This has been a tumultuous year for the housing market. Mortgage rates surged, prices held, and listing inventory fell. All the rules of thumb we started the year with ended up broken. And it doesn’t help when the Mayor of New York is doing our city’s public relations. Oof.

Eric Adams

Mayor of New York CityBut it does look like the housing market will be incrementally better next year. Fingers crossed!

——–

Did you miss last Friday’s Housing Notes?

December 15, 2023: Taking The Dot Plot Out Of Housing’s Cold Refrigerator

——–

But I digress…

Bloomberg Surveillance TV – The Housing Market Should See More Volume In 2024

I joined Lisa Abromowicz & Tom Keene on Bloomberg Surveillance. As usual, Tom teases me to no end. Ha.

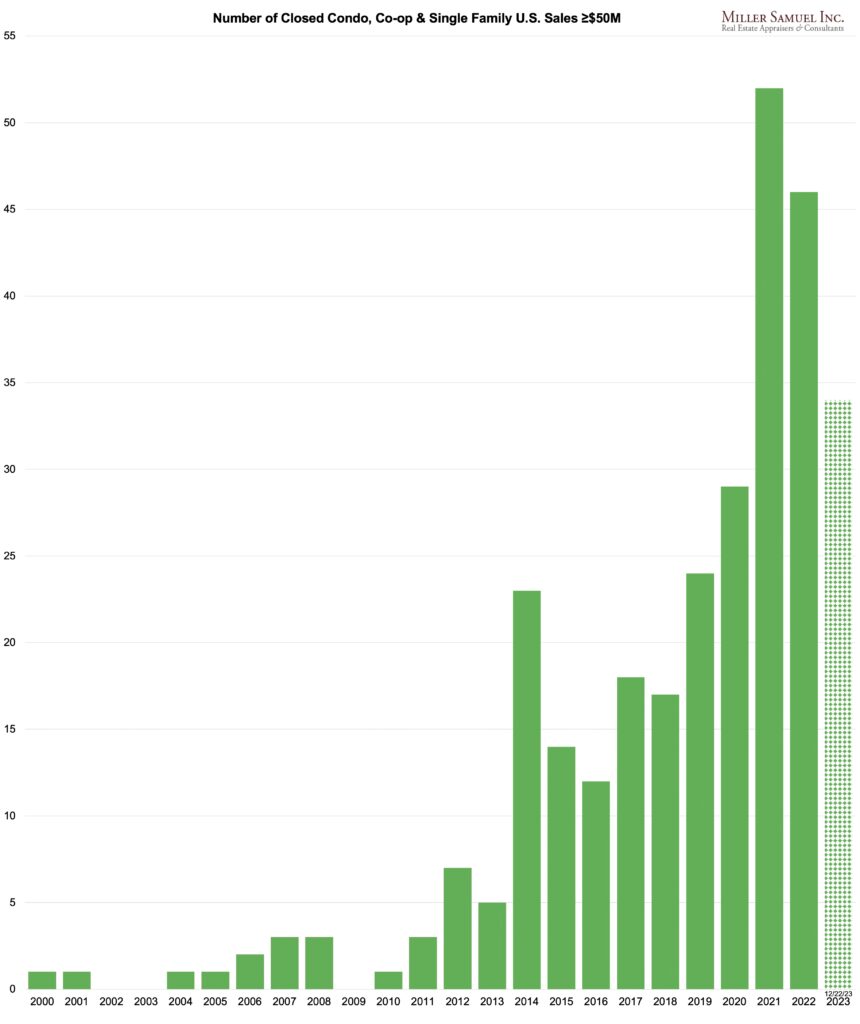

