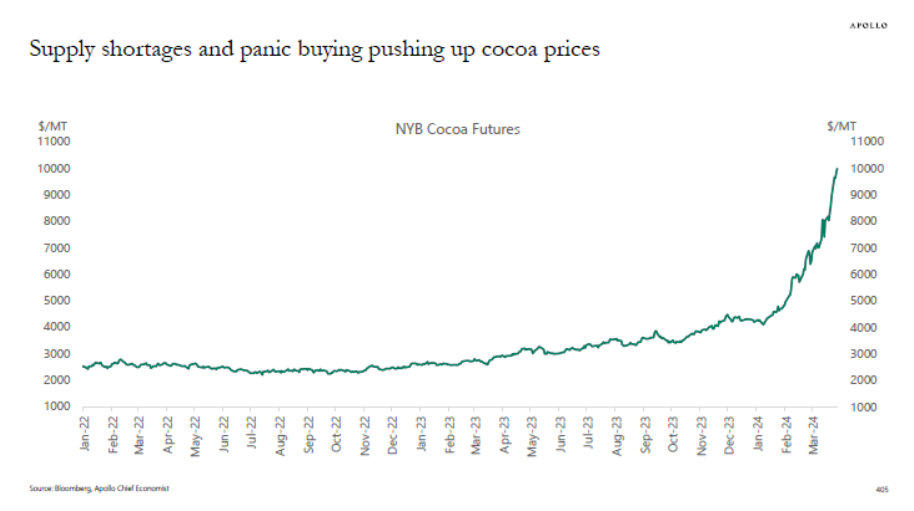

Cocoa faces challenges similar to housing in this excellent JPMorgan research paper on the causes of the chocolate crisis: climate change, lack of investment, limited supply, and shrinkflation. Also, consider the cost of lodging in the best places to view the eclipse on Monday.

Consider what can be learned from different statistical interpretations of climate change:

Or the economic signs generated from natural events as measured with alternative metrics like (counting open Waffle Houses during hurricanes) or relying on Super 8 Hotel prices or Airbnb/VRBO bookings for eclipse sightings.

As I Write Housing Notes, A 4.8 Magnitude Earthquake Hits NYC!

One more message from nature this morning in the form of an earthquake – as I was writing these Housing Notes from my home in Connecticut, my house rattled vigorously for at least 10 seconds. Immediately, I got texts from family and friends stretching from NJ to NYC to Albany, New York, and Connecticut, sharing the experience. But as our region always resolves after an event:

Did you miss last Friday’s Housing Notes?

March 29, 2024: The Future of Real Estate Brokerage That Once Had Its Max Headroom

