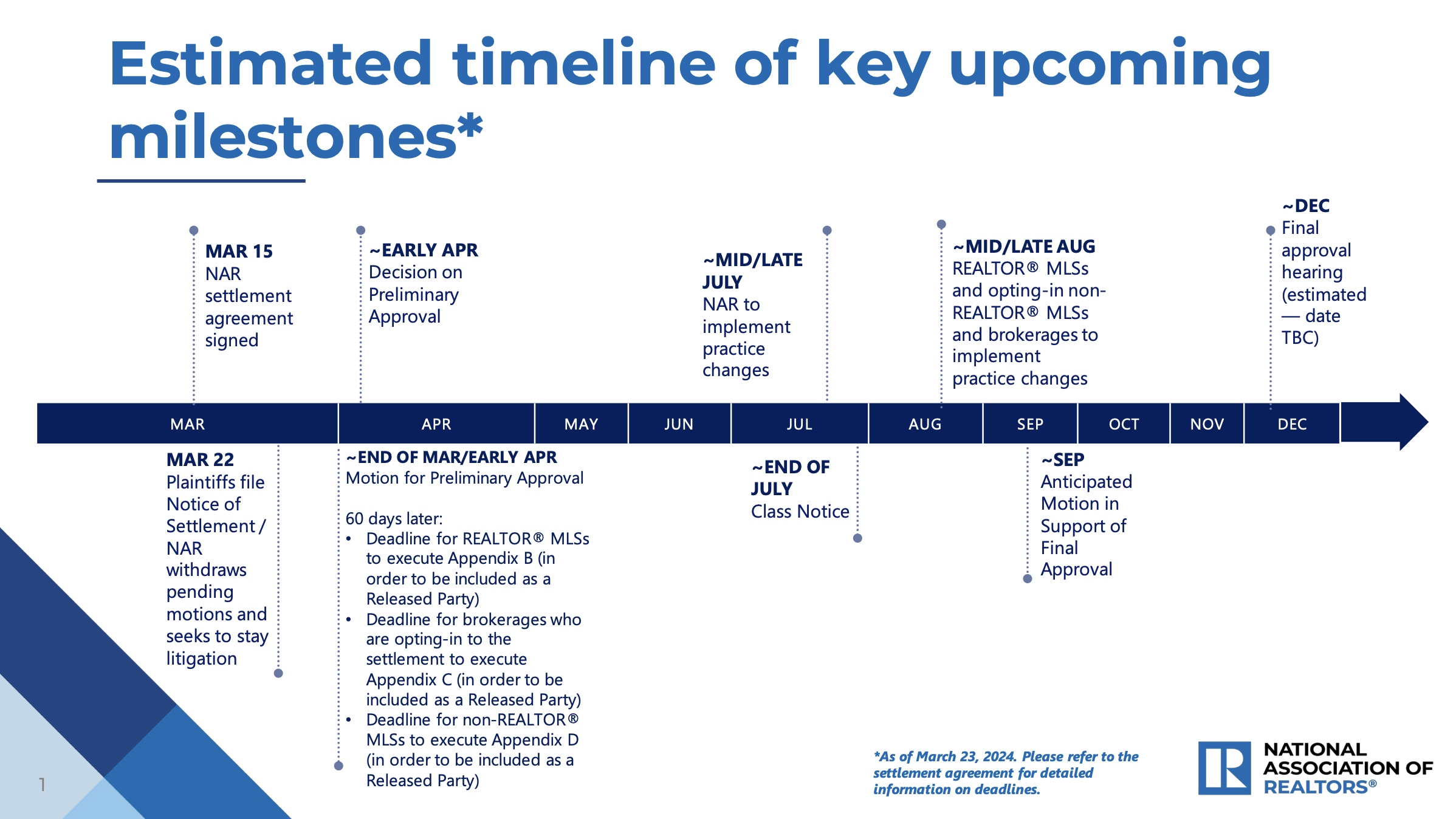

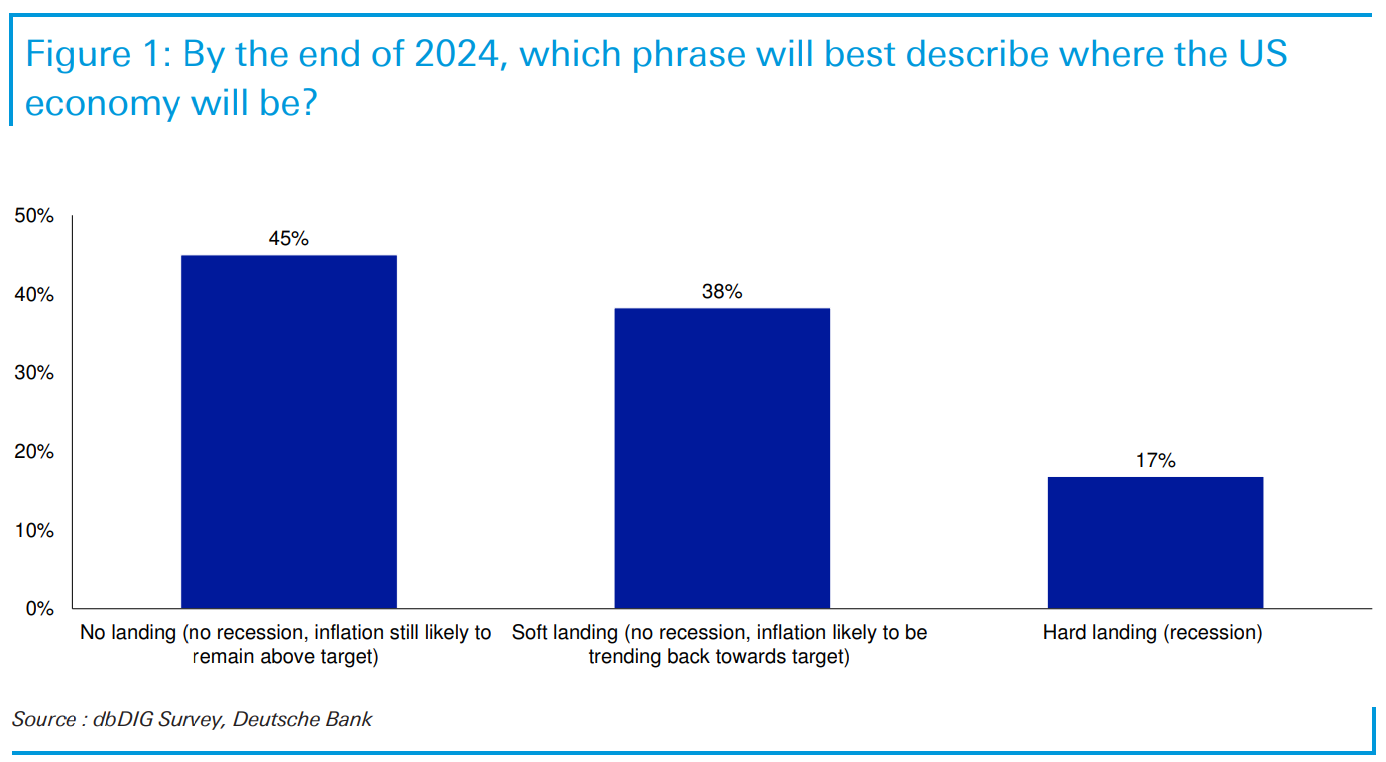

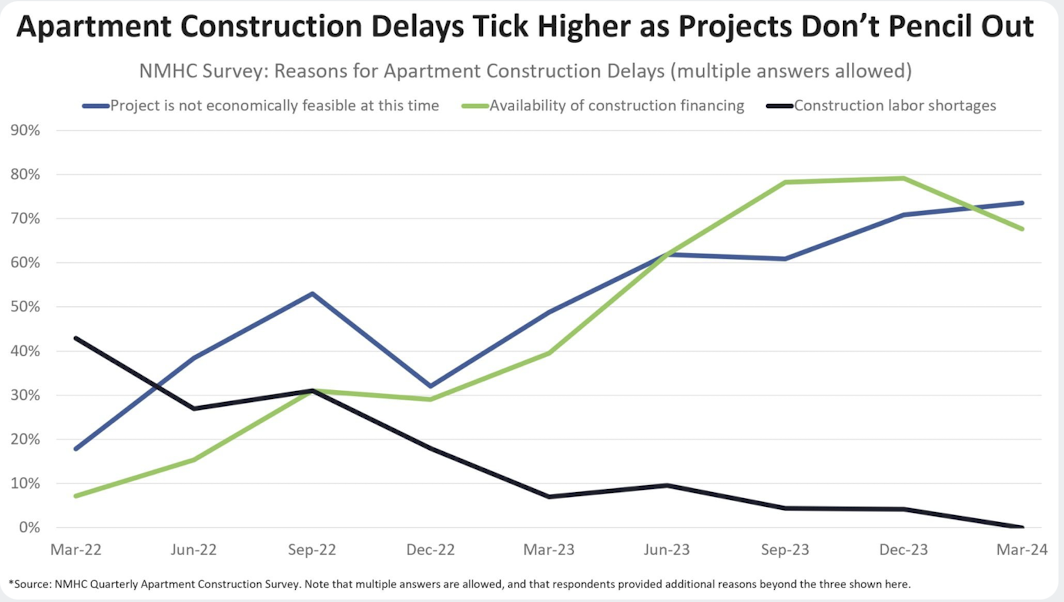

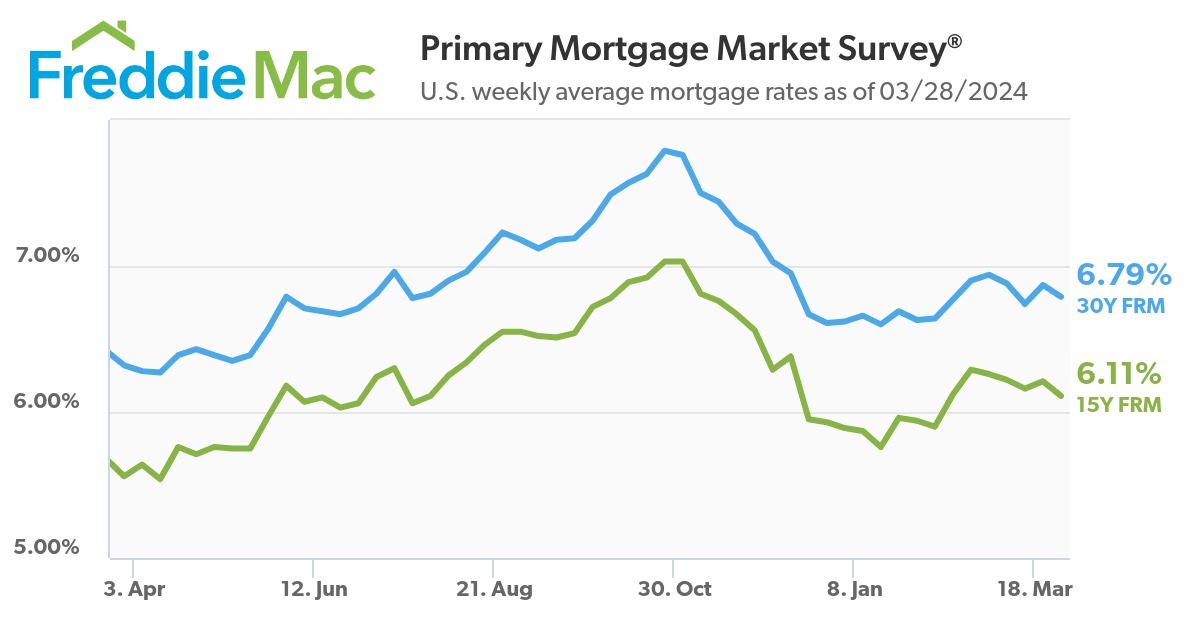

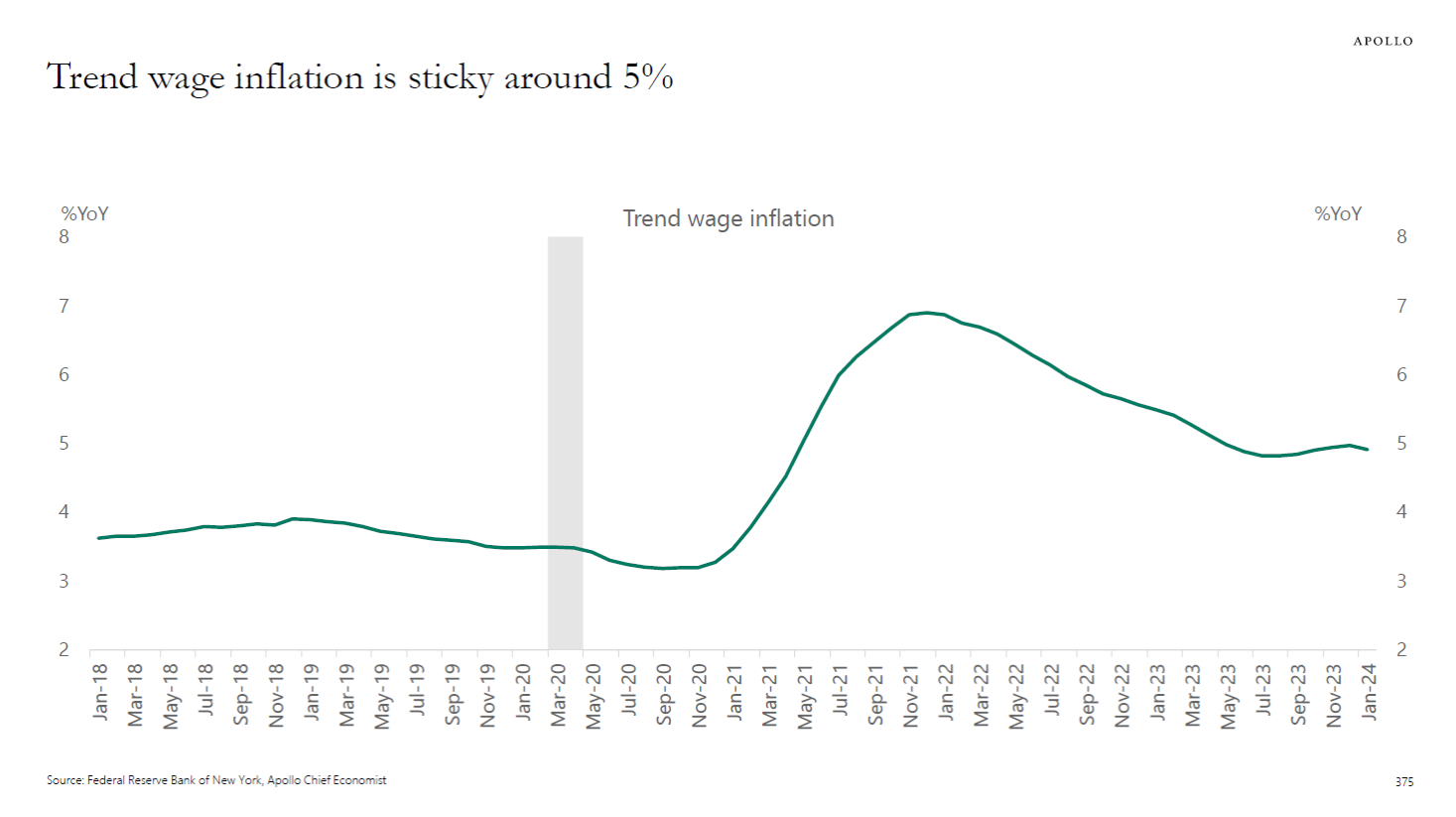

But now, the industry and the housing market are in a perfect storm, and the keyword is confusion. Buyer’s agents are the vulnerable party, and robust employment and wage growth are making us wonder about those Fed rate cuts in the back half of this year.

I have always marveled at this 1980s meme on steroids. Max Headroom was everywhere overnight, then quickly, almost nowhere. Now think about NAR’s dominance of the brokerage industry for the last century.

