- US. Retail Supply , Especial Malls, Shrunk To Better Match Demand

- Consumer Spending Shows Strong Gains At Malls

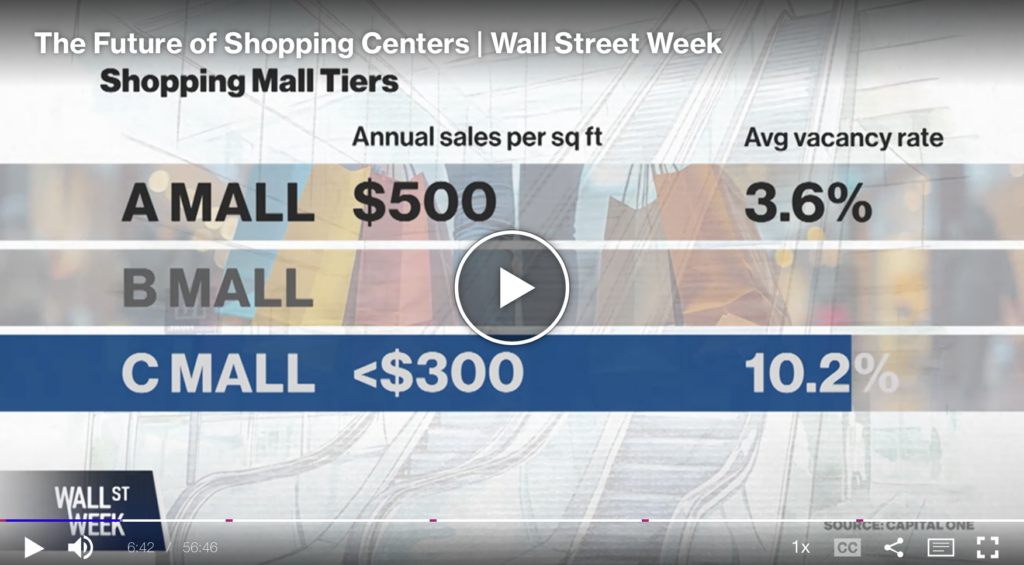

- Mall Performance Like Office Leasing Performance Is All About Class A

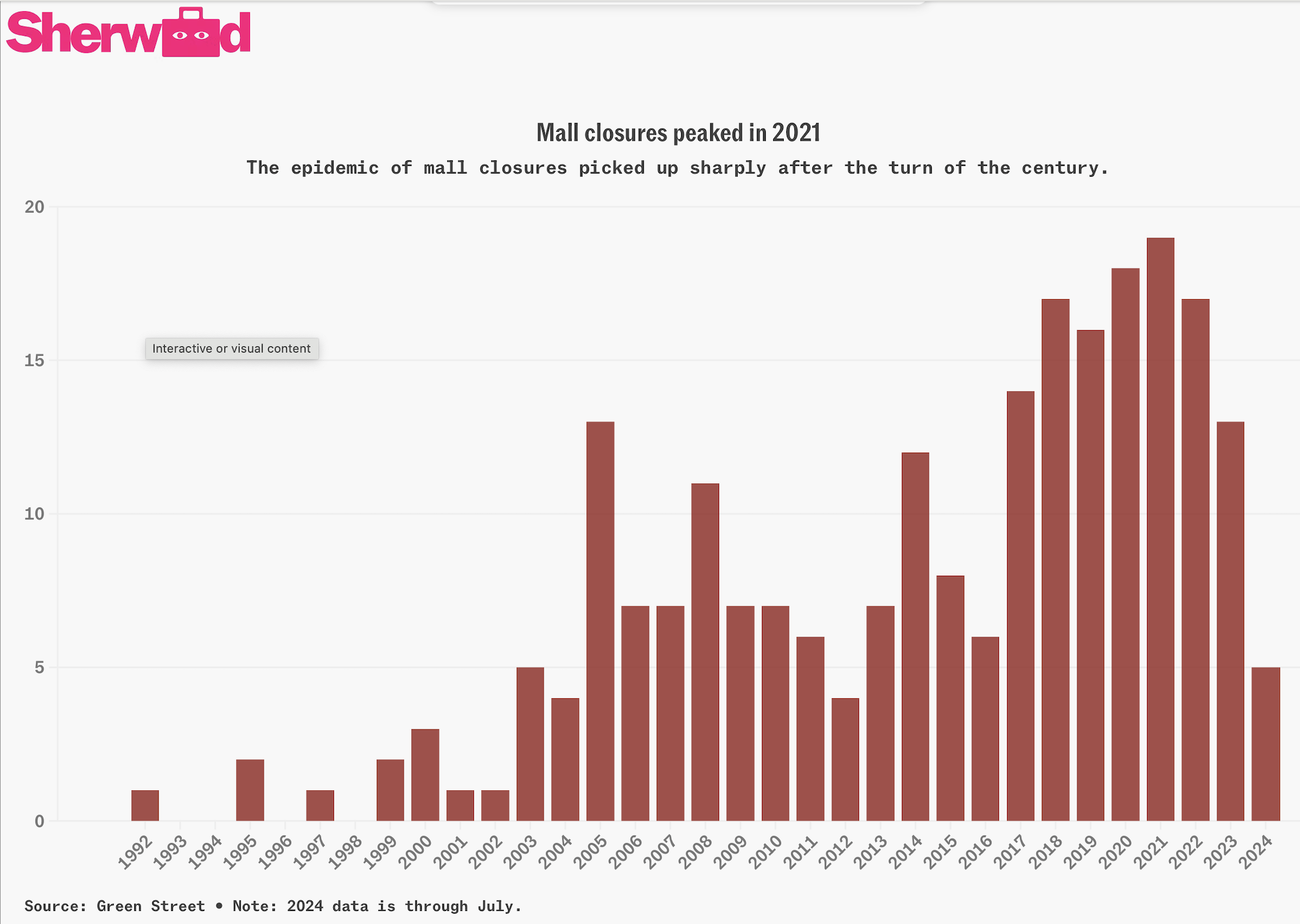

Before the pandemic, the retail narrative was that twenty percent of malls were going to go out of business over the next five years. Online shopping was the brick-and-mortar killer, and dead malls became a thing. And it wasn’t just malls – retail, as a category, was significantly overbuilt, representing bland suburbia, and high vacancies were a fact of life. My boomer generation grew up in malls. That’s where we shopped, hung out, and got jobs (me, as a busboy in a Greek restaurant on winter break, knocking over a tall stacked rack of water glasses all over the mall floor on my first day). My first job out of college was in Aurora, Illinois, west of Chicago, and Fox Valley Mall was recently developed on its outskirts. As a result, the once vibrant downtown suddenly became a ghost town, taking years to reinvent itself. However, the oversupply as an asset class seems to have bottomed out. One sign of improvement? Deadmalls.com is no longer being updated. Ha.

Back in 2019 just before the pandemic, one out of four stores on prime Manhattan’s Fifth Avenue were vacant. It seemed like retail was becoming an obsolete asset class. Here’s a little more luxury”retail detail” while strolling down Fifth Avenue. Fast forward to 2024, it is luxury that is leading retail up from the recent bottom.

