Remembering Roy Wenzlick, Even After Dialing 867-5309

Housing Notes has transitioned from WordPress/MailChimp to Substack for the first time in more than a decade. Hopefully it will give me more flexibility with less complications.

The NYC housing market continues to boom despite new mayor Zohran Mamdani’s election, disproving media narratives about wealthy residents fleeing; record Wall Street bonuses and lower mortgage rates support rising demand.

We just lost another Starchitect. Frank Gehry’s passing is another big loss. highlights inspiration from Roy Wenzlick, the mid‑century housing analyst known for accurate forecasts and deep market insights.

Housing Notes Has Moved Over To Substack!

Honestly, no one should care about this new platform, and you don’t need to do anything different, but I’m excited about the switchover. For the past 11 years of pushing out Housing Notes 1-5 times per week, maintaining a succession of WordPress websites and MailChimp, the effort began to feel overly excessive and expensive, but with limited flexibility. It was really difficult to import 11 years of photos from the old WordPress blog and keep the links, but as a chart lover, it was essential to bring in all the images.

I’ll continue to use this platform to talk about many aspects of different housing markets, zero in on key issues of the day, share insights from the latest Douglas Elliman Market Reports, share market updates from my latest housing market effort known as StreetMatrix, plus some housing market analysis takeaways from my grad students at Columbia. Plus, I’ll be able to easily send late-breaking housing market news, host podcasts, and share video interviews at a moment’s notice.

In the meantime, please be patient as I try to shake the wonkiness out of this new platform while remaining desperately focused on understanding how it all works. Incidentally, the default formatting of my old posts is quite obnoxious.

We made the platform switch this week. Since I haven’t written a post since Monday, I’m sharing a couple of short pieces here. Next week, I’ll get back on the saddle and resume my routine.