NAR’s toxic culture, leadership, and messaging conveyed censorship and self-dealing. Looking closely at the settlement, I believe almost none of the $418 million will come from NAR’s assets but rather from their members.

Did you miss last Friday’s Housing Notes?

March 22, 2024: The NAR Settlement Makes Housing Market Uncertainty Go To Eleven

But I digress…

Cryptocurrencies Have Substantial Economic Spillover Effects If You Avoid Jail Time

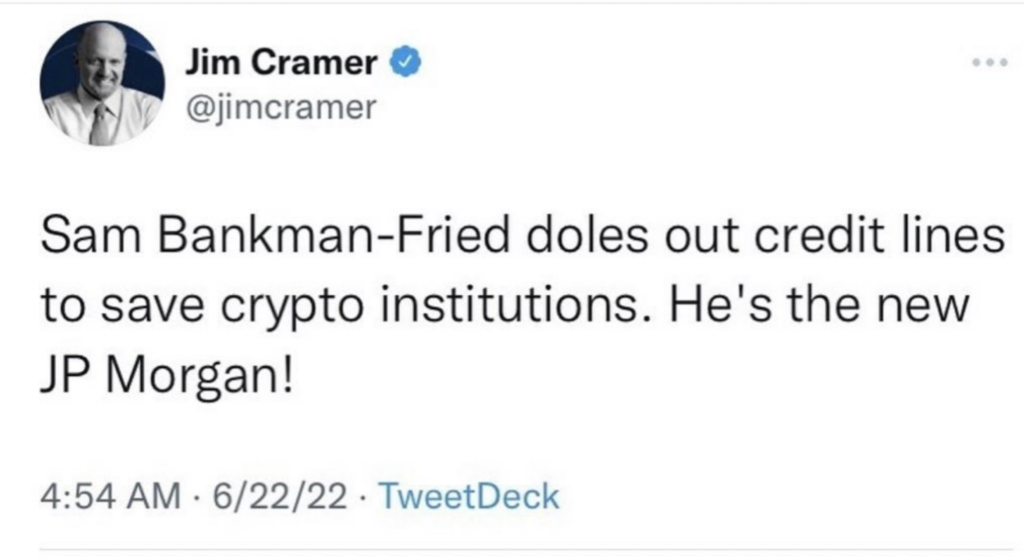

While we used to share dentists, this Jim Cramer tweet about SBF didn’t age well. Or perhaps it’s quite accurate since JP Morgan was also a robber baron!

