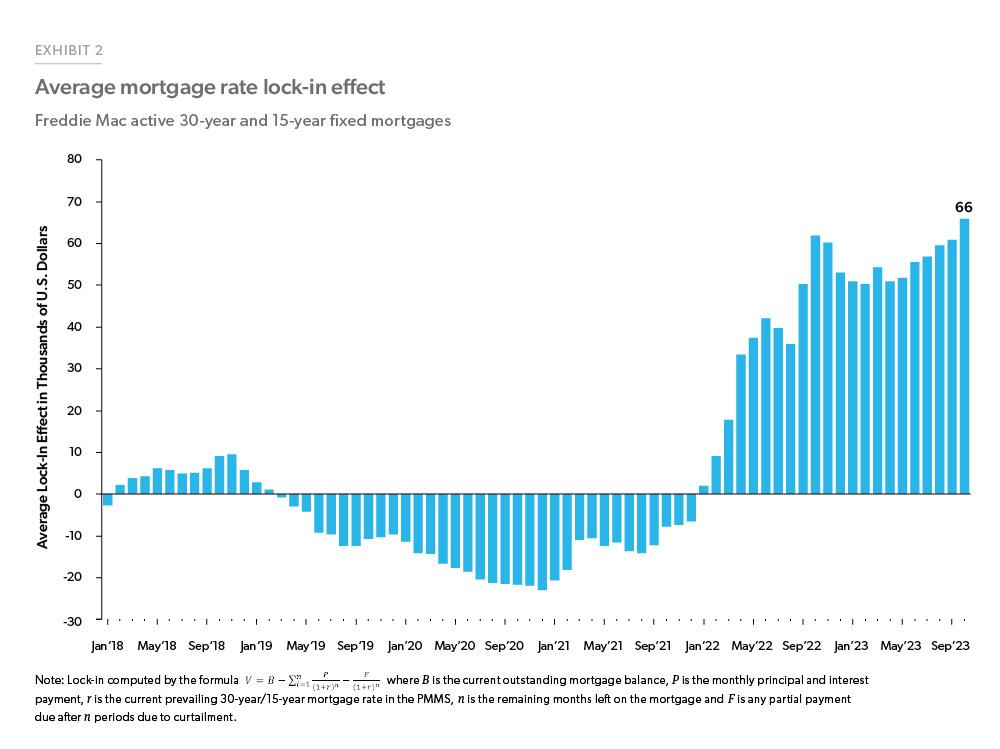

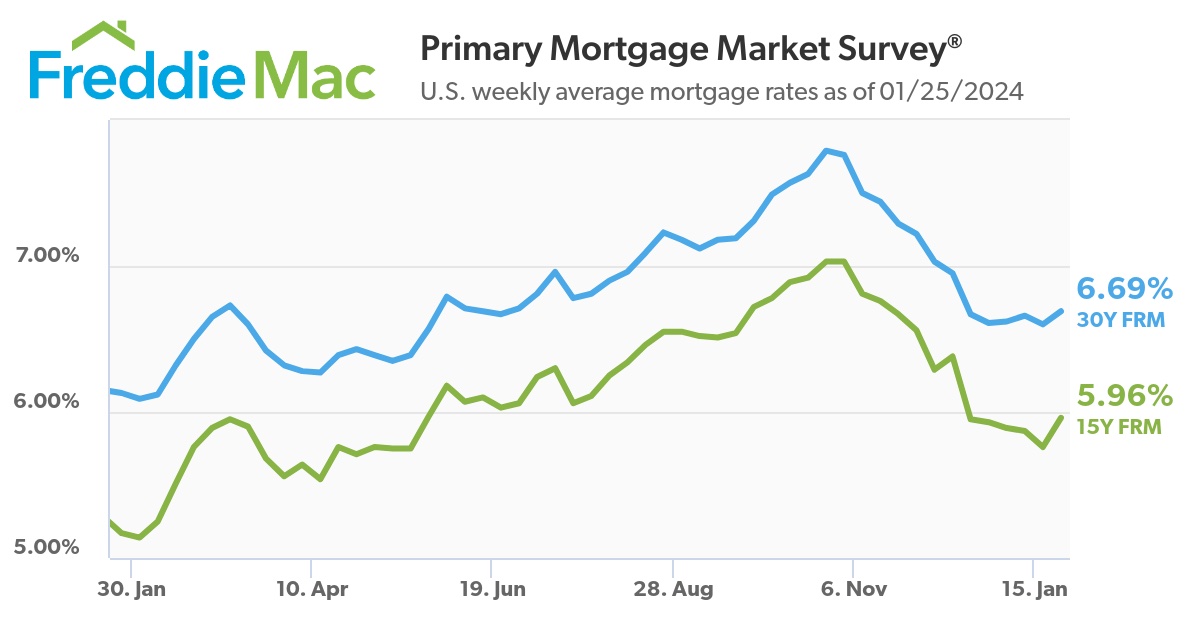

In the housing markets we cover across the U.S., more contracts are being signed in January than last January. We are publishing our Elliman Reports of newly signed contracts next week as the month closes. Since last fall, the decline in mortgage rates has trickled in more supply and encouraged more sales, yet many homeowners are still locked into a previous low rate. So don’t overinterpret the speed of this rising transaction trend. After all, this is 2024: The Year of Incremental Change.

We must follow this lesson: New York’s version of a salmon swimming upstream.

——–

Did you miss last Friday’s Housing Notes?

