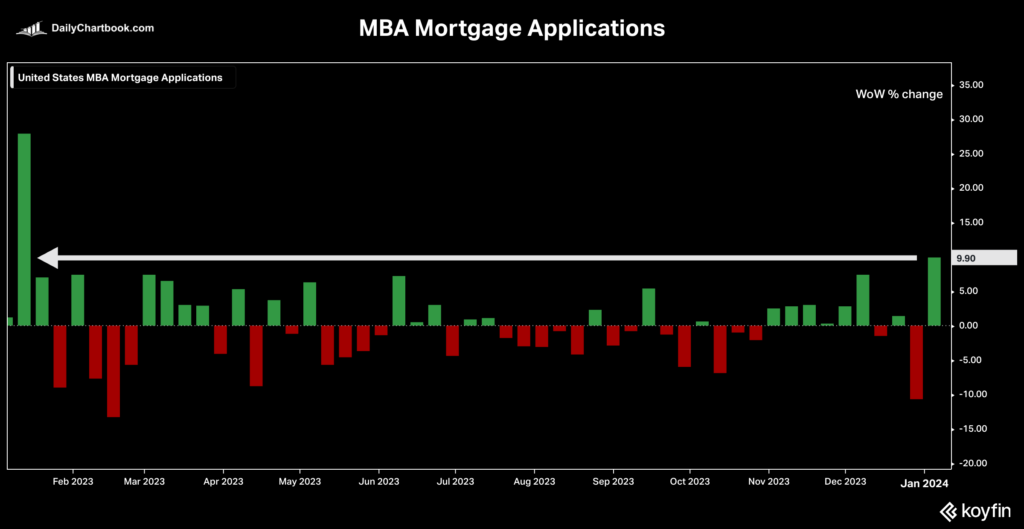

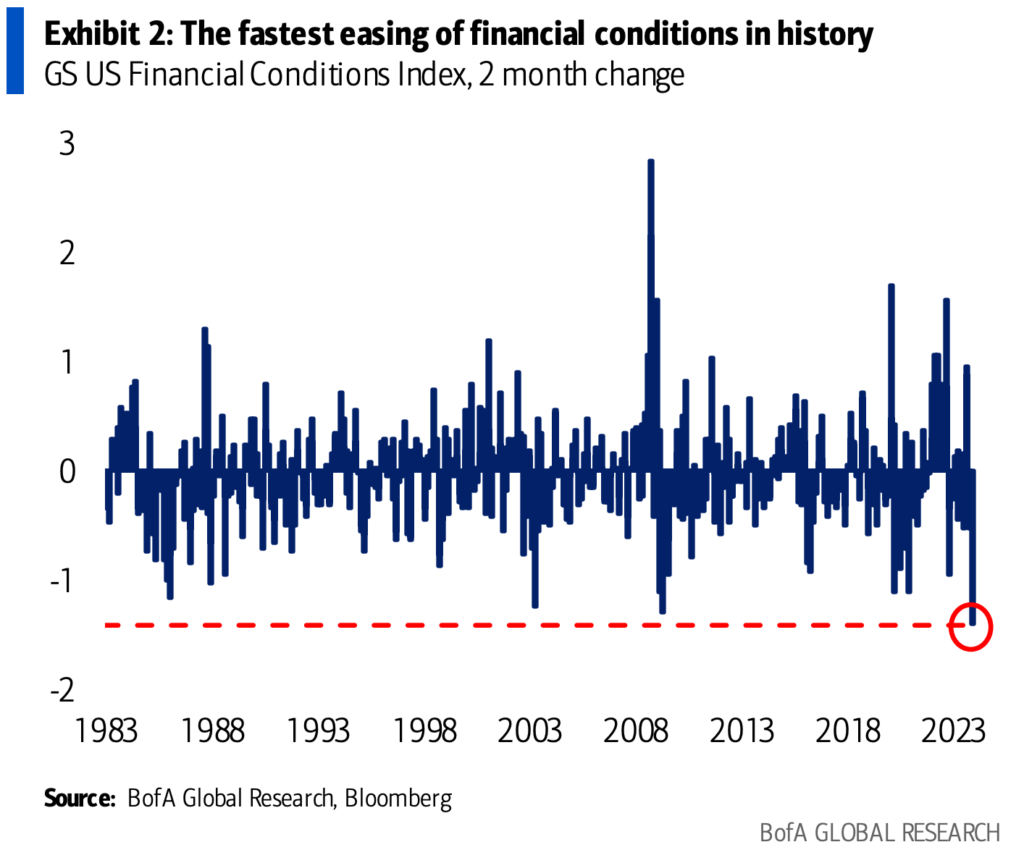

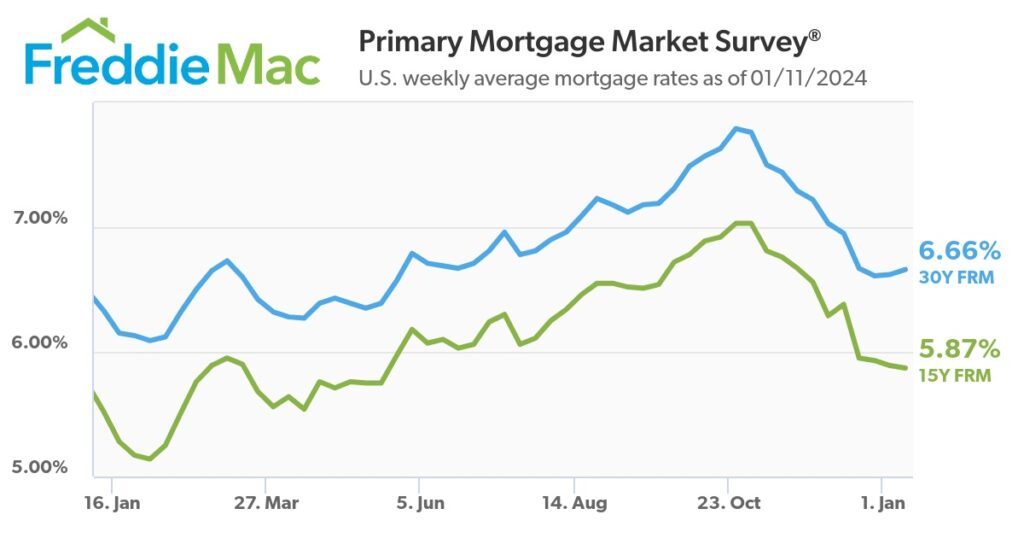

The Fed Pivot that began in December with the statement that there would be 75-basis point cuts in 2024 conveyed a sense of optimism to that economic sector after a rough two years of steep ascent in mortgage rates. Mortgage applications have rebounded, and credit has eased rapidly.

Of course, it’s also hard to believe that the Terminator came out 40 years ago and still holds up for its genre. My wife was nicknamed “Sarah Connor” by her friends at the time. It’s a good metaphor for ending the housing recession if you take Arnold’s side (honestly, it’s probably just my way of giving a shout-out to a movie I saw three times in the theatre and countless times at home without saying, “I can’t believe it’s been 40 years!) “ I’ll Housing’ll be back,” kind of.

——–

Did you miss last Friday’s Housing Notes?

January 5, 2024: Housing 2024: The Year Of LESS Disappointment (The Front Won’t Fall Off)