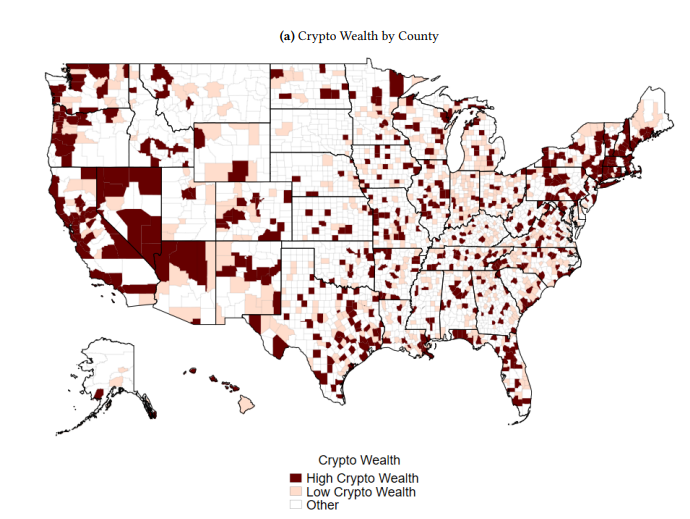

After you’ve read about SBF’s 25-year sentence, look at this Harvard Business School white paper: The Effects of Cryptocurrency Wealth on Household Consumption and Investment. A bunch of the $50+ million home sales I collected in recent years were crypto traders.

Our results indicate that cryptocurrencies have substantial spillover

HBS White Paper

effects on the real economy through consumption and investment into other asset classes.

New Casinos Don’t Bring Strong Economic Growth

There is growing talk about building a significant casino in Hudson Yards, Manhattan’s newest neighborhood. I worry that this proposed plan will come to fruition, not because I don’t want to see new construction but rather because casinos bring collateral damage. Just look at Atlantic City.

This 2016 white paper State Revenues From Gambling Short-Term Relief, Long-Term Disappointment:

In the short-run, states indeed do raise additional revenues due to expansion of gambling activities and facilities. However, history shows that in the long-run the growth in state revenues from gambling activities slows or even reverses and declines. In short, the revenue returns deteriorate—and often quickly.

Rockefeller Institute of Gambling

I taught a continuing education appraisal seminar in Atlantic City a decade ago. The speaker after me was the city’s mayor, who was very clear about the promise of casinos to the local economy. He stated there was none. There was no economic future tied to developing new casinos. He believed there was a fixed number of gamblers on the East Coast, and constructing a new casino would not attract more gamblers but would dilute their concentration on the existing product. And look at the $2 billion Reval fiasco in Atlantic City. While walking around a few casinos during that AC visit, I saw very few people; most were seniors, in wheelchairs or using walkers, and each facility stunk of stale beer and cigarettes. I’ve had the same “emptiness” experience in the two large Connecticut casinos when visiting for a convention or a getaway with friends (because they wanted to go). Also, I don’t gamble. When I was a teenager growing up in the Maryland suburbs of Washington, DC, our next-door neighbor was the president of Gamblers Anonymous and was brutally honest about the damage gambling causes.

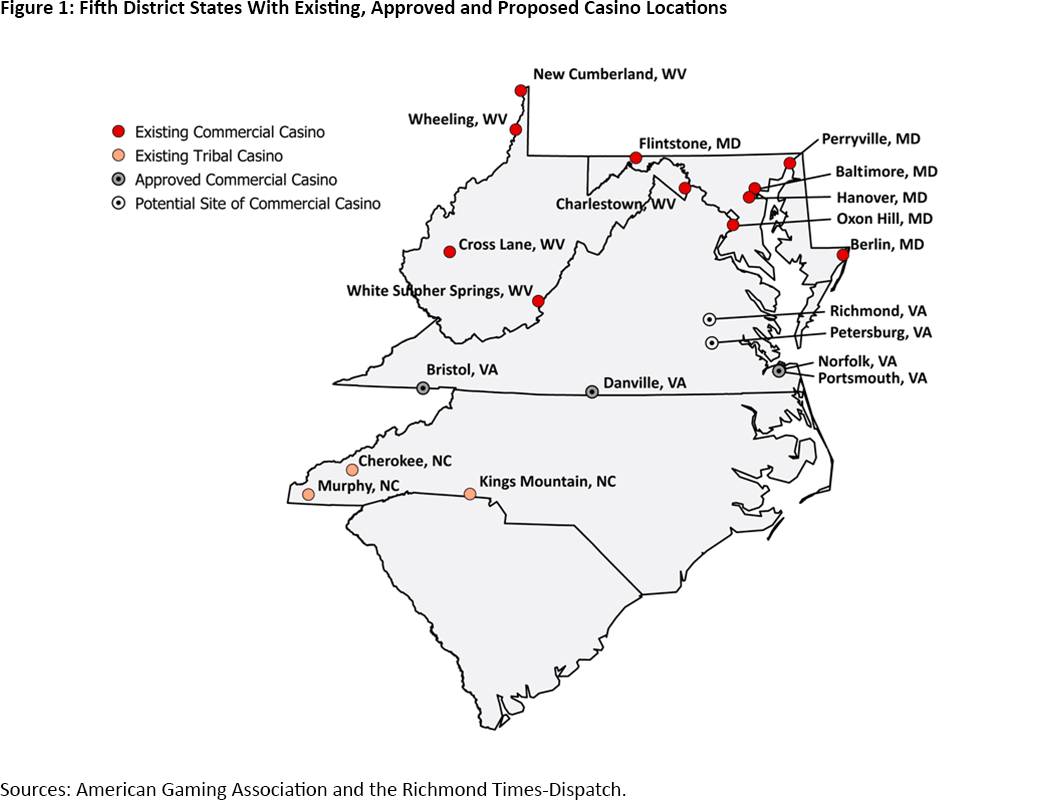

Casinos are more common across the country now than they were a generation ago. Until the late 1980s, commercial casinos were legal in only two states: Nevada and New Jersey. As of June 2022, they were legal in over 30 states and coexist with over 500 tribal casinos nationwide. This has generated much debate about their role in regional economic development.

Federal Reserve Bank of Richmond

Here is a map showing casino development south of Atlantic City. Gone are the days when Las Vegas and Atlantic City held a monopoly on gambling.

Political Posturing On Housing Becomes Blame Game Against Realtors

I’m not a fan of FBN, although I used to appear on it often years ago before I woke up. However, I am a fan of Lance Lambert, who was formerly a Fortune Magazine housing reporter before his new ResiClub venture.

The silly idea is that a supposed commission crash will Make Housing Affordable Again (MHAA). In reality, sellers won’t see savings; buyers may save some but will pay more upfront.

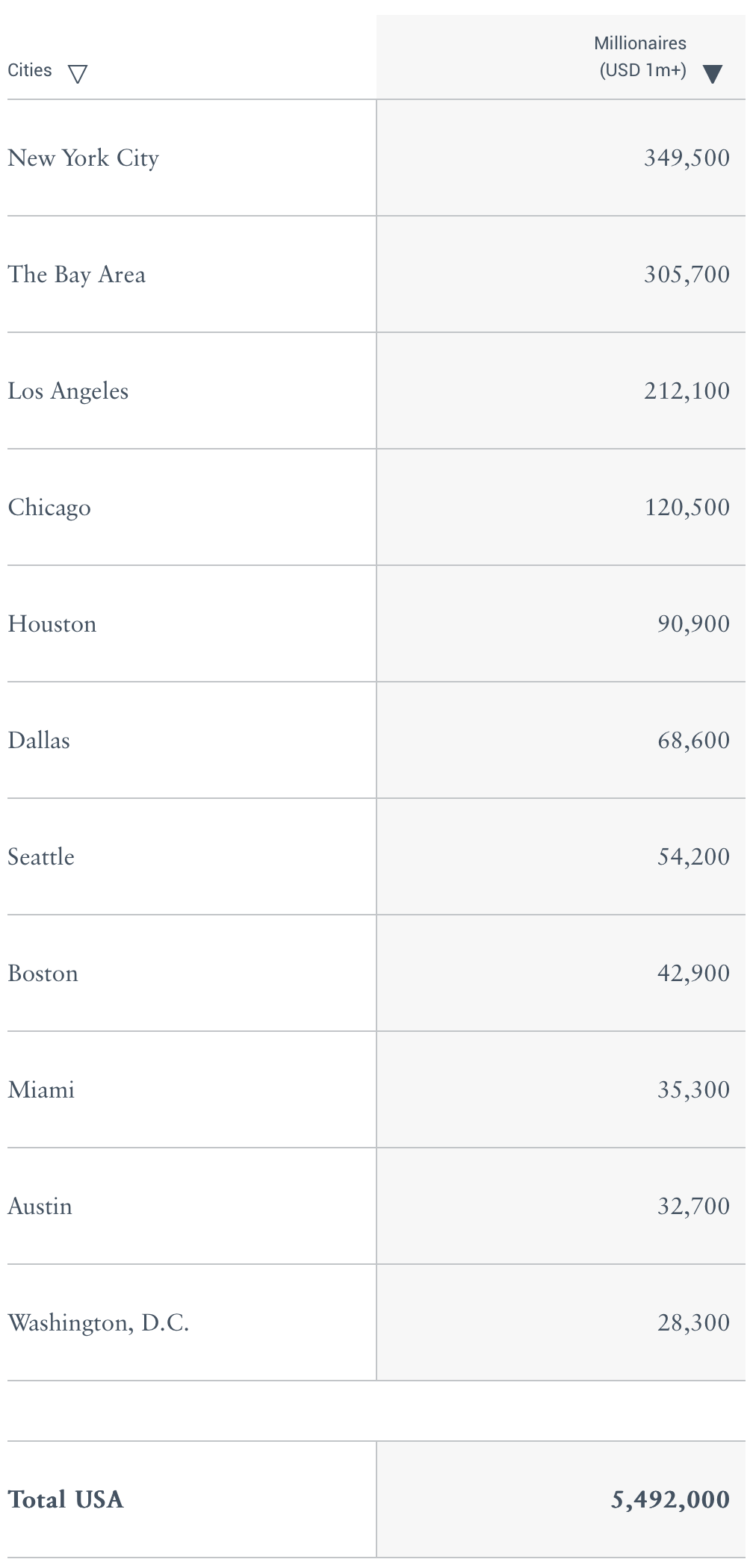

NYC Continues To Have The Most Millionaires

Number of NYC millionaires grew nearly 50% in 10 years [4 New York NBC]

