LA: Both Ends Burning

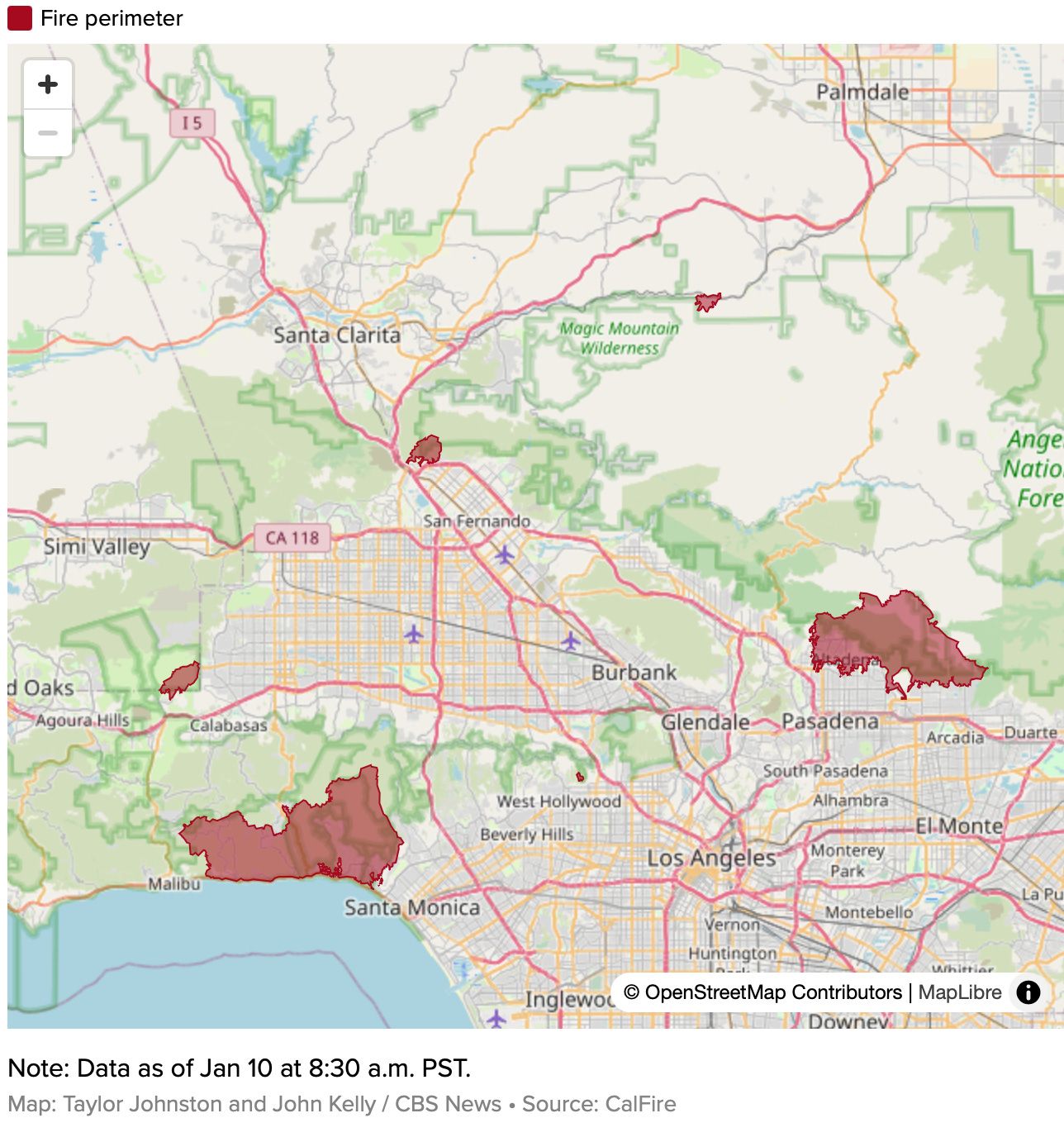

The LA Wildfires Will Be The Largest U.S. Fire Event On Record

Don’t Blame The Insurance Carriers – They Can’t Provide Coverage If Insolvent

State Farm Cancelled 69% Of Pacific Palisades Policies Earlier This Year

When I saw the early images of the LA wildfires and I learned about all the homes destroyed, the hit song by Roxy Music, “Both Ends Burning,” popped into my mind. My social media feed has been dominated by clips of the devastation. It has to be one of the biggest fires in history and has broad implications for insurance coverage, a system that is already failing. “State Farm has also decided to drop coverage for 72,000 properties, or 69 percent of its insurance plans in the Pacific Palisades area.” In fact, I wrote about the insurance situation back in August. It doesn’t make sense to blame the insurance carriers since they need to remain financially viable to provide future coverage. The LA Wildfires are a harbinger of bigger climate events in the future. I don’t have any first hand information to add about this tragedy but I wanted to talk through possible outcomes as it relates to the housing market in the environment of increasing climate change, having tracked housing markets impacted by natural disasters and experienced one first hand back in 2012 with Superstorm Sandy. With the growing number and cost of climate events, the most significant housing issue in the future will likely be obtainable insurance coverage, not housing prices.

