- US Monthly Signed Contract Increased Year Over Year

- The Midwest, Savaged By The Polar Vortex In January, Fought Back In February

- NAR Seems To Have A Supercharged Spellchecker

Although still weak, more contracts were signed in February than the month before after adjusting for seasonality. In the NAR Pending Home Sales press release, it said “Pending home sales in February augmented 2.0%.” This verbiage suggests that their spellchecker replaced the word “rose” with something less clear, and somebody didn’t catch it during editing. I had to look up the term “augmented” to confirm what meant in this usage.

Or it’s diabolical NAR messaging – market participants aren’t clear about the direction of the market with all the tariff talk coming out of DC every day. Perhaps messaging was meant to be foggy. Ha. Contracts rose month over month, not year over year. I give a lot more weight to year-over-year trends because they remove seasonality, and sales remain short of prior year levels.

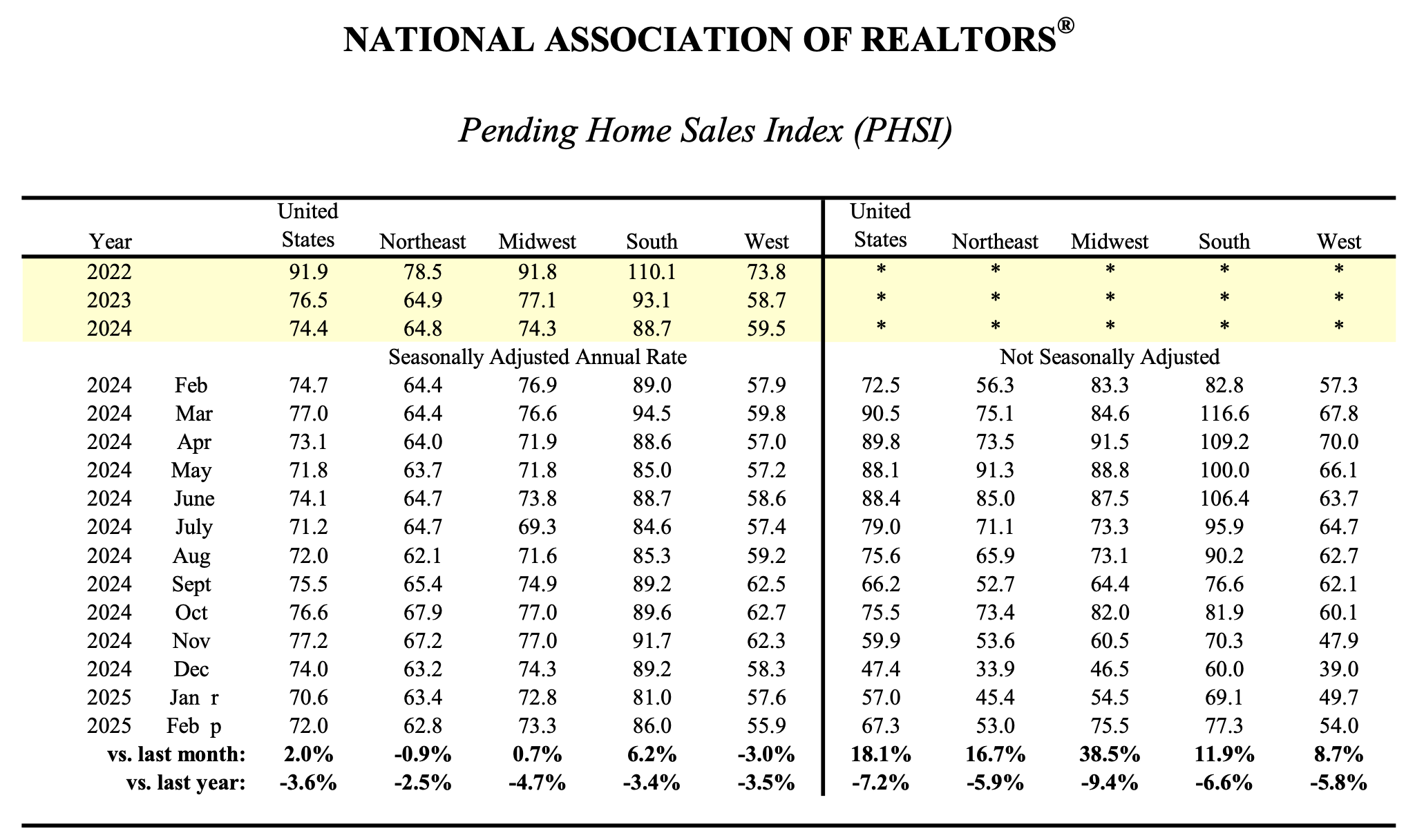

In these monthly PHSI reports, my eyes tend to focus on the right side of the table at the non seasonally adjusted numbers. The US pending home sales still fell 7.2% year over year and the month over month sales surge of 18.1% from January to February was actually below the long term 24% typical January to February bump. The uncertainty of government policy still weighs heavy on housing market participants.

Whining About The Weather

I hate being the person who blames the weather for the sales slowdown since “winter happens every year,” but a polar vortex is an extreme weather event. A polar vortex hit the Midwest hard in January It likely curtailed a lot of home showings during the month, driving contracts lower for January but causing an unusual month-over-month Midwest surge in February of 38.5%, well above the 12% average over the past couple of decades.

Back in 2014, NYC experienced a polar vortex, and our appraisal company experienced a sharp drop in business – and not just home purchases – everything. I remember media prognosticators suggesting that the spring market wasn’t going to happen. I had to point out quite often that homebuyers don’t make decisions like: “It’s just too cold to buy a home, lets wait five years.” No. Buyers delay their activities for a month or two as the extreme weather fades. Sales normalized in a few months.

NAR Forecasts If You Buy Them

In the PHSI release, NAR prognosticated on the outlook for 2025.