January 19, 2024: It’s A Green Day For Housing

——–

But I digress…

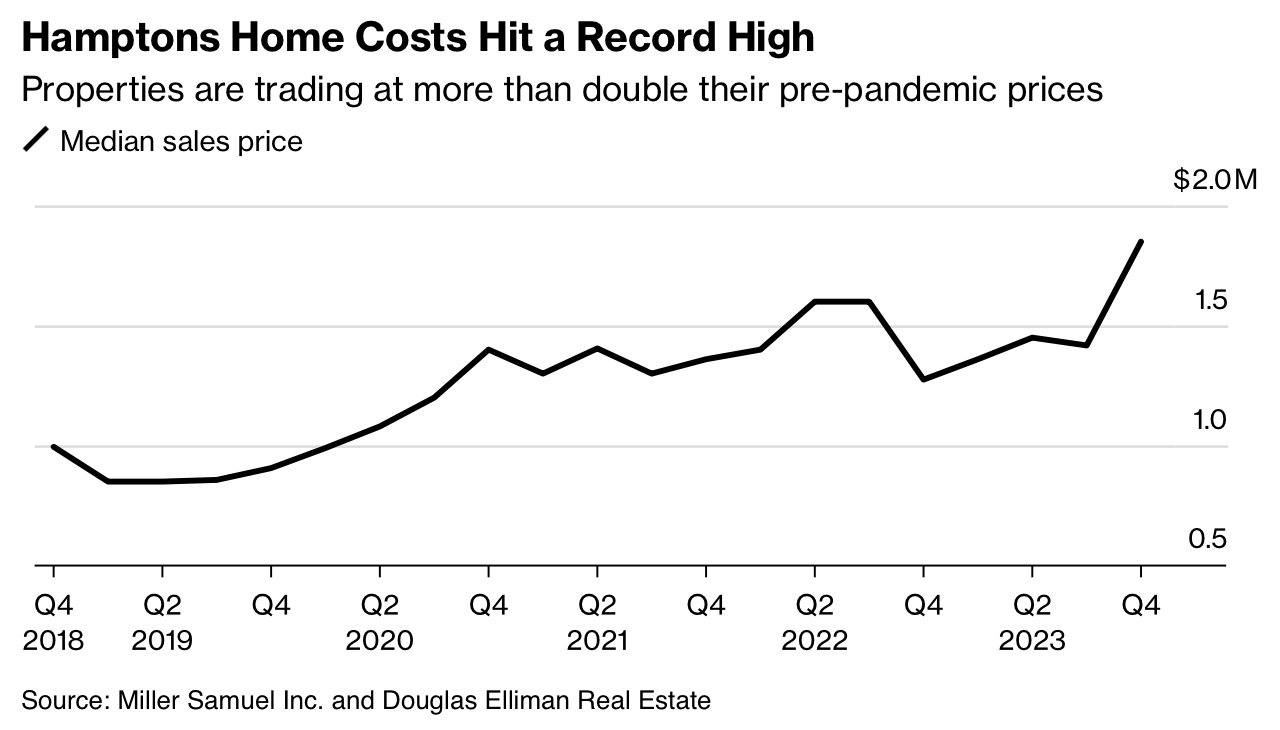

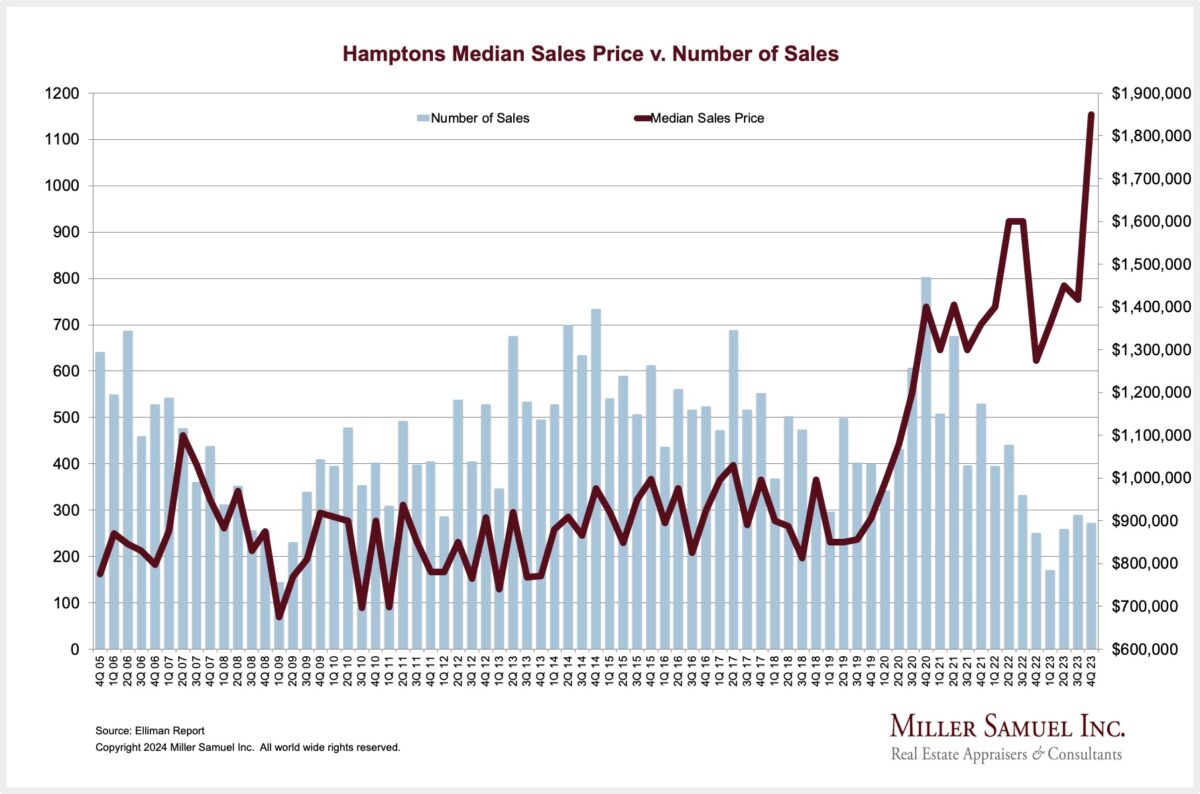

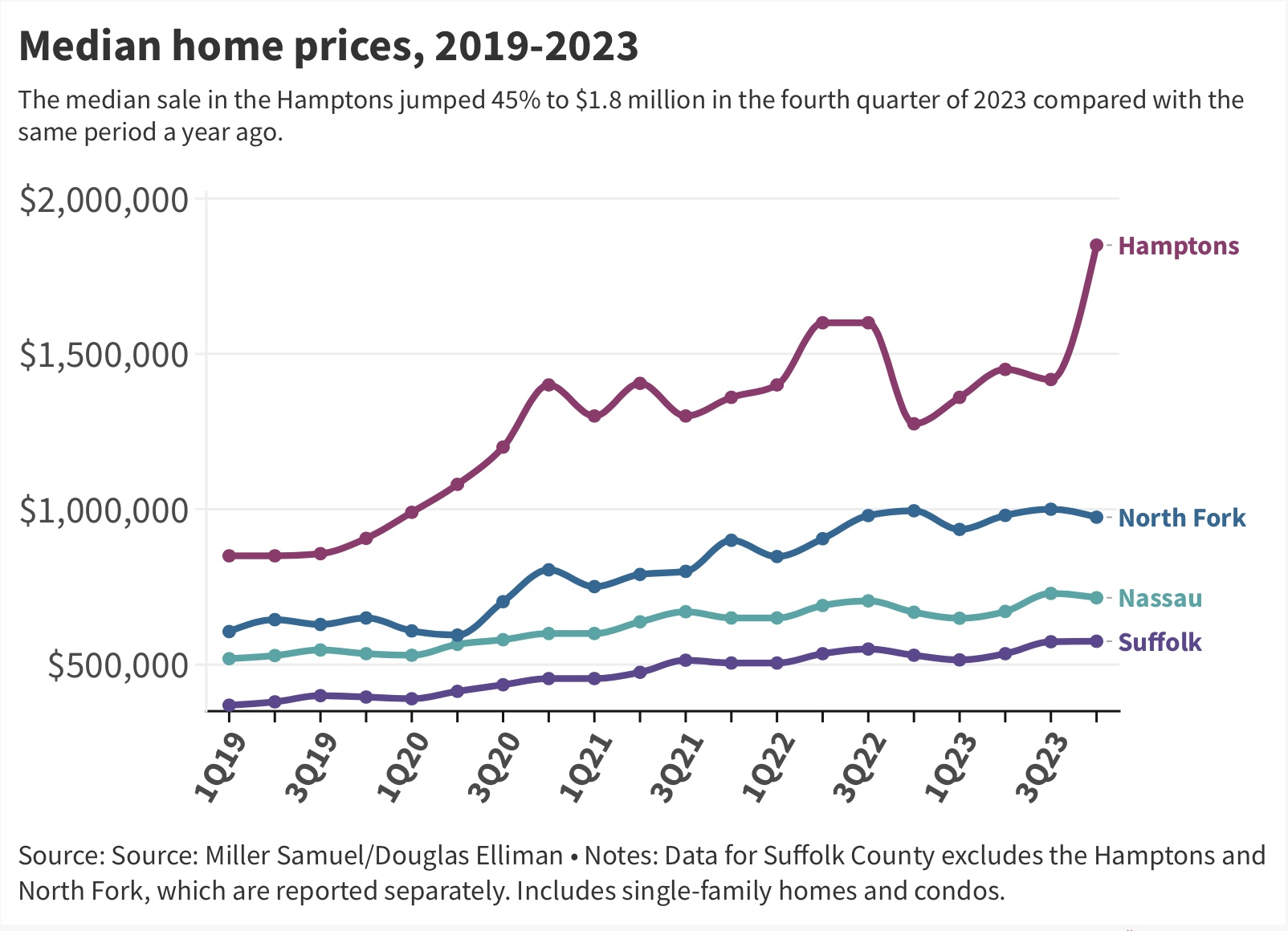

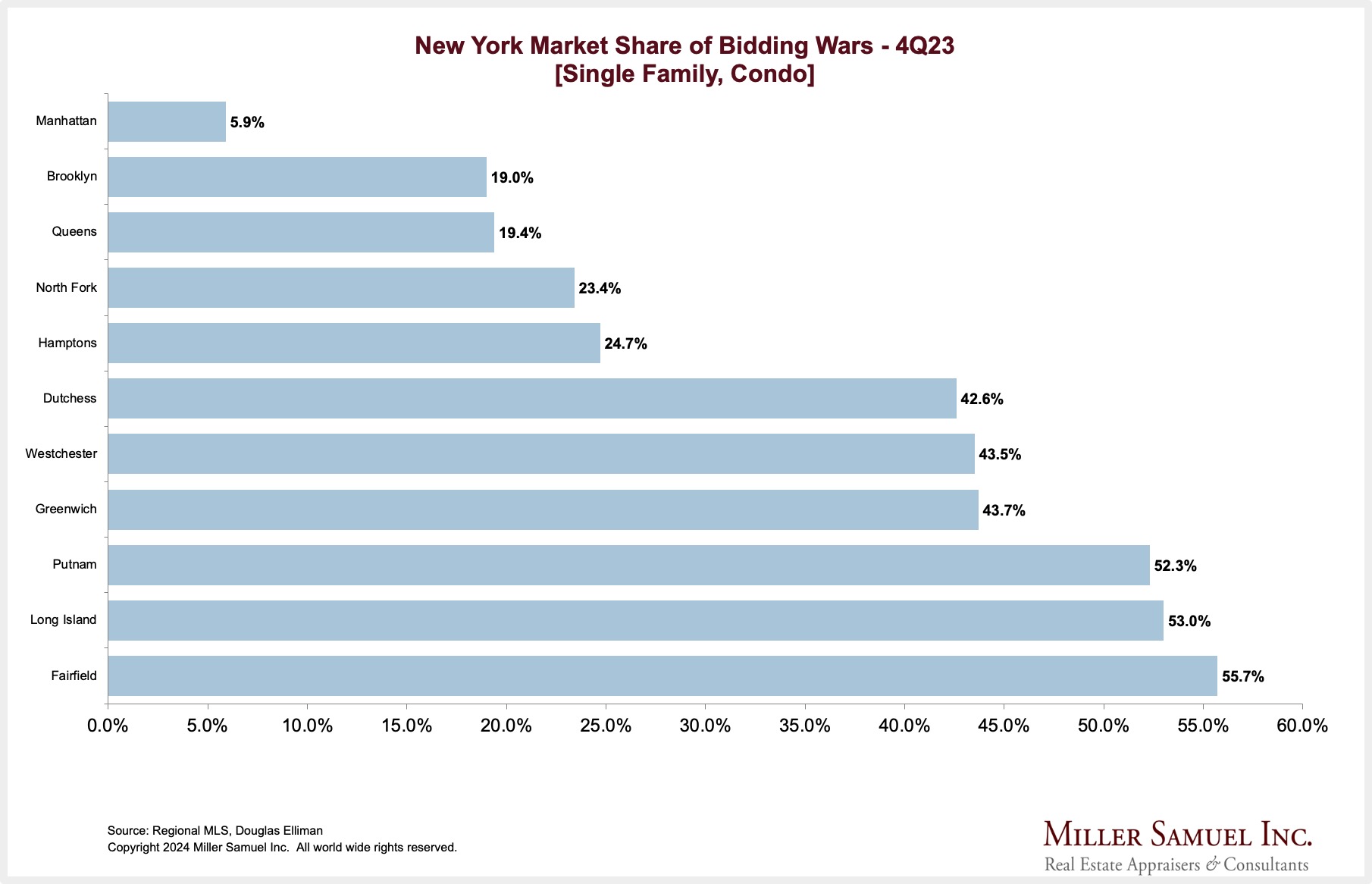

The Hamptons Market Shifted To Higher Priced Homes

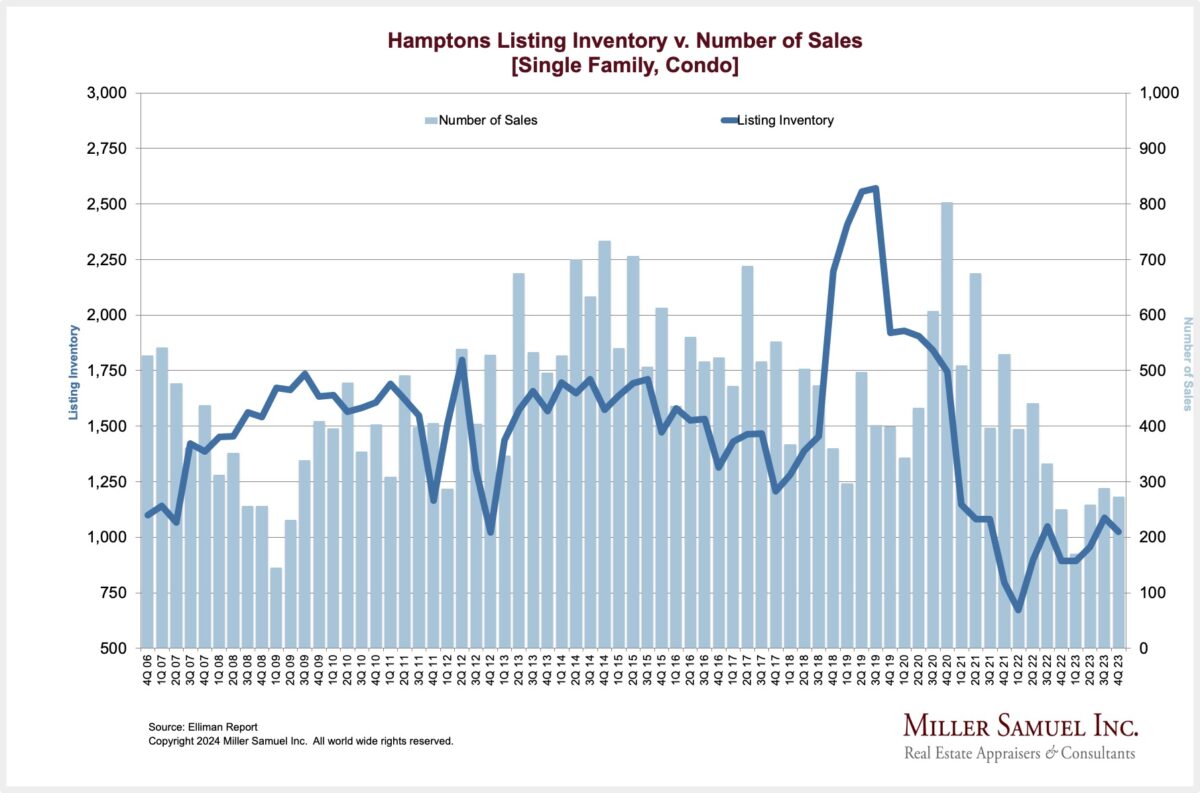

I’ve been the author of a series of market reports for real estate firm Douglas Elliman since 1994. For several years, the high-end second home market on the eastern end of Long Island has been quiet, with falling sales and a severe lack of housing stock to sell. It has long been aligned with Manhattan’s Wall Street, and after two years of surging rates, the market skewed to the high end of the market and likely to cash, just like Manhattan did, and sales rose for the first time in two years (but were still half of pre-pandemic levels). The median price surged 45.1% year over year because sales over $5 million jumped to 19.8%, the highest market share of $5 million sales on record. For context, the market share of $5 million+ sales was then record 12.9% in the third quarter of 2022.

Bloomberg covered the report Hamptons Home Prices Jump to a Record High with an always cool chart.

HAMPTONS HIGHLIGHTS

Elliman Report: Q4-2023 Hamptons Sales

“Quarterly sales expanded annually for the first time in two and a half years.”

- – Price trend indicators surged to record highs and were more than double pre-pandemic levels

