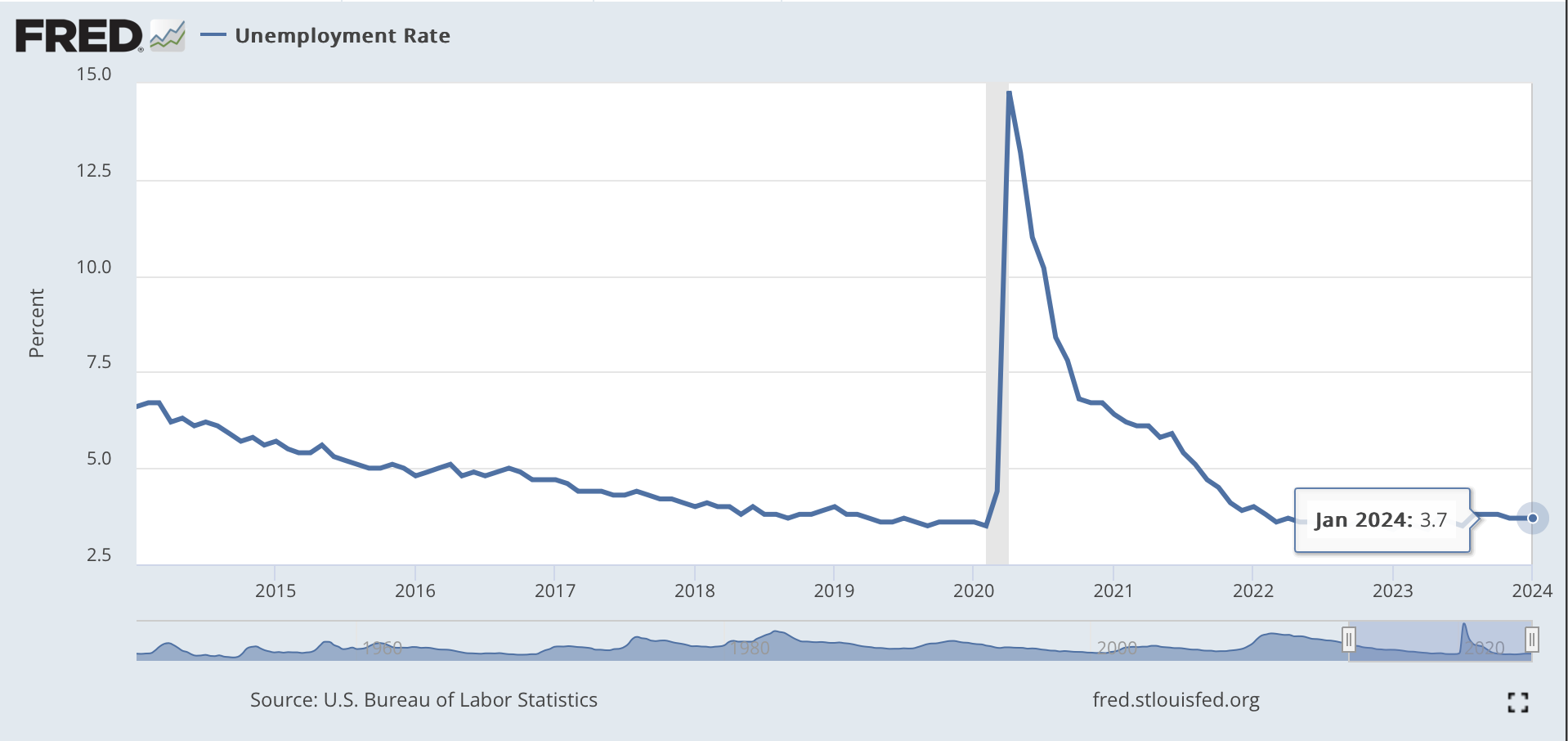

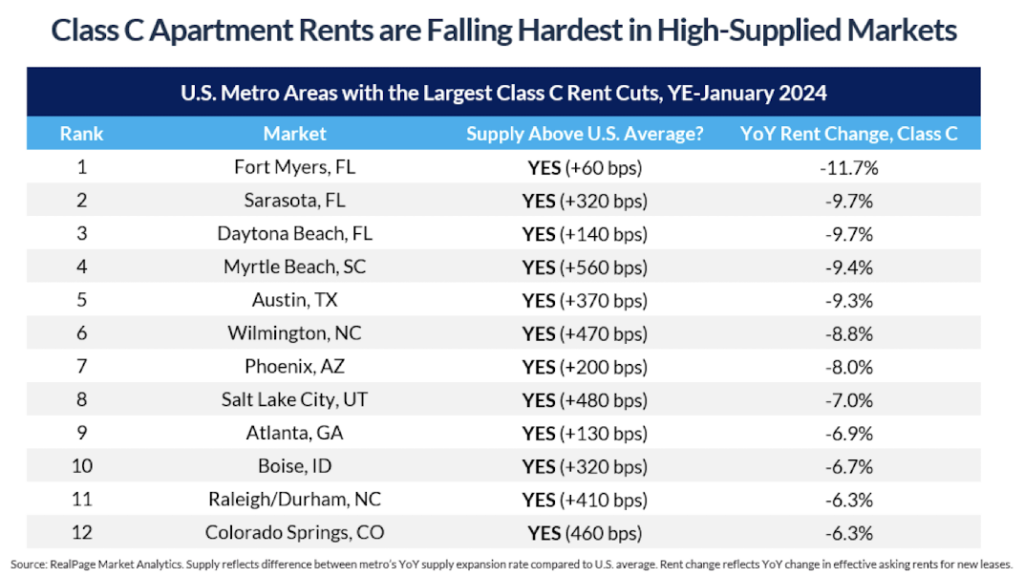

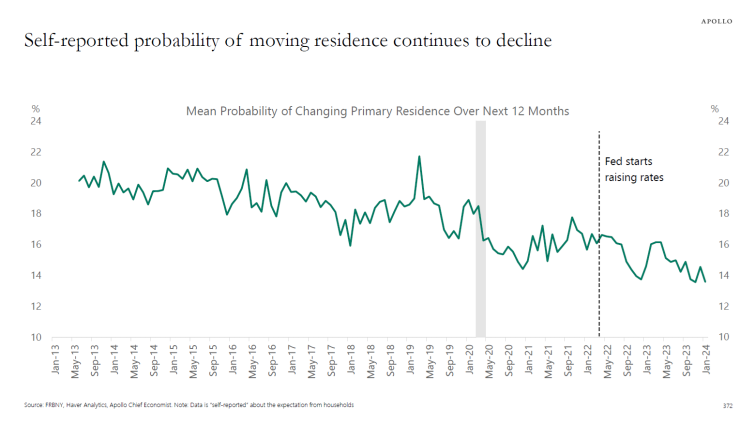

The economy continues to remain strong, with unemployment staying below 4%. While housing sales remain weak, there are recent signs of expanded new signed contract activity, a product of a strong economy and the notion that buyers might be able to refi out lower over the next few years. The housing market has been punished harder than most other sectors with the rapid gain in interest rates over the past two years. Lower rates would bring more inventory onto the market, reducing price appreciation but may also fuel inflation.

Years ago, I appraised a property for a member of the progressive rock band Yes soon after “Owner of a Lonely Heart” came out. As a long-time fan, I never thought about cowbells associated with that song until I saw the following video.

Back when one of my sons had a drum kit in our garage (hence “garage band”), the cowbell was front and center. The drum set is long gone, but I still have that cowbell on my workbench and give it a good whack when inspired. Of course, that sound became legendary after this long-ago SNL skit, just like the next rate cut by the Fed will be.

Did you miss last Friday’s Housing Notes?

February 16, 2024: Post-Super Bowl Housing Market Taylored For Swifter Conditions

But I digress…

NAR Existing Home Sales Rise Annually As Prices Jump Against Backdrop Of Massive Litigation

NAR still punches out valuable barometers of the housing market’s health while they navigate massive litigation without insurance coverage. It begs the question – if membership falls sharply over the next several years, will they have the resources to support their stable of economists and continue all these analytics? It seems unlikely.

The National Association of Realtors hit its maximum insurance coverage limit of $1 million for claims related to antitrust commission suits “some time ago,” the trade group told its local and state association executives in an email Wednesday.

Inman News 2-21-23

My goodness. The Missouri class action case came in with $1.8 billion in damages. Those damages could be tripled. How will that get paid, even if it is adjusted a lot lower on appeal?

In the meantime, here is a 16-year series of NAR’s existing home sale data that chronicles the limited nature of listing inventory, reduced sales, and listing inventory but rising prices. It’s a massive, offensively bright, colorful graphic, so please click to expand it to its full glory.

Existing home sales rose 1.3% YOY, which didn’t have enough time to be impacted by the drop in mortgage rates at the end of the year after the Fed pivot in December. Listing inventory rose 3.1% annually, and months of supply expanded 3.4%. The limited supply drove prices 5.1% higher annually, with the national median sales price at $379,100, the highest January result on record. Incidentally, with all the adjusting in NAR’s numbers (annualized and seasonal), I tend to work with non-seasonal year over year results. Still, most of the monthly news coverage relies on seasonally adjusted month-over-month results.

