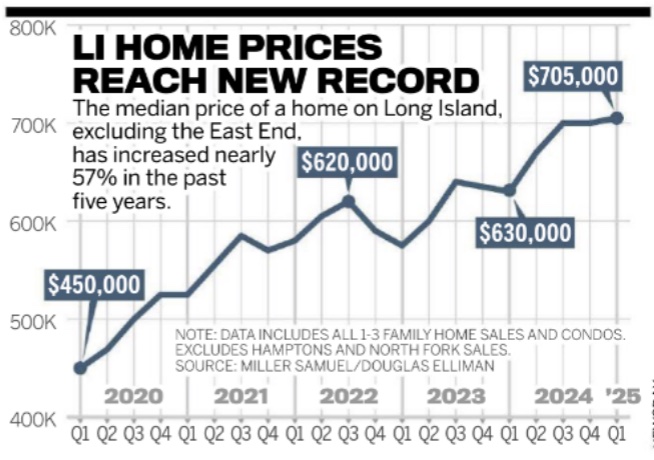

- Housing Prices Are Rising Sharply On Long Island And The Hamptons

- Sales In The Long Island Suburbs Are Falling While Rising In The Hamptons

- Wall Street Record Profits/Bonuses Expected To Drive More Hamptons Sales Despite Financial Market Volatility

I first heard the band Beruit play live at Lincoln Center with another favorite band, Calexico. The venue overlooked Central Park, and the entire experience was spectacular. Their second album was titled “Lon Gisland” and I’ve always thought about how great the phrase captured the local accent, even though the band was from New Mexico. …but I digress… I began authoring reports on the Long Island housing market prior to the GFC and see it as two distinct regions. First, The East End comprises The Hamptons and The North Fork, which are luxury second-home markets closely connected to the Manhattan securities industry (Wall Street). Long Island, excluding The East End, is a more modestly priced suburban region. Even if you don’t hail from this area, the concepts of this analysis should be applicable.

Long Island (Traditional Suburban Market)

