- BHHS CEO Who Denied Compass Was Acquiring His Firm Last Month, Just Stepped Down

- Companies Are Beginning To Use Two Scenarios When Forecasting The 2025 Economy

- Lack Of Clarity Continues To Define The New Global Trade War Era

The headlines screamed Gino Blefari had stepped down as HomeServices CEO, and everybody in the industry gave a knowing nod. A month ago, after some terrific reporting by the WSJ on an “almost” deal between Compass and Berkshire Hathaway (free link) to create a 90,000 agent brokerage firm, Gino came out with a party-ending Instagram post stating there was no deal pending. He was so positive in his conviction, most of my peers couldn’t see how he could walk it back if a deal was actually in the works.

From the BHHS CEO back on March 13th. Most of my peers wondered if this post was a hoax.

A Textbook Walk Back Of A Corporate Misstep

Assuming there really is a developing deal between Compass and BHHS, the only way the CEO could walk this back was to announce his retirement as he did a month later. It’s a shame because his actions of the past month probably tarnished a bit of his career legacy. After all, this immediate step down sure makes me think there really is a deal pending.

But the existence of potential deal is confusing because CEO Warren Buffet of Berkshire Hathaway is not known for selling his assets. Perhaps selling BHHS (if true) is a troublesome sign about the future of the full-service real estate brokerage industry, and he wants to get out. The real estate brokerage industry is currently under siege via the NAR Settlement and the Compass “Disruption By Capital” efforts to capture both sides of the commission as it battles Zillow, Redfin, and the NW MLS. Or could it be a statement on Buffet’s long-term outlook on the residential housing market? After all, two noted housing economists just cast a shadow on the housing market in Bloomberg’s Top Forecasters Warn Housing Market’s Days of Big Gains Are Over for Now (free link).

Lots Of Economic Market Uncertainty

Because we have grown to understand there is no real tariff strategy coming out of Washington other than “saber-rattling” on the daily wims of POTUS, the economy is getting harder to forecast. Here’s a good lesson on how tariffs worked during Trump I. Soybean farmers still haven’t recovered from Trump I, so the potential damage of alienating all our trading partners seems catastrophic if carried out to its fullest in Trump II. The “America First” slogan is looking more like “America Alone” every day.

