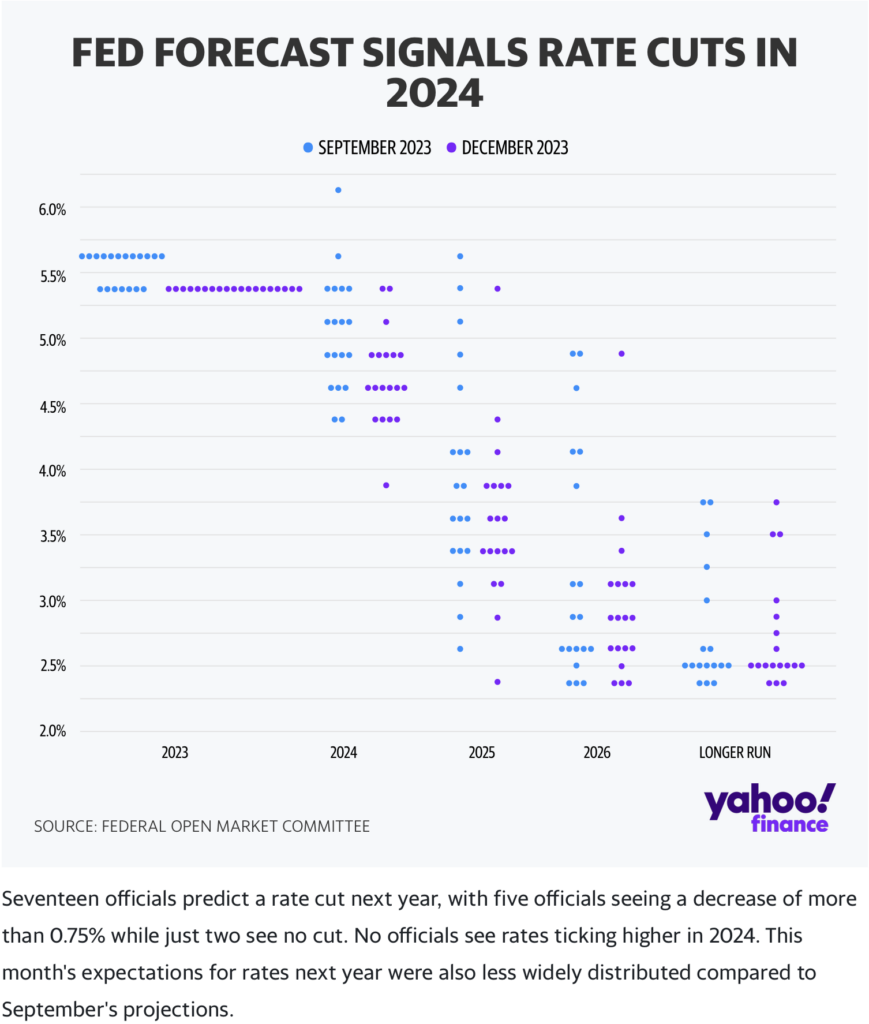

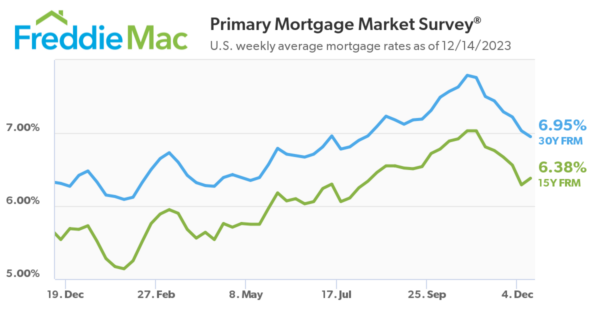

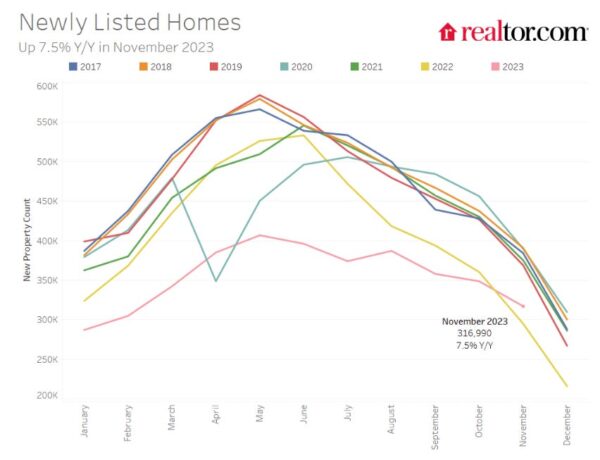

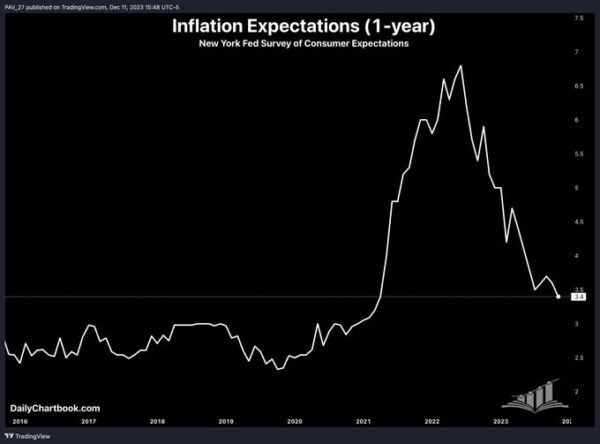

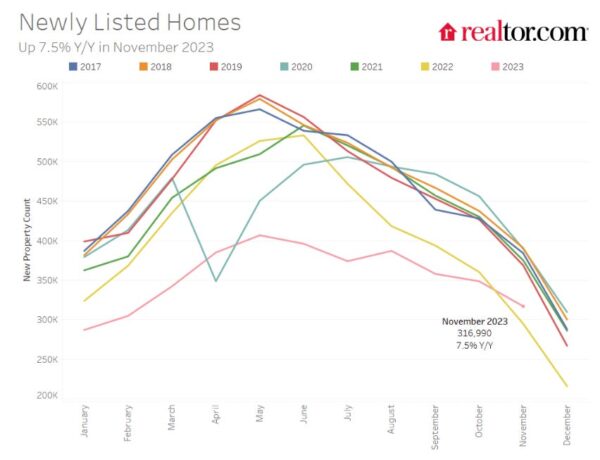

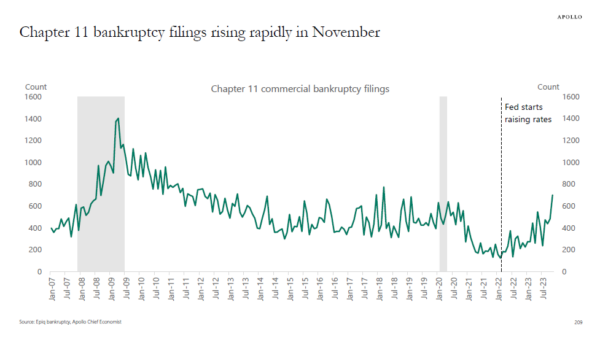

This week brought excellent news to the housing economy as the Fed telegraphed that there is a reasonable probability that their next move will be a cut in 2024 in the form of 3 cuts totaling 75 basis points.

——————————————-

And seriously…why do refrigerators of the 1950s have more features that I want from current models?

Did you miss last Friday’s Housing Notes? The previous three weeks’ posts have been placeholders while my wife and I celebrated our 40th anniversary in Antarctica, so it’s not worth sending you back to those posts. Here’s some of what we did and saw (click to expand images).