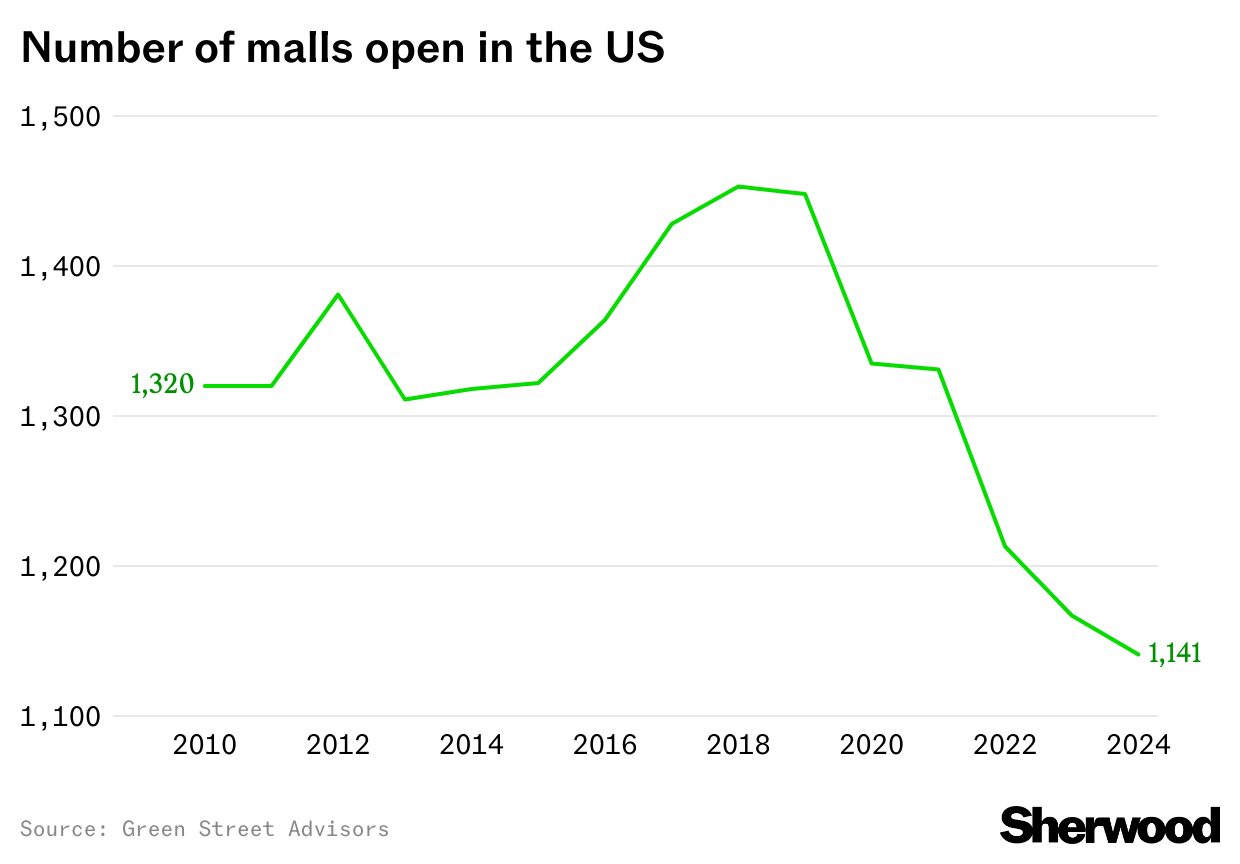

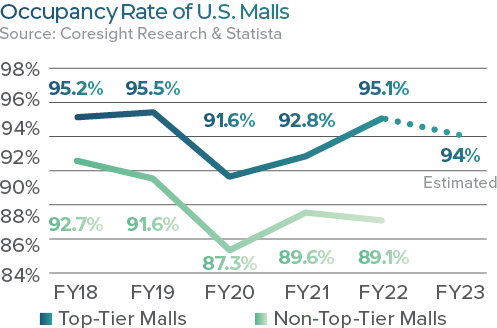

The Decline Of Malls Seems To Have Found A Bottom

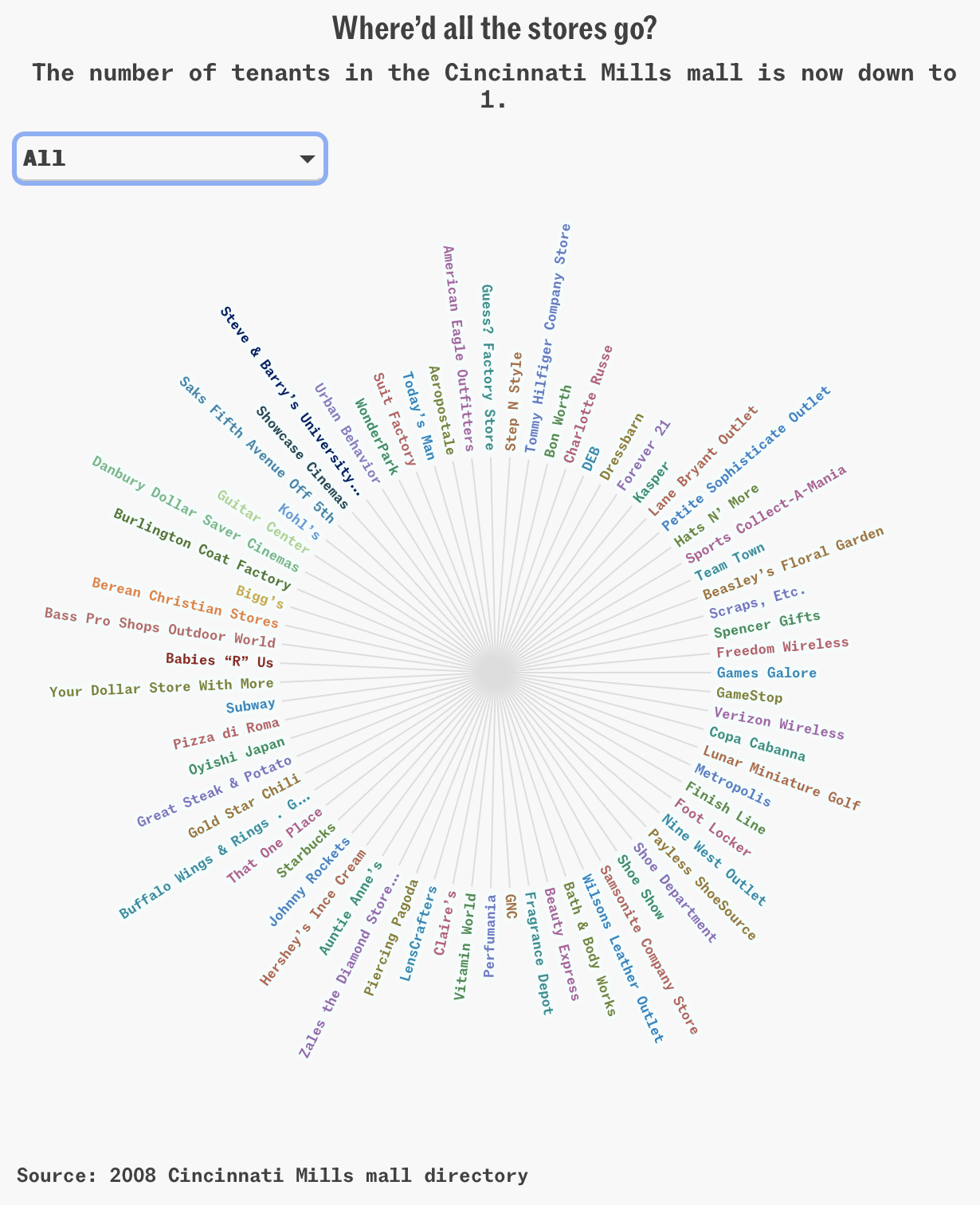

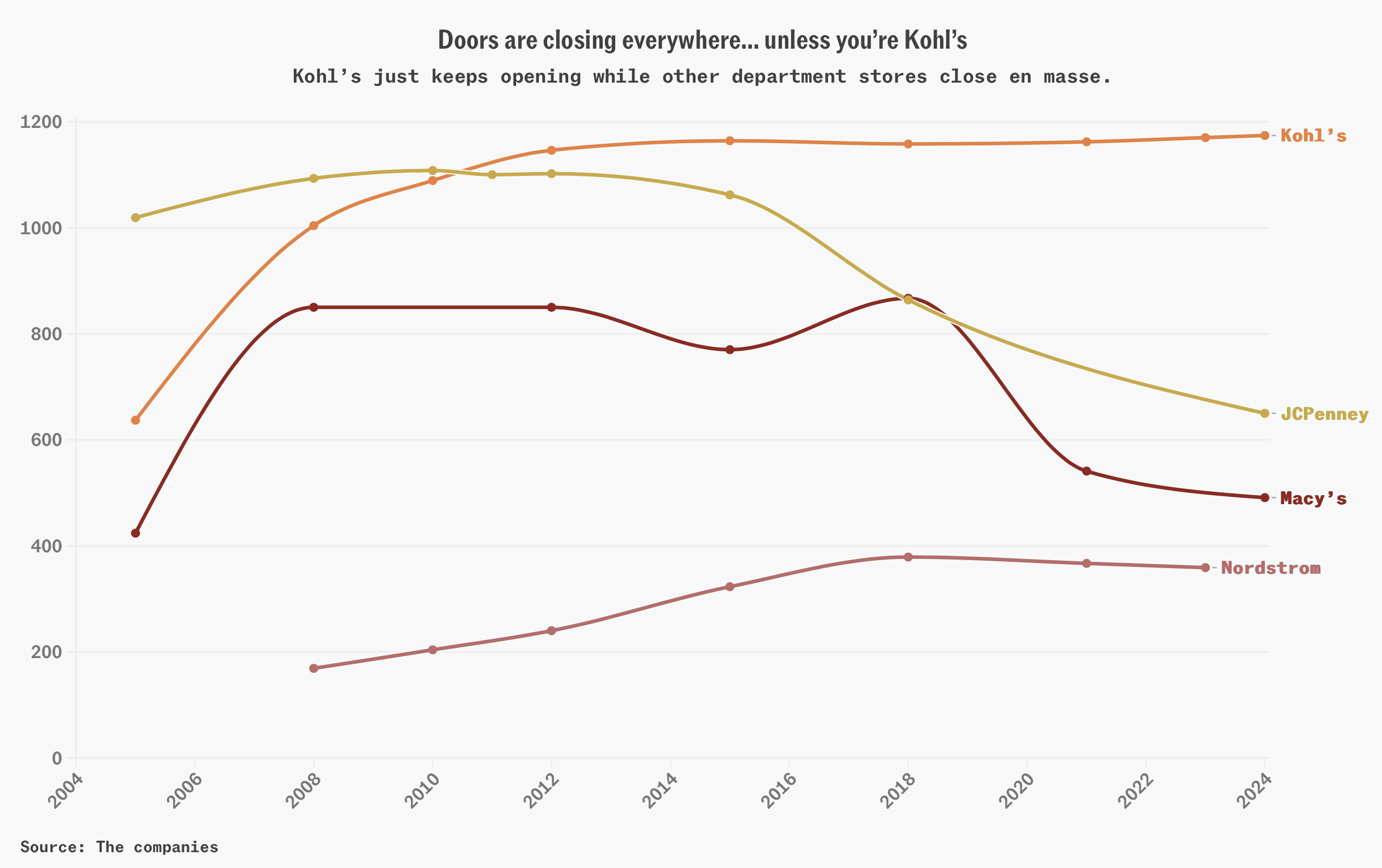

Many of the retail store stalwarts of malls have gone