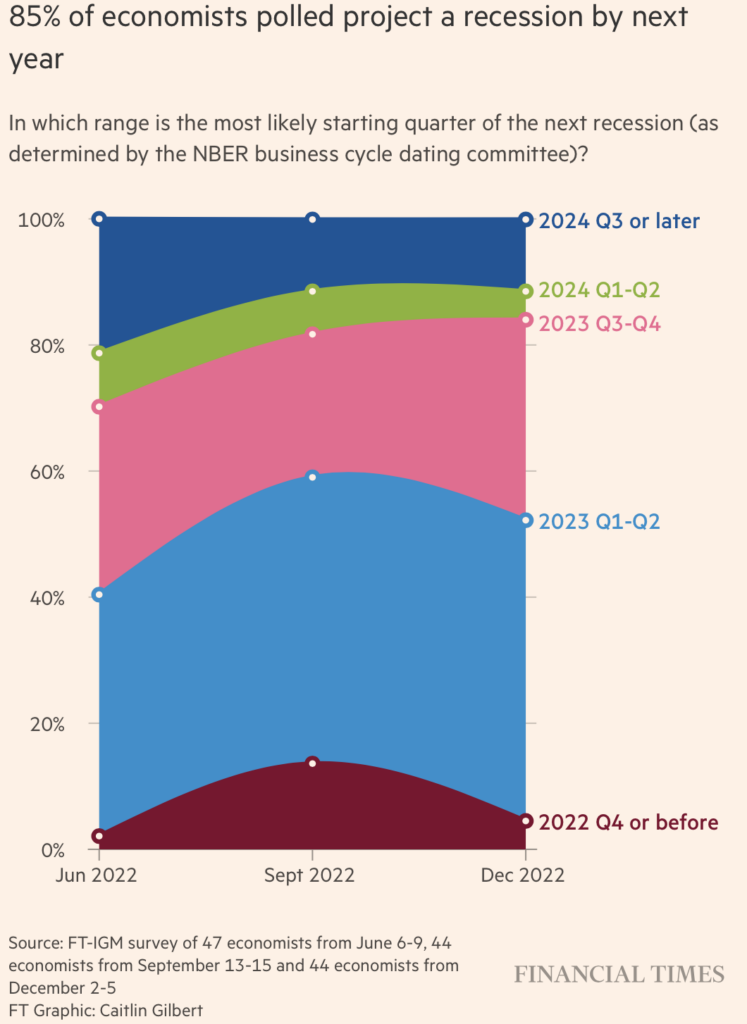

Last year, 85% of economists surveyed thought there would be a recession, yet we seem to be already experiencing a soft landing (no recession).

There were forecasts of a recession “in the next 6 months” for the last two years. To those in the real estate industry, it felt like a recession, while the rest of the economy seemed strong, with elevated wages and unemployment below 4%. The economy has been very strong, but an unusual number of people think the economy isn’t doing well. It is fair to say that it has not been clear to anyone what was going on economically speaking in 2023.

The expected better year 2024 isn’t akin to the 2021 housing boom, but it will satiate many, even without the excesses of “Taco Town.”

——–

Did you miss last Friday’s Housing Notes?

December 22, 2023: Happy Holidays To All And To All A Good 2024

——–

But I digress…

Bloomberg’s At The Money Podcast (ATM): The Best Way To Sell A House

For the second time, I joined my friend Barry Ritholtz on his new podcast, At The Money (or cleverly, ATM). Masters in Business is still strong, but he had a new idea: create an excellent personal finance-focused show. ATM is still in the MIB feed but will have its podcast feed in the new year.

Talking Head’s Burning Down_the_House is the intro music!

My previous visit on ATM:

At The Money Podcast: The Best Way to Buy a House

NYS Comptroller: The Latest Statistics On Shifting Population Shows It’s All About Immigration

As immigration to the City returns to historic

Office of the New York State Comptroller

norms and the economy continues to grow, so,

too, will the City and its population. Ultimately,

understanding these changes can help inform

policy choices necessary to serve residents and

keep the City competitive and dynamic.

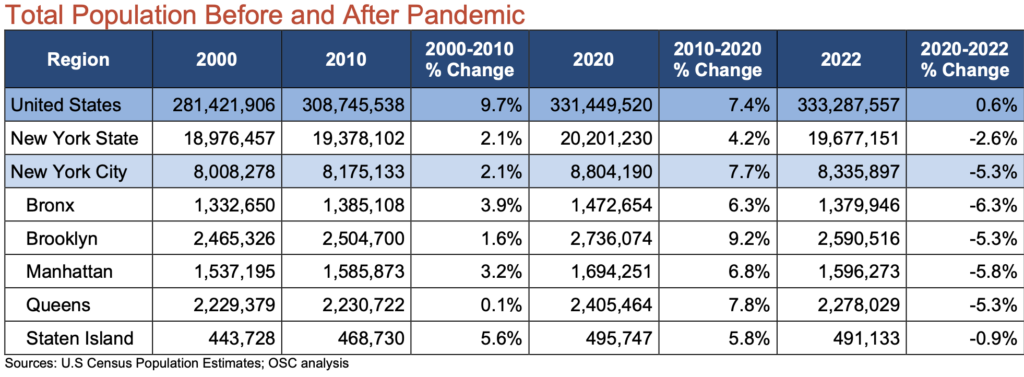

At the beginning of the pandemic lockdown, a large swath of the city, skewed to affluence, moved out temporarily. However, the constant headline drone of “Exodus” and “Fleeing The City” made it sound like Manhattan would have eleven people left by the end of 2020. When I go to Florida and speak with real estate agents or people that just arrived, it sure sounds like New Yorkers are the “new foreign buyer” of housing.

Yet the Office of The New York State Comptroller has a different narrative, using logic and facts. NYC experienced a significant 7.7% population growth over the decade, much faster than the overall U.S.

From April of 2020 to July of 2022, the New

Office of the New York State Comptroller

York City population declined by

5.3 percent. This decline of 468,293

residents, many of whom remained in New

York or neighboring New Jersey, wiped out

almost three-quarters of the population

gains from the prior decade.

It’s always been easy to dump on New York City (pizza rat withstanding), but I encourage you to read the NYS Comptroller’s study: NYC’s Shifting Population: The Latest Statistics.