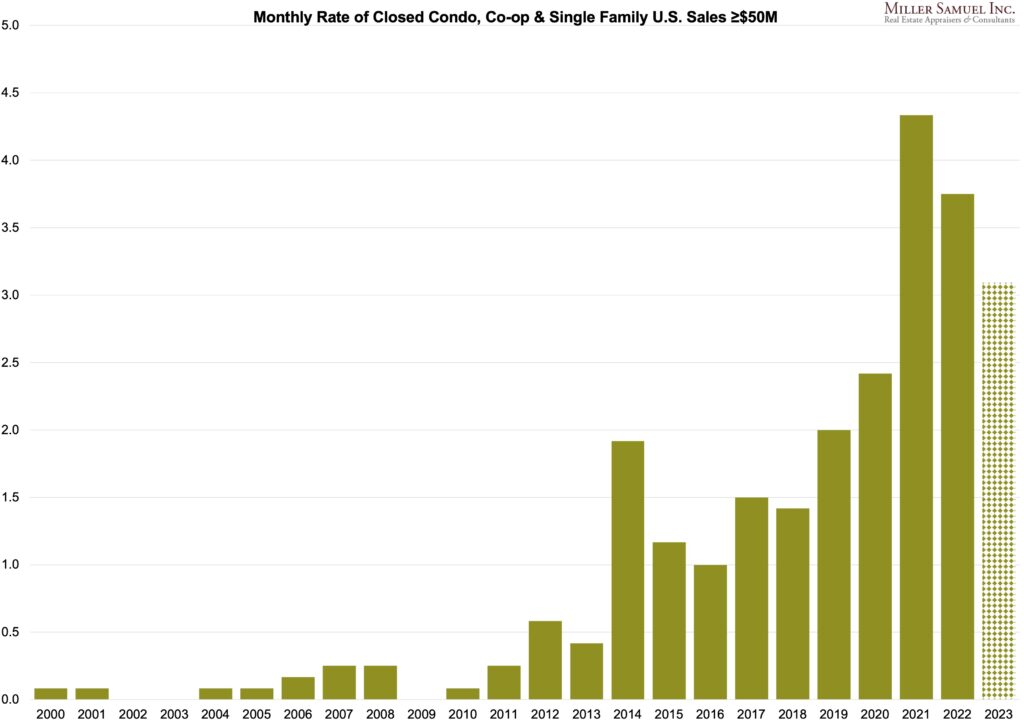

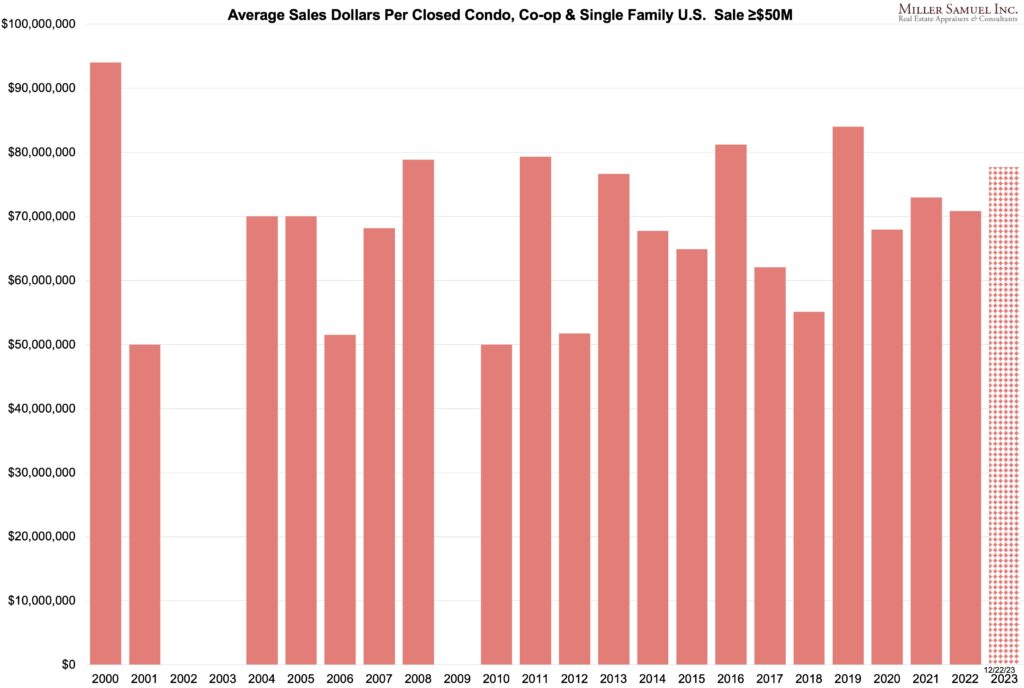

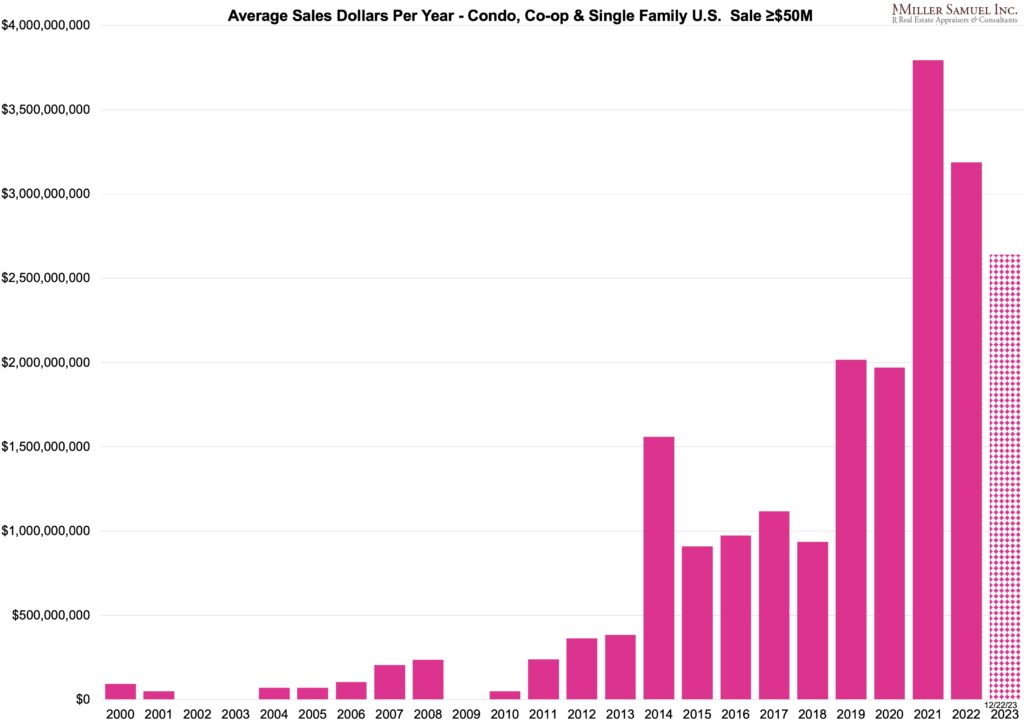

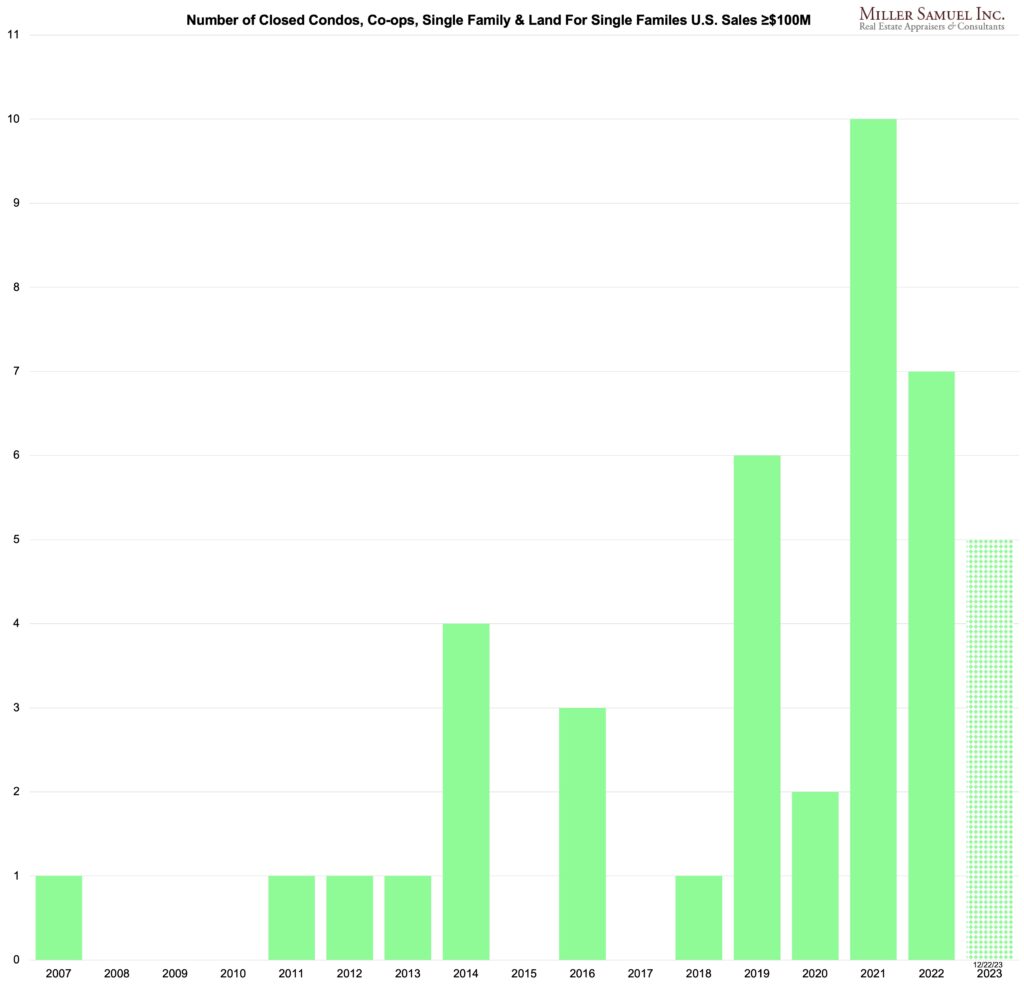

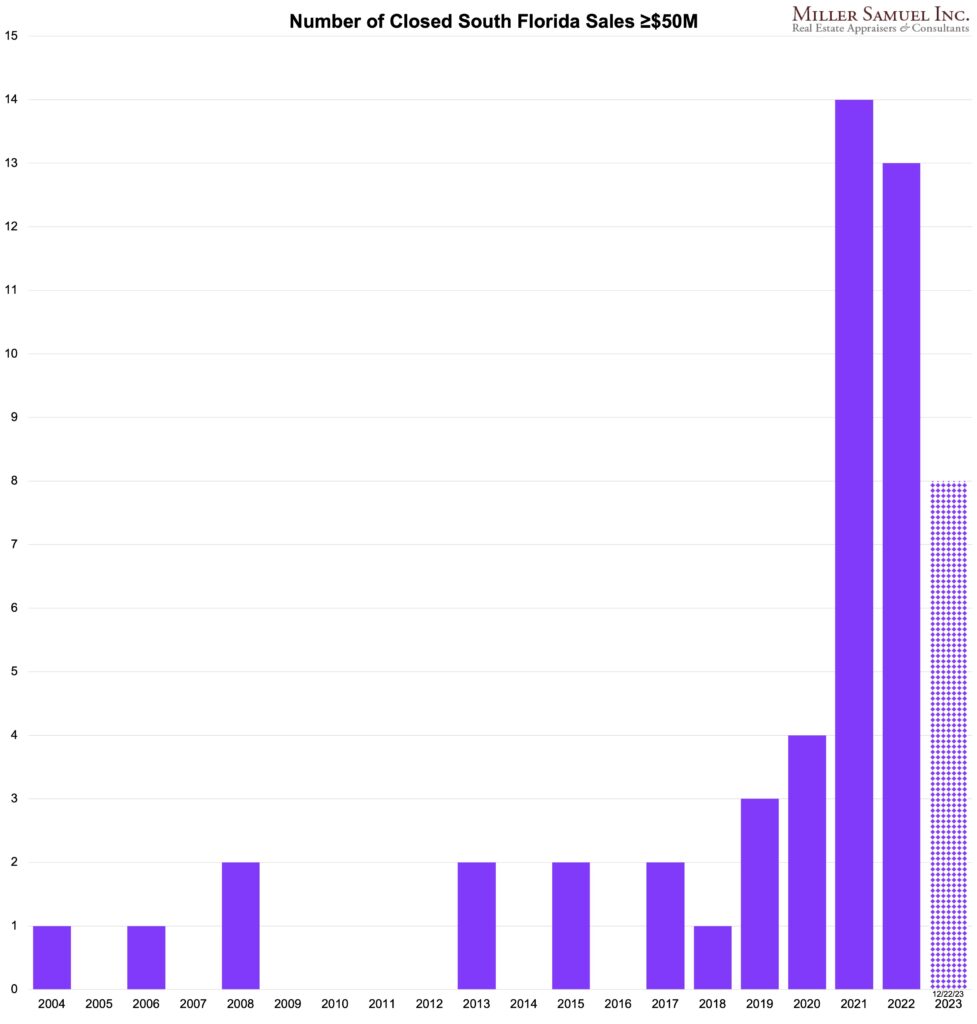

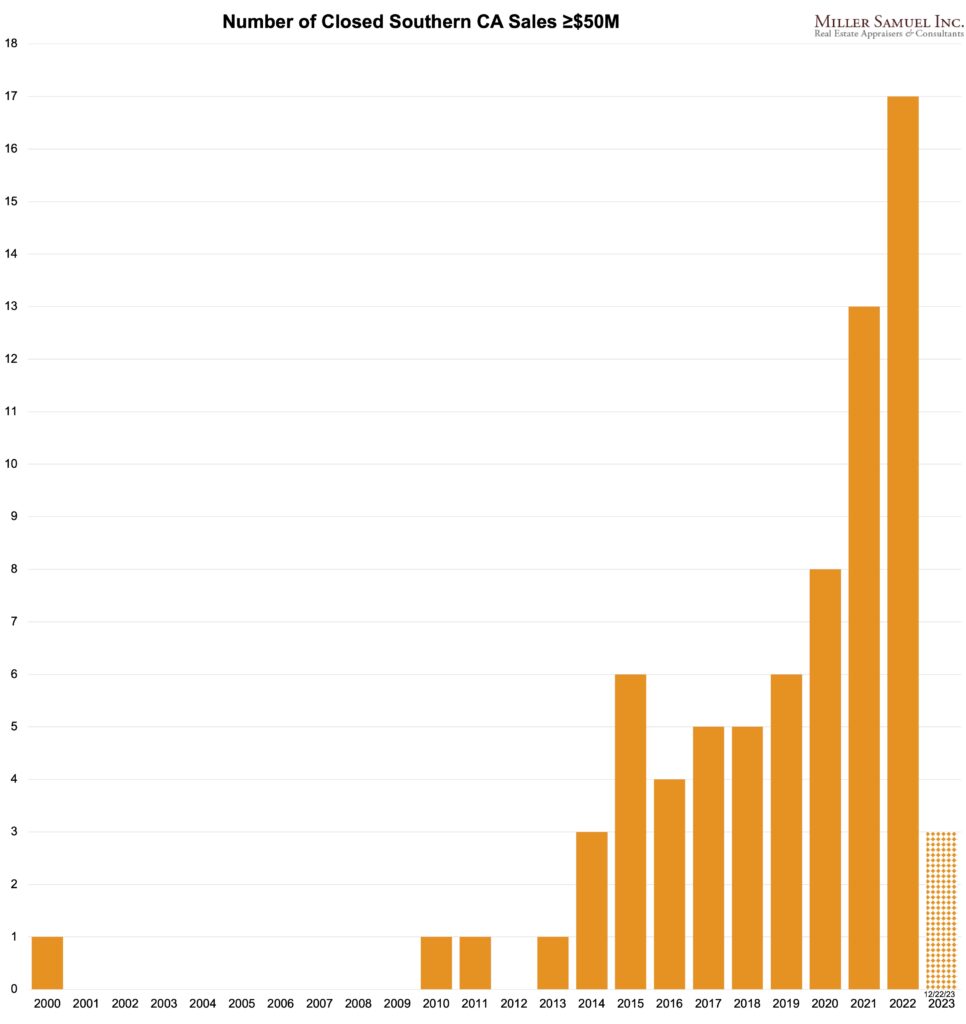

Focusing On The Super Luxury Market – Less Volume & Units

I began tracking the $50 million housing market in 2014 when I noticed that pricing seemed to have reset to a much higher level. After ten years of history, it is clear that this submarket is here to stay. This year – and it is not over yet – saw the third most sales at or above the $50 million threshold, even though we are in a “weak” housing market characterized by lower sales, stable pricing, and less listing inventory.