——————————————-

But I digress…

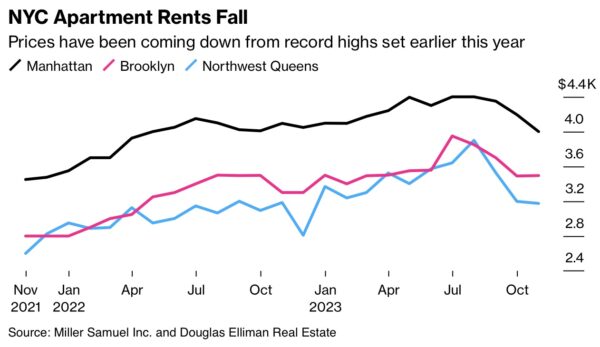

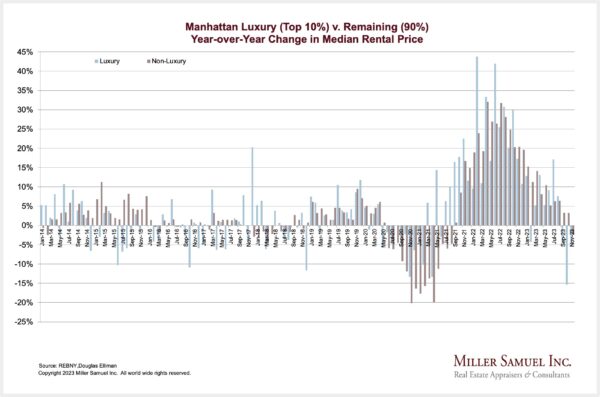

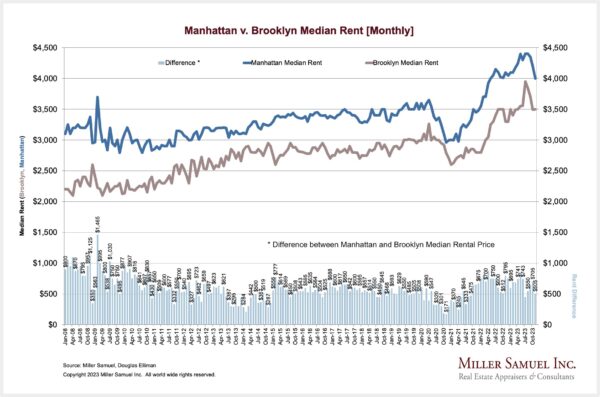

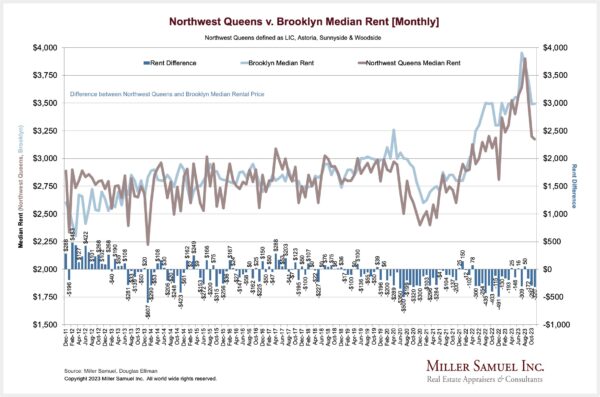

NYC Rents Are Declining From Summer Highs. More Declines Expected

I’ve been the author of the expanding market report series for Douglas Elliman since 1994 and during and after the pandemic era, our rental report garnered the most interest. Its quicker reactions to changes in economic conditions have been driving the significant coverage.

Bloomberg provided a great summary of the findings.

CNBC provided a thorough summary of our findings on their Squawk Box program in this video.

“The decline has been sudden,” said Keyan Sanai, the top rental broker for Douglas Elliman in New York. “You can feel it.”

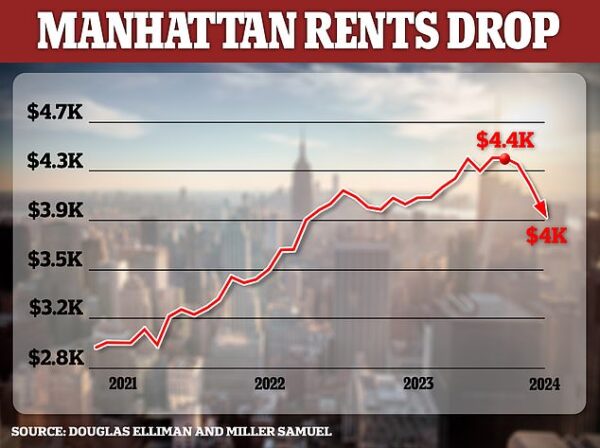

The Daily Mail flexes its chart-making skills…

Elliman Report: November 2023 Manhattan, Brooklyn & Queens Rentals

__________________________________________

MANHATTAN RENTAL MARKET HIGHLIGHTS

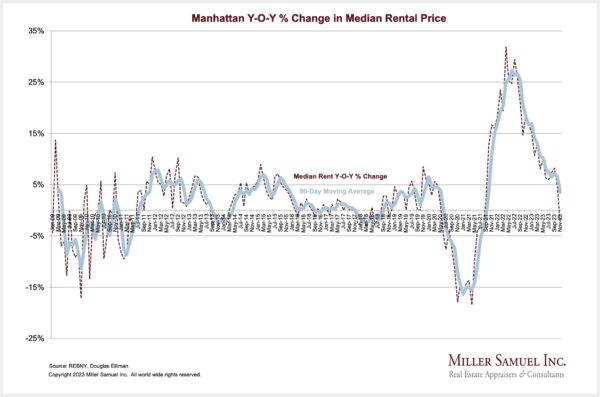

“Median rent continued to trend lower from the August record to the lowest level since May 2022.”

- Median rent slipped month over month for the third consecutive time and annually for the first time in twenty-seven months

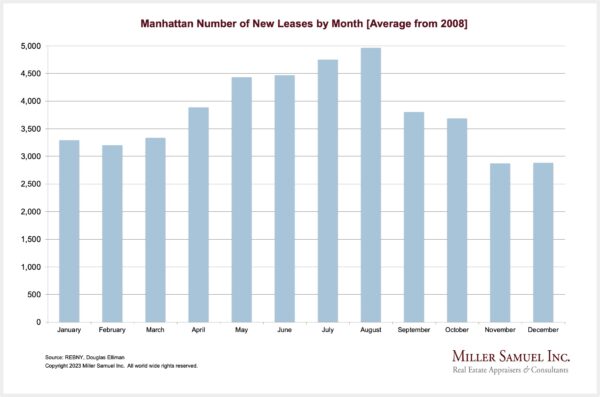

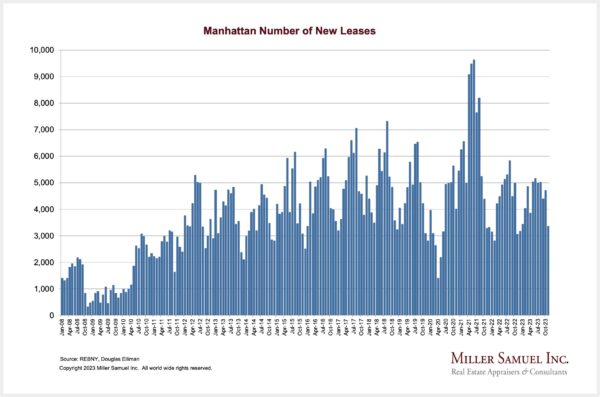

- New leases rose year over year for the first time in five months

- The vacancy rate expanded annually for the fourteenth consecutive month but remained below three percent

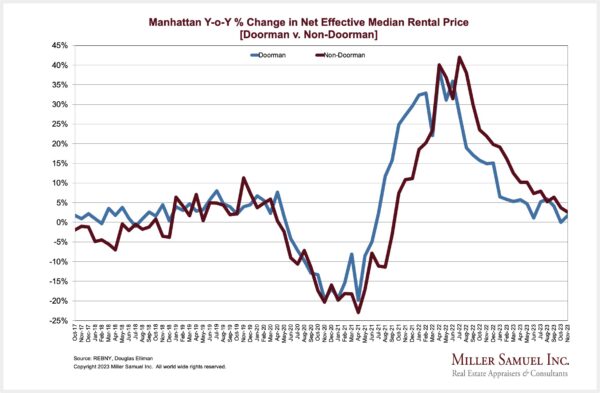

- Doorman new lease signings slipped year over year, while those from non-doorman buildings surged over the same period

