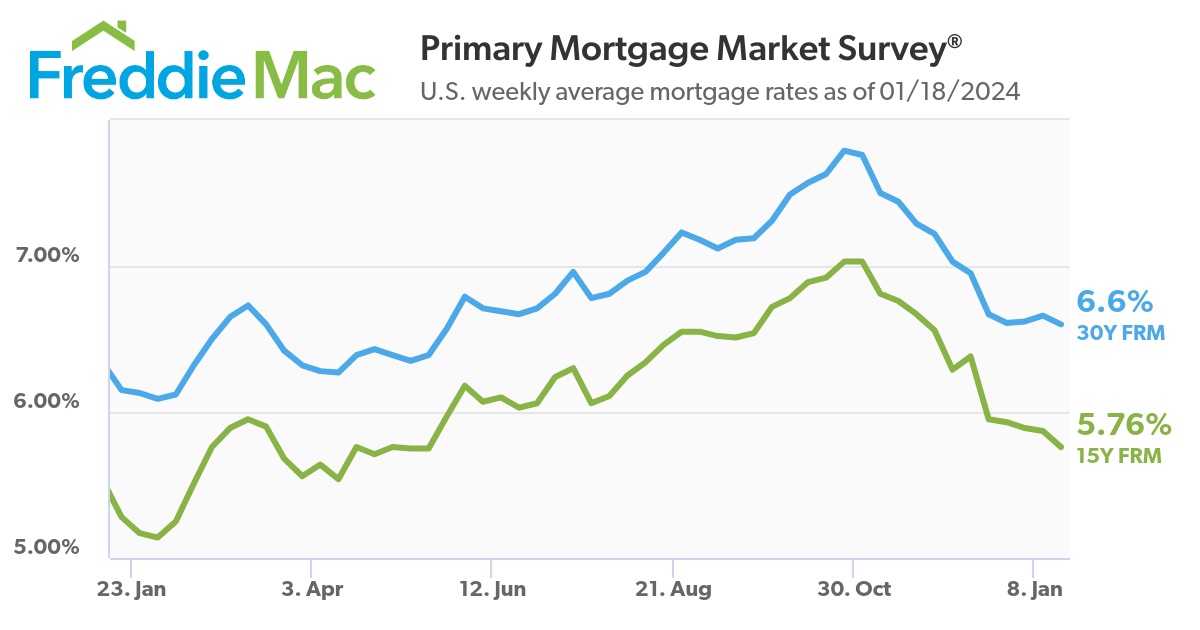

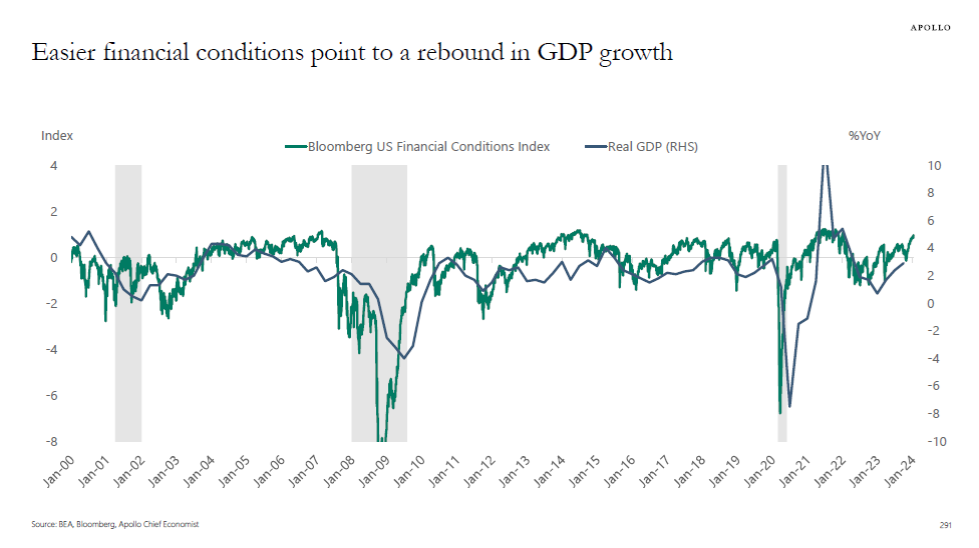

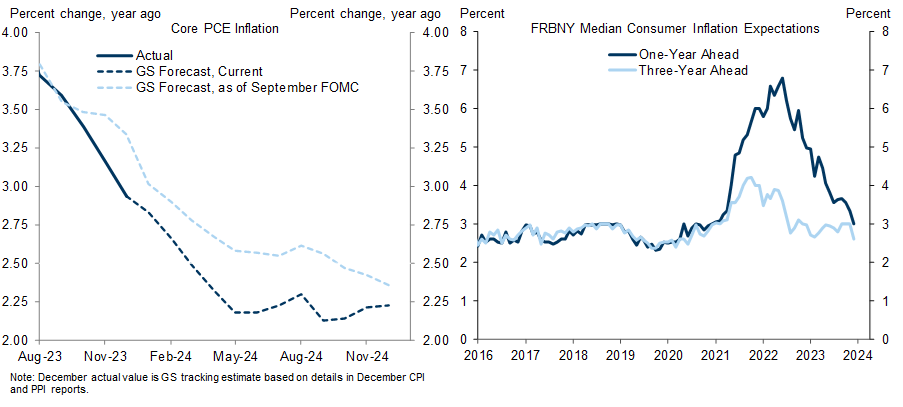

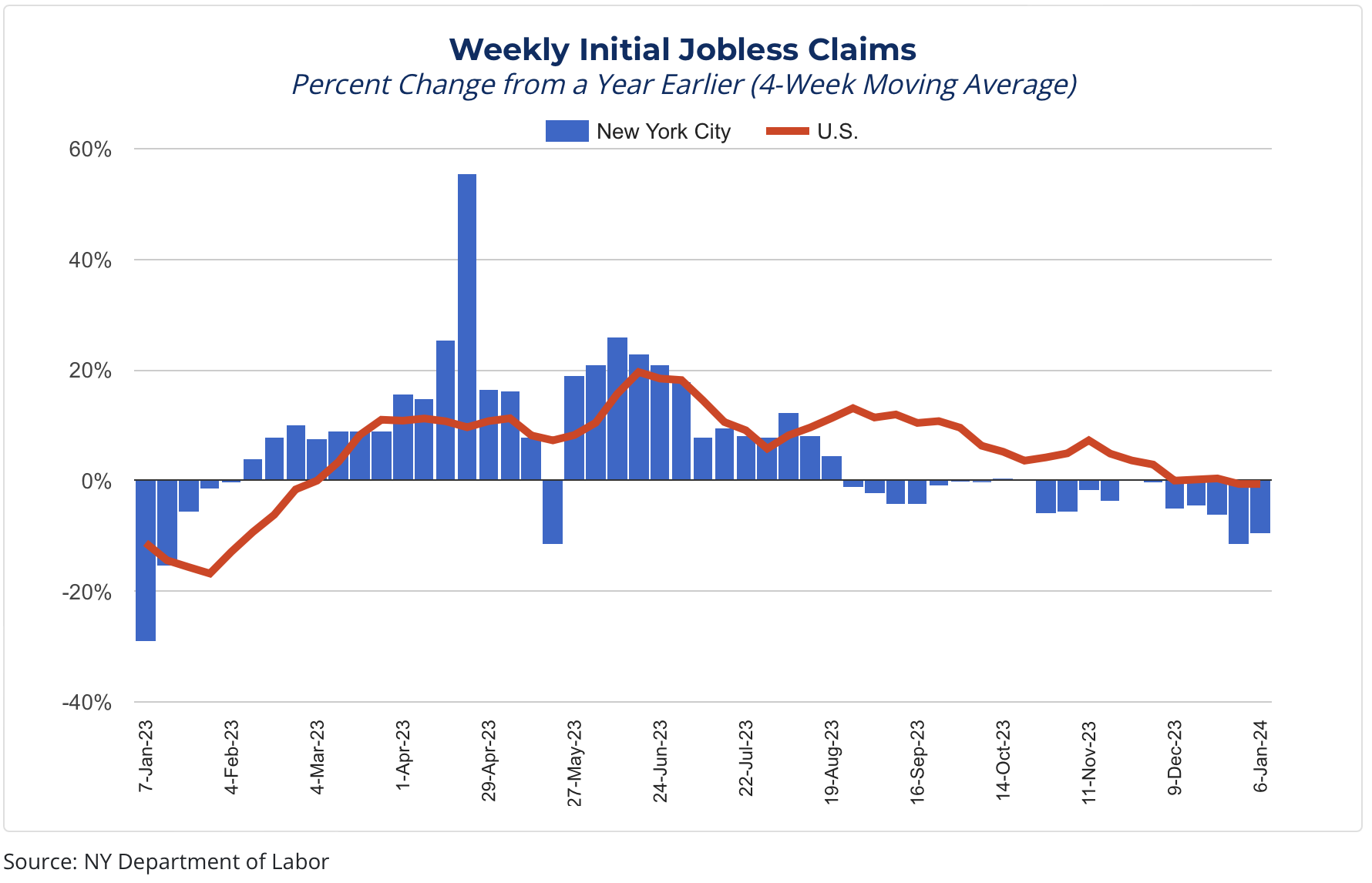

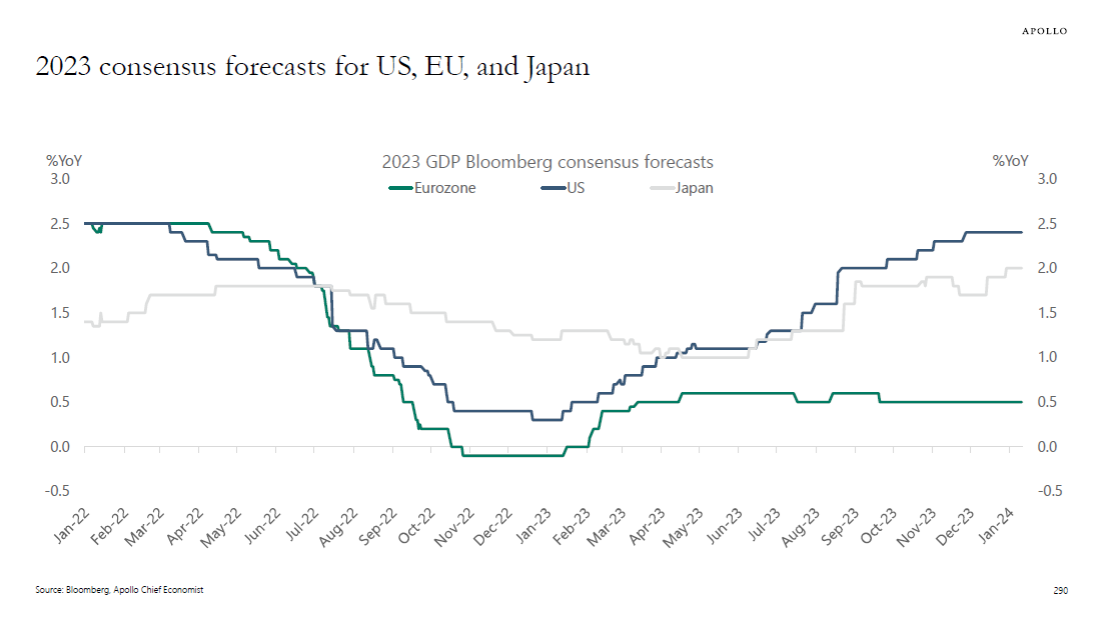

Mortgage rates continue to fall, and the Fed hasn’t cut rates yet. Credit conditions are easing, and unemployment remains low. And going on the Manhattan subway is still an inexpensive and fun way to get around the city.

Wait for it. This kind of activity is more common than you think (when we’re not searching for the “pizza rat.”)

——–

Did you miss last Friday’s Housing Notes?