But I digress…

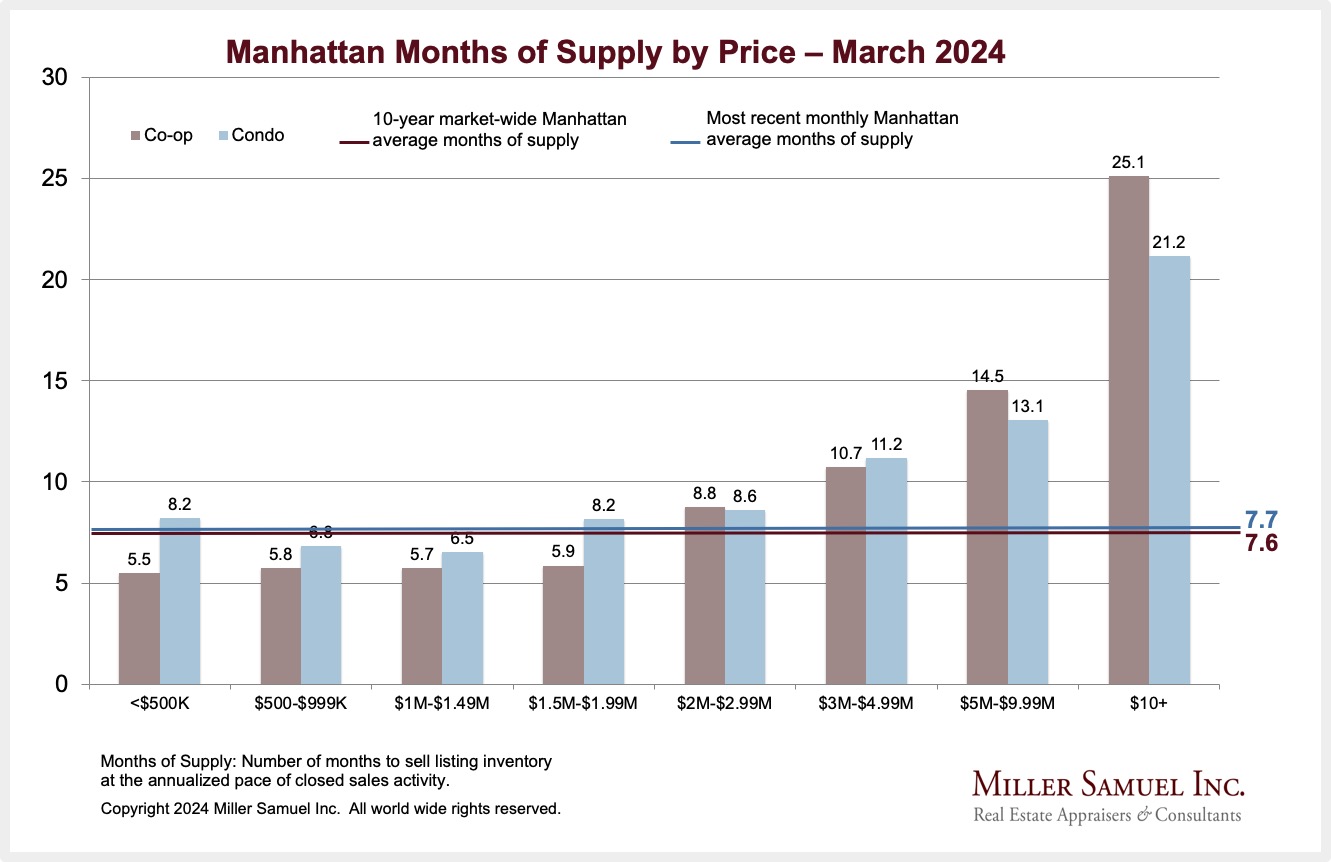

Manhattan Q1-2024 Sales Fell To Their Lowest Level In Three Years

I’ve been the author of the expanding series of market reports for Douglas Elliman since 1994. This is the first report we published back then focused on Manhattan.

MANHATTAN SALES MARKET HIGHLIGHTS

Co-ops & Condos

Elliman Report: Q1-2024 Manhattan Sales

“Cash sales continued to rise, but not enough to keep the overall market rising.”

- – All overall price trend indicators slid year over year, on par with pre-pandemic levels

- – Listing inventory edged lower year over year for the fourth consecutive quarter due to the lock-in effect

- – Overall sales fell below two thousand for the first time in three years, yet the share of cash sales were the third-highest on record

- – First-time buyers account for slightly more than one out of four sales, the lowest tracked in a decade.

- – All co-op price trend indicators increased year over year with a near-record market share for cash sales

- – All condo price trend indicators slipped year over year, with the third-highest cash market share on record

- – All new development price trend indicators increased year over year as its share of overall sales rose

- – New development sales declined year over year at the lowest rate in seven quarters as listing inventory remained limited

- – Four out of ten resales that closed in the quarter saw price cuts, more than the previous year

- – Luxury median sales price, representing the top ten percent of all sales, rose year over year for the fourth consecutive quarter

- – Luxury listing inventory increased year over year for the first time in four quarters

- – Luxury entry threshold fell annually for the first time in four quarters

New York Metro Dominates U.S. Counties With Highest Property Taxes

Property taxes are high around NYC, often because of overlapping municipal services.

