- Software Company Sued For Sharing Private Information Among Competitors

- Renewals Are Secret Sauce Of Rental Business Not Shared Publically Until Now

- Price-Fixing Litigation Is Forcing Layoffs At The Software Company

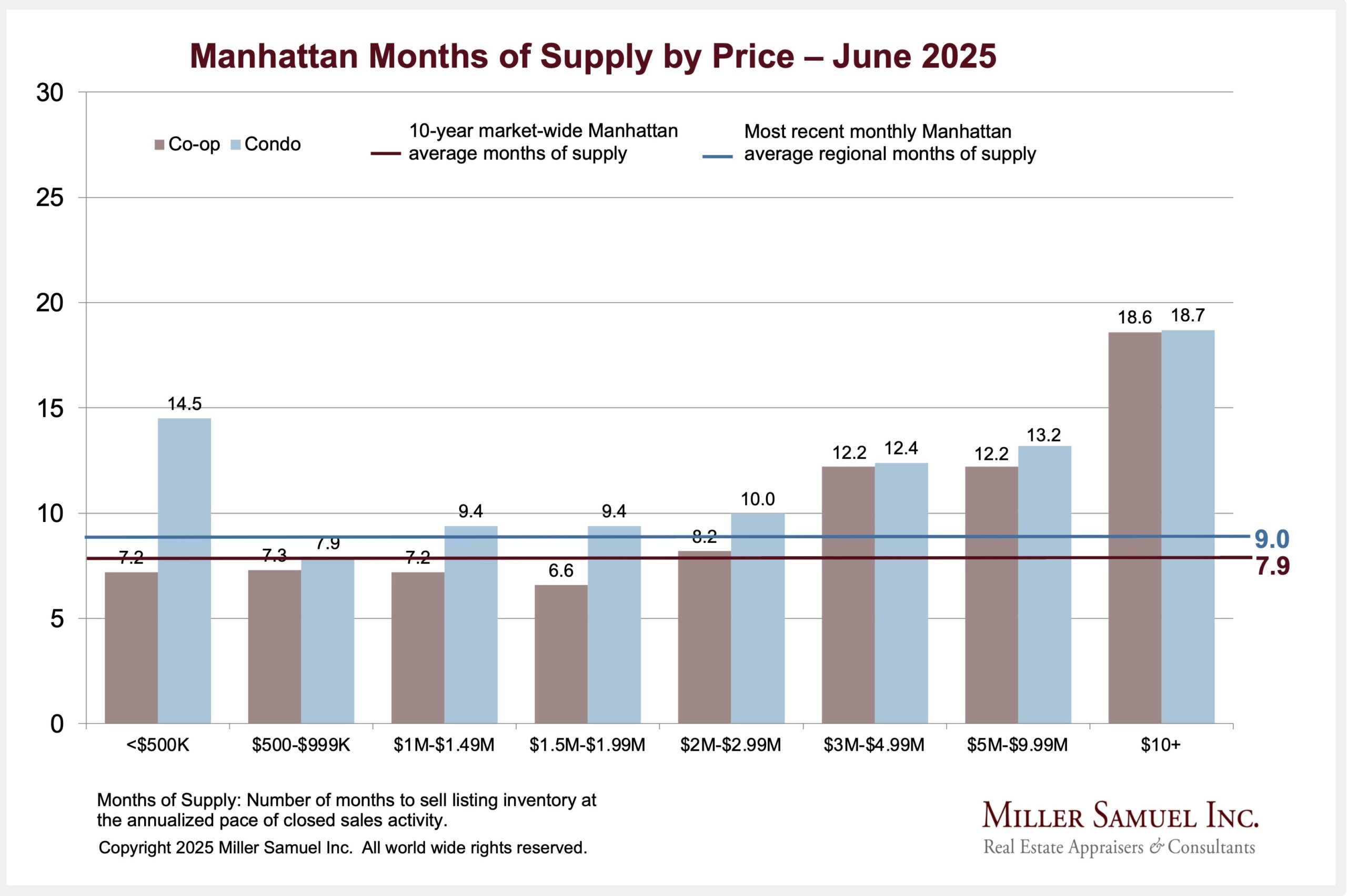

It’s been a massive rent rollercoaster during the pandemic era, and rents in some markets have surged to new highs (we’ll be releasing our July results on Thursday). The initial lawsuits started after a 2022 ProPublica study made the observation that software developer RealPage reduced price discovery by removing competition between landlords. The litigation has quickly spread to other housing markets. Their software penetration in some markets is incredible: 70% in Seattle and 90% in D.C. The concerns are that building managers, after they see acceptance of bigger increases suggested by the software than they are comfortable with, essentially get used to pushing a button at future recommendations. In other words, as the use of this software scaled larger by a merger and success in beating the market, competitors stopped discovering prices on their own, relying on private data they normally wouldn’t have access to; hence, accusations of price-fixing emerged. The expanding litigation costs have forced significant layoffs by RealPage.

