- While Renters Drove The Suburban Housing Boom During The Pandemic, They Still Love Urban Markets

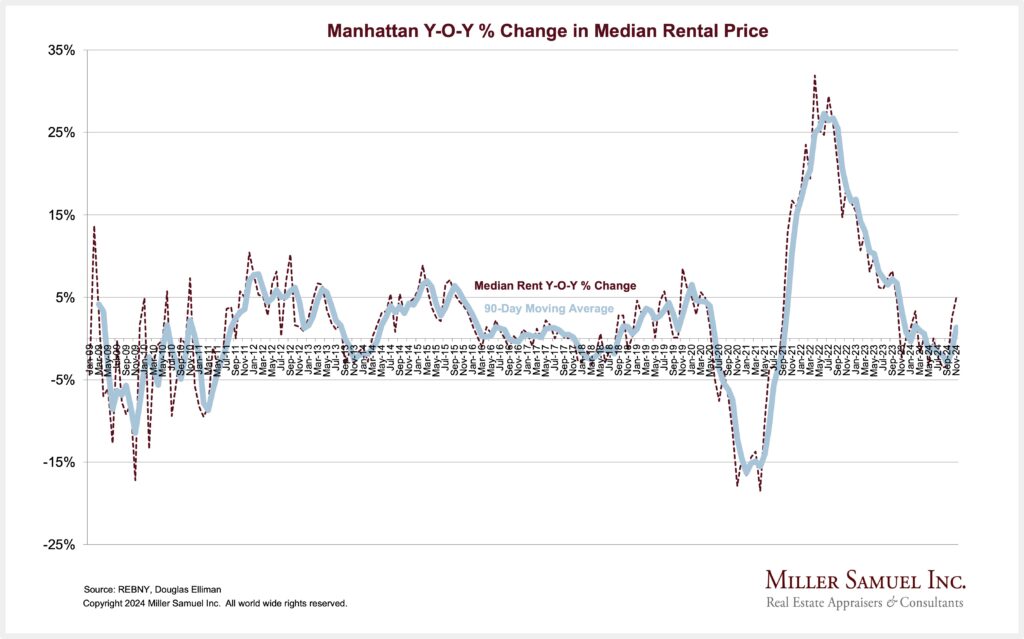

- NYC Rents Have Begun To Rise Again As Mortgage Rates Remain Elevated

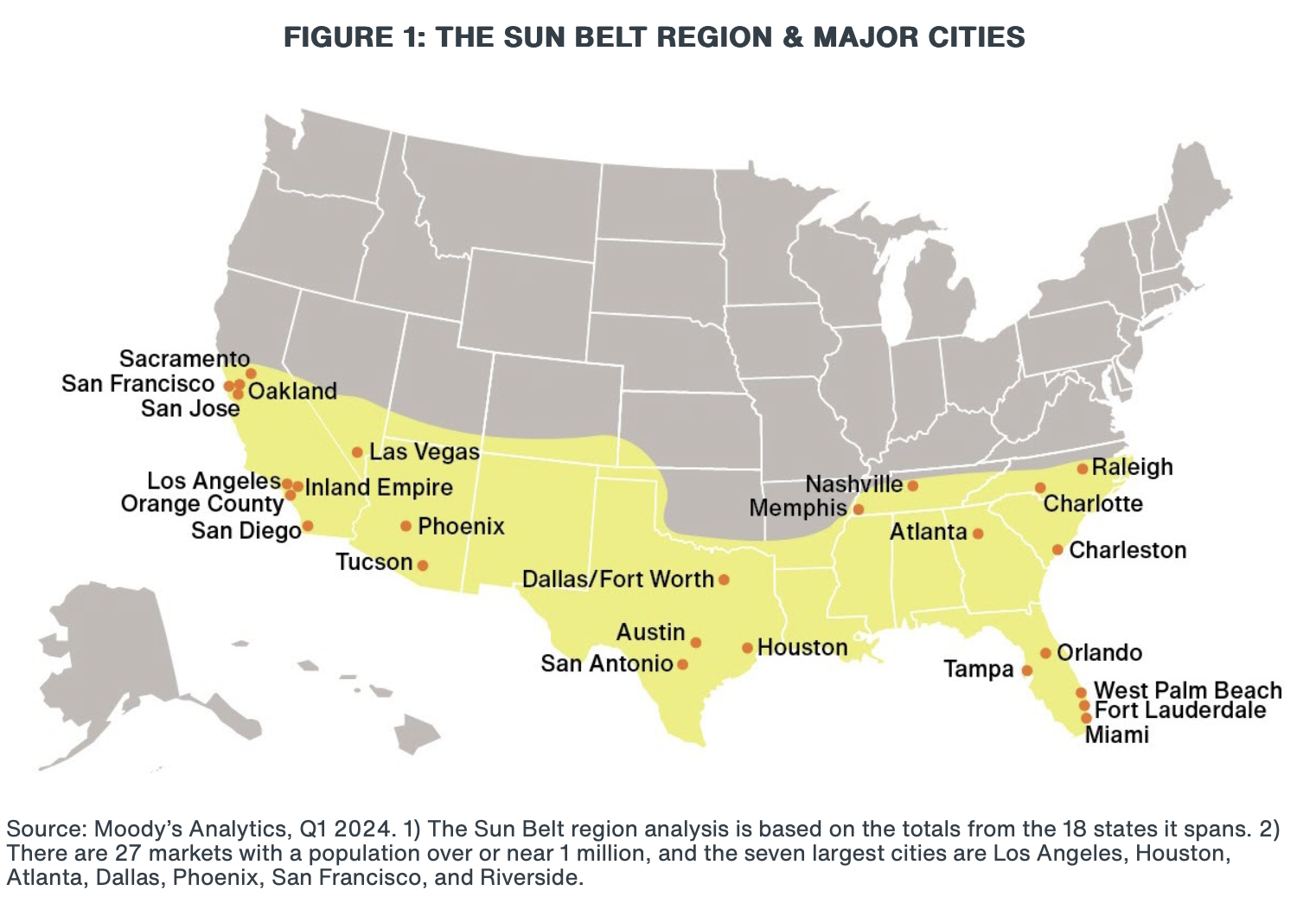

- Sun Belt Housing Supply Grew Faster Than Its Massive Population Growth

The initial thinking during the market frenzy of the pandemic era was that consumers would seek space over location and in NYC’s case move to the suburbs. After all, the flight to the suburbs came largely from the rental market since it is so much larger than the sales market. NYC homeowners weren’t selling in the middle of a pandemic which is why rents plunged initially but within a year they bounced back. The same pattern was observed in most U.S. cities in 2020. Specifically, we observed the same pattern in South Florida back then as single family sales surged first because many mistakenly thought the closer quarters of multi-family were more lethal. But that lead only lasted about three months and then condo sales boomed. I saw this in LA as well and several other markets we track. My youngest son and most of his peers who had just graduated from college in 2020, moved from the Connecticut suburbs to the city as rents plummeted. And when rents began to rise very quickly in 2021, they remained in the city and continued to live their best lives.

Incidentally, my wife and I constantly aspire to live the lives our son (in his 6th-floor Manhattan walk-up) and his friends enjoy. We remember those amazing times when we rented in Manhattan from 1985 to 1990.

NYC Rents Rise Annually For Second Month