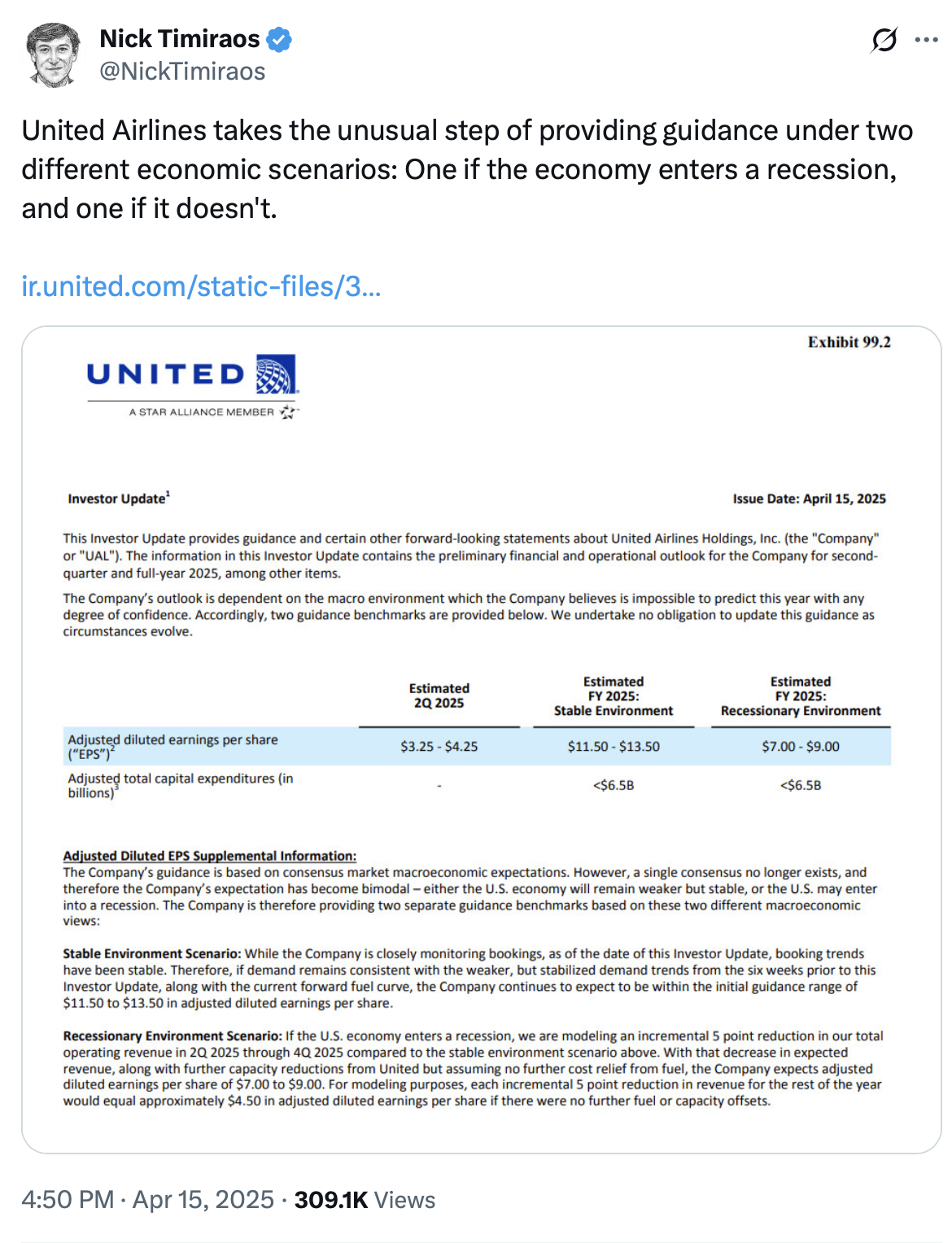

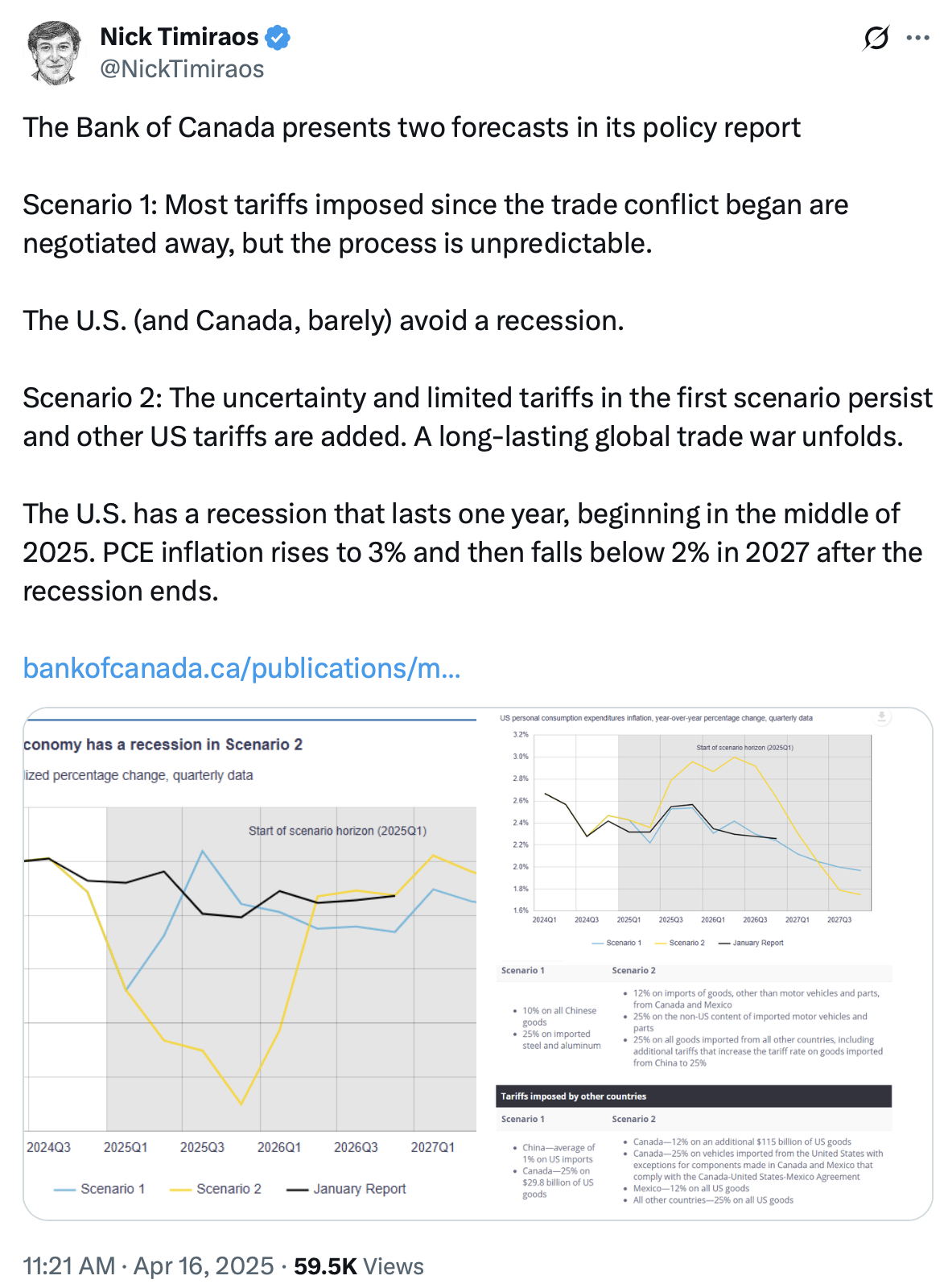

Amazingly, Fortune 500 and large financial institutions are starting to provide two types of guidance: With and without tariffs because no one has any idea what the future looks like. Corporate speak is inadequate to paste over the dark chasm of uncertainty. Here’s a couple of examples:

So is the Bank of Canada!

And investment banks are talking about gold and cash…

Final Thoughts – What’s The Point?

So here we are with buckets and buckets of uncertainty, or as my good friend Barry Ritholtz prefers to describe this tariff situation a “lack of clarity” because there is always a level of uncertainty in any economic period.

Suppose Fortune 500 companies and global financial institutions currently don’t have comfort levels in their outlook for 2025 and are beginning to provide two scenarios because of the randomness and lack of clarity coming out of Washington. How can we expect the American consumer to ignore all of this? Homebuyers clearly won’t overlook the economic chaos, especially if we slip into a recession with real job loss. The recession odds given by Wall Street are now 45% to 60%, up from 10% pre-tariff. In Manhattan, we are seeing older listings suddenly sell. They were overpriced but seller resolve weakened just enough to make the sale work. However, if mortgage rates resume their decline as the economy weakens, I suspect homebuyers will power through. Right now, we are seeing Manhattan’s new signed contracts surging in April, but very few new listings are entering the market. In some ways, the extremeness of all the bat-shit craziness of this entire tariff era makes me feel a little better about the odds of a potential palatable resolution. What a time we’re living in!