January 12, 2024: Falling Mortgage Rates Provide Possible Termination Of Housing Recession

——–

But I digress…

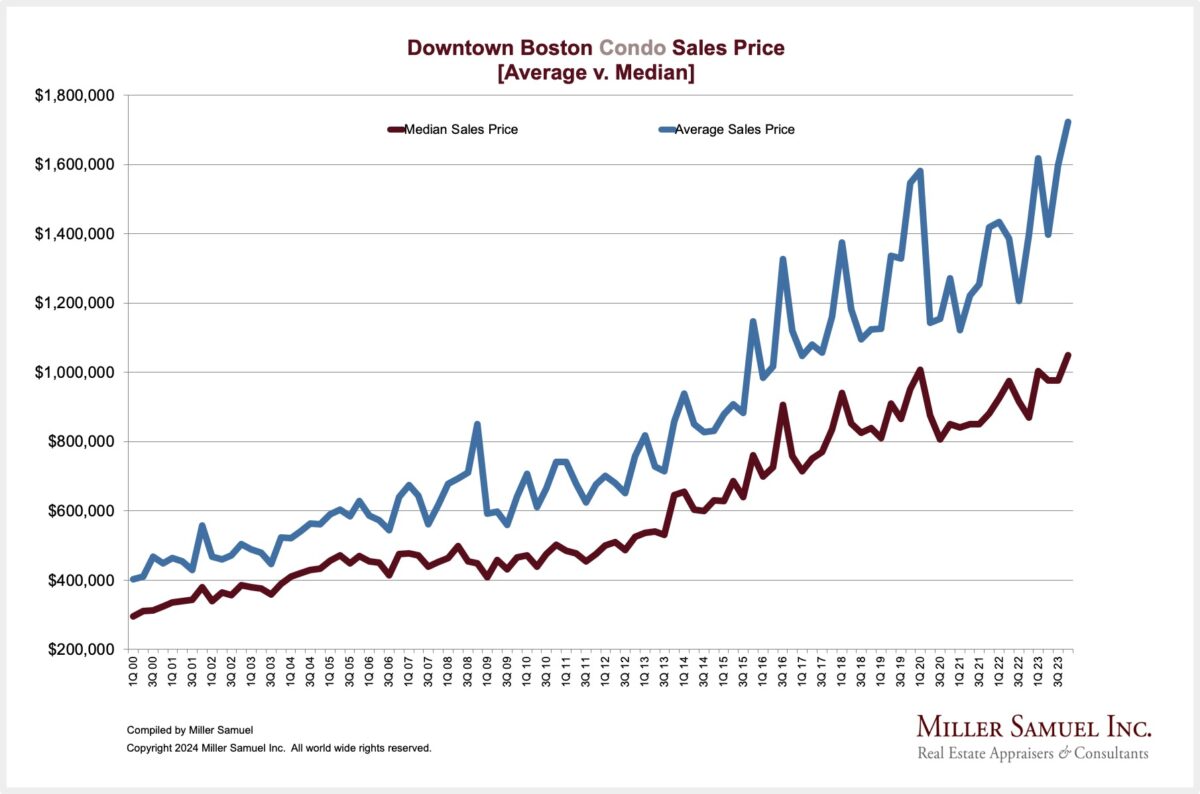

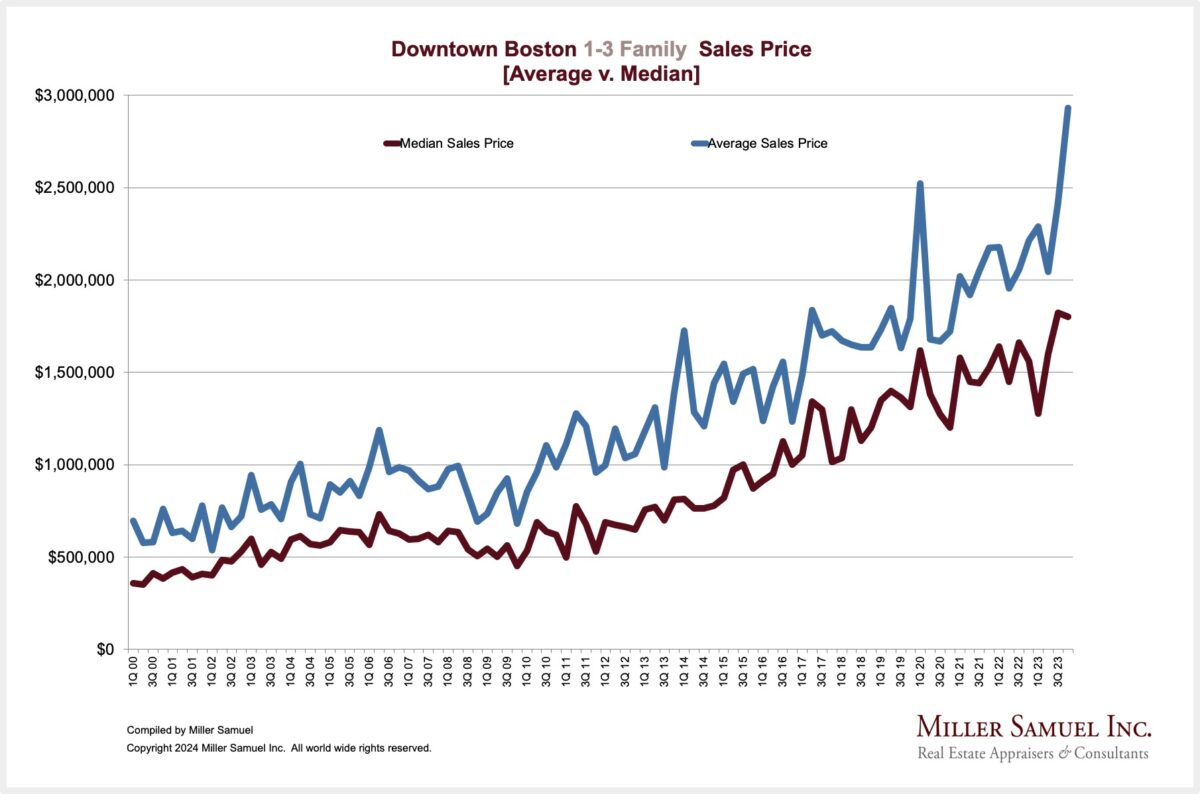

Downtown Boston Sees Record Pricing As Market Is Devoid Of Supply

I’m the author of a series of market reports for real estate firm Douglas Elliman that has expanded beyond New York City, where my efforts began. We cover the downtown Boston market, which is heavily concentrated with newly constructed condos, and it’s one of the fastest-paced U.S. markets we cover. Bisnow does a nice job covering the results of our research: Boston Median Condo Price Surpasses $1M For First Time.

Elliman Report: Q4-2023 Downtown Boston Sales

DOWNTOWN BOSTON SALES HIGHLIGHTS

CONDO

- “Median and average sales prices rose to new highs as listing inventory continued to fall.”

- – Median and average sales prices reached new highs as bidding wars accounted for nearly one in five closings

- – Sales declined year over year for the seventh time in eight quarters

- – Listing inventory declined annually for the tenth time in eleven quarters

1-3 FAMILY

- “Average sales price and average price per square foot reach new records as listing inventory expanded.”

- – Average sales price and average price per square foot set record highs

- – Sales declined year over year for the sixth consecutive quarter

- – Listing inventory expanded year over year for the third time in four quarters

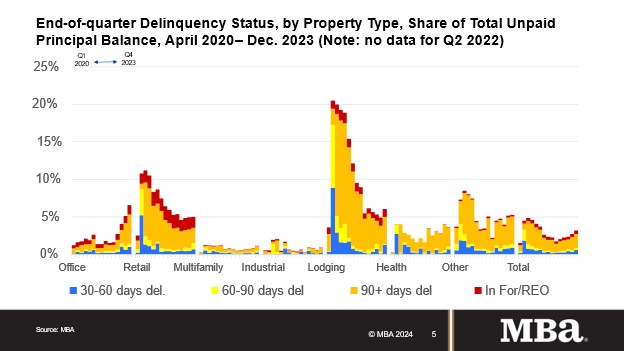

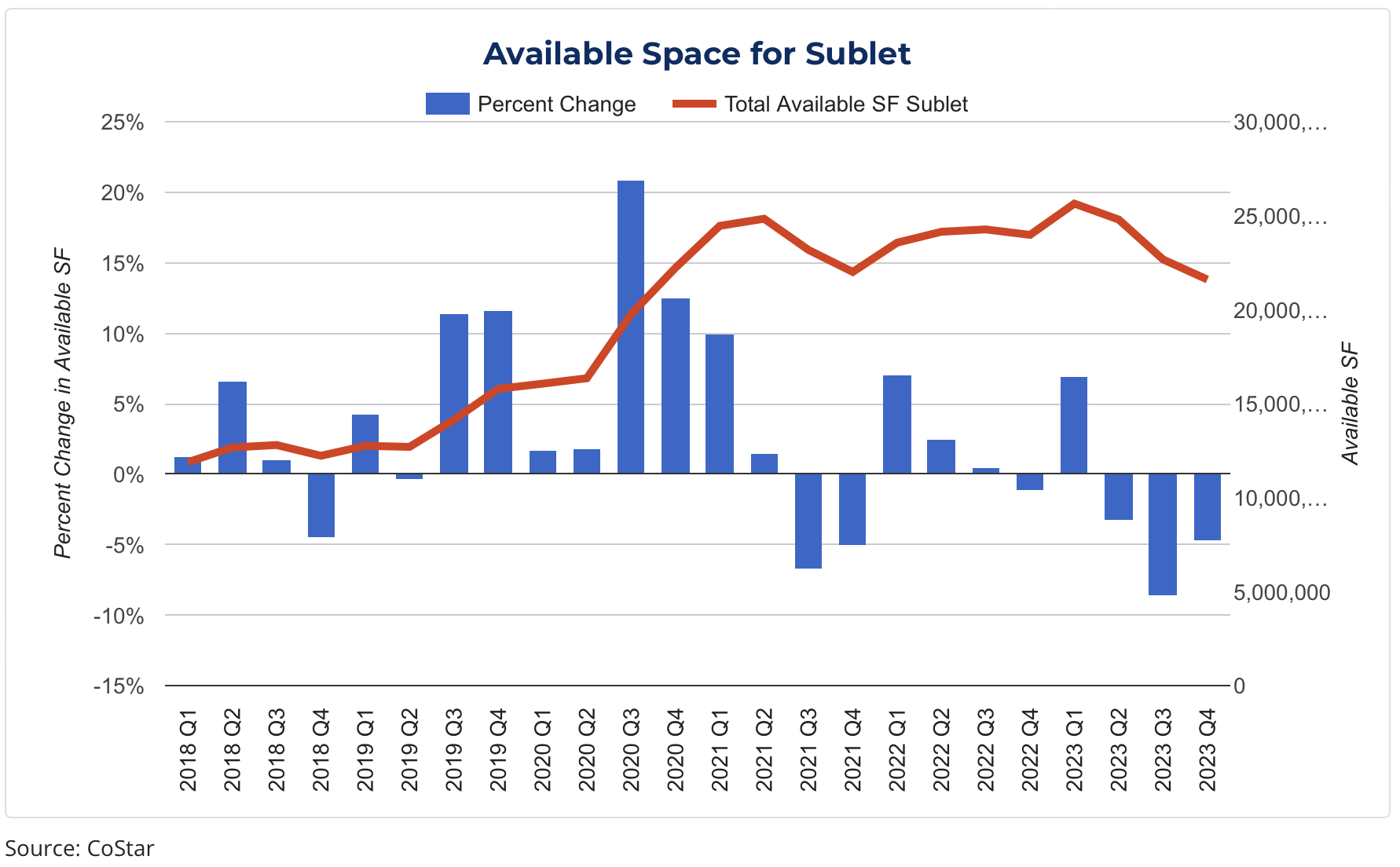

60 Minutes Finally Gets The Memo And Talks Frankly About The State Of Commercial Real Estate

We’ve been discussing the commercial office market in Manhattan here for at least three years now as those in the industry are finally leaving their state of denial phase. CBS News pushed out a story getting into the weeds as to why this is going to be a big thing. I appreciated the candor of discussion by those interviewed for this segment.

My friend and prolific blogger/radio host Barry Ritholtz gives me a shout-out on his Big Picture blog on my recent recap of the crisis. And take a look at this WSJ piece: The Reason the Office Isn’t Fun Anymore.

More importantly, commercial office delinquency rates are now rising. It’s not that landlords have empty buildings because everyone is working at home. It is because they cannot lower their rent to the market rate. After all, they will eventually be unable to pay their debt service because low rental streams from rising vacancies will have the same result.

Builders gotta build, and the only type of commercial office space that doesn’t seem to have vacancy issues is Class A. Class B & C are going to bear the brunt of the economic damage. So why not build more Class A? I suspect that is precisely what will happen over the next decade.