——–

But I digress…

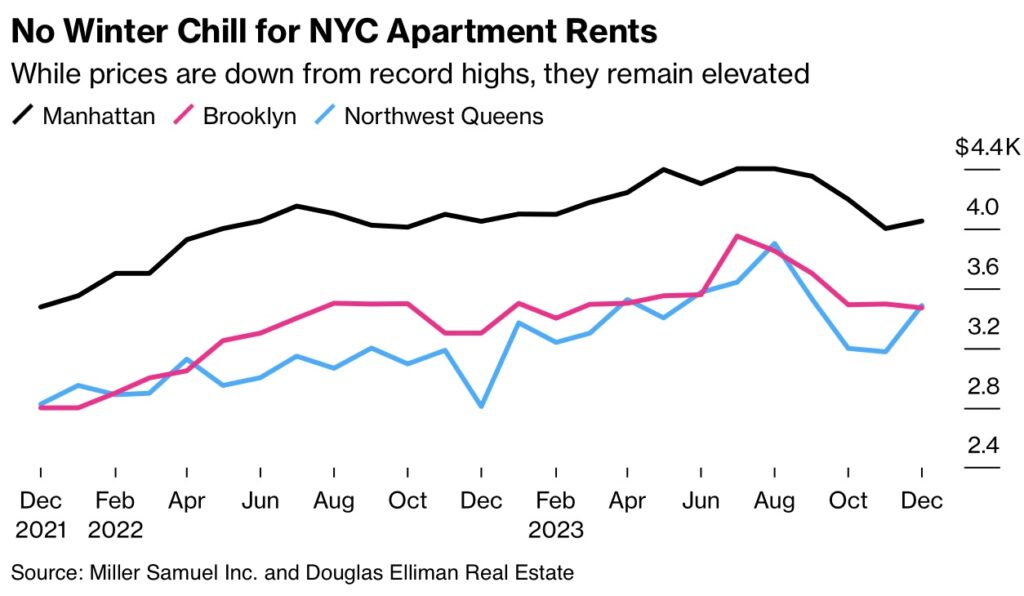

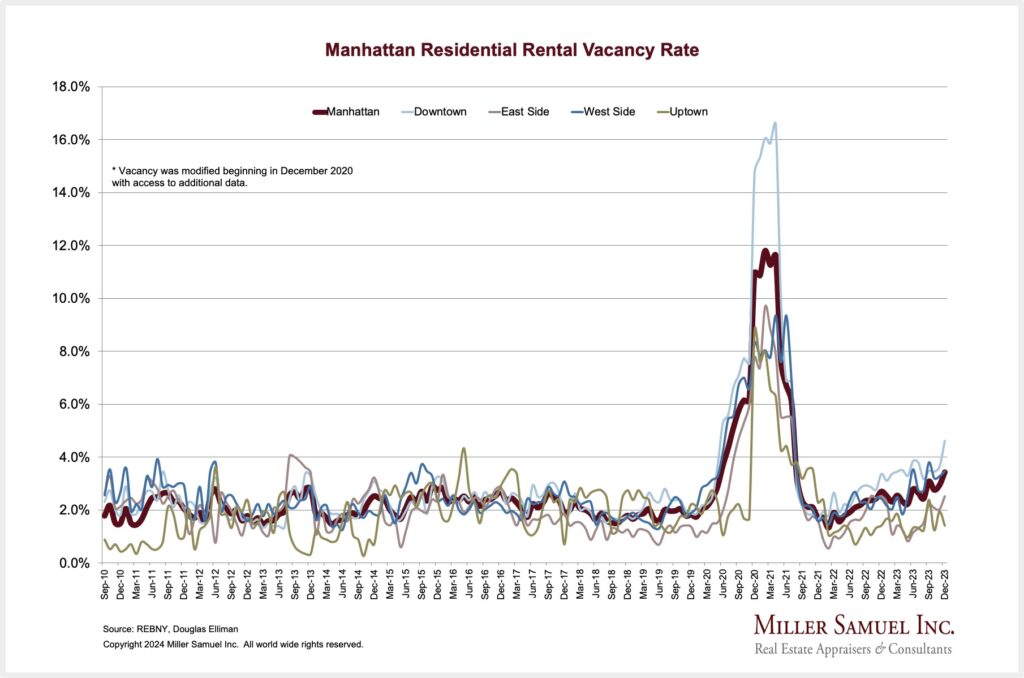

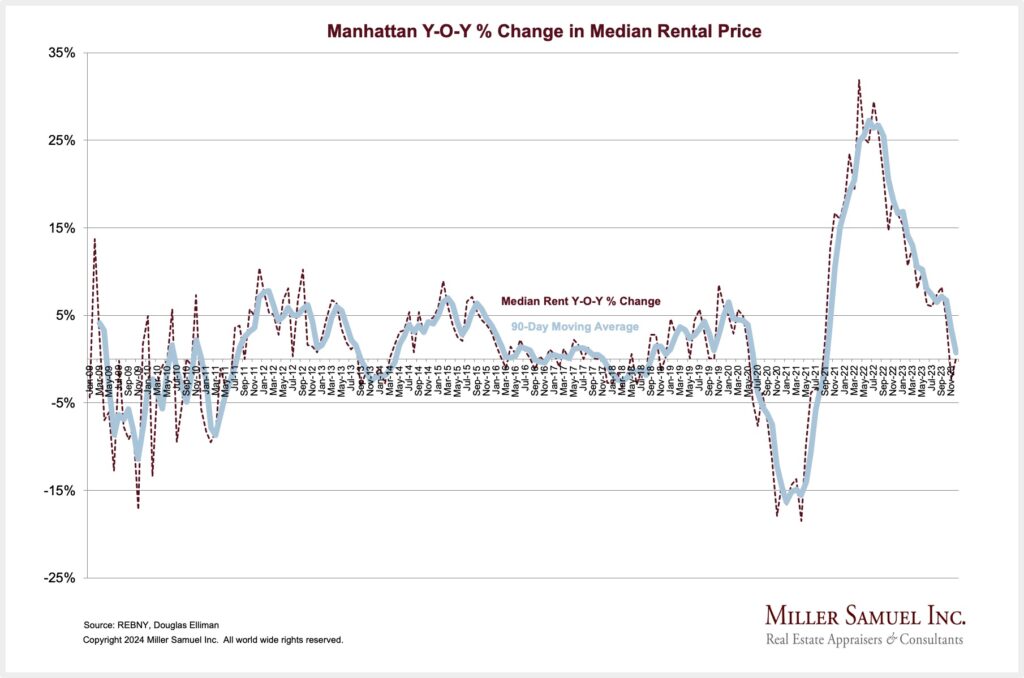

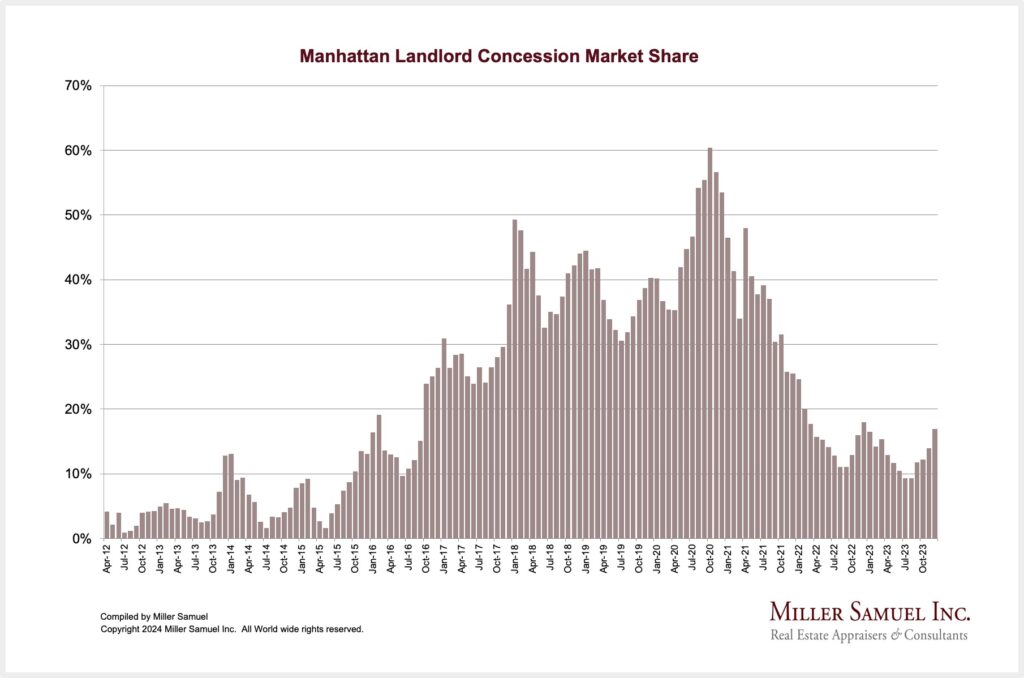

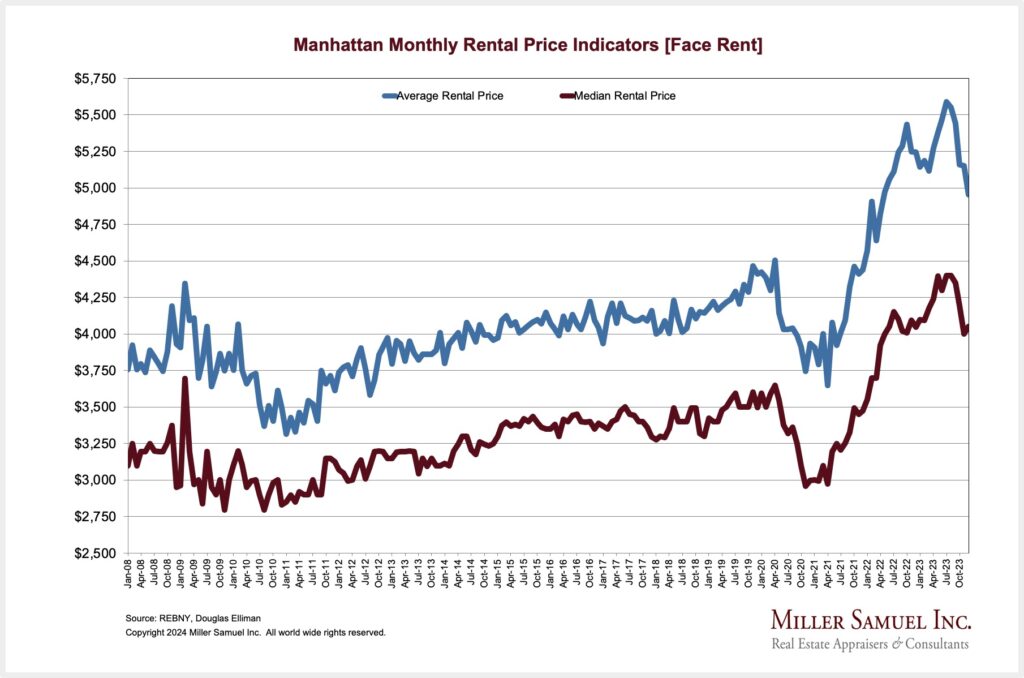

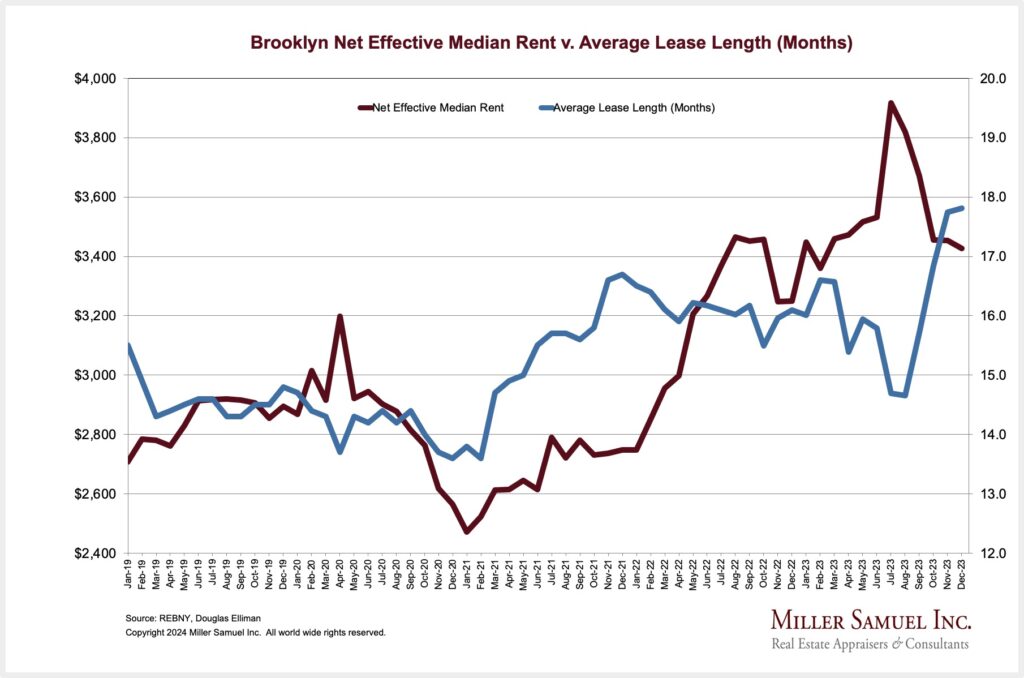

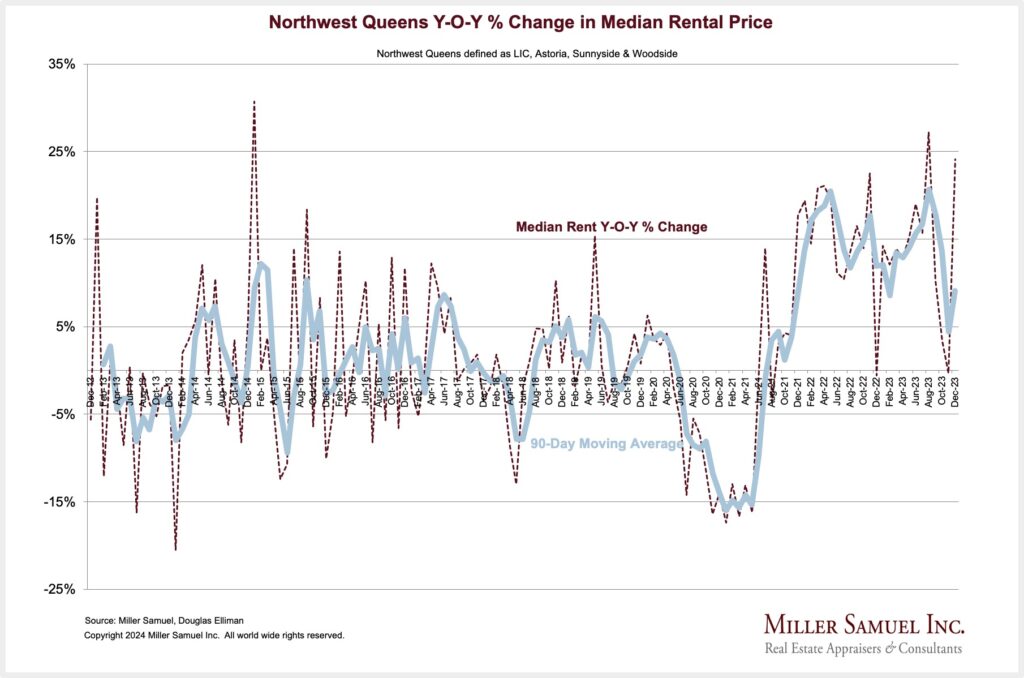

NYC Rents Are Showing Signs Of Stabilizing As Mortgage Rates Fall

I’ve been writing this series of market reports for Douglas Elliman since 1994 (30 years!), and it’s been a fun ride. The rental reports have been quite interesting over the past four years because rents react to changes in economic conditions much faster than sales.

For December, Manhattan rental prices remained flat year over year but were also well below the summer peak.

There was a lot of great coverage on the report. But Bloomberg had a chart!

Elliman Report: December 2023 Manhattan, Brooklyn & Queens Rentals

MANHATTAN RENTAL MARKET HIGHLIGHTS

- “Median rent stabilized as new lease signings rose year over year.”