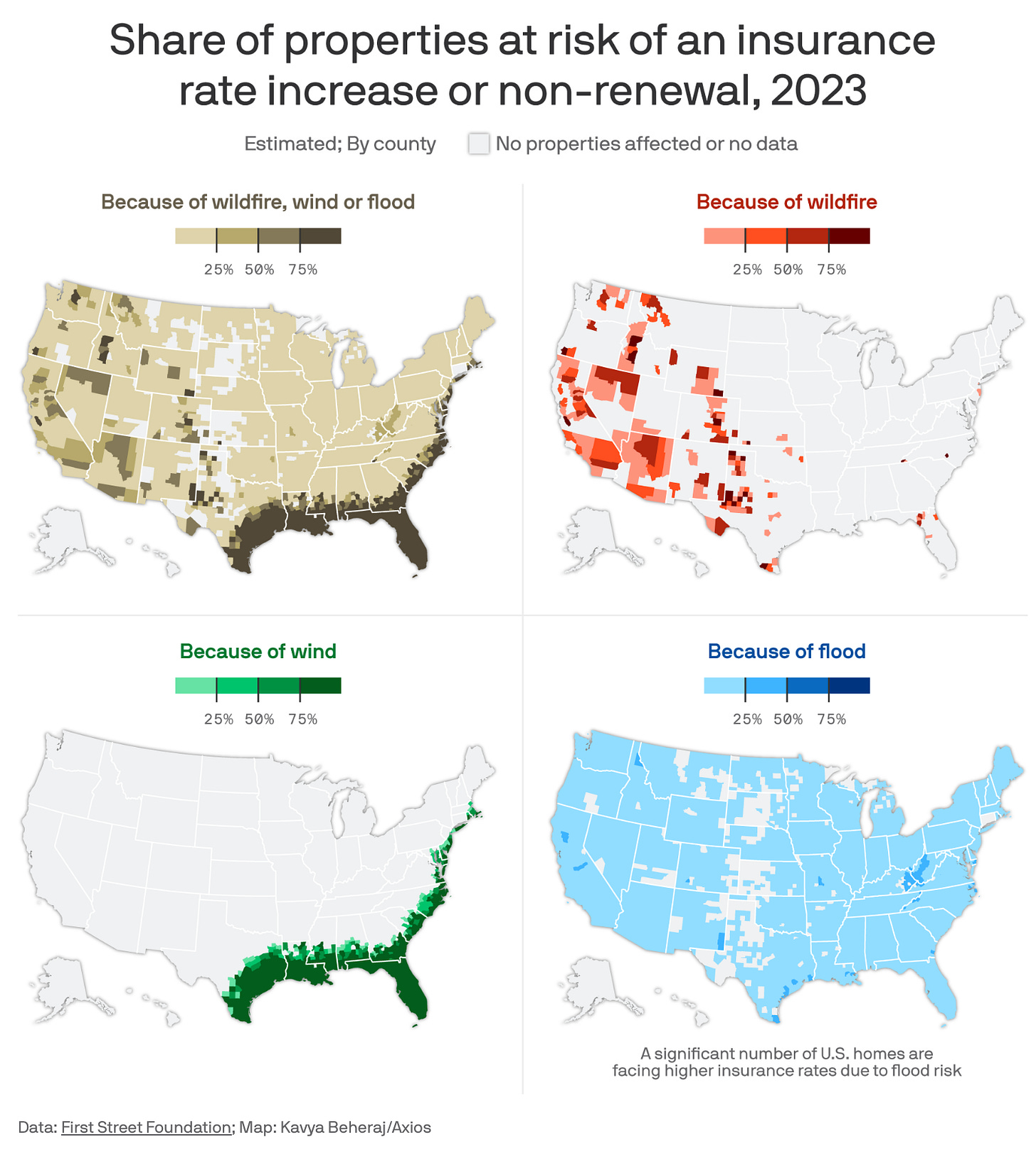

Non-Renewals: The Property Insurance System Is Broken

If we start with California, their insurer of last result is the California Fair Plan (CFP), which is the go-to for residents if private insurance carriers aren’t available. Almost a year ago, the CFP warned that they would have to assess current insurance carriers after the next big event. Of course, that would likely drive out some existing carriers. Right now, the CFP has $430 billion in exposure which is outpacing its ability to provide coverage. This means that the taxpayer has to pick up the difference. The same thing is happening in Florida where the state is the carrier of last resort for flood insurance for many homeowners.

Thoughts On Housing Prices And Sales Trends After A Catastrophic Event

Towns And Neighborhoods Get Rebuilt – It’s been my experience that housing markets tend to be rebuilt after a natural disaster. At this moment in LA, it’s hard to imagine any rebuilding with all the devastation, but I don’t think that everyone will walk away from LA.

The New Housing Stock Will Skew To Higher-End – The housing stock replacements tend to be more expensive than those it replaced. We saw that clearly on the south shore of Long Island after Hurricane Sandy in 2012. Sales fall sharply and then rebound as new construction surges. In Long Island, modest middle-class coastal housing that experienced significant damage was replaced with luxury housing, presumably because the new owners could afford the higher insurance premiums. As a result of the shift in the mix, aggregate housing prices tend to rise after a catastrophic weather event.

The Cost Of Home Construction Soars – The surge of construction strains the material supply chain, the existing labor market, and the capacity of local contractors. Thousands of requests to build new homes will occur in very short order, so the costs of labor and materials go to the moon.