- – Sales increased year over year for the first time in ten quarters

- – Listing inventory increased annually for the fourth consecutive quarter

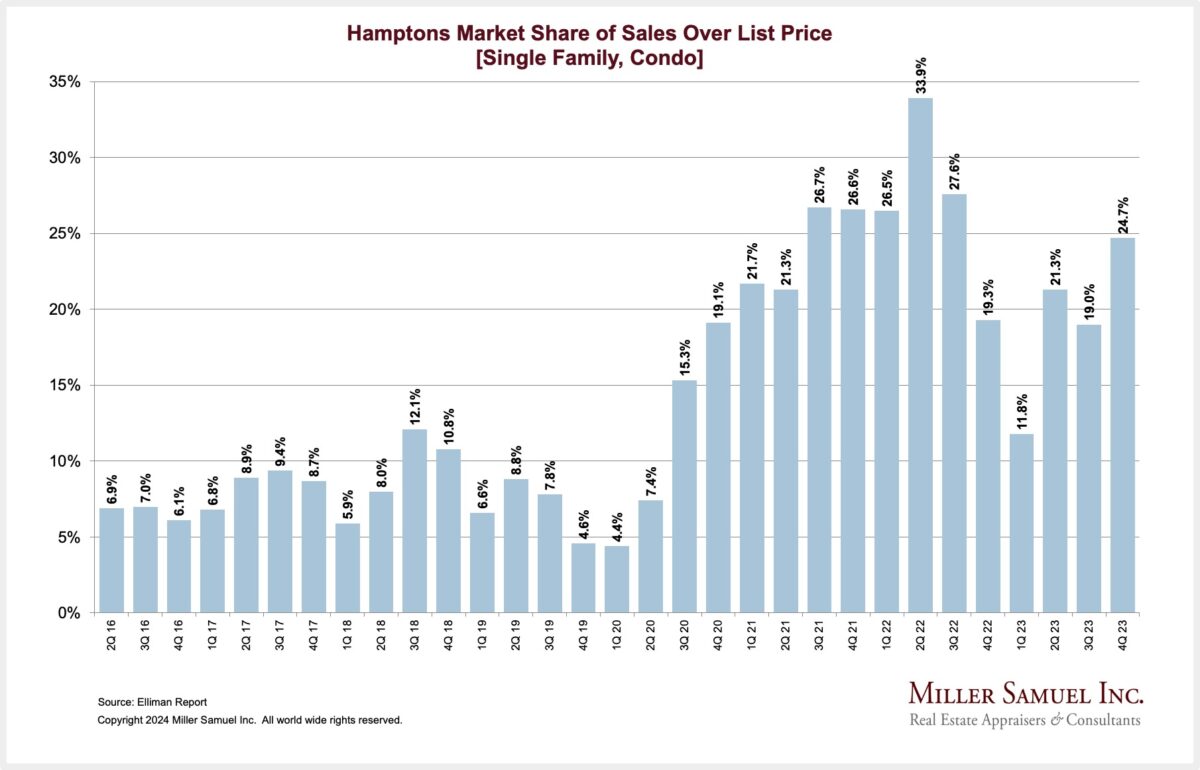

- – Bidding war market share rose year over year to one in four sales

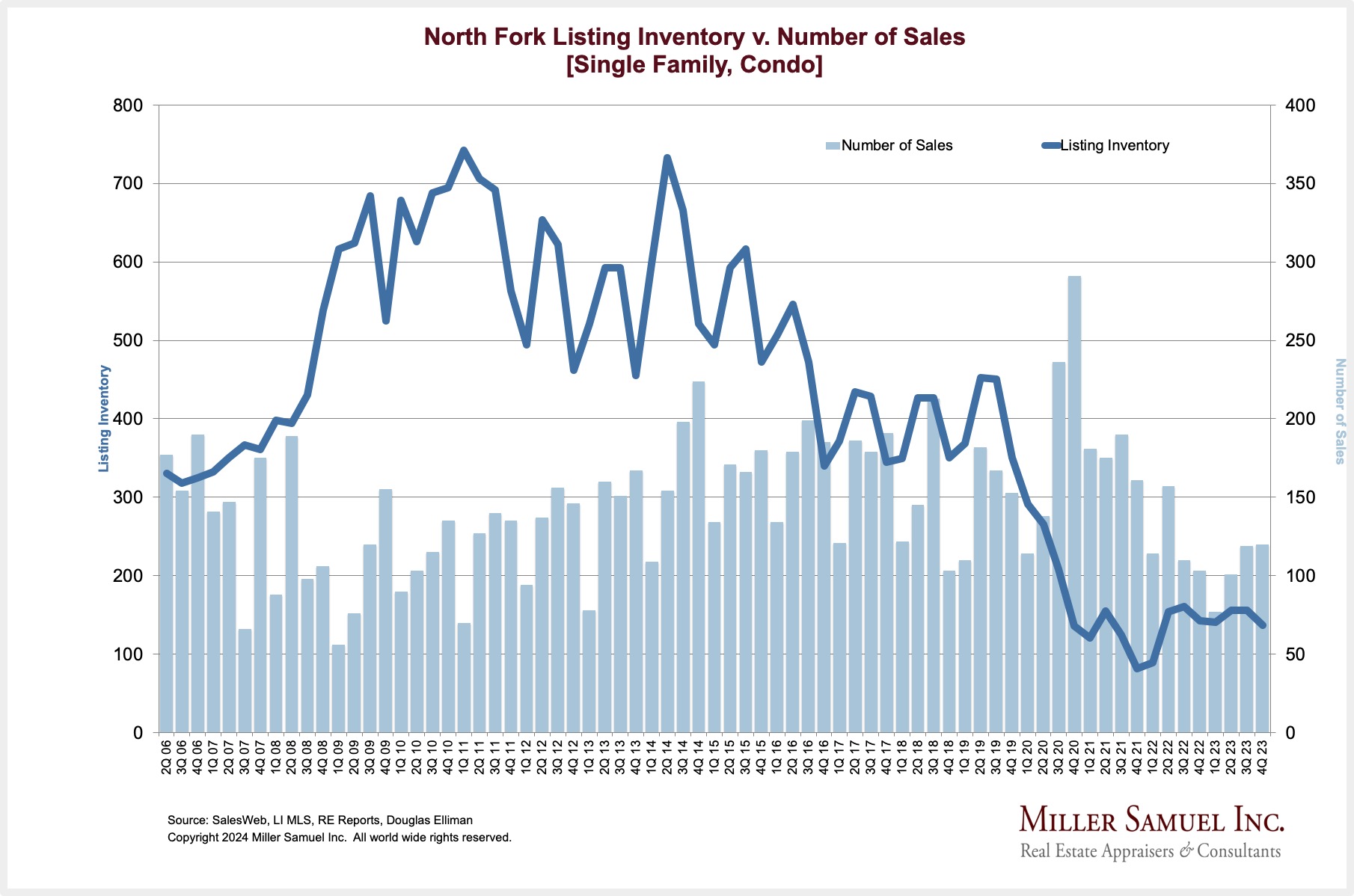

NORTH FORK HIGHLIGHTS

Elliman Report: Q4-2023 North Fork Sales

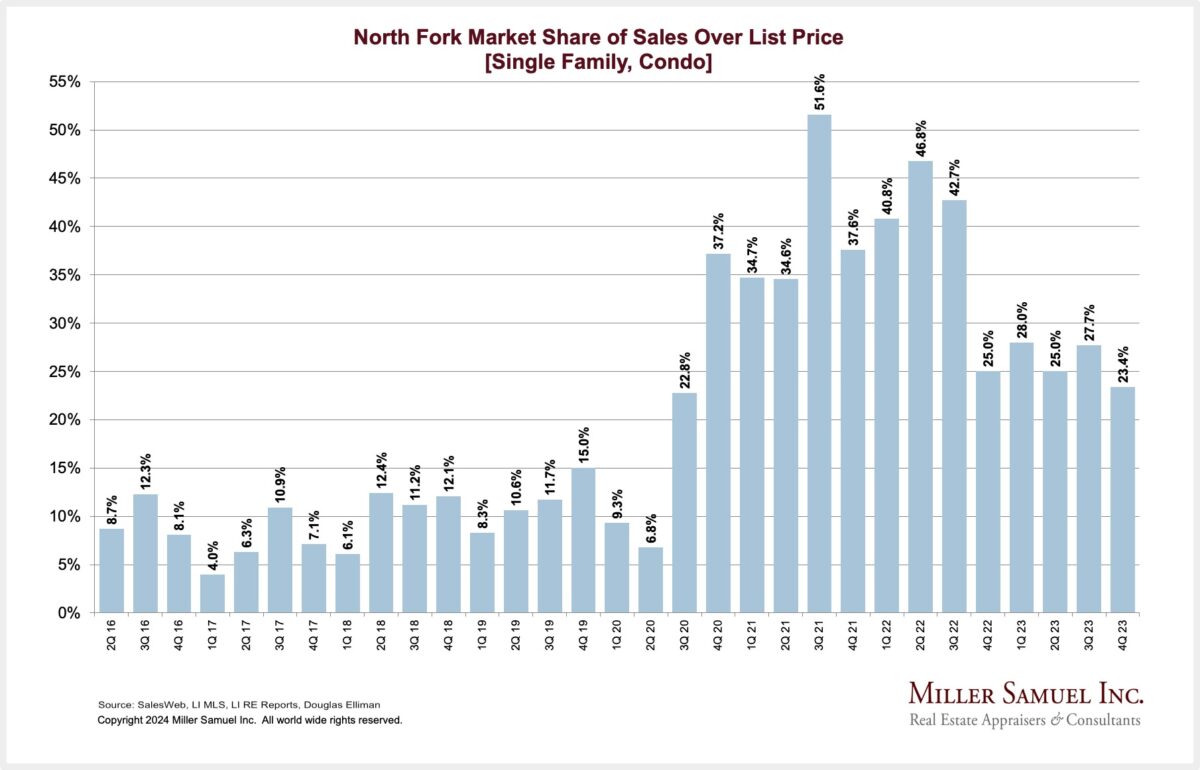

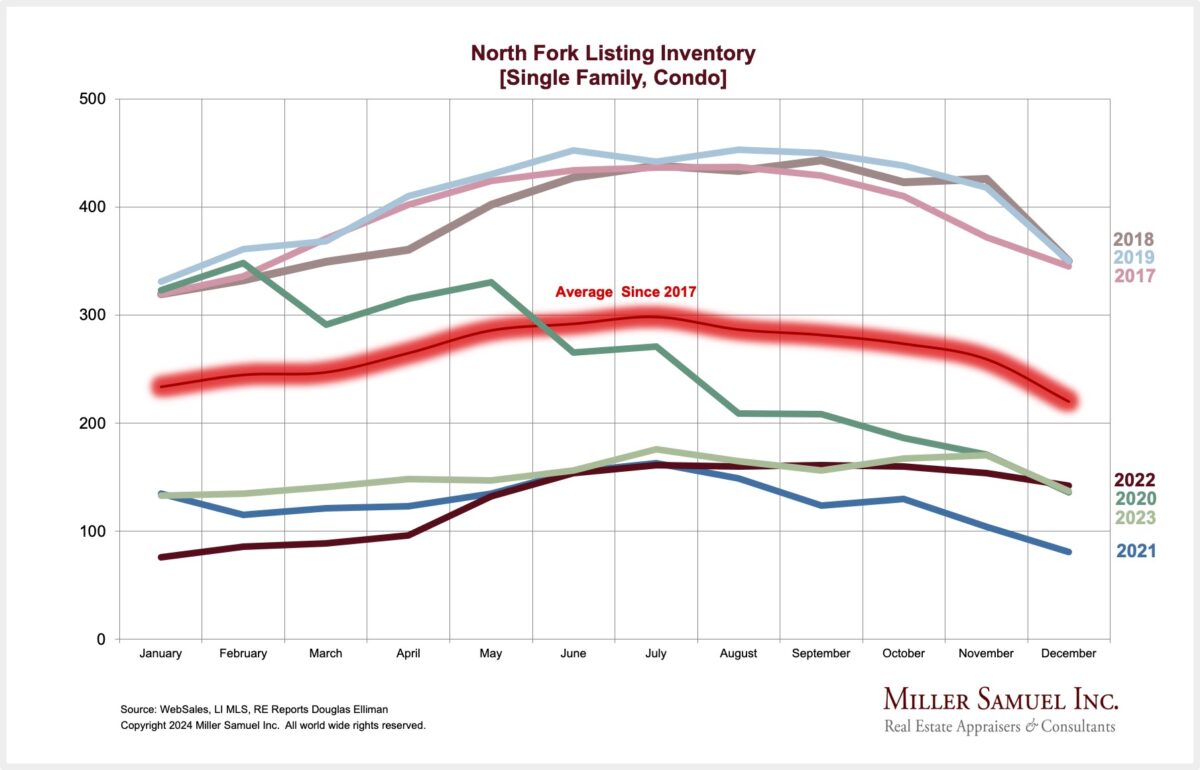

“Quarterly sales expanded annually for the second time in two and a half years.”

- – Price trend indicators slipped annually but remained significantly higher than pre-pandemic levels

- – Sales increased year over year for the second time in ten quarters

- – Listing inventory fell annually for the second time after four quarters of increases

- – Bidding war market share slipped year over year to nearly one in four sales

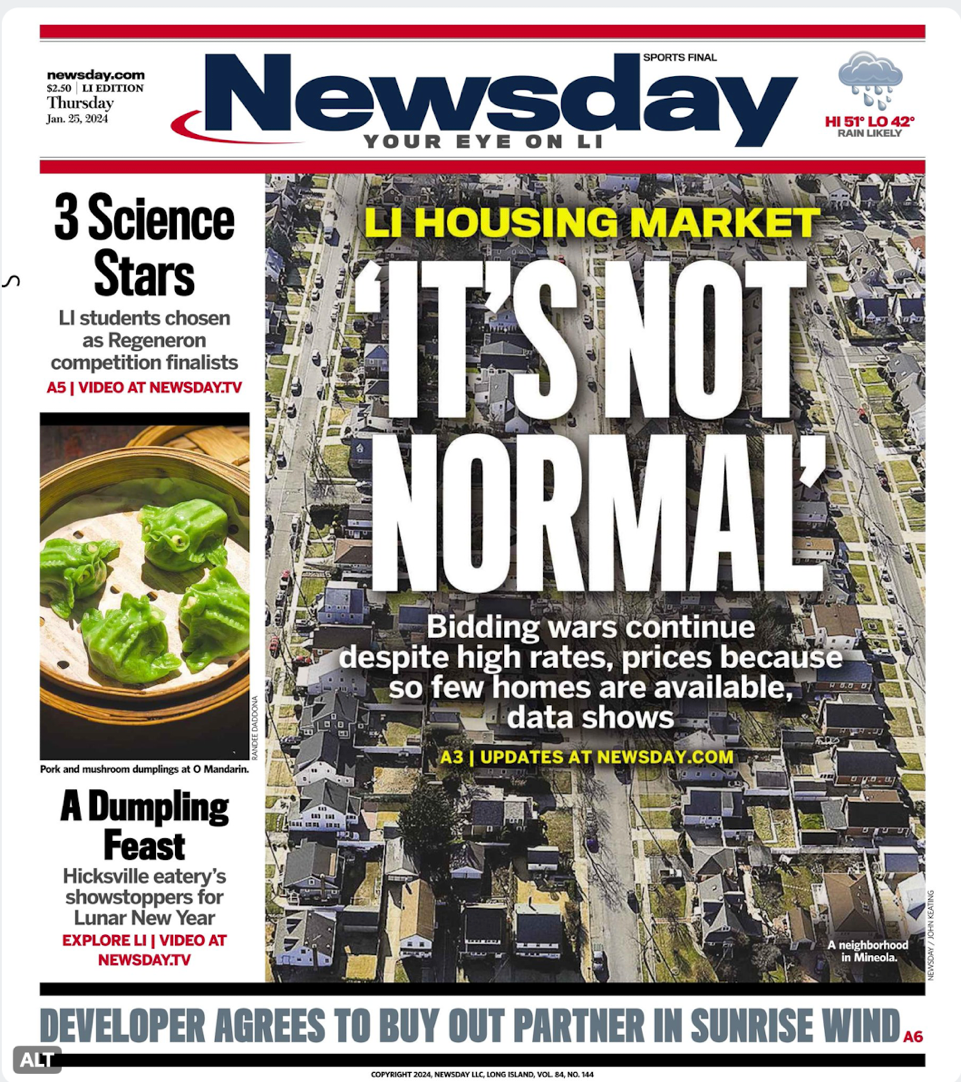

A1 At Newsday, As Long Island Remains Devoid Of Listings

Newsday editors pulled my quote from an explainer piece on the Long Island housing market and our research to place it on the cover of Long Island’s largest newspaper. It’s the tenth time (I’m a list-keeper) our Long Island quarterly market report for Douglas Elliman has been on the cover, and I’m so appreciative. Jonathan LaMantia’s cover story: Long Island home prices hover near highs, as agents wonder when more sellers will emerge.

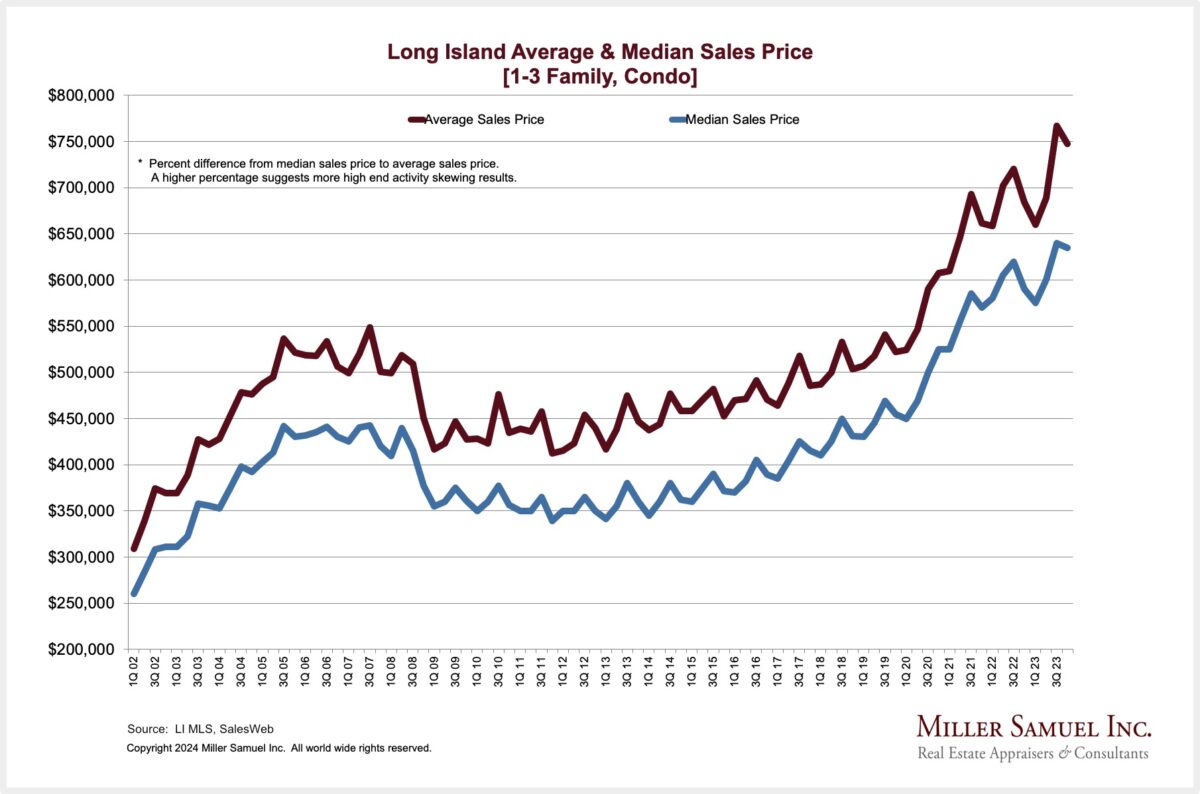

Elliman Report: Q4-2023 Long Island Sales

“Every submarket showed prices reaching new records, as sales and listing inventory declined.”

- – Average and median sales prices rose to their second-highest levels on record

- – Sales fell year over year for the ninth straight time, well below pre-pandemic levels

- – Listing inventory fell annually for the third straight quarter

- – The entry threshold for the luxury market rose to the second-highest level on record

Central Bank Central Interview: Miller Samuels’ Chief

Here’s a new substack I’m excited about – Kathleen Hays Presents Central Bank Central. I highly recommend it. A long-time friend and journalist, Kathleen Hays, invited me to speak with her about the impact of the recent Fed pivot on the U.S. housing market. She has extensive experience interviewing economic experts from her time at Bloomberg Television.