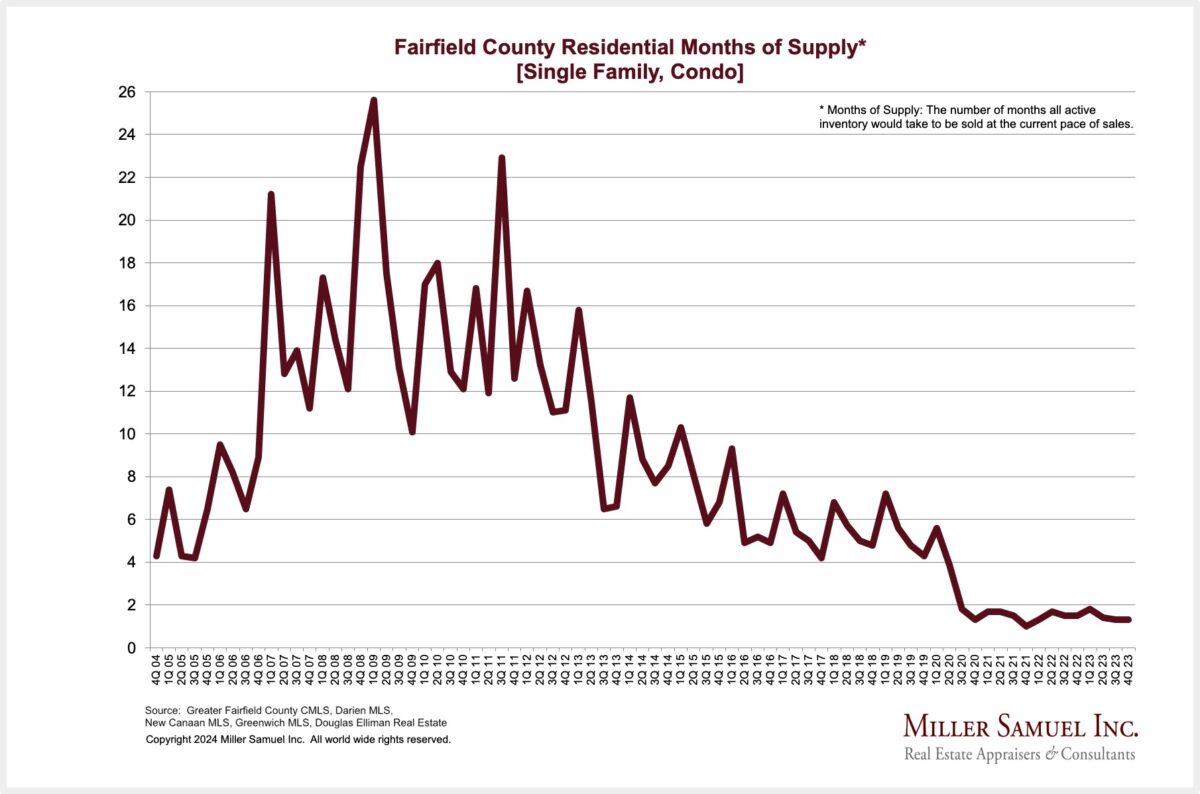

Connecticut Has More Nutmeg Than Listing Inventory

I have lived in Fairfield County, Connecticut since 1990 and cover its housing market, as well as Greenwich and New Canaan for Douglas Elliman. It’s classic suburbia for New York City, especially for Wall Street.

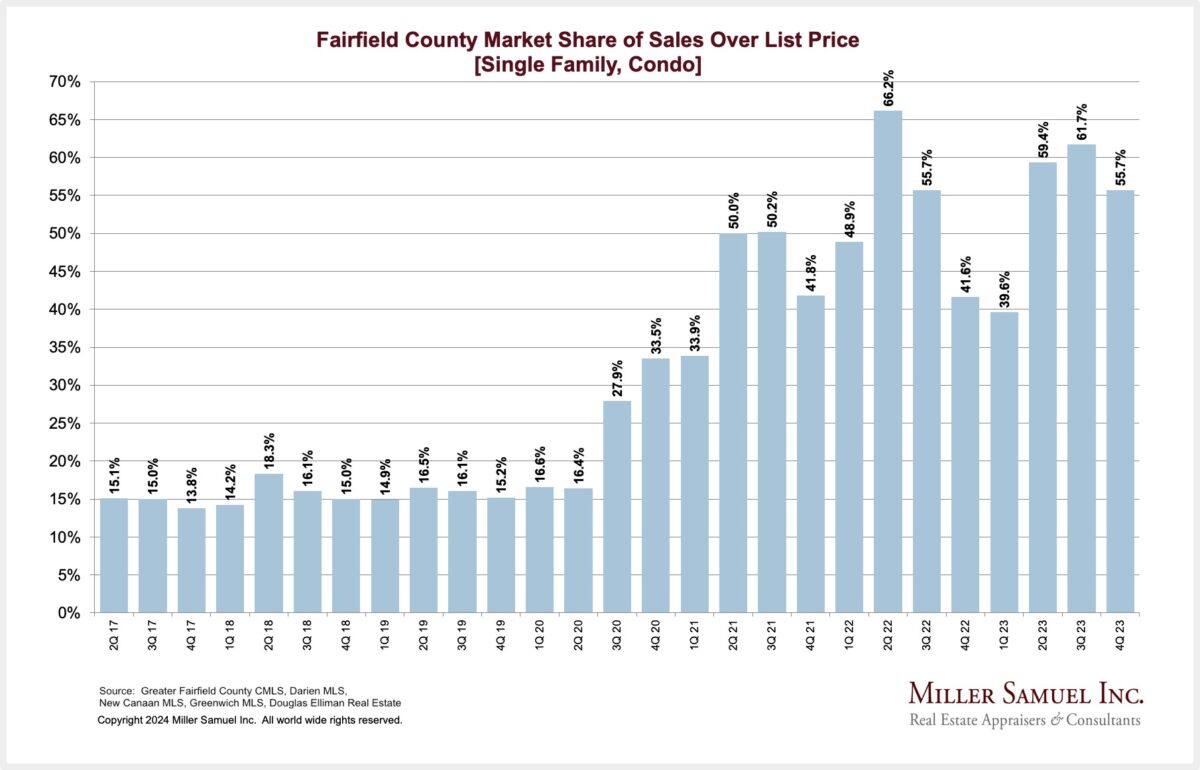

Fairfield County

Elliman Report: Q4-2023 Fairfield County Sales

“Price trend indicators continued to rise as listing inventory fell to record lows.”

- – All price trend indicators collectively rose year over year for the third straight quarter

- – Bidding war quarterly market share exceeded half of all closings for the seventh time in three years

- – Listing inventory fell significantly from the year-ago quarter for the third time

- – Luxury price trend indicators collectively rose year over year for the third straight quarter

- – Luxury listing inventory declined to its lowest level on record

- – The luxury entry price threshold expanded annually for the third consecutive quarter

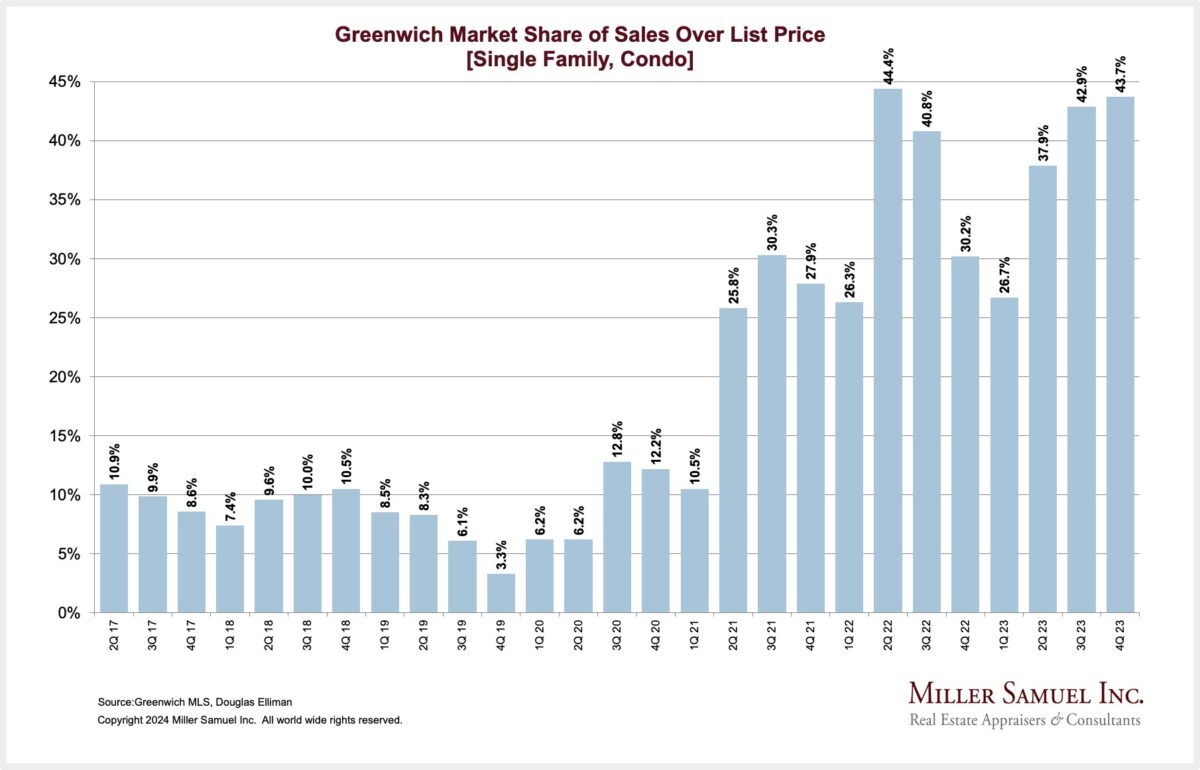

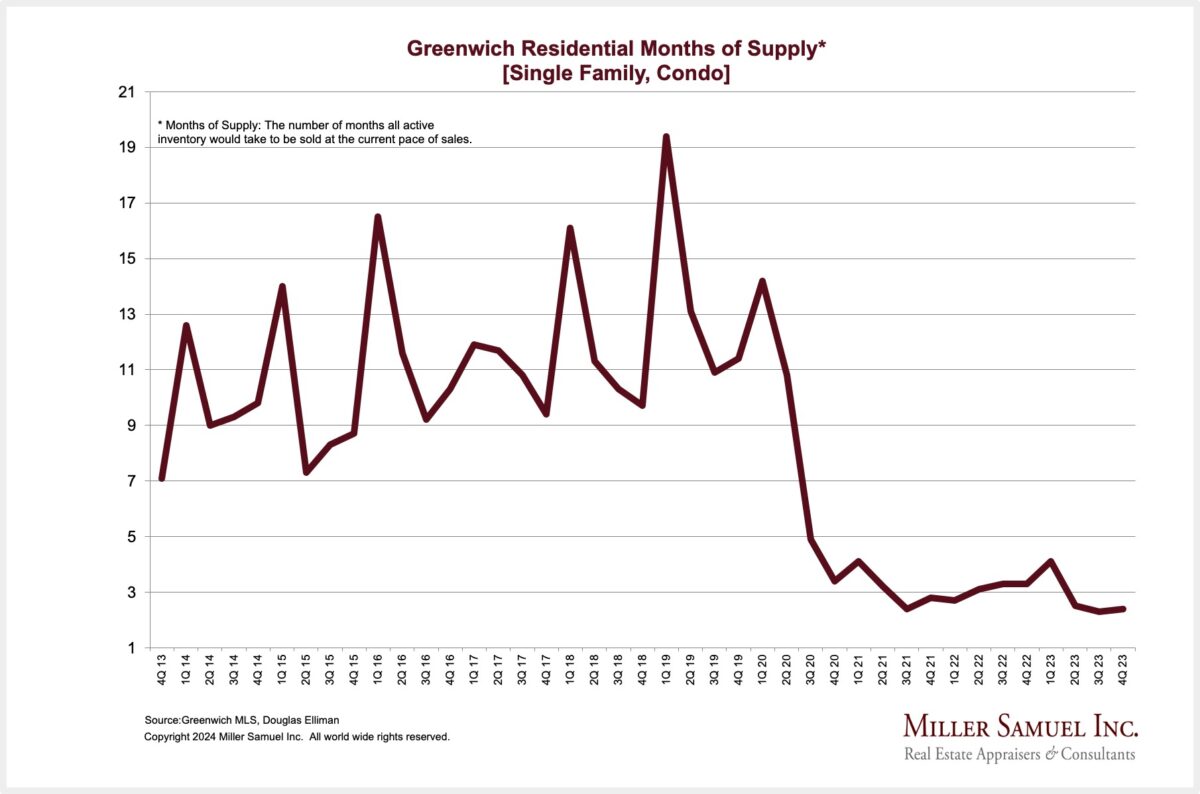

Greenwich

Elliman Report: Q4-2023 Greenwich Sales

“Listing inventory continued to fall, pressing prices higher.”