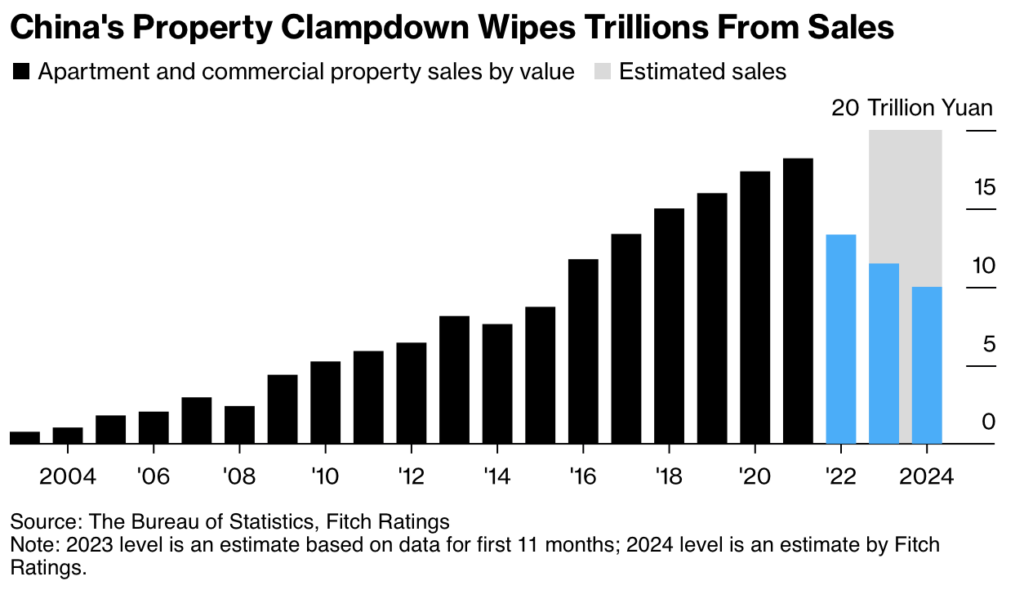

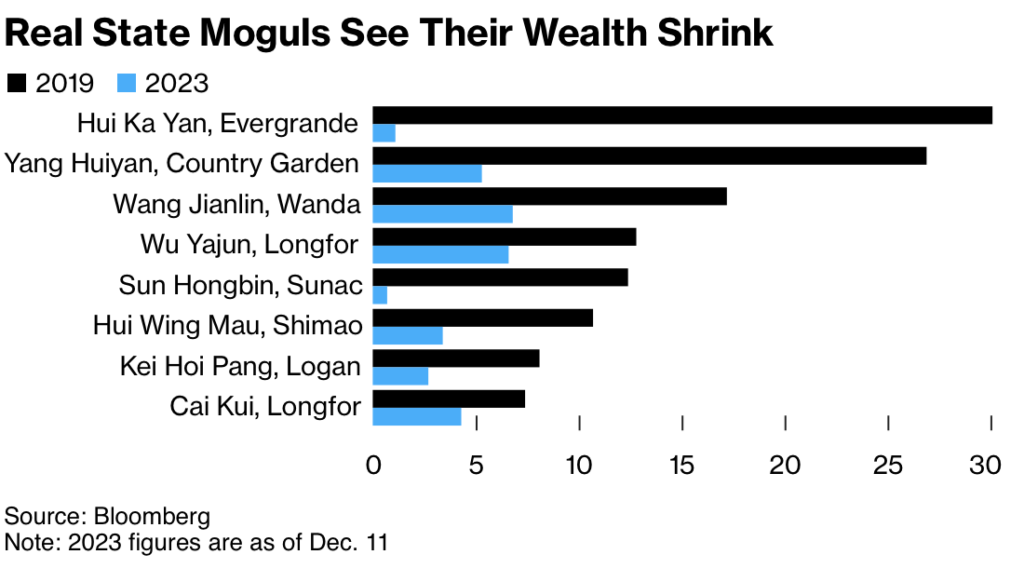

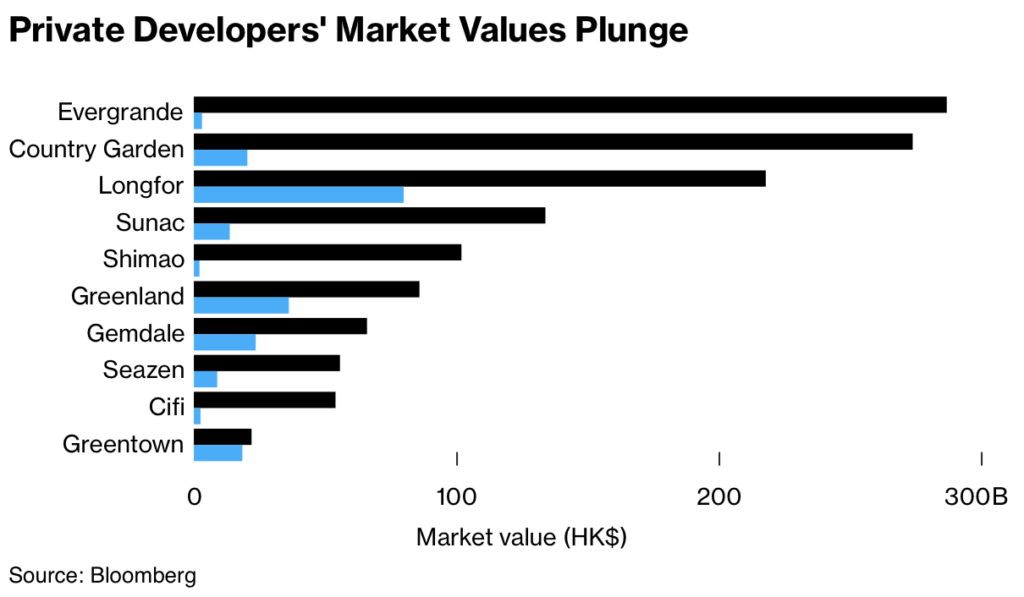

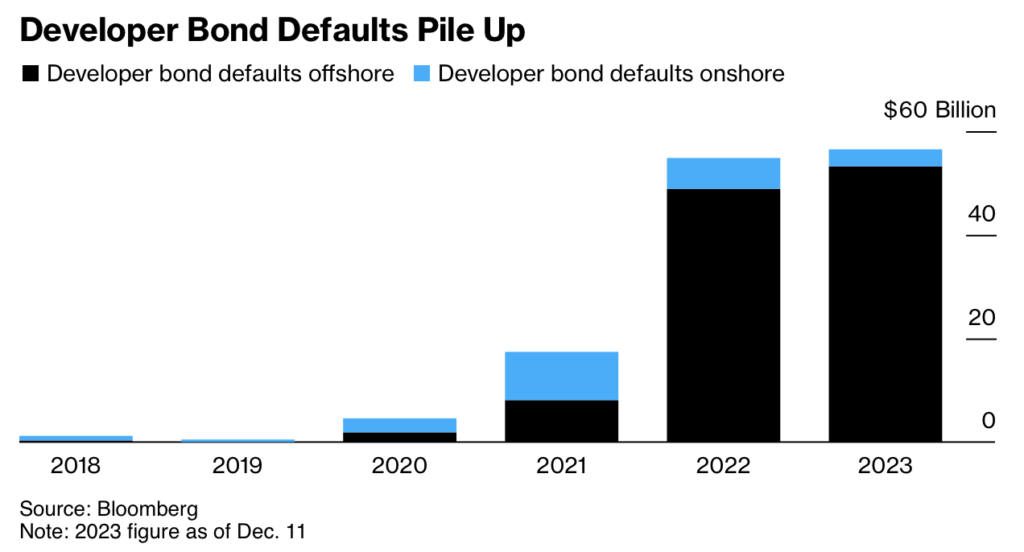

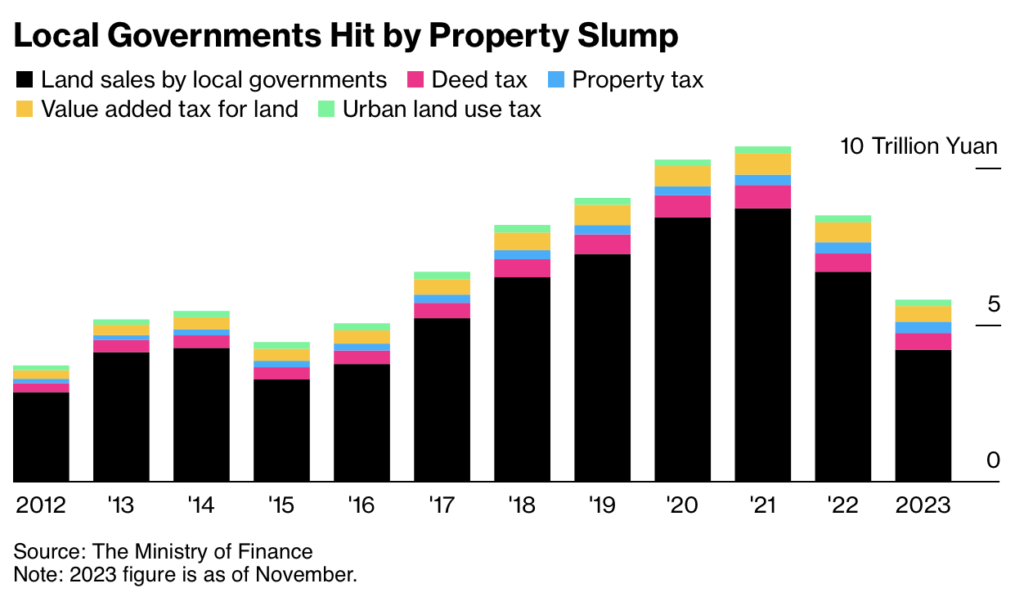

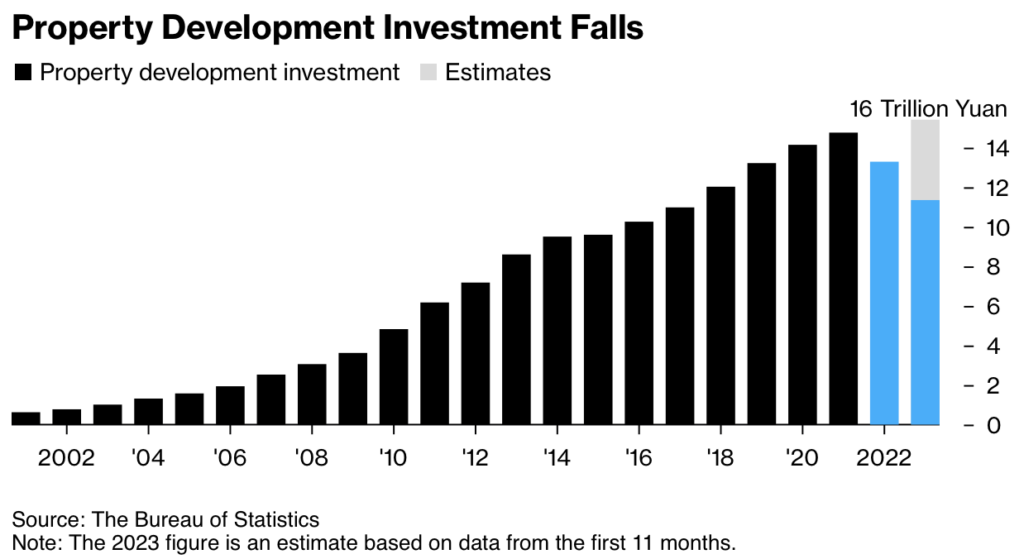

China’s Housing Market Is Tanking: Making Decrees Doesn’t Cut It

Here’s a great piece in Bloomberg: China Property Crisis in Charts: Spillover Spreads Across Economy.

The property market was booming when my wife and I visited Beijing and Shanghai five years ago. Three generations of families were pooling their funds to buy into the new multi-family towers going up everywhere. China used as much cement in a 3-year period as the U.S. did in the last 100 years. We learned about the 20+ ghost cities that popped up nationwide, created by incorrect incentives given to party leaders to raise GDP. Still, the populace was much more trusting of the housing market than the stock market, as stories of the government’s interference were quite mainstream. And because “housing prices always go up.” Until they don’t. Remember when NAR touted that same mantra the U.S. as recently as 2007 before the housing bubble burst? U.S. housing prices (in aggregate) never went down? Until they did.

