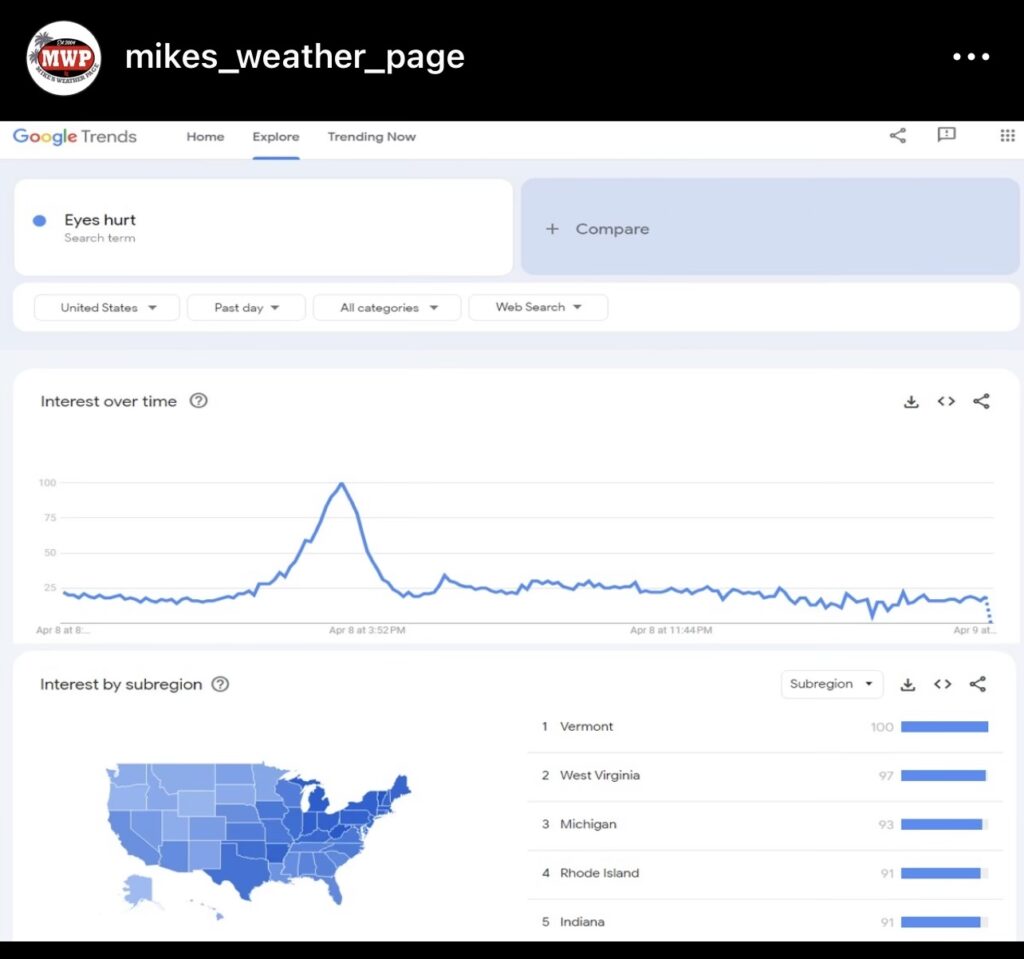

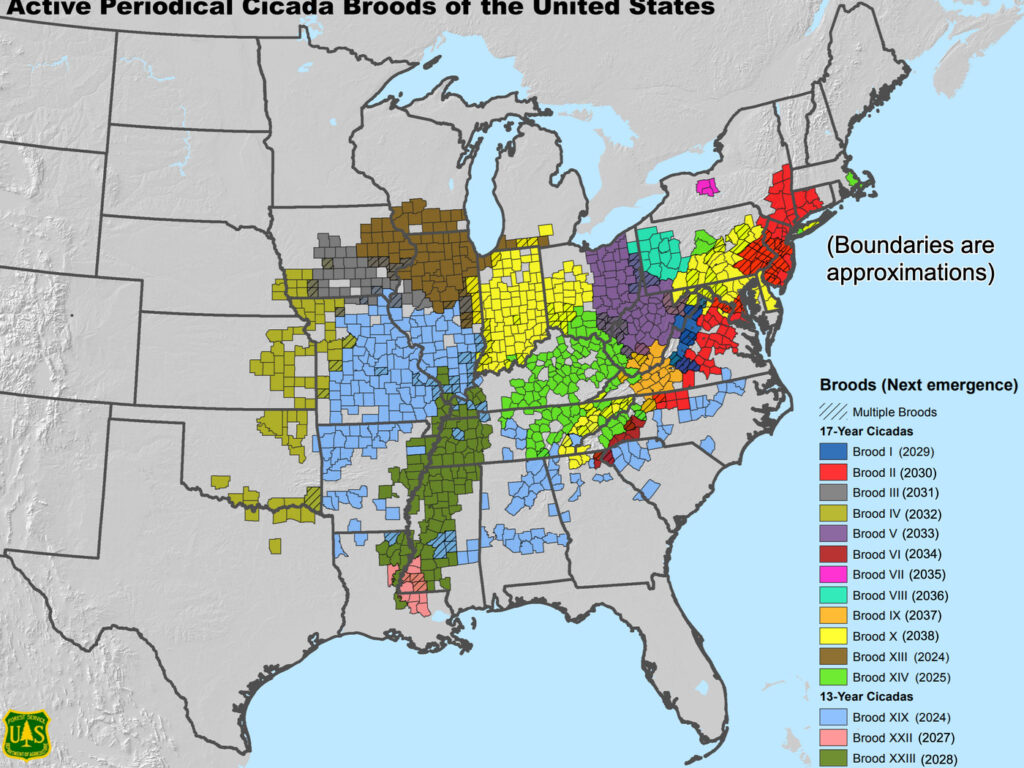

Curiously, some perceive the economy’s vibes as terrible, but this @$#^& economy is outperforming expectations with the lowest unemployment in nearly 50 years and rising wages—perfect conditions for a housing boom except for the rising homeownership costs, dearth of listing inventory (even as it rises), and the cicada apocalypse. The following chart is a reminder of how people handled watching the eclipse – those might be the same people who see the economy in terrible condition.

Get ready for the trillions of cicadas in the Midwest and South—no need to watch the whole thing unless you’re in the Midwest or love stuff about cicada-geddon.

Did you miss last Friday’s Housing Notes?

