (Eckart, 1983; Stanley, 2016). This reduces the supply of housing to both rental and ownership markets, driving-up housing costs. Again, CPTR has highlighted how wasting urban land makes all of society less prosperous, and has mapped the location of vacant and under-utilized land across NYC”

Final Thoughts

The housing market is entering a higher inflationary environment in 2025 because of expected economic policy changes that include, a higher national debt, an inflationary tariff policy expected for all imports, reducing expectations for lower mortgage rates, and a potential expiration of the TCJA.

Please remember that things can be so bad, that they’re actually quite good.

Did you miss the previous Housing Notes?

November 19, 2024

Bulletin: NAR Has Been A Leader In The Kind Of Entitlement That Comes When There Is No Competition

Image: ChatGPT

Housing Notes Reads

- Property Taxes Have Surged Nearly 60% in Tampa and Jacksonville Since 2019, Exacerbating Florida’s Housing Affordability Crisis [Redfin]

- NAR’s ‘lavish’ spending includes six-figure pay for volunteers [Real Estate News]

- NAR perks and lavish spending spotlight of new report [Inman]

- Chauffeured Cars and Broadway Tickets: Inside the National Realtors Group [NY Times]

- Ken Griffin sells remaining Faena House condo for $11.2M [The Real Deal]

- Want to Meet a Millionaire? Best Chance Is in San Francisco Area [Bloomberg]

- Ken Griffin Sells Record-Breaking Chicago Penthouse at 44% Loss [Wall Street Journal]

Market Reports

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 10-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 10-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 10-2024 [Miller Samuel]

- Elliman Report: Orange County Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Los Angeles Sales 3Q 2024 [Miller Samuel]

- Elliman Report: North Fork Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Hamptons Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Long Island Sales 3Q 2024 [Miller Samuel]

- Elliman Report: St. Petersburg Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Miami Beach + Barrier Islands Sales 3Q 2024 [Miller Samuel]

- Elliman Report: West Palm Beach Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Lee County Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Weston Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Wellington Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Vero Beach Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Fort Lauderdale Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Palm Beach Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Naples Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Delray Beach Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Coral Gables Sales 3Q 2024 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)