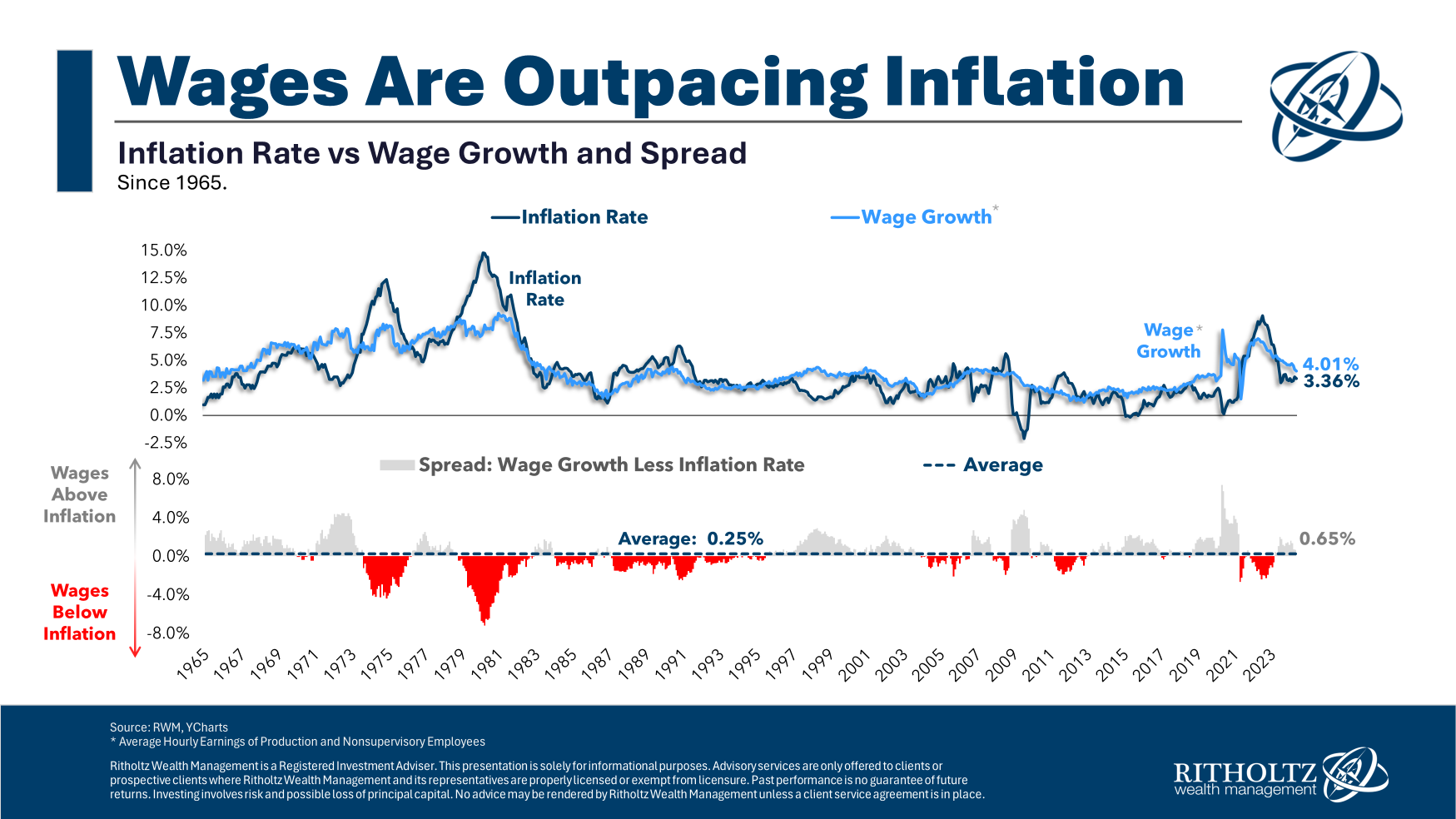

Wages have been deflationary since the 60s but have been inflationary since the pandemic. I prefer the latter for society (largely working and middle class) as well as the health of the overall housing market once mortgage rates normalize and we stop seeing a massive distortion in economic metrics. For example, I thought this was supposed to be the spring housing market where contract volume soars until the July 4th Holiday – yet contracts are down. It’s hard to imagine just how high the intensity of home sales activity will be when we finally see the first Fed rate cut, even if it’s only 25 basis points.