…on a closer look at the property taxes relative to the median sales price of housing, the results get turned around a bit:

March New Signed Contracts And New Inventory Rise Annually

Since the pandemic, we’ve been pushing out a series of new signed contract reports in different regions of the country.

- Elliman Report: March 2024 New York New Signed Contracts

- Elliman Report: March 2024 Florida New Signed Contracts

- Elliman Report: March 2024 California New Signed Contracts

The general theme is that both newly signed contracts and new listings are generally expanding across all three regions. Here is a sampling of charts across the three regions

A Quick Shoutout To Ilyce Glink of Think Glink

Years ago, I met Ilyce Glink at an Inman Conference, and we ended up running into each other more often over the next decade or so. She is a prolific producer of content in the personal finance space, a radio host and has the catchiest last name there is. I’ve been reading her substack regularly: Exploring Truths, Lies and Life’s Financial Milestones.

She’s got other interesting sites to check out as well: BestMoneyMoves.com ThinkGlink.com ThinkGlinkMedia.com

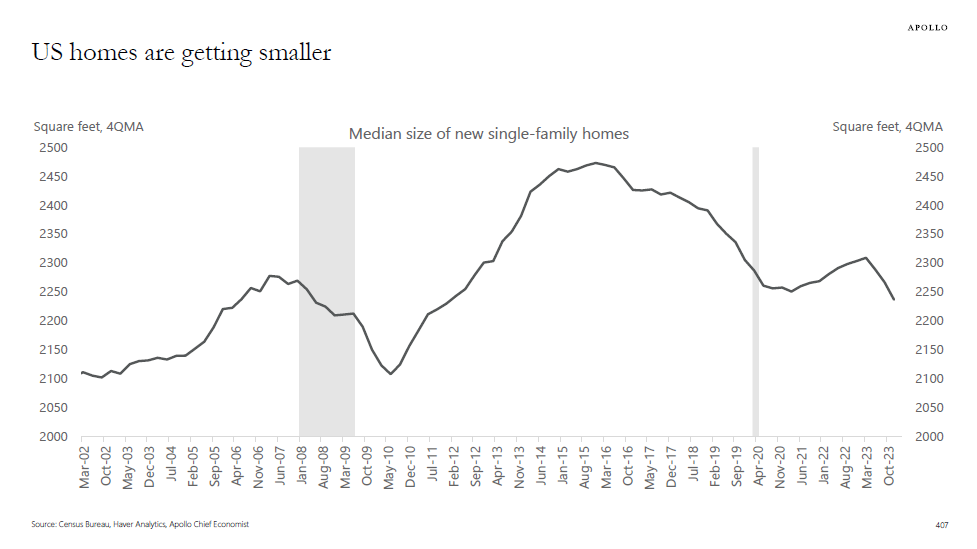

With The Chronic Existing Inventory Shortage, A Record One Out Of Three Listings Is New Construction

After the 2008 financial crisis, one out of 20 homes for sale was a new home. Today, one out of three homes for sale is a new home, see chart below.