All The Hand Wringing About The Likelihood Of A Fed Cut In The First Half Of 2024 Was Never On The Table

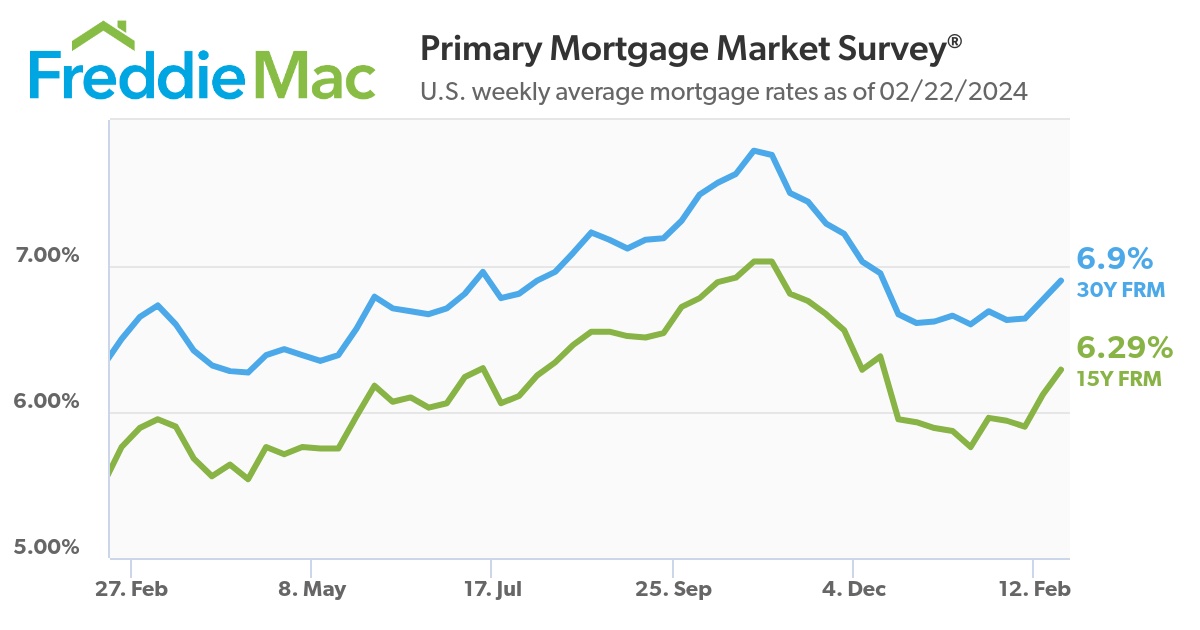

Mortgage Rates have been climbing back to 7% in recent weeks because unemployment remains below 4% (good for housing), yet the headlines keep reminding us that there won’t be mortgage rate declines anytime soon as the Fed holds on rate cuts.

- Fed’s Waller sees ‘no rush’ to cut interest rates [Reuters]

- January’s CPI Report Is Nail in the Coffin For March Interest-Rate Cut [Redfin]

- Rate Cuts Might Be Delayed. That’s No Reason to Panic. [WSJ]

- The Fed may wait too long to cut interest rates and spark a recession, economists say [USA Today]

Everything I have been reading since the December Fed pivot has placed future cuts in the back half 2024. That doesn’t mean I’m right, but after all, unemployment remains below 4% and was at that level when the Fed announced the likelihood of a 75 basis point cut sometime in 2024.

I’ve been saying for the last six months that real estate participants feel like they’ve been in a recession (not technically) for the past two years. The thought of rate cuts has fomented a lot of hyperbole on the “when,” but nothing has changed economically significantly since December. There’s growing talk there will be no rate cuts in 2024 because the economy is so strong. The idea that we are even discussing rate cuts when unemployment is 3.7% seems absurd.

The back half of 2024 has always been the more realistic once you filter out all the analysis paralysis.

[27 Speaks Podcast] Jonathan Miller Provides A 2024 Hamptons Outlook

I joined the folks at 27East again to discuss the housing market outlook for 2024 in the Hamptons. They always foster a great conversation, and I enjoyed this one as I always do.

70% of Realtors Would Leave NAR If They Could Still View Listings

When institutions become a monopoly, they lose sight of what they are there for. In this terrific WSJ summary piece: Realtors Are in Crisis—and Home Buyers Could Be the Winners.

More than 70% of real-estate agents surveyed in mid-October by 1000watt and BAM, a real-estate media company, said they would leave NAR if they could still view the listings databases and be able to give tours of homes for sale.

Source: WSJ

Back in the early 1980s, when I was a real estate agent in Chicagoland for a couple of years before I moved to New York City, NAR’s membership was about one-third of what it is now. I had to be a member to access the listing “books” and get a lockbox. All the other stuff, like advocacy and ethical standards, was not why I felt compelled to join. I had to join to have access to be in the industry. In comparison, only about 20% of doctors are members of the AMA, and the same is true for lawyers in the ABA and real estate appraisers in the Appraisal Institute. The idea that the vast majority of real estate agents are members of NAR seems wrong. A trade group is there to uplift the profession, not be the only way to access the profession.

Now that nearly all major real estate firms no longer require NAR membership, what will NAR membership levels look like three years from now? I’m guessing they’ll settle at 1980s levels.

Smaller New Builds Will Be A Larger Part Of The Calculation

Connor Doughtery of the New York Times, author of one of my recent favorite reads, “Golden Gates,” a book I didn’t want to end, wrote a fascinating piece on 400-square-foot subdivision homes: The Great Compression.

Several colliding trends — economic, demographic and regulatory— have made smaller units like Mr. Lanter’s the future of American housing, or at least a more significant part of it.

Source: New York Times

I noticed in the cover photos that, like condos, these homes will probably be located on less than-premium land, so the numbers pencil in, like the high-tension electric lines in the photo or train tracks.

Masters In Business: Bill Dudley on Monetary Policies

Barry Ritholtz’s Master in Business on Bloomberg Radio is one of my regular podcast listens, and his recent interview with Bill Dudley, formerly of the New York Fed, was particularly timely given all the focus on Fed rate cuts in the housing market discussion. The Fed marches to a different drum, and it’s fascinating to understand how they look at the economy and monetary policy. This was a good one.

Highest & Best Newsletter: 💰 Billionaire Name Game

You should sign up for this Florida newsletter I love: Highest & Best from Oshrat Carmiel, formerly of Bloomberg News…

This week’s post

💰 Billionaire Name Game JPMorgan gets Messi; Koch gets medical; Santander gets banky

