The purpose of NAR’s landmark settlement was to decouple the commissions paid by the seller from the buyer’s agent. After all, sellers don’t hire the buyer’s agent, nor does the buyer’s agent act in the seller’s best interests. The settlement means that users of representation services must pay for those services. In a traditional deal structure, the listing agent was usually paid 6% and gave 3% to the buyer’s agent. Now, the buyer could end up paying the buyer’s agent directly. NAR’s membership peaked at 1.6M+ in October 2022 and is down 6.5% through February 2024; much is due to lower sales volume in a 100% commission world. Now that membership is no longer required, I expect the trade group’s membership to collapse in a few years.

Of course, this event has many ramifications, and the devil is in the details, just like the devil is in the details of Waffle House’s Magic Marker System.

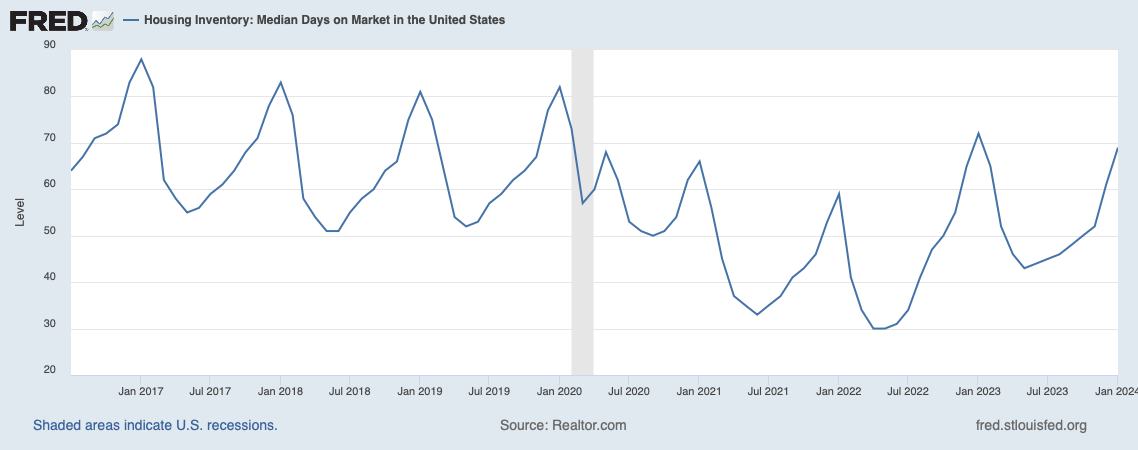

With the decline in sales and low inventory, the pace of the market still feels like an “eleven” on the ground. The clip will help explain it.

Did you miss last Friday’s Housing Notes?

March 15, 2024: The Housing Market Is Like [Insert Analogy]

Warning To Housing Notes Readers!!!

I got a bit carried away this week and wrote an “eleven” as the largest edition in my nine years of this effort, so please pace yourself, enjoy it, and take your time.

But I digress…

NAR Settles, Nuanced Changes To Transactions, Incorrect Assumptions, And The Lawyers Get Rich

The first thing I noticed about the $418 million NAR settlement in the Sitzer | Burnett class action case (yet to be approved by the court) was the focus on cost savings for the consumer and the elimination of price fixing. The 5% to 6% full-service commission is constantly being called into question in the coverage. Yet, the changes are not really about the 5% to 6% number, nor will it ultimately be about saving money for the consumer. There was a ton of that specific assumption in the coverage of the proposed settlement but I remain quite skeptical. Here are many of the breaking stories on the settlement.

- 4 Ways a Settlement Could Change the Housing Industry – NYTimes

- Realtors Reach Settlement That Will Change How Americans Buy and Sell Homes – WSJ

- The 6% commission on buying or selling a home is gone after Realtors association agrees to seismic settlement – CNN

- An anticipated settlement still shocks the real estate industry – Inman

- How the big real estate settlement will change homebuying and selling – Axios

- Roughly $30 billion could be slashed from real estate agents’ commissions: Fed economists pose solution to the ‘anomaly’ in the American housing market – Fortune

And there were some interesting takes from long-time industry insiders:

- Agents Decoded: The future is uncertain — but don’t panic! – Real Estate News

- Why the NAR Settlement is Disappointing – Notorious R.O.B.

NAR has shared some useful resources:

Correcting the Record: NAR Does Not Set Commissions

Since the courts haven’t approved the settlement, it’s hard to say how buyers and sellers will react. If all goes as expected, it will be the law of the land by mid-July. I am unsure of the specific politics of the “under $2 billion in business requirement” to carve out Berkshire Hathaway and Compass. REBNY, Manhattan’s mini-NAR, left NAR in the early 90s, and agents here are NOT realtors. Still, despite changing its rules in anticipation of the tsunami of NAR’s litigation, REBNY is facing several significant lawsuits that haven’t received much media attention. I know that nearly every other post in my Instagram feed shares an agent’s take on what the industry will be like going forward, and they are nearly all different takes, varying from calm to panic. Hence, confusion.

Much media coverage has focused on how commissions will plummet, consumers will save lots of money on commissions, and 6% is no longer the rule. Firstly, 6% was never required and was always negotiable with a full-service broker. I don’t see commissions plummeting in the long run. The buyer’s side seems more vulnerable because it’s currently unclear where their commission comes from, but I suspect that concern will be overblown.

The critical problem DOJ has with this entire situation is the appearance of price collusion. In the pre-Sitzer | Burnett world, the listing agent would split the commission evenly with the buyer’s agent. That’s the actual issue. The seller was forced to pay the commission (in a 6% example, 3%) to the buyer’s agent. Yet, the buyer’s agent doesn’t represent the seller’s interests, and the seller probably knows nothing about the buyer’s agent.

While the listing agent will still negotiate with the seller on their commission amount, so will the buyer’s agent since a home sale needs agents to bring buyers. The buyer’s representative will likely continue to be paid for the most part. The widespread assumption in the settlement coverage is that the seller will save 3% of the commission. In cases where the buyer has to pay the buyer’s agent directly, the buyer will likely offer 3% less for the house, and the seller nets the same amount, but the house sells for less.

Another potential impact concerns the MLS systems. They will be required not to show the listing commissions offered (which the public could never see) to avoid the impression of steering buyers to lower-commissioned properties, which seems pretty cynical and, in my own experience, only happens on the margin. Still, it makes me wonder if portals like Zillow would fall under the same restrictions as MLS or if there will be a tech startup workaround to share the commissions outside the MLS ecosystem with brokers. The latter seems plausible.

MLS systems require real estate agents to have a NAR membership to gain access. This is not part of this settlement but seems to be the next shoe to drop in rethinking the home-buying process. As buyer agents potentially see lower compensation and a significant decline in industry dropouts, this probably means even faster MLS consolidation for survival, much more than the current politically driven thinking. Again, many members of NAR are only members because many MLS systems require them to have membership to have access to data.

Because of all this change, a collapse of NAR membership is expected over the next several years. In past writings, I’ve used Lawyers, Bankers, and Appraisers (sounds like a Warren Zevon song) as examples since their major trade groups represent 20-25% of their respective industries. This is unlike NAR, which represents nearly 100% of the industry and is essentially the requirement for entry for new agents. That math would take NAR membership from 1.6 million (October ’22 peak) to just north of 300,000. I’m told a “comp” for the NAR situation is its counterpart in Canada, The Canadian Real Estate Association (CREA), whose annual membership fee is $1,677 and whose average members average around ten home sales yearly. NAR’s annual membership fees are $156, and about half of NAR members have 0 to 1 deals yearly. Using the CREA math at 4 million U.S. sales per year with a projected agent average of 10 sales per year after pushing out the part-timers and ghost members of MLS systems through a membership fee increase, that would leave 400,000 members. This is another way to calculate NARs anticipated membership collapse.

However, the expected revenue collapse won’t be due to the loss of membership fees since NAR dues are like monthly cable bills. NAR will likely lose its gravitas with all the affiliate and admin fees it can currently charge, just as the NFL does. Example: “Mortgage ABC Corporation is the official mortgage lender of the NAR.” Those days are likely over, and the cash stops rolling in. And I would guess that, as an organization, they will be very slow to cut costs or are trapped by high sunk costs, office redundancies, and a plethora of excess staff. In a radical idea, they could press membership fees higher to CREA levels, as I explained earlier, while proving value for those services (I know, I know) that could jettison many amateurs, leaving the professionals to operate the industry – something that appeared to be a common criticism of the settlement deal. However, it is a gamble to introduce much higher fees when new competitors are emerging, like the American Real Estate Association (AmericaREA).

My Early Takeaways (The sky is not falling for the real estate agent industry, but it is for NAR.):

- Full-service buyer’s agents will get paid but probably net out somewhat less as an industry than in the past. They will be forced to show their value upfront (and not with long lists of things they’ll do).

- Full-service listing agents will probably not be financially impacted.

- Buyers and sellers will each pay for their agent representation, which will be documented in an agreement.

- NAR effectively won this round, doing something for its members (after NAR dropped the ball) for the first time in years and perhaps the last big thing they will ever do as an organization.

- NAR membership will collapse over the next several years because it is no longer required.

I’m sure I’m missing something since there is so much here and so many unknowns, so I will continue to address this topic in the coming weeks. Please share your thoughts.