bankrupt. Most malls I have visited in my lifetime have nearly all the same stores, and if that assumption is reasonable, then the asset class is at the mercy of those stores’ performance. The Sherwood article I cited earlier talks about the Cincinnati Mills Mall’s only remaining tenant, Kohl, which continues to expand, versus its previously full roster in 2008:

And some lovely pictures of the nearly abandoned mall…

As Supply Declined, Demand Increased

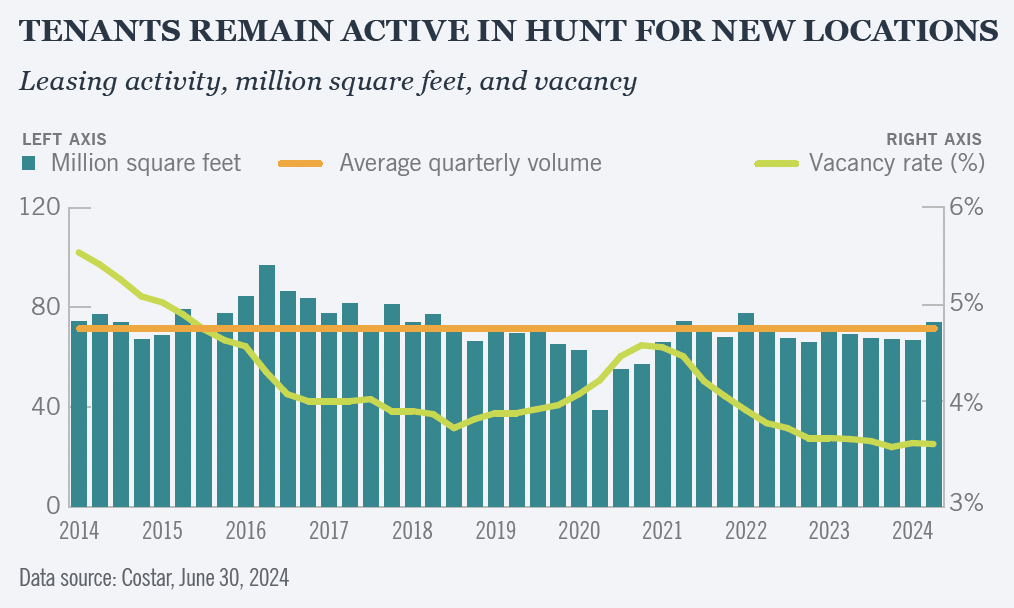

Retail vacancy rates are now lower than pre-pandemic.