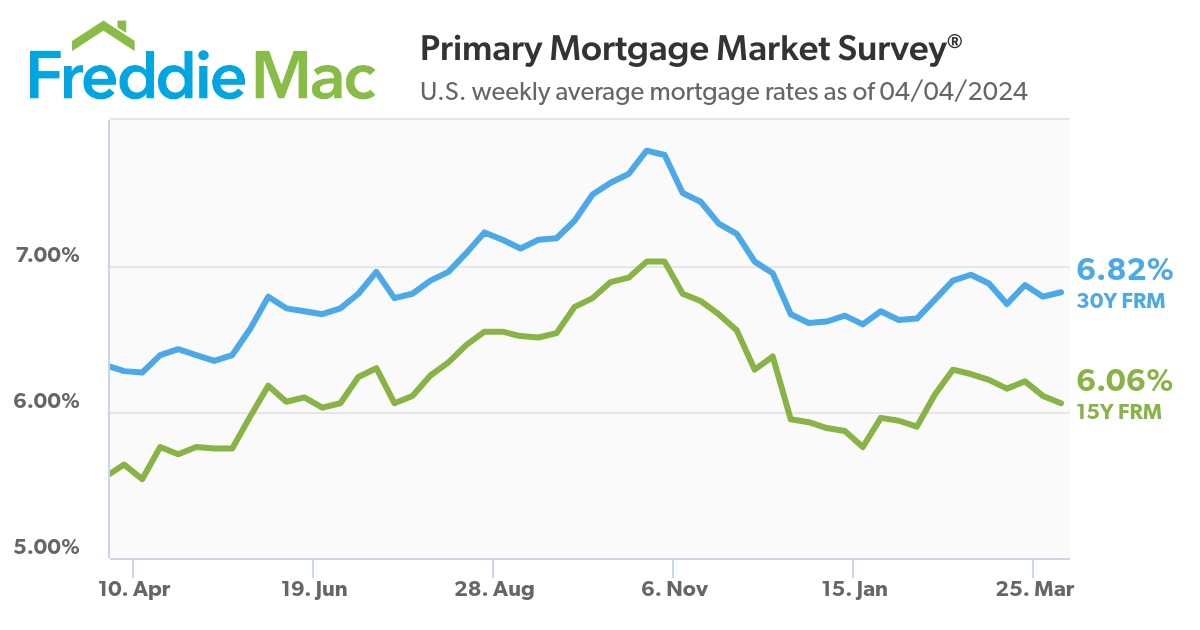

The source of the current low inventory of existing homes for sale is the lock-in effect, as homeowners with low mortgage rates are unwilling to sell their homes and buy a new one at a much higher mortgage rate.

Torsten Slok, Apollo

Buyers’ Greed On Stocks Has Gone Neutral

This CNN-created index is intended to identify the emotion driving the stock market. One of the housing market characteristics in NYC is that higher-end buyers are paying an unusually elevated share of cash, and presumably, that is coming from withdrawing equity from the financial markets.

This index just dropped from greed into neutral territory as the realization begins to hit investors that the Fed may not drop rates in 2024 as they suggested last December.

Highest & Best Newsletter: 💰Millionaire Must-Haves

If you’re interested in the Florida housing market, you should sign up for this Florida newsletter, Highest & Best, from Oshrat Carmiel, formerly of Bloomberg News…

This week’s post:

💰Millionaire Must-Haves – A college campus, a third mansion, and a rural religious community

When Harlem Rent Parties Were The Thing

Last weekend, the NYTimes real estate section had a fascinating article on Harlem Renaissance Rent Parties: The Rent Was Too High So They Threw a Party

During the Harlem Renaissance, some Black people hosted rent parties, celebrations with an undercurrent of desperation in the face of racism and discrimination.

New York Times

How Some Top LA Real Estate Brokers View The NAR Settlement

This interview was long but had some perspectives and workarounds to ensure the buyer was represented. Yes, some “entitlement talk” is sprinkled into the conversation, but who wouldn’t be frustrated with NAR? The trade group avoided the commission issue until it could no longer avoid the DOJ. It ended up sandbagging its members with the settlement terms they negotiated in the class action and other litigations.

Remember that a massive swath of NAR members only pay their dues because access to most MLS systems is required. I suspect NAR’s days are numbered, and membership totals will collapse.

Central Bank Central Interview: Dudley Not Ready to Leave “Higher for Longer Camp” on Rate Outlook

Here’s a new substack I’m excited about – Kathleen Hays Presents Central Bank Central. I highly recommend it. A long-time friend and journalist, Kathleen Hays has extensive experience interviewing economic experts in Fedworld from her time at Bloomberg Television.