- Rental price per square foot for new developments fell year over year for the first time in four months

- Luxury price per square foot year reached a new high and exceeded the $100 threshold for the first time in more than a year

- Luxury listing inventory fell year over year for the third time in four months

__________________________________________

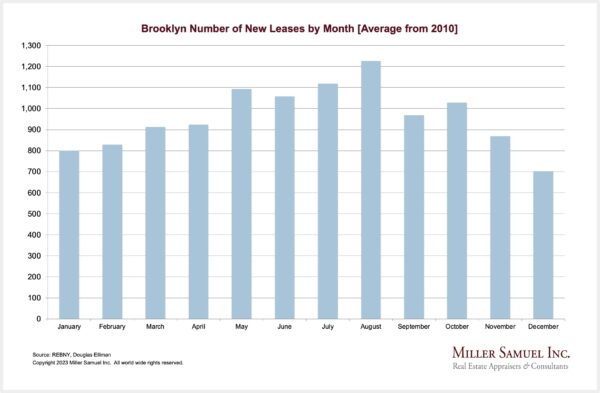

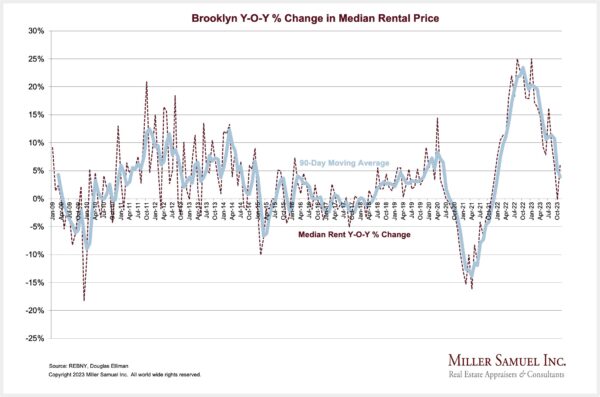

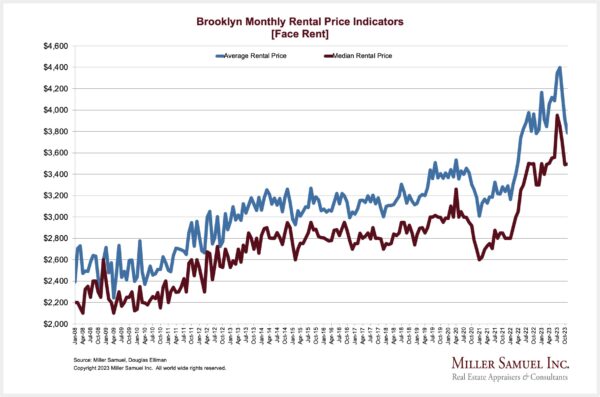

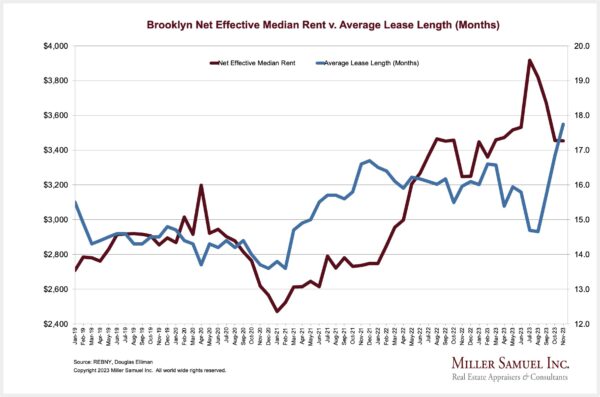

BROOKLYN RENTAL MARKET HIGHLIGHTS

“Median rent has continued to fall short of July’s record price but remains sharply above the pre-pandemic level.”

- Median rent rose year over year for the twenty-third time in two years

- New lease signings surged annually, more than doubling the November average of the decade

- Listing inventory expanded year over year for the third consecutive month

__________________________________________

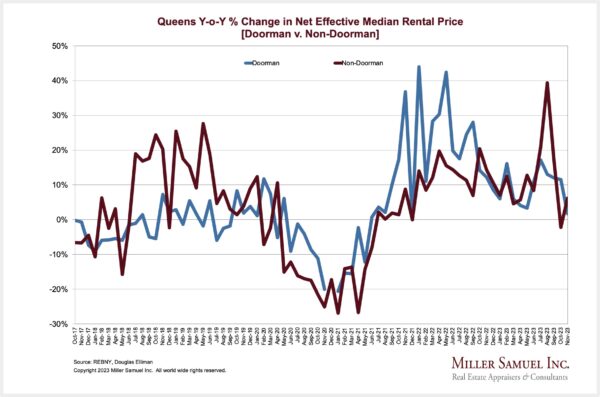

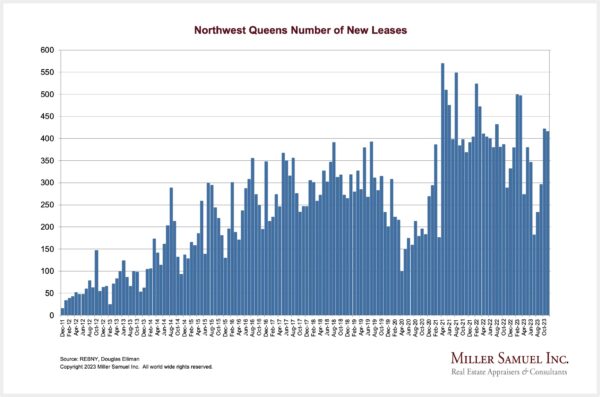

QUEENS RENTAL MARKET HIGHLIGHTS

“Median rent has continued to fall short of the record price reached in August and has been at the lowest level since last December.”

- Median rent slipped year over year for the first time in eleven months

- New lease signings surged annually at the highest rate in twenty months

- Listing inventory expanded year over year for the third consecutive month

The 2021-2023 New York Rental Housing Boom Comes To An End

I had a great conversation with Liam Bailey, Partner, Global Head of Research For Knight Frank. I always appreciate the opportunity to connect with him on matters of U.S. Housing.

https://shows.acast.com/5e74eed37e2a7d7e5e7bc166/657838d838c18400166f92f3

Insta: The Typical “Here’s The Smallest Apartment” Story

Another small apartment story.

The B1M: The Skyscraper That Ended New York’s Billionaires’ Row

I was interviewed for this project by B1M, a construction YouTube channel with 3 million subscribers. This was a joint effort with The Real Deal, the go-to trade magazine for real estate. While my onscreen interview was cut for time, I made it to the credits! They really did an excellent job on this, inspired by Kathy Clarke’s Billionaires’s Row tome and Hiten Samtani’s reporting.

