- There Was A $225 Million Home Sale In Naples, The 2nd-Highest In US History

- US Imports From China Plummeting, Projecting Near-Empty Store Shelves In A Few Weeks

- Last Week’s Weakening Dollar Translates Into A 20% Drop In US Value

Whenever I think of or use the word “Damaged,” I think of a wildly underrated DC punk album by Black Flag. For about 25 years I played tennis with a group of mid- to high-level Wall Streeters, and when someone in the group referenced Henry Rollins singing the song “Damaged” in a conversation about treasury swaps, I was impressed. I can’t remember the meaning of the reference anymore, but I brought up the song because of last week’s sale of a $225 million home sale in Naples, the highest Florida home sale on record and the second-highest US residential sale in history. Yet the buyer of the highest sale in history, a Manhattan condo for $238 million back in 2019, a Trump super donor, billionaire Ken Griffin, just criticized the tariff-driven trade war started back on April 2nd (known as “Liberation Day”). Griffin says the US is 20% poorer than a month ago because of Trump’s economic policies. The tariff-related series of events in the past two weeks have been shocking, confusing, and stupid. That’s why recession risk is now at 90%, according to a respected economist who used to be one of the most optimistic on the housing market outlook before Liberation Day.

Container Ships Piling Up At Port Of Los Angeles

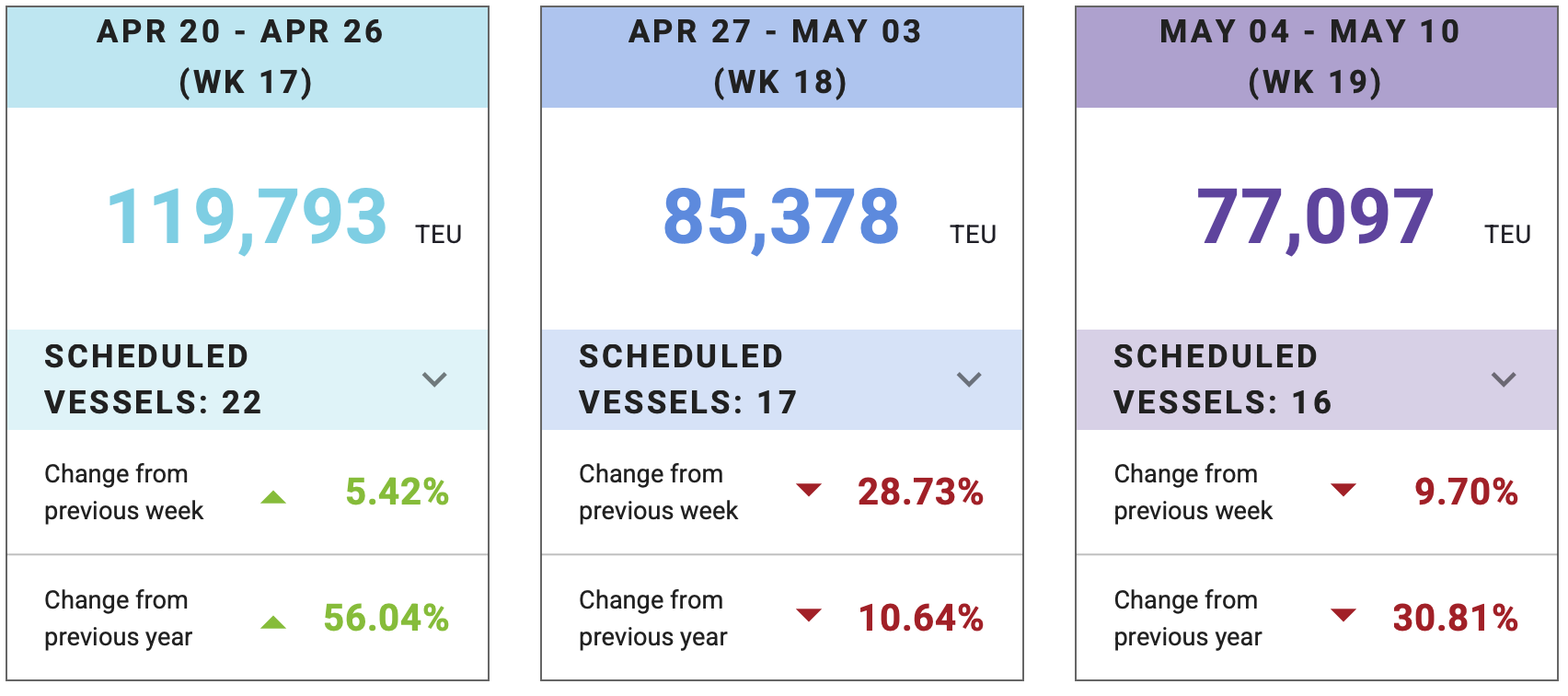

Imports coming through the port of Los Angeles are expected to plunge over the next two weeks as the 145% tariffs on China kick in. The number of empty container ships is growing as outbound volume is also collapsing since we are at war with the world without a plan. The volume of containers coming into the port is collapsing. If you’re curious, the unit of measure is a “Twenty-foot Equivalent Unit (TEU),” which is a standard-size container 20 feet long, 8 feet wide, and 8.5 feet high that many are converting into tiny homes. Empty container ships are piling up in China and the LA port. This pattern will likely significantly reduce the amount of items on store shelves over the next couple of weeks. I have already read that Amazon prices for about 1,000 items impacted by tariffs are rising an average of nearly 30%. Wow. So much for the idea of reducing inflation and lowering mortgage rates in the near term.