US Cities With Most Millionaires

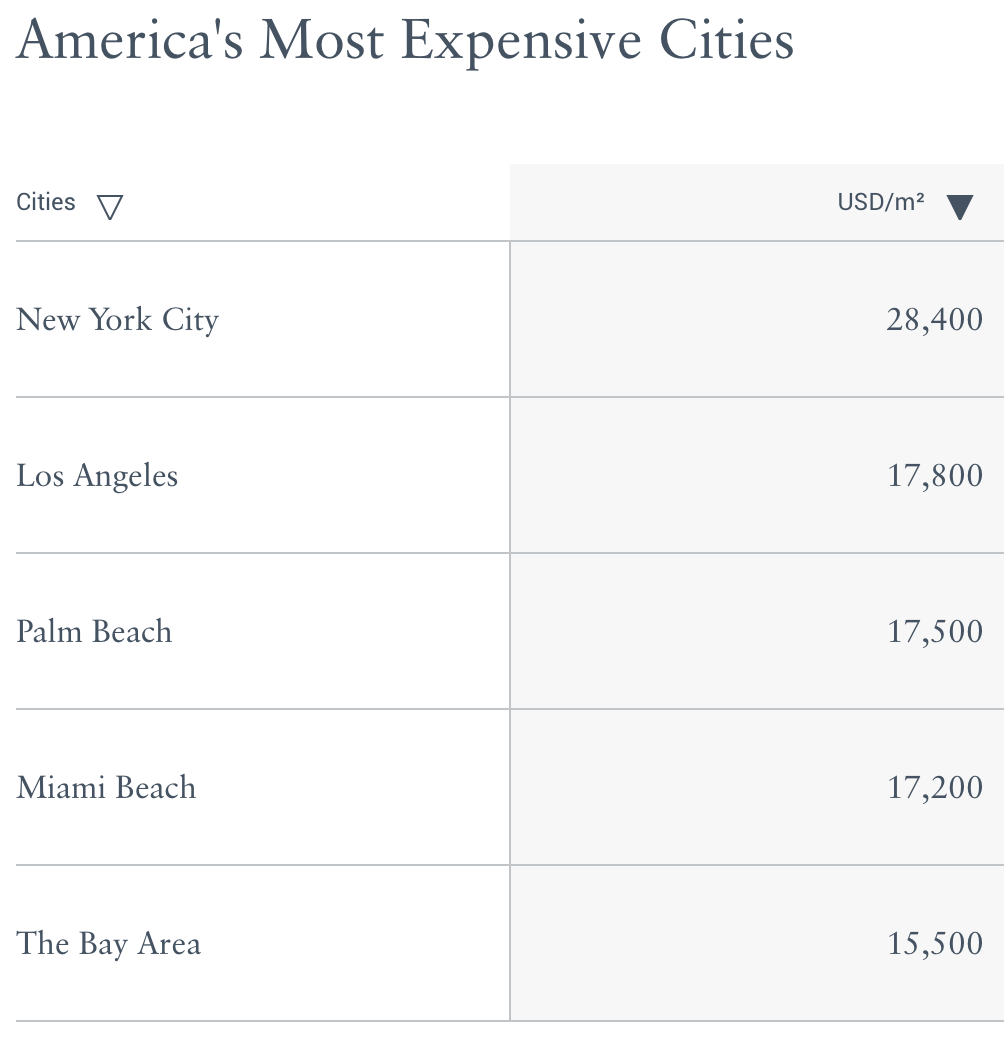

US Most Expensive Cities

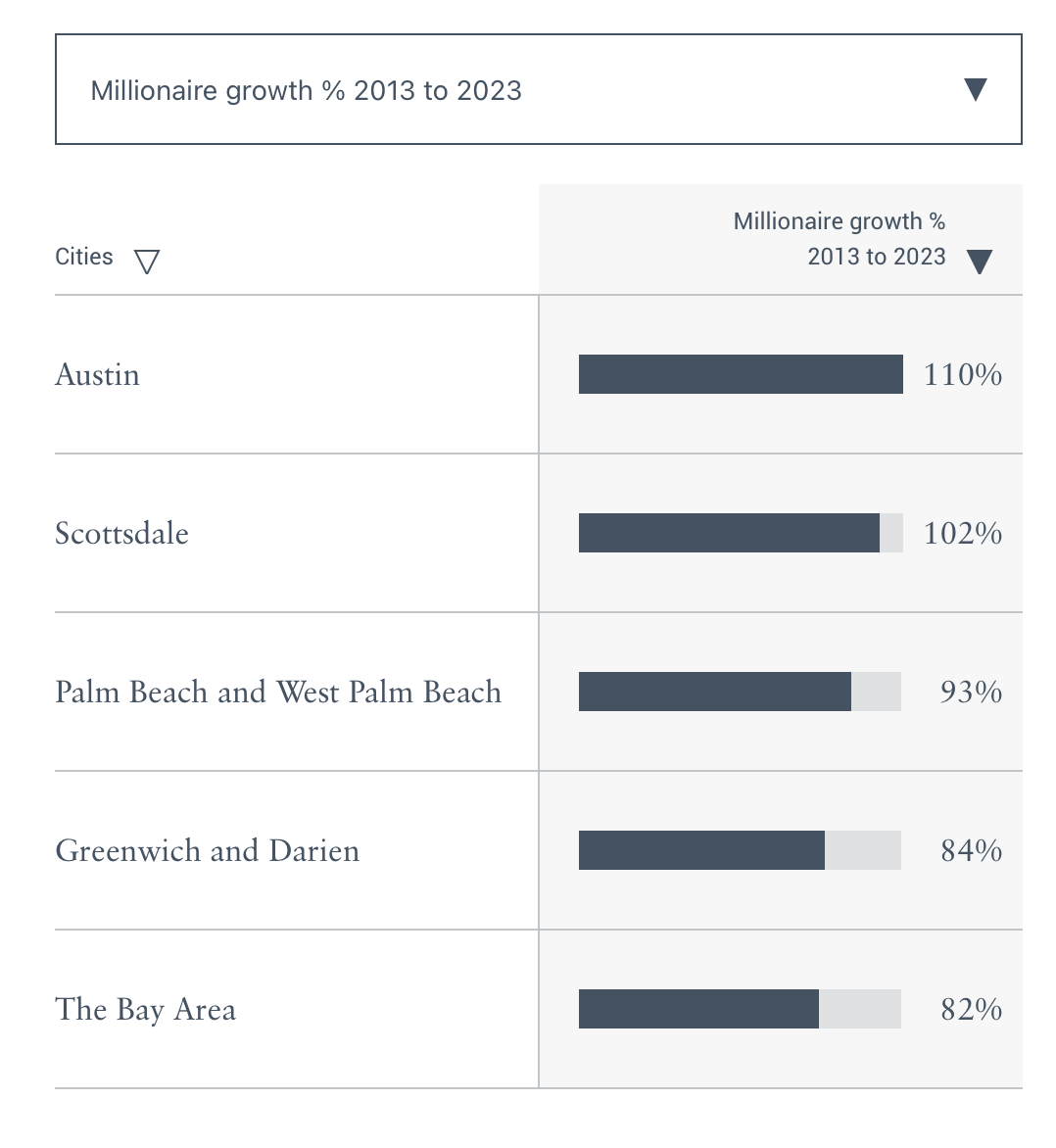

US Fastest Growing Cities

[Mike DelPrete] Profitability as Proxy for a Healthy Business Model

Mike DelPrete burst onto the real estate tech scene several years ago and presents this real estate subset in easy-to-understand presentations.