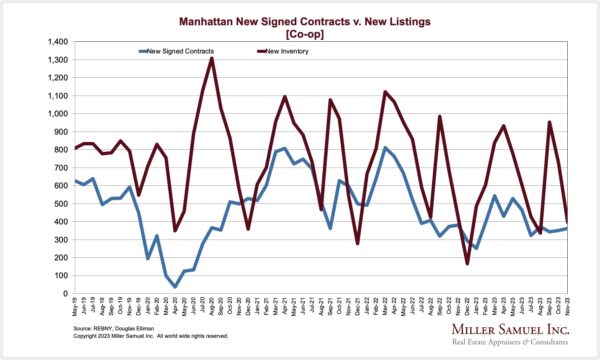

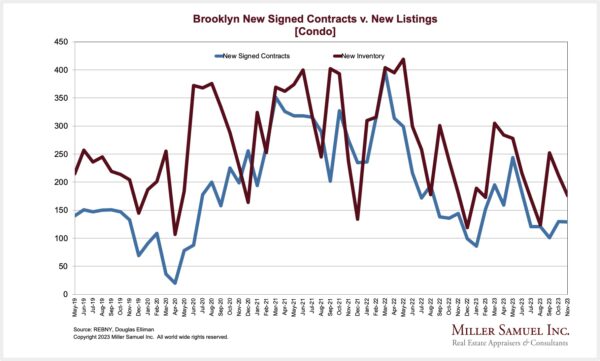

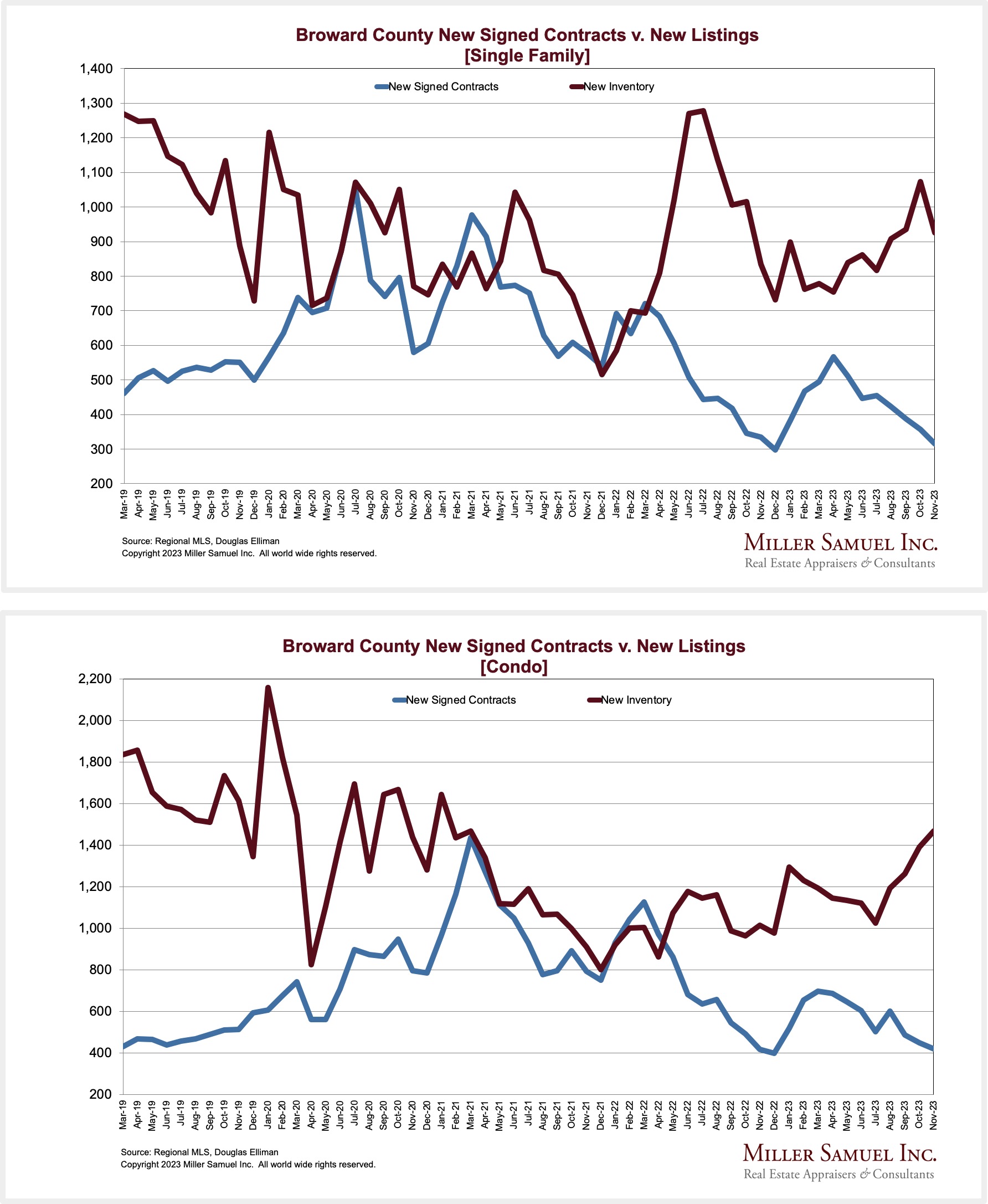

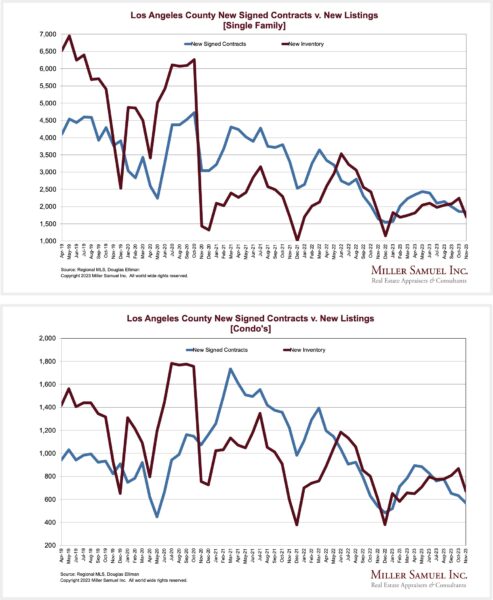

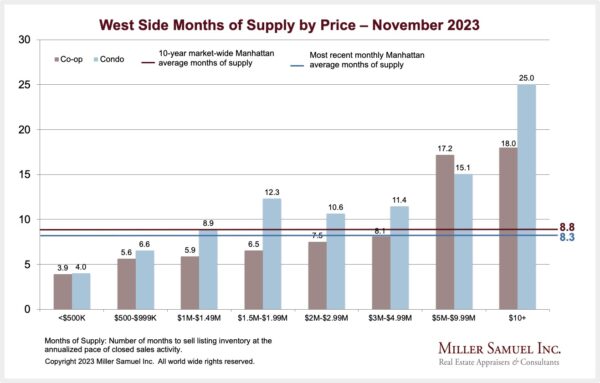

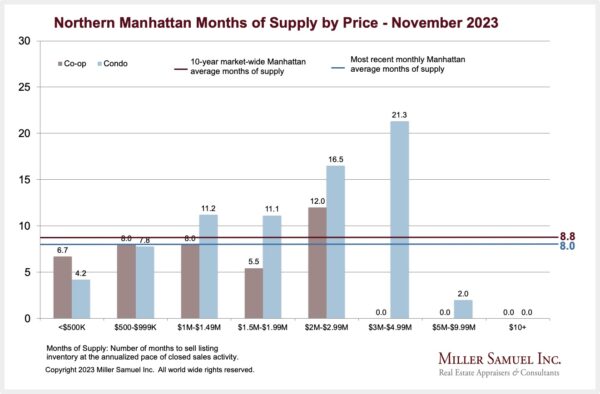

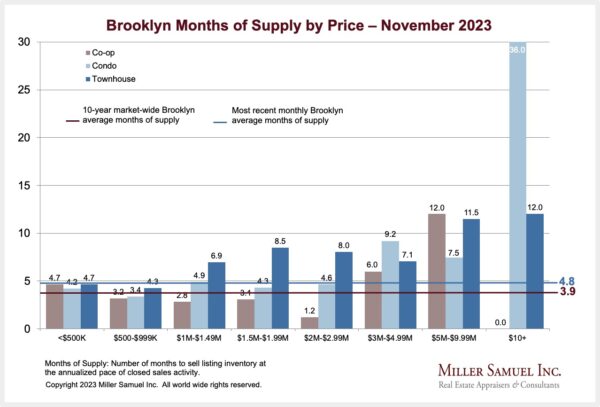

Newly Signed Contracts Across Our Three Regions Remain Lackluster

I began a series of regional contract reports for Douglas Elliman during the pandemic. There are improvements in newly signed contracts in some areas, but new listings entering the market remain anemic.