- – Single family price trend indicators showed mixed annual results

- – Single family listing inventory fell annually to a record low as sales rose for the first time in nine quarters

- – Condo listing inventory fell year over year to a new low as prices increased

- – Luxury price trend indicators surged year over year

- – Luxury listing inventory fell sharply year over year to a record low

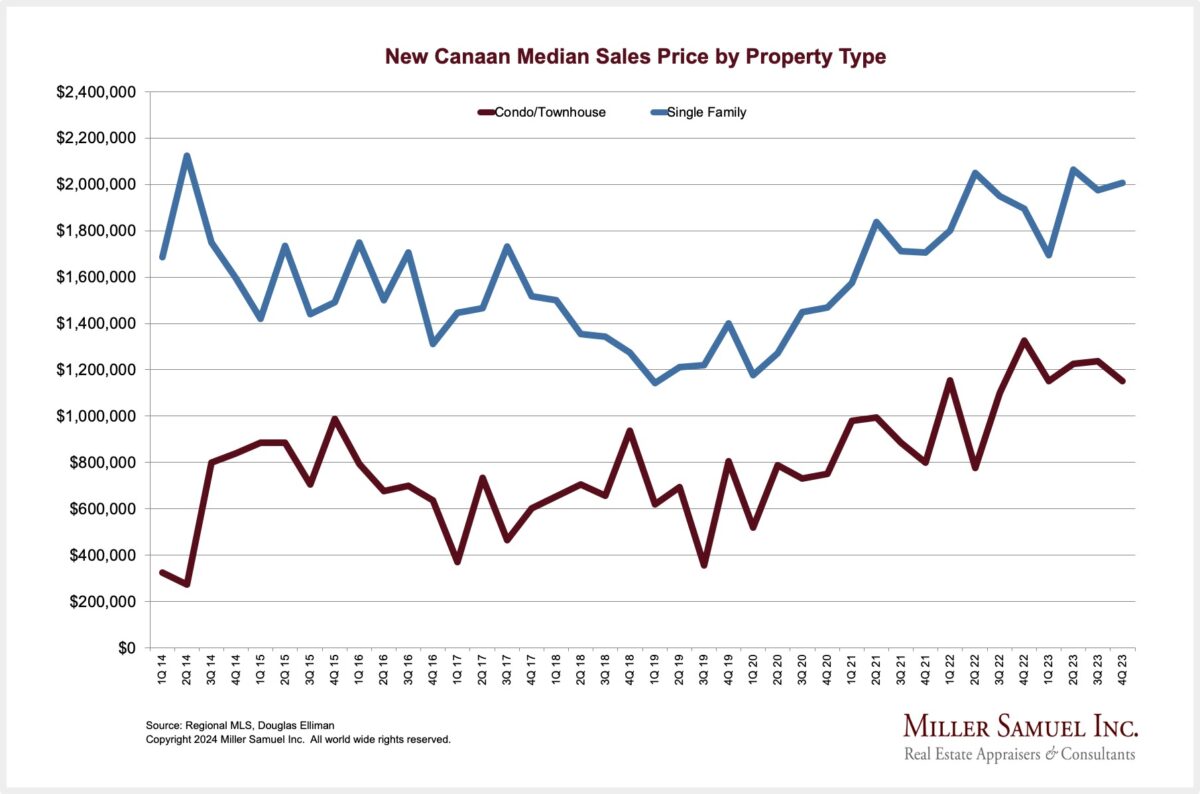

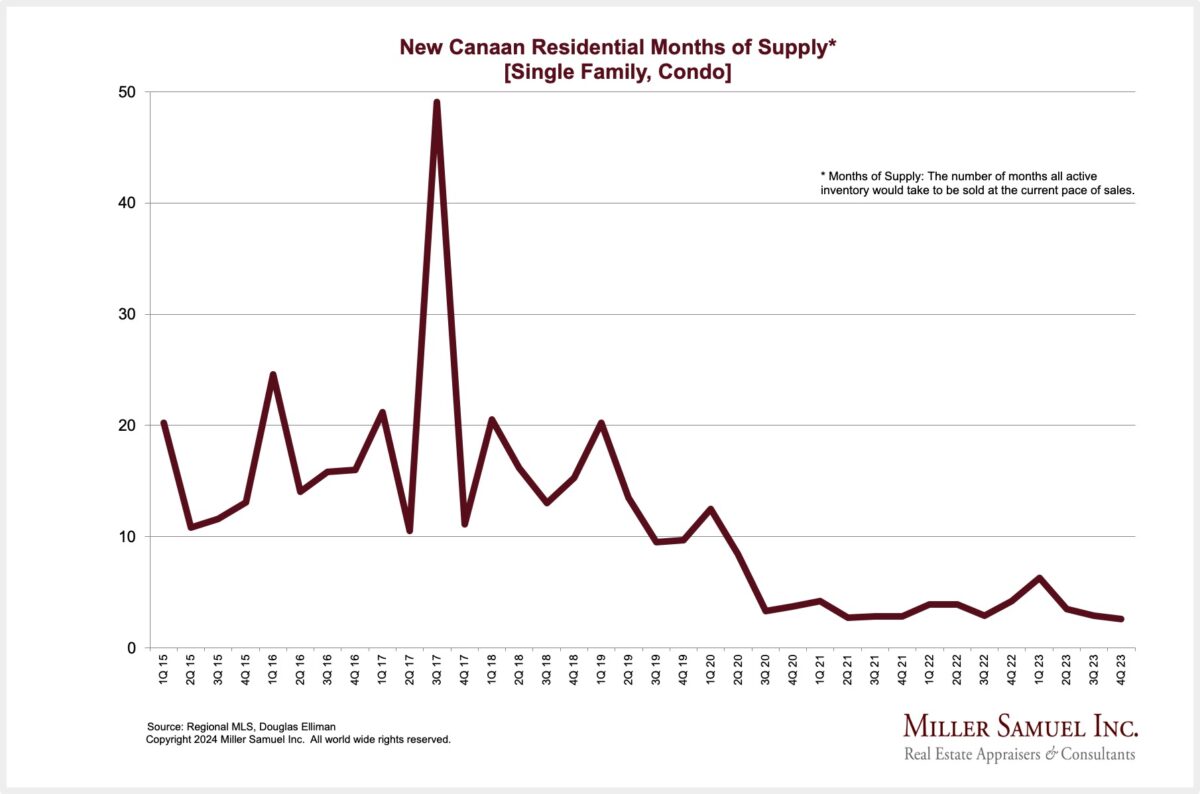

New Canaan

Elliman Report: Q4-2023 New Canaan Sales

“Listing inventory continued to fall, pressing prices higher.”

- – Single family price trend indicators increased year over year

- – Single family listing inventory fell year over year to the lowest on record

- – Condo average price per square foot reached a new high as listing inventory dropped to a record low

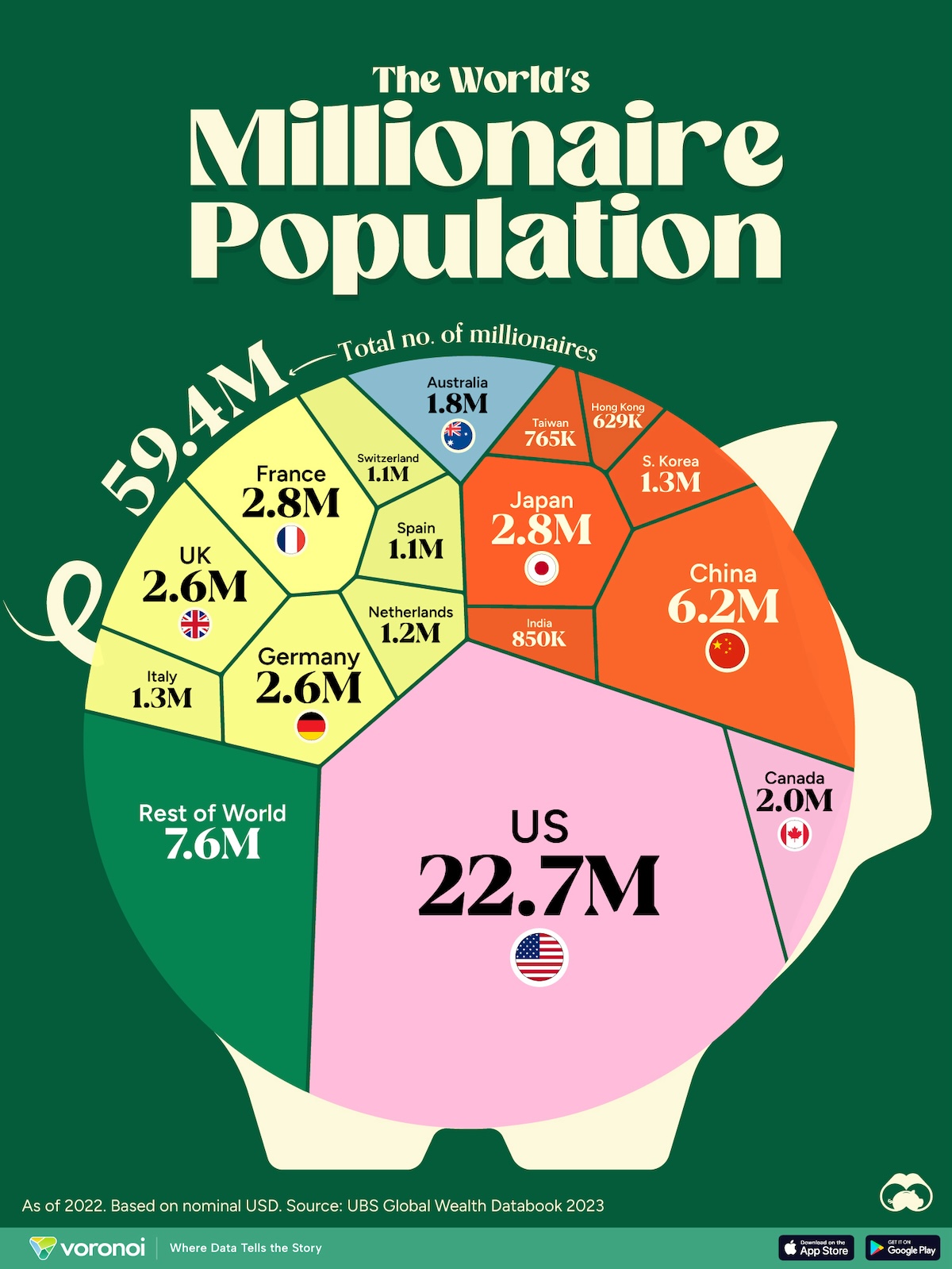

Visual Capitalist: Where Do The Wealthiest People Live

I probably slog on too much about “luxury” real estate and the wealthiest who buy it, but I work in one of the most expensive housing markets in the US, if not the world. I track, trend, appraise, testify, speak publically, and write about it. So to those who find it annoying, that’s quite rich (sorry).

Remember WeWork? The Era Of Unicorns Was Wildly Overhyped

I saw this Real Deal article on WeWork founder Adam Neumann: Adam Neumann’s Flow faces cash crunch at Nashville properties. As WeWork implodes and his new startup “Flow” is struggling, I have a long-standing question:

“Who gives these people a ton of money and seemingly does little due diligence?”

Highest & Best Newsletter: Tall Tower Tussles

You should sign up for this Florida newsletter I love: Highest & Best from Oshrat Carmiel, formerly of Bloomberg News…

This week’s post:

Tall Tower Tussles –Florida’s new law promotes affordable housing. Local leaders hate it.