- – Median rent stabilized year over year but edged nominally higher month over month for the first time since July

- – New leases surged year over year for the second consecutive month

- – The vacancy rate returned above the three percent threshold to its highest level since July 2021

- – Doorman median rent slipped yearly, while non-doorman median rent increased over the same period.

- – Rental price per square foot for new developments surged year over year to return above the $100 threshold

- – Luxury price per square foot year edged higher year over year but was short of the prior month’s record

- – Luxury listing inventory rose annually for the fourth time

- – Luxury entry threshold fell year over year for the third time

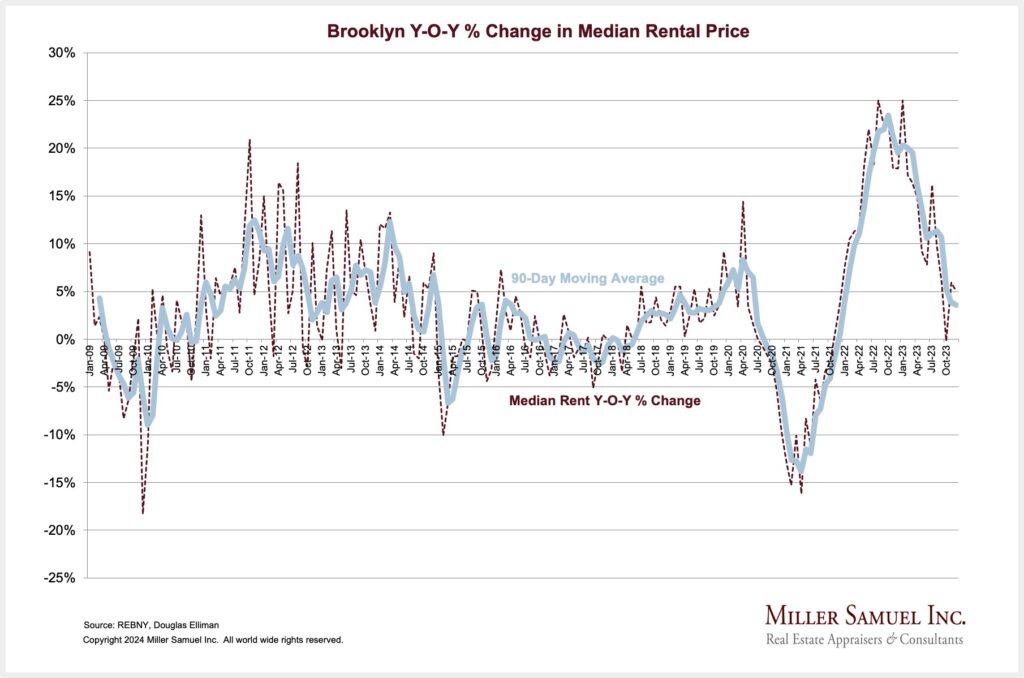

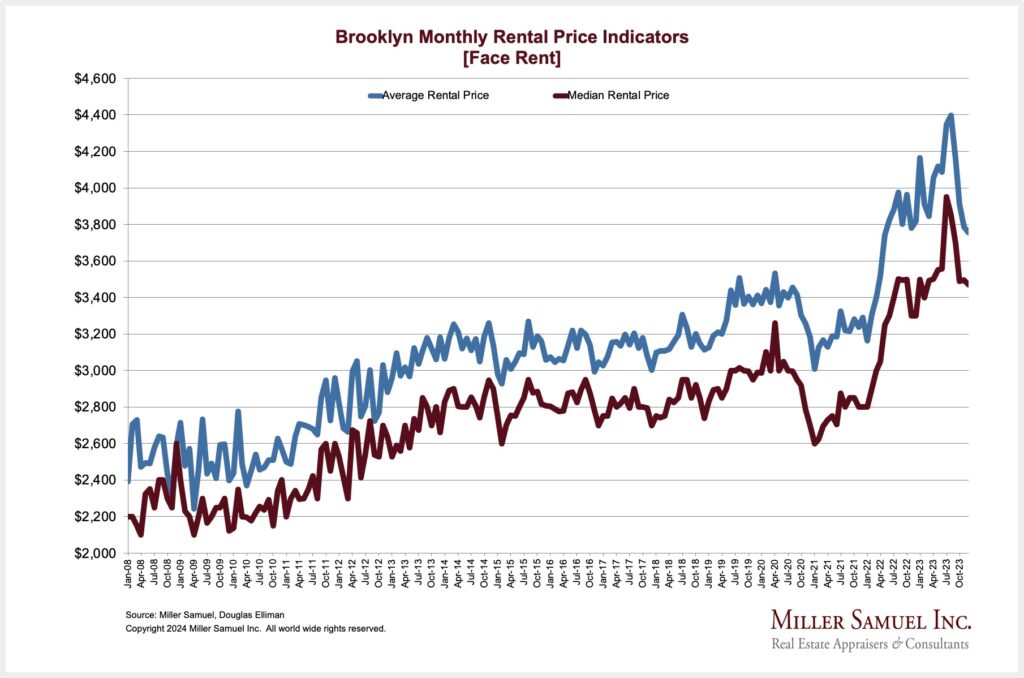

BROOKLYN RENTAL MARKET HIGHLIGHTS

- “Median rent rose as new lease signings more than doubled year over year.”

- – Median rent rose year over year for the twenty-fourth time but slipped for the fourth time in five months from the record set in July

- – New lease signings doubled year over year and remained more than double the decade average for the month

- – Listing inventory expanded annually for the fourth straight month

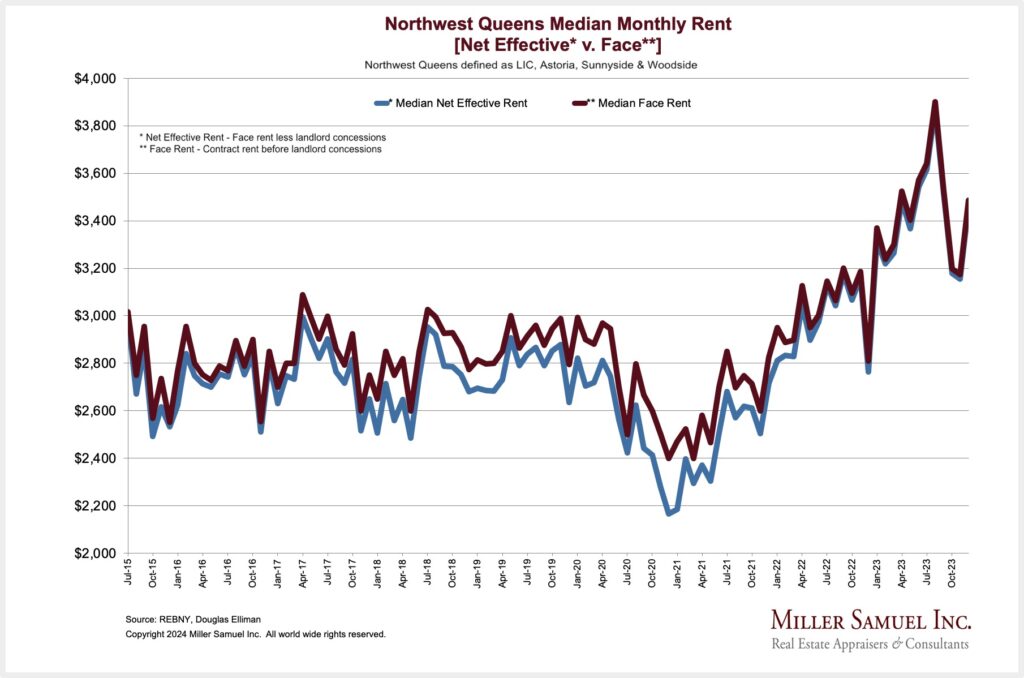

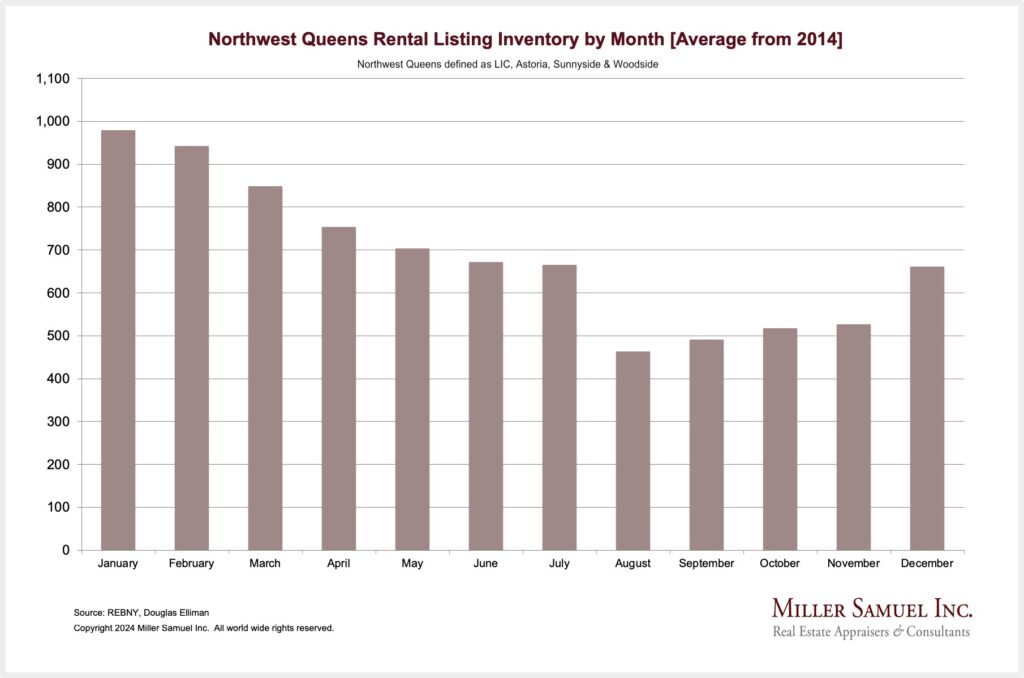

QUEENS RENTAL MARKET HIGHLIGHTS

- [Northwest Region]

- “Median rent and new lease signings surged year over year.”

- – Median rent rebounded year over year after slipping in the prior month for the first time in nearly a year

- – New lease signings surged annually at the highest rate in twenty-one months

- – Listing inventory rose year over year for the fourth straight month

Fortune Mag Features My Respect And Cash In The Market

A friend shared this Fortune magazine piece, and I was pretty amazed at how complimentary they were. I think this is a ten-year-old, 20 more pounds ago, Getty Images, but the superlatives offset the image quite a bit.