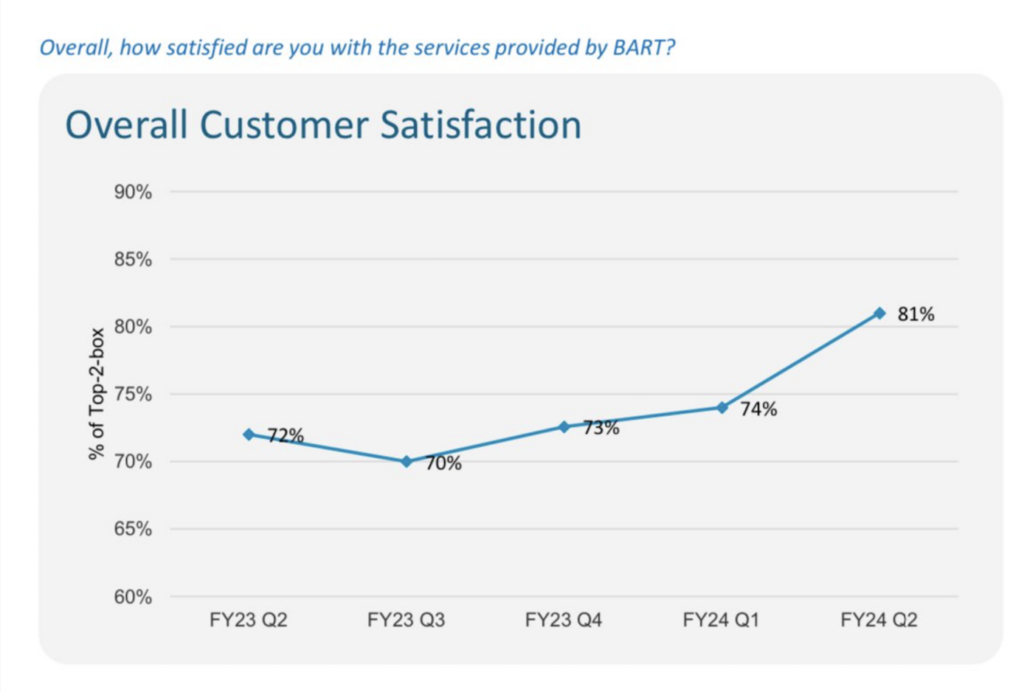

Fannie Mae Changes What It Looks For In A Condo

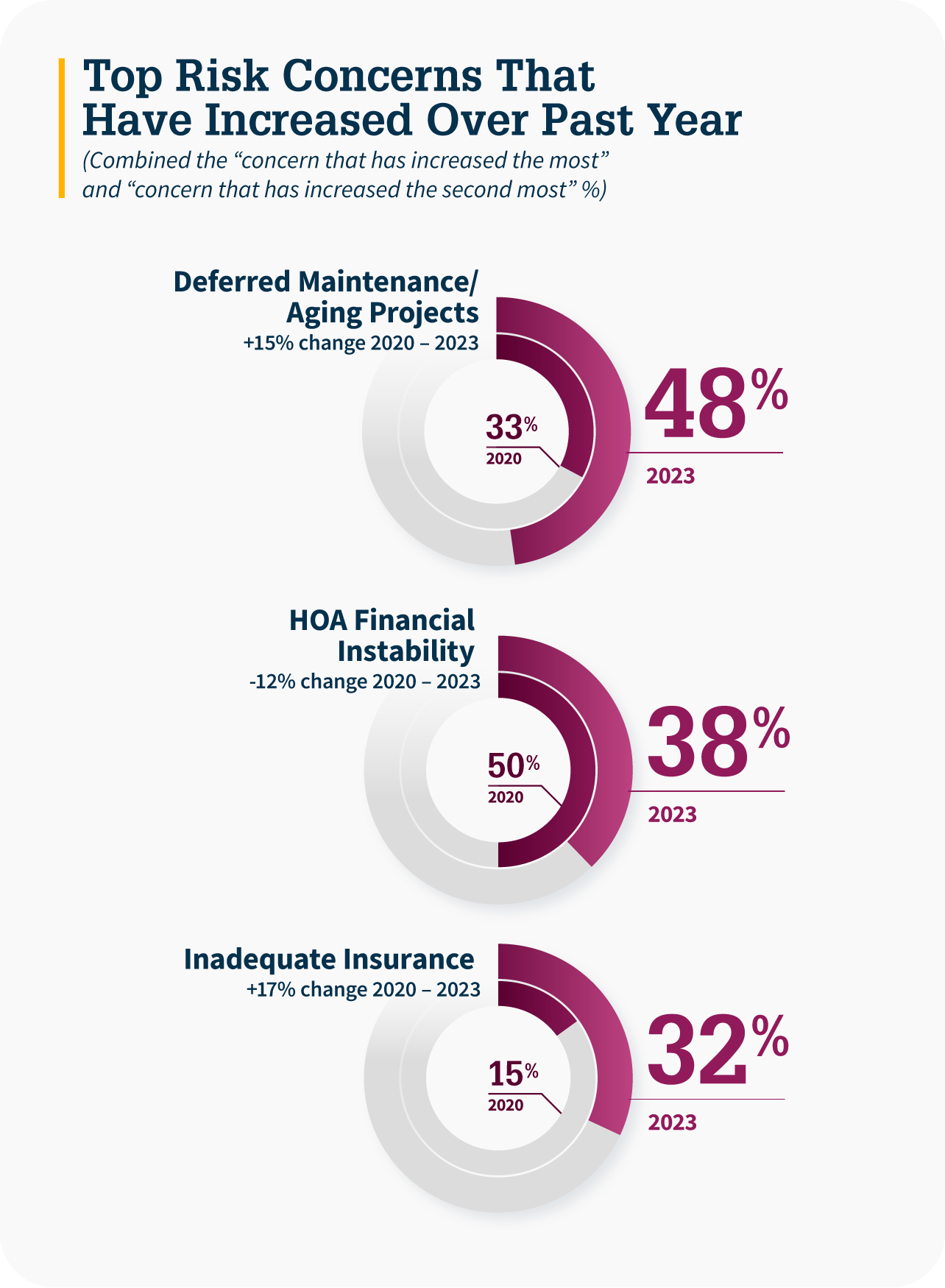

In a recent Fannie Mae blog post, Lenders Identify Risks and Opportunities for Condo Lending, HOA financial stability saw little change. Still, there was also a significant surge in focus on deferred maintenance and aging projects.

The focus on insurance as a lending risk has more than doubled since 2020.

FACT – Changing Zoning Creates More Housing

With zoning reforms, Minneapolis discovered it could create more housing in the form of small apartment buildings by removing the single family and parking restrictions. NPR provides an excellent overview of the progress in: The hottest trend in U.S. cities? Changing zoning rules to allow more housing. Here’s the transcript and the NPR audio below.

[Worth Watching] CRE® What’s Next – March 7, 2024

I’m actively involved in the Counselors of Real Estate®, an organization with tremendous expertise across many real estate types. This upcoming event is an example of that expertise.

The Counselors of Real Estate’s Economic Advisory Council is an esteemed group of American and European advisers with a stellar reputation for economic forecasting. On March 7, select members will offer 360-degree analysis and compelling interpretation of leading indicators, fiscal policies, and property market data and share how convergence of the three is impacting commercial real estate. And they won’t always agree! If you missed their top-rated session from The Counselors’ 2023 Annual Convention, don’t miss this webinar! You’re encouraged to invite your clients and colleagues. The event is free, and the information is priceless.

Can’t make the webinar? Register to receive a recording of the event.

CLAIM YOUR COMPLIMENTARY TICKET!

