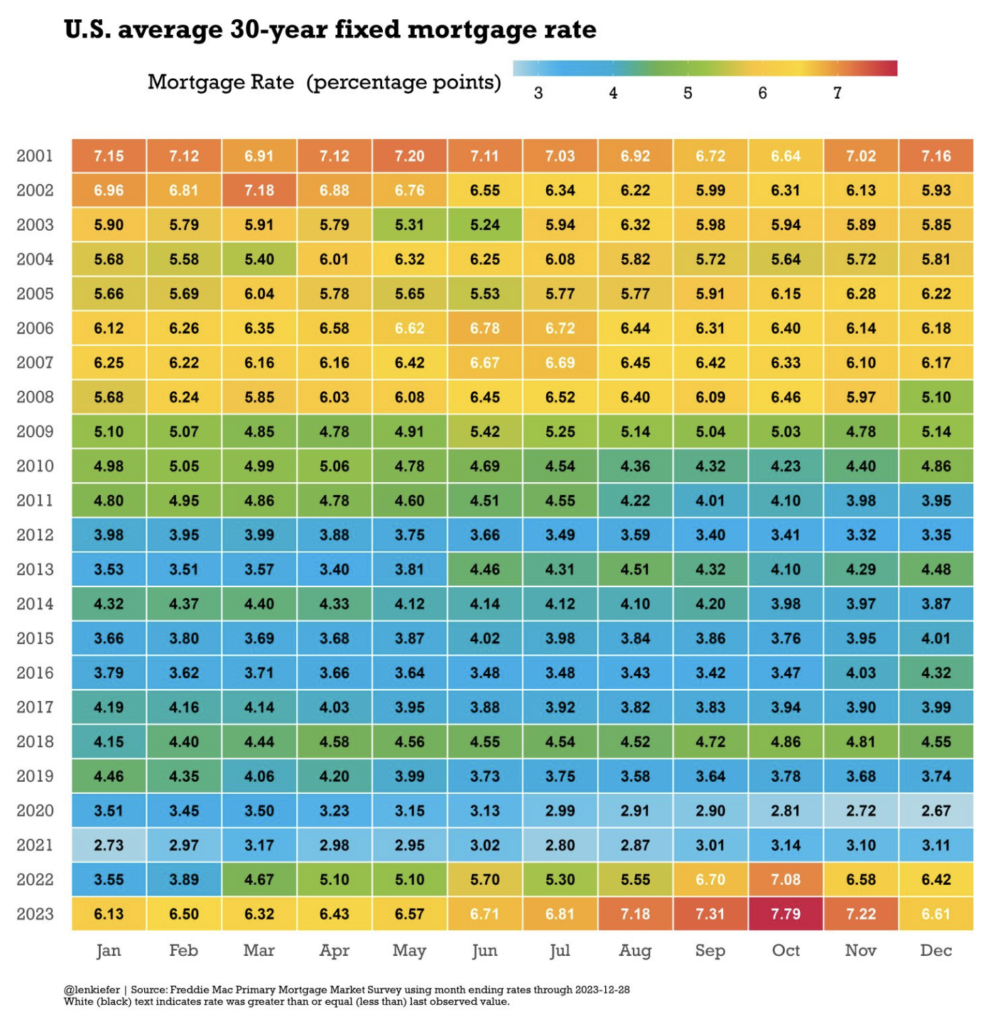

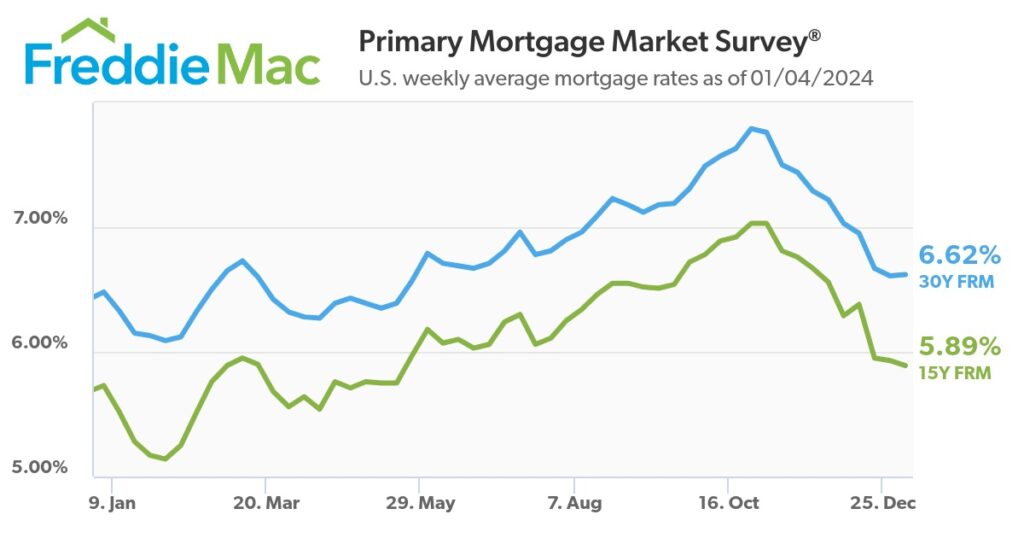

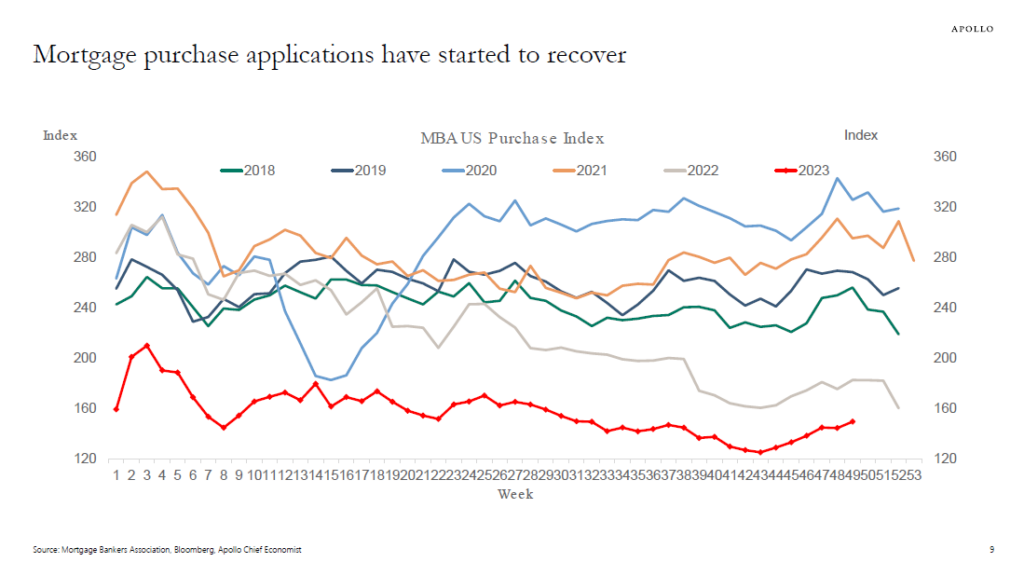

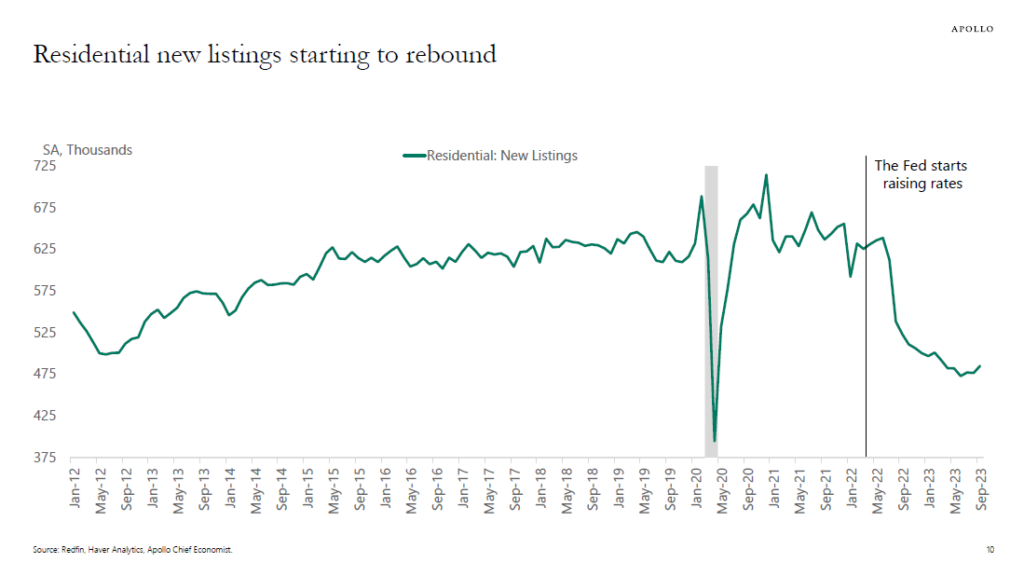

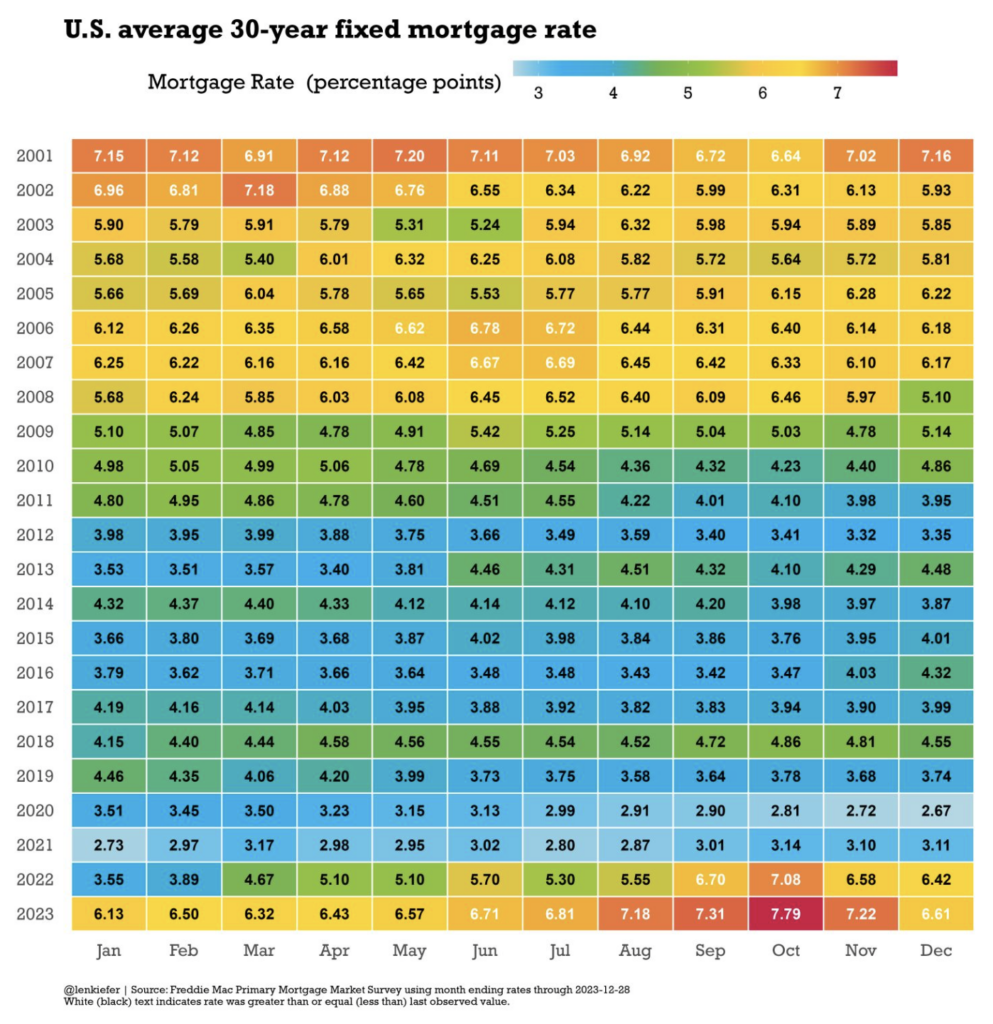

Mortgage rates have already fallen substantially since the Fed paused in December. Mortgage rates are expected to fall further in the first half of 2024 before the Fed cuts rates.

I struggled to better my 2023 market description: “2023: The Year of Disappointment.” I ended up with a 2024 descriptor of “2024: The Year of Incremental Change.” When I mentioned this descriptor to reporters, I could hear a pin drop and then a sense of their disappointment. Brick Underground went with it first in their must-read 2024 forecast piece.

“If 2023 was the year of disappointment, 2024 will be the year of incremental change. It’s not a snappy catchphrase,” Miller acknowledges. But most will probably take it.

