Lots of big sports headlines this week covering the passing of Bill Walton, the retirement of the worst MLB umpire of the modern era, taking another sub to the Titanic (gulp), Negro League stats are finally being added to the MLB, A college is shutting down but its baseball team keeps winning, and college football recruits not being paid what they were promised. Yet we’re not seeing a spring housing market surge like we usually do.

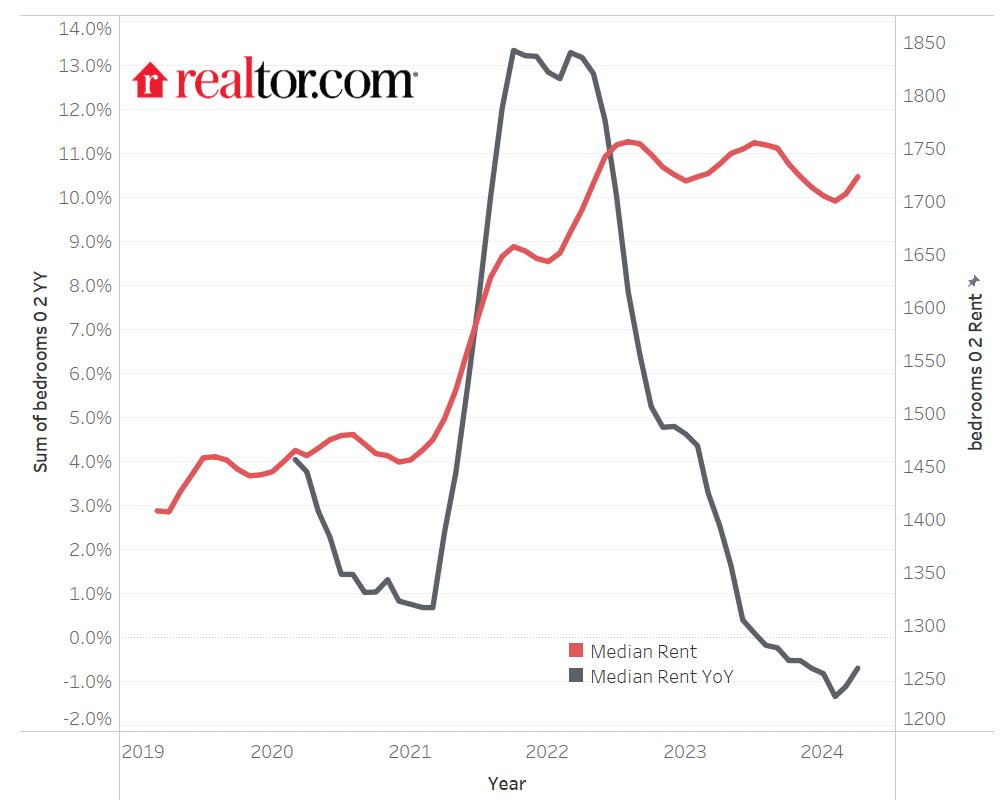

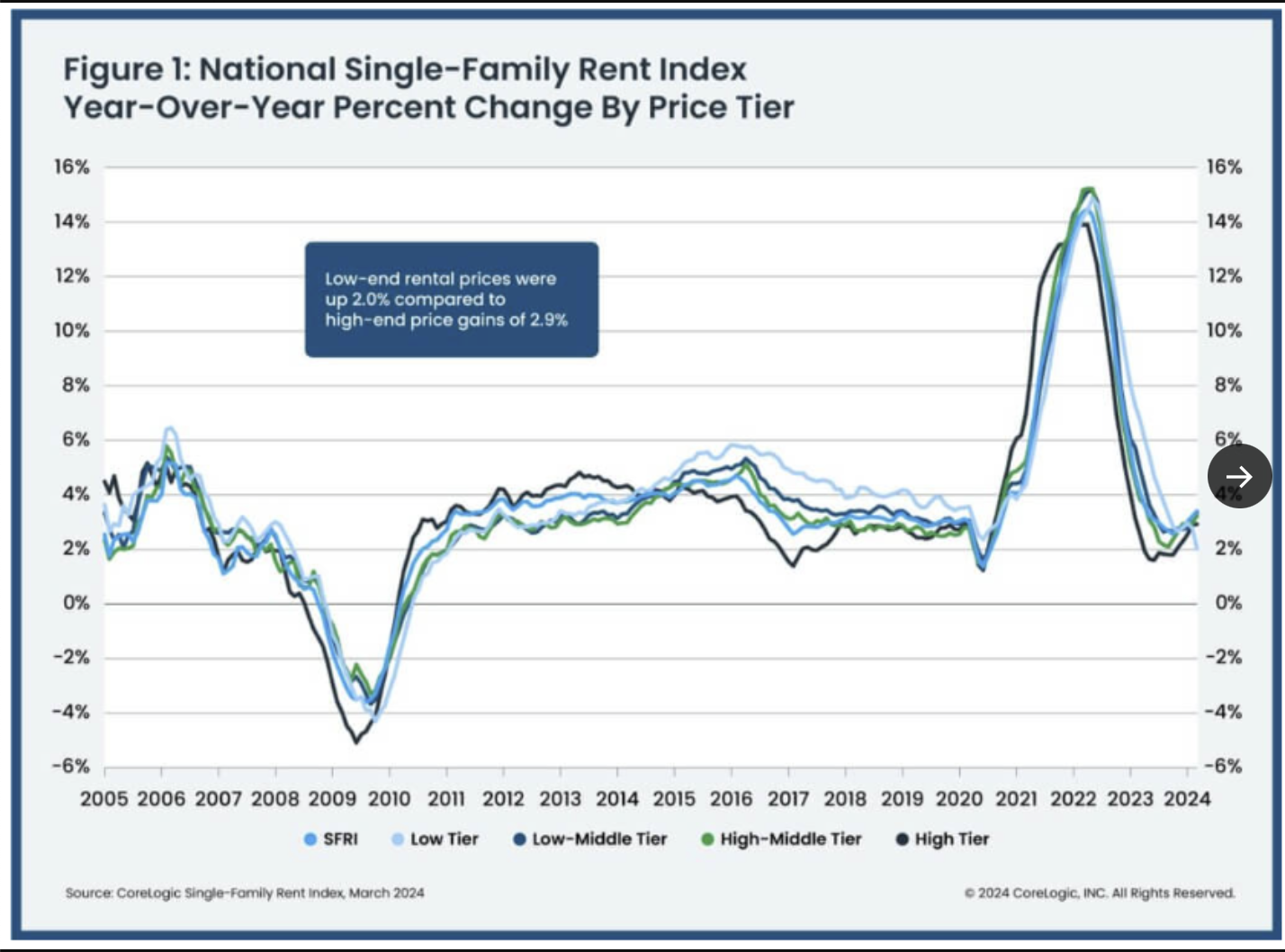

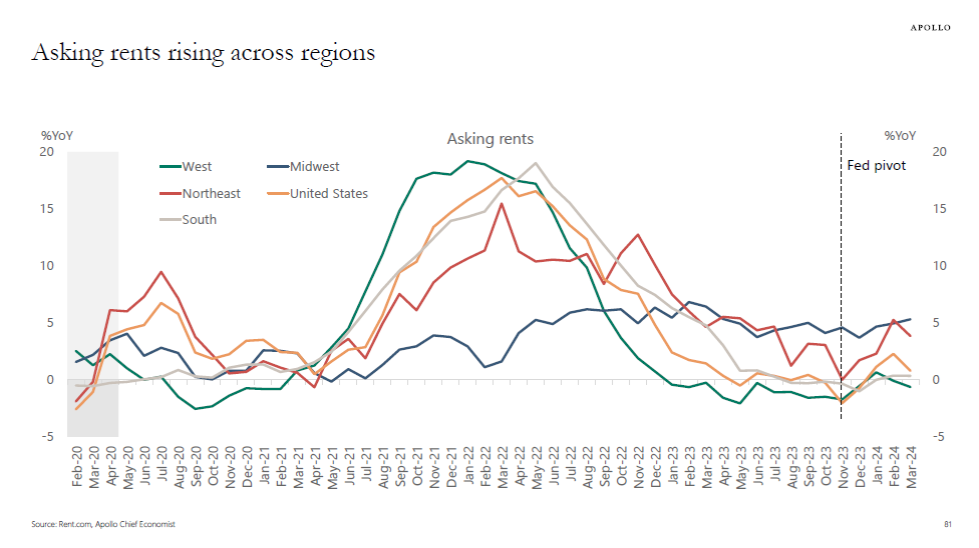

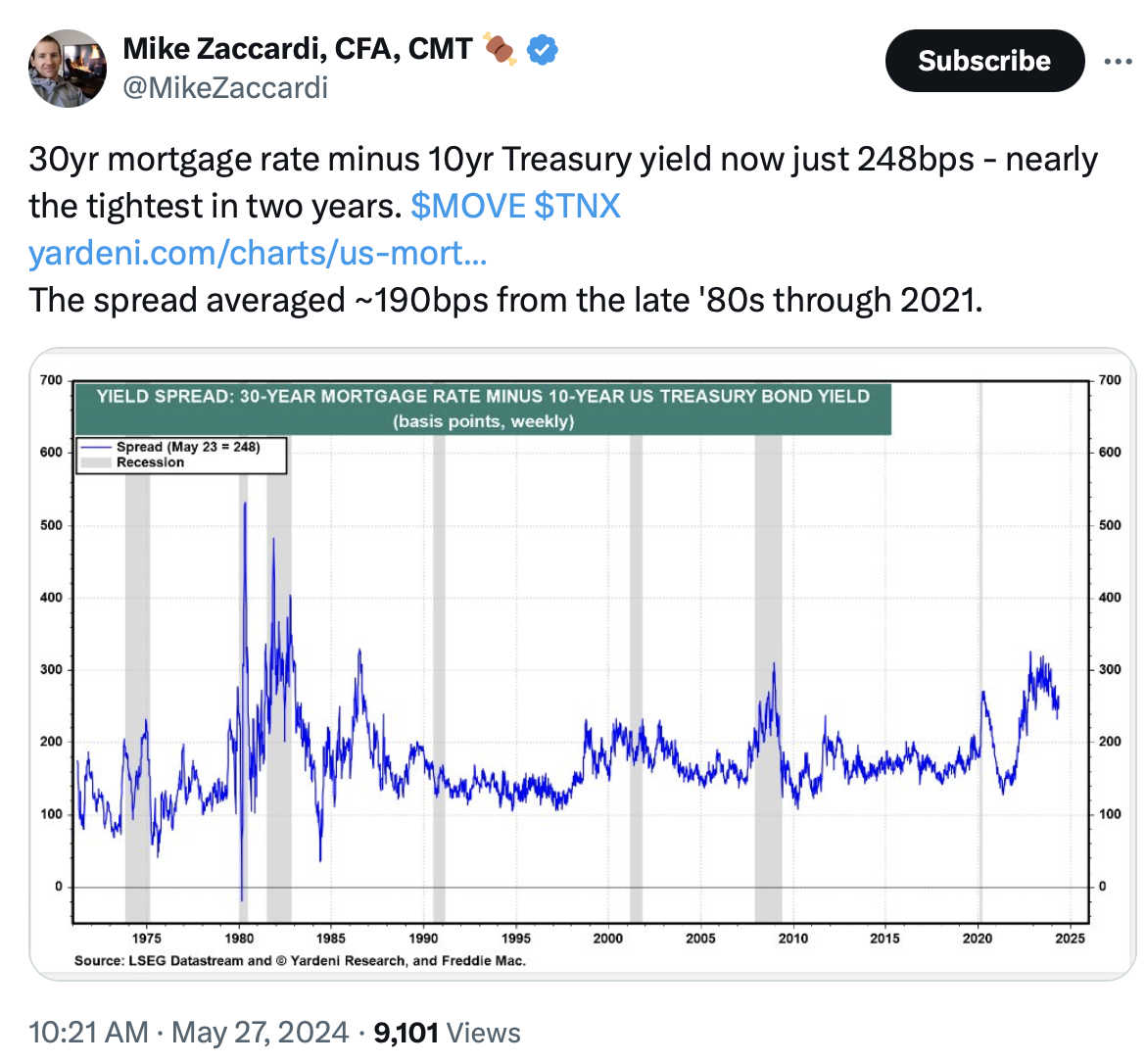

To top that, consumers don’t seem to believe the Federal Reserve these days and it is creating a paradox (explained further down), with mortgage rates stuck at an elevated level, rents are going to rise again. Realtor.com shows this in the following chart: “Rents Decline Again, but Nationwide Rent Is Just 1.9% Below 2022 Peak.”

Sadly, the NYTimes reached out to a get-rich guru who recommends renting as a long-term strategy (note to NYT – please don’t rely on get-rich gurus):

Though he’s a millionaire, Mr. Sethi has rented for the last 20 years in cities like San Francisco, New York and Los Angeles

New York Times

The narrative provided seems to infer that he got rich by not renting yet I suspect he got rich first. It’s not made clear in the piece. At the current moment, rents have softened but they are starting to rise as mortgage rates remain stuck in the low 7s. That’s going to challenge the rent-vs-buy comparison in the second half of this year, especially if there is a rate cut in September.

In my 40+ year career as an appraiser and 30+ year career as a market analyst, there is always a crop of “rent forever” stories that emerge when purchase affordability is significantly challenged. And then conditions often change. I’ve told this story before, but a close friend from college (’78-’82) once told me in the mid-1990s “Jonathan, I fear for my (3) kids. They’ll never own a home and I’ll never be able to sell mine.” Of course his three kids all own homes now and he sold his home and moved to Florida. Now think of what Professor Doom preached endlessly circa 2010 that it was the end of the financial world as we knew it.

It’s the red light theory. We never remember the green lights. I’m not arguing that purchasing is the best course of action for everyone – generally rent versus buy favors renters right now but that doesn’t mean it’s the right move for all individuals forever. Rents appear to be rising nationally and more rental homes are being built.

Here’s a very big green light as a great tribute to Bill Walton – and you don’t need to be a basketball fan to tear up – wait for it.

Did you miss our previous Housing Notes?

This Is A Whole New Thing – Housing Notes Daily

Well, I’ve been writing this Housing Notes newsletter since March 2015 (more than 9 years as a weekly exercise) and at last count were about 482 weekly iterations, evolving into a Friday 2 pm launch date no matter where I was in the world, whether or not I was on vacation, and what was going on in my personal life. It was such a consistent routine that many subscribers told me it marked the beginning of their weekend. I’m also running a 50% rate of confusing my callers, thinking I am an answering machine voice recording when I pick up the phone. Welcome to the machine. But what is going to be so new about Housing Notes?

The content will largely remain the same but shorter and the delivery of it will be daily instead of weekly. Starting immediately, Housing Notes will be released 5 weekdays each week at that same 2 pm Eastern time moment. Each note will be shorter but probably more timely. My sidebar passion project Appraiserville is being moved to the Beehiiv platform soon and I plan on releasing it weekly while linking from here temporarily. More on that soon.