Central Bank Central: Dudley Not Ready to Leave “Higher for Longer Camp” on Rate Outlook

Getting Graphic

Favorite housing market charts of the week of our OWN making

Favorite housing market/economic charts of the week made by OTHERS

Apollo’s Torsten Slok‘s amazingly clear charts

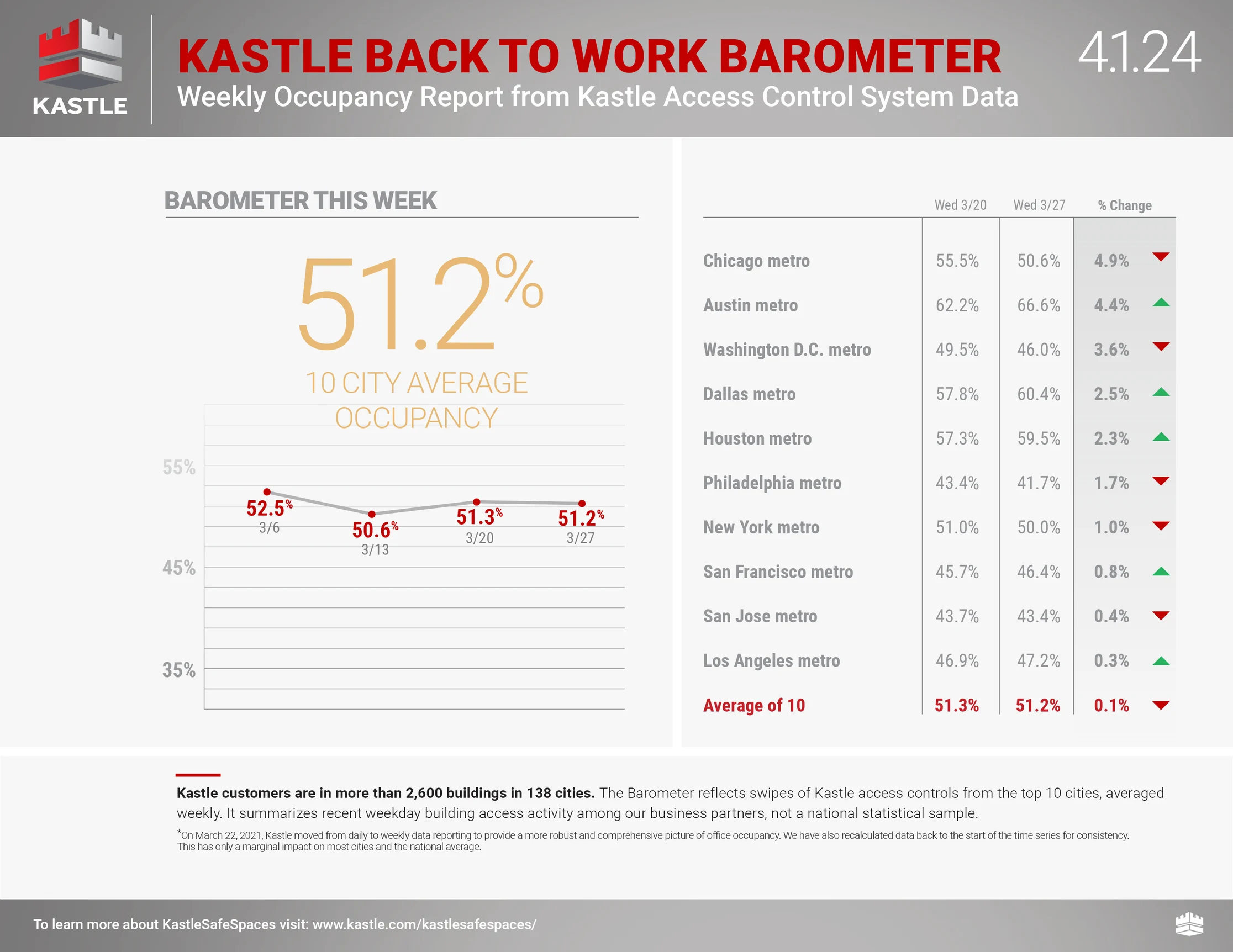

Kastle card swipe data

Remember that Kastle charts are overstating occupancy* because their pre-pandemic occupancy benchmark was 100%, which is incorrect (*measures card swipe activity as a proxy for occupancy). Still, they’ve become the standard benchmark for occupancy rates.

Favorite RANDOM charts of the week made by others

Appraiserville

Valuation Connect Wants Copies Of Our Drivers Licenses

This firm hasn’t awarded us work in about two years, and they only hire us when they are in a jam, and we require the local market rate. Immediately after asking for our driver’s licenses, which we didn’t provide, we got a request for a hybrid appraisal in Manhattan, the most expensive housing market in the U.S., for a whopping $220 (sarcastically).

They plan to have an unlicensed inspector walk into a Manhattan co-op apartment building rather than have us inspect it ourselves. We would base our appraisal report on their inspector’s information for that non-market rate fee. We have no idea about their inspector’s expertise level, nor is that “industry” regulated, and no standards have ever been established.

Based on the local market appraisal fee, Valuation Connect values the “appraisal expertise” component of a hybrid appraisal at 18% of what the consumer pays for an appraisal.

How does the hybrid model even begin to work in a specialized location like Manhattan?

Nope.

[Podcast] Lyin’ Dave’s Handpicked Successor Is A Wolf in Sheep’s Clothing