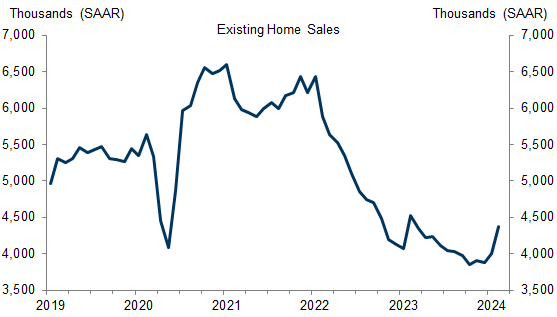

The “Lock-in Effect” Explains Listing Inventory Collapse

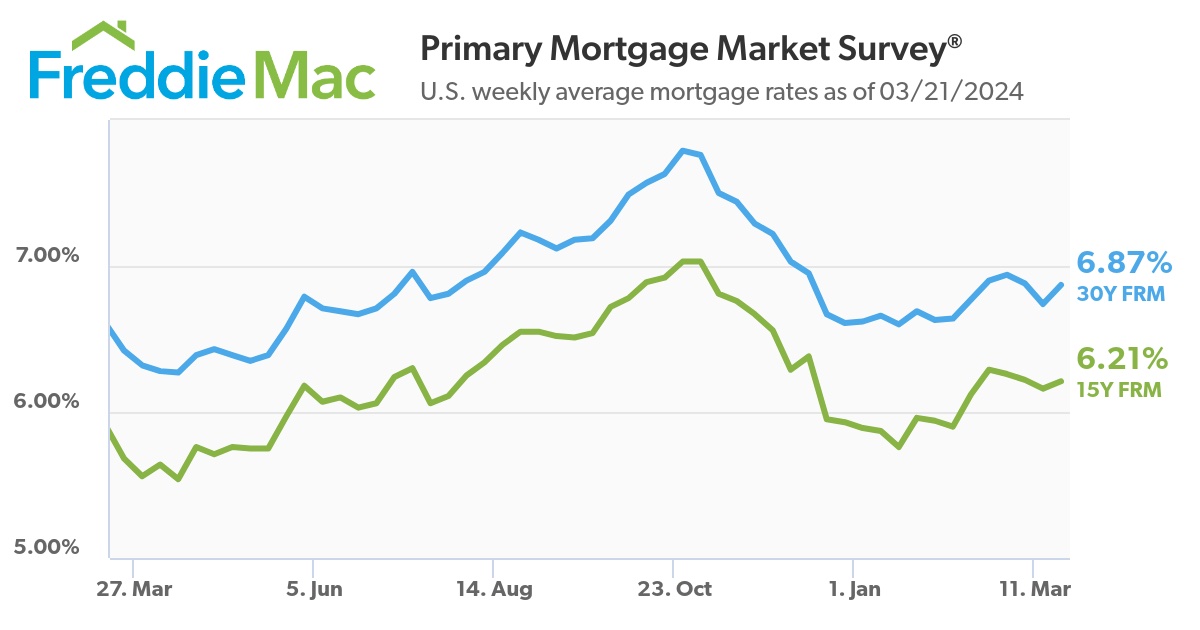

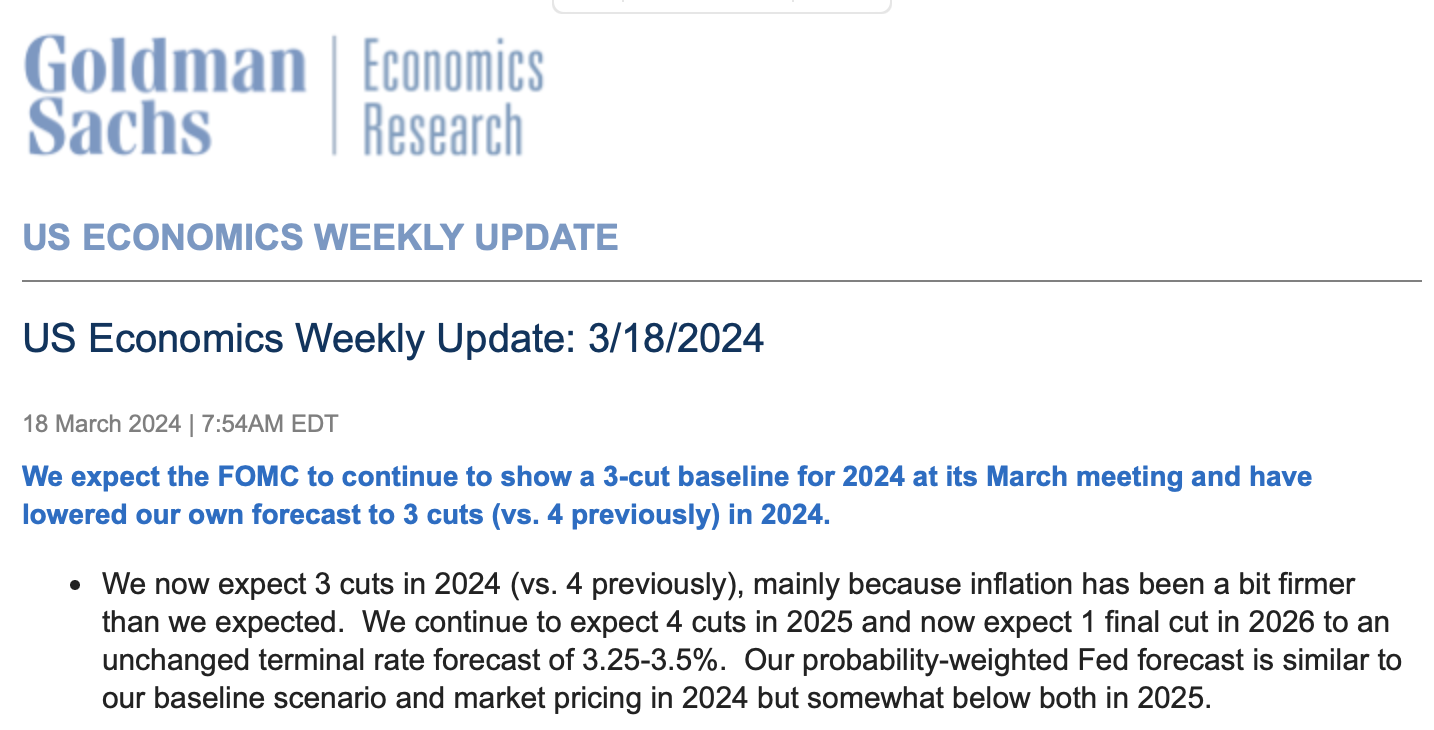

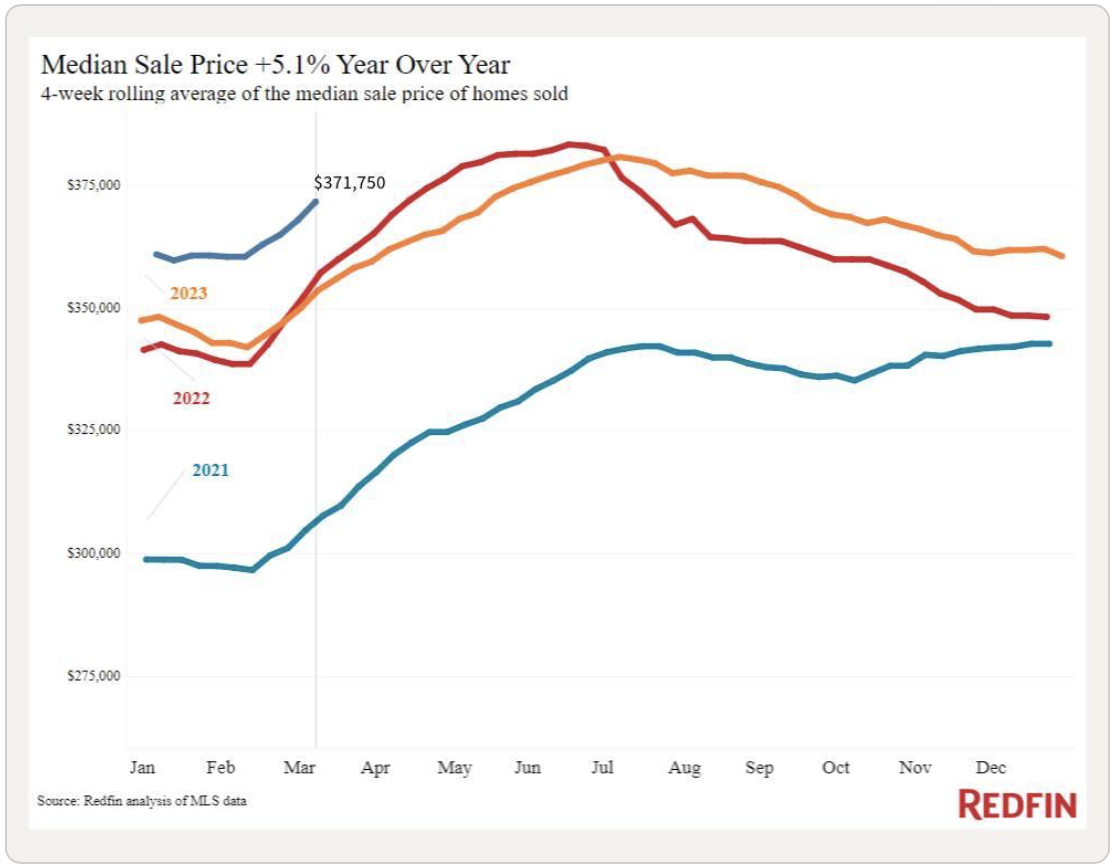

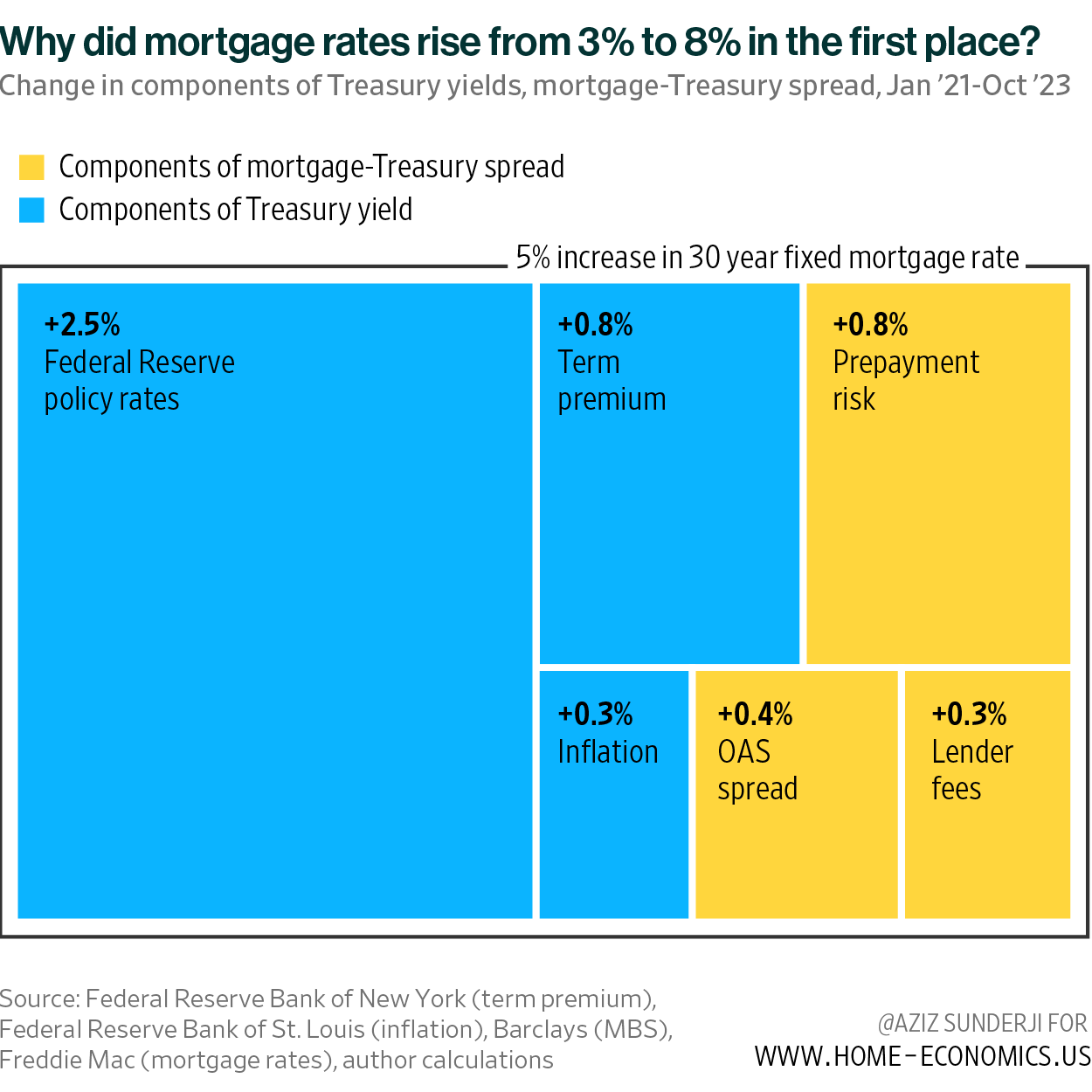

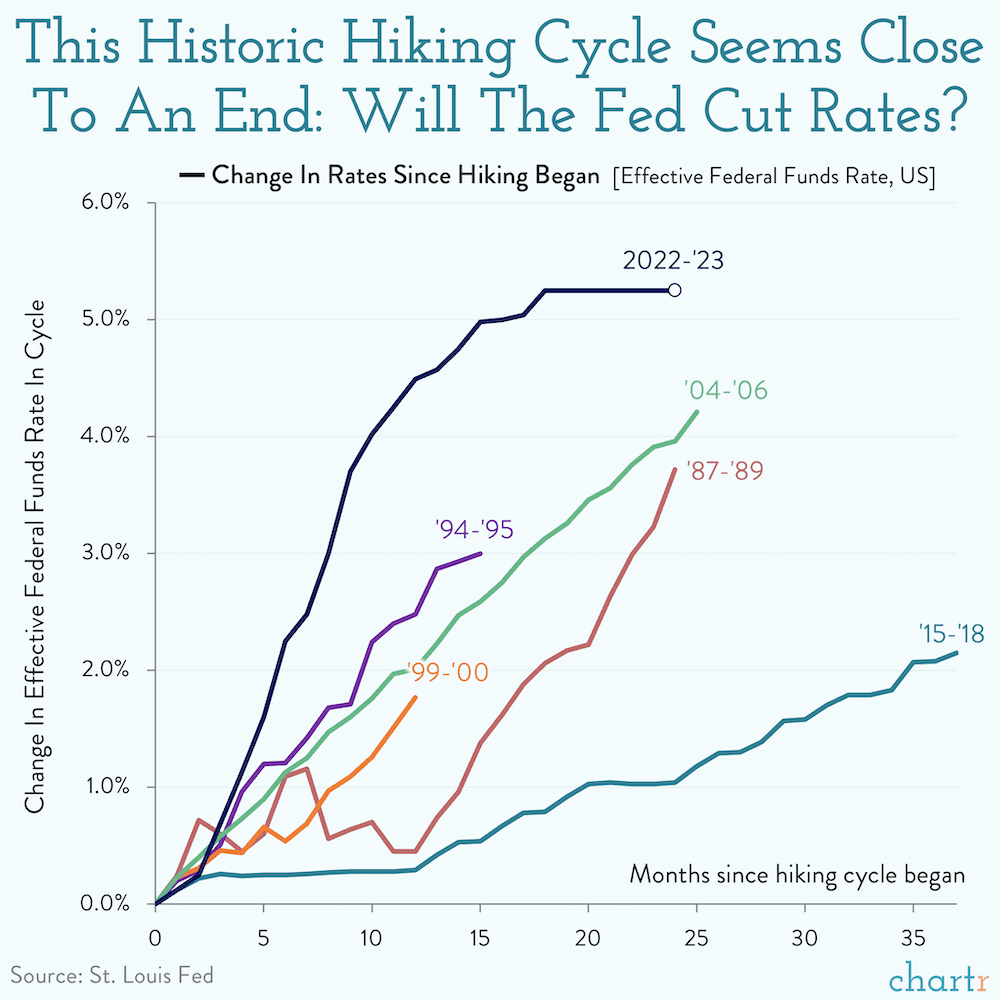

The FHFA is the regulator responsible for the GSEs, Fannie and Freddie, and they published a paper this week: Working Paper 24-03: The Lock-In Effect of Rising Mortgage Rates. As the spread between their pandemic mortgage rate and the prevailing mortgage rate expands, the probability of home sales falls. They found that:

We estimate that lock-in decreased the sales of homes with fixed-rate mortgages by 57% in 2023Q4 and prevented 1.33 million sales between 2022Q2 and the end of 2023. We test several possible scenarios and find that the reduction in sales is unlikely to dissipate quickly. Finally, we estimate that, during this period, lock-in-related supply reduction increased home prices by 5.7% while the direct effect of elevated rates decreased them by 3.3%.