Naples Florida Sees A Monster Sale

The Wall Street Journal got another scoop on price records. This time, a Naples home and two adjacent properties sold for $225,000,000 (gifted link), the highest home price in Florida history and the second-highest home price in the nation. If you need further evidence of the disconnect between super luxury property sales and the local market or the economy, this Naples transaction is something to bookmark for later reference. Our Naples research for Q1 was just published, and the median sales price in Naples was $675,000 for single families and condos combined. Specifically for single families, the median sales price was $799,900. In other words, this mega sale was 281x the local single median sales price.

Final Thoughts On “Damaged”

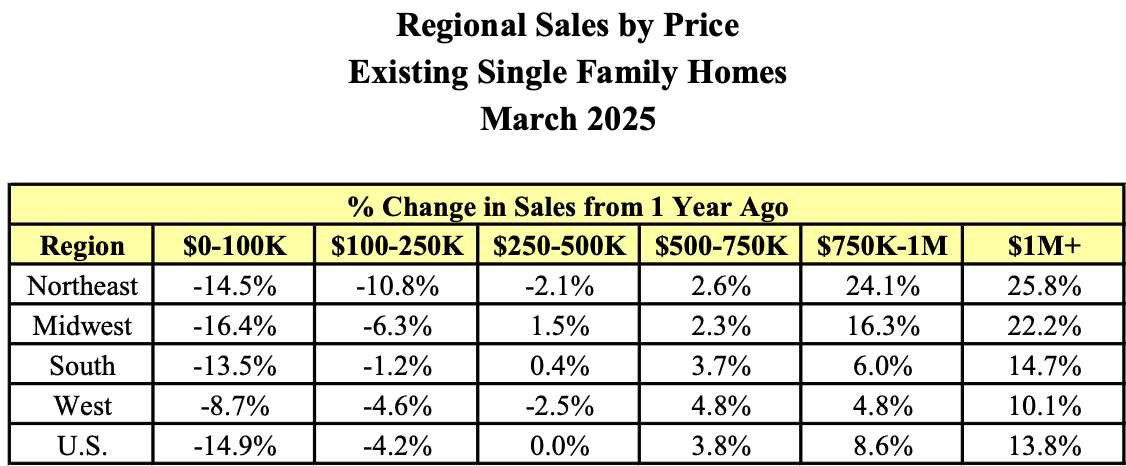

The idea that a mega US home sale just occured as the financial markets show massive volatility because of a poorly conceived trade policy (implemented without evidence of a plan or strategy) is about all the evidence you need for the disconnect between the housing market for “mere mortals” and the uber-wealthy. “Damaged” is the right word to use to describe the US housing market. Despite the volatility of the financial markets in recent weeks after realizing that there was no valid plan or strategy behind “Liberation Day,” mega sales continue to occur unabated. It’s essential to recognize that these mega sales represent a tiny fraction of 1% of US home sales since overall home sales are weak. The higher end of the housing market continues to see more sales growth as the following table clearly shows.

However, if there is a recession this year (or we are already in a recession), mortgage rates might slip a bit, and assuming job loss isn’t massive, the housing market may see a small pick up in sales, skewing towards the higher end. Admittedly there are a lot of “if’s” in that assumption about “damaged.”

The Actual Final Thought – We saw Pink Floyd at Pompeii at a nearby IMAX last week. Back in 1979, I was a college sophomore at a party in the dorms on campus. I had the bad combination of drinking a little too much and being quite bored. The music at the party was standard glam rock fare I could barely tolerate, like Journey, Styx, Boston, and REO Speedwagon. I left the party alone and walked across the street to a strip mall where I remembered a documentary, “Pink Floyd, The Movie,” was playing. I had missed the first fifteen minutes, but it didn’t matter given my condition. That 1972 documentary captured their earlier music with favorites like “Careful with that axe, Eugene,” “Echoes,” and “A Saucerful of Secrets” plus a couple of songs from 1973’s then soon to be released Dark Side of The Moon, such as “Us & Them” and “Brain Damage.” The reason I couldn’t find the documentary for years was because they renamed the movie and recently released it again with improved sound quality for IMAX. It was pure joy for Pink Floyd fans.

Monday Mailboxes, Etc. – Sharing reader feedback on Housing Notes.

April 23, 2025: The Plural Of Anecdotal Is Not Data – The Tariff Tantrum Impact Creates Housing Chaos

- Great piece…thank you!

- Now, show us the other side, how do other countries tariff us?

March 28, 2025: Let’s Talk About The Weather Since Home Sales Are Augmented

- Might I get your advice?: PE claims to own only a small fraction of the housing stock, hence that it ‘cannot’ be significantly affecting prices. This is of course sheerest sophistry, as the turnover, not the stock, is the relevant denominator. On the latter, I often see Forbes, Business Insider, and WSJ reports to the effect that institutional investors buy up anywhere from 24% to 40% of the turnover each year. Meanwhile CoreLogic and Cototality, who I assume are to real estate investors what API is to oil drillers, say it’s only 3% or so, with ‘mom and pops’ causing all the trouble. 😅 Where is the best data, do you reckon? I’d like to get some inkling, from some financially disinterested source, of the actual numbers.

Did you miss the previous Housing Notes?

Housing Notes Reads

- Too Rich for Tariffs [Curbed]

- Ken Griffin Criticizes Trump Tariffs: ‘These Jobs Are Not Coming Back’ [Bloomberg]

- Traffic at the Port of Los Angeles set to plunge amid tariffs [LA Times]

- Port Optimizer [Control Tower]

Market Reports

- Elliman Report: Hamptons Sales 1Q 2025 [Miller Samuel]

- Elliman Report: North Fork Sales 1Q 2025 [Miller Samuel]

- Elliman Report: Long Island Sales 1Q 2025 [Miller Samuel]

- Elliman Report: Los Angeles Sales 1Q 2025 [Miller Samuel]

- Elliman Report: Orange County Sales 1Q 2025 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)