Brick Underground

A top real estate broker suggested “2024: The Year Of Less Disappointment.” I kind of like that too, but I need to commit to the phrase “incremental change” in 2024.

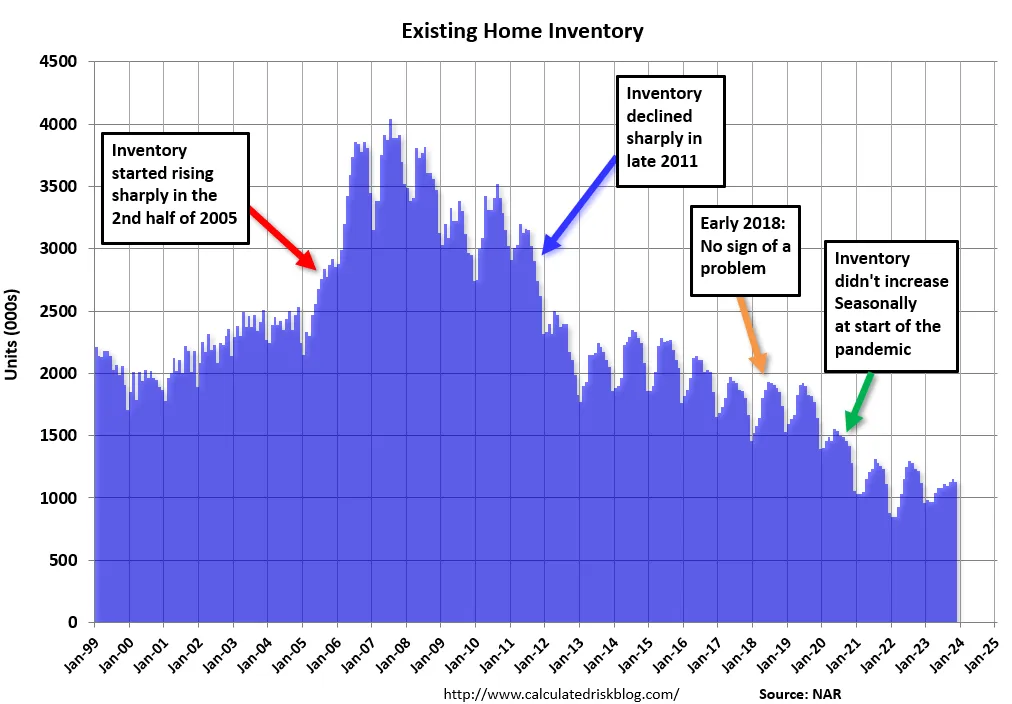

It is essential to understand that mortgage rate lows of the prior decade (see image above in blue) were a historical anomaly, and the lows observed during the pandemic era were held too low for too long, resulting in the most significant housing boom of the modern era. As a result, the recent slide in mortgage rates since December after their sharp ascent over the past two years will probably result in outsized transaction volume before the expected modest Fed cuts of 75 basis points (probably three 25 basis point cuts in 2024). This potential uptick in sales won’t be a boom, but we will probably look at 2023 as the bottom of the pandemic-era housing market rollercoaster.

Despite a weakening economy necessitating Fed rate cuts that are expected in the first half or “front” of 2024, economically speaking, I’m on “Team Soft-Landing” with limited job loss versus “Team Recession” with a lot of job loss. In fact, “the front is not expected to fall off,” and housing activity should begin to rise. Here’s a must-watch breakdown to understand the front of 2024.

——–

Did you miss last Friday’s Housing Notes?

December 29, 2023: The Housing Recession Is Probably Ending In 2024 (and other wild guesses)

——–

But I digress…

Fourth Quarter Manhattan Saw Rising Sales And Falling Inventory

I’ve been the author of a market report series for Douglas Elliman since 1994 that began with Manhattan and now covers other markets, including Boston, Connecticut, Long Island/Hamptons/North Fork, Florida, and Southern California. This week we published the Elliman Report: Q4-2023 Manhattan Sales.

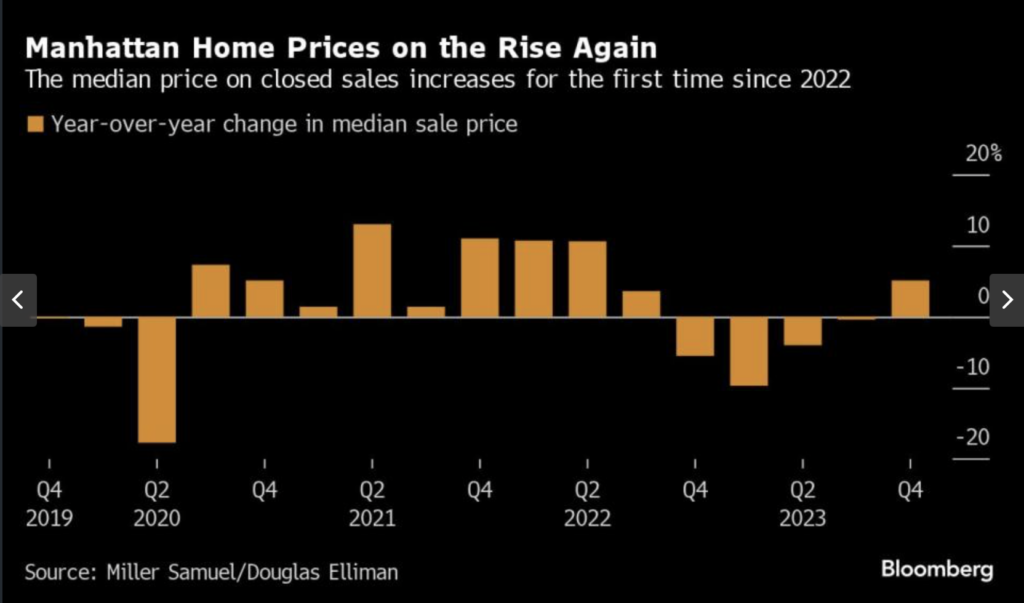

Bloomberg built an excellent chart for it for their coverage of it.

And, of course, we need to include another version of the same chart…

______________________________________________________

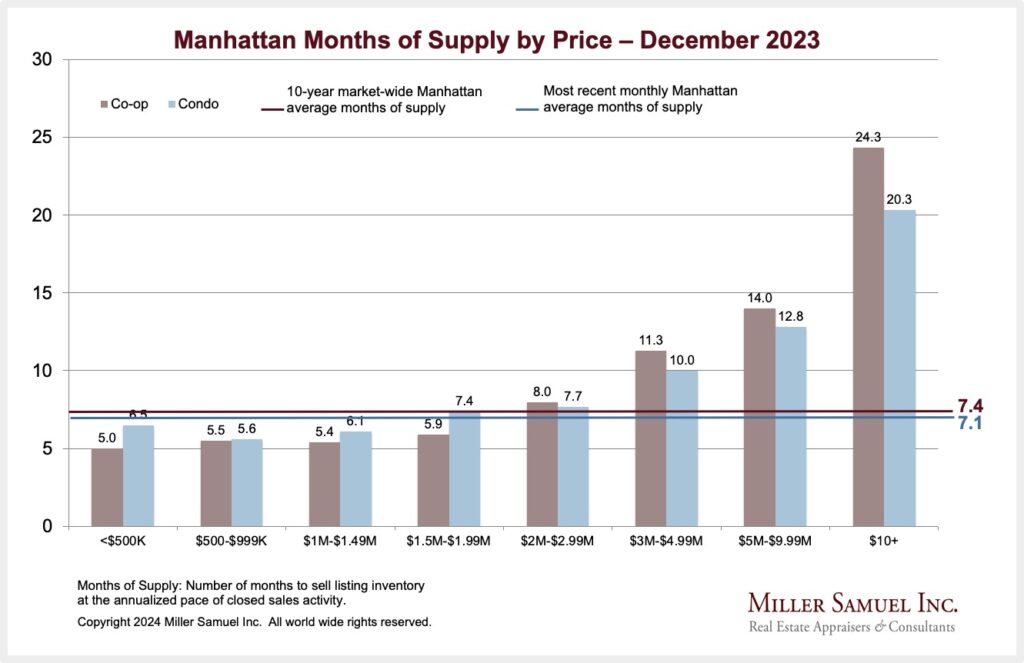

MANHATTAN SALES MARKET HIGHLIGHTS

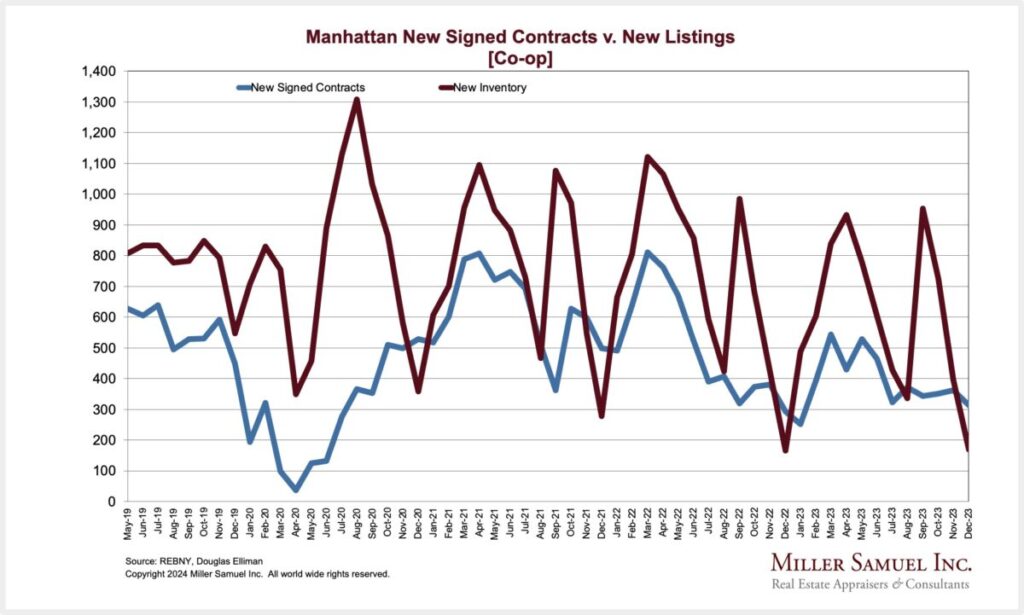

Co-ops & Condos

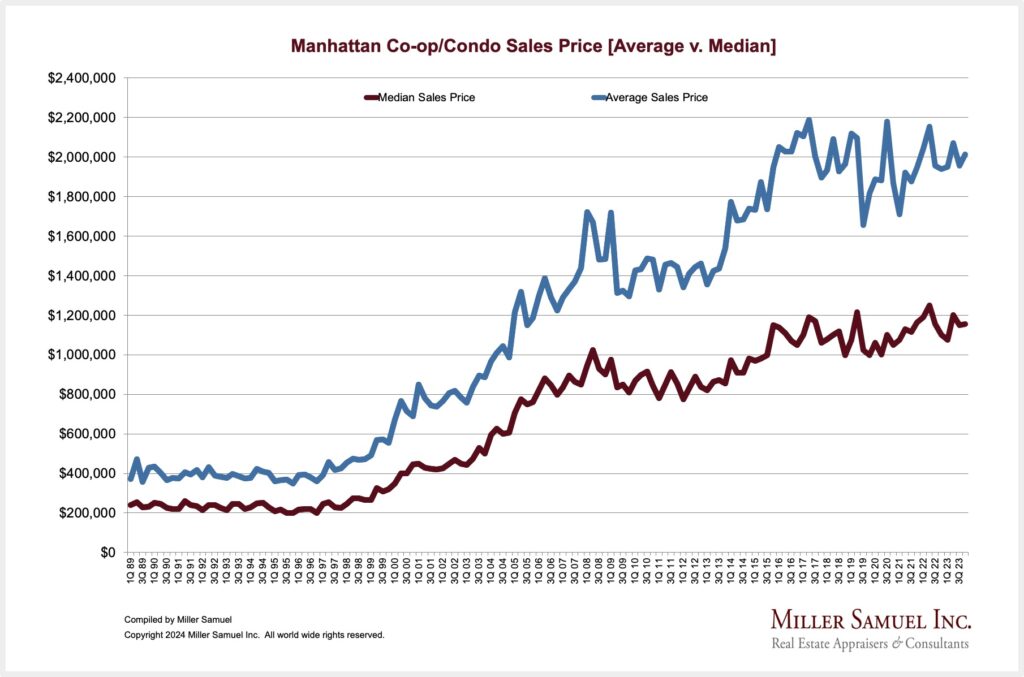

“Sales and listing inventory continued to fall as prices began to rise.”