Here’s the Fortune Magazine article:

The dean of NYC’s housing market dissects a puzzle: Manhattan’s record-high number of all-cash home sales. He sees good news ahead on mortgage rates [Fortune Magazine]

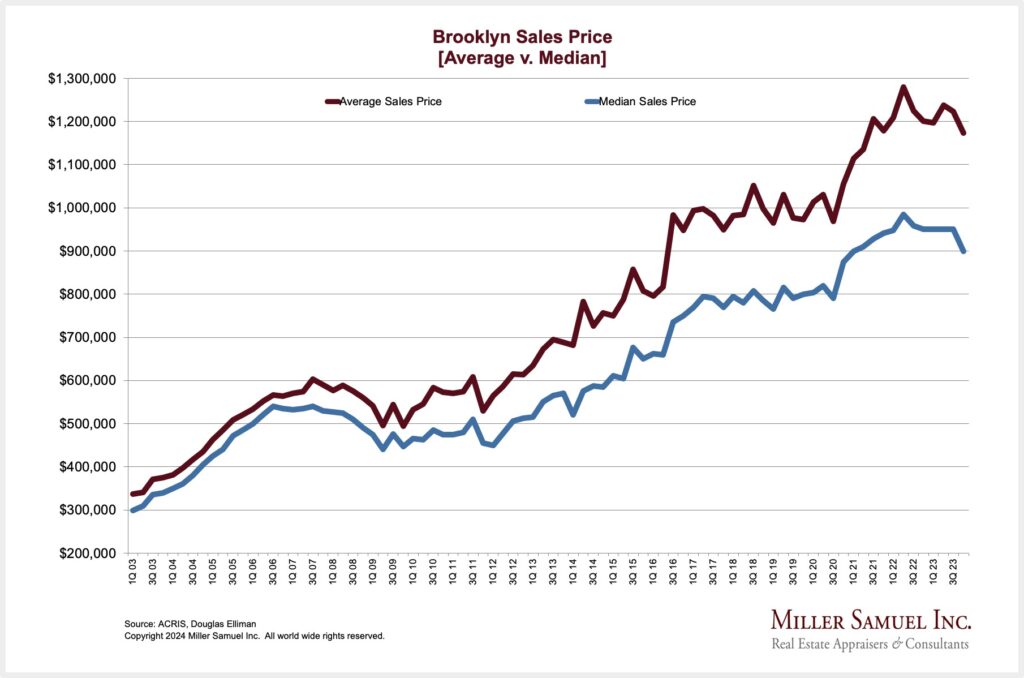

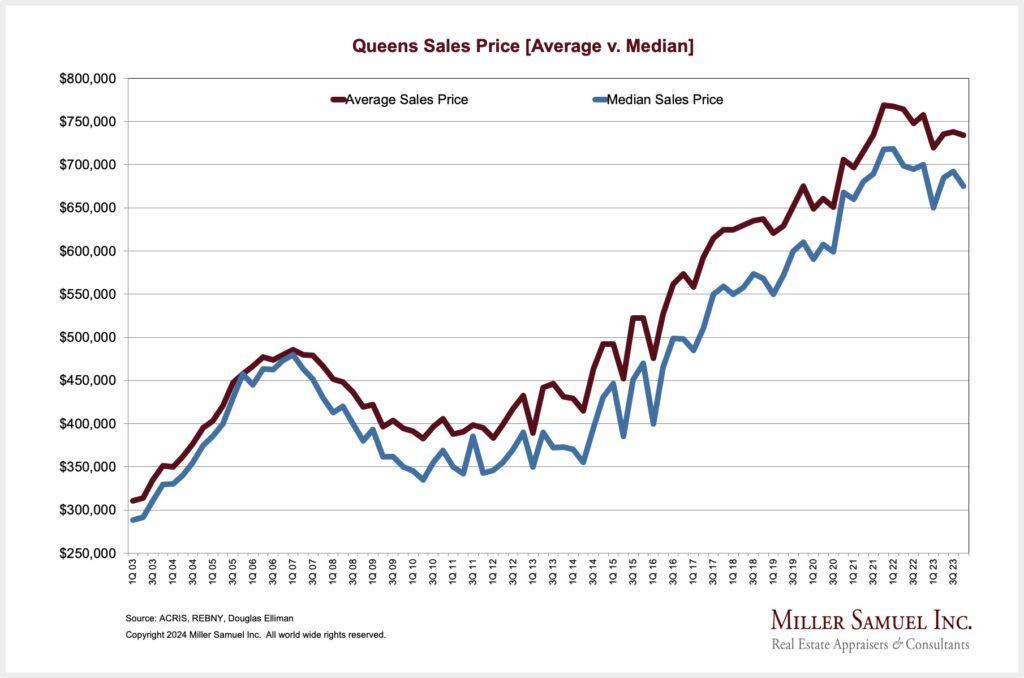

NYC Outer Boroughs See Prices Sliding Despite Less Inventory

The Fed Pivot in December happened too late to impact the quarter results of these housing markets:

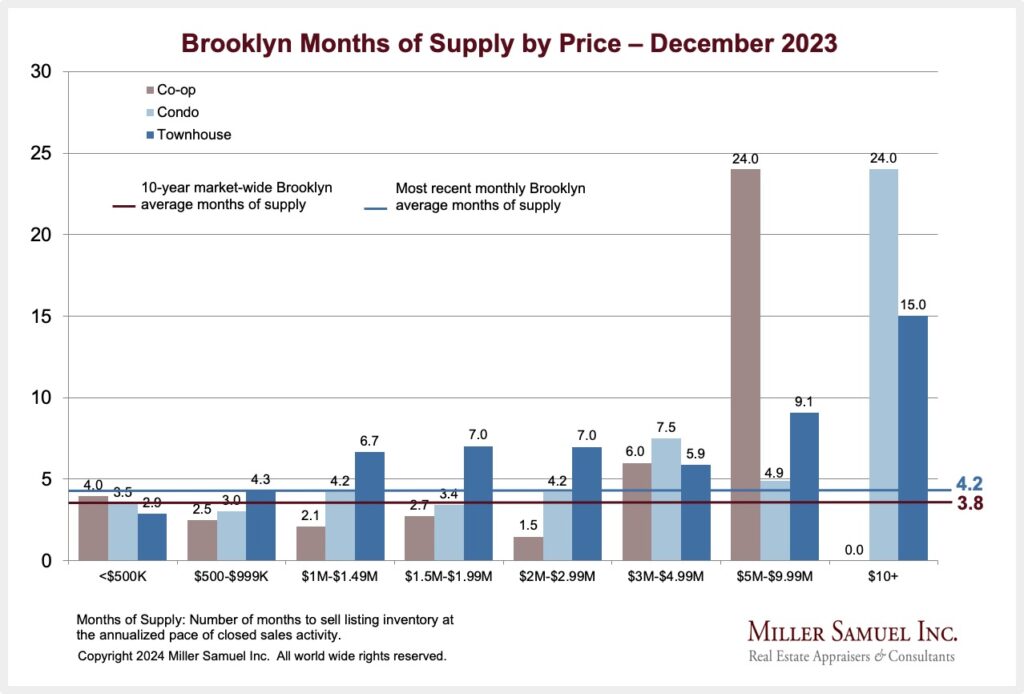

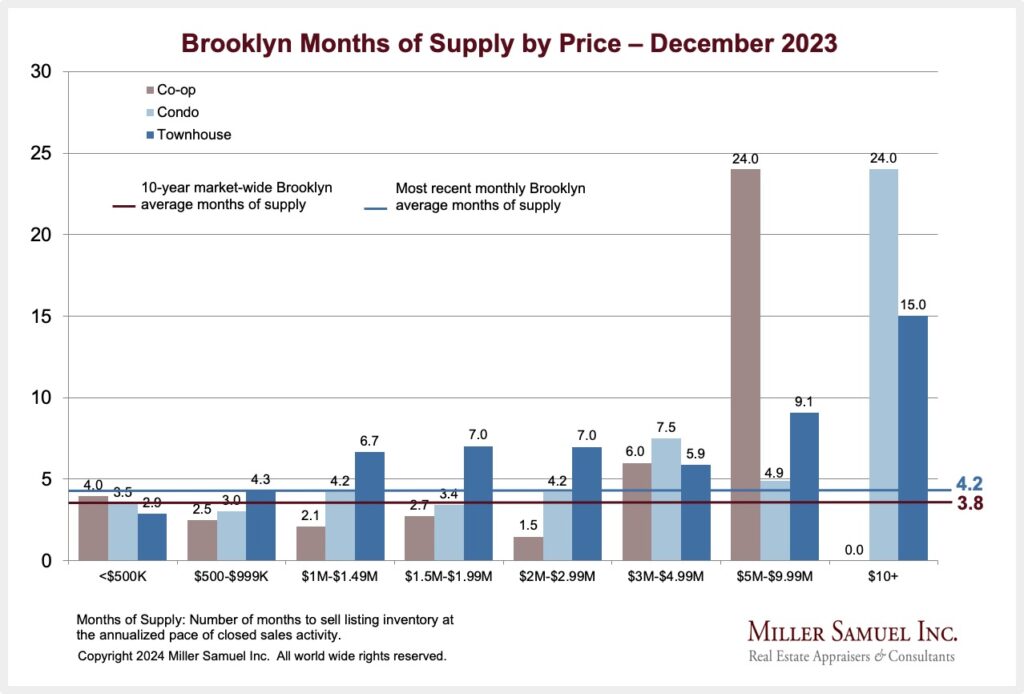

BROOKLYN SALES MARKET HIGHLIGHTS

Elliman Report: Q4-2023 Brooklyn Sales

- “Listing inventory reached a nearly six-year low as bidding wars persisted.”

- – Median sales price slipped annually for the third consecutive quarter

- – Sales declined annually for the sixth consecutive quarter as listing inventory declined for the seventh

- – While the bidding war market share fell year over year, it included nearly one in five sales

QUEENS SALES MARKET HIGHLIGHTS

Elliman Report: Q4-2023 Queens Sales

- “Listing inventory reached a nearly three-year low as bidding wars market share accounted for nearly one in five sales.”

- – Median sales price declined year over year for the fifth straight quarter

- – Sales declined annually for the sixth time as listing inventory declined for the fourth time in five quarters

- – While the bidding war market share fell year over year, it included nearly one in five sales

RIVERDALE SALES MARKET HIGHLIGHTS

Elliman Report: Q4-2023 Riverdale (Bronx) Sales

[includes Fieldston, Hudson Hill, North Riverdale, and Spuyten Duyvil]

- “Despite declining inventory, sales rose annually for the first time in six quarters.”

- – Median sales price fell year over year for the third consecutive quarter

- – The pace of the market remained one of the fastest on record

- – Sales increased year over year for the sixth time

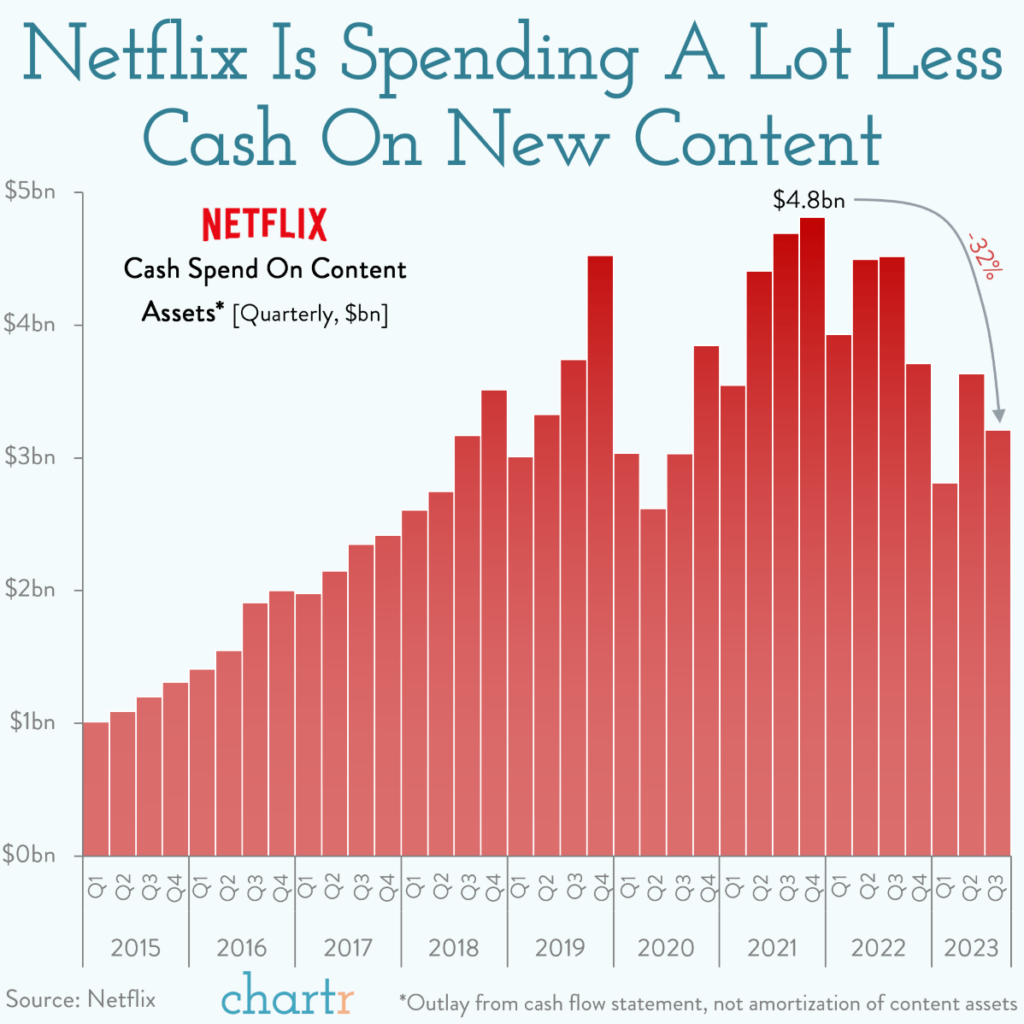

60 Minutes This Sunday – An Existential Crisis For Commercial Real Estate

This Sunday at 7 pm Eastern Time, 60 Minutes looks at the crisis in commercial office space. I’ve discussed the industry’s challenges in past editions of Housing Notes for at least three years.