The first article on this topic was from Bloomberg, with more to come shortly:

- As Super Luxury US Home Sales Plummeted in 2023, These Were the Biggest [Bloomberg]

“This isn’t a normal housing market,” Miller says, emphasizing how the spending habits of the super rich are divorced from the rest of the country. “It has nothing to do with the local markets these properties sit within. It’s more national and global in scale.”

Me! via Bloomberg

The following charts break down the segment in many ways, but this first one is my favorite.

KGMD Talks Podcast – 2023 Recap + 2024 Outlook

I had fun speaking with my friend Dan Gershburg and his law partner Sharon Darouvar of KGMD, a firm specializing in real estate transactions (not to be confused with KGMD, a TV station in Hawaii). This was recorded back on November 20, but the Thanksgiving Holiday and a two-week trip to Antarctica delayed my posting of the interview (also, my dog, if I had one, ate my homework.)

2023 – A Look Back At “The Year of Disappointment”

In early 2023, I called the year ahead the “Year of Disappointment.” Sellers would not realize their 2021 values, and buyers wouldn’t see significant discounting. In many ways, it was a housing recession while the rest of the economy roared, with unemployment remaining below 4%.

2024 – “The Year Of Incremental Change”

To come up with a catchy name for next year proved impossible, even though I reached out to a Thesaurus and my AI app for assistance. And maybe that’s just fine to have 2023 represent the bottom and 2024 see slow improvement with falling mortgage rates, slightly rising listing inventory, and stable pricing. Dull and boring.

