- Manhattan & Brooklyn New Signed Contracts Surge YOY in July

- Despite The New York Jump In Contracts, They Still Lag Pre-Pandemic

- After A Lacklust Spring Market, The Surge In July Contracts Was Unexpected

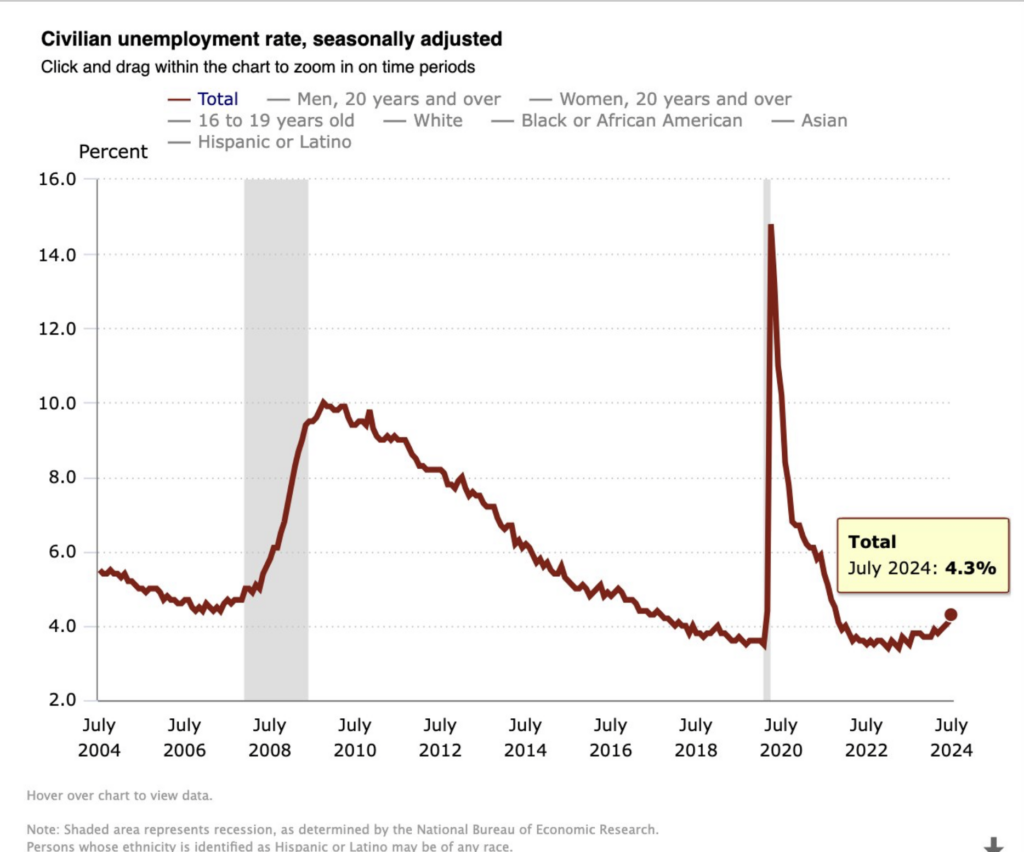

It’s been a lackluster spring market in the Big Apple, as newly signed contracts have been falling short of expectations since the beginning of 2024. Then, seemingly out of nowhere, new co-op and condo contracts surged year over year in July. If you believe that it takes three data points to make a trend, then the trend can be your friend. July is the first data point, so it’s a little early to claim a market pivot. Still, the increase in July was both robust and a surprise, so if sales growth continues in August and September, along with strong odds of two big Fed rate cuts soon and possibly more after that, the Manhattan market outlook becomes a lot more optimistic (more sales) after two and a half years of underwhelming activity.

No disrespect meant to Brooklyn since it also saw a robust rise in July in newly signed contracts.