Here’s a recap of the key issues:

- Work From Home (WFH) is a powerful force that is not going away – it promotes better work/life balance, and it kind of works. Many more people work at home because they save several hours commuting daily. On the other hand, it severely limits training and building a corporate culture.

- Class A (or upper half of Class A) office shouldn’t have a problem, but class B & C will get savaged on price.

- Residential conversions won’t happen at the scale needed, more of an “on the fringe” solution – too costly to convert to residential c of o, the lender needs to agree to change of collateral, it takes longer than new build to create, zoning and community approvals are lengthy and can be difficult, rethinking large office floorplates for light and air (20’x200′ units are not what consumers want).

- In office class B&C, landlords can’t price low enough to meet the market AND still cover their debt service.

- Large swaths of landlords will turn over keys to their lenders over the next 5-7 years, and the new owners won’t be hindered by heavy debt; landlords can meet market prices created by WFH, companies formerly priced out can enter the market, and buildings can be filled again.

- Many landlords aren’t feeling the full pain yet because a portion of their existing tenants signed leases at rates established at higher pre-pandemic levels.

- Higher interest rates make conversions very costly but accelerate the rest of the office market as a real estate asset. Even if interest rates return to pre-pandemic levels, that just slows the reset of the commercial office market repricing because WFH is the critical driver of the change in the relationship between work and home.

Broad strokes

- Most data on this topic comes from commercial leasing agents who work for landlords – never discussing the significant price correction underway.

- Probably not a banking crisis looming – banks specializing in office loans are exposed, but underwriting standards have remained conservative since the financial crisis.

- The question: “All these empty offices and the lack of affordable housing seem like a perfect opportunity to convert,” is the wrong question because the conversion route is wildly complicated, expensive, and slow. It is a solution on the margin not at scale. Conversions will rely on functionally obsolete office buildings as office space. In Manhattan, I have heard that only 3% of buildings are conversion-ready.

- Other thoughts?

Manhattan Price Records By Property Type

Click on the image below to expand.

Boroughs & Burbs Podcast – Debating 2024 (and why Zoom annoys me)

I was all set to do this podcast with John and Roberto, so I logged in 15 minutes early and spent the next 40 minutes trying to log in to Zoom. It wasn’t their fault, as I have 2-3 Zoom calls daily. I gave up and called into the conversation by phone. Fun stuff.

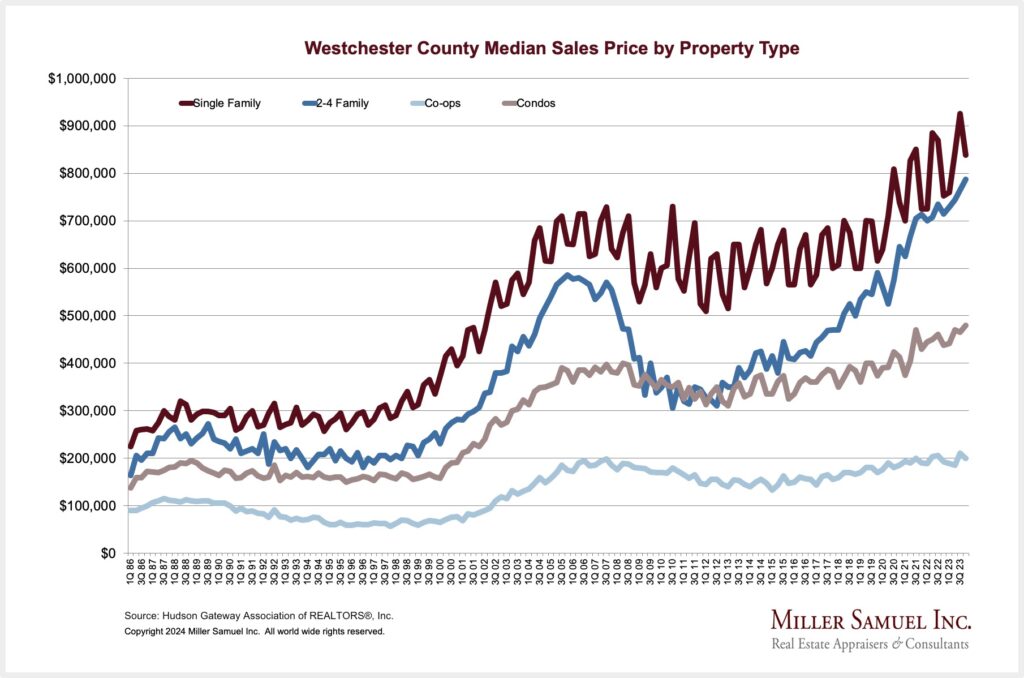

The Hudson Valley Suburbs Are Much Faster Moving Than NYC

The market conditions show rising prices and the lowest inventory in decades. Sales remain constrained by the chronically low inventory and higher mortgage rates.

WESTCHESTER SALES MARKET HIGHLIGHTS

Elliman Report: Q4-2023 Westchester Sales

- “Listing inventory fell to a multi-decade low as all price trend indicators rose.”

- – While all price trend indicators increased year over year, they fell short of the prior quarter’s records

- – For the second consecutive month, listing inventory fell to the lowest level on record, creating the fastest-paced market in history

- – Sales fell annually for the eighth straight quarter as higher mortgage rates and record-low inventory restrained activity

- – More than half of all single family sales in the quarter resulted in a bidding war

- – All condo price trend indicators rose annually as condo median sales price set a new high

- – All co-op price trend indicators rose year over year as average sales price and average price per square foot reached new highs

- – The bidding war share for the luxury market reached a new record of more than half of all sales

- – Luxury listing inventory fell annually for the third time in four quarters to a record-low

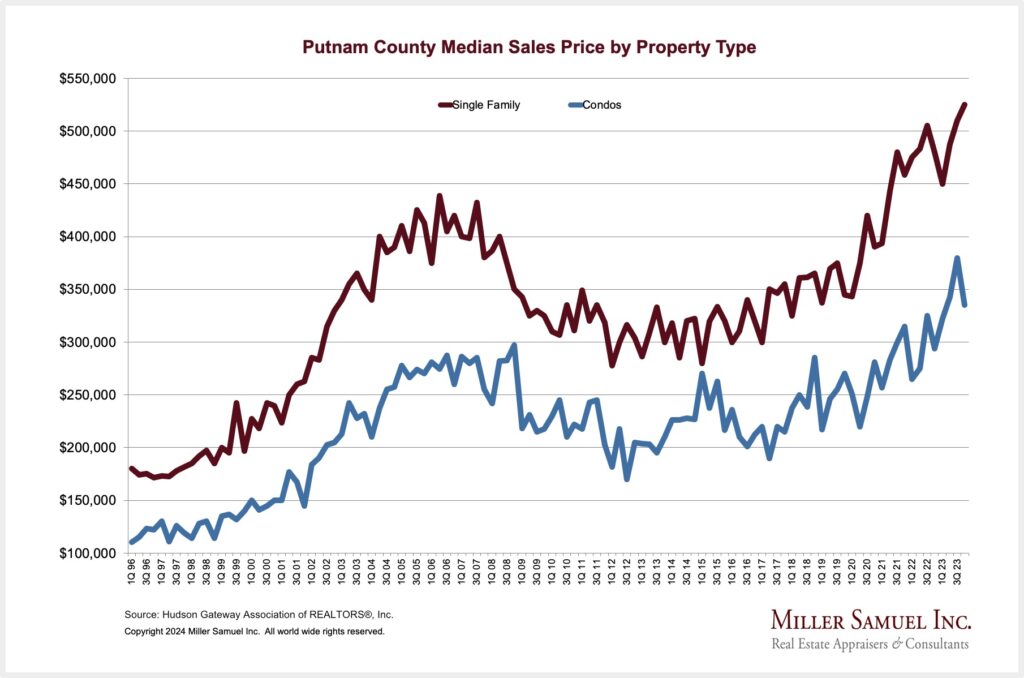

PUTNAM SALES MARKET HIGHLIGHT

Elliman Report: Q4-2023 Putnam & Dutchess

- “Overall price trend indicators expanded annually as listing inventory continued to fall sharply.”

- – Average and median sales prices increased annually to the second-highest on record

- – Sales declined year over year for the ninth quarter as listing inventory fell sharply for the fourth time

- – Bidding war market share accounted for half of all sales for the sixth time over the past two years

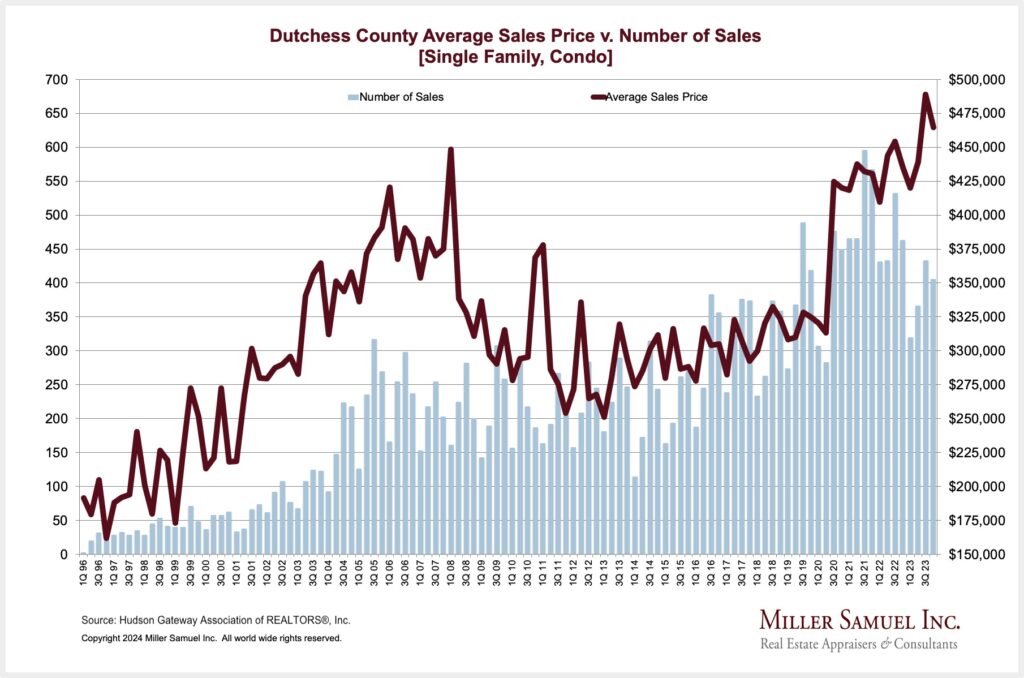

DUTCHESS SALES MARKET HIGHLIGHTS

Elliman Report: Q4-2023 Putnam & Dutchess

- “Price trend indicators rose year over year to their second-highest level with fewer sales and less listing inventory.”