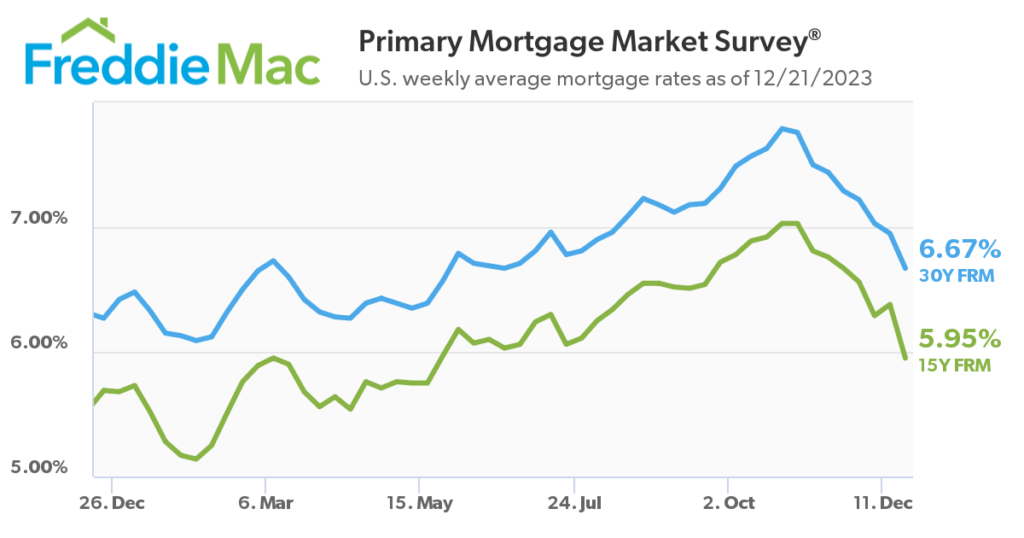

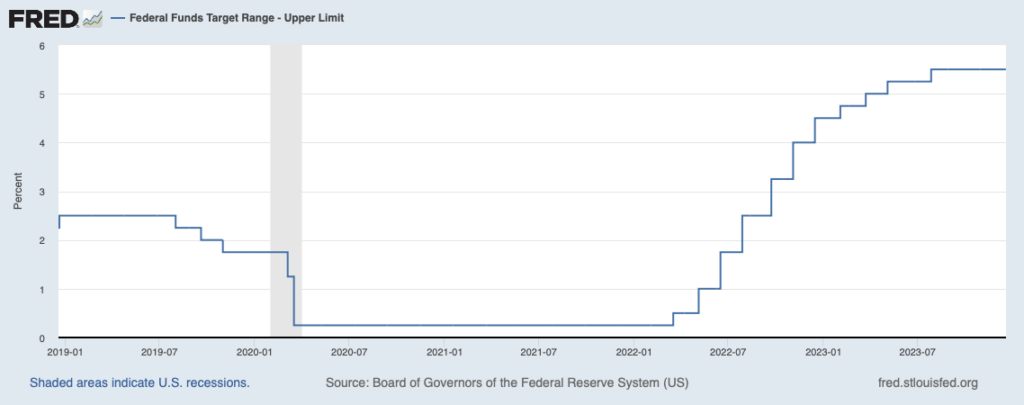

While it’s always dangerous to forecast where mortgage rates will go, they look to be lower this year than last year, and that’s been the problem or the key characteristic of the housing markets. With the most significant surge in mortgage rates in four decades, sellers locked into a comfortable 3-4% mortgage rate were reluctant to venture into a housing market with a reach of an 8% thirty-year fixed rate. Now the thirty-year mortgage rate is well below 7%, and the 10-year treasury yield is well below 4%, inferring that the thirty-year year should be below 6%, consistent with the long-term spread of 1.5 to 2%. Lower mortgage rates will bring listing inventory to market, but at the same time, lower mortgage rates will bring in more demand that will likely overpower new supply.

My wild guess is that mortgage rates settle in the mid-5 % to 6% range, where they should have been during the pandemic era, instead of in the 2.5% to 3% range that obliterates listing inventory. 5% to 6% may represent their long-term home, and we can get off the rollercoaster ride that ends up pricing out the next generation of homeowners.

I hope we’ve all learned that:

Unusually low mortgage rates make housing less affordable.

Fed Up With LA – Stay With Me Edition

Singer Rod Stewart has employed a bold marketing strategy for his home that I’m reasonably sure won’t be successful, but what do I know? I can’t sing (but I do like his music).

Rod Stewart, fed up with LA’s ‘toxic culture,’ relists mansion with $10M price increase [NY Post]

Take notes. Here’s a unique marketing strategy:

- List his LA mansion for $70 million for six months and not be able to sell it (it simply can’t be the price).

- Declare LA as having a “toxic culture,” and that made him want to move (it’s always a good idea to harshly criticize the location of your home to buyers, causing them to want to really want to buy it)

- Raise the price by $10,000,000 (14.3%). (After being reasonably exposed to the market and deriding its location, raise the price by $10,000,000 to ensure a quick sale).

Winter 2023 Market Update Column for Elliman Magazine

I’ve written columns for Douglas Elliman Real Estate’s magazines for years. Here is the Winter 2023 edition of Elliman Magazine.

Frank Loyd Wright’s Son Hated Him Enough To Invent Lincoln Logs

Versus

Click here for a fascinating story on Instagram.