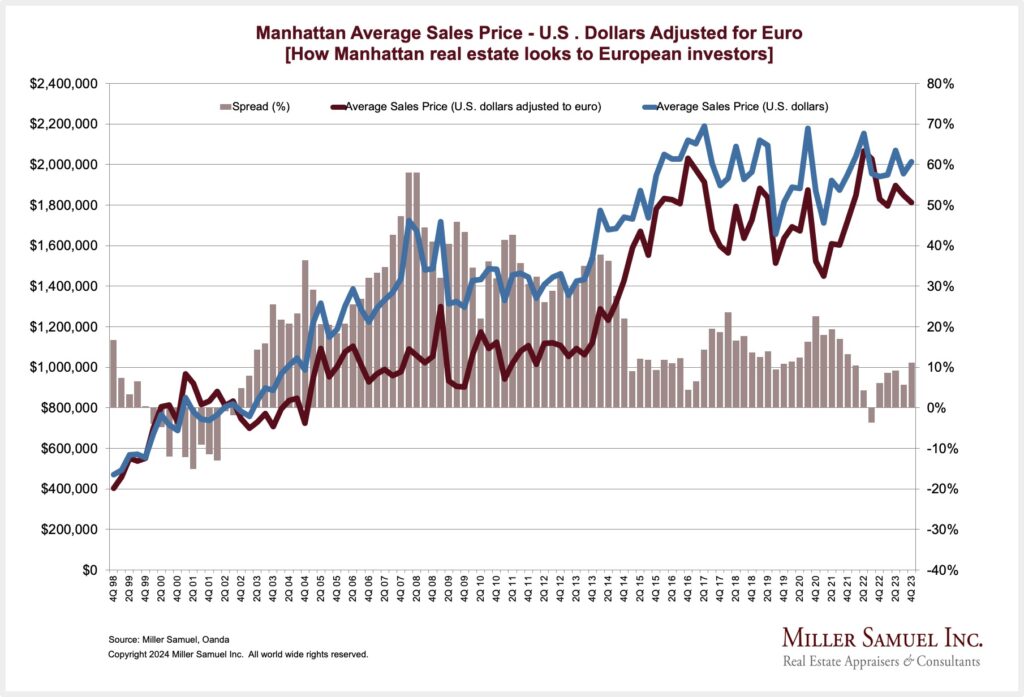

– Median sales price rose year over year for the first time in five quarters to the second-highest fourth quarter on record

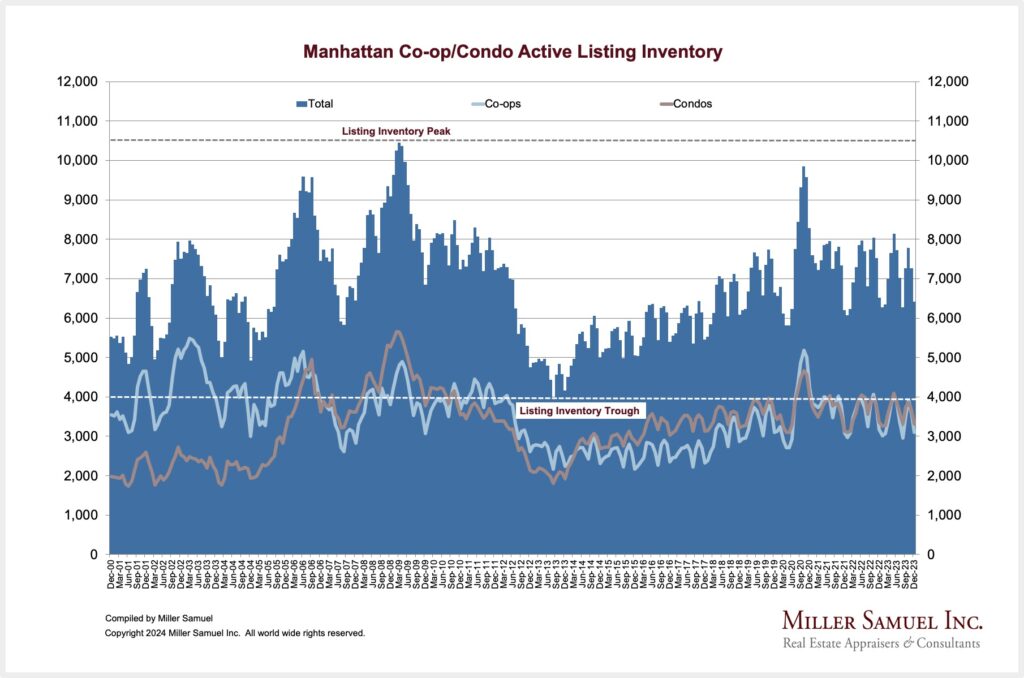

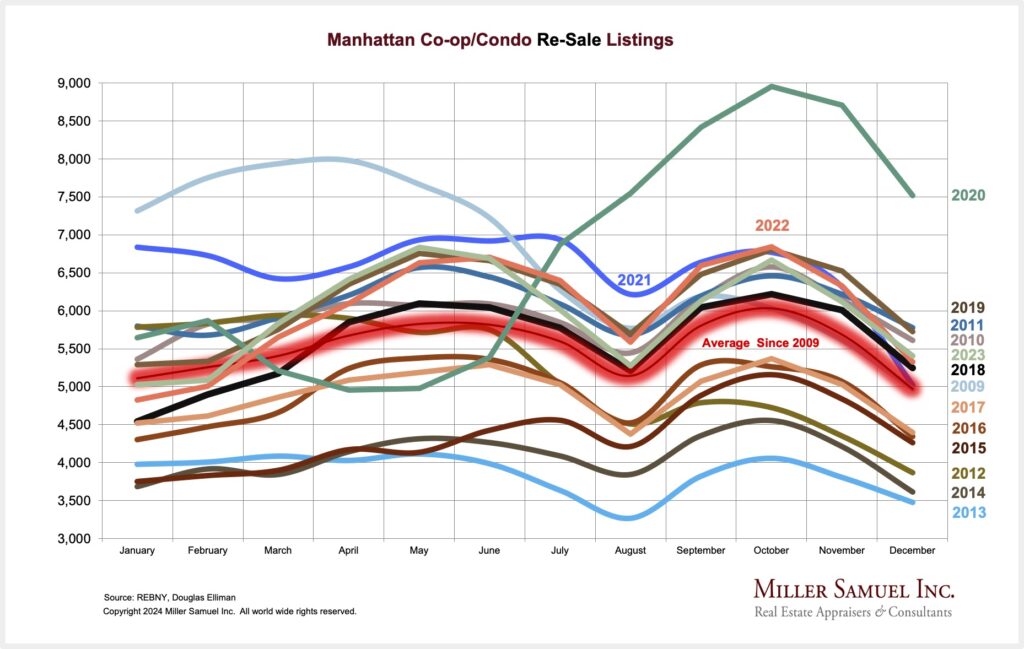

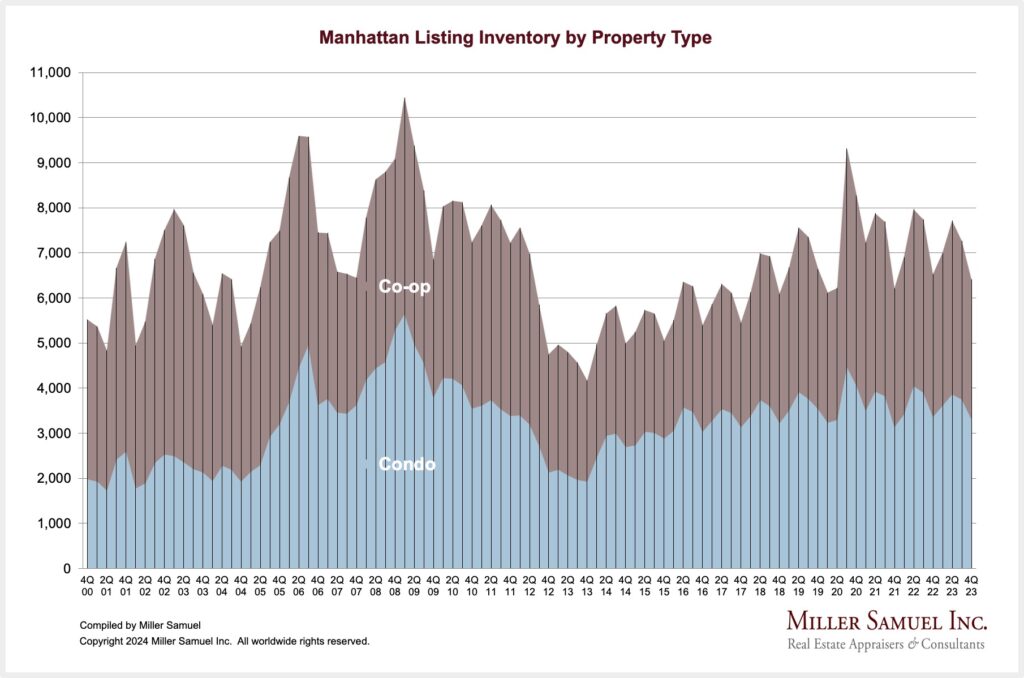

– Listing inventory declined annually for the third consecutive quarter as sales continued to fall at a declining rate

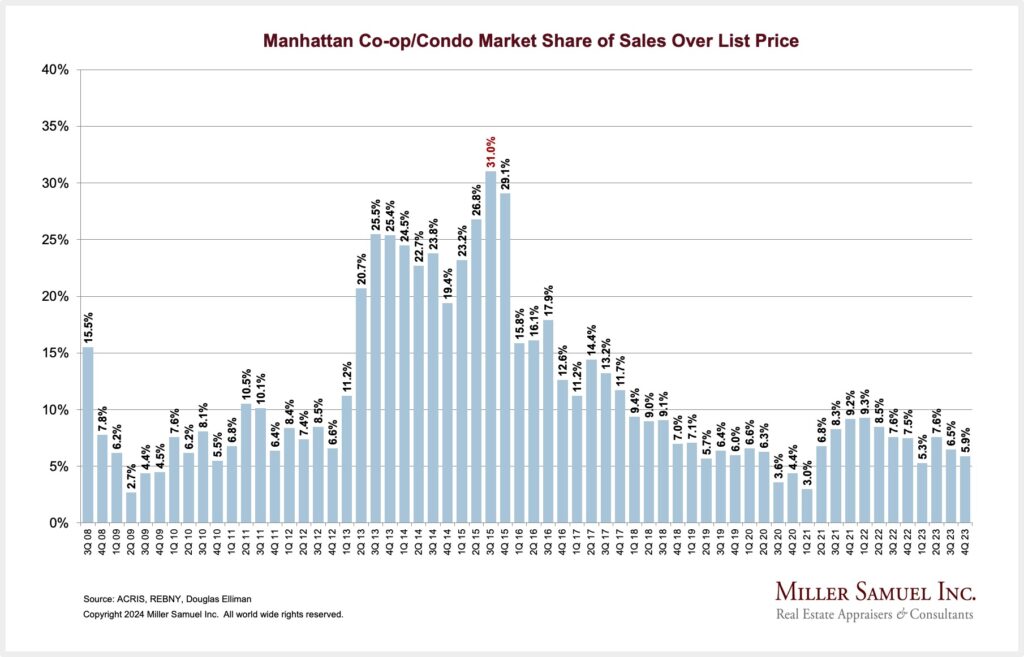

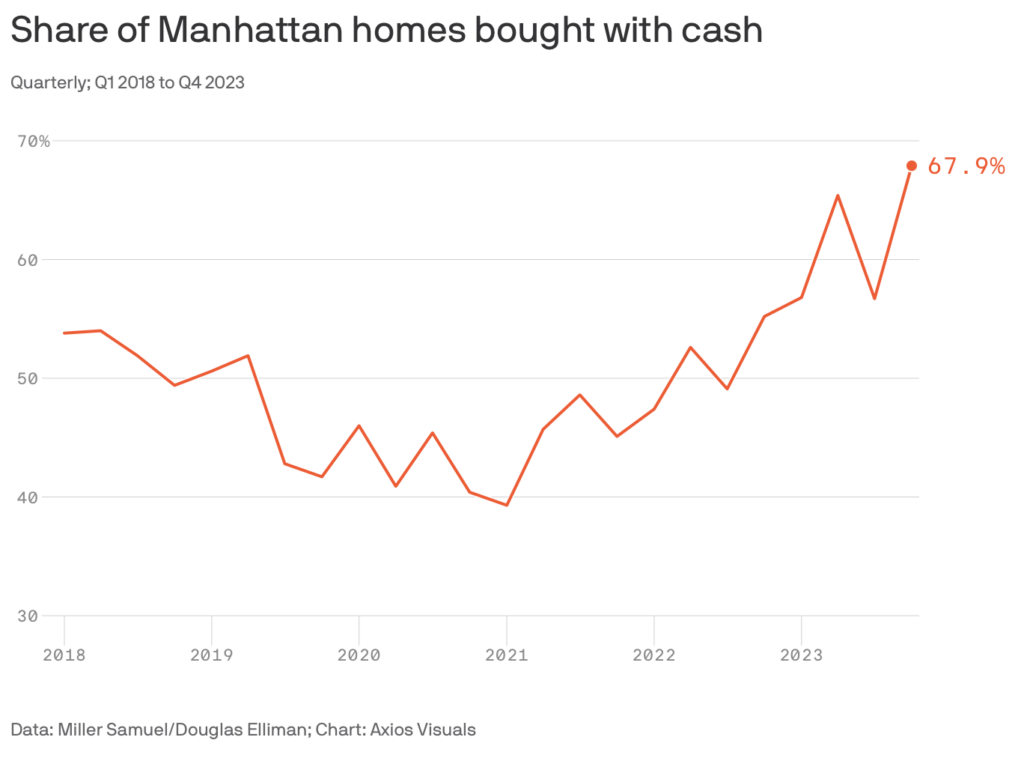

– Cash sales surged to exceed two-thirds of all sales to reach a record-high market share