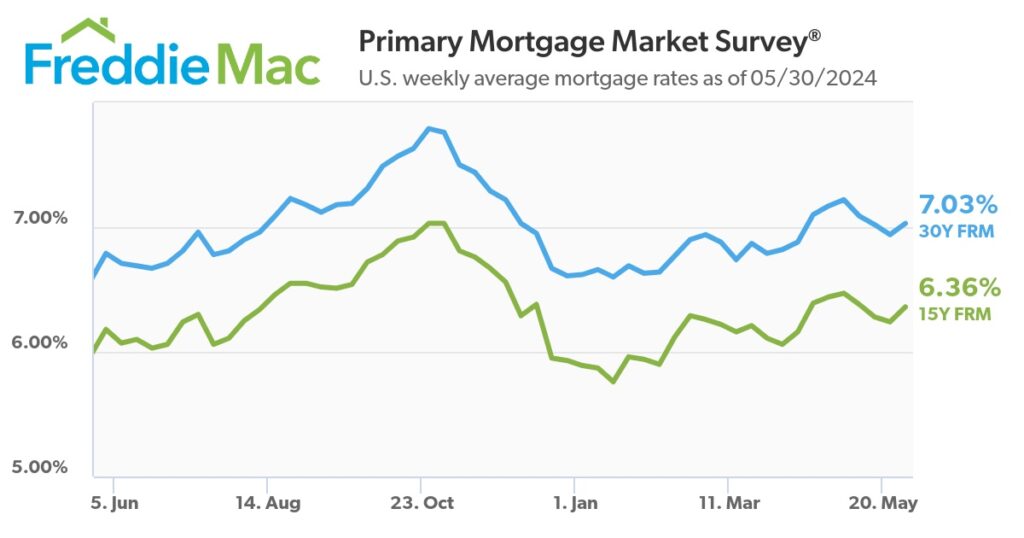

Understanding the fat percentage of milk is like understanding mortgage percentages. We’ve been living on skim for the past few years but now we are stuck with whole. Here’s the math.

Did you miss yesterday’s Housing Notes?

This Is A Whole New Thing – Housing Notes Daily

Well, I’ve been writing this Housing Notes newsletter since March 2015 (more than 9 years as a weekly exercise) and at last count were about 482 weekly iterations, evolving into a Friday 2 pm ET launch date no matter where I was in the world, whether or not I was on vacation, and what was going on in my personal life. It was such a consistent routine that many subscribers told me it marked the beginning of their weekend. As an aside, I’m also running a 50% rate of confusing my callers, thinking I am an answering machine voice recording when I pick up the phone. Welcome to the machine. But what is going to be so new about Housing Notes?

The content will largely remain the same but the delivery of it will be daily instead of weekly. Starting immediately, Housing Notes will be released 5 weekdays each week at that same 2 pm Eastern time moment. Each note will be shorter but probably more timely. My sidebar passion project Appraiserville is being moved to the Beehiiv platform soon and I plan on releasing it weekly while linking from here temporarily. More on that soon.

