- U.S. Treasury Has Updated Their Rules On Cash Buyers In Residential Real Estate

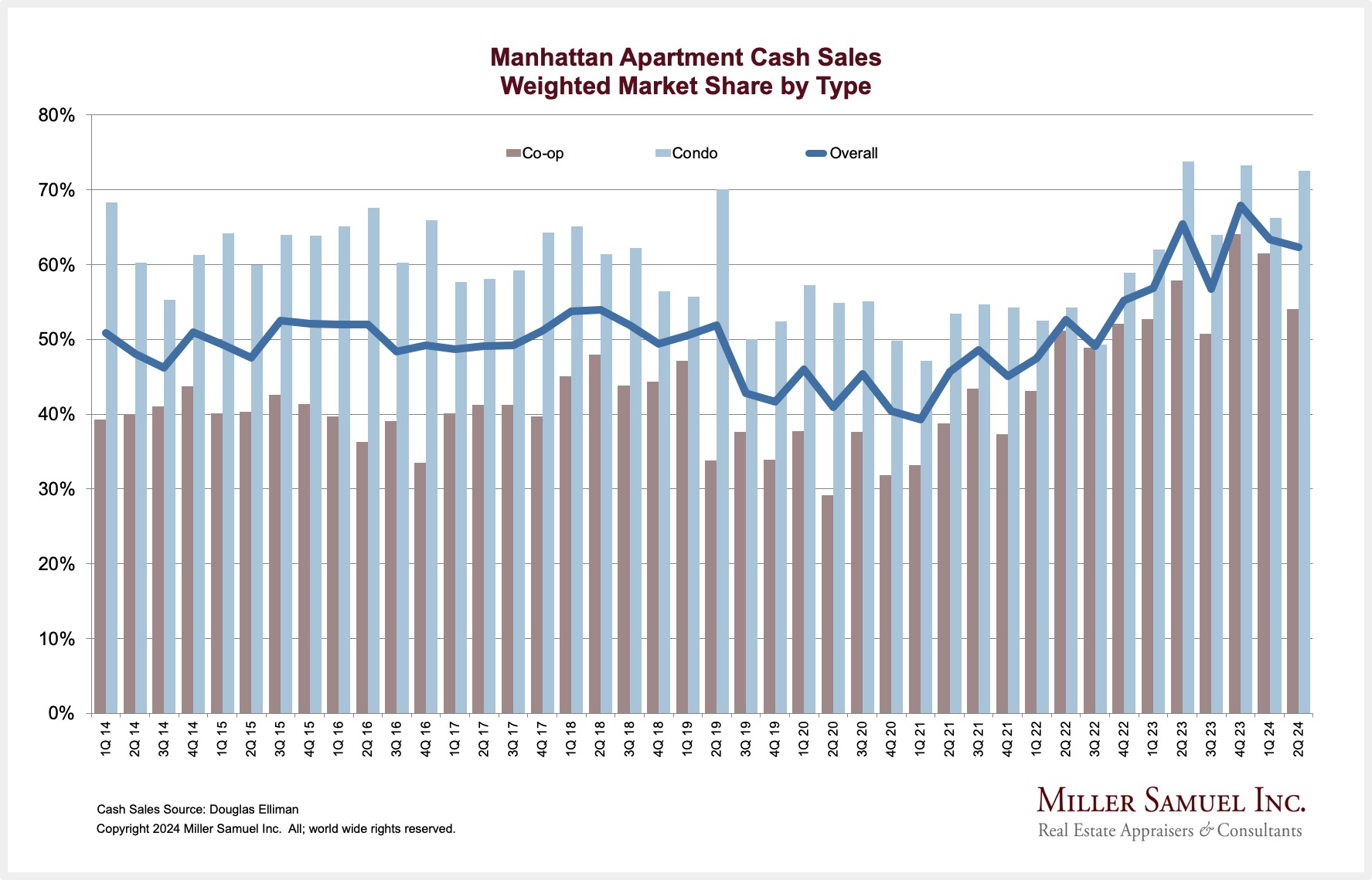

- Higher Mortgage Rates Have Pushed The Share Of Cash Buyers Higher

- Real Estate Agents, Financial Advisors Have More Exposure In the New Rules

I just finished the seminal book on money laundering and kleptocracy, Billion Dollar Whale, which was a spectacular read. Wow. By coincidence, the U.S. Treasury’s FinCEN has published new rules to prevent the flow of illicit money into the U.S. economy, effective January 1, 2026. The new rules were proposed earlier this year. Real estate agents and investment advisors will be subjected to more scrutiny. Initially designed to restrict the use of LLCs to hide the identities of buyers, there were a lot of loopholes in the early efforts to fight it. Back in 2015, when the famous front-page New York Times story was published, Towers of Secrecy, I initially had some doubts that it was as pervasive an issue on the market because it was difficult to separate the impact of the regulations from the market slow down in Manhattan and Miami. Then, I spoke with one of the article authors, did my research, and changed my mind. Real estate has been a favorite way to launder stolen funds because the players in the transaction didn’t have to question the source of the funds, and the transactions could be considerable.

Why should the real estate industry care about money laundering?

- There is now more legal liability to individuals tied to real estate transactions than just title companies, and this is done by implementing a “cascade” method where more individuals file reports. “At the top of the list are professionals who provide settlement services, followed by those who underwrite the new owner’s title insurance policy.”

- “The final residential real estate rule will require certain industry professionals to report information to FinCEN about non-financed transfers of residential real estate to a legal entity or trust, which present a high illicit finance risk. The rule will increase transparency, limit the ability of illicit actors to anonymously launder illicit proceeds through the American housing market, and bolster law enforcement investigative efforts.”

- A 2019 British Columbia government study found that money laundering adds about 5% to home prices.

Here are the facts from the FinCEN residential real estate rule change you probably want to know about.

From FinCEN:

“FinCEN is issuing a proposed rule to require certain persons involved in real estate closings and settlements to submit reports and keep records on identified non-financed transfers of residential real property to specified legal entities and trusts on a nationwide basis. Transfers made directly to an individual would not be covered by this proposed rule. The proposed rule describes the circumstances in which a report must be filed, who must file a report, what