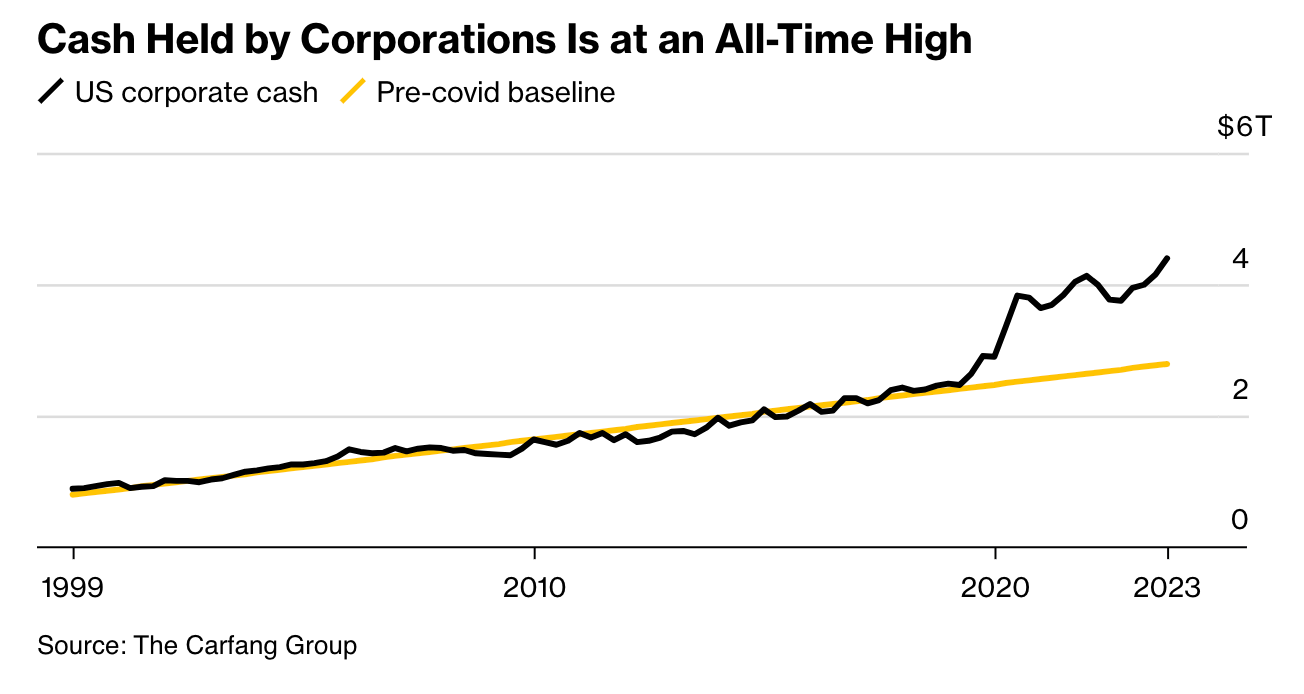

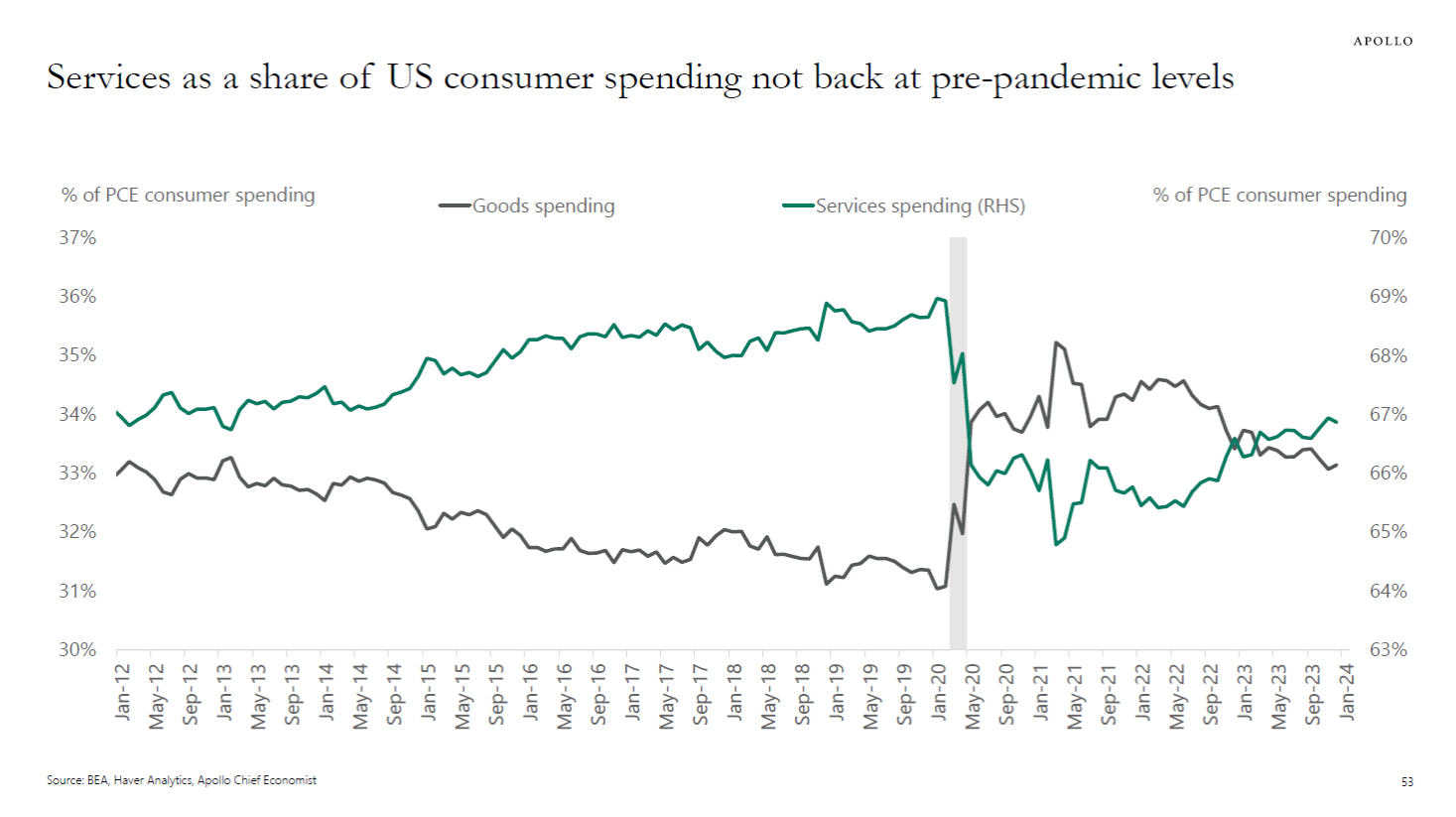

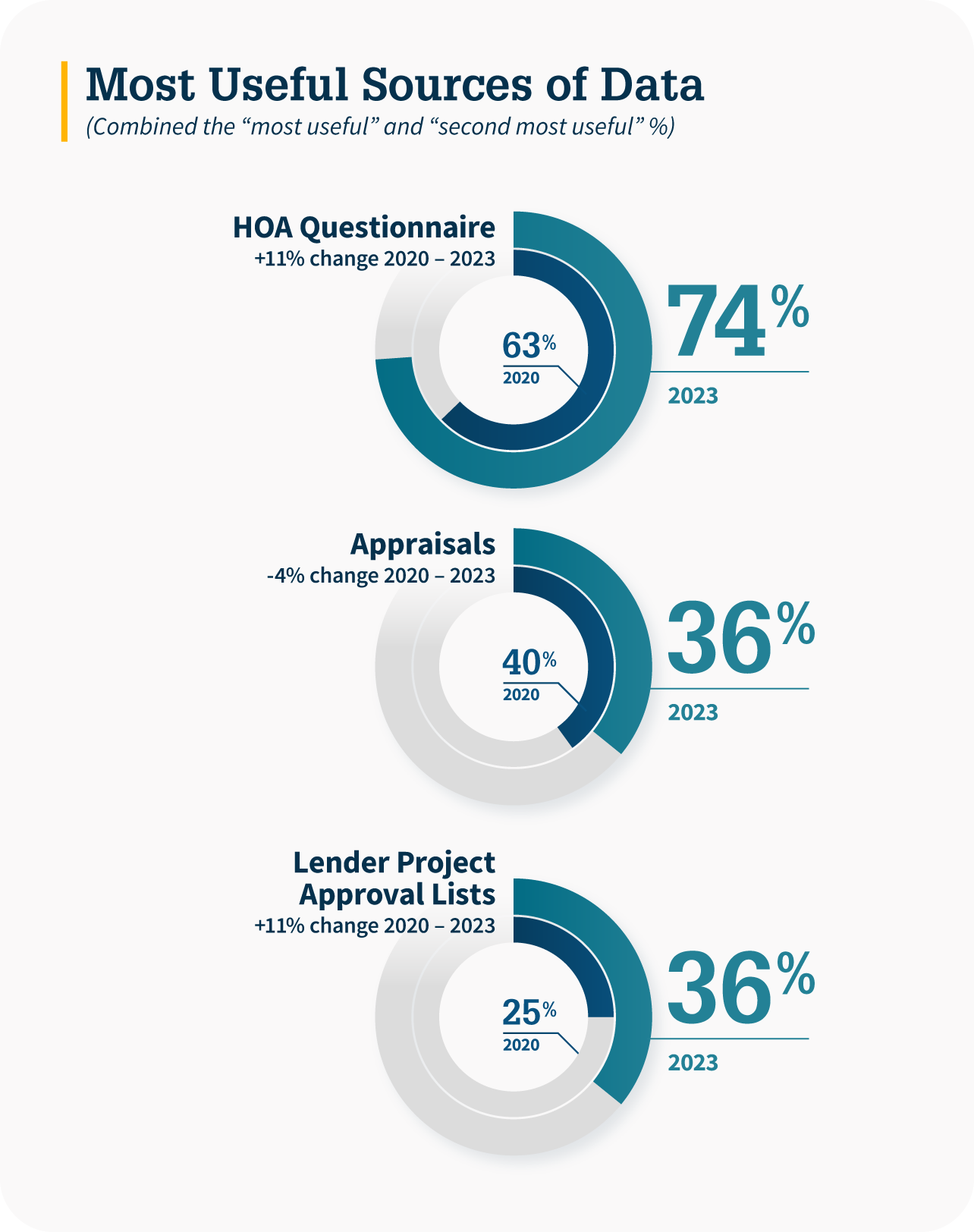

Getting Graphic

Favorite housing market/economic charts of the week made by OTHERS

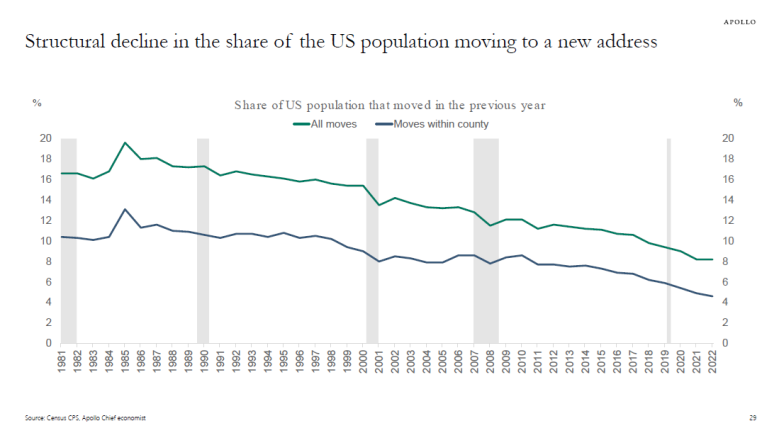

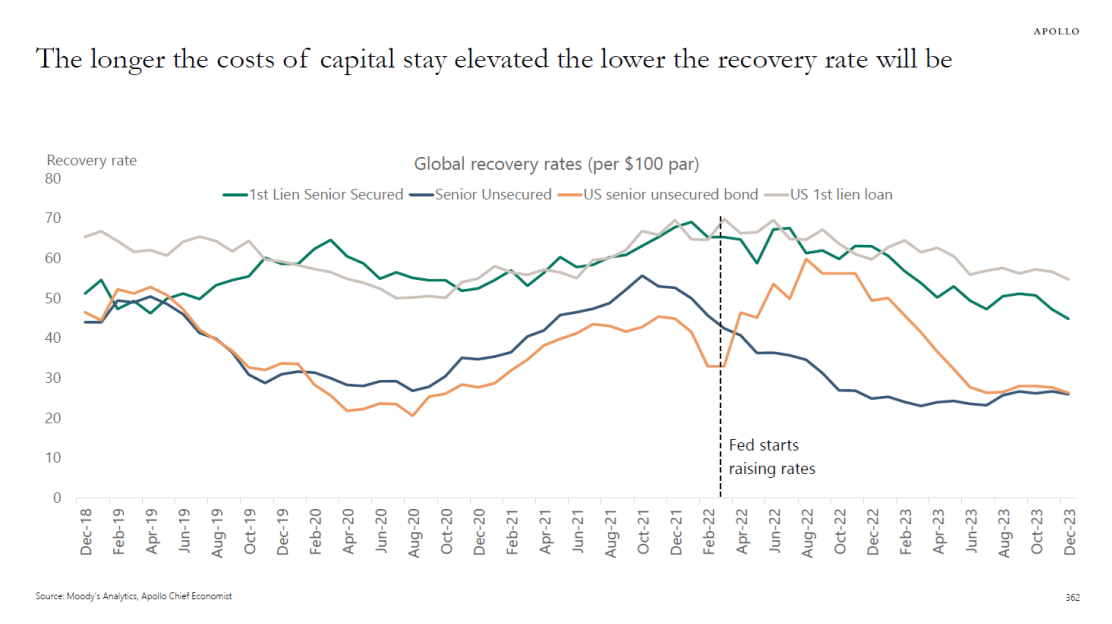

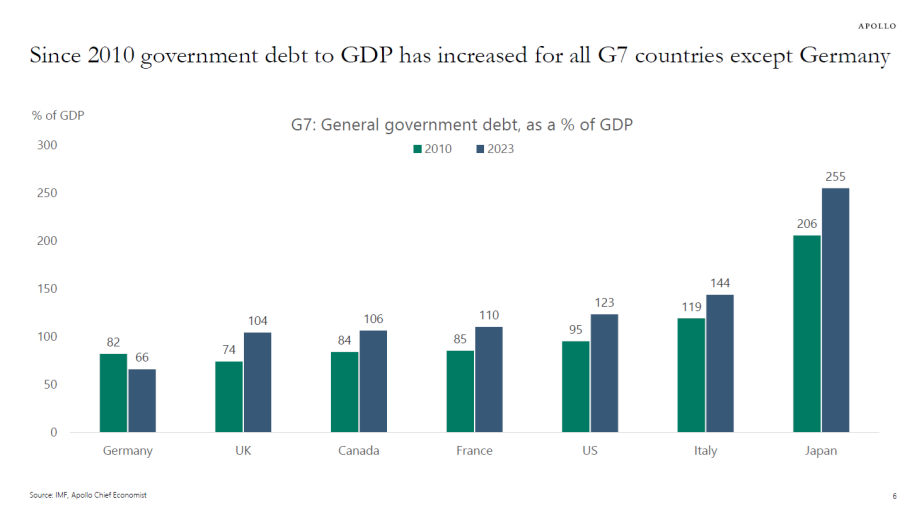

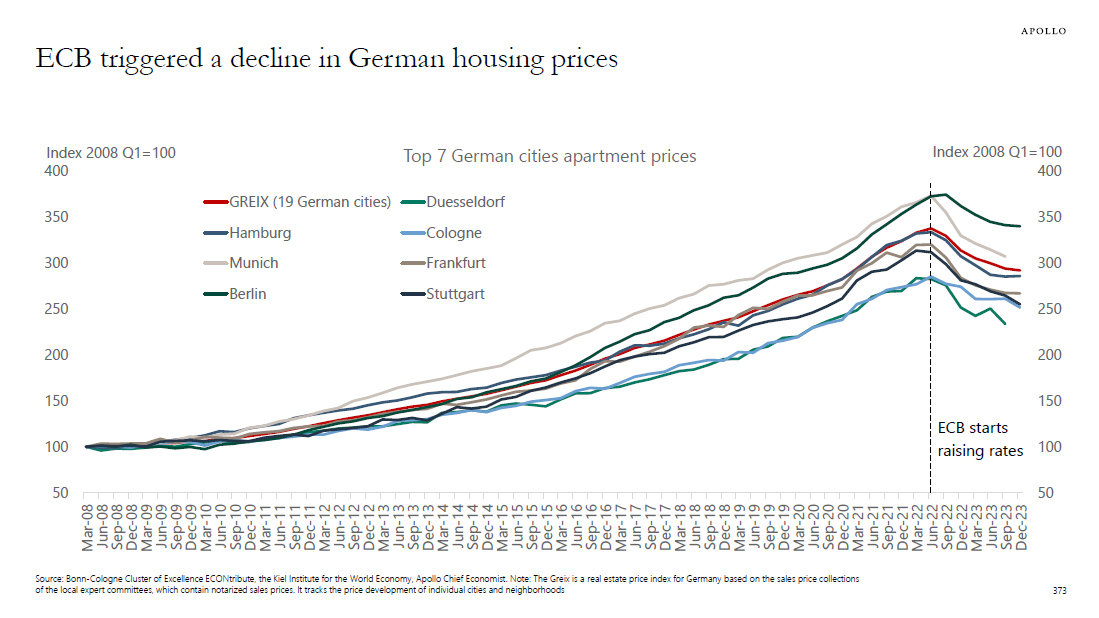

Apollo’s Torsten Slok‘s amazingly clear charts

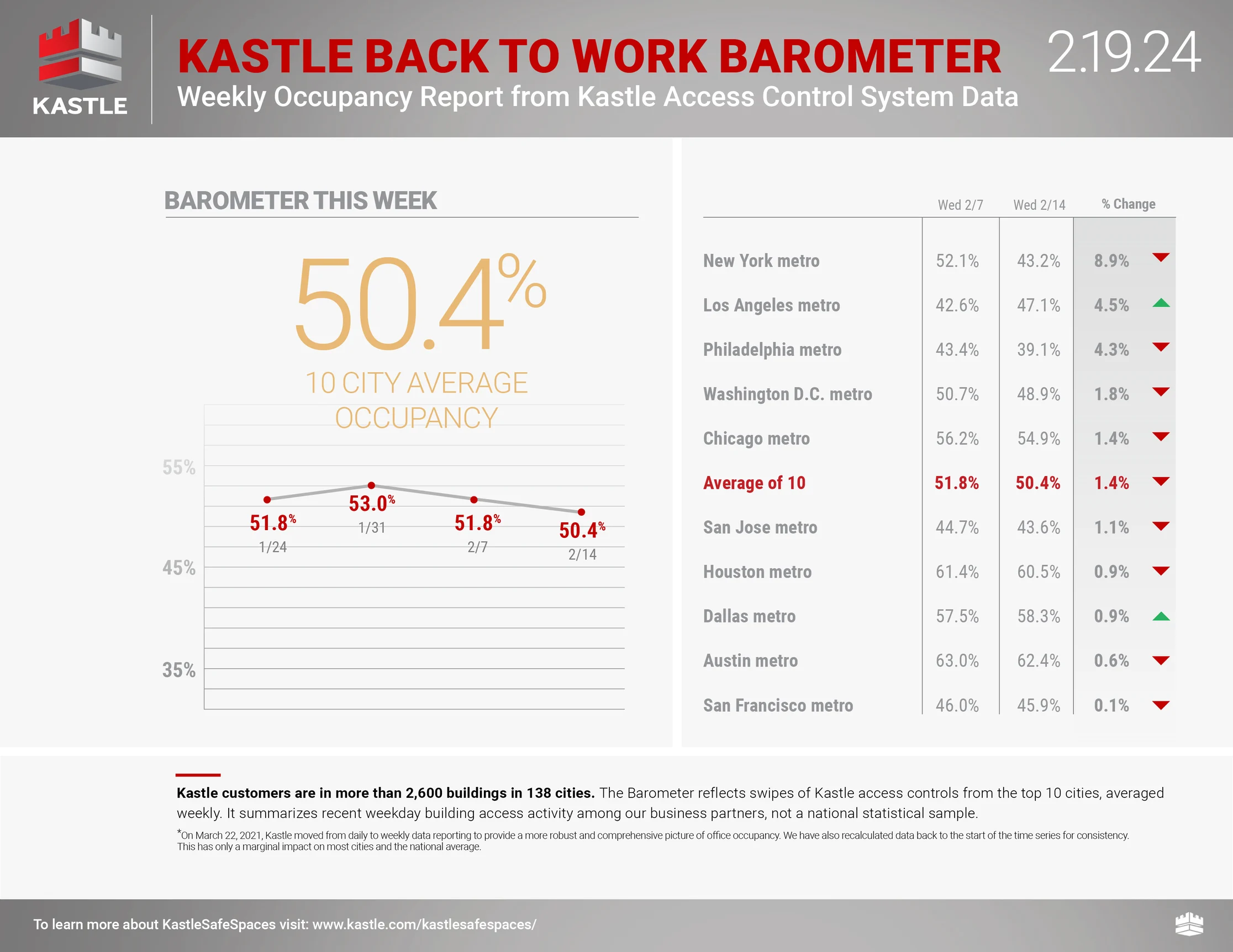

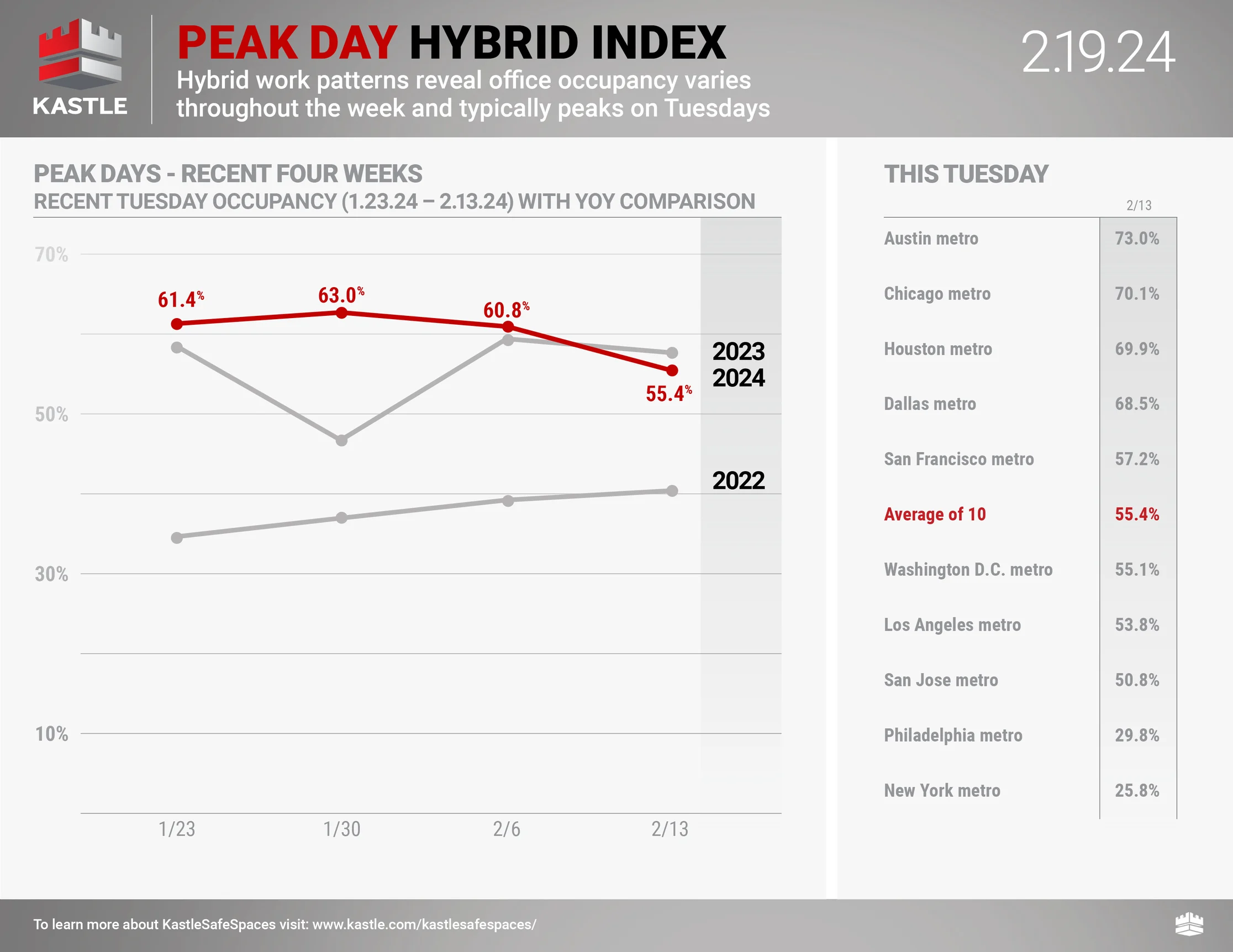

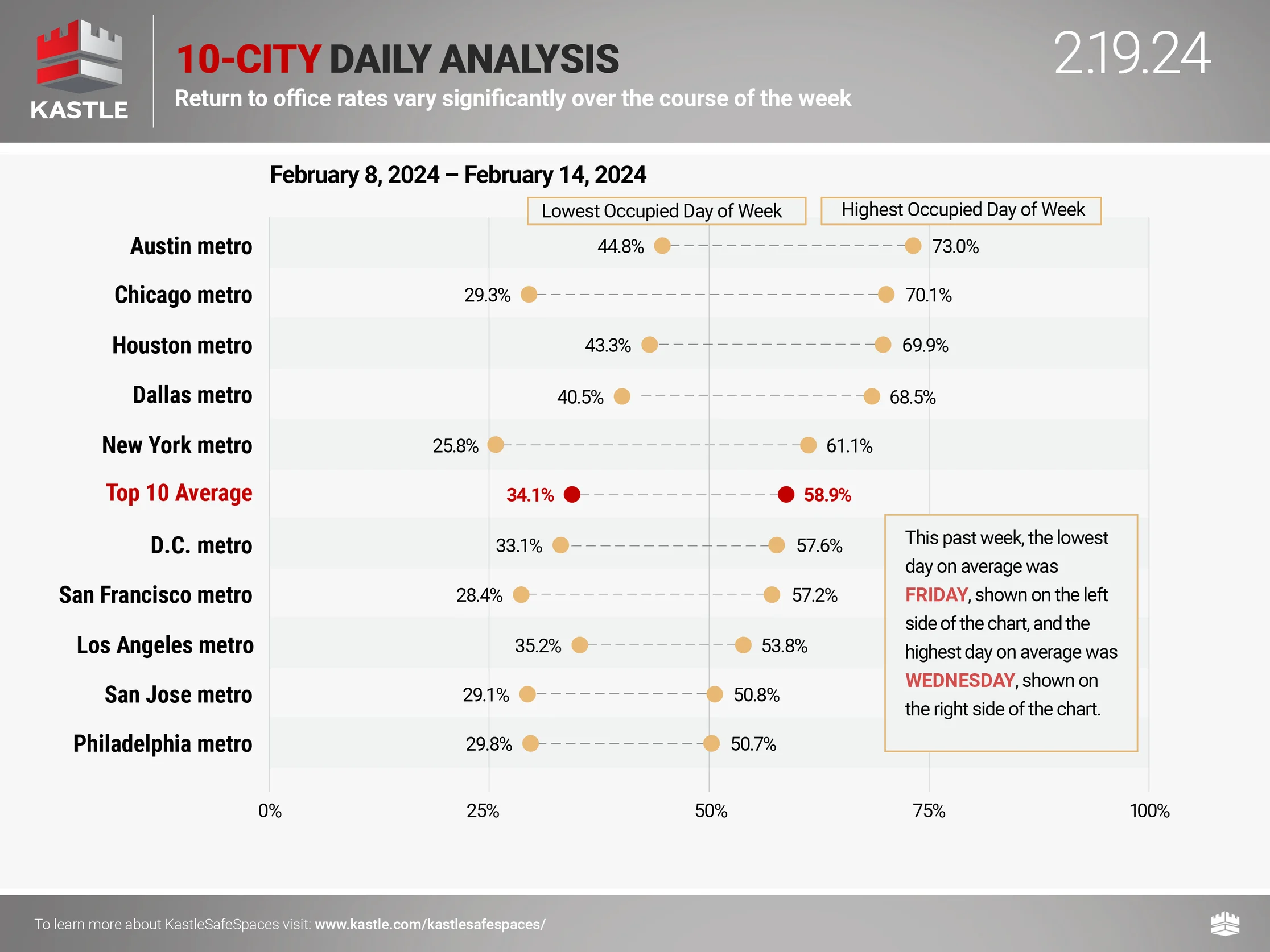

