- Wealth Gap Is Widening, And The USD Is Weakening, But No Expected Currency Play For Luxury Real Estate…Yet

- High-End Real Estate In Better Position To Weath Elevated Mortgage Rates

- Tariff Tantrums Will Keep Interest Rates Elevated In The Near Term

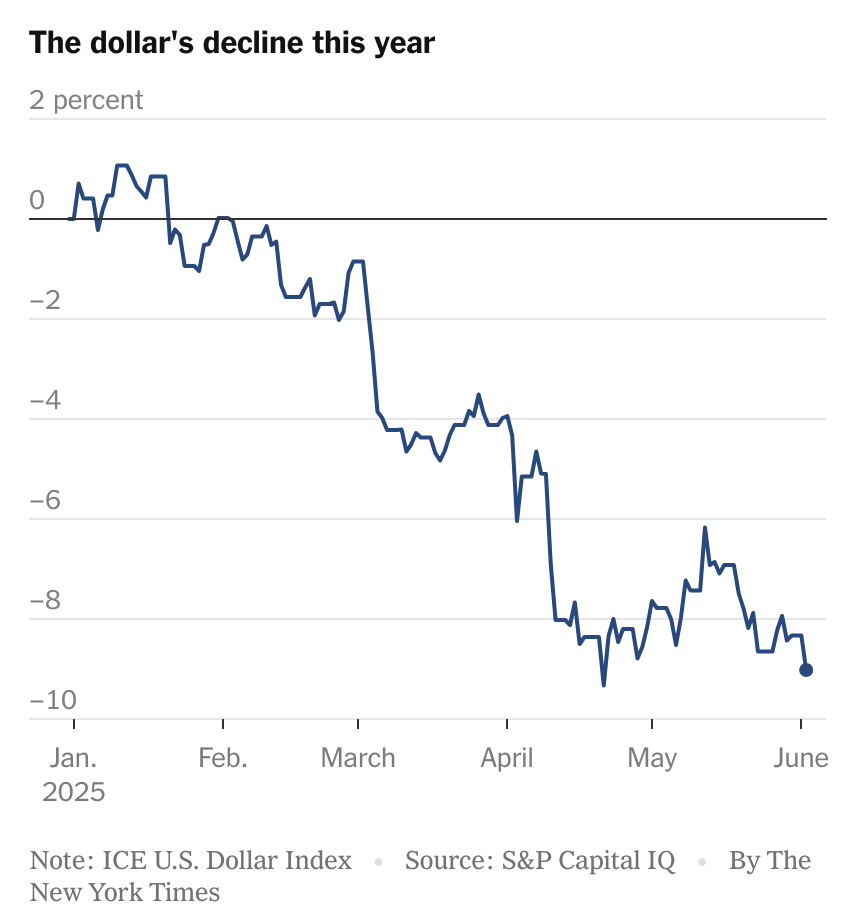

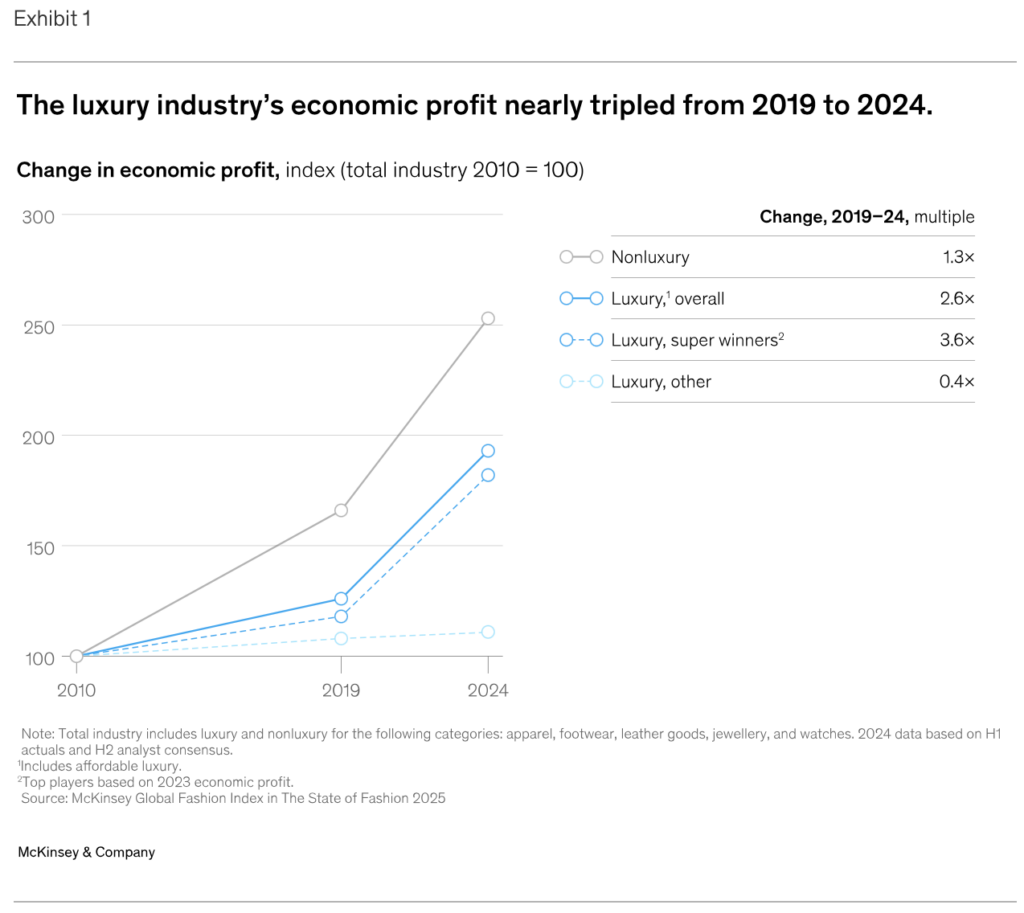

A McKinsey report on the state of luxury showed how the value of luxury goods surged over the past five years. The fertile ground of an expanding wealth gap is a key driver for the future direction of high-end real estate. The McKinsey report came out before the April Tariff Tantrums kept mortgage rates elevated, thereby crushing the spring housing market with boatloads of uncertainty (for no tangible benefit to the US). The administration’s lack of understanding of what a tariff is has alienated nearly every country in the world the US trades with, many of whom are sources of luxury housing demand in the US. For the time being, the weakening US dollar [gift link] probably won’t translate into a lot more luxury housing market sales. For there to be a tangible currency played by international demand (to enjoy a price discount), reasonable immigration reforms must be made to cool the temperature. Still, there have been no proposals so far. Eventually, a weaker US dollar with immigration reform could entice more foreign buyers of luxury real estate to venture into the US.