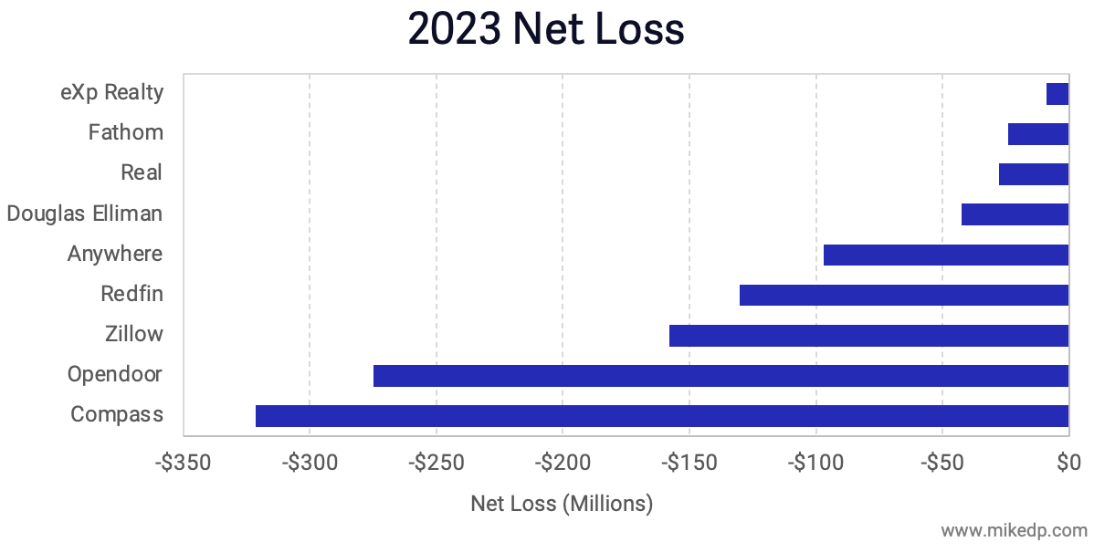

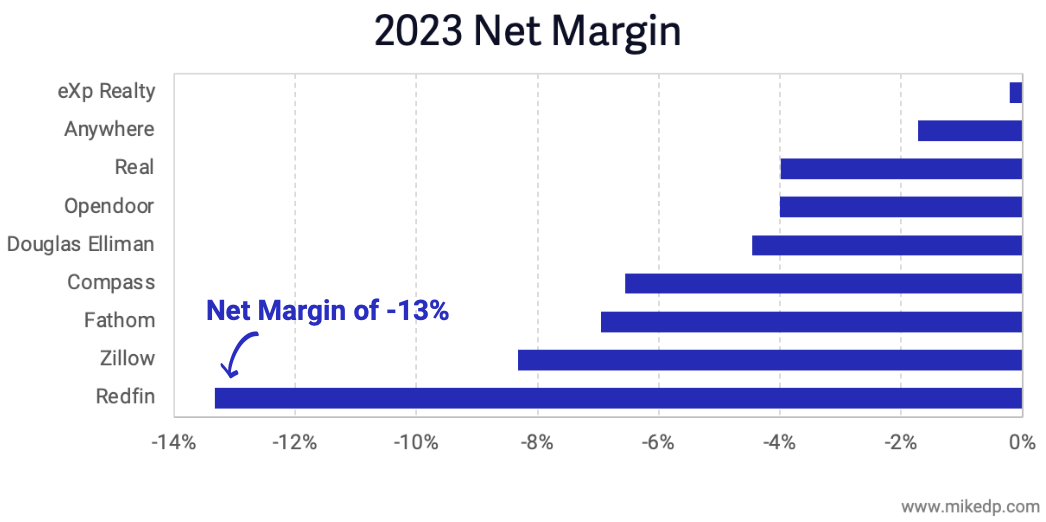

I’ve been particularly critical of Compass for years for its inability to make a profit during one of the biggest housing booms of the modern era, the pandemic. But Mike points out that it’s important how you slice it in his Profitability as Proxy for a Healthy Business Model.

But Redfin, who has been around quite a while, is wildly unprofitable.

Profitability as Proxy for a Healthy Business Model [Mike DelPrete]

Palm Beach Still Owns The Super Luxury Home Market

If this house-flip closes for its asking price, it will be the highest-priced home sale in Florida history. We’ll find out when the MLS says it is expected to close in June. I shared this sale only because it contrasts sharply with the remainder of the U.S. housing market. This Palm Beach home sits on its own island and sold for $85 million in June 2021. The property was gutted and expanded with a new list price of $225,000,000. After sitting for a year, the price dropped to $187,500,000, and it went into contract four months later, making me think the purchase price would be close to the current list price.

Central Bank Central Interview: Low Inventories, High Mortgage Rates Still Weigh on Housing Market: Miller Samuel

Here’s a substack I’m excited about – Kathleen Hays Presents Central Bank Central. I highly recommend it. A long-time friend and journalist, Kathleen Hays has extensive experience interviewing economic experts in Fedworld from her time at Bloomberg and CNBC Television.

Central Bank Central: Low Inventories, High Mortgage Rates Still Weigh on Housing Market: Miller Samuel