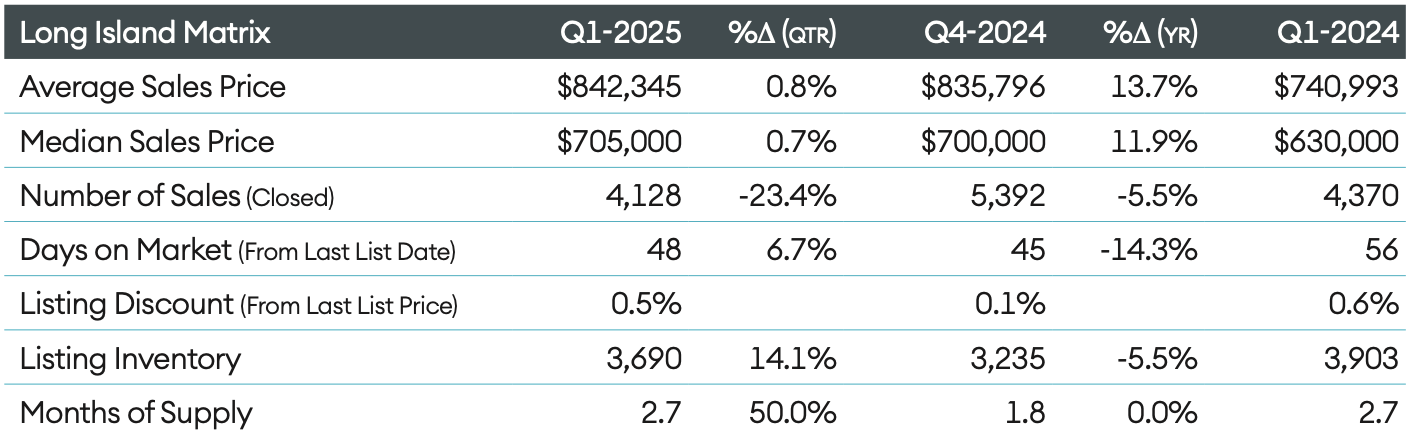

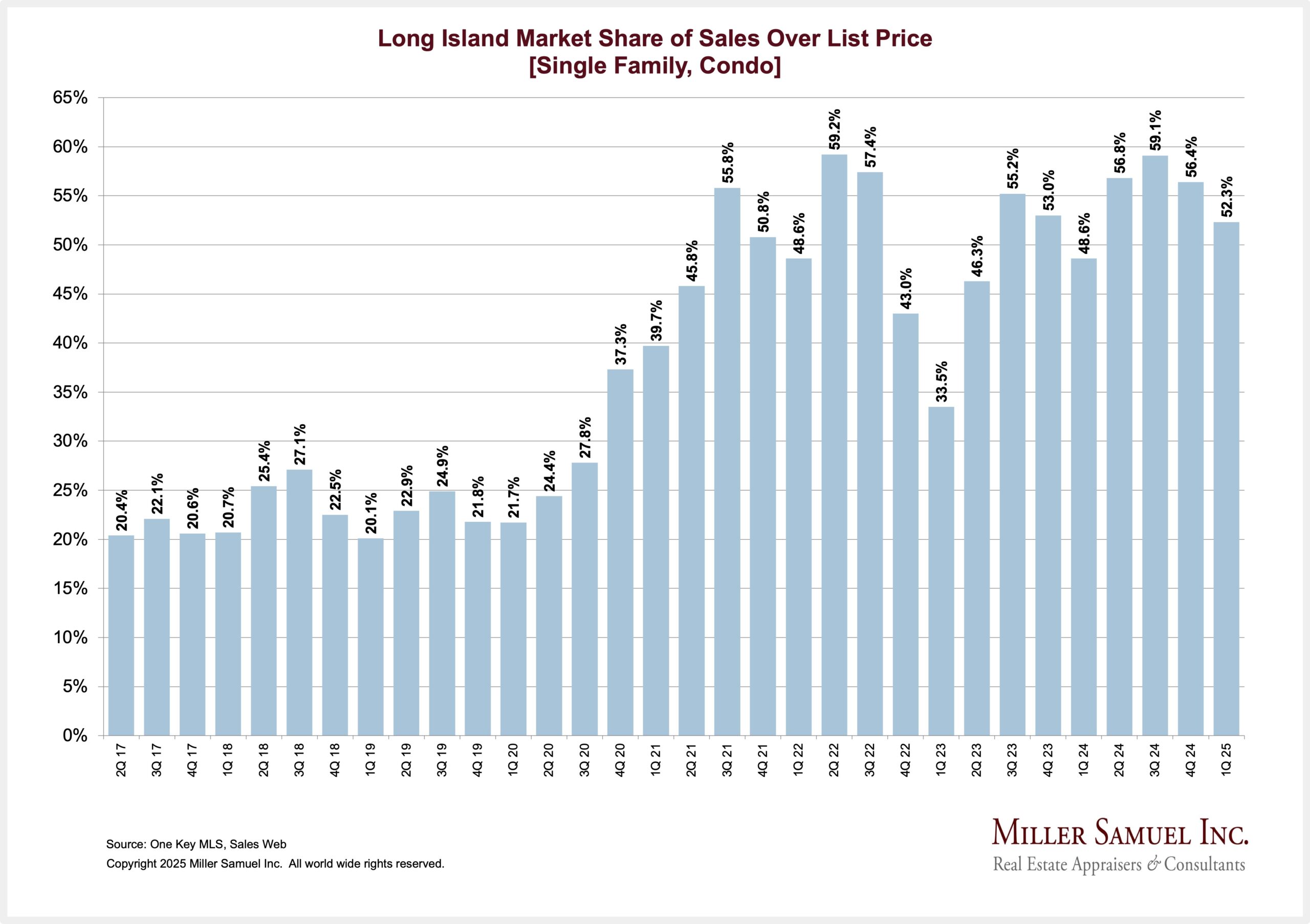

Our results for the first quarter were published this morning, and the key points were that prices continued to rise like a rocketship, and sales continued to slide, restrained by elevated mortgage rates and the second-lowest list inventory on record. Prices surged year over year, setting records for average and median sales prices for the fourth consecutive quarter. Listing inventory declined 5.5% from the prior year, but the first quarter total was not only the second lowest in more than 20 years of tracking, but it was 52.5% below the first quarter average inventory for the decade.