The study has many charts, but I thought these were the coolest.

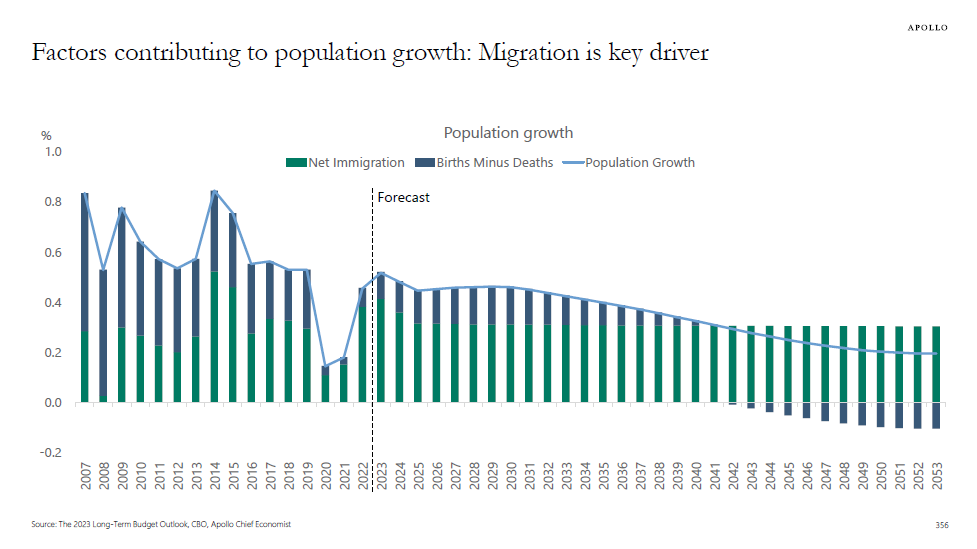

Counselors of Real Estate® Podcast On Migration’s Impact On Real Estate

In this episode, Jonathan Schein, CRE®, talks with KC Conway, CRE®, founder of KCnomics, LLC, in Norcross, Georgia, on Population Shock: Migration’s Impact on Real Estate, the number six issue on the 2023-24 Top Ten Issues Affecting Real Estate® by The Counselors of Real Estate®. I’m an active member of this unique organization and encourage you to check it out at CRE.org.

My friend Jonathan Schein, CRE® of RELPI (wearing an insanely sharp pocket square), interviews KC Conway, CRE®, one of the most prolific providers of economic insights today.

The dog catches the car, so now what does he do with it?

KC Conway, CRE®

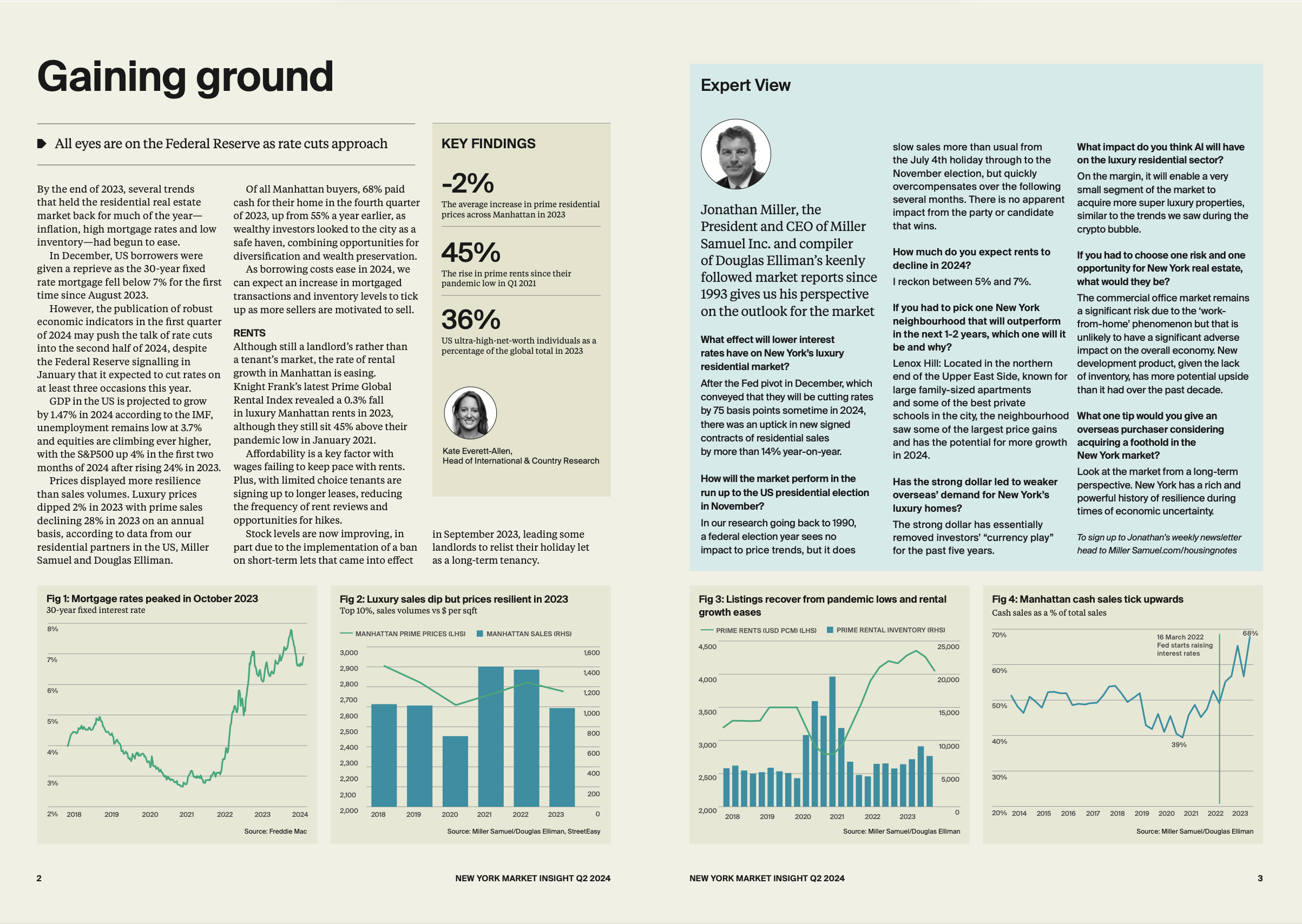

Knight Frank Interviews Me For Their Report

Here’s my take on the NYC housing market for Knight Frank, along with a few of my charts used in their Q2-2024 New York Market Insight report. We also discuss the Manhattan cash buyer phenomenon with charts! Click on the image to expand to its full glory.