information must be provided, and when a report is due. These reports are expected to assist the U.S. Department of the Treasury; Federal, State, and local law enforcement; and national security agencies in addressing illicit finance vulnerabilities in the U.S. residential real estate sector and to curtail the ability of illicit actors to anonymously launder illicit proceeds through the purchase of residential real property, which threatens U.S. economic and national security.”

The real estate sector has been emphasized because it has long been an efficient mechanism to clean funds in large amounts. This piece by GFI is eye-opening: Acres of Money Laundering: Why U.S. Real Estate is a Kleptocrat’s Dream.

Some of the more helpful interpretations of the rule change have come from international law firms, like Norton Rose Fulbright:

“On August 28, 2024, the Financial Crimes Enforcement Network (FinCEN) issued a final rule that will impose new anti-money laundering and countering terrorism financing (AML/CFT) program requirements on registered investment advisers and exempt reporting advisers (collectively,Covered IAs) by, among other things, including Covered IAs within the definition of “financial institution” under the Bank Secrecy Act (BSA).1 The new AML/CFT rule takes effect on January 1, 2026.”

…and Nixon Peabody:

- ‘Certain registered investment advisers and exempt reporting advisers are added to the definition of “financial institution.”

- The rule sets minimum standards for anti-money laundering and countering the financing of terrorism (AML/CFT) programs and requires that suspicious activity is reported to FinCEN.

- Financial services entities and professionals should prepare now to meet compliance standards by January 1, 2026.’

Final Thoughts

It is probably prudent for a real estate agent or financial advisor to become familiar with their exposure to the rule changes from FinCEN that go into effect on January 1, 2026. I’m impressed the the dogged pursuit by U.S. Treasury to stop illicit funds entering the economy.

Did you miss yesterday’s Housing Notes?

Housing Notes Reads

- Stream of Foreign Wealth Flows to Elite New York Real Estate (Published 2015) [NY Times]

- FinCEN issues new AML rule impacting registered investment advisers and exempt reporting advisers [NRF]

- New AML/SAR requirements for investment advisers [Nixon Peabody LLP]

- New US rules try to make it harder for criminals to launder money by paying cash for homes [AP News]

- Anti-Money Laundering Regulations for Residential Real Estate Transfers [Federal Register]

- Acres of Money Laundering: Why U.S. Real Estate is a Kleptocrat's Dream [Global Financial Integrity]

- Treasury proposes rule to extend anti-money laundering regs to investment advisers [CNBC]

- U.S. Treasury announces final anti-money laundering rules for real estate agents [HousingWire]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)