April 5, 2024: Chocolate Costs Are Sort Of About To Eclipse The Housing Crisis

But I digress…

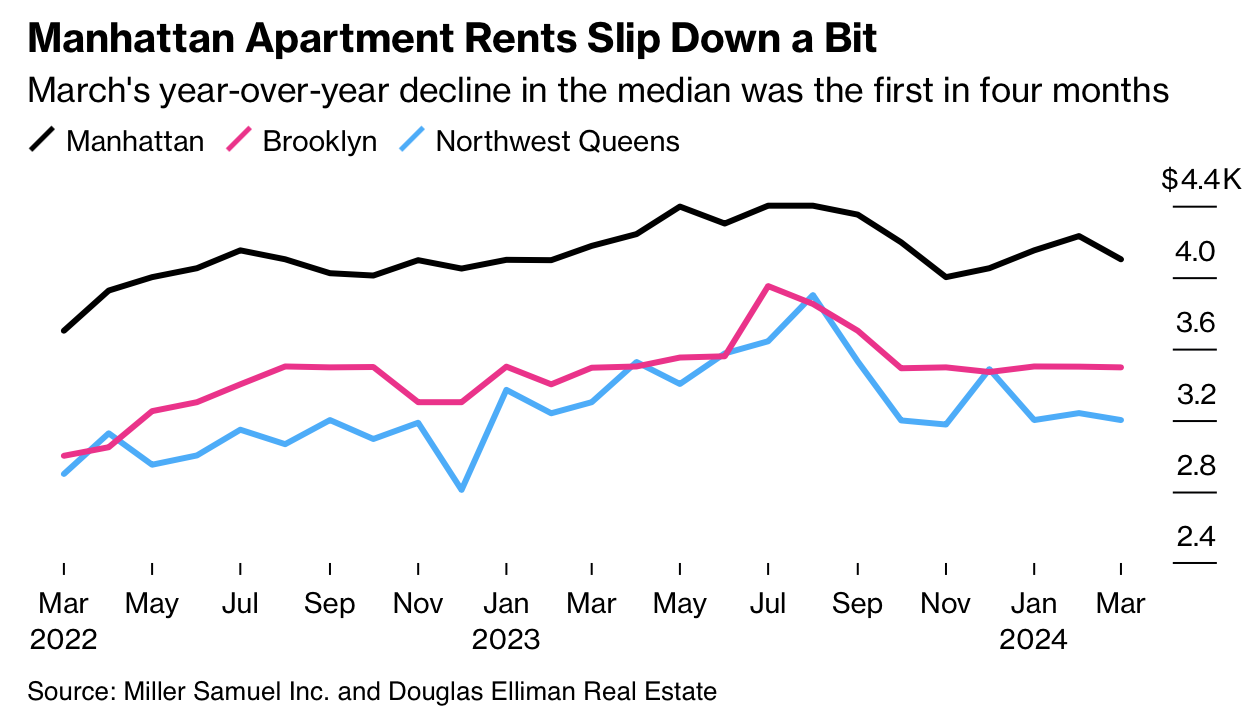

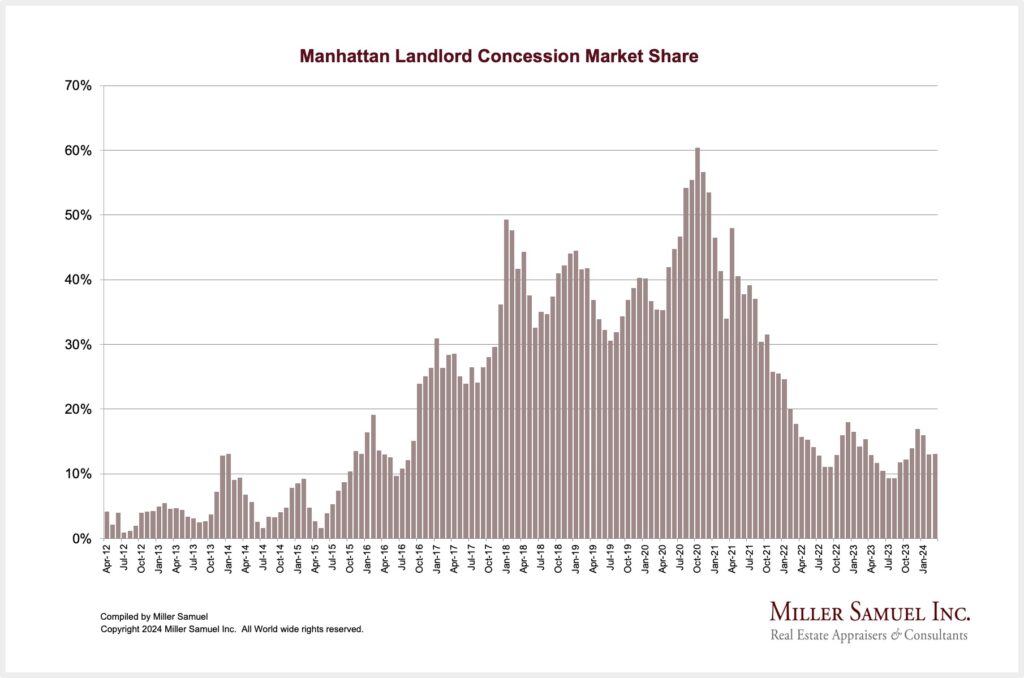

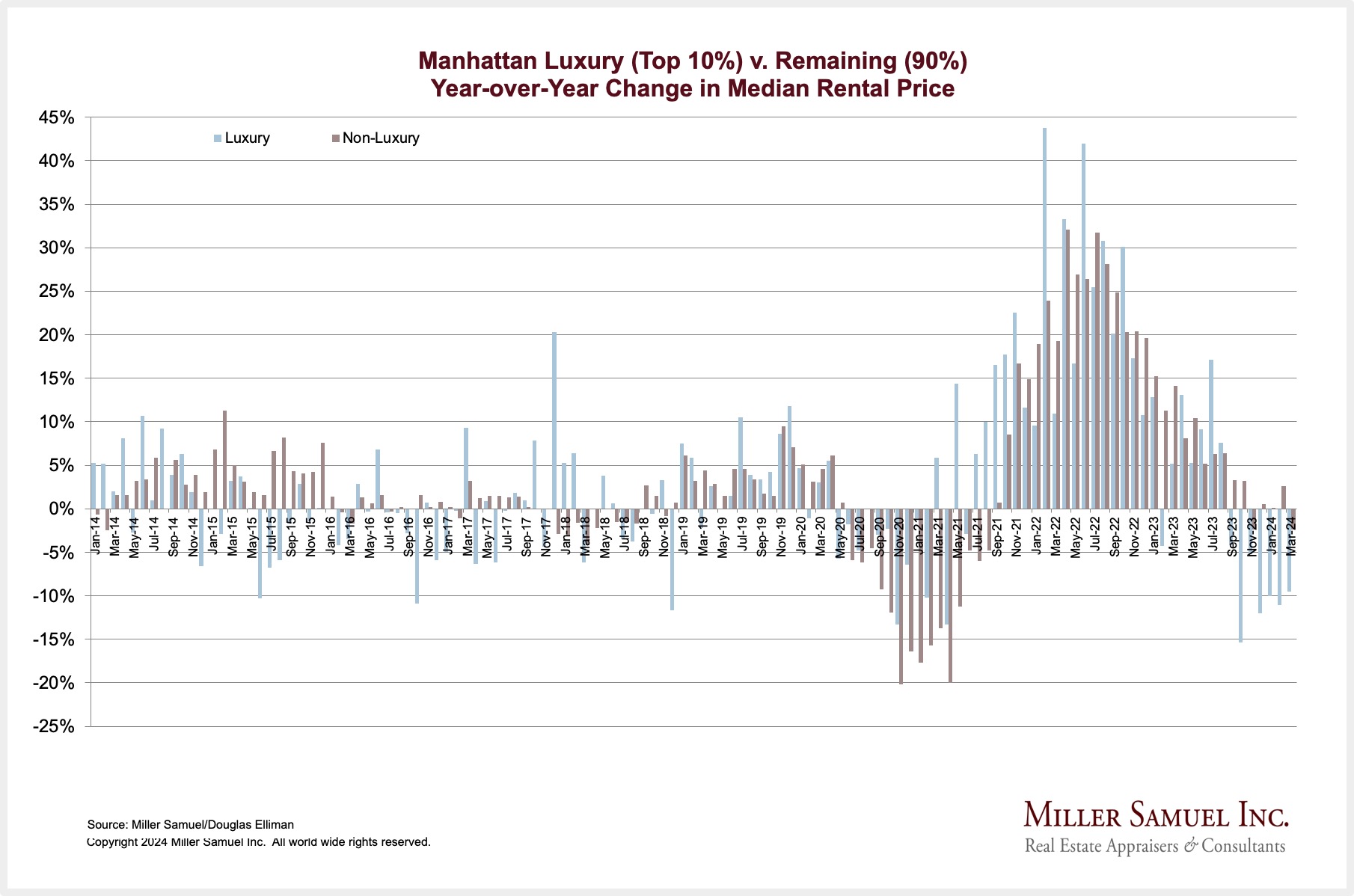

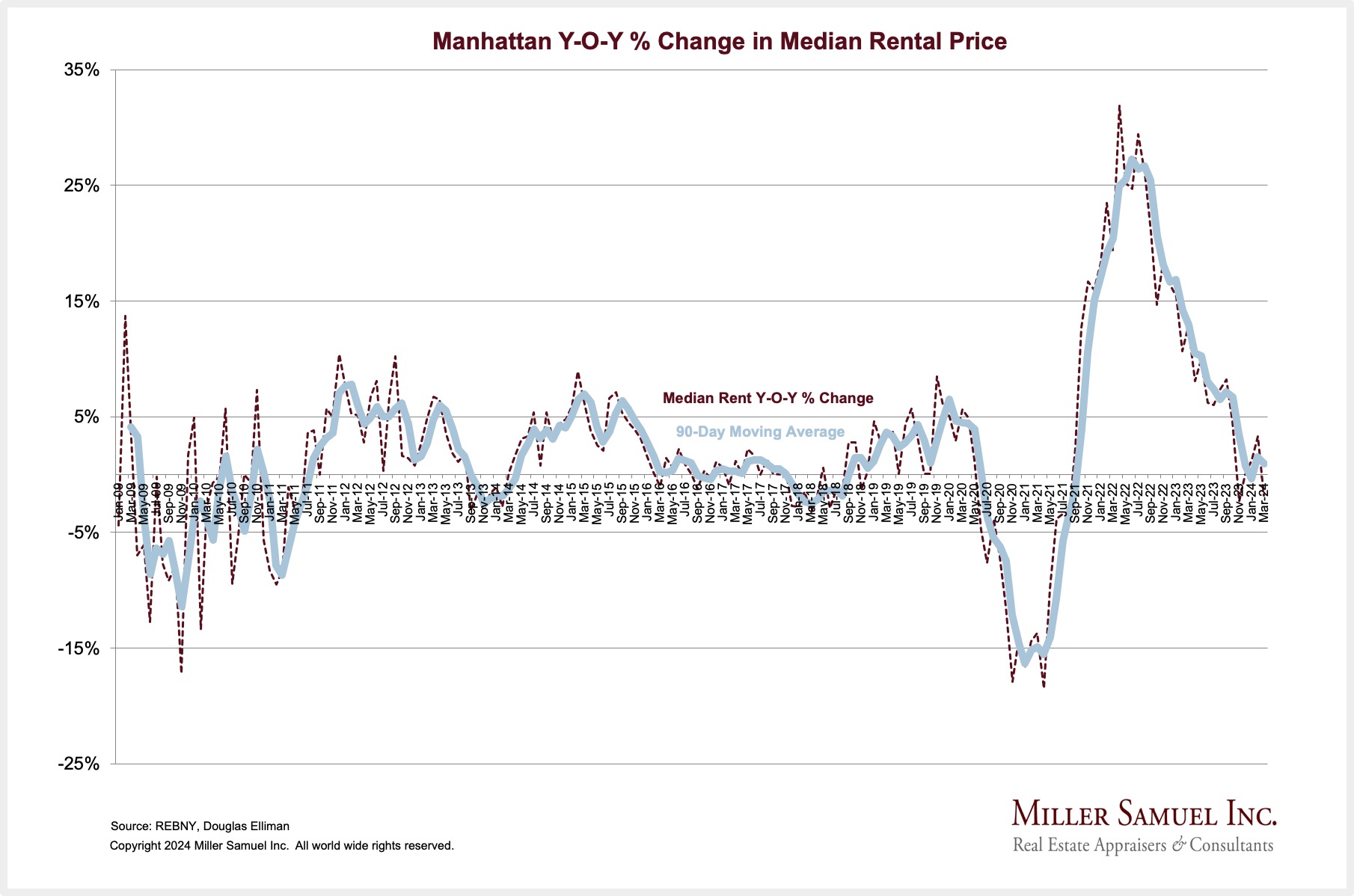

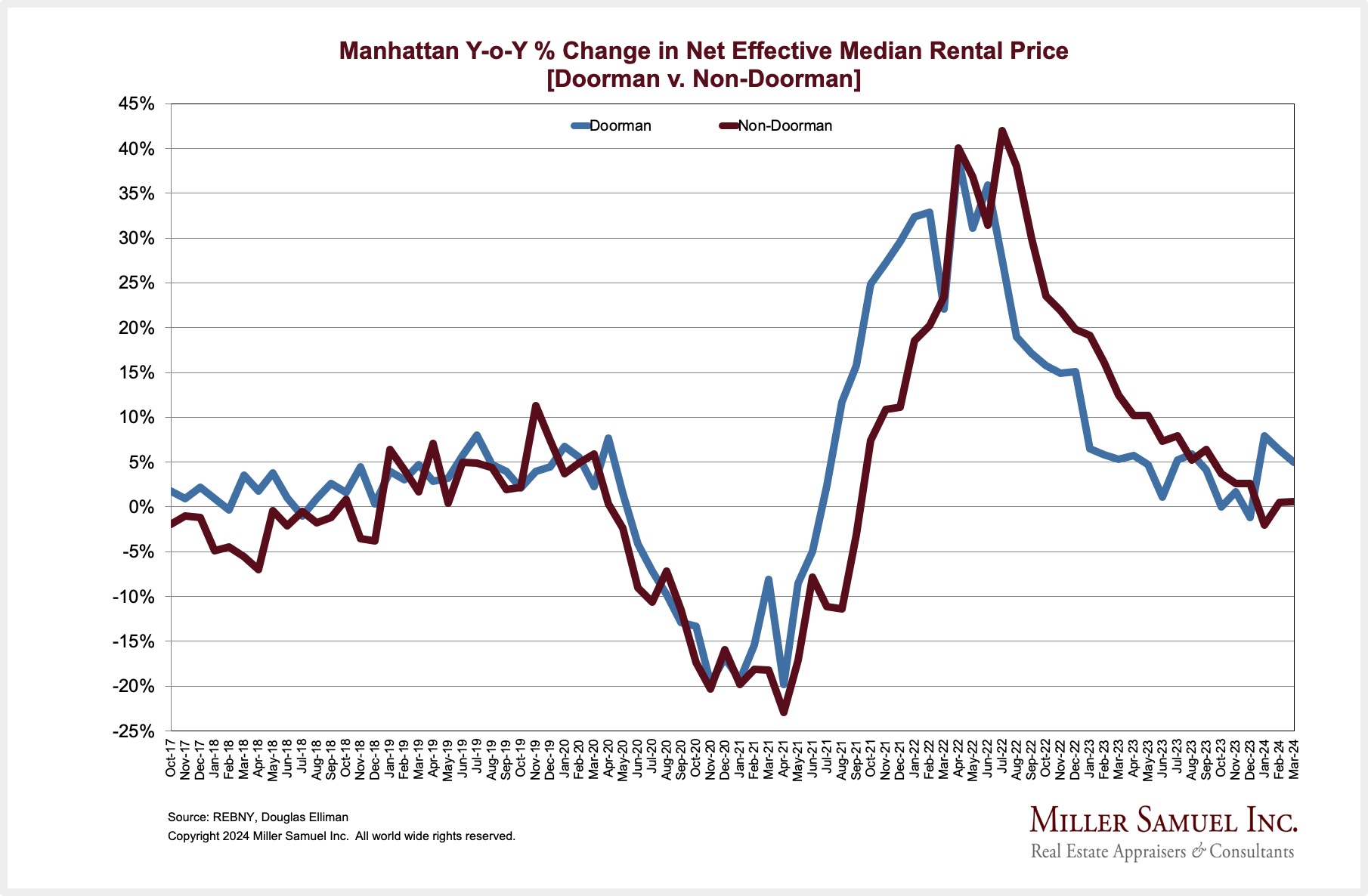

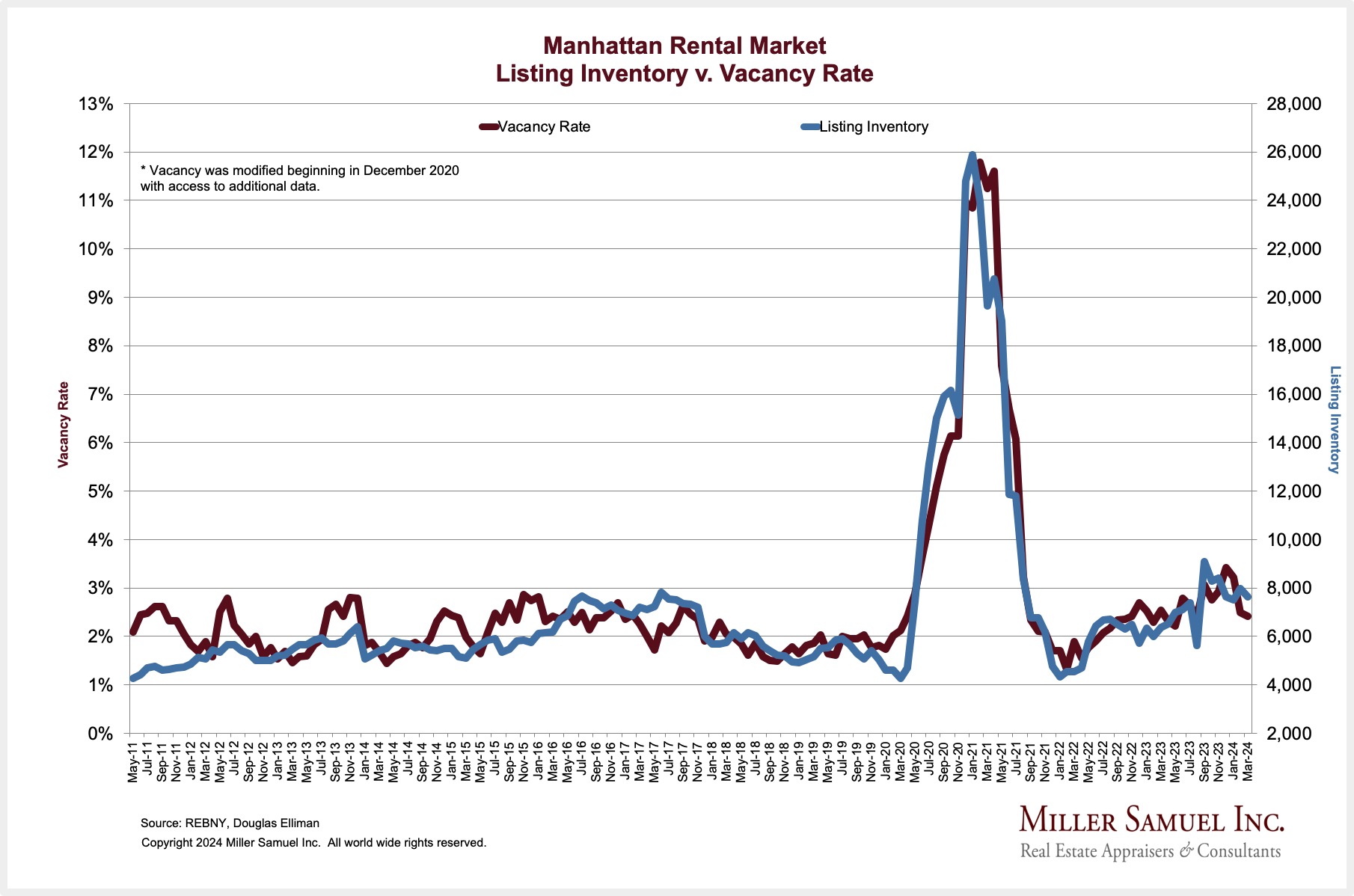

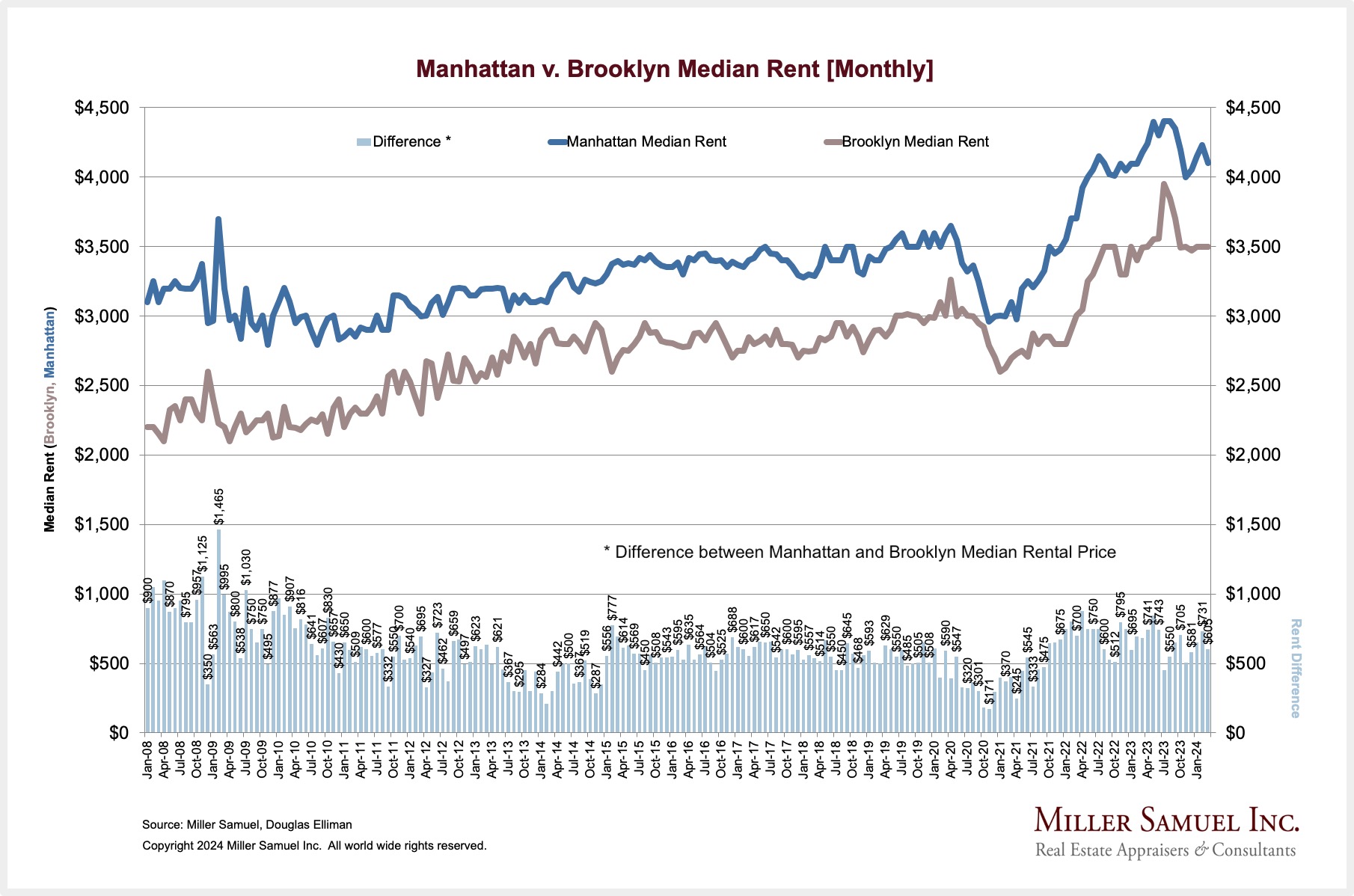

NYC Rents Continue To Disappoint Tenants By Refusing To Drop Sharply

I’ve been the author of an expanding series of market reports for Douglas Elliman since 1994. Since the pandemic era began, the rental market has been the primary focus. This is largely because it is much faster to respond to changes in market conditions than sales, which tend to be much slower and lumbering.

Bloomberg published a chart on the results of our March research.

Elliman Report: March 2024 Manhattan, Brooklyn & Queens Rentals

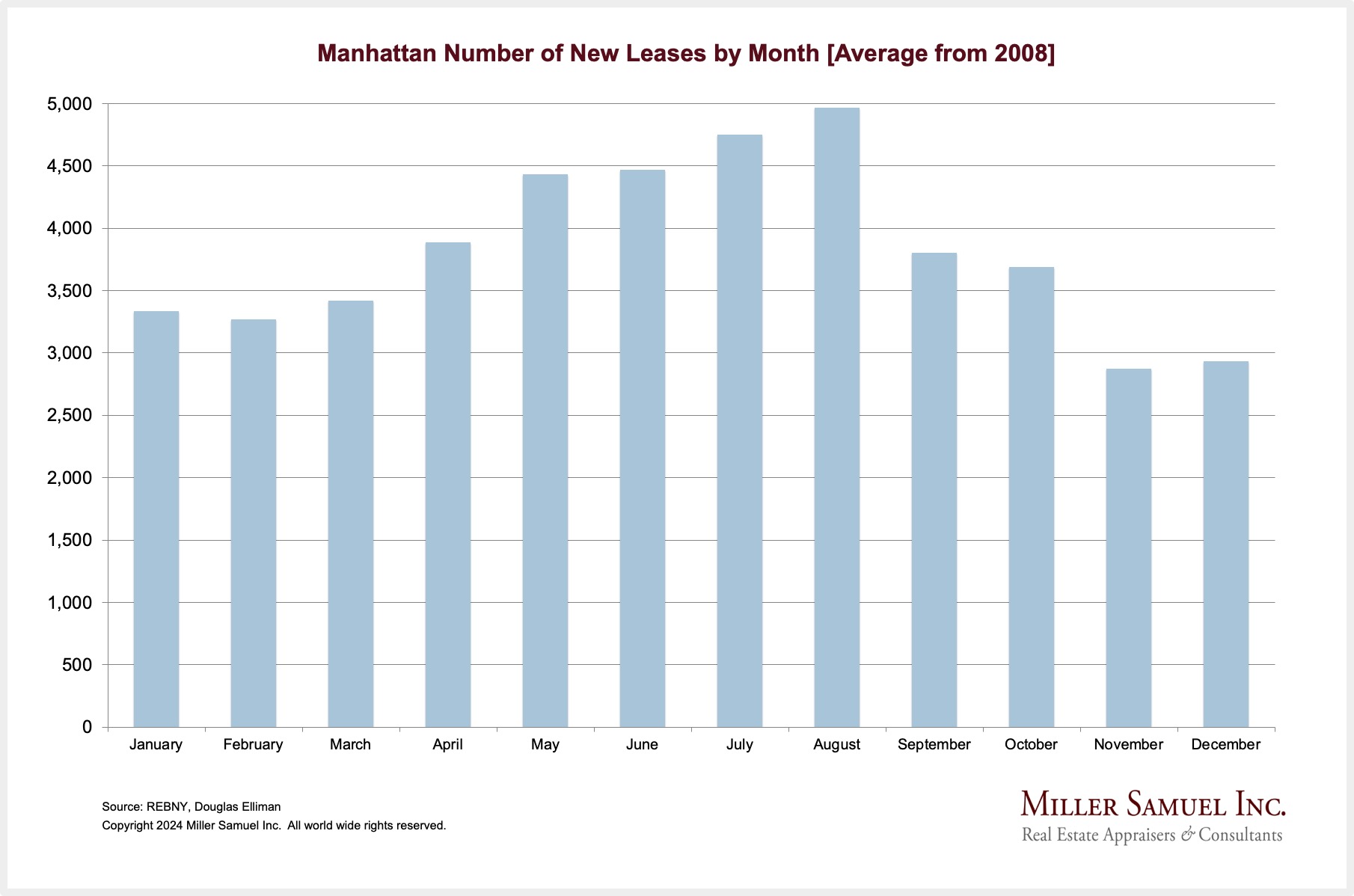

MANHATTAN RENTAL MARKET HIGHLIGHTS

Median rent declined year over year for the first time in four months.

- Median rent slipped annually to the second-highest March on record

- New lease signings surged year over year to the third-highest March on record

- Highest market share of bidding wars in twenty months

- Doorman median rent rose annually for the third straight month as non-doorman rent remained flat

- Median rent for new development continued to rise year over year as median rent for existing rentals declined

- Luxury price per square foot year expanding year over year for the fourth time in five months

- Luxury listing inventory rose year over year for the seventh time

- Luxury market bidding wars include one in five rentals, consistent with the overall market

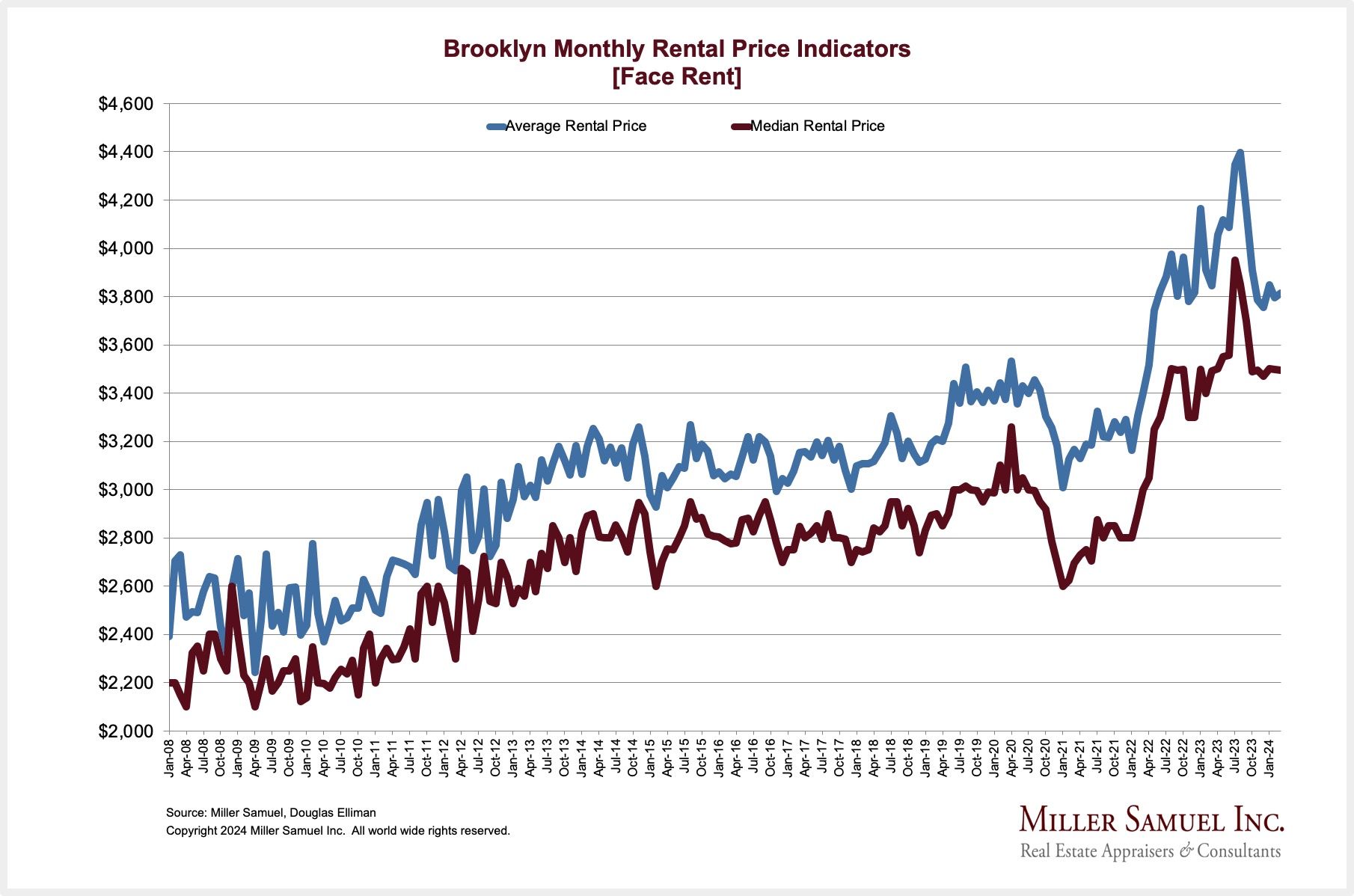

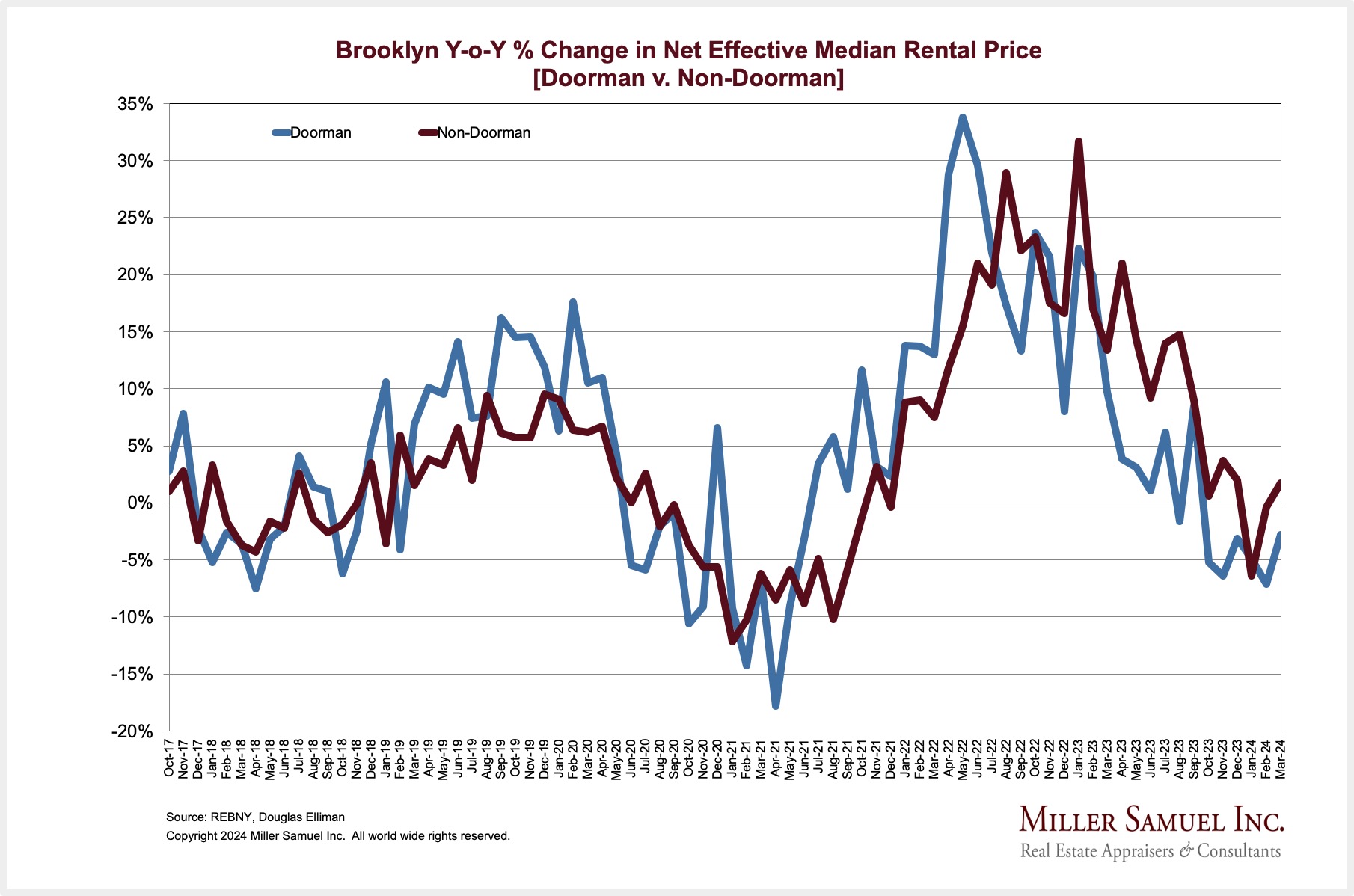

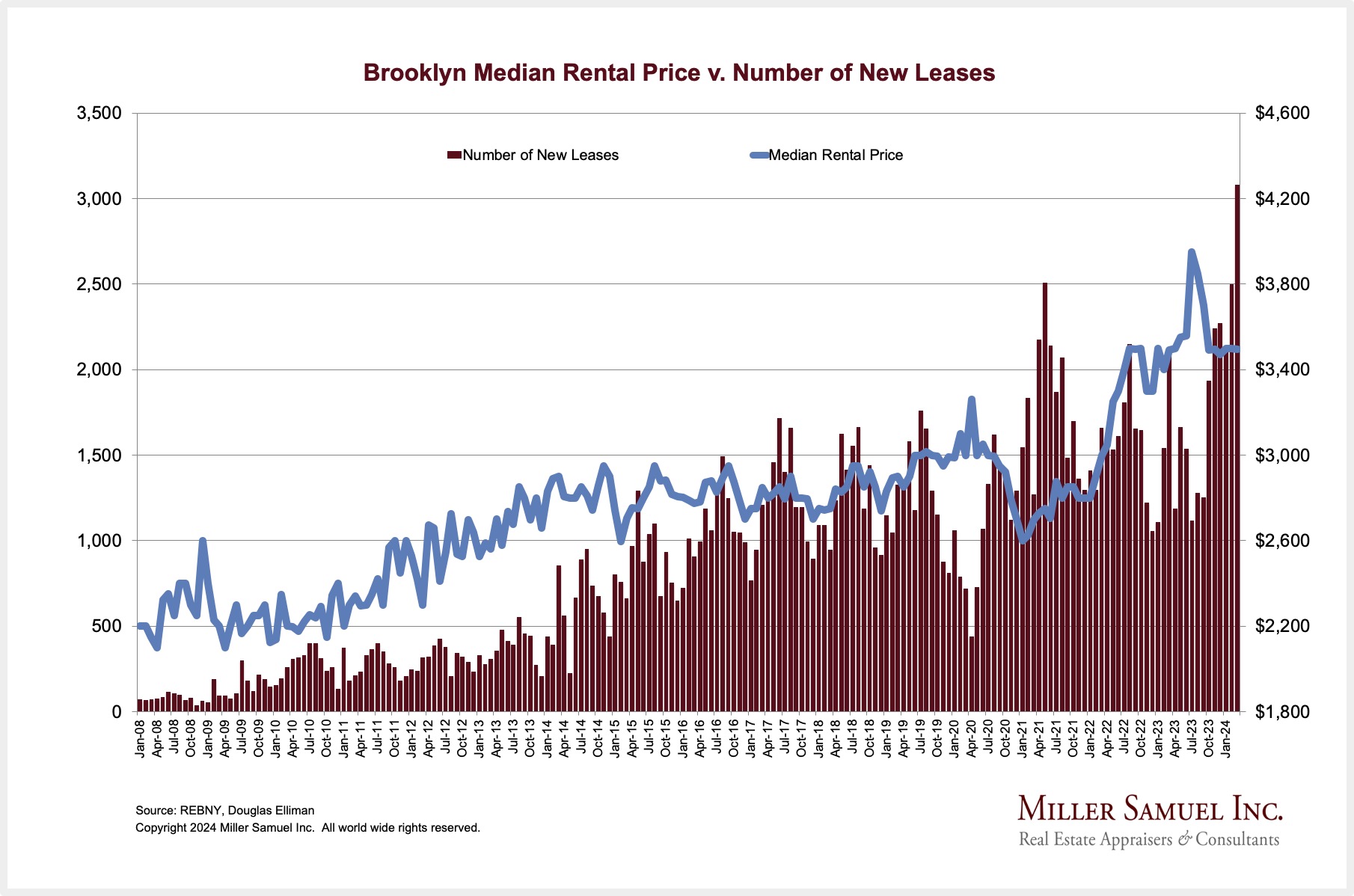

BROOKLYN RENTAL MARKET HIGHLIGHTS

Median rent rose nominally year over year new lease signings surged to a new high.

- Median rent rose annually for the fourth time in five months

- New lease signings increased year over year to the highest on record

- Listing inventory rose year over year annually for the sixth time in seven months