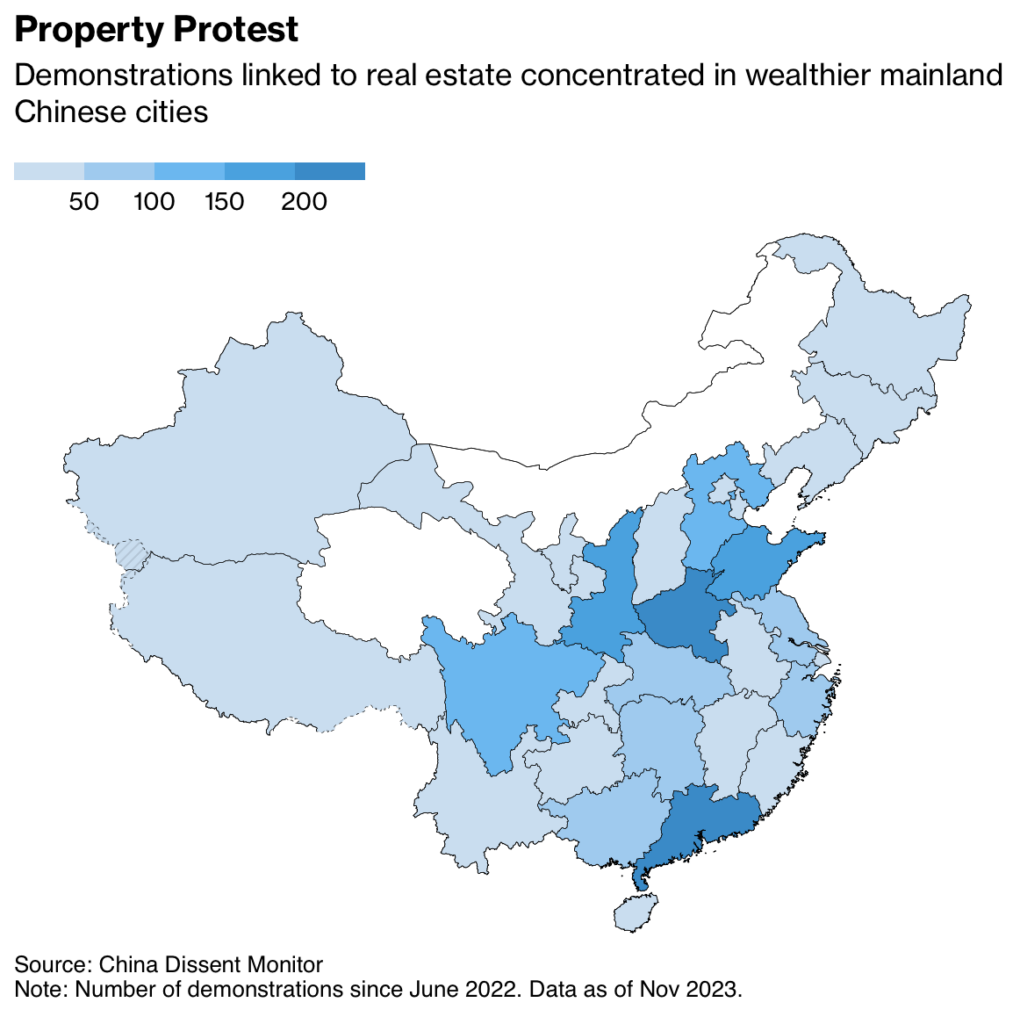

There are lots of real estate-related protests in China these days as prices drop. To learn more about the rise of China’s leader, Xi Jinping, I highly recommend the 10-part podcast by the Economist: The Prince. It is spectacular, and given the relationship between our two economies, I think it’s essential to future understanding.

Under XI’s more authoritarian leadership (like the recent mishandling of the COVID lockdown), it will be concerning to see their solutions while at the same time trying to woo Western countries back to investing in their country again.

More And More, The Onion Is Morphing Into Real News

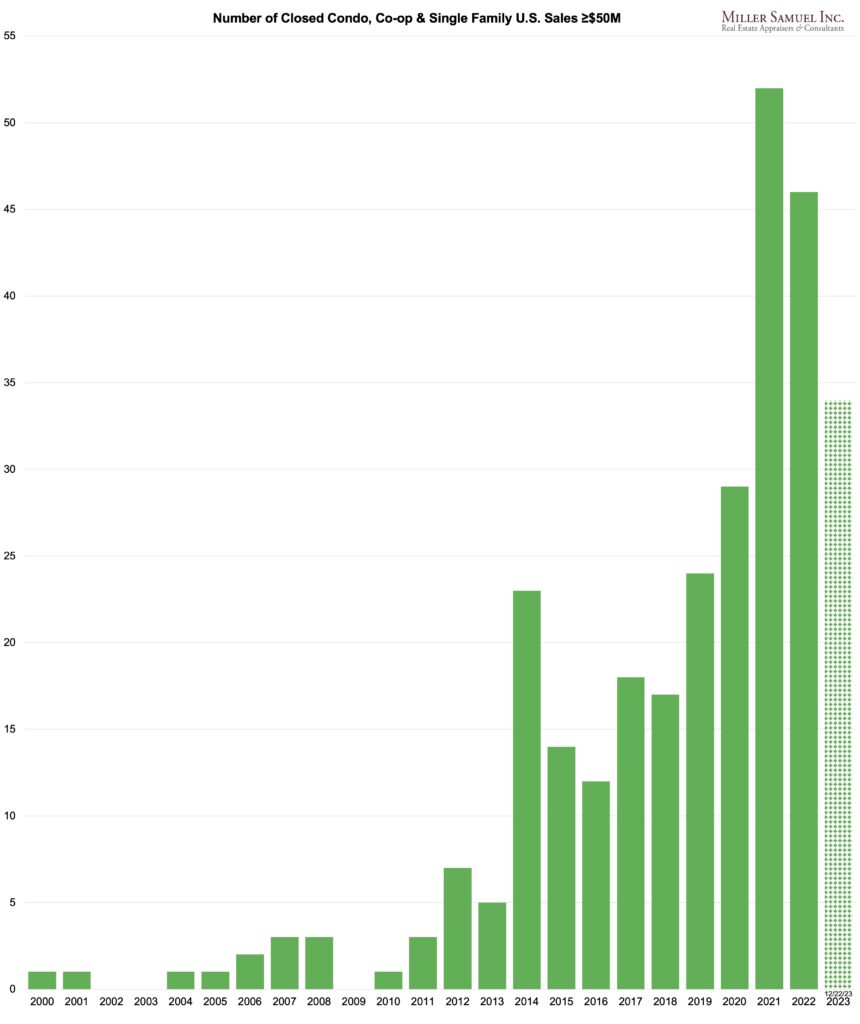

[Yawn] Record-Setting Prices Get Updated

Recently, I shared a list of U.S. sales of $50 million or higher, but that list continues to grow. Not because they were recorded and therefore visible, but because we can find them. I often ask myself, “Who cares?’ What’s my infatuation with the most expensive home sales in the U.S. or the world? I began tracking in 2014, starting with the year 2000. It’s partly because of our celebrity culture and partly because it represents extreme examples of the property market, and that, by definition, catches people’s attention, including mine. It doesn’t assist in our understanding of a local market since these sales don’t have anything to do with understanding a local market.

I remember when Michael Dell bought a $100+ million condo penthouse in One57, a super tall in the Midtown neighborhood of Manhattan, real estate agents would tell me stories of owners of co-op apartments in tenement walk-ups in the East Village, thinking their apartment was now worth more. That was a decade ago. Now I think the public better understands how disconnected these sales are from the reality of mere financial mortals like us.

Barron’s did an excellent piece on my list and threw in some international sales. So did The Real Deal, which focused on California, especially Los Angeles, coming out of the ill-advised (dumb) Measure ULA transfer tax that went into effect on April 1.

Here’s the U.S. sales result updated through this week.