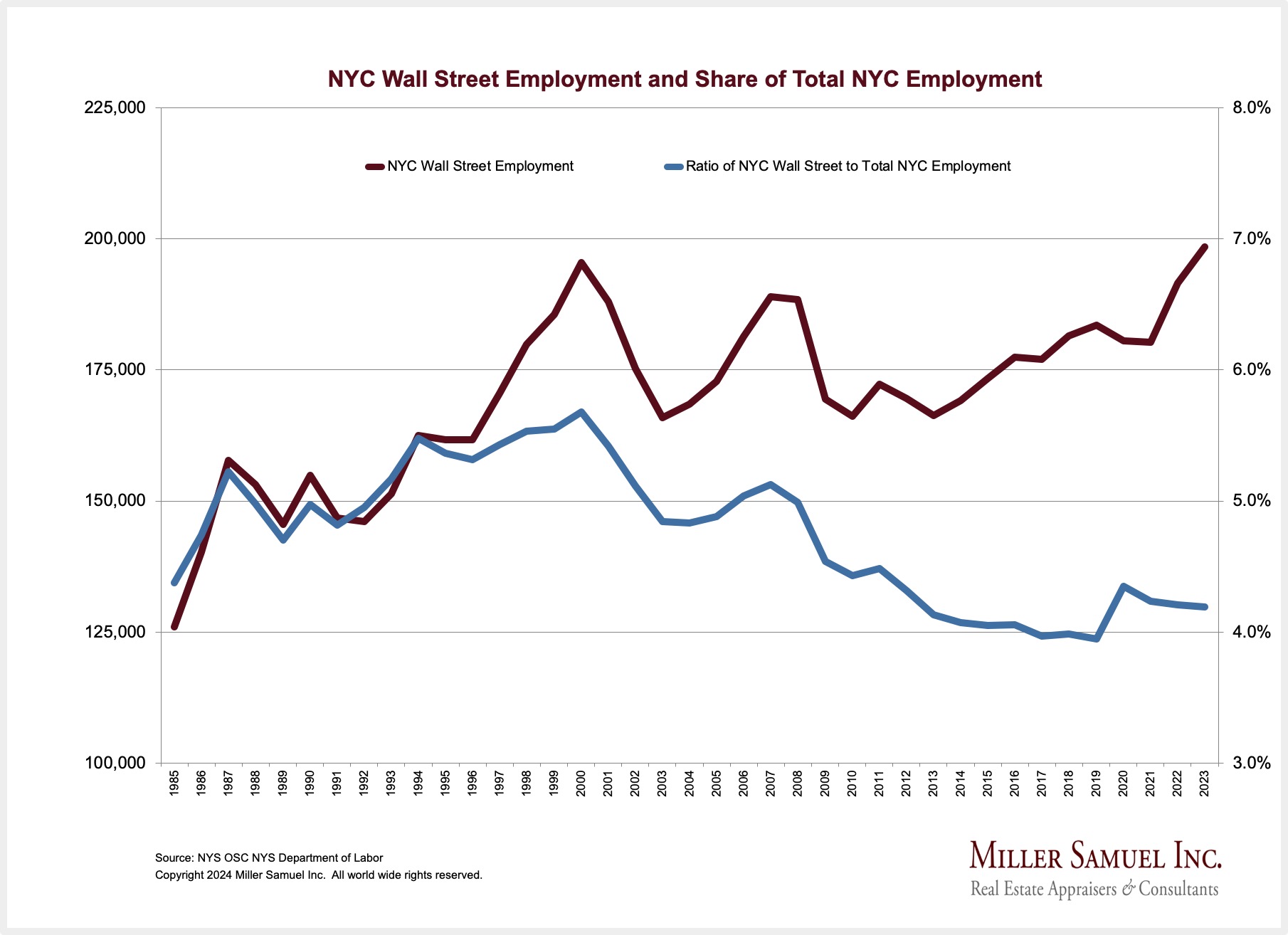

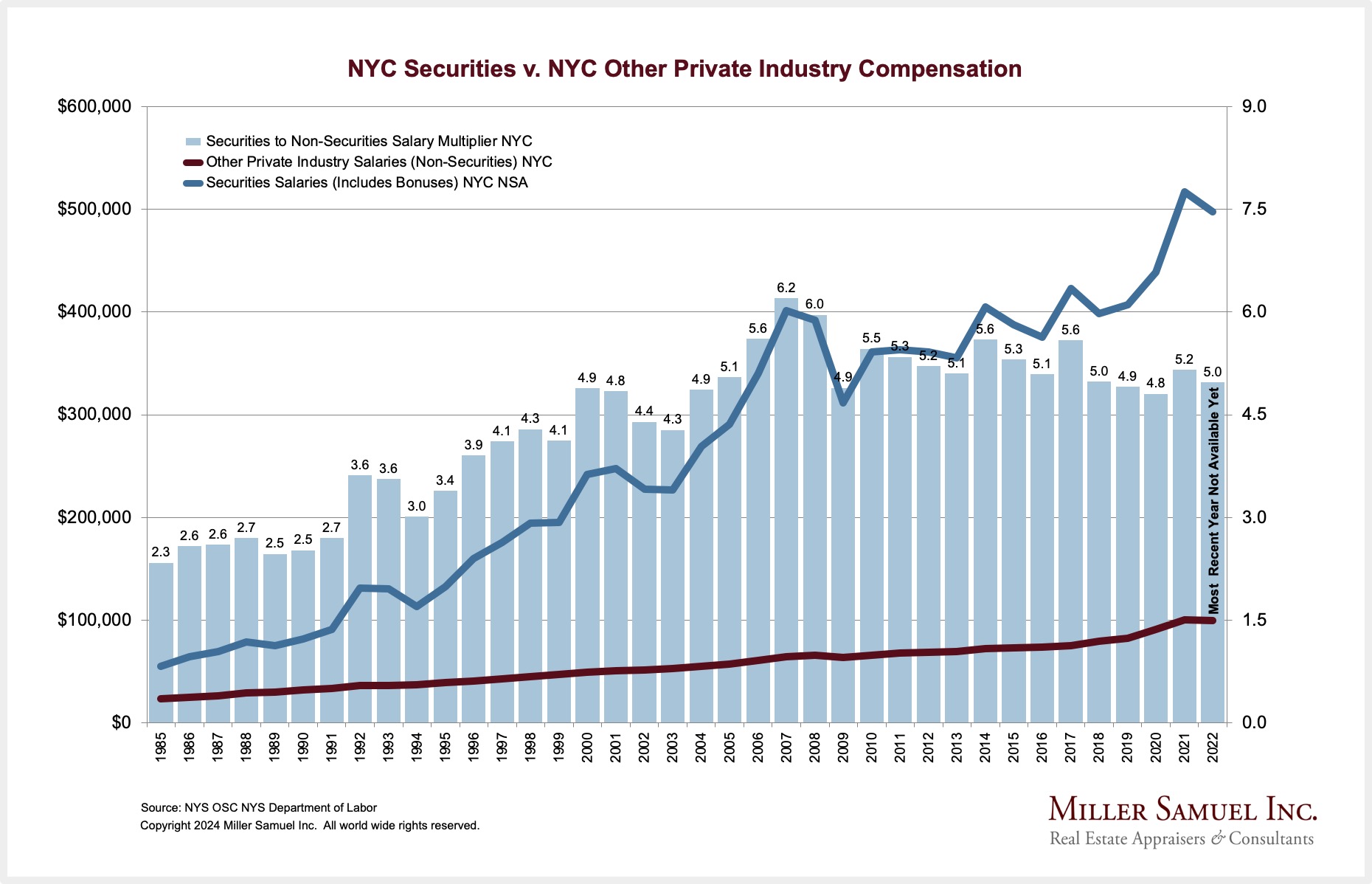

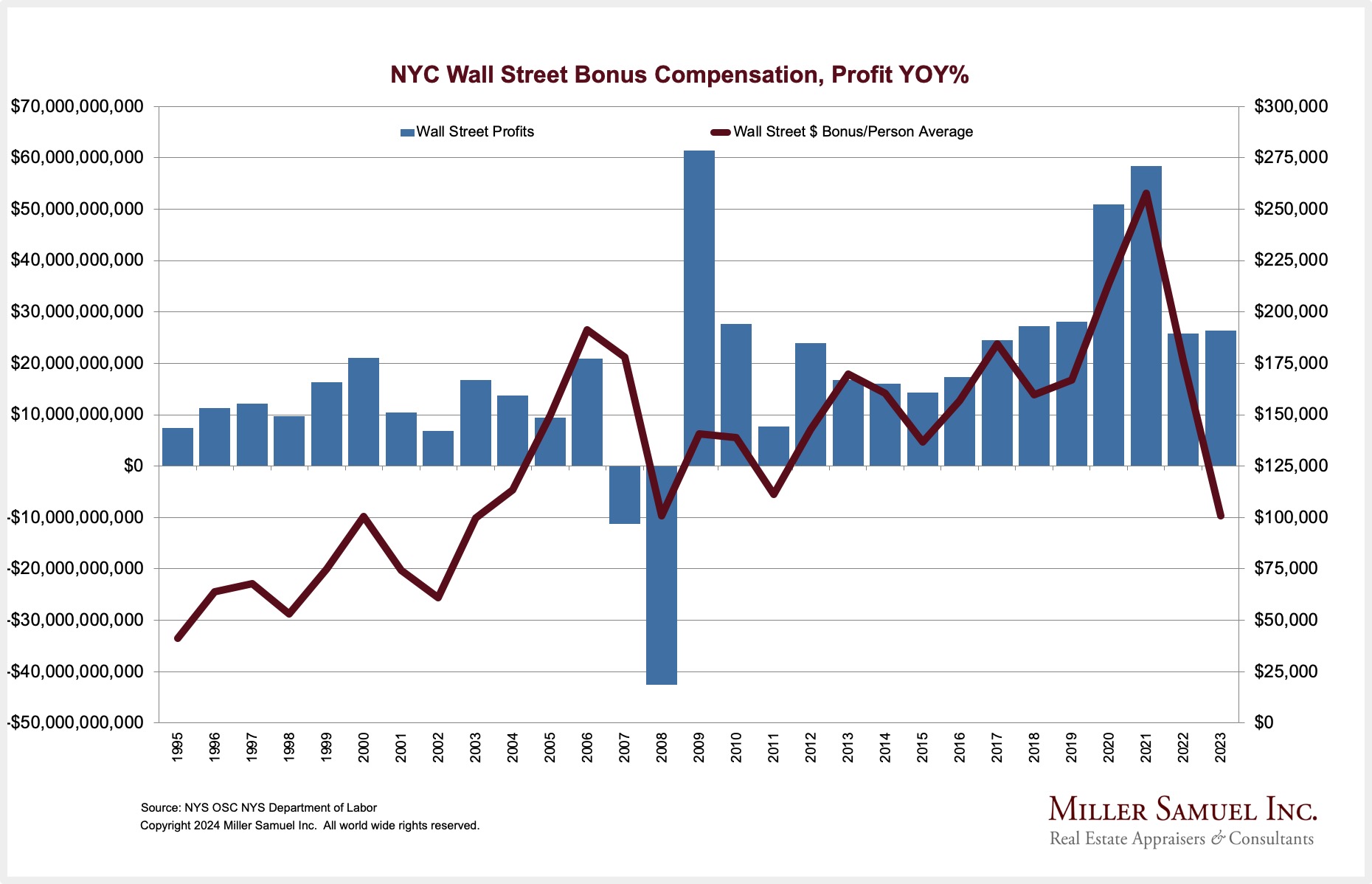

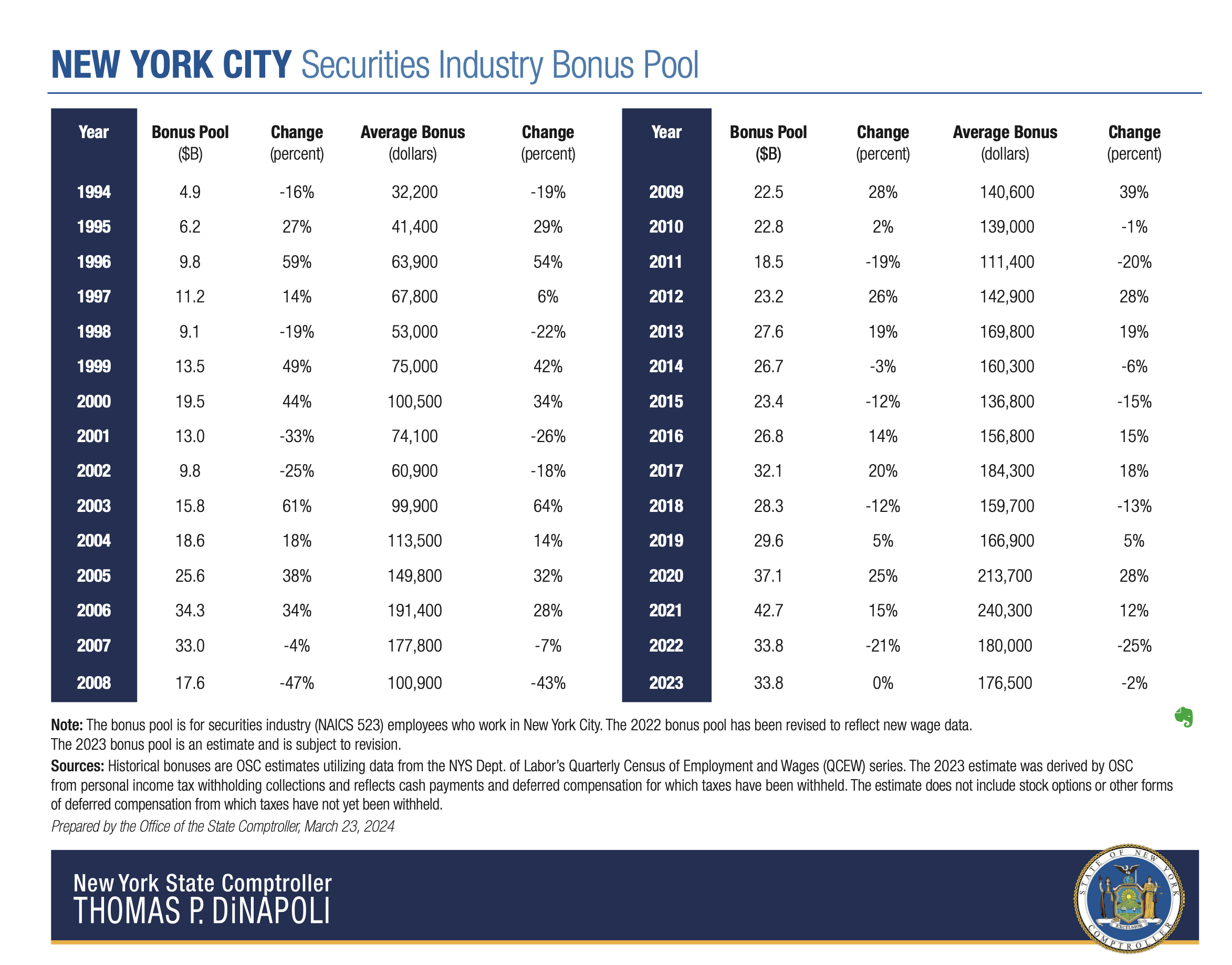

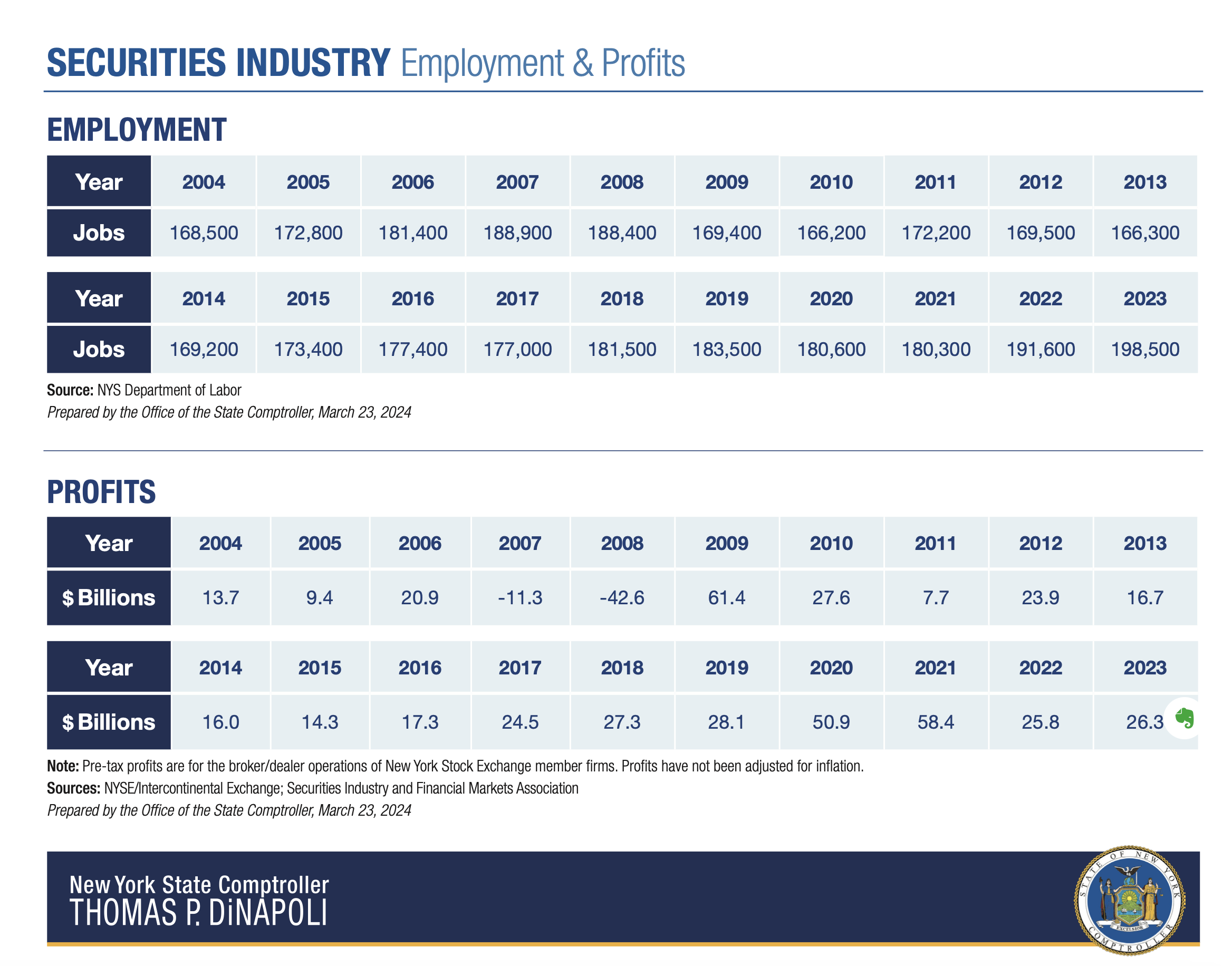

Wall Street Bonuses Are Down As Securities Industry Share Of NYC Employment Is Up Since Pre-Pandemic

The New York State Comptroller usually releases New York securities industry metrics in March, and more than a decade ago, it had an inkling of correlation to the NYC housing market. Post-financial crisis, with the addition of a Dodd-Frank regulatory overlay that attempted to discourage the rampant moral hazard of prior decades, the compensation of the securities industry is less of a future bellwether for the housing market. It’s a relief because I grew sick of the stories of 30-year-old Wall Streeters buying $250 thousand sports cars and $5 million luxury apartments as part of a financial three-ring circus. It remains a big part of the economic story but less meteoric.