– While resales slipped year over year, sales at or above the $5 million threshold surged

– Co-op sales increased annually for the first time in six quarters

– Condo median sales price edged higher year over year for the first time in five quarters

– Luxury median sales price increased annually for the third time and remained significantly above pre-pandemic levels

– Luxury listing inventory fell annually for the third consecutive quarter

– New development listing inventory declined year over year for the fourth consecutive quarter

– New development sales declined year over year for the sixth time as excess supply was sold off during the pandemic

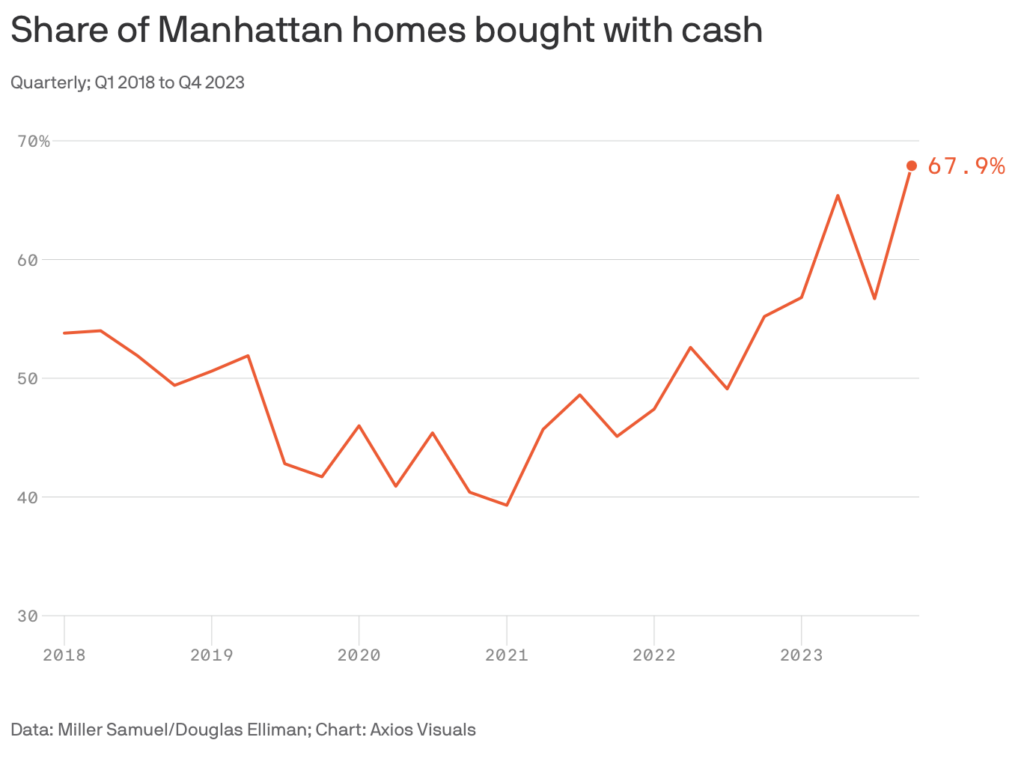

Cash Purchases Set A Manhattan Sales Record

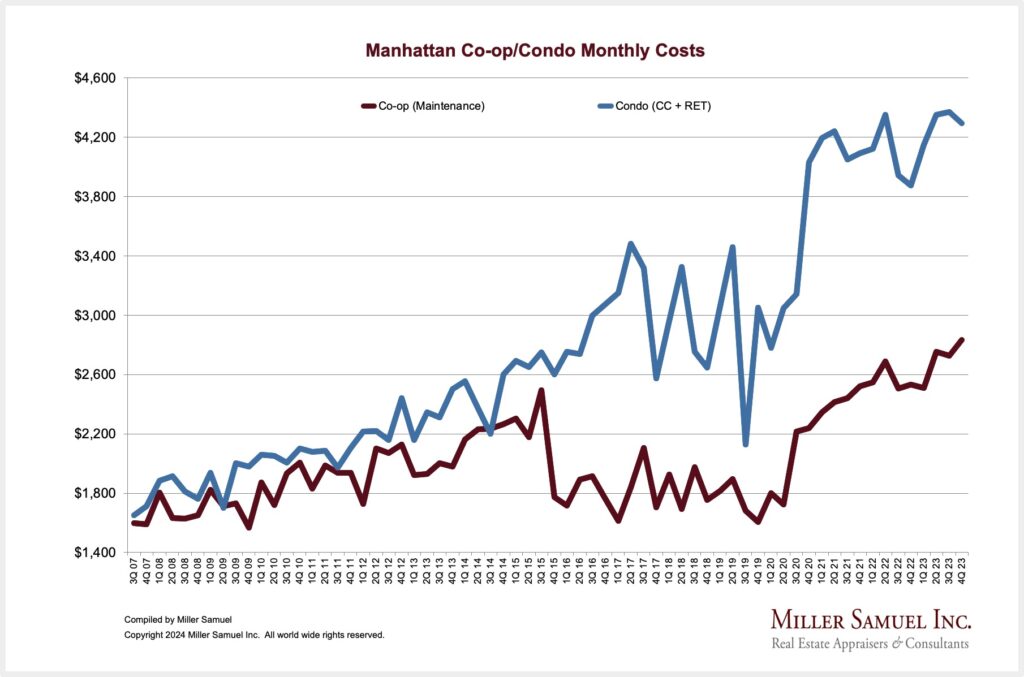

Manhattan is often stereotyped as an “all cash” housing market as the ten-year data from Douglas Elliman shows a 49.9% average since Q1-2014. Axios wrote about this phenomenon in a recent article that included a very cool chart (charts=life) about Manhattan’s record cash share of sales reaching a record of 67.9% (and financed purchases reaching a record low of 32.1%).

Here’s another way to look at the cash phenomenon. While it is clear that the surge in mortgage rates has slowed sales – financed purchases fell 32.% year over year this quarter, cash purchases surged 17.6%. While Manhattan is historically a 50% cash market, it also has many buyers who can pay cash, benefiting from the tax deductions available if needed. The upside for the current market will be more financed sales as cash sales decline with falling mortgage rates.