Nuveen – Necessity retail is typically concentrated in local neighborhood strip centers. New supply has slowed in the past six years, with fewer new properties coming online compared to more discretionary retail centers.

Two In Five Americans Have Unused Gift Cards

Most mall stores seem to have gift card programs. Neiman Marcus, Blockbuster, and Mobil were the early adopters of gift cards in the 1990s. Supposedly, gift cards are the most efficient form of gifting. If you find you don’t use them, you can sell them to platforms like CardCash or Raise. When I get gift cards as gifts, I’m immediately on a mission to spend them quickly out of fear that I’ll lose them!

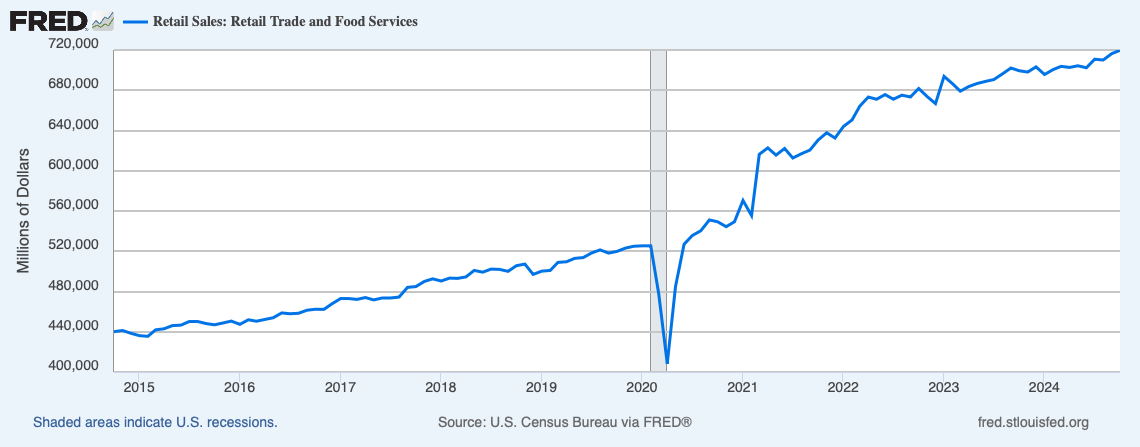

The Consumer Continues To Purchase With Abandon

While malls are shrinking as a share of brick-and-mortar, consumers are now spending more there.

The Future of Shopping Malls On Bloomberg

Like commercial offices, class-A malls are doing better than the rest in terms of occupancy. The first segment of Bloomberg’s Wall Street Week on the state of U.S. malls is essential to watch if you’re interested in the asset class.

Final Thoughts

Why am I writing about retail real estate when Housing Notes is meant to be about, well, housing? The state of retail and the services they provide impact local real estate markets, as I’ve written about in the past. Pre-pandemic was all about the death of retail in an all-online world future. As it turns out, that was an oversimplified assumption.

Stores seem crowded this holiday season, so perhaps consumers and retailers have figured out how to get along.

This somehow works in this holiday season. Have a terrific holiday on Wednesday! I’ll be back on Friday from The Motor City.