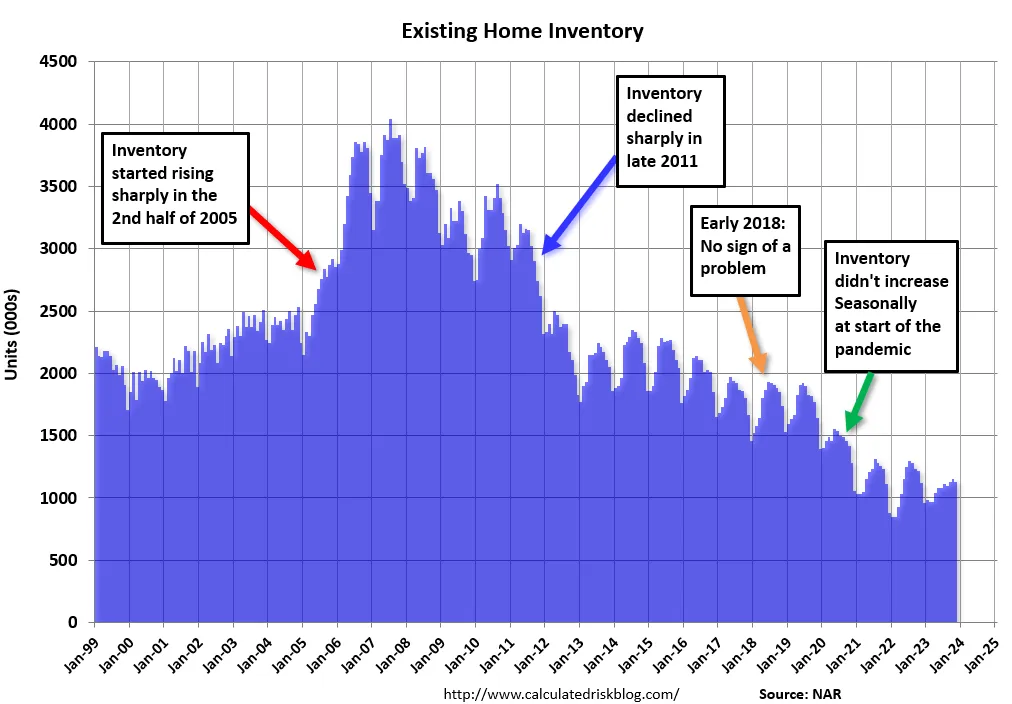

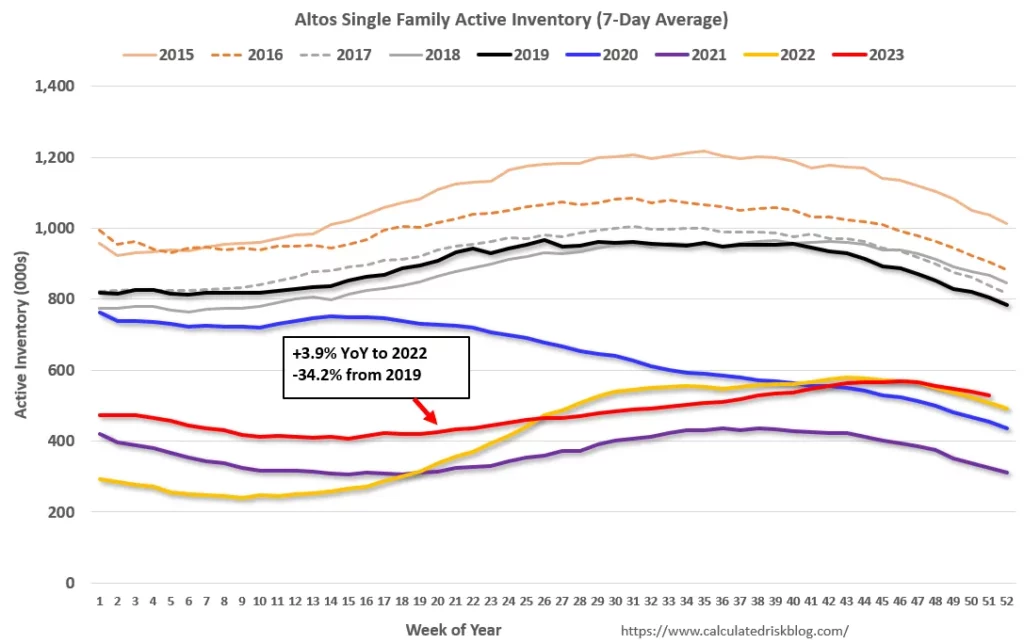

Meh, 2024 Listing Inventory Will Not Rebound Anywhere Close To 2019 Levels

This market view of anemic listing inventory rebound was espoused by Moi in recent weeks and is well-presented by Calculated Risk, the must-read blog/substack on the economy.

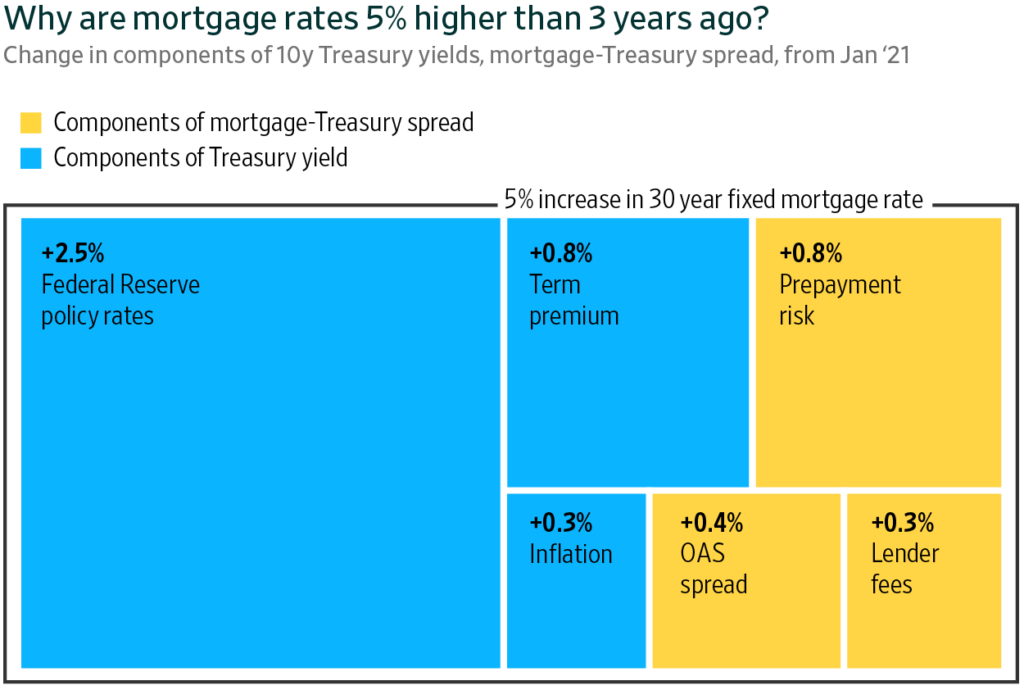

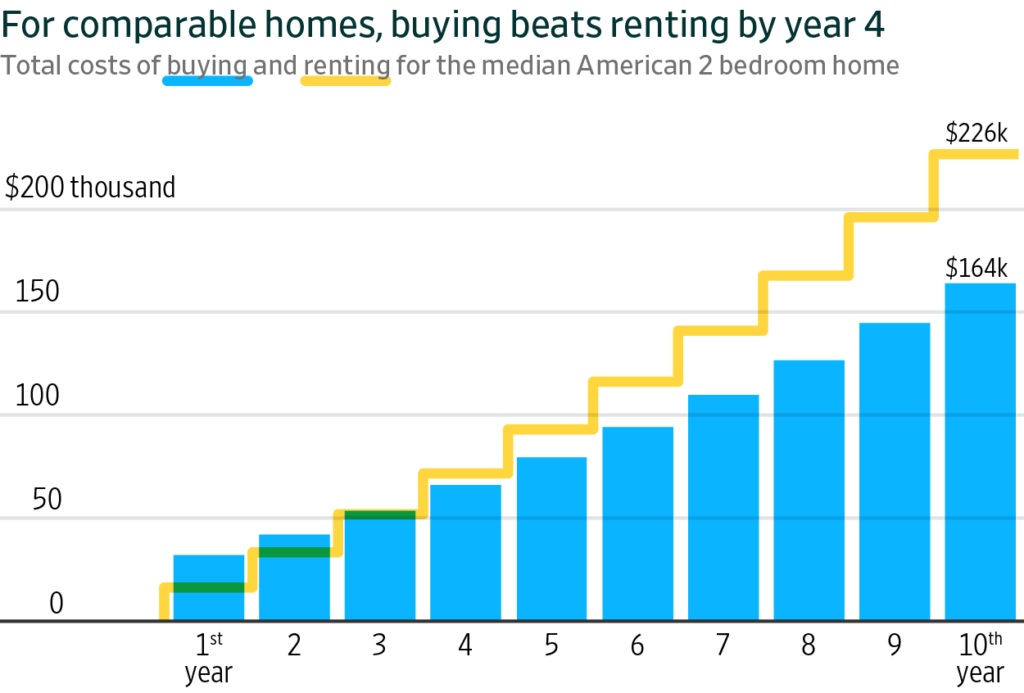

Falling mortgage rates are the only way to bring more supply into the market since new construction is only 10-15% of listing inventory in a typical year. Reducing the spread between current mortgage rates and the rates most homeowners currently enjoy (80% of U.S. mortgage holders have a rate below 5%) will incrementally raise levels but since mortgage rates are falling and are expected to be lower throughout 2024, sales will burn off much of the new inventory entering the market, keeping prices stable to rising.