Kastle card swipe data

Remember that Kastle charts are overstating occupancy* because their pre-pandemic occupancy benchmark was 100%, which is incorrect (*measures card swipe activity as a proxy for occupancy). Still, they’ve become the standard benchmark for occupancy rates.

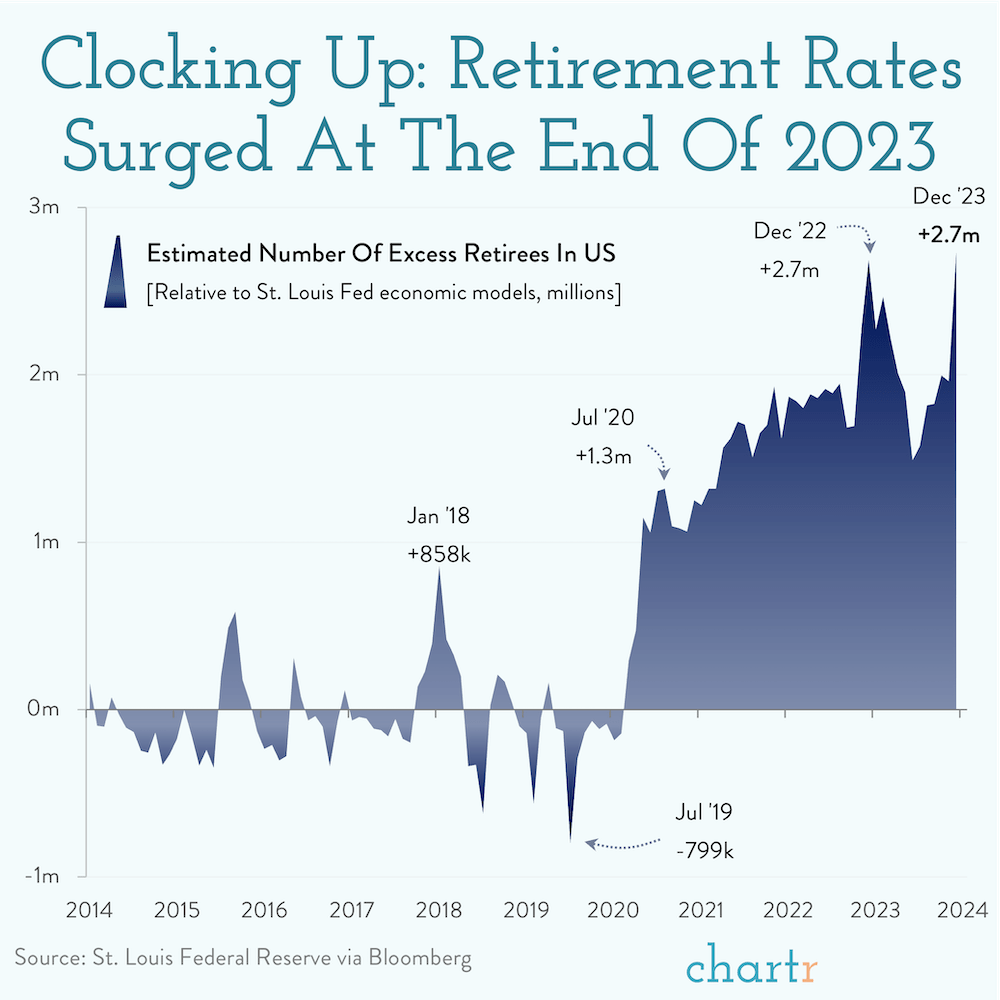

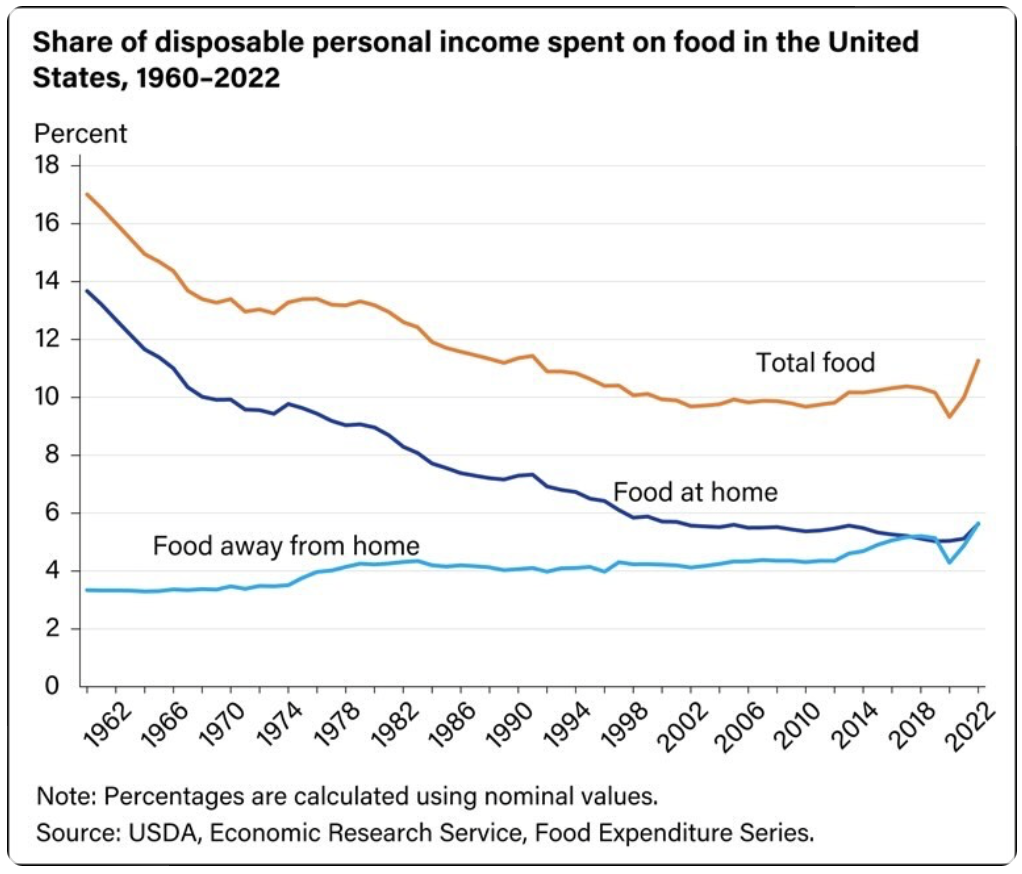

Favorite RANDOM charts of the week made by others

Appraiserville

TAF Continues To Go DIY On A Critical Data Survey

TAF doesn’t do diversity well or even take it seriously. For the second time (the first was in 2021), they are undertaking a “survey monkey” survey for appraisers who just happened to hear about the survey. I found out about it on appraisersforum since TAF has blacklisted my business email address. That’s like taking a phone survey of people with landlines today. This is one of the most critical metrics TAF needs to report in the current zeitgeist, but they are settling for an amateur approach even though. LD is skilled enough to make over $500,000 annually running a 13-person not-for-profit in Washington, D.C.