The reports and sample charts can be found below. For more charts, please go to our gallery.

Elliman Report: November 2023 New York New Signed Contracts

Elliman Report: November 2023 Florida New Signed Contracts

Elliman Report: November 2023 California New Signed Contracts

Highest & Best Newsletter: Nude Awakening

I continue to love this new Florida newsletter, Highest & Best, from Oshrat Carmiel, formerly of Bloomberg News…

Nude Awakening

Real estate pics bare all; Florida needs inventors; Miami traders

This is a very wild story – I might have named this piece “Naked & Afraid That Someone Will Walk In On Me!”

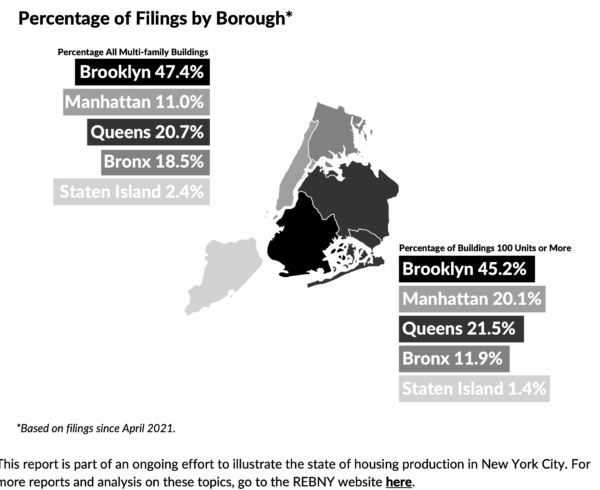

Brick Underground’s Breaking News: The GSEs Are Disclosing Their Building Blacklists

One of the more frustrating aspects of the housing market in NYC has been the lack of transparency about whether a building will be acceptable to Fannie Mae and Freddie Mac. Brick Underground just broke a story about why transparency in the housing market will improve. Until now, when an offer is made on an apartment in a NYC building, the board or condo association had no idea whether they would qualify for financing. The fact that a building would not qualify was not shared until after the fact.

I believe NYC has 64 buildings that are currently out of compliance. This transparency does apply to the U.S. housing market, not just NYC.

The twin moves will bring greater transparency to buyers and sellers and boards, who have been largely in the dark about buildings that are designated unavailable for lending. Under the current system, this status is conveyed only to lenders, and it occurs when a building doesn’t meet Fannie Mae’s and Freddie Mac’s rules for financial, structural, and mechanical fitness, guidelines which were toughened after the Surfside condo tower collapse in June 2021.

Before this change, the lender wouldn’t know that the GSEs would reject buying back a conforming mortgage, tying up their capital for future lending. This new transparency is welcomed and the beauty of it is that the GSEs are enabling buildings that don’t qualify to understand what they need to fix.

Urban Digs Talking Manhattan Videocast: Raphael De Niro

Raphael De Niro is one of the top agents in Manhattan, and I have always appreciated his candor and analytical take on the market. After all, he said he read my NYU/Furman white paper! The Condominium v. Cooperative Puzzle: An Empirical Analysis of Housing in New York City. 😉