- – All price trend indicators rose year over year to the second-highest on record

- – Sales declined year over year for the eighth quarter as listing inventory fell sharply for the third time

- – Bidding war market share accounted for more than four out of ten sales

Highest & Best Newsletter: Insure Me This!

You should sign up for this new Florida newsletter I love: Highest & Best from Oshrat Carmiel, formerly of Bloomberg News…

This week’s post:

Insure Me This! Meet the silent troublemaker for Florida’s real estate market

With the theme of declining availability of insurance for homeowners, here’s a piece she just wrote for the NY Post:

My Spellchecker Judged Me As “Neutral” In 2023

“Neutral” is always the goal here on Housing Notes, but I’m not sure about the “Free Spirit” moniker since I’m too uptight for that. I retired from wearing costumes on Halloween when I was 12.

Suit Story Redux (What A Recession Feels Like)

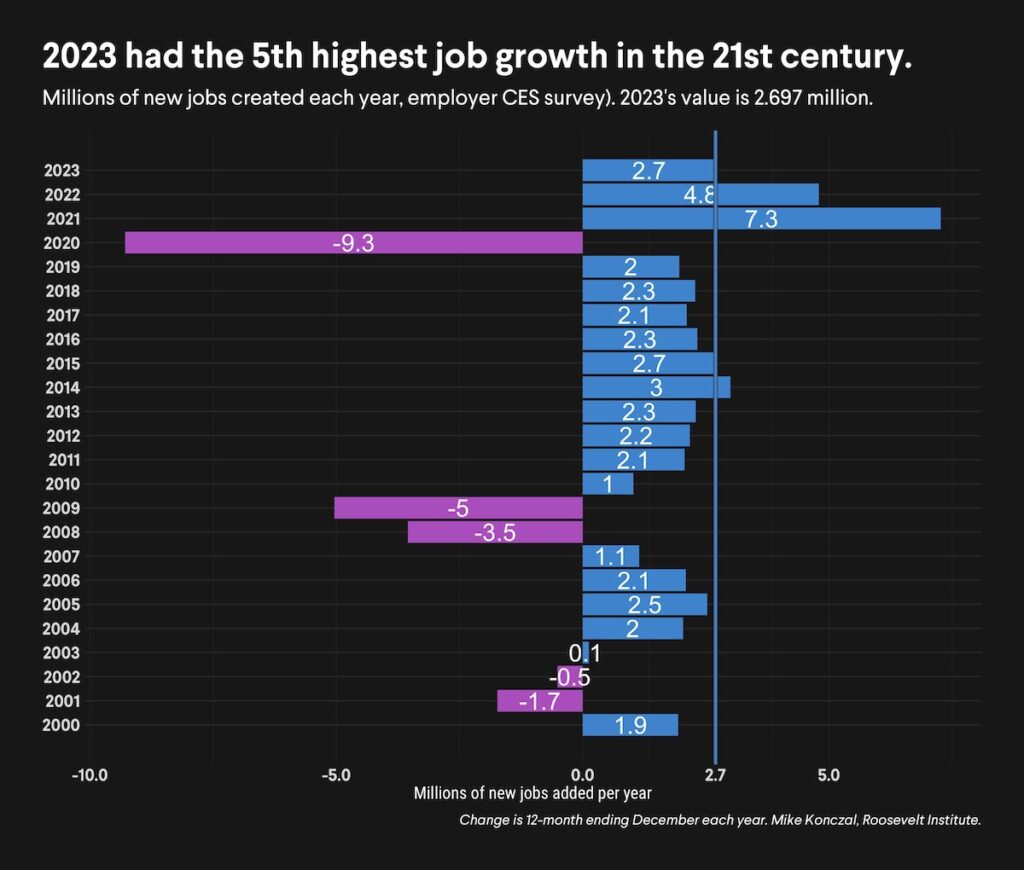

Back in 2009, I experienced what a recession feels like and wrote about it in my Matrix Blog. When I reread it recently, the memory of that feeling is still seared in my brain. With unemployment at just under 4% today, I am leaning towards the “soft landing” scenario – an economic slowdown without massive job loss like we had when I wrote this post in 2009. When I wrote it, I had been blogging for four years already!

Why It’s Not Just About Price: The $39 Dollar Suit Story [Matrix Blog]