Central Bank Central: Housing Headwinds to Persist Even When Fed Delivers Rate Cuts: Miller

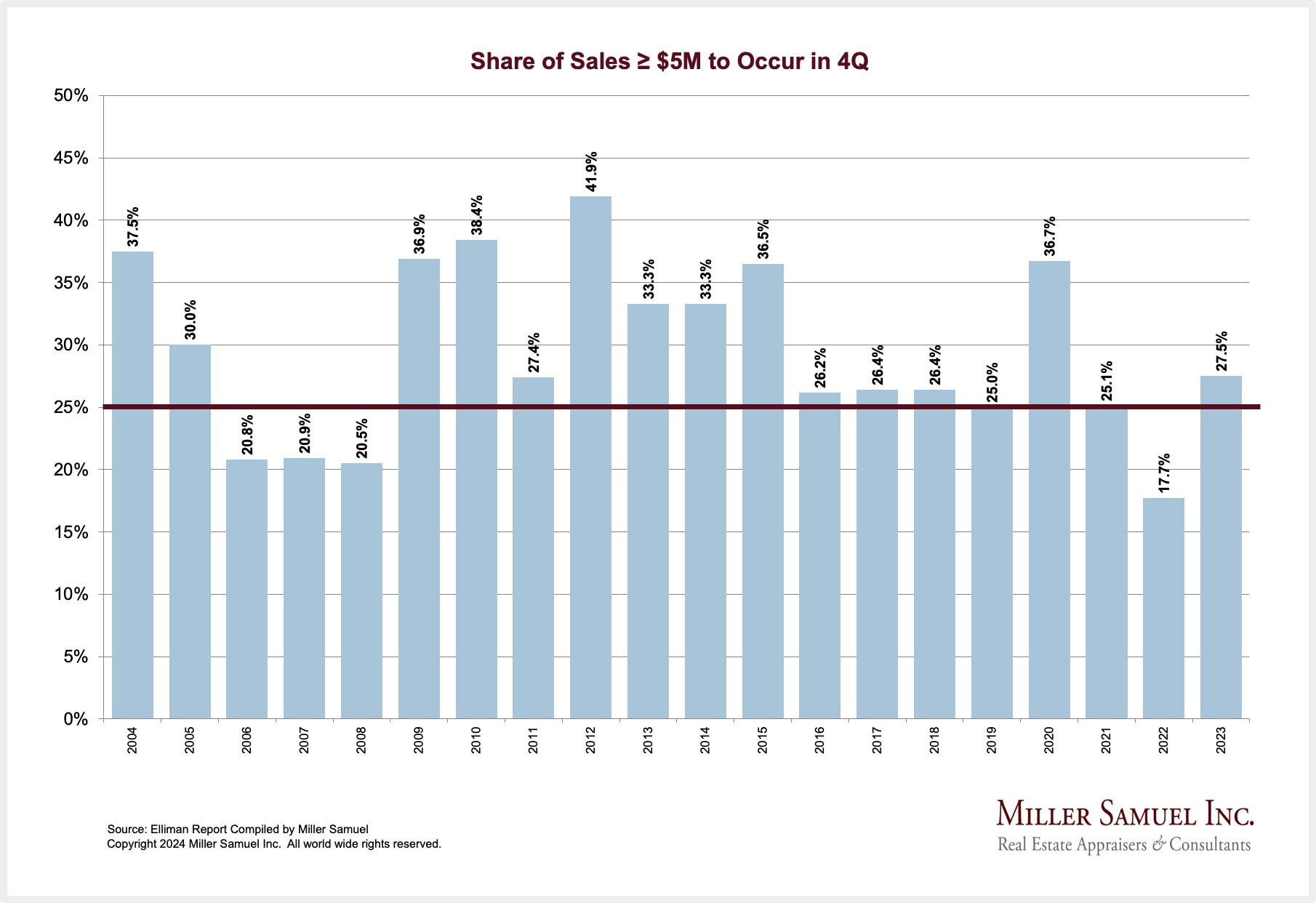

The Hamptons Fourth Quarter Is More Than A Quarter Of Annual Sales

A few years after the financial crisis, I started to look at the fourth quarter of the high-end (>$5 million) Hamptons housing market in the context of the entire year. Except for three years that straddled the financial crisis from 2006-2008, the fourth quarter outperformed its 25% mathematical share allocation, except in 2022, when mortgage rates were escalating rapidly. I suspect the fourth quarter surges are due to more exposure to high taxes in the new year. Sales that would close in the subsequent first quarter were pulled earlier to close by the end of the tax year.

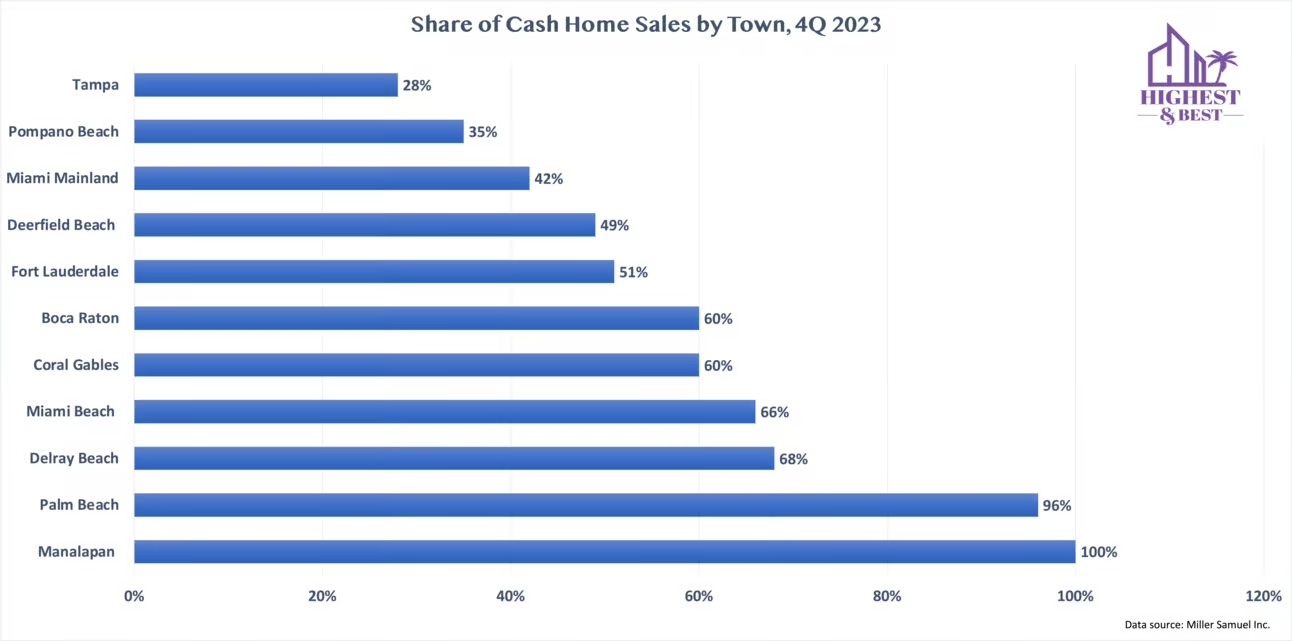

Highest & Best Newsletter: Cash Me if You Can

You should sign up for this Florida newsletter, I Love Highest & Best, from Oshrat Carmiel, formerly of Bloomberg News…

This week’s post:

Cash Me if You Can – Few mortgages for Florida homebuyers; and a mall brawl near Miami

A thorough read of the H&B column demands focus on another beautiful rendering.

Competition For NAR Begins To Emerge With AREA

Debra Kamin, who brought down the C-Suite leadership at NAR with last summer’s investigative piece – President of Powerful Realtors Group Is Accused of Sexual Harassment. Many of her subsequent articles chronicled the implosion of NAR, the real estate industry’s largest trade group. The above video by Debra and this week’s announcement of a new competing trade group, the American Real Estate Association [AREA], will begin an era of sorely needed competition with NAR. The trade group’s bad behavior has been discussed for years, and Debra’s key point in the video was that NAR membership was mandatory for many and shouldn’t be. That monopoly environment created a toxic cesspool culture decades ago and did not do much for real estate agents who had to pay dues and work in the trenches.

Think about the outlook for NAR going forward. Without membership being required for the majority of real estate agents and its current membership of 1,554,604 as of the end of December, how severe do you think the fall in membership will look like three years from now? I’m wild-guessing it will drop by at least half. Do you think they will be able to cut expenses by half (without considering all the litigation and settlements expected)? It seems dire.

I had an experience with NAR just before the pandemic, where I was invited to speak on appraisal issues in D.C., but the coordinator seemed terrified about what I would say. I spoke openly at the event, and there wasn’t any drama, but you could feel the tension from their representatives.

NAR has an “appraisal section” that gave many appraisers I know and respect a platform, but I always felt it was their misguided belief that anything meaningful could be accomplished. The fundamental problem? The trade group was in business to enable business for its member agents. I remember a conversation I had with a NAR representative in D.C., speaking about appraisers doing drive-by foreclosure work, and the rep was very concerned that it would conflict with real estate agents doing CMAs for bank foreclosures. Noted. NAR and appraisers have fundamentally different objectives.

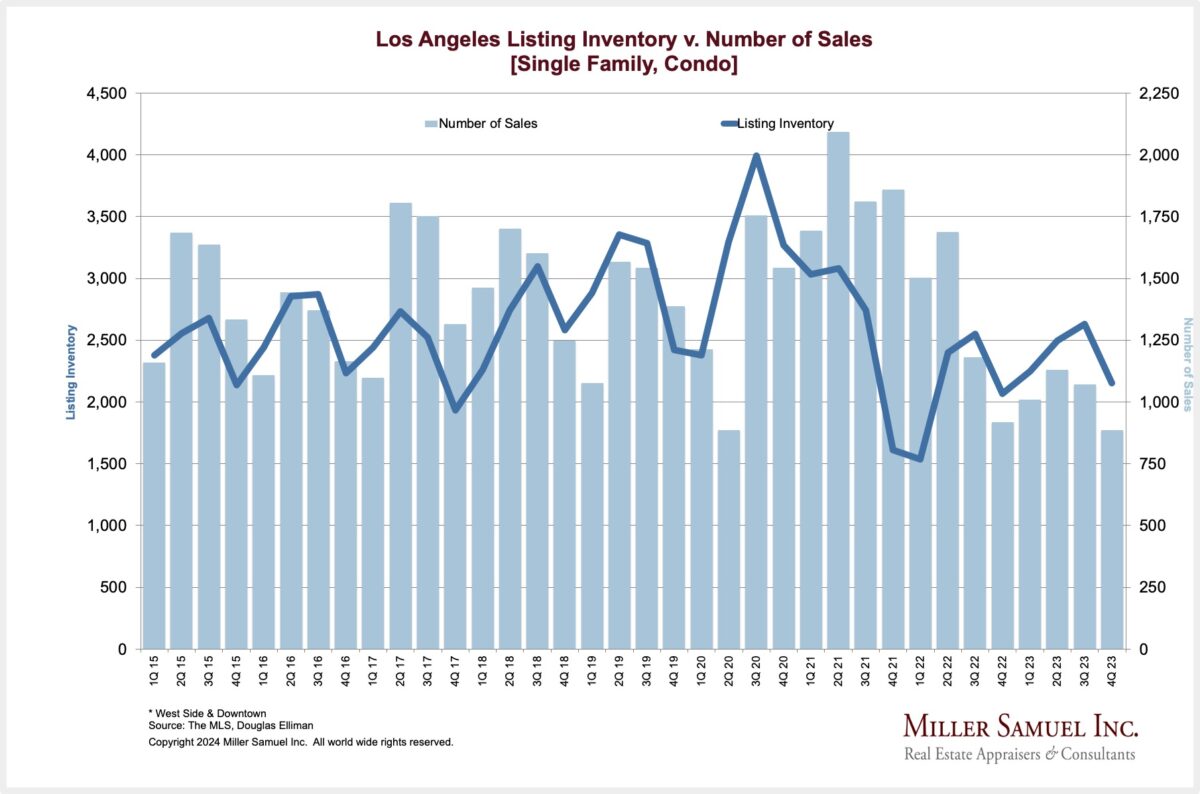

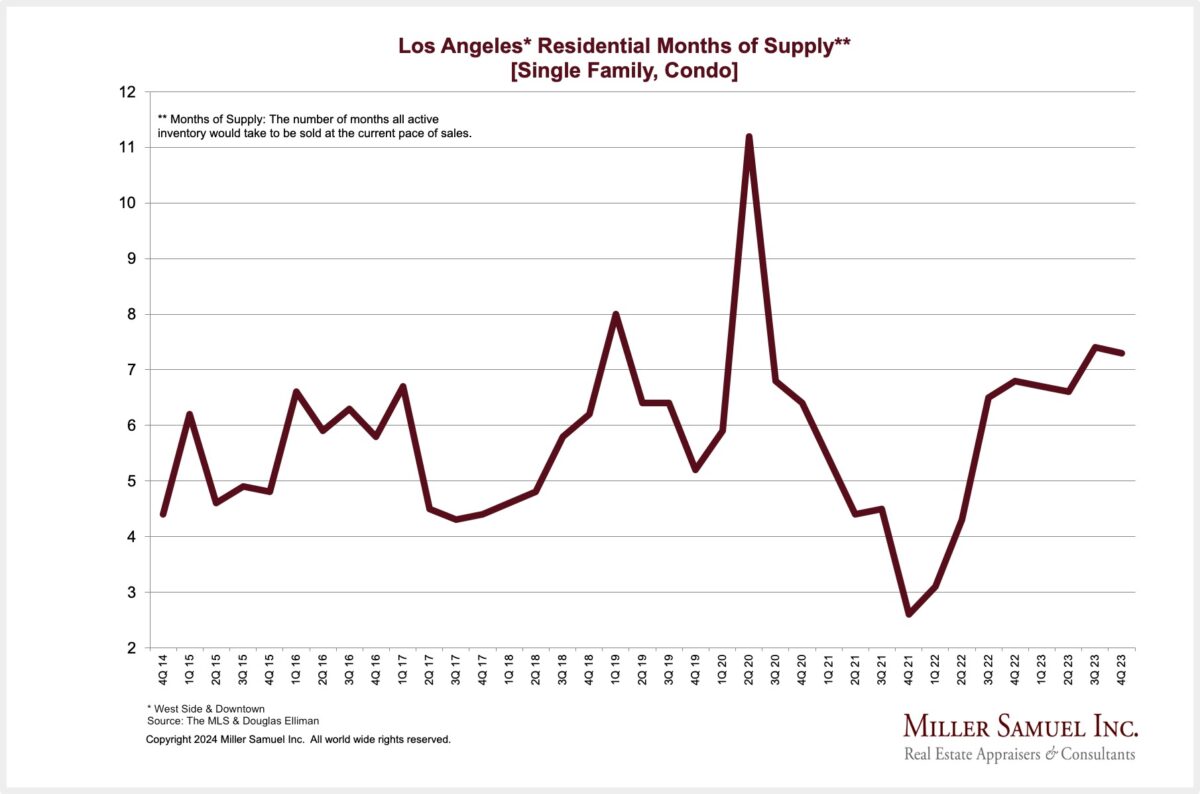

Southern California Saw A Surge In Prices And A Continued Lack Of Inventory

GREATER LOS ANGELES, INCLUDING WESTSIDE AND DOWNTOWN SALES HIGHLIGHTS

Elliman Report: Q4-2023 Los Angeles Sales

“Listing inventory edged higher annually in the overall market but fell sharply in the luxury market.”