Getting Graphic

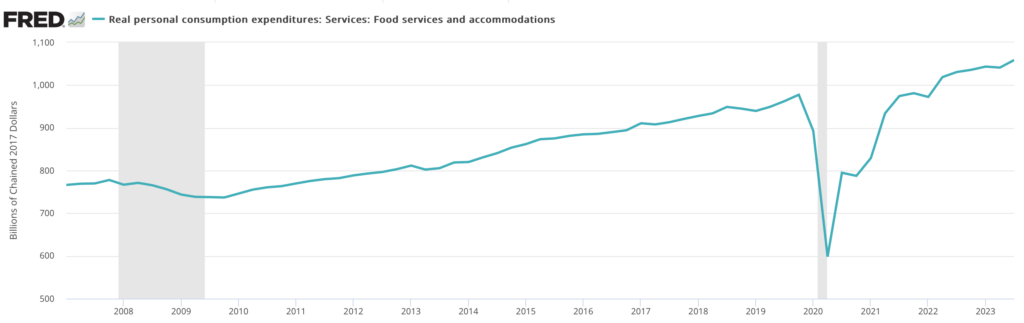

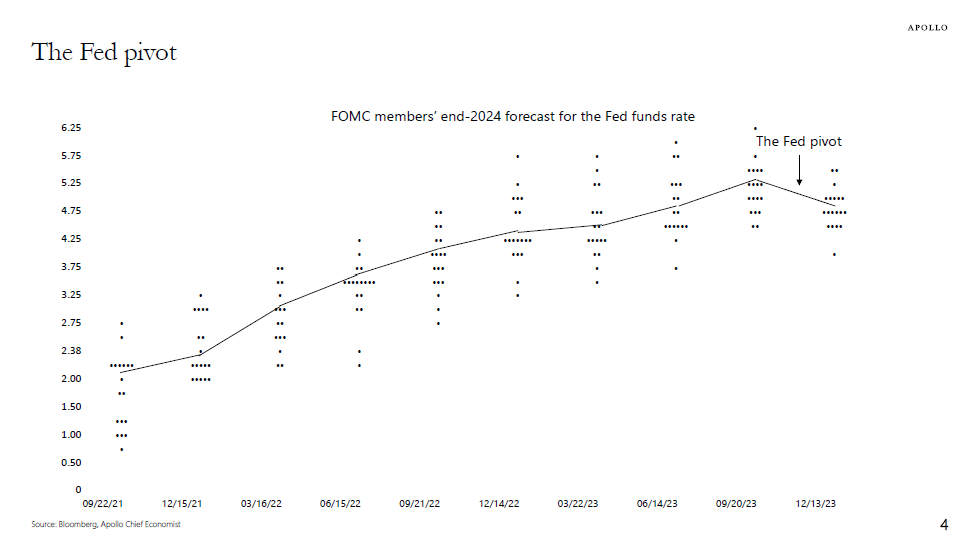

Favorite housing market/economic charts of the week made by OTHERS

Apollo’s Torsten Slok‘s amazingly clear charts

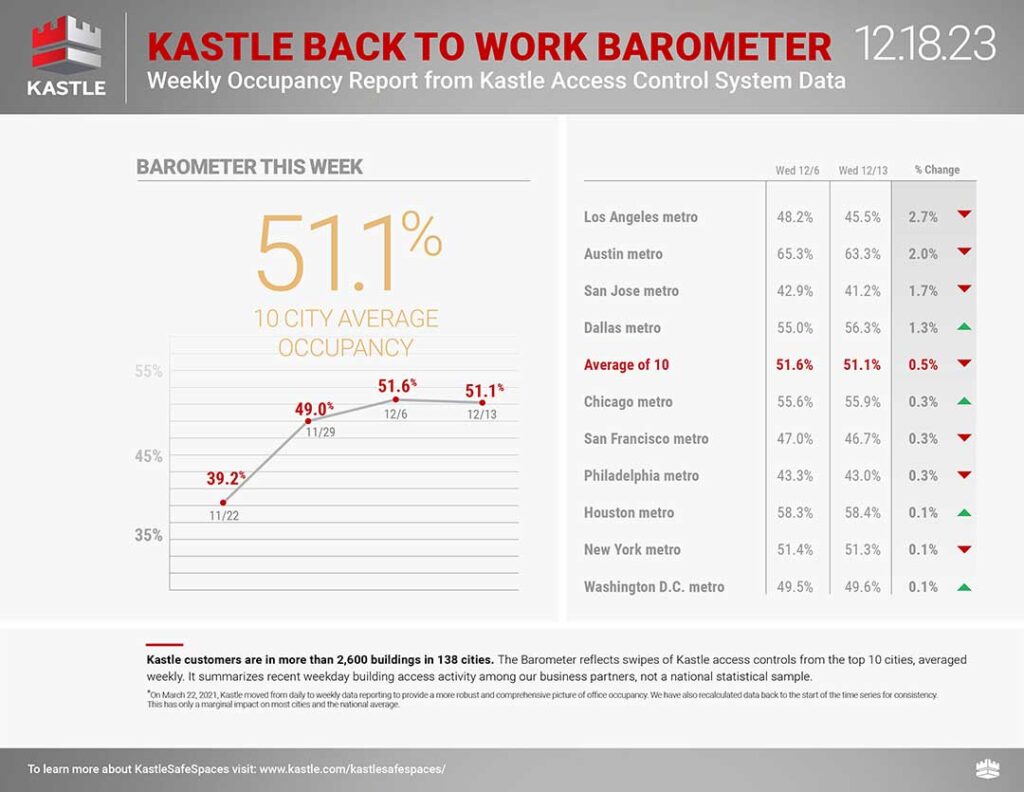

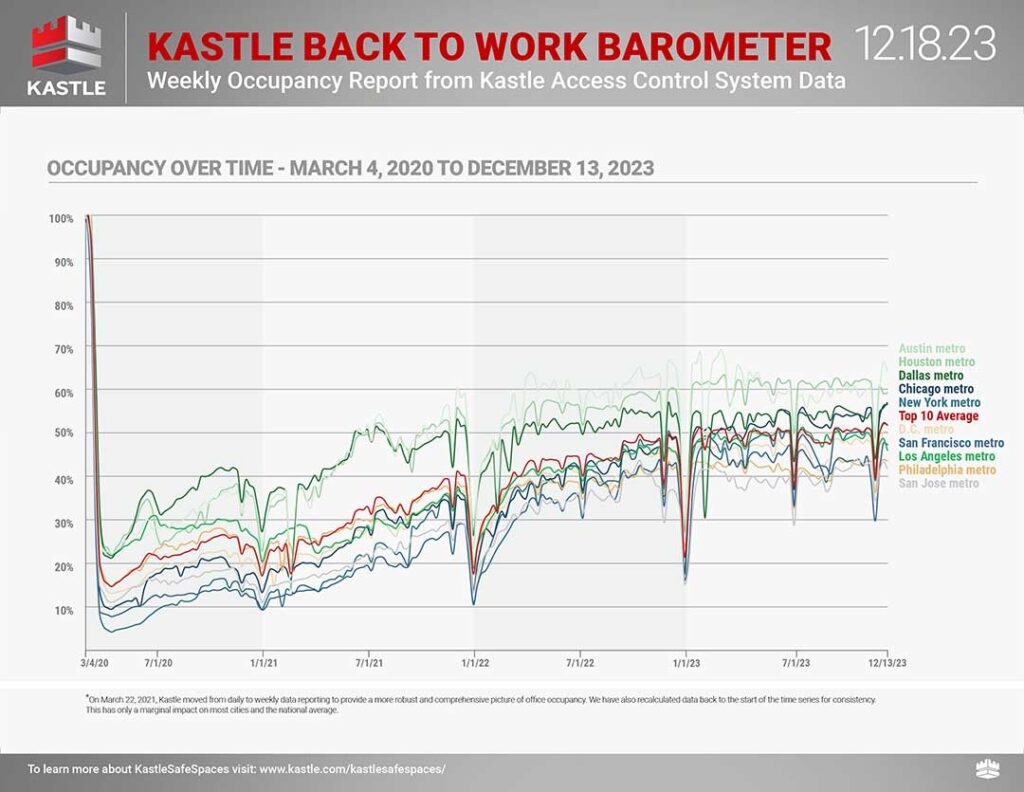

Kastle card swipe data

Remember that Kastle charts are overstating occupancy* because their pre-pandemic occupancy benchmark was 100%, which is incorrect (*measures card swipe activity as a proxy for occupancy). Still, they’ve become the standard benchmark for occupancy rates.

Favorite RANDOM charts of the week made by others

Appraiserville

Taking a break until the new year!

OFT (One Final Thought)

That’ll come next week! I’m exhausted.

Brilliant Idea #1

If you need something rock solid in your life – particularly on Friday afternoons at 2:00 PM, Eastern Time (ET) – and someone forwarded this to you, you can sign up here for these weekly Housing Notes. And be sure to share with a friend or colleague if you enjoy them because:

– They’ll be the new mayor;

– You’ll love NYC again;

– And I’ll be in NYC as always.

Brilliant Idea #2

You’re clearly full of insights and ideas as a reader of Housing Notes. Consider sharing them with me early and often. I appreciate every email I receive, as it helps me craft future Housing Notes.

See you next week!

Jonathan J. Miller, CRE®, Member of RAC

President/CEO

Miller Samuel Inc.

Real Estate Appraisers & Consultants

Matrix Blog

@jonathanmiller

Reads, Listens and Visuals I Enjoyed

- Rod Stewart, fed up with LA’s ‘toxic culture,’ relists mansion with $10M price increase [NY Post]

- Beijing home price slide fans China property sector alarm [Financial Times]

- China Property Crisis in Charts: Spillover Spreads Across Economy [Bloomberg]

- Mortgage Rates Continue Their Fall Below Seven Percent [FreddieMac]

- State of the City 2022 [Furman Center]

- Single Family Starts Increase Sharply in November, Near Record Number of Multi-Family Housing Units Under Construction [Calculated Risk]

- The 10 Priciest NYC Home Sales Show Market Doing ‘Pretty Darn Well’ [Bloomberg]

- Define ‘Penthouse’ [Curbed]

- Home Buyers Are Ready to Buy. But Sellers Aren’t Selling. [Wall Street Journal]

- The Great American Warehouse Building Boom Is Over [Wall Street Journal]