Here are the NYS Comptroller’s stats:

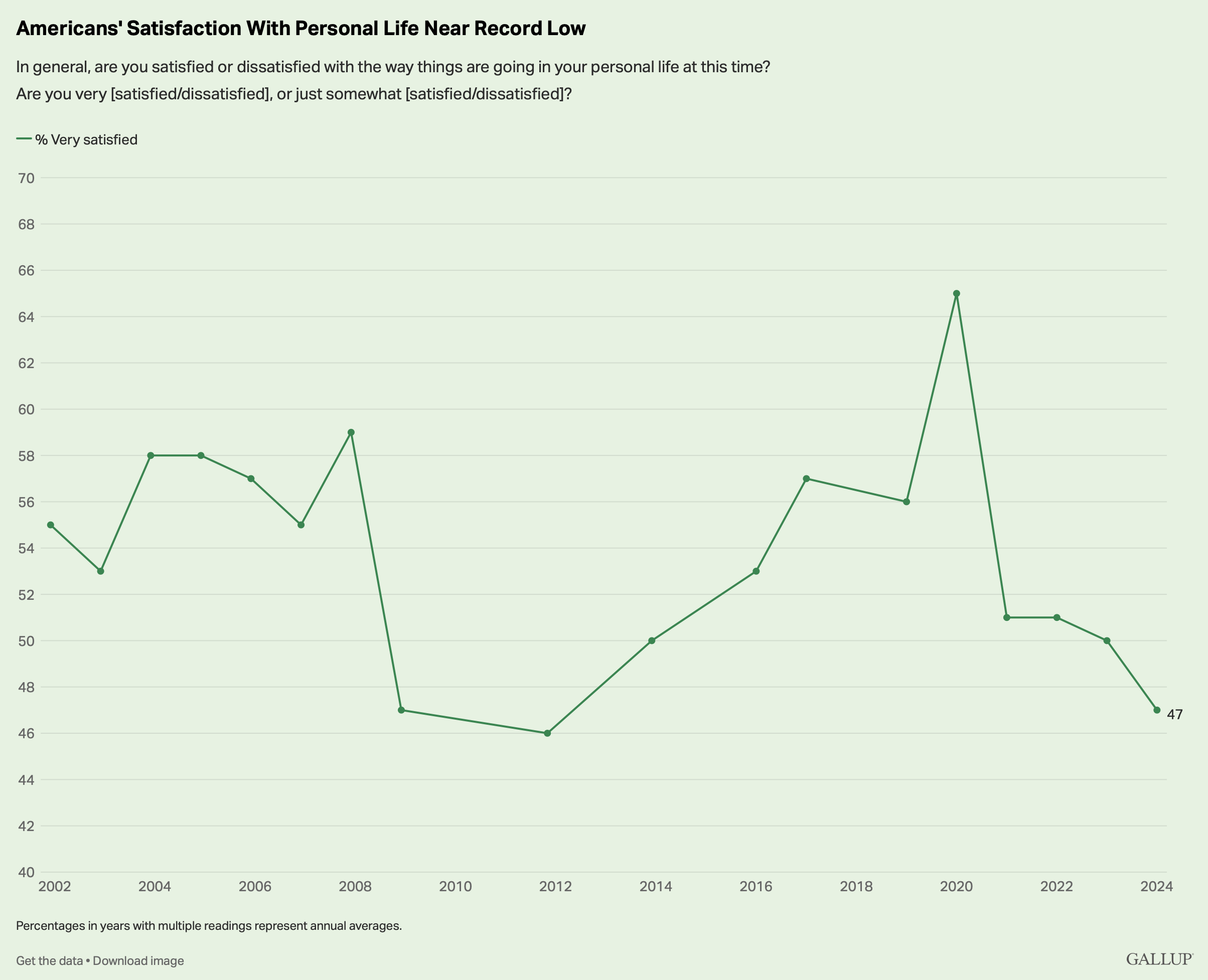

Everyone Thinks The Economy Sucks Despite Strong Job Growth, Unemployment Sustained Below 4% & Strong Wage Growth

This Gallup chart indicates that it is time for everyone to get off social media and cable news.

[WSJ] A Confusing NYC Luxury Market Explained

Kathy Clarke, author of the best-selling book Billionaires’ Row, lays out the luxury market for us. And nothing would be better to explain the situation than using our Elliman Report data in a couple of charts. Here is my favorite quote from the piece: How to Make Sense of New York’s Confusing Luxury Home Market:

Orrigo said the buyer pool is made up of tech titans and “the nepo community,” meaning the children of wealthy individuals. “We’re seeing a tremendous amount of inherited wealth,” he said.

WSJ

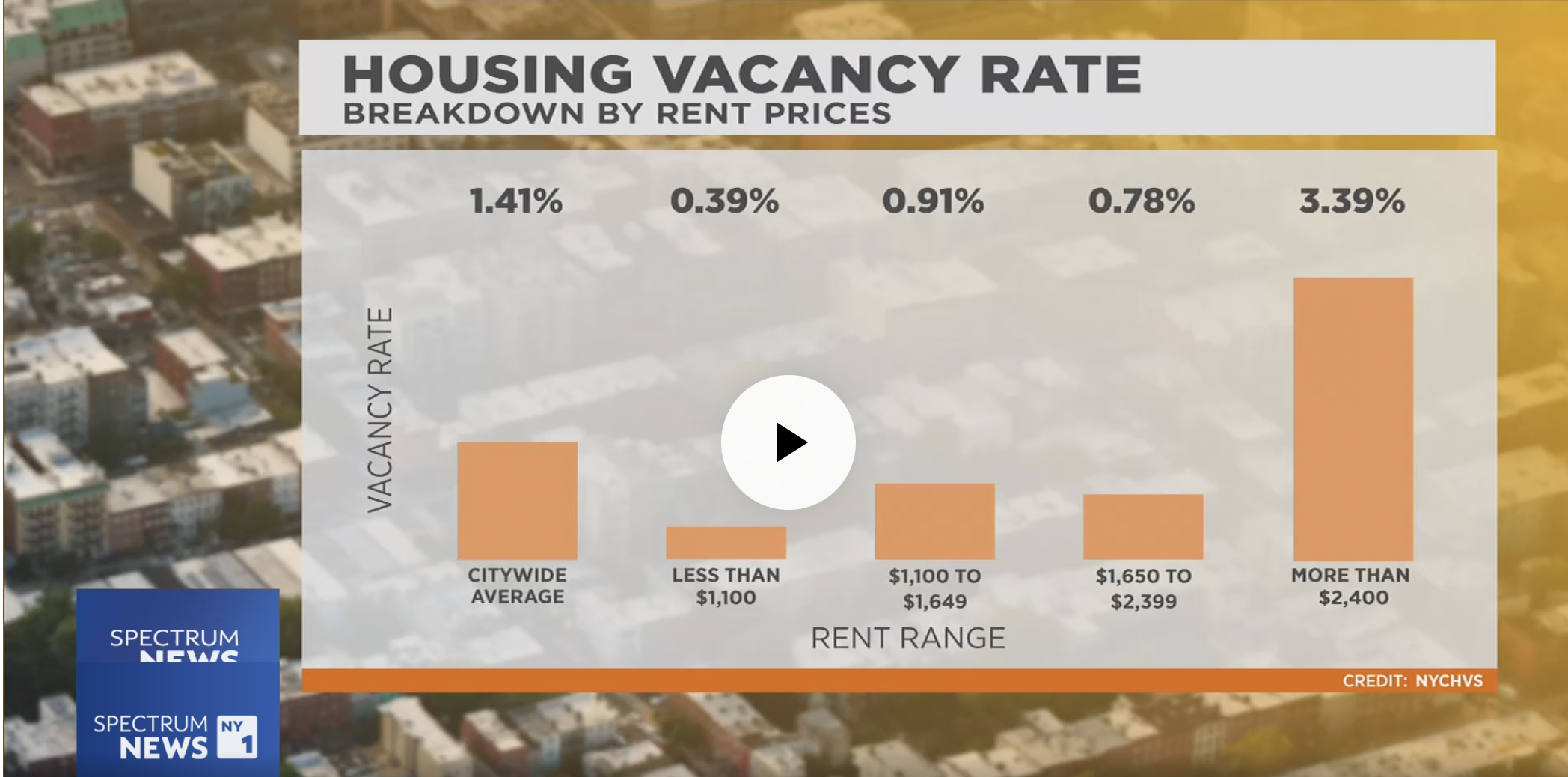

[NY1] Time For Albany To Enable More Housing To Be Built

NYC housing vacancy rate was 1.4%, the lowest since 1968. Albany has been very anti-landlord and anti-development in recent years, which keeps housing construction limited and skewed to luxury products because of market forces. Developers only develop what is most economically feasible for them. This is a good, succinct interview with Vicki Been.

Vicki Been, the former deputy mayor for housing and economic development and current faculty director of NYU’s Furman Center for Real Estate and Urban Policy, addressed the matter on “Mornings On 1” Wednesday, emphasizing the urgency for Albany to pass legislation this year to alleviate the crisis.

NY1

Click on the following image for the interview.

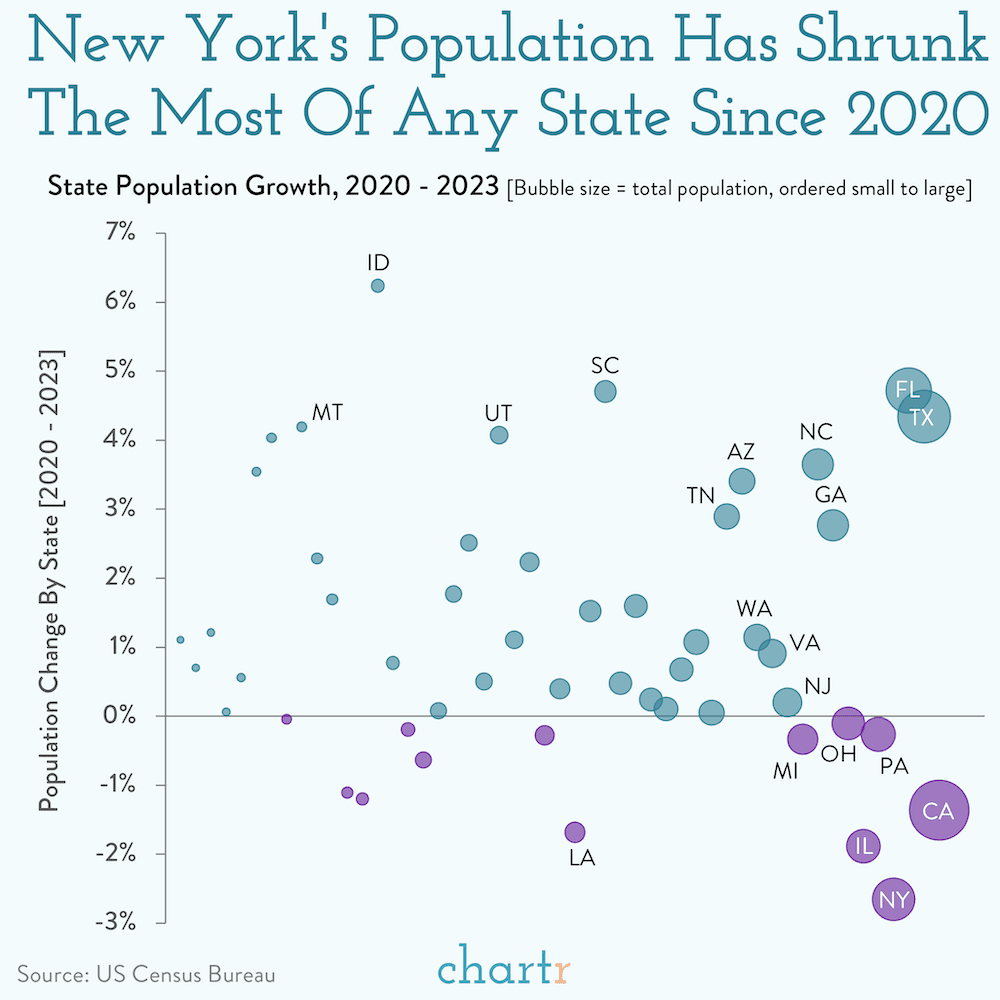

With the pandemic population loss, building more housing should be easier than before. Of course, the following chart is based on census data during the pandemic, which is much less reliable than pre-pandemic data, but you get the point.