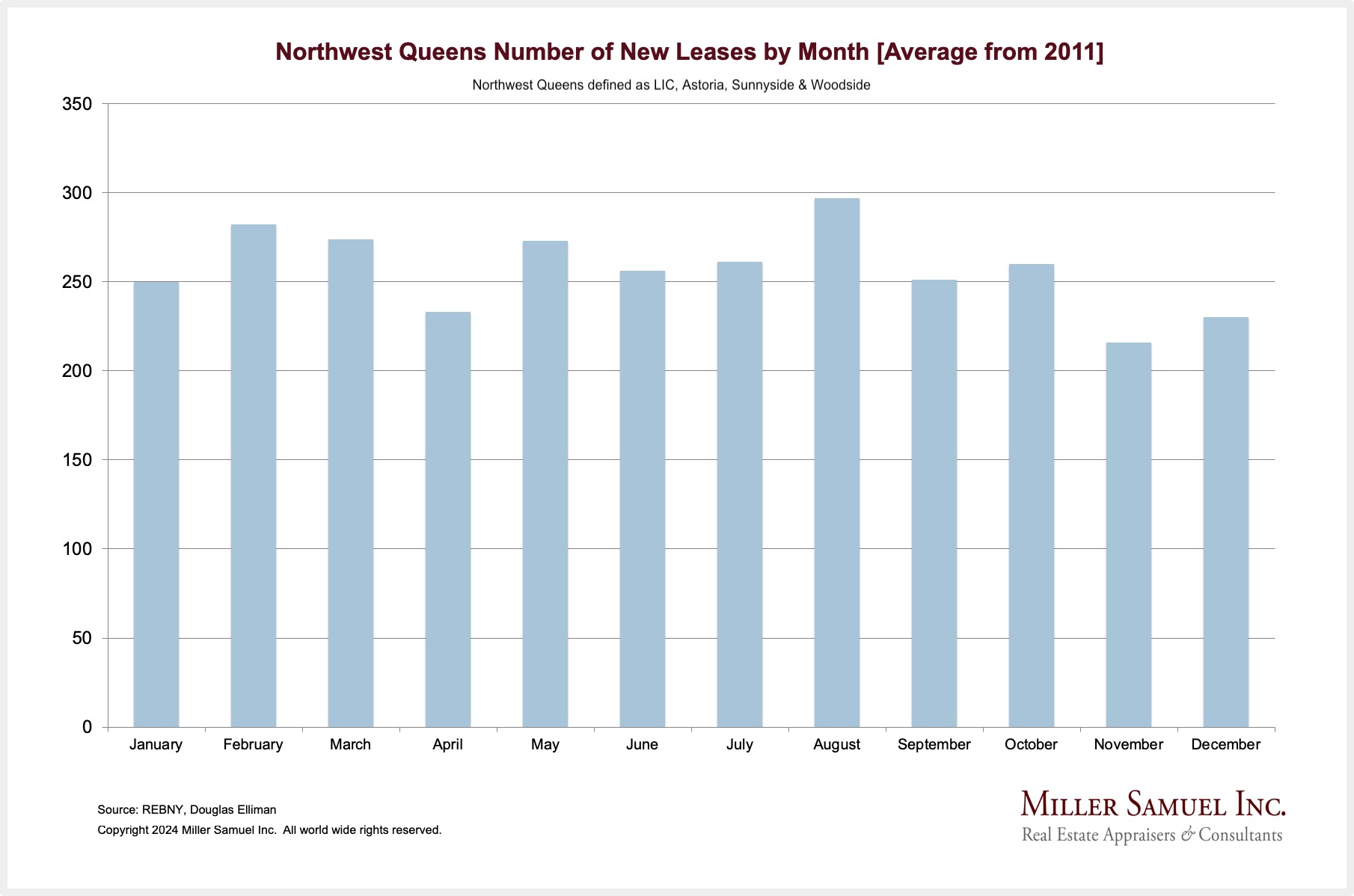

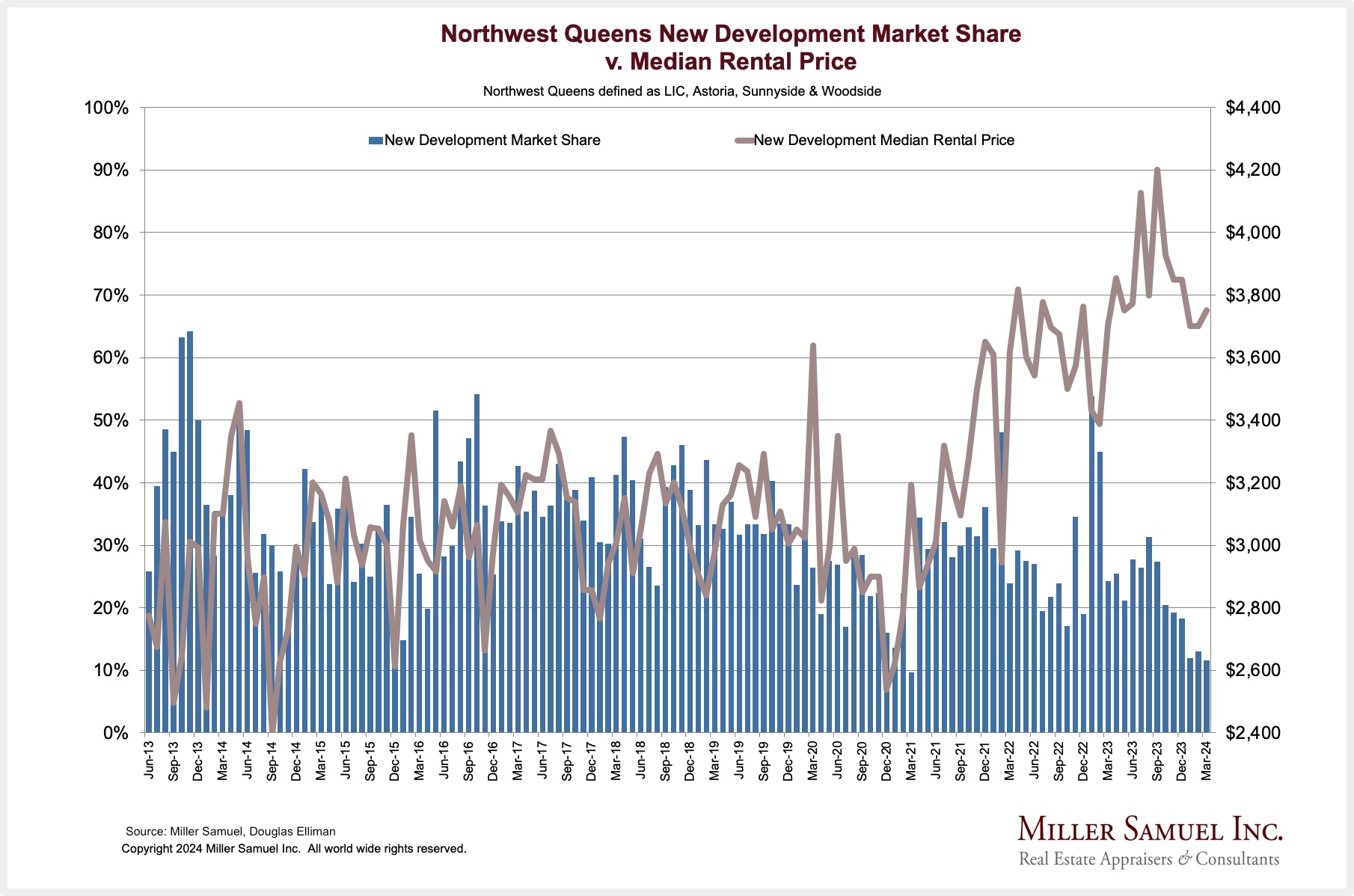

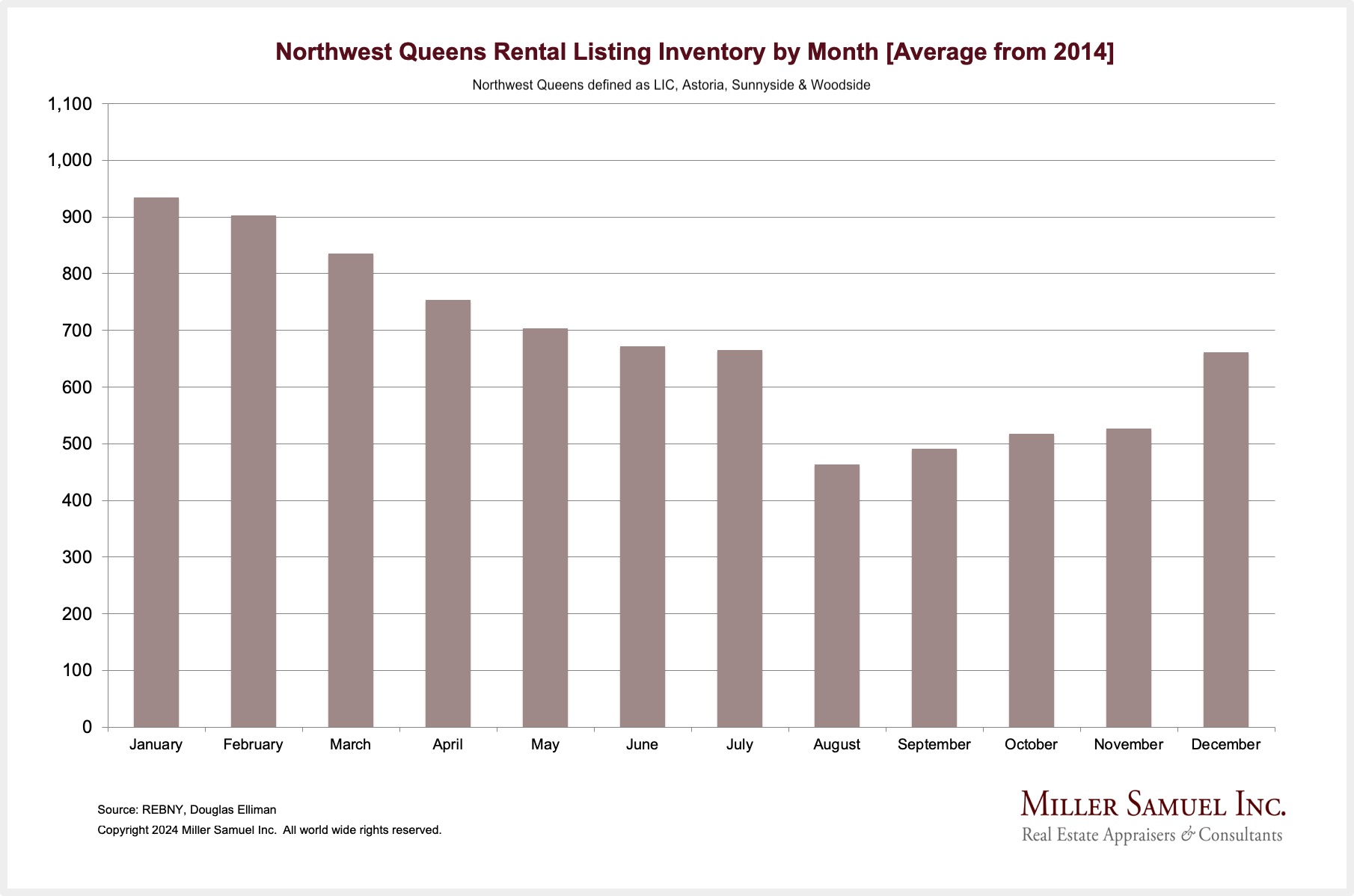

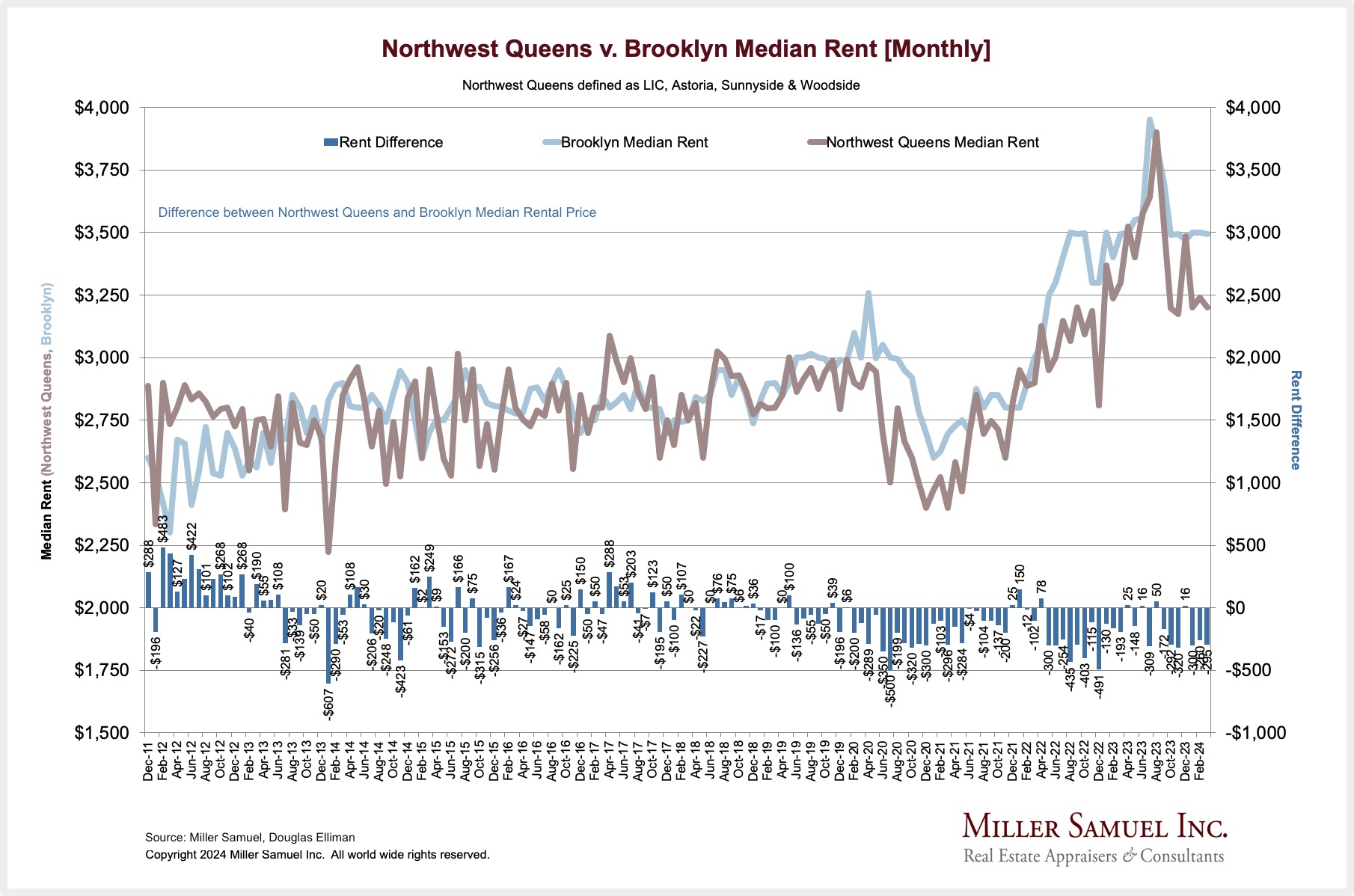

QUEENS RENTAL MARKET HIGHLIGHTS [Northwest]

Median rent declined year over year for the second time in three months as new lease signings surged to a new high.

- Median rent declined year over year for the second time in three months

- New lease signings increased year over year to the highest on record

- Listing inventory rose year over year annually for the sixth time in seven months

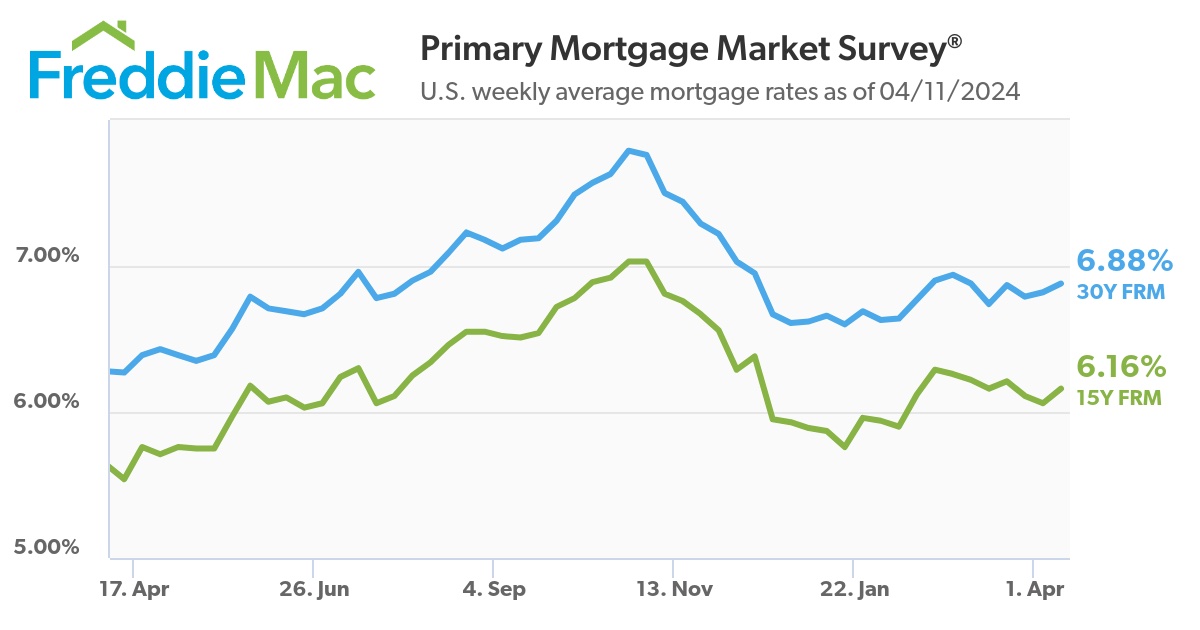

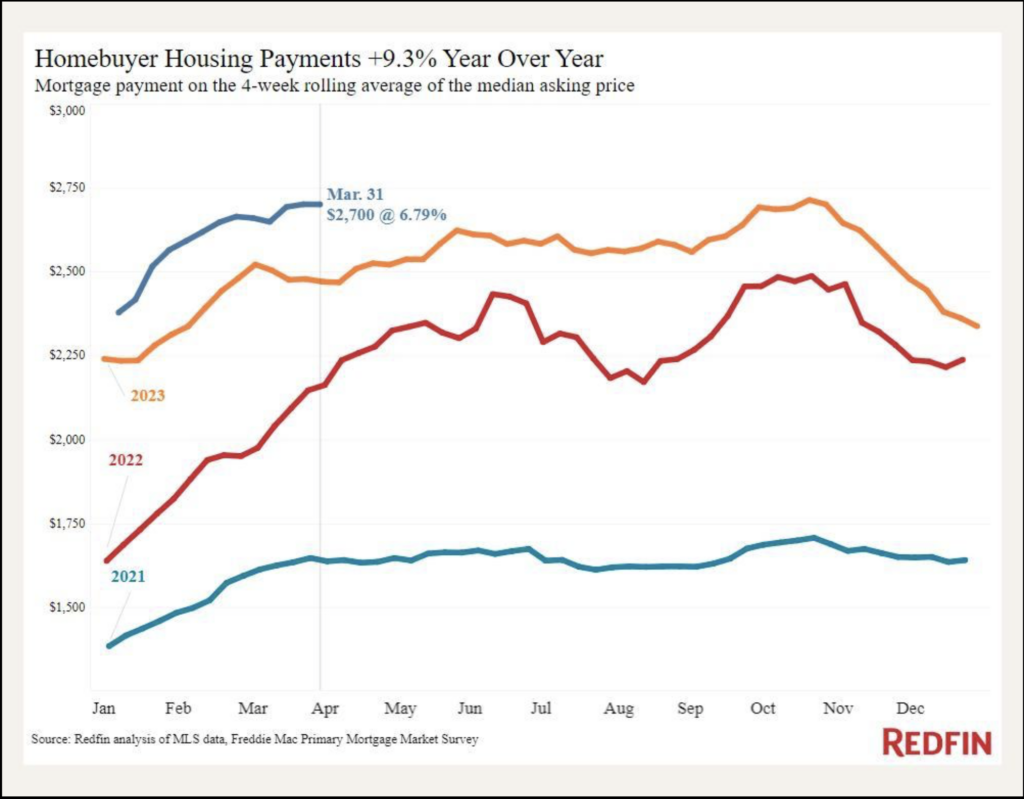

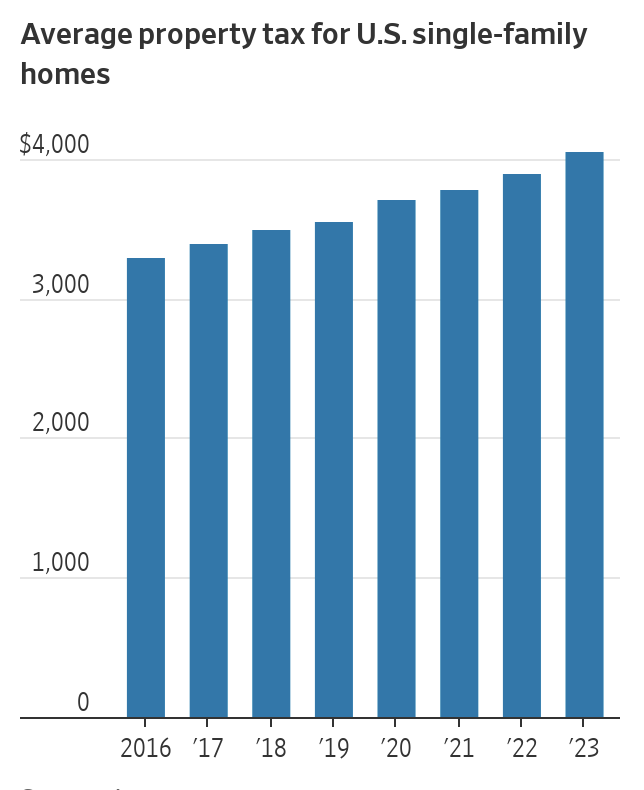

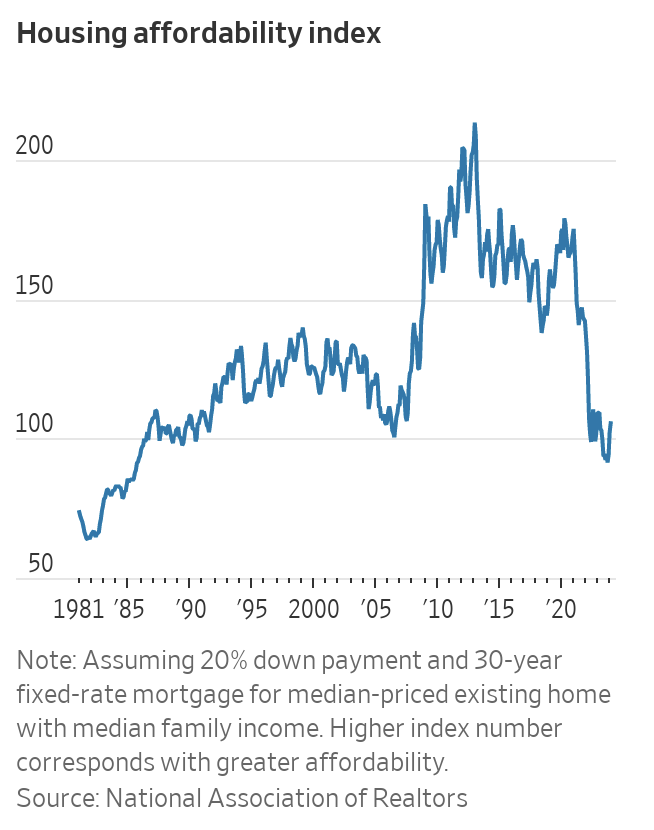

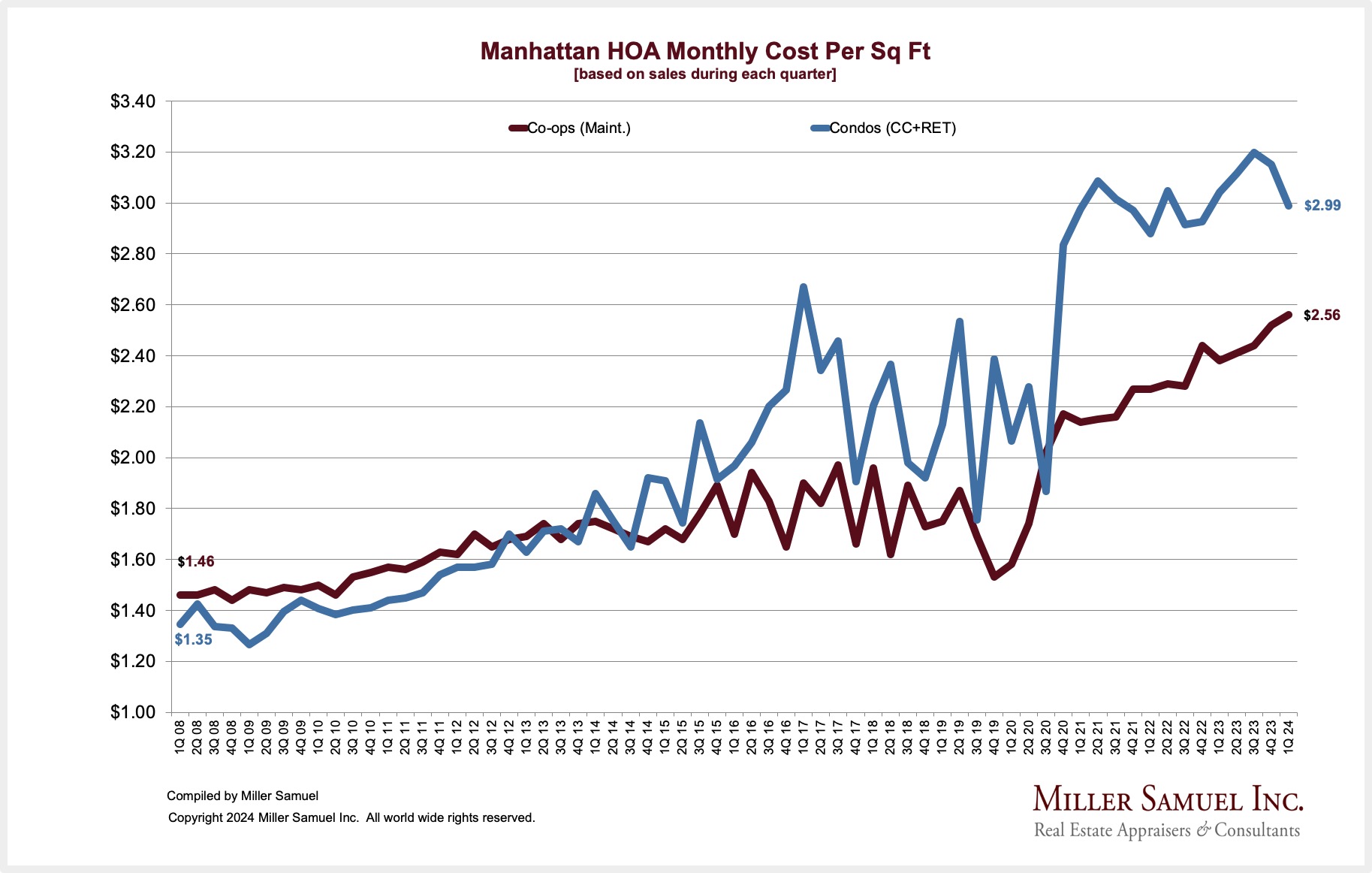

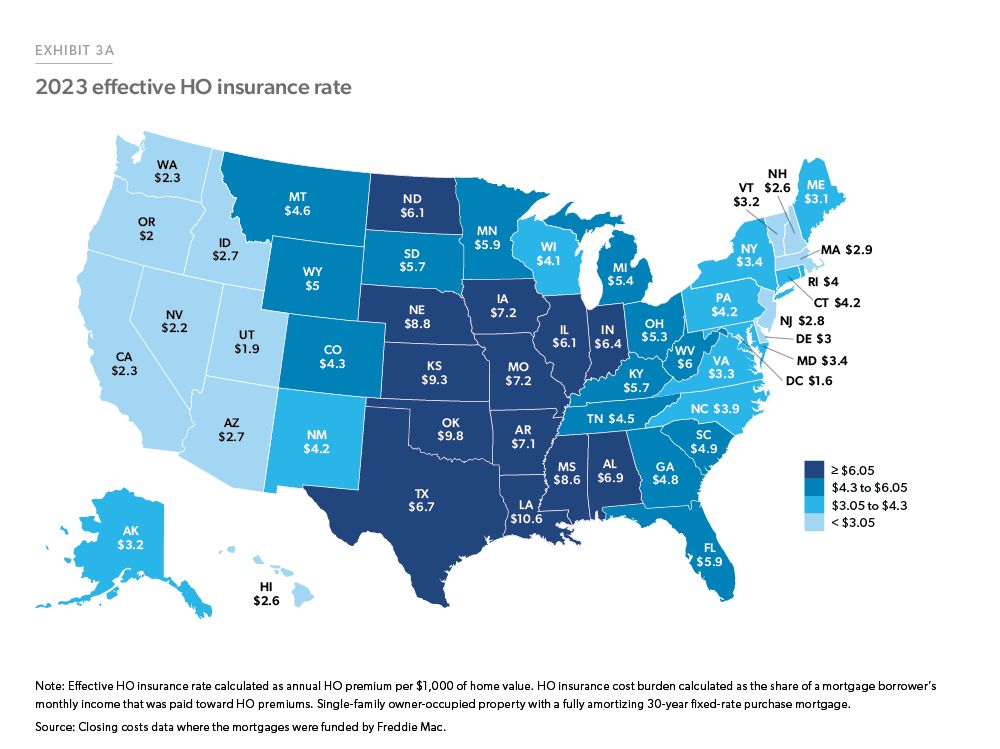

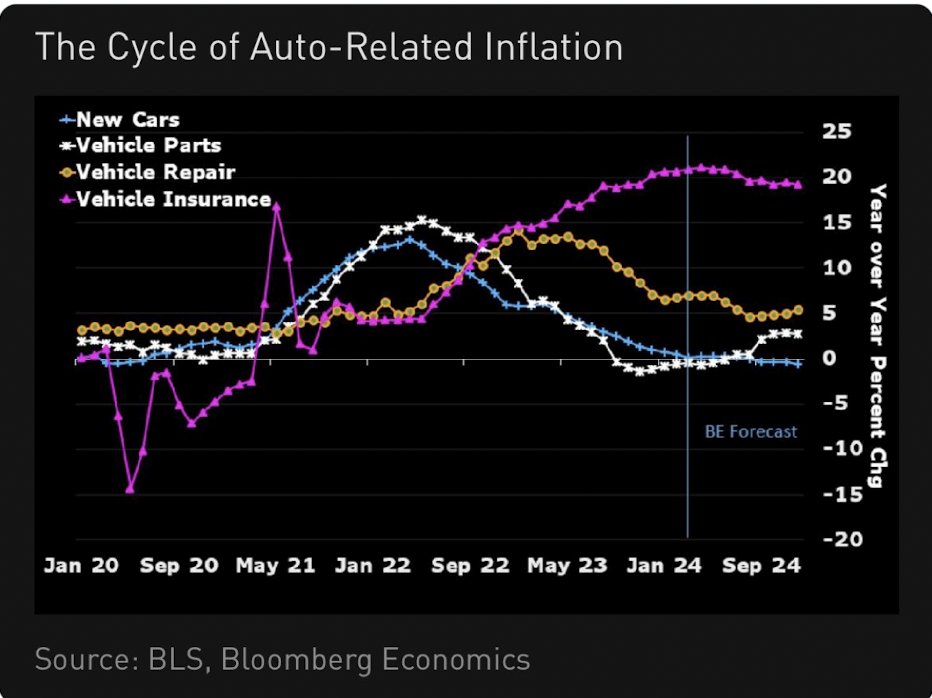

Higher Monthly Costs Are Not Just About Higher Mortgage Rates

While mortgage rates are driving housing costs higher, that’s a very one-dimensional way to look at it.