Aspiring To Be The Next Roy Wenzlick

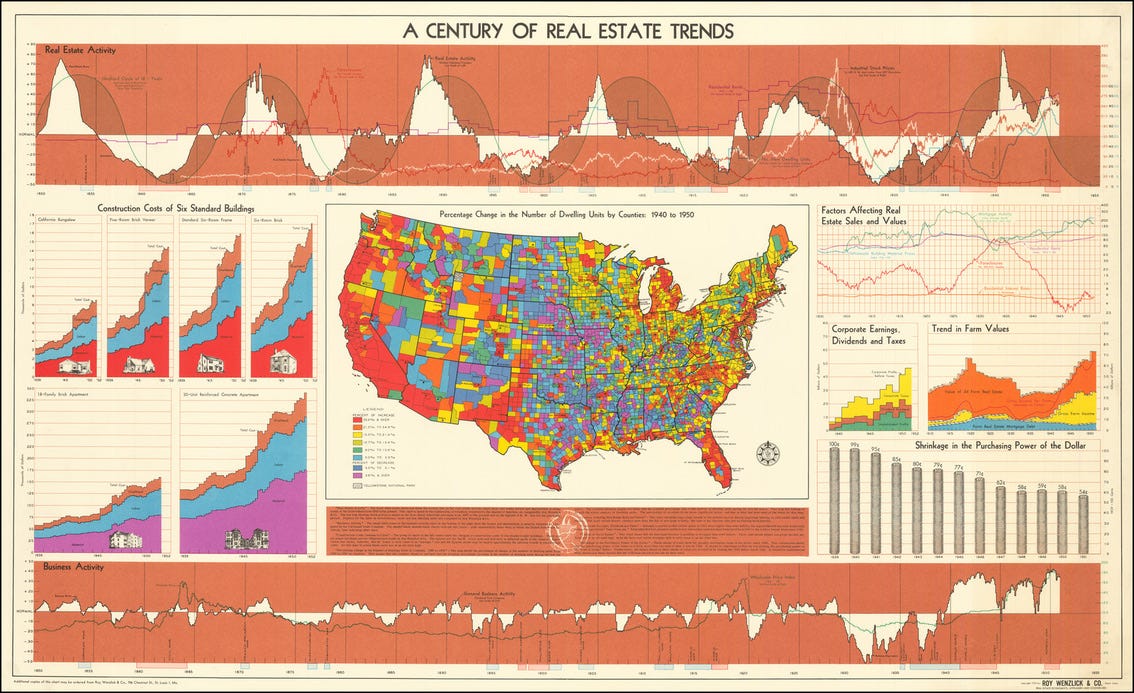

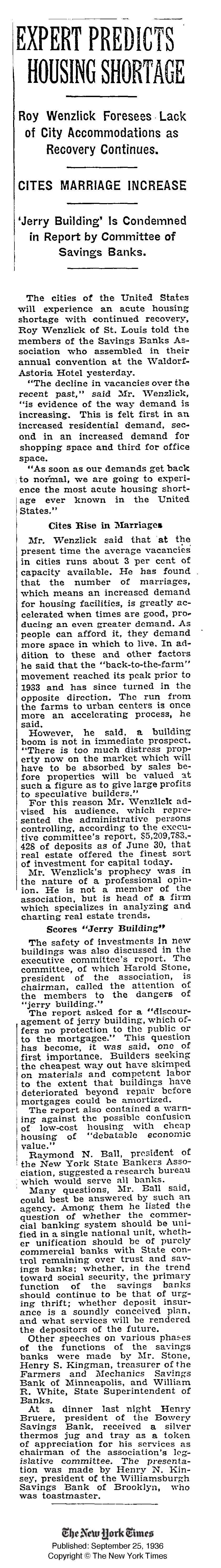

A substantial version of the immediately above infographic by Roy Wenzlick & Co. hangs in my New York office, and I love it deeply for all its 1850s-1950s details. In fact, the level of detail presented here, without the vast public resources and MLS we have today, makes this effort mind-boggling. Roy was THE national housing expert from the 1930s to the 1970s. He used his understanding of housing market performance to forecast broader economic trends. Wenzlick was especially respected for the accuracy of his work. The 1936 NY Times article below describes how Wenzlick saw the end of the Great Depression approaching and the coming housing boom. He was spot on. Here’s his position on the value of land in 1965. Wow. While the following NY Times article is a market discussion shared during the Great Depression, it is brief and is worth the read.

We Lose Another Starchitect

Last Monday, I wrote about Starchitects, focusing on Robert A.M. Stern, whose works adorn the NYC skyline. Less than a week has passed, and we lost another great one, Frank O. Gehry, Titan of Architecture, Is Dead at 96 (gift link). Here’s my favorite building he designed. I’ve visited it before - the IAC offices (photo above) and it felt like walking into a lemon meringue pie (remember: pie>cake).