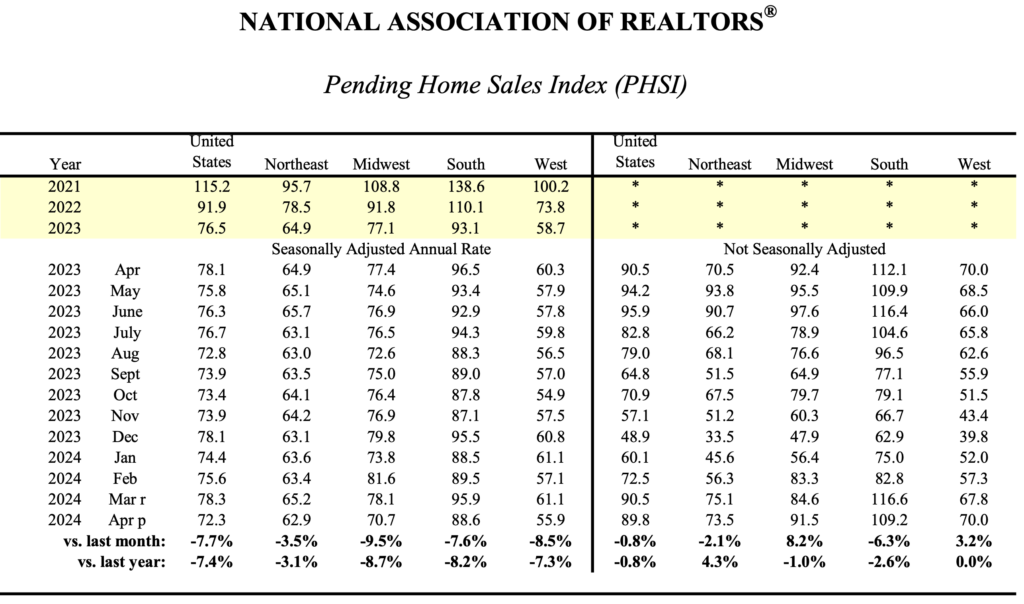

Pending Home Sales Fall YOY Despite The Fact We’re In The Spring Market

Homes under contract are down nationally by a little over 7% both month over month and year over year if it’s seasonally adjusted and only down 0.8% if we don’t seasonally adjust and just look at the hard numbers. I’m anti-seasonal adjustment on principal and this is a good time to pull this card out. Still, contract signings are below year-ago levels.

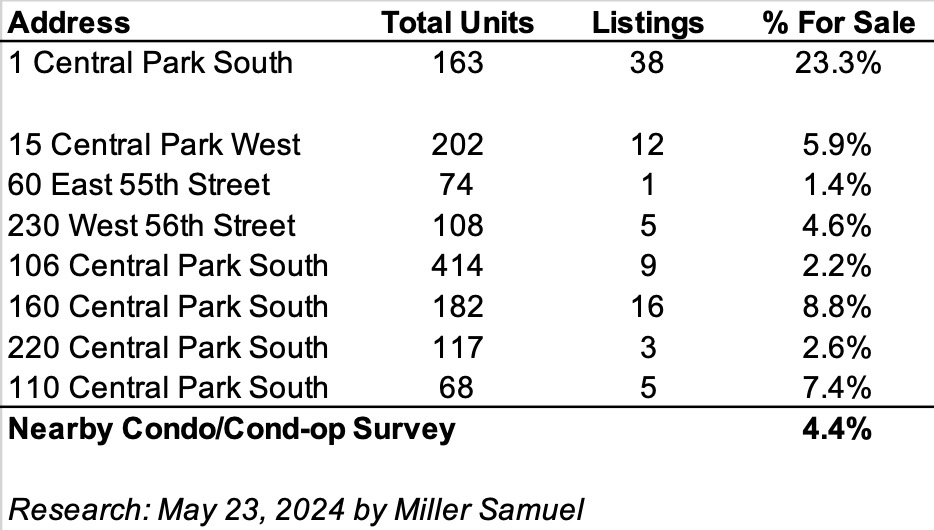

Manhattan’s Famed Plaza Condo Is Showing Greater Weakness Than The Market (here’s how)

The New York Post asked me to look at the Plaza after reports of an unusual amount of listings there. Here’s what I found.

I looked at a sample of luxury condos and cond-ops in the immediate area to observe what their ratio of listings to total units was. In our experience, the turnover rate (% for sale) at any given time for a Manhattan condo, cond-op, or co-op building, already sold out, is usually 5% to 7%, perhaps as high as 10% before I start getting concerned.

Since the percentage of listings for sale at the Plaza is 23.3%, well above nearby buildings’ average of 4.4%, it is a matter of concern. It may be nothing specifically, other than the characteristics of the building are currently less popular with current buyers or it could be something specific, not yet common knowledge. I am not aware of anything specific about this building that is prompting the surge of listings, but it does raise concerns at present.

With a glut of listings, and homes selling at a loss, NYC’s famed Plaza is losing its luster [NYPost]

BBG Appraisers Are Banned By Freddie Mac

Over the past decade, BBG, a Wall Street play for national appraisal services has been acquiring one or two major commercial firms in each major market for what seem to be incredibly high valuations. (I know there’s a joke in there somewhere.) One of the NYC commercial appraisal firms I knew first hand as a few of our commercial appraisers went there, was acquired by BBG but shortly afterward fired the founder and won a decision to get back the funds he reportedly took and the amount he reportedly he shorted from his staff on the splits. He got back on his horse again with a new firm. I brought this case up because it goes into detail on how much BBG initially bought out his firm for. I was shocked at the amount and compounded that for the reasons he was fired.

Before my long-time commercial appraisal partner retired in 2020, we looked into BBG. My partner was a great appraiser and a nice guy but was beyond miserable, stuck in the past, and probably should have retired five years earlier – he hated the industry, cut off ties with his industry colleagues, let his MAI designation go, and simply disappeared, forging a new life of travel in retirement. A BBG deal would have required him to work for 5 more years which was a non-starter so we decided to close the firm and fold the commercial services into our main firm.