- Elliman Report: July 2024 New York New Signed Contracts

A Definition That May Have Captured A Defining Moment

Born during the pandemic, our reports published today cover signed contracts that occurred only in the recently completed month (July). It is an effort to look at the current conditions rather than a cumulative analysis. In other words, if a home went to contract in April but hasn’t closed, it would be part of typical pending reports for the subsequent months of May, June, and July. However, that April contract really reflects the market conditions of last April. To counter this, this report series only looks at contracts that were signed in July for the July report. The same concept applies to new listings. Our analysis only considers listings added to the market in July. This way, we are able to consider the most current intersection of supply and demand in the most recently completed month.

And Calls For Bigger Rate Cuts Are Happening Right Now As You Read This

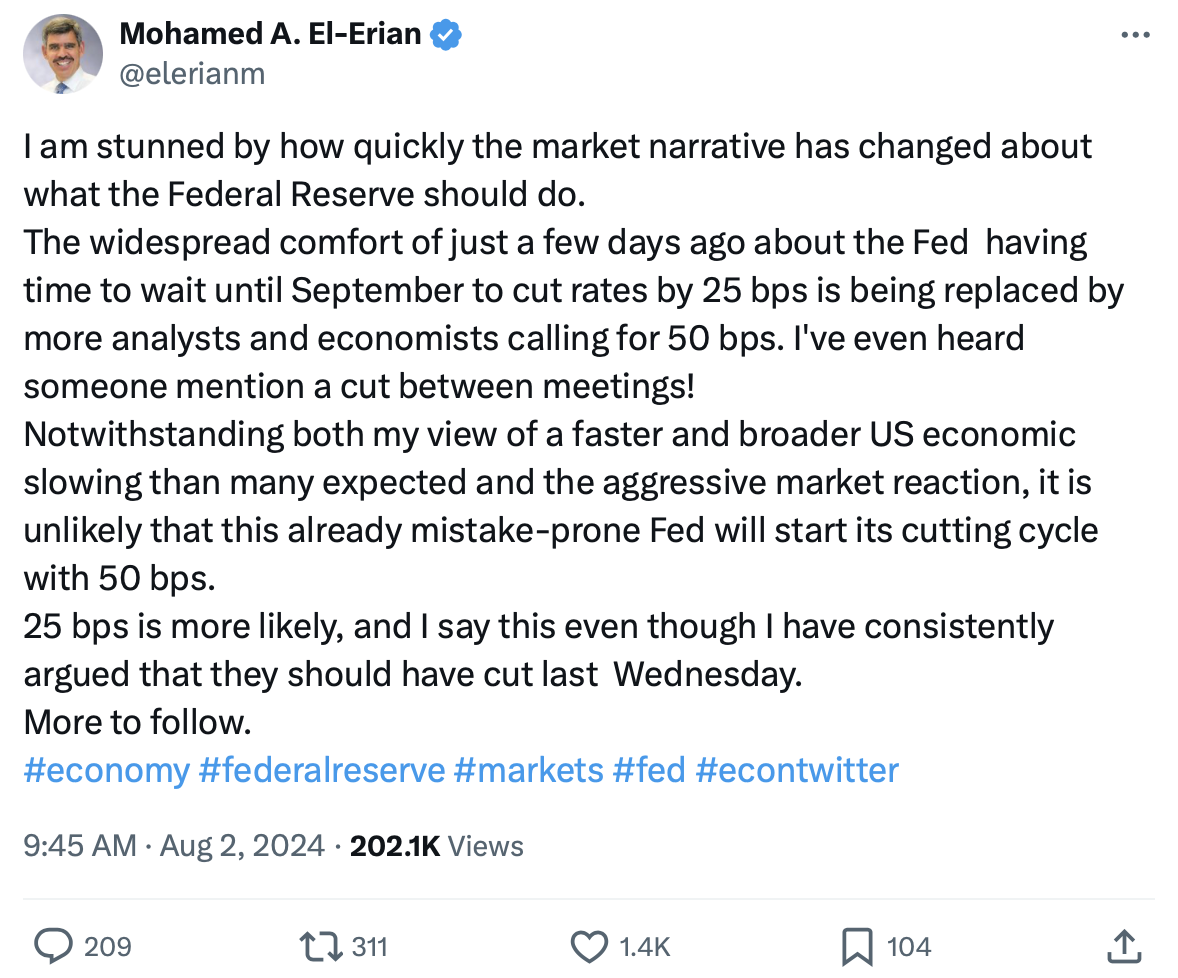