- – Price trend indicators rose annually for the fourth time in five quarters

- – Listing inventory expanded annually for the fifth time

- – Sales declined year over year for the eighth straight quarter- Listing inventory for luxury single families fell year over year for the first time in six quarters

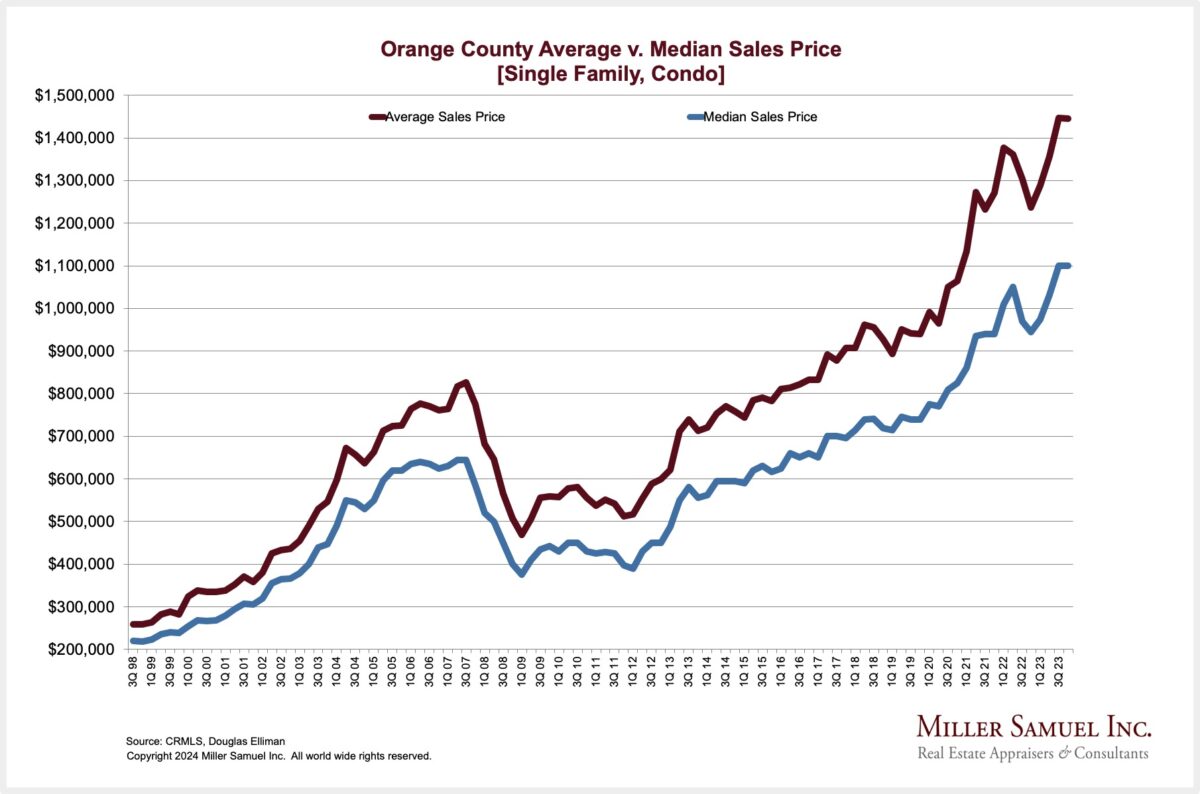

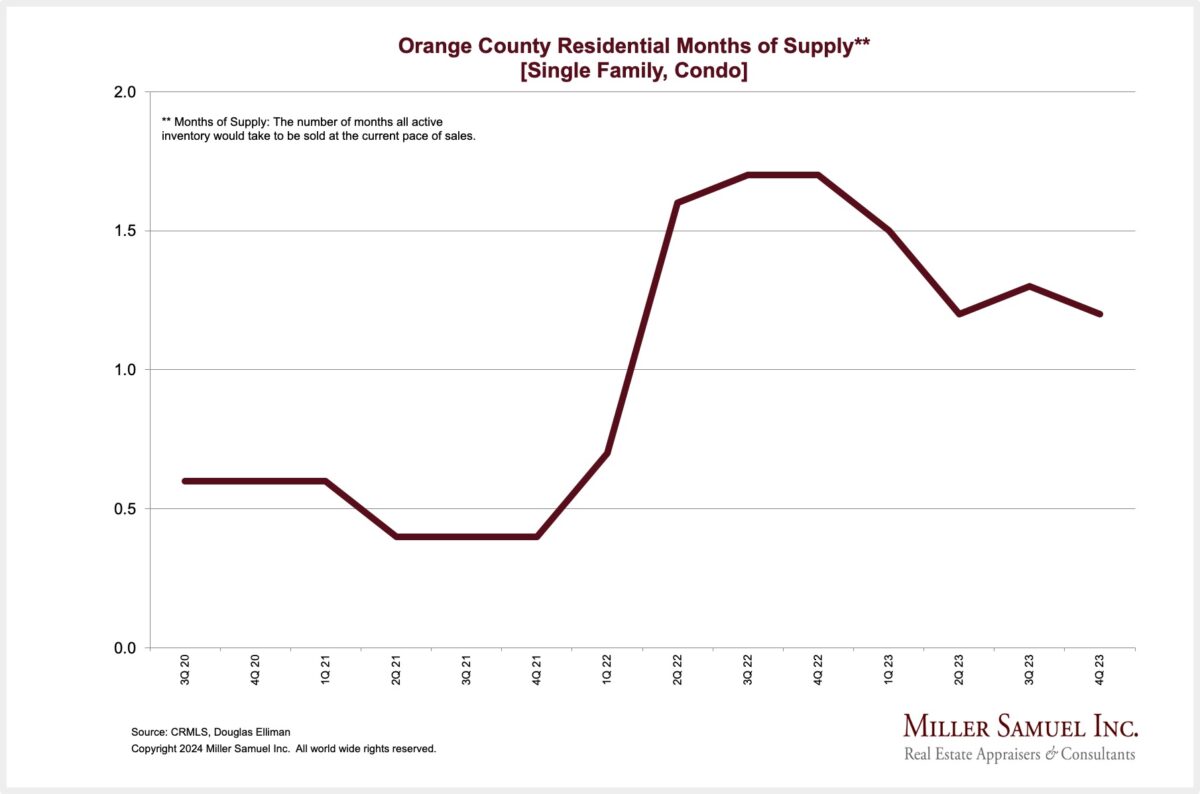

ORANGE COUNTY SALES HIGHLIGHTS

Elliman Report: Q4-2023 Orange County Sales

“Median sales price remained at a record high as listing inventory fell sharply.”

- – Median sales price remained at a record high for the second straight quarter

- – Sales declined year over year for the tenth time as bidding wars accounted for four in ten sales

- – Listing inventory fell annually for the third straight quarter

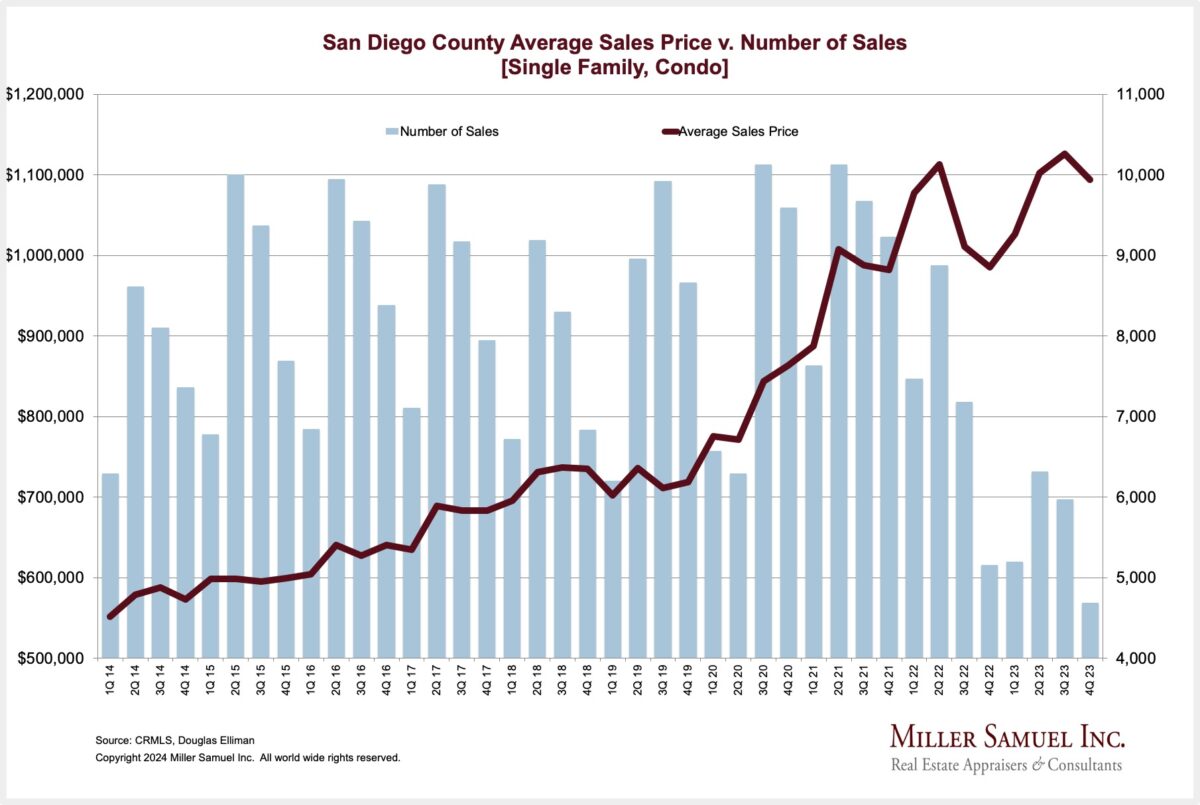

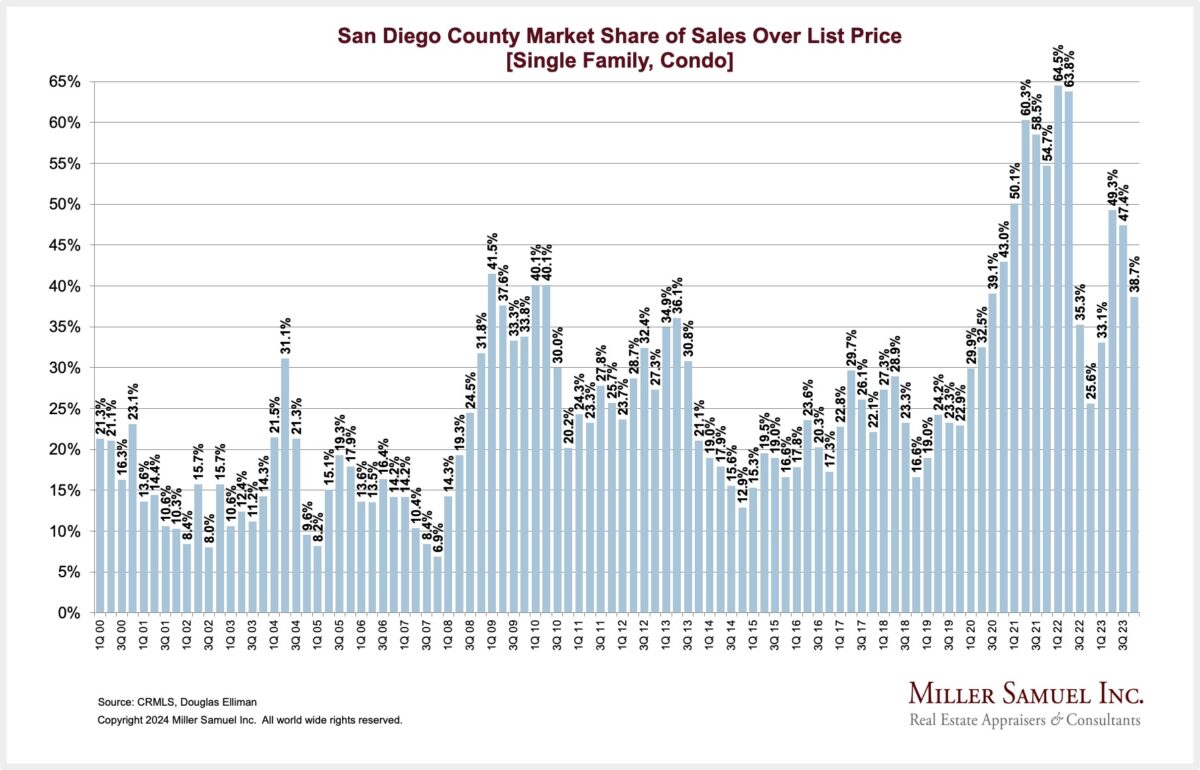

SAN DIEGO COUNTY SALES HIGHLIGHTS

Elliman Report: Q4-2023 San Diego County Sales

“Median sales price reached the second-highest on record as listing inventory fell sharply.”

- – Price trend indicators rose collectively year over year for the second time

- – Sales declined year over year for the tenth time as bidding wars accounted for four in ten sales