I share this background for context before you read The Real Deal’s blockbuster piece last week: Freddie Mac places appraiser BBG under review

BBG is the first appraiser to come under scrutiny as the investigation widens. BBG is considered to be one of the “Big Five” national commercial real estate valuation firms and has 4,500 clients and 50 offices, according to its website.

The Real Deal

Sharing feedback from my own experiences and industry feedback on their acquisitions their aftermath seems bleak. The remaining staff essentially becomes part of a sweatshop, with junior appraisers having to crank out high volume to justify the big premium BBG paid to the original owners of the firm. The staff can make low six-figure incomes but it comes with 24/7 treadmill-like conditions. The article indicated the banned group was from Dallas.

This kind of high-volume culture tends to overwhelm quality/ethics efforts and essentially fosters the potential for bad behavior. For this BBG entity from Dallas to be blacklisted by a GSE like Freddie Mac is a big deal.

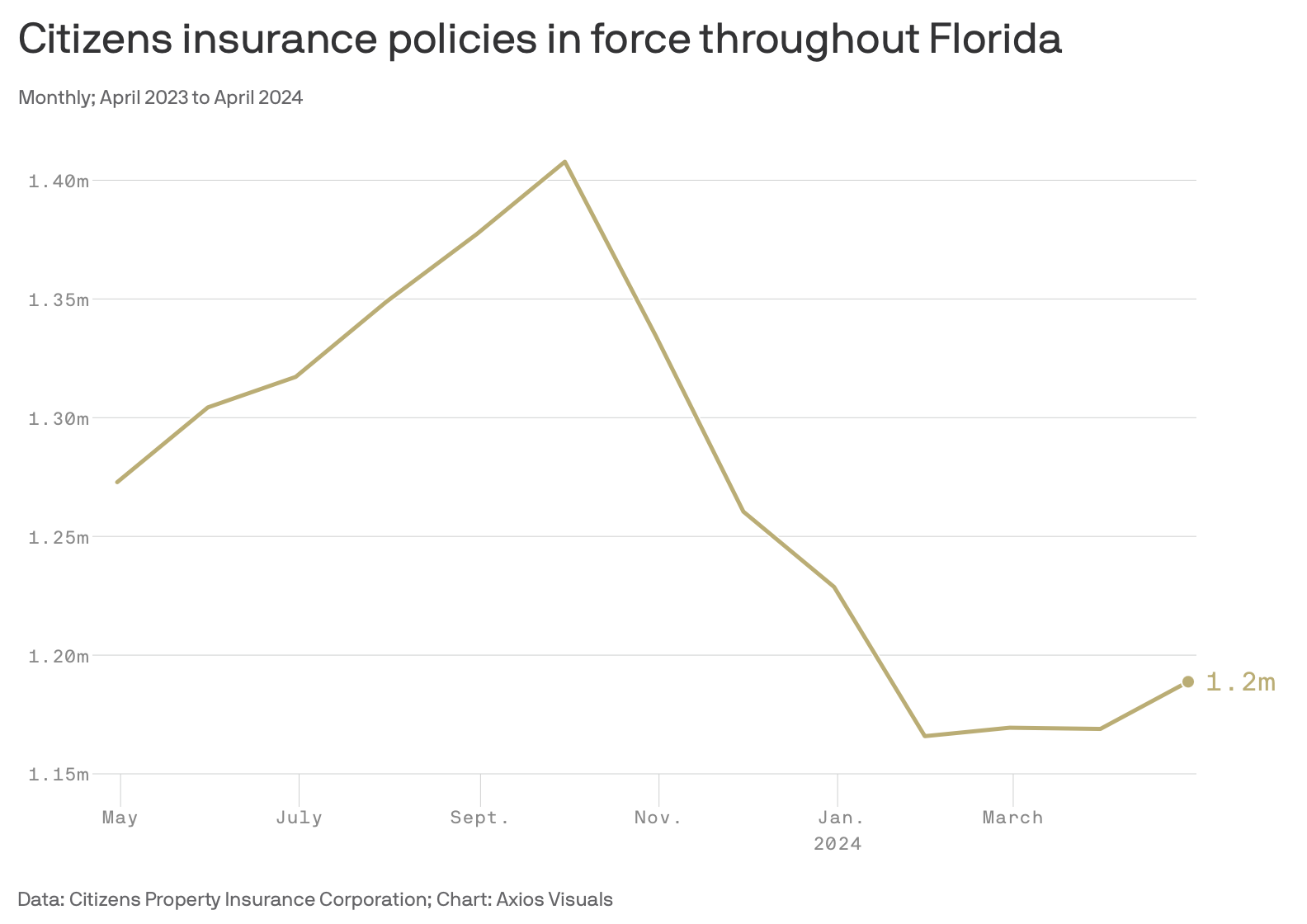

Florida Insurance Regulator Says The Flood Insurance Availability Is Just Fine

In Florida, the situation is improving but premiums remain the highest in the country – the reason? Extensive litigation.