But I digress…

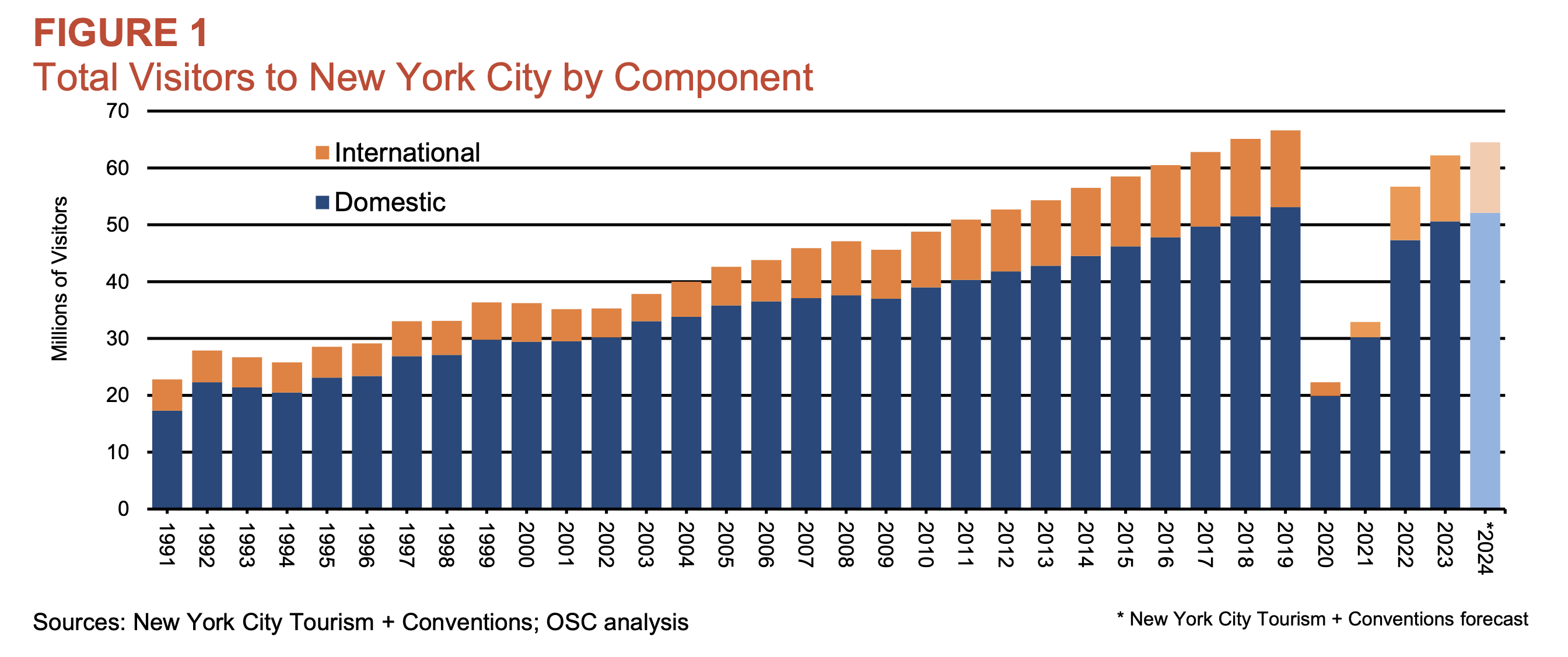

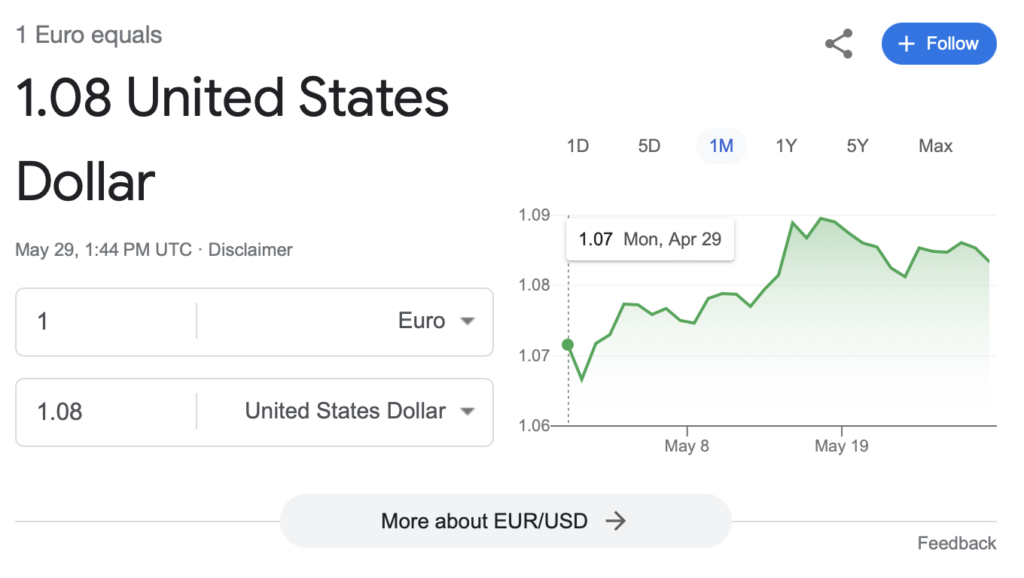

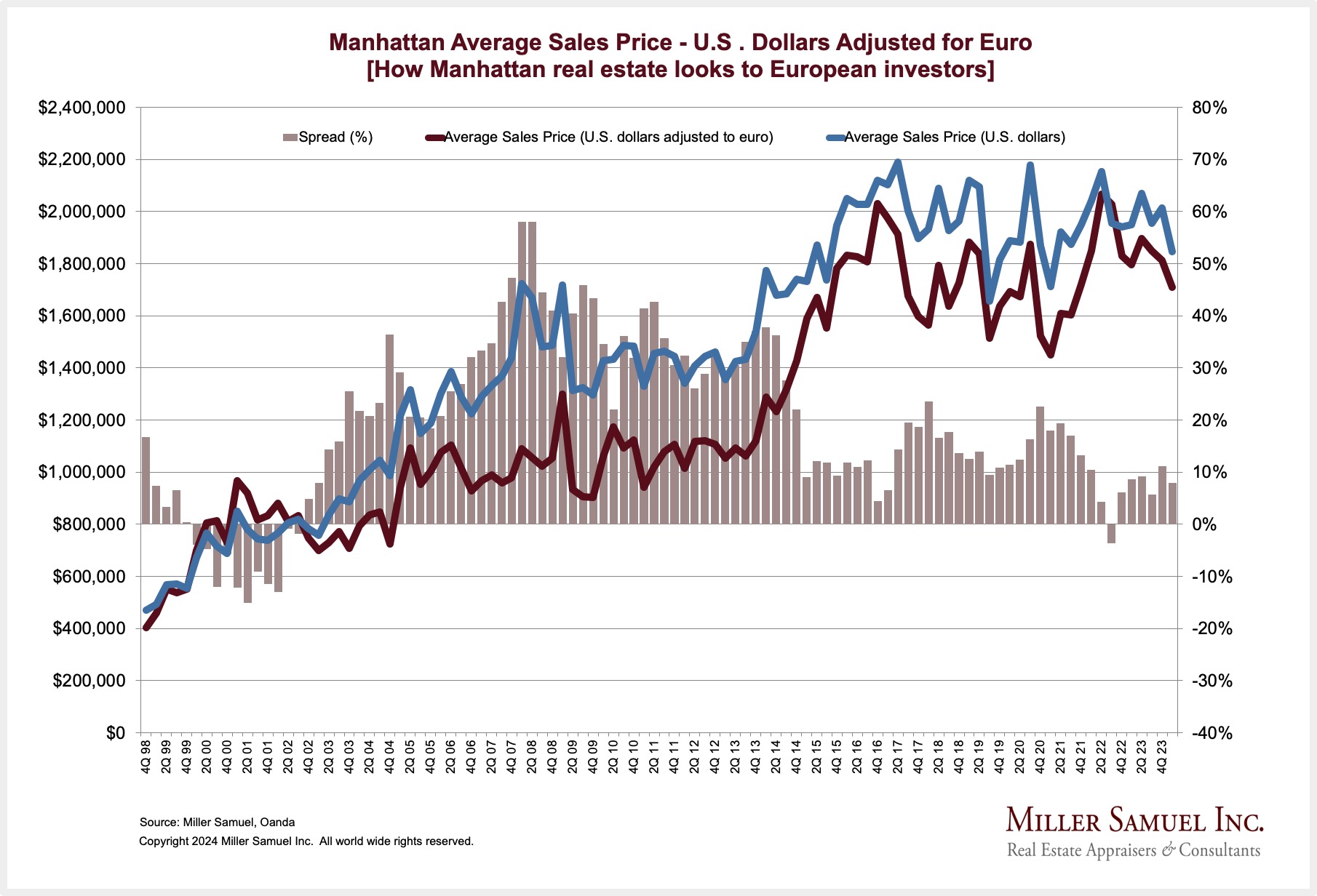

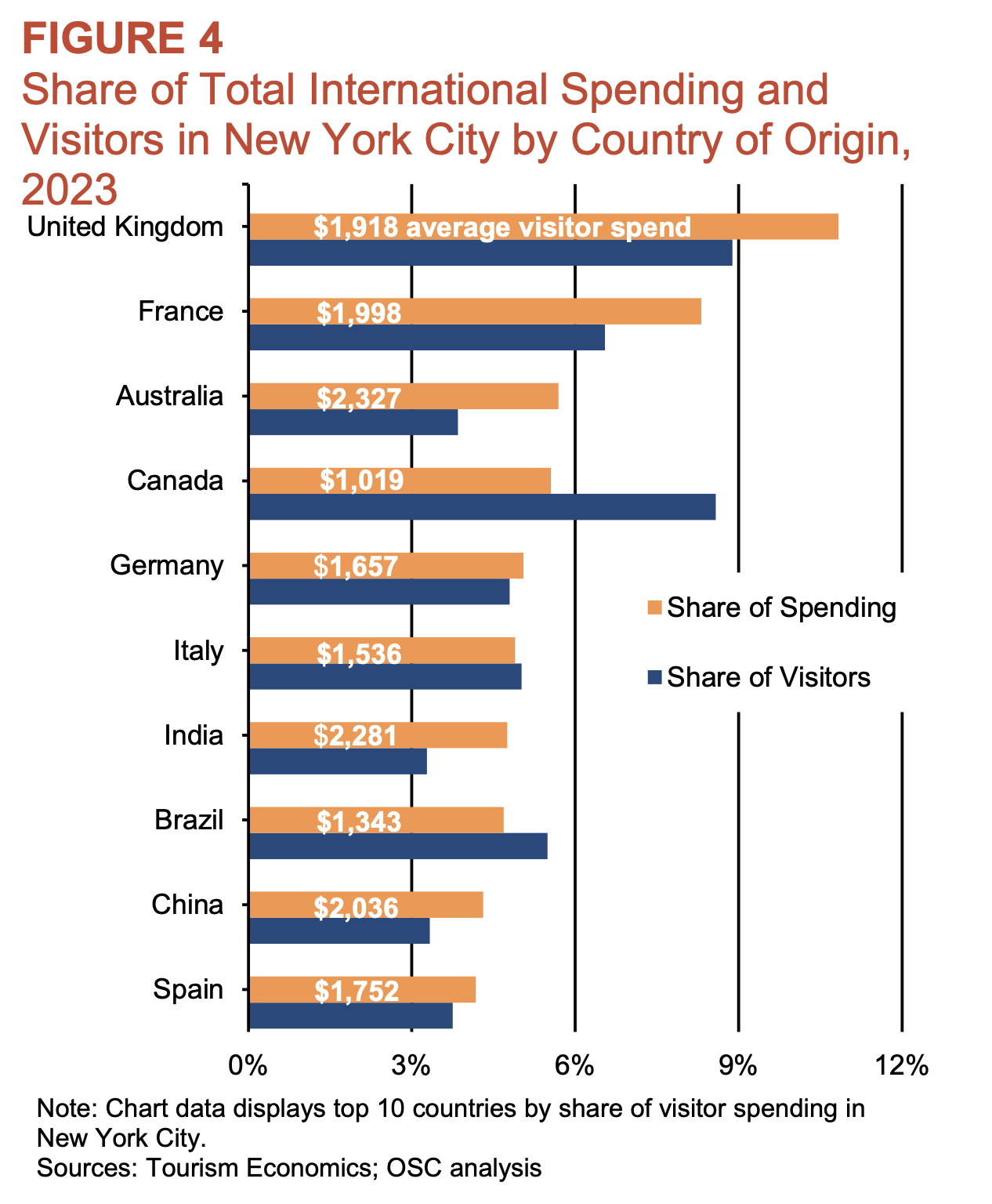

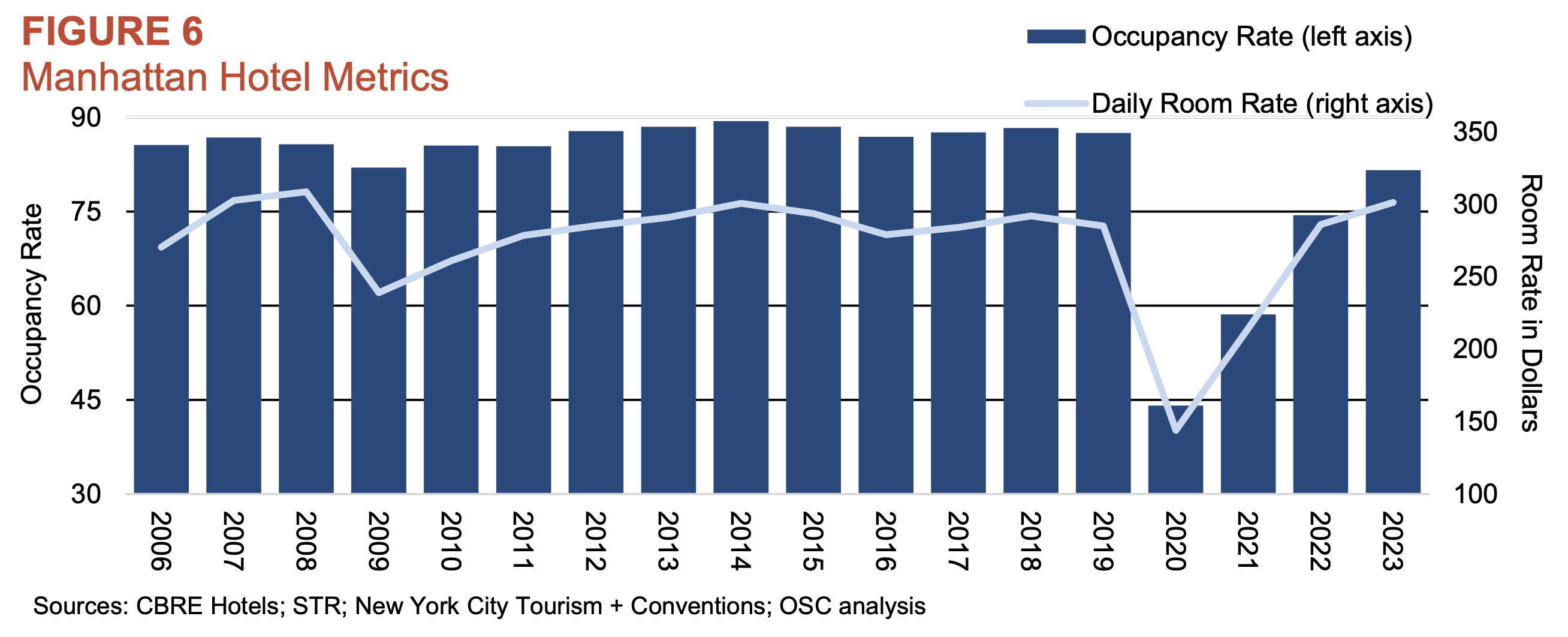

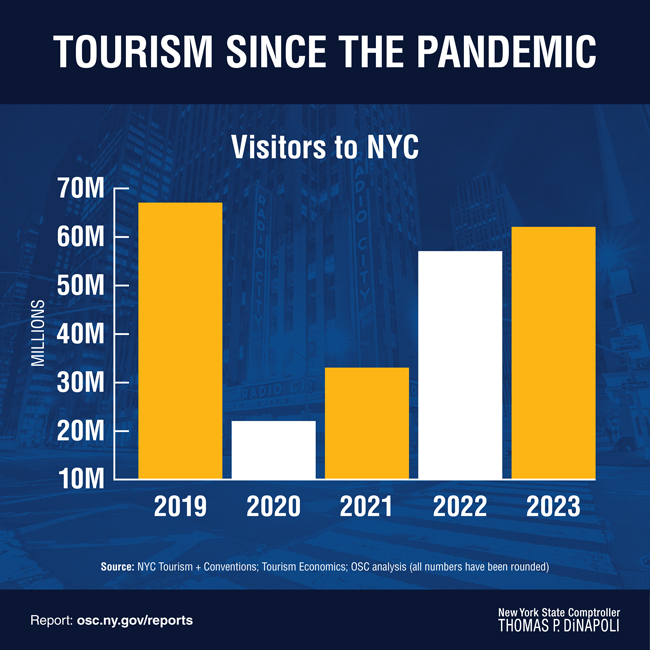

Manhattan Tourism Near Pre-Pandemic Levels As International Visits Continues To Rebound

Despite the strong USD, international tourism is rebounding significantly which seems counter to the NYC is dead narrative. About a decade ago I equated the tourism country of origin with the source of international real estate demand. It’s tough to make the same argument today with these currencies nearly on par – a currency play from the EU investor perspective doesn’t exist as it did 10-15 years ago at around 1.50, and tourism from China is now relegated to a low position as a source. But it does make me wonder about Europe and Australia and pent-up demand.