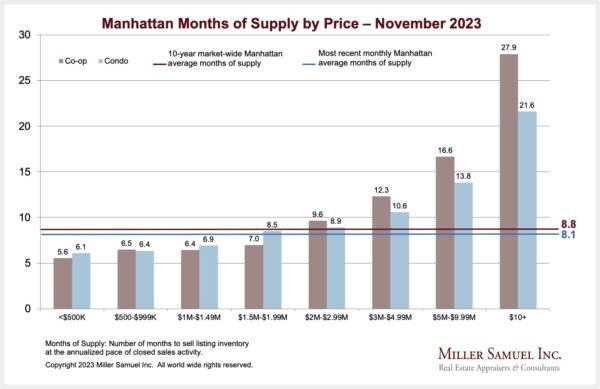

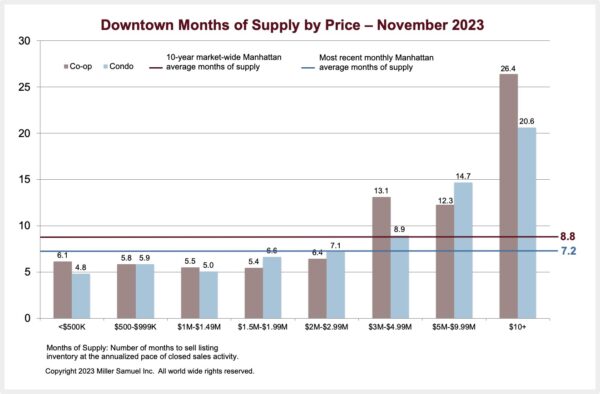

Getting Graphic

Favorite housing market charts of the week of our OWN making

Favorite housing market/economic charts of the week made by OTHERS

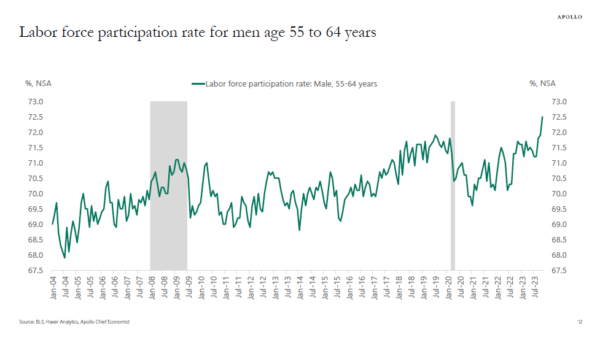

Apollo’s Torsten Slok‘s amazingly clear charts

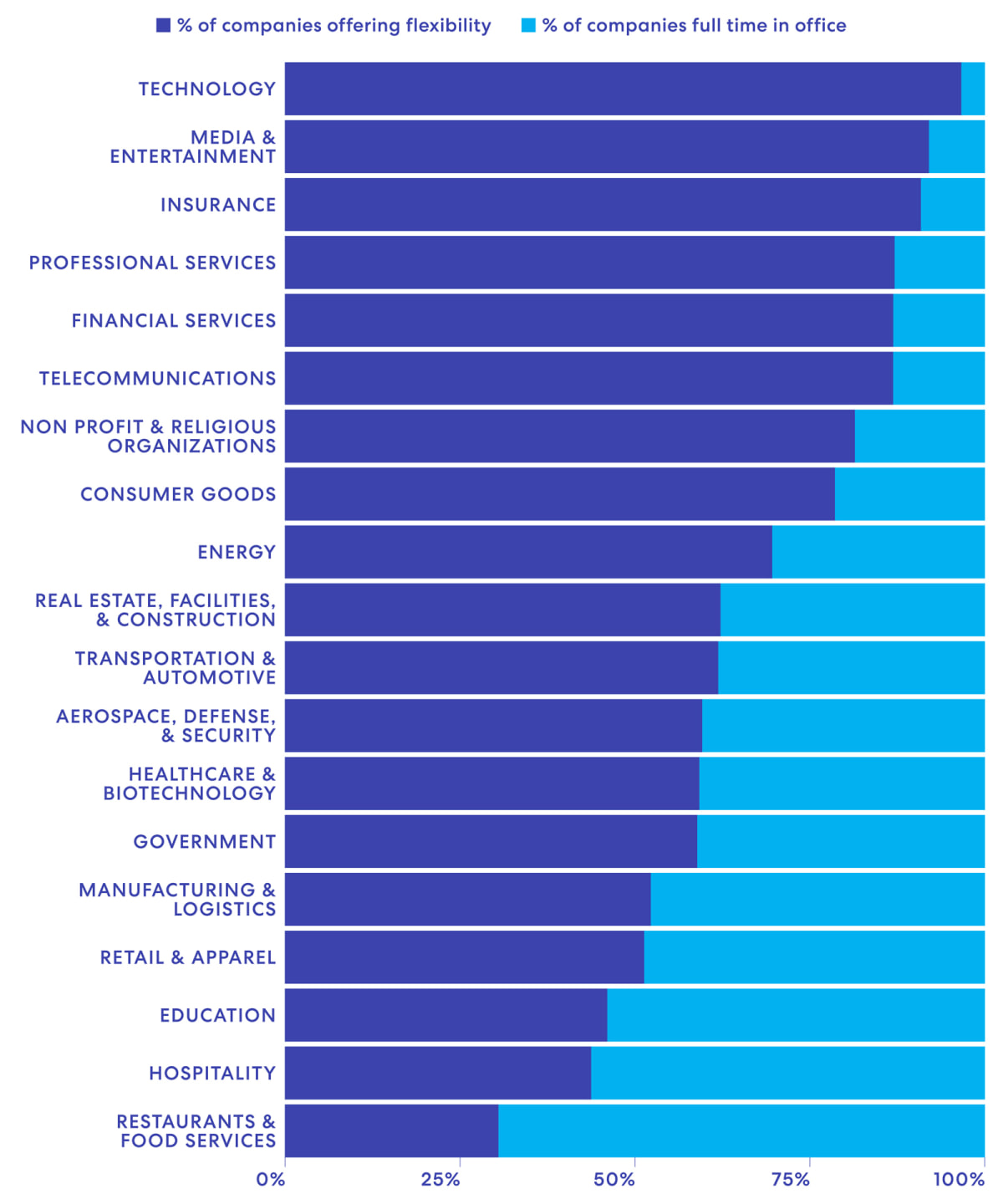

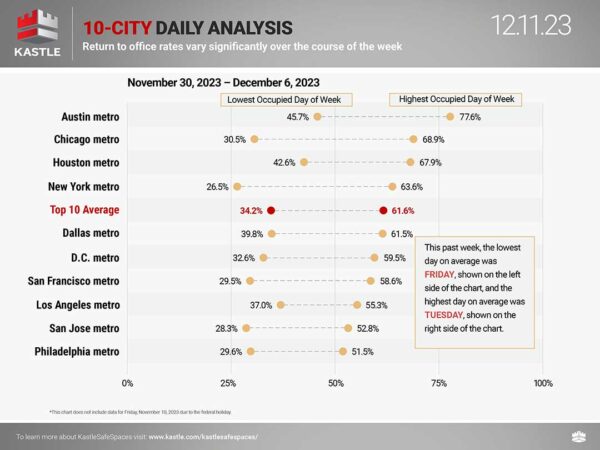

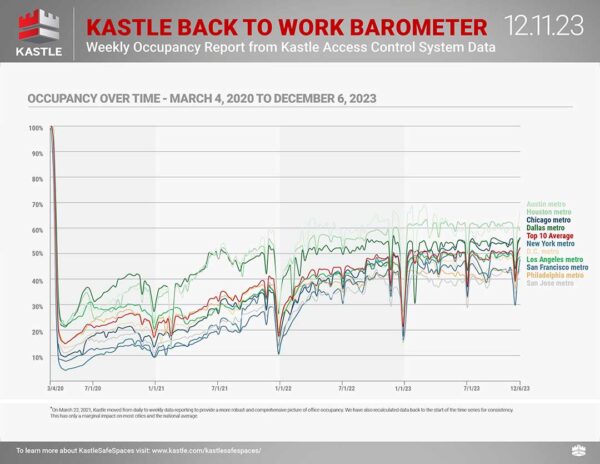

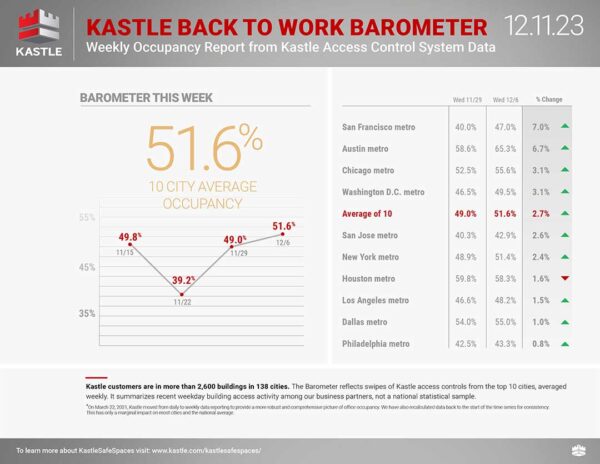

Kastle card swipe data charts

Remember that Kastle charts are overstating occupancy* because their pre-pandemic occupancy benchmark was 100%, which is incorrect (*measures card swipe activity as a proxy for occupancy). Still, they’ve become the standard benchmark for occupancy rates.