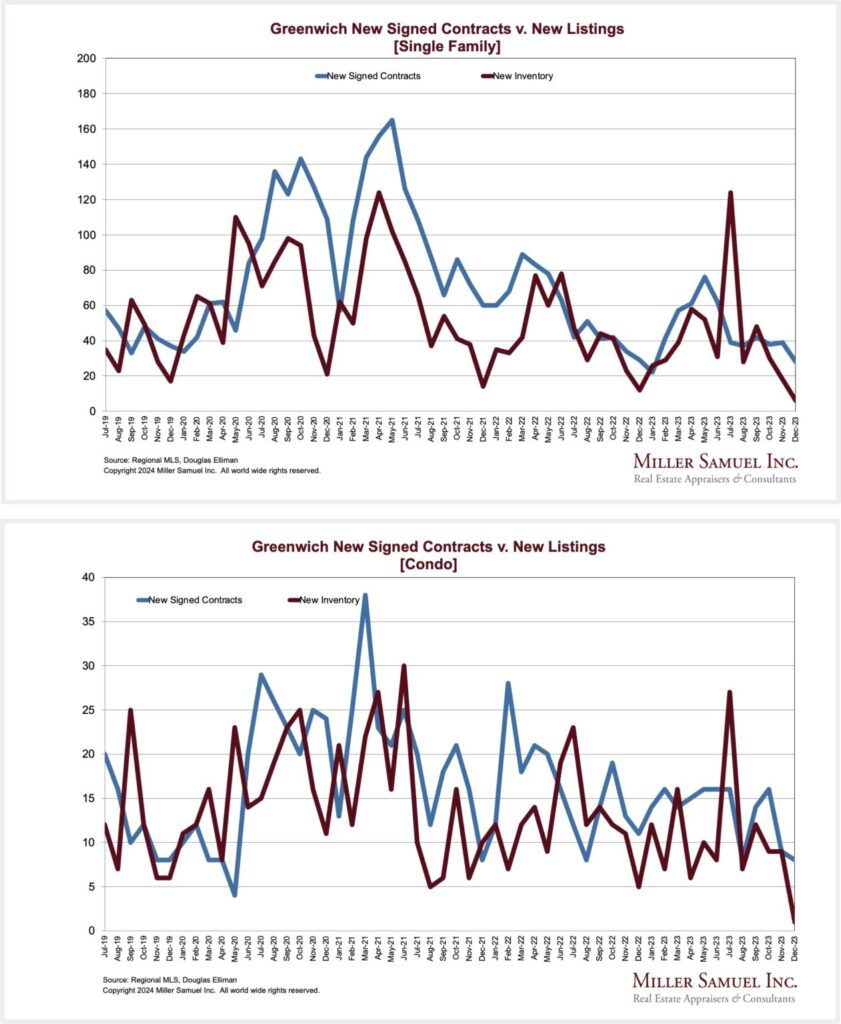

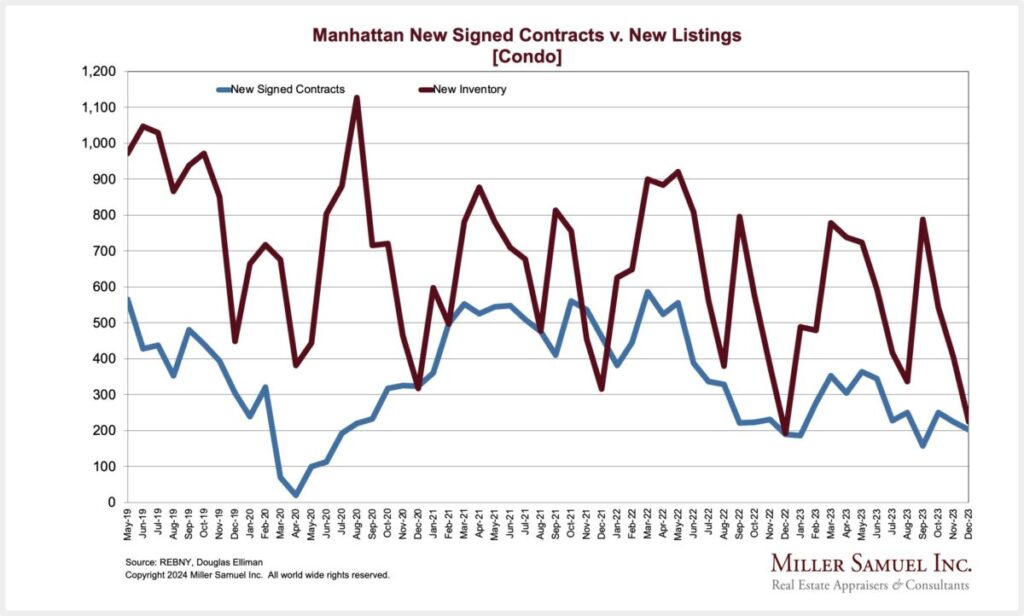

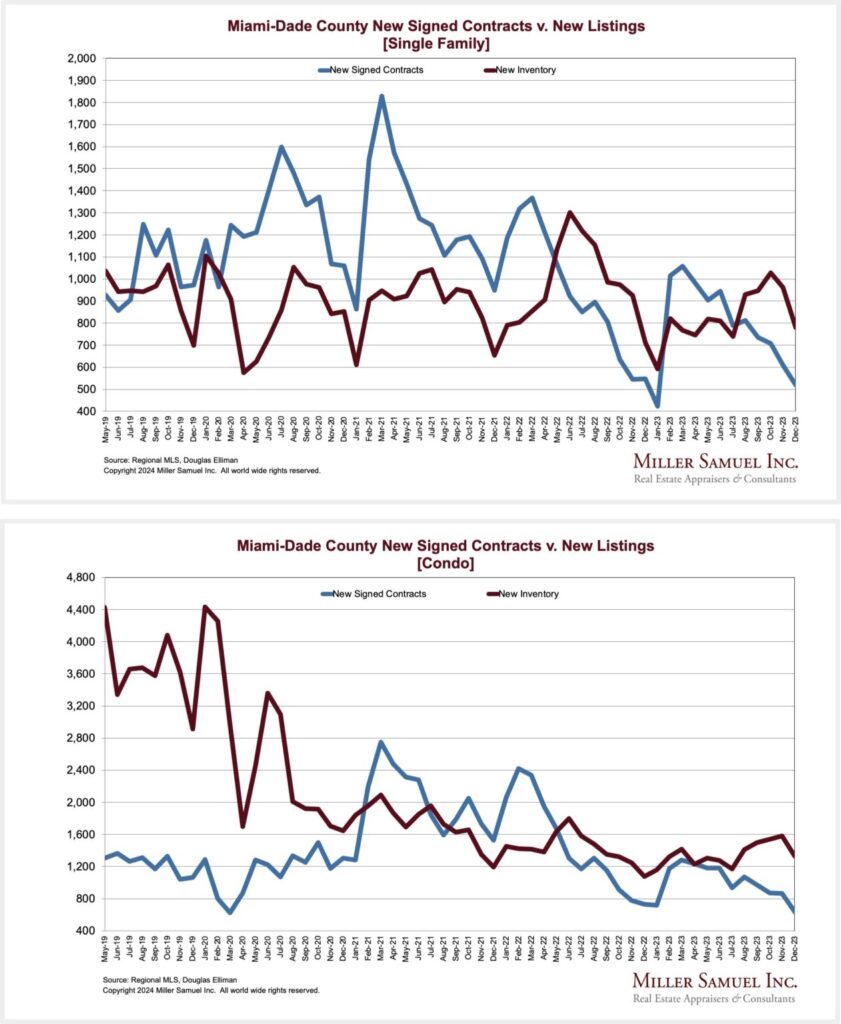

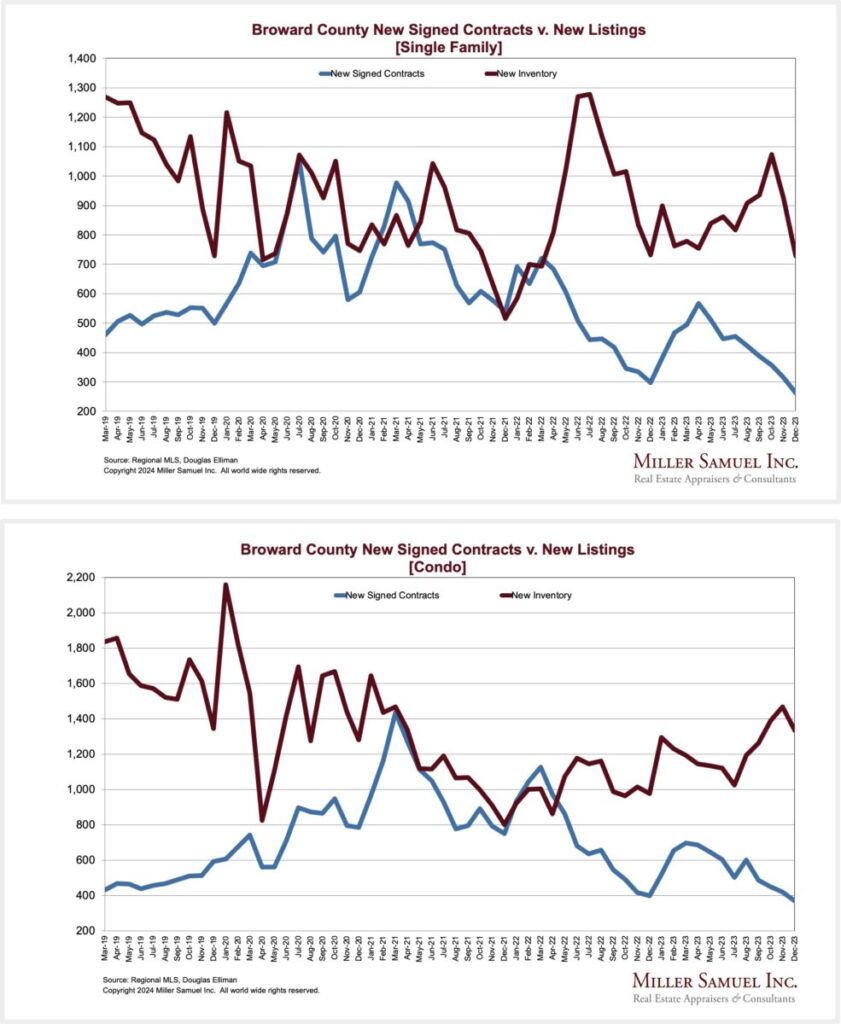

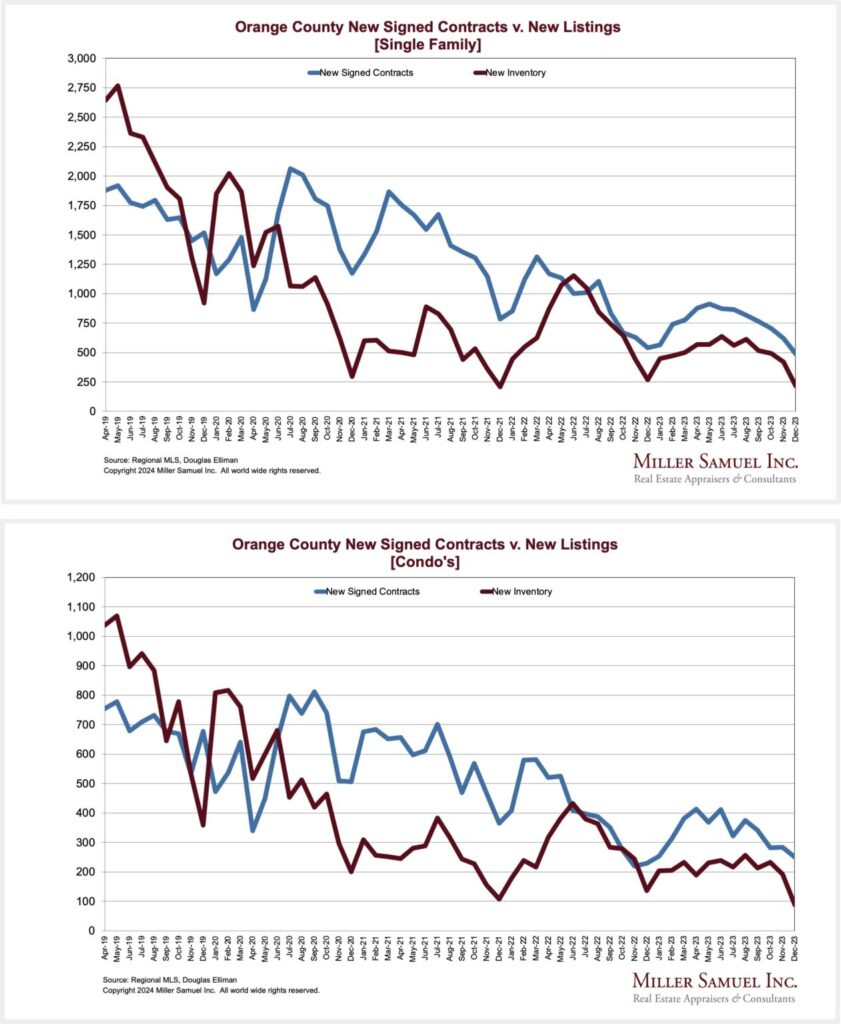

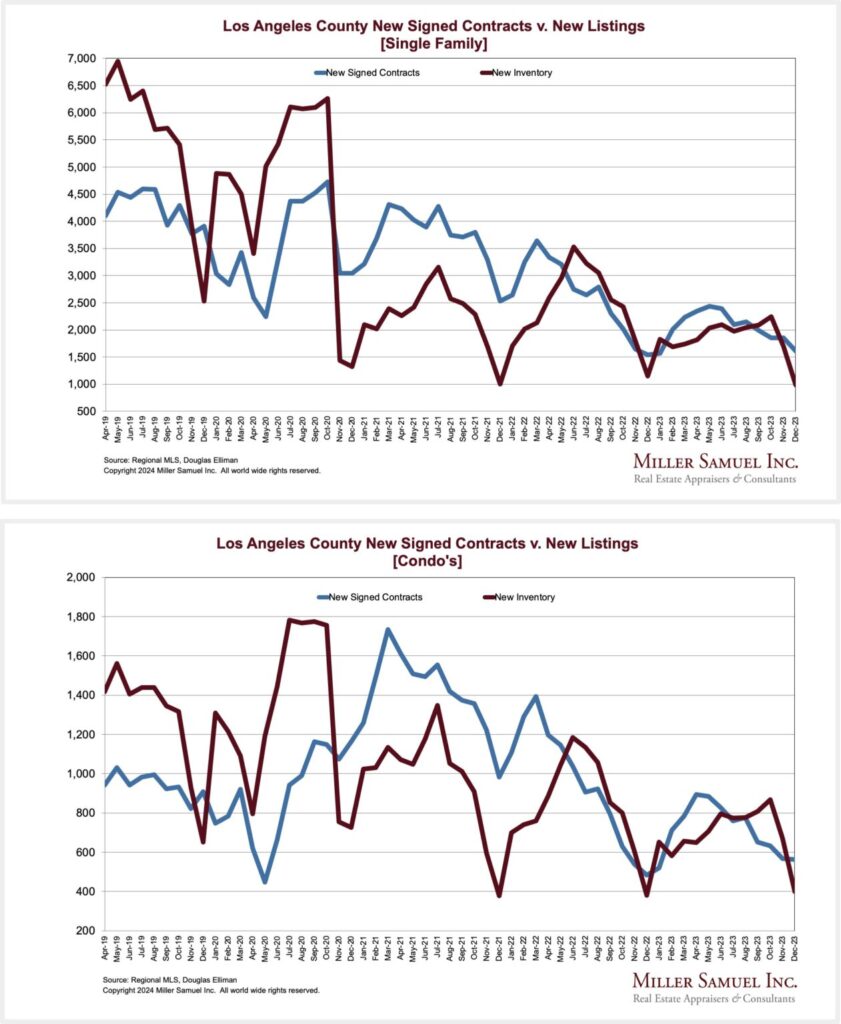

New Signed Contracts For New York Metro, Florida, and Southern California Show an Uptick In December

During the global pandemic, we began a series of “New Signed Contracts” reports for Douglas Elliman to capture the activity of the most recent month tracking new signed contracts and new listings.