NAR Lawsuits (And Bad Suits) Will Force The Drop-In Membership With Earnest Beginning In 2024

Many U.S. brokerage firms, amidst the numerous class action lawsuits and bad behavior of NAR leadership (and suit selection and fitting, my goodness, see images below),

dropped the requirement of its agents to be members of the National Association of Realtors (NAR), the largest trade group. I anticipate membership falling quite a bit over the next several years, so it will be interesting to see how the trade group manages its expenses after years of dominance. The NY Times lays it out in Powerful Realtors Group Loses Its Grip on the Industry. The barrier to entry for membership is very low, and unlike the appraisal industry, where designations translate into income (MAI = more annual income), the drop could be steep and deep. The only saving grace for NAR is that with mortgage rates falling, sales volume should expand in 2024, and that may delay many members’ exits as they become more harried in their daily lives, making up for the recent housing recession. But the reasons for membership remain weaker today than a year ago. Toxic culture, behaving like a monopoly, very ineffective lobbying, required membership from many organizations were dropped, and lots of new ideas from the tech sector entered the housing market zeitgeist.

Mobile Home Prices Are Rising Faster Than Houses

A while back, a fan of Housing Notes who worked at the Manufactured Housing Institute invited me to keynote their annual conference. I was a fish out of water topic-wise since Manhattan doesn’t have mobile homes in the traditional sense. They were really nice people in an entirely different housing space than I was accustomed to. I learned a lot.

The New York Times has an interesting piece on mobile home price trends, which tended to outpace the price trends of mobile homes. The report’s author didn’t have a firm answer as to why this happened other than it being a micro niche market. The quote from the piece is precisely what I learned when I spoke at MFI, making the price surge even harder to understand.

Mobile homes can pose unusual challenges for home buyers. If they are parked on someone else’s land, there will be rental and hookup fees. With the recent price increases, more buyers may need to finance their purchases, but that can be tricky. Because mobile homes depreciate quickly (much like an automobile), financing them is considered a greater risk by lenders and comes at a higher cost than a traditional home.