Getting Graphic

Favorite housing market/economic charts of the week made by OTHERS

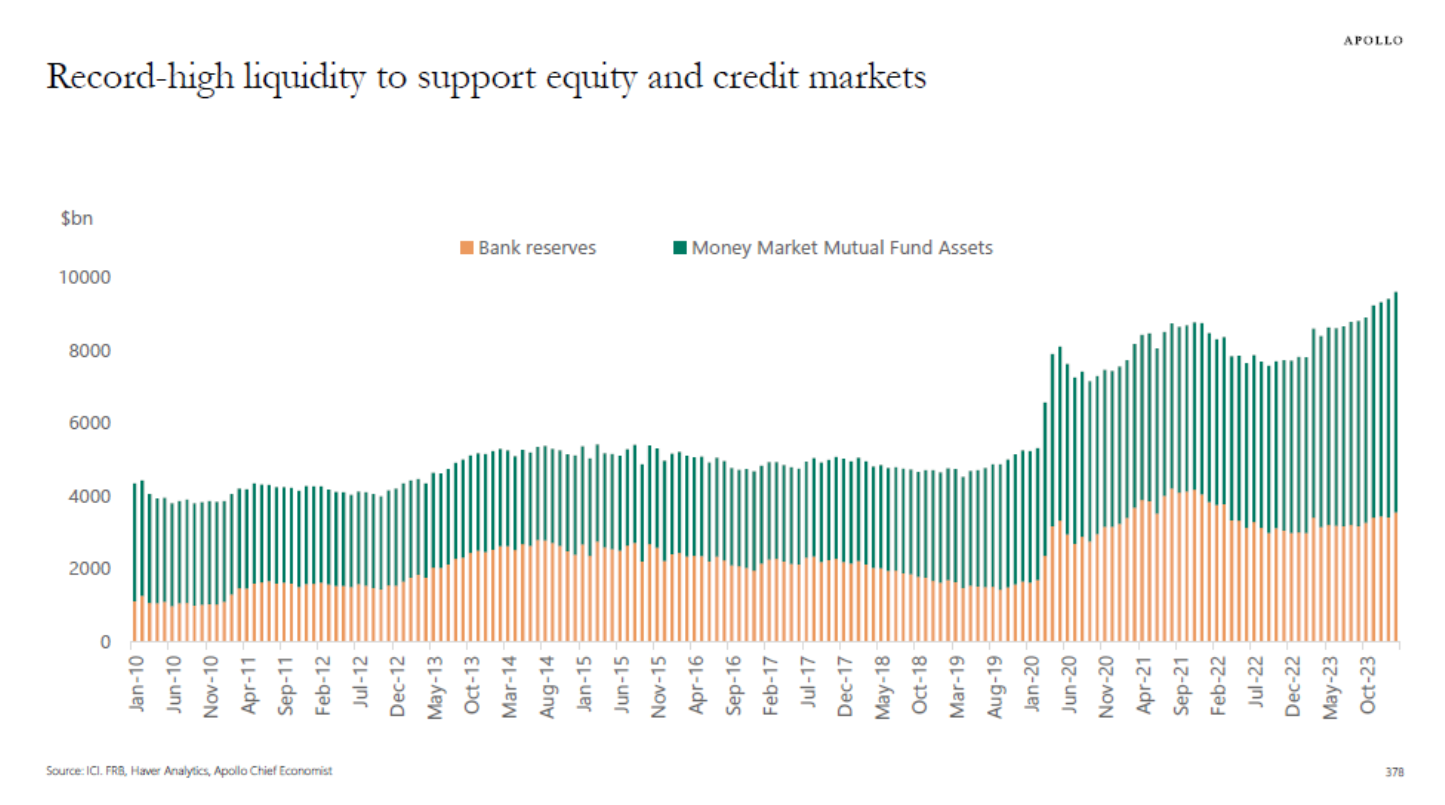

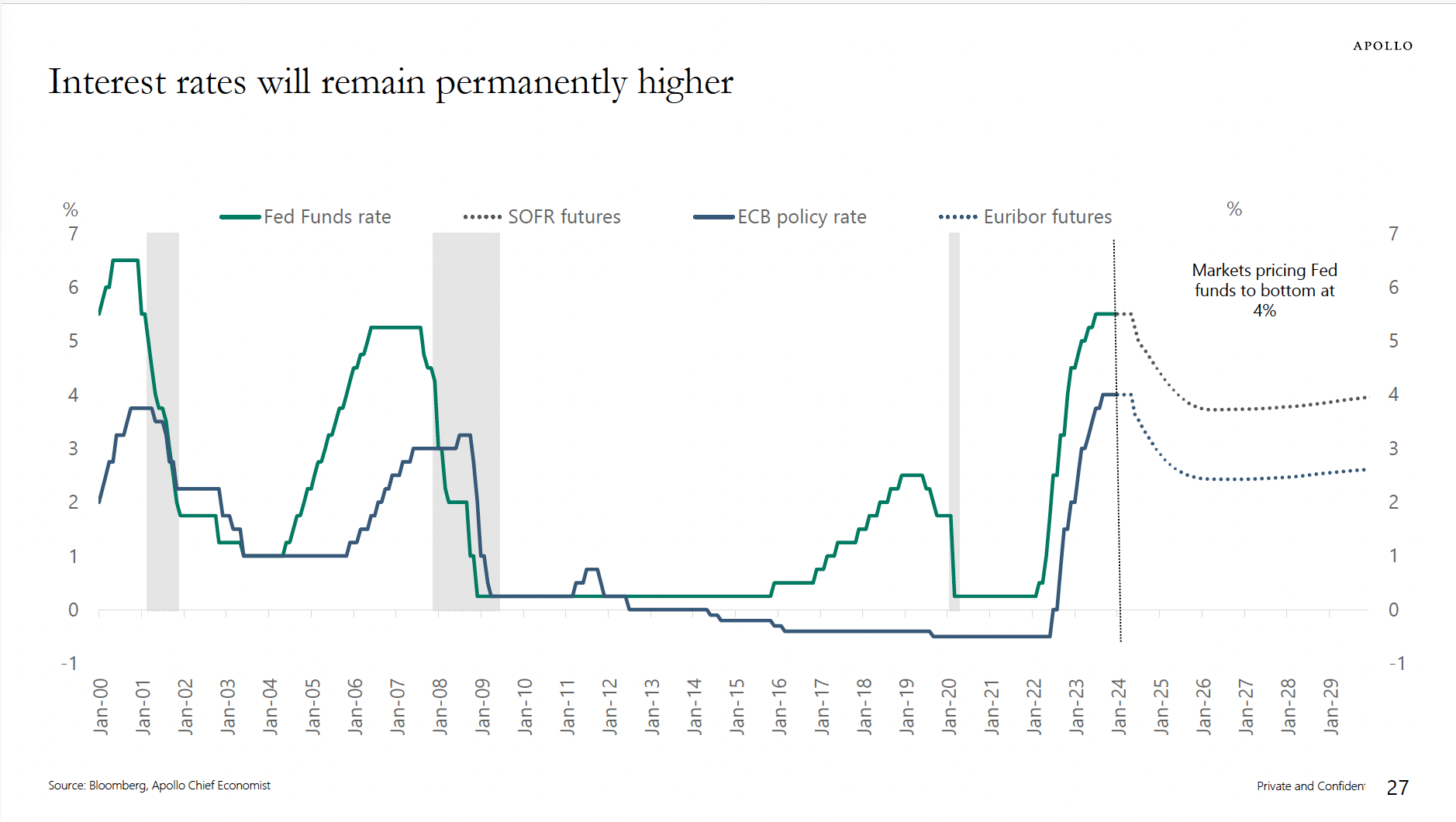

Apollo’s Torsten Slok‘s amazingly clear charts

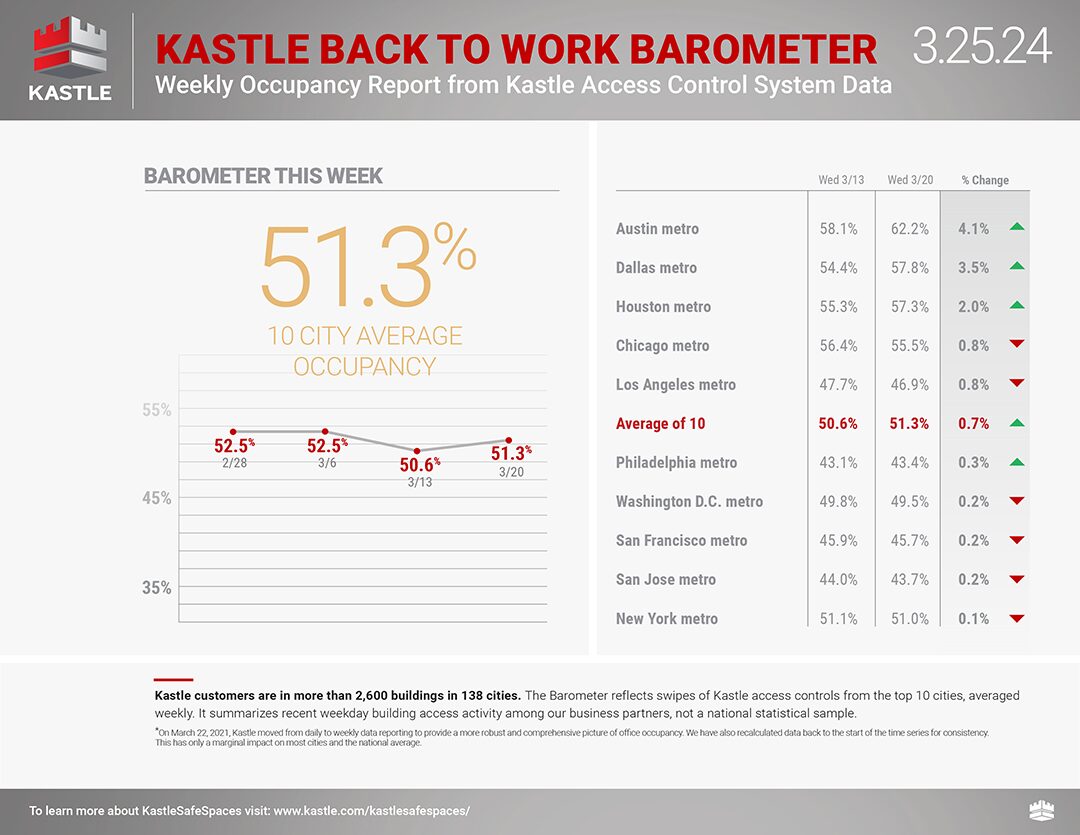

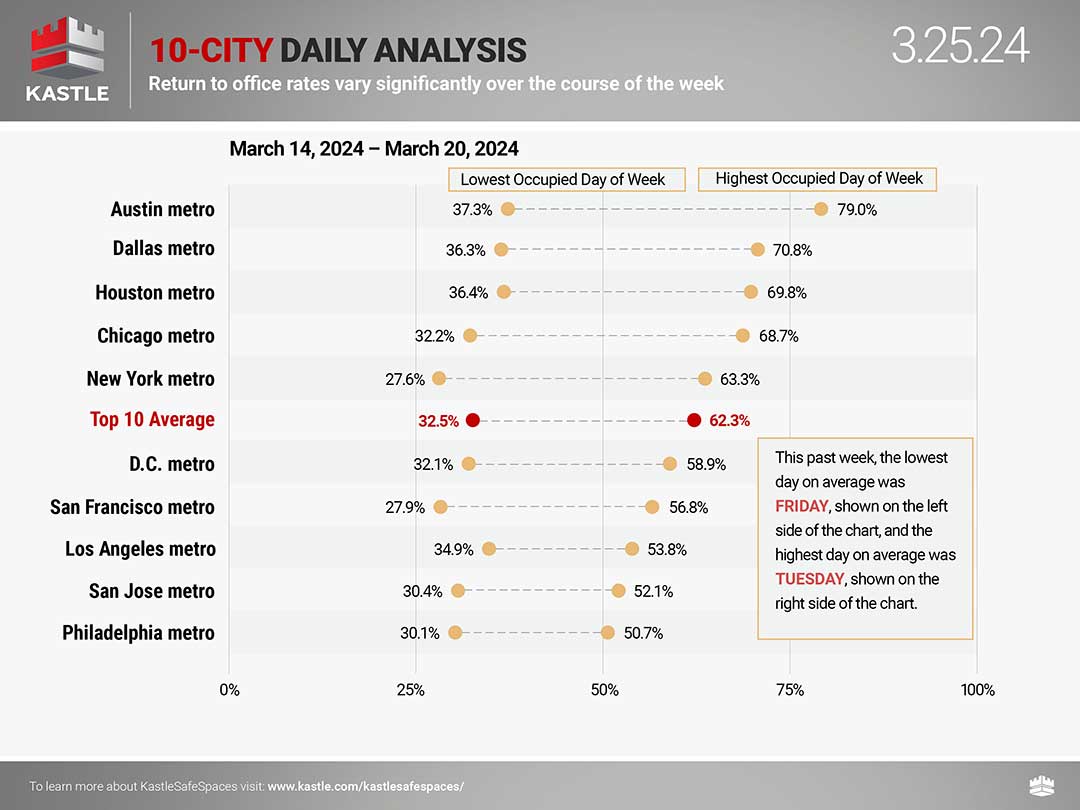

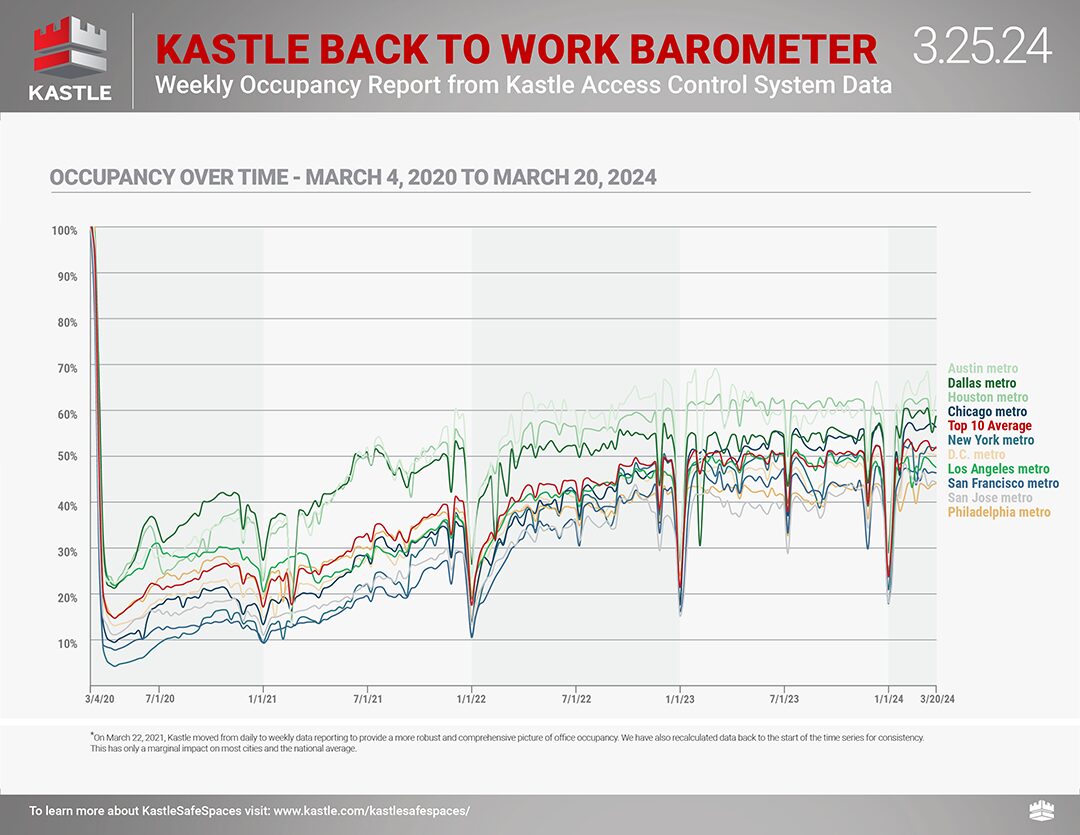

Kastle card swipe data

Kastle Data just sent their stats out this morning instead of earlier this week. I wonder if they vacated their offices?

Favorite RANDOM charts of the week made by others

Appraiserville

Lyin’ Dave Picked Kelly Last Week Without Considering Anyone Outside Of TAF

For the uninitiated, TAF is the organization that wrote the bat-shit crazy letter, the chickenshit letter, and is the subject of an active investigation by HUD on whether USPAP promotes a lack of diversity in the appraisal profession (400th out of 400 occupations, according to BLS in 2021). As a reminder, TAF president Dave Bunton called me a liar in a public forum in Washington, D.C., as he was lying (not under oath) – hence his new nickname “Lyin’ Dave,” a.k.a. “LD.”

KD was informed last week that she would be selected as the next President of TAF, and TAF negotiated her contract the previous week before the BOT vote on Monday. Lyin’ Dave will become a “senior advisor,” just as I predicted, and he said he would stay involved. Three trustees abstained, and one voted “no.” Leigh Lester voted “no.” Shelly Tanaka of AI, Scott Schafer of IAC, and Shawn Fitzgerald abstained. What was most interesting is that TAF’s press release announcing KD’s appointment came out (12:09 PM) before the BOT meeting actually ended. Wow. Serious proof the fix was in.

Lyin’ Dave said it was “thoughtful” of the search committee to consider internal candidates first. Of course, this confirms that the TAF search committee was a sham, as LD clearly misled the ASC at that last appraisal bias hearing.

This comment brings to mind the question, “Who else from TAF was a candidate besides KD?” That’s right. No one. So all the posturing by Lyin’ Dave at the fourth appraisal bias committee about the search committee for his replacement, especially when directly speaking with Chopra, while calling me a liar, was just what I said it was at the time: a lie.

KD will take over from Lyin’ Dave on Friday (today), so nothing has changed. With Dave’s presumably lucrative consulting deal and KD finally getting her title after years of waiting for something pre-agreed, it’s business as usual. She will continue to do the dirty work of TAF, but LD remains the head of the monarchy, while KD gets to be beaten up in public hearings instead of LD. I’m sure KD will either oust the board of trustee members who abstained or voted “no” from BOT, or they will not be allowed to roll back into their seats.

Can you believe the level of dishonesty coming from an organization charged with managing our certification nomenclature and protecting the public trust? Assuming the House flips politically in the fall, the expected hearings for KD will be intense, and hopefully, they will be done while sworn in under oath.

How embarrassing for the appraisal industry. It reminds us that TAF found a loophole to avoid oversight, which is not what Congress intended. I’m not sure what strategy the ASC takes at this point.

TAF Blatantly Lied To The ASC On Kelly David’s Selection

How dumb do KD and LD think the public is?

TAF now says they did zero outside interviews, so the outside consultant didn’t get to do anything tangible in this process. It sure appears they were hired to create the illusion of conducting an outside search. This confirms that Dave Bunton lied directly to CFPB Director Chopra at last month’s fourth appraisal bias hearing while lying about his interactions with me.

The following response by TAF PR for a question asked during the BOT meeting:

As Ms. Davids was an internal candidate, no further search process was conducted once the committee unanimously voted to recommend her to the full Board of Trustees

TAF PR

In other words, TAF NEVER looked at anyone outside TAF to replace Lyin’ Dave, and it is even MORE likely that NO ONE ELSE at TAF ever considered running to take Lyin’ Dave’s position. The monarchy of Lyin’ Dave would not allow a competitor to KD since this is why KD runs TAF for LD. It’s common knowledge. TAF only has 13 employees per LD, including him and KD, and this press release makes it sound like there are hundreds of employees to talk to about being the next TAF president. This makes the above quote laughable, if not wildly insulting, to all appraisers.