You have to consider the rising cost of HOA related expenses as well. Here’s a WSJ piece on this: The Hidden Costs of Homeownership Are Skyrocketing

And homeowners insurance continues to rise at a faster pace than insurance

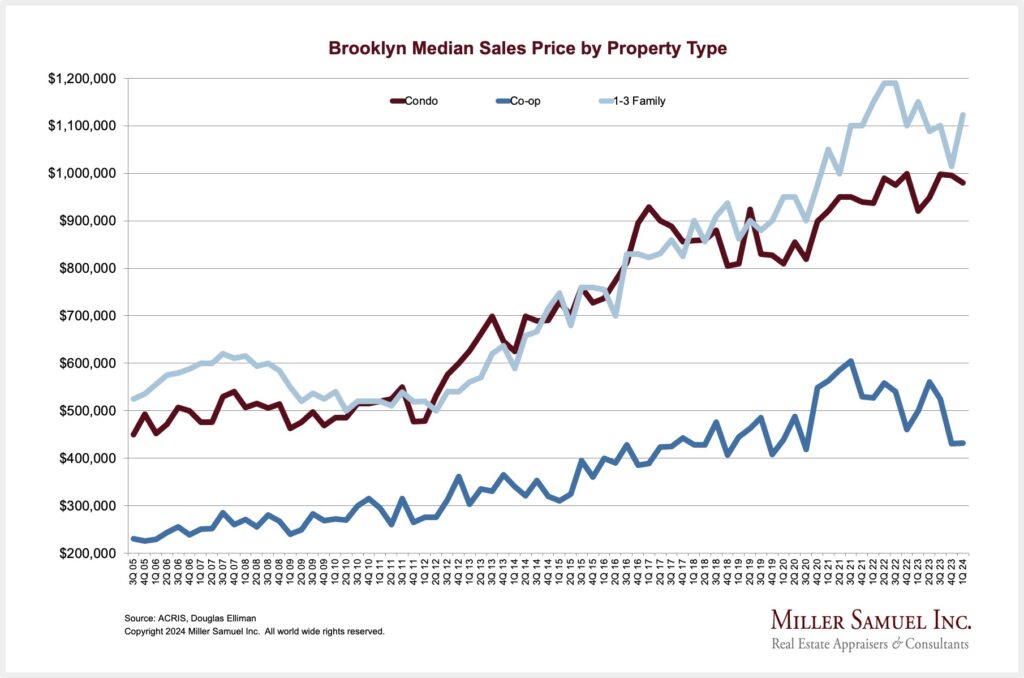

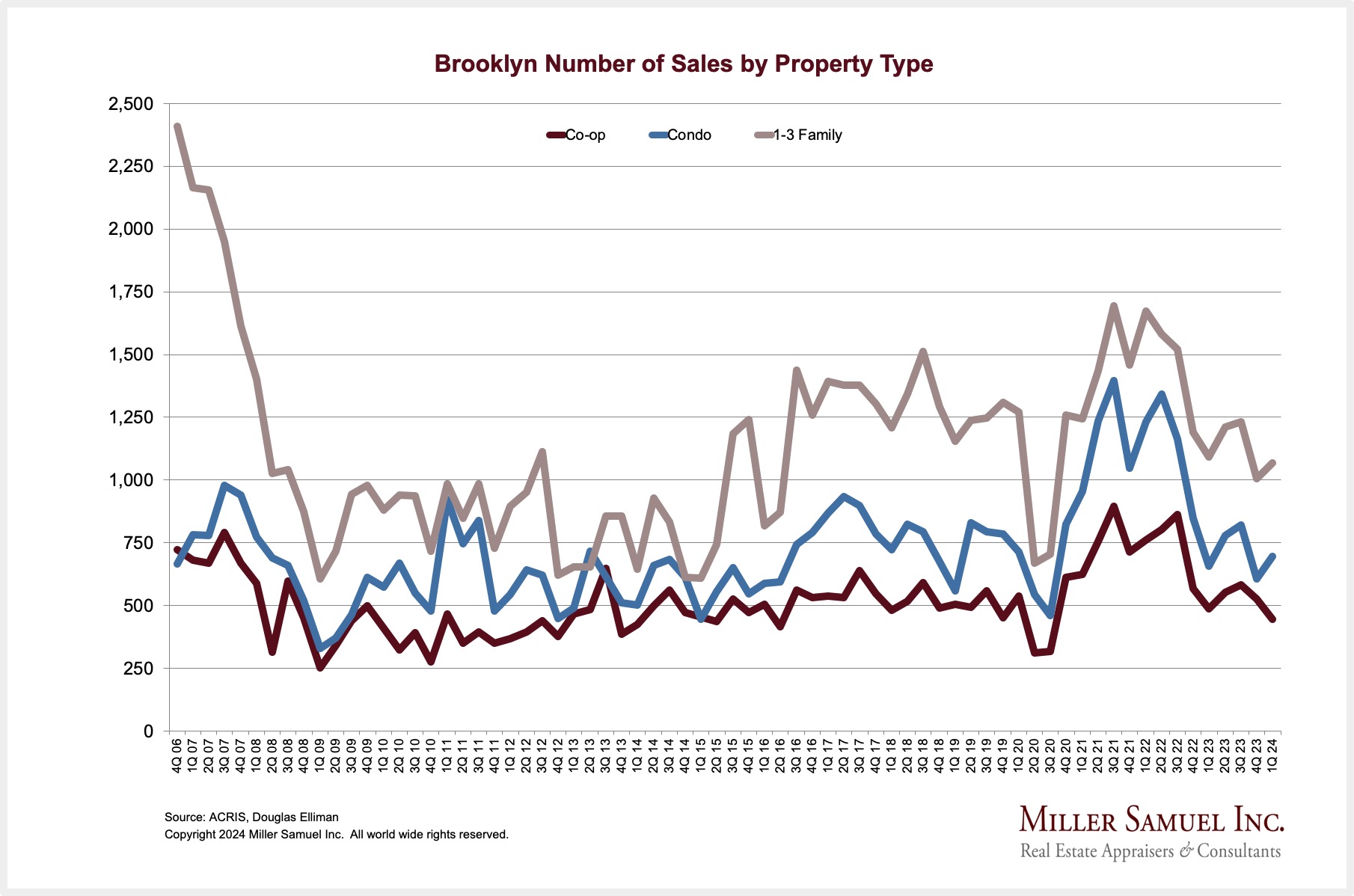

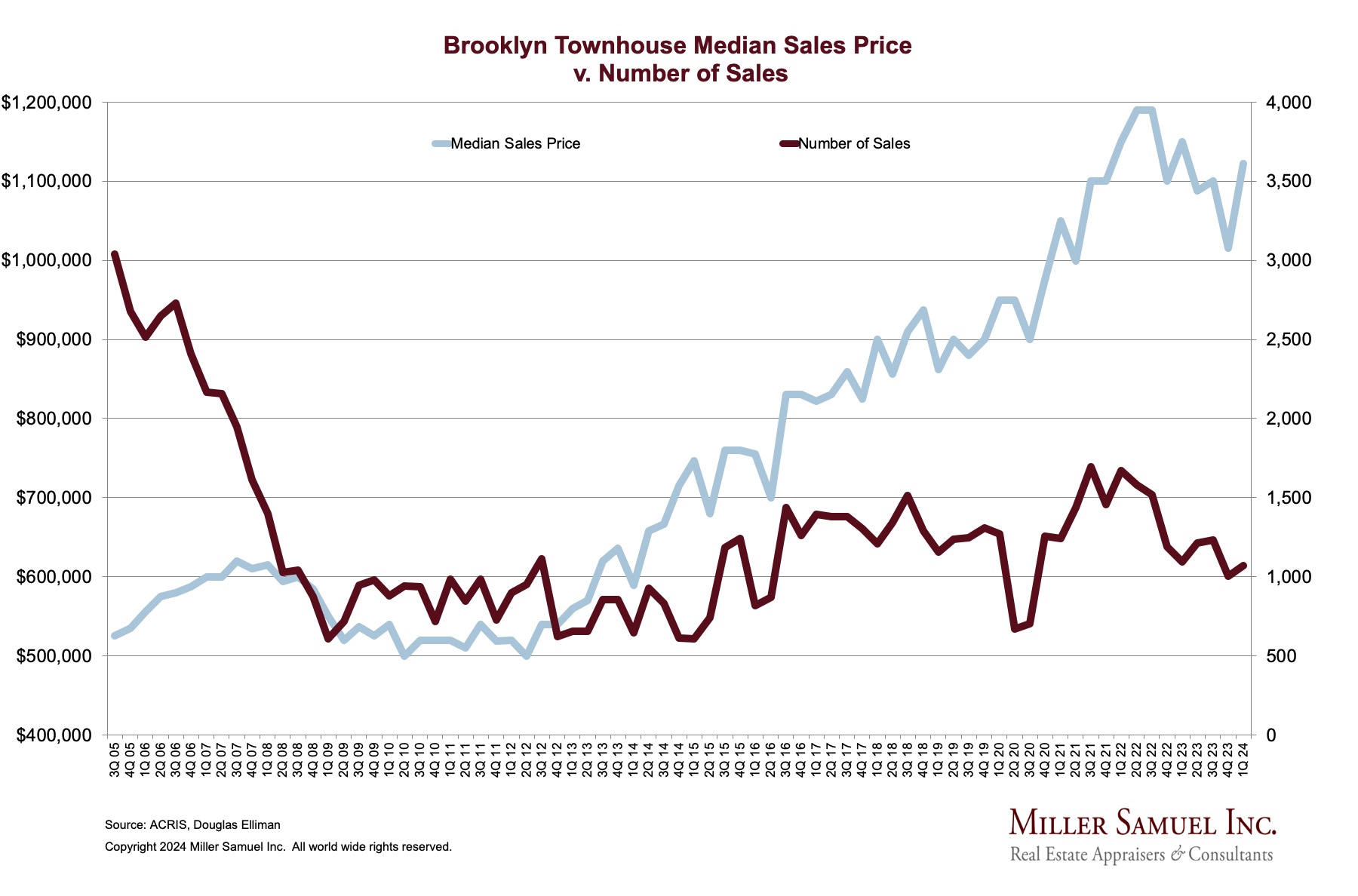

Brooklyn, Queens & Riverdale (Bronx) Prices Press Higher

Douglas Elliman publish our research yesterday on the other markets we cover in New York City outside of Manhattan.

BROOKLYN SALES MARKET HIGHLIGHTS

Elliman Report: Q1-2024 Brooklyn Sales

Price trends largely stabilized year over year as sales slipped.

- Median sales price was unchanged year over year

- Sales declined annually at a declining rate for nearly two years

- Listing inventory declined year over year for the eighth time

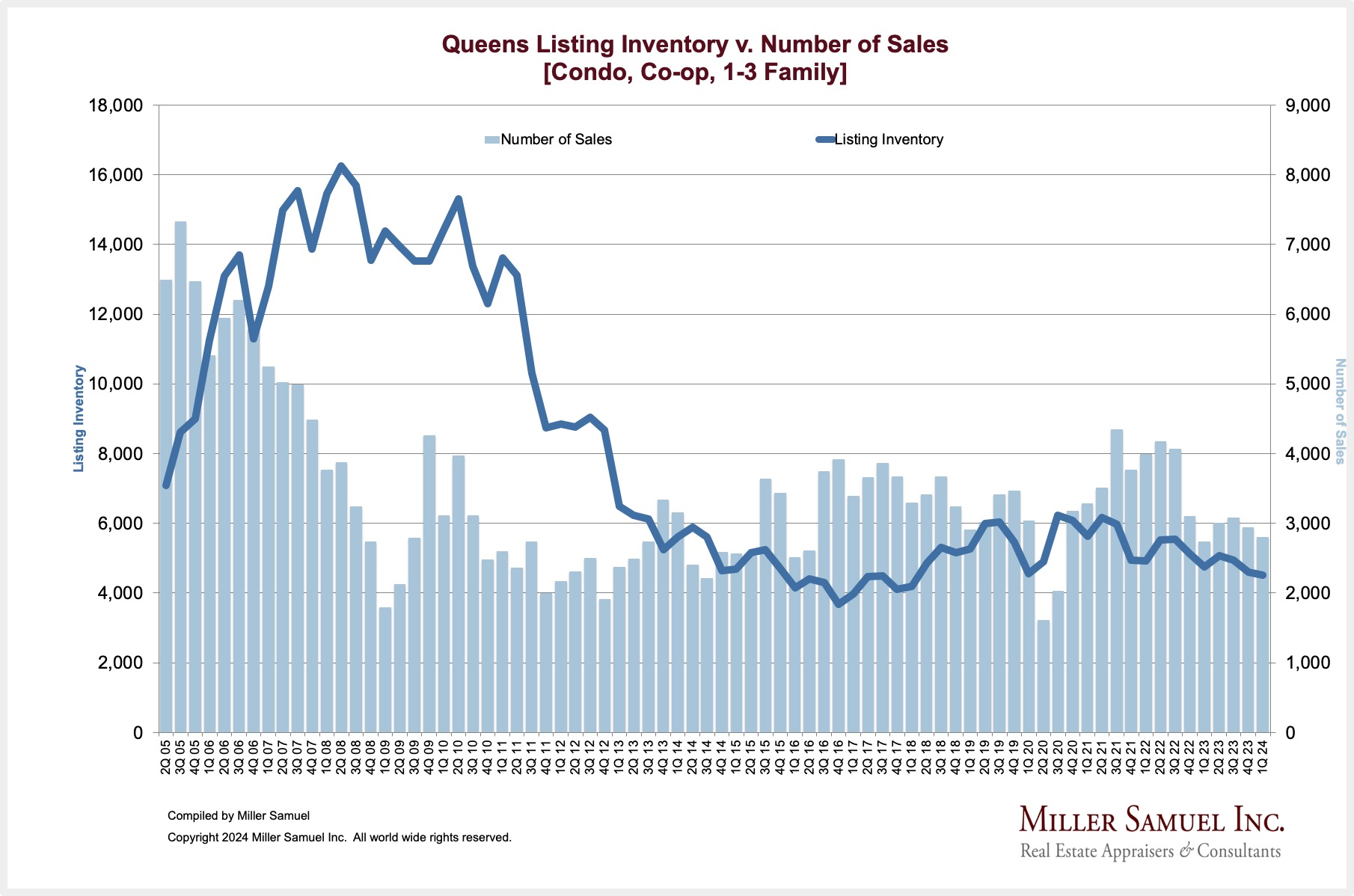

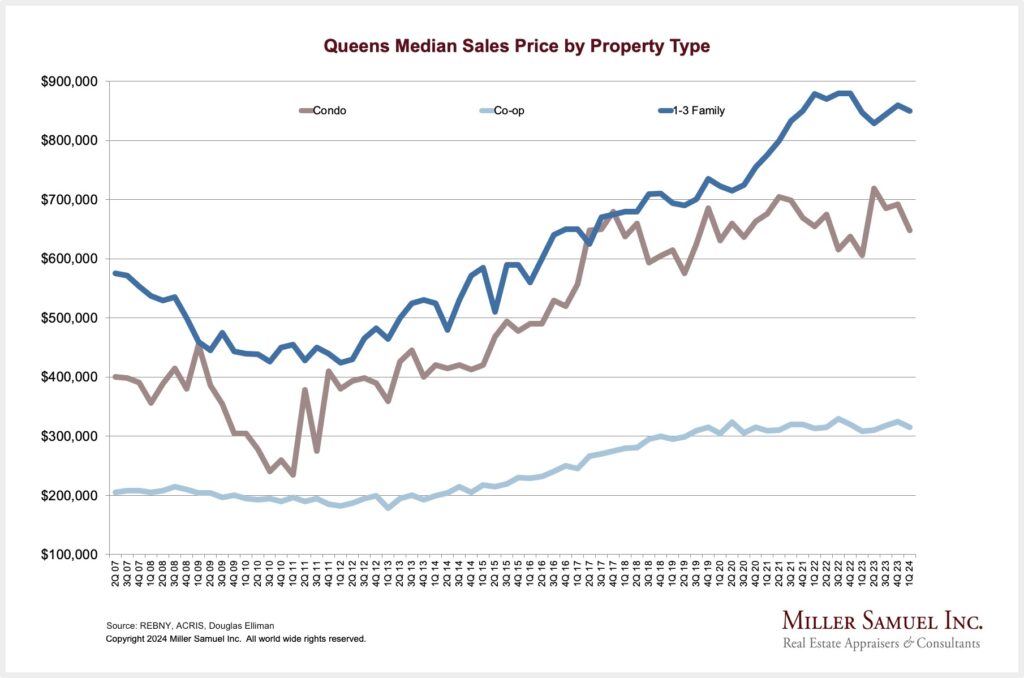

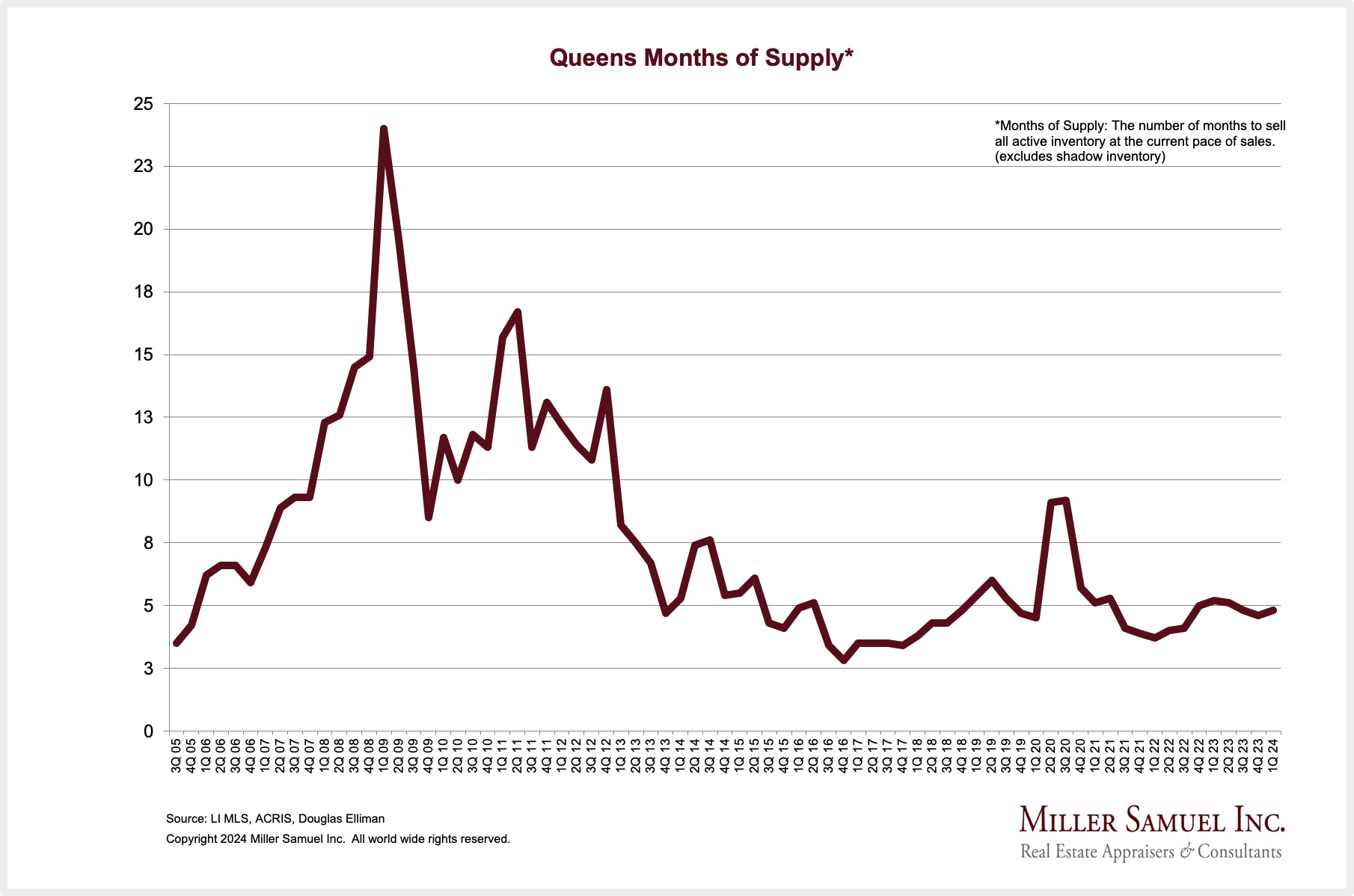

QUEENS SALES MARKET HIGHLIGHTS

Elliman Report: Q1-2024 Queens Sales

Both price trends and sales rose year over year.