Rents are rising again after a brief break over the past six months. We just released our New York City rental analysis and rents rose for the second time as mortgage rates remain stuck at elevated levels. Rents have been softening for the past six months as mortgage rates slipped and were assumed to fall further. Despite the overall increase, luxury rents (the top 10%) fell, suggesting an overweighted expectation that the high-end sales market might fare better than the remainder in 2025.

Starting To Rise Again

Sun Belt Rents Soften Despite Higher Population Growth

The Sun Belt has accounted for 80% of U.S. population growth over the decade which aligns with where a large portion of the new housing supply has been growing. Clarion Partners sees another 7.3% in population growth over the next decade while non-Sun Belt states are expected to see only 0.3% over the same period. Despite the population growth concentration, Sun Belt housing prices have been softening because of surging supply. According to CoStar, in one example, downtown Miami saw a 107% jump in new inventory added to the market, and rents there are softening.

Final Thoughts

Yes mortgage rates have slipped over the past three weeks, but the outlook for mortgage rates is notably higher post-election than just a few months ago. NYC rents are starting to rise again as mortgage rates remain elevated. This is in contrast to the national picture where rents are stabilizing or slipping, largely influenced by the Sun Belt which experienced high levels of multi-family construction and enjoyed the majority of population growth over the past decade. The burst in the region’s multi-family supply has been able to keep up or even exceed demand despite favorable regional population growth and migration patterns.

Just remember why everyone in non-Sun Belt states loves where they live this time of year.