Elliman Report: December 2023 New York New Signed Contracts

Elliman Report: December 2023 Florida New Signed Contracts

Elliman Report: December 2023 California New Signed Contracts

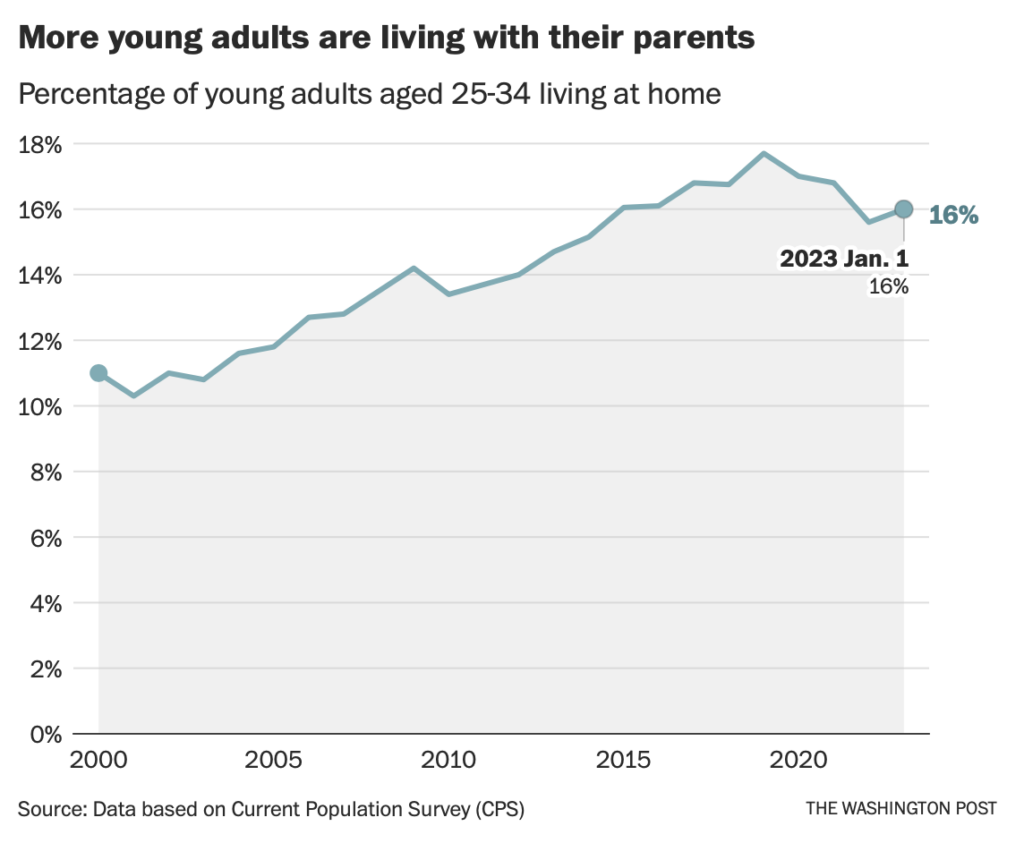

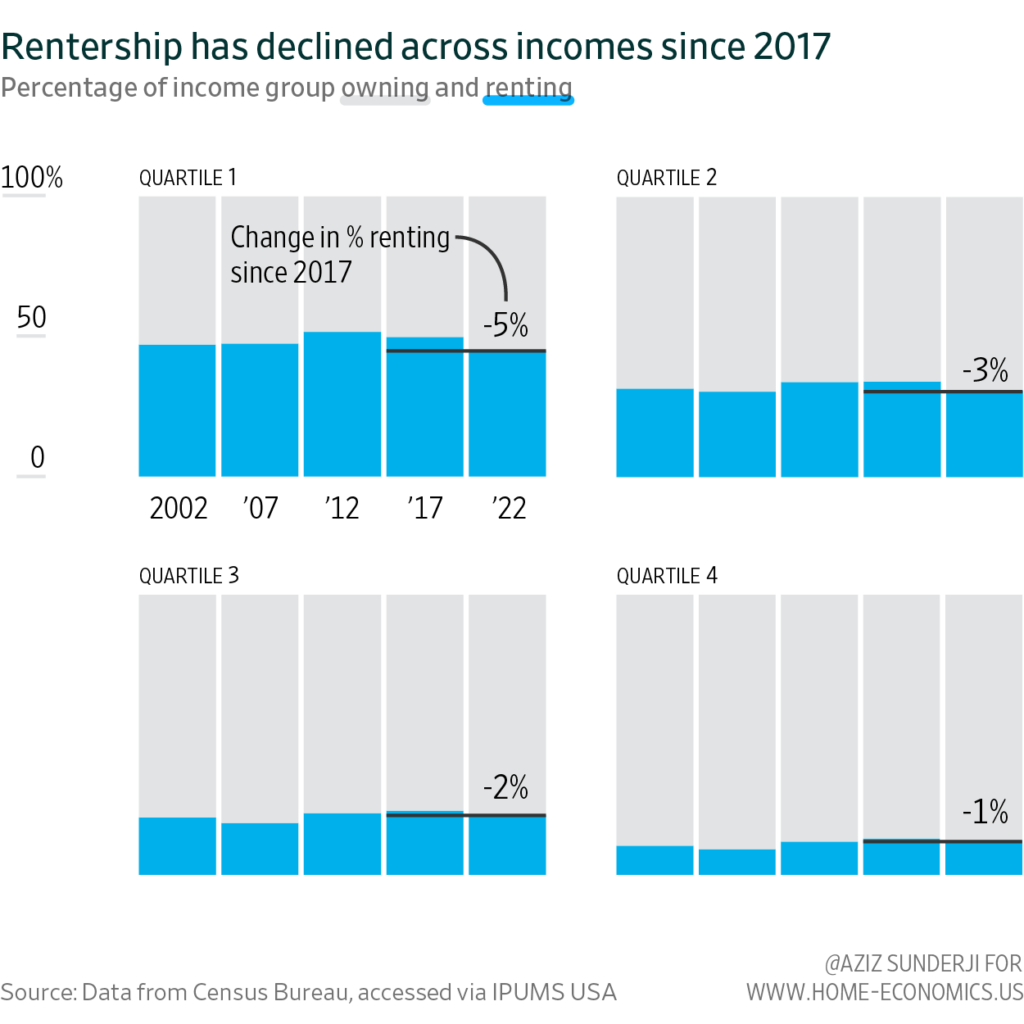

Parent’s Basement Used By Many First-Time Buyers

The Washington Post shares NAR research that 27% of millennials are living with their parents in their Millennials have found a way to buy houses: Living with mom and dad. See the chart below from a year ago from a source outside of NAR.

The following Morning Brew is a semi-comedy skit about first-time home buyers struck close to home. My three oldest sons individually moved in after college with their significant others and significant animals and saved money for a downpayment. Our youngest stayed with us after college and then moved to Manhattan with his significant other to rent and live his best life with enough savings for an eventual home purchase. My wife and I got to know them better as “adults,” as we tried to give each other some privacy. And it worked! I believe this will be the “new normal” for now.

h/t Highest & Best

Highest & Best Newsletter: The Hotel Hesitation

I love this new Florida newsletter: Highest & Best from Oshrat Carmiel, formerly of Bloomberg News…

The Hotel Hesitation (This week’s piece)

There’s a lull in lodging deals; Plus: a private-island condo loan

I love that all development renderings in Florida include helicopters and speedboats. – JM

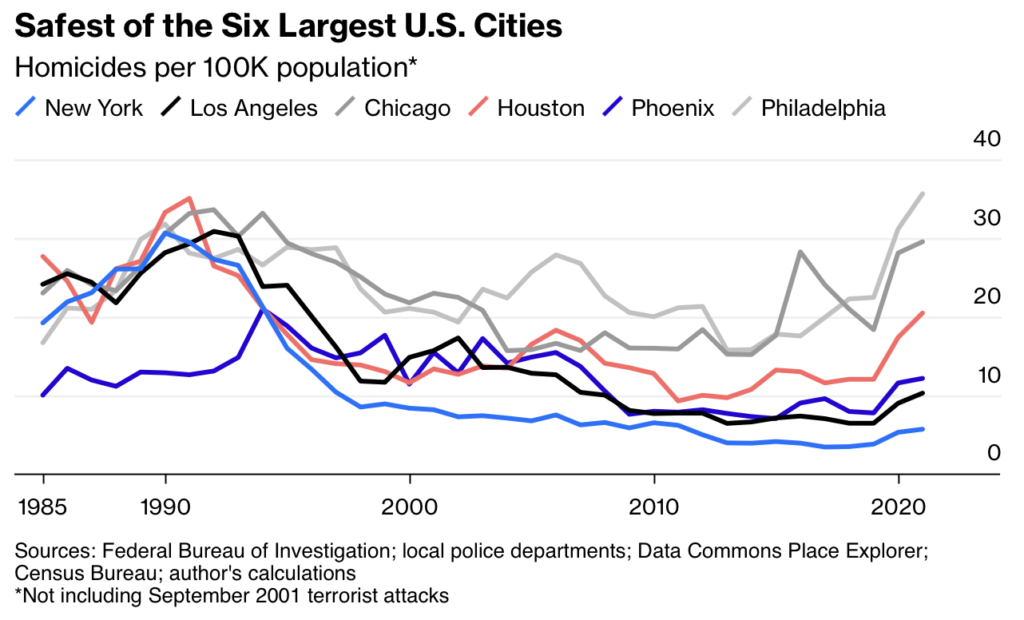

NYC Has Lower Murder Rates Than Most Big Cities And Small Towns, So There!

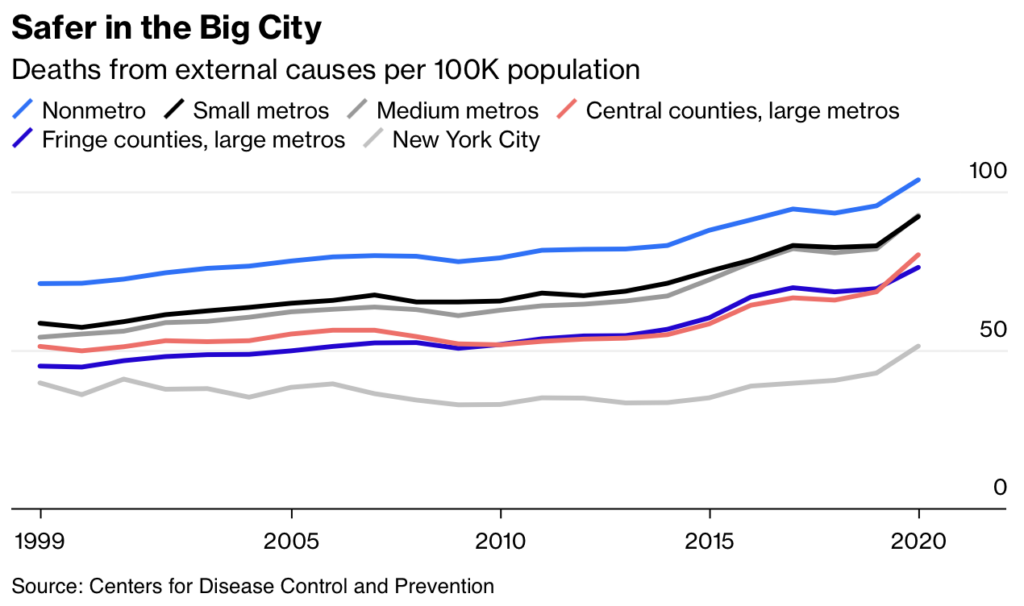

I am tired of the potshots many outside the city take at The Big Apple about its safety. When NYC was at the early center of the Covid narrative with the simplistic belief that cities were more dangerous than the suburbs, the data on the Covid maps showed just the opposite. That’s another five pages of explanation, but that scenario played out.

Here’s an excellent piece just out on Bloomberg: New York City Is a Lot Safer Than Small-Town America

The historical context, which a fair number of people are aware of, is that New York’s pandemic murder wave followed a long decline, with the city’s homicide rate in 2021 still less than a fifth what it was in 1990.