- Median sales price rose year over year for the first time in six quarters

- Sales increased year over year for the first time in seven quarters

- Listing inventory declined year over year for the fifth consecutive quarter

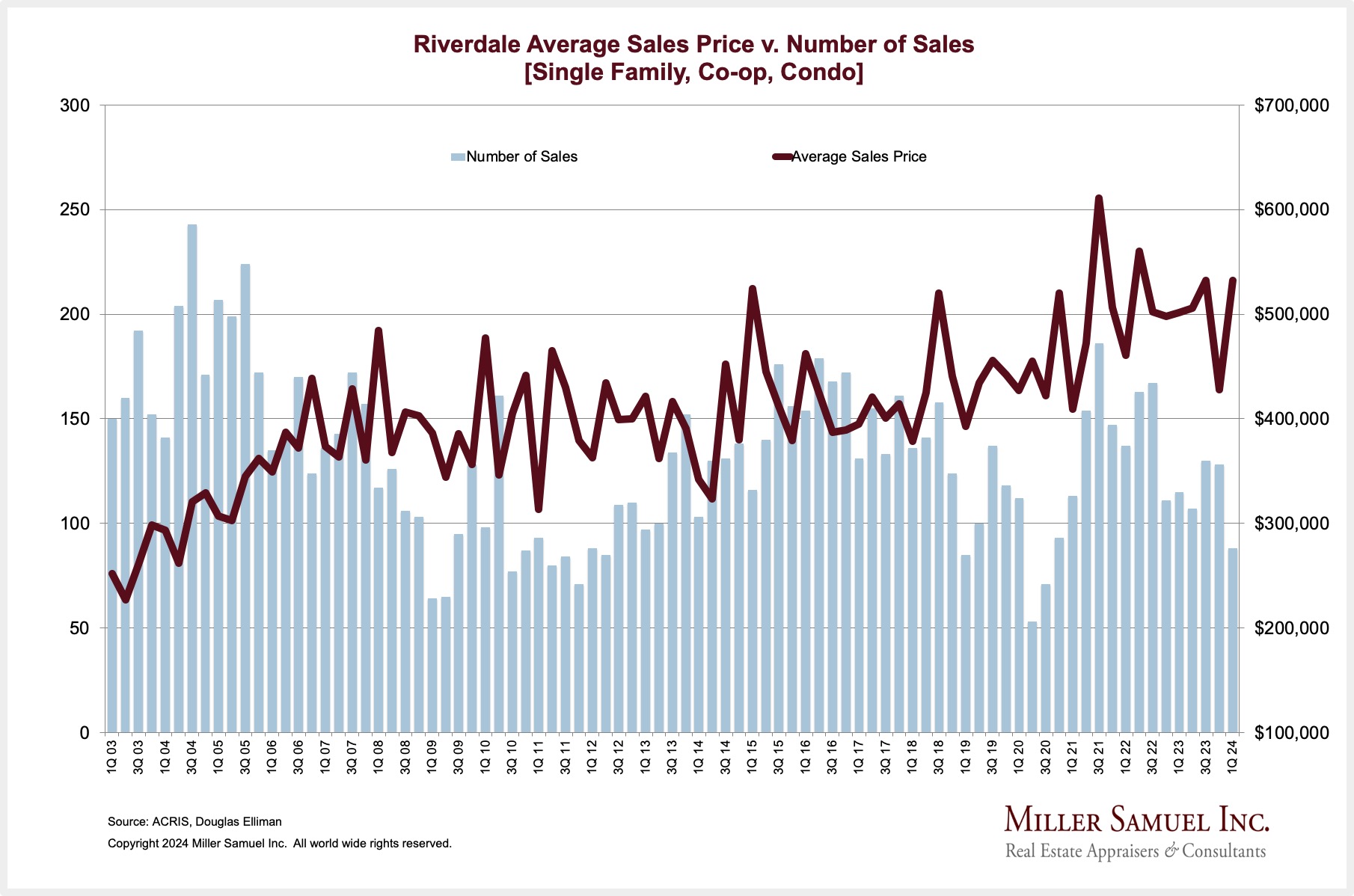

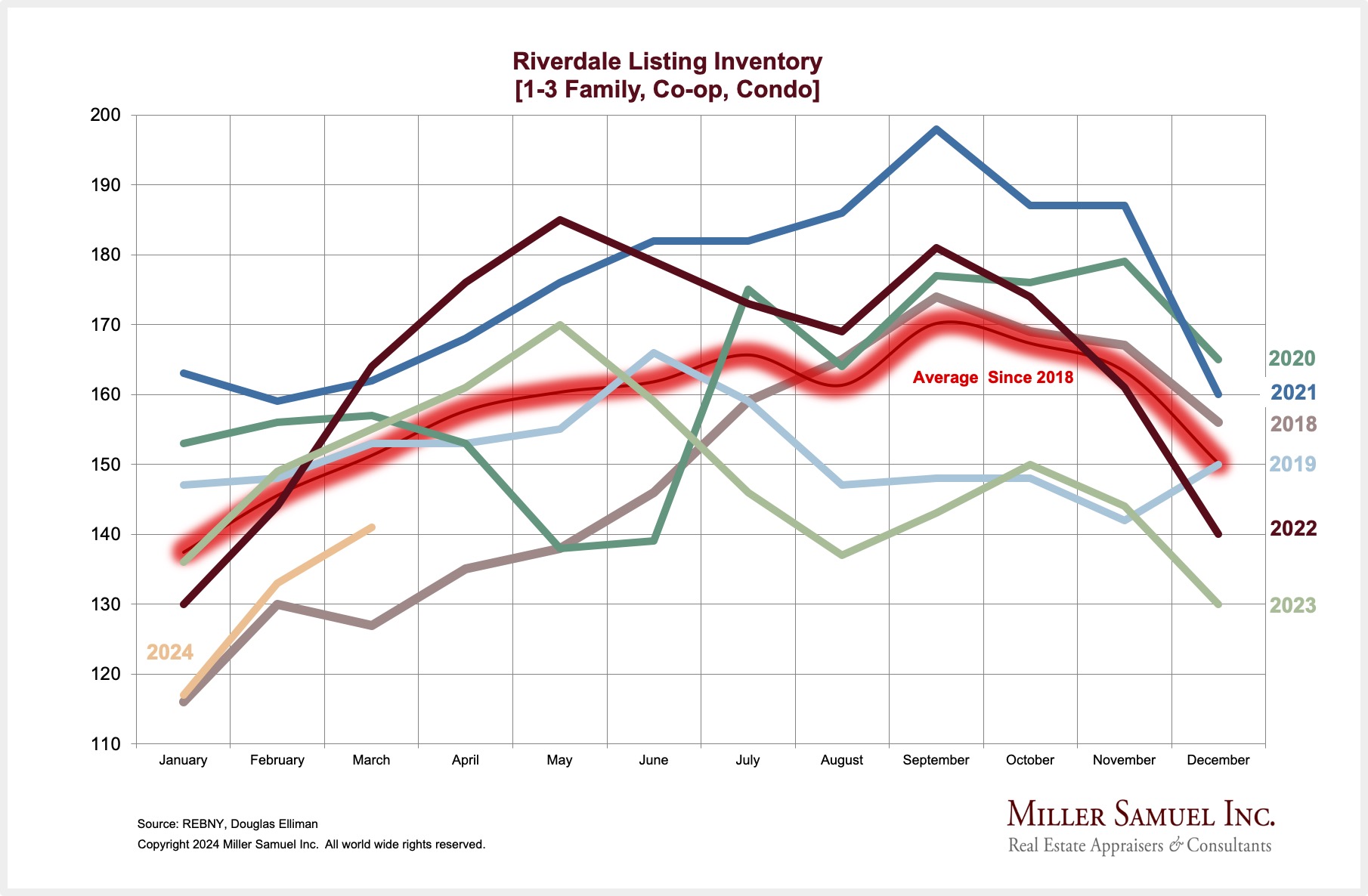

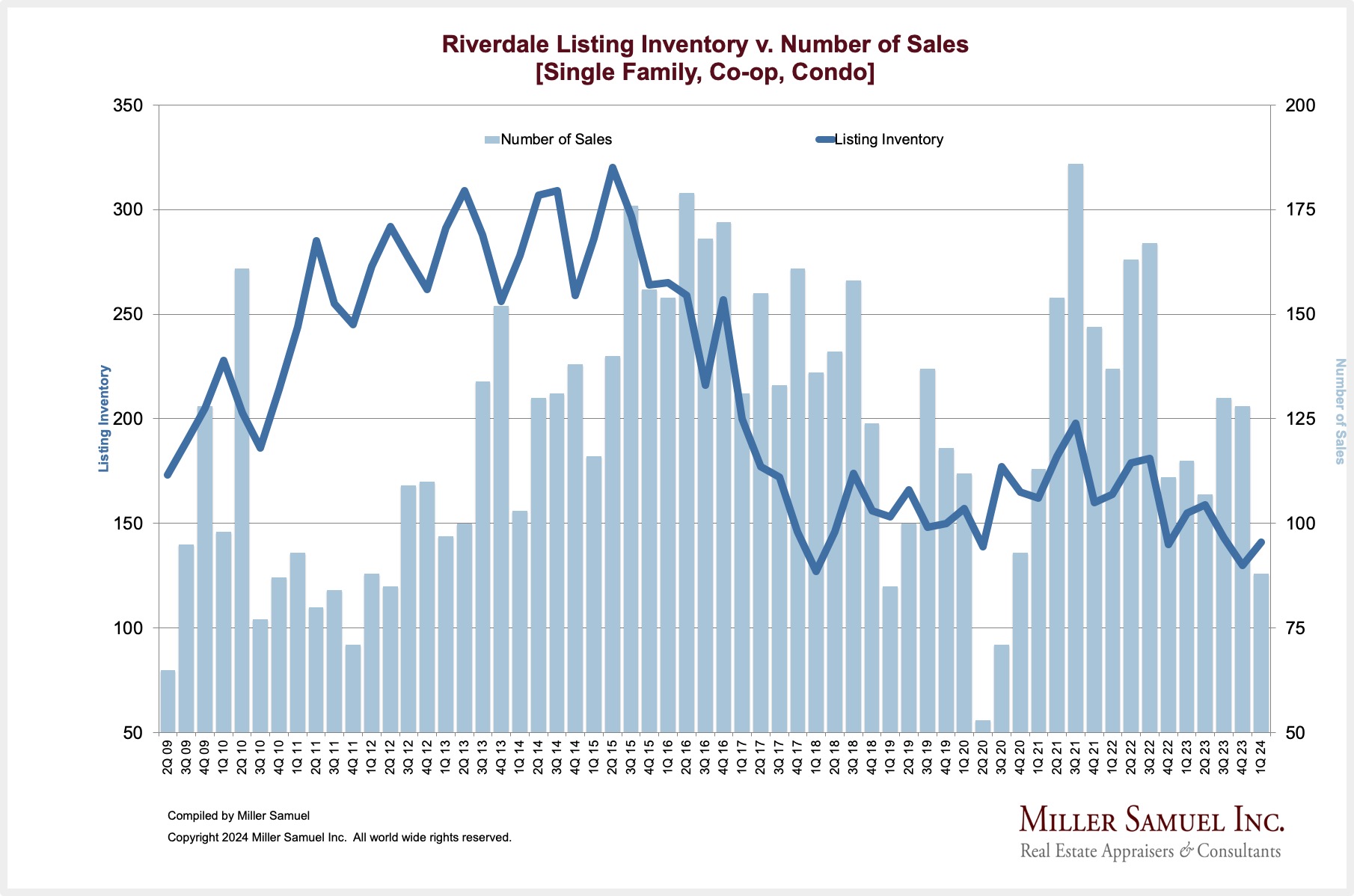

RIVERDALE SALES MARKET HIGHLIGHTS [includes Fieldston, Hudson Hill, North Riverdale, and Spuyten Duyvil]

Elliman Report: Q1-2024 Riverdale Sales

Both listing inventory and sales declined year over year.

- Median sales price slipped annually for the fourth consecutive decline

- Sales declined year over year for the second time in three quarters

- Listing inventory declined year over year for the past two years

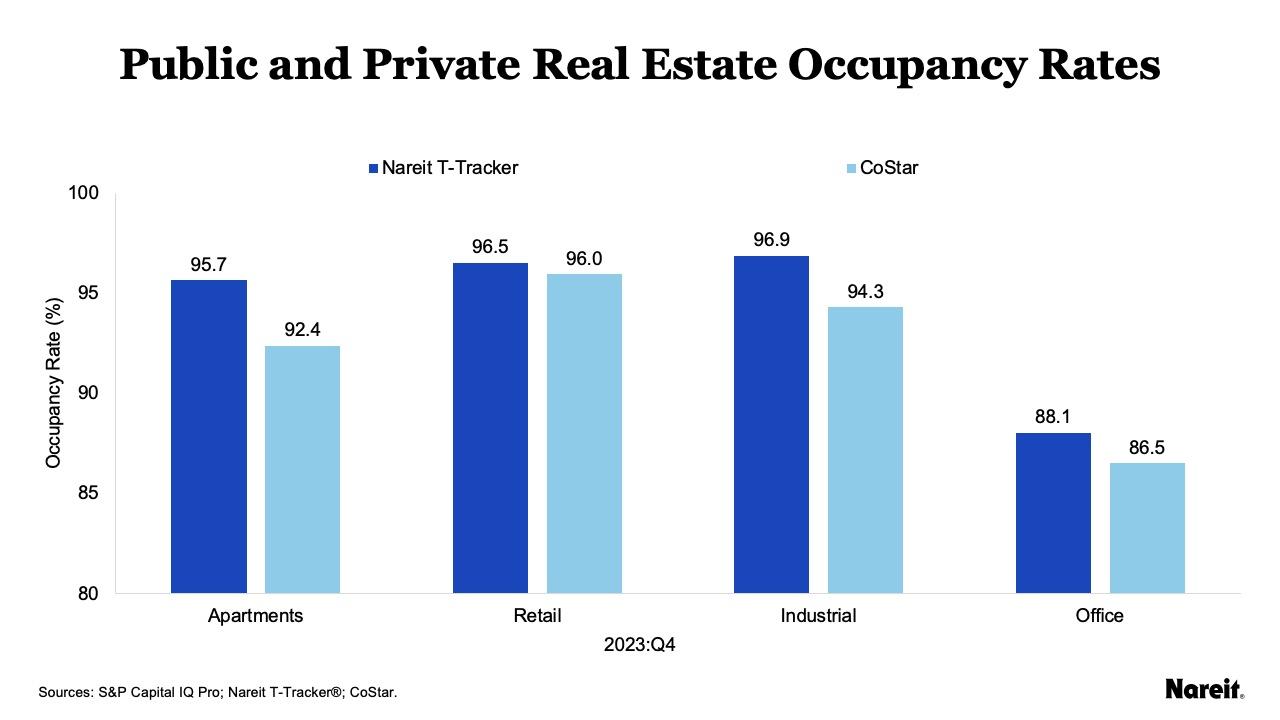

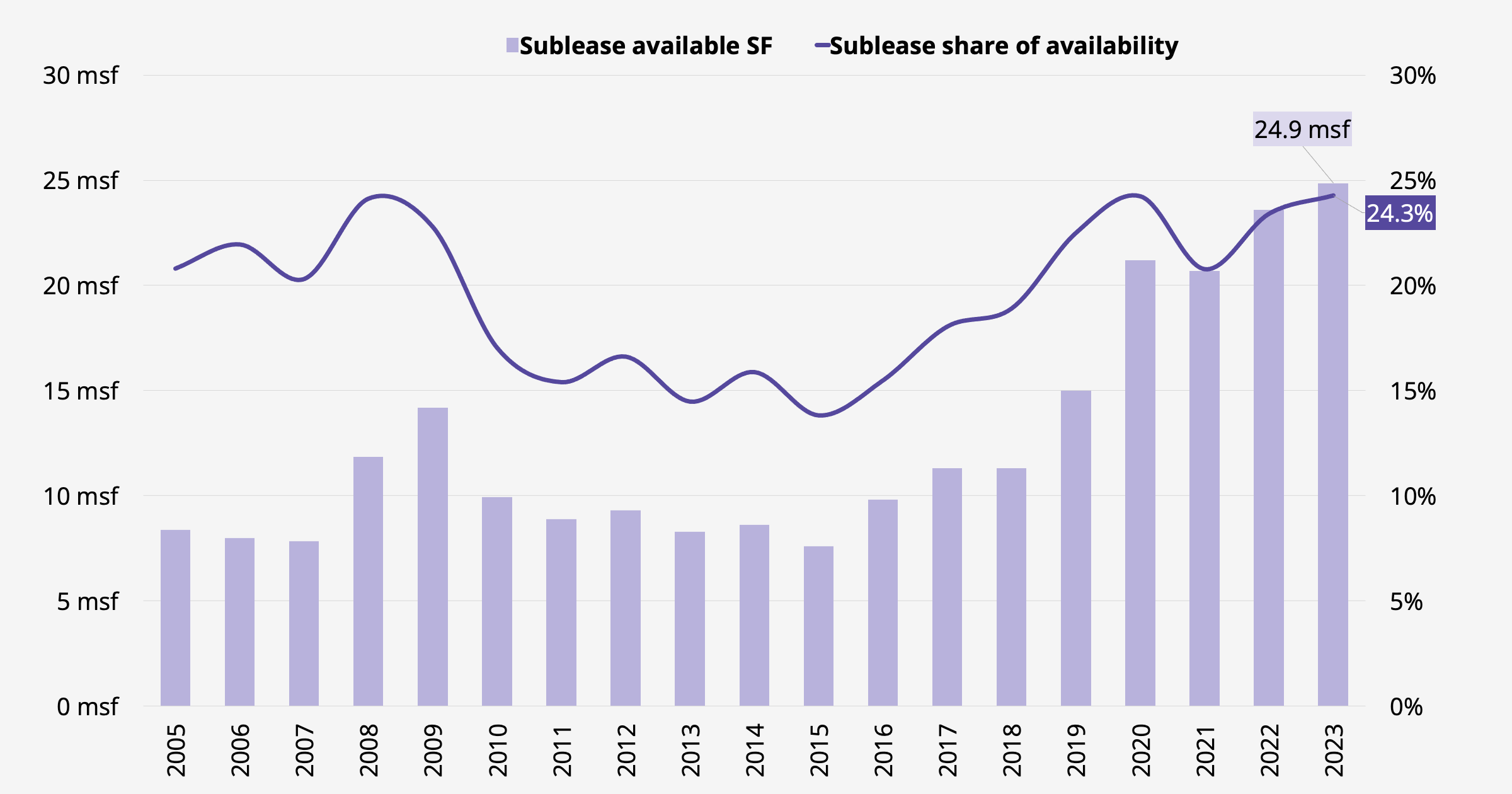

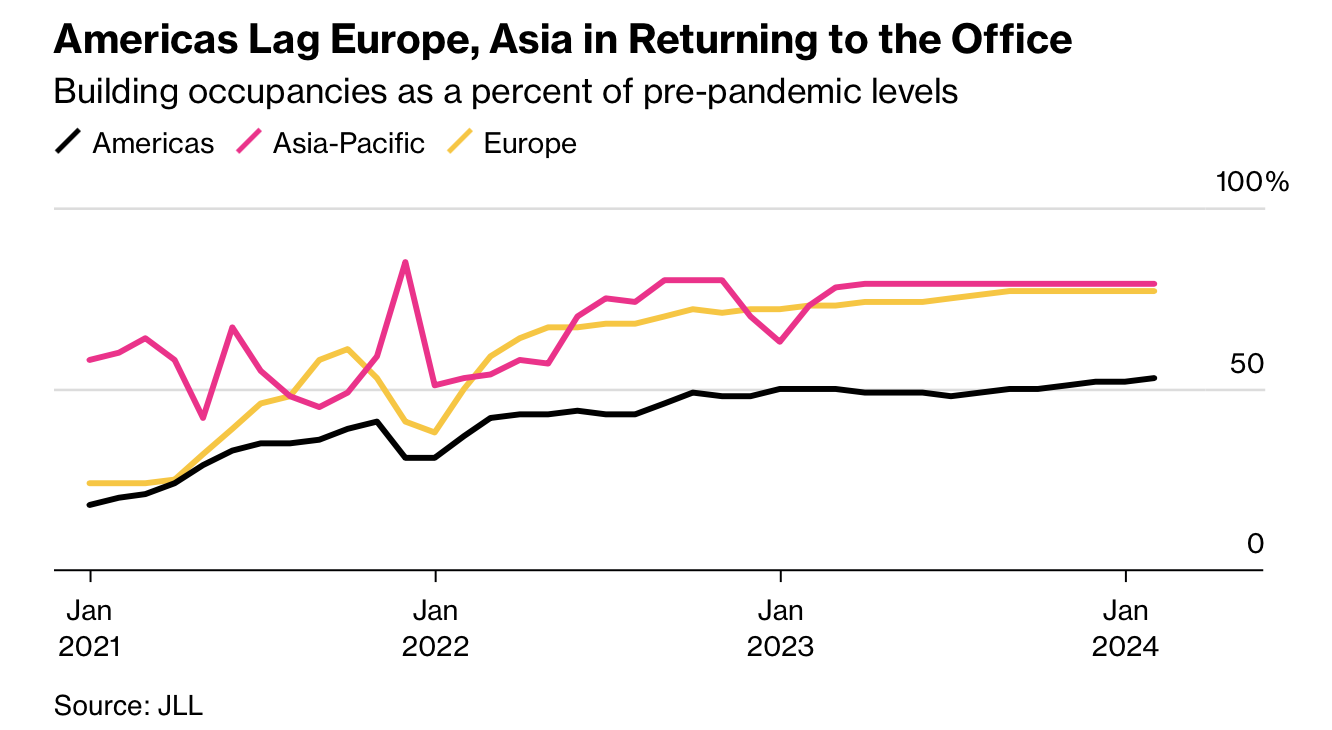

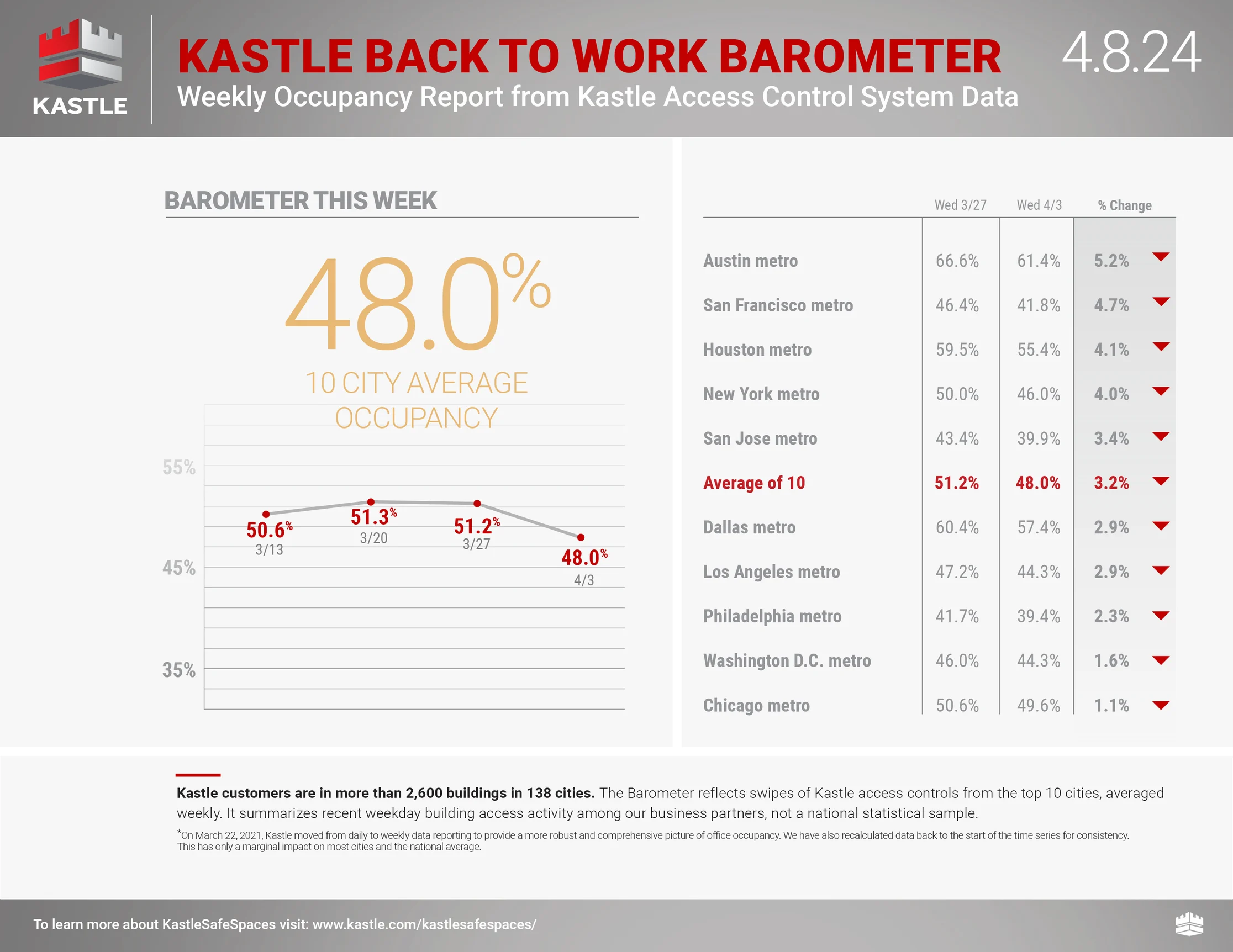

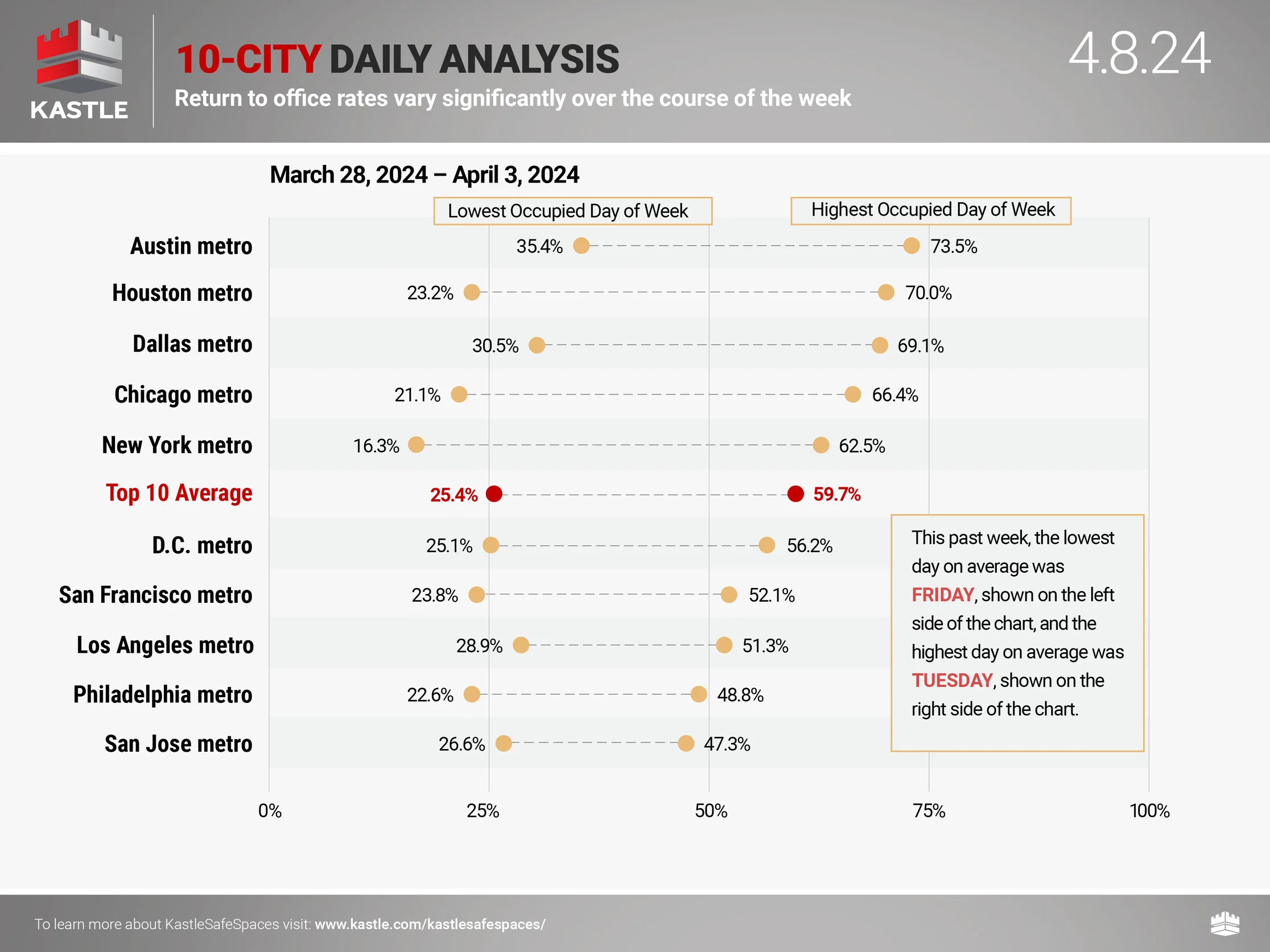

Office ‘Use’ Is Not The Same As ‘Occupancy’

In a recent NAREIT post, “A Cut Above: U.S. Public Equity REIT Occupancy Rates” I noticed this chart showing office occupancy is in the mid-80s. However this is a percentage of how many spaces are leased up, not actually used. This is why we aren’t seeing the full force of Work From Home yet.