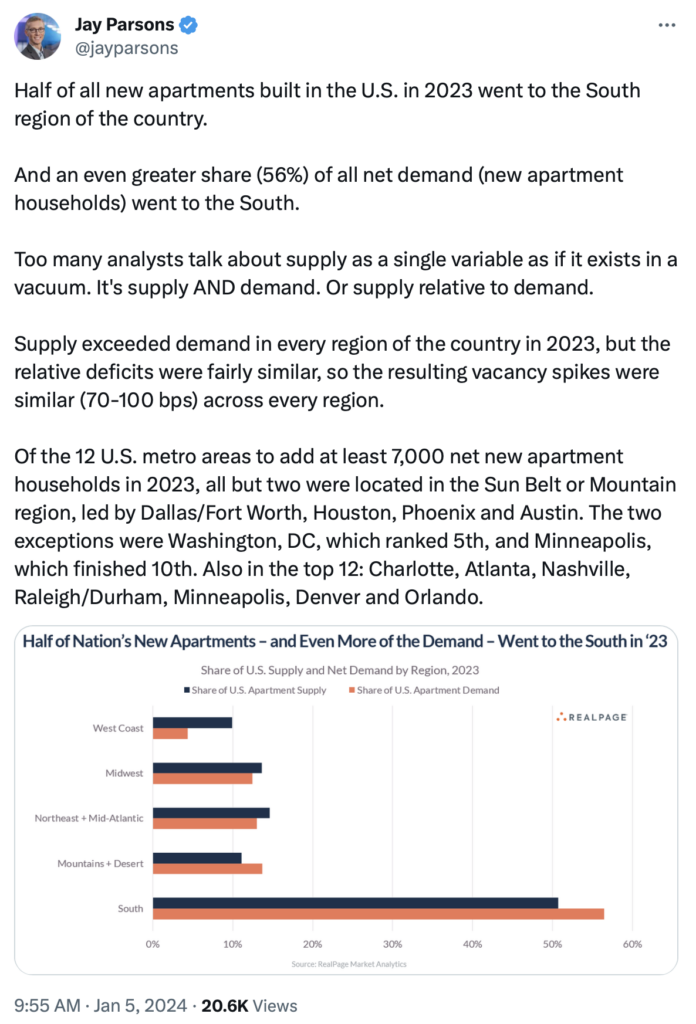

The South Is Dominating Homebuilding Activity

Getting Graphic

Favorite housing market charts of the week of our OWN making

Favorite housing market/economic charts of the week made by OTHERS

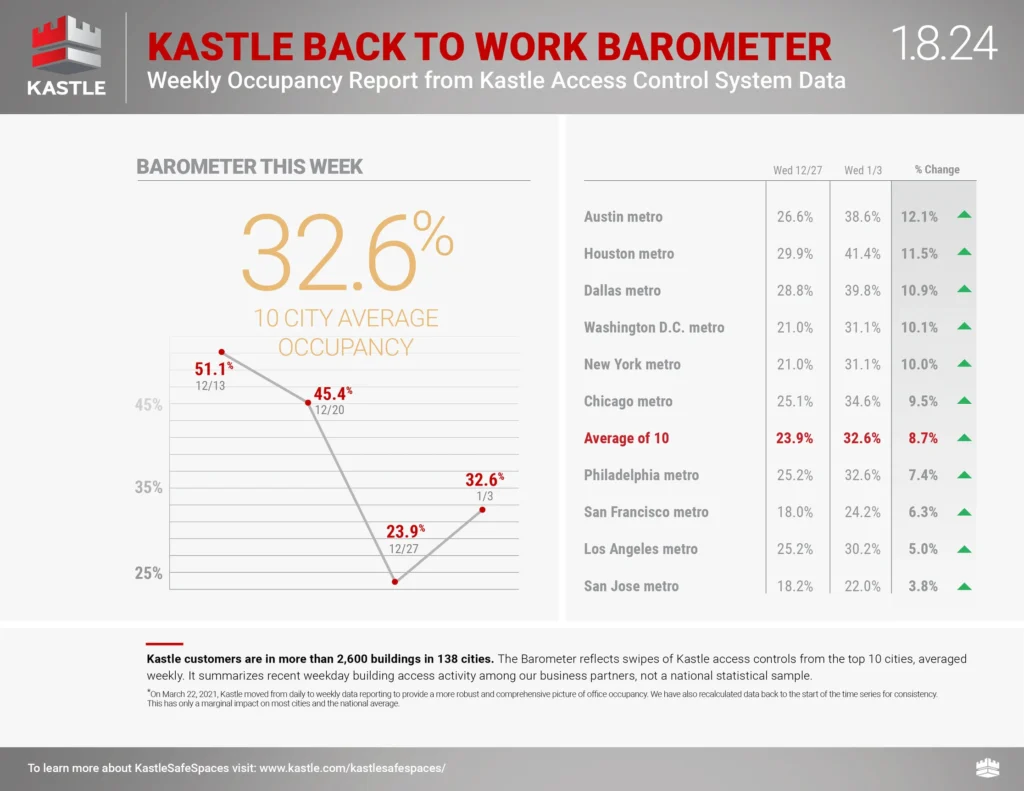

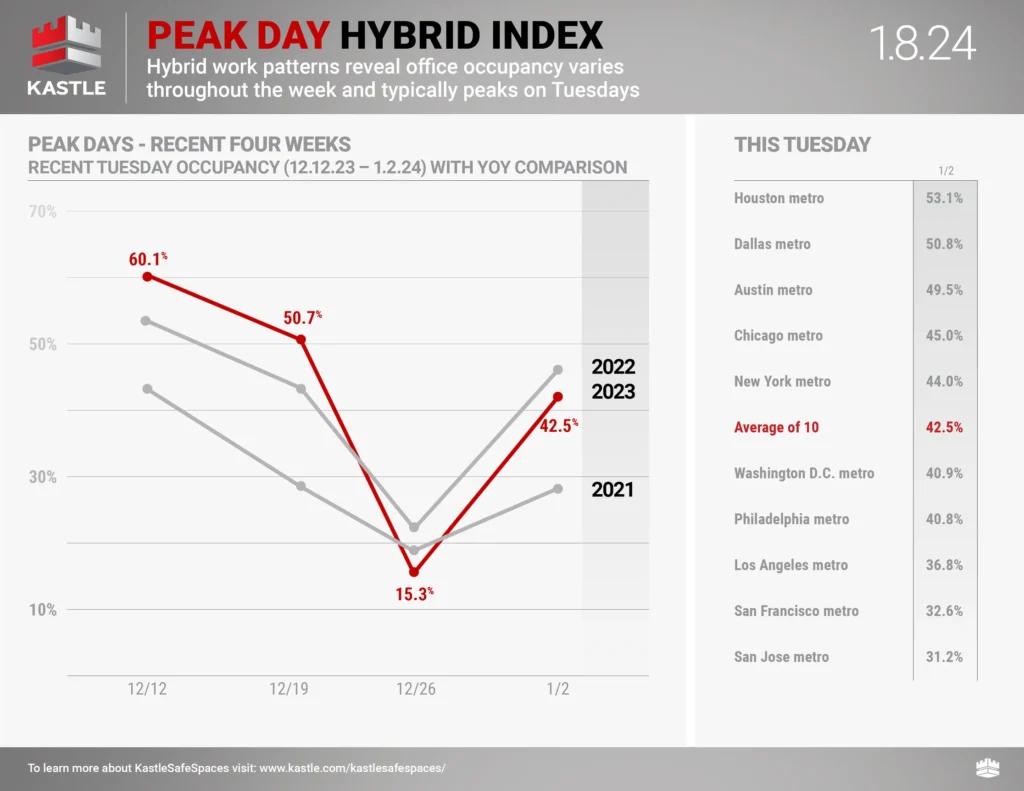

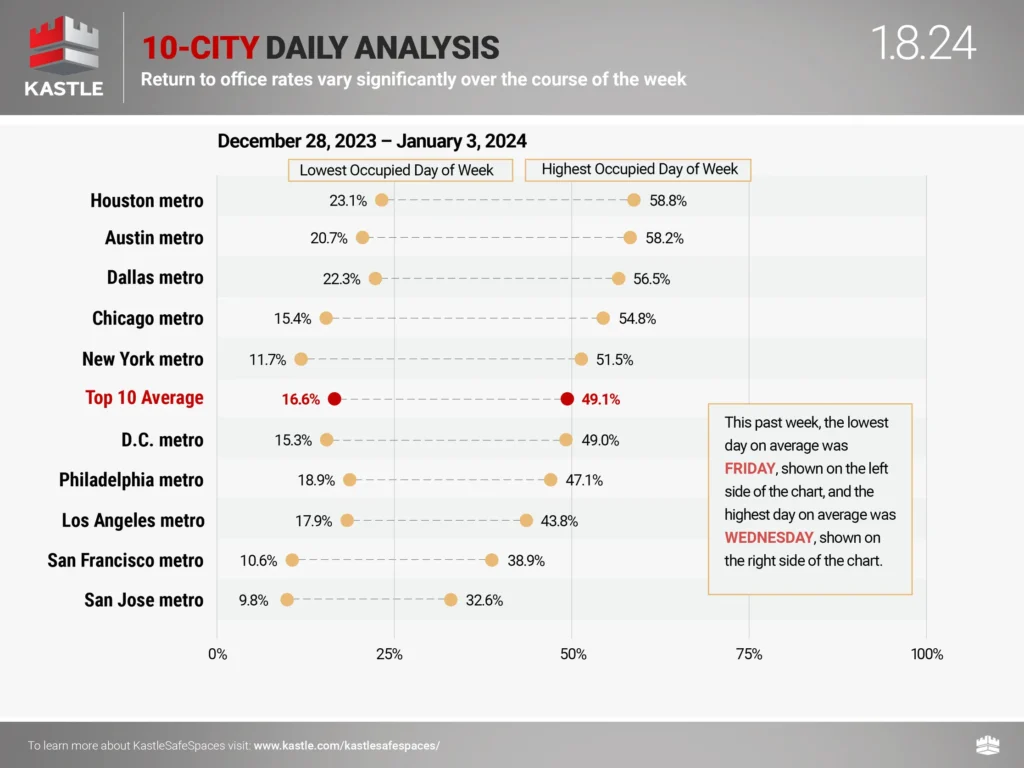

Remember that Kastle charts are overstating occupancy* because their pre-pandemic occupancy benchmark was 100%, which is incorrect (*measures card swipe activity as a proxy for occupancy). Still, they’ve become the standard benchmark for occupancy rates.

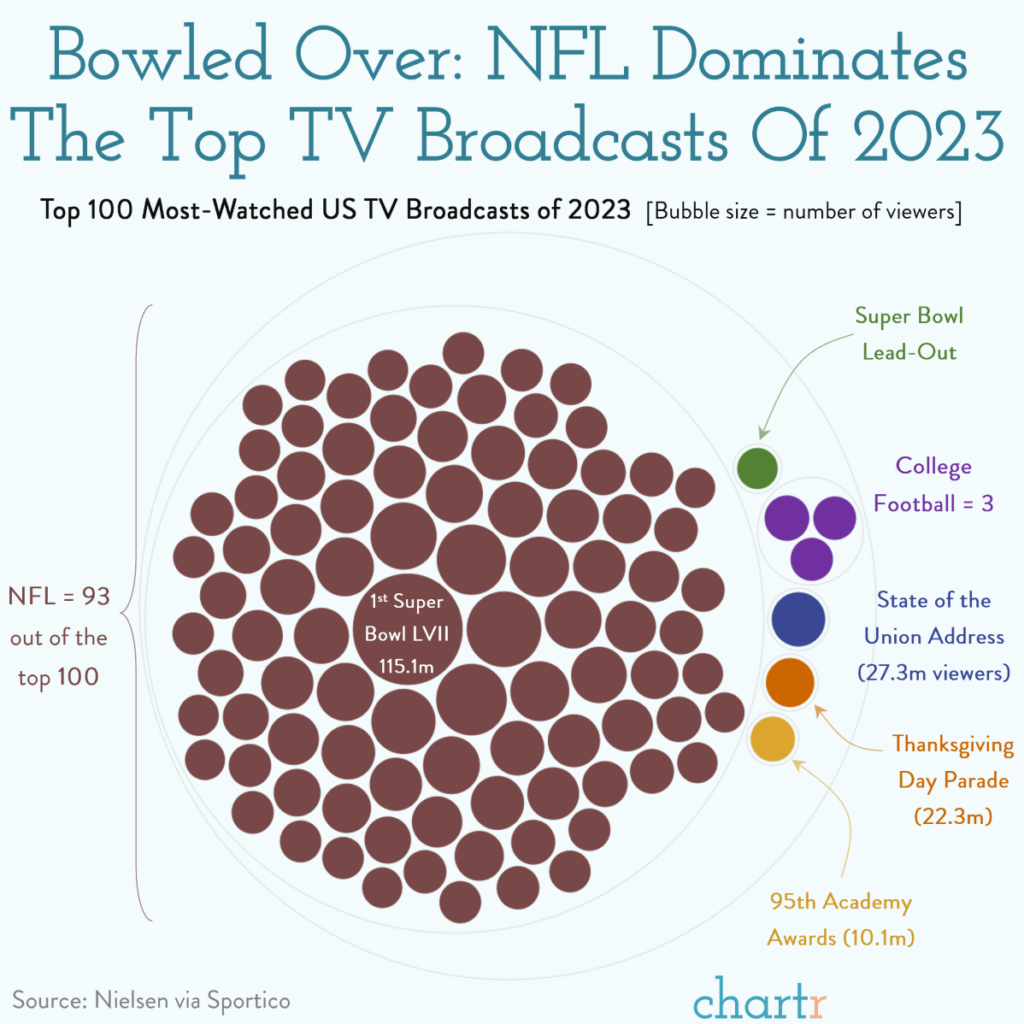

Favorite RANDOM charts of the week made by others

Appraiserville

Sandy Ran For Office On The Patronage Party Ticket

There can not be any doubt that Sandy Adomatis, the new Appraisal Institute president, is a significant, hard-core FOJ loyalist. Why did she snub immediate past president Craig Steinley at the installation like he wasn’t there and wasn’t in the photo? How petty and disrespectful. It shows us all that the cancer of FOJ still exists, and this fight is not over. All these FOJ former presidents were glad to be flown in on the membership’s dime. They can smell the grift potential to line their pockets again with Sandy in charge. And remember that “Dear Leader” had invoked the sham petition process to get Sandy in by overturning all the membership recommendations and the national nominating committee’s final recommendation because JA badly needed an FOJ. And next year, you’ve got Paula, another FOJ to look forward to. Fingers crossed, she won’t say something inappropriate.

Everyone in this photo has played a role in seriously damaging the Appraisal Institute’s national reputation and its standing in the industry. Of course, several more in the FOJs are not in the photo and should be credited for the self-dealing damage they caused, but hey, this photo says enough to make my point.

I bring all this up because I don’t want AI membership to think that JA is a past problem after he was forced to resign last year. He’s already angling with Sandy to get on the education committee after Craig revamped it. Considering this, she wants to return to the patronage system she benefitted from. JA used to maintain his power by doling out committees and classes to his JA minions. AI has had the same handful of people teaching courses for years, making AI Education stuck in the 1980s, losing 80% of its market share and being surpassed by McKissock because all AI’s FOJ focus had been on keeping out new people.

Look at these people in the photo and remember that many got to fly first-class with their significant support spouses to Europe and China for YEARS with zero benefit to AI, even though they thought they earned it. Many were doled out choice teaching assignments, preventing the next generation of leaders from being developed. This “team” is responsible for losing about one-third of its members since the financial crisis, devaluing the “SRA” designation by not understanding the concept of brand management. They may be friendly individuals, but they set back AI for generations. Good grief.

It pains me to share that Rodman Schley, another nice guy who I had dinner with in D.C. and a recent former AI president, was overheard at a conference throttling me for pointing out that his start-up had three current AI C-Suite as partners. The Appraisal Institute was heavily marketed on his startup’s website and did not share in the upside. I heard he had to re-jigger his offering and was peeved about it, even though he still doesn’t understand why it was wrong. It showed the lack of governance at AI before new CEO Cindy Chance arrived.

2023 AI President Craig Steinley Had An Incredibly Productive Year. Undoing Decades of FOJ Damage

- CEO Search Committee – CS created the committee independent of toxic politics, and they found Cindy Chance, who was a spectacular find based on feedback from her prior position. She cleared the deck of the JA patronage positions in Chicago two weeks after she started and recognized the importance of rebuilding the education that JA crushed. It should be noted that from JA’s departure on February 14, 2022, Cindy began on September 3, 2022 – an incredible achievement.

- Began The Revamp Of Education – CS took the program from the control of the staff, which was a big part of the problem with education. Education now offers a Hybrid, Synchronized, and On Demand USPAP class that is much cheaper than McKissock.

- Focus on Membership – Craig visited 40 of the 62 chapters during the year, some multiple times to be a part of the chapter officer installations (editor’s note: he flew by coach!) to emphasize the chapter level of the organization where the magic happens instead of the top-down secretive JA style that severely damaged AI.

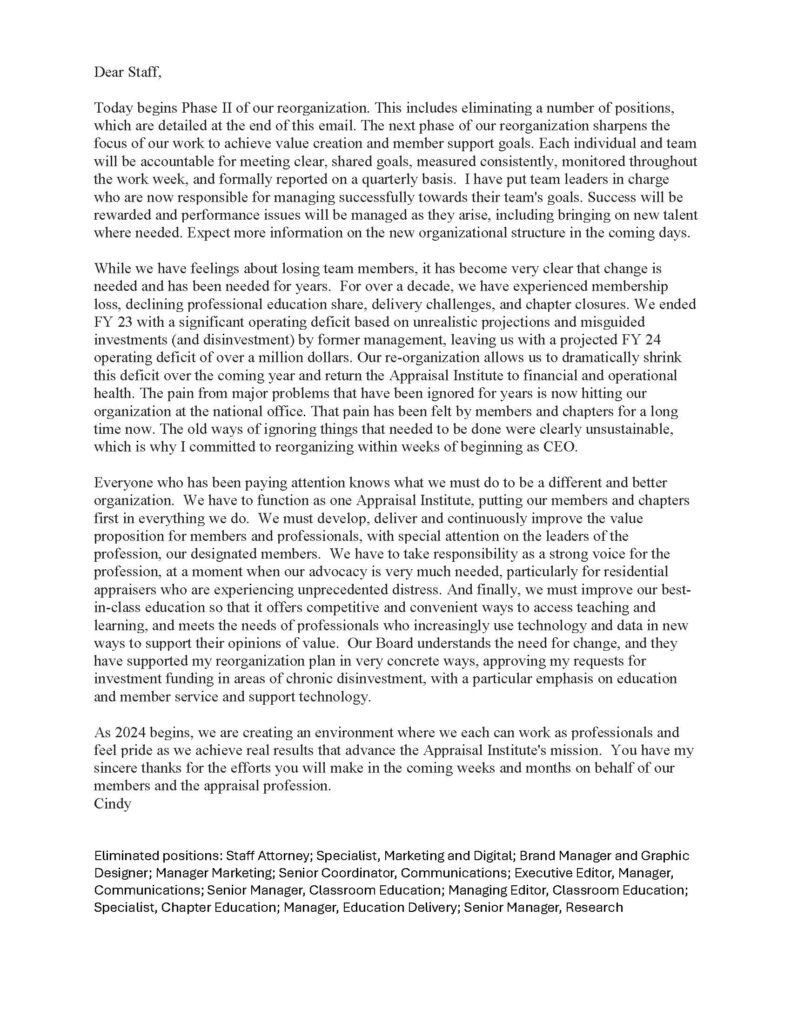

Phase II: Cindy Sends An Epic House Cleaning Letter To Chapter EDs and Presidents

I managed to get the raw text of the letter Cindy sent out to the Chapter Presidents and Executive Directors. She acts like the responsible adult in the room, removing all the patronage jobs set up in the JA/FOJ era. Look at all the positions removed at the letter’s bottom! All that patronage came from the hard-earned money from membership. I first got into this battle with the FOJs over the “Taking” of all chapter money to be controlled by AI HQ. It was an utterly unethical taking.