Bloomberg

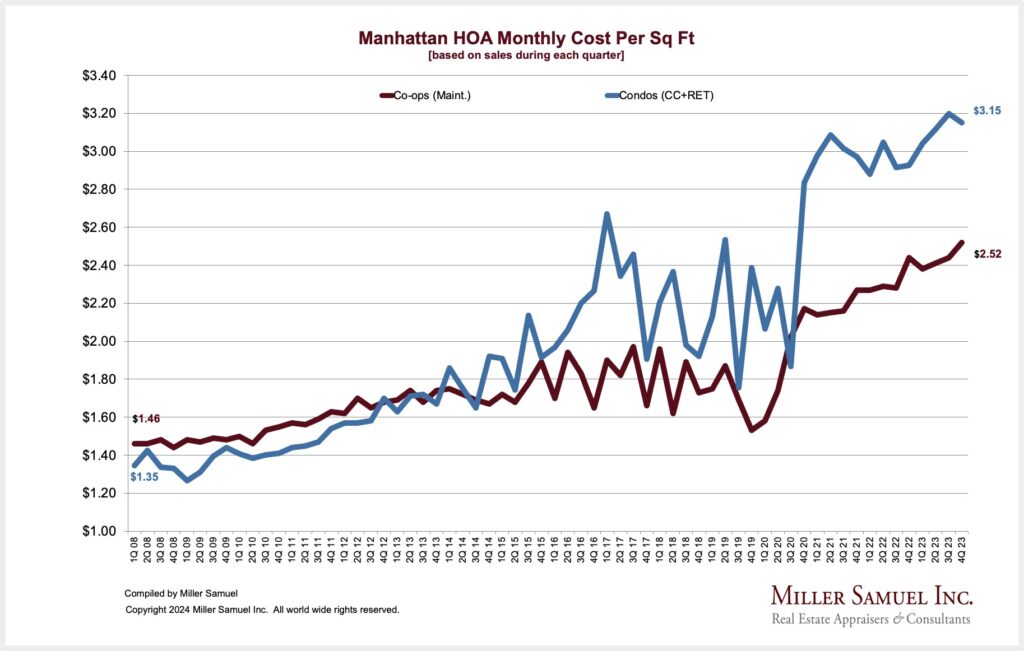

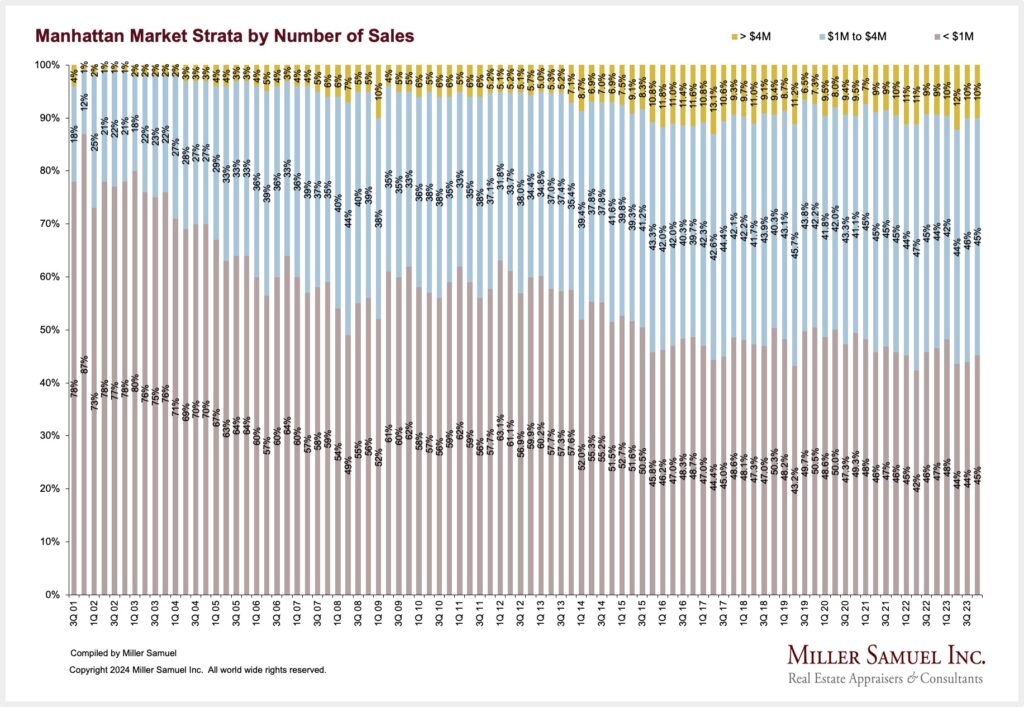

Getting Graphic

Favorite housing market charts of the week of our OWN making

Favorite housing market/economic charts of the week made by OTHERS

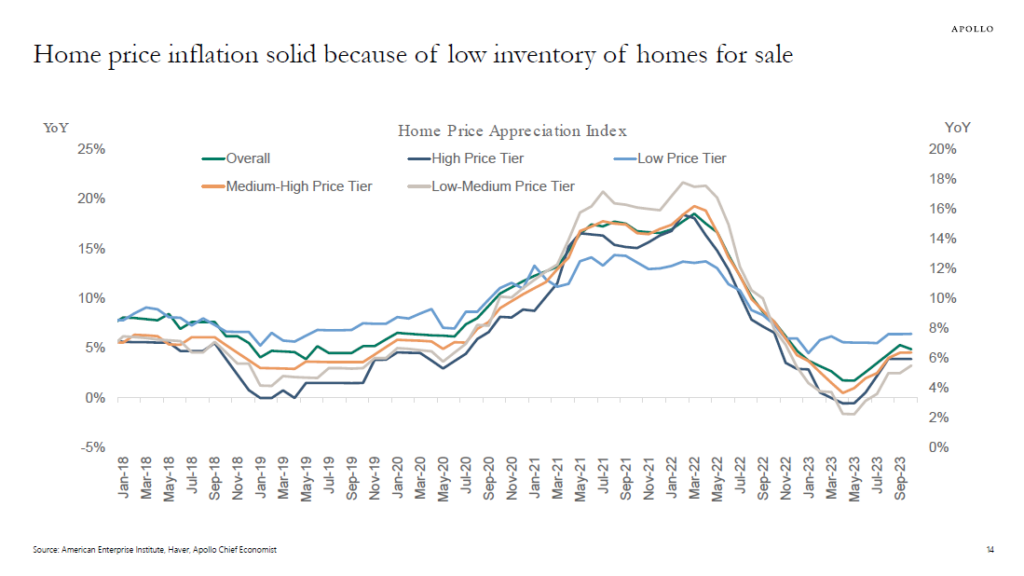

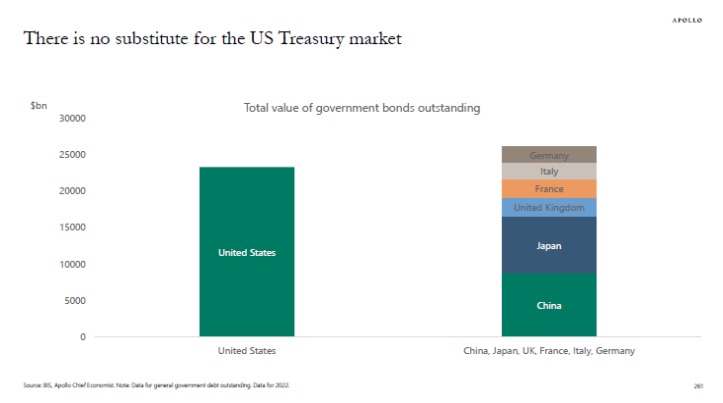

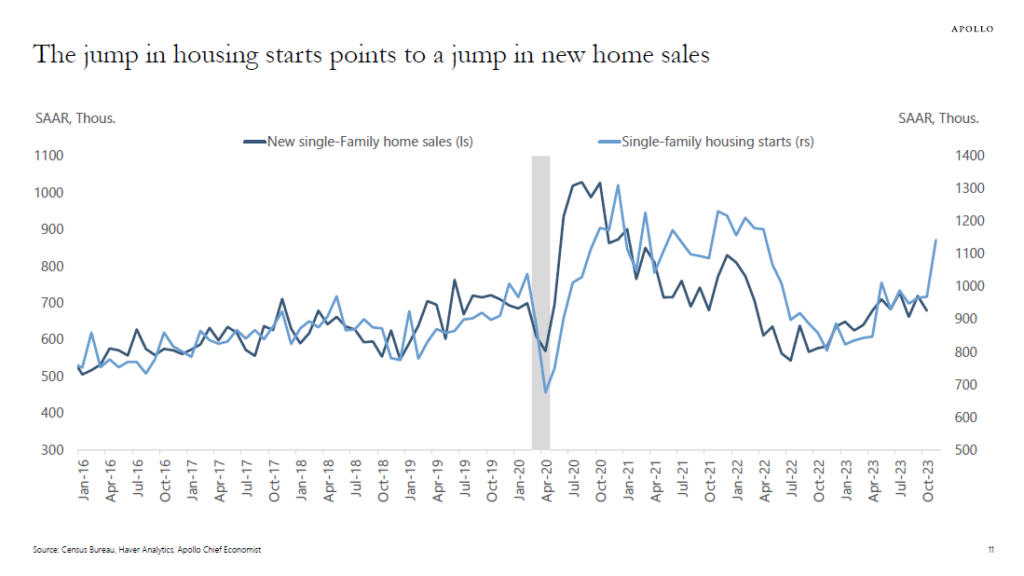

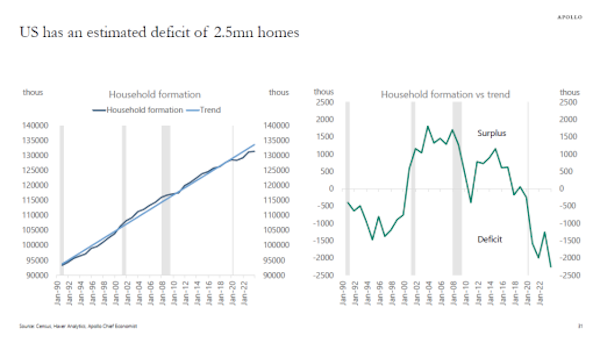

Apollo’s Torsten Slok‘s amazingly clear charts

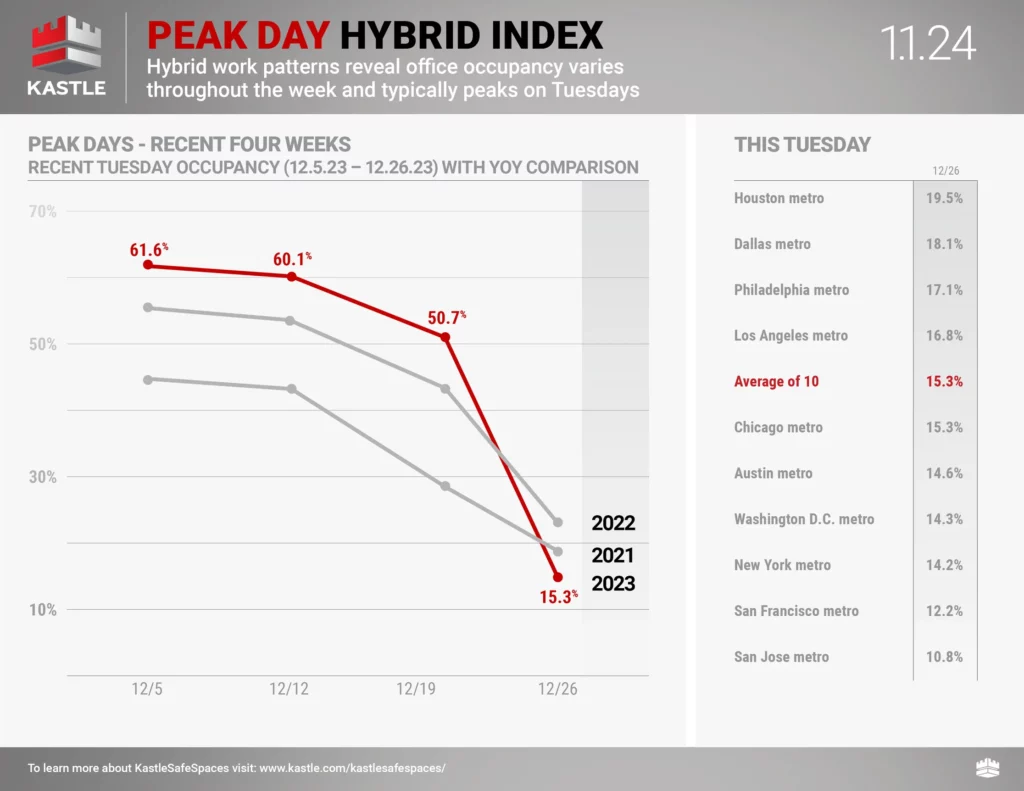

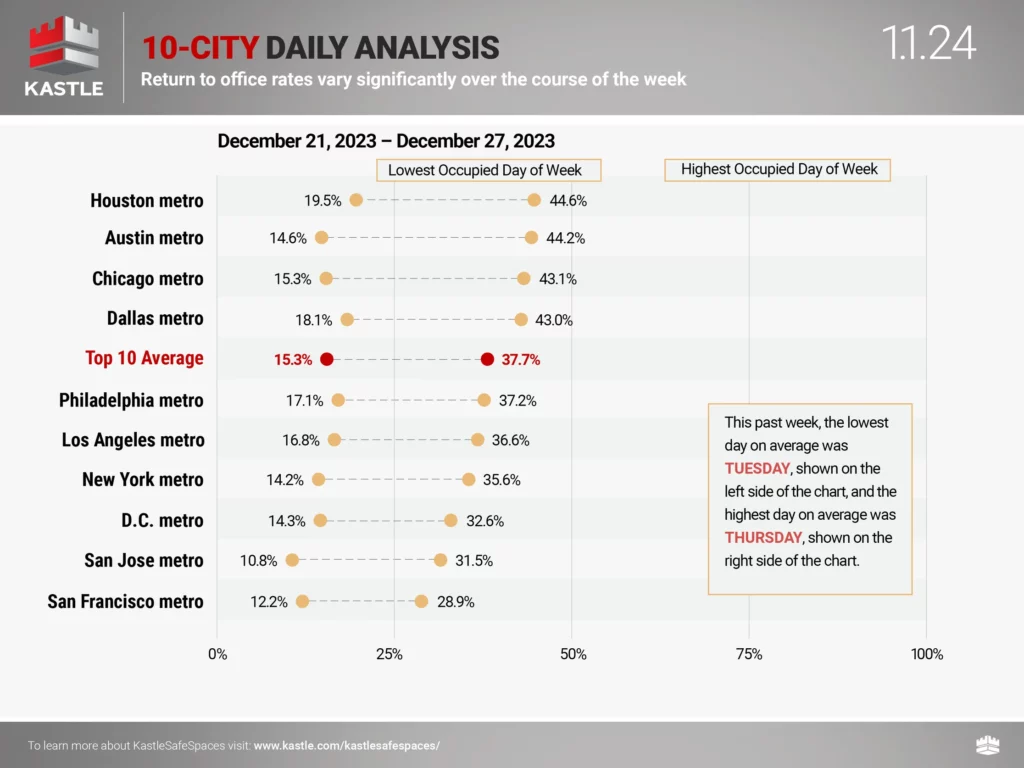

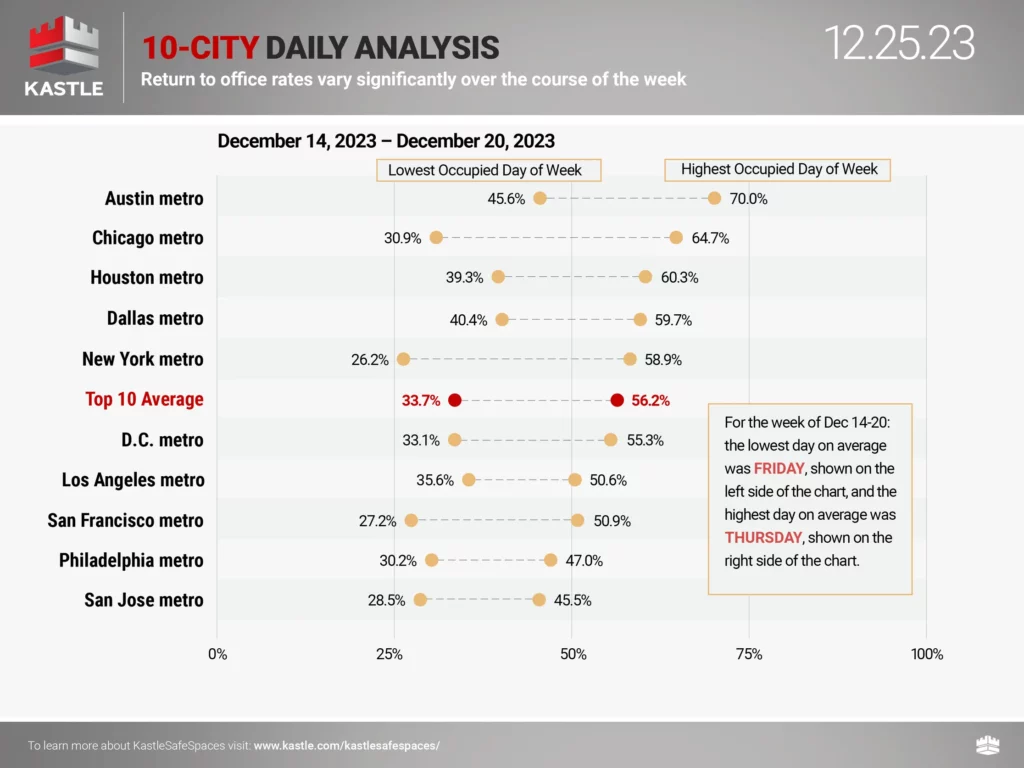

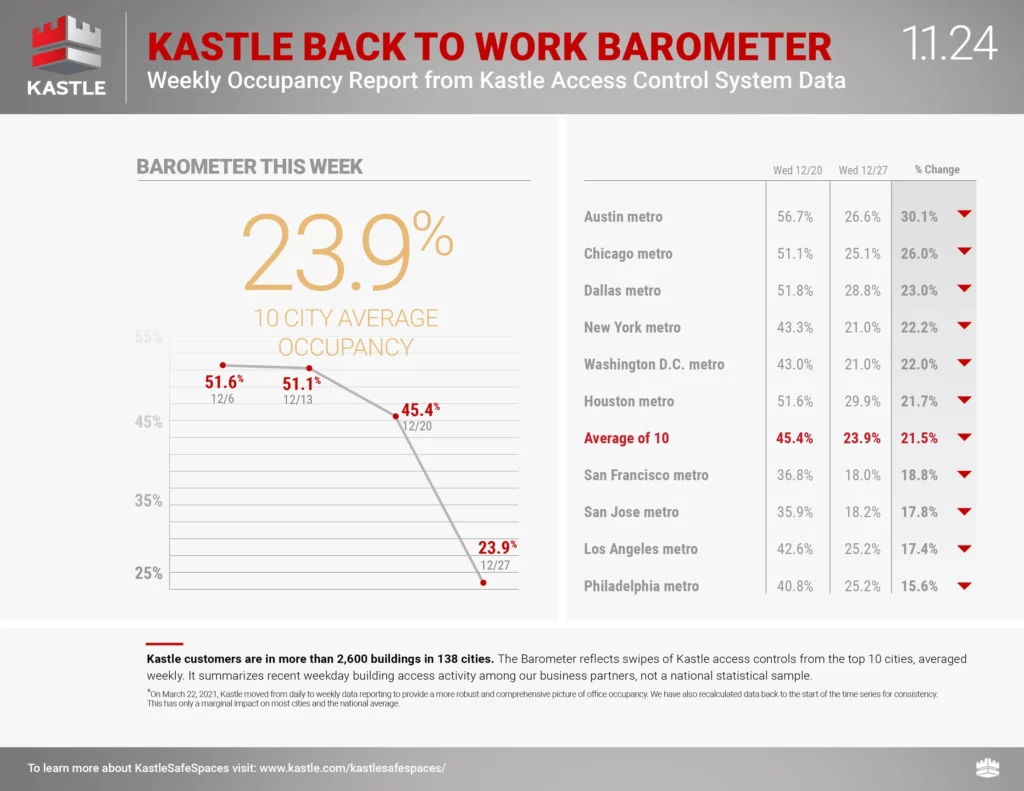

Kastle card swipe data

Remember that Kastle charts are overstating occupancy* because their pre-pandemic occupancy benchmark was 100%, which is incorrect (*measures card swipe activity as a proxy for occupancy). Still, they’ve become the standard benchmark for occupancy rates.

Len Kiefer‘s chart handiwork

Favorite RANDOM charts of the week made by others

Appraiserville

Reckon Data’s Assist In Driving Appraisers To The Brink

Appraisal reviews for $3 each and 1-2 hour turn times. It’s hard to imagine any appraiser accepting these terms, and it’s hard to imagine any lending institution accepting these as valid reviews. It’s incredibly disrespectful to the profession as they tout efficiency.

OFT (One Final Thought)

Brilliant Idea #1

If you need something rock solid in your life – particularly on Friday afternoons at 2:00 PM, Eastern Time (ET) – and someone forwarded this to you, you can sign up here for these weekly Housing Notes. And be sure to share with a friend or colleague if you enjoy them because:

– They’ll wait for the front to fall off;

– You’ll see the front fall off;

– And I’ll be wary of the pulse of Manhattan’s population.

Brilliant Idea #2

You’re clearly full of insights and ideas as a reader of Housing Notes. Consider sharing them with me early and often. I appreciate every email I receive, as it helps me craft future Housing Notes.

See you next week!

Jonathan J. Miller, CRE®, Member of RAC

President/CEO

Miller Samuel Inc.

Real Estate Appraisers & Consultants

Matrix Blog

@jonathanmiller

Reads, Listens and Visuals I Enjoyed

- Charted: Pay is beating inflation again

- Offices Around America Hit a New Vacancy Record

- Which states have the highest share of real estate agents

- Chart: Wage growth is beating inflation

- After the Surfside collapse, Florida is seeing a new condo boom

- China's property 'inventory overhang' could take more than 10 years to correct, economist says

- Ranked: Canada’s Housing Markets, by Price Growth in 2023

- The state of the US housing market in 5 charts

- 🏨 The Hotel Hesitation [Highest & Best]

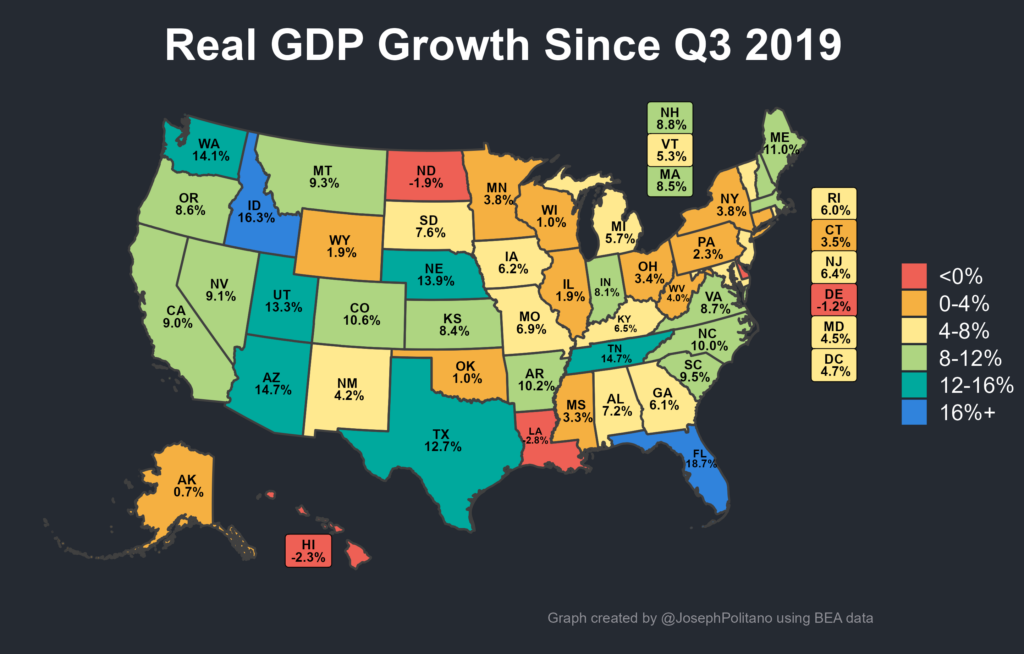

- The New Geography of American Growth [Apricitas]

- The Hidden Force Pushing Mortgage Rates Down [Wall Street Journal]

- A Dubai Penthouse Larger Than the White House Lists for About AED 600 Million [Mansion Global]

- Profile of South Florida Developer David Martin [The Real Deal]

- From Austin to Anchorage, U.S. cities opt to ditch their off-street parking minimums [NPR Illinois]

My New Content, Research and Mentions

- 68% of New Yorkers paid cash for home in Manhattan — where average price is $2M: report [NY Post]

- The Luxury Housing Market Wrapped Up 2023 With Both a Bang and a Whimper [Robb Report]

- Manhattan home prices rise in early sign of a market rebound [Business Times]