The Actual Final Thought – We are publishing 14 market reports across Florida today so it is interesting to consider what Floridians are most afraid of besides a weakening housing market.

Did you miss the previous Housing Notes?

Housing Notes Reads

- A Growing Share of New Yorkers Are Set to Receive — Not Buy — Their Homes [Bloomberg]

- Nepo babies grow up: Trusts represent more than a quarter of Manhattan transactions [The Real Deal]

- More and more New Yorkers are inheriting homes from their wealthy parents — not buying them [New York Post]

- Canadians Are Cashing Out Their American Vacation Homes [Wall Street Journal]

- Gino Blefari steps down as HomeServices CEO [Real Estate News]

Market Reports

- Elliman Report: Coral Gables Sales 1Q 2025 [Miller Samuel]

- Elliman Report: Palm Beach Sales 1Q 2025 [Miller Samuel]

- Elliman Report: Sarasota County Sales 1Q 2025 [Miller Samuel]

- Elliman Report: Weston Sales 1Q 2025 [Miller Samuel]

- Elliman Report: Wellington Sales 1Q 2025 [Miller Samuel]

Extra Curricular Reads

- Rickie Fowler 'Decaf' [ ESPN Throwback via Youtube]

- The Barry Ritholtz Interview: “Smart is good. Smart and lucky is better” [Big Think]

- Why do AI company logos look like buttholes? [Velvet Shark]

- Study: Users trust Community Notes linked to professional fact-checkers [Poynter]

- Polar vortex 2025: Extremely cold temperatures headed to the eastern US [ABC]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)