The patronage party was paused with the election of Craig Steinley in 2022, but I implore my readers not to go to sleep. The FOJ movement is still around, and JA wants to get back in. More announcements on this in the coming weeks. Get ready, Super Duper!

OFT (One Final Thought)

This doesn’t speak for the industry, but it’s still hilarious. This is called guerilla marketing by a small brokerage firm.

Brilliant Idea #1

If you need something rock solid in your life – particularly on Friday afternoons at 2:00 PM, Eastern Time (ET) – and someone forwarded this to you, you can sign up here for these weekly Housing Notes. And be sure to share with a friend or colleague if you enjoy them because:

– They’ll Terminate;

– You’ll Be Back;

– And I’ll demand doorknobs for my next rental apartment.

Brilliant Idea #2

You’re clearly full of insights and ideas as a reader of Housing Notes. Consider sharing them with me early and often. I appreciate every email I receive, as it helps me craft future Housing Notes.

See you next week!

Jonathan J. Miller, CRE®, Member of RAC

President/CEO

Miller Samuel Inc.

Real Estate Appraisers & Consultants

Matrix Blog

@jonathanmiller

Reads, Listens and Visuals I Enjoyed

- Pro Transfer-Tax Groups in Chicago Raise $700K for Campaign

- Insure Me This! [Highest and Best]

- Smaller, Older Buildings and Relaxed Zoning Restrictions are Keys to Convert More NYC Offices to Apartments [Moody's Analytics CRE]

- Mortgage Rates [FredddieMac]

- CPI Increase is Based on Bad Shelter Data – The Big Picture [Ritholtz]

- Atlanta Developer Sentenced To 25 Years In Prison For Land Conservation Tax Fraud [Bisnow]

- After NAR president resigns, Realtors lament damaged brand [Inman]

- Office vacancies hit new record high [Axios]

- See the December 2023 Foundation Permit Report [REBNY]

- Home Prices in Detroit Are Rising Even Faster Than in Miami [Bloomberg]

- To Go Forward, We Must Go Back (Part 1): The Code of Ethics [Nororious Rob]

- NAR President Tracy Kasper Resigns [The Real Deal]

- NAR President Tracy Kasper Resigns; President-elect Kevin Sears Steps into Role, Effective Immediately [NAR]

- Return-To-Office Escalates Bidding Wars for Silicon Valley Homes [The Real Deal]

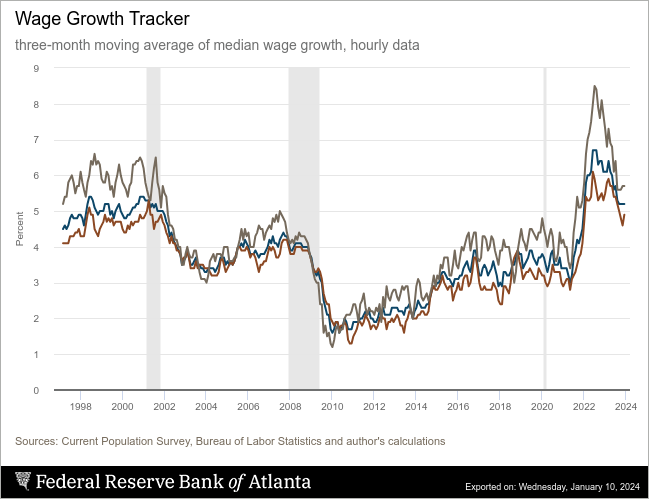

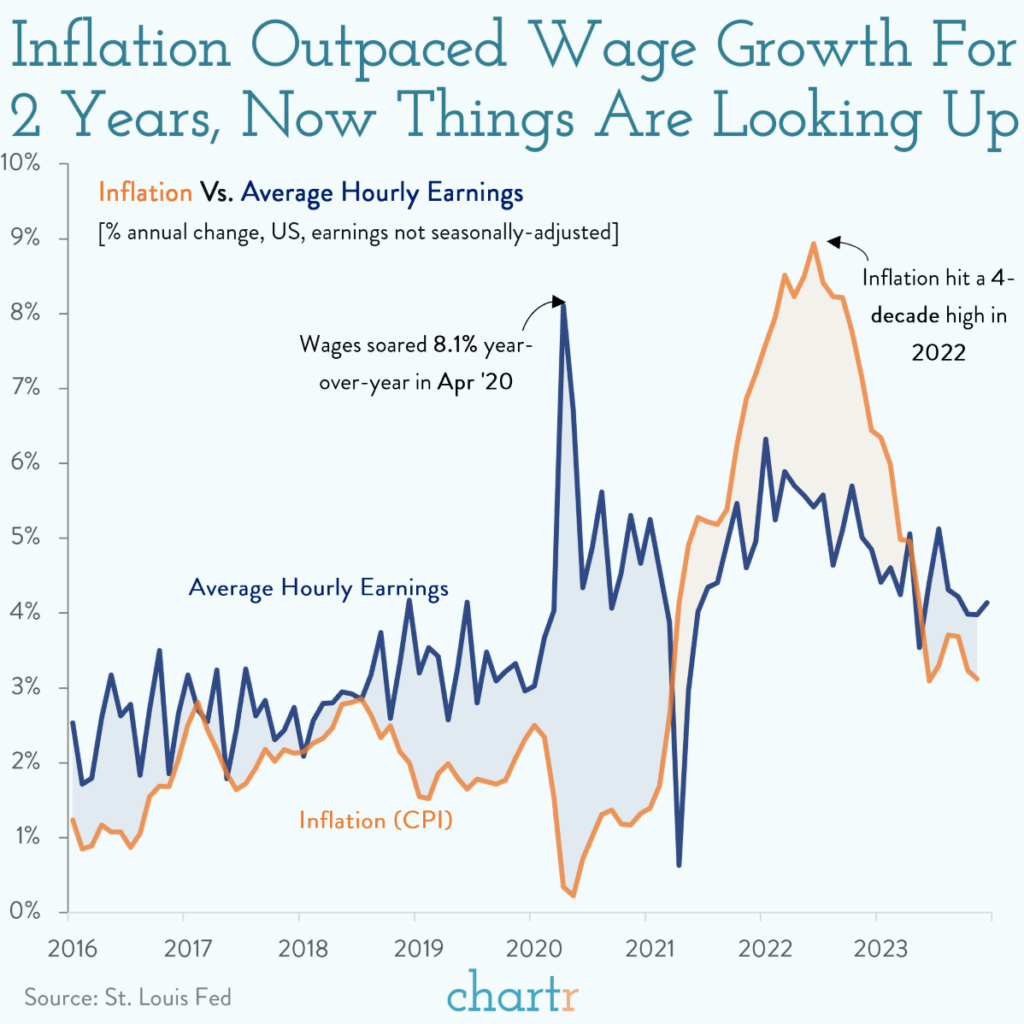

- Charted: Pay is beating inflation again [Axios]

- Offices Around America Hit a New Vacancy Record [Wall Street Journal]

- Which states have the highest share of real estate agents [Axios]

- Chart: Wage growth is beating inflation [Axios]

- After the Surfside collapse, Florida is seeing a new condo boom [NPR]

- China's property 'inventory overhang' could take more than 10 years to correct, economist says [CNBC]

- Ranked: Canada’s Housing Markets, by Price Growth in 2023 [Visual Capitalist]

- The state of the US housing market in 5 charts [Business Insider]

My New Content, Research and Mentions

- Manhattan Renters Get No Relief in a Still-Competitive Market [BNN Bloomberg]

- Priciest NYC Condo Projects Outside of Manhattan in 2023 [The Real Deal]

- WSJ News Exclusive | ‘Poor Things’ Actress Emma Stone Lists L.A. Home for $3.995 Million [Wall Street Journal]

- If You’re Thinking About Selling Your Home Without an Agent, Read This First [Mansion Global]

- Brooklyn's median sales price finally got unstuck in the fourth quarter [Brick Underground]

- NYC lease signings surged in December, a typically slow month for rentals [Brick Underground]

- New York rents now showing signs of stabilizing [Crain's New York]

- Manhattan Rents Stabilized in December [The Real Deal]

- 'Everybody's in panic mode': Ultra-rich Americans have mansions on their hands that they can't get rid of — so they're renting out their luxury LA homes for as high as $150K+ per month [Moneywise]

- Manhattan Rents Stabilized at the End of 2023 [Mansion Global]

- Detroit overtakes Miami as metro with fastest house price growth [Daily Mail]

- Manhattan Renters Get No Relief in a Still-Competitive Market [Bloomberg]

- This Midwestern city dethroned Miami as fastest-appreciating housing market: report [NY Post]

- The most expensive homes sold in Nassau County in 2023 [Newsday]

- WSJ News Exclusive | New York’s Real-Estate Market Scores Major Deal on the High Line [Wall Street Journal]

- New York’s Real-Estate Market Scores Major Deal on the High Line [Mansion Global]

- America is running out of home-owners insurance [NY Post]

Recently Published Elliman Market Reports

- Elliman Report: Putnam & Dutchess Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Westchester Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Riverdale Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Queens Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Brooklyn Sales 4Q 2023 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 12-2023 [Miller Samuel]

- Elliman Report: Manhattan Sales 4Q 2023 [Miller Samuel]

- Elliman Report: California New Signed Contracts 12-2023 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 12-2023 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 12-2023 [Miller Samuel]

Appraisal Related Reads

- Birmingham Housing Stats: A Final Look at 2023 [Birmingham Appraisal Blog]

- It was a weird housing market in 2023 [Sacramento Appraisal Blog]

- U.S. Home Appraisals Slide YoY in Q3 [DS News]

- New Legislation Impacting Appraisers [VaCAP]

Extra Curricular Reads

- Plane commutes, world peace and 100-year-old predictions about 2024 [USA Today]

- Stuck Yellow Camaro Pushed Through the NYC Blizzard [YouTube]

- Floating East River Pool May Open to Public Next Year Under Hochul Plan [NY Times]

- Sync Your Calendar With the Solar System [NY Times]

- Scientists Destroy Illusion That Coin Toss Flips Are 50–50 [Scientific American]

- Disney backs down from 'Steamboat Willie' YouTube copyright claim [Mashable]

- What We Lost When Twitter Became X [New Yorker]

- Mike Sadler, Intrepid Desert Navigator in World War II, Dies at 103 [NY Times]

![Brooklyn Rental Listing Inventory by Month [Average from 2010]](https://millersamuel.com/files/2024/04/Apr24BKLYNrent-invBYmo-1200x786.jpg)

![[27 Speaks Podcast] Jonathan Miller Provides A 2024 Hamptons Outlook](https://millersamuel.com/files/2024/02/27eastlogo-600x314.jpg)