I think there is an excellent argument to make that TAF has held the entire profession hostage for 33 years instead of just being the standards and quality-setting body that Congress intended. And this sham appointment by Lyin’ Dave means TAF will continue to damage the profession. Meanwhile, LD raids the organization for first-class travel and dining worldwide for no substantive purpose. He spent zero time seeing the lack of diversity problem approaching, so when it became public-facing, he had to pretend it was only a recent phenomenon – the homogeneity of appraisers due to TAF-created barriers to entry. It’s the classic do poorly and be rewarded anyway with the added action of punching the profession in the eye by anointing someone who will continue to do the same. TAF presented its middle finger on both hands to Chopra, the rest of the ASC, and all appraisers nationwide.

Here’s Kelly’s “Vision.” It has 51 views so far, so admittedly, I’m in danger of helping to boost the views. So you don’t have to listen to the entire word salad, please note that at about the 10:30 mark, she notes that TAF will treat its supporters with “respect and kindness.” Of course, that also means she will crush those who disagree. Welcome to the TAF silo.

Here’s the press release response, likely worded and approved by KD/LD since EVERYTHING GOES THROUGH THEM.

Thank you for your question during today’s Board of Trustees meeting. After in depth discussion and speaking with outside consultant Association Strategies, the Search Committee opted to conduct an internal search for the next President prior to conducting an external one. After an extensive vetting and interview process, the Committee determined that Kelly Davids would be the best candidate to lead the Foundation’s next chapter. As Ms. Davids was an internal candidate, no further search process was conducted once the committee unanimously voted to recommend her to the full Board of Trustees.

Thank you,

Amy

Amy Kaufman

Director of Communications

The Appraisal Foundation

1155 15th Street, NW, Suite 1111

Washington, DC

One Of The Parties In The Baltimore Bias Case Settled

According to the NY Times, the mortgage lender loanDepot “has agreed to a number of sweeping policy changes that could offer significant relief to homeowners who allege racially biased appraisals in the future” and an undisclosed sum. One of the plaintiffs, the wife of the couple who brought the lawsuit, passed away last week.

What has not been mentioned in media stories is that the other defendant, Shane Lanham, the first appraiser, has not settled. Shane has a GoFundMe page because he intends to go to trial to defend his reputation. Here’s his position:

Hello everyone. If you haven’t heard, or read, my co-defendant, LoanDepot, has decided to settle their case out of court. I want everyone to know that this does not affect my position as I still intend to take my cases, both defense of the accusations against me and prosecution of the defamation suit, to trial. The wife of the couple suing me has passed away from cancer and this will extend the timeline of the discovery portion and depositions as the prosecution/defense have asked for an extension on these matters. This means the case will likely carry on into 2025, though I will keep my fingers crossed that it doesn’t. When I have something new & noteworthy to update on, I will let you know.

Shan Lanham’s GoFundMe

Full disclosure – I donated to Shane’s cause because I believe both defendants should be able to litigate the facts and not be found guilty based on the plaintiff’s belief that a higher second appraisal means that the first appraiser was racist. As someone with over 8,000 appraisals under my belt, I have seen firsthand that it is quite common to see a mortgage broker order a miraculously higher second appraisal, which somehow hits the number needed for the mortgage- that’s because they only get paid if the deal can close. This is not said with any righteous indignation in defense of the first appraiser. I’m sure the plaintiffs feel strongly about being victims, and I respect their beliefs. The trial will shine a light on those beliefs, using facts to set the record straight. No matter what the outcome, I hope the public learns that a second higher appraisal is not evidence on its own that the first appraiser is a racist. Yet this is repeatedly the assumption that is presented. That second report should be investigated for validity, just like the first report, before such an opinion is shared.