Favorite RANDOM charts of the week made by others

Appraiserville

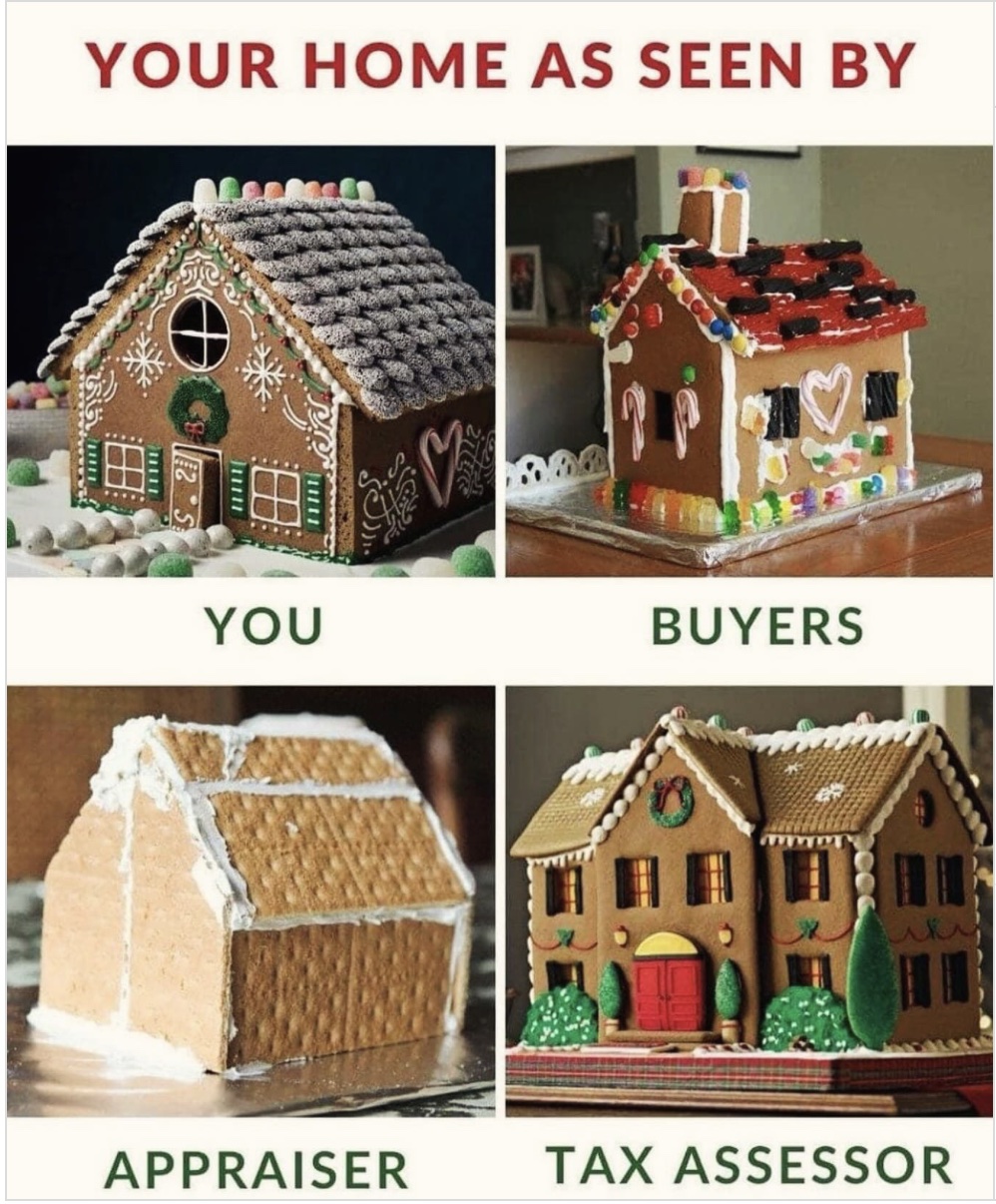

Perception of Home Value [Gingerbread Edition]

Lots of variations of this image have been floating around for years, but this is in keeping with the holiday spirit.

LAI Webinar: I Interview Craig Steinley, President of The Appraisal Institute On The Profession and Bias

This video is my second presentation for LAI (Land Economics Society/Lambda Alpha International) in 2023. They have held several presentations on the topic of Appraisal Bias for their members. I encourage all my Appraiserville readers to listen to my conversation with Craig.

One of the more interesting points was the early success of A.I.’s PAREA program in the numbers that Craig shared. PAREA is not a replacement for the mentoring system that has created an unacceptable lack of diversity in our profession but rather a supplement to entry into the profession promulgated by The Appraisal Foundation. LAI initially asked me to be on the panel with Michelle Bradley, Vice Chairman of TAF’s Appraisal Standard’s Board, but she told LAI she would be too uncomfortable pairing up with me. No surprise there. While she is a very nice person and a successful appraiser, I have been highly critical of her for the conflict of interest with McKissock’s education program. Who can blame her for avoiding me? It’s awkward to be reminded of her conflict of interest; after all, Dave Bunton is the King of the TAF Monarchy and hand-picks all board members and technical board chairs like ASB.

Further evidence of the monarchy setup was recently seen on the other technical board known as the AQB (Appraiser Qualifications Board), proved this as fact last year when then-new AQB Chair John Ryan was removed for “daring” to broach the topic of solving appraisal bias by removing him without public comment and replacing him with another sycophant like Brad Swinney – also a very nice guy but hand picked for being the mouthpiece for Dave Bunton as everyone is.

I thought about all this when I read this piece in the Wall Street Journal EY Is Laying Off U.S. Partners Amid Tough Economic Conditions. The outgoing chairman of the Board of Trustees is an EY partner. I’ve always wondered what EY would think of a partner heading the board of an organization that has promoted a severe lack of diversity in the appraisal industry through its mentoring requirements for over three decades.

For the uninitiated, TAF is the organization that wrote the bat-shit crazy letter, the chickenshit letter, and is the subject of an active investigation by HUD on whether USPAP promotes a lack of diversity in the appraisal profession (400th out of 400 occupations according to BLS in 2021).

Cosmic Cobra Guy Casts A Pox On The GSE’s Pox

*** FOR IMMEDIATE RELEASE ***

FREDDIE, FANNIE’S POX UPON MODESTO’S HOUSES

VENTURA, Calif. (December 15, 2023) – Less than two decades ago, government-sponsored mortgage giants Fannie Mae and Freddie Mac visited a pox upon the houses of Modesto, California. It culminated in the 2007-2008 financial crisis, which took a disproportionately heavy toll on the city, population 218,000. The twins are at it again, in Modesto and other exploitable communities. This time harnessing fashionable DEI groupthink on behalf of their allies to distort local markets. This time around, the city attorney needs to be proactive.

In 2008, Time magazine published a piece about Modesto, in the state’s agricultural Northern San Joaquin Valley. The city, with one of the highest foreclosure rates in the nation, was portrayed as a cautionary tale. Abandoned homes tainted neighborhoods citywide. Overgrown vegetation created protective cover for vandals and squatters. The stench of human waste wafted through neighborhoods. Once well-kept homes became graffiti-covered shells, gutted by fire.

In places like Modesto, Freddie and Fannie created an enormous market for toxic “Alt-A” subprime mortgages, negative-amortizing mortgages, stated-income loans – so-called “liar loans” – and other predatory lending products. As the trend lines went vertical, lenders, brokers and home builders packed warm bodies into homes, squeezing out lucrative front-end fees. They then sold the notes into a secondary market that clamored for them. In fairness, it wasn’t just Freddie and Fannie at fault – private-label investment banks like Lehman, Bear Stearns and Goldman Sachs did much damage as well.

So, alarms predictably sounded when Modesto cameoed on the August 2023 top 10 U.S. cities for foreclosure filings, according to the National Association of Realtors. Modesto joined perennial bedfellows like Atlantic City, New Jersey; Florence, South Carolina; New Haven Connecticut; Baltimore; Mobile, Alabama; Orlando, Florida; Macon, Georgia; Philadelphia; and Peoria, Illinois.

The 2007-2008 destruction cost many Modestans their homes and billions in lost property values. It battered fiscal coffers and eroded county tax rolls. Modestans also helped pay at the federal level to bail out the twins for a combined $200 billion – the highest bailouts of the crisis. The twins have been in federal conservatorship since.

Now, Freddie and Fannie, with their allies in Congress and the Biden administration, along with the powerful lobbies of the Realtors, home builders, lenders and fintechs, are up to their old tricks in Modesto. They’re readying for another dine-and-dash.

The twins, with the blessing of their patrons, whose aim is to privatize profits and socialize risks, have been working a new soft spot – appraisals. Glomming onto trendy DEI orthodoxies and a false narrative of systemic bias based on now-discredited research, the mortgage giants are censoring the observations of local appraisers, discouraging them from physically viewing the properties they appraise and waiving appraisal requirements altogether. It is skewing values upward, creating a derivative effect, allowing sellers to overcharge and forcing buyers to overpay. It’s impeding price discovery. One appraiser calls the effect “data cancer.” It has again put buyers in Modesto into homes they can’t afford. Some go underwater immediately.

In 2008, the Modesto Police Department was getting six to 10 calls a day on vacant homes. A city health unit was formed to deal with the blight. Burglaries surged by 26%; police attributed the increase to the persistent assault on vacant homes. Scavengers stole from foreclosed and non-foreclosed homes alike. Squatters treated the yards as makeshift dumps, and about 40% of foreclosed homes had their power stolen, reported the Modesto Irrigation District.

Freddie and Fannie are again promoting predatory lending using the following three gimmicks that attack the appraisal:

Hybrid appraisals – This involves the use of unlicensed individuals to perform appraisal inspections. A state-licensed appraiser is then expected to rely on the photos, sketches and observations provided by these individuals to complete the appraisal. (You’ll just have to trust them.) The appraiser is kept from ever viewing any deferred maintenance, noting any smells (such as those that could indicate mold), viewing signs of unpermitted additions or contamination, or noticing any nearby environmental or economic influences.

Value Acceptance – This is a new twist on the stated-income loan – known colloquially as the “liar loan” – made famous during the run-up to the last financial crisis. Fannie uses the euphemism “Value Acceptance” to accept lender-submitted values. This means parties whose bonuses and commissions ride on making a given value are permitted to submit values without an appraisal. Let’s just say, “the values fell off the back of a truck.”