- Mortgage rates will average 6.4% for the year. When I read that prediction and considered that rates have been higher year to date, it suggests that rates could fall to the low 6% level. The rate could be lower than it is now in the back half of the year if tariffs damage the economy. The odds of a recession have been rising, but still only 35%.

- New Home Sales will be 10% higher in 2025 because there is plenty of supply. That sounds reasonable if mortgage rates inch lower, and we don’t experience a recession.

- Existing Home Sales will rise 6% in 2025 and 11% in 2026. I think that’s dependent on the points I raised above.

- National median home price will rise by 3% in 2025 and 4% in 2026 despite the increase in listing inventory in many markets.

Using Perplexity.AI, here are the odds of a recession:

- JPMorgan’s chief economist Bruce Kasman estimates a 40% recession risk, up from 30% at the start of the year.

- Deutsche Bank’s survey of 400 participants puts the chance of economic contraction over the next year at approximately 43%.

- The US Recession Probability indicator by Estrella and Mishkin stands at 23.18% as of January 2026, higher than the long-term average of 15.10%.

- Polymarket data shows the chance of a US recession in 2025 surged to 32%, up from 23% in late February.

- BCA Research’s strategist Peter Berezin sees a 75% chance of a recession within the next three months.

A recession means lower mortgage rates but a lot of job loss.

Final Thoughts

Although we shouldn’t think about housing as a national market, reports are pushed out every month and read by market participants, forming expectations. Sales remained challenged as consumer confidence wanes, but pent-up demand should drive more sales if mortgage rates drift lower. Tariffs should damage the economy (they already have, hence rising layoff numbers), so it is a matter of degree. Mortgage rates may continue their current downward drift and gradually stimulate more sales if buyers still have their jobs.

The Actual Final Thought – This somehow seems appropriate.

Did you miss the previous Housing Notes?

Housing Notes Reads

- Wall Street bonus pool hit record $47.5BN in 2024 [NY Post]

- Wall Street Bonus Pool Surges to a Record $47.5 Billion for 2024 [Bloomberg]

- DiNapoli: Wall Street Bonus Pool Reaches Record High of $47.5 Billion in 2024 [OSC.NY.GOV]

- GSE Reform Resurfaces: Challenges and Implications [JPMorgan]

- What happens to mortgage rates if conservatorship ends for Freddie Mac and Fannie Mae? [Fast Company]

Market Reports

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 2-2025 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 2-2025 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 2-2025 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)