- Teardowns Occur When The Land Will Economically Support A More Valuable Use

- Land Appreciates While Buildings Depreciate

- A $70 Million Teardown In Fort Lauderdale Breaks The Rules Of Economics

Think of a ‘teardown‘ as a land sale. The house becomes a teardown when the land supports a different, usually higher-value property use. Years and two houses ago, my wife and I were looking for a larger home with more acreage than our then-current home. Living with our four young sons required a lot more elbow and running room than we had. Unfortunately, the bigger homes with more land that were listed for sale within our price range needed a lot of work. In other words, each listing was a ‘Money Pit.’ To make matters worse, as each listing entered the market, we found ourselves competing with a couple of developers who were only interested in tearing down the listings and replacing them with much bigger homes. The bigger lots could support much higher-valued property, so they were willing to pay much more than buyers like us who just wanted to move into the house, apply a little paint, and slowly upgrade it.

Teardowns are a common housing market phenomenon and represent the concept of highest and best use. Appraisers run into teardowns all the time during the research of the “comps” of a home they are appraising. When driving by a listing to take a photo, they see a brand new house, but the price in the MLS reflects the amount paid for the original house that was torn down. If a real estate professional isn’t familiar with the local market, they might assume the price reflects the new house. I’ve observed this situation occur on a number of occasions.

The Teardowns.com Website

During the Housing Bubble nearly two decades ago, there was a website known as teardowns.com, which attempted to monetize the niche. I recall seeing a listing for sale near my house with their sign. Back then, the website inspired me to write a post about the teardown phenomenon (the old blog post format is broken), which prompted criticism from the company (also broken).

The website shares a recent white paper, Neighborhood Renewal: The Decision to Renovate or Tear Down, which is an interesting read.

“…the primary determinants of the decision, particularly highlighting the importance structural attributes for renovations, land for tear downs, and location and prior redevelopment activity for both. Additionally, as a test of a proposition from prior studies, major renovations are found to be equivalent to teardown sales, where the property is valued only for the underlying land. The level of expected renovations is also shown to decrease the selling price of properties requiring renovations.”

Land Appreciates, Buildings Depreciate

A common misconception about home values, which I frequently share here, is that the land appreciates. When a homeowner can sell a home for more than they paid for it, assuming no upgrades were made, it is the land that becomes more valuable.

I wrote about this during my stint as a columnist for Bloomberg Opinion a decade ago in Housing Bust Wasn’t About the House.

In the case of a teardown, the land value expands, and if the building becomes obsolete relative to the land, it begins to make sense to tear it down and build something more valuable.