If the alleged price-fixing is true, this software may have exacerbated the surge in rents nationwide during the pandemic era.

Tacit Collusion Isn’t A Defense

The accusations of price-fixing are being defended with the concept of sharing rental data without agreeing to manipulate prices (tacit collusion). The Federal Trade Commission (FTC) may have an issue with that.

But Maureen K. Ohlhausen, who was then the acting chair of the Federal Trade Commission, said in a 2017 talk that it could be problematic if a group of competitors all used the same outside firm’s algorithm to maximize prices across a market.

ProPublica

She suggested substituting “a guy named Bob” everywhere the word algorithm appears.

“Is it OK for a guy named Bob to collect confidential price strategy information from all the participants in a market and then tell everybody how they should price?” she said. “If it isn’t OK for a guy named Bob to do it, then it probably isn’t OK for an algorithm to do it either.”

Price Discovery Is The Holy Grail Of Free And Fair Competition

In our appraisal business, estimating market value is totally dependent on the concept of “price discovery.”

RealPage literally marketed itself to enable subscribers to obtain higher rents. The problem with that claim, as interpreted from some of the litigation I’ve read, is that by sharing the results of private data, there is no free market anymore. It doesn’t matter whether there was any intent to manipulate prices. The contention is that landlords now have analysis based on their competitors’ private pricing data (presumably most of that is “renewal” data that is never typically shared publically), and that’s “price-fixing.”

If RealPage loses all this litigation, it becomes quite interesting how modern tech can sleep-walk customers into potential criminal activity.

Price discovery is the central function in any marketplace, whether it is a financial exchange or a local farmer’s market. The market brings potential buyers and sellers together, with members of each side having very different reasons for trading and varying styles for doing so.

Investopedia

Market Forces Can Never Be Manipulated

The term “manipulation” is why I went bananas during the pandemic when NYRAC lobbied REBNY and Streeteasy to hide Days on Market calculations back in 2020. The Manhattan DOM numbers got really high during the 2020 pandemic as the market nearly stopped. Every seller was subjected to a sharp sales slowdown, and DOM spiked. Agents probably had the best intentions by giving sellers a sense of relief, but they forgot about the buy side. The long marketing times could easily be explained to buyers. Yet agents and the reporting services were unintentionally colluding to misinform the buyers. I asked the question repeatedly at that time: “Who feels sorry for the buyers?” When I look at this pandemic practice in the same way as the recent litigation against RealPage, I’m surprised there wasn’t a lawsuit back then.

The price-fixing claims against RealPage seem to be based on the concept that landlords are sharing private rental information through the software, which recommends price changes across competitors who are subscribers. This mutual sharing of private rental data shouldn’t be confused with the sales market since sales are nearly always a matter of public record or available through the local MLS, especially in a non-disclosure state. Rental prices are essentially the secret sauce of landlords at the time of lease renewals, and they generally aren’t shared publicly. However, in this use case, the algorithm created by RealPage garnered critical mass across many markets, and by using private data to generate recommended prices for subscribers, they allegedly ended price discovery. And that’s what is getting RealPage in hot water.

Price discovery is more a “process” rather than a “thing.”

Did you miss Friday’s Housing Notes?

August 2, 2024

Dang. Manhattan Sees Contracts Surge And Two 50-Basis Point Fed Cuts Are Next.

Image: Chat & Ask AI

Housing Notes Reads

- Repost: Measuring Manhattan Values By Floor Level [Miller Samuel]

- [ChartFloor] Manhattan Price Per Floor Breakdown [Miller Samuel]

- Central Park Place [Wikipedia]

- So How Much Is That . . . . . . . . Worth? (Published 2003) [NY Times]

- Exploring hotel superstitions: The mystery of the missing 13th floor [Scripps News]

- Why do many Las Vegas casinos skip floors 40-49? [Review Journal]

- Superstition in Real Estate [Appraisal Buzz]

Market Reports

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 7-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 7-2024 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)