New York Times

Getting Graphic

Favorite housing market/economic charts of the week made by OTHERS

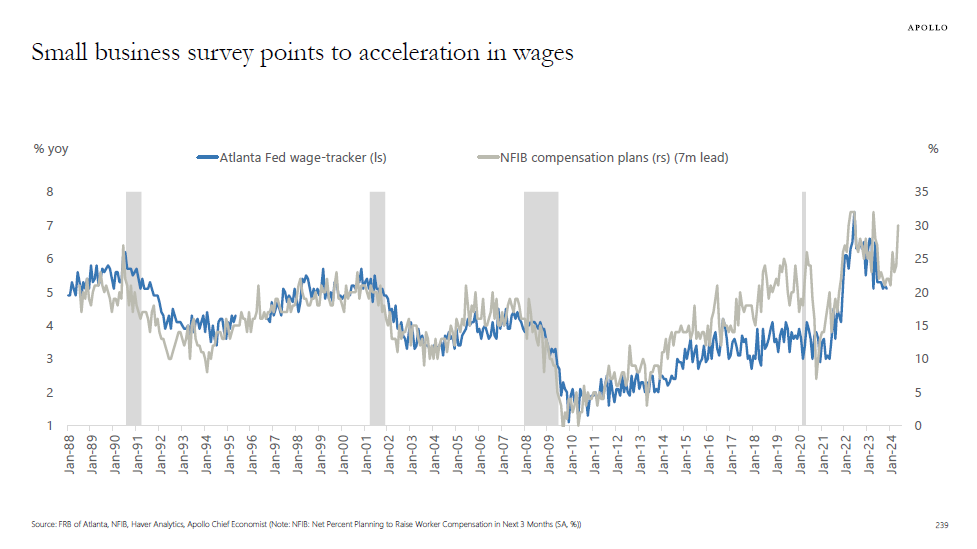

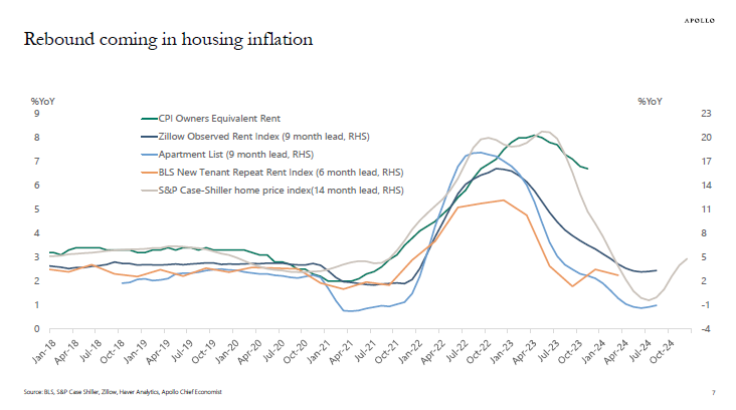

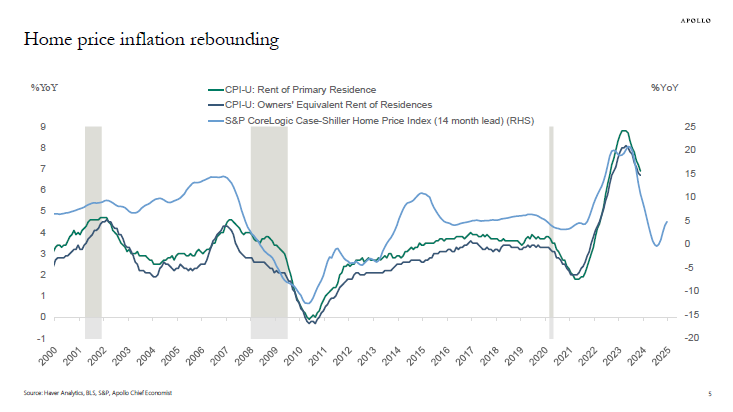

Apollo’s Torsten Slok‘s amazingly clear charts

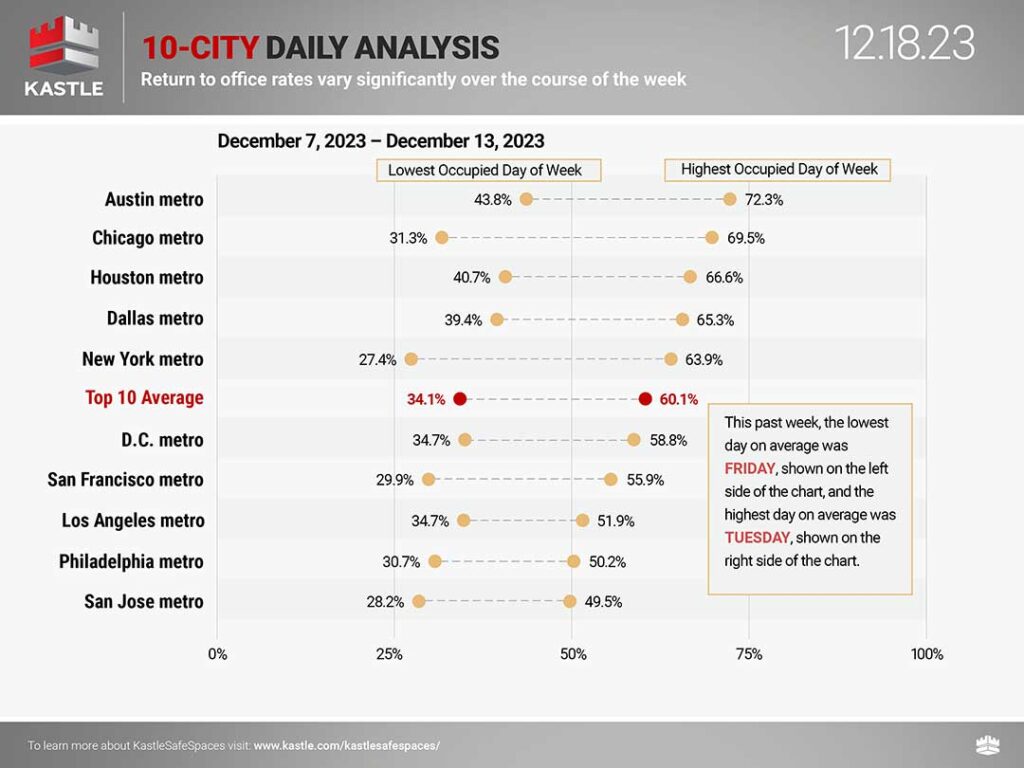

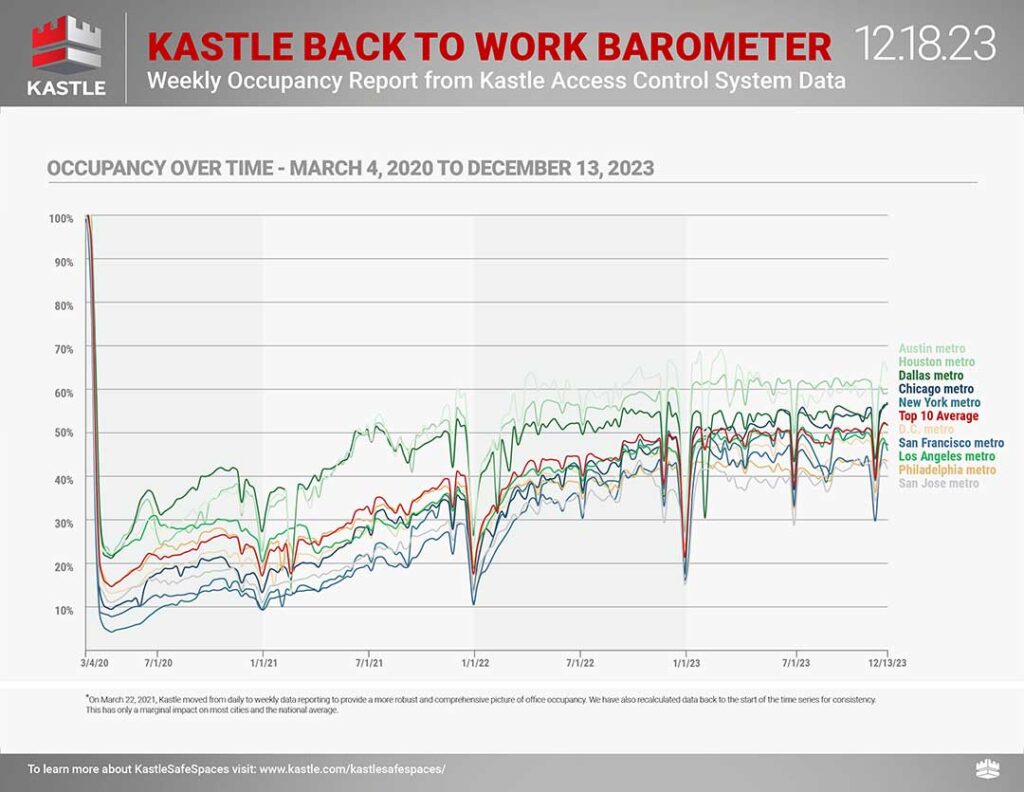

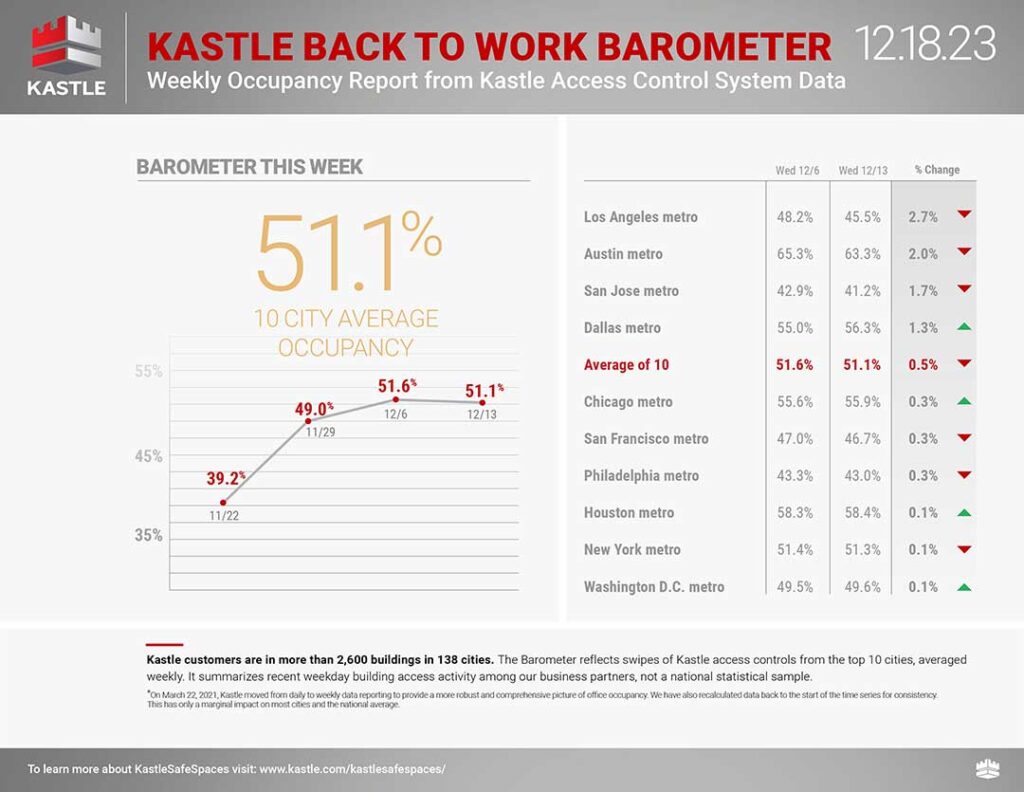

Kastle card swipe data

Remember that Kastle charts are overstating occupancy* because their pre-pandemic occupancy benchmark was 100%, which is incorrect (*measures card swipe activity as a proxy for occupancy). Still, they’ve become the standard benchmark for occupancy rates.