Censorship – This is by far the most disturbing activity the twins are engaged in. Freddie, in particular, is actively censoring appraisers for the use of words like “crime,” “graffiti,” “student,” “preferred,” “school district,” “well-kept,” “desirable,” “undesirable,” “good” and “bad.” Also being censored are words any economist, financial analyst or market observer would use like “high,” “low,” “strong,” “weak,” “slow,” and “rapid.” Many puzzlingly innocuous phrases like “convenient to” are also being censored. The new policy is contained in Freddie’s Soviet-like directive “5603.4 Unacceptable Appraisal Practices.” It went into effect November 1, 2023. The true crackdown is slated to start at the end of January 2024. Its aim is to silence appraisers and cow them into sidestepping critical adjustments and rubber-stamping values that make deals work.

The Modesto City Attorney has a unique opportunity, particularly with the censorship, to sue individuals at Freddie and Fannie along with federal officials at the Federal Housing Finance Agency, the twins’ conservator and regulator, for limiting the First Amendment rights of local independent appraisers engaged by lenders uniquely for their independence and knowledge of local markets.

Without action, to quote malapropism king Yogi Berra, it will seem like deja vu all over again.

# #

Jeremy Bagott is a real estate appraiser and former newspaperman. His most recent book, “The Ichthyologist’s Guide to the Subprime Meltdown,” is a concise almanac that distills the cataclysmic financial crisis of 2007-2008 to its essence. This pithy guide to the upheaval includes essays, chronologies, roundups and key lists, weaving together the stories of the politics-infused Freddie and Fannie; the doomed Wall Street investment banks Lehman and Bear Stearns; the dereliction of duty by the Big Three credit-rating services; the mayhem caused by the shadowy nonbank lenders; and the massive government bailouts. It provides a rapid-fire succession of “ah-hah” moments as it lays out the meltdown, convulsion by convulsion.

# #

If you’d like to be on this mailing list but at a different email address, please go to the sign-up page here.

-END-

OFTHE (One Final Thought Holiday Edition)

As we are in the thick of the holiday season, I recently learned that Black Sabbath’s song “War Pigs” matches up perfectly with “Deck the Halls.” That information, my friends, is what the interwebs are really for.

And one more essential video.

Brilliant Idea #1

If you need something rock solid in your life – particularly on Friday afternoons at 2:00 PM, Eastern Time (ET) – and someone forwarded this to you, you can sign up here for these weekly Housing Notes. And be sure to share with a friend or colleague if you enjoy them because:

- They’ll buy an old refrigerator;

- You’ll dance with penguins;

- And I’ll pull out some Black Sabbath records for the holiday party.

Brilliant Idea #2

You’re clearly full of insights and ideas as a reader of Housing Notes. Consider sharing them with me early and often. I appreciate every email I receive, as it helps me craft future Housing Notes.

See you next week!

Jonathan J. Miller, CRE®, Member of RAC

President/CEO

Miller Samuel Inc.

Real Estate Appraisers & Consultants

Matrix Blog

@jonathanmiller

Reads, Listens and Visuals I Enjoyed

- Nude Awakening [Highest and Best]

- Housing inflation is on its way down [Axios]

- New Legislation Proposes to Take Wall Street Out of the Housing Market [NY Times]

- Single Women Are More Rent Burdened Than Single Men [NY Times]

- December 2023 Fed Dot Plot Projects 2.5-Point Rate Cut by 2026 [Bondsavvy]

- Fed 'dot plot' shows central bank will cut interest rates by 0.75% in 2024 [Yahoo Finance]

- Luxury Upper West Side Apartment Building Slips Into Default [Bisnow]

- RTO in 2024: Fast Company’s 8-point guide for designing an office your workers actually want to return to [Fast Company]

- Federal Reserve Meeting: Fed Holds Rates Steady [NY Times]

- The semi-secret building blacklist will no longer be hidden from co-op and condo boards [Brick Underground]

- A record share of Americans are still unhappy with the housing market [Yahoo Finance]

- Redfin: High Debt, Low Cash, and Unprofitable [Mike DelPrete – Real Estate Tech Strategist]

- Renters Are Starting to Get Concessions From Landlords Again [Wall Street Journal]

- New Data Shows Where New York’s Rent-Stabilized Apartments Might Be Disappearing [The City]

- Yes, building more housing does lower rents, study says [CommonWealth Beacon]

- Citadel’s Ken Griffin Taps St. Patrick’s Air Rights to Boost NYC Office Tower [Bloomberg]

- Americans haven't been this happy at work since the 1980s [Axios]

- Kennedy Wilson Sells Glendale Office at 60% Haircut [The Real Deal]

- This photographer was hired to take pics for luxury real estate listings [Axios]

- A time-warp 1960s dome home is for sale in Vermont [The Spaces]

- What time does summer '24 start? [Found NYC]

- 🌇 Skyline Gold Rush [Highest & Best]

My New Content, Research and Mentions

- Manhattan Rents Fall For First Time in Two Years [Kiplinger]

- The Skyscraper That Ended New York's Billionaires' Row [B1M]

- New Home Sales Jump Dramatically In Palm Beach County [BocaNewsNow.com]

- Manhattan Apartment Rents Keep Retreating from Summer Peak [GlobeSt]

- Manhattan rents post first annual drop in over 2 years [CNN Business]

- December 2023 [The Shirley Hackel Team]

- Manhattan rent falls annually for first time in over 2 years [CBS New York]

- Manhattan’s Year-Over-Year Median Rent Drops for First Time in 27 Months [CoStar]

- Manhattan rents post first annual drop in over 2 years [Yahoo Finance]

- Manhattan rents post first annual drop in over 2 years [KAKE]

- Manhattan median rent 'is falling faster than anticipated' [Brick Underground]

- Manhattan rent prices fall year-over-year for first time since 2021 — but median prices still top $5K [NY Post]

- Manhattan Apartment Rents Record First Year-Over-Year Decline Since 2021 [ZeroHedge]

- Manhattan rents post first annual drop in over 2 years [News Channel 3-12]

- Manhattan's average rent has fallen for the first time in two years [Business News]

- Manhattan rents DROP for the first time in two years to $4k a month [Daily Mail UK]

- Manhattan apartment rents see 1st year-over-year drop since 2021 [1010 WINS New York]

- Manhattan Rents Drop Annually for First Time in Two Years [The Real Deal]

- Manhattan rents fall to lowest level in almost 2 years [Crain's New York]

- L.A. Condos Have Failed to Fetch Big Prices. Will This $50 Million Penthouse Be Any Different? [Wall Street Journal]

- Manhattan Apartment Rents See First Year-Over-Year Drop Since 2021 [Bloomberg]

- Manhattan median rent falls for the first time in over two years [CNBC]

- How 220 Central Park South Became World's Most Profitable Condo [The Real Deal]

- The great New York rental boom of 2023 [Knight Frank]

- How NYC's Office and Investment Sales Market Struggled in 2023 [Commercial Observer]

- Macy's shares surge after buyout bid, but unlocking its real estate value will take work [Yahoo Finance]

Recently Published Elliman Market Reports

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 11-2023 [Miller Samuel}

- Elliman Report: California New Signed Contracts 11-2023 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 11-2023 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 11-2023 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 10-2023 [Miller Samuel]

- Elliman Report: California New Signed Contracts 10-2023 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 10-2023 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 10-2023 [Miller Samuel]

- Elliman Report: San Diego County Sales 3Q 2023 [Miller Samuel]

- Elliman Report: Orange County Sales 3Q 2023 [Miller Samuel]

Extra Curricular Reads

- The year Twitter died: a special series from The Verge [The Verge]

- What the %!?! Everyone’s Cursing on the Screen [Wall Street Journal]

- Retail Group Retracts Startling Claim About ‘Organized’ Shoplifting [NY Times]

- Musk's Scandinavian woes deepen as Tesla loses Swedish court case, Finnish union joins port blockade [CNBC]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)