- – Listing inventory fell annually for the third straight quarter

Getting Graphic

Favorite housing market charts of the week of our OWN making

Favorite housing market/economic charts of the week made by OTHERS

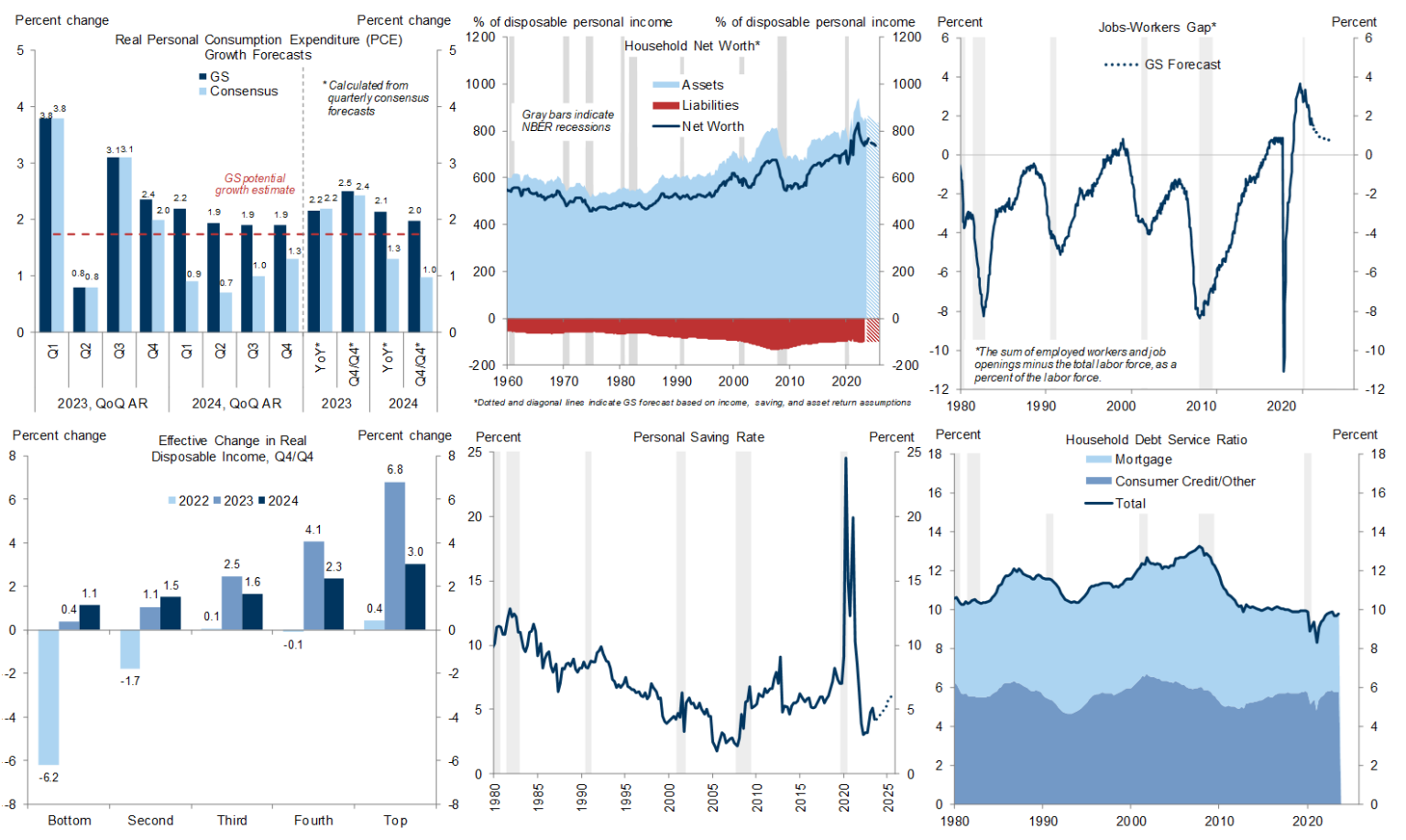

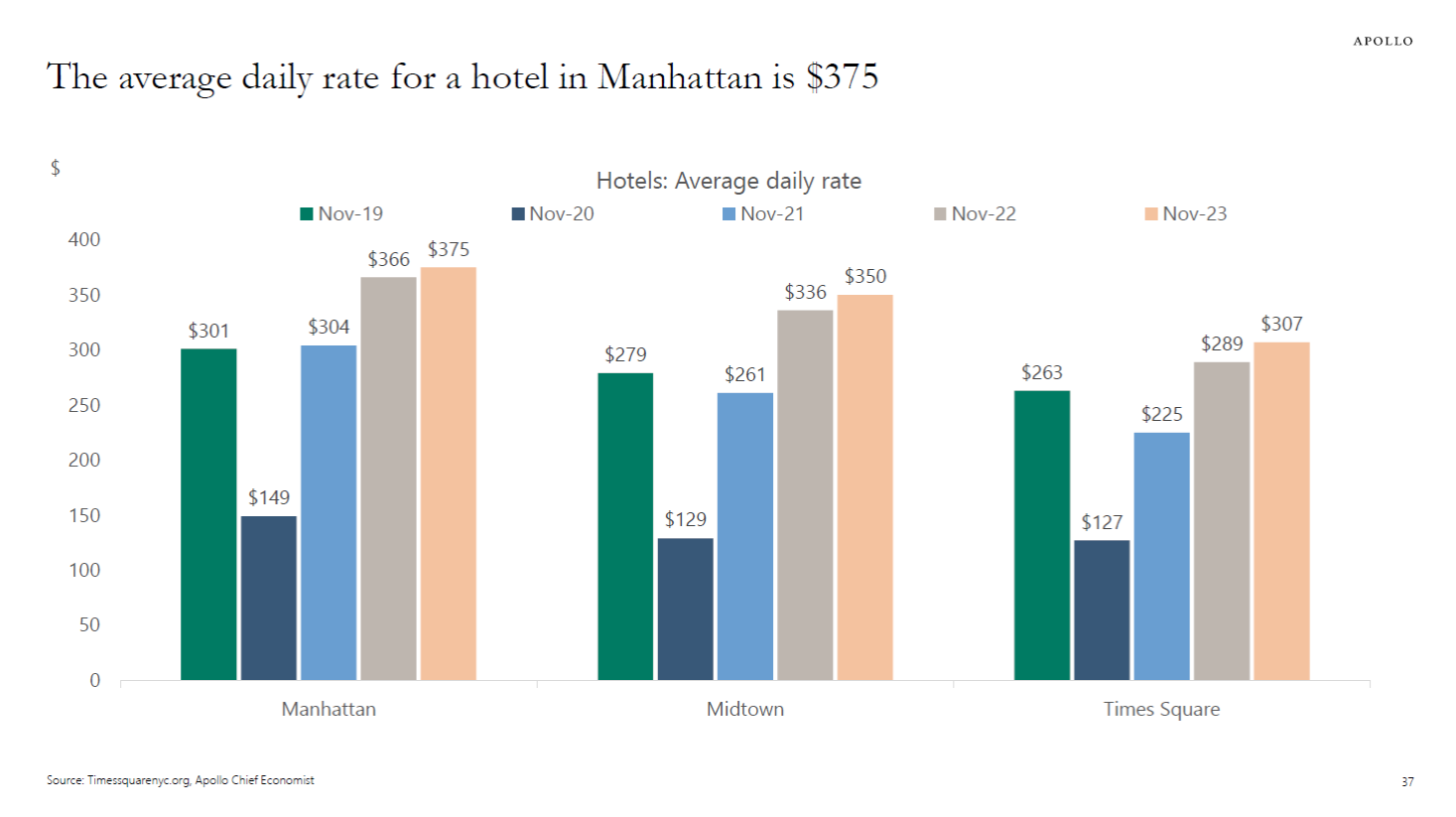

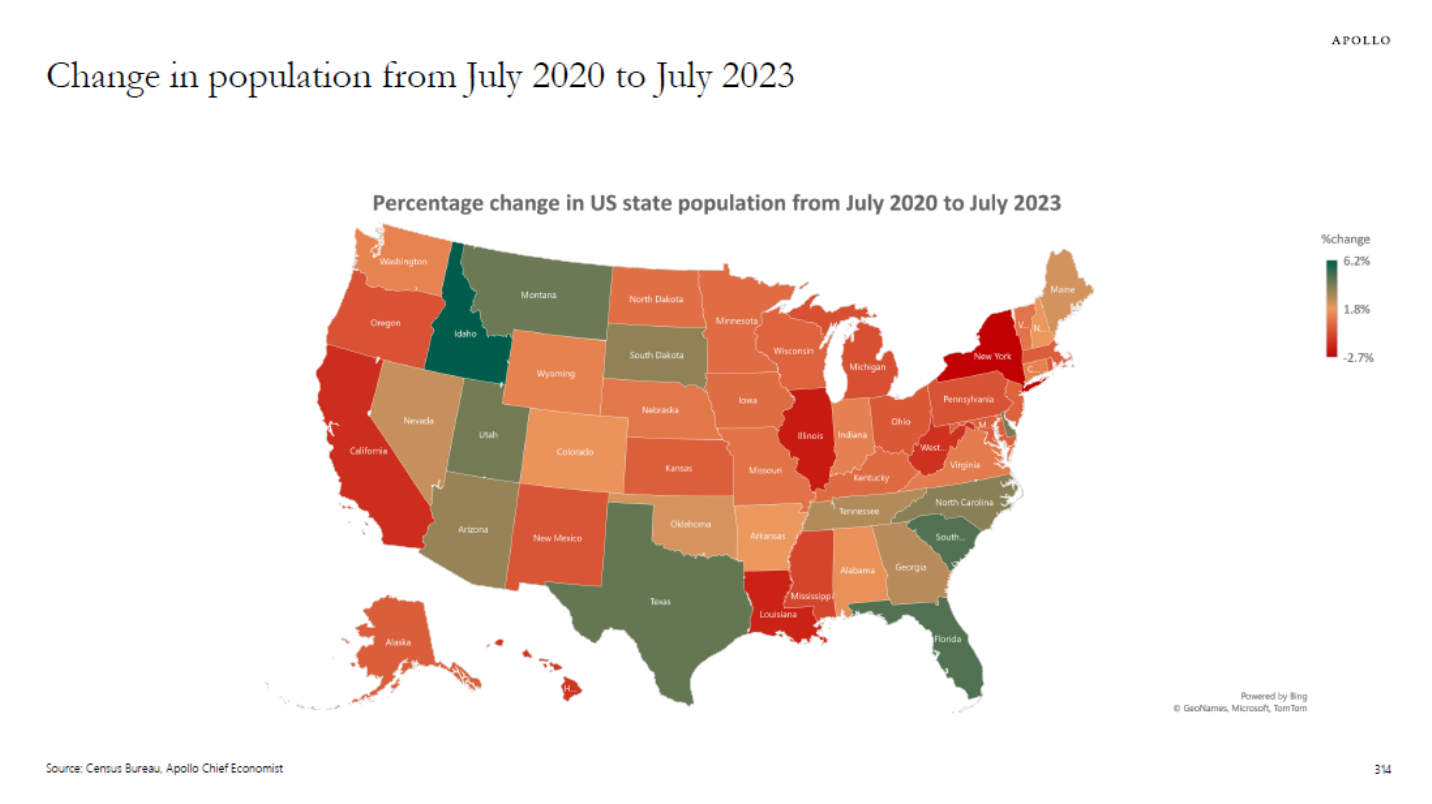

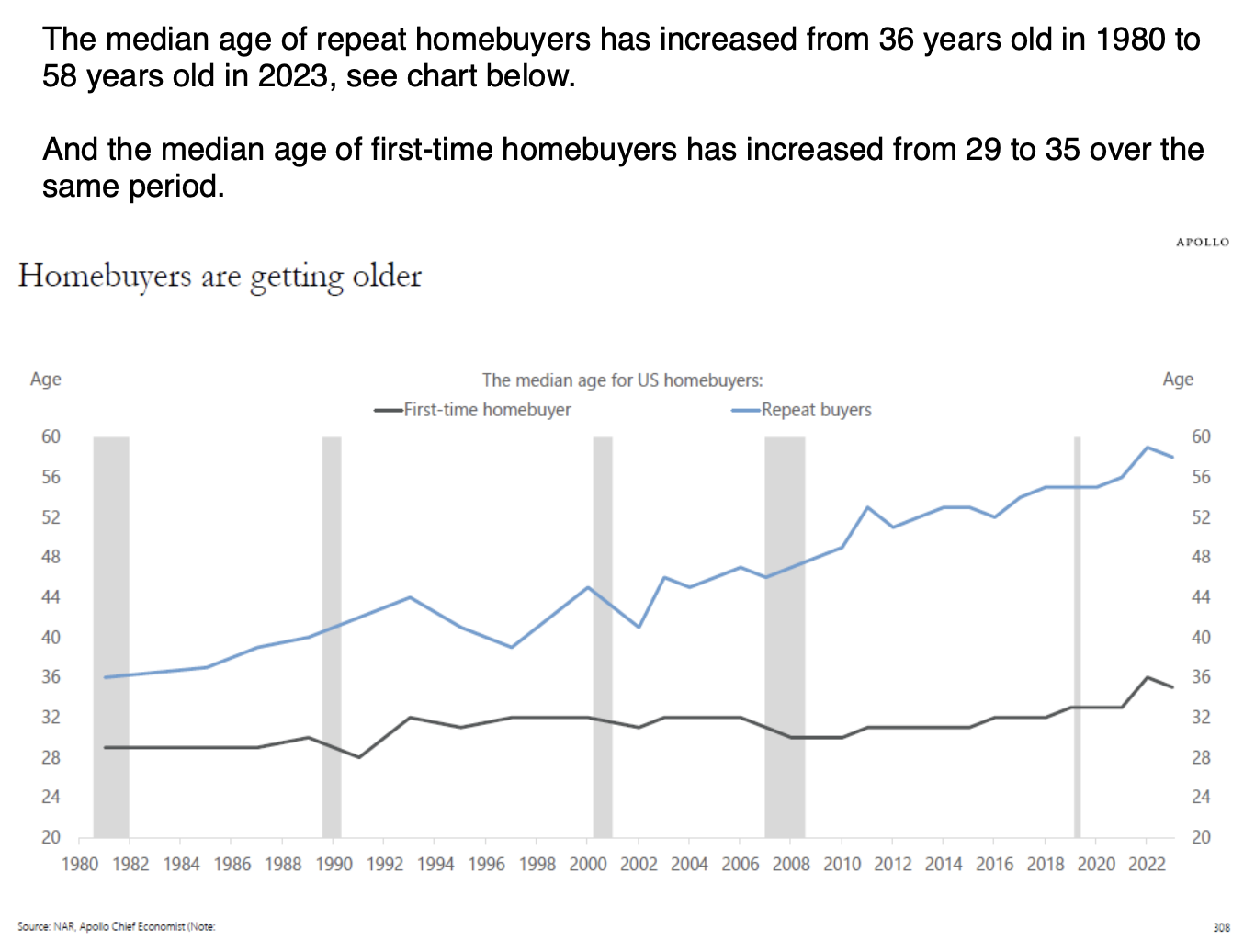

Apollo’s Torsten Slok‘s amazingly clear charts

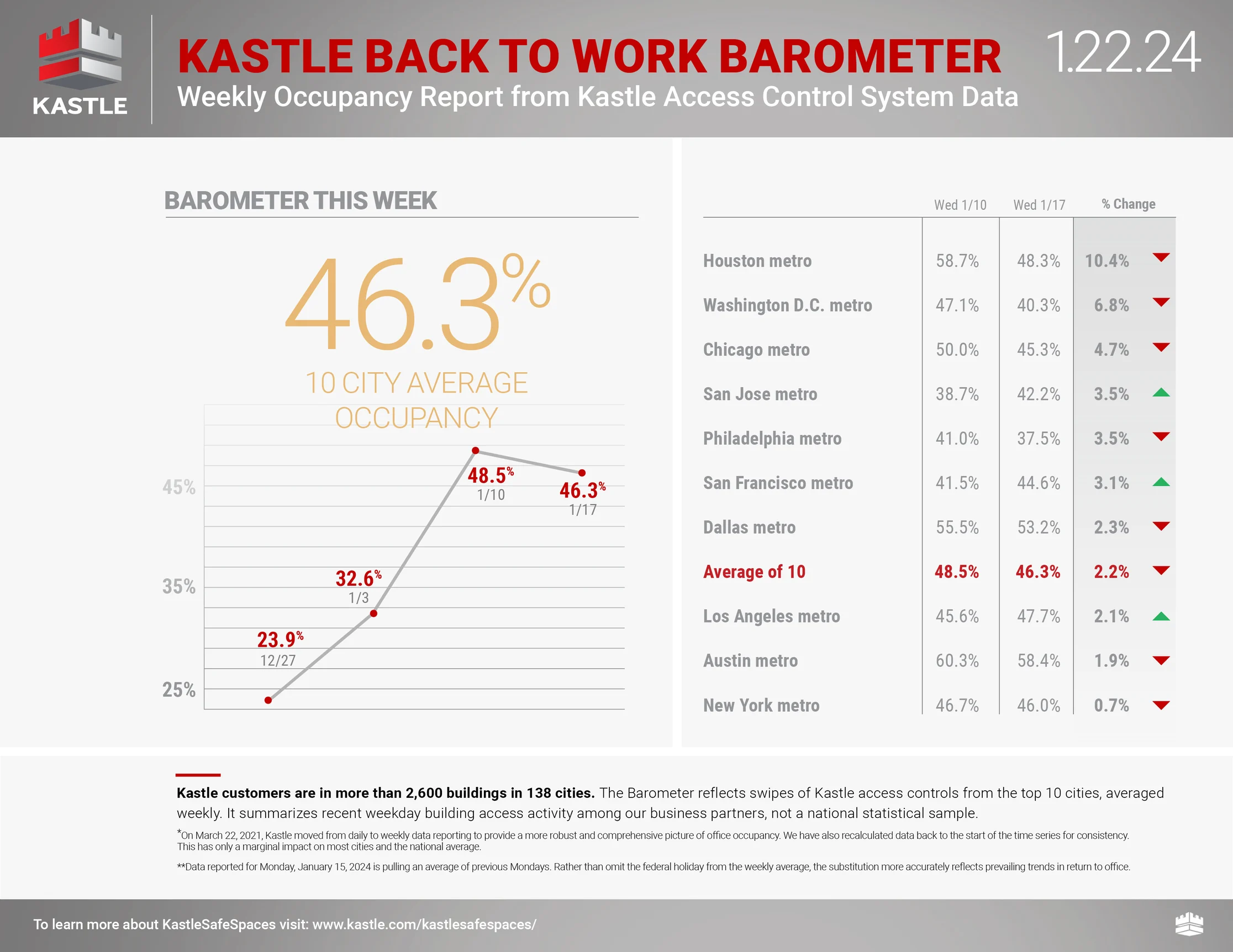

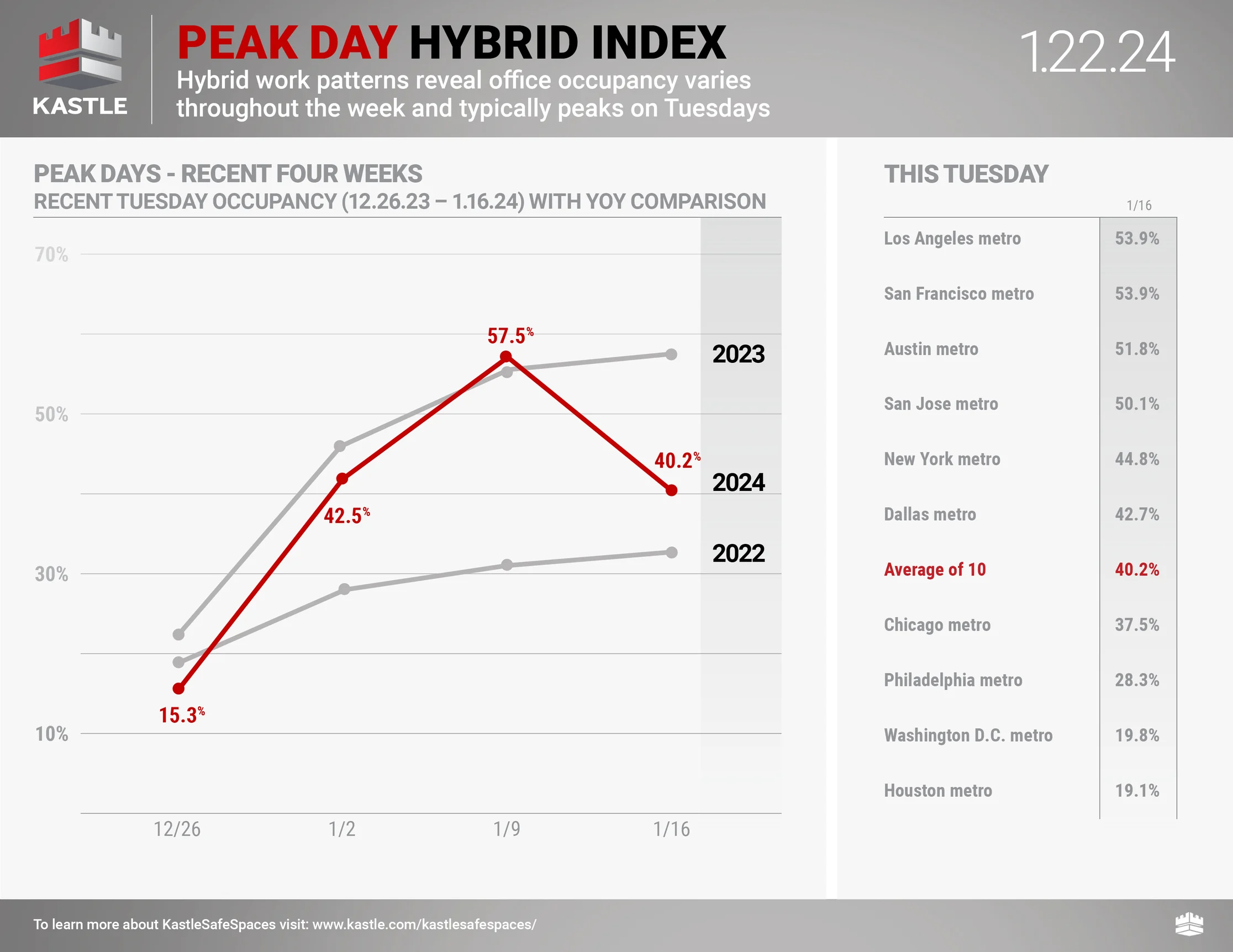

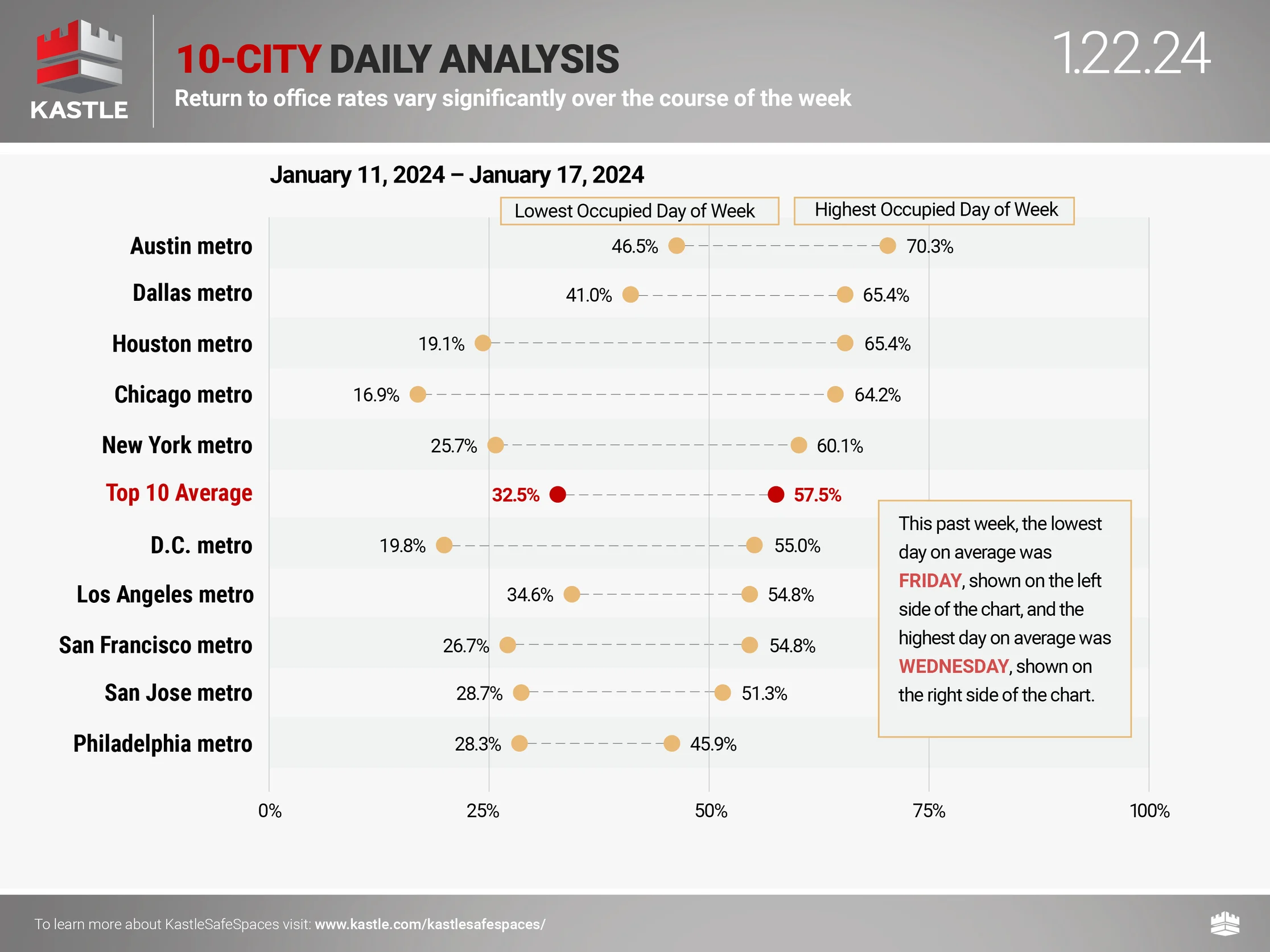

Kastle card swipe data

Remember that Kastle charts are overstating occupancy* because their pre-pandemic occupancy benchmark was 100%, which is incorrect (*measures card swipe activity as a proxy for occupancy). Still, they’ve become the standard benchmark for occupancy rates.

Favorite RANDOM charts of the week made by others

Appraiserville

TAF Has Been Laying Low To Avoid Scrutiny As Dave’s Exit Draws Near

For the uninitiated, TAF is the organization that wrote the bat-shit crazy letter, the chickenshit letter, and is the subject of an active investigation by HUD on whether USPAP promotes a lack of diversity in the appraisal profession (400th out of 400 occupations, according to BLS in 2021). Dave Bunton announced his retirement last year, and all my colleagues assume he’ll bless Kelly Davids, his long-time sycophant, to run the monarchy still devoid of oversight. She helped rid TAF of all the long-time staff with all their institutional knowledge.

Let’s ensure that TAF holds an independent executive search like we saw performed at AI to find a new CEO and fix TAF from its bureaucratic money-making focus.

Appraisal Stories From The Clipboard

I thought it would be great to share anonymous stories from appraisers working in all kinds of markets here in Appraiserville.

An Appraiser From Alaska (unedited)

I wanted to let you know that I read your Housing Notes religiously. I learn quite a bit.

Most of it doesn’t apply to me as I live in a town of 300 people in Alaska. Most of our appraisals are between a 1-2 hour drive away. We have no cookie cutters, every house is different

My partner and I have been appraising for 20+ years and still enjoy it.