Subleasing is surging, where a landlord cannot fill the space they signed up for and attempts to rent it out.

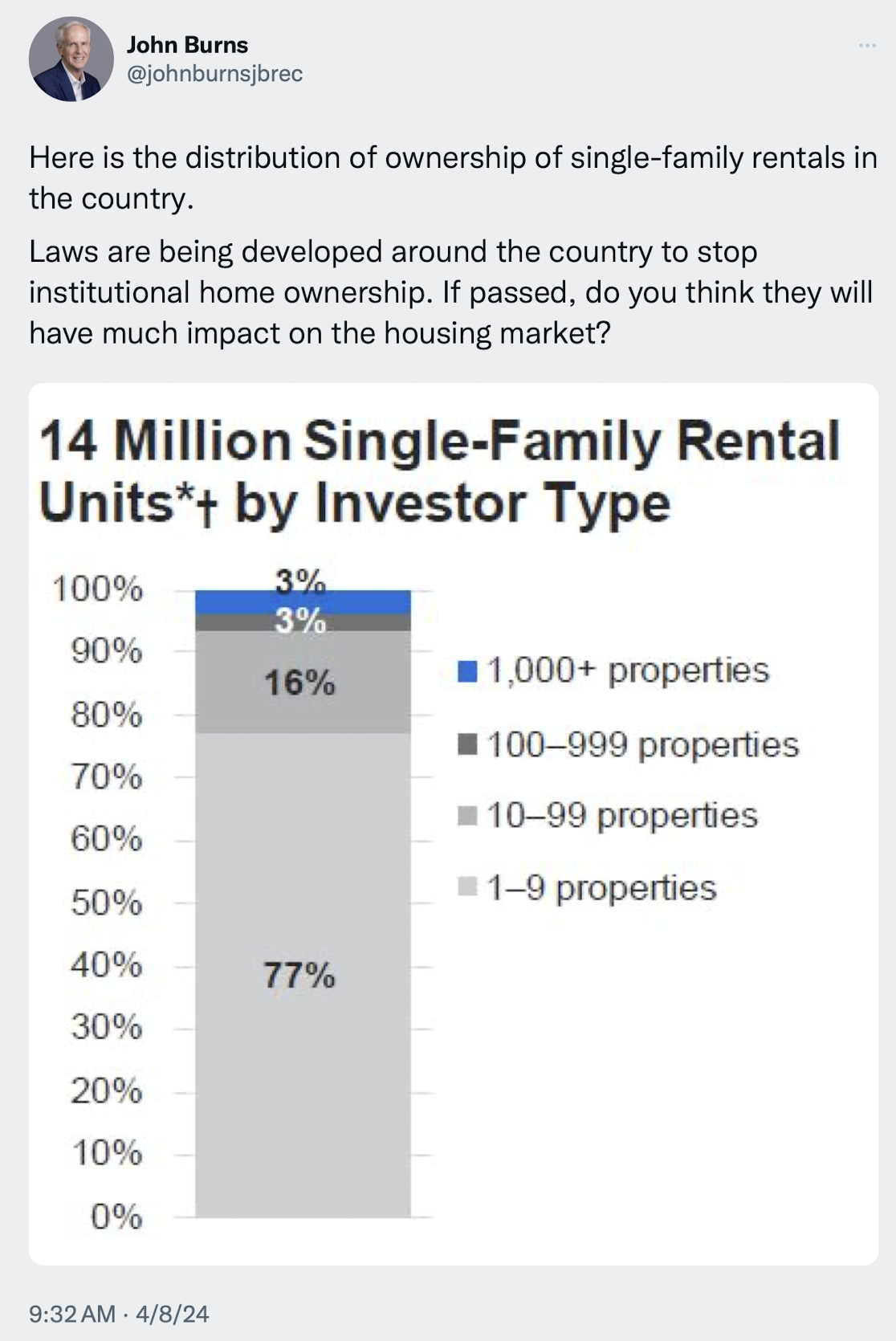

Single Family Rentals By Investors Under Siege

One of the serious issues in the residential housing market is the surge in Wall Street’s ownership of single family homes for rent. It helps exaggerate the supply shortage. On the one hand, it provides people access to better access to superior school districts and shorter commutes to central business districts, but it also drives the costs substantially higher. In addition to Congress, local governments are beginning to address this market distortion.