While we watched unemployment edging higher in today’s jobs report, rising to 4.3% from 3.5% a year ago, it seems to confirm a rate cut in September. While the unemployment rate remains low, the job market is slowing quickly. I’m already anxious to see whether the August new signed contract numbers jump. The pivot in expectations for two 50-basis point cuts in the fall strongly suggests a release of some of that 2.5 years of pent-up housing demand soon.

We Might See Two 50-Basis Fed Cuts This Fall And More.

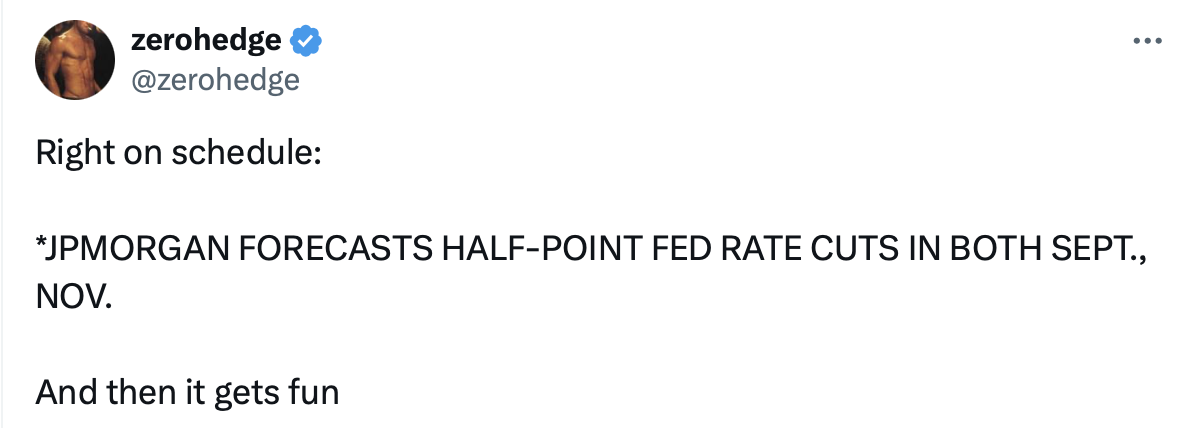

I’m wondering if the rising contract numbers are explained by the 80% odds of a 50-basis point September Fed cut and possibly another 50-basis point cut in November and even more cuts after those. Both JP Morgan and Citigroup are calling for two big cuts rather than one plain old 25 basis point cut we’ve been talking about since early June.

“So we now think the FOMC cuts by 50bp at both the September and November meetings, followed by 25bp cuts at every meeting thereafter. From a risk management perspective we think there’s a strong case to act before September 18th,” economist Michael Feroli writes.