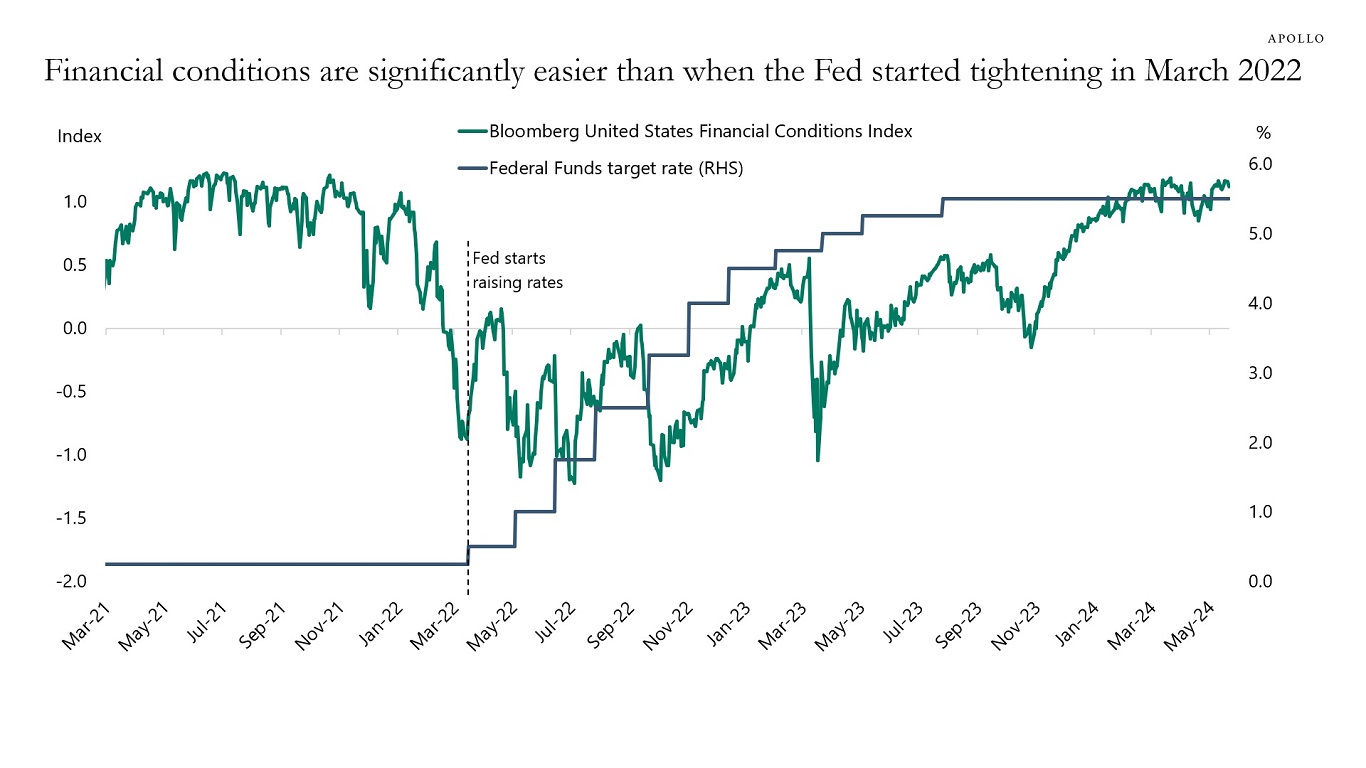

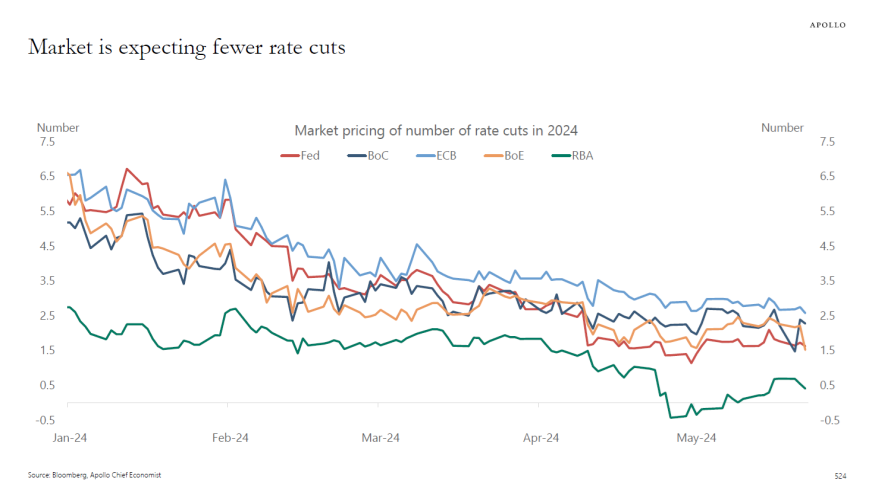

Self-Fulfilling Fed Prophecy/Paradox On Rates

The more the Fed talks about their next move as a cut, the harder it becomes to cut – Apollo. Everyone is now expecting fewer cuts.