Favorite RANDOM charts of the week made by others

Appraiserville

For the uninitiated, TAF is the organization that wrote the bat-shit crazy letter, the chickenshit letter, and is the subject of an active investigation by HUD on whether USPAP promotes a lack of diversity in the appraisal profession (400th out of 400 occupations according to BLS in 2021).

Relying On Automation Makes The Bond Market More Vulnerable To Instability

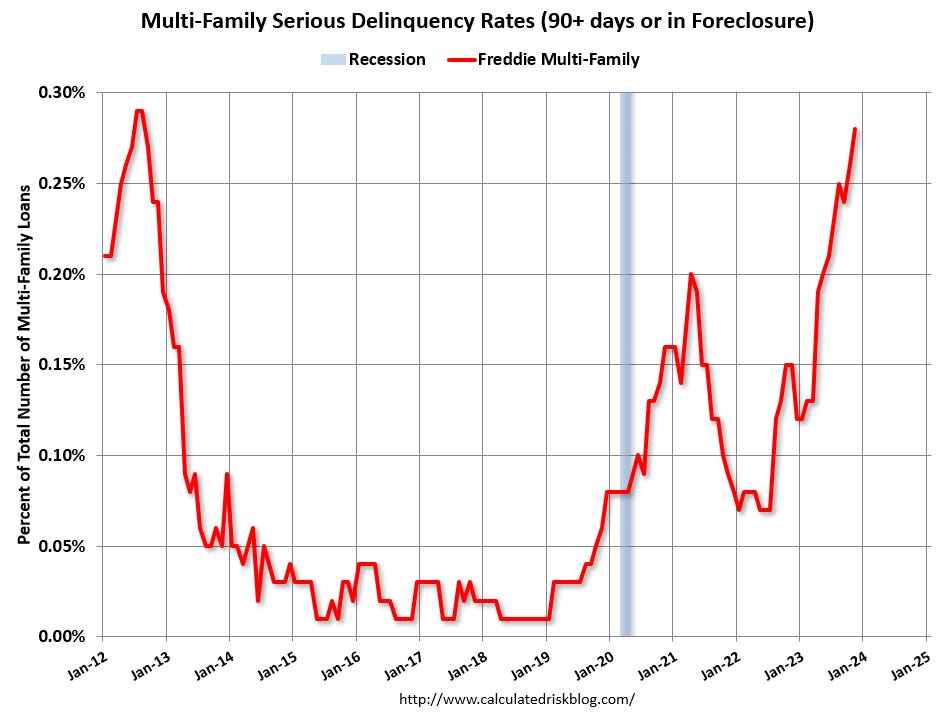

Recently there was a cyber attack on First American, one of the largest data providers in the U.S.. Earlier this year, the Cincy MLS was attacked, and the leadership had a conflicted sense of duty due to their positions at Perchwell. This is going to be a recurring reframe in the real estate industry and especially the appraisal industry. Trillions of dollars sit within the bond market, relying on housing as collateral. Fannie Mae is already trying to convert appraisers into data collectors because they think they can do the analytics through Automated Valuation Models.

Let’s not kid ourselves.

Happy New Year to the Appraisal Industry. 2024 Will See More Volume.

OFT (One Final Thought)

From the vantage point of my Manhattan office window in Midtown, I’ve seen many of these wooden water towers constructed on rooftops. Here’s one set to that hit song, “OSHA Violations.” Three families have a lock on this niche construction market.

Brilliant Idea #1

If you need something rock solid in your life – particularly on Friday afternoons at 2:00 PM, Eastern Time (ET) – and someone forwarded this to you, you can sign up here for these weekly Housing Notes. And be sure to share with a friend or colleague if you enjoy them because:

– They’ll go to Taco Town;

– You’ll Look At Water Towers;

– And I’ll be looking for another pizza rat in 2024.

Brilliant Idea #2

You’re clearly full of insights and ideas as a reader of Housing Notes. Consider sharing them with me early and often. I appreciate every email I receive, as it helps me craft future Housing Notes.

See you next week!

Jonathan J. Miller, CRE®, Member of RAC

President/CEO

Miller Samuel Inc.

Real Estate Appraisers & Consultants

Matrix Blog

@jonathanmiller

Reads, Listens and Visuals I Enjoyed

- Question #10 for 2024: Will inventory increase further in 2024? [Calculated Risk]

- Powerful Realtors Group Loses Its Grip on the Industry [NY Times]

- The Building Spree That Reshaped Manhattan’s Skyline? It’s Over. [NY Times]

- Home Prices Grew, but Mobile Home Prices Grew Faster [NY Times]

- Billionaires’ Row Leads NYC’s Priciest Home Sales of 2023 [The Real Deal]

- Economic, Housing and Mortgage Market Outlook – December 2023 [FreddieMac]

- Compass CEO Robert Reffkin Gets $900K Salary, $7M Bonus [The Real Deal]

- Los Angeles Office Building Sells at 52% Less Than 2018 Price [Bloomberg]

- Interactive Map: U.S. Property Taxes by State [Visual Capitalist]

- First American Suffers Cyber Attack, Pausing Deals [The Real Deal]

- New RealtyHop Study Finds No Collusion Between Brokerages and REBNY [RealtyHop]

My New Content, Research and Mentions

- From Beyoncé’s Beach Pad to a Dubai Aerie—Six Record-Breaking Home Sales Made This Year [Barron's]

- More cannabis, better housing market? How LI's economy might change in 2024 [Newsday]

- Lower interest rates in 2024 could boost condo sales, reduce apartment rents [Crain's New York]

- Podcast: Jonathan Miller discusses The Best Way to Sell Your House [Bloomberg]

- $200M Deal Tops List of LA’s Priciest House Sales in 2023 [The Real Deal]

- From Beyoncé’s Beach Pad to a Dubai Aerie—Six Record-Breaking Home Sales Made This Year [Mansion Global]

- ☀️ 1,000 New Floridians Per Day [Highest & Best]

Recently Published Elliman Market Reports

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 11-2023 [Miller Samuel}

- Elliman Report: California New Signed Contracts 11-2023 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 11-2023 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 11-2023 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 10-2023 [Miller Samuel]

- Elliman Report: California New Signed Contracts 10-2023 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 10-2023 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 10-2023 [Miller Samuel]

- Elliman Report: San Diego County Sales 3Q 2023 [Miller Samuel]

- Elliman Report: Orange County Sales 3Q 2023 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)