- Ken Griffin Has Had Significant Influence Over The US Super Luxury Market

- “Vertical Travel” Is An Urban Real Estate Commuting Phrase

- Tariffs Are A Huge US Policy Mistake, Says Everyone

Yesterday, I promised I would take a short break from tariff talk, so consider today’s Housing Notes as a partial palette cleanser. Admittedly, I’ve only eased off nominally since I included two must-watch videos on the topic of tariffs at the end of these notes. Billionaire Ken Griffin (42B) just spoke publicly about the adverse impact of the tariff tantrums emanating from Washington. “President Donald Trump’s latest tariffs amount to a hefty tax on families and are a “huge policy mistake” by the administration.” So it’s just a short leap to talk about his impact on the super luxury space which was chronicled in a recent Wall Street Journal piece (gift link). To catch you up. he is the same person who purchased a US record price of $239 million for a condo in Manhattan (gift link). That particular transaction reinforced the idea that these mega purchases have little to do with local housing markets. That’s why I refer to such transactions as a circus sideshow. In the coverage of the purchase and his firm Citadel’s big office lease, the phrase “Vertical Travel” was added to the real estate lexicon.

From the 2019 Bloomberg story, Ken Griffin’s Buying Binge Shows He’s the Ultimate Trophy Hunter (gift link), “Citadel has signed a lease to anchor a skyscraper at 425 Park Avenue, eight-tenths of a mile from Griffin’s new apartment, not including vertical travel” (bold my emphasis.) My above artistic masterpiece was an attempt to illustrate what his hypothetical walk to work would entail.

Griffin Helped Grow The US Super Luxury Market

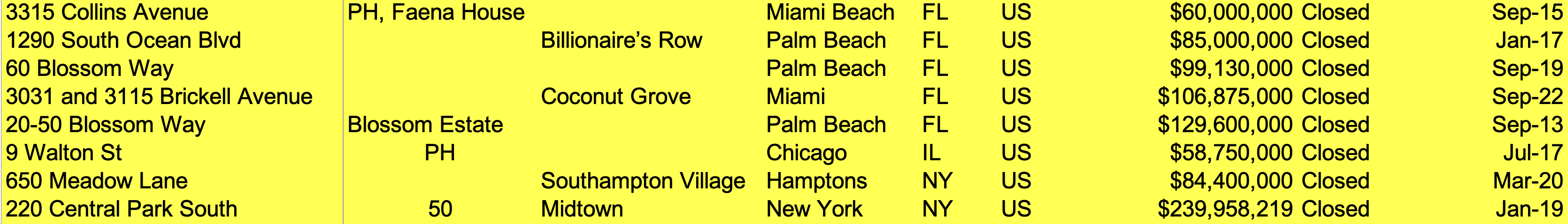

Can one person have a substantial financial influence on a US housing market segment? Yes. The above sales in the table above are just the residential properties he purchased that closed above $50 million.

The Wall Street Journal’s Kathy Clarke, Author of the best-selling book Billionaire’s Row, penned a great piece about the Griffin effect: Ken Griffin Pushed the Luxury Home Market to New Highs—for Better or Worse (gift link).

There was a $120 million home sale in Palm Beach last month and local spec developer Todd Michael Glaser was relieved it wasn’t Griffin. “Griffin’s track record of aggressively purchasing the country’s highest-end homes could lead to a damaging perception in the market—that Griffin’s the only buyer in town.”

I’ve been a long-time chronicler of the $50 million or higher US housing market. Please forgive my indulgence, but here are a series of quotes in the WSJ piece that expressed my view of Griffin’s contribution to the US superluxury market segment:

‘”He’s a whale’s whale,” said property appraiser Jonathan Miller of Miller Samuel. “In my career, I’ve really never run into somebody that singularly has dominated a segment of the market in so many different places. He’s a prolific buyer of full retail-price real estate.”’

‘“He didn’t create the superluxury market but he emboldened more participants to buy higher sooner”’

‘“With all this activity, he appears to—I don’t know if we can say like the attention—but he doesn’t seem to have any problem with it,” Miller said.’

The Actual Final Thought – Tariffs are actually lowering investment in manufacturing. That’s how damaging these tariff tantrums are to the US economy. My goodness, this is all so dumb.

Tariff Talking, Podcast Squawking

Boroughs & Burbs, The National Real Estate Conversation Podcast

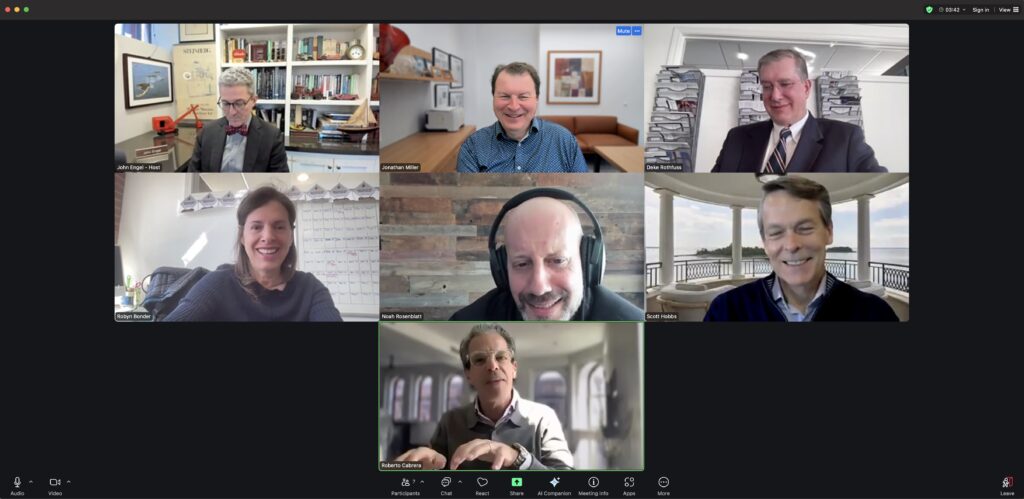

– Episode 179 Tariffs and Industry Impacts The conversation was excellent from all angles – I joined a former Goldman Sachs bond trader, a luxury home builder, and real estate agents, as well as my buddy Noah Rosenblatt of Urban Digs, a real estate analytics firm.

Barry Ritholtz & Rick Wilson – Losing Our Asses Podcast

- My friend Barry Ritholtz calmly breaks down the impact the tariff tantrums will have on the economy.

Did you miss the previous Housing Notes?

Housing Notes Reads

- Ken Griffin Pushed the Luxury Home Market to New Highs—For Better or Worse [Wall Street Journal]

- Trump’s Trade Math Ignores a Major Export: American Services [Wall Street Journal]

- The Dollar and the Bond Market’s Ominous Message for Trump [WSJ]

- Ken Griffin's Buying Binge Shows He's the Ultimate Trophy Hunter [Bloomberg]

Market Reports

- Elliman Report: Queens Sales 1Q 2025 [Miller Samuel]

- Elliman Report: Brooklyn Sales 1Q 2025 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 3-2025 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 3-2025 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 3-2025 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)