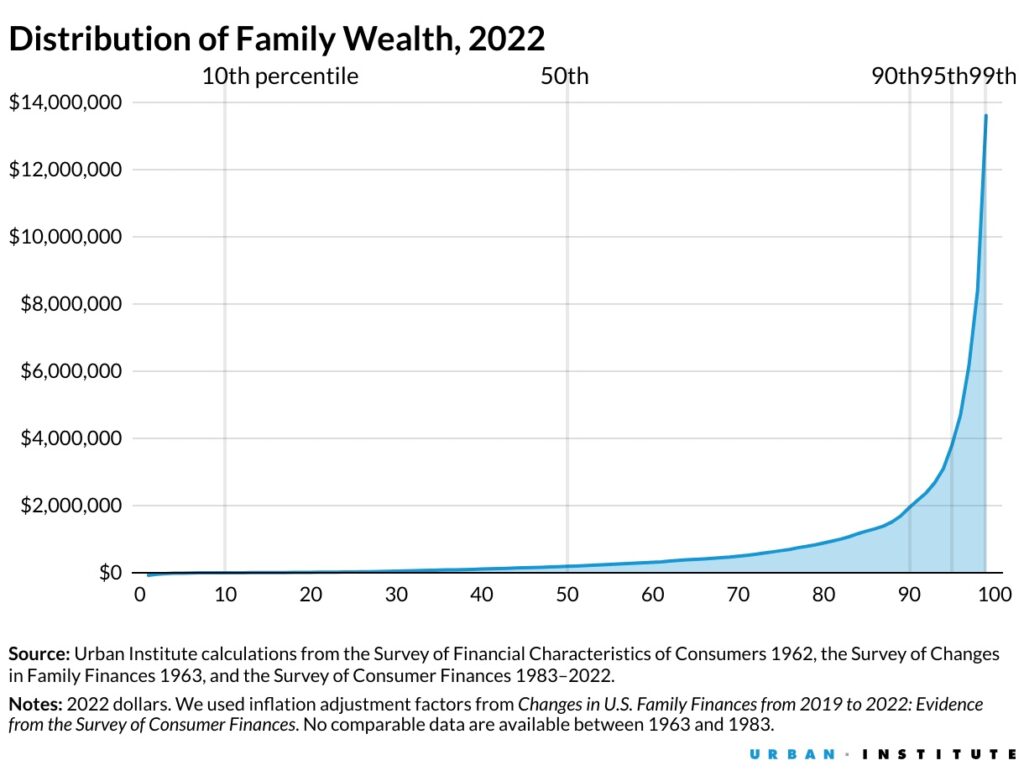

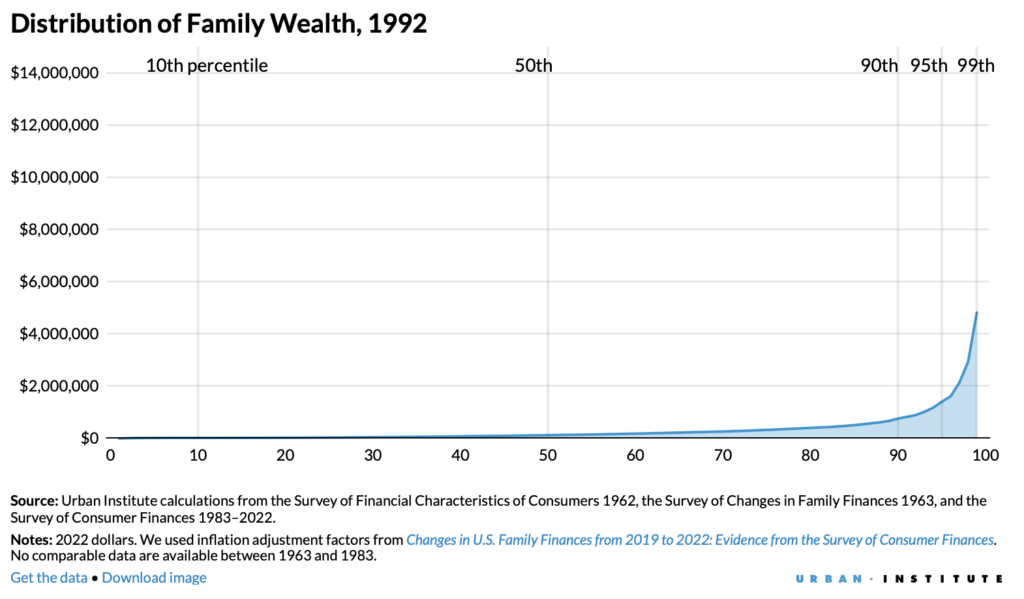

The Wealth Gap Is Widening

The comparison from 1992 to 2002 is startling.

Profits On Luxury Goods Soared Over Past 5 Years

Elevated Mortgage Rates Have A Less Adverse Impact On Luxury Real Estate

In some of the markets that I track, there is a clear pattern of a higher market share of cash buyers than those reliant on purchase finance mortgages. In fact, cash buyers tend to be more dependent on the financial markets for leverage. While the financial markets have become increasingly volatile due to the Tariff Tantrums, they generally have clawed back most of the losses incurred. There may even be an eventual move from intangible assets to tangible assets (real estate) to reduce investor exposure to extreme volatility.

Final Thoughts

Luxury real estate is likely to fare better over the near term than the remainder of the housing market, mainly because interest rates are less likely to fall under current trade policies. The rising wealth gap is priming the pump for ongoing future luxury demand once the policy chaos settles down a bit (wishful thinking, I know).

The Actual Final Thought – I don’t have the luxury of another thought today.

Here’s My Podcast: What It Means

The latest episode is a click away as well as the podcast feeds for all the “What It Means with Jonathan Miller (WIM).”