- Florida housing market takes December hit, rebound projected for 2024 [Florida Politics]

- New Yorkers buy 67% of homes with cash – despite $2 million cost [Daily Mail UK]

- The Luxury Housing Market Wrapped Up 2023 With Both a Bang and a Whimper [Yahoo]

- For LA Agents, Luxury Home Sales Surge in December [The Real Deal]

- Most expensive Hamptons home sales of 2023 led by $112.5 million Southampton estate [Newsday]

- Manhattan Real Estate Defies Odds Amid Rising Mortgage Rates [Financial World]

- Manhattan apartment prices rose at end of 2023 as all-cash sales hit record high [CNN Business]

- Manhattan Home Prices Rise for The First Time in More Than a Year [The Messenger]

- More than two-thirds of Manhattan deals in the fourth quarter were all cash [Brick Underground]

- Hamptons, North Fork Residential Markets Finally Looking Up [The Real Deal]

- Manhattan, Brooklyn Home Sales Poised to Gain in 2024 [The Real Deal]

- Manhattan’s Trophy-Home Market Ended 2023 With a Bang [Mansion Global]

- All-cash home deals in Manhattan hit record high [6sqft]

- Manhattan apartment sales dropped 16% at the end of 2023 [Crain's New York]

- 2024 NYC real estate forecast: Buyers and sellers emerge, renters gain leverage [Brick Underground]

- Stumbling: The Bloomberg Open, Americas Edition [Bloomberg]

- Manhattan Home Prices Rise in Early Sign of a Market Rebound [Bloomberg]

- Home Sales Drop In Palm Beach County, As New Listings Rise [BocaNewsNow.com]

- All-cash home sales in Manhattan hit record high [Axios]

- Manhattan Home Prices Rise in Early Sign of a Market Rebound [Yahoo Finance]

- Manhattan Home Prices Rise in Early Sign of a Market Rebound [Yahoo Finance Canada]

- Celebrities and Taxes Top LA’s Buzzy Stories for 2023 [The Real Deal]

- Shopping for a new home? Buyers in Miami-Dade County may have a change of luck in 2024 [Miami Herald]

- Beyoncé and Jay-Z’s $190 Million Malibu Buy Topped the Real-Estate Charts in 2023 [Wall Street Journal]

- Is 2024 a good year to buy a home? [CNN Business]

Recently Published Elliman Market Reports

- Elliman Report: Manhattan Sales 4Q 2023 [Miller Samuel]

- Elliman Report: California New Signed Contracts 12-2023 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 12-2023 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 12-2023 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 11-2023 [Miller Samuel}

- Elliman Report: California New Signed Contracts 11-2023 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 11-2023 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 11-2023 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 10-2023 [Miller Samuel]

- Elliman Report: California New Signed Contracts 10-2023 [Miller Samuel]

Appraisal Related Reads

Extra Curricular Reads

- Floating East River Pool May Open to Public Next Year Under Hochul Plan

- Sync Your Calendar With the Solar System

- Scientists Destroy Illusion That Coin Toss Flips Are 50–50

- Disney backs down from 'Steamboat Willie' YouTube copyright claim

- What We Lost When Twitter Became X

- Mike Sadler, Intrepid Desert Navigator in World War II, Dies at 103

- The American Soldier Whose Fear of Fighting in Vietnam Led Him to Defect to North Korea. He Stayed There for 40 Years [Smithsonian Magazine]

![[27 Speaks Podcast] Jonathan Miller Provides A 2024 Hamptons Outlook](https://millersamuel.com/files/2024/02/27eastlogo-600x314.jpg)