Apparently, a recent exception just occurred in Fort Lauderdale…

Turning The Teardown Concept Upside Down

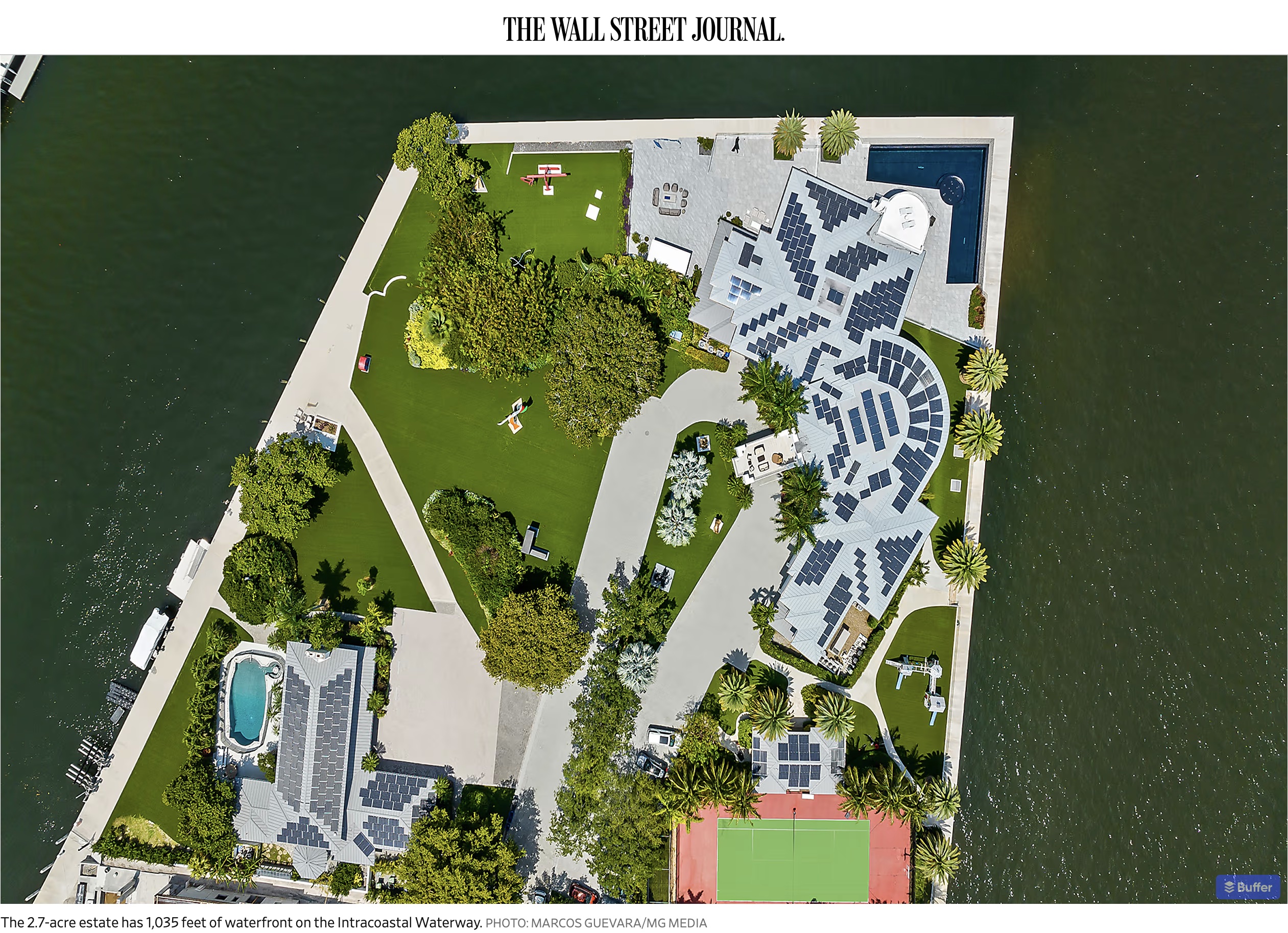

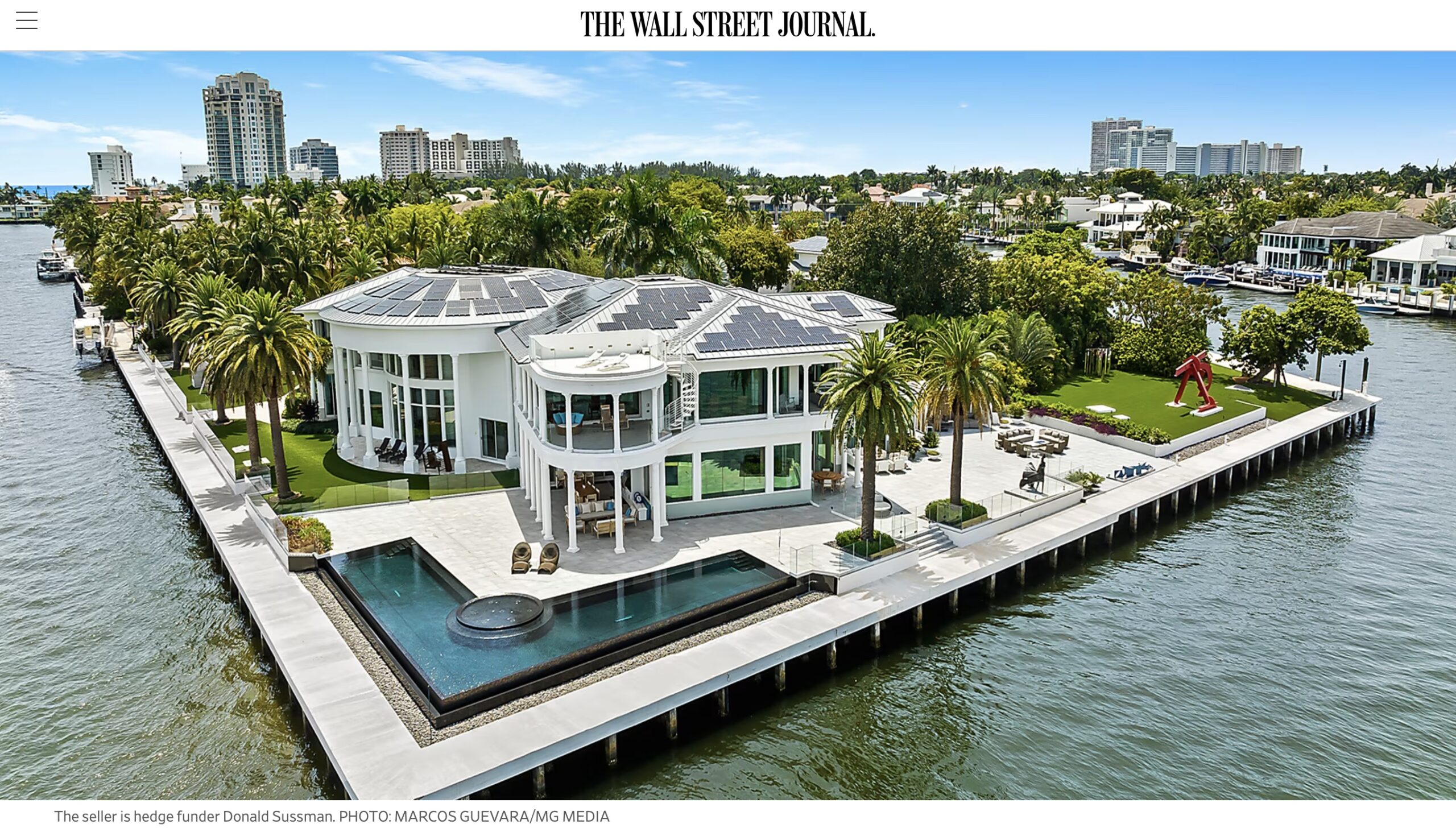

This week, the Wall Street Journal reported that A $70 Million Teardown Smashes Fort Lauderdale’s Home Price Record. The home was constructed in 2008 and was recently gut-renovated.

Within Broward County, our newly signed contract data, which was published today, showed that single families rose 9.7% annually, and those at or above $5,000,000 surged 100% year over year.

What does someone do with a large, beautifully renovated home on the Intracoastal Waterway in Fort Lauderdale?

Tear it down! The new owners plan to tear it down and build a smaller house in its place.

The act of tearing down a large renovated house and replacing it with a smaller one seems to contradict the economic principle of highest and best use unless the new home ends up being more valuable. Imagine paying a record price for a recently renovated house and then tearing it down to build a smaller one. The owner apparently has the money to create what they want in this specific location and doesn’t appear to be concerned about their return on investment.

Wow.

Did you miss yesterday’s Housing Notes?

September 4, 2024

The Phrase That Shaped New York City: ‘You can’t make an omelet without breaking some eggs.’

Image: Chat & Ask AI

Housing Notes Reads

- Exclusive | A $70 Million Teardown Smashes Fort Lauderdale’s Home Price Record [Wall Street Journal]

- Housing inventory falls as mortgage rates drop [HousingWire]

- Finding the Direction of Future Sales Prices In a Residential Market Analysis Using the Months-of-Supply Indicator [Counselors of Real Estate]

- Neighborhood Renewal: The Decision to Renovate or Tear Down [SSRN]

- Exclusive | Byron Allen Just Sold His Aspen Mansion for More Than Double What He Paid For It [Wall Street Journal]

Market Reports

- Elliman Report: New York New Signed Contracts 8-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 8-2024 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 7-2024 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)