New York Is A Radiant City

Highest & Best Newsletter: 🚨 Miami Tower Turmoil

If you’re interested in the Florida housing market, you should sign up for this Florida newsletter, Highest & Best, from Oshrat Carmiel, formerly of Bloomberg News…

This week’s post:

🚨 Miami Tower Turmoil – Two potential foreclosures in Florida’s best office market

Realtor.com Says Week Of April 14 Is Best Time Of Year To Sell

I don’t believe in timing the market. There are lots of viewpoints on this topic. Days on market trends are one thing, but getting significantly more granular on when to sell, nah. Here are a bunch of recommendations that show you it doesn’t matter.

- Week of April 14 – Realtor.com

- June – Zillow

- May – Bankrate

- Wednesday – Redfin

- Impossible to Time – Forbes

- Thursday In Mid-March – US News

- Friday – The Balance

Central Bank Central Interview: Plosser Sees Fed “Treading Water,” Waiting for News, Waiting for Data

Here’s a new substack I’m excited about – Kathleen Hays Presents Central Bank Central. I highly recommend it. A long-time friend and journalist, Kathleen Hays has extensive experience interviewing economic experts in Fedworld from her time at Bloomberg Television.

Central Bank Central: Plosser Sees Fed “Treading Water,” Waiting for News, Waiting for Data