As a result of limited supply, bidding wars (a proxy for a purchase price higher than the last asking price) were over 50% for the fourth consecutive quarter. The chronic lack of supply is the most critical metric of the current Long Island housing market.

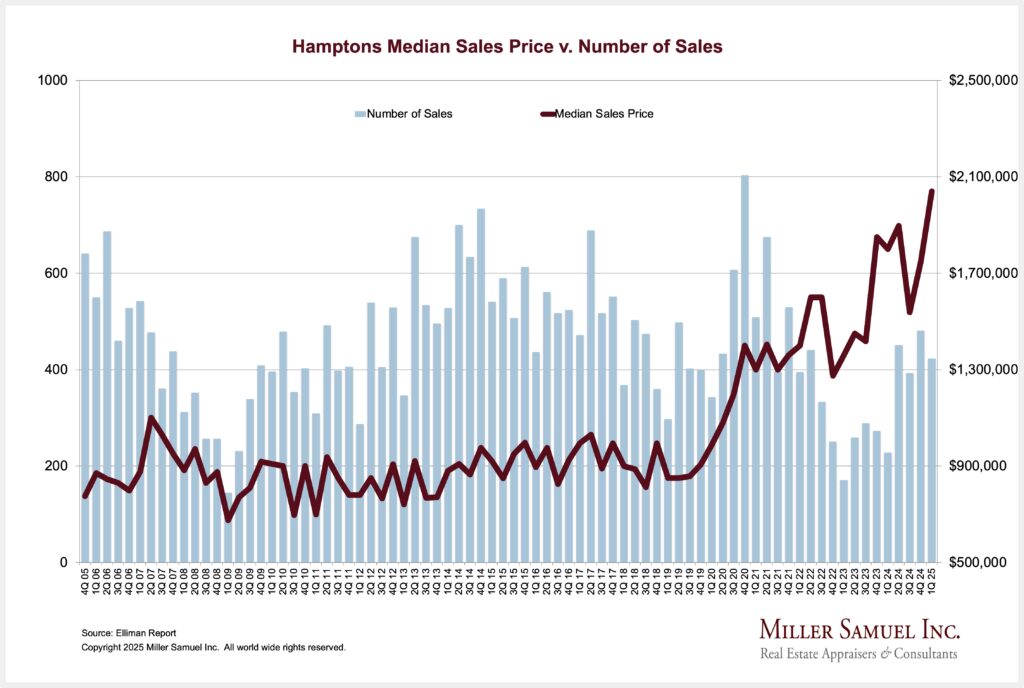

Hamptons/North Fork (Luxury Second Home Market)

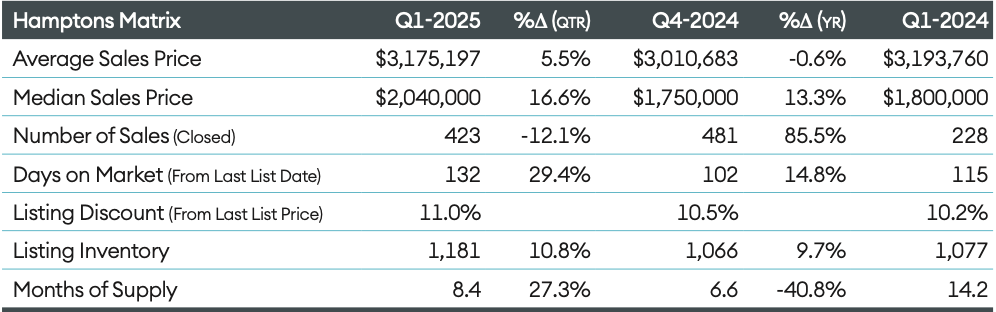

Our Hamptons report was published today that coverage the first quarter sales market.