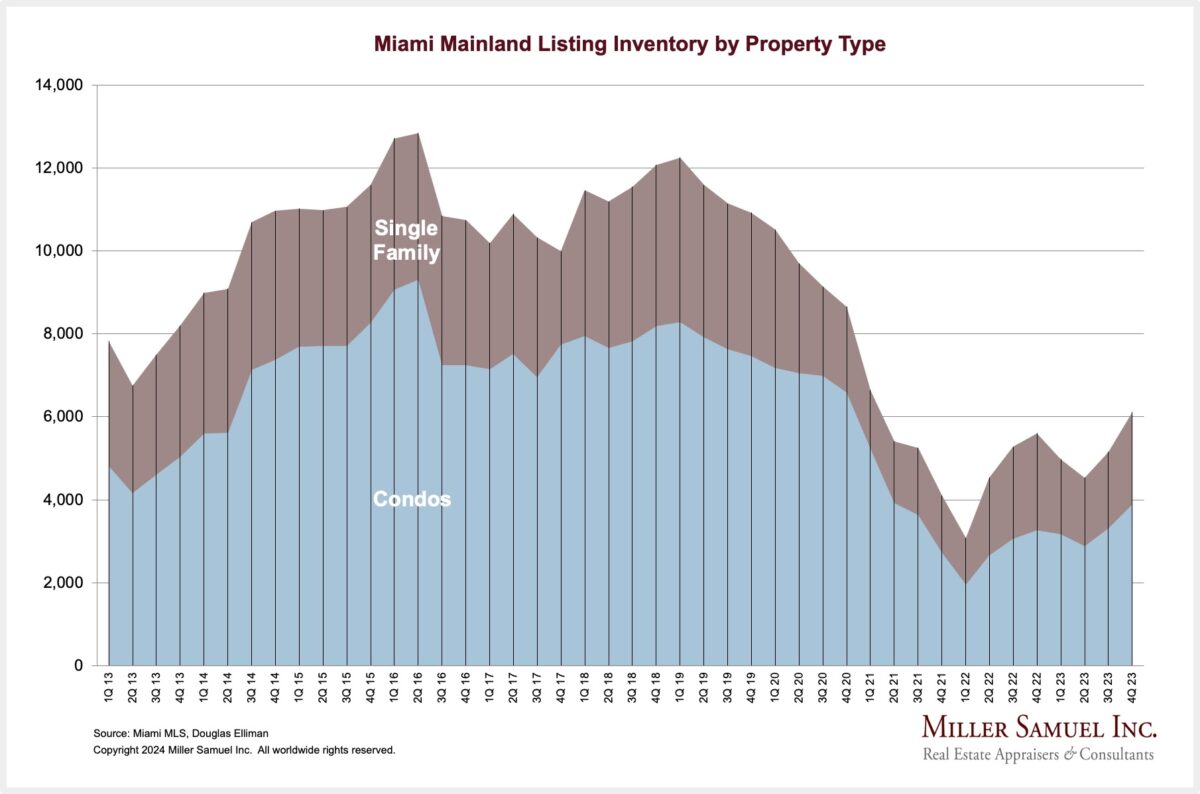

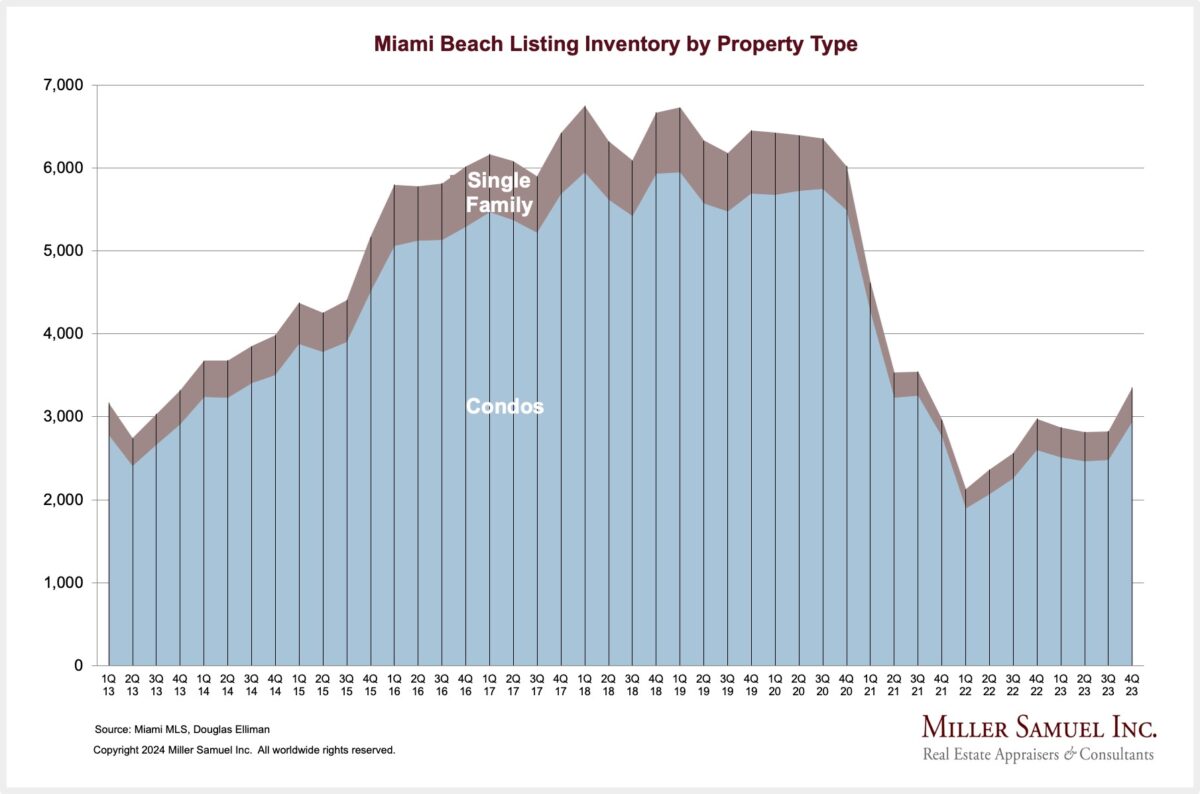

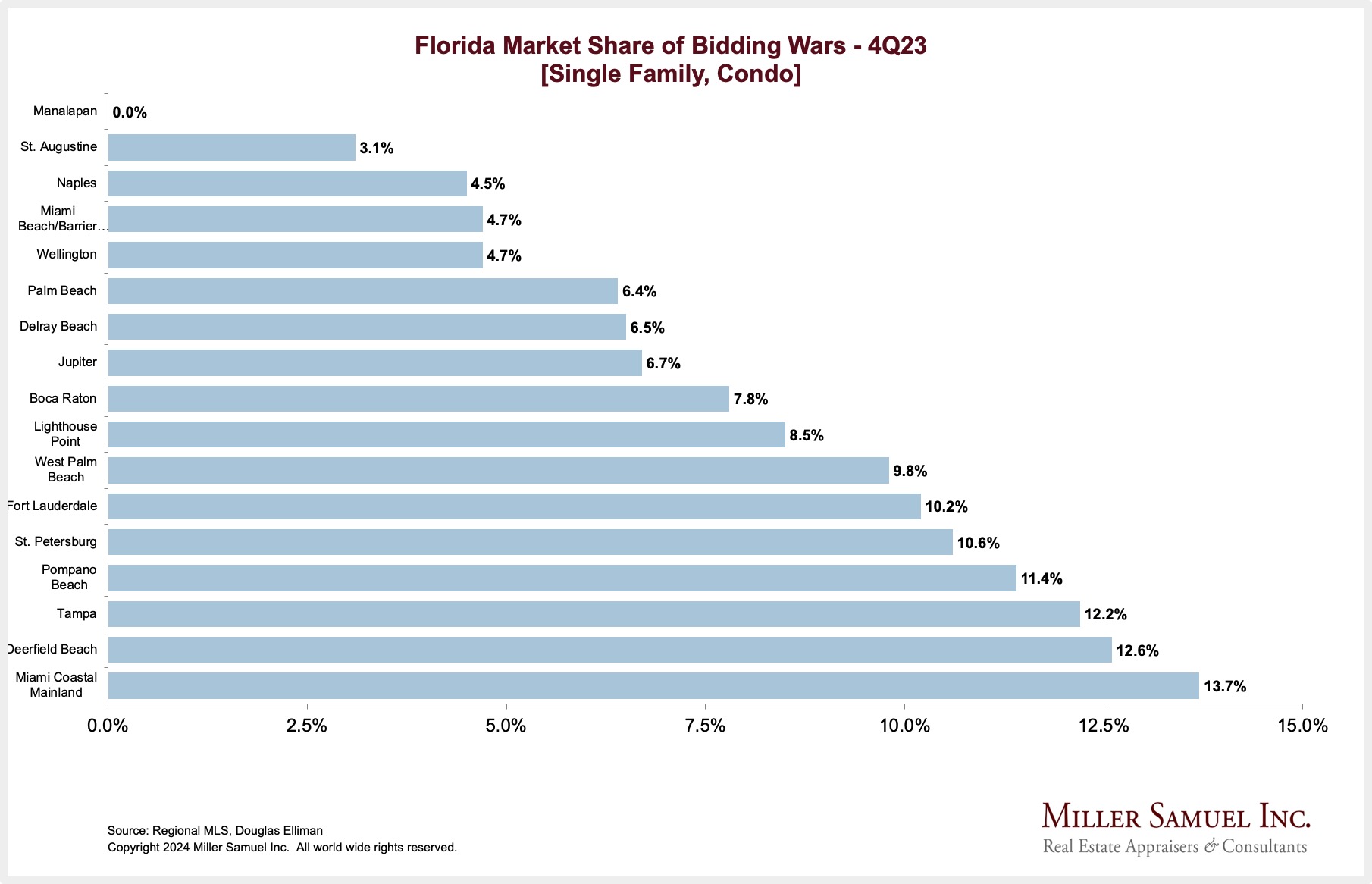

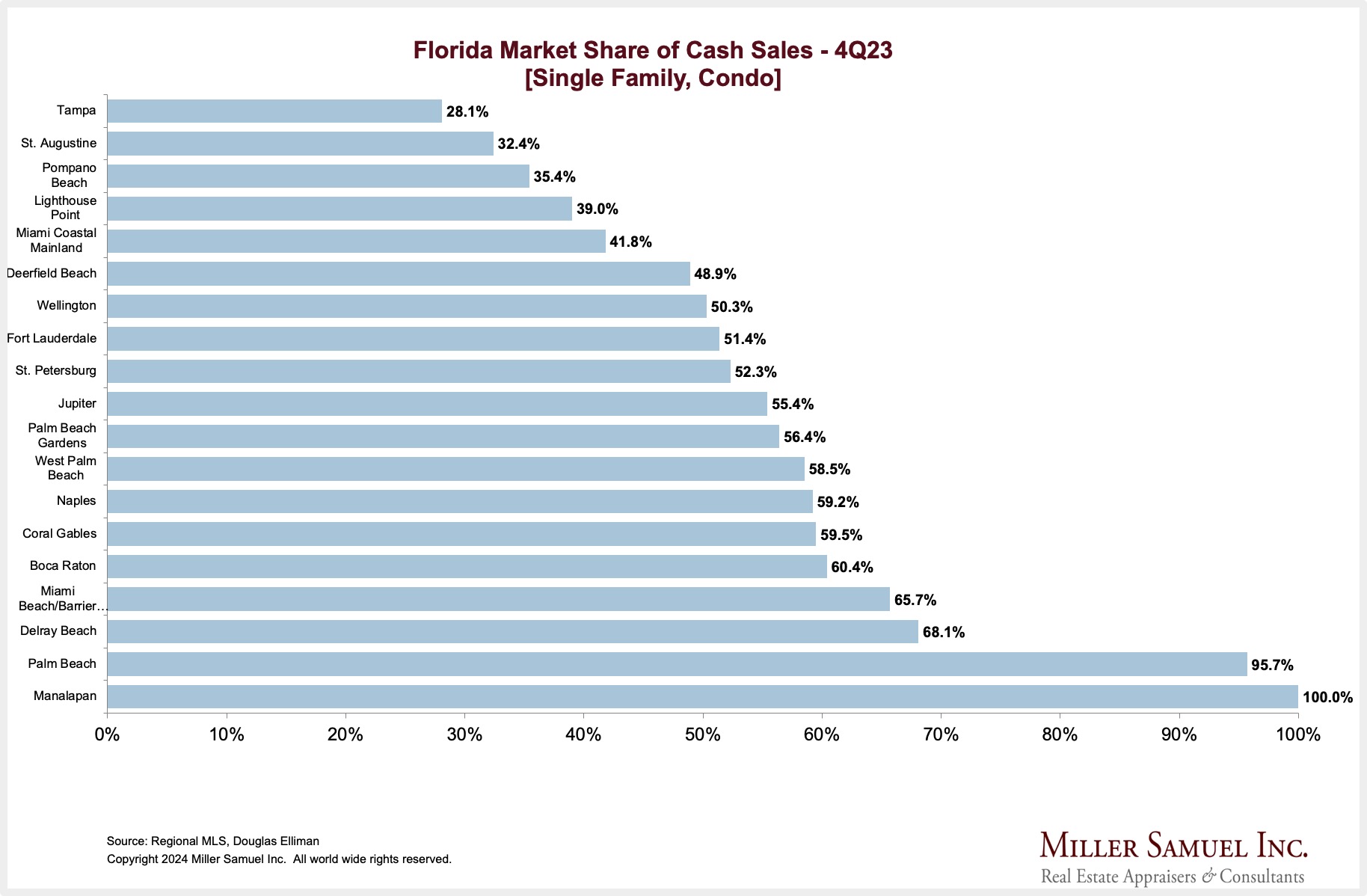

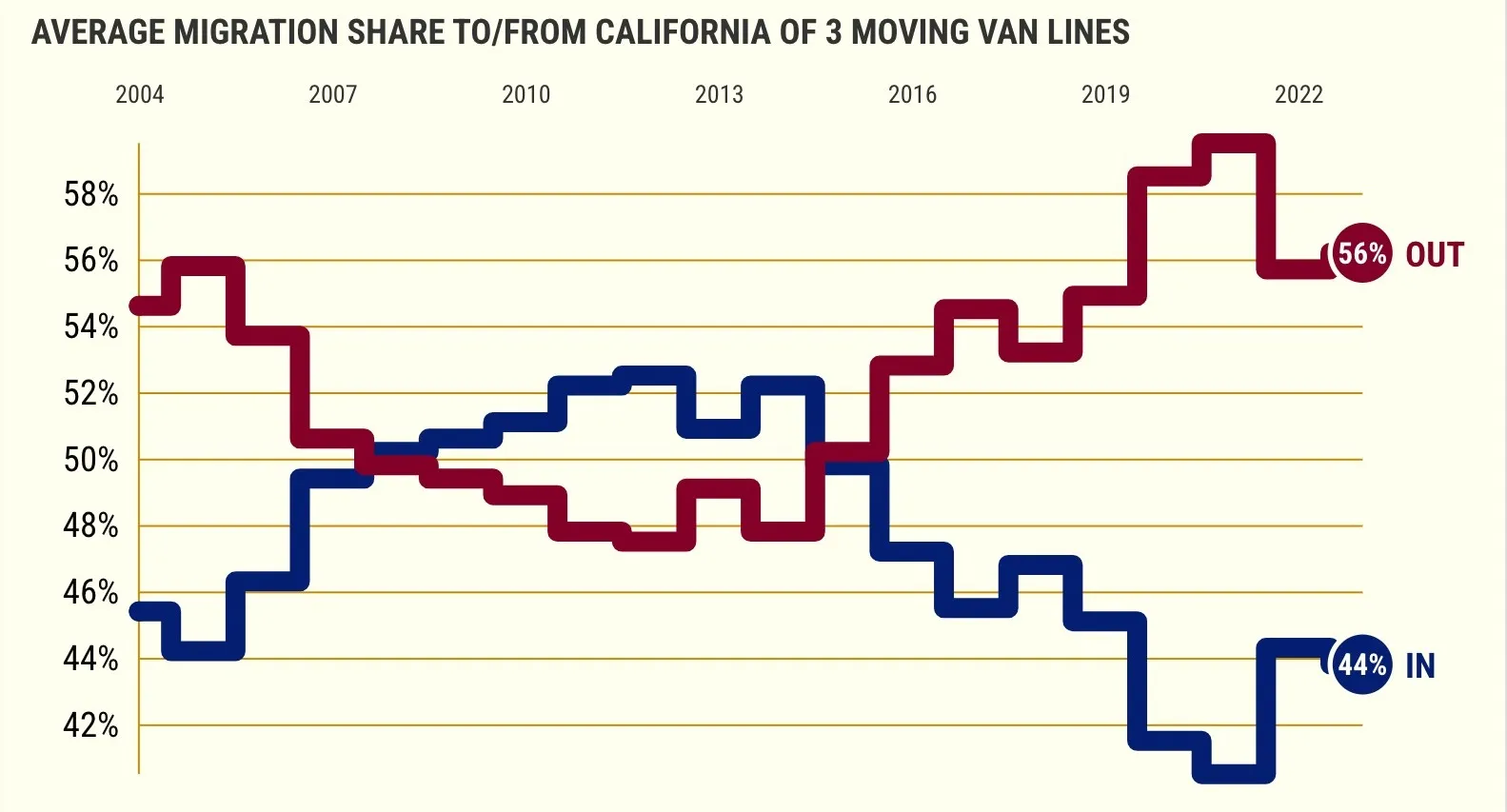

Florida Inventory, Despite Increases, Remains Very Limited

I’ve been the author of many Florida market reports for Douglas Elliman over the past decade. Since the pandemic, Florida seems to have more upside potential as a supercharged beneficiary of the WFH phenomenon. I like to say that New Yorkers are the new foreign buyers in Florida residential real estate.

The Real Deal covered the release of our slew of Florida Douglas Elliman Reports. More importantly, I got a cool photo mashup in their online coverage. And they got my good side!

Douglas Elliman’s Q4-2023 Florida Market Reports

Most Q4-2023 Florida markets we cover are seeing the following results:

- – Condo sales across the region have generally outperformed single family sales

- – Listing inventory is up modestly year over year but still down about 50% from pre-pandemic levels (4Q-2019). Low mortgage rates will help more supply trickle in, but it won’t be enough.

