- A Brutal Murder Seemingly Had No Impact On The Market Value Of The Home

- Stigma Can Have A Fleeting Influence On Values If Supply Is Tight

- No Clear Understanding Why Some Communities Respond More Than Others

Back in April, a house located at 2825 Saratoga Trail in Frederick, Colorado, was placed on the market. The home was the location of a brutal murder. Chris Watts murdered his pregnant wife and two small children in 2018. I attempt to explore the impact of a tragedy like this on the value of the home.

There was a Netflix documentary about the tragedy American Murder: The Family Next Door. Here’s the trailer:

Sales History Of The Home

- $399,954 May 1, 2013 (as new construction)

- $600,000 November 22, 2022 (1st resale after tragedy)

- $724,900 July 11, 2024 (listed April 10, 2024, with 3 price cuts)

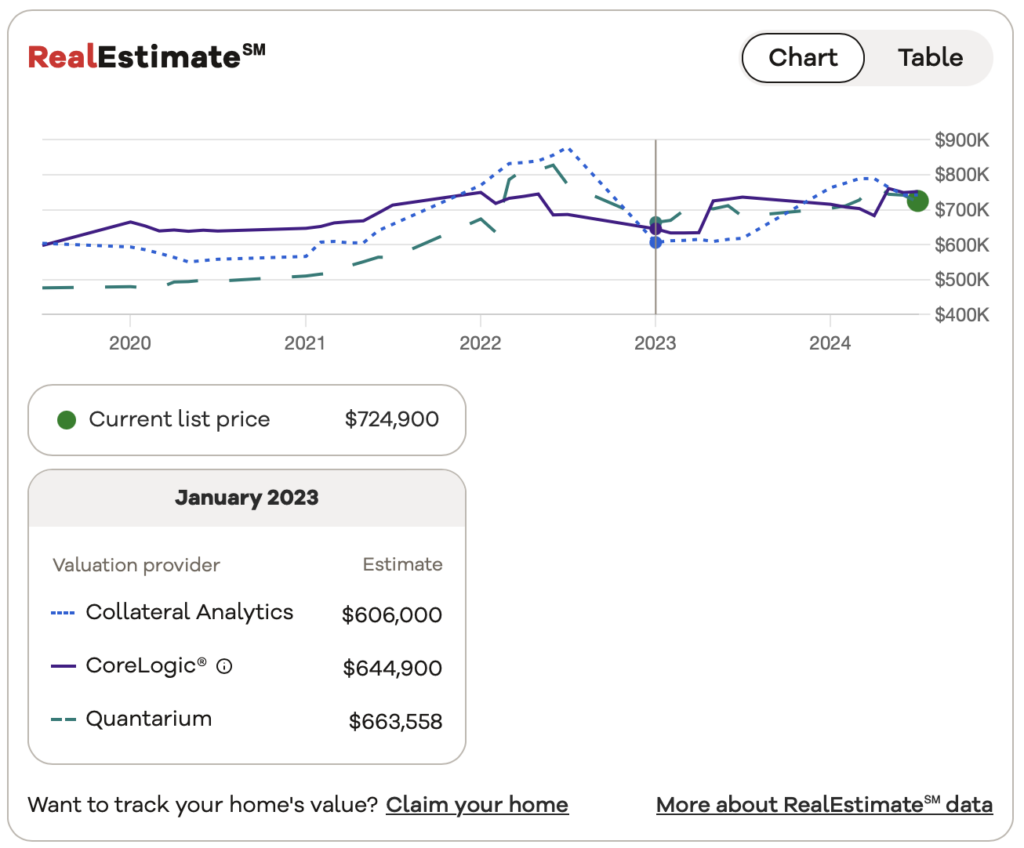

I thought it was odd that there was no Zestimate for this listing. I suspect the feature was disabled due to the salacious potential of such information. Not being familiar with the housing market in this town, I looked at what was available online as a “lurker” and became comfortable with the idea that the 2022 resale was not a below-market sales price of $600,000. Collateral Analytics, one of the three price estimators used by Realtor.com, is one I am familiar with, and their estimate was $606,000.