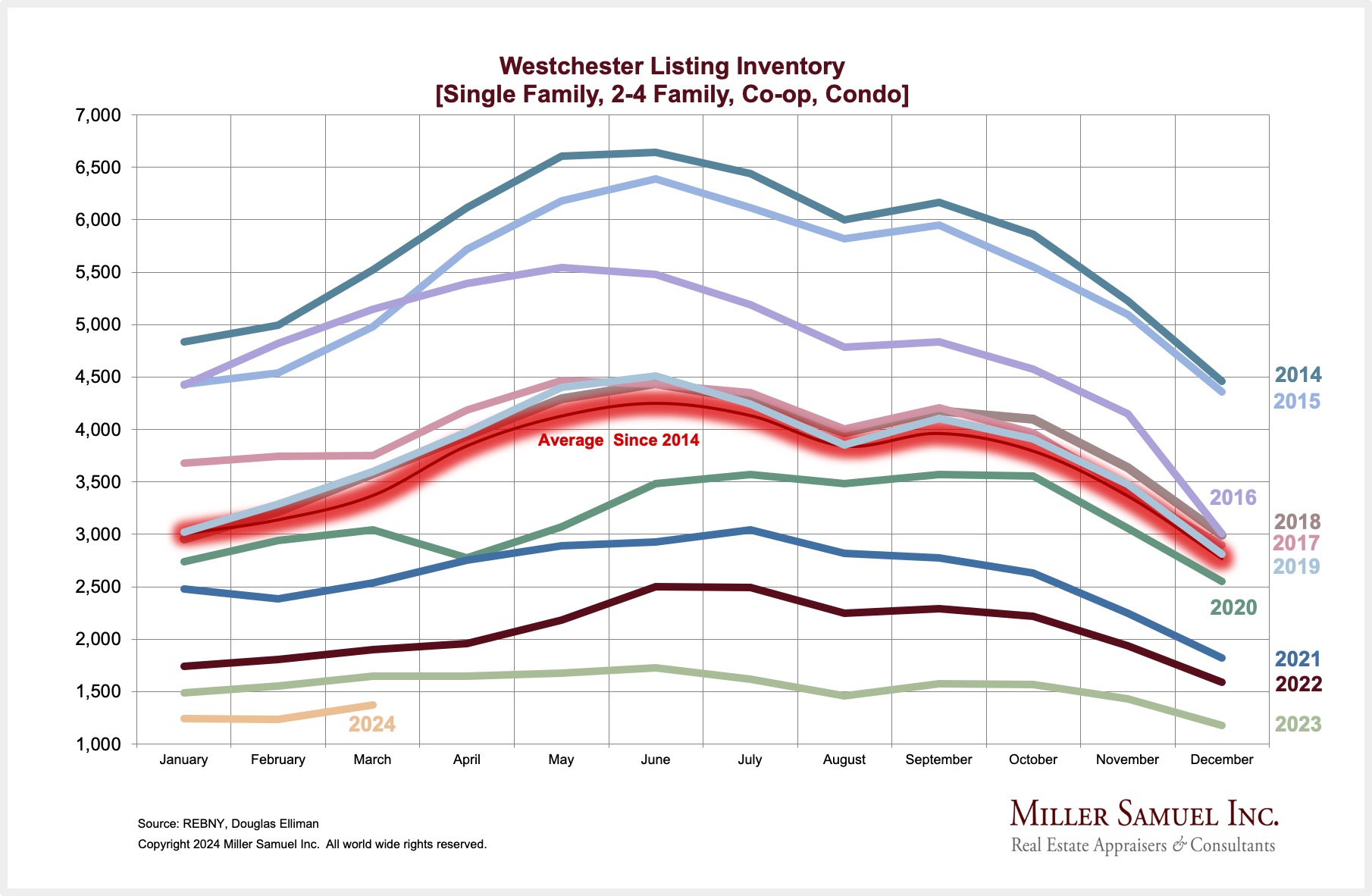

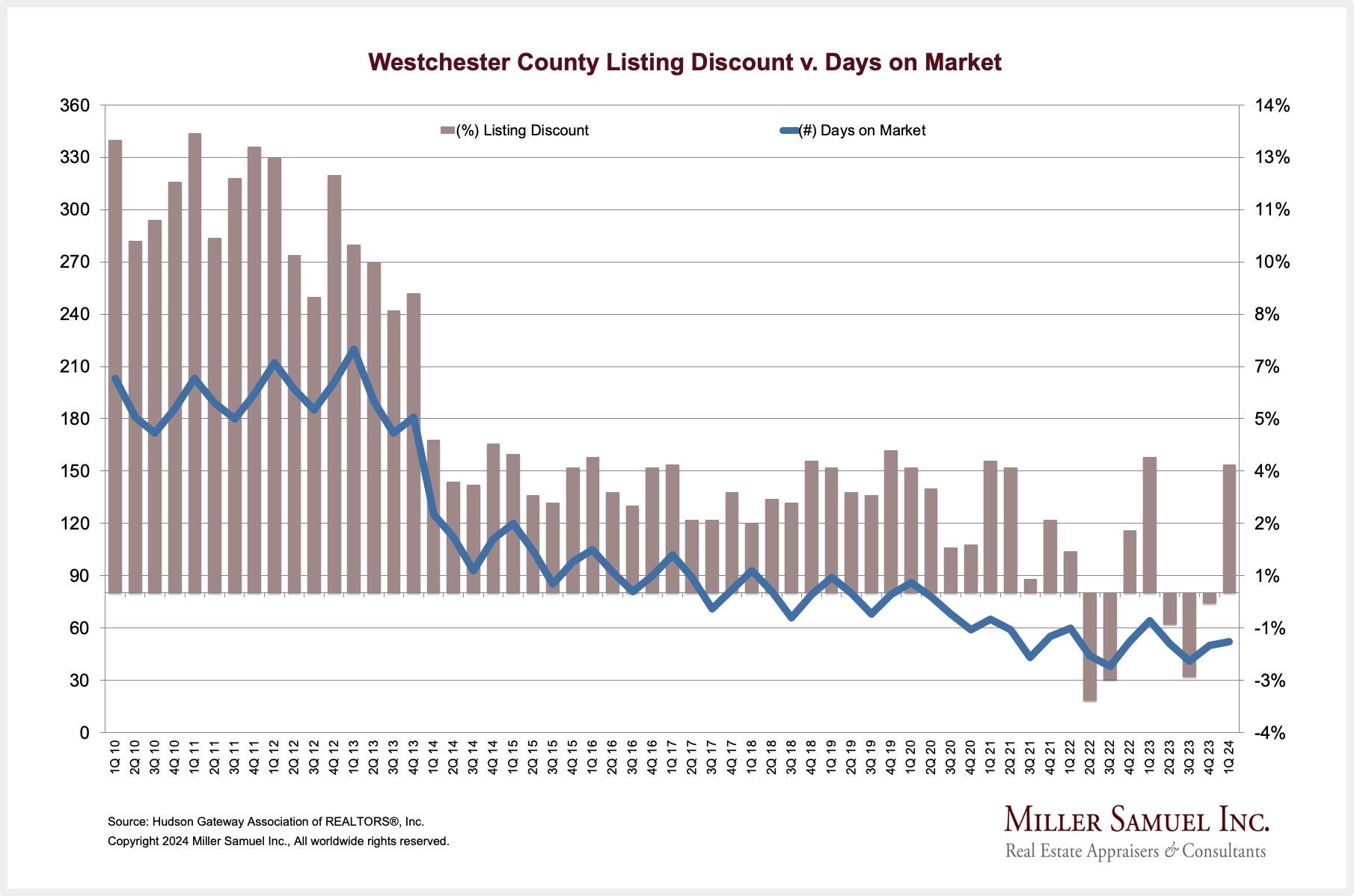

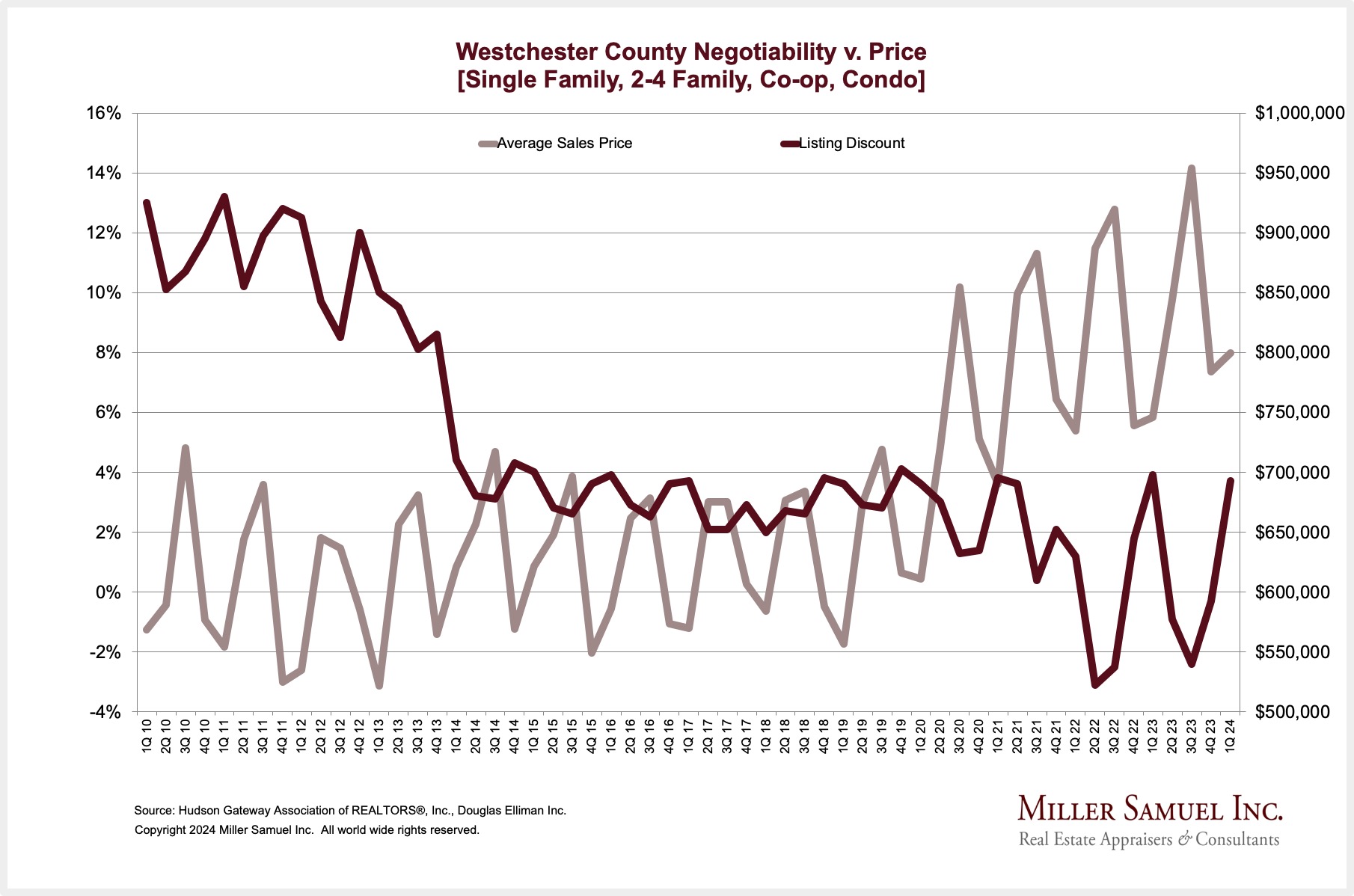

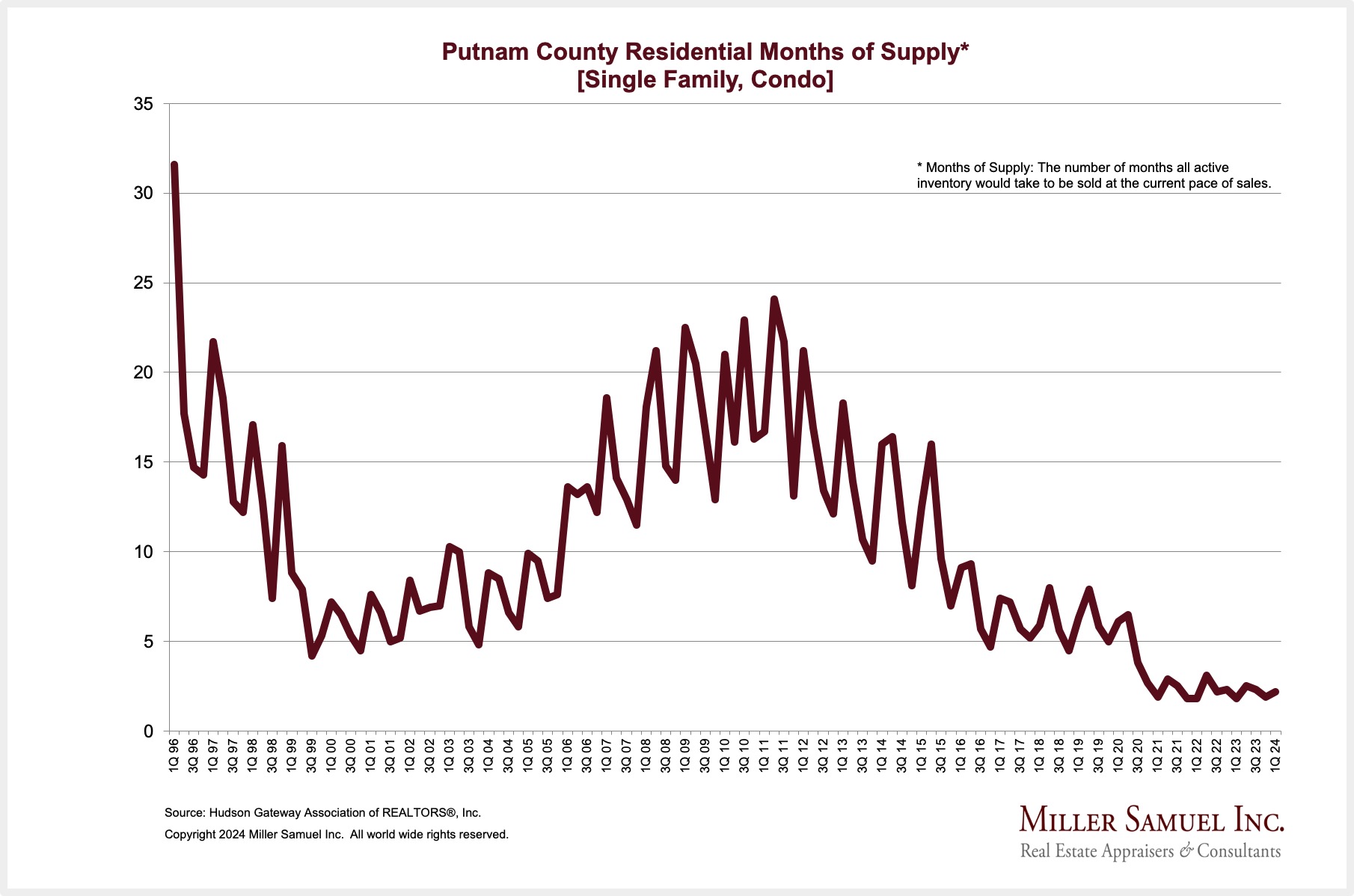

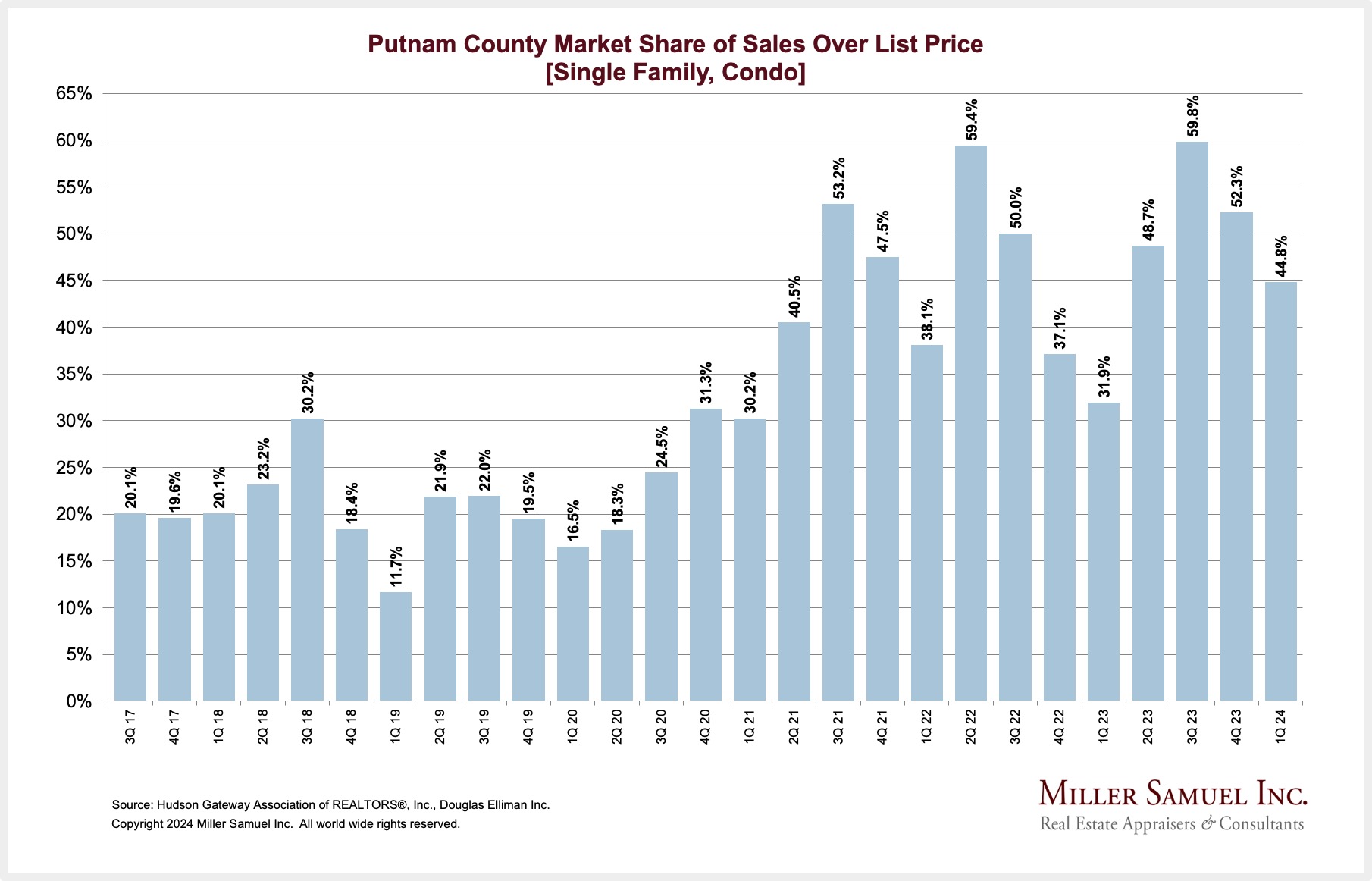

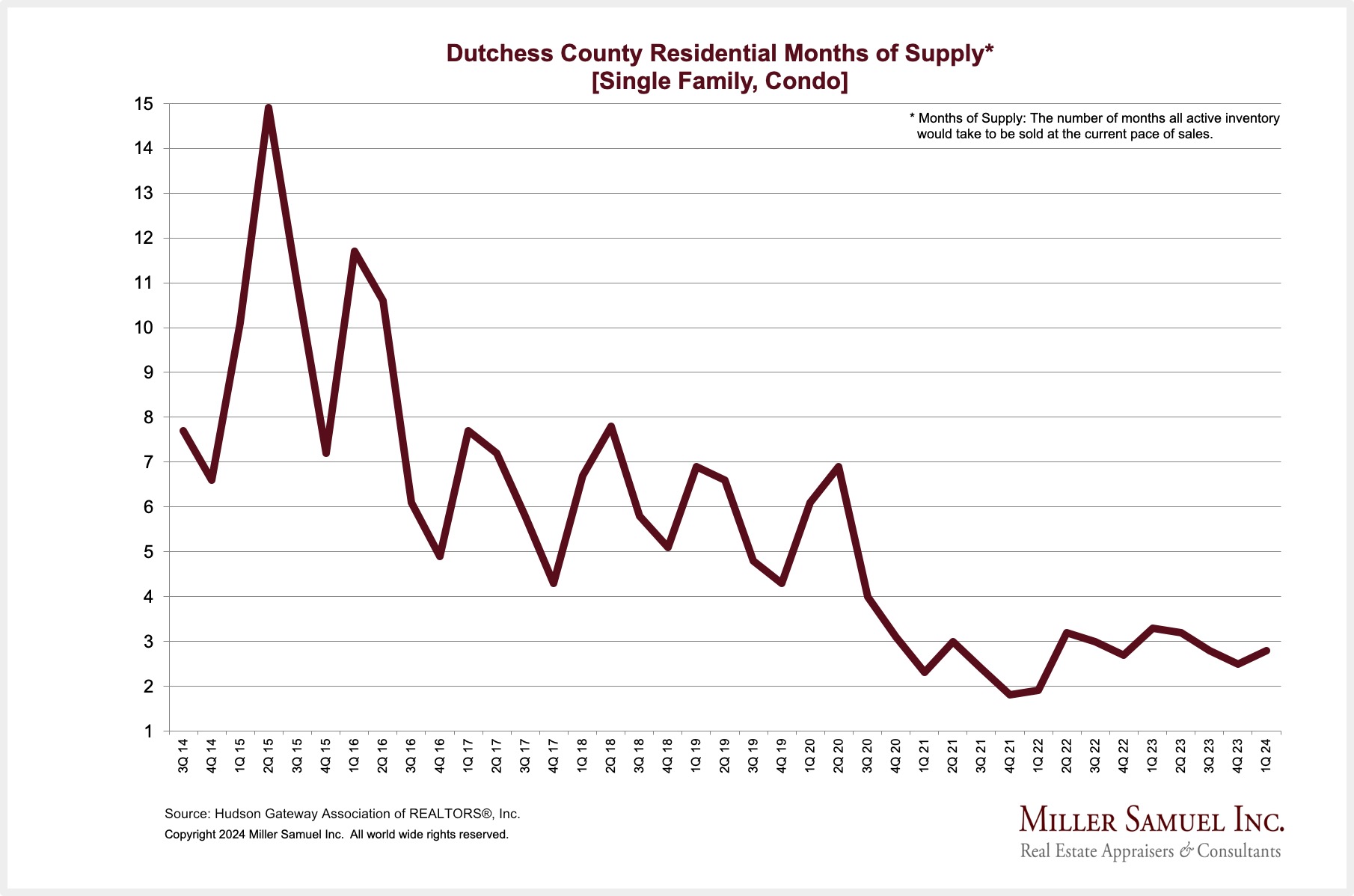

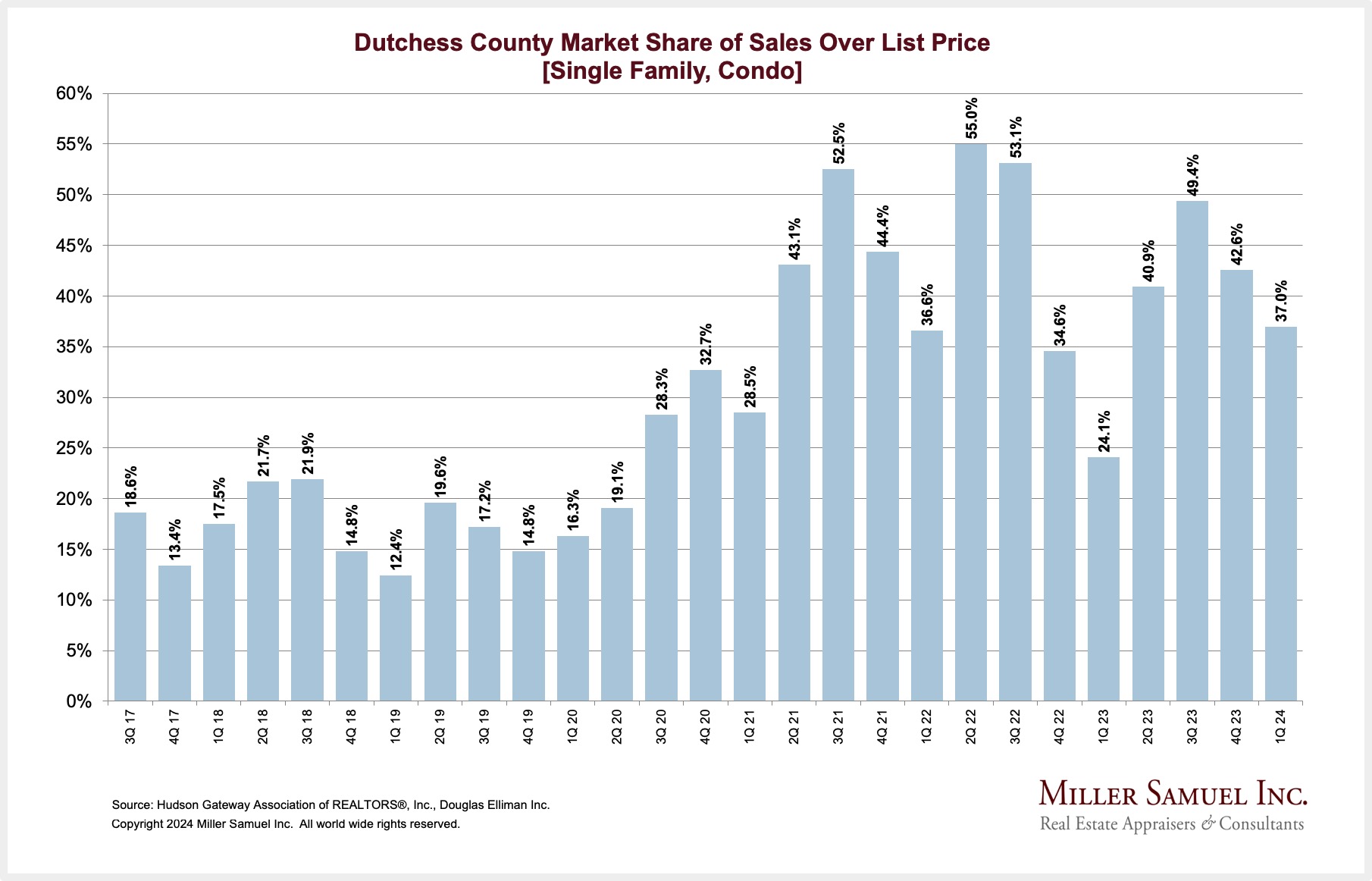

Westchester, Putnam & Dutchess Counties Remain Devoid of Listing Inventory

WESTCHESTER SALES MARKET HIGHLIGHTS

Elliman Report: Q1-2024 Westchester County Sales

PUTNAM SALES MARKET HIGHLIGHTS

DUTCHESS SALES MARKET HIGHLIGHTS

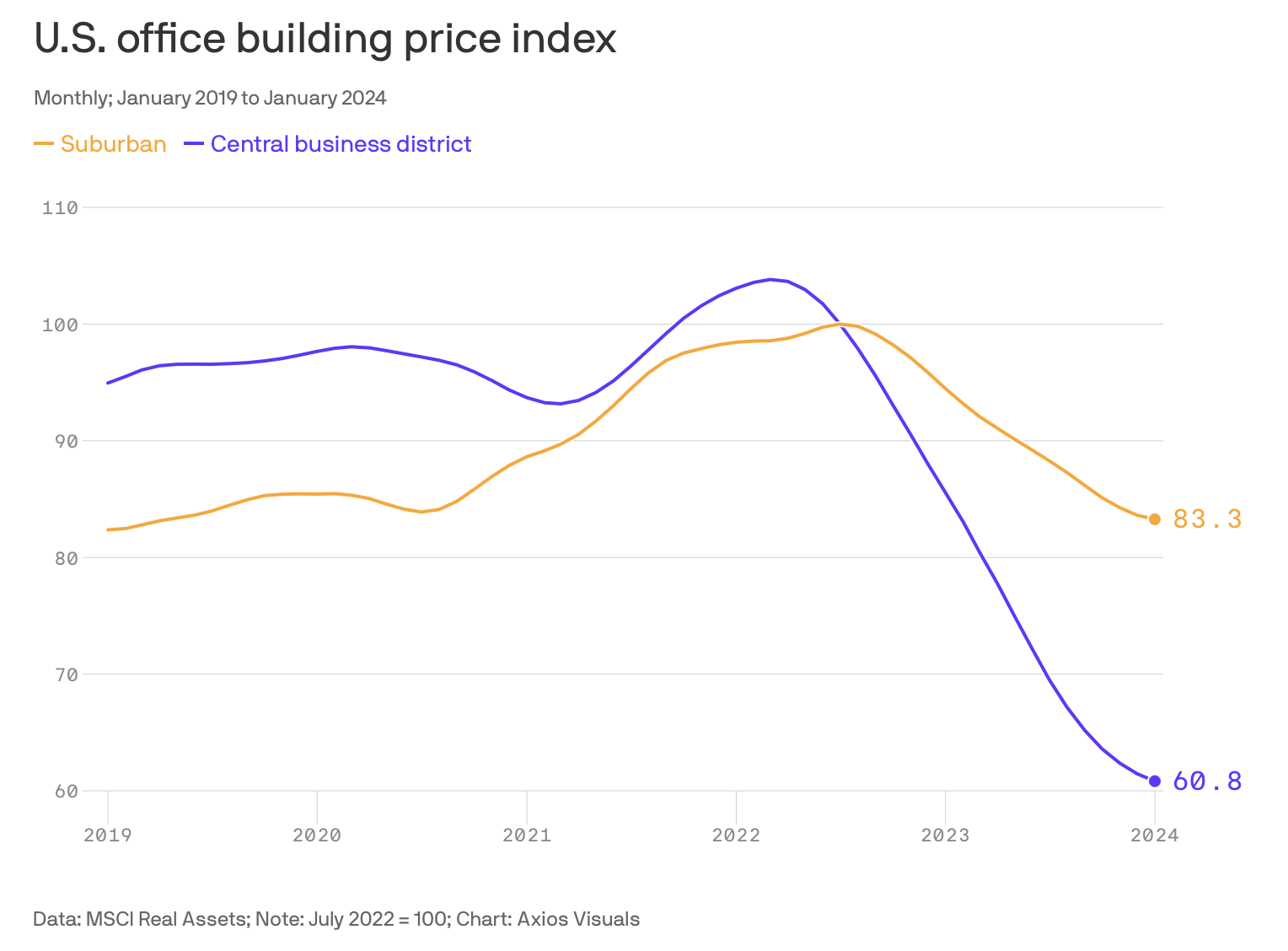

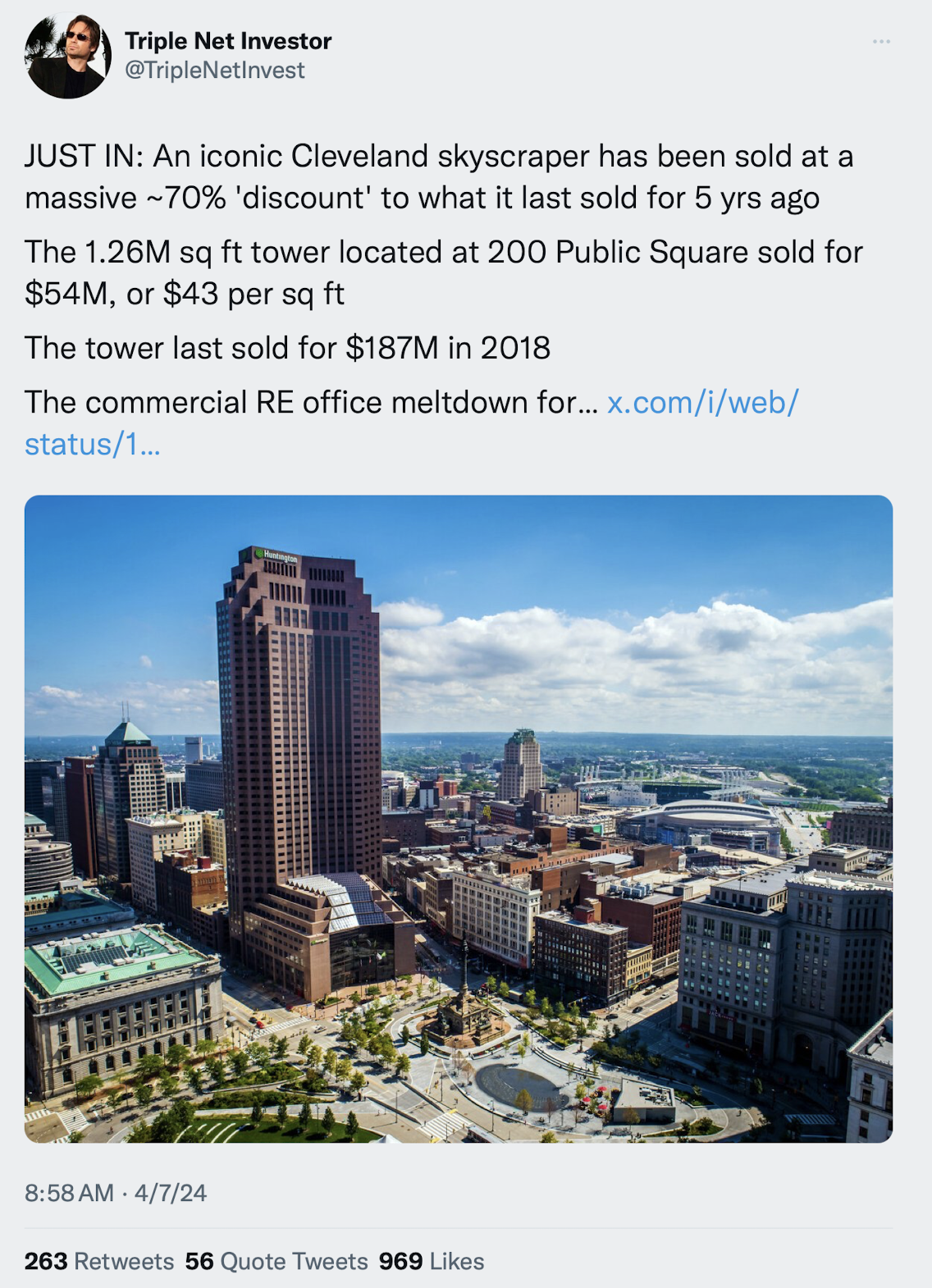

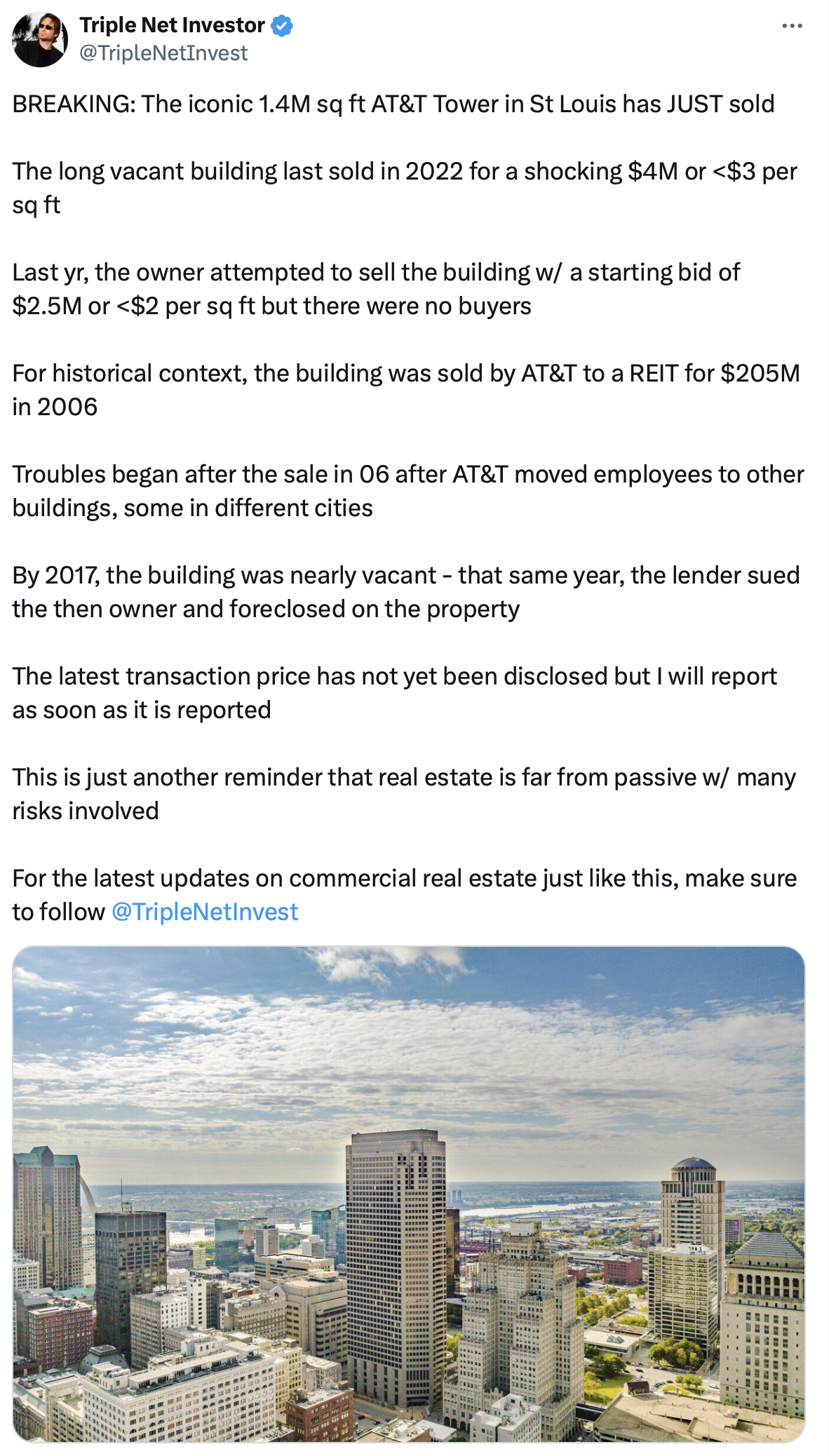

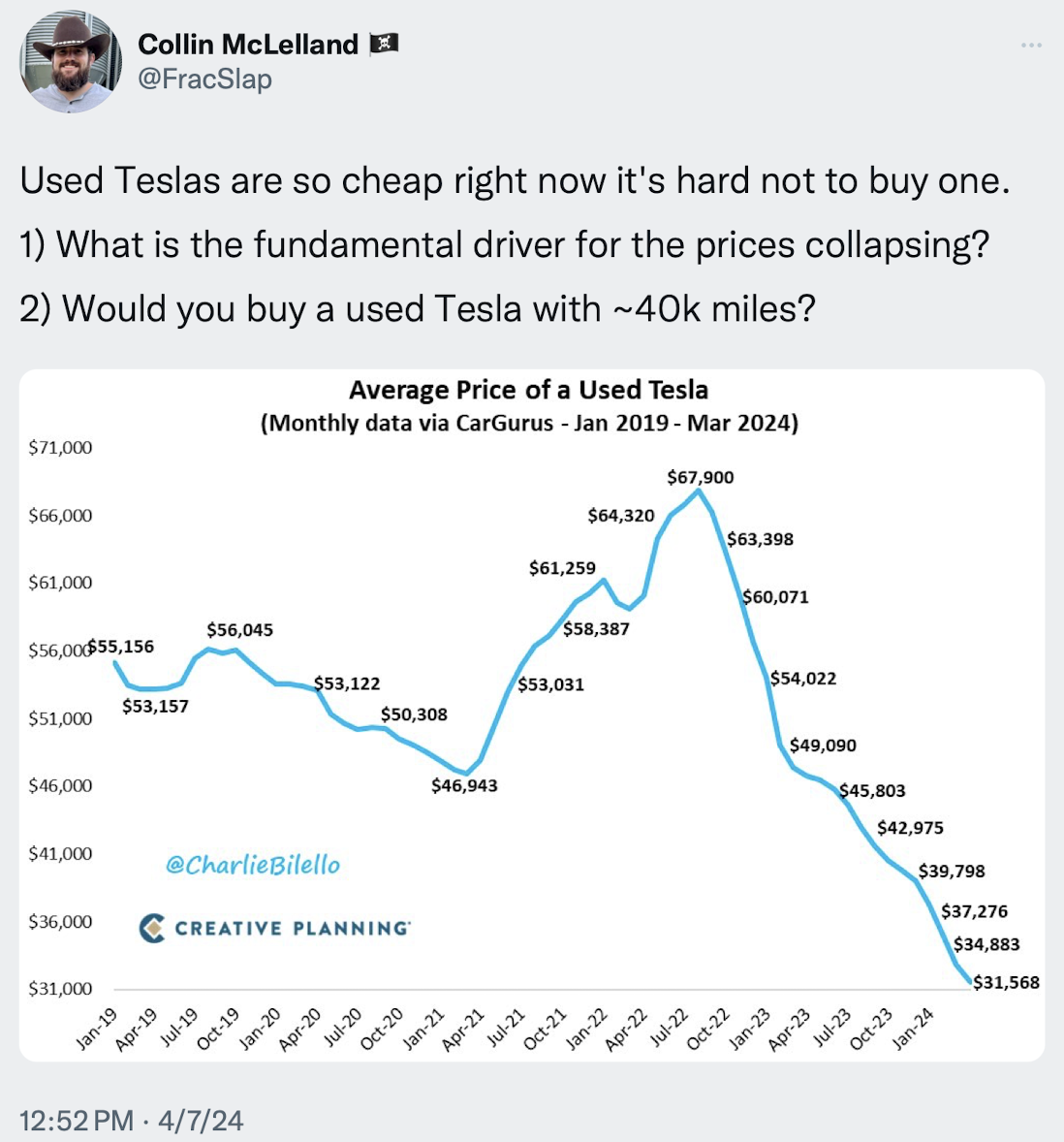

70% Off Is The New Normal

When the public began to realize that WFH was not going away, the values of office buildings began to plummet, especially in the U.S.

However, it is clear that the value discount from WFH is likely to be more significant.

Admittedly, this is anecdotal, but I keep reading about office buildings selling for 70% less than they were valued pre-pandemic.