- – Lower mortgage rates are expected to elevate demand, selling off much of the new inventory that enters.

- – Sales remain below pre-pandemic conditions but are expected to rise as more inventory enters the market.

- – Prices are up annually as bidding wars remain a constant factor in the market

For a lot more charts…

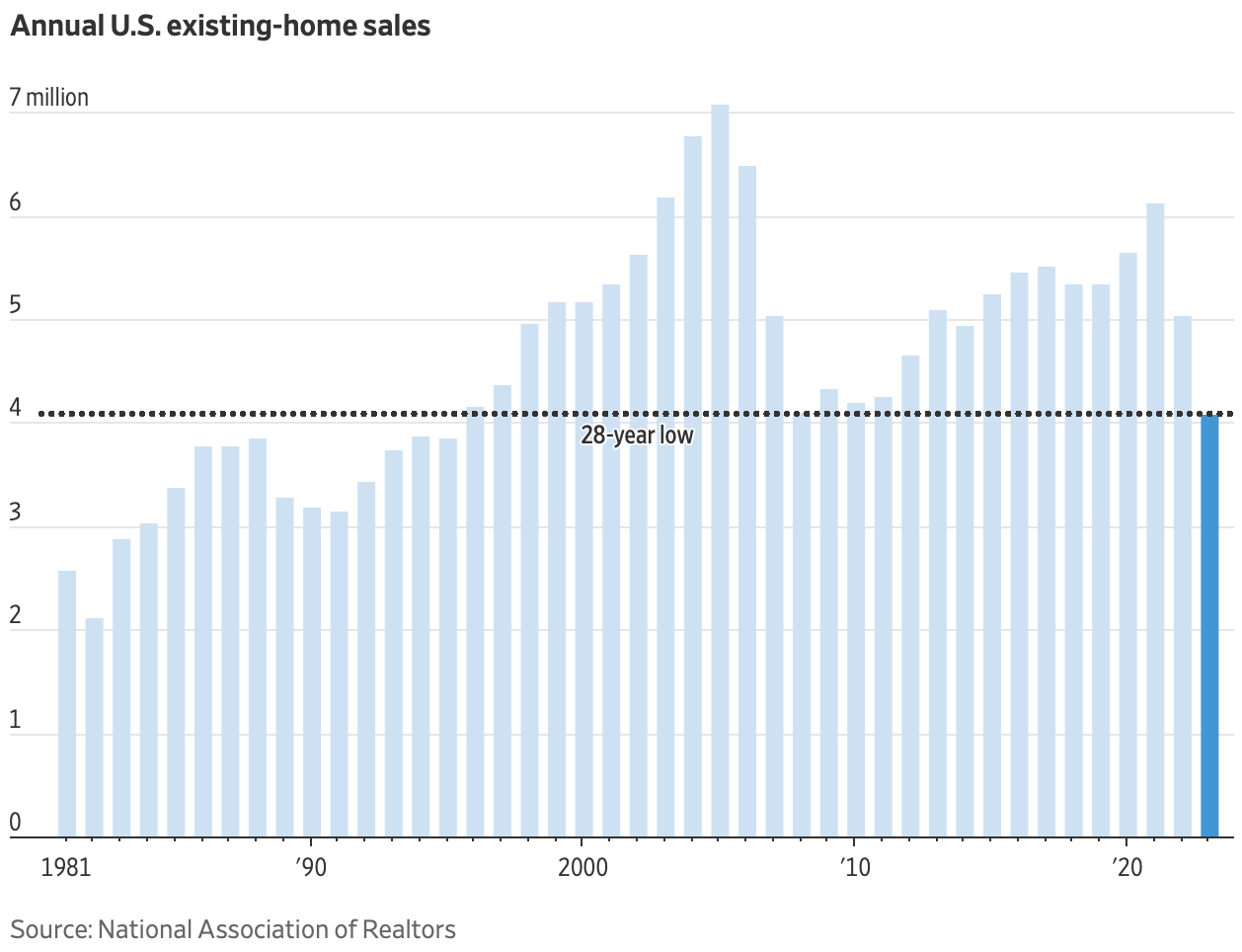

2023 Is Probably The Bottom For Home Sales, A 28-Year Low

Since closing data lags the current market conditions a bit, it sure looks like 2023 is the bottom of the Fed pivot downturn of the past few years now that mortgage rates are falling. The WSJ breaks it down for us:

Home Sales Were the Lowest in Almost 30 Years in 2023 – High mortgage rates, prices made home-buying prohibitively expensive for many last year

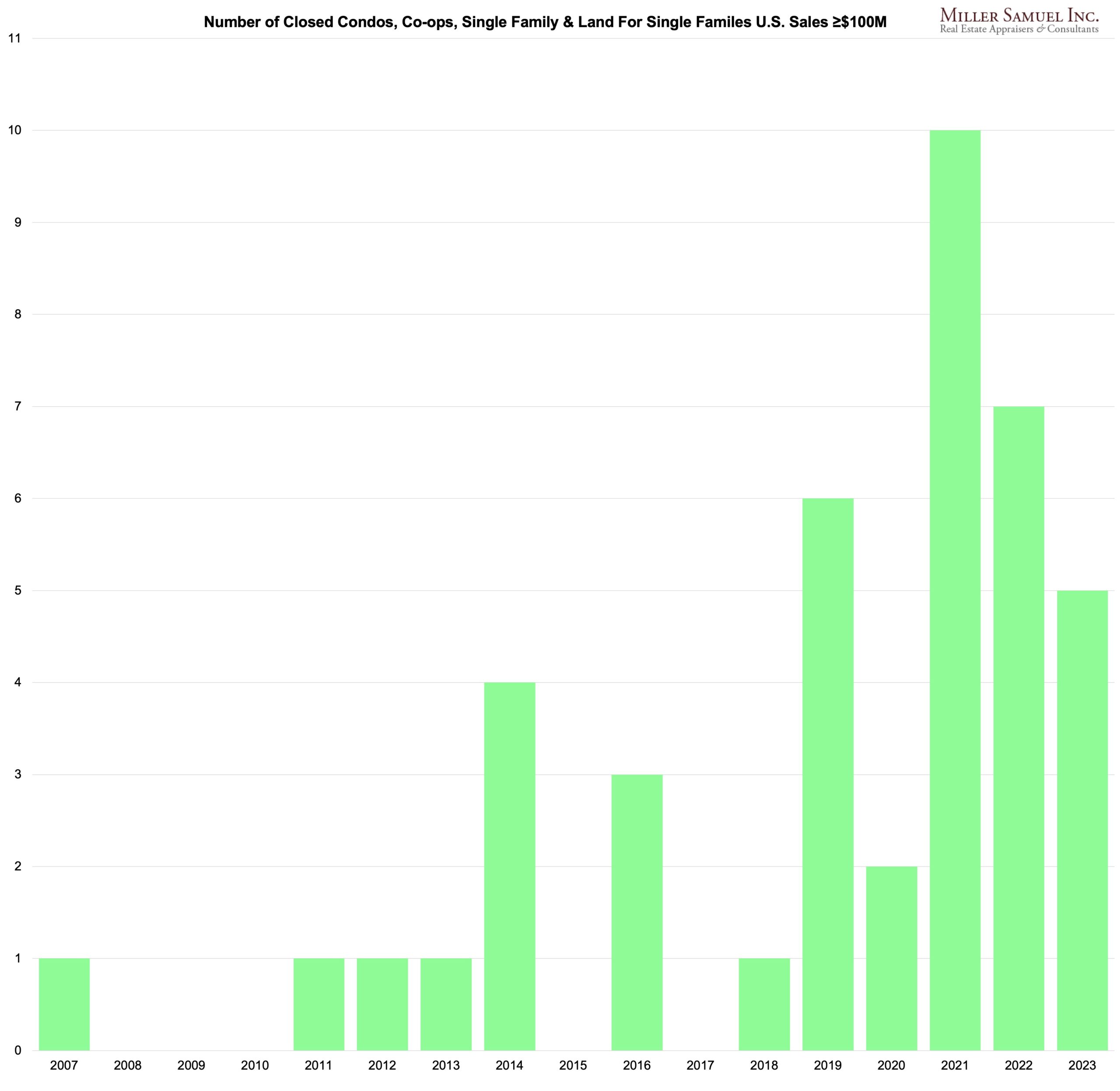

Selling Chicken Fingers For A $100 Million+ Purchase

I’ve been tracking $50 million+ sales for over a decade and have data from 2000. Here is a chart of $100 million+ closed sales by year.