The Availability Of Home Insurance Is Diminished – The availability of insurance coverages becomes the more significant issue over the cost. The idea that State Farm recently dropped 69% of its wildfire coverage in Pacific Palisades, where a large portion of the devastation occurred, says a lot about the consistency of coverage. How does a local market make sure its residents have available coverage? I think this needs to be resolved first.

Privatizing Fire Departments Won’t Solve The Problem – I belive that private fire departments would be used by wealthy homeowners when available. However the safety of their luxury homes would still remain in jeopardy as the rest of the city burns.

Local and state governments need to be much more proactive – Government needs to place a much higher priority on reducing risk conditions of their local area. I read that after years of drought, LA experienced a year of incredible rainfall volume, the second most in history. The wet conditions enabled the underlying brush to grow significantly. However, in the past year, the amount of rainfall collapsed and the overgrown brush became kindling for the unusually high 100 mph Santa Ana winds (that have been around for hundreds of years). I suspect the lack of proactive management of potentially hazardous conditions by the city and state will be a key issue when investigators assess what happened.

We don’t have an insurance plan developed yet that could enable the states to provide a resolution to this crisis. It’s complicated but not unsolvable.

I heard someone on a podcast suggest that homeowners will collect their insurance and simply leave. No, I don’t believe that is true. LA homeowners won’t just “walk away.”

Boroughs & Burbs Podcast January 9, 2025

Once again I joined John Engel and Roberto Cabrera on their Boroughs & Burbs Podcast to talk about the the NYC and U.S. housing market. Always fun. Click here or the image.

Did you miss the previous Housing Notes?

January 8, 2025

Consumer Sentiment Is Confidentally Showing A Better Outlook For Housing

Image: Grok