Florida’s insurance market “more stable” ahead of 2024 hurricane season, experts say [AXIOS]

Getting Graphic

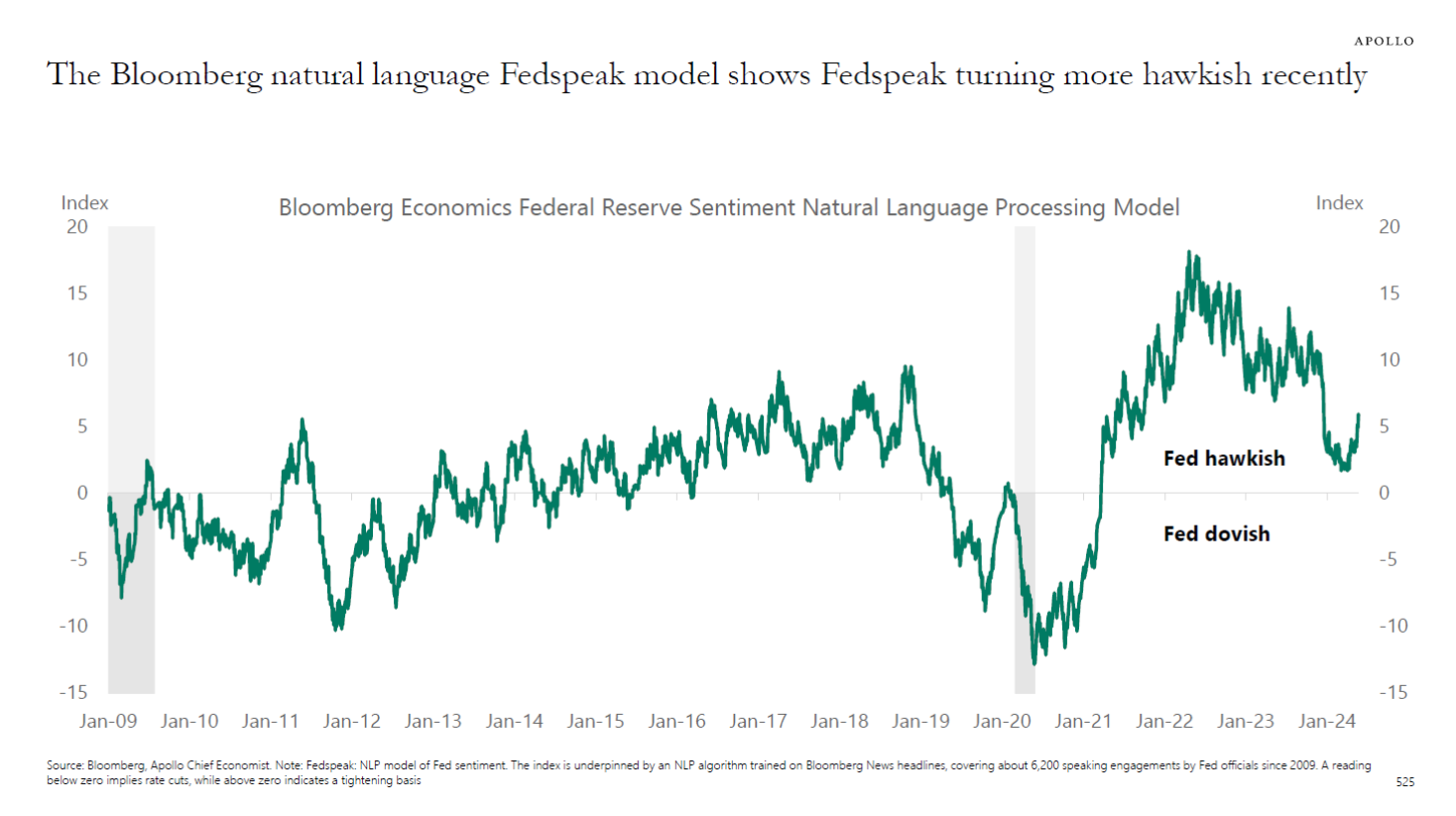

Apollo’s Torsten Slok‘s amazingly clear charts

OFT (One Final Thought)

This is clearly unfair to real estate agents, but still…

Brilliant Idea #1

If you need something rock solid in your life – particularly at 2:00 PM, Eastern Time (ET) every weekday – and someone forwarded this to you, you can sign up here for Housing Notes. And be sure to share with a friend or colleague if you enjoy them because:

– They’ll drink whole milk;

– You’ll drink skim;

– And I’ll drink 2%.