For the uninitiated, TAF is the organization that wrote the bat-shit crazy letter, the chickenshit letter, and is the subject of an active investigation by HUD on whether USPAP promotes a lack of diversity in the appraisal profession (400th out of 400 occupations, according to BLS in 2021). As a reminder, TAF president Dave Bunton called me a liar in February 2024 at a public forum in Washington, D.C., as he was lying – hence his permanent nickname “Lyin’ Dave,” a.k.a. “LD.”

The Appraisal Foundation Diversity Survey 2024

Bank Reliance On Appraiser Data Fell

(as Fannie Mae is asking us to shift from being appraisers to data collectors)

From Fannie Mae’s Lenders Identify Risks and Opportunities for Condo Lending recent blog post. Appraisers as an information resource have fallen.

OFT (One Final Thought)

When I applied to college in the late 70s, I won a national scholarship from Heinz, and I am forever appreciative and still have a soft spot for ketchup (except for hot dogs). Quick question: What has more sugar in it: a pound of ketchup or a pound of ice cream? That’s why I’m also partial to ice cream.

Here is a one-year-old Heinz AI commercial a year ago that foretold the now AI over hype.

Brilliant Idea #1

If you need something rock solid in your life – particularly on Friday afternoons at 2:00 PM, Eastern Time (ET) – and someone forwarded this to you, you can sign up here for these weekly Housing Notes. And be sure to share with a friend or colleague if you enjoy them because:

– They’ll get more cowbell;

– You’ll be an owner of a lonely heart;

– And I’ll have too much ketchup.

Brilliant Idea #2

You’re clearly full of insights and ideas as a reader of Housing Notes. Consider sharing them with me early and often. I appreciate every email I receive, as it helps me craft future Housing Notes.

See you next week!

Jonathan J. Miller, CRE®, Member of RAC

President/CEO

Miller Samuel Inc.

Real Estate Appraisers & Consultants

Matrix Blog @jonathanmiller

Reads, Listens and Visuals I Enjoyed

- How CNBC Built an Entire Financial Channel That Mainly Loses People Money

- 💰 Billionaire Name Game [Highest & Best]

- NAR's commission suit insurance has already run out [Inman]

- An incredible new map could help bring down America's sky-high home prices [Business Insider]

- New York’s rent stabilization laws will stand after Supreme Court declines to hear challenges [CNN Politics]

- NAR: Existing-Home Sales Increased to 4.00 million SAAR in January [Calculated Risk]

- What’s behind the US housing crunch [Harvard Law School]

- Why Are There Suddenly So Many Car Washes? [Bloomberg]

- Trump Tower mall faces a crossroads, four decades after its splashy debut [Crain's New York]

- Toll Brothers, Inc. (TOL) Q1 2024 Earnings Call Transcript [Seeking Alpha]

- Housing Market Update: Home Prices and Mortgage Rates Rise, Pushing Would-Be Buyers to the Sidelines [Redfin]

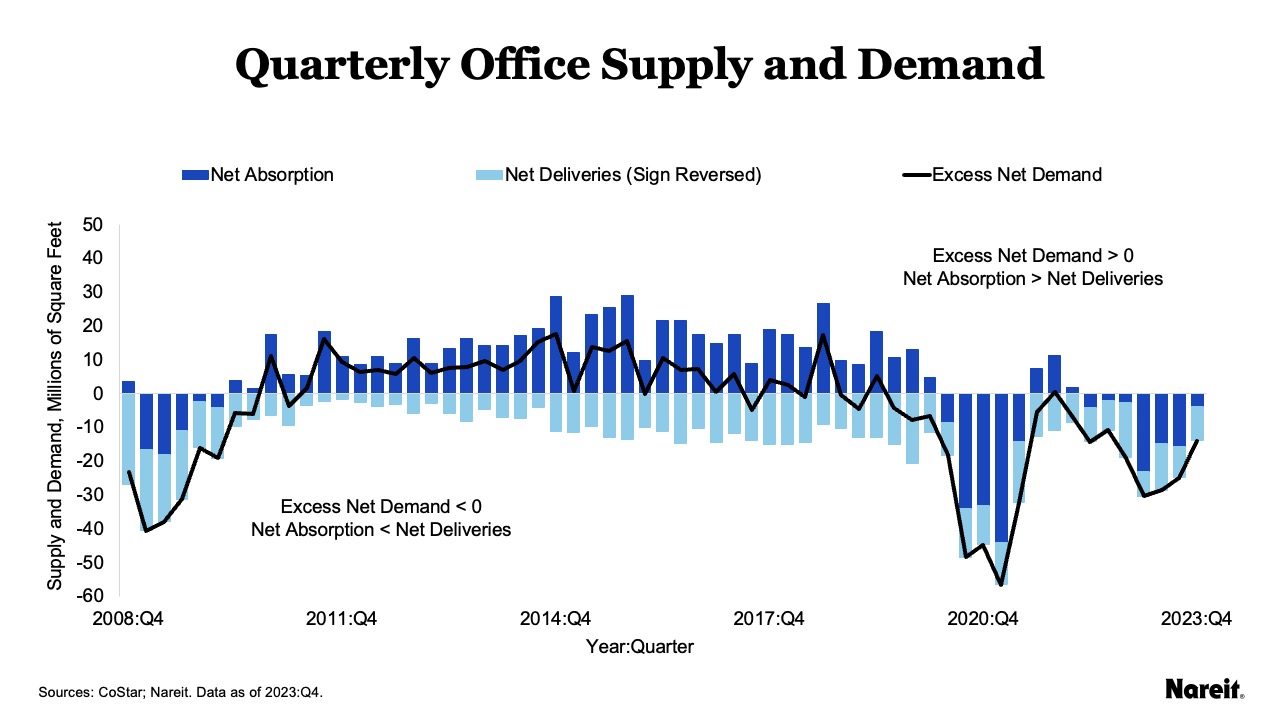

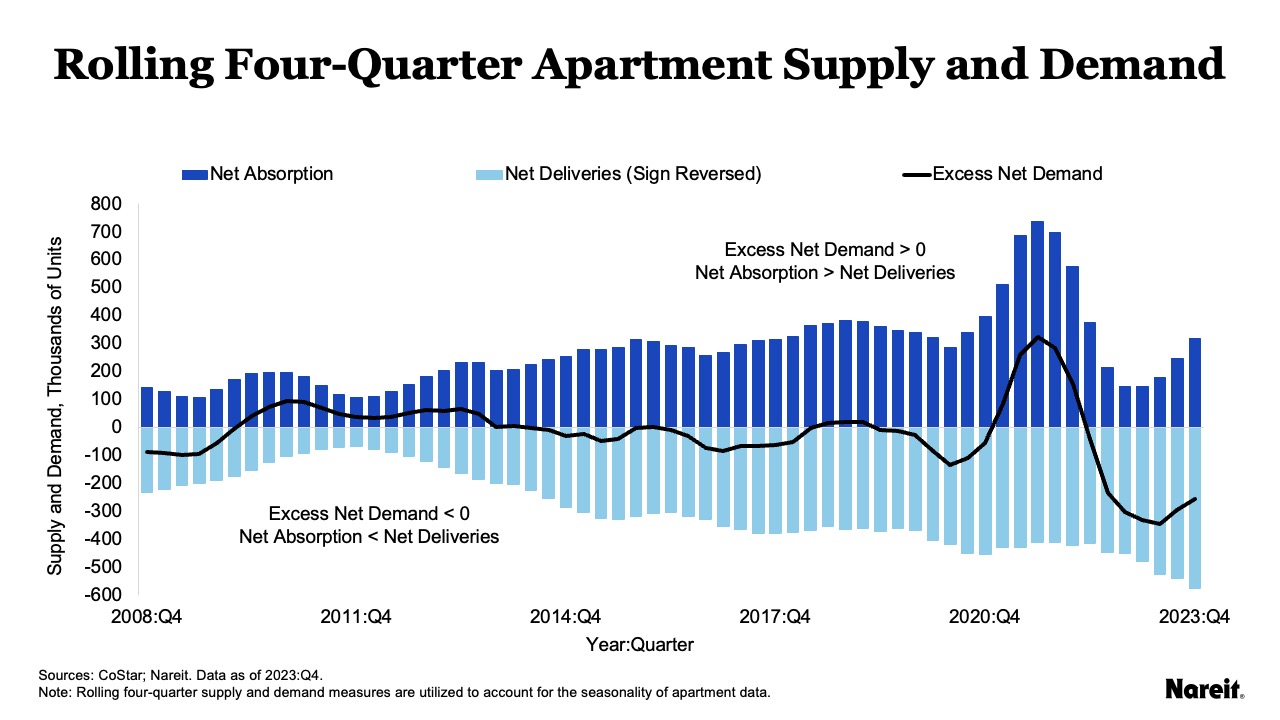

- Supply-Demand Imbalances Diminish Strength of Property Fundamentals [Nareit]