Apple (within the Douglas Elliman feed) Soundcloud Youtube

Monday Mailboxes, Etc. – Sharing reader feedback on Housing Notes.

June 6, 2025: The Plural Of Anecdotal Is Not Data But With Massive Uncertainty It’s All We’ve Got

- Always enjoy your blog. You follow a number of markets. — best source of local real estate stats is the Cromford Report. It’s put together by Michael Orr, formerly Director of Real Estate Theory and Practice at W.P. Carey School of Business at ASU. It was free when Orr was at ASU, but now is a subscriber model for local real estate agents. I came upon Shambreskis and Howard real estate agents site which posts the monthly Cromford Report and their own insights monthly. It’s free. If you are interested in following the Phoenix market.

- Whoa – you responded! Haha I’ve been a big fan for years, thanks for all the insights.

Did you miss the previous Housing Notes?

June 6, 2025

The Plural Of Anecdotal Is Not Data But With Massive Uncertainty It’s All We’ve Got

Image: Instagram

Housing Notes Reads

- The State of Luxury: How to navigate a slowdown [McKinsey]

- Inequalities in household wealth and financial insecurity of households [OECD]

- Nine Charts about Wealth Inequality in America [Urban Institute]

- 1. Trends in income and wealth inequality [Pew Research]

- How Low Will the Dollar Go? [NY Times]