Alaska is often seen as a place where people move to to get away from things or to get away with things. My biggest frustration is other appraisers work. The sheer number of appraisers that should be turned into the Real Estate Appraisers board is unfathomable. Some have been turned in but nothing ever comes of it.

We review appraisals where data is made up, comps in a residential neighborhood are compared to a riverfront property in another town, ranch-style homes are compared to 3-story homes, wrong bedroom counts, wrong GLA, and no mention of an accessory unit. and lack of adjustments for the patio or garage.

Appraising in Alaska is a bit like shooting from the hip Annie Oakley-style.

We aren’t assigned as many appraisals as we could be as we don’t shoot from the hip. We hang our hats on the data and even after the 2007-2008 crash, the lenders and AMCs have found ways to assign appraisals to those who always bring the appraisal in at the numbers they need.

So there you have it. I thought I would share a bit of our appraisal world since you share so much.

OFT (One Final Thought)

I was trying to think of a fitting ending to 2023, and I found it.

And if that doesn’t mess with your head, try listening to Led Zeppelin’s “Stairway to Heaven” if it was a Beatles song.

Brilliant Idea #1

If you need something rock solid in your life – particularly on Friday afternoons at 2:00 PM, Eastern Time (ET) – and someone forwarded this to you, you can sign up here for these weekly Housing Notes. And be sure to share with a friend or colleague if you enjoy them because:

– They’ll race the rat up the escalator;

– You’ll keep the trucks off the highway overpasses;

– And I’ll break out my Led Zepplin albums and get reacquainted.

Brilliant Idea #2

You’re clearly full of insights and ideas as a reader of Housing Notes. Consider sharing them with me early and often. I appreciate every email I receive, as it helps me craft future Housing Notes.

See you next week!

Jonathan J. Miller, CRE®, Member of RAC

President/CEO

Miller Samuel Inc.

Real Estate Appraisers & Consultants

Matrix Blog

@jonathanmiller

Reads, Listens and Visuals I Enjoyed

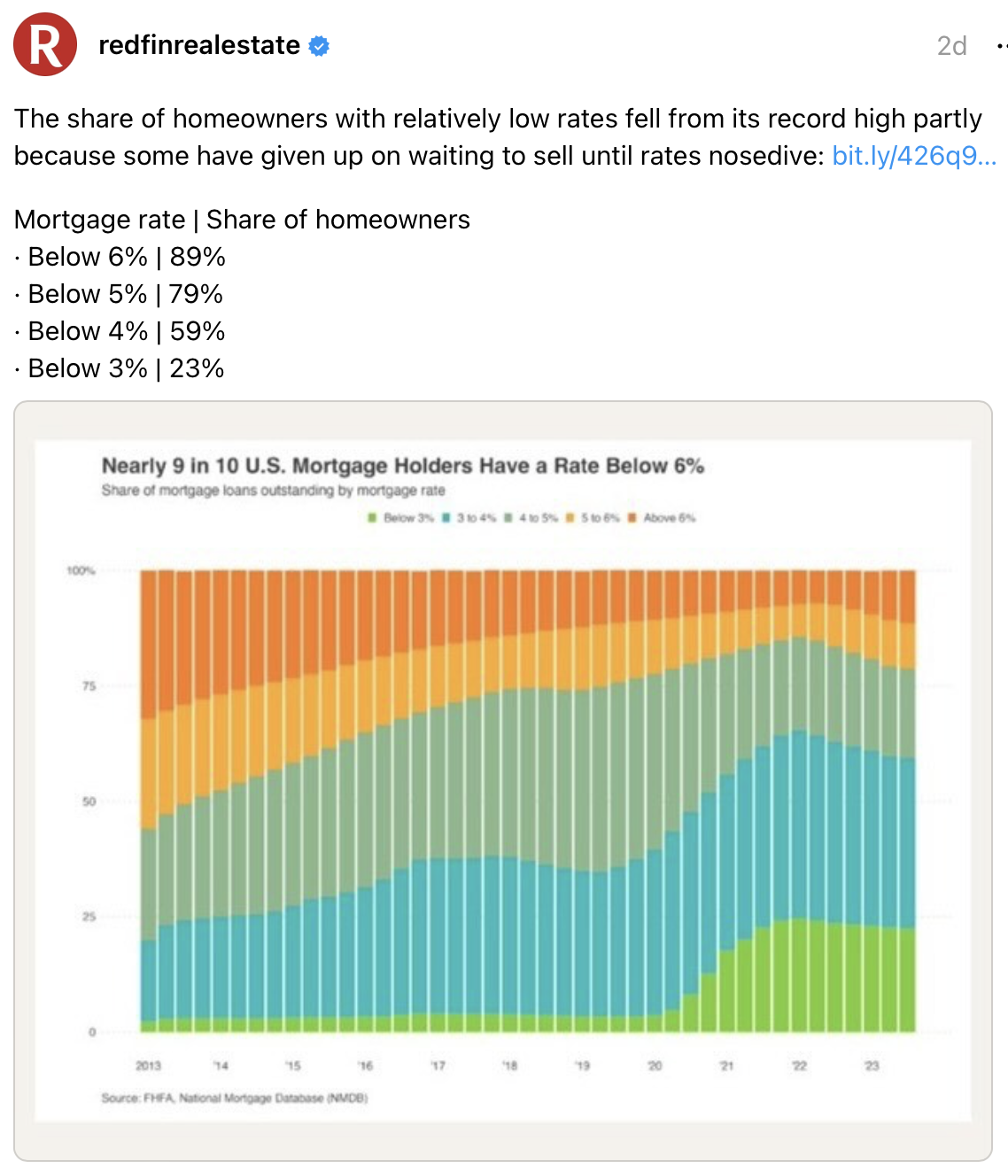

- The Lock-in Effect: 89% of People With Mortgages Have an Interest Rate Below 6%, Down From a Record 93% in 2022 [Redfin]