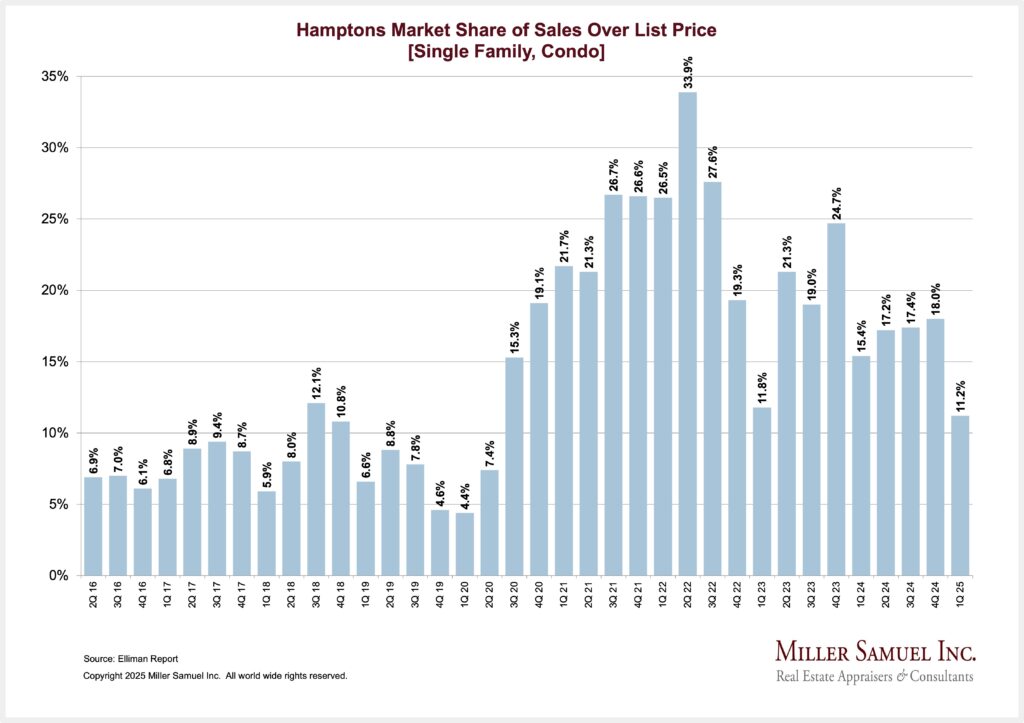

For years, the median sales price of the Hamptons market tracked the Manhattan market. However, from the pandemic era through today, this luxury second-home market has seen median sales prices double as the market became crimped by the lack of inventory. Median sales price saw a similar pattern of gains that Long Island did, but listing inventory has begun to enter the market, triggering a lot more sales. In fact, sales have been rising higher over the past year as supply has become more available. The slowdown in sales in the prior several years was less about increasing mortgage rates and more about the lack of listing inventory. The Hamptons market is much more of a cash market than Long Island and, therefore, less traumatized by higher rates. It’s not impervious to higher rates, though, just less severely impacted. Given the market’s Wall Street relationship and dependence on the financial markets for cash drawdowns, the tariff tantrums of the past couple of weeks might bring more urgency to some investors to reduce exposure to tangible assets from intangible assets.

The lack of listing inventory situation is not as low as what Long Island is experiencing, so the share of bidding wars is less.

Final Thoughts

The takeaway from comparing a traditional suburban housing market and a high-end housing market is that rising prices and high mortgage rates much more challenge the relative affordability of the suburbs. The booming financial markets (Wall Street experienced record profits and bonus comp this year) have provided an alternative to relying on higher mortgage rates. In fact, more wealth brings access to lower mortgage rates or other alternative financing. With the wealth gap widening, higher-end niche markets like The Hamptons seem better positioned for more transactions relative to their market size.

The Actual Final Thought – Sometimes two stories don’t compare (NSFW).

Did you miss the previous Housing Notes?

April 23, 2025

The Plural Of Anecdotal Is Not Data – The Tariff Tantrum Impact Creates Housing Chaos

Image: Gemini

Housing Notes Reads

- Long Island home prices rose to record high of $705,000 in the first quarter [Newsday]

- Hamptons luxury market soars in the first quarter [The Real Deal]

- What to Know About Broker Fees in New York City [New York Times]

- Why Florida’s Condo Owners Are So Desperate to Sell [Wall Street Journal]

Market Reports

- Elliman Report: Hamptons Sales 1Q 2025 [Miller Samuel]

- Elliman Report: North Fork Sales 1Q 2025 [Miller Samuel]

- Elliman Report: Long Island Sales 1Q 2025 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)