Forex/JPMorgan Report

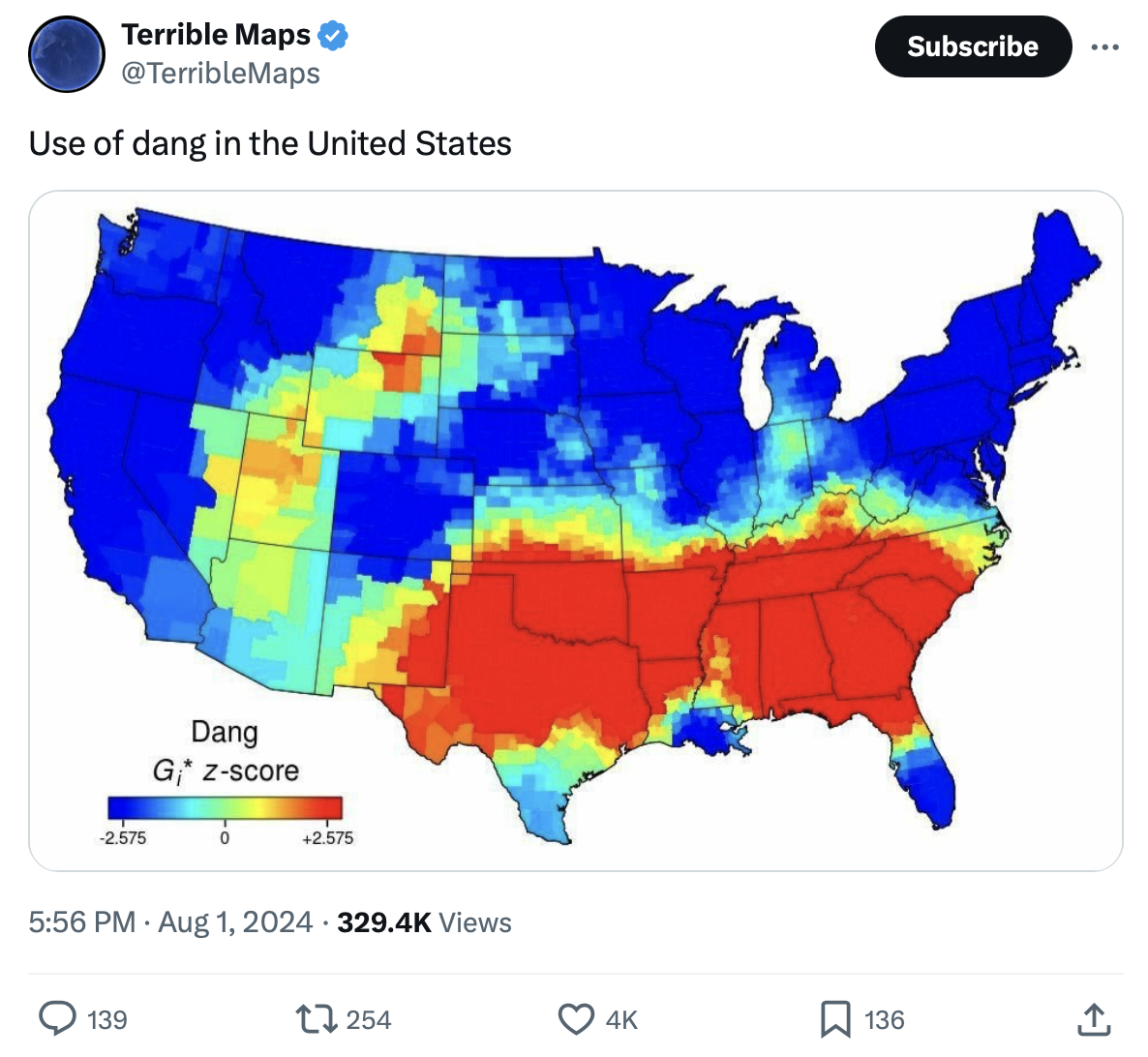

And just like that, the housing market outlook is about to pivot towards a bunch more activity. Dang!

Did you miss yesterday’s Housing Notes?

Housing Notes Reads

- Homeowners’ Association Horror Stories [Family Handyman]

- I'd really like some good HOA horror stories. [Reddit]

- 'My House Was Sold on the Courthouse Steps for $3.24 Because I Didn't Pay My $800 HOA Fees' [SFGATE]

- HOA Members Are Sharing The Most Ridiculous Rule In Their Neighborhood, And Some People Are So Petty [Buzzfeed]

- ‘You broke us.’ GA lawmakers to rein in aggressive HOAs after hearing homeowner horror stories [WSBTV]

- In-state owners dominate the Hamptons [The Real Deal]

- Kaplan: Fed to Cut Rate in September as Long as Inflation Doesn't Misbehave [Central Bank Central]

- Pocket listings lawsuit gets (another) new lease on life [Real Estate News]

- Pocket Listings: Meaning, Pros and Cons, Example [Investopedia]

Market Reports

- Elliman Report: Florida New Signed Contracts 7-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 7-2024 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)