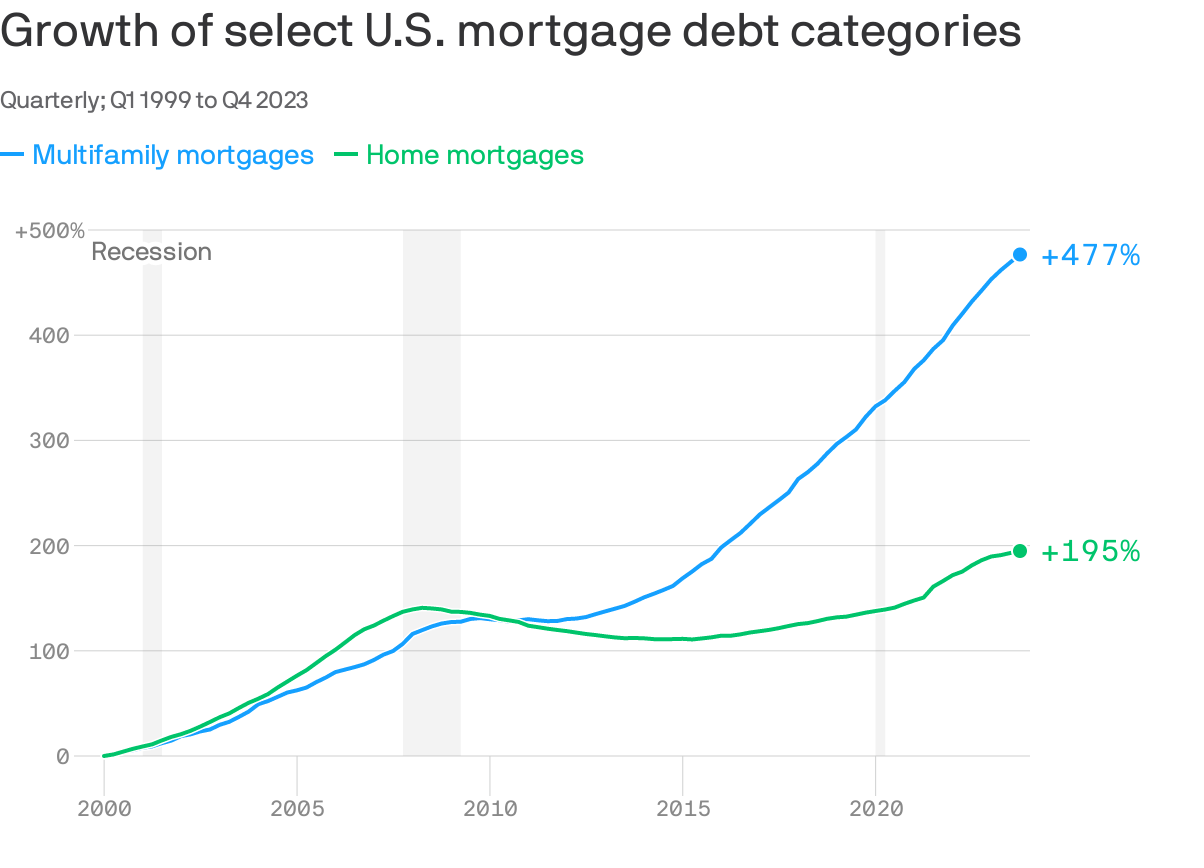

- 📊 Next bank worry [Axios]

- A Bad Office Can (Maybe) Become a Good Apartment [Curbed]

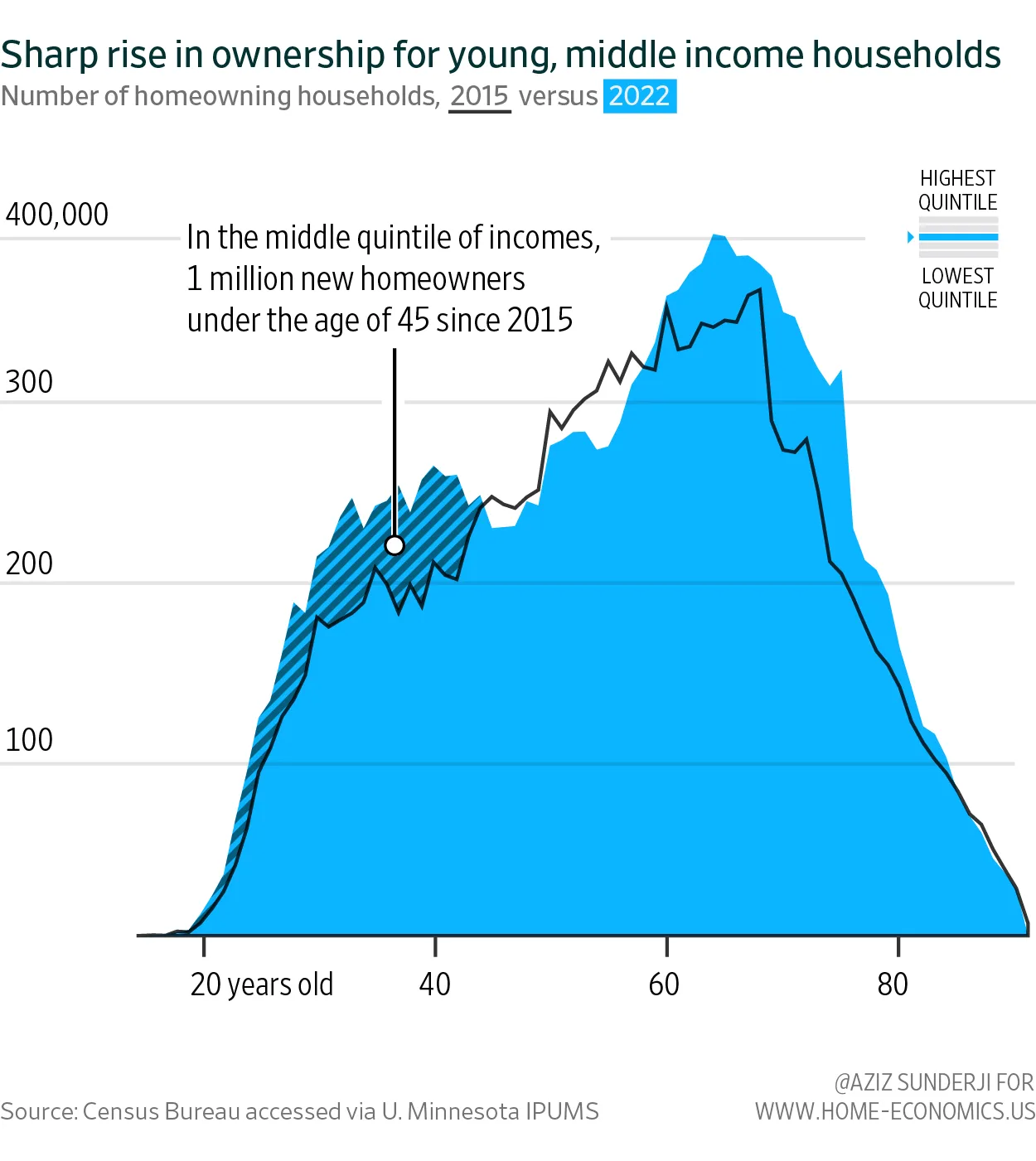

- America has 10 Million New Homeowners [Home-economics]

- “We Buy Ugly Houses” Company Overhauls Policies in the Wake of ProPublica Investigation [ProPublica]

- America's Rental Housing 2024 [JCHS Harvard]

- US Median Rents Fall for Eighth Month on Boom in New Apartments [Bloomberg]

- WSJ News Exclusive | La Dune Compound, Once Priced at $150 Million, to Sell for $79 Million [Wall Street Journal]

- We're worried about lithium-ion battery fires in our building. How do we create an e-bike policy? [Brick Underground]

- Why Rich People Don’t Cover Their Windows [The Atlantic]

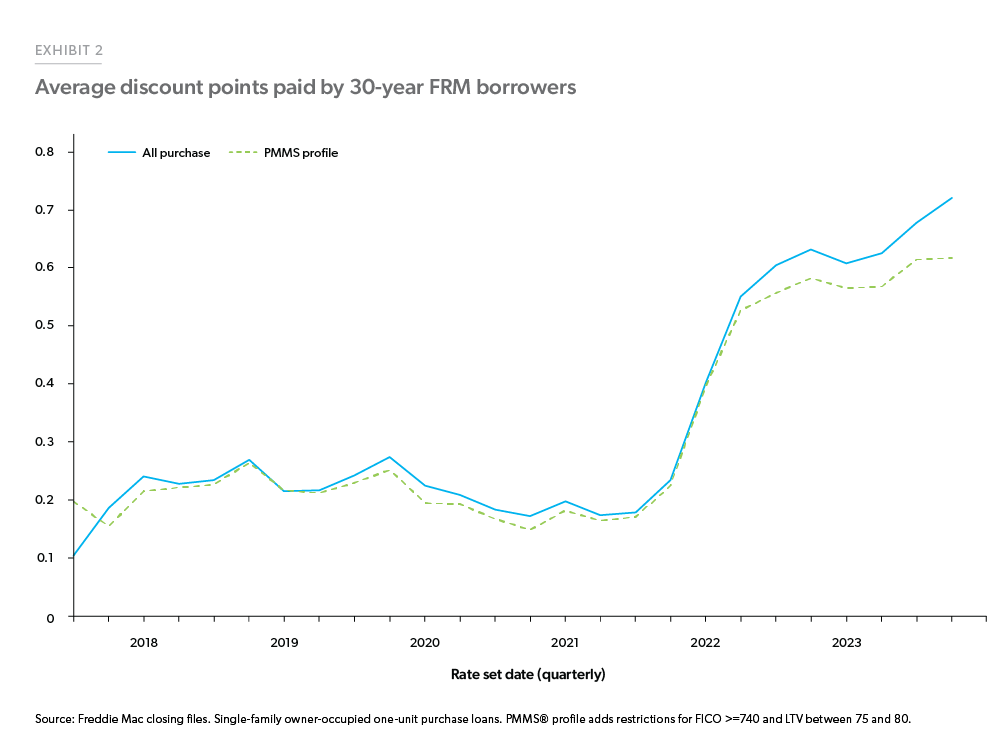

- Economic, Housing and Mortgage Market Outlook – January 2024 [FreddieMac]

- Palm Springs capped Airbnb rentals. Now some home prices are in free-fall [LA Times]

- National Association of Realtors Faces Competition From New Group [NY Times]

- CBRE’s Spencer Levy Talks CRE, Interest Rates, 2024 Economy [The Real Deal]

- Home Price-to-Income Ratio Reaches Record High [JCHS Harvard]

- NMHC: "Apartment Market Continues to Loosen" [Calculated Risk]

- The U.S. Seems to Be Dodging a Recession. What Could Go Wrong? [NY Times]

- The return-to-office wars are over — here's who won [Axios]

- "MyPillow guy" Mike Lindell hasn't paid Fox News bill since August [Axios]

- Delinquencies rise on loans tied to office buildings [Axios]

- Blackstone doubles down on the U.S. housing market with acquisition of Tricon and its nearly 40,000 homes [ResiClub]

- California commission suit filed against NAR and 35 others [Inman]

- Home sales in South Florida dropped by double digits in 2023. What happened to prices? [Miami Herald]

My New Content, Research and Mentions

- 💵 Cash Me if You Can [Highest & Best]

- Hamptons home prices jump to record high [Crain's New York]

- Hamptons Sales Break 10-Month Slump [The Real Deal]

- The Hamptons Real Estate Boom Is Back, Shattering Pricing Records [The Messenger]

- Homes Prices in New York’s Hamptons Beach Towns Surged to Record Highs in the Fourth Quarter [Mansion Global]

- Southampton Town Board Takes First Dip From Community Housing Fund [WLIW FM]

- Crackdown: The Bloomberg Open, Americas Edition [Bloomberg]

- SL Green Eyes $1B NYC Property Debt Vehicle [The Real Deal]

- Jonathan Miller Housing Notes: Falling Mortgage Rates Provide Possible Termination Of Housing Recession • James Lane Post • Hamptons Culture & Lifestyle Magazine [James Lane Post]

- “Poor Things” Star Emma Stone Sells Westwood Bungalow [The Real Deal]

- Bloomberg Money Watch MediaView [WINS-AM]

- Hamptons Home Prices Jump to a Record High [Yahoo Finance]

- Hamptons Home Prices Jump to a Record High [BNN Bloomberg]

- Hamptons Home Prices Jump to a Record High [Bloomberg]

- Long Island home prices hover near highs, as agents wonder when more sellers will emerge [Newsday]

- Real estate market in Miami cools off as demand shifts to other cities FXCompared.com [FX Compared]

- WSJ News Exclusive | Emma Stone’s Los Angeles Home Finds a Buyer in Less Than Two Weeks [Wall Street Journal]

- Emma Stone’s Los Angeles Home Finds a Buyer in Less Than Two Weeks [Mansion Global]

- Nearly 80% of Luxury Homeowners Plan to Ditch a House This Year (Exclusive) [The Messenger]

- Raising Cane’s Founder Todd Graves Buys Luxury Condo in Dallas [The Real Deal]

- Move Over Miami—Five Even Hotter Luxury Housing Markets [Barron's]

- Home Sale Prices Dropping In Boca Raton, Rising In Delray Beach [BocaNewsNow.com]

Recently Published Elliman Market Reports

- Elliman Report: San Diego County Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Orange County Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Los Angeles Sales 4Q 2023 [Miller Samuel]

- Elliman Report: North Fork Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Hamptons Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Long Island Sales 4Q 2023 [Miller Samuel]

- Miller Samuel New York City Market Brief 4Q 2023 [3 Year Comparison] | Miller Samuel Real Estate Appraisers & Consultants

- Elliman Report: Weston Sales 4Q 2023 [Miller Samuel]

- Elliman Report: St. Petersburg Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Manalapan, Hypoluxo Island & Ocean Ridge Sales 4Q 2023 [Miller Samuel]

Appraisal Related Reads

- Housing Statistics for Beginners [Birmingham Appraisal Blog]

- The Appraisal Foundation Opens Call for Board of Trustees Members [Yahoo Finance]

- The housing market has ’80s vibes [Sacramento Appraisal Blog]

- Mortgage Fraud Prevention [Fannie Mae]

Extra Curricular Reads

- Jason Snell: ‘The Mac Turns 40’ [Daring Fireball]

- The Movement to 'Make America Rake Again' [Reasons to be Cheerful]

- The Interpreter: Glamorous murders, casualties of modern capitalism? [NY Times]

- The Introverts Have Taken Over the US Economy [Bloomberg]

- Still whipping it good, Devo looks back on 50 years via a new Sundance documentary [LA Times]

- Congress Trading [Quiver Quantitative]

- Why China Would Struggle to Invade Taiwan [CFR]

- How platforms killed Pitchfork [Platformer]

![San Diego County Average v. Median Sales Price [Single Family, Condo]](https://millersamuel.com/files/2024/01/1Q24SD-avgMED-1200x794.jpg)

![[27 Speaks Podcast] Jonathan Miller Provides A 2024 Hamptons Outlook](https://millersamuel.com/files/2024/02/27eastlogo-600x314.jpg)