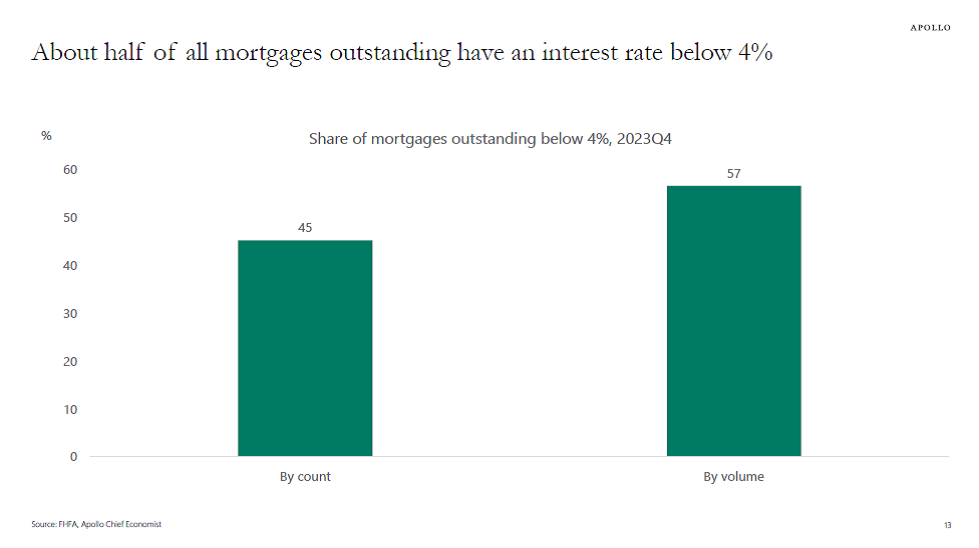

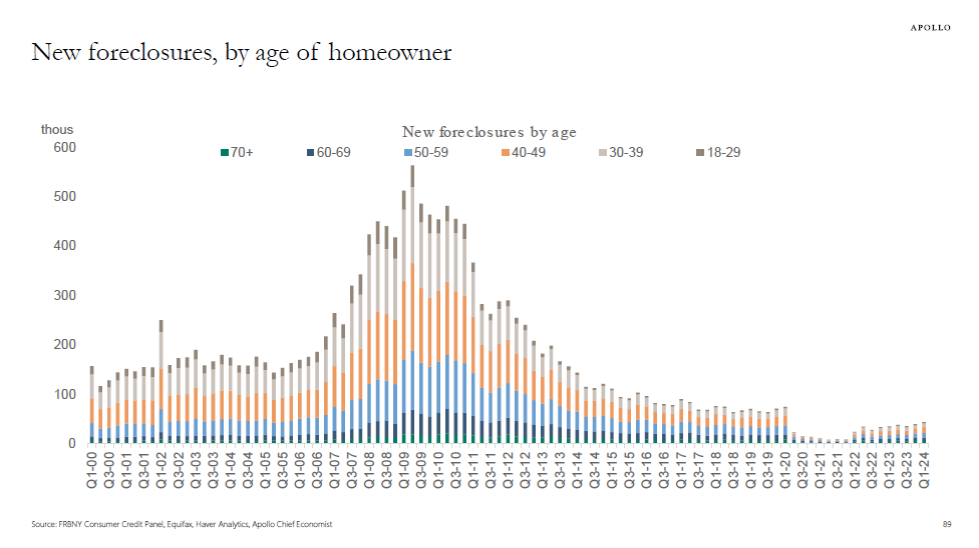

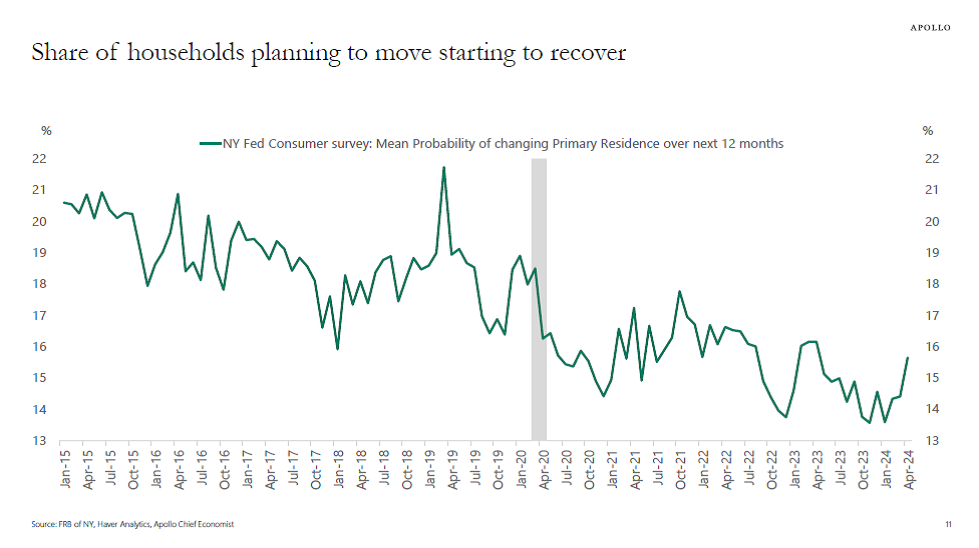

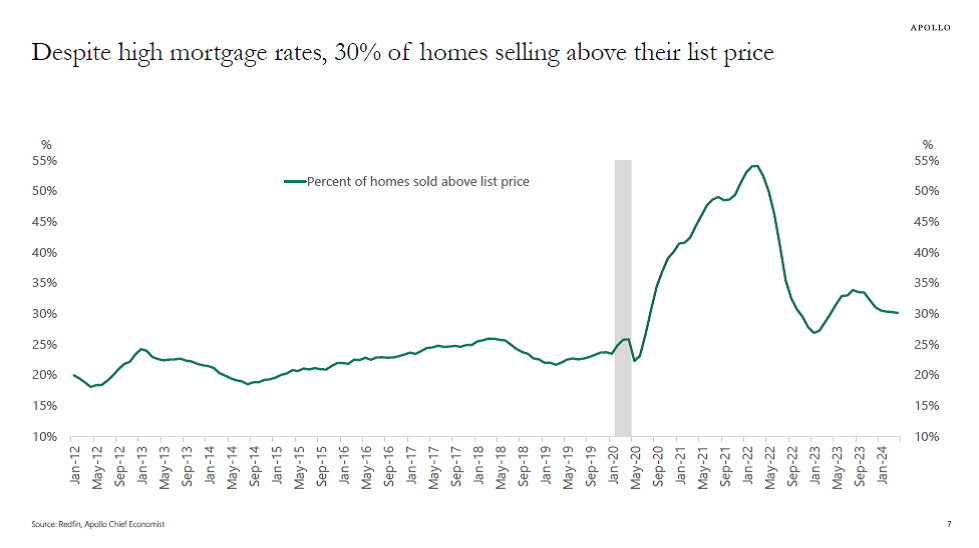

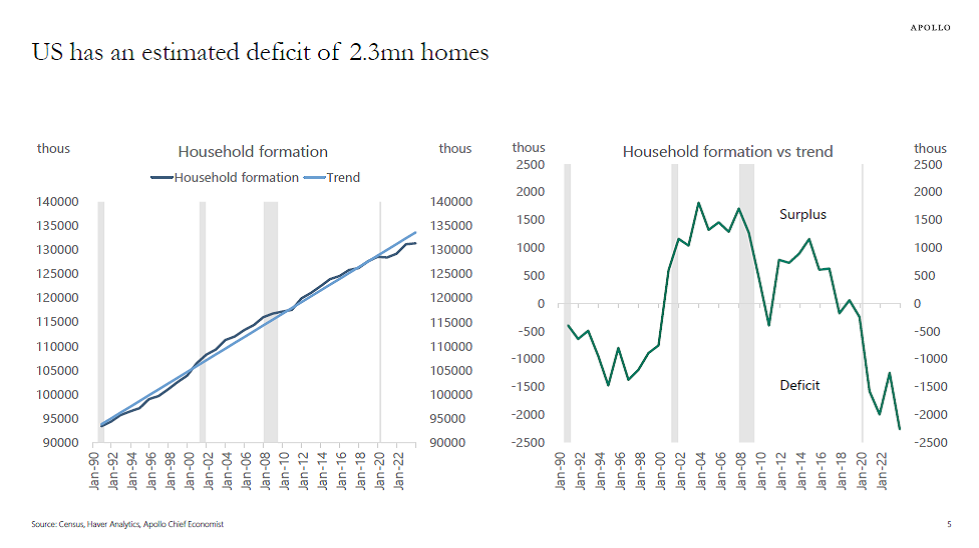

Let’s Break Out Supply And Demand With Apollo

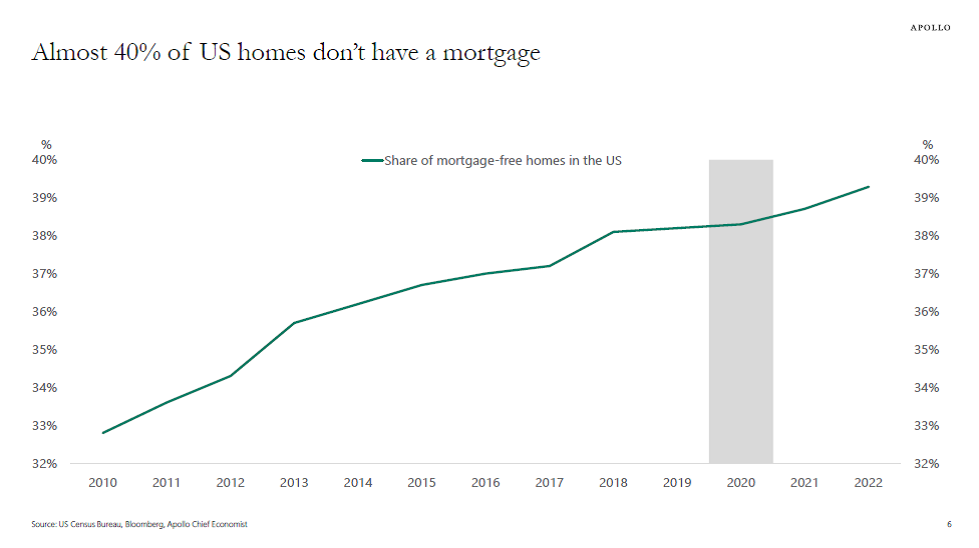

Demand

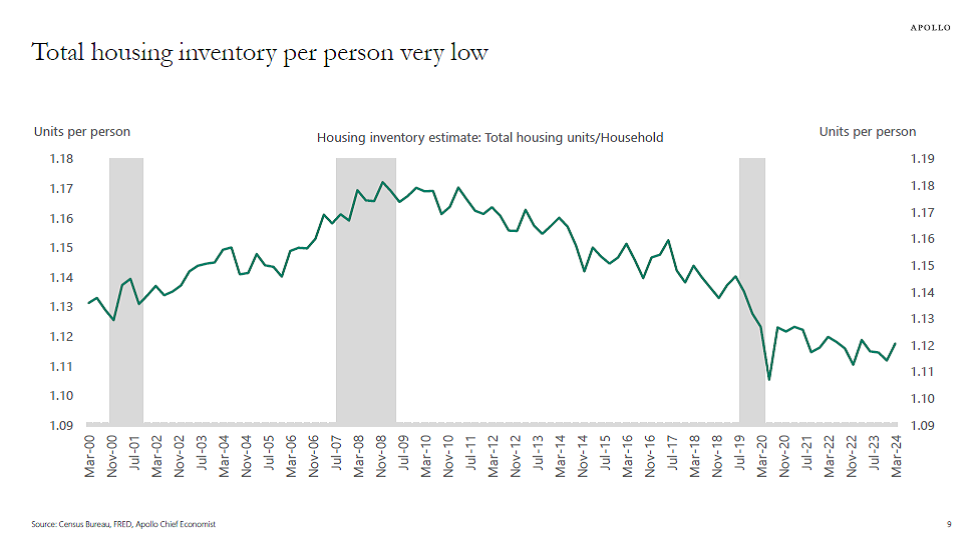

Supply

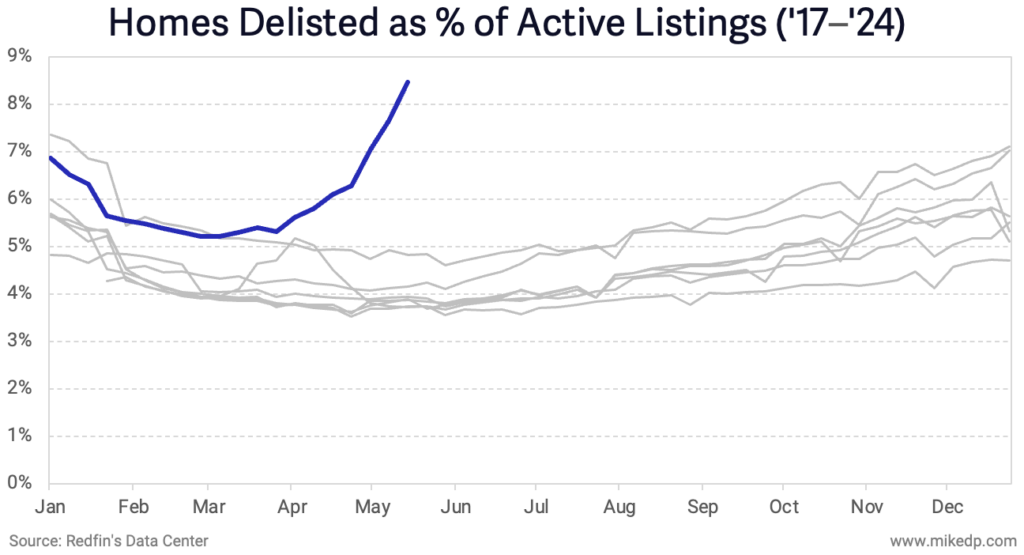

[Mike DelPrete] Delistings Are Surging

Mike DelPrete burst onto the real estate tech scene several years ago and presents this real estate subset in easy-to-understand presentations.

I’ve contended that listings entering the market today are generally overpriced and therefore don’t provide a lot more competition.

Skyrocketing Delistings and the Pricing Imbalance [Mike DelPrete]

Reminder: Land Appreciates, Improvements Depreciate

Back in 2017, I was asked to keynote the annual conference for the Manufactured Housing Institute in Chicago. I enjoyed it as it was a parallel universe from the world of traditional home builders.

A few days ago I read a WaPo op-ed piece Want affordable housing? Take the chassis off manufactured houses. That seemed simple enough, except the distinguished professors/authors of this piece seem to be missing the point or perhaps I am. Price growth is about the land, not the improvements and their recommendation wouldn’t make the land more affordable.

I touched on the idea that land was responsible for most of the price appreciation and not the improvements (i.e. the house) for a Bloomberg column I wrote almost a decade ago: Housing Bust Wasn’t About the House and I used this chart to illustrate:

Getting Graphic

Apollo’s Torsten Slok‘s amazingly clear charts

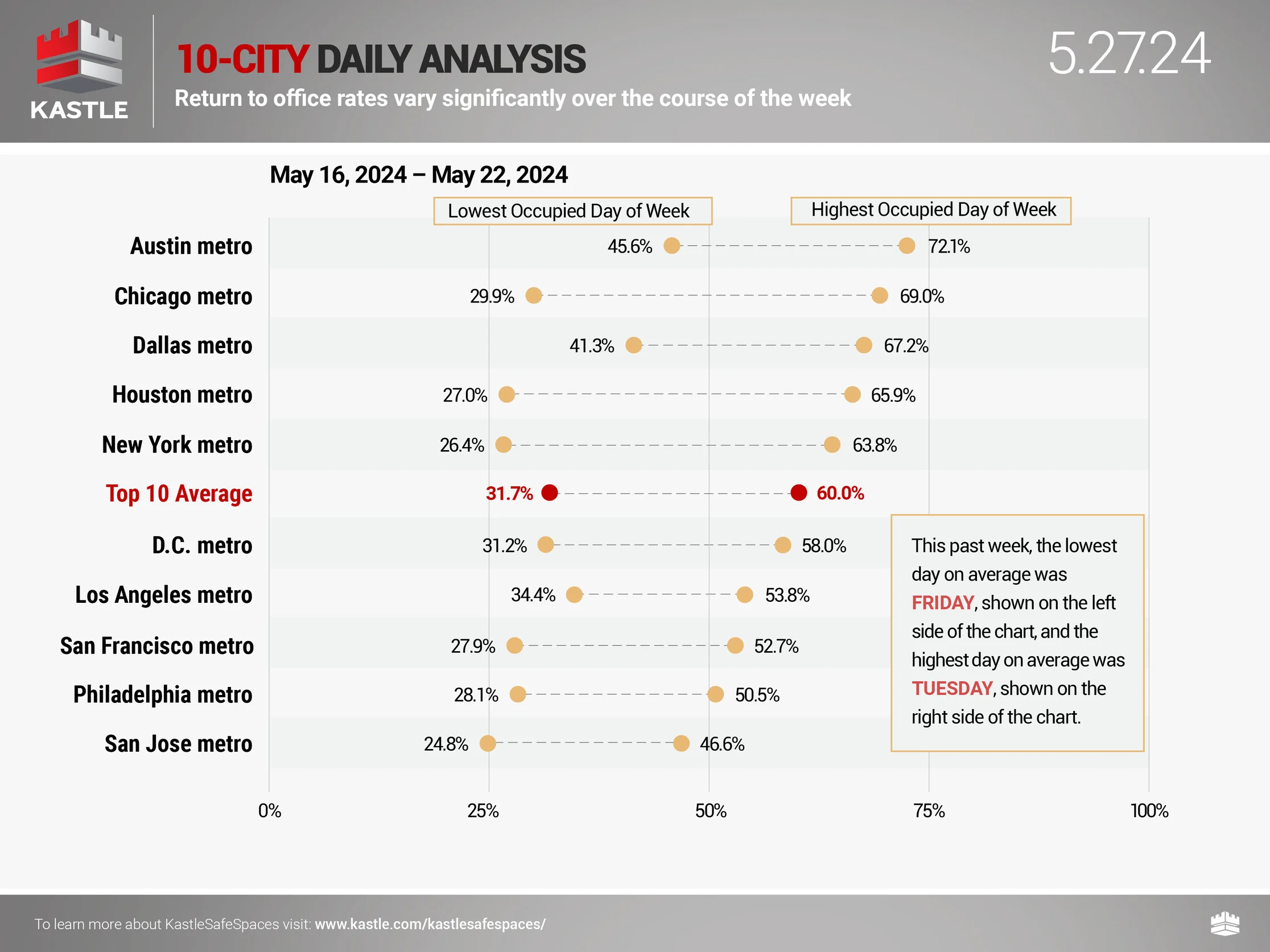

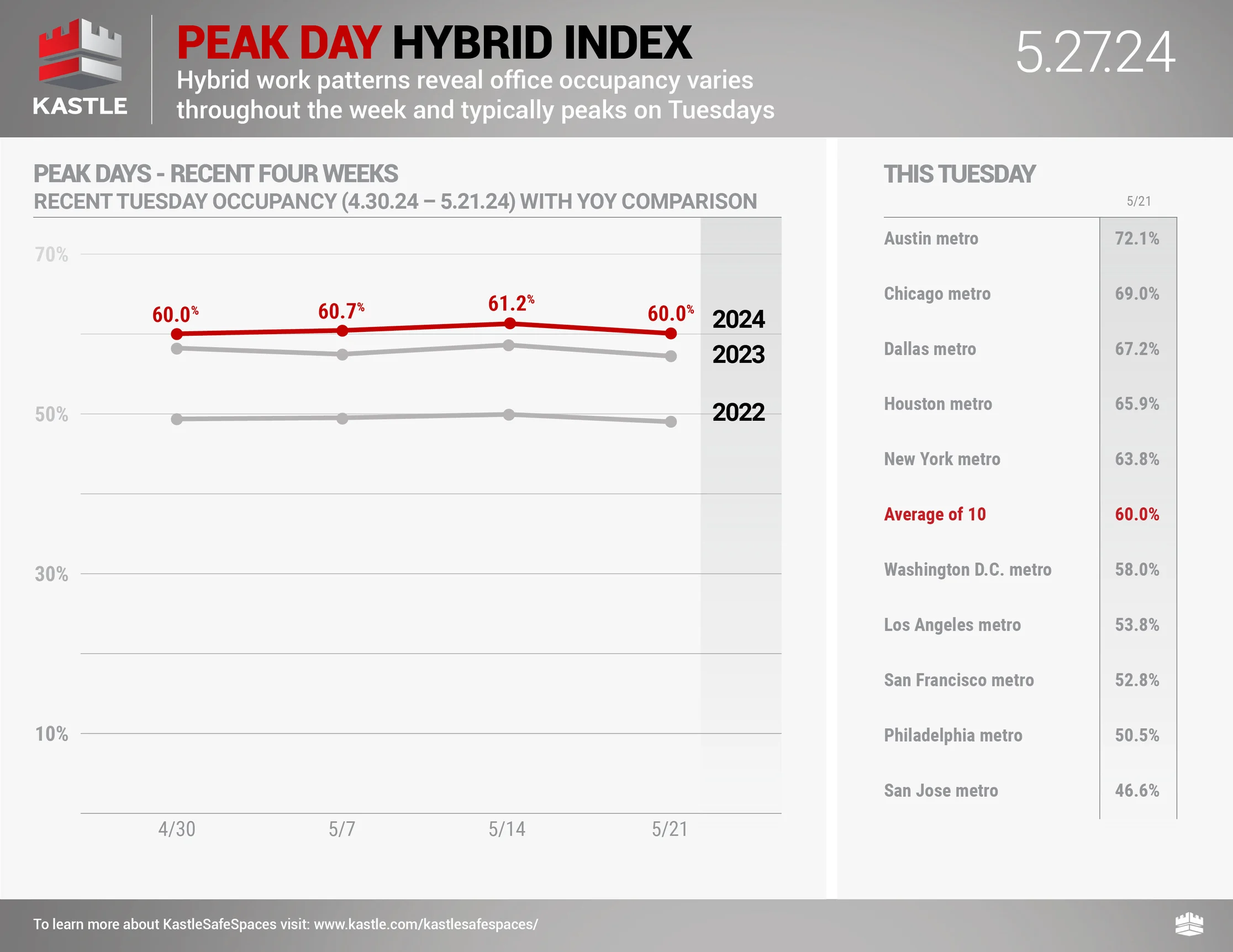

Kastle card swipe data

Remember that Kastle charts are overstating occupancy* because their pre-pandemic occupancy benchmark was 100%, which is incorrect (*measures card swipe activity as a proxy for occupancy). Still, they’ve become the standard benchmark for occupancy rates.

Favorite RANDOM charts of the week made by others

Appraiserville

Soon, you’ll be able to once again sign up for ruminations on the Appraisal Industry.

OFT (One Final Thought)

An absolute legend for making the worst calls in MLB retires this week after three decades. I know nothing about him as a person, but it is hard to comprehend how bad the calls were unless you were watching the game and were invested in the outcome. While many people spew hate towards officiating in sports for many reasons, his bad calls were at another level and especially well-documented. Here are some of his legendary bad calls. While I’m not excited about calling this person out (that’s a pun), it seems to be quite a relief to baseball fans to be at the end of a particularly stressful era.

Brilliant Idea #1

If you need something rock solid in your life – particularly on a weekday afternoon at 2:00 PM, Eastern Time (ET) – and someone forwarded this to you, you can sign up here for these weekly Housing Notes. And be sure to share with a friend or colleague if you enjoy them because:

– They’ll wear tie die shirts;

– You’ll tear up;

– And I’ll be calling balls and strikes with accuracy every weekday.

Brilliant Idea #2

You’re full of insights and ideas as a reader of Housing Notes. Consider sharing them with me early and often. I appreciate every email I receive, as it helps me craft future Housing Notes.

See you next week!

Jonathan J. Miller, CRE®, Member of RAC

President/CEO

Miller Samuel Inc.

Real Estate Appraisers & Consultants

Matrix Blog @jonathanmiller

Reads, Listens and Visuals I Enjoyed

- Repost: Measuring Manhattan Values By Floor Level [Miller Samuel]

- [ChartFloor] Manhattan Price Per Floor Breakdown [Miller Samuel]

- Central Park Place [Wikipedia]

- So How Much Is That . . . . . . . . Worth? (Published 2003) [NY Times]

- Exploring hotel superstitions: The mystery of the missing 13th floor [Scripps News]

- Why do many Las Vegas casinos skip floors 40-49? [Review Journal]

- Superstition in Real Estate [Appraisal Buzz]

- Official exodus: Miami, New York agents depart brokerage tainted by allegations against co-founders [The Real Deal]

- Alexander brothers left as sole owners of Official after failed exit negotiations [The Real Deal]

- Inside ‘Billionaires’ Bluff’: Why Paradise Cove Keeps Drawing the Superrich [Wall Street Journal]

- Sales of $100M homes are expected to double in 2024: ‘It’s a substantial uptick in the pace of sales’ [NY Post]

- Ultra-luxury soars above wider market slowdown [The Real Deal]

Recently Published Elliman Market Reports

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 7-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 7-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 7-2024 [Miller Samuel]

- Elliman Report: Orange County Sales 2Q 2024 [Miller Samuel]

- Elliman Report: North Fork Sales 2Q 2024 [Miller Samuel]

- Elliman Report: Hamptons Sales 2Q 2024 [Miller Samuel]

- Elliman Report: Long Island Sales 2Q 2024 [Miller Samuel]

- Elliman Report: Miami Beach + Barrier Islands Sales 2Q 2024 [Miller Samuel]

- Elliman Report: Lee County Sales 2Q 2024 [Miller Samuel]

- Elliman Report: St. Petersburg Sales 2Q 2024 [Miller Samuel]

Appraisal Related Reads

- HOA fees are standing out in a bad way [Sacramento Appraisal Blog]

- FHA Announces New Guidelines Allowing Borrowers to Challenge Appraisals [The National Law Review]

- An insurance crisis wasn’t on my bingo card [Sacramento Appraisal Blog]

- Freddie Mac Calls Halt on New Loans From Appraiser BBG [Commercial Observer]

Extra Curricular Reads

- Nights in Las Vegas Are Becoming Dangerously Hot [NY Times]

- What happened when the Chicago Sun-Times freed the news [NeimanLab]

- Are Overdose Deaths Finally Peaking? [Scientific American]

- A Few Little Ideas [Collab Fund]

- The 40 Essential Zombie Movies to Watch [Rotten Tomatoes]

- Consent in Crisis: The Rapid Decline of the AI Data Commons [Data Provenance]

- Disruptions continue after IT outage affects millions around the globe [NPR]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)