When researching this case, I learned that the buyers of the home were being inundated by people commenting and criticizing them on social media, so they ranted on Facebook. The hassle by the public is a factor I probably haven’t paid enough attention to in considering the impact on value.

No Evidence Of Value Stigma

Not knowing the relationship between the assessed value and market value in this market, I saw that the assessed value in 2014 was $29,950 (presumably made after the house was finished in 2013) and was $39,740 in 2022. The gain in assessed value over the period was 32.3%. The change in market value over the same period was 50% as evidenced by sales prices, so it would appear reasonable that the $600,000 sales price at the end of 2022 was not a lowball or massively discounted price based on the information available online.

The home was listed again in April for $775,000, a 29.2% increase over the $600,000 sales price in November 2022. The listing price was cut three times in two months (and notice the 2.8% buyer’s agent fee in the era of the NAR Settlement). I appreciated that the journalist reached out to Randall Bell, a national valuation specialist of real estate impacted by tragedies or disasters. I’ve admired and followed his work for years.

The seller offered a $15,000 interest rate buy down, and the home was reportedly contracted in July. If this purchase ultimately closes, the three months of marketing time it took to go to contract doesn’t seem like a penalty from stigma to me.

Thoughts on the market value impact of this tragedy from online evidence and personal experience:

- When listing inventory is tight, the stigma of a tragic event in a home can be fleeting

- The financial penalty on market value tends to wear off over time – four years passed after the tragedy before the home was sold.

- While this was a horrific event, the property was not demolished as with Sandy Hook, so it’s not clear what specifically drives community reactions to a tragedy

- If listing inventory was bloated, I believe there would have been a stigma penalty, but I still believe it would be temporary

- Part of the impact on buyers of a potentially stigmatized property is the public reaction to such a purchase. The 2022 buyers felt compelled to write a Facebook rant to push back against all the perceived public shaming.

- There is no mention of any tragedy in the listing write-ups.

On that last point, I’m not sure what form a notification would or could take. I’ll bet the lack of value impact was probably enabled by the lack of information on the tragedy made public to buyers. I don’t have the local expertise of a real estate broker. I know I’d be upset if I found out about a tragedy like this long after I closed.

A couple of houses and 20+ years ago, my wife and I bid on a home, and we lost out to someone who bid higher. We found out later that the sellers were selling specifically because they had “a neighbor from hell,” so we were very thankful we had lost the bid.

Open 25 Hours

Update To July 19, 2024 Post: A Listings Cluster Makes Sellers Confusingly Flustered

A few weeks ago, I got a call from a Wall Street Journal reporter about Park Slope, Brooklyn. The neighborhood had nine brownstones asking for a total of more than $100,000,000, so I wanted to write about it when the story came out. The next day, I got a call from another reporter, this time from the New York Post, about the same townhouse cluster phenomenon, but on West 11th Street in Manhattan. The New York Post held the story for a few weeks, so I went ahead and wrote A Listings Cluster Makes Sellers Confusingly Flustered last week on the Park Slope cluster.

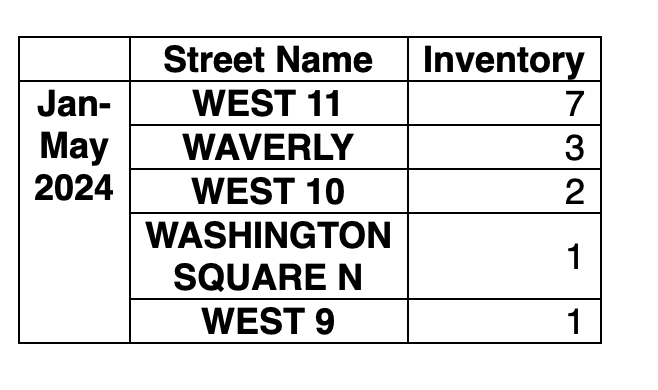

That New York Post cluster story finally dropped this week, and it was excellent, although I wish it had come out last week! The NY Post reported that the West 11th block of Greenwich Village has a cluster of 7 townhouse listings in the $10 million to $20 million price range, so I am posting this as an extension to my original post because Housing Notes is open 25 hours.