Getting Graphic

Favorite housing market/economic charts of the week made by OTHERS

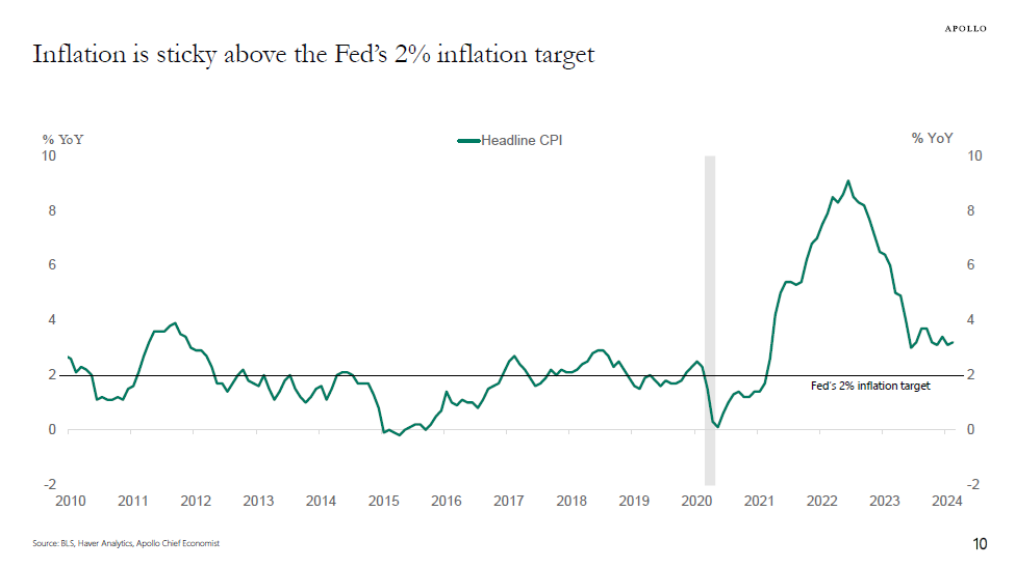

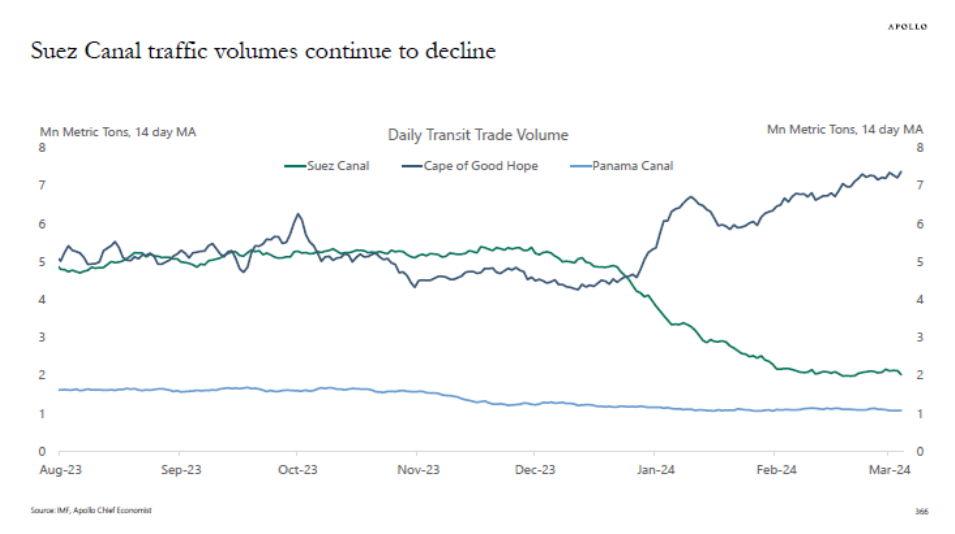

Apollo’s Torsten Slok‘s amazingly clear charts

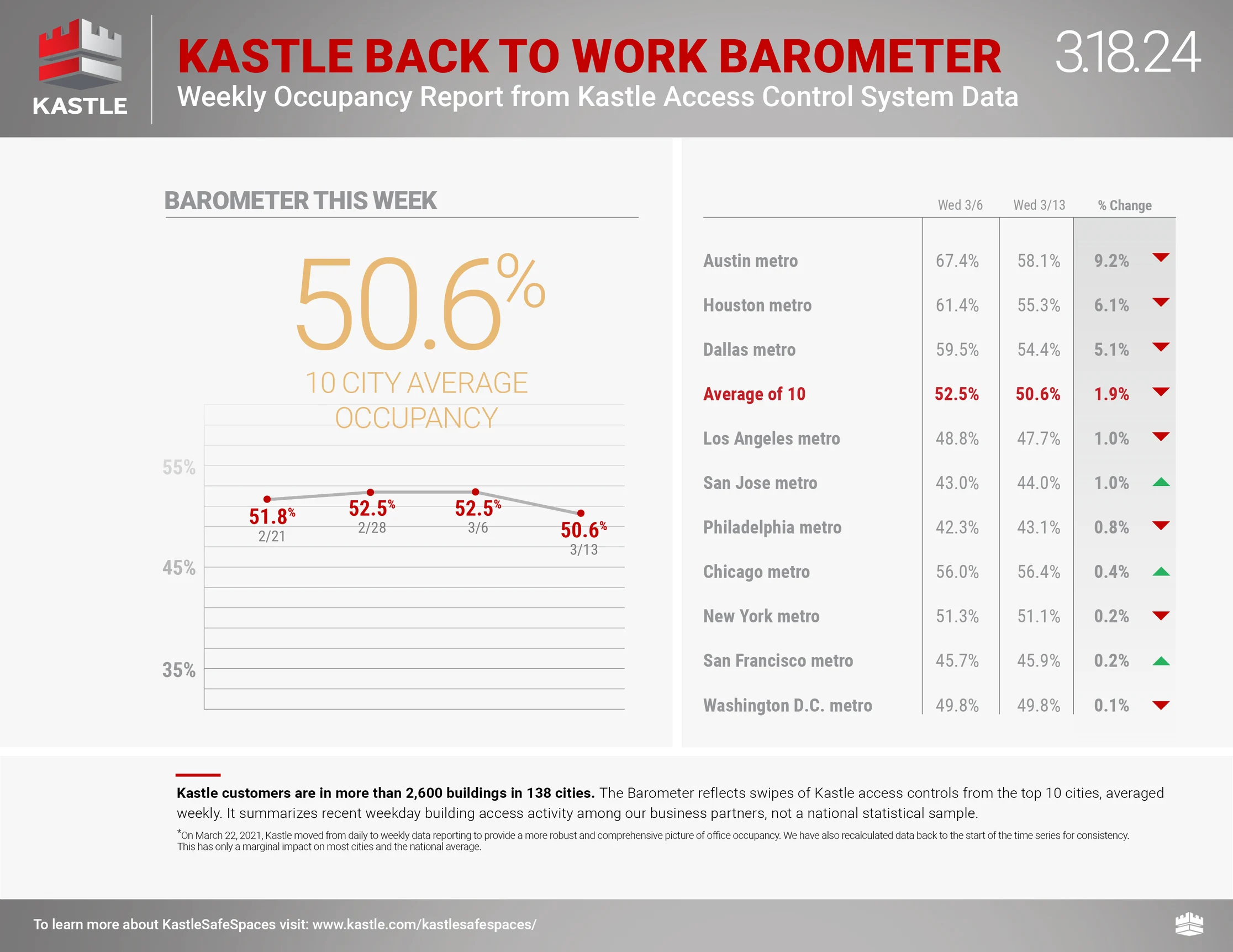

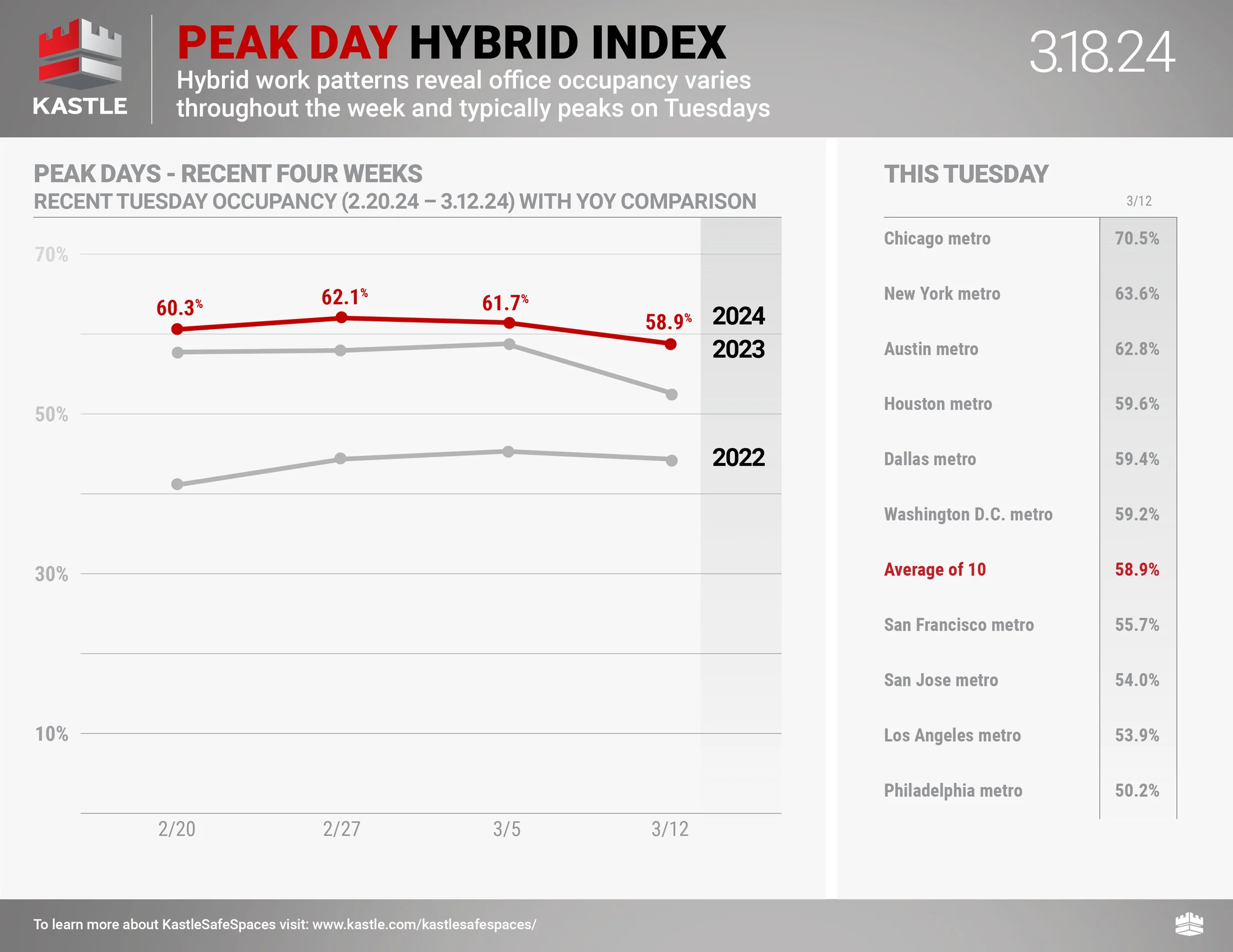

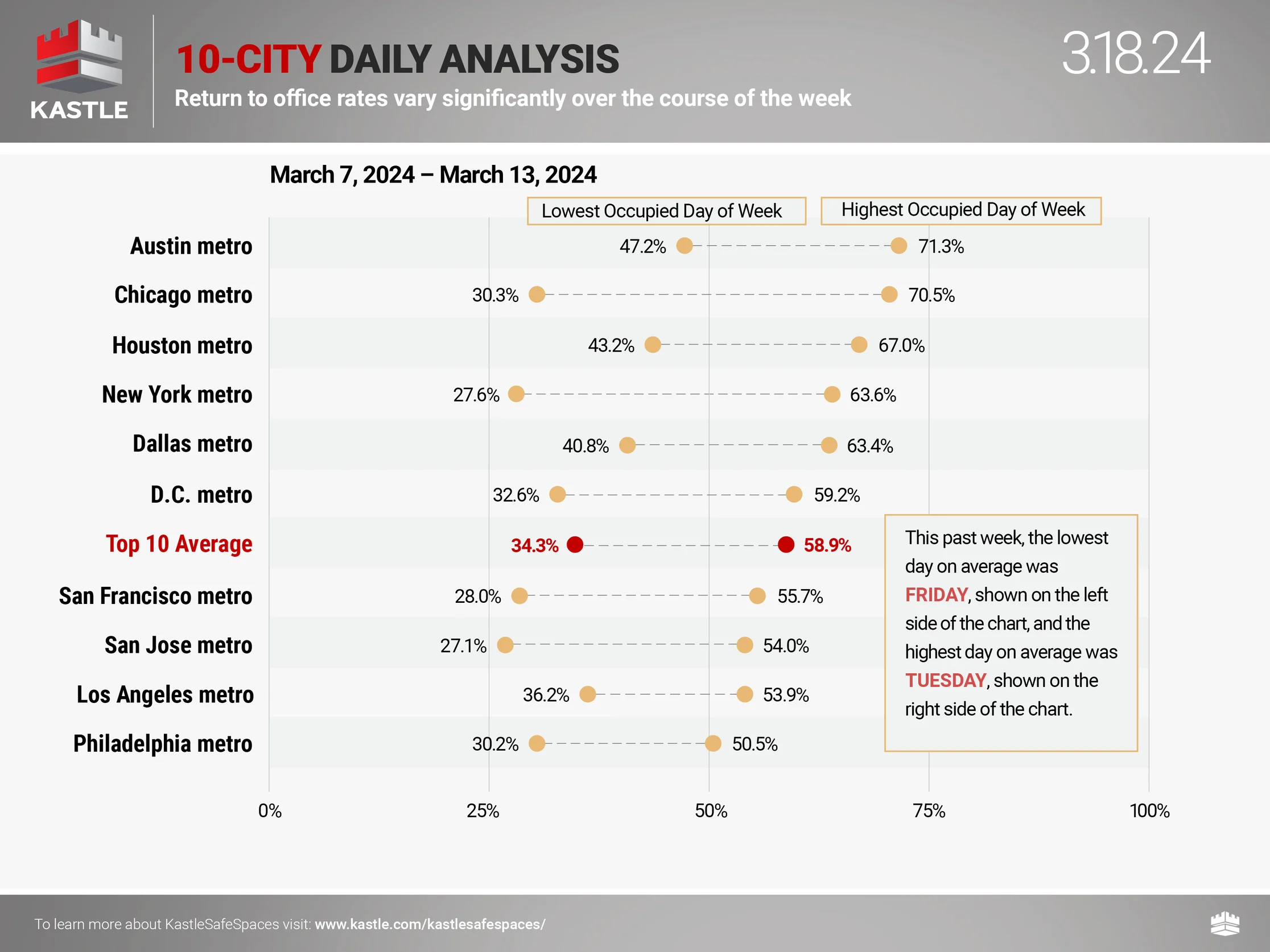

Kastle card swipe data

Remember that Kastle charts are overstating occupancy* because their pre-pandemic occupancy benchmark was 100%, which is incorrect (*measures card swipe activity as a proxy for occupancy). Still, they’ve become the standard benchmark for occupancy rates.

Favorite RANDOM charts of the week made by others

Appraiserville

TAFs Lyin’ Dave Is Disappointed About Being Personally Attacked After Personally Attacking Me

For the uninitiated, TAF is the organization that wrote the bat-shit crazy letter, the chickenshit letter, and is the subject of an active investigation by HUD on whether USPAP promotes a lack of diversity in the appraisal profession (400th out of 400 occupations, according to BLS in 2021). As a reminder, TAF president Dave Bunton called me a liar in a public forum in Washington, D.C., as he was lying (not under oath) – hence his new nickname “Lyin’ Dave,” a.k.a. “LD.”

Journalist Kyle Campbell of American Banker has been a stalwart covering the TAF debacle and shared his Monday American Banker article on his LinkedIn page. He commented on CFPB Director Rohit Chopra’s TAF statement:

Kyle noted:

This week, Consumer Financial Protection Bureau Director Rohit Chopra laid much of the blame at the feet of The Appraisal Foundation. In a written statement, he said the non-profit rule-writing entity was “essentially a lawmaking body,” one this accountable to neither the public nor the free market.

Kyle Campbell,American Banker

Wow. Chopra gets it. In response to Chopra, Lyin’ Dave complained:

I am disappointed that a hearing on appraisal bias turned to personal attacks rather than exploring opportunities to collaborate on this critical issue,” Bunton said.

Kyle Campbell,American Banker

Before we explore the extreme irony of his whining, it is essential to note that Dave’s testimony was all about his having nothing to do with any process at TAF (lies). But in reality, he is the sun king of the monarchy, and the monarchy was repeatedly challenged at the hearing, so he took it personally.

To put this in a geopolitical perspective, Russia’s President Putin just got 86% of the vote in their recent election, and Saddam Hussein got 100% of the vote when he was in power. LD handpicks every BOT member, every ASB member, and every AQB member. Because he handpicks every person, LD always gets 100% of what he wants.

Okay, now for the irony part—Lyin’ Dave completely forgot he attacked me personally during the fourth hearing on appraisal bias in Washington, D.C., saying that I “had a problem with the truth, often” and that he had spoken to me “often” about this. Phil Crawford at Voice of Appraisal took down LD’s hypocrisy. LD’s complete lack of contrition is breathtaking. Take notes, everyone, because this is what hypocrisy looks like.

Lyin’ Dave (“LD”) Calls Me A Liar While Lying [February 16, 2024, Appraiserville]

LD is a master bureaucrat who has been the leader of TAF for more than thirty-three years, so…

he argues that the organization has done much to tackle bias and evaluate its internal policies and practices.

Kyle Campbell,American Banker

This is because LD wants us to think that making lists, forming committees, and creating councils that effectively all report to him is the same as doing something about anything. This is how he has remained in power for so long, even while damaging the public trust. He has long mastered creating busy work to make it look like TAF is doing something. A combination of CFPB, ASC, and Congress needs to figure out how to clean house at TAF and keep LD’s deputy successor, Kelly Davids, from taking over, or it will be the same old do-nothing game for another 30+ years.

Hey Dave – the walls are closing in on you as you continue to destroy your legacy.

Here’s Kyle’s LinkedIn piece from American Banker that says it all.

Rumormill: Lyin’ Dave Is Going To Pick KD To Succeed Him On Monday At The BOT

Lyin’ Dave knows that the ASC has no oversight powers on TAF. His soon-to-be successor, Kelly Davids, wrote in the “bat-shit crazy letter” I share every week (she probably ghostwrote for LD and the then BOT chair): “We don’t need oversight because our record is unblemished.” My goodness.

In light of the Foundation’s unblemished record, it is absurd that now, after 30+ years without issue, the ASC has autocratically declared an expansion of its role and beyond what Congress envisioned

TAF’s bat-shit crazy letter

Lyin’ Dave’s action of appointing Kelly this Monday is equivalent to raising his middle finger to all appraisers nationwide and the ASC. LD is gambling on the GOP retaining control of the House in the fall. Remember when Chopra congratulated LD on his announced retirement? To translate: Don’t let the door hit you on the way out.

The political fact that the House Financial Services Committee Chairman Patrick McHenry (NC-10) hates Director of the Consumer Financial Protection Bureau Director Rohit Chopra is that nothing would change for TAF if the GOP retains the House. However, with the House and Senate both projected to flip in opposite directions in November, you can probably bet KD will be grilled about TAF’s behavior on the House side of Congress, hopefully to the point where Congress will give ASC oversight powers and clean house (no pun intended).

And here’s a sidebar thought about all the LD-appointed TAF BOT members who are going to be given Kelly’s name by Lyin’ Dave on Monday to approve: You are personally responsible for your actions as a board member, and this qualifies you to the appraisal industry as “selling your soul” if you vote for KD to continue TAF’s do-nothing-but-make-lists culture. Hopefully, you now know that being on the current BOT is not the resume padding you thought it was. It could open you up to future personal legal peril. Will it be worth it? I doubt it. Plus, think about your national reputation.

Lyin’ Dave Rides Off Into The Sunset As An Appraisal Industry Pariah

After thirty-three years of running TAF and making appraisers’ professional lives 10x more complex than they had to be, Lyin’ Dave will be remembered outside of the TAF kingdom by the appraisal industry as an analogy similar to those on the following list:

- Captain of the Titanic

- Ken Lay, CEO of Enron

- Roger Smith, Chairman of GM

- Bernie Ebbers, Chairman of Worldcom

- Angelo Mozilo, Founder of Countrywide – his “Friends of Angelo” was my inspiration for “Friends of Dave Bunton” (FOD) and for the Appraisal Insitute’s “Friends of Jim Amorin” (FOD).

Lyin’s Dave is retiring with TAF’s broken legacy hung around his neck. KD will proudly continue his legacy of damaging the public trust in the appraisal industry because they have no oversight, which Congress DID NOT intend. It’s a shame. LD could have made a difference, even as a skilled bureaucrat, and I always found him pleasant, personally. His actions showed he didn’t think about appraisers since he focused solely on generating revenue for TAF. I realize his job wasn’t to coddle appraisers. Still, TAF morphed into an organization built to fleece appraisers with unnecessary busy work and costs so TAF execs could fly to Dubai conferences first-class, frequently dining on steak and fine wine. Since LD fought so hard to protect his replacement, one could assume he will get a nice consulting contract from KD at TAF when he resigns and continues the fun.

Quick legal Q&A in light of what Lyin’ Dave said about me:

Q: Why don’t any experts who have testified in the four Washington, D.C. appraisal bias hearings get sworn in (allowing LD to lie as he did)?

A: The ASC does not have the specific legal authority to swear in experts to testify under oath.

Voice of Appraisal’s Discussion Of The Conflict of Interest Titanic

Phil Crawford drops another powerful podcast this week, including his debut of the “You and Me and the Big Fan-nie” segment – part of his effort to expose “data cancer.” Data cancer is the concept that home sales pollute the sales pool when an appraiser doesn’t inspect them (a waiver is given). When the home closes, it becomes part of the widely relied-on data set. In the context of millions upon millions of sales, it is a real problem. The arrogance of the GSE culture (lack of competition fosters this, and Freddie is not a competitor but more of a sister organization) has evolved to the point that they (namely Fannie Mae) believe in automation entirely and plan to replace their “eyes on the ground” (appraisers) because, hey, they’ve got the numbers, with AVMs. They throw a bone at appraisers by suggesting we become “property data collectors.” Who is going to get hurt by this mentality ultimately? The consumer will be the one who gets throttled in slow motion as waivers push valuations higher.

Phil wants Fannie Mae to share the addresses of the properties that got appraisal waivers so that they can be mapped out via GIS. Properties bypassing an appraisal inspection with a waiver become comps foundational to skewing local housing prices higher than the market can support. Also note Phil’s use of the word “often” about me, which is a play on TAF’s Lyin’ Dave’s lies about me at the 4th appraisal bias hearing in D.C., saying he has spoken to me “often” about my lack of telling the truth, and that I won’t listen to him. Of course, he was blatantly lying as he said that – he never called or emailed me to do that. We only spoke when I had a question or called for clarification. LOL.