Brilliant Idea #2

You’re clearly full of insights and ideas as a reader of Housing Notes. Consider sharing them with me early and often. I appreciate every email I receive, as it helps me craft future Housing Notes.

See you next week!

Jonathan J. Miller, CRE®, Member of RAC

President/CEO

Miller Samuel Inc.

Real Estate Appraisers & Consultants

Matrix Blog @jonathanmiller

Reads, Listens and Visuals I Enjoyed

- Related Sells 321 West 44th Street at $103M Loss [Commercial Observer]

- Exclusive | Buyers Battle Over Sean Hannity’s Long Island Home, Which Sells for Roughly $12.7 Million Cash [Wall Street Journal]

- How Much Is Mar-a-Lago Actually Worth? It’s a Billion-Dollar Question. [Wall Street Journal]

- How Much Is Mar-a-Lago Actually Worth? It’s a Billion-Dollar Question. [Mansion Global]

- Homebuilders are still buying down rates to move houses [HousingWire]

- High-end condos, co-ops bright spots for Manhattan in May [Inman]

- After backlash, Bing is removing MLS listings [Real Estate News]

- Homes for Sale Are Piling Up, Just Not Where the Buyers Are [Bloomberg]

- 😮 Foreclosure, Fines and Forklifts [Highest & Best]

- National Housing Survey [Fannie Mae]

- ECB Sends Message of Confidence on D-Day Anniversary: Finel-Honigman [Kathleen Hays CBC]

- Manhattan Resi Market Stays Flat [The Real Deal]

- Manhattan’s $5 Million-Plus Condos Outperformed an Otherwise Sluggish Real Estate Market in May [Mansion Global]

- Asking Rents Mostly Unchanged Year-over-year [Calculated Risk]

- Vague Threats That Make No Sense [Notorious Rob]

- Hamptons Resi Market Perks Up [The Real Deal]

- Mortgage Rates [FreddieMac]

- Hiring blows past expectations, showing lingering labor market heat [Axios]

- I'm Overspending on Rent in New York. Should I Stop? [Bloomberg]

My New Content, Research and Mentions

- ‘Toxic’ lawsuit tanks sale prices at NYC ‘Billionaires’ Row’ luxury tower: report [NY Post]

- A Mega-Lawsuit, a Rush of Listings and Price Cuts Galore: What’s Going on at 432 Park? [MSN Money]

- Exclusive | A Mega-Lawsuit, a Rush of Listings and Price Cuts Galore: What’s Going on at 432 Park? [Wall Street Journal]

- Luxury Murray Hill apartment building sells for $68M [Crain's New York]

- Drew Barrymore Quickly Finds Buyer for Hamptons Farmhouse [The Real Deal]

- With a glut of listings, and homes selling at a loss, NYC’s famed Plaza is losing its luster [NY Post]

Recently Published Elliman Market Reports

- Elliman Report: Florida New Signed Contracts 5-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 5-2024 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 4-2024 [Miller Samuel]

- Elliman Report: California New Signed Contracts 4-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 4-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 4-2024 [Miller Samuel]

- Elliman Report: Manalapan, Hypoluxo Island & Ocean Ridge Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Lee County Sales 1Q 2024 [Miller Samuel]

- Elliman Report: San Diego County Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Orange County Sales 1Q 2024 [Miller Samuel]

Appraisal Related Reads

- HOA fees are standing out in a bad way [Sacramento Appraisal Blog]

- FHA Announces New Guidelines Allowing Borrowers to Challenge Appraisals [The National Law Review]

- An insurance crisis wasn’t on my bingo card [Sacramento Appraisal Blog]

- Freddie Mac Calls Halt on New Loans From Appraiser BBG [Commercial Observer]

- Fannie, Freddie's Offshore Gambit Imperils Privacy of Millions [Appraisers Blogs]

- The Appraiser's Guide to Evaluating Home Value Before You Buy [Birmingham Appraisal Blog]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)