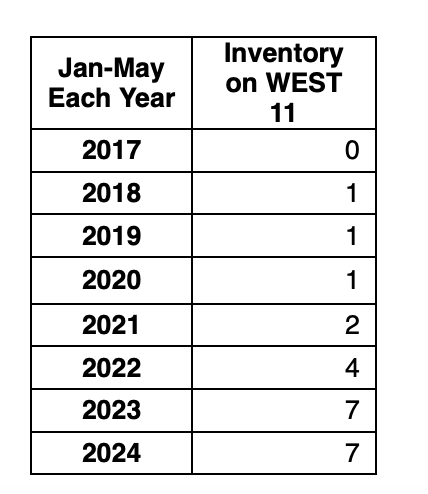

In recent years, the townhouse listing norm for West 11th Street has been about one at a time.

And it’s not as if all nearby blocks were suddenly bulging with listings. West 11th Street appears to be an outlier for now.

My rationale for the clustering of high-end brownstone listings?

From zero to seven is a trend line — not an idiosyncrasy,” said Jonathan Miller, president of the appraisal firm Miller Samuel. And he suspects the increase results from macroeconomic forces: goings-on in the financial markets, changes to the Fed’s monetary policy and uncertainty about the November presidential election.

Me!

Did you miss yesterday’s Housing Notes?

July 23, 2024

Tell Me Why: Old Enough To Repaint But Young Enough To Sell (Cement)

Image: Chat & Ask AI

Housing Notes Reads

- Infamous Colorado Home Where Chris Watts Killed His Wife Finds a Buyer [Realtor]

- Nearly Half of CFO's in PNC Survey See No 2024 Fed Rate Cuts: Faucher [Central Bank Central]

- Exclusive | Why are so many townhouses for sale on this prime Manhattan block? [NY Post]

- Colorado Home Where Chris Watts Murdered His Pregnant Wife and Their Daughters Lists for $775K [People]

- Killer dad Chris Watts: I feel like I killed my daughters ‘twice’ [NY Post]

- 2825 Saratoga Trail, Frederick, CO 80516 | MLS #4939940 [Zillow]

- Watts family murders [Wikipedia]

- A Windows version from 1992 is saving Southwest’s butt right now [Yahoo]

Market Reports

- Elliman Report: Miami Beach + Barrier Islands Sales 2Q 2024 [Miller Samuel]

- Elliman Report: Lee County Sales 2Q 2024 [Miller Samuel]

- Elliman Report: St. Petersburg Sales 2Q 2024 [Miller Samuel]

- Elliman Report: Naples Sales 2Q 2024 [Miller Samuel]

- Elliman Report: Fort Lauderdale Sales 2Q 2024 [Miller Samuel]

- Elliman Report: Coral Gables Sales 2Q 2024 [Miller Samuel]

- Elliman Report: Wellington Sales 2Q 2024 [Miller Samuel]

- Elliman Report: West Palm Beach Sales 2Q 2024 [Miller Samuel]

- Elliman Report: Weston Sales 2Q 2024 [Miller Samuel]

- Elliman Report: Vero Beach Sales 2Q 2024 [Miller Samuel]

- Elliman Report: Palm Beach Sales 2Q 2024 [Miller Samuel]

- Elliman Report: Delray Beach Sales 2Q 2024 [Miller Samuel]

- Elliman Report: Boca Raton 2Q 2024 [Miller Samuel]

- Elliman Report: Brooklyn Sales 2Q 2024 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 6-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 6-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 6-2024 [Miller Samuel]

- Elliman Report: Manhattan Sales 2Q 2024 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)