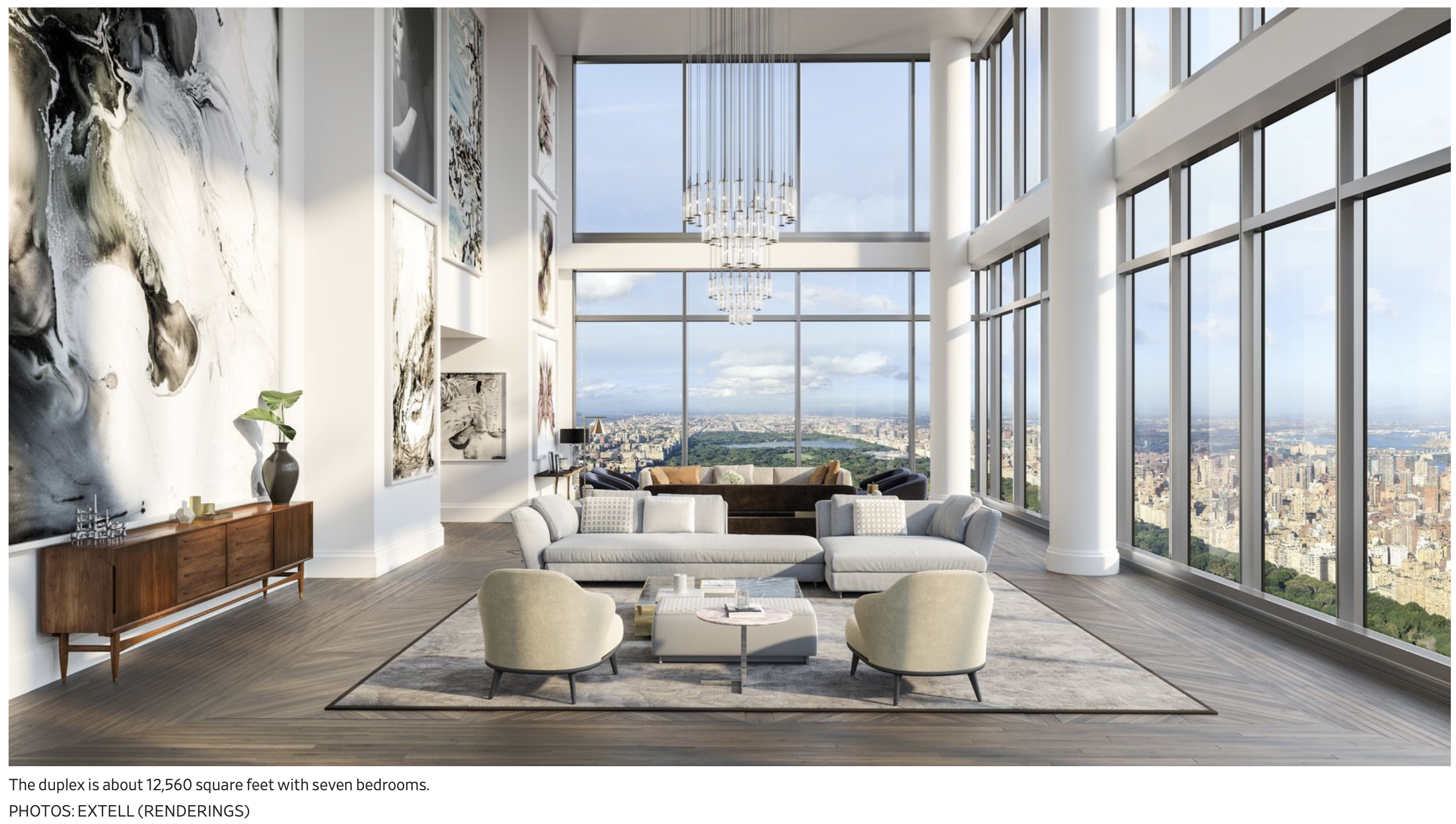

Right now, in Manhattan, a $115 million contract is out at Central Park Tower on Billionaires Row.

The duplex at Extell Development’s Central Park Tower on Billionaires’ Row first hit the market for $175 million, and most recently asked $149.5 million

Wall Street Journal

I do like this living room. Click to open image. Wow.

I thought it was fascinating to read at the same time a subsequent Yahoo Finance article on a Dallas sale of a $25 million (not sure of actual price) PH, with “NYC prices” and, oh, that headline: Chicken Finger Billionaire Buys Dallas Condo Priced Like NYC. Gotta love it.