- What city’s homes have California’s smallest yards? [OC Register]

- Tech Leaders Fled San Francisco During the Pandemic. Now, They’re Coming Back. [Wall Street Journal]

- One of the World’s Most Expensive Luxury Property Markets Is Becoming a Lot Cheaper [Wall Street Journal]

- The Great Compression [NY Times]

- The hottest trend in U.S. cities? Changing zoning rules to allow more housing [NPR]

- Prime London house prices back at 2014 levels as buyers shun South Kensington and Chelsea [City AM]

- The housing market is terrible: Why now is the time to rent, not own [USA Today]

- Realtors Are in Crisis—and Home Buyers Could Be the Winners [Wall Street Journal]

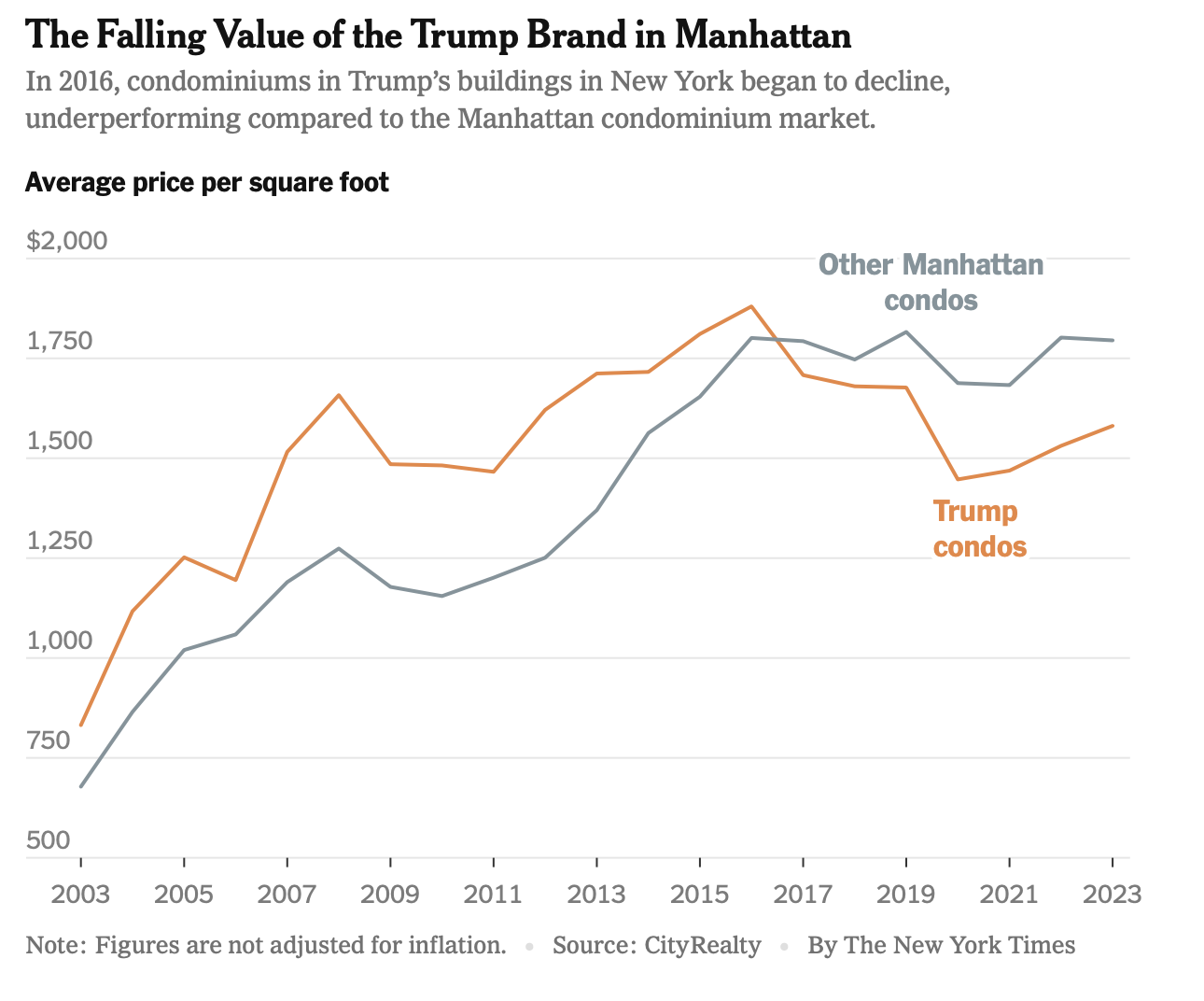

- In New York, the Trump Brand Is Costing Some Condo Owners [NY Times]

- Why New York City Can’t Fix Its Ugly Scaffolding Problem [Wall Street Journal]

- When a New Condo Building Has Problems, Who Pays to Fix Them? [NY Times]

My New Content, Research and Mentions

- A Home-Furnishings Mogul Wants $68 Million for Getty Center ‘Sister’ [Mansion Global]

- Real Estate Analyst Gives 2024 Hamptons Outlook [27Speaks Podcast]

- WSJ News Exclusive | A Home-Furnishings Mogul Wants $68 Million for Getty Center ‘Sister’ [Wall Street Journal]

- Ultra-Wealthy Home Buyers and Renters Are Getting an Early Start in New York’s Tony Hamptons [Barron's]

- Ultra-Wealthy Home Buyers and Renters Are Getting an Early Start in New York’s Tony Hamptons [Mansion Global]

Recently Published Elliman Market Reports

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 1-2024 [Miller Samuel]

- Elliman Report: Manhattan Decade 2014-2023 [Miller Samuel]

- Elliman Report: Manhattan Townhouse Sales 2014-2023 [Miller Samuel]

- Elliman Report: San Diego County Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Orange County Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Los Angeles Sales 4Q 2023 [Miller Samuel]

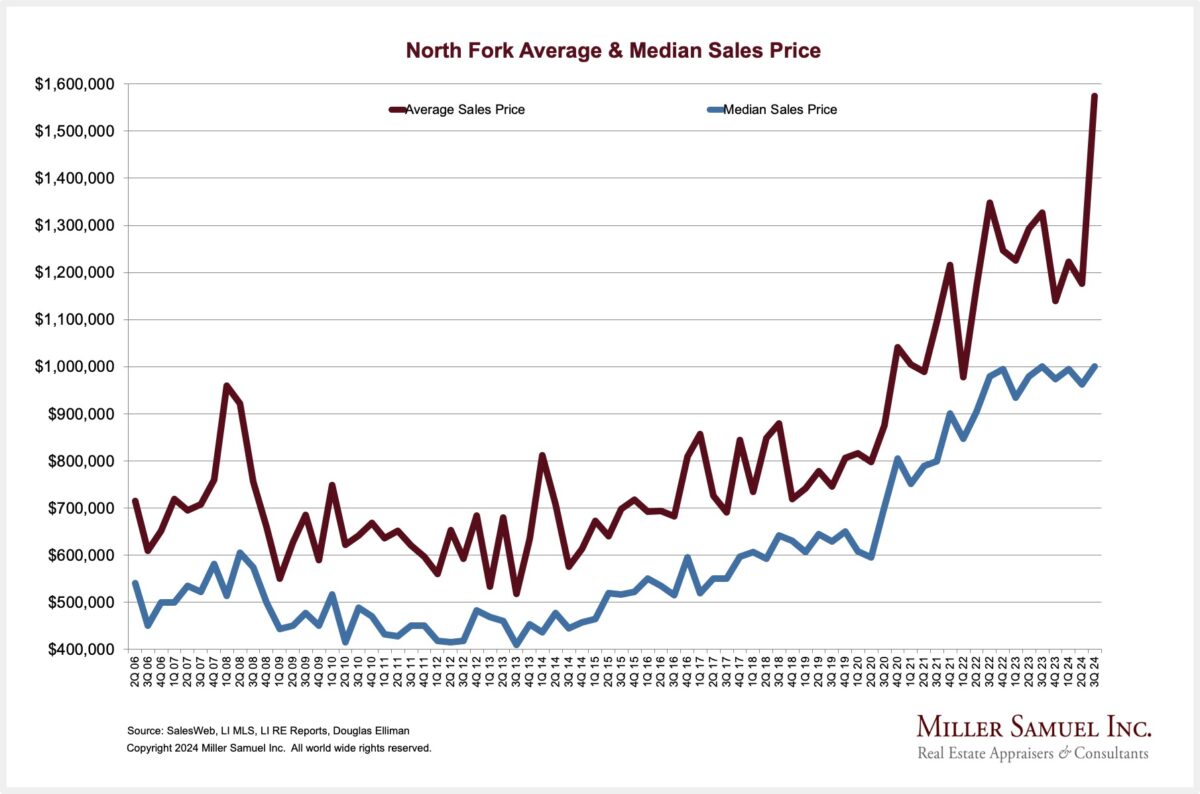

- Elliman Report: North Fork Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Hamptons Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Long Island Sales 4Q 2023 [Miller Samuel]

- Miller Samuel New York City Market Brief 4Q 2023 [3 Year Comparison] | Miller Samuel Real Estate Appraisers & Consultants

Appraisal Related Reads

- Things I’ve learned after 15 years of blogging [Sacramento Appraisal Blog]

- Why Agents Should Share Their CMA With The Appraiser [Birmingham Appraisal Blog]

- What to Expect from the Appraisal Institute in 2024 [The Appraisal Buzzcast]