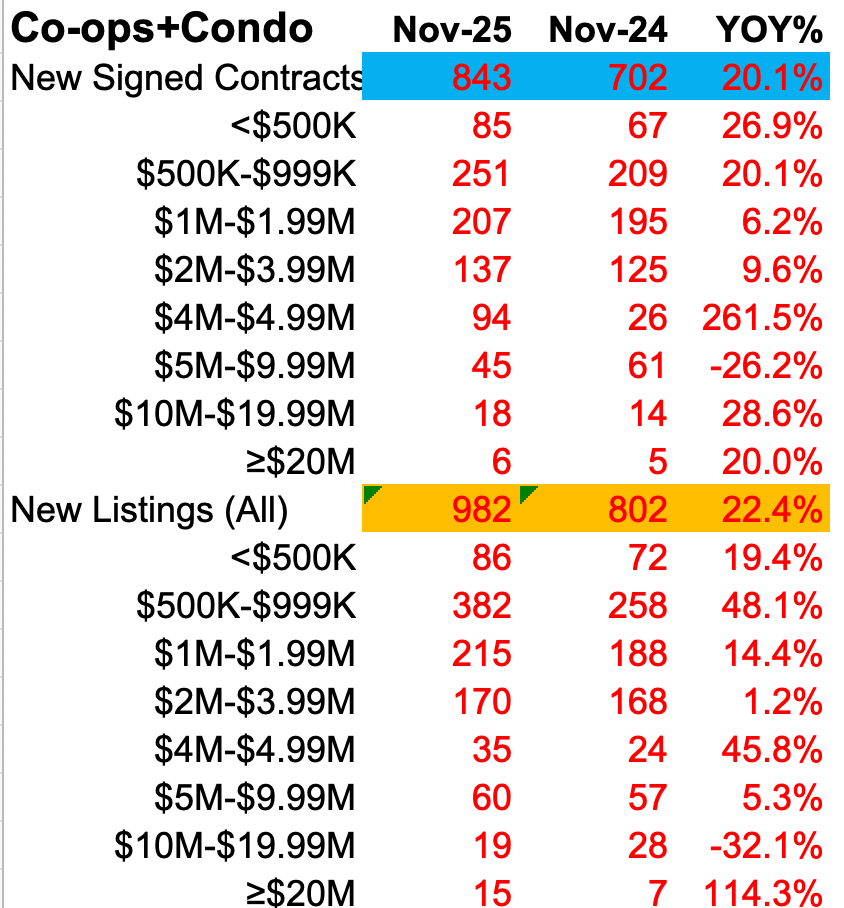

Apparently, The NYC Housing Market Is Booming Despite The New Mayor

Since the first week of July, just-elected NYC mayor Zohran Mamdani became a household name nationwide. It started with Greenwich real estate agents proclaiming that their phones were “ringing off the hook,” which I don’t doubt, but not for the reasons they were assuming. The incorrect narrative was that wealthy New Yorkers wanted to flee the city because of the new mayor. I talked to real estate agents in Florida who were all excited about the potential tsunami of wealthy homebuyers who would “flee NYC” and buy houses in the safe haven away from Mamdani. The only problem was that this assumption was false.

The surge in NYC sales and rents has been going on for more than a year and a half, well before the new mayor came into public awareness outside of NYC. And, even more importantly, after Mamdani became a sure winner, sales, sale prices, rents, and lease signings did not weaken. Record Wall Street compensation in 2024 and 2025 certainly played a major role.

For the past several months, I’ve been railing against this false “fleeing the city” narrative, and finally, I think it’s run out of steam. Here were several summary pieces that came out this week that made the point about the new mayor’s impact on the NYC housing market:

Manhattan Rent Prices Climbed Near Record in Month Before Mamdani Win [Bloomberg gifted link]

Manhattan Luxury Apartment Market Surges in Month After Mamdani’s Win [Bloomberg gifted link]

NYC rental market in crisis — as tenants are priced out and rent-stabilized landlords rush to sell cheap [NY Post] Note - rents are rising now because demand is higher.

Wall Street bankers will get bonus bonanza for second straight year, top consultancy says [NY Post]

‘There is no Mamdani effect’: Manhattan luxury home sales surge after mayoral election, undercutting predictions of doom and escape to Florida [Fortune]. Incidentally, in a prior post about the new mayor, I was highly critical of an earlier Fortune article that pushed the false narrative. This author wrote a refreshingly honest and accurate update to the earlier piece, citing it.

Mortgage rates are down about 50 basis points since early August.

Final Thoughts

Housing Notes has officially moved from WordPress/MailChimp to Substack, which I’m excited about. One of the tidbits I spoke about today was the continued strength of the New York City housing market despite the false claim that wealthy residents are fleeing under newly elected mayor Zohran Mamdani. Instead, sales, prices, and rents remain robust, fueled by Wall Street bonuses and lower mortgage rates.

Someday I want to grow up to be mid-century housing analyst Roy Wenzlick, whose detailed market studies and economic forecasting from the 1930s to 1970s was legendary even though his name has been forgotten from public discourse. My goodness, he didn’t have Excel and charting software!

The Actual Final Thought – As time passes, many still remember Jenny’s number if you are old enough, and especially here. For a refresher on what it was and where it came from.