- How College Football Is Clobbering Housing Markets Across the Country [NY Times]

- Top 10 NYC Neighborhoods for Commercial-to-Resi Conversions [The Real Deal]

- Where Have All the Workers Gone? The Labor Shortage [Counselors of Real Estate]

- Opinion | Most homeowners are both richer and poorer than they understand [Washington Post]

- Snakes, Spores and Sewage: Life in the Neighborhood Called ‘the Hole’ [NY Times]

My New Content, Research and Mentions

- The housing market of 2024 is likely to be better than 2023 [Business News]

- Three New York sales among the biggest in the U.S. this year [Crain's New York]

- WSJ News Exclusive | Connecticut’s Ziegler Farm Sells for $57.5 Million After Listing for $85 Million Last Year [Wall Street Journal]

- 2024 Will Be a Better Year for Homebuyers [Curbed]

- A leading real estate appraiser shares why 'a reversal of fortune' will follow a disappointing year in the housing market — and why the highest rents in the country will continue to tumble [Business Insider]

- NAR: Existing-Home Sales Increased to 3.82 million SAAR in November [Calculated Risk]

- California Landlords Are Charging $150,000 Per Month For Some Properties: 'I Feel Like Everybody's In Panic Mode Now' [Benzinga]

- What NYC Real Estate Pros Think of Interest Rate Cuts in 2024 [The Real Deal]

- Future Mortgage Rate Cuts Offer Hope for Hamptons Market [The Real Deal]

Recently Published Elliman Market Reports

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 11-2023 [Miller Samuel}

- Elliman Report: California New Signed Contracts 11-2023 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 11-2023 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 11-2023 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 10-2023 [Miller Samuel]

- Elliman Report: California New Signed Contracts 10-2023 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 10-2023 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 10-2023 [Miller Samuel]

- Elliman Report: San Diego County Sales 3Q 2023 [Miller Samuel]

- Elliman Report: Orange County Sales 3Q 2023 [Miller Samuel]

![Brooklyn Rental Listing Inventory by Month [Average from 2010]](https://millersamuel.com/files/2024/04/Apr24BKLYNrent-invBYmo-1200x786.jpg)

![[27 Speaks Podcast] Jonathan Miller Provides A 2024 Hamptons Outlook](https://millersamuel.com/files/2024/02/27eastlogo-600x314.jpg)