For the uninitiated, TAF is the organization that wrote the bat-shit crazy letter, the chickenshit letter and is the subject of an active investigation by HUD on whether USPAP promotes a lack of diversity in the appraisal profession (400th out of 400 occupations, according to BLS in 2021). As a reminder, former TAF president Dave Bunton called me a liar in a February 2024 public forum in Washington, D.C., as he was lying (not under oath) – hence his new nickname “Lyin’ Dave,” a.k.a. “LD.”

After Lyin’ Dave lied about his replacement to CFPB and the entire ASC during the fourth appraisal bias hearing, he “soon” picked KD as his successor even before the BOT voted on it. As I’ve said here in Housing Notes many times, LD would get a lucrative consulting contract, and of course, he did.

The April Fools Day Edition of TAF’s podcast, Appraiser Talk: Episode 147: A Chat with The Appraisal Foundation’s New President Kelly Davids. Nothing is gained by listening to it unless you want to listen to (someone said to me) “Wolf In Sheep’s Clothing” about what LD has already set up over the past 33 years.

OFT (One Final Thought)

TEXT

Brilliant Idea #1

If you need something rock solid in your life – particularly on Friday afternoons at 2:00 PM, Eastern Time (ET) – and someone forwarded this to you, you can sign up here for these weekly Housing Notes. And be sure to share with a friend or colleague if you enjoy them because:

– They’ll see the eclipse;

– You’ll book a room in a Super 8;

– And I’ll ride an earthquake.

Brilliant Idea #2

You’re clearly full of insights and ideas as a reader of Housing Notes. Consider sharing them with me early and often. I appreciate every email I receive, as it helps me craft future Housing Notes.

See you next week!

Jonathan J. Miller, CRE®, Member of RAC

President/CEO

Miller Samuel Inc.