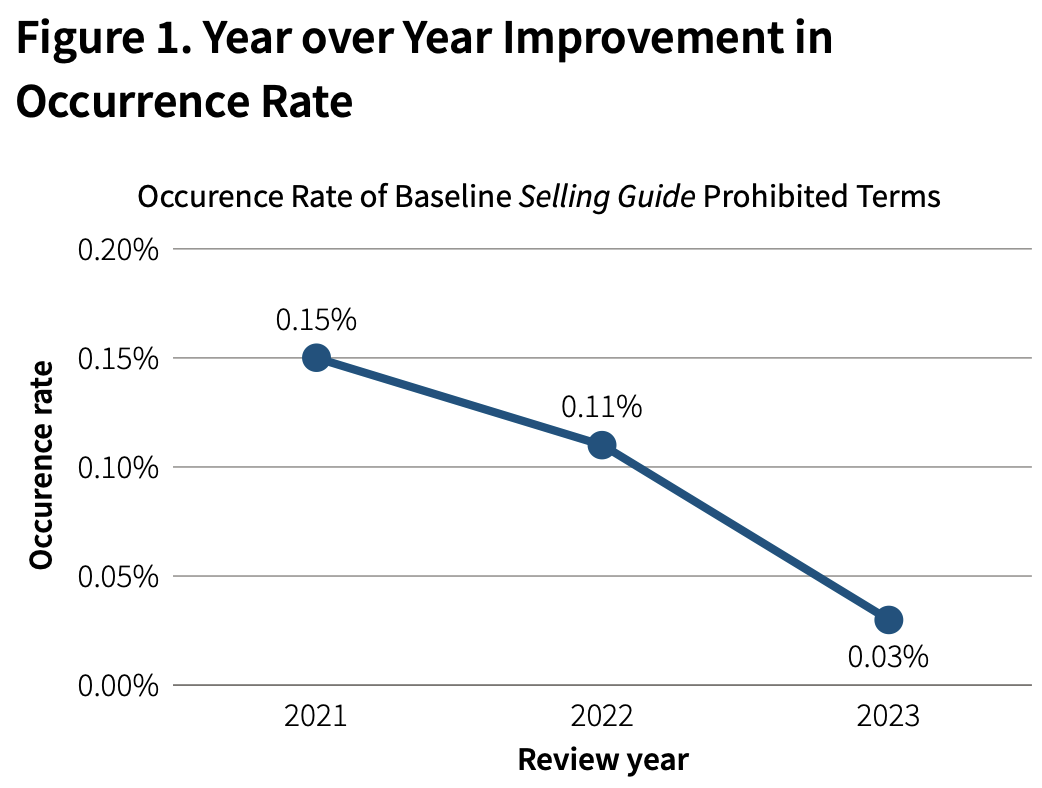

The Headlines About Inappropriate Appraisal Language Didn’t Match The Stats

The GSEs made a big deal about the inappropriate language used by appraisers a couple of years ago as part of their effort to champion automation – leading to conversations about appraisers becoming property data collectors. Reading their research coverage made me feel dirty as if I was using inappropriate language without even knowing it, and I’m sure many of my colleagues felt the same way.

And then, I received this March 2024 FNMA Appraiser Update, and this chart caught my attention. For the 2023 calendar year, inappropriate appraiser language accounted for only three one hundreds of one percent, and back in 2021, at the height of this “scandal,” it accounted for only fifteen one hundreds of one percent even though it felt like most appraisers were spewing buckets of toxic jargon.

When I read this chart, I realized that appraiser language had improved by 80% after training and shaming began in 2021 (from a tiny number to begin with). What am I missing? Indeed, this chart shows that appraisers can readily update their already decent skills and perhaps were not adequately trained. (Yet another failing of TAF).

OFT (One Final Thought)

Pete Holmes tells us that Life Doesn’t Make Sense. It’s a little NSFW, but it’s a palette cleanser that really explains where we are right now.

Brilliant Idea #1

If you need something rock solid in your life – particularly on Friday afternoons at 2:00 PM, Eastern Time (ET) – and someone forwarded this to you, you can sign up here for these weekly Housing Notes. And be sure to share with a friend or colleague if you enjoy them because:

– They’ll crank it up to eleven;

– You’ll wonder why ten isn’t enough;

– And I’ll be thinking about our expanding universe of nothingness.

Brilliant Idea #2

As a reader of Housing Notes, you’re clearly full of insights and ideas. Consider sharing them with me early and often. I appreciate every email I receive, as it helps me craft future Housing Notes.

See you next week!

Jonathan J. Miller, CRE®, Member of RAC

President/CEO

Miller Samuel Inc.

Real Estate Appraisers & Consultants

Matrix Blog @jonathanmiller

Reads, Listens and Visuals I Enjoyed

- https://assets.bwbx.io/s3/readings/S8WOIDT0G1KW1708041543448.mp3

- Chicago Voters Reject Real Estate Tax Change to Fund Homeless Programs

- What Does the Real Estate Shake-Up Mean for New Yorkers? [NY Times]

- 🚨 Miami Tower Turmoil [Highest & Best]

- Expert urges Albany to act following housing emergency extension [NY1]

- Insurance Rates Are Soaring for US Homeowners in Climate Danger Zones [Wired]

- U.S. Home Sales Jumped 9.5% in February [Wall Street Journal]

- MBA chief economist addresses industry challenges in House testimony [HousingWire]

- The Global Danger of Boring Buildings [Wired]

- Soaring Home Insurance Costs Could Push Homeowners Out of These 10 States [Insurify]

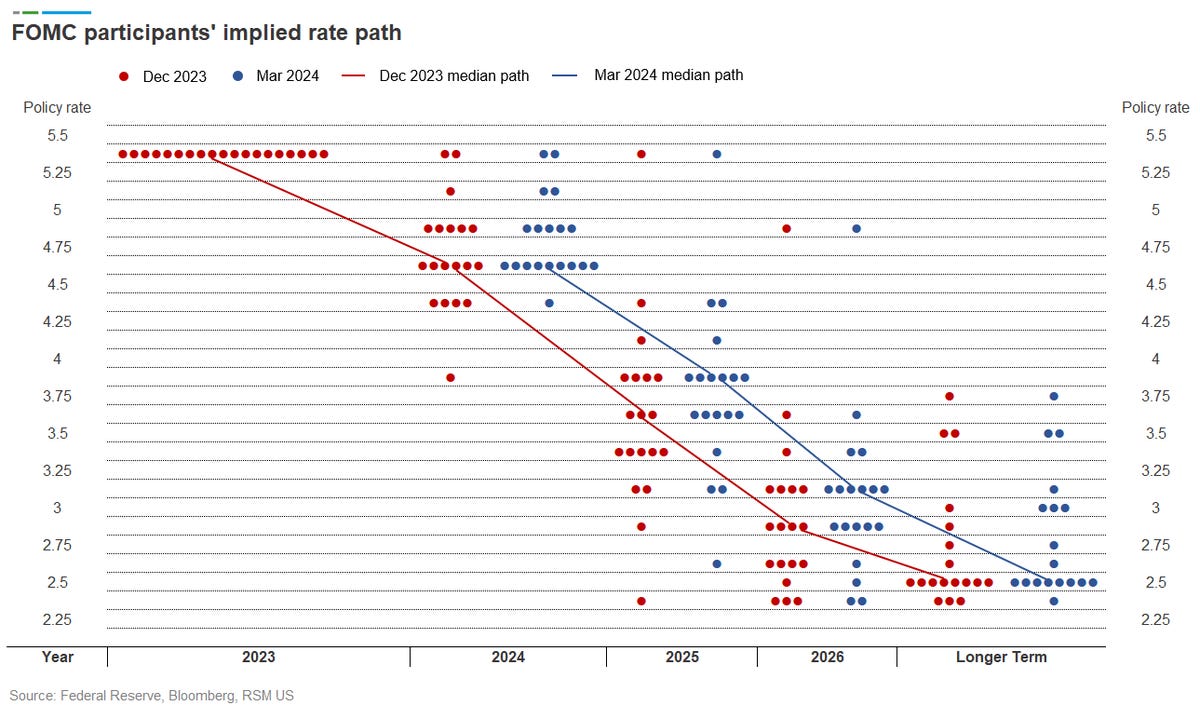

- The Main Qs and As from the Fed March 2024 meeting [Robert Brusca]

- Less Than Half of Americans "Very Satisfied" With Own Lives [Gallup]

- Apartment permits are back to recession lows. Will mortgage rates follow? [HousingWire]

- 😃 🫠 Condo Boom, Office Gloom? [Highest & Best]

- The average bonus on Wall Street last year was $176,500, down slightly from 2022 [ABC News]

- DiNapoli: 2023 Wall Street $34 Billion Bonus Pool Relatively Flat Over 2022 [Office of the NYS Comptroller]

- Luxury-Car Makers Are Building … Apartments? [Airmail]

- New York City’s First All-Electric Skyscraper Is a Stunning Game-Changer [Architectural Digest]

- Donald Trump Can’t Afford $464M Bond [The Real Deal]

- NYCB | CRE Bank Regulators [CRE CLO]

- Comedian Joe Lycett’s Home Value Crusade [The Real Deal]

- Fed Pencils In Three Rate Cuts in 2024, Shallower Path Ahead [Bloomberg]

- Sun Belt Cities Are Adding Millionaires Much Faster Than NYC [Bloomberg]

- Federal Reserve officials still expect to cut interest rates by 75 basis points this year [Financial Times]

- Commercial Real Estate's Busiest Era of Big-Name Turnover in 20 Years [Commercial Observer]

- Inflation at the Grocery Store [A Wealth of Common Sense]

- Business Leaders Survey [New York Fed]

My New Content, Research and Mentions

- CNN suggests Trump should sell Mar-a-Lago to post bond, $18M value magically turns to $240M [BPR]

- Donald Trump's running out of time to sell Mar-a-Lago [Newsweek]

- How to Make Sense of New York’s Confusing Luxury Home Market [Wall Street Journal]

- The Boomers Who Tried Moving to Florida and Ended Up in Appalachia [Wall Street Journal]

- Rafael Viñoly’s Long-Delayed Luxury Condo Tower Begins Sales [Costar]

- The price of luxury homes in the United States has hit another record, and the rich love to buy townhouses_Tencent News [QQ.com]

- Luxury home prices in the U.S. hit record highs again, and the rich love buying townhouses [STCN]

- Luxury home prices in the United States hit another record, and the rich love to buy townhouses_ Oriental Fortune Network [East Money]

- Luxury home prices in the U.S. hit record highs again, and the rich love buying townhouses [Baidu]

- Luxury home prices in the U.S. hit record highs again, and the rich love buying townhouses [Baidu]

- Luxury home prices in the U.S. hit record highs again, and the rich love buying townhouses [Yicai]

- Rents hit record February high in Manhattan and Brooklyn [Brick Underground]

- Bess Freedman says Trump is too late to cash out properties [Inman]

- Lower Manhattan condo tower a decade in the making starts sales [Crain's New York]

- Five New Developments Entering Miami’s Hot Condo Market This Spring [Mansion Global]

- Dip in Interest Rates Won't Fix Squeeze on Supply of Co-ops and Condos [Habitat]

- Insider’s Guide: Jonathan Miller on the outlook for New York’s luxury property market [Knight Frank]

- New York sees cash buyers surge to 68% [Knight Frank]

- "Urgent Action Needed" As Manhattan Rents Inch Towards Record Highs [ZeroHedge]

- Town Line Road New Modern Farmhouse Sells for $20.5 Million [27 East]

- Lower Manhattan Condo Tower a Decade in the Making Starts Sales [Bloomberg]

Recently Published Elliman Market Reports

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 2-2024 [Miller Samuel]

- Elliman Report: California New Signed Contracts 2-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 2-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 2-2024 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 1-2024 [Miller Samuel]

- Elliman Report: Manhattan Decade 2014-2023 [Miller Samuel]

- Elliman Report: Manhattan Townhouse Sales 2014-2023 [Miller Samuel]

- Elliman Report: San Diego County Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Orange County Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Los Angeles Sales 4Q 2023 [Miller Samuel]

That One Big Thing

- Powerful Realtor Group Agrees to Slash Commissions to Settle Lawsuits [NY Times]

- 4 Ways a Settlement Could Change the Housing Industry [NY Times]

- Realtors Reach Settlement That Will Change How Americans Buy and Sell Homes [Wall Street Journal]

- Roughly $30 billion slashed from real estate agents’ commissions: Fed economists pose solution to the 'anomaly' in the American housing market [Fortune]

- A court settlement is about to change how we buy and sell homes. Here's how. [Axios]

- National Association of REALTORS® Reaches Agreement to Resolve Nationwide Claims Brought by Home Sellers [NAR]

- An anticipated settlement still shocks real estate industry [Inman]

- The 6% commission on buying or selling a home is gone after Realtors association agrees to seismic settlement [CNN Business]

- Agents Decoded: The future is uncertain — but don’t panic! [Real Estate News]

- National Association of Realtors Settlement Will Reverberate Throughout Real Estate Industry [27 East]

- The Realtors’ Big Defeat [NY Times]

Appraisal Related Reads

- Make your 2024 NYC Annual Convention Hotel Reservations! [CRE]

- Some things on my mind about the NAR lawsuit [Sacramento Appraisal Blog]

- Chopra: 'Insular' Appraisal Foundation unlikely to address bias [American Banker]

![San Diego County Average v. Median Sales Price [Single Family, Condo]](https://millersamuel.com/files/2024/01/1Q24SD-avgMED-1200x794.jpg)

![[27 Speaks Podcast] Jonathan Miller Provides A 2024 Hamptons Outlook](https://millersamuel.com/files/2024/02/27eastlogo-600x314.jpg)