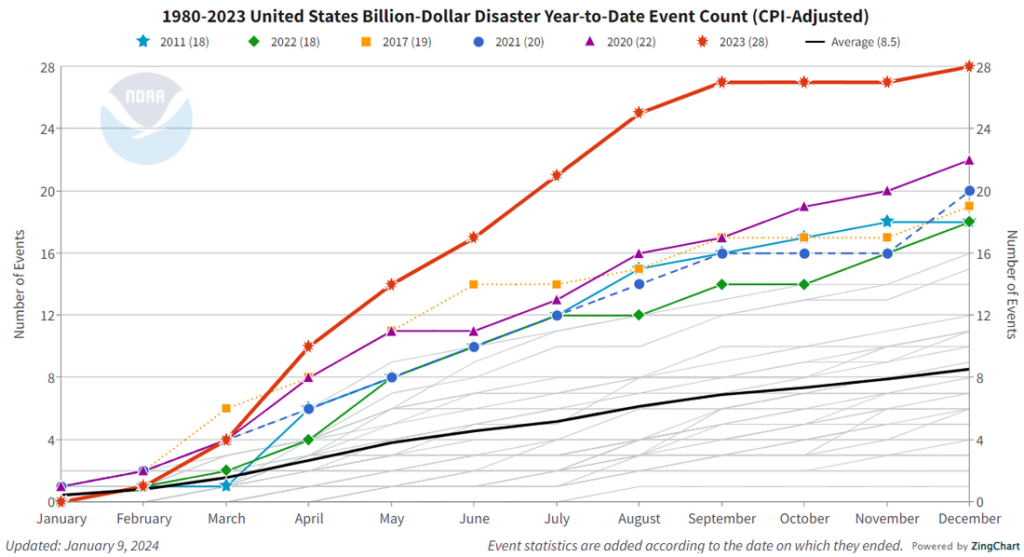

- 2023 Was The Highest Year on Record For Climate Disasters

- California Insurance Providers Are Pulling Out Or Raising Costs By As Much As 50%

- The Fed Study Shows That Insurance Won’t Stop Home Values From Being Impacted.