Real Estate Appraisers & Consultants

Matrix Blog @jonathanmiller

Reads, Listens and Visuals I Enjoyed

- DOJ can reopen its investigation into NAR, appeals court rules [Real Estate News]

- Fly Me To The Moon: The Need For U.S. Lunar Development Legislation That Balances Property Rights, Commercial Incentives, & International Obligations [Counselors of Real Estate]

- Real Estate Commissions Are Going to Fall. These Stocks Can Weather the Storm. [Barron's]

- Opendoor will refund homesellers $62M under FTC settlement [Inman]

- World’s richest: Palm Beach is home to 58 billionaires, says our look at 2024 Forbes data [Palm Beach Daily News]

- Majority of older homeowners plan to stay in their home as they age: Redfin [HousingWire]

- You'll need more than $100,000 in income to afford a typical home, studies show [NPR]

- Amazon Billionaire Bezos Buys 3rd Indian Creek Mansion [The Real Deal]

- OPINION: It’s time to take back our housing from Wall Street [The Nevada Independent]

- Buyer agreements work, sellers still willing to pay: Baird & Warner [Real Estate News]

- CoStar News – Bob Knakal Launches Investment Sales Firm With Artificial Intelligence Focus [CoStar]

- Can My Landlord Force Me to Use a Rent Guarantor? [NY Times]

- The Rent Was Too High So They Threw a Party [NY Times]

- Office Market Still Moving In Wrong Direction For Manhattan Landlords [Bisnow]

- How canny foreigners are investing their way into a green card [NY Post]

- CoStar News – Property Prices, Transaction Volume Slide as Demand for Space Plummets [CoStar]

- How Much Higher Are Your Post-Pandemic Property Taxes? [NY Times]

- A Reporter Appraises the State of Real Estate [NY Times]

- Why buying a house feels impossible right now [VOX]

- 🧲 Millionaire Magnet [Highest & Best]

My New Content, Research and Mentions

- 💰Millionaire Must-Haves [Highest & Best]

- How U.S. Homeowners Can Cash in on the Domestic Travel Boom [Mansion Global]

- Manhattan co-op and condo deals fall to lowest level in three years [Brick Underground]

- Home Sales Largely Down, New Listings Up In Palm Beach County [BocaNewsNow.com]

- Miami ‘Condo King’ Scores $150 Million for Two Island Penthouses [Bloomberg]

- Currency Angst Goes Global as Strong Dollar Vexes Officials [Bloomberg]

- Risk On: The Bloomberg Open, Europe Edition [Bloomberg]

- Luxury Home Sales in Manhattan Fell During the First Quarter as Prices Continued to Tick Up [Mansion Global]

