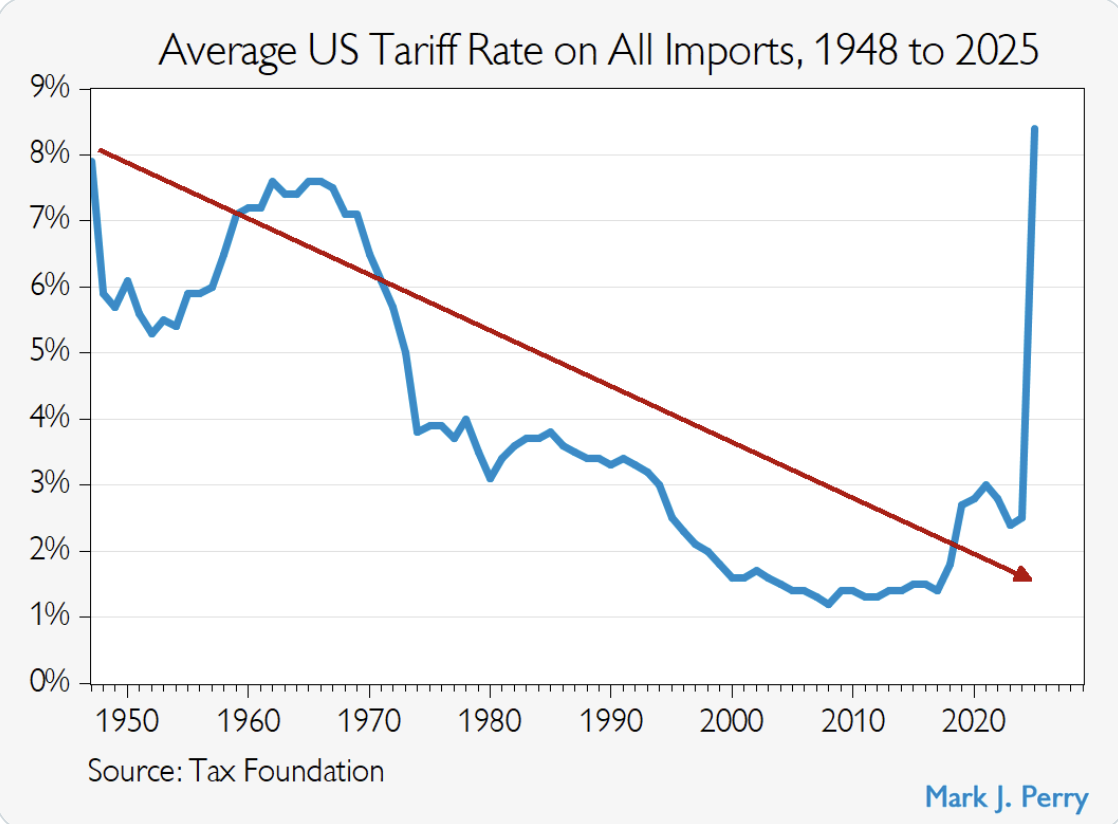

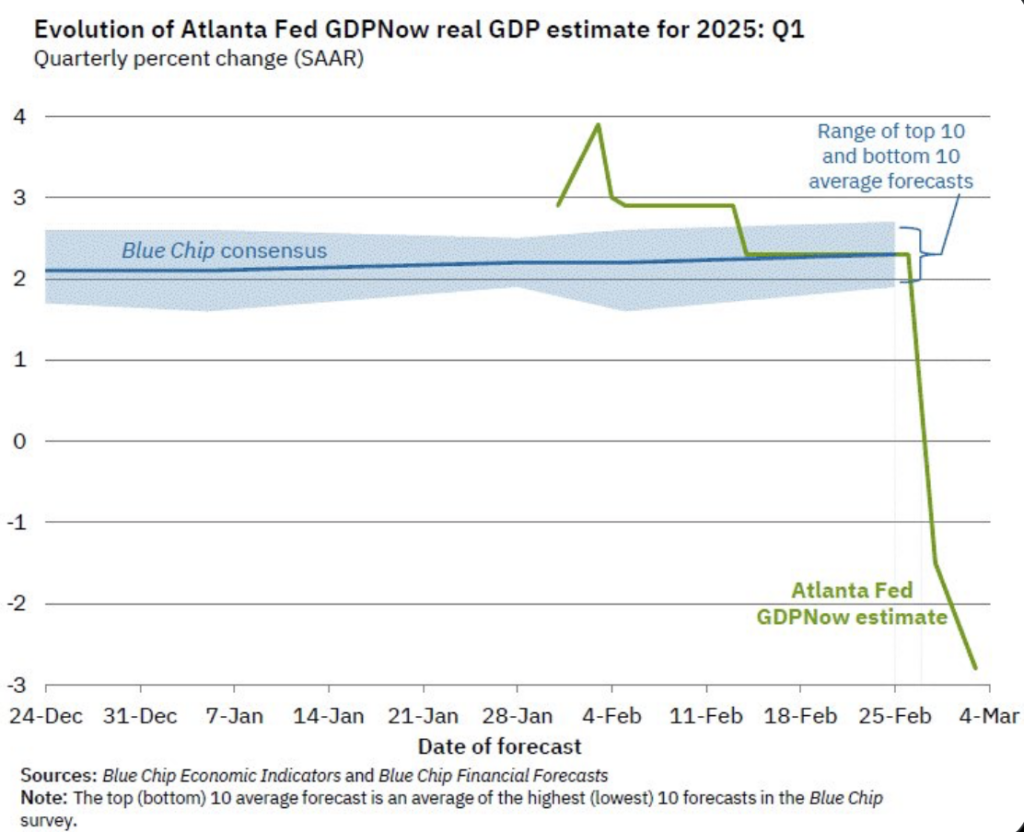

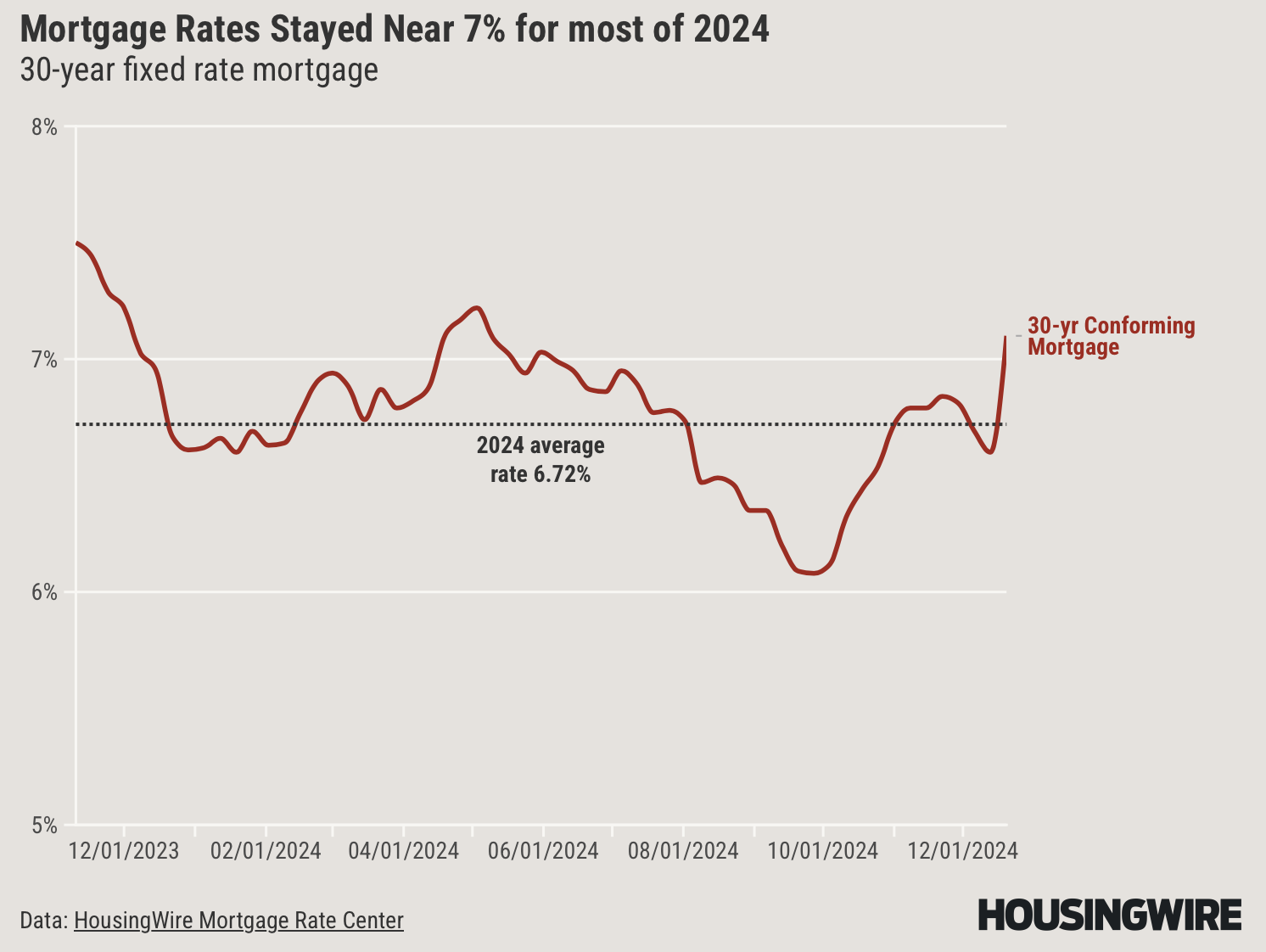

Fannie Mae’s Institutional Arrogance Earned Them A Leadership Purge The GSEs Are Up For Sale To Fund The Big Beautiful Bill The Time Of The Tariff Chaos Is Not The Time To Privatize The GSEs Fannie Mae, the dominant of the two governmentsponsored entities (GSEs), has long permitted a reckless culture that was maintained after going into receivership. They’ve seen some significant lapses of...

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)