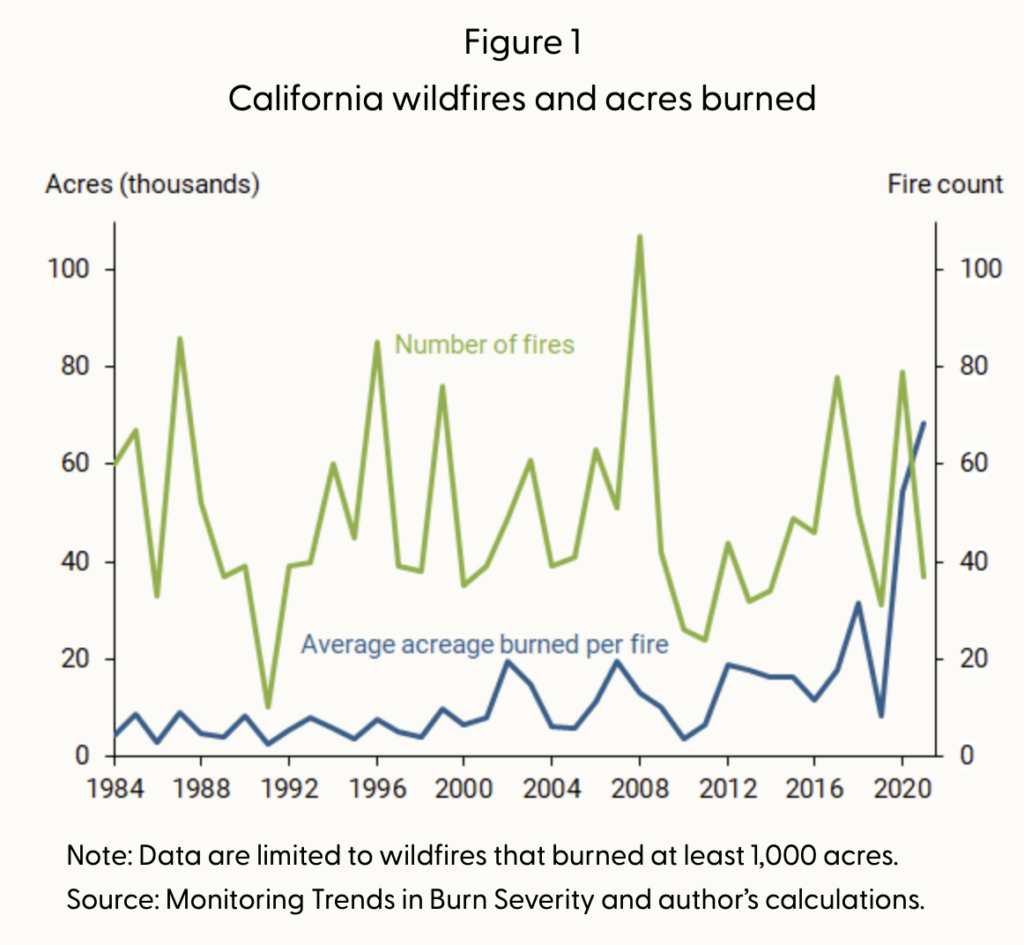

The frequency of U.S. climate disasters is rising with more flooding, tornados, and wildfires. The year 2023 was a banner year for climate disaster costs, reaching all-time highs. The increased frequency of wildfires in California is having a significant impact on the cost of homeownership. The burning question is more about whether coverage will be available there in the future. The costs might jump 30% to 50% higher this year, assuming a homeowner can find coverage. Fire insurance coverage is simply burning out. The Federal Reserve Bank of San Francisco just released a study – Wildfires and Real Estate Values in California – saying that insurance coverage doesn’t really impact the loss in value from proximity to fires.

- State Farm cancels 72,000 policies in California and wants to raise policy costs by 30% to 52%

- Liberty Mutual cancels 17,000 policies in California

- Allstate Approved to Raise Home Insurance Rates by 34% in Wildfire-Prone California

After Adjusting For Inflation, Disaster Costs Are The Highest On Record

Leading up to the Hurricane Katrina event in New Orleans, the Federal Emergency Management Association (FEMA) was on autopilot and filled by political appointees. Nearly two decades later, that doesn’t seem to be the case these days, as the department is constantly on the “hot” seat.

I’ve never been around a wildfire, but plenty of hurricanes. When I was growing up in Rehoboth Beach, Delaware (5 doors down from the president’s summer home), we used to have a lot of hurricanes smack into the town. Some kids in my school were actually named after some of the storms, such as Hurricane Donna. The National Guard would come by and beat on everyone’s front doors with orders to evacuate. Once, a giant oil tanker washed on shore, and we drove to the beach with my parent’s car’s high beams on the ominous hulking image in the dark. After the storm cleared, prisoners in shackles with blue and white striped outfits (like in the old movies) from the state penitentiary raked the beach to remove the oil. It was quite a scene.

In 2012, Super Storm Sandy pushed the water from the ocean into Long Island Sound, flooding everywhere along the coast. My wife and I went to check on our boat, saying our goodbyes at the dock. The rising water was expected to float the dock above the pilings at the lunar high tide in twelve hours. Luckily, it didn’t float away.

The San Francisco Fed Study

Wildfires and Real Estate Values in California [SF Fed]

“Our results suggest that property values have been more adversely impacted in recent years by being close to past wildfires than was the case previously. Moreover, while having insurance can help mitigate some of the costs associated with fire episodes, our results suggest that insurance does little to improve the adverse effects on property values.”

Mansion Global wrote an excellent summary piece of the SF Fed study – Chronic Wildfires Are Impacting California Home Values.

The acreage impacted by fires in recent years has surged (blue line). No wonder coverage costs are surging, and companies are pulling out.

It looks like significant insurance reform is going to be needed it homeownership will continue to be part of the American Dream.

Did you miss yesterday’s Housing Notes?

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)