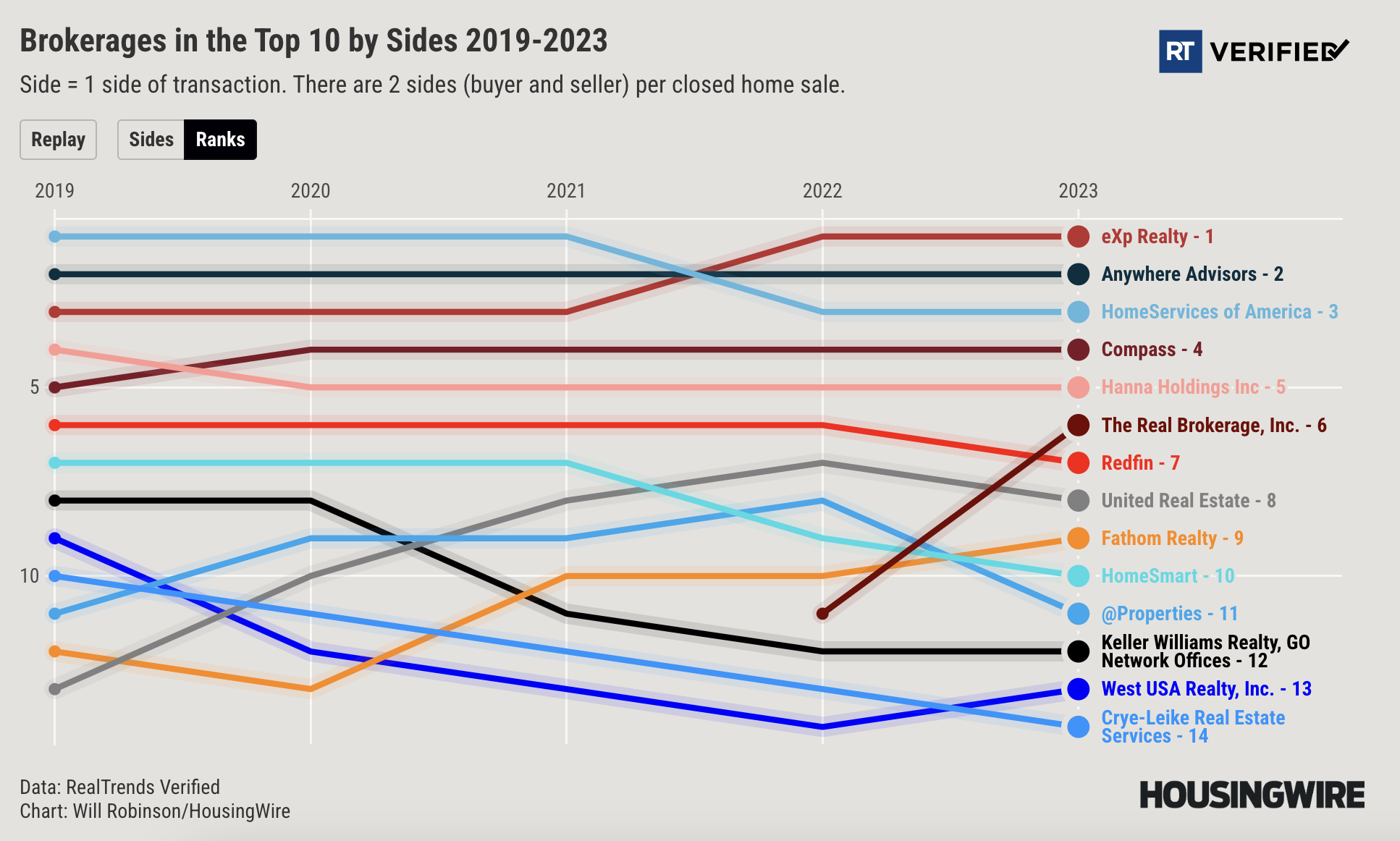

- How the brokerage landscape has changed in the last five years – HousingWire

- Inside Icon’s Plans to Expand 3D-Printed Homes [The Real Deal]

- Why New York City's Condo Market Is an Uncertain Balancing Act [The Real Deal]

- The State of Los Angeles Real Estate A Year Into Measure ULA [The Real Deal]

- Low Inventories, High Mortgage Rates Still Weigh on Housing Market: Miller Samuel [Kathleen Hays' Central Bank Central]

Recently Published Elliman Market Reports

- Elliman Report: California New Signed Contracts 3-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 3-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 3-2024 [Miller Samuel]

- Elliman Report: Manhattan Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 2-2024 [Miller Samuel]

- Elliman Report: California New Signed Contracts 2-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 2-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 2-2024 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 1-2024 [Miller Samuel]

- Elliman Report: Manhattan Decade 2014-2023 [Miller Samuel]

Appraisal Related Reads

- Adding too many ADUs gets awkward [Sacramento Appraisal Blog]

- Maryland Lawsuit Alleged Racial Discrimination [Real Estate Appraisal Nathan Connolly, Shani Mott by Mary Cummins]

Extra Curricular Reads

- Airbnb eclipse bookings illustrate the path of totality [Axios]

- Eclipse’s Path Is Also Leaving a Trail of High Hotel Prices [NY Times]

- Krispy Kreme introduces Total Solar Eclipse doughnuts: How to order while supplies last [USA Today]

- The Kim Mulkey way [Washington Post]

- Analysis | Wait, does America suddenly have a record number of bees? [Washington Post]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)