Getting Graphic

Favorite housing market charts of the week of our OWN making

Favorite housing market/economic charts of the week made by OTHERS

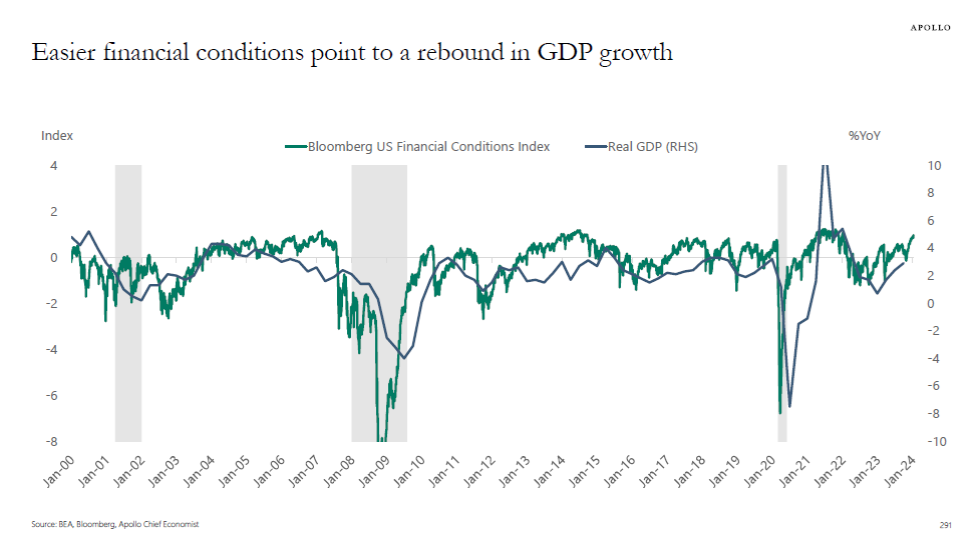

Apollo’s Torsten Slok‘s amazingly clear charts

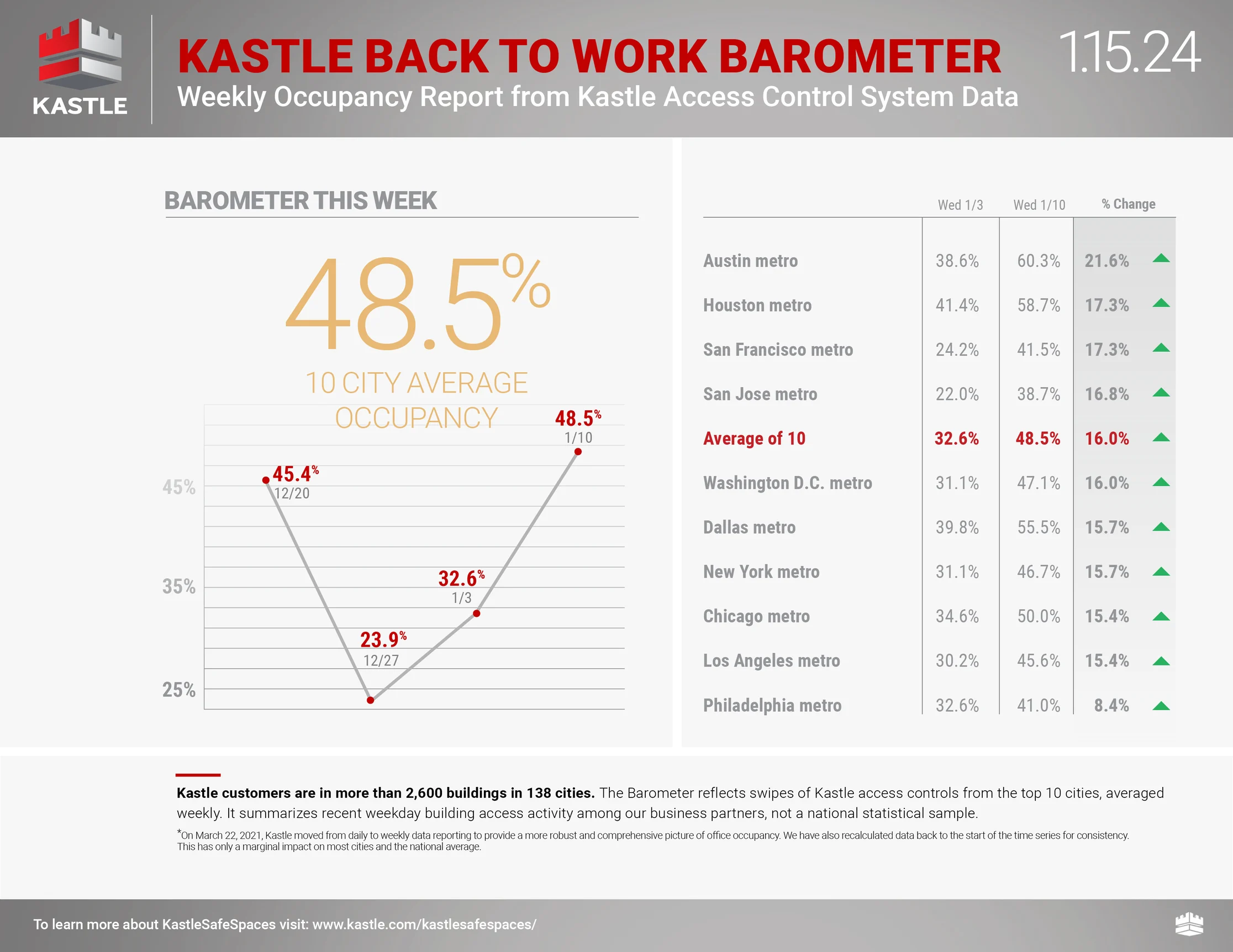

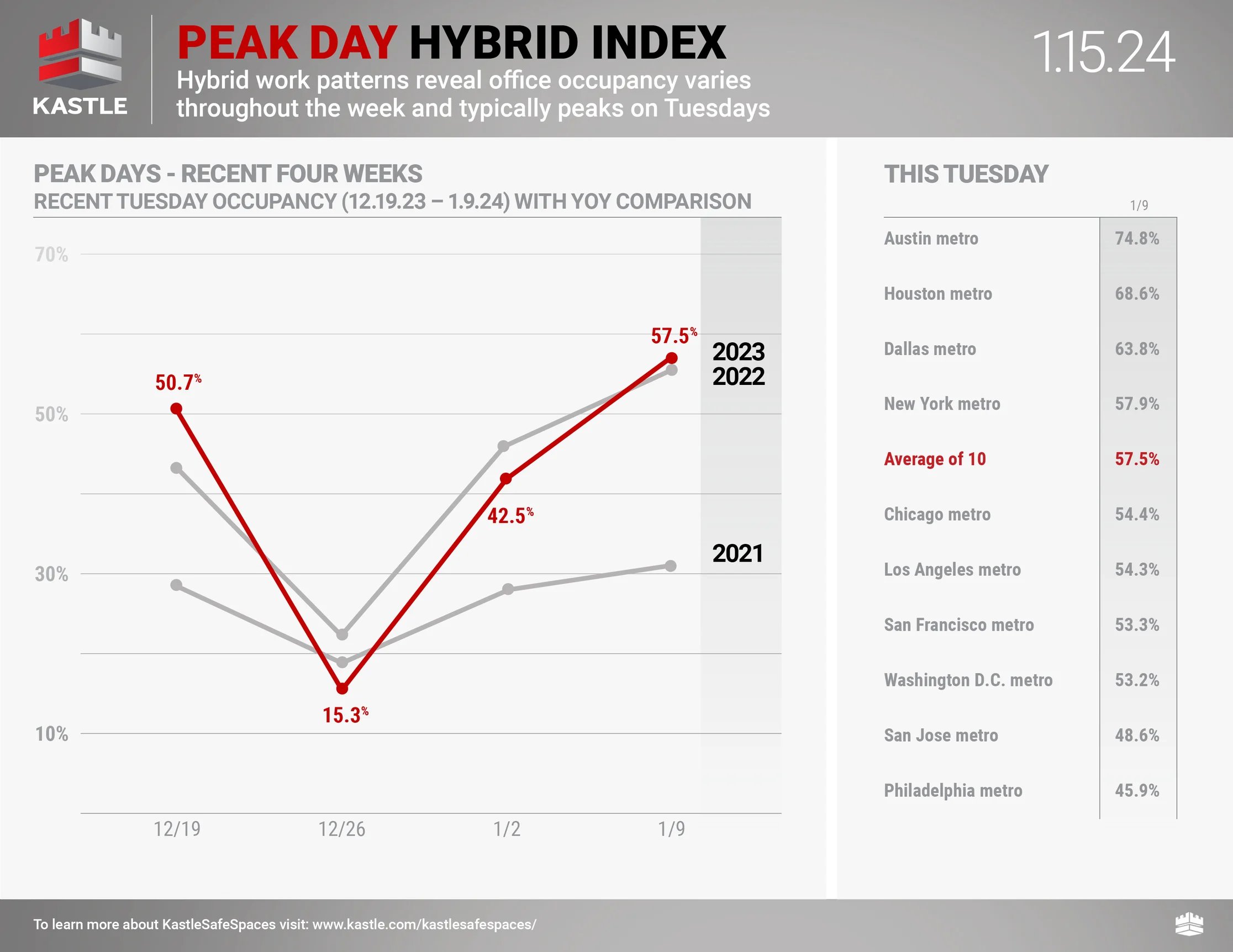

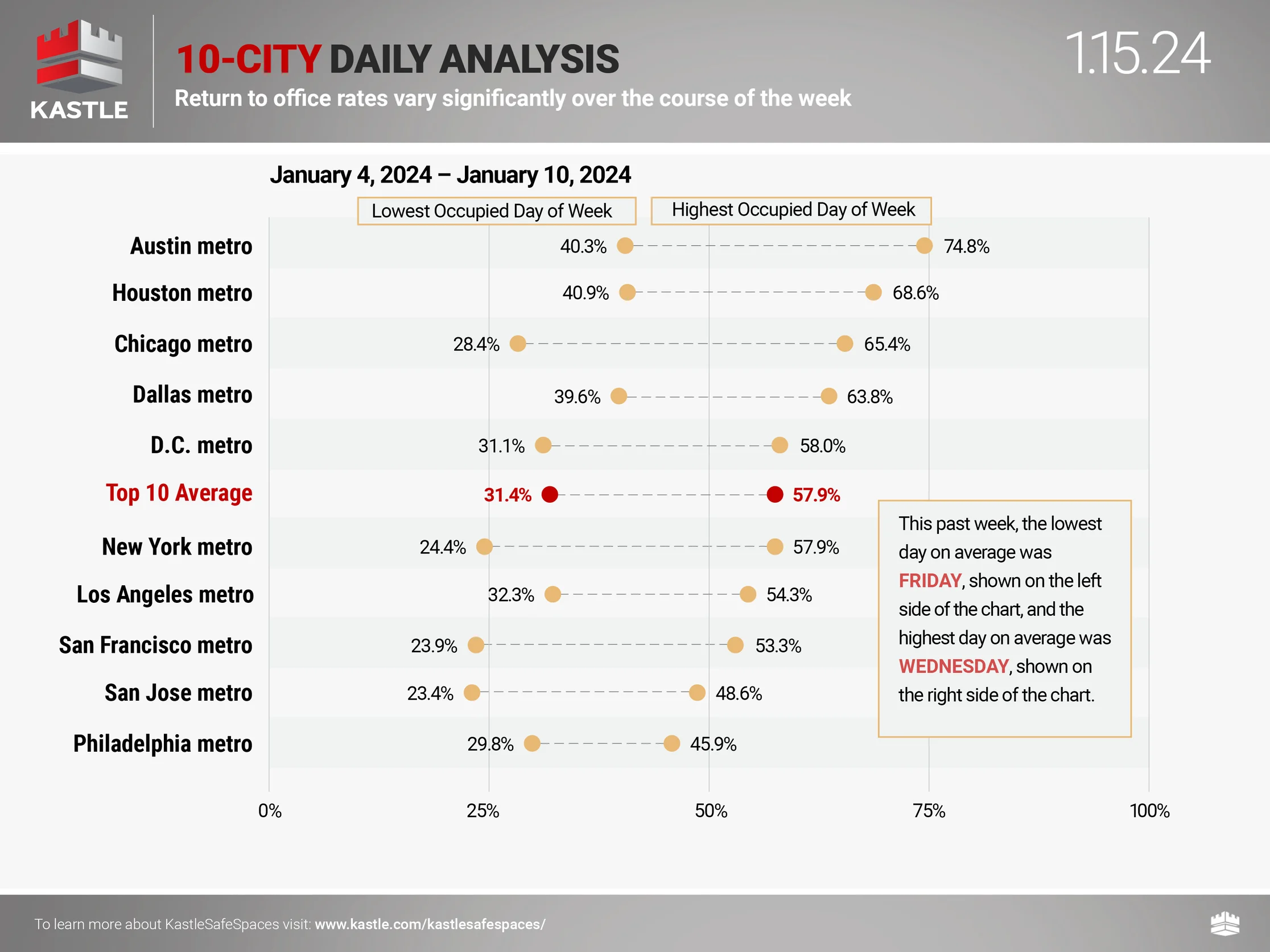

Kastle card swipe data

Remember that Kastle charts are overstating occupancy* because their pre-pandemic occupancy benchmark was 100%, which is incorrect (*measures card swipe activity as a proxy for occupancy). Still, they’ve become the standard benchmark for occupancy rates.

Appraiserville

Introducing A New Concept To The Appraisal Institute: Transparency

AI CEO Cindy Chance issued a press release summarizing the organization’s actions for the fourth quarter of 2023. What a concept!!! New leadership shares what they are doing with the public and the membership. In my battle with prior leadership, this would never have happened. The power of JA and FOJs was in keeping everything a secret. They thought it was beneath them to let the membership know what was happening, and the members had no one to contact or turn to in Chicago.

A couple of financial items in this press release stood out to me:

- Identifying and remediating a $1.2 million operating deficit for FY 24

- Eliminating 15% of staff positions representing almost $2 million in annual savings, and establishing new roles and performance management standards

This would never be addressed in the FOJ community other than raising membership fees and stealing funds from local chapters from the “taking” a few years ago.

How refreshing that AI now has a CEO acting like an adult. Membership must remember that Sandy (and I assume Paula will, too) is now trying to get FOJs embedded again into leadership positions, including JA, to restart the grift. I encourage members to take this lousy behavior very seriously. FOJs are in it for the grift, which weakens the organization, diminishes our industry, and damages the value of the designations you worked so hard to achieve.

OFT (One Final Thought)

I admire people who are quick to capitalize on the current zeitgeist.

Brilliant Idea #1

If you need something rock solid in your life – particularly on Friday afternoons at 2:00 PM, Eastern Time (ET) – and someone forwarded this to you, you can sign up here for these weekly Housing Notes. And be sure to share with a friend or colleague if you enjoy them because:

– They’ll have a Green Day;

– You’ll wait for the next train;

– And I’ll be building an igloo with luxury amenities.

Brilliant Idea #2

You’re clearly full of insights and ideas as a reader of Housing Notes. Consider sharing them with me early and often. I appreciate every email I receive, as it helps me craft future Housing Notes.

See you next week!

Jonathan J. Miller, CRE®, Member of RAC

President/CEO

Miller Samuel Inc.

Real Estate Appraisers & Consultants

Matrix Blog

@jonathanmiller

Reads, Listens and Visuals I Enjoyed

- 🤼♂️ Tall Tower Tussles [Highest & Best]

- Home Sales Likely Fell to 15-Year Low in 2023 [Wall Street Journal]

- Move over, millennials: Gen Zers are coming for boomer houses [Business Insider]

- The Reason the Office Isn’t Fun Anymore [Wall Street Journal]

- Delinquency Rates for Commercial Properties Increased in Fourth-Quarter 2023 [MBA]

- Trophy Office Space Is Hot. What Will It Take To Build More? [Bisnow]

- Mortgage Rates [FreddieMac]

- David Stevens, influential mortgage finance leader, dies [Inman]

- Palm Beach house being built across from Trump-owned home next to Mar-a-Lago lists at $45M [Palm Beach Daily News]

- Soft Landing [The Transcript]

- Update: The Housing Bubble and Mortgage Debt as a Percent of GDP [Calculated Risk]

- Convicted Conservation Easement Promoters Get 25 And 23 Years In Jail [Forbes]

- Real estate owners saddled with half-empty office buildings as hybrid work trend continues [CBS News]

- Alice Mason, Legendary Real Estate Broker, Dies [The Real Deal]

- What the inflation rise means for mortgage rates [CBS News]

- Where Do the World’s Wealthiest People Live? [Visual Capitalist]

- Coastal flooding inundates parts of New York City after storm [Gothamist]

- Adam Neumann Faces Shortfalls on Flow Properties in Nashville [The Real Deal]

- Pro Transfer-Tax Groups in Chicago Raise $700K for Campaign [The Real Deal]

My New Content, Research and Mentions

- Chicken Finger Billionaire Buys Dallas Penthouse Priced Like NYC [Bloomberg]

- Raising Cane’s founder buys penthouse atop luxe Knox Street development [Dallas News]

- Chicken Finger Billionaire Buys Dallas Penthouse Priced Like NYC [Yahoo Finance]

- In Palm Beach, Florida, the Once-Roaring Trophy-Home Market Is Taking a Breather [Mansion Global]

- South Florida Resi Prices, Inventory Rise in Q4 2023 [The Real Deal]

- Palm Beach real estate: 2023 dollar volume down but prices far above pre-pandemic levels [Palm Beach Daily News]

- Boston Median Condo Price Surpasses $1M For First Time [Bisnow]

- WSJ News Exclusive | Someone Is About to Pay More Than $100 Million for This New York City Penthouse [Wall Street Journal]

- Someone Is About to Pay More Than $100 Million for This New York City Penthouse [Mansion Global]

- 60 Minutes on Commerical Real Estate – The Big Picture [Ritholtz]

- Manhattan Residential Vacancy Rate Ticks Up as Brooklyn Rent Spikes [Commercial Observer]

- Manhattan Apartment Hunters Get No Relief Ahead Of Spring Season [ZeroHedge]

- Commercial Real Estate's Challenges Collide With NYC's Tax Rolls [Commercial Observer]

Recently Published Elliman Market Reports

- Elliman Report: Weston Sales 4Q 2023 [Miller Samuel]

- Elliman Report: St. Petersburg Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Manalapan, Hypoluxo Island & Ocean Ridge Sales 4Q 2023 [Miller Samuel]

- Elliman Report: West Palm Beach Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Wellington Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Vero Beach Sales 4Q 2023 [Miller Samuel]

- Elliman Report: South & Greater Downtown Tampa Sales 4Q 2023 [Miller Samuel]

- Elliman Report: St. Augustine Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Pompano Beach Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Palm Beach Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Naples Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Miami Coastal Mainland Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Miami Beach + Barrier Islands Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Lighthouse Point Beach Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Jupiter + Palm Beach Gardens Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Fort Lauderdale Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Delray Beach Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Royal Palm/Boca Raton 4Q 2023 [Miller Samuel]

- Elliman Report: Boca Raton 4Q 2023 [Miller Samuel]

- Elliman Report: Deerfield Beach Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Coral Gables Sales 4Q 2023 [Miller Samuel]

- Elliman Report: New Canaan Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Greenwich Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Fairfield County Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Downtown Boston Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Putnam & Dutchess Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Westchester Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Riverdale Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Queens Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Brooklyn Sales 4Q 2023 [Miller Samuel]

Appraisal Related Reads

- The spring housing market is waking up & random stats [Sacramento Appraisal Blog]

- Appraisal Institute Update for the Fourth Quarter of 2023 [PR NEWSWIRE]

- New Legislation Impacting Appraisers [VaCAP Online]

- Appraisal Reviews for $3 – The Devaluation of Appraisers [Appraisers Blogs]

- Convicted Conservation Easement Promoters Get 25 And 23 Years In Jail [Forbes]

- What’s Working and What’s Not Working in CRE | NAIOP [Commercial Real Estate Development Association]

- Murphy administration launches initiative to battle appraisal discrimination [New Jersey Monitor]

Extra Curricular Reads

- Just How Wild Was This Week’s Weather? One Image Tells the Tale. [NY Times]

- Your New $3,000 Couch Might Be Garbage in Three Years. This Is Why. [Wall Street Journal]

- Inside the Crime Rings Trafficking Sand â [Scientific American]

- I’m a Supercommuter. Here’s What It’s Really Like. [Wall Street Journal]

- The Last Days of the Barcode [The Atlantic]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)