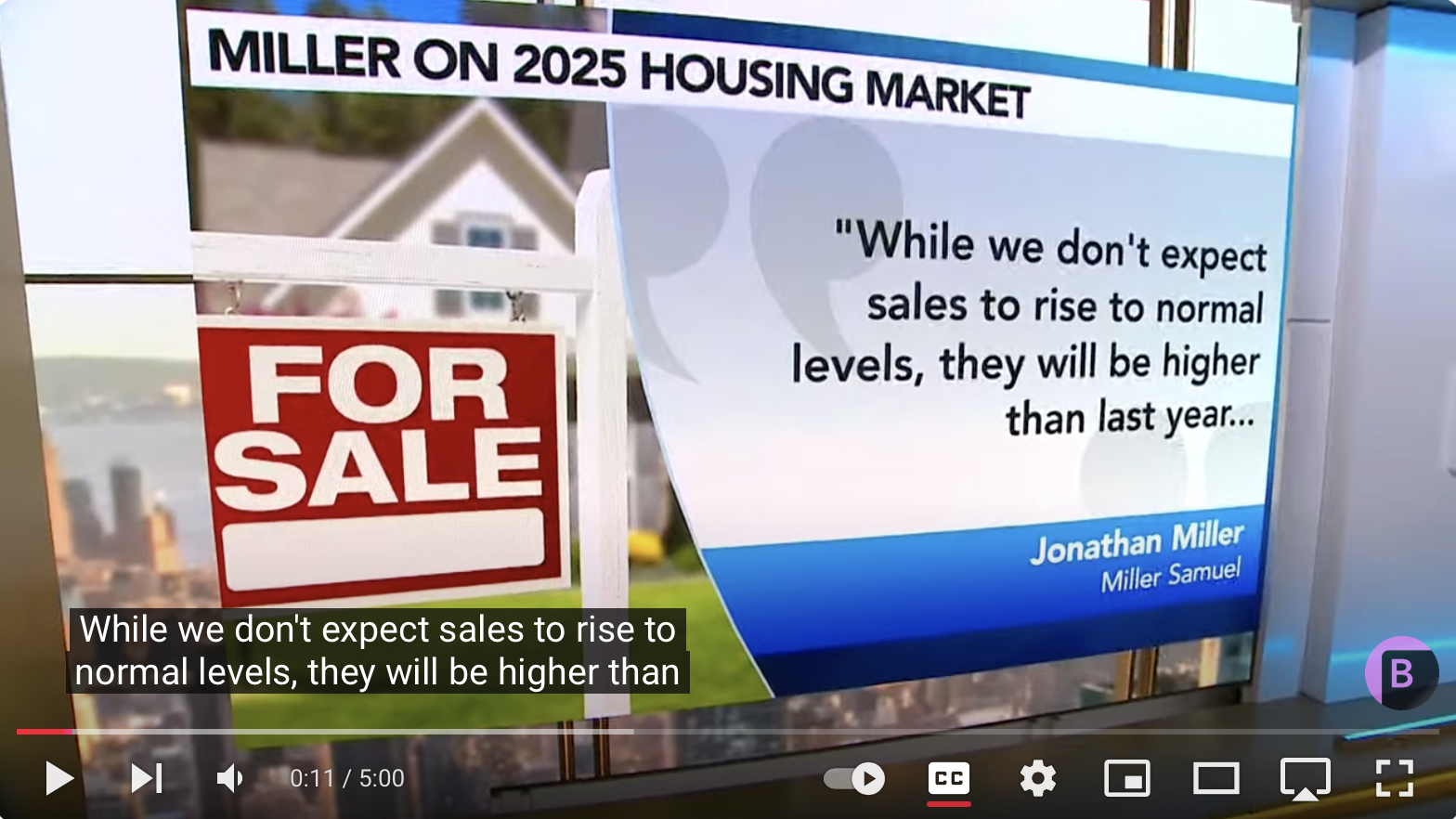

Today’s Appearance On Bloomberg Television

I gave a recap of the residential and commercial housing markets this morning on Bloomberg – Always fun.

Did you miss the previous Housing Notes?

December 18, 2024

2025 Luxury Housing Sellers Need To Buckle Up: Consumers Have Record Optimism Over The Stock Market

Image: Gemini

Housing Notes Reads

- Economic, Housing and Mortgage Market Outlook – December 2024 | Spotlight: Homeowner vs. Renter Spending [Freddie Mac]

- Zillow's price estimates are screwing up homebuying [Business Insider]

- The Retail Profitability Paradox [MIT Sloan]

- The Repurposing of the American Mall [Matthews]

- The State of the American Mall: Competitive, Attractive and Here To Stay [Coresight]

- The Fifth Avenue Retail Apocolypse? [2019 Inside Edition TV]

- You Can Get Anything You Want At Alice’s Restaurant, Starbucks, and Whole Foods Because It Makes Housing Grow [Housing Notes]

- Americans have billions in unused gift cards [Quartz]

- Boom, bust, back from the dead: Why are mall retailers the most interesting stocks on the market? [Sherwood]

- What Do We Want From the Mall? [NY Times]

- This New York mall symbolized cross-border aspirations. Its proposed demolition reflects retail reality. [Costar]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)