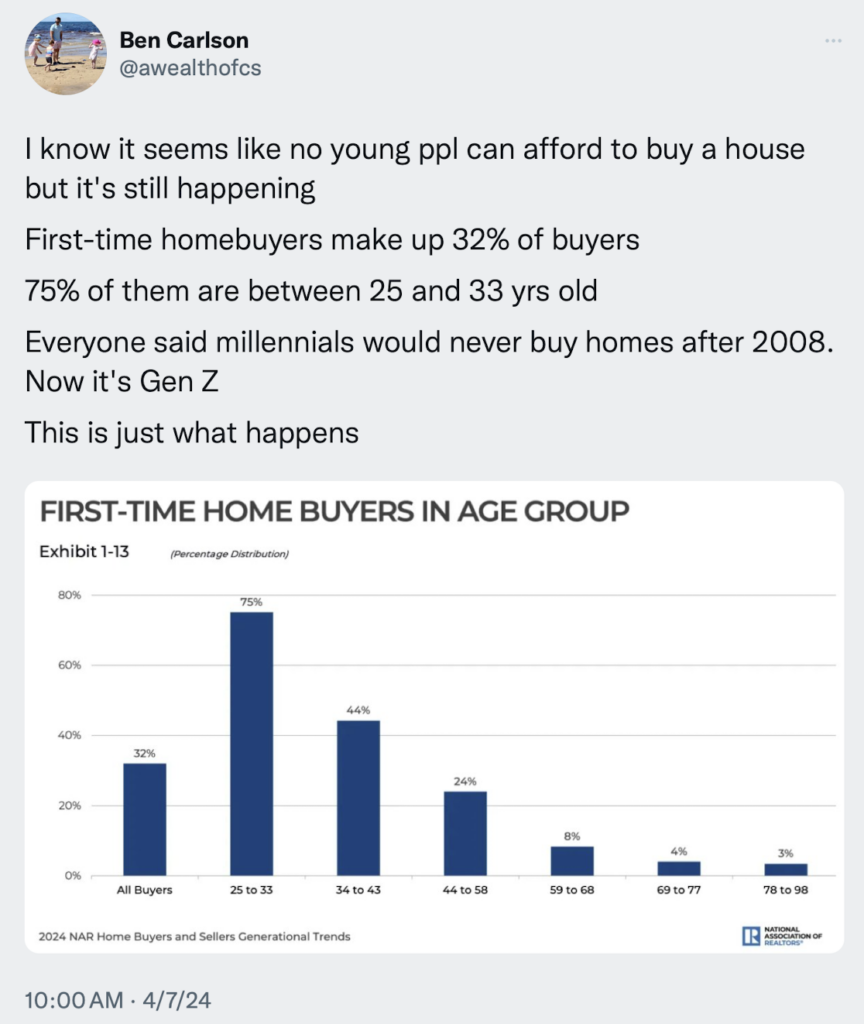

I Fear For My Children And Other ‘Doom & Gloom’ Forecasts About Housing

A good friend I met in college told me about twenty years ago, that he feared for his kids, that they would never be able to afford a home when they were adults. Of course, three kids later, they all have homes. I have four kids from ages 25 to 35, and among them, they have bought and sold five homes and given us four grandchildren so far. I know this kind of logic is cringy, but when we think about macro forces in the economy, I grow weary of the absolutism that no one can buy a home. I realize that many can’t, but it’s hard to square with the aggregate data. This is explained well in “Generational Luck in the Housing Market.“

Highest & Best Newsletter: 💎 Ritzy Foreclosure Suit

If you’re interested in the Florida housing market, you should sign up for this Florida newsletter, Highest & Best, from Oshrat Carmiel, formerly of Bloomberg News…

This week’s post:

💎 Ritzy Foreclosure Suit A loan default; Blackstone buys Miami; Apple finds an office

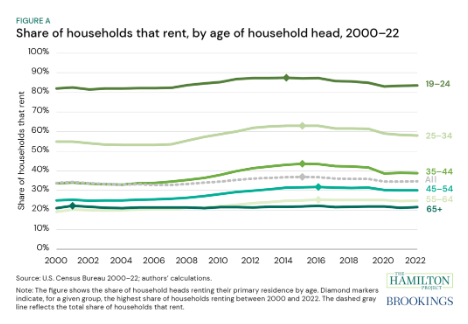

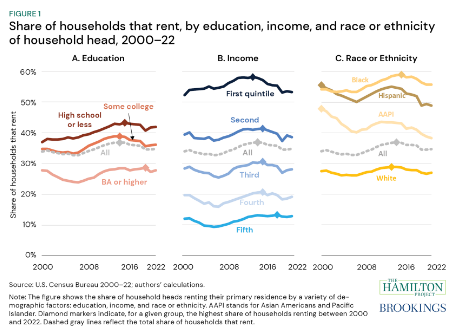

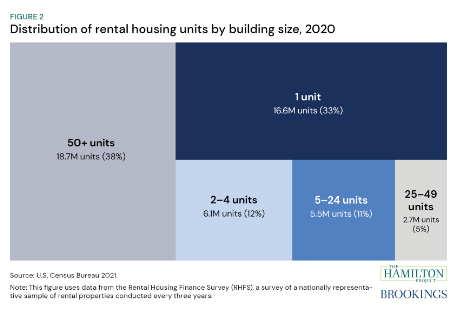

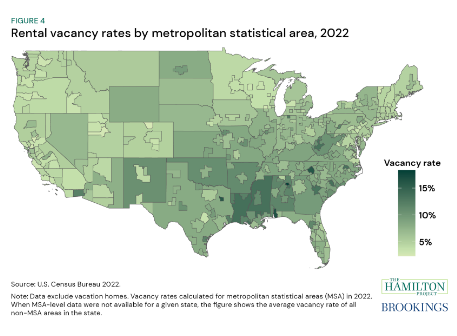

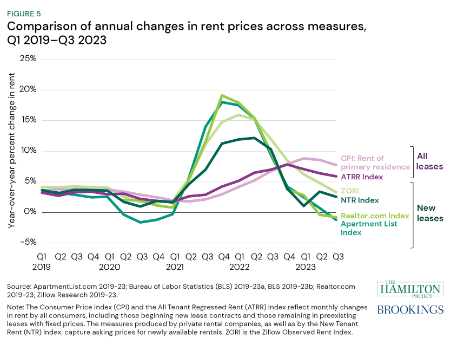

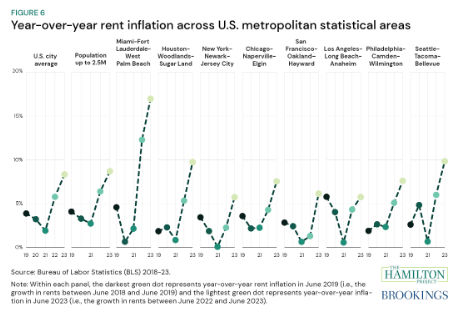

A Rental Economy Chart Jam Via The Hamilton Project

I encourage you to read about the rental housing market summary from the Hamilton Project.

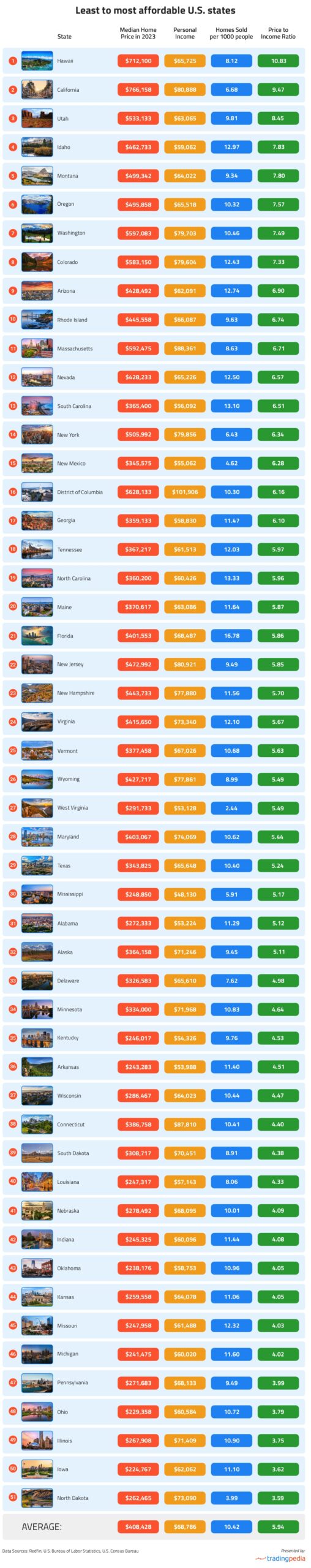

States Ranked By Affordability

I tend to avoid listicles like this, but I was surprised by some unexpected result, with Utah and Montana appearing near the top of the list. Of course, the local income levels are the differentiating factors.

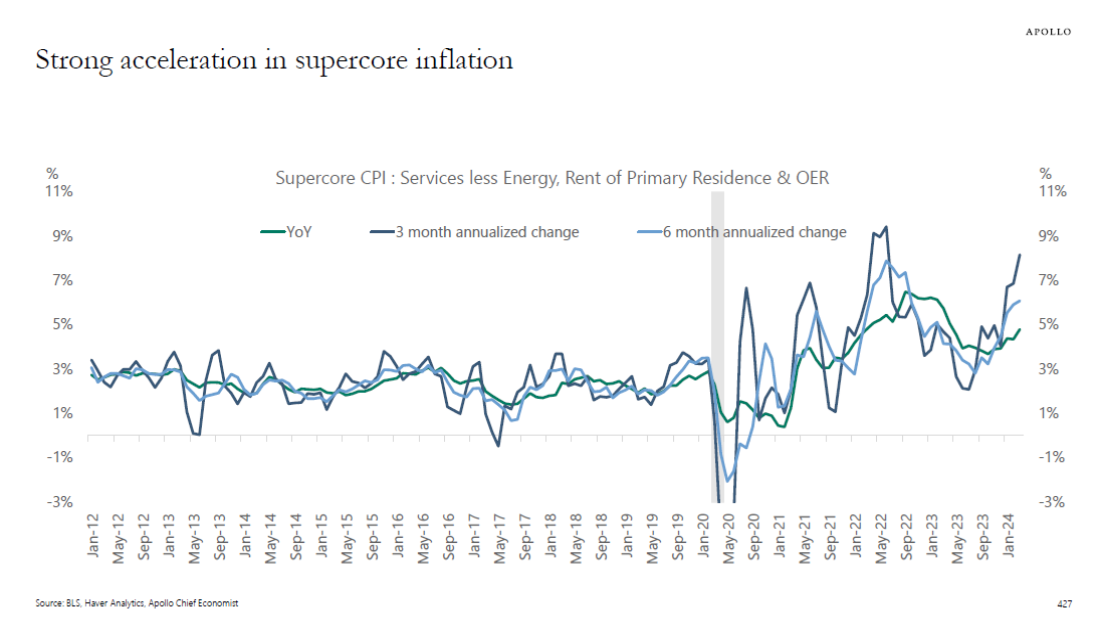

Central Bank Central Interview: Levin Sees “Material Risk” Inflation Not Heading Back to Fed’s 2% Target

Here’s a substack I’m excited about – Kathleen Hays Presents Central Bank Central. I highly recommend it. A long-time friend and journalist, Kathleen Hays has extensive experience interviewing economic experts in Fedworld from her time at Bloomberg Television.

Central Bank Central: Levin Sees “Material Risk” Inflation Not Heading Back to Fed’s 2% Target

Getting Graphic

Favorite housing market charts of the week of our OWN making

Favorite housing market/economic charts of the week made by OTHERS

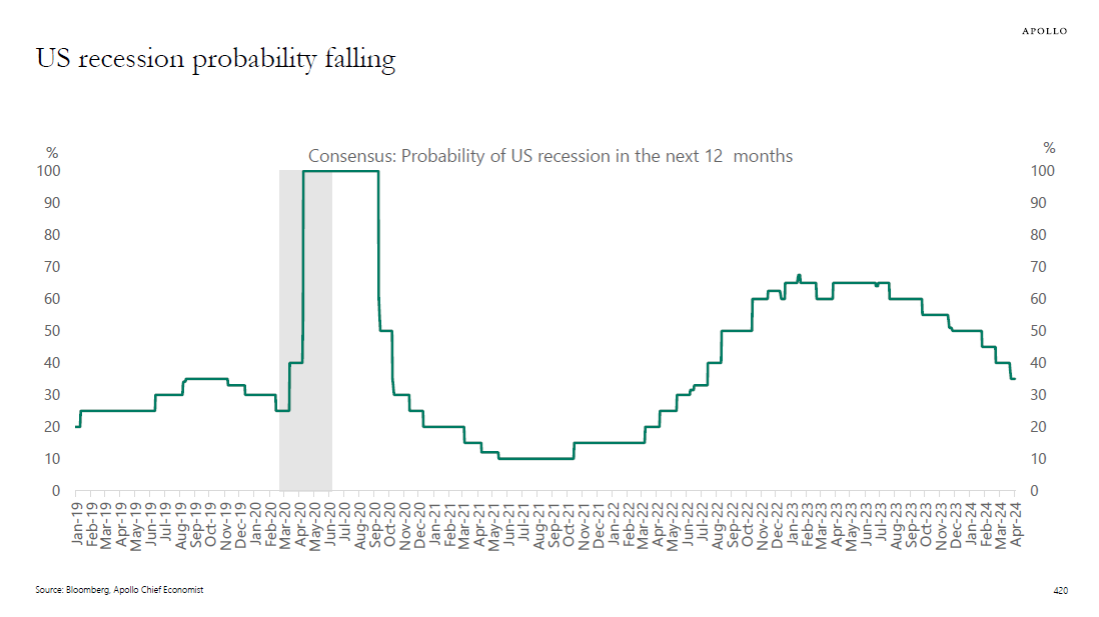

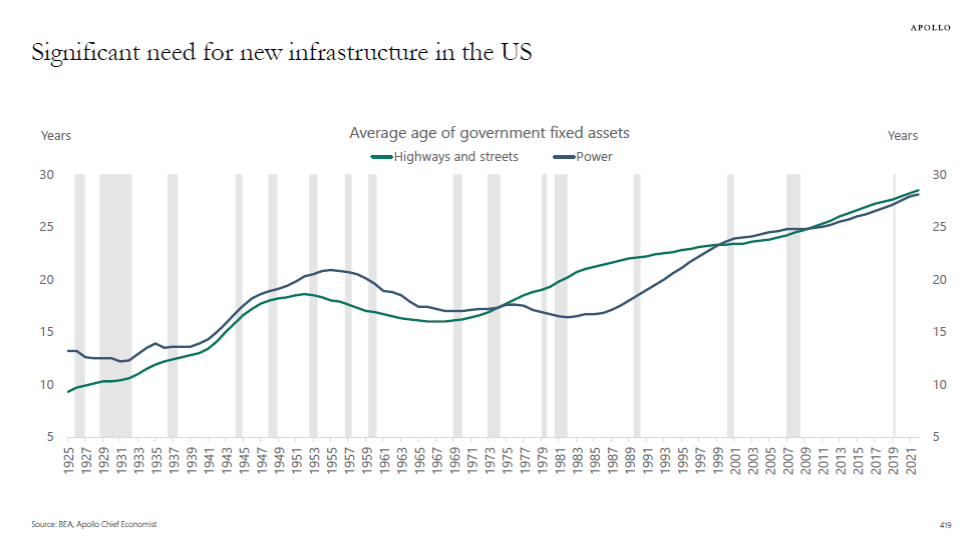

Apollo’s Torsten Slok‘s amazingly clear charts

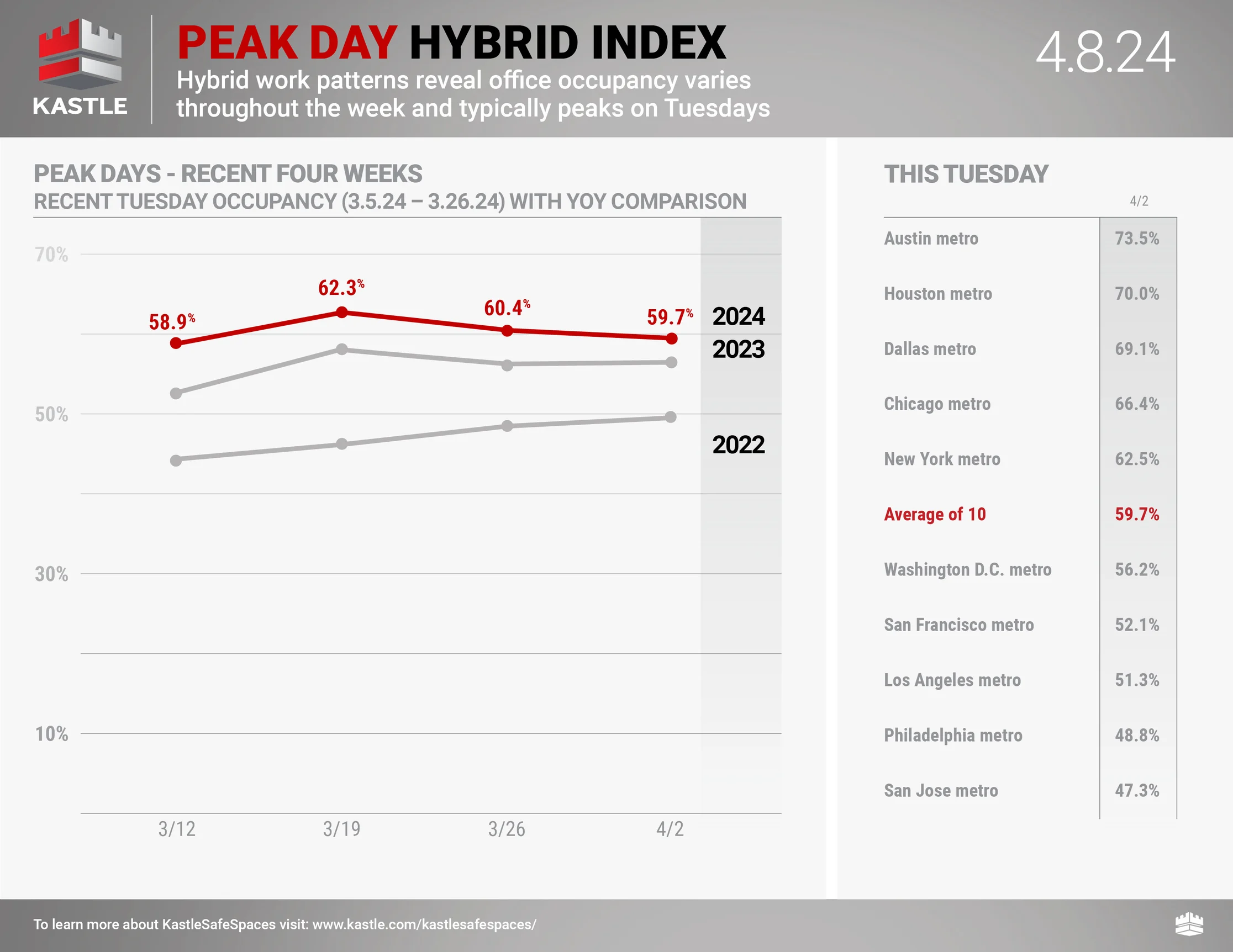

Kastle card swipe data

Remember that Kastle charts are overstating occupancy* because their pre-pandemic occupancy benchmark was 100%, which is incorrect (*measures card swipe activity as a proxy for occupancy). Still, they’ve become the standard benchmark for occupancy rates.

Favorite RANDOM charts of the week made by others

Appraiserville

JA Wants Back Into The Appraisal Institute For The Grift & Power He Coveted

It’s Spring, and we know what that means – elections for the AI C-Suite. There are two candidates this year that the National Nominating Committee (NNC) nominated, and their final selection will be made the day before the May 8 AI BOD meeting. Then the BOD has 30 days to ratify the NNC choice. If any BOD member(s) wants to implement the sham petition process, they must do so within the thirty days and don’t need to share this effort until the 30th day if they wish. They only need 30% of the board to initiate the sham petition process, which is an insult to the membership because the whole purpose of the SPP is to eliminate what the membership had voted for. It was invented by an FOJ crony years ago to insert Sellers onto the president track when he threw a hissyfit that the NNC didn’t select him. In the future, I’d love to see the SPP removed from the bylaws if AI wants to maintain election integrity and provide respect to the membership (to whom the BOD really reports).

Each candidate was asked to answer a series of questions. As members, you have them so that I won’t clutter up this post.

Let’s start with “Tank” – a hard-core JA disciple promised the presidency by the previous CEO (JA) if he became part of the sham petition process (ignoring the membership’s recommendations) so he could fly first-class to Munich to drink beer paid by membership. At that moment, I found Tank’s decision an absolute collapse of credibility for him being any part of National leadership EVER.

Craig then beat him in the election despite JA telling Tank he could get the necessary board votes. Suppose you vote for Tank, and he wins. In that case, you essentially guarantee that the Appraisal Institute will descend back into the dark days of grift that the current officers Sandy & Paula once enjoyed and re-focus on what the leadership (first-class flights with their significant support spouse to drink beer in Munich on the membership’s dime) and of course ignoring membership needs and not telling them anything about their actions. This is the moment to determine which direction AI goes. (Forward with Craig or Backward with Tank).

Here is some feedback on Tank’s answers to the questionnaire:

- 2. He’s never served as chapter president. If the chapter doesn’t trust him to lead it, why should National?

- 3. He served on the Education Committee and never informed the board about its problems. Given the collapse of AI’s education program reputation, he was part of the do-nothing problem.

- 4. The best way to optimize education delivery is online and sell the use of the platform to other appraisal organizations. His solutions are too convoluted, although he says in the next question they’re “easy.”

- 5. He talks a lot about his role with CFMAP and GSPT. I hope someone raises his role in dividing the board for years with his questionable petition.

- 6. Actually, the target market for new members is the real estate agents that will be out of business with the NAR settlement. AI should have a plan to give education and experience credit to those agents who want a designation. Make it an easy transition when they’re afraid about their careers, and they’ll be with you forever.

- The rest is a lot of recycled propaganda we’ve all heard for years with no results.

Here is some feedback to Craig’s answers to the questionnaire:

- 1. Good answer to Q1.

- 2. I LOVE the chatbot idea for the body of knowledge. That’s a winner.

- 3. Great shout out to Johnson and Wright on the Education Committee.

- 4. Good job on the goals, and you mentioned your work ethic.

- 5. I like the expanded budget for officers to visit chapters. The us versus them attitude developed from watching officers chugging beers in Munich on Facebook and ignoring the needs of dues-paying members.

- 6. Good stuff in Q6 and continue to stress the independence the profession affords to practitioners.

- 7. Good responses to the rest of the questions.

Here’s what this election comes down to:

If you vote for Tank, he’s shown that he’s all about moving AI backward to the days of grift to all the friends of JA (FOJs). He is a faithful JA sycophant and stands for the past. He is not a leader; he’s a follower (a follower of JA). Who in membership doesn’t get this unless you are an FOJ?

If you vote for Craig, he’s already proven as President that he’s all about moving AI forward and refocusing the institution away from the self-dealing that defined AI for the past two decades. When the sham petition process was defeated with the election of Craig over Tank in 2020, AI began to get fixed, moving away from the grifting and entitlement, and leadership began to behave better, eventually causing JA to resign.

Good riddance. JA proved that he has no business being any part of AI National and so a vote for Tank is a vote for JA. Two executive committee members were inserted via the sham petition process to keep JA in power: Sandy & Paula. I sincerely hope the membership realizes this and that a vote for Tank makes the severe threat to AI’s future very real.

This is it, my friends. FOJs are responsible for damaging the AI brand. Let’s hope this election will keep out an unneeded FOJ grifter that will put in motion the end of AI as a respected institution and brand damage the appraisal industry even more.

VOTE FOR CRAIG AS IF YOUR CAREER DEPENDED ON IT.

OFT (One Final Thought)

The science of performance motivation is explained in scientific detail.

Brilliant Idea #1

If you need something rock solid in your life – particularly on Friday afternoons at 2:00 PM, Eastern Time (ET) – and someone forwarded this to you, you can sign up here for these weekly Housing Notes. And be sure to share with a friend or colleague if you enjoy them because:

– They’ll look for cicadas;

– You’ll stop looking at the sun;

– And I’ll be sitting on the bench.

Brilliant Idea #2

You’re clearly full of insights and ideas as a reader of Housing Notes. Consider sharing them with me early and often. I appreciate every email I receive, as it helps me craft future Housing Notes.

See you next week!

Jonathan J. Miller, CRE®, Member of RAC

President/CEO

Miller Samuel Inc.

Real Estate Appraisers & Consultants

Matrix Blog @jonathanmiller

Reads, Listens and Visuals I Enjoyed

- Market Research: The Least and Most Affordable U.S. States to Buy a Home [Tradingpedia]

- 💎 Ritzy Foreclosure Suit [Highest & Best]

- Ten economic facts about rental housing [The Hamilton Project]

- The Brutal Reality of Plunging Office Values Is Here [Bloomberg]

- Inside the “standoff” over what office buildings are worth [Axios]

- Congress’ Quest to Ban Investors from Single-Family Rentals [The Real Deal]

- New Legislation Proposes to Take Wall Street Out of the Housing Market [NY Times]

- Levin Sees "Material Risk" Inflation Not Heading Back to Fed's 2% Target [Kathleen Hays]

- A Cut Above: U.S. Public Equity REIT Occupancy Rates [REIT]

- How Dallas Newcomer Stephen Kotler Plans to Grow Douglas Elliman's Local Market Share [D Magazine]

- Sold for $85 million: Vacant lot of about an acre has 225 feet on the ocean in Palm Beach [Palm Beach Daily News]

- NAR president talks ‘stability’ — and dollars and cents [Real Estate News]

- DOJ will intervene in NAR’s commission lawsuit settlement: KBW analysts [HousingWire]

- How Have Recent Rezonings Affected the City’s Ability to Grow? [Furman Center]

- Households May Finally Be Adjusting to Higher Mortgage Rates [FannieMae]

- How to Lie With Charts [A Wealth of Common Sense]

My New Content, Research and Mentions

- Manhattan Rents Tick Down As More Renters Choose The Boroughs [Bisnow]

- Exclusive | Late Designer Max Azria’s Massive Compound is Heading To Auction [Wall Street Journal]

- Billionaire shampoo honcho cleans up with $20M sale of Upper East Side townhouse [Crain's New York]

- Once again, Brooklyn sales decline but this time it's good news [Brick Underground]

- Manhattan median rent reached the second-highest March on record [Brick Underground]

- NYC Rents Remain High as Mortgage Rates Hold at 7 Percent [The Real Deal]

- Manhattan Apartment Rents Drop in Sign of Market’s Stability [BNN Bloomberg]

- Brooklyn Real Estate Prices Hold Steady in First Quarter [Brownstoner]

- City rents dip overall, and the outer boroughs reap the benefits [Crain's New York]

- NYC March rents dip in Manhattan, Queens but climb in Brooklyn [NY Daily News]

- Manhattan Apartment Rents Drop in Sign of Market’s Stability [Bloomberg]

- The Hidden Costs of Homeownership Are Skyrocketing [Wall Street Journal]

- Manhattan Co-Op and Condo Market's Sales Decline, Prices Increase [Habitat Magazine]

- Doctors making $350K are struggling to find Long Island homes [Crain's New York]

- Doctors Making $350,000 Are Struggling To Find Long Island Homes [Financial Advisors]

- Doctors Making $350,000 Are Struggling to Find Long Island Homes [Bloomberg]

- Rupert Murdoch Makes Another Bid to Sell One Madison Condo [The Real Deal]

- Rupert Murdoch’s NYC Penthouse Listed Again, Down $23 Million From First Price [Bloomberg]

Recently Published Elliman Market Reports

- Elliman Report: Putnam & Dutchess Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Westchester Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Riverdale Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Queens Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Brooklyn Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 3-2024 [Miller Samuel]

- Elliman Report: California New Signed Contracts 3-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 3-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 3-2024 [Miller Samuel]

- Elliman Report: Manhattan Sales 1Q 2024 [Miller Samuel]

Appraisal Related Reads

- Wait, so rates aren’t going down now? [Sacramento Appraisal Blog]

- Appraisal Institute Update for the First Quarter of 2024 [EIN News]

- What's Up With Insurance? [CRE]

Extra Curricular Reads

- O.J. Simpson, Football Star Whose Trial Riveted the Nation, Dies at 76 [NY Times]

- MLB is trying to find answers to the pitching injury crisis. It’s going to take a while [The Athletic]

- Philippe Aghion | The Growth and Employment Effects of AI [San Francisco Fed]

- Deciphering Avian Emotions: A Novel AI and Machine Learning Approach to Understanding Chicken Vocalizations [Research Square]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)