Lesson learned: Because of TAF’s systemic flaws and incompetence, which fostered an industry and an organization with virtually zero diversity, appraisers are now highly vulnerable to litigation over the outcomes in their reports, effectively destroying public trust. If anyone deserves to be sued here, it’s The Appraisal Foundation for its incompetence and self-dealing.

The Appraisal Institute Continues To Pull New Voices From Membership, Share Its Actions, And Act Financially Responsible

Just look at the messaging on the Appraisal Institute home page now and all the notices. It is positive, inclusive, transparent, and shows action. They’ve even got Maureen Sweeny at the top of the home page!

I encourage you to explore the content populating the website’s public-facing side. It’s all about building “One Appraisal Institute.” This leading trade group for appraisers has taken an incredible pivot since Cindy Chance became CEO last fall. Wow.

The following Vimeo clip is worth watching to get a sense of the organization’s direction after years of zero transparency to membership—no more. The FOJ toxic culture I’ve been railing about since 2016 will hopefully die as light is shed on it and the wrong incentives for leadership are removed.

OFT (One Final Thought)

Seemingly, all the 1980s TV commercials included this fastest talker in the world.

Brilliant Idea #1

If you need something rock solid in your life – particularly on Friday afternoons at 2:00 PM, Eastern Time (ET) – and someone forwarded this to you, you can sign up here for these weekly Housing Notes. And be sure to share with a friend or colleague if you enjoy them because:

– They’ll find their max headroom;

– You’ll hit your head;

– And I’ll be fast-talking.

Brilliant Idea #2

You’re clearly full of insights and ideas as a reader of Housing Notes. Consider sharing them with me early and often. I appreciate every email I receive, as it helps me craft future Housing Notes.

See you next week!

Jonathan J. Miller, CRE®, Member of RAC

President/CEO

Miller Samuel Inc.

Real Estate Appraisers & Consultants

Matrix Blog @jonathanmiller

Reads, Listens and Visuals I Enjoyed

- Opendoor will refund homesellers $62M under FTC settlement [Inman]

- World’s richest: Palm Beach is home to 58 billionaires, says our look at 2024 Forbes data [Palm Beach Daily News]

- Majority of older homeowners plan to stay in their home as they age: Redfin [HousingWire]

- You'll need more than $100,000 in income to afford a typical home, studies show [NPR]

- Amazon Billionaire Bezos Buys 3rd Indian Creek Mansion [The Real Deal]

- OPINION: It’s time to take back our housing from Wall Street [The Nevada Independent]

- Buyer agreements work, sellers still willing to pay: Baird & Warner [Real Estate News]

- CoStar News – Bob Knakal Launches Investment Sales Firm With Artificial Intelligence Focus [CoStar]

- Can My Landlord Force Me to Use a Rent Guarantor? [NY Times]

- The Rent Was Too High So They Threw a Party [NY Times]

- Office Market Still Moving In Wrong Direction For Manhattan Landlords [Bisnow]

- How canny foreigners are investing their way into a green card [NY Post]

- CoStar News – Property Prices, Transaction Volume Slide as Demand for Space Plummets [CoStar]

- How Much Higher Are Your Post-Pandemic Property Taxes? [NY Times]

- A Reporter Appraises the State of Real Estate [NY Times]

- Why buying a house feels impossible right now [VOX]

- 🧲 Millionaire Magnet [Highest & Best]

- Housing market affordability is so strained and difficult to fix that politicians are resorting to scapegoating [ResiClub Analytics]

- State Revenues from Gambling: Short-Term Relief, Long-Term Disappointment [Rockefeller Institute of Government]

My New Content, Research and Mentions

- Home Sales Largely Down, New Listings Up In Palm Beach County [BocaNewsNow.com]

- Miami ‘Condo King’ Scores $150 Million for Two Island Penthouses [Bloomberg]

- Currency Angst Goes Global as Strong Dollar Vexes Officials [Bloomberg]

- Risk On: The Bloomberg Open, Europe Edition [Bloomberg]

- Luxury Home Sales in Manhattan Fell During the First Quarter as Prices Continued to Tick Up [Mansion Global]

- How the brokerage landscape has changed in the last five years – HousingWire

Recently Published Elliman Market Reports

- Elliman Report: California New Signed Contracts 3-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 3-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 3-2024 [Miller Samuel]

- Elliman Report: Manhattan Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 2-2024 [Miller Samuel]

- Elliman Report: California New Signed Contracts 2-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 2-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 2-2024 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 1-2024 [Miller Samuel]

- Elliman Report: Manhattan Decade 2014-2023 [Miller Samuel]

That One Big Thing

Appraisal Related Reads

- Maryland Lawsuit Alleged Racial Discrimination [Real Estate Appraisal Nathan Connolly, Shani Mott by Mary Cummins]

- Do appraisers deduct value if there are concessions? [Sacramento Appraisal Blog]

- Can a New Construction Sale be Used as a Comp for an Older Home? [Birmingham Appraisal Blog]

- Shani T. Mott, Black studies scholar at Hopkins who sued over home’s appraisal, dies [Baltimore Sun]

- Could Trump’s Properties Really Be Seized? [NY Times]

- Make your 2024 NYC Annual Convention Hotel Reservations! [CRE]

Extra Curricular Reads

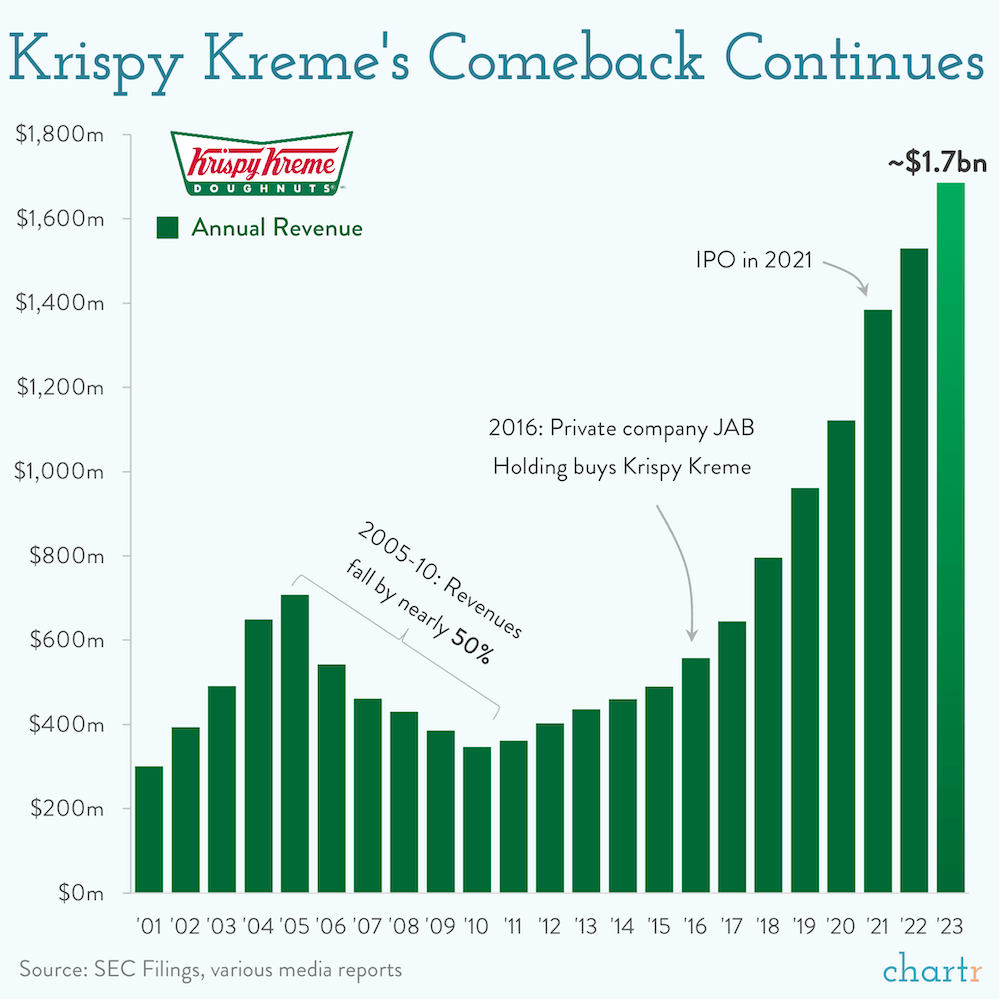

- Krispy Kreme introduces Total Solar Eclipse doughnuts: How to order while supplies last [USA Today]

- The Kim Mulkey way [Washington Post]

- Analysis | Wait, does America suddenly have a record number of bees? [Washington Post]

- Polar ice is melting and changing Earth’s rotation. It’s messing with time itself [CNN]

![Orange County Average v. Median Sales Price [Single Family, Condo]](https://millersamuel.com/files/2024/04/2Q24OC-avgMED-1200x794.jpg)