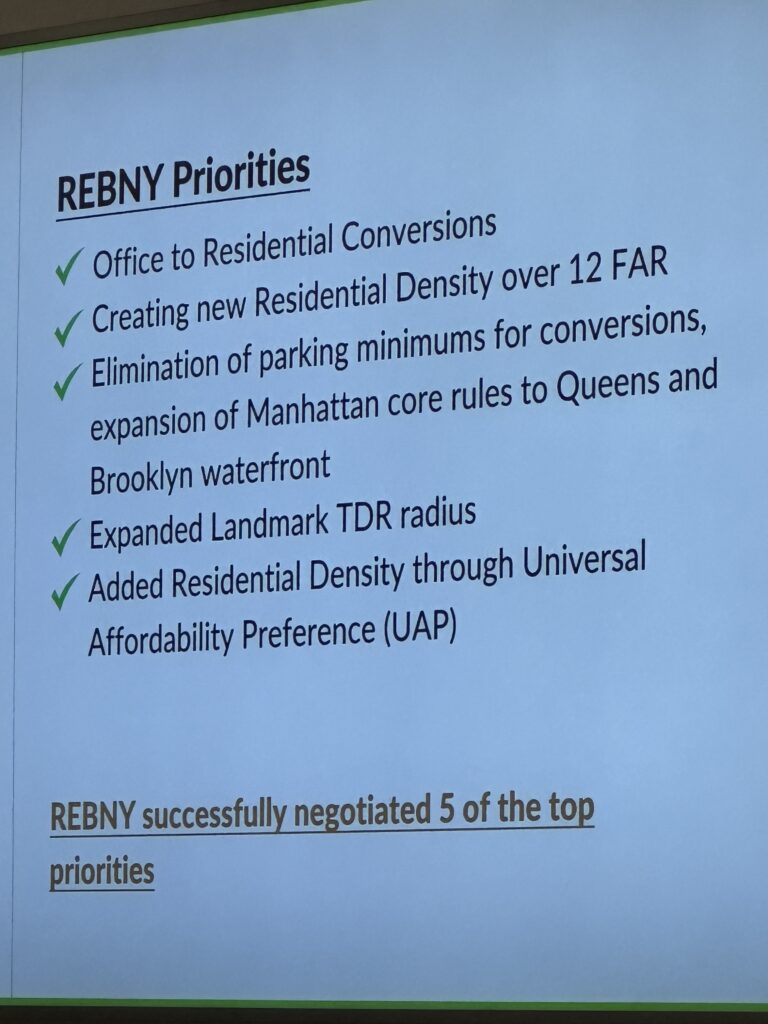

REBNY Residential Annual Meeting

Yesterday I spoke at their annual meeting on the outlook for the 2025 residential housing market in NYC. If you focus a little, you can see my actual free CoreLogic socks. For those of you who aren’t familiar with REBNY (Real Estate Board of New York), they are the leading real estate trade group in New York. Most real estate agents in Manhattan are not “REALTORS” since REBNY is not affiliated with NAR. However, the NAR settlement and all the copy-cat litigation that has come out of Sitzer Burnett, has pulled REBNY into the mix.

It was unanimous that all panelists thought 2025 would see higher prices and more sales in NYC’s residential market but the wild card was what would happen to mortgage rates. With more sales, I contend that sales might normalize or what I dubbed “getting back to zero.” We’ve started to see signs of this in contract activity. There has been a significant upward movement in contracts since July and that has continued through November, after the election.

REBNY weathered a tumultuous year for residential real estate and presented the following items (on the image below) as their top accomplishments largely in the form of the City of Yes zoning changes, the first major modification to the NYC zoning resolution of 1961, enabling the development of 82,000 new housing units over the next fifteen years. Admittedly I have not finished reading the document (working on the illustrated version now) yet but I plan to write about it in a future issue of Housing Notes.

Did you miss the previous Housing Notes?

December 11, 2024

Messaging About The New York Commercial Office Distress Remains Opaque So Look At The Second City

Image: Gemini

Housing Notes Reads

- Average rate on 30-year mortgage hits 6.6%, its third straight weekly decline [ABC]

- NYC rents post biggest jump since 2023 amid sticky mortgage rates [The Real Deal]

- Manhattan’s Luxury Rents Fell More Than 10% in November [Mansion Global]

- City rents rise as mortgage rates stay high [Crain's New York]

- Renters were expected to abandon downtowns and other urban areas. That's not what the data says. [CoStar News]

- For the second month in a row, NYC median rents rise [Brick Underground]

- New York City Rent Squeeze Continues: Median Prices Up Across Manhattan, Brooklyn, and Queens Amid High Mortgage Rates [Hoodline]

- Sun Belt Market Trents [Clarion Partners]

Market Reports

- Elliman Report: Florida New Signed Contracts 11-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 11-2024 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 10-2024 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)